Table of Contents

Filed Pursuant to Rule 424(b)(3)

File No. 333-282554

PROSPECTUS

FirstEnergy Transmission, LLC

Offer to exchange up to

400,000,000 aggregate principal amount of 4.550% Senior Notes due 2030

(CUSIP No. 33767B AG4)

registered under the Securities Act of 1933, as amended (“Securities Act”)

for

$400,000,000 aggregate principal amount of 4.550% Senior Notes due 2030

(CUSIP Nos. 33767B AE9 and U3200V AE0)

that have not been registered under the Securities Act

and

$400,000,000 aggregate principal amount of 5.000% Senior Notes due 2035

(CUSIP No. 33767B AH2)

registered under the Securities Act

for

$400,000,000 aggregate principal amount of 5.000% Senior Notes due 2035

(CUSIP Nos. 33767B AF6 and U3200V AF7)

that have not been registered under the Securities Act

THE EXCHANGE OFFER EXPIRES AT 5:00 P.M., NEW YORK CITY TIME,

ON JANUARY 24, 2025, UNLESS WE EXTEND IT.

Terms of the Exchange Offer

We are offering to exchange all outstanding (i) $400,000,000 aggregate principal amount of our 4.550% Senior Notes due 2030 (the “Outstanding 2030 Notes”) and (ii) $400,000,000 aggregate principal amount of our 5.000% Senior Notes due 2035 (the “Outstanding 2035 Notes” and, together with the Outstanding 2030 Notes, the “Outstanding Notes”) that were issued in a transaction not requiring registration under the Securities Act for an equal amount of new (i) $400,000,000 aggregate principal amount of 4.550% Senior Notes due 2030 (the “New 2030 Notes”) and (ii) $400,000,000 aggregate principal amount of 5.000% Senior Notes due 2035 (the “New 2035 Notes” and, together with the New 2030 Notes, the “New Notes”). We refer to this offer to exchange as the “exchange offer.”

| • | We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered Outstanding Notes for freely tradable New Notes that have been registered under the Securities Act. |

| • | The exchange offer expires at 5:00 p.m., New York City time, on January 24, 2025, unless extended. The exchange offer will remain open for at least 20 full business days calculated in accordance with the requirements of Regulation 14E under the Securities Exchange Act of 1934, as amended, which we |

Table of Contents

refer to as the “Exchange Act” (or longer if required by applicable law, including Regulation 14E), after the date notice of the exchange offer is first sent to holders of the Outstanding Notes. We do not currently intend to extend the expiration date. |

| • | Upon expiration of the exchange offer, all Outstanding Notes that are validly tendered and not withdrawn will be exchanged for an equal principal amount of the applicable series of New Notes. |

| • | You may withdraw tendered Outstanding Notes at any time prior to the expiration or termination of the exchange offer. |

| • | The exchange of Outstanding Notes for New Notes will not be a taxable event for U.S. federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offer. |

| • | The terms of the New Notes to be issued in the exchange offer are substantially the same as the terms of the corresponding series of Outstanding Notes, except that the offer of the New Notes is registered under the Securities Act, and the New Notes have no transfer restrictions, rights to additional interest or registration rights. In addition, the New Notes will bear a different CUSIP number than the Outstanding Notes. |

| • | The exchange offer is not subject to any minimum tender condition but is subject to customary conditions. |

| • | There is no existing public market for the Outstanding Notes or the New Notes. We do not intend to list the New Notes on any securities exchange or quotation system. |

Investing in the New Notes to be issued in the exchange offer involves certain risks. See “Risk Factors” beginning on page 12.

We are not making an offer to exchange Outstanding Notes for New Notes in any jurisdiction where the offer is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the New Notes to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives New Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such New Notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. A broker dealer who acquired Outstanding Notes as a result of market making or other trading activities may use this prospectus, as supplemented or amended from time to time, in connection with any resales of the New Notes. We have agreed that, for a period of up to 180 days after the commencement of the exchange offer, we will make this prospectus available for use in connection with any such resale. See “Plan of Distribution.”

The date of this prospectus is December 23, 2024.

Table of Contents

| ii | ||||

| iv | ||||

| 1 | ||||

| 12 | ||||

| 32 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 33 | |||

| 58 | ||||

| 77 | ||||

| 80 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 81 | |||

| 83 | ||||

| 86 | ||||

| 96 | ||||

| 112 | ||||

| 113 | ||||

| 114 | ||||

| 114 | ||||

| F-1 |

We have not authorized anyone to provide you with any additional information or any information that is different from that contained in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may be used only for the purposes for which it has been published, and no person has been authorized to give any information not contained herein. The information contained in this prospectus is accurate only as of its respective date. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any state where the offer is not permitted.

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We caution you that this prospectus contains forward-looking statements based on information currently available to us. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “could,” “target,” “will,” “intend,” “believe,” “project,” “forecast,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

The forward-looking statements contained herein are qualified in their entirety by reference to the following important factors, which are difficult to predict, contain uncertainties, are in some cases beyond our control and may cause actual results to differ materially from those contained in forward-looking statements:

| • | the risks and uncertainties associated with government investigations and audits regarding House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; |

| • | the risks and uncertainties associated with litigation, arbitration, mediation and similar proceedings, particularly regarding FE’s HB 6 and related matters, including risks associated with obtaining dismissal of the FE derivative shareholder lawsuits; |

| • | the ability to experience growth in our business at ATSI, MAIT and TrAIL (collectively, the “Regulated Transmission Subsidiaries”); |

| • | the accomplishment of our Regulated Transmission Subsidiaries’ regulatory and operational goals in connection with their transmission plan; |

| • | changes in assumptions regarding factors such as economic conditions within our Regulated Transmission Subsidiaries’ territories, assessments of the reliability of our Regulated Transmission Subsidiaries’ transmission systems, or the availability of capital or other resources supporting identified transmission investment opportunities; |

| • | the reliability of the transmission grid; |

| • | the ability of our Regulated Transmission Subsidiaries to accomplish or realize anticipated benefits through establishing a culture of continuous improvement and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing Energize365, FirstEnergy’s transmission and distribution investment plan (“Energize365”), executing on FirstEnergy’s rate filing strategy, controlling costs, improving credit metrics, maintaining investment grade ratings, and growing earnings; |

| • | costs being higher than anticipated and the success of our policies to control costs at our Regulated Transmission Subsidiaries; |

| • | variations in weather conditions and severe weather (including events caused, or exacerbated, by climate change, such as wildfires, hurricanes, flooding, droughts, high wind events and extreme heat events) and other natural disasters affecting future revenues and all associated regulatory events or actions in response to such conditions; |

| • | changes in national and regional economic conditions, including recession, volatile interest rates, inflationary pressure, supply chain disruptions, higher fuel costs and workforce impacts, affecting our Regulated Transmission Subsidiaries and other counterparties with which they do business; |

ii

Table of Contents

| • | the risks associated with physical attacks, such as acts of war, terrorism, sabotage or other acts of violence, cyber-attacks and other disruptions to our information technology system, which may compromise our Regulated Transmission Subsidiaries’ transmission services, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information regarding our business, employees, shareholders, customers, suppliers, business partners and other individuals in our data centers and on our networks; |

| • | our Regulated Transmission Subsidiaries’ ability to comply with applicable federal reliability standards; |

| • | other legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cybersecurity and climate change; |

| • | changes to environmental laws and regulations, including, but not limited to, rules finalized by the United States Environmental Protection Agency (the “EPA”) and the United States Securities and Exchange Commission (the “SEC”) related to climate change, and potential changes to such laws as a result of a new presential administration in the United States following the 2024 U.S. presidential election; |

| • | changes in our Regulated Transmission Subsidiaries’ customers’ demand for power, including, but not limited to, economic conditions, the impact of climate change, emerging technology, particularly with respect to data centers, electrification, energy storage and distributed sources of generation; |

| • | the impact of changes to significant accounting policies; |

| • | the impact of any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022 (the “IRA of 2022”), or adverse tax audit results or rulings; |

| • | the ability to access the public securities and other capital and credit markets in accordance with our announced financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us and our Regulated Transmission Subsidiaries, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; |

| • | future actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; |

| • | issues concerning the stability of domestic and foreign financial institutions and counterparties with which we do business; |

| • | our dependence on FE and its affiliates, including FESC, for employees and key personnel; |

| • | the risks and other factors discussed in this prospectus and in our financial statements and other similar factors; and |

| • | any other statements that relate to non-historical or future information. |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus and should be read in conjunction with the risk factors and other disclosures contained in this prospectus. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors or assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. We expressly disclaim any obligation to update or revise, except as required by law, any forward-looking statements contained herein as a result of new information, future events or otherwise.

