UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 22, 2025 |

WESBANCO, INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | |

West Virginia | 001-39442 | 55-0571723 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | |

1 Bank Plaza | |

Wheeling, West Virginia | | 26003 |

(Address of Principal Executive Offices) | | (Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 304 234-9000 |

Former Name or Former Address, if Changed Since Last Report : Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class

| | Trading

Symbol(s) | |

Name of each exchange on which registered

|

Common Stock $2.0833 Par Value | | WSBC | | Nasdaq Global Select Market |

Depositary Shares (each representing 1/40th interest in a share of 6.75% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series A) | | WSBCP | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Wesbanco, Inc. issued a press release and earnings call presentation today announcing earnings for the three and twelve months ended December 31, 2024. The press release is attached as Exhibit 99.1 and the earnings call presentation is attached as Exhibit 99.2 to this report.

Wesbanco, Inc. will host a conference call to discuss the Company's financial results for the fourth quarter of 2024 on Thursday, January 23, 2025 at 3:00 p.m. ET.

Interested parties can access the live webcast of the conference call through the Investor Relations section of the Company's website, www.wesbanco.com. Participants can also listen to the conference call by dialing 888-347-6607, 855-669-9657 for Canadian callers, or 1-412-902-4290 for international callers, and asking to be joined into the WesBanco call. Please log in or dial in at least 10 minutes prior to the start time to ensure a connection.

A replay of the conference call will be available by dialing 877-344-7529, 855-669-9658 for Canadian callers, or 1-412-317-0088 for international callers, and providing the access code of 8807978. The replay will begin at approximately 5:00 p.m. ET on January 23, 2025 and end at 12 a.m. ET on February 6, 2025. An archive of the webcast will be available for one year on the Investor Relations sections of the Company's website (www.wesbanco.com)

Item 8.01 Other Events.

Additional Information About the Merger and Where to Find It

In connection with the proposed Merger, the Company filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 which includes a joint proxy statement of Premier Financial and the Company and a prospectus of the Company with respect to shares of the Company’s common stock to be issued in the proposed transaction, as well as other relevant documents concerning the proposed transaction. The Form S-4 was declared effective on October 28, 2024, and Wesbanco and Premier Financial commenced mailing to their respective shareholders on or about November 1, 2024 in connection with their respective special meetings of shareholders, which were held on December 11, 2024, at which the shareholders of both companies approved all matters related to the proposed transaction that were submitted for a vote. This communication is not a substitute for the Registration Statement on Form S-4, the joint proxy statement/Prospectus or any other document that the Company and/or Premier Financial may file with the SEC in connection with the proposed transaction. SHAREHOLDERS OF THE COMPANY, SHAREHOLDERS OF PREMIER FINANCIAL AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. The Registration Statement on Form S-4, which includes the joint proxy statements/prospectus, and other related documents filed by the Company or Premier with the SEC, may be obtained for free at the SEC’s website at www.sec.gov, and from either the Company’s or Premier Financial’s website at www.wesbanco.com or www.premierfincorp.com, respectively.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

99.1 - Press release dated January 22, 2025 announcing earnings for the three and twelve months ended December, 31 2024.

99.2 - Fourth quarter 2024 earnings conference call presentation.

104 - Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | |

| | | Wesbanco, Inc.

(registrant) |

| | | |

Date: | January 22, 2025 | By: | /s/ Daniel K. Weiss, Jr. |

| | | Daniel K. Weiss, Jr.

Senior Executive Vice President and

Chief Financial Officer

|

Exhibit 99.1

WesBanco Announces Fourth Quarter 2024 Financial Results

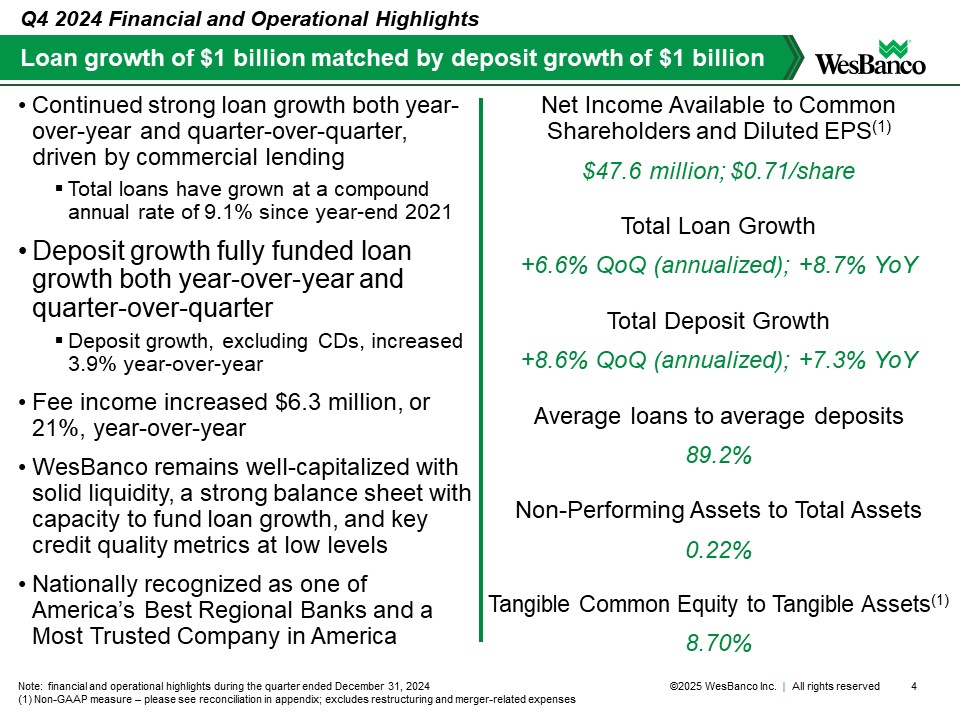

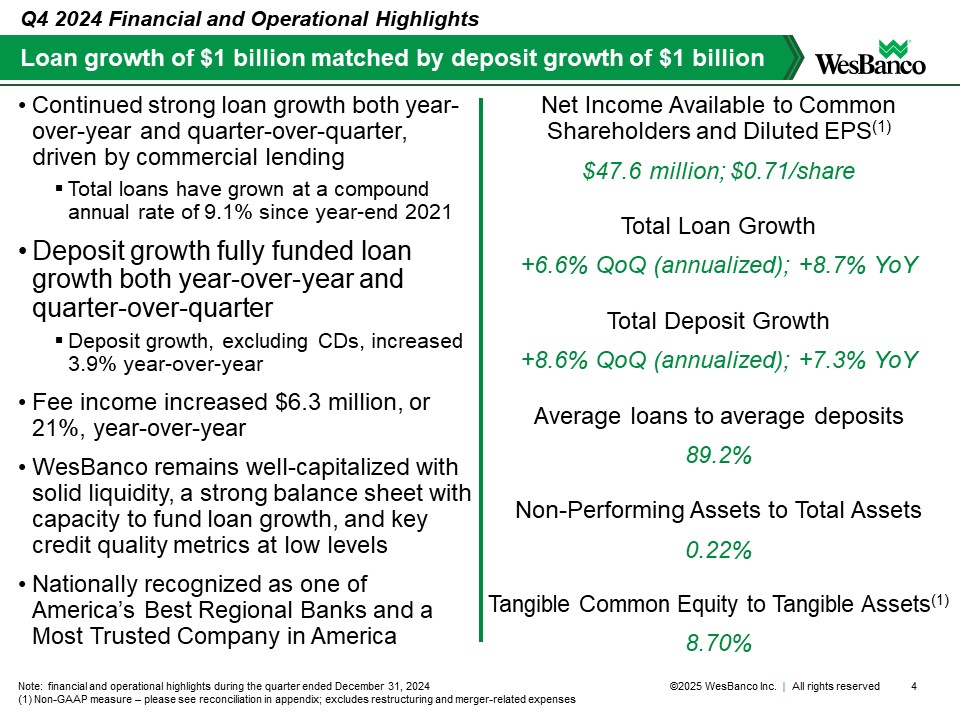

Strong year-over-year loan growth of $1 billion, matched by deposit growth of $1 billion

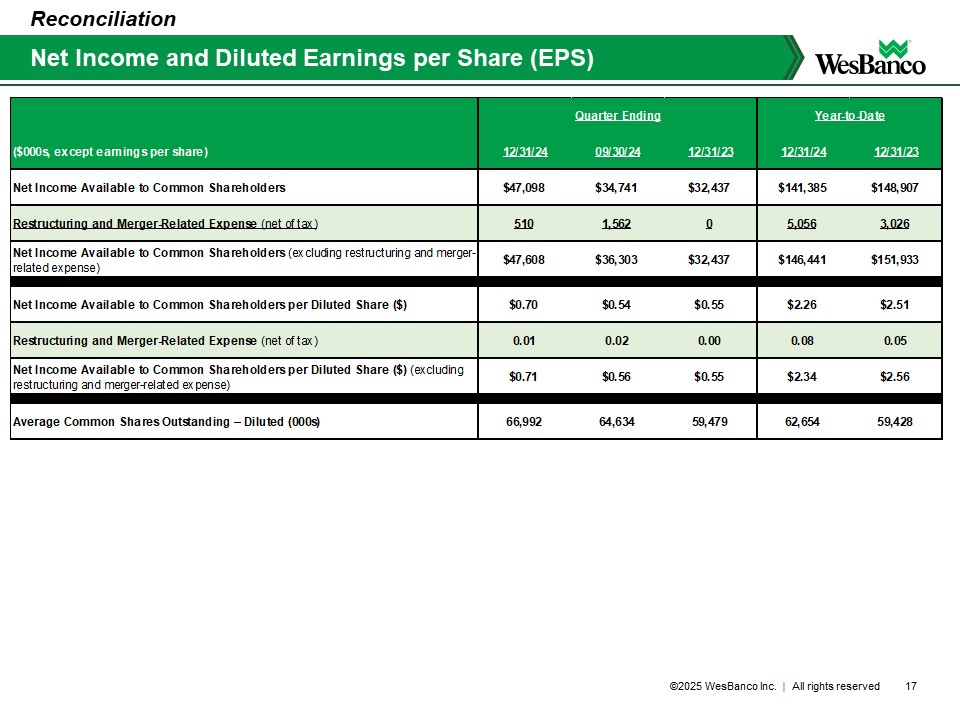

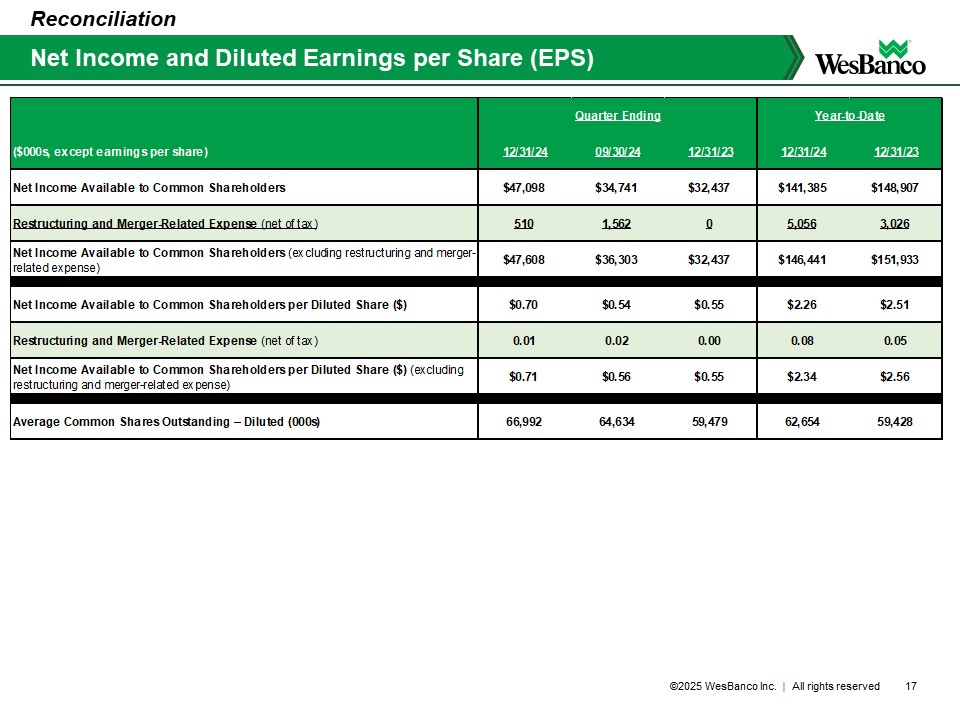

Wheeling, WVa. (January 22, 2025) – WesBanco, Inc. (“WesBanco” or “Company”) (Nasdaq: WSBC), a diversified, multi-state bank holding company, today announced net income and related earnings per share for the three and twelve months ended December 31, 2024. Net income available to common shareholders for the fourth quarter of 2024 was $47.1 million, with earnings per share of $0.70, compared to $32.4 million and $0.55 per share, respectively, for the fourth quarter of 2023. For the twelve months ended December 31, 2024, net income was $141.4 million, or $2.26 per share, compared to $148.9 million, or $2.51 per share, for the 2023 period. As noted in the following table, net income available to common shareholders, excluding after-tax restructuring and merger-related expenses, for the twelve months ended December 31, 2024 was $146.4 million, or $2.34 per share, as compared to $151.9 million, or $2.56 per share (non-GAAP measures).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended December 31, | | | For the Twelve Months Ended December 31, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

(unaudited, dollars in thousands,

except per share amounts) | | Net

Income | | | Diluted

Earnings

Per Share | | | Net

Income | | | Diluted

Earnings

Per Share | | | Net

Income | | | Diluted

Earnings

Per Share | | | Net

Income | | | Diluted

Earnings

Per Share | |

Net income available to common shareholders (Non-GAAP)(1) | $ | 47,608 | | | $ | 0.71 | | | $ | 32,437 | | | $ | 0.55 | | | $ | 146,441 | | | $ | 2.34 | | | $ | 151,933 | | | $ | 2.56 | |

Less: After tax restructuring and merger-related expenses | | (510 | ) | | | (0.01 | ) | | | - | | | | - | | | | (5,056 | ) | | | (0.08 | ) | | | (3,026 | ) | | | (0.05 | ) |

Net income available to common shareholders (GAAP) | $ | 47,098 | | | $ | 0.70 | | | $ | 32,437 | | | $ | 0.55 | | | $ | 141,385 | | | $ | 2.26 | | | $ | 148,907 | | | $ | 2.51 | |

(1) See non-GAAP financial measures for additional information relating to these items. | |

Financial and operational highlights during the quarter ended December 31, 2024:

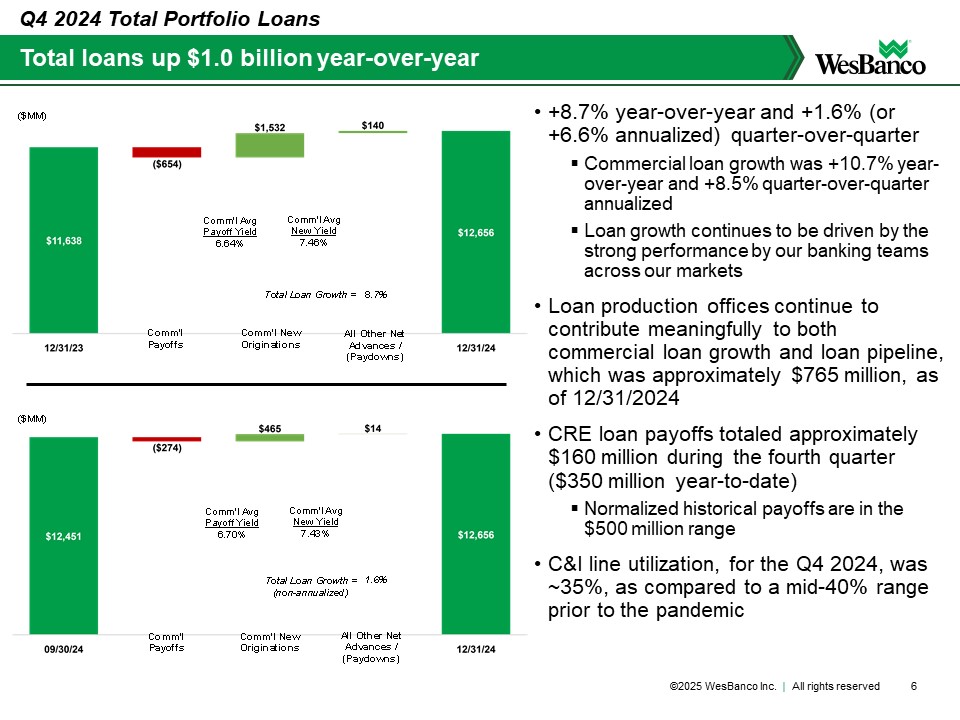

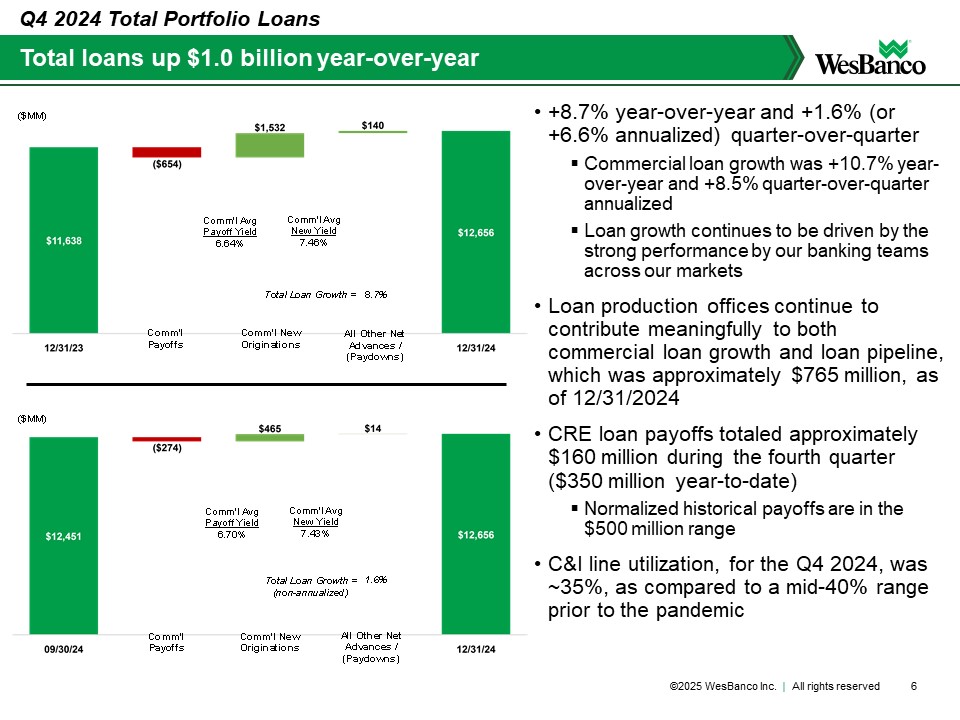

•Total loan growth was 8.7% year-over-year and 6.6% over the sequential quarter, annualized

oSequential quarter loan growth was fully funded through deposit growth

oTotal loans are up $1.0 billion compared to the prior year, driven by commercial loan growth

