1. ORGANIZATION AND BASIS OF PRESENTATION

Unless otherwise indicated, defined terms and abbreviations used herein have the meanings set forth in the accompanying Glossary of Terms.

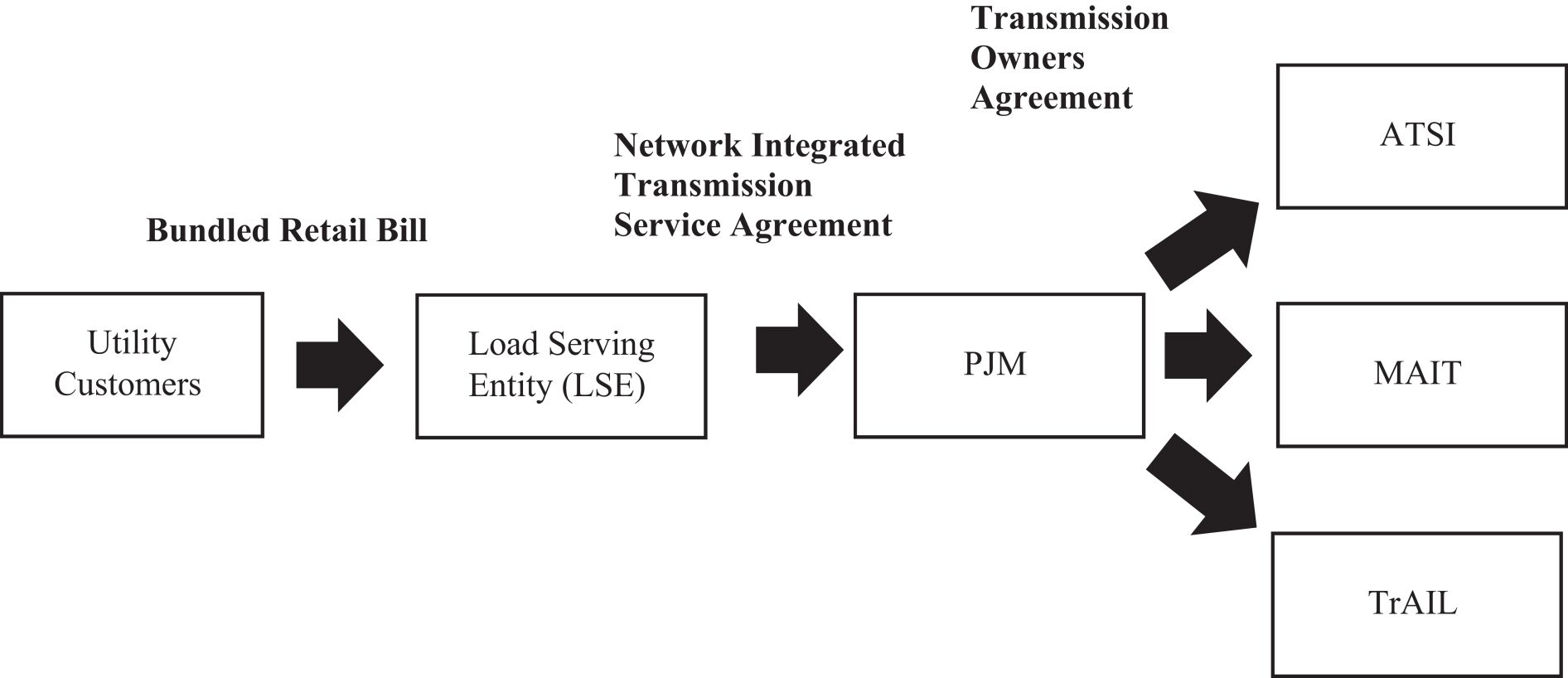

FET, a consolidated VIE of FE, is the parent of ATSI, MAIT, TrAIL and PATH. Through its subsidiaries, FET owns high-voltage transmission facilities in PJM, which consist of approximately 12,500 circuit miles of transmission lines with nominal voltages of 500 kV, 345 kV, 230 kV, 138 kV, 115 kV, 69 kV and 46 kV in Ohio, Pennsylvania, West Virginia, Maryland and Virginia, and has a rate base of $7.3 billion. FET plans, operates, and maintains its transmission system in accordance with NERC reliability standards, and other applicable regulatory requirements. In addition, FET and its subsidiaries comply with the regulations, orders, policies and practices prescribed by FERC and the PUCO, PPUC, WVPSC, MDPSC and VSCC. FET does not have separate reportable segments.

FET and its subsidiaries consolidate all majority-owned subsidiaries over which they exercise control and, when applicable, entities for which they have a controlling financial interest. Intercompany transactions and balances are eliminated in consolidation as appropriate and permitted pursuant to GAAP. FET and its subsidiaries consolidate a VIE (MAIT) when it is determined to be a primary beneficiary. An enterprise has a controlling financial interest if it has both power and economic control, such that an entity has: (i) the power to direct the activities of a VIE that most significantly impact the entity’s economic performance; and (ii) the obligation to absorb losses of the entity that could potentially be significant to the VIE or the right to receive benefits from the entity that could potentially be significant to the VIE.

MAIT, which is organized under Delaware law, is a consolidated VIE of FET. Following receipt of necessary regulatory approvals, on January 31, 2017, MAIT issued membership interests to FET and FE PA predecessors, PN and ME in exchange for their respective cash and transmission asset contributions. As of December 31, 2023, ME’s and PN’s approximate ownership of MAIT was 17% and 25%, respectively. As further discussed below, on January 1, 2024, FE PA, as successor-in-interest to PN and ME, transferred their respective Class B equity interests of MAIT to FE. MAIT owns and operates all of the FERC-jurisdictional transmission assets previously owned by ME and PN.

On November 6, 2021, FirstEnergy, along with FET, entered into the FET P&SA I, with Brookfield and the Brookfield Guarantors, pursuant to which FET agreed to issue and sell to Brookfield at the closing, and Brookfield agreed to purchase from FET, certain newly issued membership interests of FET, such that Brookfield would own 19.9% of the issued and outstanding membership interests of FET, for a purchase price of $2.375 billion. The transaction closed on May 31, 2022. KATCo, which was a subsidiary of FET, became a wholly owned subsidiary of FE prior to the closing of the transaction.

Pursuant to the terms of the FET P&SA I, on May 31, 2022, Brookfield, FET and FE entered into the FET LLC Agreement. The FET LLC Agreement, among other things, provides for the governance, exit, capital and distribution, and other arrangements for FET from and following the closing. Under the FET LLC Agreement, Brookfield is entitled to appoint a number of directors to the FET Board, in approximate proportion to Brookfield’s ownership percentage in FET (rounded to the next whole number). The FET Board now consists of five directors, one appointed by Brookfield and four appointed by FE. The FET LLC Agreement contains certain investor protections, including, among other things, requiring Brookfield’s approval for FET and its subsidiaries to take certain major actions. Under the terms of the FET LLC Agreement, for so long as Brookfield holds a 9.9% interest in FET, Brookfield’s consent is required for FET or any of its subsidiaries to incur indebtedness (other than the refinancing of existing indebtedness on commercially reasonable terms reflecting then-current credit market conditions) that would reasonably be expected to result in FET’s consolidated Debt-to-Capital Ratio (as defined in the FET LLC Agreement) equaling or exceeding (i) prior to the fifth anniversary of the effective date, 65%, and (ii) thereafter, 70%. As discussed below, pursuant to the terms of the FET P&SA II and in connection with the closing thereof, Brookfield, FET and FE will enter into the A&R FET LLC Agreement, which will amend and restate in its entirety the FET LLC Agreement.

F-12