iii

Table of Contents

The following abbreviations and acronyms are used to identify frequently used terms in this prospectus:

| 2021 Credit Facilities | Collectively, the two separate senior unsecured five-year syndicated revolving credit facilities entered into by FE, FET, ATSI, MAIT and TrAIL, on October 18, 2021, as amended through October 20, 2023 | |

| 2023 Credit Facilities | Collectively, the FET Revolving Facility and the ATSI, MAIT and TrAIL revolving facilities as amended through October 20, 2023 | |

| A&R FET LLC Agreement | Fourth Amended and Restated Limited Liability Company Operating Agreement of FET | |

| AEP | American Electric Power Company, Inc. | |

| AFUDC | Allowance for Funds Used During Construction | |

| ARO | Asset Retirement Obligation | |

| ASC | Accounting Standards Codification | |

| ASIC | Australian Securities and Investments Commission | |

| ASX | ASX Limited | |

| ATSI | American Transmission Systems, Incorporated, a transmission subsidiary of FET | |

| Brookfield | North American Transmission Company II L.P., a Delaware limited partnership and a controlled investment vehicle entity of Brookfield Super-Core Infrastructure Partners | |

| CEI | The Cleveland Electric Illuminating Company, an Ohio electric power company subsidiary of FE | |

| CWIP | Construction work in progress | |

| D.C. Circuit | United States Court of Appeals for the District of Columbia Circuit | |

| Distribution Segment | FirstEnergy reportable segment consisting of the Ohio Companies and FE PA | |

| DPA | Deferred Prosecution Agreement entered into on July 21, 2021 between FE and the U.S. Attorney’s Office for the Southern District of Ohio | |

| DTC | The Depository Trust Company | |

| DTCC | The Depository Trust & Clearing Corporation, the holding company for DTC, National Securities Clearing Corporation and Fixed Income Clearing Corporation | |

| EEA | European Economic Area | |

| EEI | The Edison Electric Institute | |

| EESG | Employee, Environmental, Social and Corporate Governance | |

| EH | Energy Harbor Corp | |

| Electric Companies | OE, CEI, TE, FE PA, JCP&L, MP, and PE | |

iv

Table of Contents

| Energize365 | FirstEnergy’s Transmission and Distribution Infrastructure Investment Program | |

| EPA | United States Environmental Protection Agency | |

| EPAct 2005 | 2005 Energy Policy Act | |

| ERO | Electric Reliability Organization | |

| Exchange Act | Securities Exchange Act of 1934, as amended | |

| FASB | Financial Accounting Standards Board | |

| FATCA | Foreign Account Tax Compliance Act | |

| FE | FirstEnergy Corp., a public electric power holding company | |

| FE Board | The Board of Directors of FirstEnergy Corp. | |

| FE PA | FirstEnergy Pennsylvania Electric Company, a Pennsylvania electric power company subsidiary of FirstEnergy Pennsylvania Holding Company LLC, a wholly owned subsidiary of FE | |

| FE Revolving Facility | FE and the Electric Companies’ former five-year syndicated revolving credit facility, as amended, and replaced by the 2021 Credit Facilities on October 18, 2021 | |

| FENOC | Energy Harbor Nuclear Corp. (formerly known as FirstEnergy Nuclear Operating Company), a subsidiary of EH, which operates EH’s nuclear generating facilities | |

| FERC | Federal Energy Regulatory Commission | |

| FES | Energy Harbor LLC (formerly known as FirstEnergy Solutions Corp.), a subsidiary of EH, which provides energy-related products and services | |

| FESC | FirstEnergy Service Company, which provides legal, financial and other corporate support services | |

| FET | FirstEnergy Transmission, LLC, a consolidated VIE of FE, and the parent company of ATSI, MAIT and TrAIL, and having a joint venture in PATH | |

| FET Board | The Board of Directors of FET | |

| FET Equity Interest Sale | Sale of an additional 30% membership interest of FET, such that Brookfield will own 49.9% of FET | |

| FET Revolving Facility | FET’s five-year syndicated revolving credit facility, dated as of October 20, 2023 | |

| FirstEnergy | FirstEnergy Corp., together with its consolidated subsidiaries | |

| Fitch | Fitch Ratings, Inc. | |

| FPA | Federal Power Act | |

| FSMA | Financial Services and Markets Act 2000 | |

| GAAP | Accounting Principles Generally Accepted in the United States of America | |

| GHG | Greenhouse Gas | |

v

Table of Contents

| HB 6 | House Bill 6, as passed by Ohio’s 133rd General Assembly | |

| Integrated Segment | FirstEnergy reportable segment consisting of MP, PE and JCP&L | |

| IRA | Individual Retirement Account | |

| IRA of 2022 | Inflation Reduction Act of 2022 | |

| IRS | Internal Revenue Service | |

| ISO | Independent System Operator | |

| JCP&L | Jersey Central Power & Light Company, a New Jersey electric power company subsidiary of FE | |

| KATCo | Keystone Appalachian Transmission Company, a wholly owned transmission subsidiary of FE | |

| kV | Kilovolt | |

| LOC | Letter of Credit | |

| LSE | Load Serving Entity | |

| MAIT | Mid-Atlantic Interstate Transmission, LLC, a transmission subsidiary of FET | |

| MDPSC | Maryland Public Service Commission | |

| ME | Metropolitan Edison Company, a former Pennsylvania electric power company subsidiary of FE, which merged with and into FE PA on January 1, 2024 | |

| MISO | Midcontinent Independent System Operator, Inc. | |

| Moody’s | Moody’s Investors Service, Inc. | |

| MP | Monongahela Power Company, a West Virginia electric power company subsidiary of FE | |

| N.D. Ohio | Federal District Court, Northern District of Ohio | |

| NERC | North American Electric Reliability Corporation | |

| New 2030 Notes | New $400,000,000 aggregate principal amount of 4.550% Senior Notes due 2030 | |

| New 2035 Notes | New $400,000,000 aggregate principal amount of 5.000% Senior Notes due 2035 | |

| New Notes | New 2030 Notes and New 2035 Notes | |

| OAG | Ohio Attorney General | |

| OCC | Ohio Consumers’ Counsel | |

| ODSA | Ohio Development Service Agency | |

| OE | Ohio Edison Company, an Ohio electric power company subsidiary of FE | |

| Ohio Companies | CEI, OE and TE | |

vi

Table of Contents

| OOCIC | Ohio Organized Crime Investigations Commission, which is composed of members of the Ohio law enforcement community and is chaired by the OAG | |

| OPEB | Other Postemployment Benefits | |

| Outstanding 2030 Notes | $400,000,000 aggregate principal amount of our 4.550% Senior Notes due 2030 | |

| Outstanding 2035 Notes | $400,000,000 aggregate principal amount of our 5.000% Senior Notes due 2035 | |

| Outstanding Notes | The Outstanding 2030 Notes and the Outstanding 2035 Notes | |

| PA Consolidation | Consolidation of the Pennsylvania Companies, effective January 1, 2024 | |

| PATH | Potomac-Appalachian Transmission Highline, LLC, a joint venture between FE and a subsidiary of AEP | |

| PATH-Allegheny | PATH Allegheny Transmission Company, LLC | |

| PATH-WV | PATH West Virginia Transmission Company, LLC | |

| PE | The Potomac Edison Company, a Maryland and West Virginia electric power company subsidiary of FE | |

| Penn | Pennsylvania Power Company, a former Pennsylvania electric power company subsidiary of OE, which merged with and into FE PA on January 1, 2024 | |

