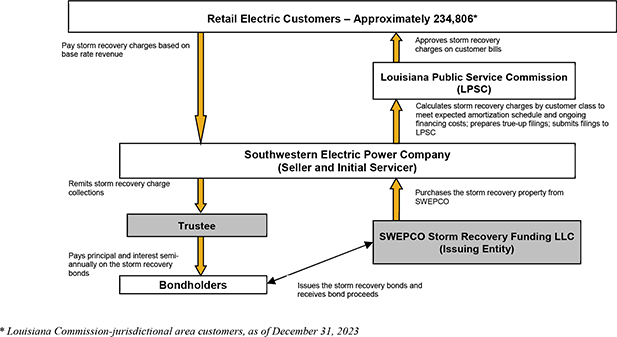

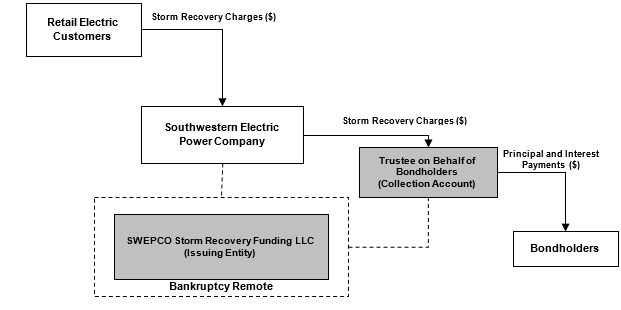

Service Territories. SWEPCO provides integrated electric utility services, including generation, transmission, distribution and sale of electricity, to approximately 234,806 Louisiana Commission-jurisdictional area customers in northwestern and central Louisiana through its retail business. As of December 31, 2023, SWEPCO had 25,500 miles of distribution lines and 4,130 miles of transmission lines. For SWEPCO Louisiana, their portion of the distribution system consisted of 13,500 circuit miles of distribution lines. As of December 31, 2023, SWEPCO owned or partially owned 12 generating plants, consisting of 22 generating units for an aggregate net generating capacity of 5,009 MW. SWEPCO also has additional generation and capacity through power purchase agreements and capacity purchase agreements. During 2023, SWEPCO’s owned generating capacity was 5,009 MW and power purchase agreement capacity was 469 MW. The generating and power purchase agreement capacity by fuel mix was the following: coal and lignite - 32.70%; natural gas - 44.0%; and renewables (wind) - 23.3%.

Executive Offices. SWEPCO’s principal executive offices are located at 1 Riverside Plaza, Columbus, Ohio 43215. The phone number at this address is (614) 716-1000.

Where to Find Information About SWEPCO. Our sponsor and sole member, SWEPCO, together with AEP, a public utility holding company that wholly owns SWEPCO, voluntarily files periodic reports with the SEC. These SEC filings are available to the public over the internet at the SEC’s website at www.sec.gov. AEP maintains a website at https://www.aep.com/, where it posts SWEPCO’s and AEP’s SEC filings. Except as provided in this prospectus, no other information contained on that website constitutes part of this prospectus.

Servicing Experience

The storm recovery bonds are the first issuance of bonds SWEPCO has sponsored that are secured by storm recovery property created under the Securitization Act; however, AEP through its other subsidiaries has prior experience as servicer in the issuance of bonds similar to the storm recovery bonds, including the issuance of the following:

(i) $696,920,000 aggregate principal amount of ratepayer-backed bonds by The Oklahoma Development Finance Authority, a public trust and instrumentality of the State of Oklahoma, issued September 7, 2022, for the purpose of allowing Public Service Company of Oklahoma (“PSO”) to recover certain costs it incurred as a result of winter storm Uri, where PSO, a subsidiary of AEP, acted as servicer (the “2022 ODFA-PSO RBB Bonds”);

(ii) $235,282,000 aggregate principal amount of senior secured system restoration bonds by AEP Texas Restoration Funding LLC, a wholly owned special purpose subsidiary of AEP Texas Inc. (“AEP Texas”), issued on September 18, 2019, for the purpose of allowing AEP Texas to recover certain distribution-related system restoration costs in its Central Division related to Hurricane Harvey and certain other weather-related events occurring after December 2008 but prior to Hurricane Harvey, where AEP Texas, a subsidiary of AEP, acted as the servicer (the “2019 AEP Texas SRC Bonds”);

(iii) $380,300,000 aggregate principal amount of senior secured consumer rate relief bonds by Appalachian Consumer Rate Relief Funding LLC, a wholly owned special purpose subsidiary of Appalachian Power Company (“APCo”), issued on November 15, 2013, for the purpose of allowing APCo to recover certain uncollected expanded net energy costs and associated financing costs, where APCo, a subsidiary of AEP, acted as the servicer (the “2013 APCo CRR Bonds”);

(iv) $267,408,000 aggregate principal amount of senior secured phase-in recovery bonds by Ohio Phase-In-Recovery Funding LLC, a wholly owned special purpose subsidiary of Ohio Power Company (“OPCo”), issued on August 1, 2013, for the purpose of allowing OPCo to recover certain uncollected previously approved phase-in costs and associated financing costs, where OPCo, a subsidiary of AEP, acted as the servicer (the “2013 OPCo PIR Bonds”); and

(v) $800,000,000 aggregate principal amount of senior secured transition bonds by AEP Texas Central Transition Funding III LLC, a wholly owned special purpose subsidiary of AEP Texas, issued on March 14, 2012, for the purpose of allowing AEP Texas’s Central Division to recover certain costs related to its transition-to-competition in the State of Texas, where AEP Texas, a subsidiary of AEP, acted as the servicer (the “2012 AEP TCC Transition Bonds” and together with the 2022 ODFA-PSO RBB Bonds, the 2019 AEP Texas SRC Bonds, the 2013 APCo CRR Bonds, the 2013 OpCo PIR Bonds, the “prior securitizations”).

52