oTotal loans have grown at a compound annual rate of 9.1% since year-end 2021

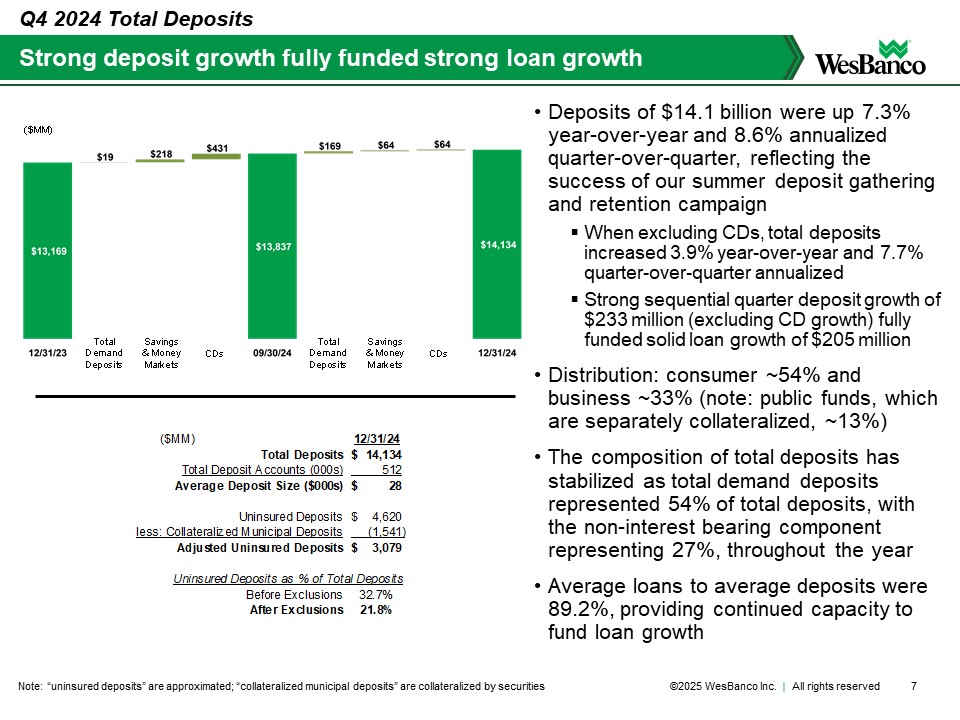

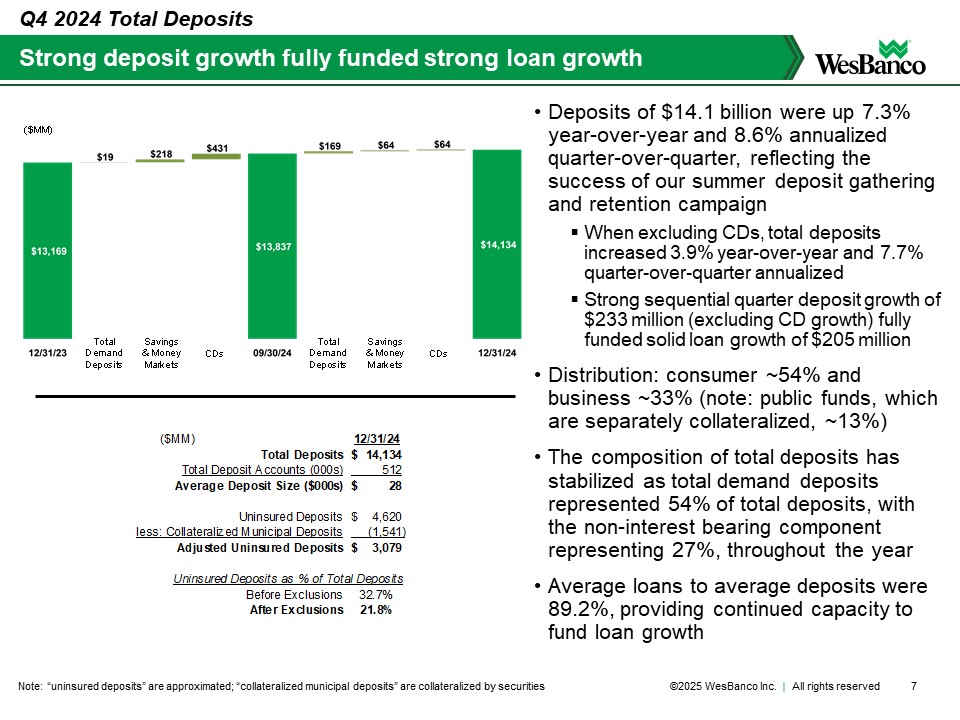

•Deposits of $14.1 billion increased 7.3% year-over-year and 8.6% over the sequential quarter, annualized

oDeposit growth, excluding certificates of deposit, increased 3.9% year-over-year and 7.7% over the sequential quarter, annualized

oTotal deposits are up $1.0 billion compared to the prior year, matching loan growth

oAverage loans to average deposits were 89.2%, providing continued capacity to fund loan growth

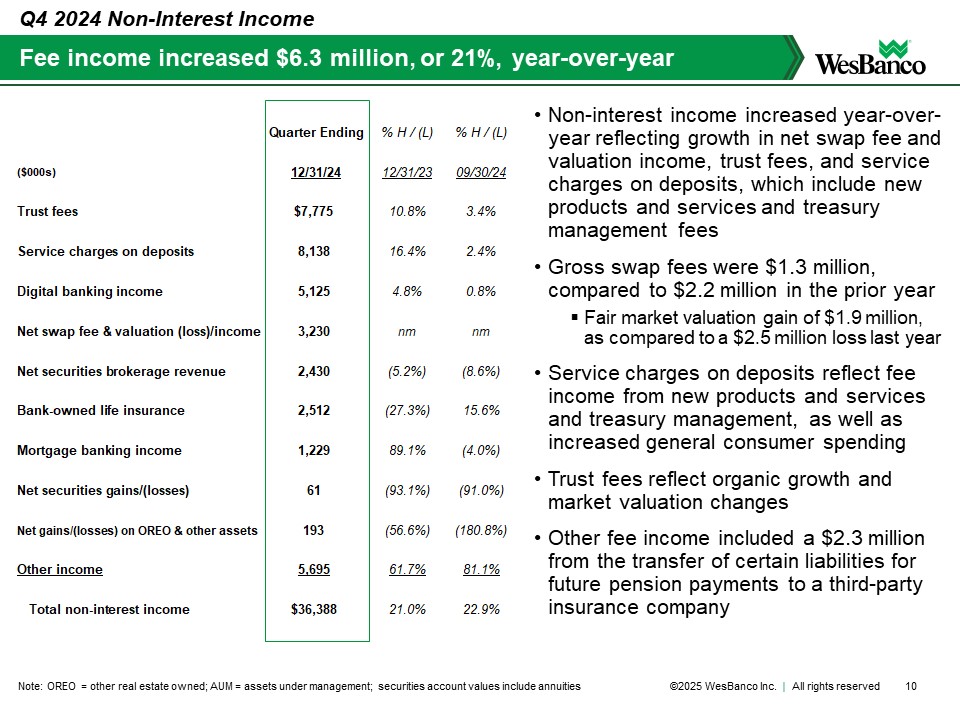

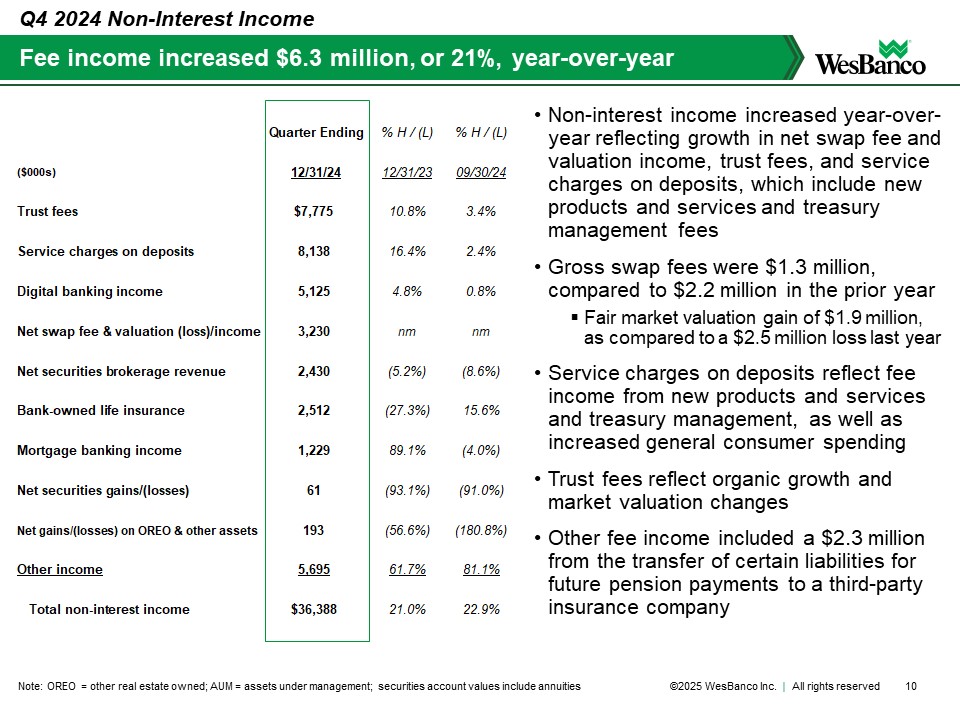

•Fee income increased $6.3 million, or 21%, year-over-year reflecting growth in net swap fee and valuation income, trust fees, and service charges on deposits, which include new products and services and treasury management fees

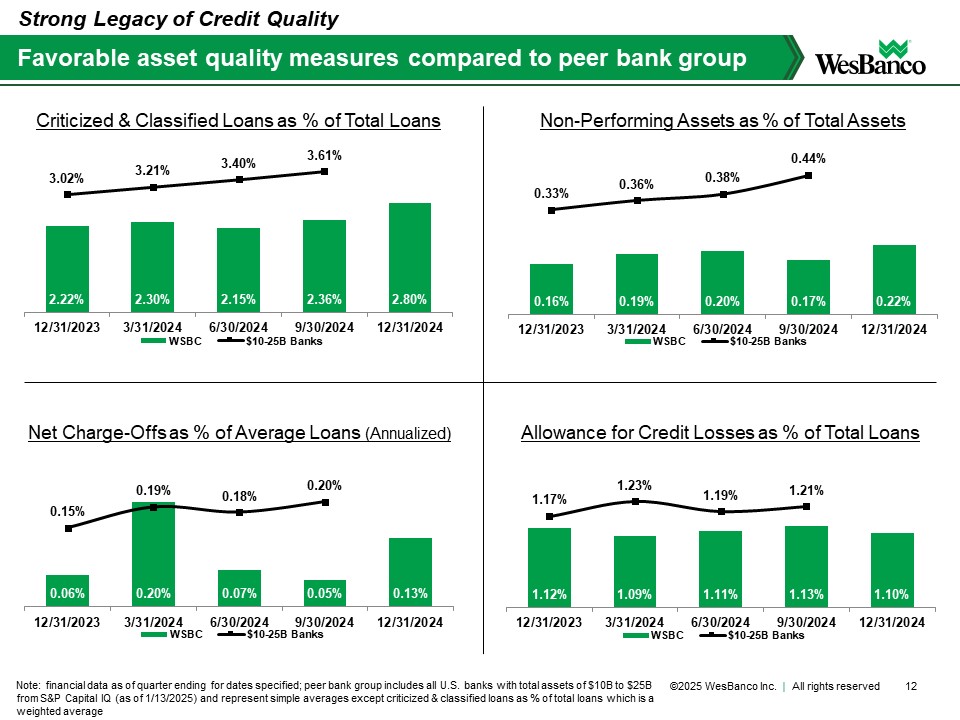

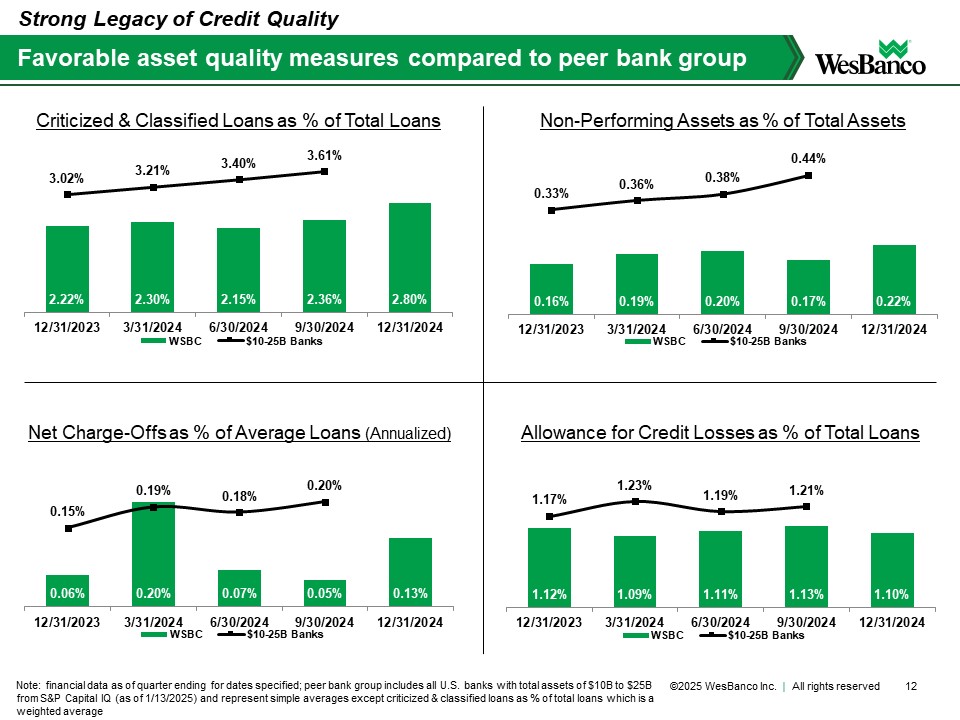

•Key credit quality metrics continued to remain at low levels and favorable to peer bank averages (based upon the prior four quarters for banks with total assets between $10 billion and $25 billion)

•The acquisition of Premier Financial Corp. remains on track, pending regulatory approvals

•WesBanco was recently named one of America’s Best Regional Banks by Newsweek and a Most Trusted Company in America by Forbes

“2024 was an excellent year for WesBanco. We delivered strong loan growth of $1 billion, which was fully funded by deposit growth. We also announced our transformational merger with Premier Financial and continued to earn national recognitions for stability, trustworthiness, and workplace excellence,” said Jeff Jackson, President and Chief Executive Officer, WesBanco. “We have achieved a compound annual loan growth rate of 9% over the past three years, raised $200 million of common equity and paid down higher-cost borrowings – key successes in our strategy to strengthen our balance sheet and net interest margin. Additionally, we continued to focus on cost-control while enhancing our wealth and treasury management businesses to deepen client relationships and drive positive operating leverage. With the pending Premier Financial merger and the strength of our proven strategies, we are well positioned to build on our momentum and continue delivering value for our customers and stakeholders.”

Balance Sheet

As of December 31, 2024, portfolio loans were $12.7 billion, which increased $1.0 billion, or 8.7%, year-over-year driven by strong performance by our banking teams across our markets. Total commercial loans of $9.1 billion increased 10.7% year-over-year and 8.5% quarter-over-quarter annualized. Commercial loan growth continues to reflect the success of our strategies, as well as lower commercial real estate payoffs, which totaled approximately $350 million during 2024.

Deposits, as of December 31, 2024, were $14.1 billion, up 7.3% year-over-year and up 8.6% quarter-over-quarter annualized, reflecting the success of our efforts on deposit gathering and retention. The composition of total deposits continues to have some mix shift; however, total demand deposits continue to represent 54% of total deposits, with the non-interest bearing component representing 27%, which remains consistent with the percentage range prior to the pandemic. When excluding certificate of deposits, total deposits increased 3.9% year-over-year and 7.7% quarter-over-quarter annualized.

Federal Home Loan Bank (“FHLB”) borrowings totaled $1.0 billion, at December 31, 2024, a decrease of 14.9%, or $175.0 million from September 30, 2024. This paydown was funded by deposit growth exceeding loan growth during the fourth quarter.

Credit Quality

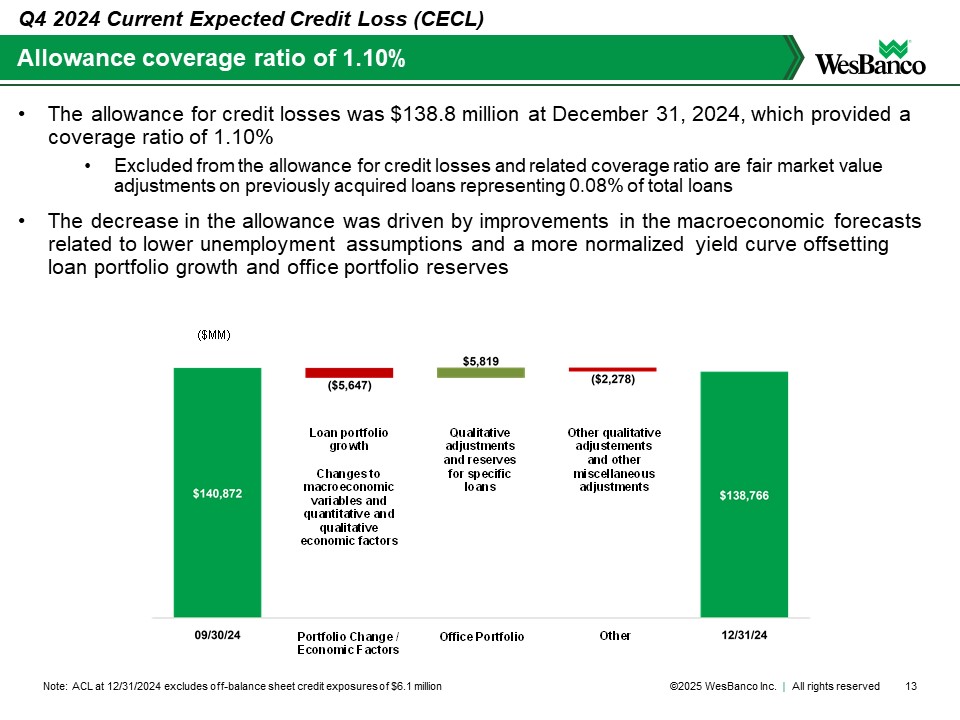

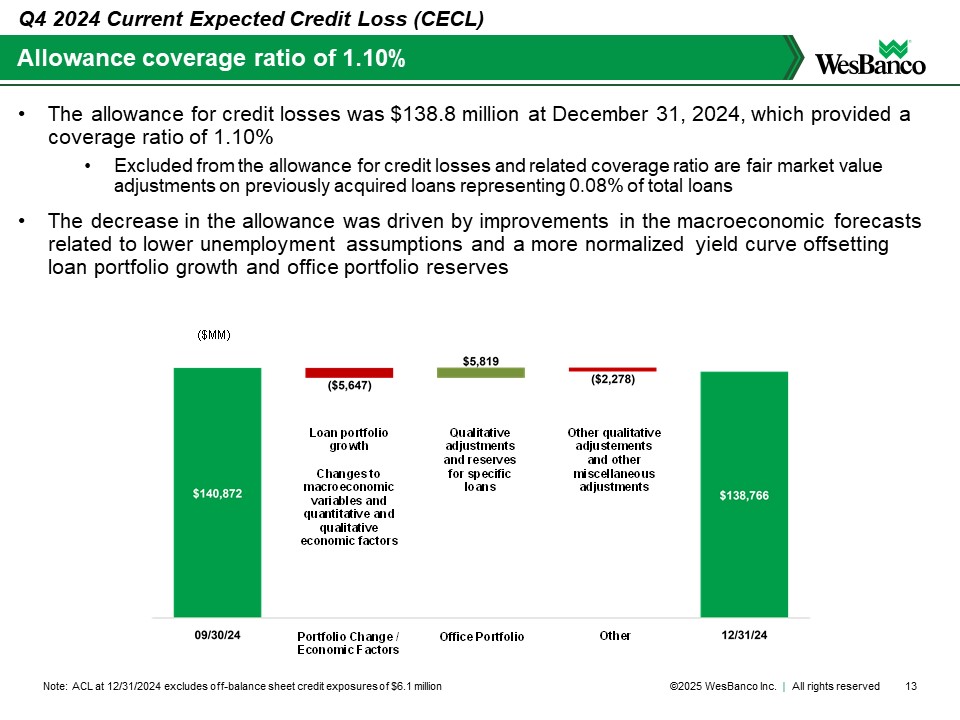

As of December 31, 2024, total loans past due, criticized and classified loans, non-performing loans, and non-performing assets as percentages of the loan portfolio and total assets have remained low, from a historical perspective, and within a consistent range through the last three years. Total loans past due as a percent of the loan portfolio increased 3 basis points quarter-over-quarter to 0.47%, while non-performing assets as a percentage of total assets increased 6 basis points to 0.22% from the prior year period. The fourth quarter provision for credit losses decreased both year-over-year and sequentially to a negative provision of $0.1 million. The allowance for credit losses was $138.8 million at December 31, 2024, which provided a coverage ratio of 1.10%. The coverage ratio was down 3 basis points from prior quarter, primarily due to improvements in the macroeconomic forecasts related to lower unemployment assumptions and a more normalized yield curve, offsetting loan portfolio growth and office portfolio reserves. Excluded from the allowance for credit losses and related coverage ratio are fair market value adjustments on previously acquired loans representing 0.08% of total loans.

