As filed with the U.S. Securities and Exchange Commission on February 14, 2025.

Registration No. 333-[*]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pitanium Limited

(Exact name of registrant as specified in its charter)

| British Virgin Islands | | 2844 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

30F, Gravity, 29 Hing Yip Street,

Kwun Tong, Kowloon, Hong Kong

Tel: +852 6297-5255

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

COGENCY GLOBAL INC.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1-800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Henry Yin, Esq. Loeb & Loeb LLP 2206-19 Jardine House 1 Connaught Place Central, Hong Kong SAR (852) 3923-1111 | | Andrei Sirabionian, Esq. Norly S. Jean-Charles, Esq. Loeb & Loeb LLP 345 Park Avenue New York, NY 10154 (212) 407-4271 | | Fang Liu, Esq. VCL Law LLP 1945 Old Gallows Road, Suite 260 Vienna, VA 22182 703-919-7285 |

Approximate date of commencement of proposed sale to public: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We will not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION , 2025 |

Pitanium Limited

1,750,000 Class A Ordinary Shares

This is an initial public offering (the “Offering”) of 1,750,000 Class A ordinary shares with a par value of US$0.0001 each (the “Class A Ordinary Shares”), of Pitanium Limited (“Pitanium”, the “Company”, “we, “our”, “us”). Following the Offering, 8.86% of the Class A Ordinary Shares will be held by public shareholders, assuming the underwriters do not exercise the over-allotment option.

We anticipate that the initial public offering price (the “Offering Price”) will be between US$4 and US$5 per Class A Ordinary Share. Prior to this Offering, there has been no public market for our Class A Ordinary Shares. We intend to apply to list our Class A Ordinary Shares on the Nasdaq Capital Market under the symbol “PTNM”. This Offering is contingent upon us listing our Class A Ordinary Shares on the Nasdaq Capital Market, or Nasdaq. However, there is no assurance that such application will be approved, and if our application is not approved by Nasdaq, this Offering cannot be completed.

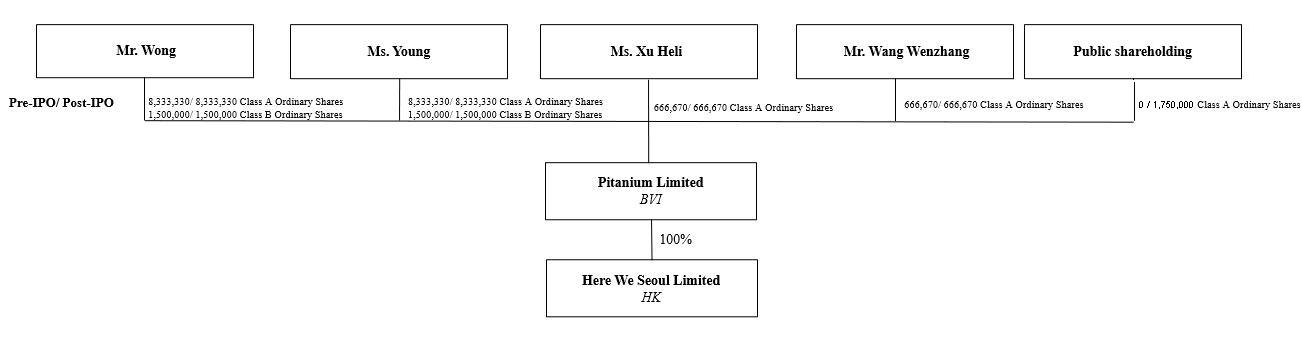

Pitanium Limited’s issued share capital is a dual-class structure consisting of Class A Ordinary Shares and Class B Ordinary Shares. Class A Ordinary Shares are the only class of Ordinary Shares being offered in this Offering. Each of the Class A Ordinary Shares has one vote per share, while each of the Class B Ordinary Shares has twenty (20) votes per share.

We will not be considered a “controlled company” under Nasdaq corporate governance rules as we do not currently expect that more than 50% of Pitanium’s voting power will be held by an individual, a group or another company immediately following the consummation of this offering. Nonetheless, due to the disparate voting powers associated with our two classes of ordinary shares, upon completion of this Offering, the two largest shareholders of our company, Mr. Ying Yeung Wong, our director and Chief Executive Officer, and Ms. Yuen Yi Young, our director and the Chairwoman of the Board, will beneficially own approximately 48.07% and 48.07% of the aggregate voting power of our issued and outstanding Class A and Class B Ordinary Shares, respectively; and together, 96.14% of the aggregate voting power, assuming that the underwriters do not exercise their over-allotment option. Although we are not considered a “controlled company” under Nasdaq corporate governance rules, if Ms. Young and Mr. Wong act together, they will be able to control the management and affairs of our Company and most matters requiring shareholder approval, including the election of directors, amendment of organizational documents and approval of significant corporate transactions, such as mergers, consolidations or sale of all or substantially all of the assets of our Company.

Investing in our Class A Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 20 to read about factors you should consider before buying our Class A Ordinary Shares.

Pitanium Limited, or Pitanium, is a holding company incorporated in British Virgin Islands (“BVI”). As a holding company with no material operations, Pitanium conducts all of its operations through its operating entity, Here We Seoul Limited (“Operating Subsidiary”), a company incorporated in Hong Kong. Investors in our Class A Ordinary Shares should be aware that they will not and may never directly hold equity interests in our Operating Subsidiary, but rather purchasing equity solely in Pitanium, the BVI holding company. This structure involves unique risks to the investors, and the PRC regulatory authorities could disallow this structure, which would likely result in a material change in Pitanium’s operations and/or a material change in the value of the securities Pitanium is registering for sale, including that such event could cause the value of such securities to significantly decline or become worthless. Furthermore, shareholders may face difficulties enforcing their legal rights under United States securities laws against our directors and officers who are located outside of the United States.

All of the legal and operational risks associated in operating in Mainland China also apply to our operations in Hong Kong, and we face the risks and uncertainties associated with the legal system in the Mainland China, complex and evolving PRC laws and regulation, and as to whether and how the recent PRC government statements and regulatory developments, such as those relating to data and cyberspace security and anti-monopoly concerns, would be applicable to companies like our Operating Subsidiary and us, given the substantial operations of our Operating Subsidiary in Hong Kong and PRC government may exercise significant oversight over the conduct of business in Hong Kong.

All of our operations are conducted by our wholly-owned Operating Subsidiary in Hong Kong, which is a special administrative region of the PRC. We currently do not have any operations in Mainland China. We do not have any operation or maintain an office or personnel in Mainland China, nor currently do we have, nor intend to have, any contractual arrangements to establish a variable interest entity (“VIE”) structure with any entity in Mainland China.

However, we are also subject to the risks of uncertainty about any future actions of the PRC government or authorities in Hong Kong in this regard. The PRC government may exert significant oversight over the current and future operations in Hong Kong, or may exert more oversight and control over offerings conducted overseas and/or foreign investment in issuers like us. Such governmental actions:

| | ● | could result in a material change in our operations and/or the value of our Class A Ordinary Shares; |

| | | |

| | ● | could significantly limit or completely hinder our ability to continue our operations; |

| | | |

| | ● | could significantly limit or hinder our ability to offer or continue to offer our Class A Ordinary Shares to investors; and |

| | | |

| | ● | may cause the value of our Class A Ordinary Shares to significantly decline or be worthless. |

See “Risk Factors — Risks Related to Doing Business in Hong Kong — All of our operations are in Hong Kong. However, the PRC government may exercise significant oversight and discretion over the conduct of our business, which could result in a material change in our operations and/or the value of our Class A Ordinary Shares. Our Operating Subsidiary in Hong Kong may be subject to certain PRC laws and regulations, which may impair our ability to operate profitably and result in a material negative impact on our operations and/or the value of our Class A Ordinary Shares. Furthermore, the PRC legal system is evolving rapidly, and enforcement of certain laws, regulations and rules may further change or develop and thus our assertions and beliefs of the risk imposed by the Mainland China legal and regulatory system cannot be certain.” on page 30.

We are aware that, in recent years, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in Mainland China, including cracking down on illegal activities in the securities market, enhancing supervision over Mainland China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. This indicated the PRC government’s intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in Mainland China-based issuers. Since these statements and regulatory actions are relatively new, it is highly uncertain how soon the legislative or administrative regulation-making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It is also highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, its ability to accept foreign investments, and the listing of our Class A Ordinary Shares on a U.S. or other foreign exchanges. These actions could result in a material change in our operations and/or the value of our Class A Ordinary Shares and could significantly limit or completely hinder our ability to offer or continue to offer our Class A Ordinary Shares to investors.

Our Class A Ordinary Shares may be prohibited from trading on a national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable Act (the “HFCAA”) if the Public Company Accounting Oversight Board (“PCAOB”) determines that it is unable to inspect or fully investigate our auditor and as a result the exchange where our securities are traded may delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022, amending the HFCAA and requiring the Securities and Exchange Commission to prohibit an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to inspect or investigate completely certain named registered public accounting firms headquartered in Mainland China and Hong Kong.

On August 26, 2022, the PCAOB signed SOP Agreements with the CSRC and the Ministry of Finance of the PRC. The SOP Agreements established a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB vacated its previous 2021 determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our control. The PCAOB is continuing to demand complete access in mainland China and Hong Kong moving forward. The PCAOB has indicated that it will act immediately to consider the need to issue new determinations with the Holding Foreign Companies Accountable Act if needed. If the PCAOB in the future again determines that it is unable to inspect and investigate completely auditors in mainland China and Hong Kong, then the companies audited by those auditors would be subject to a trading prohibition on U.S. markets pursuant to the Holding Foreign Companies Accountable Act and the Consolidated Appropriations Act.

