Exhibit 10.2

| NAME OF COMPANY | HERE WE SEOUL LIMITED (the “Company”) |

| REGISTERED OFFICE | 30/F GRAVITY 29 HING YIP ST KWUN TONG KLN HK |

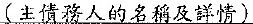

| TO: BANK OF CHINA (HONG KONG) LIMITED |

CERTIFIED EXTRACT OF THE MINUTES OF BOARD MEETING OF THE COMPANY

| 1. | The Chairman reported that Bank of China (Hong Kong) Limited (the “Bank”) had agreed to make available certain banking facilities (the “Facilities”) supported by the SME Financing Guarantee Scheme guaranteed by The HKMC Insurance Limited (“HKMCI”) to the Company upon the terms and conditions set out in a facility letter dated 2023/10/27 issued by the Bank (the “Facility Letter”), copy(ies) of which was/were tabled. The Chairman reported that it was a term of the Facility Letter that the following document(s) (the “Document(s)”) (copies of which was/were then tabled) had to be executed by the Company and delivered to the Bank before the Facilities would become available to the Company: |

Name of the Document(s)

| | ● | Direct Debit Authorization |

| | | |

| | ● | The Form of Acceptance of Conditions for the issue of Guarantee by HKMCI |

| | | |

| ● | The Application Form for the issue of Guarantee by HKMCI |

| 2. | Discussion then took place on the terms of the tabled documents. Each of the Directors declared the nature and extent of his/her interest and if applicable, the interest of any entity connected with him/her (in each case, if any and whether direct or indirect) in the transaction, arrangement or contract to the other Directors in accordance with the requirements of its constitutional documents and the applicable law. |

| 3. | The Chairman confirmed that the Company was solvent and that the entering into of the Facility Letter and the Document(s) by the Company would not render the Company unable to pay its debts. |

| (1) | it is in the best interest of the Company, to its benefit and in furtherance of its objects that the Facilities as set out in the Facility Letter be obtained from the Bank. |

| | | |

| (2) | the terms of the Facility Letter and the Document(s) in the forms tabled be and are hereby approved, where any Document(s) have to be executed by way of deed, such Document(s) may be executed in accordance with Companies Ordinance (Cap. 622) or where any Document(s) are to be executed under seal, the seal of the Company be affixed to such Document(s) in accordance with the constitutional documents of the Company and any - ( ) of the person(s) named below (“the Authorized Signatory(ies)”) be and is/are hereby authorized to sign on behalf of the Company the Facility Letter and the Document(s), such other documents relating to the Facility Letter and/or the Document(s) and do such other things as such Authorized Signatory(ies) may deem necessary and proper in connection there with. |

| Authorized Signatory(ies) | | Specimen Signature |

| | | | |

| Mr/Ms | WONG YING YEUNG | | /s/ WONG YING YEUNG |

| | | | |

| Mr/Ms | YOUNG YUEN YI | | /s/ YOUNG YUEN YI |

| | | | |

| Mr/Ms | | | |

| (3) | any ONE (01) of the Authorized Signatory(ies) or the authorized signatories (with signing arrangement) set out in the Company’s account mandate for Current/Savings Account No. ----------,------, with the Bank shall have the authority to give drawdown notice(s) in such form acceptable to the Bank relating to the Facilities; |

| (4) | any actions taken by any Director and/or any of the abovementioned Authorized Signatory(ies) prior to the date hereof in connection with the transactions contemplated by any of the foregoing resolutions be and are hereby adopted, approved, confirmed and ratified; and |

| | | |

| (5) | any Director may, from time to time, on behalf of the Company agree with the Bank to vary and/or accept variation of the terms (including any change in the purpose of: any extension of or any increase in any facility or the addition of any new facility) of the Facility Letter and/or the Document(s) and/or confirm the effectiveness of the Document(s) and, in this respect, execute (under hand or by way of deed) any document (including new or supplemental facility/guarantee/security documents and/or confirmations) and do such other things as such Director may deem necessary and proper in connection therewith unless and until the Bank shall have received a certified extract of the Minutes of Board Resolutions signed by a Director of the Company notifying the Bank any changes in the arrangement. |

As the Chairman of the meeting, I hereby certify that the foregoing is an up-to-date, true and correct extract of the minutes of the meeting of the board of directors of the Company held on __________(of which due notice thereof has been given to all directors of the Company). I further certify that the foregoing resolutions, which have been duly passed and minuted in accordance with the constitutional documents of the Company and the applicable law and have not been revoked, are in full force, validity and effect.

| Dated this 27 day of Nov, 2023 | |

/s/ WONG YING YEUNG | |

| Chairman | |

| (Name in block letters: WONG YING YEUNG) | |

| | |

| Singnature(s) Verified by: | |

| | |

| /s/ Yun Ka Ki Catharine | |

| Name: | Yun Ka Ki Catharine 8827348 | |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

Date : 27 October 2023

HERE WE SEOUL LIMITED (the “Borrower”)

Important Notice: | This Facility Letter sets out the terms and conditions upon which our bank would provide banking facilities to the Borrower under the SME Financing Guarantee Scheme (the “Scheme”) guaranteed by The HKMC Insurance Limited (“HKMCI”). The Borrower and the Guarantor(s) are advised (i) to note and understand the declaration and notes contained in the Application, the Acceptance of Conditions and the related legal documentation before execution, (ii) to read and understand the terms and conditions under this Facility Letter before accepting this Facility Letter, and (iii) to seek independent legal advice before signing this Facility Letter and/or any security document to which any of them is a party. |

Dear Sirs,

Re: General Banking Facilities granted under the Scheme.

Futher to om recent discussions, the Bank is pleased to grant the following general banking facility(ies) (the “Facility(ies)”) to the Borrower under the Scheme, subject to the Bank’s General Terms and Conditions for General Banking Facilities and Loan Facility(ies) (as amended from time to time, the “General Terms”) and the terms and conditions as stated below. Words and expressions defined in the General Terms shall have the same meanings when used in this Facility Letter. Any appendix hereto forms an integral pait of this Facility Letter.

| 1.1 | Non-revolving Facility Amount |

| | Term Loan | Up to HKD9,000,000.00 | ■ | Please refer to Appendix I for other terms and conditions. |

Proceeds from the Facility shall be used to pay wages and rents by the Borrower. In addition to paying wages and rents, Borrower may use the proceeds from the Facility to meet imminent 1ieeds in working capital.

Notwithstanding any provisions of this Facility Letter, the General Terms (if applicable) or any other documents between the Borrower and the Bank to the contrary, the Bank may at any time without prior notice modify, cancel or suspend the Facility/Facilities at its sole discretion including, without limitation, canceling any unutilized facilities and declaring any outstanding amount to be immediately due and payable.

Subject to all the security or documents listed out in the section of “Conditions Precedent / Collateral Security(ies)” have been satisfied, the Facilities are available for drawing by the Borrower within 30 days from the date of the Notification of Result of Application for Financing Guarantee issued by HKMCI (the “Notification”).