| Pennsylvania Companies | ME, PN, Penn and WP, each of which merged with and into FE PA on January 1, 2024 | |

| PN | Pennsylvania Electric Company, a former Pennsylvania electric power company subsidiary of FE, which merged with and into FE PA on January 1, 2024 | |

| PJM | PJM Interconnection, LLC | |

| PJM CTOA | Consolidated Transmission Owners Agreement of PJM | |

| PJM OA | Amended and Restated Operating Agreement of PJM | |

| PJM OATT | PJM Open Access Transmission Tariff | |

| PJM Tariff | PJM Open Access Transmission Tariff | |

| PPUC | Pennsylvania Public Utility Commission | |

| PTRR | Projected Transmission Revenue Requirement | |

| PUCO | Public Utilities Commission of Ohio | |

| Registration Rights Agreements | Registration Rights Agreements in respect of each series of Outstanding Notes entered into on September 5, 2024, among FET and the initial purchasers. | |

| Regulated Transmission Subsidiaries | ATSI, MAIT, and TrAIL, collectively | |

| RFC | ReliabilityFirst Corporation | |

| ROE | Return on Equity | |

| RTEP | PJM’s Regional Transmission Expansion Plan | |

vii

Table of Contents

| RTO | Regional Transmission Organization | |

| S.D. Ohio | Federal District Court, Southern District of Ohio | |

| SEC | United States Securities and Exchange Commission | |

| SLC | Special Litigation Committee of the FE Board | |

| SOFR | Secured Overnight Financing Rate | |

| S&P | Standard & Poor’s Ratings Service | |

| SVC | Static Var Compensator | |

| Stand-Alone Transmission Segment | FirstEnergy reportable segment consisting of FE’s ownership in FET and KATCo | |

| Tax Act | Tax Cuts and Jobs Act adopted December 22, 2017 | |

| TE | The Toledo Edison Company, an Ohio electric power company subsidiary of FE | |

| TrAIL | Trans-Allegheny Interstate Line Company, a transmission subsidiary of FET | |

| Transmission Companies | ATSI, KATCo, MAIT and TrAIL | |

| USAO | U.S. Attorney’s Office for the Southern District of Ohio | |

| VEPCO | Virginia Electric and Power Company | |

| VIE | Variable Interest Entity | |

| VSCC | Virginia State Corporation Commission | |

| WP | West Penn Power Company, a former Pennsylvania electric power company subsidiary of FE, which merged with and into FE PA on January 1, 2024 | |

| WVPSC | Public Service Commission of West Virginia | |

viii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that is important to you, and it is qualified in its entirety by the more detailed information and financial statements, including the notes to those financial statements, appearing elsewhere in this prospectus. Before making an investment decision, we encourage you to consider the information contained in this prospectus, including the risks discussed under the heading “Risk Factors” beginning on page 12 of this prospectus.

In this prospectus, unless the context requires otherwise, references to “we,” “us,” “our,” “FET” and the “Company” refer to FirstEnergy Transmission, LLC. Capitalized terms used in this prospectus without definition have the meanings set forth in the Glossary of Terms included herein.

The Company

FET was organized as a limited liability company under the laws of the State of Delaware in 2006. On May 31, 2022, North American Transmission Company II L.P. (“Brookfield”), a controlled investment vehicle entity of Brookfield Super-Core Infrastructure Partners, acquired 19.9% of the membership interests of FET. On March 25, 2024, Brookfield acquired an additional 30% of the outstanding membership interests of FET for $3.5 billion. As a result, Brookfield’s equity interest in FET increased to 49.9%, while FirstEnergy Corp. (“FE”) retained the remaining 50.1% equity interest in FET. We are a consolidated variable interest entity of FE. Our principal executive offices are located at 5001 NASA Blvd., Fairmont, West Virginia 26554. Our telephone number is (800) 736-3402.

Our Business

FET is the holding company for American Transmission Systems, Incorporated (“ATSI”), Mid-Atlantic Interstate Transmission, LLC (“MAIT”) and Trans-Allegheny Interstate Line Company (“TrAIL”), and is in the process of winding up a joint venture in Potomac-Appalachian Transmission Highline, LLC (“PATH”) with a subsidiary of American Electric Power Company, Inc. (“AEP”). Through its subsidiaries, FET owns and operates high-voltage transmission facilities within PJM Interconnection, L.L.C. (“PJM”), a regional transmission organization, which consist of approximately 12,500 circuit miles of transmission lines with nominal voltages of 500 kV, 345 kV, 230 kV, 138 kV, 115 kV, 69 kV and 46 kV in Ohio, Pennsylvania, West Virginia, Maryland and Virginia, and has a rate base of $7.3 billion as of December 31, 2023. We refer herein to ATSI, MAIT and TrAIL, collectively, as our Regulated Transmission Subsidiaries. We refer herein to FE and its consolidated subsidiaries, collectively, as FirstEnergy.

Regulated Transmission Subsidiaries

ATSI was organized under the laws of the State of Ohio in 1998 to engage exclusively in the transmission of electricity (i.e., at voltages of 69 kV and above). The substantial portion of ATSI’s transmission assets were originally acquired in September 2000 from certain of FE’s Ohio and Pennsylvania distribution utility subsidiaries. In June 2011, ATSI transferred functional control of its transmission facilities from Midcontinent Independent System Operator, Inc. (“MISO”) to PJM.

MAIT was organized under the laws of the State of Delaware in 2015 to own and operate the Federal Energy Regulatory Commission (“FERC”) jurisdictional transmission assets that were transferred to MAIT on January 31, 2017, by two regulated utility subsidiaries of FE, Metropolitan Edison Company (“ME”) and Pennsylvania Electric Company (“PN”), following receipt of necessary regulatory approvals. In exchange for their transmission asset contributions, MAIT issued Class B membership interests to ME and PN. On January 1,

1

Table of Contents

2024, FirstEnergy consolidated its Pennsylvania electric utility subsidiaries, ME, PN, Penn and West Penn Power Company (“WP”) (together, the “Pennsylvania Companies”), into FirstEnergy Pennsylvania Electric Company (“FE PA”), a Pennsylvania electric power company subsidiary of FirstEnergy Pennsylvania Holding Company LLC, a wholly owned subsidiary of FE. In addition to merging each of the Pennsylvania Companies with and into FE PA, with FE PA surviving such mergers as the successor-in-interest to all assets and liabilities of the Pennsylvania Companies, (i) WP transferred certain of its Pennsylvania-based transmission assets to KATCo, and (ii) PN and ME contributed their respective Class B equity interests of MAIT to FE (the “PA Consolidation”), which were ultimately contributed to FET in exchange for a special purpose membership interest in FET. So long as FE holds the FET special purpose membership interests, it will receive 100% of any Class B distributions made by MAIT.

We own all of the outstanding Class A membership interests of MAIT, which MAIT issued to us in exchange for our cash contribution. TrAIL was organized under the laws of the State of Maryland and the Commonwealth of Virginia in 2006 to finance, construct, own, operate and maintain high-voltage transmission facilities in PJM. TrAIL currently has several transmission facilities in operation including a 500 kV transmission line extending approximately 150 miles from southwestern Pennsylvania through West Virginia to a point of interconnection with an unaffiliated utility, Virginia Electric and Power Company (“VEPCO”) in northern Virginia that was completed and placed into service in May 2011. This line is known as the Trans-Allegheny Interstate Line.