Our auditor, Enrome LLP, the independent registered public accounting firm that issues the audit report included elsewhere in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Our auditor is headquartered in Singapore, and is currently subject to inspection by the PCAOB on a regular basis. As of the date of this prospectus, the PCAOB has not yet issued an inspection report for Enrome LLP. However, the recent developments would add uncertainties to our offering and we cannot assure you whether the national securities exchange we apply to for listing or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach, or experience as it relates to our audit. Furthermore, the Accelerating Holding Foreign Companies Accountable Act, which requires the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years, may result in the delisting of our Company in the future if the PCAOB is unable to inspect our accounting firm at such future time.

Cash is transferred through our organization in the following manner: (i) funds are transferred from Pitanium, our holding company incorporated in BVI, to our Operating Subsidiary in Hong Kong, in the form of capital contributions or loans, as the case may be; and (ii) dividends or other distributions may be paid by our Operating Subsidiary in Hong Kong to Pitanium. If Pitanium intends to distribute dividends to its shareholders, it will depend on payment of dividends from our Operating Subsidiary to Pitanium in accordance with the laws and regulations of Hong Kong, and the dividends will be distributed by Pitanium to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions. See “Prospectus Summary - Transfer of cash to and from our Operating Subsidiary” on page 7.

For FY2023 and FY2024 and up to the date of this prospectus, no transfer of cash or other types of assets has been made between Pitanium and Operating Subsidiary; and Pitanium, our holding company, has not declared or made any dividends or other distribution to its shareholders in the past, nor has any dividends or distributions been made by our Operating Subsidiary to our holding company. Furthermore, no payments of any kind (including transfers, capital contributions and loans) have been made between Pitanium and our Operating Subsidiary for FY2023 and FY2024. For FY2023 and FY2024, our Operating Subsidiary declared dividends in an aggregate of HK$8,000,000 and HK$7,327,215 (approximately US$937,715) directly to its then shareholders before the incorporation of Pitanium. Please see the audited combined financial statements and the accompanying footnotes beginning on F-2 of this prospectus.

As of the date of this prospectus, there were no transfers, dividends or distributions that have been made between our holding company, Pitanium, and Operating Subsidiary or to any investors.

Our holding company rely on dividends paid by our Operating Subsidiary for its cash requirements, including funds to pay any dividends and other cash distributions to its shareholders, service any debt it may incur and pay its operating expenses. Our holding company’s ability to pay dividends to its shareholders will depend on, among other things, the availability of dividends from our Operating Subsidiary.

Investing in our Class A Ordinary Shares involves a high degree of risk. Please see “Risk Factors” beginning on page 20 of the prospectus for more information.

We are both an “emerging growth company” and a “foreign private issuer” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Prospectus Summary — Implications of Being a Foreign Private Issuer” for additional information.

Neither the U.S. Securities and Exchange Commission (“SEC”) nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total Without

Over-Allotment

Option(4) | | | Total With Full

Over-Allotment

Option | |

| Offering price(1) | | US$ | 4.00 | | | US$ | 7,000,000 | | | US$ | 8,050,000 | |

| Underwriting discounts(2) | | US$ | 0.28 | | | US$ | (490,000 | ) | | US$ | (563,500 | ) |

| Proceeds to the company before expenses(3) | | US$ | 3.72 | | | US$ | 6,510,000 | | | US$ | 7,486,500 | |

| (1) | Determined based on the proposed minimum offering price per Class A Ordinary Share. |

| | |

| (2) | We have agreed to pay the underwriters a discount equal to 7% of the gross proceeds of the offering. For a description of the other compensation to be received by the underwriters, see “Underwriting” beginning on page 139. |

| | |

| (3) | It includes the non-accountable expenses, out-of-pocket expenses payable to underwriter(s) and other estimated listing expenses. |

| | |

| (4) | Assumes that the underwriters do not exercise any portion of their over-allotment option. |

This Offering is being conducted on a firm commitment basis. The underwriter(s) are obligated to take and pay for all of the shares offered by the Company if any such shares are taken. We have granted the underwriter(s) an option, exercisable one or more times in whole or in part, to purchase up to 15% additional Class A Ordinary Shares from us at the initial public offering price, less underwriting discounts, within 45 days from the closing of this Offering to cover over-allotments, if any. If the underwriter(s) exercise the option in full, assuming the public offering price per share is US$4.00, the low end of the estimated range of the initial public offering price, the total underwriting discounts payable to the underwriter(s) will be US$563,500, and the total proceeds to us, before expenses, will be US$7,486,500.

If we complete this Offering, net proceeds will be delivered to us on the closing date.

The underwriter (s) expect to deliver the Class A Ordinary Shares against payment as set forth under “Underwriting”, on or about [*], 2025.

CATHAY SECURITIES, INC.

The date of this prospectus is [*], 2025

TABLE OF CONTENTS

Until and including ________, 2025 (the 25 days after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this Offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not, and the Underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the Underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. For the avoidance of doubt, no offer or invitation to subscribe for Class A Ordinary Shares Is made to the public in the BVI. You should not rely upon any information about us that is not contained in this prospectus or in one of our public reports filed with the Securities and Exchange Commission (“SEC”) and incorporated into this prospectus. The information in this registration statement is not complete and is subject to change. No person should rely on the information contained in this document for any purpose other than participating in our proposed Offering, and only the prospectus dated hereof, is authorized by us to be used in connection with our proposed Offering. Our business, financial condition, results of operations, and prospects may have changed since that date.

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Except where the context otherwise requires and for purposes of this prospectus only, references to:

| ● | “Articles of Association” refers to the articles of association of Pitanium adopted on October 22, 2024; |

| ● | “BVI” refers to the British Virgin Islands; |

| ● | “BVI Act” refers to the BVI Business Companies Act, 2004 (as amended); |

| ● | “CAGR” refers to compounded annual growth rate, the year-on-year growth rate over a specific period of time; |

| ● | “Class A Ordinary Shares” refers to the class A ordinary shares of Pitanium (as defined below) with a par value of US$0.0001 each; |

| ● | “Class B Ordinary Shares” refers to the class B ordinary shares of Pitanium (as defined below) with a par value of US$0.0001 each; |

| ● | “FY2023”, “FY2024” refer to fiscal year ended September 30, 2023 and 2024, respectively; |

| ● | “F&S” are to Frost & Sullivan, an independent industry consultant commissioned by our Company; |

| ● | “F&S Report” are to the industry report on the overview of the industry in which our Company operates, prepared by Frost & Sullivan and commissioned by our Company dated December 16, 2024; |

| ● | “Hong Kong dollar(s)”, or “HK$” refer to the legal currency of Hong Kong; |

| ● | “Hong Kong” or “HKSAR” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| ● | “Mainland China” refers to the mainland of the People’s Republic of China; excluding Taiwan, Hong Kong and the Macau Special Administrative Regions of the People’s Republic of China for the purposes of this prospectus only; |

| ● | “Memorandum” refers to the memorandum of association of Pitanium (as defined below) adopted on October 22, 2024; |

| ● | “Memorandum and Articles of Association” refers to the Memorandum and the Articles of Association; |

| ● | “Pitanium” and the “Company” refers to Pitanium Limited, a BVI business company with limited liability incorporated under the laws of BVI, and the holding company of our businesses; |

| ● | “Operating Subsidiary” refers to Here We Seoul Limited, a company with limited liability incorporated under the laws of Hong Kong, and a wholly-owned subsidiary of Pitanium; |

| ● | “Ordinary Shares” refers to Class A and Class B Ordinary Shares; |

| ● | “PRC” refer to the People’s Republic of China, including Hong Kong and the Macau Special Administrative Regions of the People’s Republic of China; |

| | | |

| | ● | “PRC Counsel” refers to Tian Yuan Law Firm; |

| ● | “PRC government” are to the government and governmental authorities of Mainland China for the purposes of this prospectus only; |

| ● | “SEC” refers to the United States Securities and Exchange Commission; |

| ● | “US$”, “$”, or “U.S. dollar(s)” refer to the legal currency of the United States; |

| ● | “U.S.”, or “United States” refers to the United States of America; |

| ● | “U.S. GAAP” refers to generally accepted accounting principles in the United States; and |

| ● | “we”, “group”, “us”, “or “our” refer to Pitanium Limited, the BVI holding company that will issue the Class A Ordinary Shares being offered, and its subsidiary. |

Unless otherwise noted, all translations from Hong Kong dollars to U.S. dollars and from U.S. dollars to Hong Kong dollars in this prospectus are made at HK$7.8139 to US$1.00 for the year ended September 30, 2024 and HK$7.7698 to US$1.00 as at September 30, 2024, the exchange rate set forth in the https://www.x-rates.com and website of Inland Revenue Department. We make no representation that any Hong Kong dollars or U.S. dollar amounts could have been, or could be, converted into Hong Kong dollars or Renminbi, as the case may be, at any particular rate, the rates stated below, or at all.

This prospectus contains information derived from various public sources and certain information from an industry report commissioned by us and prepared by Frost & Sullivan, a third-party industry research firm, to provide information regarding our industry and market position. Such information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including those described in “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications and reports.

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our Class A Ordinary Shares. You should carefully consider, among other things, our combined financial statements and the related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Overview

Our Operating Subsidiary is a retailer in Hong Kong focusing on the sale of its proprietary brand products, namely PITANIUM and BIG PI online. It also generates revenue from the offline sale at six retail stores situated in Hong Kong’s premier shopping destinations. This positioning not only enhances the brand’s visibility but also aligns it with the discerning tastes of its target demographic.

The brand “PITANIUM” was launched in 2019 and began by offering high-end skincare and haircare solutions to spas in Hong Kong. These brand products were later offered for sale to retail customers in our online shop, which allows customers to enjoy the use of professional skincare and personal care products in the comfort of their homes, thereby promoting their health and well-being. The brand “BIG PI” was launched in 2023 and offers whole sets of products to its retail customers using different product formulas.