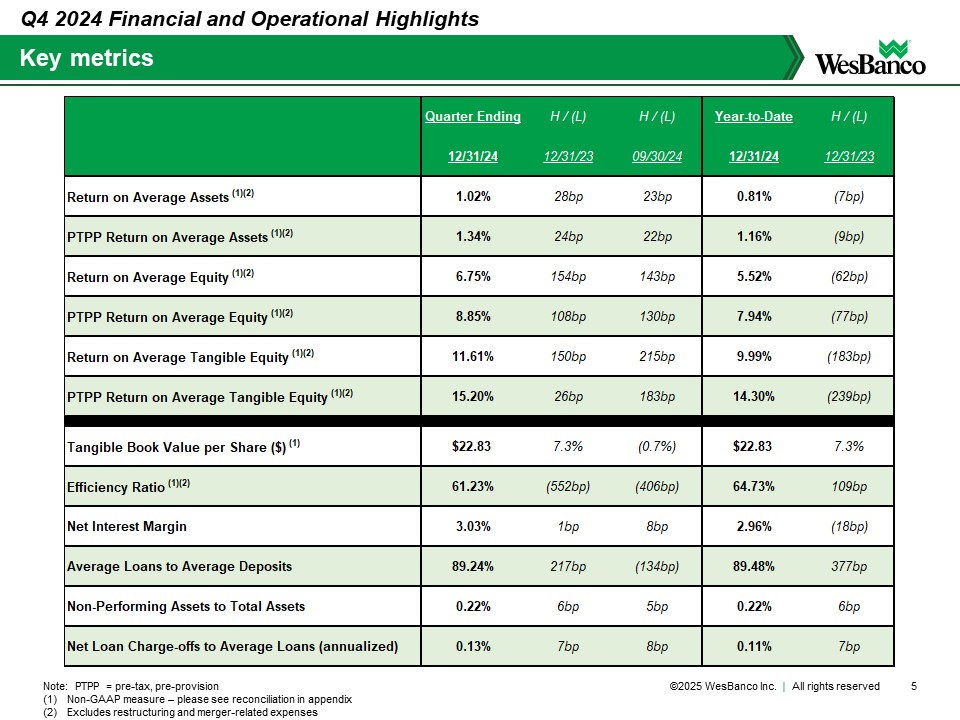

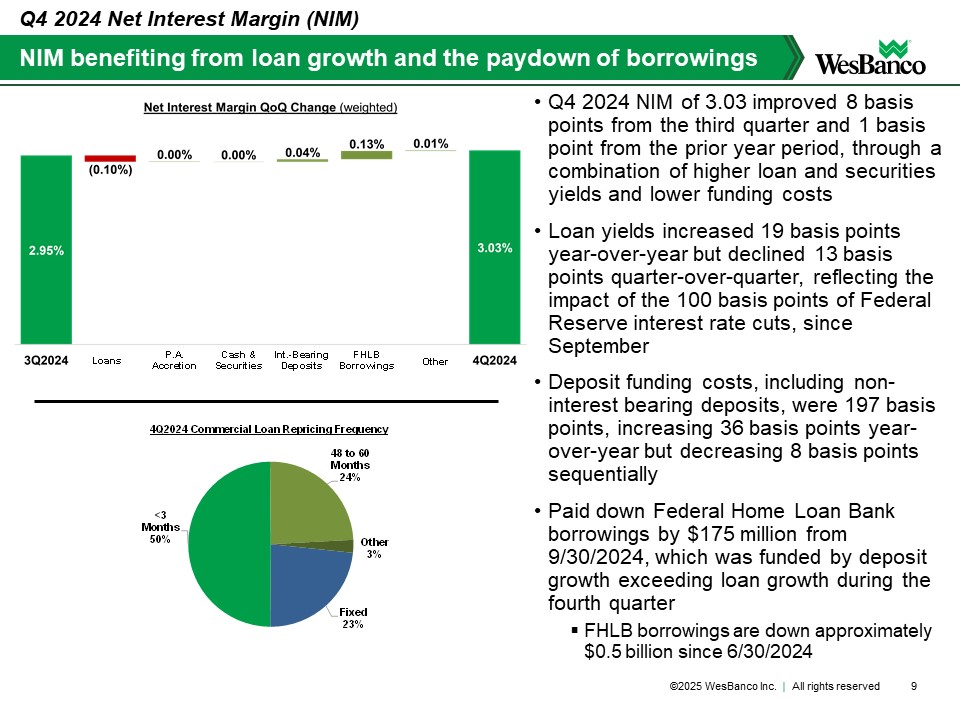

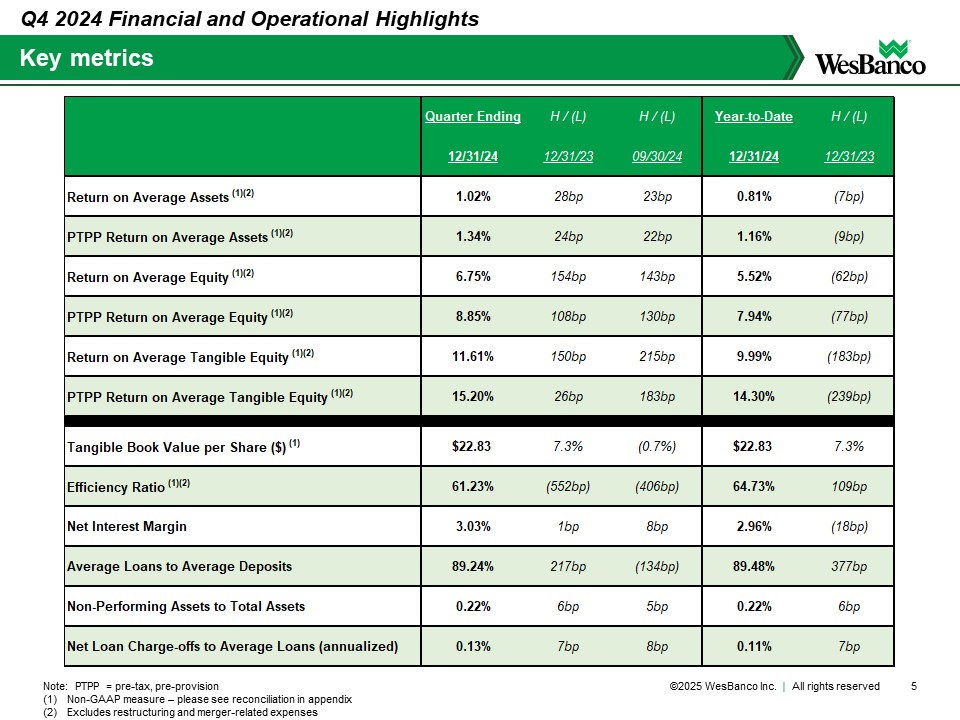

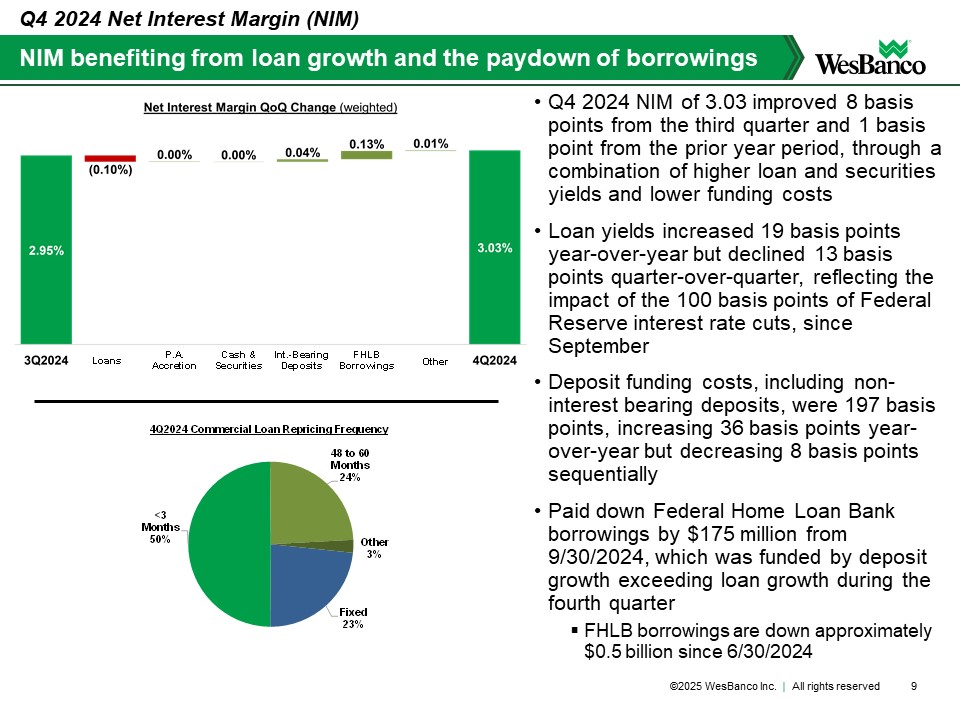

Net Interest Margin and Income

The fourth quarter margin of 3.03% improved 8 basis points compared to the third quarter and 1 basis point on a year-over-year basis, through a combination of higher loan and securities yields and lower funding costs. Deposit funding costs were 271 basis points for the fourth quarter of 2024, as compared to 285 basis points in the third quarter of 2024 and 234 basis points in the prior year period. When including non-interest bearing deposits, deposit funding costs for the fourth quarter were 197 basis points.

Net interest income for the fourth quarter of 2024 was $126.5 million, an increase of $8.7 million, or 7.4% year-over-year, reflecting the impact of loan growth, higher loan and securities yields, and lower FHLB borrowings more than offsetting higher deposit funding costs. For the twelve months ended December 31, 2024, net interest income of $478.2 million decreased $3.1 million, or 0.7%, primarily due to higher funding costs offsetting the impact of loan growth and higher loan and securities yields in the year-to-date period.

Non-Interest Income

For the fourth quarter of 2024, non-interest income of $36.4 million increased $6.3 million, or 21.0%, from the fourth quarter of 2023 due to higher net swap fee and valuation income, service charges on deposits, and trust fees. Gross swap fees were $1.3 million in the fourth quarter, compared to $2.2 million in the prior year period, while fair value adjustments were $1.9 million compared to a loss of $2.5 million, respectively. Service charges on deposits increased $1.1 million year-over-year, reflecting fee income from new products and services and treasury management, as well as increased general consumer spending. Trust fees increased $0.8 million due to organic growth and market valuation changes. Other income included a $2.3 million gain from the transfer of certain liabilities for future pension payments to a third-party insurance company.

Primarily reflecting the items discussed above and mortgage banking income, non-interest income, for the twelve months ended December 31, 2024, increased $7.5 million, or 6.3%, year-over-year to $128.0 million. Trust fees increased $2.5 million, reflecting higher assets under management from organic growth and market appreciation. Mortgage banking income increased $1.6 million year-over-year due to more residential mortgages sold in the secondary market, as well as an associated wider gain-on-sale margin.

Non-Interest Expense

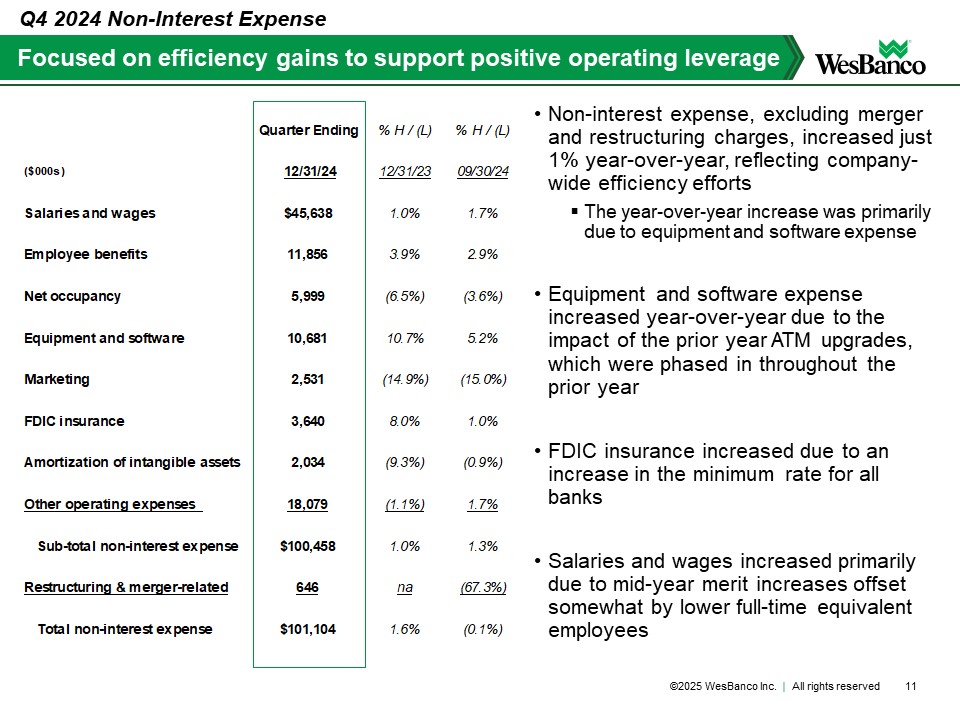

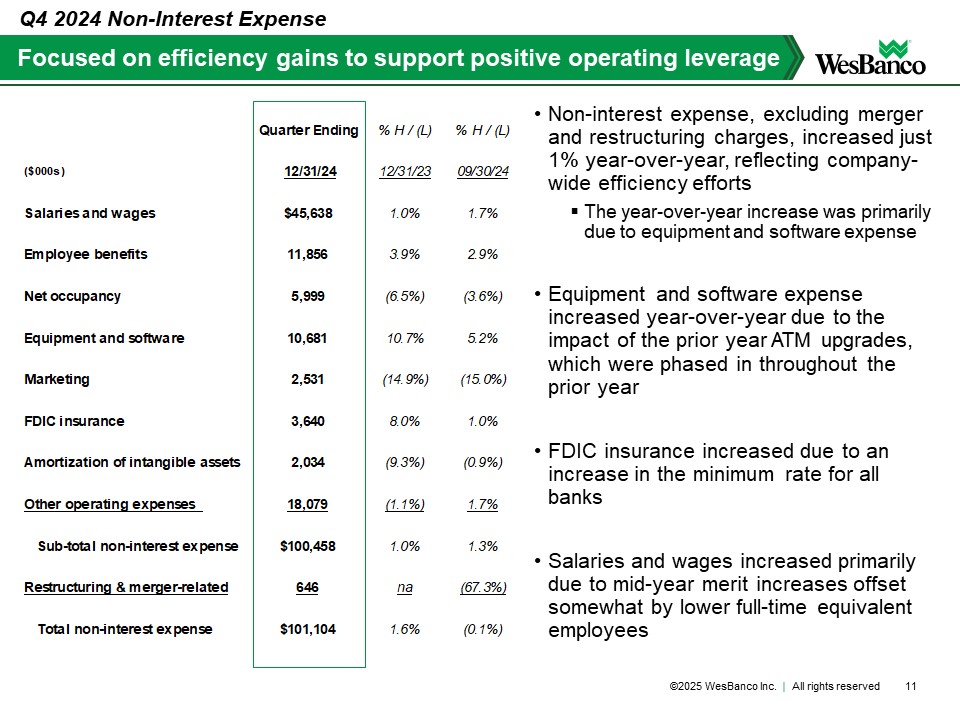

Non-interest expense, excluding restructuring and merger-related costs, for the three months ended December 31, 2024 were $100.5 million, a $1.0 million, or 1.0%, increase year-over-year primarily due to increases in equipment and software expenses, which increased $1.0 million reflecting the impact of the prior year ATM upgrades, which were phased in throughout the prior year.

Excluding restructuring and merger-related expenses, non-interest expense for 2024 of $395.5 million increased $9.3 million, or 2.4%, compared to the prior year period, due primarily to equipment and software expense, as described above, other operating expenses, and higher FDIC insurance expense. Other operating expenses increased $5.3 million primarily due to higher costs and fees in support of loan growth and higher other miscellaneous expenses. FDIC insurance increased $2.0 million year-over-year due to an increase in the minimum rate for all banks.