Revenues and Rates

We derive all of our revenue from our Regulated Transmission Subsidiaries. Our Regulated Transmission Subsidiaries, in turn, derive nearly all of their revenues from providing:

| • | network transmission service; |

| • | point-to-point transmission service; and |

| • | scheduling, control and dispatch service over their respective systems. |

PJM, on behalf of our Regulated Transmission Subsidiaries, charges rates established by our Regulated Transmission Subsidiaries using a forward-looking cost-of-service formula rate template on file with FERC. Under these formulas, MAIT and ATSI post to PJM’s website their Projected Transmission Revenue Requirement (“PTRR”) each October 5 and October 15 respectively, to be effective for the following January through December (the “Rate Year”). The PTRR represents the amount of revenue necessary to recover projected prudently-incurred expenses and a return on projected rate base, consisting primarily of property, plant and equipment on a 13-month average, for the Rate Year. MAIT and ATSI determine their respective PTRRs based on updates to the inputs to the formula rate template. MAIT and ATSI on each June 1 and May 1, respectively, calculate actual results for the previous Rate Year and compare them to the amount PJM billed on their behalf based on the PTRR for that Rate Year and include the resulting true-up in the PTRR for the coming Rate Year. MAIT’s and ATSI’s projected rate bases for the PTRRs effective January 1, 2024 through December 31, 2024 are $2.4 billion and $4.1 billion, respectively. Each May 15, TrAIL posts to PJM’s website its “Annual Update” consisting of (1) a “Reconciliation” reflecting its actual revenue requirement for the previous calendar year and (2) a “Forecast” reflecting the Reconciliation plus projected capital projects placed into service for the current calendar year as well as a true-up for the difference between the previous calendar year Forecast and Reconciliation. During June 1 through May 31 of each year, PJM bills, on behalf of TrAIL, TrAIL’s revenue requirement determined by its Forecast. TrAIL’s projected rate base in its Forecast posting on May 15, 2024 is $1.4 billion.

Operations

Our Regulated Transmission Subsidiaries’ transmission facilities are connected to generation resources, distribution facilities and neighboring transmission systems. Our transmission facilities currently transmit

2

Table of Contents

electricity in PJM from generating stations to local electricity distribution facilities located, in the case of ATSI, primarily in Ohio and Pennsylvania, in the case of MAIT, primarily in Pennsylvania, and in the case of TrAIL, primarily in Pennsylvania, West Virginia and northern Virginia. ATSI’s facilities consist of approximately 7,900 circuit miles of transmission lines with nominal voltages of 345 kV, 138 kV (bulk transmission) and 69 kV (area transmission). MAIT’s facilities consist of approximately 4,300 circuit miles of transmission lines with nominal voltages of 500 kV, 345 kV, 230 kV, 138 kV, 115 kV, 69 kV and 46 kV. TrAIL’s facilities consist of approximately 260 circuit miles of transmission lines with nominal voltage of 500 kV, 345 kV, 230 kV and 138 kV.

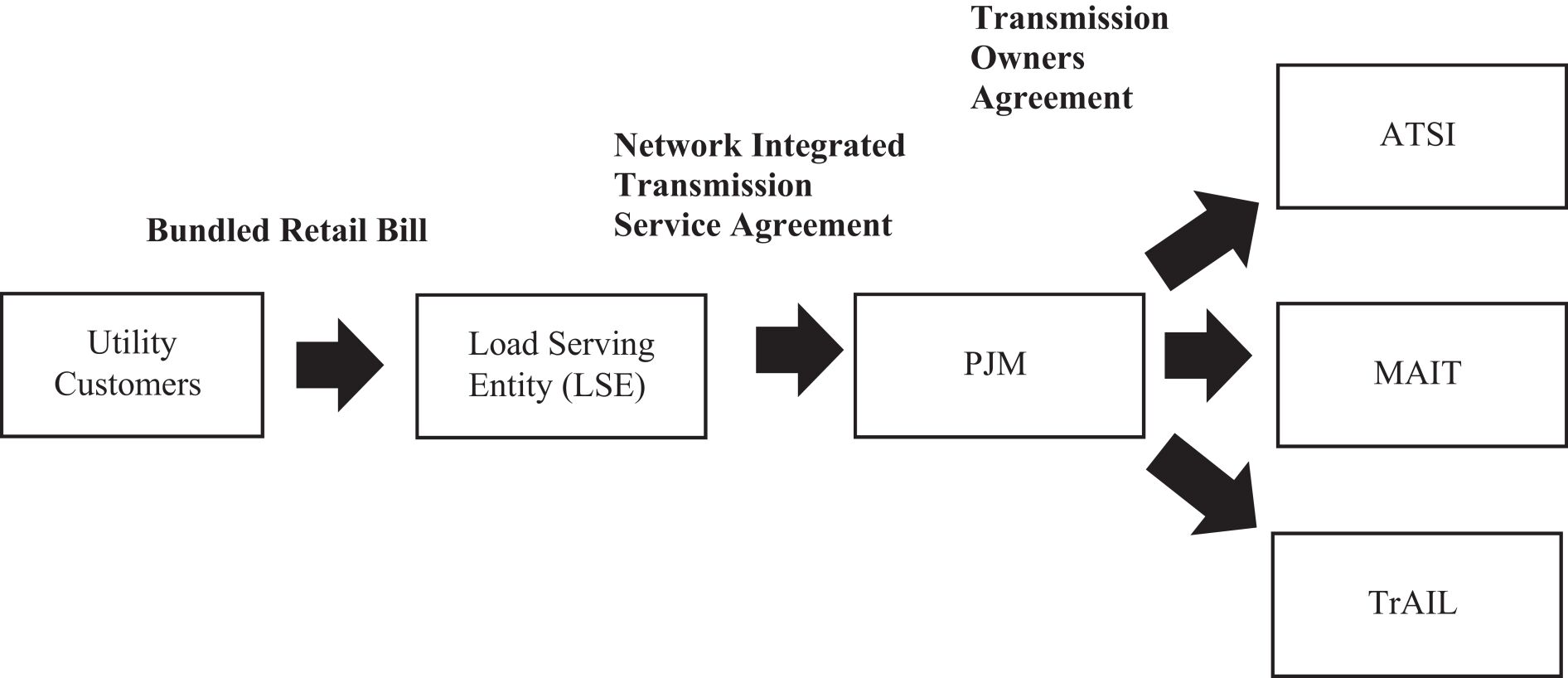

As transmission-only companies, our Regulated Transmission Subsidiaries function as conduits, moving power from unaffiliated generators to local distribution facilities or to interconnected transmission systems either entirely through their own systems or in conjunction with neighboring transmission systems. Affiliated and unaffiliated entities then distribute power through these local distribution facilities to end-use customers. The transmission of electricity by our Regulated Transmission Subsidiaries is a central function to the provision of electricity to residential, commercial and industrial end-use customers. As a member of PJM, functional control, but not ownership, over the transmission assets of our Regulated Transmission Subsidiaries has been transferred to PJM.

FirstEnergy’s Stand-Alone Transmission Segment, including our Regulated Transmission Subsidiaries, together with PJM, plans, operates and maintains its transmission systems in accordance with the reliability standards developed by North American Electric Reliability Corporation (“NERC”) (which is the Electric Reliability Organization (“ERO”), designated by FERC under Section 215 of the Federal Power Act (“FPA”) and approved by FERC to ensure reliable service to customers. FirstEnergy’s business strategy for its transmission systems, which includes those of our Regulated Transmission Subsidiaries, is to operate, maintain and invest in transmission infrastructure to continue to ensure system integrity and reliability and to prudently manage expenses, capital expenditures and regulatory compliance.

Executive Offices

Our principal executive offices are located at 5001 NASA Blvd., Fairmont, West Virginia 26554. Our telephone number is (800) 736-3402.

Risk Factors

You should carefully consider the information set forth under the section entitled “Risk Factors” beginning on page 12 of this prospectus as well as the other information contained in this prospectus before participating in the exchange offer.

3

Table of Contents

Summary of the Exchange Offer

A brief description of the material terms of the exchange offer follows. We are offering to exchange both series of New Notes for the corresponding series of Outstanding Notes. The terms of each series of New Notes offered in the exchange offer are substantially identical to the terms of the corresponding series of Outstanding Notes, except that the New Notes will be registered under the Securities Act and transfer restrictions, registration rights and additional interest provisions relating to the Outstanding Notes do not apply to the New Notes. For a more complete description of the exchange offer, see “The Exchange Offer.”