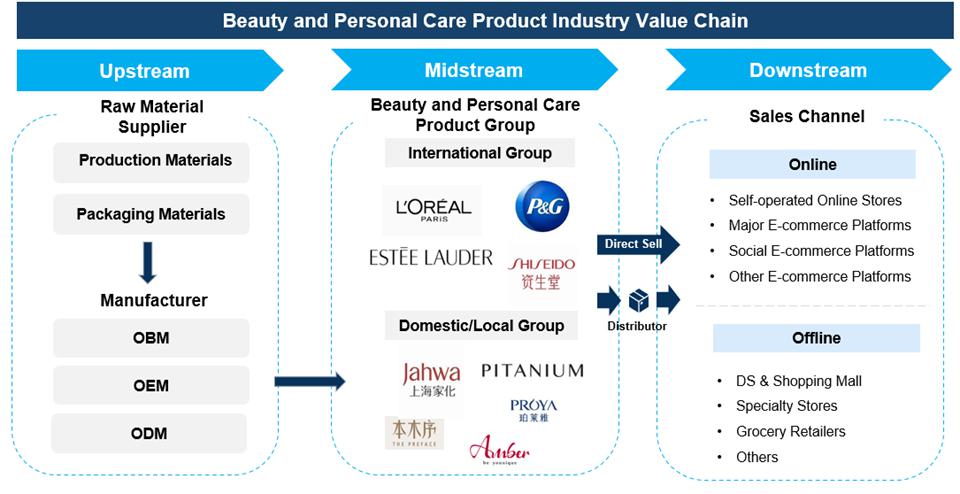

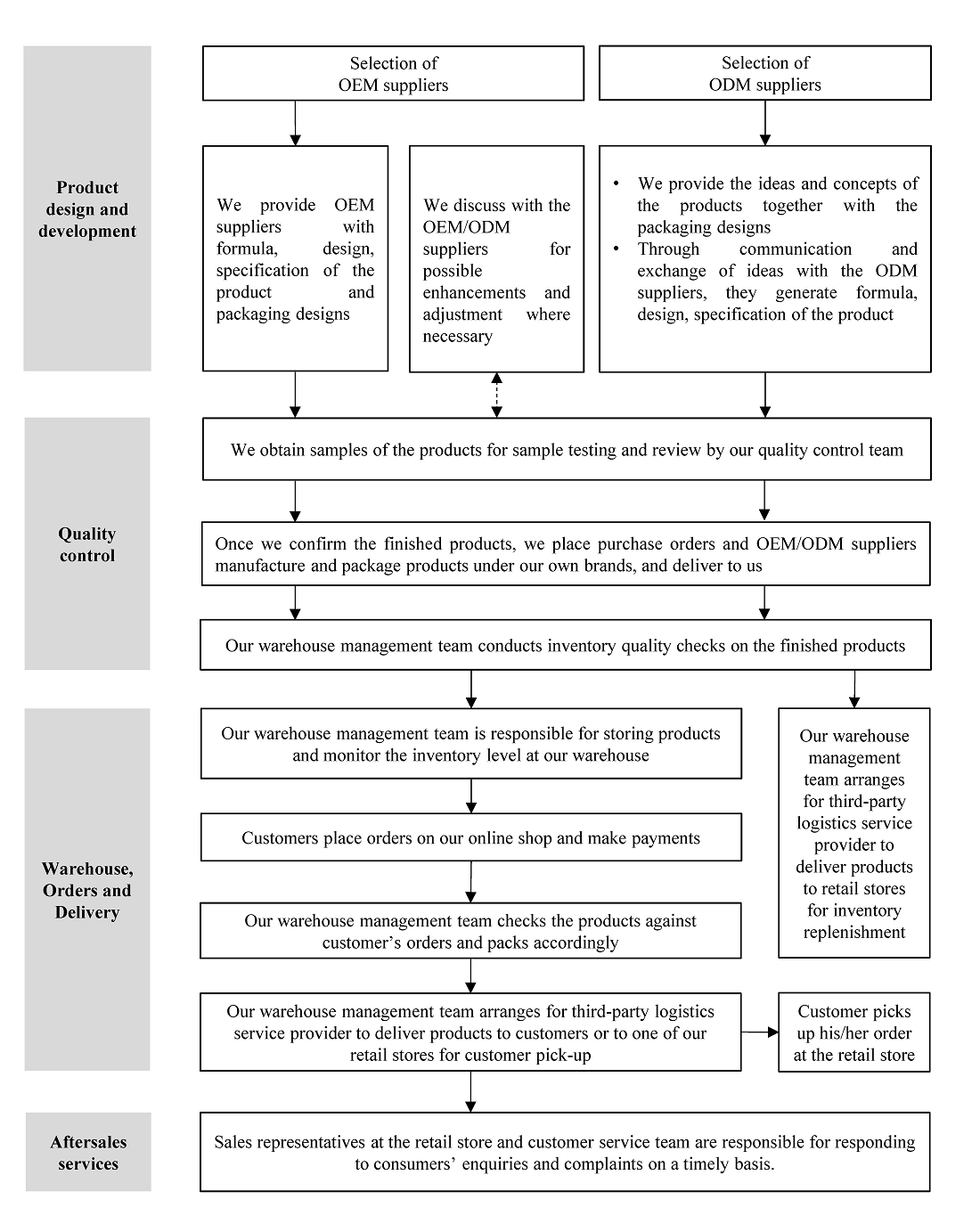

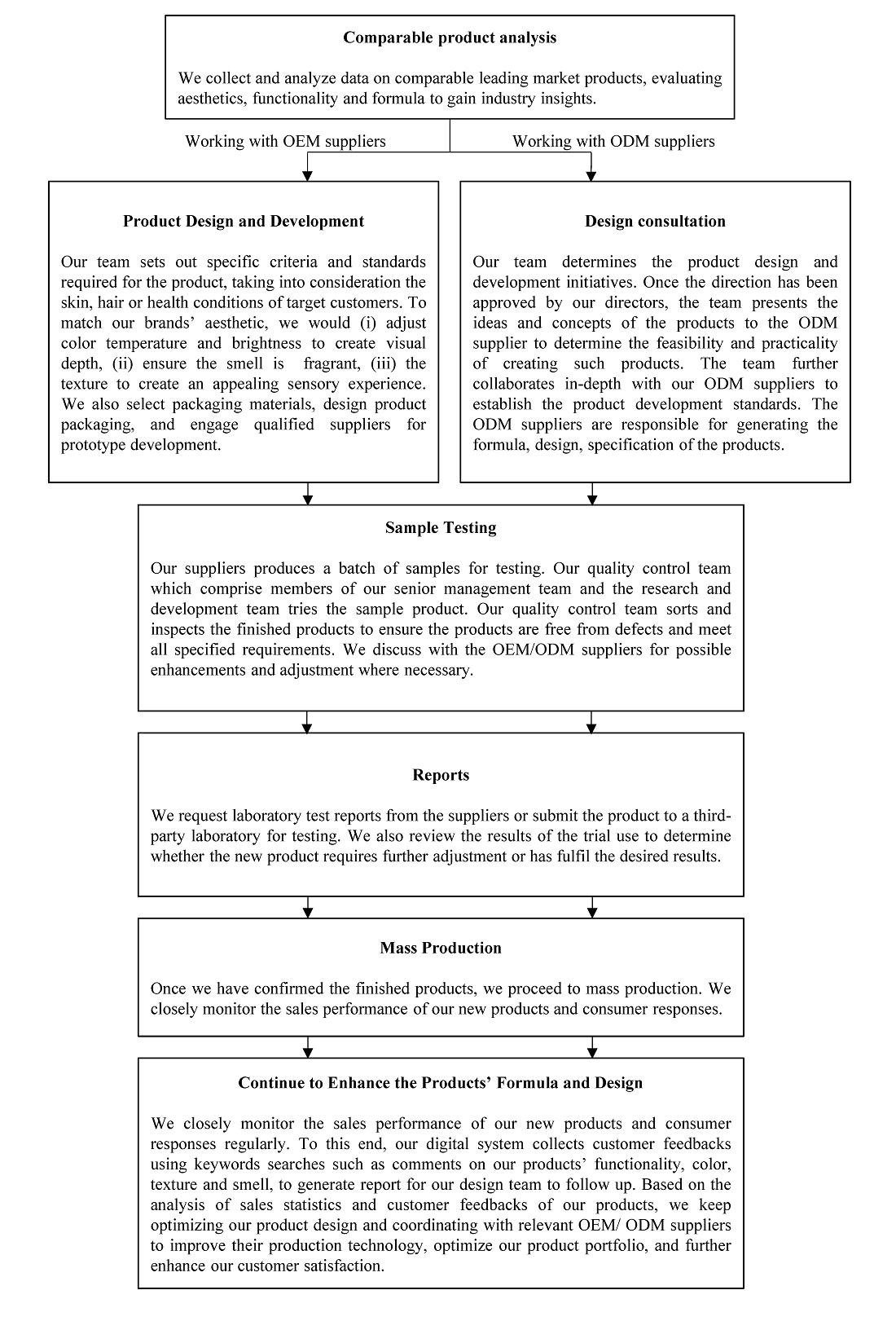

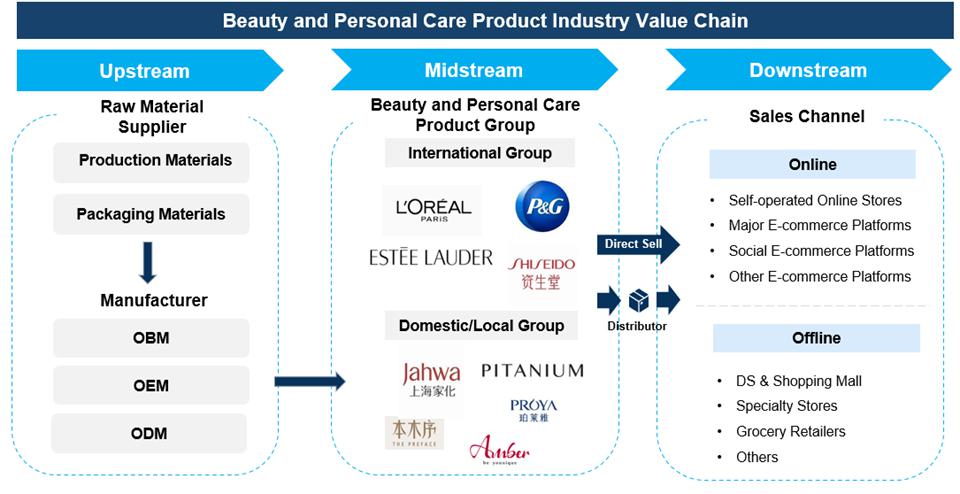

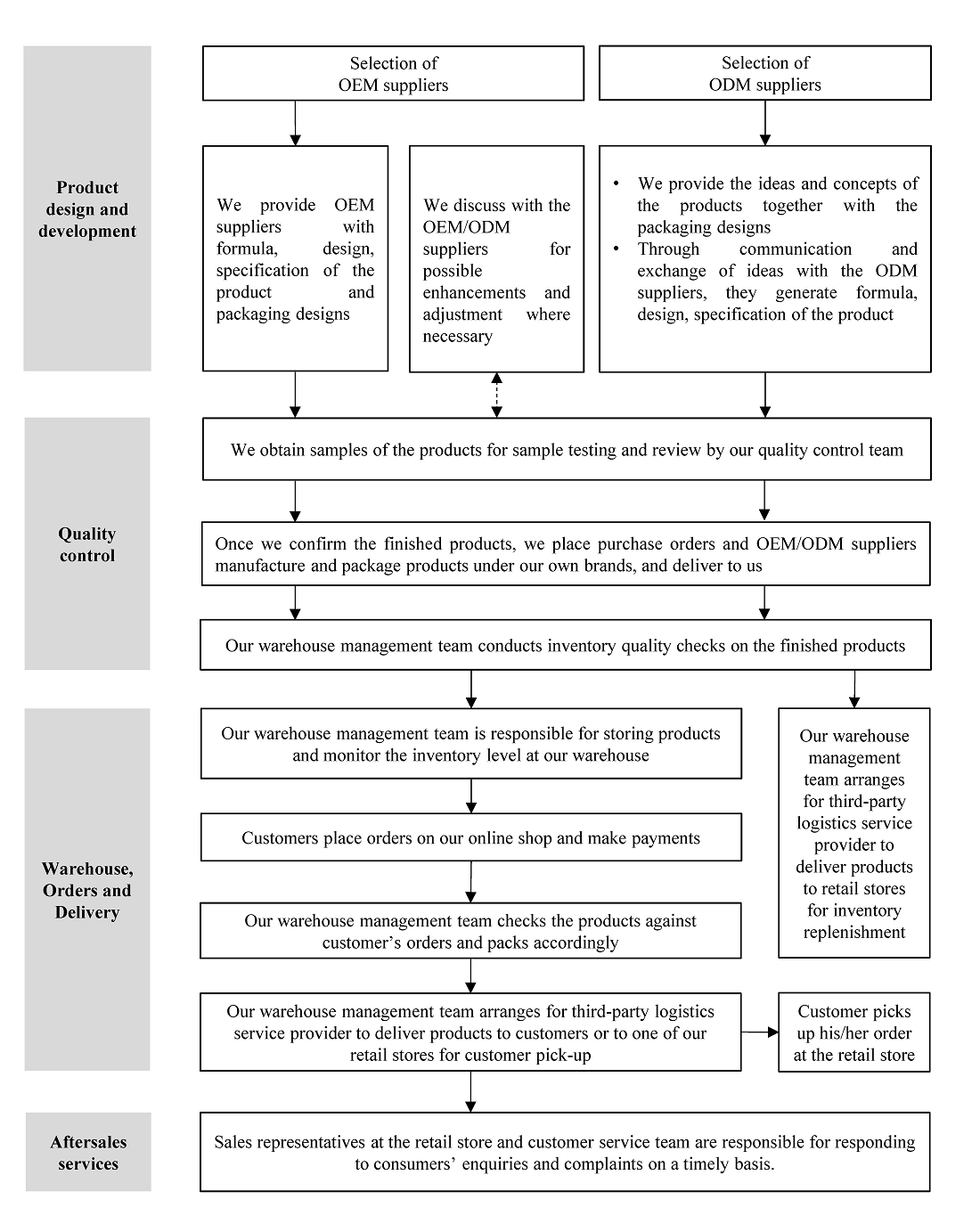

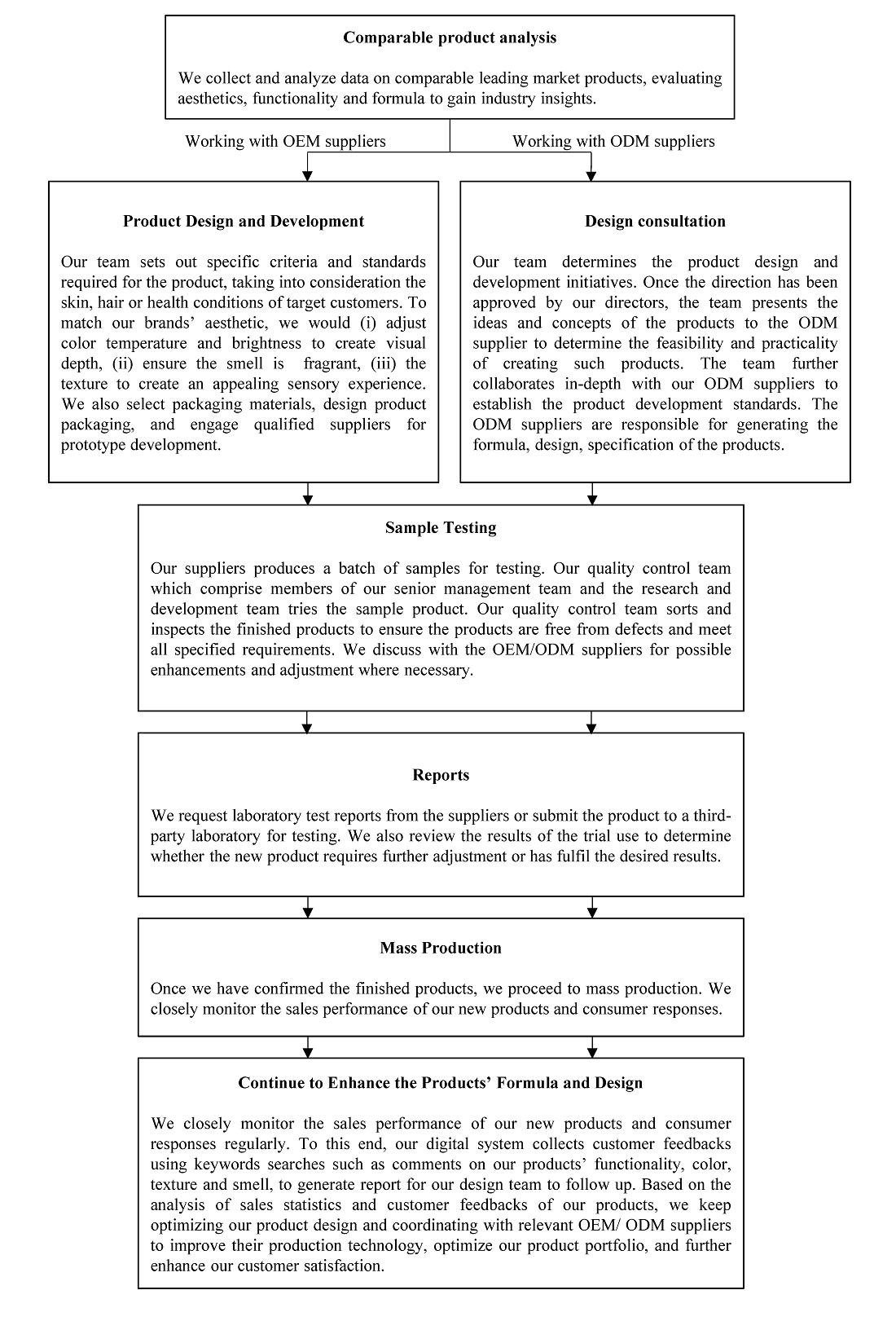

Our Operating Subsidiary emphasizes product design and development with an in-house product development team working closely with its original equipment manufacturing (“OEM”) and original design manufacturing (“ODM”) suppliers. It takes a proactive approach in expanding its product portfolio with a view to staying ahead of market trends and showcasing its ability to cater to the evolving needs of its customers.

Our Operating Subsidiary hosts and manages an online shop “www.pitanium.com” to display its best-selling products and latest marketing and promotional initiatives on its home page. Our Operating Subsidiary regularly updates its online shop to keep customers updated about its product offerings. Meanwhile, our Operating Subsidiary is operating six retail stores in Hong Kong. Its customers placed 68,406 and 77,101 orders with the sales amounts of approximately HK$68,196,877 and HK$74,930,388 (approximately US$9,589,371) for the years ended September 30, 2023 and 2024.

Industry Background

Beauty and personal care products, also known as cosmetics and personal care products, are substances, preparations, or items designed to be applied to the human body for cleansing, beautifying, promoting attractiveness, or altering appearance. These products are formulated to enhance or maintain various aspects of personal hygiene, skin health, and aesthetic appeal.

Beauty and personal care products encompass a diverse array of items, including but not limited to skincare treatments, haircare products, makeup, deodorant and personal hygiene essentials. These products also come in various forms such as creams, lotions, powders, sprays, oils, gels, and solid items like lipsticks or compacts, and are intended for application on different parts of the body, particularly the skin, hair, nails, and teeth. Some beauty and personal care retailers also carry complementary household cleaning essentials to provide a comprehensive shopping experience for their customers.