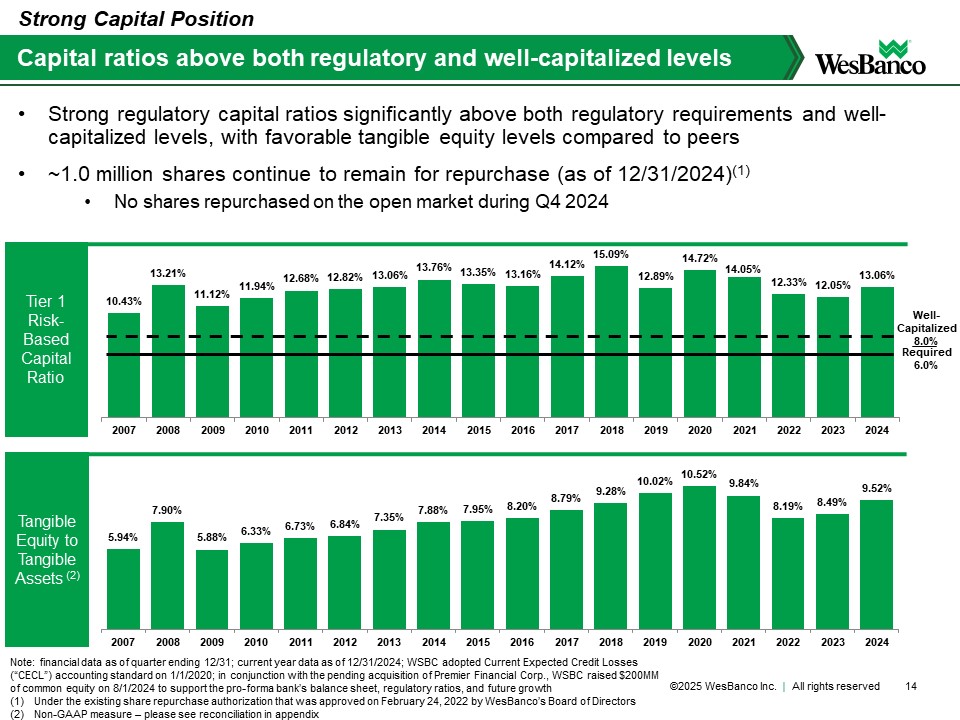

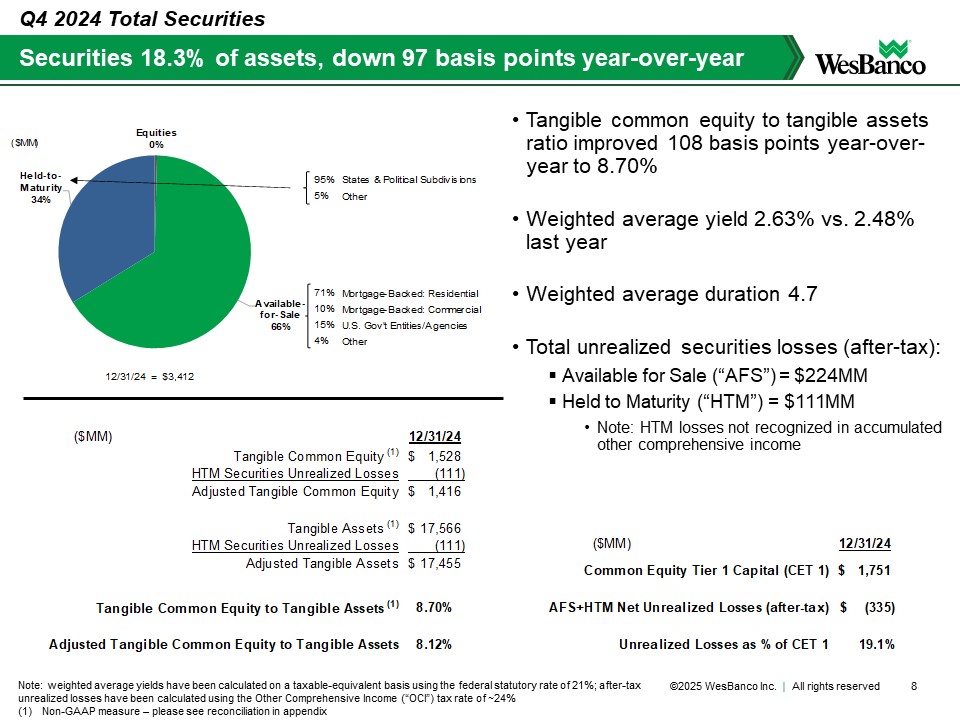

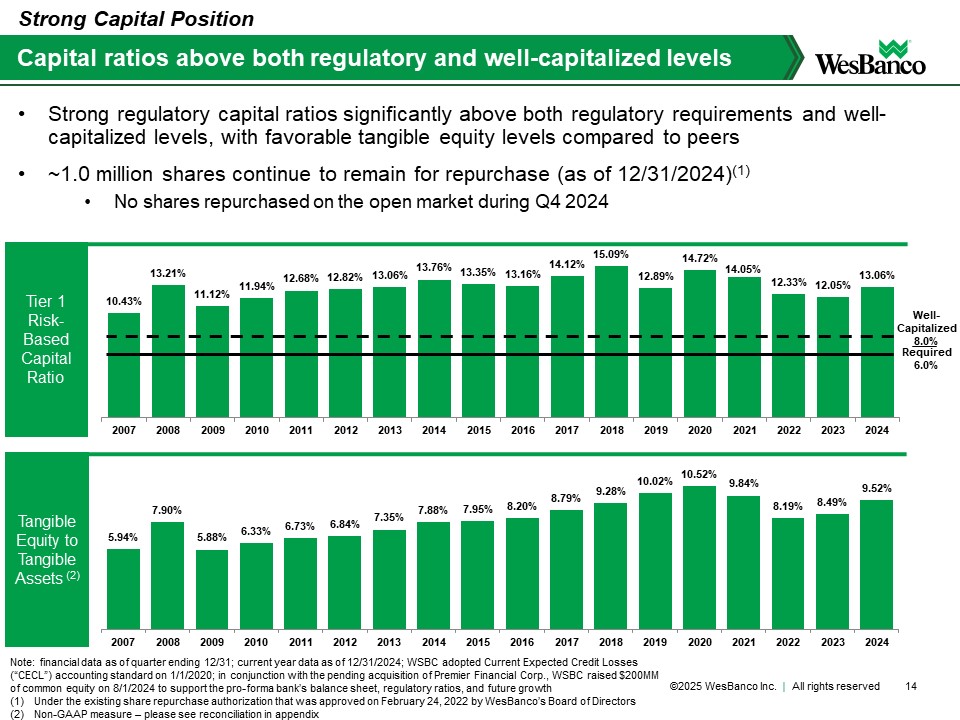

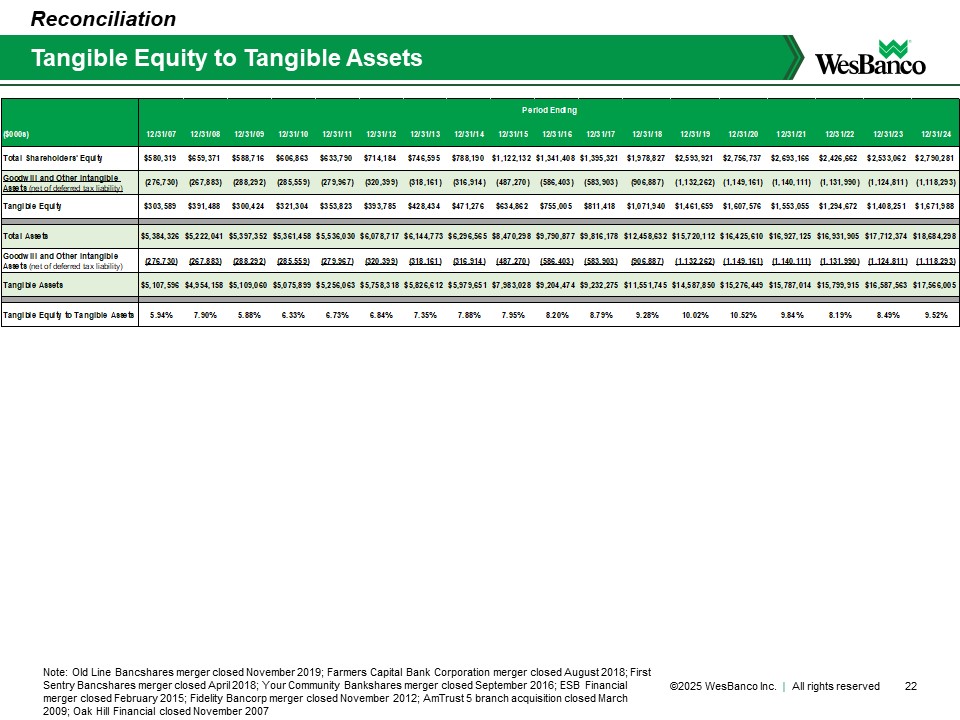

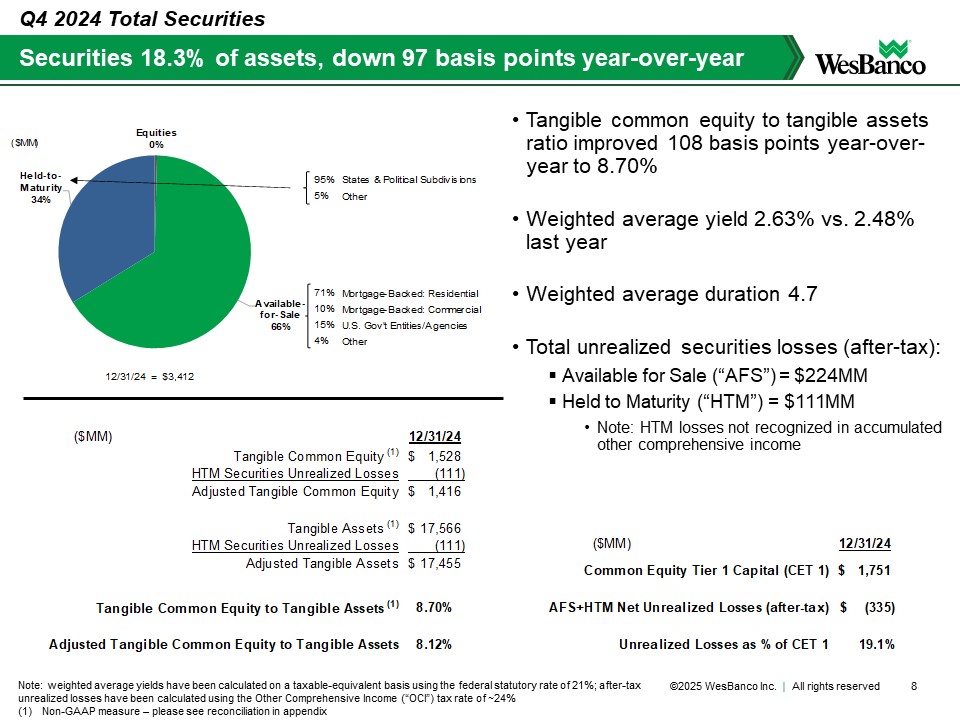

Capital

WesBanco continues to maintain what we believe are strong regulatory capital ratios, as both consolidated and bank-level regulatory capital ratios are well above the applicable “well-capitalized” standards promulgated by bank regulators and the BASEL III capital standards. At December 31, 2024, Tier I leverage was 10.68%, Tier I risk-based capital ratio was 13.06%, common equity Tier 1 capital ratio (“CET 1”) was 12.07%, and total risk-based capital was 15.88%. In addition, the tangible common equity to tangible assets ratio was 8.70% due to strong earnings and the third quarter common equity raise.

Conference Call and Webcast

WesBanco will host a conference call to discuss the Company's financial results for the fourth quarter of 2024 at 3:00 p.m. ET on Thursday, January 23, 2025. Interested parties can access the live webcast of the conference call through the Investor Relations section of the Company's website, www.wesbanco.com. Participants can also listen to the conference call by dialing 888-347-6607, 855-669-9657 for Canadian callers, or 1-412-902-4290 for international callers, and asking to be joined into the WesBanco call. Please log in or dial in at least 10 minutes prior to the start time to ensure a connection.

A replay of the conference call will be available by dialing 877-344-7529, 855-669-9658 for Canadian callers, or 1-412-317-0088 for international callers, and providing the access code of 8807978. The replay will begin at approximately 5:00 p.m. ET on January 23, 2025 and end at 12 a.m. ET on February 6, 2025. An archive of the webcast will be available for one year on the Investor Relations section of the Company’s website (www.wesbanco.com).

Forward-Looking Statements

Forward-looking statements in this report relating to WesBanco’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this report should be read in conjunction with WesBanco’s Form 10-K for the year ended December 31, 2023 and documents subsequently filed by WesBanco with the Securities and Exchange Commission (“SEC”) including WesBanco’s Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024, which are available at the SEC’s website, www.sec.gov or at WesBanco’s website, www.WesBanco.com. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco’s most recent Annual Report on Form 10-K filed with the SEC under “Risk Factors” in Part I, Item 1A. Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements, including, without limitation, that the proposed merger with Premier Financial Corp. (“Premier Financial” or “Premier”) may not close when expected, that the businesses of WesBanco and Premier may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the merger of WesBanco and Premier may not be fully realized within the expected timeframes; disruption from the proposed merger of WesBanco and Premier may make it more difficult to maintain relationships with clients, associates, or suppliers; the required governmental approvals of the proposed Merger may not be obtained on the expected terms and schedule; the effects of changing regional and national economic conditions, changes in interest rates, spreads on earning assets and interest-bearing liabilities, and associated interest rate sensitivity; sources of liquidity available to WesBanco and its related subsidiary operations; potential future credit losses and the credit risk of commercial, real estate, and consumer loan customers and their borrowing activities; actions of the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau, the SEC, the Financial Institution Regulatory Authority, the Municipal Securities Rulemaking Board, the Securities Investors Protection Corporation, and other regulatory bodies; potential legislative and federal and state regulatory actions and reform, including, without limitation, the impact of the implementation of the Dodd-Frank Act; adverse decisions of federal and state courts; fraud, scams and schemes of third parties; cyber-security breaches; competitive conditions in the financial services industry; rapidly changing technology affecting financial services; marketability of debt instruments and corresponding impact on fair value adjustments; and/or other external developments materially impacting WesBanco’s operational and financial performance. WesBanco does not assume any duty to update forward-looking statements.

While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law.

Statements in this presentation with respect to the expected timing of and benefits of the proposed merger between WesBanco and Premier, the parties’ plans, obligations, expectations, and intentions, and the statements with respect to accretion, earn back of tangible book value, tangible book value dilution and internal rate of return, constitute forward-looking statements as defined by federal securities laws. Such statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied by such statements for a variety of factors including: the businesses of WesBanco and Premier may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the proposed merger may not be fully realized within the expected time frames; disruption from the proposed merger may make it more difficult to maintain relationships with clients, associates, or suppliers; the required governmental approvals of the proposed merger may not be obtained on the expected terms and schedule; changes in economic conditions; movements in interest rates; competitive pressures on product pricing and services; success and timing of other business strategies; the nature, extent, and timing of governmental actions and reforms; extended disruption of vital infrastructure; and other factors described in WesBanco’s 2023 Annual Report on Form 10-K, Premier’s 2023 Annual Report on Form 10-K, and documents subsequently filed by WesBanco and Premier with the Securities and Exchange Commission.

Non-GAAP Financial Measures

In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), WesBanco's management uses, and this presentation contains or references, certain non-GAAP financial measures, such as pre-tax pre-provision income, tangible common equity/tangible assets; net income excluding after-tax restructuring and merger-related expenses; efficiency ratio; return on average assets; and return on average tangible equity. WesBanco believes these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although WesBanco believes that these non-GAAP financial measures enhance investors' understanding of WesBanco's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the Quarterly Reports on Forms 10-Q for WesBanco and its subsidiaries, as well as other filings that the company has made with the SEC.

Additional Information About the Merger and Where to Find It

In connection with the proposed Merger, the Company filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 which includes a joint proxy statement of Premier Financial and the Company and a prospectus of the Company with respect to shares of the Company’s common stock to be issued in the proposed transaction, as well as other relevant documents concerning the proposed transaction. The Form S-4 was declared effective on October 28, 2024, and Wesbanco and Premier Financial commenced mailing to their respective shareholders on or about November 1, 2024 in connection with their respective special meetings of shareholders, which were held on December 11, 2024, at which the shareholders of both companies approved all matters related to the proposed transaction that were submitted for a vote. This communication is not a substitute for the Registration Statement on Form S-4, the joint proxy statement/Prospectus or any other document that the Company and/or Premier Financial may file with the SEC in connection with the proposed transaction. SHAREHOLDERS OF THE COMPANY, SHAREHOLDERS OF PREMIER FINANCIAL AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. The Registration Statement on Form S-4, which includes the joint proxy statements/prospectus, and other related documents filed by the Company or Premier with the SEC, may be obtained for free at the SEC’s website at www.sec.gov, and from either the Company’s or Premier Financial’s website at www.wesbanco.com or www.premierfincorp.com, respectively.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About WesBanco, Inc.

With over 150 years as a community-focused, regional financial services partner, WesBanco Inc. (NASDAQ: WSBC) and its subsidiaries build lasting prosperity through relationships and solutions that empower our customers for success in their financial journeys. Customers across our eight-state footprint choose WesBanco for the comprehensive range and personalized delivery of our retail and commercial banking solutions, as well as trust, brokerage, wealth management and insurance services, all designed to advance their financial goals. Through the strength of our teams, we leverage large bank capabilities and local focus to help make every community we serve a better place for people and businesses to thrive. Headquartered in Wheeling, West Virginia, WesBanco has $18.7 billion in total assets, with our Trust and Investment

Services holding $6.0 billion of assets under management and securities account values (including annuities) of $1.9 billion through our broker/dealer, as of December 31, 2024. Learn more at www.wesbanco.com and follow @WesBanco on Facebook, LinkedIn and Instagram.

SOURCE: WesBanco, Inc.

WesBanco Company Contact:

John H. Iannone

Senior Vice President, Investor Relations

304-905-7021

###

| | | | | | | | | | | | | | | | | | | | | | | | | |

WESBANCO, INC. | |

Consolidated Selected Financial Highlights | |

(unaudited, dollars in thousands, except shares and per share amounts) | |

| | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended | | | For the Twelve Months Ended | |

| STATEMENT OF INCOME | | December 31, | | | December 31, | |

| | | 2024 | | | 2023 | | | % Change | | | 2024 | | | 2023 | | | % Change | |

| Interest and dividend income | | | | | | | | | | | | | | | | | | |

| Loans, including fees | | $ | 183,251 | | | $ | 162,498 | | | | 12.8 | | | $ | 709,802 | | | $ | 596,852 | | | | 18.9 | |

| Interest and dividends on securities: | | | | | | | | | | | | | | | | | | |

| Taxable | | | 18,575 | | | | 17,798 | | | | 4.4 | | | | 70,559 | | | | 73,449 | | | | (3.9 | ) |

| Tax-exempt | | | 4,449 | | | | 4,639 | | | | (4.1 | ) | | | 18,089 | | | | 18,830 | | | | (3.9 | ) |

| Total interest and dividends on securities | | | 23,024 | | | | 22,437 | | | | 2.6 | | | | 88,648 | | | | 92,279 | | | | (3.9 | ) |

| Other interest income | | | 7,310 | | | | 6,383 | | | | 14.5 | | | | 27,191 | | | | 22,385 | | | | 21.5 | |

| Total interest and dividend income | | | 213,585 | | | | 191,318 | | | | 11.6 | | | | 825,641 | | | | 711,516 | | | | 16.0 | |

| Interest expense | | | | | | | | | | | | | | | | | | |

| Interest bearing demand deposits | | | 27,044 | | | | 23,686 | | | | 14.2 | | | | 107,700 | | | | 72,866 | | | | 47.8 | |

| Money market deposits | | | 18,734 | | | | 14,302 | | | | 31.0 | | | | 72,899 | | | | 36,616 | | | | 99.1 | |

| Savings deposits | | | 7,271 | | | | 7,310 | | | | (0.5 | ) | | | 31,066 | | | | 23,869 | | | | 30.2 | |

| Certificates of deposit | | | 16,723 | | | | 8,380 | | | | 99.6 | | | | 53,236 | | | | 18,472 | | | | 188.2 | |

| Total interest expense on deposits | | | 69,772 | | | | 53,678 | | | | 30.0 | | | | 264,901 | | | | 151,823 | | | | 74.5 | |

| Federal Home Loan Bank borrowings | | | 12,114 | | | | 14,841 | | | | (18.4 | ) | | | 62,489 | | | | 59,318 | | | | 5.3 | |

| Other short-term borrowings | | | 1,291 | | | | 891 | | | | 44.9 | | | | 3,953 | | | | 2,545 | | | | 55.3 | |

| Subordinated debt and junior subordinated debt | | | 3,902 | | | | 4,150 | | | | (6.0 | ) | | | 16,090 | | | | 16,492 | | | | (2.4 | ) |

| Total interest expense | | | 87,079 | | | | 73,560 | | | | 18.4 | | | | 347,433 | | | | 230,178 | | | | 50.9 | |

| Net interest income | | | 126,506 | | | | 117,758 | | | | 7.4 | | | | 478,208 | | | | 481,338 | | | | (0.7 | ) |

| Provision for credit losses | | | (147 | ) | | | 4,803 | | | | (103.1 | ) | | | 19,206 | | | | 17,734 | | | | 8.3 | |