Background | On September 5, 2024, we issued $400,000,000 aggregate principal amount of Outstanding 2030 Notes and $400,000,000 aggregate principal amount of Outstanding 2035 Notes in a private offering. In connection with that offering, we entered into Registration Rights Agreements corresponding to each series of Outstanding Notes (as defined in “The Exchange Offer”) in which we agreed, among other things, to deliver this prospectus to you and use our reasonable best efforts to cause this exchange offer to be completed before the 366th day after the initial issuance of the Outstanding Notes. |

| Under the terms of the exchange offer, you are entitled to exchange the Outstanding 2030 Notes and the Outstanding 2035 Notes for New 2030 Notes and New 2035 Notes, respectively, evidencing the same indebtedness and with substantially identical terms to the corresponding series of Outstanding Notes. You should read the discussion under the heading “Description of the Notes” for further information regarding the New Notes. |

New Notes Offered | $400,000,000 aggregate principal amount of Senior Notes due 2030; and |

| $400,000,000 aggregate principal amount of Senior Notes due 2035. |

Exchange Offer | We are offering to exchange the Outstanding Notes for a like principal amount of the corresponding series of New Notes. Outstanding Notes may be exchanged only in minimum denominations of $2,000 and in integral multiples of $1,000 in excess thereof. The exchange offer is being made pursuant to the Registration Rights Agreements, which grant the initial purchasers and any subsequent holders of the Outstanding Notes certain exchange and registration rights. This exchange offer is intended to satisfy those exchange and registration rights with respect to the Outstanding Notes. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your Outstanding Notes. |

Expiration Date | The exchange offer will expire 5:00 p.m., New York City time, on January 24, 2025, or a later time if we choose to extend this exchange offer in our sole and absolute discretion. We do not currently intend to extend the expiration date for the exchange offer. The exchange offer will remain open for at least 20 full business days (or longer if required by applicable law) after the date notice of the exchange offer is first sent to holders of the Outstanding Notes. |

4

Table of Contents

Withdrawal of Tender | You may withdraw your tender of Outstanding Notes at any time prior to the expiration date. All Outstanding Notes that are validly tendered and not properly withdrawn will be accepted for exchange. |

Conditions to the Exchange Offer | Our obligation to accept for exchange, or to issue the New Notes in exchange for, any Outstanding Notes is subject to certain customary conditions, including our determination that the exchange offer does not violate applicable law or interpretation by the Staff of the SEC, some of which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See “The Exchange Offer — Conditions to the Exchange Offer.” |

Procedures for Tendering Outstanding Notes Held in the Form of Book-Entry Interests | The Outstanding Notes were issued as global securities and were deposited upon issuance with U.S. Bank Trust Company, National Association, which issued uncertificated depositary interests in those Outstanding Notes, which represent a 100% interest in those Outstanding Notes, to The Depository Trust Company (“DTC”). |

| Beneficial interests in the Outstanding Notes, which are held by direct or indirect participants in DTC, are shown on, and transfers of the Outstanding Notes can only be made through, records maintained in book-entry form by DTC. |

| You may tender your Outstanding Notes by instructing your broker or bank where you keep the Outstanding Notes to tender them for you. In some cases, you may be asked to submit the letter of transmittal that may accompany this prospectus. By tendering your Outstanding Notes, you will be deemed to have acknowledged and agreed to be bound by the terms set forth under “The Exchange Offer.” Your Outstanding Notes must be tendered in minimum denominations of $2,000 and in multiples of $1,000 in excess thereof. |

| We are not providing for guaranteed delivery procedures, and therefore you must allow sufficient time for the necessary tender procedures to be completed during normal business hours of DTC on or prior to the expiration time. If you hold your Outstanding Notes through a broker, dealer, commercial bank, trust company or other nominee, you should consider that such entity may require you to take action with respect to the exchange offer a number of days before the expiration time in order for such entity to tender notes on your behalf on or prior to the expiration time. In order for your tender to be considered valid, the exchange agent must receive a confirmation of book-entry transfer of your Outstanding Notes into the exchange agent’s account at DTC, under the procedure described in this prospectus under the heading “The Exchange Offer,” on or before 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

5

Table of Contents

| By executing the letter of transmittal or by transmitting an agent’s message in lieu thereof, you will represent to us that, among other things: |

| • | the New Notes that you receive will be acquired in the ordinary course of its business; |

| • | you are not participating in, and have no arrangement with any person or entity to participate in, the distribution of the New Notes; |

| • | you are not our “affiliate” (as defined in Rule 405 under the Securities Act) or if you are such an “affiliate,” you will comply with the prospectus delivery requirements of the Securities Act to the extent applicable in connection with any resale of the New Notes; and |

| • | if you are a broker-dealer that will receive New Notes for your own account in exchange for Outstanding Notes acquired as a result of market making or other trading activities, then you will comply with the prospectus delivery requirements of the Securities Act, to the extent applicable, in connection with any resale of the New Notes. |

United States Federal Income Tax Consequences | The exchange of Outstanding Notes for New Notes pursuant to the exchange offer generally will not be a taxable event for U.S. federal income tax purposes. See “Certain United States Federal Income Tax Consequences.” |

Use of Proceeds | We will not receive any proceeds from the issuance of the New Notes in the exchange offer. |

Fees and Expenses | We will pay all of our expenses incident to the exchange offer. |

Exchange Agent | U.S. Bank Trust Company, National Association is serving as the exchange agent for the exchange offer. |

Resales of New Notes | Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties that are not related to us, we believe that the New Notes you receive in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act so long as: |

| • | the New Notes are being acquired in the ordinary course of business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate in the distribution of the New Notes issued to you in the exchange offer; |

| • | you are not our affiliate; |

6

Table of Contents

| • | you are not a broker-dealer tendering Outstanding Notes acquired directly from us for your account, or if you are such a broker-dealer, then you will comply with the prospectus delivery requirements of the Securities Act, to the extent applicable, in connection with any resale of the New Notes. |

| The SEC has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the SEC would make similar determinations with respect to this exchange offer. If any of these conditions are not satisfied, or if our belief is not accurate, and you transfer any New Notes issued to you in the exchange offer without delivering a resale prospectus meeting the requirements of the Securities Act or without an exemption from registration of your New Notes from those requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. Each broker-dealer that receives New Notes for its own account in exchange for Outstanding Notes, where the Outstanding Notes were acquired by such broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such New Notes. See “Plan of Distribution.” |

Consequences of Not Exchanging Outstanding Notes | Outstanding Notes that are not tendered or that are tendered but not accepted will remain outstanding and continue to accrue interest but continue to be subject to the restrictions on transfer that are described in the legend on the Outstanding Notes. |

| In general, you may offer or sell your Outstanding Notes only if they are registered under, or offered or sold under an exemption from, or are not subject to, the Securities Act and applicable state securities laws. If you do not participate in the exchange offer, the liquidity of your Outstanding Notes could be adversely affected. See “The Exchange Offer — Consequences of Failure to Exchange.” |

7

Table of Contents

Summary of the Terms of the New Notes

The New Notes will be substantially identical to the Outstanding Notes, except that the New Notes will be registered under the Securities Act and will not have restrictions on transfer, rights to additional interest or registration rights. The New Notes will evidence the same debt as the Outstanding Notes, and the same Indenture (as defined herein) will govern the New Notes and the Outstanding Notes. We sometimes refer to the New Notes and the Outstanding Notes collectively as the “Notes.”

The following summary contains basic information about the New Notes and is not intended to be complete. It does not contain all the information that may be important to you. For a more complete understanding of the New Notes, please read “Description of the Notes.”