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

| 1.5 | Expiry of the Facilities: |

Each of the Revolving Facilities and the Non-revolving Facility shall be cancelled and ceased to be operated after the guarantee period as stated in the relevant guarantee (covering either the Revolving Facilities or the Non-revolving Facility) issued by HKMCI pursuant to the Scheme (the “Guarantee”). All outstandings under the relevant Facilities shall be fully repaid on or before the last day of the relevant guarantee period.

| 2. | Conditions Precedent/ Collateral Security(ies) |

Subject to the compliance with all the requirements specified in the Notification by the Borrower, the receipt of all the following condition precedent documents in form and substance satisfactory to the Bank and in the absence of any Event of Default or prospective Event of Default, the Facility(ies) shall be made available for drawdown or utilization by the Borrower:-

| 2.1 | A duly signed copy of this Facility Letter indicating the Borrower’s and the security providers’ acceptance of the Facility(ies) on the terms and conditions set out in this Facility Letter; |

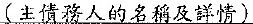

| 2.2 | Direct Debit Authorization duly executed by the relevant account holder(s) for Term Loan; |

| 2.3 | Continuing personal guarantee(s) executed/to be executed by the following guarantor(s) in the Bank’s favour to cover the Facilities to be granted by the Bank to the Borrower, provided that the total liability of each guarantor under the guarantee shall not be less than the guaranteed amount stated below, together with interest and any other money set out in the guarantee:- |

| Name of the Guarantor | Guaranteed Amount |

| WONG YING YEUNG | Unlimited Extent |

| YOUNG YUEN YI | Unlimited Extent |

| 2.4 | Copy, certified by a director, of each of the following documents of the Borrower: |

| | ▪ | Certificate of Incorporation. |

| ▪ | Memorandum and Articles of Association or other constitutional documents (if any) . |

| ▪ | List of directors with their specimen signatures. |

| | ▪ | Current Business Registration Certificate (if any). |

| 2.5 | If any of the Borrower/ the guarantor(s) / security provider(s) is a limited company, the relevant shareholder and board resolutions for the execution of the facility/security documents to which it is a party and certified copies of the constitutional documents of that company; |

| 2.6 | The Application for Non-revolving Facility prescribed by HKMCI for the Guarantee (“the Application”) duly completed and signed by the Borrower and the Guarantor(s), and submitted to bank for on-forwarding to HKMCI. |

| | 2.7 | The Acceptance of Conditions for the Issue of a Guarantee (which is the form prescribed by HKMCI from time to time containing conditions for the issue of a Guarantee for acceptance by the Borrower the issuance of a Guarantee, the “Acceptance Form”) duly completed and signed by the Borrower and submitted to the Bank for on- forwarding to HKMCI. |

| 2.8 | The Notification(s) duly issued by HKMCI specifying its decision to grant an approval-in-principle for the issuance of a Guarantee for 100% of Non-revolving Facility Amount. |

| 2.9 | The Borrower has submitted to the Bank the Borrower’s audited account(s) of its latest financial year which has been duly certified by the auditor of the Borrower (if the Borrower is a company within the meaning of the Companies Ordinance (Cap. 622) or the financial statements of its latest financial year including a certified balance sheet and profit and loss account, as the case may be, to the Bank for assessment. |

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

| | 2.10 | HKMCI has issued the Guarantee(s) for the Non-revolving Facility for a guarantee limit not exceeding 100% of the Facility Amount in favour of the Bank in accordance with the Scheme, and the fulfillment and compliance in full of all special conditions specified in the Guarantee. For the avoidance of doubt but without prejudice to the other provisions of this paragraph, the Bank may withhold the granting of the Facility at any time should any of the conditions precedent or criteria set out in the Guarantee issued by HKMCI have not been duly complied with or fulfilled to the satisfaction of HKMCI (including without limitation the payment of the Guarantee Fee). |

| | | |

| | 2.11 | Such other documents as the Bank and/or HKMCI may request including but not limited to all the necessary application documents and the relevant supporting documents including any documents reasonably required by the HKMCI in a Request for Further Information prescribed by HKMCI and/or those as may be required to evidence any and all licenses, authorizations, consents or approvals necessary for the performance by the Borrower or the security provider(s) of their respective obligations under this Facility Letter and the security documents. |

| 3. | Representations, Warranties and Covenants: |

| 3.1. | In addition to the Borrower’s representations, warranties and covenants to the Bank as set out in the Schedule attached to this Facility Letter, the Borrower and the Guarantor(s) (where applicable) hereby confirm and undertake the following: |

| | ▪ | Each of the Borrower and the Guarantor(s) hereby acknowledges, agrees and authorises that the Bank. and its related bodies may disclose and/or transfer my/our personal data and other information from time to time in its possession to HKMCI in relation to the Facilities, the application for financing under the Scheme, the relevant guarantee given by the Guarantor(s), the Borrower and/or any Guarantor and other related purposes; |

| | ▪ | The Borrower (including its partners where the Borrower is a partnership) shall give a written consent to permit the representatives and appointed agents of the Bank and/or HKMCI, to access, inspect and take copies of all books, records, accounts and any other information relating to the Borrower’s business, whether in the paper, electronic or any other form or medium from time to time; and the Borrower shall ensure that any individual who is a signatory of the Application or any other individual whose personal data may otherwise be included in the loan file relating to a Facility shall give a written consent to permit disclosure of personal data to the Bank and the HKMCI for the purposes of such Facility and the relevant Guarantee; |

| ▪ | The Borrower agrees that the use of the Facilities is subject to the terms and conditions of the Scheme and undertakes that it shall not use any proceeds of the Facilities, whether in whole or in part, for (i) paying, repaying, restructuring or repackaging any loans, credit facilities or payment obligations (including loans that are ref<med to as classified loans by Hong Kong Monetary Authority from time to time, except facilities guaranteed under the Special Loan Guarantee Scheme) of the Borrower, its subsidiaries or its Related Entities (as defined in the Application of the Scheme); and/or (ii) financing and/or re-financing the acquisition of any business installation, machinery, equipment or other asset that was in the ownership, control or possession of the Borrower, its subsidiaries and/or its Related Entities (whether as owner or otherwise), existing before the date on which the application for the Facilities is received by the Bank, or existing at the time of each drawdown of the Facilities or otherwise; |

| | ▪ | The Borrower undertakes to submit to the Bank the books, records, accounts and any other information relating to the Borrower’s business, whether in the paper, electronic or any other form or medium from time to time; |