| Net interest income after provision for credit losses | | | 126,653 | | | | 112,955 | | | | 12.1 | | | | 459,002 | | | | 463,604 | | | | (1.0 | ) |

| Non-interest income | | | | | | | | | | | | | | | | | | |

| Trust fees | | | 7,775 | | | | 7,019 | | | | 10.8 | | | | 30,676 | | | | 28,135 | | | | 9.0 | |

| Service charges on deposits | | | 8,138 | | | | 6,989 | | | | 16.4 | | | | 29,979 | | | | 26,116 | | | | 14.8 | |

| Digital banking income | | | 5,125 | | | | 4,890 | | | | 4.8 | | | | 19,953 | | | | 19,454 | | | | 2.6 | |

| Net swap fee and valuation income / (loss) | | | 3,230 | | | | (345 | ) | | NM | | | | 5,941 | | | | 6,912 | | | | (14.0 | ) |

| Net securities brokerage revenue | | | 2,430 | | | | 2,563 | | | | (5.2 | ) | | | 10,238 | | | | 10,055 | | | | 1.8 | |

| Bank-owned life insurance | | | 2,512 | | | | 3,455 | | | | (27.3 | ) | | | 9,544 | | | | 11,002 | | | | (13.3 | ) |

| Mortgage banking income | | | 1,229 | | | | 650 | | | | 89.1 | | | | 4,270 | | | | 2,652 | | | | 61.0 | |

| Net securities gains | | | 61 | | | | 887 | | | | (93.1 | ) | | | 1,408 | | | | 900 | | | | 56.4 | |

| Net gains on other real estate owned and other assets | | | 193 | | | | 445 | | | | (56.6 | ) | | | 142 | | | | 1,520 | | | | (90.7 | ) |

| Other income | | | 5,695 | | | | 3,521 | | | | 61.7 | | | | 15,832 | | | | 13,701 | | | | 15.6 | |

| Total non-interest income | | | 36,388 | | | | 30,074 | | | | 21.0 | | | | 127,983 | | | | 120,447 | | | | 6.3 | |

| Non-interest expense | | | | | | | | | | | | | | | | | | |

| Salaries and wages | | | 45,638 | | | | 45,164 | | | | 1.0 | | | | 177,516 | | | | 176,938 | | | | 0.3 | |

| Employee benefits | | | 11,856 | | | | 11,409 | | | | 3.9 | | | | 46,141 | | | | 46,901 | | | | (1.6 | ) |

| Net occupancy | | | 5,999 | | | | 6,417 | | | | (6.5 | ) | | | 25,157 | | | | 25,338 | | | | (0.7 | ) |

| Equipment and software | | | 10,681 | | | | 9,648 | | | | 10.7 | | | | 41,303 | | | | 36,666 | | | | 12.6 | |

| Marketing | | | 2,531 | | | | 2,975 | | | | (14.9 | ) | | | 9,764 | | | | 11,178 | | | | (12.6 | ) |

| FDIC insurance | | | 3,640 | | | | 3,369 | | | | 8.0 | | | | 14,215 | | | | 12,249 | | | | 16.1 | |

| Amortization of intangible assets | | | 2,034 | | | | 2,243 | | | | (9.3 | ) | | | 8,251 | | | | 9,088 | | | | (9.2 | ) |

| Restructuring and merger-related expense | | | 646 | | | | - | | | | 100.0 | | | | 6,400 | | | | 3,830 | | | | 67.1 | |

| Other operating expenses | | | 18,079 | | | | 18,278 | | | | (1.1 | ) | | | 73,124 | | | | 67,814 | | | | 7.8 | |

| Total non-interest expense | | | 101,104 | | | | 99,503 | | | | 1.6 | | | | 401,871 | | | | 390,002 | | | | 3.0 | |

| Income before provision for income taxes | | | 61,937 | | | | 43,526 | | | | 42.3 | | | | 185,114 | | | | 194,049 | | | | (4.6 | ) |

| Provision for income taxes | | | 12,308 | | | | 8,558 | | | | 43.8 | | | | 33,604 | | | | 35,017 | | | | (4.0 | ) |

| Net Income | | | 49,629 | | | | 34,968 | | | | 41.9 | | | | 151,510 | | | | 159,032 | | | | (4.7 | ) |

| Preferred stock dividends | | | 2,531 | | | | 2,531 | | | | - | | | | 10,125 | | | | 10,125 | | | | - | |

| Net income available to common shareholders | | $ | 47,098 | | | $ | 32,437 | | | | 45.2 | | | $ | 141,385 | | | $ | 148,907 | | | | (5.1 | ) |

| | | | | | | | | | | | | | | | | | | |

| Taxable equivalent net interest income | | $ | 127,689 | | | $ | 118,991 | | | | 7.3 | | | $ | 483,016 | | | $ | 486,343 | | | | (0.7 | ) |

| | | | | | | | | | | | | | | | | | | |

| Per common share data | | | | | | | | | | | | | | | | | | |

| Net income per common share - basic | | $ | 0.70 | | | $ | 0.55 | | | | 27.3 | | | $ | 2.26 | | | $ | 2.51 | | | | (10.0 | ) |

| Net income per common share - diluted | | | 0.70 | | | | 0.55 | | | | 27.3 | | | | 2.26 | | | | 2.51 | | | | (10.0 | ) |

| Net income per common share - diluted, excluding certain items (1)(2) | | | 0.71 | | | | 0.55 | | | | 29.1 | | | | 2.34 | | | | 2.56 | | | | (8.6 | ) |

| Dividends declared | | | 0.37 | | | | 0.36 | | | | 2.8 | | | | 1.45 | | | | 1.41 | | | | 2.8 | |

| Book value (period end) | | | 39.54 | | | | 40.23 | | | | (1.7 | ) | | | 39.54 | | | | 40.23 | | | | (1.7 | ) |

| Tangible book value (period end) (1) | | | 22.83 | | | | 21.28 | | | | 7.3 | | | | 22.83 | | | | 21.28 | | | | 7.3 | |

| Average common shares outstanding - basic | | | 66,895,834 | | | | 59,370,171 | | | | 12.7 | | | | 62,589,406 | | | | 59,303,210 | | | | 5.5 | |

| Average common shares outstanding - diluted | | | 66,992,009 | | | | 59,479,031 | | | | 12.6 | | | | 62,653,557 | | | | 59,427,989 | | | | 5.4 | |

| Period end common shares outstanding | | | 66,919,805 | | | | 59,376,435 | | | | 12.7 | | | | 66,919,805 | | | | 59,376,435 | | | | 12.7 | |

| Period end preferred shares outstanding | | | 150,000 | | | | 150,000 | | | | - | | | | 150,000 | | | | 150,000 | | | | - | |

| | | | | | | | | | | | | | | | | | | |

| (1) See non-GAAP financial measures for additional information relating to the calculation of this item. | | | | | | | | | | | | | |

| (2) Certain items excluded from the calculation consist of after-tax restructuring and merger-related expenses. | | | | | | | |

| NM - Not Meaningful | | | | | | | |

| | | | | | | | | | | | | |

WESBANCO, INC. |

Consolidated Selected Financial Highlights |

(unaudited, dollars in thousands, unless otherwise noted) |

| | | | | | | | | | |

| Selected ratios | | | | | | | | | |

| | For the Twelve Months Ended | | |

| | December 31, | | |

| | 2024 | | | 2023 | | | % Change | | |

| Return on average assets | | 0.78 | | % | | 0.86 | | % | | (9.30 | ) | % |

| Return on average assets, excluding after-tax restructuring and merger-related expenses (1) | | 0.81 | | | | 0.88 | | | | (7.95 | ) | |

| Return on average equity | | 5.33 | | | | 6.02 | | | | (11.46 | ) | |

| Return on average equity, excluding after-tax restructuring and merger-related expenses (1) | | 5.52 | | | | 6.14 | | | | (10.10 | ) | |

| Return on average tangible equity (1) | | 9.66 | | | | 11.59 | | | | (16.65 | ) | |

| Return on average tangible equity, excluding after-tax restructuring and merger-related expenses (1) | | 9.99 | | | | 11.82 | | | | (15.48 | ) | |

| Return on average tangible common equity (1) | | 10.66 | | | | 12.99 | | | | (17.94 | ) | |

| Return on average tangible common equity, excluding after-tax restructuring and merger-related expenses (1) | | 11.03 | | | | 13.24 | | | | (16.69 | ) | |

| Yield on earning assets (2) | | 5.10 | | | | 4.63 | | | | 10.15 | | |

| Cost of interest bearing liabilities | | 3.07 | | | | 2.25 | | | | 36.44 | | |

| Net interest spread (2) | | 2.03 | | | | 2.38 | | | | (14.71 | ) | |

| Net interest margin (2) | | 2.96 | | | | 3.14 | | | | (5.73 | ) | |

| Efficiency (1) (2) | | 64.73 | | | | 63.64 | | | | 1.71 | | |

| Average loans to average deposits | | 89.48 | | | | 85.71 | | | | 4.40 | | |

| Annualized net loan charge-offs/average loans | | 0.11 | | | | 0.04 | | | | 175.00 | | |

| Effective income tax rate | | 18.15 | | | | 18.05 | | | | 0.55 | | |

| | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | |

| Dec. 31, | | | Sept. 30, | | | June 30, | | | Mar. 31, | | | Dec. 31, | | |

| 2024 | | | 2024 | | | 2024 | | | 2024 | | | 2023 | | |

Return on average assets | | 1.01 | | % | | 0.76 | | % | | 0.59 | | % | | 0.75 | | % | | 0.74 | | % |

Return on average assets, excluding after-tax restructuring and merger-related expenses (1) | | 1.02 | | | | 0.79 | | | | 0.66 | | | | 0.75 | | | | 0.74 | | |

Return on average equity | | 6.68 | | | | 5.09 | | | | 4.17 | | | | 5.24 | | | | 5.21 | | |

Return on average equity, excluding after-tax restructuring and merger-related expenses (1) | | 6.75 | | | | 5.32 | | | | 4.65 | | | | 5.24 | | | | 5.21 | | |

Return on average tangible equity (1) | | 11.49 | | | | 9.07 | | | | 7.93 | | | | 9.85 | | | | 10.11 | | |

Return on average tangible equity, excluding after-tax restructuring and merger-related expenses (1) | | 11.61 | | | | 9.46 | | | | 8.78 | | | | 9.85 | | | | 10.11 | | |

Return on average tangible common equity (1) | | 12.56 | | | | 9.97 | | | | 8.83 | | | | 10.96 | | | | 11.32 | | |

Return on average tangible common equity, excluding after-tax restructuring and merger-related expenses (1) | | 12.69 | | | | 10.40 | | | | 9.77 | | | | 10.96 | | | | 11.32 | | |

Yield on earning assets (2) | | 5.10 | | | | 5.19 | | | | 5.11 | | | | 4.98 | | | | 4.88 | | |

Cost of interest bearing liabilities | | 2.96 | | | | 3.21 | | | | 3.12 | | | | 2.98 | | | | 2.76 | | |

Net interest spread (2) | | 2.14 | | | | 1.98 | | | | 1.99 | | | | 2.00 | | | | 2.12 | | |

Net interest margin (2) | | 3.03 | | | | 2.95 | | | | 2.95 | | | | 2.92 | | | | 3.02 | | |

Efficiency (1) (2) | | 61.23 | | | | 65.29 | | | | 66.11 | | | | 66.65 | | | | 66.75 | | |

Average loans to average deposits | | 89.24 | | | | 90.58 | | | | 89.40 | | | | 88.67 | | | | 87.07 | | |

Annualized net loan charge-offs and recoveries /average loans | | 0.13 | | | | 0.05 | | | | 0.07 | | | | 0.20 | | | | 0.06 | | |

Effective income tax rate | | 19.87 | | | | 16.75 | | | | 17.42 | | | | 17.74 | | | | 19.66 | | |

Trust and Investment Services assets under management (3) | $ | 5,968 | | | $ | 6,061 | | | $ | 5,633 | | | $ | 5,601 | | | $ | 5,360 | | |

Broker-dealer securities account values (including annuities) (3) | $ | 1,852 | | | $ | 1,853 | | | $ | 1,780 | | | $ | 1,751 | | | $ | 1,686 | | |

| | | | | | | | | | | | | | | |

(1) See non-GAAP financial measures for additional information relating to the calculation of this item. |

(2) The yield on earning assets, net interest margin, net interest spread and efficiency ratios are presented on a fully taxable-equivalent (FTE) and annualized basis. The FTE basis adjusts for the tax benefit of income on certain tax-exempt loans and investments. WesBanco believes this measure to be the preferred industry measurement of net interest income and provides a relevant comparison between taxable and non-taxable amounts. |

(3) Represents market value at period end, in millions |

| | | | | | | | | | | | | | | | | | | |

WESBANCO, INC. | |

Consolidated Selected Financial Highlights | |

(unaudited, dollars in thousands, except shares) | |

| | | | | | | | | | | | | % Change | |

| | | December 31, | | | | | September 30, | | September 30, 2024 | |

| Balance sheets | | 2024 | | | 2023 | | | % Change | | 2024 | | to December 31, 2024 | |

| Assets | | | | | | | | | | | | | |

| Cash and due from banks | | $ | 142,271 | | | $ | 158,504 | | | | (10.2 | ) | $ | 172,221 | | | (17.4 | ) |

| Due from banks - interest bearing | | | 425,866 | | | | 436,879 | | | | (2.5 | ) | | 448,676 | | | (5.1 | ) |

| Securities: | | | | | | | | | | | | | |

| Equity securities, at fair value | | | 13,427 | | | | 12,320 | | | | 9.0 | | | 13,355 | | | 0.5 | |

| Available-for-sale debt securities, at fair value | | | 2,246,072 | | | | 2,194,329 | | | | 2.4 | | | 2,228,527 | | | 0.8 | |

| Held-to-maturity debt securities (fair values of $1,006,817, $1,069,159 and $1,052,781 respectively) | | | 1,152,906 | | | | 1,199,527 | | | | (3.9 | ) | | 1,162,359 | | | (0.8 | ) |

| Allowance for credit losses - held-to-maturity debt securities | | | (146 | ) | | | (192 | ) | | | 24.0 | | | (148 | ) | | 1.4 | |

| Net held-to-maturity debt securities | | | 1,152,760 | | | | 1,199,335 | | | | (3.9 | ) | | 1,162,211 | | | (0.8 | ) |

| Total securities | | | 3,412,259 | | | | 3,405,984 | | | | 0.2 | | | 3,404,093 | | | 0.2 | |

| Loans held for sale | | | 18,695 | | | | 16,354 | | | | 14.3 | | | 22,127 | | | (15.5 | ) |

| Portfolio loans: | | | | | | | | | | | | | |

| Commercial real estate | | | 7,326,681 | | | | 6,565,448 | | | | 11.6 | | | 7,206,271 | | | 1.7 | |

| Commercial and industrial | | | 1,787,277 | | | | 1,670,659 | | | | 7.0 | | | 1,717,369 | | | 4.1 | |

| Residential real estate | | | 2,520,086 | | | | 2,438,574 | | | | 3.3 | | | 2,519,089 | | | 0.0 | |

| Home equity | | | 821,110 | | | | 734,219 | | | | 11.8 | | | 796,594 | | | 3.1 | |

| Consumer | | | 201,275 | | | | 229,561 | | | | (12.3 | ) | | 212,107 | | | (5.1 | ) |

| Total portfolio loans, net of unearned income | | | 12,656,429 | | | | 11,638,461 | | | | 8.7 | | | 12,451,430 | | | 1.6 | |

| Allowance for credit losses - loans | | | (138,766 | ) | | | (130,675 | ) | | | (6.2 | ) | | (140,872 | ) | | 1.5 | |

| Net portfolio loans | | | 12,517,663 | | | | 11,507,786 | | | | 8.8 | | | 12,310,558 | | | 1.7 | |

| Premises and equipment, net | | | 219,076 | | | | 233,571 | | | | (6.2 | ) | | 222,005 | | | (1.3 | ) |

| Accrued interest receivable | | | 78,324 | | | | 77,435 | | | | 1.1 | | | 79,465 | | | (1.4 | ) |

| Goodwill and other intangible assets, net | | | 1,124,016 | | | | 1,132,267 | | | | (0.7 | ) | | 1,126,050 | | | (0.2 | ) |

| Bank-owned life insurance | | | 360,738 | | | | 355,033 | | | | 1.6 | | | 358,701 | | | 0.6 | |

| Other assets | | | 385,390 | | | | 388,561 | | | | (0.8 | ) | | 370,273 | | | 4.1 | |

| Total Assets | | $ | 18,684,298 | | | $ | 17,712,374 | | | | 5.5 | | $ | 18,514,169 | | | 0.9 | |

| Liabilities | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | |

| Non-interest bearing demand | | $ | 3,842,758 | | | $ | 3,962,592 | | | | (3.0 | ) | $ | 3,777,781 | | | 1.7 | |

| Interest bearing demand | | | 3,771,314 | | | | 3,463,443 | | | | 8.9 | | | 3,667,082 | | | 2.8 | |

| Money market | | | 2,429,977 | | | | 2,017,713 | | | | 20.4 | | | 2,347,444 | | | 3.5 | |

| Savings deposits | | | 2,362,736 | | | | 2,493,254 | | | | (5.2 | ) | | 2,381,542 | | | (0.8 | ) |

| Certificates of deposit | | | 1,726,932 | | | | 1,231,702 | | | | 40.2 | | | 1,663,494 | | | 3.8 | |

| Total deposits | | | 14,133,717 | | | | 13,168,704 | | | | 7.3 | | | 13,837,343 | | | 2.1 | |

| Federal Home Loan Bank borrowings | | | 1,000,000 | | | | 1,350,000 | | | | (25.9 | ) | | 1,175,000 | | | (14.9 | ) |

| Other short-term borrowings | | | 192,073 | | | | 105,893 | | | | 81.4 | | | 140,641 | | | 36.6 | |

| Subordinated debt and junior subordinated debt | | | 279,308 | | | | 279,078 | | | | 0.1 | | | 279,251 | | | 0.0 | |

| Total borrowings | | | 1,471,381 | | | | 1,734,971 | | | | (15.2 | ) | | 1,594,892 | | | (7.7 | ) |

| Accrued interest payable | | | 14,228 | | | | 11,121 | | | | 27.9 | | | 16,406 | | | (13.3 | ) |

| Other liabilities | | | 274,691 | | | | 264,516 | | | | 3.8 | | | 263,943 | | | 4.1 | |

| Total Liabilities | | | 15,894,017 | | | | 15,179,312 | | | | 4.7 | | | 15,712,584 | | | 1.2 | |

| Shareholders' Equity | | | | | | | | | | | | | |

| Preferred stock, no par value; 1,000,000 shares authorized; 150,000 shares 6.75% non-cumulative perpetual preferred stock, Series A, liquidation preference $150.0 million, issued and outstanding, respectively | | | 144,484 | | | | 144,484 | | | | - | | | 144,484 | | | - | |

| Common stock, $2.0833 par value; 200,000,000, 100,000,000, and 100,000,000 shares authorized; 75,354,034, 68,081,306 and 75,354,034 shares issued; 66,919,805, 59,376,435 and 66,871,479 shares outstanding, respectively | | | 156,985 | | | | 141,834 | | | | 10.7 | | | 156,985 | | | - | |

| Capital surplus | | | 1,809,679 | | | | 1,635,859 | | | | 10.6 | | | 1,808,272 | | | 0.1 | |

| Retained earnings | | | 1,192,091 | | | | 1,142,586 | | | | 4.3 | | | 1,169,808 | | | 1.9 | |