Issuer | FirstEnergy Transmission, LLC. |

Securities Offered | $400,000,000 aggregate principal amount of Senior Notes due 2030; and |

| $400,000,000 aggregate principal amount of Senior Notes due 2035. |

Maturity Dates | New 2030 Notes: January 15, 2030. |

| New 2035 Notes: January 15, 2035. |

Interest Rates and Interest Rate Periods | Interest on the New 2030 Notes will accrue at a rate of 4.550% per annum from the date of the original issuance and will be payable semi-annually in arrears on each January 15 and July 15, beginning on January 15, 2025. |

| Interest on the New 2035 Notes will accrue at a rate of 5.000% per annum from the date of original issuance and will be payable semi-annually in arrears on each January 15 and July 15, beginning on January 15, 2025. |

Security and Ranking | The New Notes will be our senior unsecured general obligations. They will rank equally with all of our other existing and future senior unsecured and unsubordinated indebtedness, senior to all of our existing and future subordinated indebtedness and junior to all of our future senior secured indebtedness. As of September 30, 2024, we had $2.8 billion of senior unsecured and unsubordinated long-term indebtedness outstanding and no other long-term debt outstanding. See “Description of the Notes— Ranking.” |

| The New Notes will be effectively subordinated to all existing and future indebtedness and other obligations of our subsidiaries, including: |

| • | trade payables; |

| • | ATSI’s $75 million aggregate principal amount of outstanding 4.00% Senior Notes due 2026; |

| • | ATSI’s $100 million aggregate principal amount of outstanding 4.32% Senior Notes due 2030; |

8

Table of Contents

| • | ATSI’s $100 million aggregate principal amount of outstanding 4.38% Senior Notes due 2031; |

| • | ATSI’s $150 million aggregate principal amount of outstanding 3.66% Senior Notes due 2032; |

| • | ATSI’s $600 million aggregate principal amount of outstanding 2.65% Senior Notes due 2032; |

| • | ATSI’s $150 million aggregate principal amount of outstanding 5.13% Senior Notes due 2033; |

| • | ATSI’s $400 million aggregate principal amount of outstanding 5.00% Senior Notes due 2044; |

| • | ATSI’s $75 million aggregate principal amount of outstanding 5.23% Senior Notes due 2045; |

| • | ATSI’s $150 million aggregate principal amount of outstanding 5.63% Senior Notes due 2034; |

| • | MAIT’s $600 million aggregate principal amount of outstanding 4.10% Senior Notes due 2028; |

| • | MAIT’s $125 million aggregate principal amount of outstanding 3.60% Senior Notes due 2032; |

| • | MAIT’s $175 million aggregate principal amount of outstanding 5.39% Senior Notes due 2033; |

| • | MAIT’s $250 million aggregate principal amount of outstanding 5.94% Senior Notes due 2034; |

| • | MAIT’s $125 million aggregate principal amount of outstanding 3.70% Senior Notes due 2035; |

| • | TrAIL’s $75 million aggregate principal amount of outstanding 3.76% Senior Notes due 2025; and |

| • | TrAIL’s $550 million aggregate principal amount of outstanding 3.85% Senior Notes due 2025. |

| For more information, see Note 6, “Capitalization—Long-Term Debt and Other Long-Term Obligations” of the notes to the audited consolidated annual financial statements and Note 8, “Fair Value Measurements” of the notes to the unaudited consolidated interim financial statements in this prospectus. |

Optional Redemption | The New 2030 Notes will be redeemable, in whole or in part, at our option, at any time prior to December 15, 2029 (the date that is one month prior to the scheduled maturity date of the New 2030 Notes) at a “make-whole” redemption price, as described under the heading “Description of the Notes—Optional Redemption” below, and, on or after such date, at par. |

The New 2035 Notes will be redeemable, in whole or in part, at our option, at any time prior to October 15, 2034 (the date that is three months prior to the scheduled maturity date of the New 2035 Notes) at a “make-whole” redemption price, as described under the heading |

9

Table of Contents

“Description of the Notes—Optional Redemption” below, and, on or after such date, at par. |

| See “Description of the Notes — Optional Redemption.” |

Form and Denomination | The New Notes will be issued in fully-registered form. The New Notes will be represented by one or more global notes, deposited with the trustee as custodian for DTC and registered in the name of Cede & Co., DTC’s nominee. Beneficial interests in the global notes will be shown on, and any transfers will be effective only through, records maintained by DTC and its participants. |

| The New Notes will be issued in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

Certain Covenants | The terms of the New Notes contain only very limited protections for holders of New Notes. In particular, the New Notes will not place any restrictions on our or our subsidiaries’ ability to: |

| • | issue debt securities or otherwise incur additional indebtedness or other obligations ranking equal in right of payment with the New Notes; or |

| • | conduct other transactions that may adversely affect the holders of the New Notes. |

Events of Default and Acceleration | The only events of default with respect to the New Notes are: |

| • | failure to pay principal, any premium or required interest for 30 days after it is due; |

| • | failure to perform other covenants in the Indenture for 90 days after we are given notice from the Trustee or the Trustee receives, and provides to us, written notice from the registered holders of at least 33% in principal amount of the outstanding New Notes of such series; provided, however, that the Trustee, or the Trustee and the holders of such principal amount of the New Notes of such series can agree to an extension of the 90-day period and, will be deemed to have agreed to an extension of that period if corrective action has been initiated by us within that period and is being diligently pursued; and |

| • | certain events of insolvency or bankruptcy, whether voluntary or not, involving FET. |

| Only these events of default provide for a right of acceleration of the New Notes. No other events will result in acceleration. |

| See “Risk Factors — Risks Associated with the Exchange Offer.” |

Additional Notes | We may from time to time, without consent of the holders of the Notes, issue Notes having the same terms and conditions as any series of New Notes being offered hereby or any series of Outstanding Notes (except for the issue date, offering price and, if applicable, the first interest payment date). Additional Notes issued in this manner will form a single series with the applicable outstanding series of |

10

Table of Contents

Notes and will be treated as a single class for all purposes under the Indenture governing the Notes, including, without limitation, voting, waivers and amendments. |

Risk Factors | See “Risk Factors” and the other information included in this prospectus for a discussion of the factors you should carefully consider before deciding to invest in the New Notes. |

No Listing of the Notes | There is no public trading market for the New Notes, and we do not intend to list the New Notes on any national securities exchange or to arrange for quotation on any automated dealer quotation systems. There can be no assurance that an active trading market will develop for the New Notes. If an active trading market does not develop, the market price and liquidity of the New Notes may be adversely affected. |

No Public Market | The New Notes will be new securities for which no market currently exists, and we cannot assure you that any public market for the New Notes will develop or be sustained. |

Governing Law | The New Notes will be governed by the laws of the State of New York. |

Trustee | U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association). |

Book-Entry Depository | DTC. |

11

Table of Contents

You should carefully consider the following risk factors and all other information contained in this prospectus before participating in the exchange offer. The risks and uncertainties described below are not the only risks facing us and your investment in the exchange notes. Additional risks and uncertainties that we are unaware of, or those we currently deem immaterial, also may become important factors that affect us. The following risks could materially and adversely affect our business, financial condition, cash flows or results of operations.

Risks Associated with Damage to FirstEnergy’s Reputation and HB 6 Related Litigation and Investigations

Damage to our and/or FirstEnergy’s reputation may arise from numerous sources making it and its subsidiaries vulnerable to negative customer perception, adverse regulatory outcomes, or other consequences, which could materially adversely affect our business, results of operations, and financial condition.

Our reputation is important. Damage to FirstEnergy’s reputation, including the reputation of any of its subsidiaries, such as FET, could materially adversely affect our business, results of operations and financial condition. Such damage may arise from numerous sources further discussed below, negative outcomes associated with the Deferred Prosecution Agreement (the “DPA”), entered into on July 21, 2021 between FE and the U.S. Attorney’s Office for the Southern District of Ohio (the “USAO”) the August 2020 SEC investigation described below or other HB 6 litigation or investigations, a significant cyber-attack, data security or physical security breach, failure to provide safe and reliable service and negative perceptions regarding the operation of coal-fired generation, particularly Greenhouse Gas (“GHG”) emissions. Any damage to our reputation, either generally or as a result of the foregoing, may lead to negative customer perception, which may make it difficult for us to compete successfully for new opportunities, or could adversely impact our ability to launch new sophisticated technology-driven solutions to meet our customer expectations. A damaged reputation could further result in FERC, the Public Utilities Commission of Ohio (the “PUCO”) and other regulatory and legislative authorities being less likely to view us in a favorable light and could negatively impact the rates we charge customers or otherwise cause us to be susceptible to unfavorable legislative and regulatory outcomes, as well as increased regulatory oversight and more stringent legislative or regulatory requirements.

HB 6 related investigation and litigation could have a material adverse effect on FirstEnergy’s reputation, business, financial condition, results of operations, liquidity or cash flows and such adverse effects could extend to us.