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

| | ▪ | The Borrower shall not do or permit to be done anything which would prejudice or jeopardize the rights of the Bank or HKMCI, or both, in respect of the Facilities; |

| | ▪ | The Borrower shall not create, or permit to be created or subsist, any subsequent charges or encumbrances ranking in priority to or pari passu with any security that may be given to or held by the Bank for the Facilities; |

| | ▪ | The Borrower and all the persons giving the security or guarantee to support/secure the obligation of the Borrower hereunder, hereby acknowledge that the rights of HKMCI, as guarantor under the Guarantee, shall at all time rank in priority to the rights and remedies of such security providers. Each of the Borrower and the security providers undertake that it shall not exercise in any manner or to any extent its rights or remedies against the Borrower or such person or in relation to any such security or guarantee, including but not limited to any right of subrogation or contribution which it has or may have in law or equity or under, pursuant to or in connection with the relevant security documents, or otherwise, unless and until the Bank and HKMCI has fully and unconditionally recovered all amounts paid by the HKMCI under the relevant Guarantee or unless and until the HKMCI otherwise consents in writing, and (2) shall not assert against the HKMCI any right of contribution or any analogous rights and remedies; |

| | ▪ | The Borrower shall not during the Guarantee Period sell, sub-lease, charge, part with possession of or otherwise deal with (whether in whole or in part) any business installations and equipment and/or other assets referred to in the Application or Facility Letter as to be acquired with any of the proceeds of the relevant Facility without the prior written consent of the Bank and HKMCI, and, if the foregoing has not been complied with, the Borrower shall ensure that all the proceeds or sums realised or generated as a result shall be paid direct to the Bank for application in or towards payment and discharge of the outstanding under the Facilities; |

| ▪ | the Borrower is not carrying on the business of a Bank or otherwise providing funds available for borrowing in any way or an affiliate (as defined in the Application under SME Financing Guarantee Scheme of The HKMC Insurance Limited (the “Application”) of the Bank; |

| | ▪ | the Borrower is a company, sole proprietorship, partnership or unincorporated body of persons (where applicable) which has business operation in Hong Kong and has been registered and remains duly registered for can-ying on a business in Hong Kong under the Business Registration Ordinance (Chapter 310 of the Laws of Hong Kong) and has been in operation for at least one year in Hong Kong as of the date of this application; |

| | ▪ | the Borrower does not have any of its shares listed on The Stock Exchange of Hong Kong Limited (whether on its Main Board or the Growth Enterprise Market) or any similar exchanges in or outside Hong Kong; |

| | ▪ | the Borrower hereby undertakes to inform the Bank if there is any material change of shareholding/equity interest which affects the Personal Guarantee(s) provided to the HKMCI and the Bank as declared under Patt B of the Application; |

| ▪ | the Borrower’s consent is hereby given for the HKMCI’s access to (and make copies of) all books, records, accounts and any other information concerning the Borrower or the Borrower’s business, whether in paper, electronic or any other form or medium, that is in the possession, custody or control of the Bank specified in Part C of the Application, if any, for the purpose of processing the application, monitoring the performance of the Facility prior to the expiry of the Guarantee conducting due diligence review, processing a request for payment under the Scheme and other related purposes; |

| | ▪ | the Borrower has not failed to repay a loan, interest or other payments, or any part thereof, in accordance with the relevant facility, whereby the indebtedness remains outstanding for more than sixty (60) days after the relevant repayment or payment date: (a) as evidenced by the latest report issued by any credit information provider(s) made available to the Bank and which is issued not earlier than thirty (30) days prior to the date of submission of the Application Form to the HKMCI; or (b) in respect of any facility granted by the Bank, with reference to the Bank’s records, external credit information searches (as appropriate) (collectively, the “Outstanding Default”); |

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

| | ▪ | the Borrower hereby undertakes to inform the HKMCI and the Bank if any of the information provided by the Borrower is no longer valid or accurate. The Borrower undertakes to repay in full all the outstanding amounts with respect to the Facilities under the Scheme, with interest, prior to the expiry of the Guarantee, within such time specified upon notification by the HKMCI or the Bank, if any information provided by the Borrower in connection with the Application, is no longer valid or accurate, or found to be false/no longer valid or accurate. The Borrower acknowledges that the HKMCI and the Bank reserve the right to take any actions, including legal actions, deemed appropriate against the Bo1TOwer for furnishing false information; |

| | ▪ | without prejudice to any rights and remedies that the Bank or the HKMCI may have, the Borrower acknowledges that the HKMCI may forthwith request the Bank to suspend the Facility, and the Bank shall act accordingly, in the event that the HKMCI is in the opinion that the Borrower is: |

| (a) | in breach of any of the undertakings given herein; |

| (b) | in breach of any of the terms and conditions mentioned in the Acceptance of Conditions under the Scheme; or |

| (c) | no longer in compliance with, or has not complied with any terms and conditions set out in this Facility Letter(s); and |

| ▪ | each signatory to the Application and this Facility Letter for and on behalf of the Borrower hereby declares and confirms that such signatory has the requisite authority and is duly authorised (in the case of a Borrower which is a company) in accordance with the memorandum and articles of association and/or other corporate approvals of the Borrower or (in the case of a Borrower which is a partnership) by all partners of such partnership to execute the Application and this Facility Letter which shall be binding on the Borrower |

| 3.2. | The Guarantor(s) and the security provider(s), who provide any security to support/secure the obligations of the Borrower hereunder, confirm that if they have provided guarantee(s) or other security to support/secure other facilities of the Borrower granted by the Bank, any amounts received thereform after a demand has been made hereunder may at the sole discretion of the Bank be applied to settle any outstanding hereunder or thereunder. |

Currently, the Borrower represents that (i) the Borrower is not (or is not in any way related to) any of the directors, employees, controllers or minority shareholder controllers of Bank of China (Hong Kong) Limited (“BOCHK”) or their relatives or BOCHK within the meaning of Rule 85 of Banking (Exposure Limits) Rules (Cap 155S of the Laws of Hong Kong); (ii) the Borrower is not (or is not in any way related to) (a) the senior management and key staff of BOCHK or their relatives, (b) subsidiaries, affiliates and other entities over which BOCHK is able to exert control or (c) the controllers, minority shareholder controllers, directors, senior management and key staff of the subsidiaries, affiliates and other entities mentioned in (b) above or their relatives within the meaning of Hong Kong Monetary Authority Supervisory Policy CR-G-9 and (iii) the Borrower is not a connected patty to BOCEK and/or Bank of China Limited under the applicable rules of the Shanghai Stock Exchange, China Banking Regulatory Commission, Hong Kong Exchanges & Clearing Limited. If the Facility(ies) is/are guaranteed/secured or to be guaranteed/secured by any guarantee or security from any third party, the Bo1wwer also represents that none of such third parties is so related or be such a party as mentioned above. The Borrower undertakes that if the Borrower or any such third party becomes so related or be such a patty as mentioned above, the Borrower will promptly notify the Bank in writing.

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

Please signify the Borrower’s receipt of the General Terms and the Borrower’s understanding and acceptance of this offer by signing and returning to us the duplicate copy of this Facility Letter on or before 26 January 2024, failing which this offer shall lapse unless otherwise agreed by the Bank.

Please be informed that in connection with your application for the Facilities referred to in this Facility Letter, the Bank have considered a credit report on each individual Guarantor and/or where applicable, sole proprietor and/or each partner and/or each individual Mortgagor (collectively, the “Individual Obligors”) provided by TransUnion in approving your application. Should any of the Individual Obligors wish to access or correct the credit report, please contact TransUnion (at Suite 811, 8th Floor, Tower 5, The Gateway, 15 Canton Road, Tsim Sha Tsui, Kowloon, Hong Kong; Tel: (852) 2577 1816).