| Treasury stock (8,434,229, 8,704,871 and 8,482,555 shares - at cost, respectively) | | | (292,244 | ) | | | (302,995 | ) | | | 3.5 | | | (294,079 | ) | | 0.6 | |

| Accumulated other comprehensive loss | | | (218,632 | ) | | | (226,693 | ) | | | 3.6 | | | (181,804 | ) | | (20.3 | ) |

| Deferred benefits for directors | | | (2,082 | ) | | | (2,013 | ) | | | (3.4 | ) | | (2,081 | ) | | (0.0 | ) |

| Total Shareholders' Equity | | | 2,790,281 | | | | 2,533,062 | | | | 10.2 | | | 2,801,585 | | | (0.4 | ) |

| Total Liabilities and Shareholders' Equity | | $ | 18,684,298 | | | $ | 17,712,374 | | | | 5.5 | | $ | 18,514,169 | | | 0.9 | |

| | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

WESBANCO, INC. |

Consolidated Selected Financial Highlights |

(unaudited, dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended Dec. 31, | | | | For the Twelve Months Ended Dec. 31, | | |

| | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | | |

| Average balance sheet and net interest margin analysis | | Average | | Average | | | | Average | | Average | | | | Average | | Average | | | | Average | | Average | | |

| | | Balance | | Rate | | | | Balance | | Rate | | | | Balance | | Rate | | | | Balance | | Rate | | |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Due from banks - interest bearing | | $ | 474,933 | | | 5.05 | | % | | $ | 332,670 | | | 6.25 | | % | | $ | 409,900 | | | 5.48 | | % | | $ | 348,109 | | | 5.43 | | % |

| Loans, net of unearned income (1) | | | 12,565,244 | | | 5.80 | | | | | 11,490,379 | | | 5.61 | | | | | 12,185,386 | | | 5.83 | | | | | 11,132,618 | | | 5.36 | | |

| Securities: (2) | | | | | | | | | | | | | | | | | | | | | | | | |

| Taxable | | | 2,924,539 | | | 2.53 | | | | | 3,010,064 | | | 2.35 | | | | | 2,894,993 | | | 2.44 | | | | | 3,150,781 | | | 2.33 | | |

| Tax-exempt (3) | | | 734,929 | | | 3.05 | | | | | 770,186 | | | 3.02 | | | | | 748,304 | | | 3.06 | | | | | 783,697 | | | 3.04 | | |

| Total securities | | | 3,659,468 | | | 2.63 | | | | | 3,780,250 | | | 2.48 | | | | | 3,643,297 | | | 2.57 | | | | | 3,934,478 | | | 2.47 | | |

| Other earning assets | | | 51,208 | | | 9.99 | | % | | | 52,879 | | | 8.57 | | % | | | 57,845 | | | 8.20 | | | | | 55,368 | | | 6.26 | | |

| Total earning assets (3) | | | 16,750,853 | | | 5.10 | | % | | | 15,656,178 | | | 4.88 | | % | | | 16,296,428 | | | 5.10 | | % | | | 15,470,573 | | | 4.63 | | % |

| Other assets | | | 1,842,412 | | | | | | | 1,769,933 | | | | | | | 1,826,197 | | | | | | | 1,789,147 | | | | |

| Total Assets | | $ | 18,593,265 | | | | | | $ | 17,426,111 | | | | | | $ | 18,122,625 | | | | | | $ | 17,259,720 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest bearing demand deposits | | $ | 3,763,465 | | | 2.86 | | % | | $ | 3,417,220 | | | 2.75 | | % | | $ | 3,604,463 | | | 2.99 | | % | | $ | 3,243,786 | | | 2.25 | | % |

| Money market accounts | | | 2,427,005 | | | 3.07 | | | | | 1,985,203 | | | 2.86 | | | | | 2,259,882 | | | 3.23 | | | | | 1,763,921 | | | 2.08 | | |

| Savings deposits | | | 2,365,805 | | | 1.22 | | | | | 2,515,798 | | | 1.15 | | | | | 2,422,859 | | | 1.28 | | | | | 2,655,105 | | | 0.90 | | |

| Certificates of deposit | | | 1,704,878 | | | 3.90 | | | | | 1,191,583 | | | 2.79 | | | | | 1,467,738 | | | 3.63 | | | | | 1,008,950 | | | 1.83 | | |

| Total interest bearing deposits | | | 10,261,153 | | | 2.71 | | | | | 9,109,804 | | | 2.34 | | | | | 9,754,942 | | | 2.72 | | | | | 8,671,762 | | | 1.75 | | |

| Federal Home Loan Bank borrowings | | | 972,283 | | | 4.96 | | | | | 1,080,163 | | | 5.45 | | | | | 1,164,344 | | | 5.37 | | | | | 1,138,247 | | | 5.21 | | |

| Repurchase agreements | | | 179,052 | | | 2.87 | | | | | 114,801 | | | 3.08 | | | | | 125,534 | | | 3.15 | | | | | 115,817 | | | 2.20 | | |

| Subordinated debt and junior subordinated debt | | | 279,277 | | | 5.56 | | | | | 282,004 | | | 5.84 | | | | | 279,189 | | | 5.76 | | | | | 281,788 | | | 5.85 | | |

| Total interest bearing liabilities (4) | | | 11,691,765 | | | 2.96 | | % | | | 10,586,772 | | | 2.76 | | % | | | 11,324,009 | | | 3.07 | | % | | | 10,207,614 | | | 2.25 | | % |

| Non-interest bearing demand deposits | | | 3,819,593 | | | | | | | 4,086,366 | | | | | | | 3,863,366 | | | | | | | 4,316,245 | | | | |

| Other liabilities | | | 275,828 | | | | | | | 284,448 | | | | | | | 282,076 | | | | | | | 261,234 | | | | |

| Shareholders' equity | | | 2,806,079 | | | | | | | 2,468,525 | | | | | | | 2,653,174 | | | | | | | 2,474,627 | | | | |

| Total Liabilities and Shareholders' Equity | | $ | 18,593,265 | | | | | | $ | 17,426,111 | | | | | | $ | 18,122,625 | | | | | | $ | 17,259,720 | | | | |

| Taxable equivalent net interest spread | | | | | 2.14 | | % | | | | | 2.12 | | % | | | | | 2.03 | | % | | | | | 2.38 | | % |

| Taxable equivalent net interest margin | | | | | 3.03 | | % | | | | | 3.02 | | % | | | | | 2.96 | | % | | | | | 3.14 | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) Gross of allowance for credit losses, net of unearned income and includes non-accrual and loans held for sale. Loan fees included in interest income on loans were $1.1 million and $0.7 million for the three months ended December 31, 2024 and 2023, respectively, and were $2.9 million and $2.7 million for the twelve months ended December 31, 2024 and 2023, respectively. Additionally, loan accretion included in interest income on loans acquired from prior acquisitions was $0.8 million and $1.0 million for the twelve months ended December 31, 2024 and 2023, respectively, and $3.1 million and $4.5 million for the twelve months ended December 31, 2024 and 2023, respectively. |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (2) Average yields on available-for-sale securities are calculated based on amortized cost. |

| (3) Taxable equivalent basis is calculated on tax-exempt securities using a rate of 21% for each period presented. |

| (4) Accretion on interest bearing liabilities acquired from prior acquisitions was $0.2 million for the three months ended December 31, 2023 and $0.2 million and $0.5 million for the twelve months ended December 31, 2024 and 2023, respectively. There was no accretion on interest bearing liabilities recorded for the three months ended December 31, 2024. |

| | | | | | | | | | | | | | | | | | | | | |

WESBANCO, INC. | |

Consolidated Selected Financial Highlights | |

(unaudited, dollars in thousands, except shares and per share amounts) | |

| | | | | | | | | | | | | | | | |

| | | Quarter Ended | |

| | | Dec. 31, | | | Sept. 30, | | | June 30, | | | March 31, | | | Dec. 31, | |

| Statement of Income | | 2024 | | | 2024 | | | 2024 | | | 2024 | | | 2023 | |

| Interest and dividend income | | | | | | | | | | | | | | | |

| Loans, including fees | | $ | 183,251 | | | $ | 184,215 | | | $ | 175,361 | | | $ | 166,974 | | | $ | 162,498 | |

| Interest and dividends on securities: | | | | | | | | | | | | | | | |

| Taxable | | | 18,575 | | | | 17,651 | | | | 16,929 | | | | 17,404 | | | | 17,798 | |

| Tax-exempt | | | 4,449 | | | | 4,498 | | | | 4,556 | | | | 4,586 | | | | 4,639 | |

| Total interest and dividends on securities | | | 23,024 | | | | 22,149 | | | | 21,485 | | | | 21,990 | | | | 22,437 | |

| Other interest income | | | 7,310 | | | | 7,365 | | | | 6,147 | | | | 6,369 | | | | 6,383 | |

| Total interest and dividend income | | | 213,585 | | | | 213,729 | | | | 202,993 | | | | 195,333 | | | | 191,318 | |

| Interest expense | | | | | | | | | | | | | | | |

| Interest bearing demand deposits | | | 27,044 | | | | 28,139 | | | | 26,925 | | | | 25,590 | | | | 23,686 | |

| Money market deposits | | | 18,734 | | | | 19,609 | | | | 18,443 | | | | 16,114 | | | | 14,302 | |

| Savings deposits | | | 7,271 | | | | 8,246 | | | | 7,883 | | | | 7,667 | | | | 7,310 | |

| Certificates of deposit | | | 16,723 | | | | 14,284 | | | | 11,982 | | | | 10,247 | | | | 8,380 | |

| Total interest expense on deposits | | | 69,772 | | | | 70,278 | | | | 65,233 | | | | 59,618 | | | | 53,678 | |

| Federal Home Loan Bank borrowings | | | 12,114 | | | | 17,147 | | | | 16,227 | | | | 17,000 | | | | 14,841 | |

| Other short-term borrowings | | | 1,291 | | | | 1,092 | | | | 896 | | | | 674 | | | | 891 | |

| Subordinated debt and junior subordinated debt | | | 3,902 | | | | 4,070 | | | | 4,044 | | | | 4,075 | | | | 4,150 | |

| Total interest expense | | | 87,079 | | | | 92,587 | | | | 86,400 | | | | 81,367 | | | | 73,560 | |

| Net interest income | | | 126,506 | | | | 121,142 | | | | 116,593 | | | | 113,966 | | | | 117,758 | |

| Provision for credit losses | | | (147 | ) | | | 4,798 | | | | 10,541 | | | | 4,014 | | | | 4,803 | |

| Net interest income after provision for credit losses | | | 126,653 | | | | 116,344 | | | | 106,052 | | | | 109,952 | | | | 112,955 | |

| Non-interest income | | | | | | | | | | | | | | | |

| Trust fees | | | 7,775 | | | | 7,517 | | | | 7,303 | | | | 8,082 | | | | 7,019 | |

| Service charges on deposits | | | 8,138 | | | | 7,945 | | | | 7,111 | | | | 6,784 | | | | 6,989 | |

| Digital banking income | | | 5,125 | | | | 5,084 | | | | 5,040 | | | | 4,704 | | | | 4,890 | |

| Net swap fee and valuation income/ (loss) | | | 3,230 | | | | (627 | ) | | | 1,776 | | | | 1,563 | | | | (345 | ) |

| Net securities brokerage revenue | | | 2,430 | | | | 2,659 | | | | 2,601 | | | | 2,548 | | | | 2,563 | |

| Bank-owned life insurance | | | 2,512 | | | | 2,173 | | | | 2,791 | | | | 2,067 | | | | 3,455 | |

| Mortgage banking income | | | 1,229 | | | | 1,280 | | | | 1,069 | | | | 693 | | | | 650 | |

| Net securities gains | | | 61 | | | | 675 | | | | 135 | | | | 537 | | | | 887 | |

| Net gains/(losses) on other real estate owned and other assets | | | 193 | | | | (239 | ) | | | 34 | | | | 154 | | | | 445 | |

| Other income | | | 5,695 | | | | 3,145 | | | | 3,495 | | | | 3,497 | | | | 3,521 | |

| Total non-interest income | | | 36,388 | | | | 29,612 | | | | 31,355 | | | | 30,629 | | | | 30,074 | |

| Non-interest expense | | | | | | | | | | | | | | | |

| Salaries and wages | | | 45,638 | | | | 44,890 | | | | 43,991 | | | | 42,997 | | | | 45,164 | |

| Employee benefits | | | 11,856 | | | | 11,522 | | | | 10,579 | | | | 12,184 | | | | 11,409 | |

| Net occupancy | | | 5,999 | | | | 6,226 | | | | 6,309 | | | | 6,623 | | | | 6,417 | |

| Equipment and software | | | 10,681 | | | | 10,157 | | | | 10,457 | | | | 10,008 | | | | 9,648 | |

| Marketing | | | 2,531 | | | | 2,977 | | | | 2,371 | | | | 1,885 | | | | 2,975 | |

| FDIC insurance | | | 3,640 | | | | 3,604 | | | | 3,523 | | | | 3,448 | | | | 3,369 | |

| Amortization of intangible assets | | | 2,034 | | | | 2,053 | | | | 2,072 | | | | 2,092 | | | | 2,243 | |

| Restructuring and merger-related expense | | | 646 | | | | 1,977 | | | | 3,777 | | | | - | | | | - | |

| Other operating expenses | | | 18,079 | | | | 17,777 | | | | 19,313 | | | | 17,954 | | | | 18,278 | |

| Total non-interest expense | | | 101,104 | | | | 101,183 | | | | 102,392 | | | | 97,191 | | | | 99,503 | |

| Income before provision for income taxes | | | 61,937 | | | | 44,773 | | | | 35,015 | | | | 43,390 | | | | 43,526 | |

| Provision for income taxes | | | 12,308 | | | | 7,501 | | | | 6,099 | | | | 7,697 | | | | 8,558 | |

| Net Income | | | 49,629 | | | | 37,272 | | | | 28,916 | | | | 35,693 | | | | 34,968 | |

| Preferred stock dividends | | | 2,531 | | | | 2,531 | | | | 2,531 | | | | 2,531 | | | | 2,531 | |

| Net income available to common shareholders | | $ | 47,098 | | | $ | 34,741 | | | $ | 26,385 | | | $ | 33,162 | | | $ | 32,437 | |

| | | | | | | | | | | | | | | | |

| Taxable equivalent net interest income | | $ | 127,689 | | | $ | 122,338 | | | $ | 117,804 | | | $ | 115,185 | | | $ | 118,991 | |

| | | | | | | | | | | | | | | | |

| Per common share data | | | | | | | | | | | | | | | |

| Net income per common share - basic | | $ | 0.70 | | | $ | 0.54 | | | $ | 0.44 | | | $ | 0.56 | | | $ | 0.55 | |

| Net income per common share - diluted | | | 0.70 | | | | 0.54 | | | | 0.44 | | | | 0.56 | | | | 0.55 | |

| Net income per common share - diluted, excluding

certain items (1)(2) | | | 0.71 | | | | 0.56 | | | | 0.49 | | | | 0.56 | | | | 0.55 | |

| Dividends declared | | | 0.37 | | | | 0.36 | | | | 0.36 | | | | 0.36 | | | | 0.36 | |

| Book value (period end) | | | 39.54 | | | | 39.73 | | | | 40.28 | | | | 40.30 | | | | 40.23 | |

| Tangible book value (period end) (1) | | | 22.83 | | | | 22.99 | | | | 21.45 | | | | 21.39 | | | | 21.28 | |

| Average common shares outstanding - basic | | | 66,895,834 | | | | 64,488,962 | | | | 59,521,872 | | | | 59,382,758 | | | | 59,370,171 | |

| Average common shares outstanding - diluted | | | 66,992,009 | | | | 64,634,208 | | | | 59,656,429 | | | | 59,523,679 | | | | 59,479,031 | |

| Period end common shares outstanding | | | 66,919,805 | | | | 66,871,479 | | | | 59,579,310 | | | | 59,395,777 | | | | 59,376,435 | |

| Period end preferred shares outstanding | | | 150,000 | | | | 150,000 | | | | 150,000 | | | | 150,000 | | | | 150,000 | |

| Full time equivalent employees | | | 2,262 | | | | 2,277 | | | | 2,370 | | | | 2,331 | | | | 2,368 | |

| | | | | | | | | | | | | | | | |

| (1) See non-GAAP financial measures for additional information relating to the calculation of this item. | |

| (2) Certain items excluded from the calculation consist of after-tax restructuring and merger-related expenses. | |

| | | | | | | | | | | | | | | | | | | | | | |

WESBANCO, INC. |

Consolidated Selected Financial Highlights |

(unaudited, dollars in thousands) |

| | | Quarter Ended | | |

| | | Dec. 31, | | | Sept. 30, | | | June 30, | | | March 31, | | | Dec. 31, | | |

| Asset quality data | | 2024 | | | 2024 | | | 2024 | | | 2024 | | | 2023 | | |

| Non-performing assets: | | | | | | | | | | | | | | | | |

| Total non-performing loans | | $ | 39,752 | | | $ | 30,421 | | | $ | 35,468 | | | $ | 32,919 | | | $ | 26,808 | | |

| Other real estate and repossessed assets | | | 852 | | | | 906 | | | | 1,328 | | | | 1,474 | | | | 1,497 | | |

| Total non-performing assets | | $ | 40,604 | | | $ | 31,327 | | | $ | 36,796 | | | $ | 34,393 | | | $ | 28,305 | | |

| | | | | | | | | | | | | | | | | |

| Past due loans (1): | | | | | | | | | | | | | | | | |

| Loans past due 30-89 days | | $ | 45,926 | | | $ | 33,762 | | | $ | 20,237 | | | $ | 18,515 | | | $ | 22,875 | | |

| Loans past due 90 days or more | | | 13,553 | | | | 20,427 | | | | 9,171 | | | | 5,408 | | | | 9,638 | | |

| Total past due loans | | $ | 59,479 | | | $ | 54,189 | | | $ | 29,408 | | | $ | 23,923 | | | $ | 32,513 | | |

| | | | | | | | | | | | | | | | | |

| Criticized and classified loans (2): | | | | | | | | | | | | | | | | |

| Criticized loans | | $ | 242,000 | | | $ | 200,540 | | | $ | 179,621 | | | $ | 171,536 | | | $ | 183,174 | | |

| Classified loans | | | 112,669 | | | | 93,185 | | | | 83,744 | | | | 101,898 | | | | 75,497 | | |

| Total criticized and classified loans | | $ | 354,669 | | | $ | 293,725 | | | $ | 263,365 | | | $ | 273,434 | | | $ | 258,671 | | |

| | | | | | | | | | | | | | | | | |

| Loans past due 30-89 days / total portfolio loans | | | 0.36 | | % | | 0.27 | | % | | 0.17 | | % | | 0.16 | | % | | 0.20 | | % |

| Loans past due 90 days or more / total portfolio loans | | | 0.11 | | | | 0.16 | | | | 0.07 | | | | 0.05 | | | | 0.08 | | |

| Non-performing loans / total portfolio loans | | | 0.31 | | | | 0.24 | | | | 0.29 | | | | 0.28 | | | | 0.23 | | |

| Non-performing assets/total portfolio loans, other

real estate and repossessed assets | | | 0.32 | | | | 0.25 | | | | 0.30 | | | | 0.29 | | | | 0.24 | | |

| Non-performing assets / total assets | | | 0.22 | | | | 0.17 | | | | 0.20 | | | | 0.19 | | | | 0.16 | | |

| Criticized and classified loans / total portfolio loans | | | 2.80 | | | | 2.36 | | | | 2.15 | | | | 2.30 | | | | 2.22 | | |

| | | | | | | | | | | | | | | | | |

| Allowance for credit losses | | | | | | | | | | | | | | | | |

| Allowance for credit losses - loans | | $ | 138,766 | | | $ | 140,872 | | | $ | 136,509 | | | $ | 129,190 | | | $ | 130,675 | | |

| Allowance for credit losses - loan commitments | | | 6,120 | | | | 8,225 | | | | 9,194 | | | | 8,175 | | | | 8,604 | | |

| Provision for credit losses | | | (147 | ) | | | 4,798 | | | | 10,541 | | | | 4,014 | | | | 4,803 | | |

| Net loan and deposit account overdraft charge-offs and recoveries | | | 4,066 | | | | 1,420 | | | | 2,221 | | | | 5,935 | | | | 1,857 | | |

| Annualized net loan charge-offs and recoveries / average loans | | | 0.13 | | % | | 0.05 | | % | | 0.07 | | % | | 0.20 | | % | | 0.06 | | % |

| Allowance for credit losses - loans / total portfolio loans | | | 1.10 | | % | | 1.13 | | % | | 1.11 | | % | | 1.09 | | % | | 1.12 | | % |

| Allowance for credit losses - loans / non-performing loans | | | 3.49 | | x | | 4.63 | | x | | 3.85 | | x | | 3.92 | | x | | 4.87 | | x |

| Allowance for credit losses - loans / non-performing loans

and loans past due | | | 1.40 | | x | | 1.66 | | x | | 2.10 | | x | | 2.27 | | x | | 2.20 | | x |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Quarter Ended | | |

| | | Dec. 31, | | | Sept. 30, | | | June 30, | | | Mar. 31, | | | Dec. 31, | | |

| | | 2024 | | | 2024 | | | 2024 | | | 2024 | | | 2023 | | |

| Capital ratios | | | | | | | | | | | | | | | | |

| Tier I leverage capital | | | 10.68 | | % | | 10.69 | | % | | 9.72 | | % | | 9.79 | | % | | 9.87 | | % |

| Tier I risk-based capital | | | 13.06 | | | | 12.89 | | | | 11.58 | | | | 11.87 | | | | 12.05 | | |

| Total risk-based capital | | | 15.88 | | | | 15.74 | | | | 14.45 | | | | 14.76 | | | | 14.91 | | |

| Common equity tier 1 capital ratio (CET 1) | | | 12.07 | | | | 11.89 | | | | 10.58 | | | | 10.84 | | | | 10.99 | | |

| Average shareholders' equity to average assets | | | 15.09 | | | | 14.84 | | | | 14.21 | | | | 14.38 | | | | 14.17 | | |