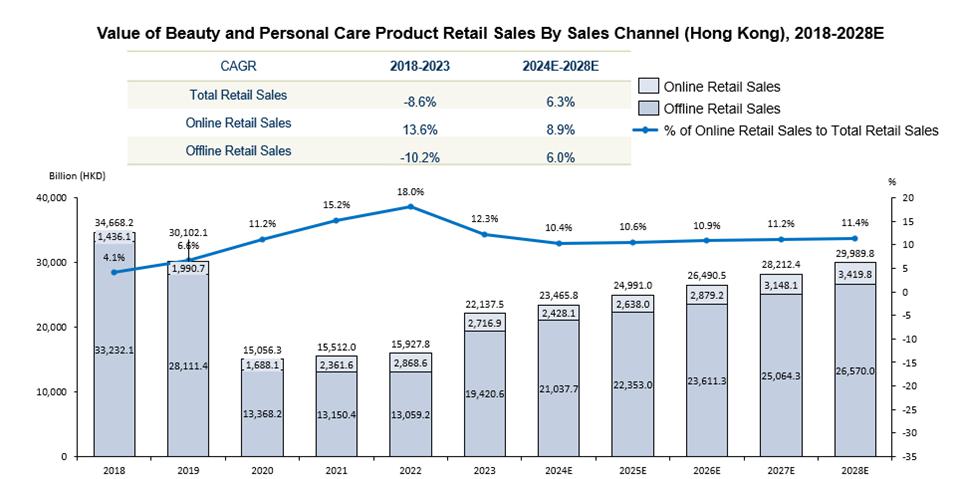

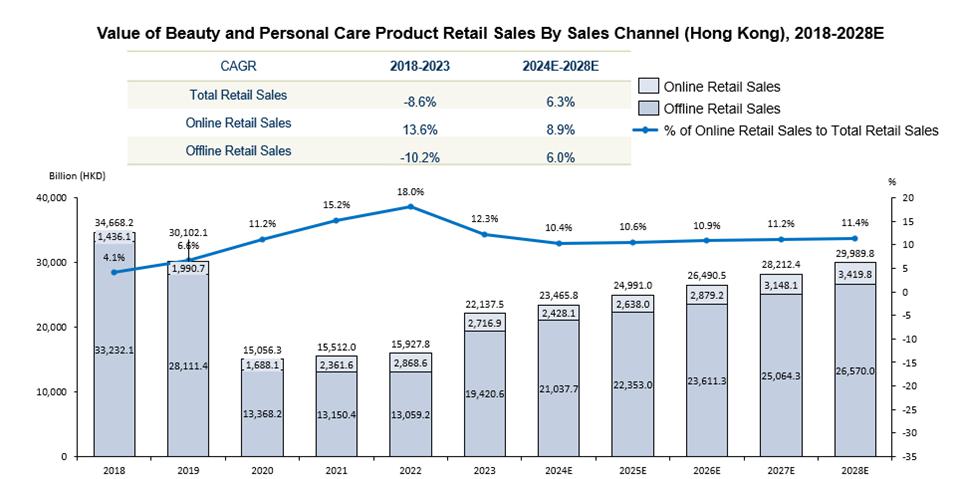

The Hong Kong online retail sales of beauty and personal care product market encompasses the digital commerce ecosystem dedicated to the sale and distribution of beauty and personal care products through internet-based platforms to consumers within Hong Kong’s geographical boundaries.

The Hong Kong offline retail sales of beauty and personal care product market encompasses the traditional brick-and-mortar retail ecosystem dedicated to the sale and distribution of beauty and personal care products through physical stores within Hong Kong’s geographical boundaries. It includes department stores, specialty cosmetics shops, drugstores, beauty chain stores, supermarkets, and independent retailers that maintain physical premises where customers can personally examine, test, and purchase products while receiving face-to-face customer service and professional beauty advice.

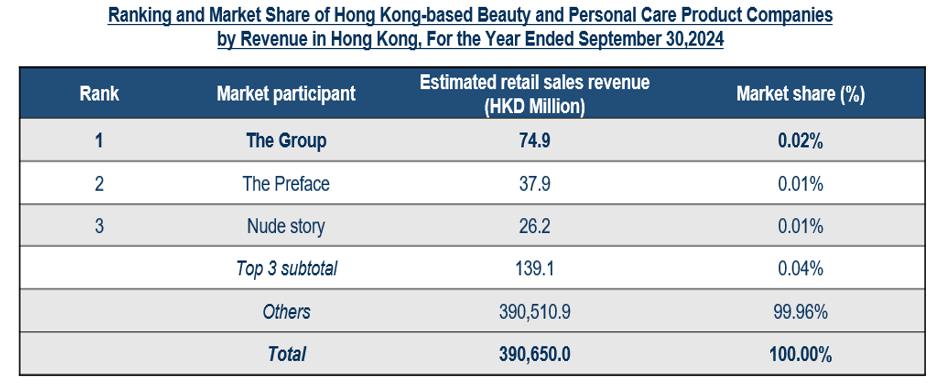

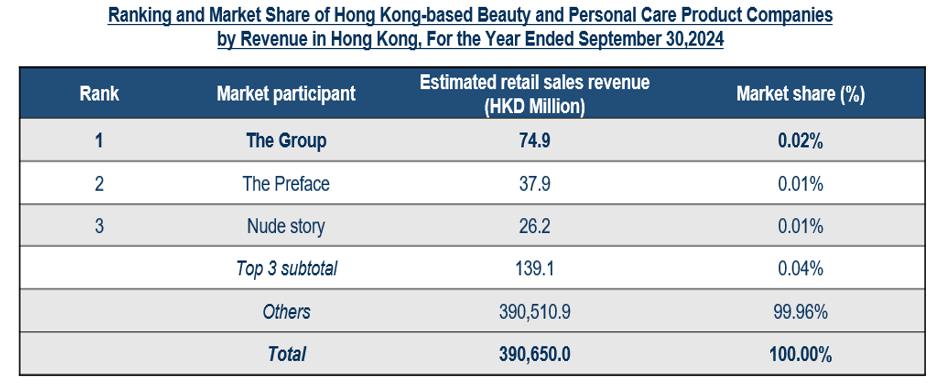

Competitive Landscape

The beauty and personal care product market in Hong Kong is highly fragmented. In 2023, there were approximately five thousand brands, which can be classified into two primary categories based on the extent of their operational coverage: (i) large multinational corporations and (ii) local small and medium-sized brands. The Group with two other major leading players in the Hong Kong beauty and personal care product industry in 2024, collectively accounting for 0.04% of the total retail sales value of beauty and personal care product in Hong Kong. The Group ranked first among local beauty and personal care brands, achieving an estimated HK$74.9 million for the year ended September 30, 2024.

Our Competitive Strengths

We believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

| | ● | Our Operating Subsidiary is committed to excellence in product design and development that yields high quality products. |

| | ● | Our Operating Subsidiary conducts marketing and promotion initiatives to boost its proprietary brands’ reputation. |

| | ● | Integration of online and offline channels achieving an effective reach of customers. |

| | ● | We have an experienced senior management and dedicated workforce. |

Our Growth Strategies

We plan to grow our business by upgrading our current operations in Hong Kong and expand our operations to markets outside Hong Kong by pursuing the following business strategies:

| | ● | We plan to enhance customer experience through launching a mobile application. |

| | ● | We will develop a new line of products solely for home treatment. |

| | ● | We will expand its product portfolio and explore new suppliers. |

| | ● | We plan to further enhance its marketing strategies. |

Summary of Risk Factors

Investing in our Class A Ordinary Shares involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in our Class A Ordinary Shares. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors”. The following is a summary of what we view as our most significant risk factors:

Risks Related to our Business and Operations

| | ● | Our Operating Subsidiary’s business success is dependent on its ability to continuously upgrade and innovate its existing product offerings, and failure to do so may compromise its competitive edge and reduce its market share. |

| | | |

| | ● | If our Operating Subsidiary fails to gauge customers’ taste and trend in the changing industry conditions and maintain a large variety of product portfolio, its financial performance could be adversely affected. |

| | | |

| | ● | Our Operating Subsidiary may have difficulties in managing its marketing efforts and may face increased competition in its marketing efforts, which could materially and adversely affect its business and growth prospects. |

| | | |

| | ● | Our Operating Subsidiary’s website for the online shop may be excluded from or ranked lower in organic search results due to changes to search engines’ algorithms or terms of services. |

| | | |

| | ● | Any material shortage or delay in supply by our Operating Subsidiary’s suppliers or instability of their product quality, and any difficulty in maintaining its current relationships with its suppliers or finding replacements for its suppliers in a timely manner, could materially and adversely affect its business. |

| | ● | Product quality is core to our Operating Subsidiary’s business. Any quality issues related to the products may result in a loss of customers and subject our Operating Subsidiary to product liability claims. |

| | | |

| | ● | Failure to maintain optimal inventory level could increase our Operating Subsidiary’s operating costs or lead to unfulfilled customer demands, either of which could have a material adverse effect on its business, financial condition, results of operations and prospects. |

| | | |

| | ● | Our Operating Subsidiary’s business operations may be affected by risks related to logistics services providers. |

| | | |

| | ● | As our Operating Subsidiary compete to a certain degree on price, fluctuations in freight charges may materially and adversely affect its financial conditions and results of operations. |

| | | |

| | ● | Any interruption in the operation of our Operating Subsidiary’s warehouses for an extended period may have an adverse impact on its business. |

| | | |

| | ● | Our success depends on the market recognition of our brands PITANIUM and BIG PI for offering quality beauty and personal care products and any damage to our brand name could materially and adversely affect our business and results of operations. |

| | | |

| | ● | We depend on our core management personnel in operating our business. As competition for such management talents is fierce and new hires may not necessarily fit in well with the current management team, any failure in retaining our key management personnel or hiring suitable talents may be detrimental to our business and prospects. |

| | | |

| | ● | Our management team lacks experience in managing a U.S. public company and complying with laws applicable to such company, the failure of which may adversely affect our business, financial condition and results of operations. |