Should the Borrower has any queries, please contact the Bank’s Ms. YUEN KA KI CATHARINE at 35569189 / 51105224 at any time. The Bank is here to serve the Borrower better.

Yours faithfully,

For and on behalf of

Bank of China (Hong Kong) Limited

| |

| Authorized Signature(s) | |

| Encl. | ▪ | General Terms and Conditions for General Banking Facilities and Loan Facility(ies) 202307 |

| | ▪ | Certified Extract of the Minutes of Board Meeting |

| | ▪ | Deed of Guarantee and its Pre-advice |

| | ▪ | Application |

| | ▪ | Acceptance of Conditions |

| | ▪ | Form of Drawdown Notice |

| | ▪ | Direct Debit Authorization |

| ▪ | Data Policy Notice 202210 |

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

Appendix I

| Facility | | Term Loan Facility |

| | | |

| Purpose | | To pay wages and rents by the Borrower or to meet the needs in working capital |

| | | |

| Interest Rate | | Interest shall be charged at 2.5%p.a. below the Hong Kong Dollars Prime Rate quoted by The Hong Kong Mortgage Corporation Limited from time to time. |

| | | |

| Drawdown | | Subject to the due fulfillment and observance of all conditions precedent contained in Clause 2 and other procedures from time to time required by the Bank, the Borrower may on any Business Day during the Availability Period make a drawing under the Facility by giving the Bank at least three (3) Business Days’ written drawdown notice (“Drawdown Notice”) prior to the relevant drawdown date, such Drawdown Notice should be duly signed by the authorized signatories of the Borrower. |

| | | |

| Repayment | | All accrued interest shall be paid monthly in arrears commencing one month from the date of drawdown (“Interest Payment Date”). The outstanding principal and interest accrued thereon of the Facility shall be repaid by one hundred and eight (108) equal monthly instalments, commencing 13 month(s) after the date of drawdown (each a “Repayment Date)”. If the rate of interest changes, the amount of the remaining instalments will be varied by the Bank accordingly and the Bank will notify the Borrower in writing of the effective date of such variation. |

| | | | |

| Prepayment | | (a) | The Borrower may prepay all or any part of the Facility on any Repayment Date in a minimum amount of HKD50,000.00 and integral multiples of HKDl0,000.00, together with all accrued interest, provided that at least 30 days’ prior written notice shall have been given to the Bank. |

| | | | |

| | | (b) | Prepayments shall where applicable be applied to reduce repayment instalments in inverse order of maturity and shall not be reborrowed. |

| | | | |

| | | (c) | If prepayment (whether total or partial) is made without the Borrower having given at least 1 month’s prior written notice to the Bank, a prepayment fee of 1 month’s interest calculated at the then prevailing interest rate of the Facility on the amount prepaid will be charged on the date of prepayment. |

| | | | |

| Default Interest | | (a) | Any payment/repayment required to be made hereunder which is not made when due shall bear default interest, payable in the currency of such payment. Such default interest shall be charged on the overdue amount at the rate certified by us as being 6% per annum over the Hong Kong Dollars Prime Rate quoted by The Hong Kong Mortgage Corporation Limited from time to time, subject to fluctuation, provided that the Bank may vary the rate or the basis of calculation by notice displayed or posted up in our banking halls. |

| | | | |

| | | (b) | Default interest shall accrue and be calculated from the date when the relevant payment was due to the date of its final payment in full, on a day to day basis. |

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/10073 4-00/F/8884246

SME Financing Guarantee Scheme

Schedule

The representations and warranties set out in Clause 1.1 (Status) to Clause 1.15 (Compliance) of this Schedule are to be made by the Borrower as of the date of the relevant Facility Letter and the Borrower expressly acknowledges that the Bank enters into the Facility Letter in reliance on all those representations and warranties. In addition, the Borrower expressly acknowledges that each of the representations and warranties set out in Clause 1.1 (Status) to Clause 1.8 (Claims Pari Passu), Clause 1.10 (No Immunity) to Clause 1.15 (Compliance) shall be deemed to be repeated by the Borrower by reference to the facts and circumstances then existing on each date on which a Drawdown is made under the relevant Facility and on each date on which any amount is payable by the Borrower under the relevant Facility.

The Borrower makes all those representations and warranties relating to its status as an eligible Borrower that:

| 1.1.1 | it has a business operation in Hong Kong and remains registered under the Business Registration Ordinance (Chapter 310 of the Laws of Hong Kong); |

| | | |

| 1.1.2 | it is not and agrees that it shall not be carrying on the business of a Bank or otherwise providing funds available for borrowing in any way; |

| | | |

| 1.1.3 | it is not and agrees that it shall not be an affiliate of the Bank; |

| | | |

| | l. l .4 | it is not and agrees that it shall not be a company or corporation which has any of its shares listed on The Stock Exchange of Hong Kong Limited (whether on its Main Board or the Growth Enterprise Market) or any similar exchange in or outside Hong Kong; and |

| | | |

| | 1.1.5 | it has no Outstanding Default as at the date of submission of the relevant Application. |

The Borrower’s business must have been in operation for at least one year in Hong Kong as at the date of submission of the relevant Application.

| 1.2 | Governing Law and Judgments |

In any proceedings taken in its jurisdiction of incorporation or establishment in relation to the Facility Letter, the choice of Hong Kong law as the governing law of the Facility Letter and any judgment obtained in Hong Kong against it with respect to the Facility Letter will be recognised and enforced.

The obligations expressed to be assumed by it in the Facility Letter are legal and valid obligations binding on it and enforceable against it in accordance with the terms thereof.

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

| 1.4 | Execution of the Facility Letter |

Its execution of the Facility Letter, its exercise of its rights and performance of its obligations thereunder and the transactions contemplated thereby do not and will not:

| 1.4.1 | contravene any agreement, mortgage, bond or other instrument or treaty to which it is a party or which is binding upon it or any of its assets; |

| | | |

| 1.4.2 | conflict with its memorandum and articles of association or any other constitutional documents; or |

| | | |

| 1.4.3 | conflict with any applicable law or regulation. |

It has the power to enter into the Facility Letter and all corporate and other action required to authorise the execution of the Facility Letter and the performance of its obligations thereunder has been duly taken. No limit on its powers will be exceeded as a result of the borrowing or other assumption of obligations, or any grant of security or giving of indemnities, contemplated by the Facility Letter.

| 1.5 | No Material Proceedings |

No litigation, arbitration, administrative proceedings or labour controversy before any court, tribunal, arbitrator or other relevant authority is current or, to the knowledge and belief of a senior officer of it, pending or threatened against it which would have a Material Adverse Effect, save for any such legal proceedings commenced by a third party which are frivolous or vexatious, have no reasonable cause of action or which are being contested in good faith by appropriate proceedings and against which adequate reserves are maintained.

| 1.6 | No Material Adverse Change |

Since the date of its most recent financial statements (or audited financial statements in the case where the Borrower is a limited company), there has been no material adverse change in the business or financial condition of it.

| 1.7 | Validity and Admissibility in Evidence |

All acts, conditions and things required to be done, fulfilled and performed and all authorisations (governmental or otherwise) required to be obtained in order (a) to enable it lawfully to enter into, exercise its rights and perform and comply with its obligations in the Facility Letter, (b) to ensure that its obligations in the Facility Letter are legal, valid, binding and enforceable and (c) to make the Facility Letter admissible in evidence in its jurisdiction of incorporation or establishment have been done, fulfilled, performed and obtained and in full force and effect.