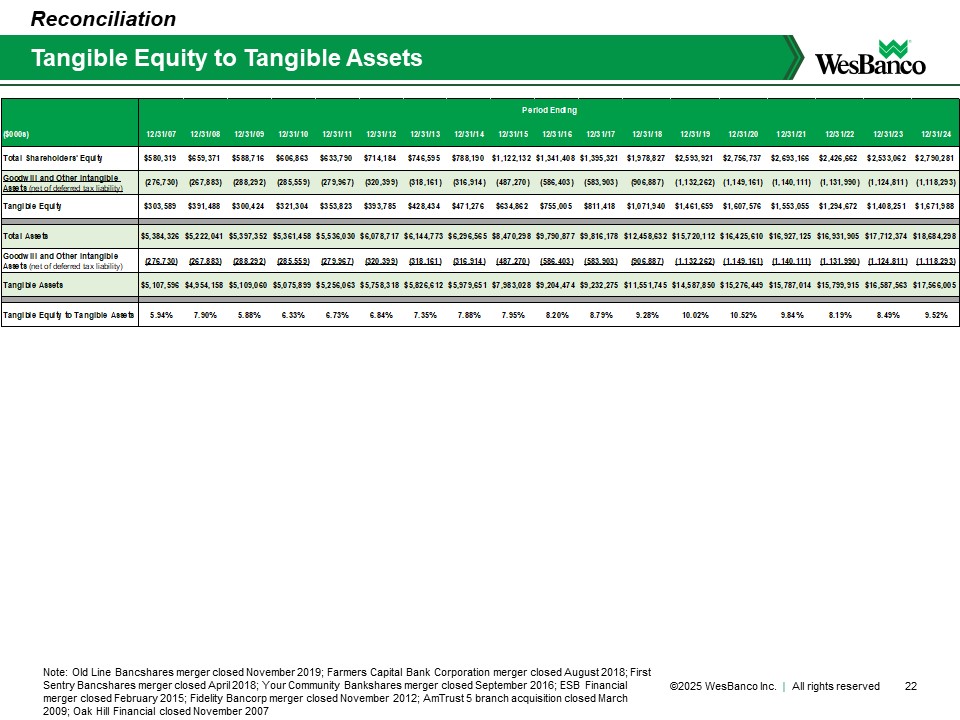

| Tangible equity to tangible assets (3) | | | 9.52 | | | | 9.67 | | | | 8.37 | | | | 8.50 | | | | 8.49 | | |

| Tangible common equity to tangible assets (3) | | | 8.70 | | | | 8.84 | | | | 7.52 | | | | 7.63 | | | | 7.62 | | |

| | | | | | | | | | | | | | | | | |

| (1) Excludes non-performing loans. | | |

| (2) Criticized and classified commercial loans may include loans that are also reported as non-performing or past due. | | |

| (3) See non-GAAP financial measures for additional information relating to the calculation of this ratio. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

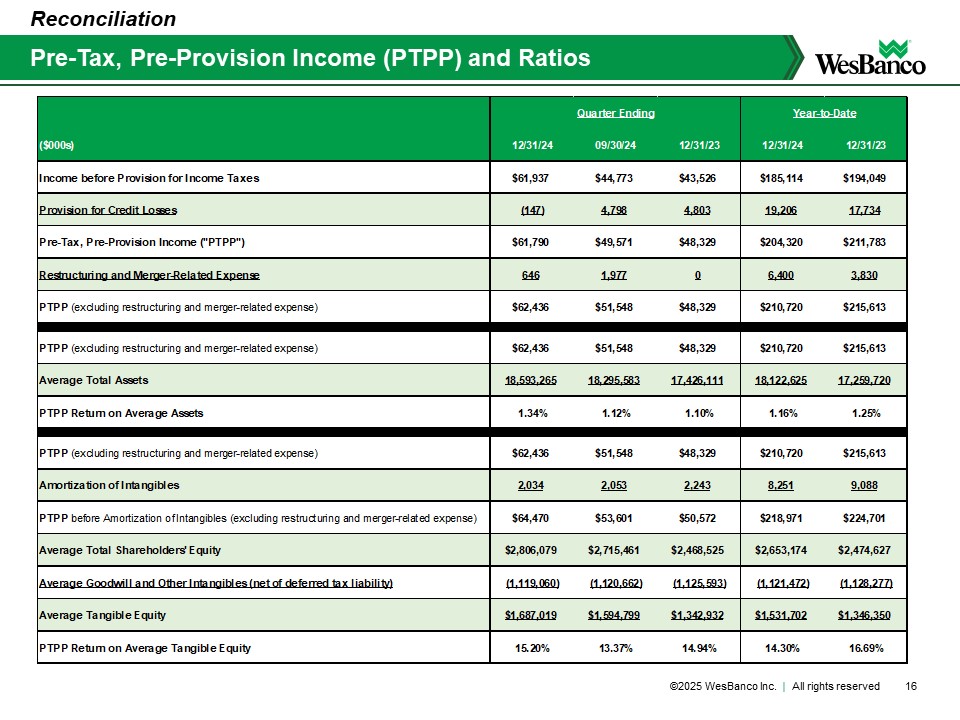

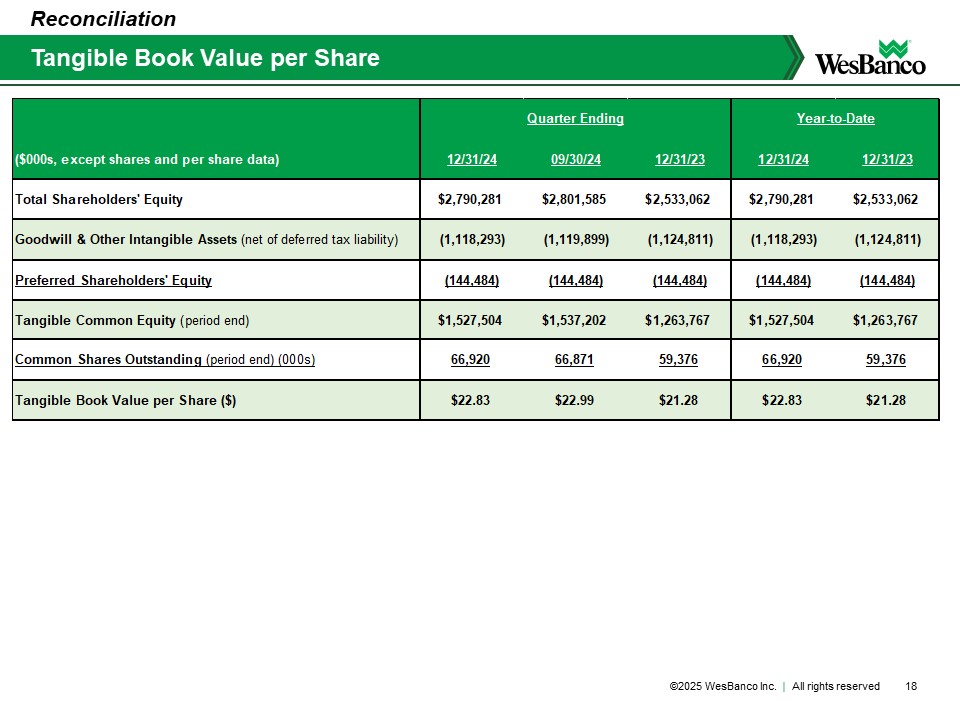

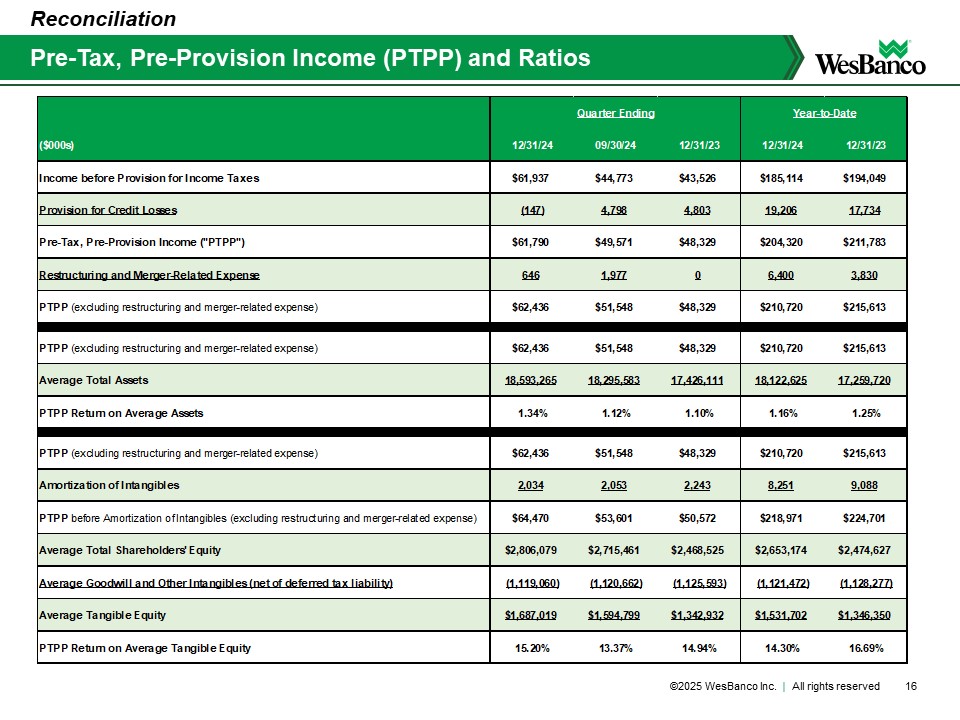

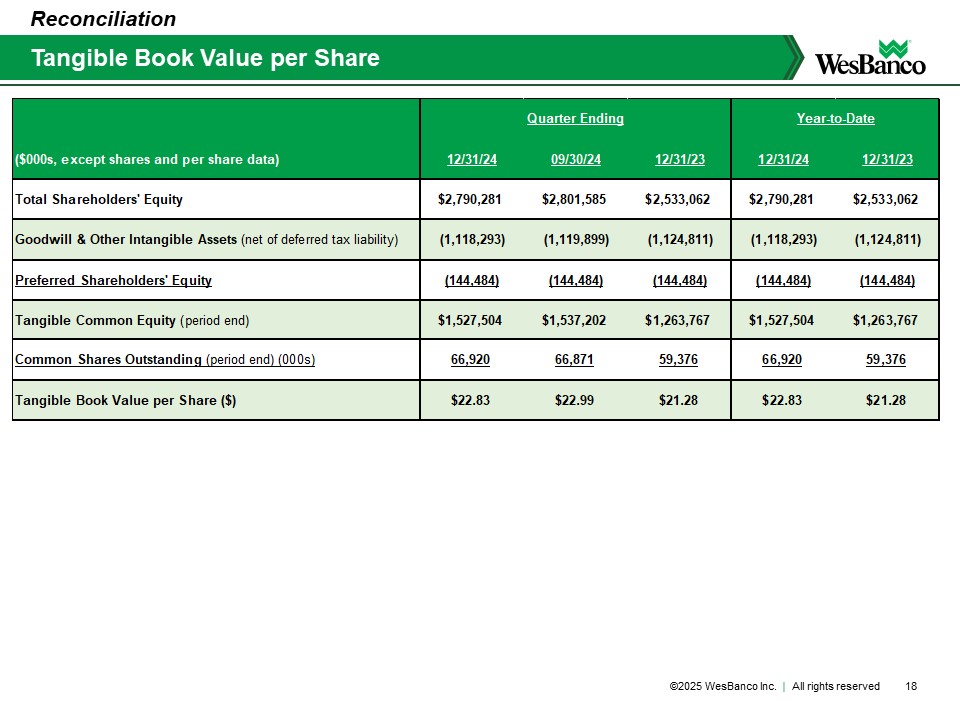

NON-GAAP FINANCIAL MEASURES | |

The following non-GAAP financial measures used by WesBanco provide information useful to investors in understanding WesBanco’s operating performance and trends, and facilitate comparisons with the performance of WesBanco’s peers. The following tables summarize the non-GAAP financial measures derived from amounts reported in WesBanco’s financial statements. | |

| | | | Three Months Ended | | | Year to Date | |

| | | | Dec. 31, | | | Sept. 30, | | | June 30, | | | Mar. 31, | | | Dec. 31, | | | Dec. 31, | |

| | (unaudited, dollars in thousands, except shares and per share amounts) | | 2024 | | | 2024 | | | 2024 | | | 2024 | | | 2023 | | | 2024 | | 2023 | |

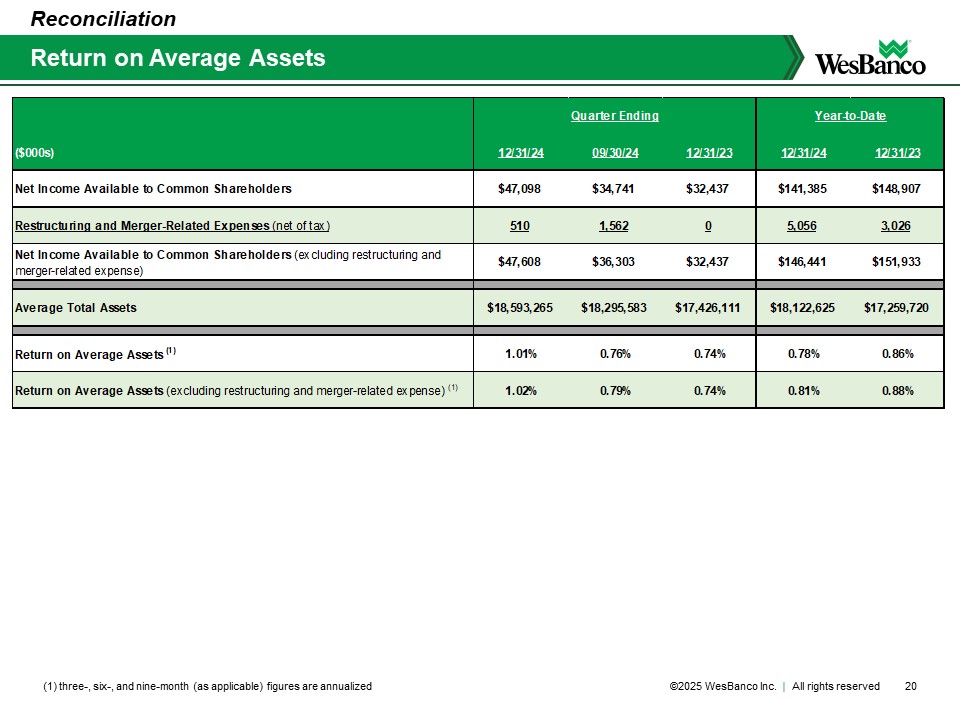

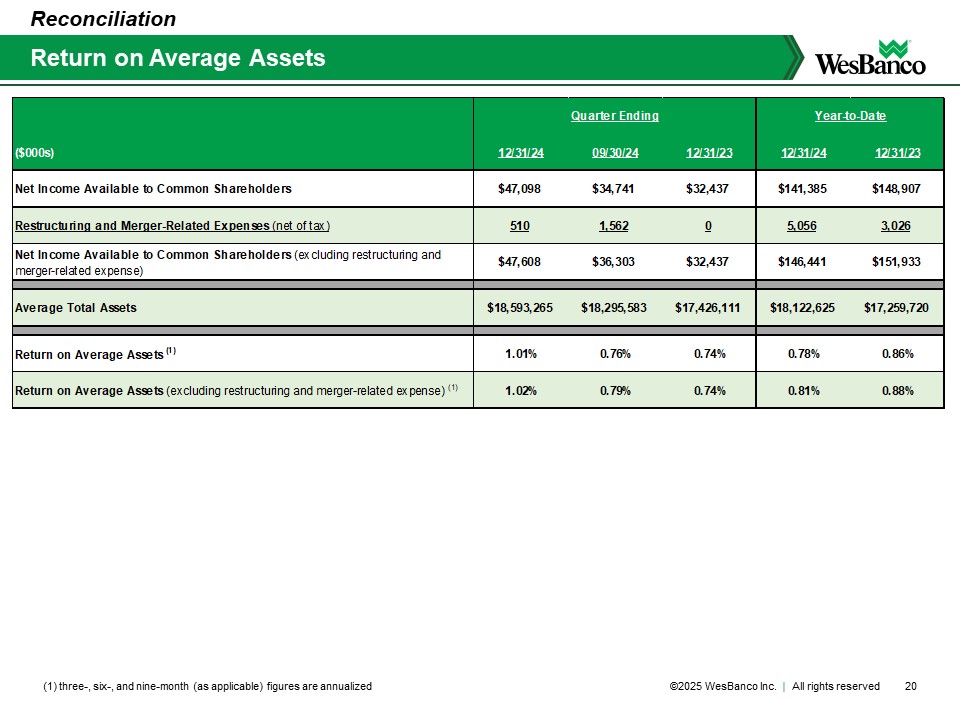

| | Return on average assets, excluding after-tax restructuring and merger-related expenses: | | | | | | | | | | | | | | | | | | | | |

| | Net income available to common shareholders | | $ | 47,098 | | | $ | 34,741 | | | $ | 26,385 | | | $ | 33,162 | | | $ | 32,437 | | | $ | 141,385 | | $ | 148,907 | |