| | | |

| | ● | Any loss of our senior management and failure to attract and retain qualified personnel could affect our operations and growth prospects. |

| | | |

| | ● | Our Operating Subsidiary relies on certain OEM and ODM suppliers to design, develop and produce our products and its dependence on these external parties could expose it to additional risks. |

| | | |

| | ● | Disruptions of our Operating Subsidiary’s supply chain could have a material adverse effect on its operating and financial results. |

| | | |

| | ● | Events such as epidemics, natural disasters, adverse weather conditions, political unrest and terrorist attacks may affect our business operations. |

| | | |

| | ● | Violation, infringement or any failure to protect our intellectual property rights could harm our business and competitive position. |

| | | |

| | ● | We may be subject to intellectual property disputes, which may result in significant legal cost and may disrupt our business and operations. |

| | | |

| | ● | We are exposed to the risks relating to the commercial real estate rental market. |

| | ● | Our Operating Subsidiary has not entered into any long-term agreements with its retail customers. |

| | | |

| | ● | We may not be able to implement our business strategies and expansion plans effectively to achieve future growth. |

| | | |

| | ● | We rely on information technology systems to process transactions, summarize results, and manage our business. Disruptions in both our primary and back-up systems could adversely affect our business and operating results. |

| | | |

| | ● | Successful cyber-attacks and the failure to maintain adequate cyber-security systems and procedures could materially harm our operations. |

| | | |

| | ● | Failure to protect confidential information of our customers and our network against security breaches could damage our reputation and substantially harm our business and results of operations. |

Risks Related to the Industry in which we Operate

| | ● | We operate in a regulated industry, any changes in existing laws and regulations may affect our business operations. |

| | | |

| | ● | New and existing competitors could adversely affect prices and demand for beauty and personal care products and decrease our market share. |

Risks Related to Doing Business in Hong Kong

| | ● | All of our operations are in Hong Kong. However, the PRC government may exercise significant oversight and discretion over the conduct of our business, which could result in a material change in our operations and/or the value of our Class A Ordinary Shares. Our Operating Subsidiary in Hong Kong may be subject to certain PRC laws and regulations, which may impair our ability to operate profitably and result in a material negative impact on our operations and/or the value of our Class A Ordinary Shares. Furthermore, the PRC legal system is evolving rapidly, and enforcement of certain laws, regulations and rules may further change or develop and thus our assertions and beliefs of the risk imposed by the Mainland China legal and regulatory system cannot be certain. In light of the foregoing, there are risks and uncertainties which we cannot foresee, and policies, rules and regulations and the enforcement of laws in the PRC can change quickly with little advance notice, and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain. There are risks that the PRC government may intervene or influence our current and future operations in Hong Kong at any time, or may exert more control over offerings conducted overseas and/or foreign investment in issuers likes ourselves. If the PRC government intervenes or influences our current and future operations in Hong Kong, the PRC regulatory authorities may disallow our holding company structure, which would likely result in a material change in our operations and/or the value of our Class A Ordinary Shares, including the possibility that such a change may cause the value of such Ordinary Shares to significantly decline or become worthless. |

| | | |

| | ● | There remain some uncertainties as to whether we will be required to obtain approvals from the PRC authorities to list on the U.S. exchanges and offer securities in the future, and if required, we cannot assure you that we will be able to obtain such approval. We may become subject to a variety of PRC laws and other obligations regarding data security in relation to offerings that are conducted overseas, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations and may hinder our ability to offer or continue to offer Class A Ordinary Shares to investors and cause the value of our Class A Ordinary Shares to significantly decline or be worthless. |

| | | |

| | ● | Compliance with Hong Kong’s Personal Data (Privacy) Ordinance and any such other existing or future data privacy related laws, regulations and governmental orders may entail significant expenses and could materially affect our business. |

| | | |

| | ● | If the PRC government chooses to extend the oversight and control over offerings that are conducted overseas and/or foreign investment in Mainland China-based issuers to Hong Kong-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Class A Ordinary Shares to investors and cause the value of our Class A Ordinary Shares to significantly decline or be worthless. |

| | ● | The enactment of the law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Hong Kong subsidiary, which represent substantially all of our business. |

| | | |

| | ● | The Hong Kong legal system embodies uncertainties which could limit the availability of legal protections, which could result in a material change in our Operating Subsidiary’s operations and/or the value of the securities we are offering. |

| | | |

| | ● | There are political risks associated with conducting business in Hong Kong. |

| | | |

| | ● | Because our business is conducted in Hong Kong dollars and the price of our Class A Ordinary Shares is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments. |

Risks Related to Our Corporate Structure

| | ● | We rely on dividends and other distributions on equity paid by our Operating Subsidiary to fund any cash and financing requirements we may have. In the future, to the extent funds or assets in the business are in Hong Kong or a Hong Kong entity, funds or assets may not be available to fund operations or for other use outside of Hong Kong, due to the imposition of restrictions and limitations on, our ability or our Operating Subsidiary by the PRC government to transfer cash or assets. Any limitation on the ability of our Operating Subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and might materially decrease the value of our Class A Ordinary Shares or cause them to be worthless. |

| | | |

| | ● | It may be difficult for overseas shareholders and/or regulators to conduct investigations or collect evidence within the territory of the PRC, including Hong Kong. |

| | | |

| | ● | You may incur additional costs and procedural obstacles in effecting service of legal process, enforcing foreign judgments or bringing actions in Hong Kong against us or our management named in this prospectus based on Hong Kong laws. |

| | | |

| | ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under BVI law. |

Risks Related to our Class A Ordinary Shares and this Offering

| | ● | We have a dual-class voting structure consisting of Class A Ordinary Shares and Class B Ordinary Shares. Such dual-class voting structure will limit your ability to influence corporate matters, and allow our directors, officers and principal shareholders have significant voting power and may take actions that may not be in the best interests of our other shareholders, which could severely limit the ability of other shareholders to influence matters requiring shareholder approval and, as a result, we may take actions that our other shareholders do not view as beneficial. |

| | | |

| | ● | We cannot predict the effect our dual-class structure may have on the market price of our Class A Ordinary Shares. |

| | ● | Our Class A Ordinary Shares may be prohibited from being traded on a national exchange under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors. The delisting of our Class A Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was signed into law on December 29, 2022, amending the HFCAA to require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. |

| | ● | There has been no public market for our Class A Ordinary Shares prior to this Offering, and you may not be able to resell our Class A Ordinary Shares at or above the price you paid, or at all. |

| | ● | We may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Class A Ordinary Shares. |

| | ● | Our Class A Ordinary Shares may be thinly traded and you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares. |

| | ● | Future issuances of our Class B Ordinary Shares may be dilutive to the voting power of our Class A Ordinary Shareholders. |

| | ● | You will experience immediate and substantial dilution in the net tangible book value of Class A Ordinary Shares purchased. |

| | ● | Shares eligible for future sale may adversely affect the market price of our Class A Ordinary Shares, as the future sale of a substantial amount of issued and outstanding Class A Ordinary Shares in the public marketplace could reduce the price of our Class A Ordinary Shares. |

| | | |

| | ● | Our pre-initial public offering investors, namely Ms. Xu Heli and Mr. Wang Wenzhang (each a “Pre-IPO Investor”), will be able to sell their shares upon completion of this Offering subject to restrictions under Rule 144 under the Securities Act and the lock-up agreements. |

| | ● | If securities or industry analysts do not publish research or reports about our business, or if they publish a negative report regarding our Class A Ordinary Shares, the price of our Class A Ordinary Shares and trading volume could decline. |

| | ● | We have broad discretion in the use of the net proceeds from this Offering and may not use them effectively. |

| | ● | Our existing shareholders that are not included in this registration statement will be able to sell their Class A Ordinary Shares after completion of this Offering subject to restrictions under the Rule 144. |

| | ● | Nasdaq may apply additional and more stringent criteria for our initial and continued listing because we plan to have a small public offering and our insiders will hold a large portion of our listed securities. |

| | ● | If we cannot satisfy, or continue to satisfy, the initial listing requirements and other rules of Nasdaq Capital Market, although we are exempt from certain corporate governance standards applicable to US issuers as a Foreign Private Issuer, our Class A Ordinary Shares may not be listed or may be delisted, which could negatively impact the price of our Class A Ordinary Shares and your ability to sell them. |

| | ● | We are an “emerging growth company,” and the reduced disclosure requirements applicable to emerging growth companies may make our Class A Ordinary Shares less attractive to investors. |

| | ● | We will incur increased costs as a result of being a public company, particularly after we cease to qualify as an emerging growth company. |

| | ● | We are a “foreign private issuer” and a BVI company, and our disclosure obligations differ from those of U.S. domestic reporting companies. As a result, we may not provide you the same information as U.S. domestic reporting companies or we may provide information at different times, which may make it more difficult for you to evaluate our performance and prospects. |

| | ● | If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we would incur significant additional legal, accounting and other expenses that we would not incur as a foreign private issuer. |

| | | |

| | ● | There can be no assurance that we will not be a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for any taxable year, which could subject U.S. investors in the Ordinary Shares to significant adverse U.S. income tax consequences. |