On July 21, 2020, a complaint and supporting affidavit containing federal criminal allegations were unsealed against the now former Ohio House Speaker Larry Householder and other individuals and entities allegedly affiliated with Mr. Householder. In March 2023, a jury found Mr. Householder and his co-defendant, Matthew Borges, guilty and in June 2023, the two were sentenced to prison for 20 and five years, respectively. Messrs. Householder and Borges have appealed their sentences. Also, on July 21, 2020, and in connection with the USAO’s investigation, FirstEnergy received subpoenas for records from the USAO. FirstEnergy was not aware of the criminal allegations, affidavit or subpoenas before July 21, 2020. On July 21, 2021, FE entered into a three-year DPA with the USAO that, subject to court proceedings, resolves this matter. Among other things under the DPA, FirstEnergy paid a $230 million monetary penalty in 2021 and agreed to the filing of a criminal information charging FirstEnergy with one count of conspiracy to commit honest services wire fraud. The $230 million payment will neither be recovered in rates or charged to FirstEnergy customers, nor will FirstEnergy seek any tax deduction related to such payment. As of July 21, 2024, FirstEnergy successfully completed the obligations required within the three-year term of the DPA. Under the DPA, and until the conclusion of any related investigation, criminal prosecution and civil proceeding brought by the USAO, FirstEnergy has an obligation to continue (i) publishing quarterly a list of all payments to 501(c)(4) entities and all payments to entities known by FirstEnergy operating for the benefit of a public official, either directly or

12

Table of Contents

indirectly; (ii) not making any statements that contradict the DPA; (iii) notifying the U.S. Attorney’s Office of the Southern District of Ohio (the “USAO”) of any changes in FirstEnergy’s corporate form; and (iv) cooperating with the USAO.

Following the announcement by the USAO of the investigation surrounding HB 6 in July 2020, certain of FirstEnergy’s stockholders and customers filed several lawsuits against FirstEnergy and certain current and former directors, officers and other employees, including the federal securities class action litigation In re FirstEnergy Corp. Securities Litigation (Federal District Court, Southern District of Ohio (“S.D. Ohio”)). We and FirstEnergy believe that it is probable that FirstEnergy will incur a loss in connection with the resolution of In re FirstEnergy Corp. Securities Litigation. Given the ongoing nature and complexity of such litigation, we and FirstEnergy cannot yet reasonably estimate a loss or range of loss that may arise from its resolution. However, if it is resolved against FirstEnergy, substantial monetary damages could result and its reputation, business, financial condition, results of operations, liquidity or cash flows may be materially adversely affected, which may, in turn, have an adverse material impact on us.

The investigations and litigation related to HB 6 could divert management’s focus and have resulted in, and could continue to result in, substantial investigation expenses and the commitment of substantial corporate resources. The outcome, duration, scope, result or related costs of the investigations and related litigation of the government investigations, particularly the securities class action litigation In re FirstEnergy Corp. Securities Litigation discussed above, are inherently uncertain. Therefore, any of these risks could impact us significantly beyond expectations. Moreover, we are unable to predict the potential for any additional investigations or litigation, including the potential focus thereof on FirstEnergy’s subsidiaries, any of which could expose us to potential criminal or civil liabilities, sanctions or other remedial measures, and could have a material adverse effect on our reputation, business, financial condition, results of operations, liquidity or cash flows.

On August 10, 2020, the SEC, through its Division of Enforcement, issued an order directing an investigation of possible securities laws violations by FirstEnergy, and on September 1, 2020, issued subpoenas to FirstEnergy and certain of its officers. FirstEnergy continues to cooperate with the SEC in their ongoing investigation. On April 28, 2021, July 11, 2022, and May 25, 2023, the SEC issued additional subpoenas to FirstEnergy, with which FirstEnergy has complied. On September 12, 2024, the SEC issued a settlement order that concludes and resolves, in its entirety, the SEC investigation. Under the terms of the settlement, FirstEnergy agreed to pay a civil penalty of $100 million and to cease and desist from committing or causing any violations and any future violations of specified provisions of the federal securities laws and rules promulgated thereunder. Prior to the issuance of the settlement order, FirstEnergy had recorded a loss contingency of $100 million relating to the SEC investigation during the second quarter of 2024. This civil penalty was neither allocated nor charged to FET.

The HB 6 related state regulatory proceedings could have a material adverse effect on FirstEnergy’s reputation, business, financial condition, results of operations, liquidity or cash flows and such adverse effects could extend to us, including on an indirect basis.

There are several ongoing HB 6 related state regulatory proceedings relating to FirstEnergy. As a result of those proceedings, there could be adverse impacts to FET, including because the rates that the Regulated Transmission Subsidiaries are allowed to charge may be decreased as a result of regulatory action taken within the jurisdictions to which the Regulated Transmission Subsidiaries are subject. Furthermore, any failure by FirstEnergy to have complied with anti-corruption laws, contractual requirements, or other legal or regulatory requirements, could adversely impact FET, including through reputational harm.

We are unable to predict the adverse impacts of such regulatory matters, including with respect to rates charged by our Regulated Transmission Subsidiaries, and, therefore, any of these risks could impact us significantly beyond expectations. Moreover, we are unable to predict the potential for any additional regulatory actions, any of which could exacerbate these risks or expose FirstEnergy and its subsidiaries and FET to adverse

13

Table of Contents

outcomes in pending or future rate cases and could have a material adverse effect on our reputation, business, financial condition, results of operations, liquidity or cash flows.

Risks Associated with Our Business and Industry

Failure to comply with debt covenants in FET’s five-year syndicated revolving credit facility, dated as of October 20, 2023 (the “FET Revolving Facility”) could adversely affect our ability to execute future borrowings and/or require early repayment and could restrict our ability to obtain additional or replacement financing on acceptable terms or at all.

Our FET Revolving Facility contains various financial and other covenants, including maintaining a consolidated debt to total capitalization ratio of no more than 75%. Compliance with each covenant is measured at the end of each fiscal quarter.

Our FET Revolving Facility contains certain negative and affirmative covenants. Our ability to comply with the covenants and restrictions contained in our FET Revolving Facility has been, and may in the future, be affected by events related to the ongoing government investigations or otherwise.

A breach of any of the covenants contained in our FET Revolving Facility, including any breach related to alleged failures to comply with anti-corruption and anti-bribery laws, could result in an event of default under the FET Revolving Facility and we would not be able to access the FET Revolving Facility for additional borrowings and letters of credit while any default exists. Upon the occurrence of such an event of default, any amounts outstanding under our FET Revolving Facility could be declared to be immediately due and payable and all applicable commitments to extend further credit could be terminated. There were no amounts outstanding under our FET Revolving Facility as of September 30, 2024. If future indebtedness under our FET Revolving Facility is accelerated, there can be no assurance that we will have sufficient assets to repay the indebtedness. In addition, certain events, including but not limited to any covenant breach related to alleged failures to comply with anti-corruption and anti-bribery laws, an event of default under our FET Revolving Facility and the acceleration of applicable commitments under our FET Revolving Facility could restrict our ability to obtain additional or replacement financing on acceptable terms or at all. The operating and financial restrictions and covenants in our FET Revolving Facility and any future financing agreements may adversely affect our ability to finance future operations or capital needs or to engage in other business activities.

In connection with FirstEnergy’s actions to focus on its regulated operations, our Regulated Transmission Subsidiaries have taken steps to focus on growing their respective businesses and earnings. The ability of our Regulated Transmission Subsidiaries to successfully grow their respective businesses is subject to certain risks that could adversely affect profitability and our financial condition in the future.

FirstEnergy has undertaken a transmission expansion plan designed to improve operating flexibility, increase reliability, position transmission capacity for future load growth and facilitate response to system events. This plan allows FirstEnergy to capitalize on growth opportunities available to its regulated operations, particularly in transmission. FirstEnergy intends to grow its Stand-Alone Transmission Segment and Integrated Segment with projects extending throughout FirstEnergy’s service area, including the transmission systems of our Regulated Transmission Subsidiaries.