Under the laws of its jurisdiction of incorporation or establishment in force at the date hereof, the claims of the Bank against it under the Facility Letter rank at least pari passu with claims of all its other unsecured and unsubordinated creditors save those whose claims are mandatory preferred by law applying to companies generally.

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/l 00734-00/F/8884246

| 1.9 | No Filing or Stamp Taxes |

Under the laws of its jurisdiction of incorporation or establishment in force at the date hereof, it is not necessary that the Facility Letter be filed, recorded or enrolled with any court or other authority in such jurisdiction or that any stamp, registration or similar tax be paid on or in relation to the Facility Letter or the transactions contemplated by the Facility Letter.

In any proceedings taken in the jurisdiction of incorporation or establishment of it in relation to the Facility Letter, it will not be entitled to claim for it or any of its assets immunity from suit, execution, attachment or other legal process.

It has not taken any corporate action nor have any other steps been taken or legal proceedings (save for any such legal proceedings commenced by a third party which are (i) frivolous or vexatious or (ii) which are being contested in good faith by appropriate proceedings and against which adequate reserves are maintained and, in each case, are unconditionally discharged or dismissed within 180 (one hundred and eighty) days) been started or threatened against it for its winding-up, dissolution, administration or reorganisation (whether by voluntary arrangement, scheme of arrangement or otherwise) or for the appointment of a liquidator, receiver, administrator, administrative receiver, compulsory or interim manager, conservator, custodian, trustee or similar officer of it or of any or all of its assets or revenues.

All material written information supplied by the Borrower is true, complete and accurate in all material respects as at the date it was given and is not misleading in any respect.

It is able to pay its debts as they fall due and has not commenced negotiations with any one or more of its creditors with a view to the general readjustment or rescheduling of its indebtedness or made a general assignment for the benefit of or a composition with its creditors.

It has filed or caused to be filed all tax returns which are required to be filed by it and has paid all taxes shown to be due and payable by it on such returns or any assessment received by it, save for taxes which are being contested in good faith by appropriate proceedings and in respect of which adequate reserves have been set aside by it.

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

It is, to the knowledge and belief of a senior officer of it, in compliance with the requirements of all applicable laws, rules and regulations and orders of governmental or regulatory authorities save those which are not material to its business and the effect of such non-compliance is not significantly adverse to it.

| 2.1 | Maintenance of Legal Validity |

The Borrower shall promptly obtain, comply with the terms of and do all that is necessary to maintain in full force and effect all authorisations, approvals, licences and consents required in or by the laws of its jurisdiction of incorporation or establishment to enable it to lawfully enter into and perform its obligations under the Facility Letter and to ensure the legality, validity, enforceability or admissibility in evidence in its jurisdiction of incorporation of the Facility Letter.

| 2.2 | Notification of Events of Default |

The Borrower shall promptly inform the Bank after it becomes aware of the occurrence of any default or event of default under the Facility Letter or of any event which might reasonably be expected to have a Material Adverse Effect.

Subject to Clause 2.13 below, the Borrower shall ensure that at all times the claims of the Bank against it under the Facility Letter rank and continue to rank at least pari passu with the claims of all its other unsecured and unsubordinated creditors save those whose claims are mandatorily preferred by law applying to companies generally.

The Borrower shall duly and punctually file all tax returns when due and pay and discharge all taxes prior to the date on which penalties are attached thereto except for such taxes which are being contested in good faith by appropriate proceedings and for which adequate reserves have been set aside and payment of which can be lawfully withheld.

The Borrower shall promptly deliver to the Bank copies of all its audited and unaudited financial statements and such other reports and information relating to the Borrower as the Bank may reasonably request from time to time.

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

| 2.6 | Maintenance of Records |

The Borrower shall maintain all books of records and accounts with respect to itself and its business in good order.

The Borrower shall, upon reasonable prior written notice from the Bank and during normal working hours, permit and arrange for the Bank or its other authorized representatives (including representatives of HKMCI) to inspect all financial records and books of accounts and discuss the Borrower’s business affairs with its officers and advisors as the Bank may reasonably request.

The Borrower shall apply the Facility solely for the purpose of Clause 1.2 of this Facility Letter:

The Borrower shall comply in all respects with the requirements of all applicable laws, rules and regulations and orders of governmental or regulatory authorities if failure to comply with such requirements would (either individually or in aggregate) have a Material Adverse Effect (as defined in paragraph 3 below).

The Borrower shall maintain insurances on and in relation to its business and assets, in each case, with reputable underwriters or insurance companies against such risks and to such extent as is usual for companies carrying on a business such as that carried on by the Borrower and is commercially available.

The Borrower shall ensure that:

| 2.11.1 | it has power to own its assets and carry on business as conducted from time to time; |

| | | |

| 2.11.2 | it has good title (free from any restrictions or onerous covenants) to all of the assets required for carrying on its business; and |

| | | |

| 2.11.3 | it has obtained or effected all authorisations, approvals, consents, exemptions, filings, licenses, notarisations, permits and registrations which are required in connection with its business, and that all such authorisations, approvals, consents, exemptions, filings, licenses, notarisations, permits and registrations are in full force and effect, except where the failure to obtain or effect the same or, as the case may be, the cessation of the force and effect of the same would not reasonably be expected to, have a Material Adverse Effect. |

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/3O5/23/100734-00/F/8884246

Without prejudice to the performance of the Borrower’s other obligations under the Facility Letter, the Borrower shall perform all its obligations under all of the material agreements or contracts to which it is a party.

| 2.13 | Security and Further Assurance |

If by the terms of the Facility Letter, security is to be given by the Borrower in favour of the Bank, the Borrower shall ensure that each security document confers valid security, of the type which such security document purports to create, in favour of the Bank, over each asset, right and benefit expressed to be subject to such security and ensure that the Bank enjoys the priority which such security is expressed to have. The Borrower shall promptly execute all documents and do all things that the Bank reasonably specifies for the purpose of enabling the Bank to exercise its rights under each security document or preserving the priority and effectiveness of such security. (For the avoidance of doubt, the Borrower confirms that all sums from time to time owing by it to the Bank under the Facility Letter are and shall be secured by all and any security created by it, before or at the date of the Facility Letter or at any time after that date, which is by its terms expressed (in any manner whatsoever) to secure all monies owing by the Borrower to the Bank, and the Borrower will not seek to claim or assert anything to the contrary.)