| | Plus: after-tax restructuring and merger-related expenses (1) | | | 510 | | | | 1,562 | | | | 2,984 | | | | - | | | | - | | | | 5,056 | | | 3,026 | |

| | Net income available to common shareholders excluding after-tax restructuring and merger-related expenses | | | 47,608 | | | | 36,303 | | | | 29,369 | | | | 33,162 | | | | 32,437 | | | | 146,441 | | | 151,933 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Average total assets | | $ | 18,593,265 | | | $ | 18,295,583 | | | $ | 17,890,314 | | | $ | 17,704,265 | | | $ | 17,426,111 | | | $ | 18,122,625 | | $ | 17,259,720 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Return on average assets, excluding after-tax restructuring and merger-related expenses (annualized) (2) | | | 1.02 | % | | | 0.79 | % | | | 0.66 | % | | | 0.75 | % | | | 0.74 | % | | | 0.81 | % | | 0.88 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | Return on average equity, excluding after-tax restructuring and merger-related expenses: | | | | | | | | | | | | | | | | | | | | |

| | Net income available to common shareholders | | $ | 47,098 | | | $ | 34,741 | | | $ | 26,385 | | | $ | 33,162 | | | $ | 32,437 | | | $ | 141,385 | | $ | 148,907 | |

| | Plus: after-tax restructuring and merger-related expenses (1) | | | 510 | | | | 1,562 | | | | 2,984 | | | | - | | | | - | | | | 5,056 | | | 3,026 | |

| | Net income available to common shareholders excluding after-tax restructuring and merger-related expenses | | | 47,608 | | | | 36,303 | | | | 29,369 | | | | 33,162 | | | | 32,437 | | | | 146,441 | | | 151,933 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Average total shareholders' equity | | | 2,806,079 | | | | 2,715,461 | | | | 2,542,948 | | | | 2,545,841 | | | | 2,468,525 | | | | 2,653,174 | | | 2,474,627 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Return on average equity, excluding after-tax restructuring and merger-related expenses (annualized) (2) | | | 6.75 | % | | | 5.32 | % | | | 4.65 | % | | | 5.24 | % | | | 5.21 | % | | | 5.52 | % | | 6.14 | % |

| | | | | | | | | | | | | | | | | | | | | | |

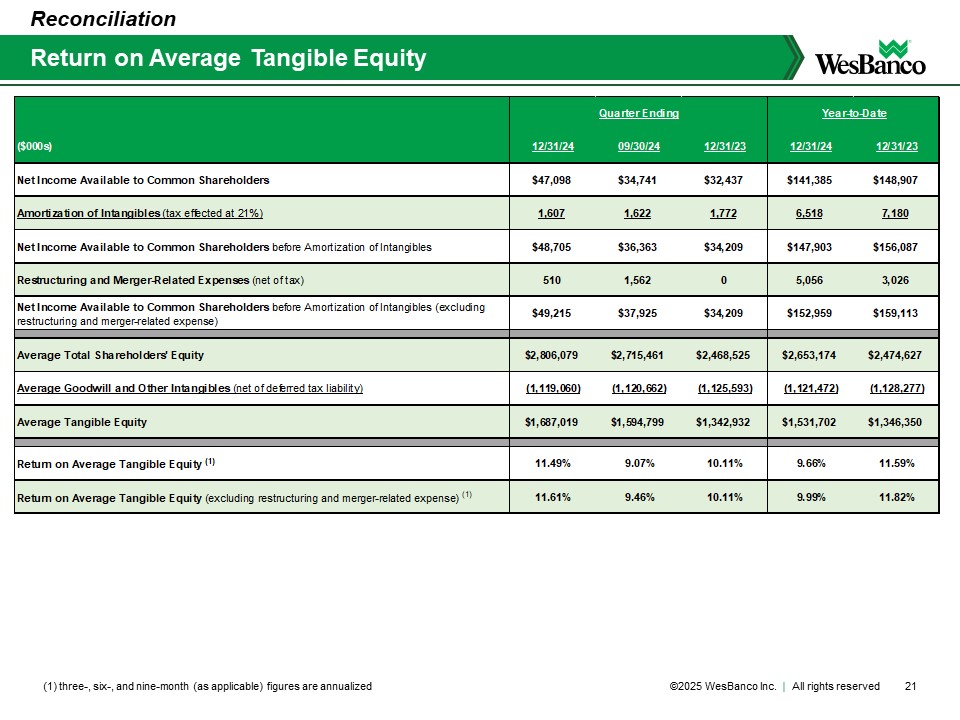

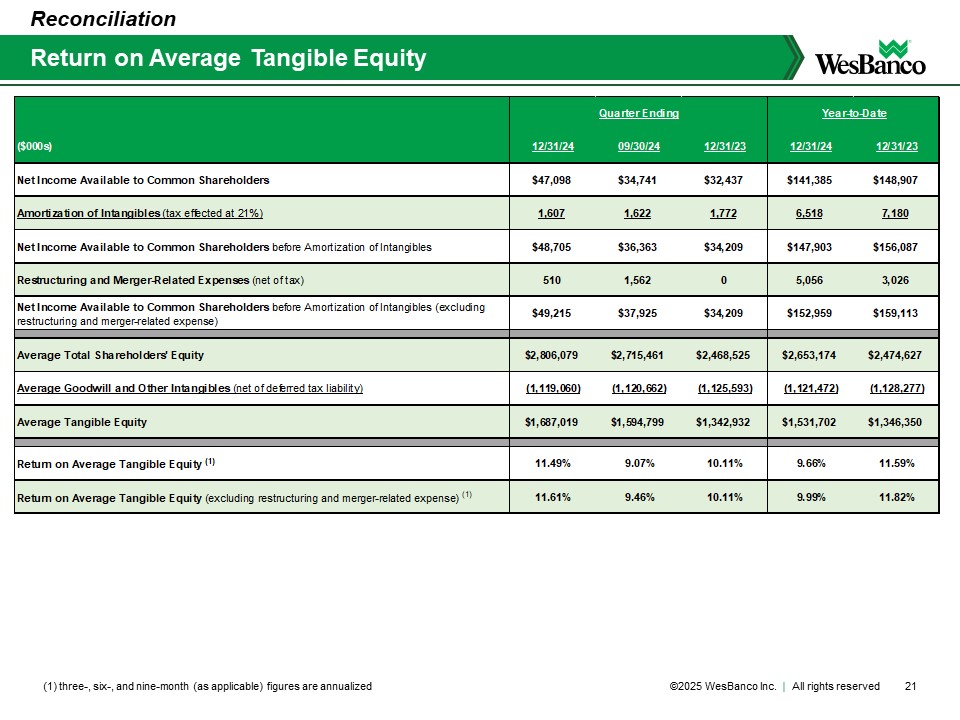

| | Return on average tangible equity: | | | | | | | | | | | | | | | | | | | | |

| | Net income available to common shareholders | | $ | 47,098 | | | $ | 34,741 | | | $ | 26,385 | | | $ | 33,162 | | | $ | 32,437 | | | $ | 141,385 | | $ | 148,907 | |

| | Plus: amortization of intangibles (1) | | | 1,607 | | | | 1,622 | | | | 1,637 | | | | 1,653 | | | | 1,772 | | | | 6,518 | | | 7,180 | |

| | Net income available to common shareholders before amortization of intangibles | | | 48,705 | | | | 36,363 | | | | 28,022 | | | | 34,815 | | | | 34,209 | | | | 147,903 | | | 156,087 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Average total shareholders' equity | | | 2,806,079 | | | | 2,715,461 | | | | 2,542,948 | | | | 2,545,841 | | | | 2,468,525 | | | | 2,653,174 | | | 2,474,627 | |

| | Less: average goodwill and other intangibles, net of def. tax liability | | | (1,119,060 | ) | | | (1,120,662 | ) | | | (1,122,264 | ) | | | (1,123,938 | ) | | | (1,125,593 | ) | | | (1,121,472 | ) | | (1,128,277 | ) |

| | Average tangible equity | | $ | 1,687,019 | | | $ | 1,594,799 | | | $ | 1,420,684 | | | $ | 1,421,903 | | | $ | 1,342,932 | | | $ | 1,531,702 | | $ | 1,346,350 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Return on average tangible equity (annualized) (2) | | | 11.49 | % | | | 9.07 | % | | | 7.93 | % | | | 9.85 | % | | | 10.11 | % | | | 9.66 | % | | 11.59 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | Average tangible common equity | | $ | 1,542,535 | | | $ | 1,450,315 | | | $ | 1,276,200 | | | $ | 1,277,419 | | | $ | 1,198,448 | | | $ | 1,387,218 | | $ | 1,201,866 | |

| | Return on average tangible common equity (annualized) (2) | | | 12.56 | % | | | 9.97 | % | | | 8.83 | % | | | 10.96 | % | | | 11.32 | % | | | 10.66 | % | | 12.99 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | Return on average tangible equity, excluding after-tax restructuring and merger-related expenses: | | | | | | | | | | | | | | | | | | | | |

| | Net income available to common shareholders | | $ | 47,098 | | | $ | 34,741 | | | $ | 26,385 | | | $ | 33,162 | | | $ | 32,437 | | | $ | 141,385 | | $ | 148,907 | |

| | Plus: after-tax restructuring and merger-related expenses (1) | | | 510 | | | | 1,562 | | | | 2,984 | | | | - | | | | - | | | | 5,056 | | | 3,026 | |

| | Plus: amortization of intangibles (1) | | | 1,607 | | | | 1,622 | | | | 1,637 | | | | 1,653 | | | | 1,772 | | | | 6,518 | | | 7,180 | |

| | Net income available to common shareholders before amortization of intangibles and

excluding after-tax restructuring and merger-related expenses | | | 49,215 | | | | 37,925 | | | | 31,006 | | | | 34,815 | | | | 34,209 | | | | 152,959 | | | 159,113 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Average total shareholders' equity | | | 2,806,079 | | | | 2,715,461 | | | | 2,542,948 | | | | 2,545,841 | | | | 2,468,525 | | | | 2,653,174 | | | 2,474,627 | |

| | Less: average goodwill and other intangibles, net of def. tax liability | | | (1,119,060 | ) | | | (1,120,662 | ) | | | (1,122,264 | ) | | | (1,123,938 | ) | | | (1,125,593 | ) | | | (1,121,472 | ) | | (1,128,277 | ) |

| | Average tangible equity | | $ | 1,687,019 | | | $ | 1,594,799 | | | $ | 1,420,684 | | | $ | 1,421,903 | | | $ | 1,342,932 | | | $ | 1,531,702 | | $ | 1,346,350 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Return on average tangible equity, excluding after-tax restructuring and merger-related expenses (annualized) (2) | | | 11.61 | % | | | 9.46 | % | | | 8.78 | % | | | 9.85 | % | | | 10.11 | % | | | 9.99 | % | | 11.82 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | Average tangible common equity | | $ | 1,542,535 | | | $ | 1,450,315 | | | $ | 1,276,200 | | | $ | 1,277,419 | | | $ | 1,198,448 | | | $ | 1,387,218 | | $ | 1,201,866 | |

| | Return on average tangible common equity, excluding after-tax restructuring and merger-related expenses (annualized) (2) | | | 12.69 | % | | | 10.40 | % | | | 9.77 | % | | | 10.96 | % | | | 11.32 | % | | | 11.03 | % | | 13.24 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Year to Date | |

| | Dec. 31, | | | Sept. 30, | | | June 30, | | | Mar. 31, | | | Dec. 31, | | | Dec. 31, | |

(unaudited, dollars in thousands, except shares and per share amounts) | | 2024 | | | 2024 | | | 2024 | | | 2024 | | | 2023 | | | 2024 | | 2023 | |

| | | | | | | | | | | | | | | | | | | | |

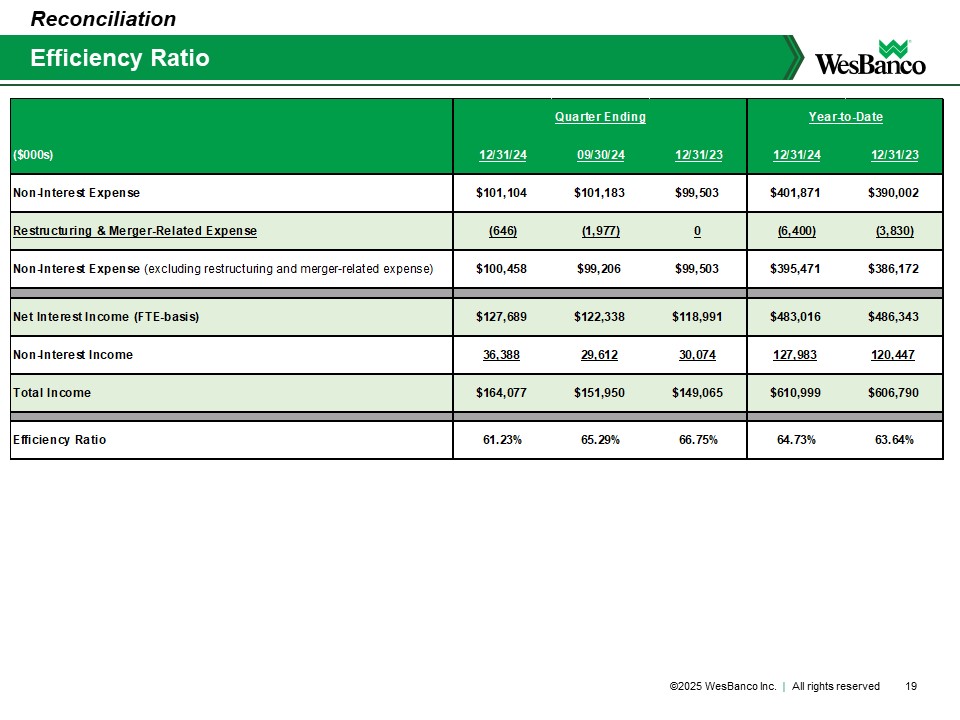

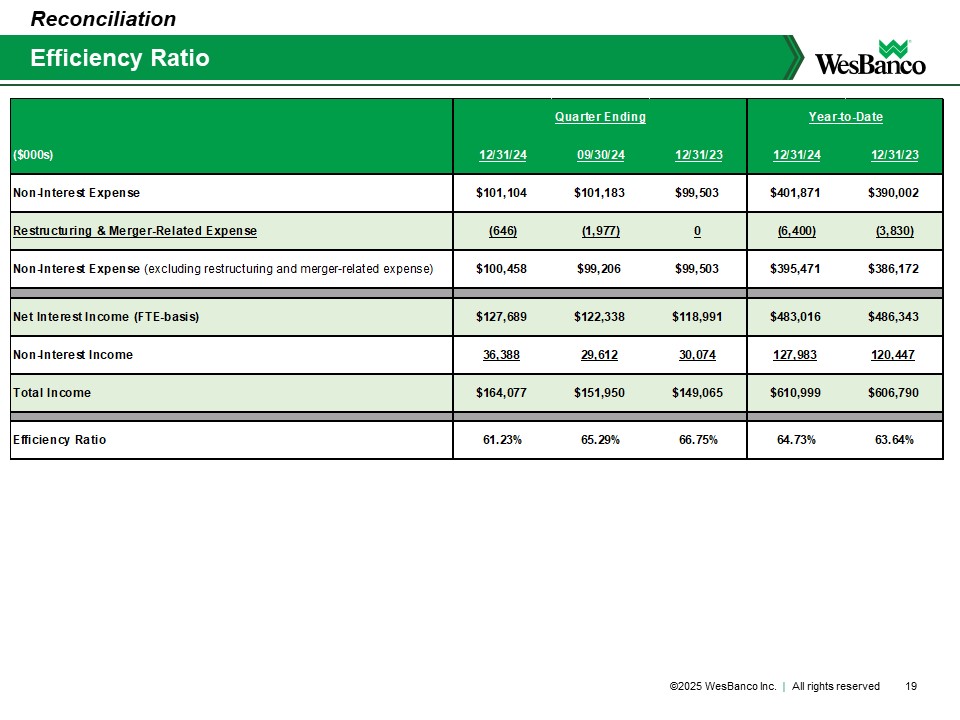

Efficiency ratio: | | | | | | | | | | | | | | | | | | | | |

Non-interest expense | | $ | 101,104 | | | $ | 101,183 | | | $ | 102,392 | | | $ | 97,191 | | | $ | 99,503 | | | $ | 401,871 | | $ | 390,002 | |

Less: restructuring and merger-related expense | | | (646 | ) | | | (1,977 | ) | | | (3,777 | ) | | | - | | | | - | | | | (6,400 | ) | | (3,830 | ) |

Non-interest expense excluding restructuring and merger-related expense | | | 100,458 | | | | 99,206 | | | | 98,615 | | | | 97,191 | | | | 99,503 | | | | 395,471 | | | 386,172 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income on a fully taxable equivalent basis | | | 127,689 | | | | 122,338 | | | | 117,804 | | | | 115,185 | | | | 118,991 | | | | 483,016 | | | 486,343 | |

Non-interest income | | | 36,388 | | | | 29,612 | | | | 31,355 | | | | 30,629 | | | | 30,074 | | | | 127,983 | | | 120,447 | |

Net interest income on a fully taxable equivalent basis plus non-interest income | | $ | 164,077 | | | $ | 151,950 | | | $ | 149,159 | | | $ | 145,814 | | | $ | 149,065 | | | $ | 610,999 | | $ | 606,790 | |

Efficiency Ratio | | | 61.23 | % | | | 65.29 | % | | | 66.11 | % | | | 66.65 | % | | | 66.75 | % | | | 64.73 | % | | 63.64 | % |

| | | | | | | | | | | | | | | | | | | | |

Net income available to common shareholders, excluding after-tax restructuring and merger-related expenses: | | | | | | | | | | | | | | | | | | | | |

Net income available to common shareholders | | $ | 47,098 | | | $ | 34,741 | | | $ | 26,385 | | | $ | 33,162 | | | $ | 32,437 | | | $ | 141,385 | | $ | 148,907 | |

Add: After-tax restructuring and merger-related expenses (1) | | | 510 | | | | 1,562 | | | | 2,984 | | | | - | | | | - | | | | 5,056 | | | 3,026 | |

Net income available to common shareholders, excluding after-tax restructuring and merger-related expenses | | $ | 47,608 | | | $ | 36,303 | | | $ | 29,369 | | | $ | 33,162 | | | $ | 32,437 | | | $ | 146,441 | | $ | 151,933 | |

| | | | | | | | | | | | | | | | | | | | |

Net income per common share - diluted, excluding after-tax restructuring and merger-related expenses: | | | | | | | | | | | | | | | | | | | | |

Net income per common share - diluted | | $ | 0.70 | | | $ | 0.54 | | | $ | 0.44 | | | $ | 0.56 | | | $ | 0.55 | | | $ | 2.26 | | $ | 2.51 | |

Add: After-tax restructuring and merger-related expenses per common share - diluted (1) | | | 0.01 | | | | 0.02 | | | | 0.05 | | | | - | | | | - | | | | 0.08 | | | 0.05 | |

Net income per common share - diluted, excluding after-tax restructuring and merger-related expenses | | $ | 0.71 | | | $ | 0.56 | | | $ | 0.49 | | | $ | 0.56 | | | $ | 0.55 | | | $ | 2.34 | | $ | 2.56 | |

| | | | | | | | | | | | | | | | | | | | |

| | Period End | | | | | | |

| | Dec. 31, | | | Sept. 30, | | | June 30, | | | March 31, | | | Dec. 31, | | | | | | |

| | 2024 | | | 2024 | | | 2024 | | | 2024 | | | 2023 | | | | | | |

Tangible book value per share: | | | | | | | | | | | | | | | | | | | | |