Corporate History

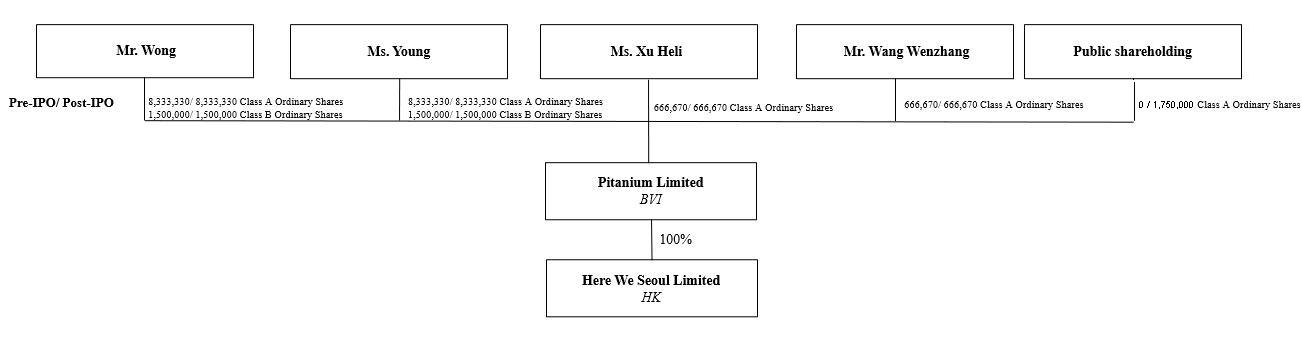

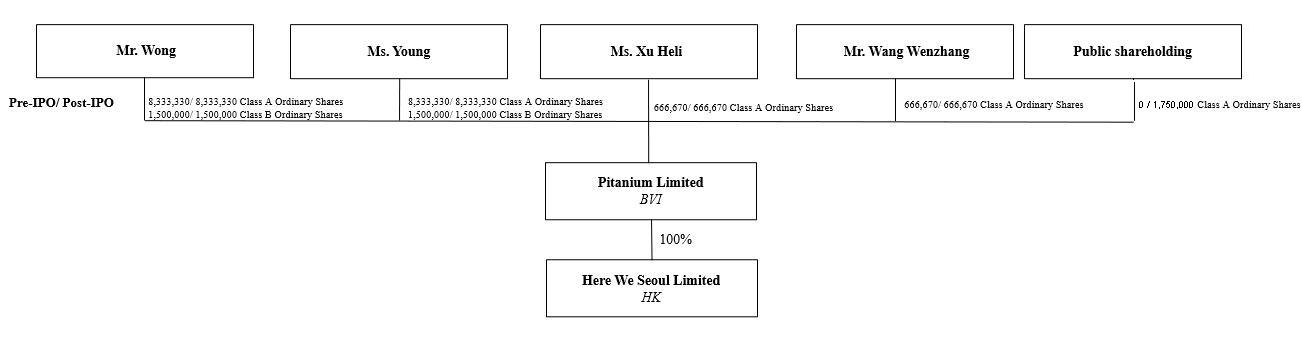

Pitanium Limited (“Pitanium”) was incorporated as a BVI business company with limited liability on October 22, 2024 under the laws of the BVI. Upon the acquisition of our Operating Subsidiary, Pitanium became the holding company for our Operating Subsidiary. Pitanium has no material operation of its own, and we conduct operations through our Operating Subsidiary, namely Here We Seoul Limited. As of the date of this prospectus, Pitanium is authorized to issue a maximum of 500,000,000 Ordinary Shares in aggregate divided into Class A Ordinary Shares with a par value of US$0.0001 each and Class B Ordinary Shares with a par value of US$0.0001 each.

Here We Seoul Limited was incorporated as a company with limited liability under the laws of Hong Kong on December 9, 2013. Here We Seoul Limited is our sole operating entity. On November 28, 2024, Pitanium acquired all of the issued and outstanding shares of Here We Seoul Limited from Mr. Ying Yeung Wong and Ms. Yuen Yi Young. In consideration thereof, Pitanium allotted and issued as fully paid 3,333,330 Class A Ordinary Shares each to Mr. Wong and Ms. Young. The said transfer was properly and legally completed and settled on the same date. After the said transfer, our Operating Subsidiary has become wholly-owned subsidiary of Pitanium.

Corporate Structure

We are offering 1,750,000 Class A Ordinary Shares, representing 8.86% of the Class A Ordinary Shares issued and outstanding following completion of the Offering, assuming the underwriter do not exercise the over-allotment option.

Pitanium’s issued share capital is a dual-class structure consisting of Class A Ordinary Shares and Class B Ordinary Shares. Class A Ordinary Shares are the only class of Ordinary Shares being offered in this Offering. Holders of Class A Ordinary Shares and Class B Ordinary Shares shall vote together as one class on all resolutions of the shareholders and have the same rights except each Class A Ordinary Share shall entitle its holder to one (1) vote and each Class B Ordinary Share shall entitle its holder to twenty (20) votes.

The following diagram illustrates our corporate structure, including our subsidiary, as of the date of the prospectus and after this Offering (assuming no exercise of the over-allotment option by the underwriters):

For more details on our corporate history and structure, please refer to “Corporate History and Structure” on page 54.

Corporate Information

Our principal executive office is located at 30F, Gravity, 29 Hing Yip street, Kwun Tong, Kowloon, Hong Kong. The telephone number of our principal executive office is +852 6297-5255. Our registered agent in the BVI is Hermes Corporate Services (BVI) Ltd. Our registered office and our registered agent’s office in the BVI are both located at the office of Sixth (6th) Floor, Water’s Edge Building 1, Wickham’s Cay II, Road Town, Tortola, British Virgin Islands. Our agent for service of process in the United States is 122 East 42nd Street, 18th Floor, New York, NY 10168.

We maintain a website at https://pitanium.com/. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

Transfer of Cash to and from our Operating Subsidiary

Pitanium has no operations of its own. It conducts its operations in Hong Kong through our Operating Subsidiary. Pitanium may rely on dividends or payments to be paid by our Operating Subsidiary to fund its cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders and U.S. investors, to service any debt we may incur and to pay our operating expenses. If our Operating Subsidiary incurs debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us.

Cash is transferred through our organization in the following manner: (i) funds are transferred from Pitanium, our holding company incorporated in BVI, to our Operating Subsidiary in Hong Kong, in the form of capital contributions or loans, as the case may be; and (ii) dividends or other distributions may be paid by our Operating Subsidiary in Hong Kong to Pitanium. If Pitanium intends to distribute dividends to its shareholders, it will depend on payment of dividends from our Operating Subsidiary to Pitanium in accordance with the laws and regulations of Hong Kong, and the dividends will be distributed by Pitanium to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions.

There is no restriction under the BVI Act on the amount of funding that Pitanium may provide to its subsidiary in Hong Kong (i.e., Pitanium to our Operating Subsidiary) through loans or capital contributions, provided that such provision of funds is in the best interests of, and of commercial benefit to, Pitanium. The Operating Subsidiary is also permitted under the laws of Hong Kong, to provide funding to Pitanium, through dividend distributions or payments, without restrictions on the amount of the funds.

We can distribute accumulated and realized profits (so far as not previously utilized by distribution or capitalization) available for distribution less its accumulated loss (to the extent that they have not been previously written off in a reduction or reorganization of capital) by dividends from our Operating Subsidiary in Hong Kong to the Company and our shareholders and U.S. investors, provided that the entity remains solvent after such distribution. Subject to the BVI Act and our Memorandum and Articles of Association, our board of directors may, by resolutions of directors, authorize and declare a dividend to shareholders from time to time and of an amount they deem fit if they are satisfied, on reasonable grounds, that immediately after the distribution, the value of our assets will exceed our liabilities, and Pitanium will be able to satisfy our debts as they fall due in the ordinary course of business. According to the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), a company may only make a distribution out of profits available for distribution. Other than the above, we did not adopt or maintain any cash management policies and procedures as of the date of this prospectus.

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us.

Furthermore, as of the date of this prospectus, there is no restrictions or limitations under the laws of Hong Kong imposed on the conversion of Hong Kong dollar into foreign currencies and the remittance of currencies out of Hong Kong, nor is there any restriction on foreign exchange to transfer cash between Pitanium and its subsidiary, across borders and to U.S investors, nor are there any restrictions and limitations to distribute earnings from our business and subsidiary, to Pitanium and U.S. investors and amounts owed. As advised by our PRC Counsel, while the laws and regulations of Mainland China do not currently have any material impact on our ability to transfer cash or assets between Pitanium or our Operating Subsidiary or to the investors in the U.S, however, if certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future were to become applicable to us, and to the extent our cash or assets are in Hong Kong or a Hong Kong entity (such as our Operating Subsidiary), such funds or assets may not be available to fund operations or for other use outside of Hong Kong due to the imposition of restrictions and limitations on our ability to transfer funds or assets by the PRC government on the ability of Pitanium or our Operating Subsidiary to transfer cash and/or assets. Furthermore, we cannot assure you that the PRC government will not impose restrictions on Pitanium or our Operating Subsidiary to transfer or distribute cash within the organization, which could result in an inability of or prohibition on making transfers or distributions to entities outside of Hong Kong.

Any limitation, if imposed in the future, on the ability of our subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and might materially decrease the value of our Class A Ordinary Shares or cause them to be worthless. The promulgation of new laws or regulations, or the new interpretation of existing laws and regulations, in each case, that restrict or otherwise unfavorably impact the ability or way we conduct our business, could require us to change certain aspects of our business to ensure compliance, which could decrease demand for our services, reduce revenues, increase costs, require us to obtain more licenses, permits, approvals or certificates, or subject us to additional liabilities. To the extent any new or more stringent measures are required to be implemented, our business, financial condition and results of operations could be adversely affected and such measured could materially decrease the value of our Class A Ordinary Shares, potentially rendering it worthless. For a more detailed discussion of how the cash is transferred within our organization. See “Risk Factors — Risks related to our corporate structure — We rely on dividends and other distributions on equity paid by our Operating Subsidiary to fund any cash and financing requirements we may have. In the future, to the extent funds or assets in the business are in Hong Kong or a Hong Kong entity, the funds or assets may not be available to fund operations or for other uses outside of Hong Kong, due to the imposition of restrictions and limitations on, our ability or our Operating Subsidiary by the PRC government to transfer cash or assets. Any limitation on the ability of our Operating Subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and might materially decrease the value of our Class A Ordinary Shares or cause them to be worthless” on page 38 and “Dividend Policy” on page 53.