In this Schedule, “Material Adverse Effect” means (a) a material adverse effect on the business, assets, operations or condition (financial or otherwise) of the Borrower; (b) a material impairment of the ability of the Borrower to perform any of its obligations under the Facility Letter; or (c) a material impairment of the rights of, or benefits available to, the Bank under the Facility Letter.

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

|

BANK OF CHINA (HONG KONG) |

Ref: L/CCA/305/23/100734-00/F/8884246

After due and careful consideration of the contents of this letter and the General Terms (as defined above), 1/we agree to (i) accept the Faci1ities and (ii) be bound by all the terms and conditions herein set out. If I/we have granted security in your favour, I/we confirm that each security document executed by me/us in respect of, among other things, our obligations to you is not (and will not be) discharged, prejudiced or affected in any way whatsoever and will remain in full force and effect at all times, notwithstanding any variations, amendments and/or supplements to the Facilities.

For and on behalf of

HERE WE SEOUL LIMITED

| |

| Authorized Signatory(ies) | |

| Date: 27 NOV 2023 | |

After due and careful consideration of the contents of this letter and the General Terms (as defined above) and in consideration of you agreeing to continue to make available the Facilities to the Borrower as amended pursuant to this letter and for other good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged):

(a) I/we consent to all the terms and conditions herein set out; and

(b) To the extent this letter in any way whatsoever varies, amends and/or supplements the facility letter(s) previously issued by you to the Borrower, I/we confirm that each guarantee and/or security document executed by me/us in respect of, among other things, the Borrower’s obligations to you is not (and will not be) discharged, prejudiced or affected in any way whatsoever and will remain in full force and effect at all times, notwithstanding any such variations, amendments and/or supplements, and I/we acknowledge that I/we fully understand, confirm and agree to be bound by all the terms and conditions herein set out, and to continue to be liable for all debts and liabilities of the Borrower upon the terms and conditions of the guarantee and/or security document executed or to be executed by me/us.

| /s/ WONG YING YEUNG | | /s/ YOUNG YUEN YI |

| Name: | WONG YING YEUNG | | Name: | YOUNG YUEN YI |

| Date: | 27 NOV 2023 | | Date | 27 NOV 2023 |

| | | | | |

| Witness: | | | |

| | | | | |

| /s/ Yun Ka Ki Catharine | | | |

| Name: | Yun Ka Ki Catharine 8827348 | | | |

| Bank of China (Hong Kong) Limited Loans Division 12/E, Bank of China Center, Olympian City, 11 Hoi Fai Road, West Kowloon, Hong Kong. Website: www.bochk.com |

MEMORANDUM

To: Guarantor(s)

Re: HERE WE SEOUL LIMITED (the “Borrower”)

We intend to grant general banking facilities to the Borrower against, inter alia, the security of your guarantee.

In this connection, we enclose for your consideration a form of the Deed of Guarantee (the “Guarantee”) which you are required to execute in our favour. Meanwhile, without any prejudice to our rights under the Guarantee, we would draw your attention to the following matters:-

| (1) | As the Guarantee will create legal liabilities and obligations on your part, you are advised to seek independent legal advice before entering into the Guarantee. |

| | |

| (2) | Your maximum liability under the Guarantee is:- |

| | ☐ | the amount specified in the Second Schedule of the Guarantee plus the sums referred to in Proviso (ii) of Section B of the Guarantee, or |

| | | |

| | ☒ | unlimited. |

| (3) | If the second box in paragraph (2) above is checked, and your liability is unlimited, your liabilities under the Guarantee are not confined solely to the facilities proposed to be granted to the Borrower (in the case where the Borrower consists of one person, whether alone or jointly with any other person, or in the case where the Borrower consists of two or more persons, then only to those persons jointly) when the Guarantee is executed but may extend to other facilities at any time and from time to time granted by us to the Borrower as aforesaid. You will become liable for all debts and.liabilities (whether actual or contingent, and whether past, present or future) incurred by and owing from the Borrower (in the case where the Borrower consists of one person, whether alone or jointly with any other person, or in the case where the Borrower consists of two or more persons, then only by and from those parties jointly) to us at any time and from time to time. We are entitled to make further advances to the Borrower at such time and to such extent as we and the Borrower may from time to time agree without seeking your consent. |

| | |

| (4) | You will be required to pay (and if you consist of two or more persons, you may become liable jointly and severally to pay), subject to (2) above, ON DEMAND by us, all sums of moneys debts and liabilities of the Borrower as aforesaid. By way of examples and without limitation, you may be called upon to pay under the Guarantee when the Borrower has failed to pay us any indebtedness when due or on demand or if you and/or the Borrower is/are unable or admit inability to pay debts generally as they become due or in the event of any proceedings in or analogous·to bankruptcy, insolvency, winding up or liquidation against you and/or the Borrower. |

| | |

| (5) | The Guarantee is a continuing guarantee. Nevertheless, you may extinguish your liability under the Guarantee if (i) pursuant to Clause 5 of Section C of the Guarantee, you give us 3 months’ prior written notice of determination; and (ii) your liabilities thereunder in respect of all or any debts and obligations (actual or contingent) incurred by the Borrower to us prior to the effective date of determination of the Guarantee have been satisfied in full. |

| | |

| (6) | We shall be entitled to retain the Guarantee for at least 25 months after you have extinguished your liabilities under the Guarantee. |

Please be informed that the Borrower has agreed to our providing the following information to you:-

| (a) | a copy of contract evidencing the obligations to be guaranteed or secured by you or a summary thereof; and |

| | |

| (b) | a copy of any formal demand for overdue payment served by us on the Borrower from time to time; and |

| | |

| (c) | a copy of the Borrower’s latest statement of accounts provided to the Borrower from time to time upon your request, |

and we now, pursuant to (a) above, enclose a copy of a ☒ facility letter ☐ summary evidencing the facilities now proposed to be granted to the Borrower and guaranteed by you under the Guarantee. However, please note that your liabilities under the Guarantee are not confined solely to the facilities described in such facility letter/summary, but may extend to other facilities at any time and from time to time granted by us to the Borrower as aforesaid without prior notice to you.

Please refer to our “Data Policy Notice” or such documents in whatever name issued from time to time relating to our general policies on use, disclosure and transfer of personal data (as amended from time to time and collectively, the “Notice”).

The Chinese version of this Memorandum is for reference only. If there is any conflict between the English and the Chinese versions, the English version shall prevail.

Kindly consider the above and any other matters as you may consider relevant to your execution of the Guarantee. If you are prepared to execute the Guarantee, as proposed, please sign and return the duplicate of this Memorandum to us.

Bank of China (Hong Kong) Limited

Acknowledgement

To: Bank of China (Hong Kong) Limited

I/We have considered all relevant matters and am/are prepared to execute the Guarantee in your favour.

I/We acknowledge that (a) I/we have been given a copy of the form of Guarantee to be signed, (b) I/we have been given the option of executing either (i) an unlimited Guarantee or (ii) a Guarantee limiting my/our liability to the amount specified in the Second Schedule of the Guarantee plus the sums referred to in Proviso (ii) of Section B of the Guarantee, (c) I/we have understood the difference between the two types of Guarantee, and (d) I/we have freely chosen to accept the type of liability indicated above under paragraph (2).