The success of FirstEnergy’s growth strategy will depend, in part, on our and our Regulated Transmission Subsidiaries’ successful recovery of our transmission investments. Factors that may affect rate recovery of our and our Regulated Transmission Subsidiaries’ transmission investments may include: (1) FERC’s timely approval of rates to recover such investments; (2) whether the investments are included in PJM’s Regional Transmission Expansion Plan (“RTEP”); (3) FERC’s evolving policies with respect to incentive rates for transmission investment assets; (4) FERC’s evolving policies with respect to the calculation of the base return on equity (“ROE”) component of transmission rates; (5) consideration and potential impact of the objections of those who oppose such investments and their recovery; and (6) timely development, construction and operation

14

Table of Contents

of the new facilities. See “—Complex and changing government regulations, including those associated with rates, could have a negative impact on our results of operations” and “—Certain elements of our Regulated Transmission Subsidiaries’ cost recovery through rates can be challenged, which could result in lower rates and/or refunds of amounts previously collected and thus have an adverse effect on our and our Regulated Transmission Subsidiaries’ businesses, financial condition, results of operations and cash flows” below.

Our ability to capitalize on investment opportunities available to our business depends, in part, on any future transmission rate filings at FERC, including maintaining the affordability of the rates charged to customers. Any denial of, or delay in, the approval of any future transmission rate requests could restrict us from fully recovering our cost of service, may impose risks on the transmission operations and could have a material adverse effect on our regulatory strategy, results of operations and financial condition.

FirstEnergy’s growth strategy also could be adversely impacted by any impediments to its or our ability to finance the proposed expansion projects while maintaining adequate liquidity. There can be no assurance that FirstEnergy’s investment strategy will deliver the desired result, which could adversely affect our results of operations and financial condition.

We are subject to risks arising from our Regulated Transmission Subsidiaries’ operation of transmission facilities.

Operation of transmission facilities involves risk, including the risk of potential breakdown or failure of equipment or processes due to aging infrastructure, fuel supply or transportation disruptions, accidents, labor disputes or work stoppages by employees, human error in operations or maintenance, acts of terrorism or sabotage, cyber-attacks, construction delays or cost overruns, shortages of or delays in obtaining equipment, material and labor, operational restrictions resulting from environmental requirements and governmental interventions and operational performance below expected levels. In addition, weather-related incidents and other natural disasters can disrupt transmission systems and, in some cases, lead to catastrophic effects such as wildfires. Because our Regulated Transmission Subsidiaries’ transmission facilities are interconnected with those of third parties, the operation of our Regulated Transmission Subsidiaries’ facilities could be adversely affected by unexpected or uncontrollable events occurring on the systems of such third parties.

We and our Regulated Transmission Subsidiaries remain obligated to provide safe and reliable service to customers. Meeting this commitment requires the expenditure of significant capital resources. Failure to provide safe and reliable service and failure to meet regulatory reliability standards due to a number of factors, including, but not limited to, equipment failure and weather, could harm our and our Regulated Transmission Subsidiaries’ business reputations and adversely affect our and our Regulated Transmission Subsidiaries’ operating results through reduced revenues and increased capital and operating costs, the concurrence of liabilities to claimholders and the imposition of penalties/fines or other adverse regulatory outcomes.

Current or future litigation or administrative proceedings could have a material adverse effect on our and our Regulated Transmission Subsidiaries’ businesses, financial condition, results of operations and cash flows.

Our Regulated Transmission Subsidiaries have been and continue to be involved in legal proceedings, administrative proceedings, claims and other litigation that arise in the ordinary course of business. Various individuals and interest groups may challenge the issuance of relevant state utility commission authorizations to construct new transmission lines, or other relevant certificates, permits or approvals. In addition, we and our Regulated Transmission Subsidiaries are sometimes subject to investigations and inquiries by various state and federal regulators due to the heavily regulated nature of our industry. Unfavorable outcomes or developments relating to these or other proceedings or investigations, such as judgments for monetary damages and other remedies, including injunctions or revocation of relevant authorizations, certificates, permits or approvals, could have a material adverse effect on our and our Regulated Transmission Subsidiaries’ businesses, financial condition, results of operations and cash flows and our ability to pay interest on, and the principal of, the Notes.

15

Table of Contents

Although our Regulated Transmission Subsidiaries intend to vigorously defend these matters, the results of these proceedings or investigations cannot be determined. For more information on these proceedings and other litigation, see “Our Business—Litigation.”

We and our Regulated Transmission Subsidiaries are subject to various regulatory requirements, including reliability standards, rate tariff and contract filing requirements, reporting, recordkeeping and accounting requirements, transaction approval requirements, requirements of the regional transmission organization in which they operate, and foreign investment regulations. Violations of current or future requirements, whether intentional or unintentional, or failure to obtain necessary regulatory approvals may result in substantial costs, sanctions or penalties that, under some circumstances, could have a material adverse effect on our and our Regulated Transmission Subsidiaries’ businesses, financial condition, results of operations and cash flows.

Our operations and other regulated activities are subject to audit by FERC, which may conduct routine or special audits and issue requests designed to ensure compliance with FERC rules, regulations, policies and procedures. Owners, operators and users of the bulk electric system are subject to mandatory reliability standards promulgated by NERC and approved by FERC. The standards are based on the functions that need to be performed to ensure that the bulk electric system operates reliably. NERC, FERC and ReliabilityFirst Corporation (“RFC”), which is one of the regional reliability entities responsible for the PJM region, continue to refine existing reliability standards as well as develop and adopt new reliability standards. The reliability standards address operation, planning and security of the bulk electric system, including requirements with respect to real-time transmission operations, emergency operations, vegetation management, critical infrastructure protection and personnel training. Compliance with modified or new reliability standards may subject our Regulated Transmission Subsidiaries to higher operating costs and/or increased capital expenditures. If one of our Regulated Transmission Subsidiaries were found not to be in compliance with one or more of the mandatory reliability standards, we or such Regulated Transmission Subsidiary could be subject to sanctions, including substantial monetary penalties.

Monetary penalties for violations of reliability standards vary based on an assigned risk factor for each potential violation, the severity of the violation and various other circumstances, such as whether the violation was intentional or concealed, whether there are repeated violations, the degree of the violator’s cooperation in investigating and remediating the violation and the presence of a compliance program. FERC has authority under the FPA to impose penalties up to and including $1.5 million per day, subject thereafter to annual adjustments for inflation, for failure to comply with these mandatory reliability standards. Potential non-monetary sanctions include imposing limitations on the violator’s activities or operation and placing the violator on a watch list for major violators.

Our Regulated Transmission Subsidiaries are also subject to requirements under Sections 203, 204 and 205 of the FPA, including the requirement to obtain prior FERC approval of certain transactions, issuances of securities and assumptions of liabilities; reporting, recordkeeping and accounting requirements; and for filing rate tariffs and contracts related to the provision of services subject to FERC jurisdiction. Under FERC policy, failure to file a jurisdictional tariff or agreement on a timely basis may result in an entity having to refund the time value of revenues collected under the relevant tariff or agreement. The failure to obtain timely approval of transactions subject to Section 203 of the FPA or of issuances of securities or assumptions of liabilities under Section 204 of the FPA, or to comply with applicable filing, reporting, recordkeeping or accounting requirements under Section 205 of the FPA, could subject our Regulated Transmission Subsidiaries to penalties. FERC has authority under the FPA to impose penalties in 2024 up to and including $1.5 million per day, subject thereafter to annual adjustments for inflation, per violation of the FPA or rules or orders issued pursuant thereto.

Despite our Regulated Transmission Subsidiaries’ best efforts to comply and FirstEnergy’s implementation of a compliance program intended to ensure reliability and compliance with the FPA and rules and orders issued

16

Table of Contents

by FERC, there can be no assurance that violations that could result in material penalties or sanctions will not occur. If any of our Regulated Transmission Subsidiaries were to violate mandatory reliability standards or other NERC or FERC requirements, even unintentionally, in any material way, any penalties or sanctions imposed against us or our Regulated Transmission Subsidiaries could have a material adverse effect on our and our Regulated Transmission Subsidiaries’ businesses, financial condition, results of operations and cash flows and our ability to pay interest on, and the principal of, the New Notes.