For FY2023 and FY2024 and up to the date of this prospectus, no transfer of cash or other types of assets has been made between Pitanium and Operating Subsidiary; and Pitanium, our holding company, has not declared or made any dividends or other distribution to its shareholders in the past, nor has any dividends or distributions been made by our Operating Subsidiary to our holding company. Furthermore, no payments of any kind (including transfers, capital contributions and loans) have been made between Pitanium and our Operating Subsidiary for FY2023 and FY2024. For FY2023 and FY2024, our Operating Subsidiary declared dividends in an aggregate of HK$8,000,000 and HK$7,327,215 (approximately US$937,715) directly to its then shareholders before the incorporation of Pitanium.

If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on receipt of funds from our Operating Subsidiary by way of dividend payments.

We do not have any present plan to declare or pay any dividends on our Ordinary Shares in the foreseeable future. We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments. See “Risk Factors — Risks related to our Corporate Structure — We rely on dividends and other distributions on equity paid by our Operating Subsidiary to fund any cash and financing requirements we may have. In the future, to the extent funds or assets in the business are in Hong Kong or a Hong Kong entity, funds or assets may not be available to fund operations or for other uses outside of Hong Kong, due to the imposition of restrictions and limitations on, our ability or our Operating Subsidiary by the PRC government to transfer cash or assets. Any limitation on the ability of our Operating Subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and might materially decrease the value of our Class A Ordinary Shares or cause them to be worthless.” on page 38, and the audited combined financial statements and the accompanying footnotes beginning on F-2 of this prospectus.

Regulatory Development in the PRC

We are a holding company incorporated in the BVI with all of the operations conducted by our Operating Subsidiary in Hong Kong. We currently do not have, nor do we currently intend to establish, any subsidiary nor do we plan to enter into any contractual arrangements to establish a VIE structure with any entity in Mainland China.

Hong Kong is a special administrative region of the PRC and the basic policies of the PRC regarding Hong Kong are reflected in the Basic Law, which serves as Hong Kong’s constitution. The Basic Law provides Hong Kong with a high degree of autonomy and executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one country, two systems”. Accordingly, we believe that the PRC laws and regulations on cybersecurity, M&A and the oversight and control over overseas securities offerings do not currently have any material impact on our business, financial condition or results of operations. However, there is no assurance that there will not be any changes in the economic, political and legal environment in Hong Kong in the future.

We are aware that, in recent years, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in Mainland China, including cracking down on illegal activities in the securities market, enhancing supervision over Mainland China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. This indicated the PRC government’s intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in Mainland China-based issuers. Since these statements and regulatory actions are relatively new, it is highly uncertain how soon the legislative or administrative regulation-making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It is also highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, its ability to accept foreign investments, and the listing of our Class A Ordinary Shares on a U.S. or other foreign exchanges. These actions could result in a material change in our operations and/or the value of our Class A Ordinary Shares and could significantly limit or completely hinder our ability to offer or continue to offer our Class A Ordinary Shares to investors.

Cybersecurity Review

On August 20, 2021, the 30th meeting of the Standing Committee of the 13th National People’s Congress voted and passed the “Personal Information Protection Law of the People’s Republic of China”, or “PRC Personal Information Protection Law”, which became effective on November 1, 2021. The PRC Personal Information Protection Law applies to the processing of personal information of natural persons within the territory of Mainland China that is carried out outside of Mainland China where (i) such processing is for the purpose of providing products or services for natural persons within Mainland China, (ii) such processing is to analyze or evaluate the behavior of natural persons within Mainland China, or (iii) there are any other circumstances stipulated by related laws and administrative regulations.

On December 24, 2021, the CSRC together with other relevant government authorities in Mainland China issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments), and the Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (“Draft Overseas Listing Regulations”). The Draft Overseas Listing Regulations require that Overseas Issuance and Listing shall complete the filing procedures of and submit the relevant information to the CSRC. The Overseas Issuance and Listing include direct and indirect issuance and listing.

On December 28, 2021, the CAC jointly with the relevant authorities formally published the Measures which took effect on February 15, 2022 and replaced the former Measures for Cybersecurity Review (2020) issued on July 10, 2021. The Measures provide that operators of critical information infrastructure purchasing network products and services, and online platform operators carrying out data processing activities that affect or may affect national security (together with the operators of critical information infrastructure, the “Operators”), shall conduct a cybersecurity review, and that any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country. The publication of the Measures expands the application scope of the cybersecurity review to cover data processors and indicates greater oversight by the CAC over data security, which may impact our business and this Offering in the future.

Data Security Law

The PRC Data Security Law (the “Data Security Law” or “DSL”), which was promulgated by the Standing Committee of the National People’s Congress on June 10, 2021 and took effect on September 1, 2021, requires data collection to be conducted in a legitimate and proper manner, and stipulates that, for the purpose of data protection, data processing activities must be conducted based on data classification and hierarchical protection system for data security. According to Article 2 of the Data Security Law, DSL applies to data processing activities within the territory of Mainland China as well as data processing activities conducted outside the territory of Mainland China which jeopardize the national interest or the public interest of PRC or the rights and interest of any PRC organization and citizens. Any entity failing to perform the obligations provided in the Data Security Law may be subject to orders to correct, warnings and penalties including ban or suspension of business, revocation of business licenses or other penalties.

CSRC Filing or Approval

On August 8, 2006, six PRC regulatory agencies jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”), which came into effect on September 8, 2006 and were amended on June 22, 2009. The M&A Rules requires that an offshore special purpose vehicle formed for overseas listing purposes and controlled directly or indirectly by the PRC Citizens shall obtain the approval of the CSRC prior to overseas listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. Based on our understanding of the Chinese laws and regulations currently in effect at the time of this prospectus, we will not be required to submit an application to the CSRC for its approval of this Offering and the listing and trading of our Class A Ordinary Shares on the Nasdaq under the M&A Rules. However, there remains some uncertainty as to how the M&A Rules will be interpreted or implemented, and the opinions summarized above are subject to any new laws, rules and regulations or detailed implementations and interpretations in any form relating to the M&A Rules. We cannot assure you that relevant PRC government agencies, including the CSRC, would reach the same conclusion.

The General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Strictly Cracking Down on Illegal Securities Activities (“Opinions”), which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by PRC-based companies. Pursuant to the Opinions, Chinese regulators are required to accelerate rulemaking related to the overseas issuance and listing of securities, and update the existing laws and regulations related to data security, cross-border data flow, and management of confidential information. Numerous regulations, guidelines and other measures are expected to be adopted under the umbrella of or in addition to the Cybersecurity Law and Data Security Law. As of the date of this prospectus, no official guidance or related implementation rules have been issued. As a result, the Opinions on Strictly Cracking Down on Illegal Securities Activities remain unclear on how they will be interpreted, amended and implemented by the relevant PRC governmental authorities.

On December 24, 2021, the CSRC, together with other relevant PRC government authorities issued the Draft Overseas Listing Regulations. The Draft Overseas Listing Regulations requires that Overseas Issuance and Listing shall complete the filing procedures of and submit the relevant information to CSRC. The Overseas Issuance and Listing includes direct and indirect issuance and listing.

On February 17, 2023, the CSRC released the Trial Measures and five supporting guidelines, which came into effect on March 31, 2023. According to the Trial Measures, among other requirements, (1) domestic companies that seek to offer or list securities overseas, both directly and indirectly, should fulfill the filing procedures with the CSRC; if a domestic company fails to complete the filing procedures, such domestic company may be subject to administrative penalties; (2) where a domestic company seeks to indirectly offer and list securities in an overseas market, the issuer shall designate a major domestic operating entity responsible for all filing procedures with the CSRC, and such filings shall be submitted to the CSRC within three business days after the submission of the overseas offering and listing application. On the same day, the CSRC also held a press conference for the release of the Trial Measures and issued the Notice on Administration for the Filing of Overseas Offering and Listing by Domestic Companies, which clarifies that (1) on or prior to the effective date of the Trial Measures, domestic companies that have already submitted valid applications for overseas offering and listing but have not obtained approval from overseas regulatory authorities or stock exchanges may reasonably arrange the timing for submitting their filing applications with the CSRC, and must complete the filing before the completion of their overseas offering and listing; (2) a six-month transition period will be granted to domestic companies which, prior to the effective date of the Trial Measures, have already obtained the approval from overseas regulatory authorities or stock exchanges, but have not completed the indirect overseas listing; if domestic companies fail to complete the overseas listing within such six-month transition period, they shall file with the CSRC according to the requirements; and (3) the CSRC will solicit opinions from relevant regulatory authorities and complete the filing of the overseas listing of companies with contractual arrangements which duly meet the compliance requirements, and support the development and growth of these companies.

Since recent statements, laws and regulatory actions by the PRC government are newly published, their interpretation, application and enforcement of unclear and there also remains significant uncertainty as to the enactment, interpretation and implementation of other regulatory requirements related to overseas securities offerings and other capital markets activities. It also remains uncertain whether the PRC government will adopt additional requirements or extend the existing requirements to apply to our Operating Subsidiary located in Hong Kong. It is also uncertain whether the Hong Kong government will be mandated by the PRC government, despite the constitutional constraints of the Basic Law, to control over offerings conducted overseas and/or foreign investment of entities in Hong Kong, including our Operating Subsidiary. Any actions by the PRC government to exert more oversight and control over offerings (including of businesses whose primary operations are in Hong Kong) that are conducted overseas and/or foreign investments in Hong Kong-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. If there is significant change to current political arrangements between Mainland China and Hong Kong, or the applicable laws, regulations, or interpretations change, and, in such event, if we are required to obtain such approvals in the future and we do not receive or maintain the approvals or is denied permission from Mainland China or Hong Kong authorities, we will not be able to list our Class A Ordinary Shares on a U.S. exchange, or continue to offer securities to investors, which would materially affect the interests of the investors and cause significant the value of our Class A Ordinary Shares significantly decline or be worthless.

Permission Required from Hong Kong and PRC authorities