I/We acknowledge that I/we have noted the content of the Notice and agree that it is necessary to supply the Bank with data under the Deed or as required by the Bank in order that the Bank will accept the Deed. I/We further authorize the Bank to use my/our data for the purposes set out in the Notice and note that data held by the Bank will be kept confidential but permit the Bank to provide such information to the persons listed in the Notice or any other persons (including credit reference agencies and debt collecting agents) for the purposes set out in the Notice or in compliance with any laws, regulations, guidelines or directions binding on the Bank or its branches/sub-branches. I/We further authorize the Bank to contact any of my/our employers (if applicable), banks, credit reference agencies, referees or any other sources for the purpose of obtaining or exchanging any information and to compare the information provided by me/us with other information collected by the Bank for checking purposes. The Bank is entitled to use the result of such comparison to take any action which may be adverse to the interest of or against me or any of us. I/We consent to my/our data being transferred to another jurisdiction outside Hong Kong.

| | | Signature(s) Versified/Witnessed by: |

| | | | |

| /s/ WONG YING YEUNG andYOUNG YUEN YI | | /s/ Yun Ka Ki Catharine |

| Guarantor(s) | | Name: | Yun Ka Ki Catharine |

| Name(s) | WONG YING YEUNG andYOUNG YUEN YI | | | 8827348 |

| Date | 27 NOV 2023 | | | |

| | | | | |

DEED OF GUARANTEE

IMPORTANT NOTICE TO THE GUARANTOR

This Guarantee will create legal obligations and liabilities on your part. You are strongly advised (i) to note and understand the declaration and notes contained in the Application Form, the Acceptance of Conditions and the related legal documentation in respect of the SME Financing Guarantee Scheme (the “Scheme” guaranteed by the HKMC Insurance Limited (“HKMCI”) and (ii) to seek independent legal advice before you execute this Guarantee.

Without prejudice to any provision of this Guarantee, please take note of the following:-

| (1) | You may become liable (and if you consist of two or more persons, you may become liable jointly and severally), instead of or as well as the Principal, for all money, debts and liabilities incurred by and owing from the Principal in respect of the Guaranteed Obligations to us, whether actual or contingent, past, present or future, or as principal or surety, at any time and from time to time. |

| | |

| (2) | Your maximum liability under this Guarantee is the amount set out in the Second Schedule hereto plus the sums referred to in Proviso (ii) of Section B of this Guarantee. Where no amount is specified in the Second Schedule, the amount ultimately enforceable against you will be unlimited. |

| | |

| (3) | Subject to paragraph (2) above, you will be required to pay, on demand by us, all sums of money, debts and liabilities of the Principal in respect of the Guaranteed Obligations. By way of examples and without limitation, you may be called upon to pay under this Guarantee if the Principal has failed to pay us any indebtedness when due or on demand or if you and/or the Principal are unable or admit inability to pay debts generally as they become due or in the event of any proceedings in or analogous to bankruptcy, insolvency, winding up or liquidation against you or the Principal. |

| | |

| (4) | This Guarantee is a continuing guarantee. Nevertheless, you may extinguish your liability under this Guarantee if (i) pursuant to Clause 5 of Section C of this Guarantee, you give us 3 months’ prior written notice of determination; and (ii) your liabilities hereunder in respect of all or any money, debts and liabilities (actual or contingent) incurred by the Principal in respect of the Guaranteed Obligations to us prior to the effective date of determination of this Guarantee have been satisfied in full. |

| | |

| (5) | We shall be entitled to retain this Guarantee for at least 25 months after you have extinguished your liabilities under this Guarantee. |

Bank of China (Hong Kong) Limited

To: Bank of China (Hong Kong) Limited

Unless the context otherwise requires, all capitalized terms used herein shall have their respective meanings as defined in Clause 29 of Section C of this Guarantee,

In consideration of Bank of China (Hong Kong) Limited (hereinafter called the “Bank”) agreeing at the request of the principal debtor (hereinafter called “the Principal”, whose particulars are set out in Part A of the First Schedule hereto) and/or the undersigned (whose particulars are set out in Part B of the First Schedule hereto) from time to time or at any time (i) to grant or continue to grant general banking facilities of whatever nature and in whatever currency to the Principal (in the case where the Principal consists of one person, whether alone or jointly with any other person, or in the case where the Principal consists of two or more persons, only to those persons jointly) and/or to any other person or persons for or on account of the Principal as aforesaid on such terms, manner and form and for so long as the Bank may in its absolute discretion think fit; and/or (ii) to withhold proceedings against or not to make immediate demand for repayment from the Principal for so long and on such terms and conditions as the Bank may in its absolute discretion think fit, I, the undersigned, HEREBY AGREE (and in case where there are more than one undersigned, we, the undersigned, HEREBY JOINTLY AND SEVERALLY AGREE), as primary obligor and not merely as surety, to PAY and SATISFY to the Bank ON DEMAND in writing, irrespective of whether any demand has been made on the Principal (and in case where there are more than one undersigned, with the intent that this Guarantee shall operate so as to create separate and independent guarantees by each of us), all sums of money, debts and liabilities whether actual or contingent, whether now or at any time hereafter owing or incurred, due but unpaid to the Bank from or by the Principal (in the case where the Principal consists of one person, whether alone or jointly with any other person, or in the case where the Principal consists of two or more persons, only from or by those persons jointly) in any manner howsoever or on any account whether as principal or surety and whether from or by any firm in which the Principal may be a partner and in whatever name, style or form (hereinafter referred to as the “Guaranteed Obligations”). The Guaranteed Obligations shall include, without limitation, the following:

| (a) | any or all sum or sums due owing and/or payable to the Bank by the Principal under any general banking facilities, dealings, transactions, undertakings, contracts and/or obligations, liabilities, engagements of whatever nature and/or under any bills, drafts, notes, guarantees and/or indemnities; |

| (b) | interest accrued or to be accrued; |

| | | |

| (c) | commissions, fees and other charges payable by the Principal to the Bank; and |

| | | |

| (d) | any legal or other costs, expenses, disbursements and/or payment of whatsoever nature of reasonable amount and reasonably incurred by the Bank for the recovery of payment from the Principal and/or me/us and/or for the enforcement and realisation of any security or guarantee or otherwise in relation to the Principal as aforesaid, me/us or this Guarantee or any other guarantee, indemnity or security for any money, obligations or liabilities hereby guaranteed on a full indemnity basis. |

PROVIDED ALWAYS that:

| (i) | where no amount is specified in the Second Schedule hereto as a Specified Amount, the amount ultimately enforceable against me/us under this Guarantee shall for all intents and purposes be unlimited; but |

| | | |

| (ii) | where there is a Specified Amount set out in the Second Schedule hereto, the total liability ultimately enforceable against me/us under this Guarantee shall not exceed in the aggregate an amount being the total of (A) the Specified Amount, (B) a sum equal to all interest accrued or to be accrued on the Specified Amount calculated at the Agreed Interest Rate(s) (both before and after judgment) to the date of actual payment, (C) all those amounts referred to in paragraphs (c) and (d) above, and (D) a sum equal to all interest accrued or to be accrued on those amounts referred to in sub-paragraphs (A) and (B) above calculated at the Default Interest Rate (both before and after judgment) to the date of actual payment, PROVIDED ALWAYS that where the total money, debts and liabilities owing by the Principal in respect of the Guaranteed Obligations to the Bank exceeds the limit ultimately enforceable against me/us under this Guarantee, the Bank shall be entitled in its absolute discretion to determine which part or parts of such money, debts and liabilities shall be guaranteed and/or demanded hereunder AND PROVIDED FURTHER that in such event, should such money, debts and liabilities (or any part or parts thereof) determined by the Bank to be guaranteed and/or demanded under this Guarantee be paid by the Principal or any third party or parties other than me/us, my/our liabilities hereunder shall not thereby be deemed diminished or discharged and the Bank shall be entitled to re-determine such other part or parts of the money, debts and liabilities then owing by the Principal in respect of the Guaranteed Obligations to be guaranteed hereunder and demanded accordingly. |

I/We hereby expressly acknowledge and agree that references in this Guarantee to the Bank shall include any or all of the Bank’s branches and offices whether located or operating in Hong Kong or elsewhere and this Guarantee shall cover all debts, obligations and liabilities (whether actual or contingent) of the Principal in respect of the Guaranteed Obligations to the Bank anywhere in the world whether to any one or more of the Bank’s branches and/or offices in Hong Kong or elsewhere. The Bank or any of its branches and offices in Hong Kong or elsewhere shall be entitled to enforce this Guarantee against me/us in Hong Kong or elsewhere notwithstanding that any debts, obligations and liabilities (whether actual or contingent) of the Principal in respect of the Guaranteed Obligations are owing or incurred to the Bank acting through any of its other branches or offices in any other jurisdiction.

I, the undersigned, HEREBY FURTHER AGREE AND UNDERTAKE (and in case where there are more than one undersigned, we, the undersigned, HEREBY JOINTLY AND SEVERALLY AGREE AND UNDERTAKE) as follows:-

| (a) | All moneys received or held by the Bank under this Guarantee may from time to time after demand has been made be converted into such other currency as the Bank considers necessary or desirable to cover my/our obligations and liabilities in that currency at the then prevailing spot rate of exchange of the Bank (as conclusively determined by the Bank) for purchasing the currency to be acquired with the existing currency. |

| | | |

| (b) | If and to the extent I/we fail to pay the amount due on demand the Bank may in its absolute discretion without notice to me/us purchase at any time thereafter so much of a currency as the Bank considers necessary or desirable to cover my/our obligations and liabilities in such currency hereby secured at the then prevailing spot rate of exchange of the Bank (as conclusively determined by the Bank) for purchasing such currency with Hong Kong Dollars and I hereby agree (and in case where there are more than one undersigned), we hereby jointly and severally agree to indemnify the Bank against the full Hong Kong Dollar price (including all costs, charges and expenses) paid by the Bank. |

| | | |

| (c) | No payment to the Bank (whether under any judgment or court order or otherwise) shall discharge my/our obligation or liability in respect of which it was made unless and until the Bank shall have received payment in full in the currency in which such obligation or liability was incurred and to the extent the amount of any such payment shall on actual conversion into such currency fall short of such obligation or liability expressed in that currency, the Bank shall have a further separate cause of action against me/us and shall be entitled to enforce the guarantee hereby created to recover the amount of the shortfall. |

| | 2. | Payment not subject to deduction: All payments under this Guarantee shall be made free of any restriction and counterclaim and without any set-off, deductions or withholdings whatsoever. If any payment to be made under this Guarantee is subject to any tax or other withholding, I undertake (and in case where there are more than one undersigned, we hereby jointly and severally undertake) to pay to the Bank such additional amount as may be necessary to ensure that the net amount received (whether as principal or interest) is equal to the amount which the Bank would have received if there had been no such tax or withholding. |

| 3. | Interest on sums demanded hereunder: Without prejudice to Proviso (ii) of Section B above, all sums demanded for payment but unpaid under this Guarantee shall bear interest from the date of the Bank’s demand hereunder to the date of actual payment (both before and after judgment) at the Bank’s default interest rate as may be specified by the Bank from time to time and displayed or posted in the Bank’s banking halls. |

| | | |

| 4. | Guarantee security: This Guarantee shall not be considered as satisfied by any intermediate payment or satisfaction of the whole or any part of any sum or sums of money owing by the Principal but shall be a continuing guarantee and shall extend to cover all sum or sums of money which shall for the time being or at any time constitute the balance due from the Principal in respect of the Guaranteed Obligations to the Bank in whatsoever manner. |

| | | |

| 5. | Happening of Specified Events: This Guarantee shall be binding as continuing guarantee on me/us and shall not be discharged or be in any way affected by the occurrence of any one or more or all of the Specified Events. This Guarantee shall be valid, binding and enforceable notwithstanding any change in the Bank’s name or constitution or the Bank’s amalgamation with, or absorption by, any other bank or corporation. Without prejudice to the generality of the foregoing, this Guarantee may be determined upon the expiration of three calendar months from the date of the Bank’s actual receipt of a notice in writing to determine this Guarantee given by:- |

| (a) | if there is only one undersigned, the undersigned, or the undersigned’s liquidator, receiver, personal or legal representative(s) (as the case may be); or |

| | | |

| (b) | if there is more than one undersigned, all of us or, as the case may be, the liquidator, receiver, personal or legal representative(s), of each and every one of us to which a Specified Event has occurred jointly together with all of us (if any) not affected by any Specified Event. |

| 6. | Liabilities on determination : Determination of this Guarantee as provided in Clause 5 or by whatever reason shall not release me/us and/or my/our heir(s), executor(s), administrator(s), liquidator(s) or estate(s) from this Guarantee in respect of any liability incurred by the Bank for account of the Principal in respect of the Guaranteed Obligations during the currency of this Guarantee (including those incurred during the period of the required three months’ notice of determination as stipulated in Clause 5) whether such liability is past, present or future, actual or contingent, accrued or not yet accrued and whether or not such liability matures or becomes due or payable or accrues only after the expiration of the required three months’ notice of determination as stipulated in Clause 5. Without prejudice to the generality of the foregoing, I/we hereby expressly agree, admit and declare that notwithstanding the giving of any notice of determination to the Bank pursuant to Clause 5, the Bank shall be entitled (during the period of the required three months’ notice of determination as stipulated in Clause 5) to continue to make available general banking facilities to the Principal in respect of the Guaranteed Obligations and to make further advances to the Principal as aforesaid and to open new accounts with or for the Principal as aforesaid in respect thereof and where the Bank has incurred any irrevocable obligation to make any advance to, or incur any liability for account of, the Principal as aforesaid prior to the expiration of the required three months’ notice of determination as stipulated in Clause 5, the Bank shall have the right to continue making the advance to or incurring the liability for account of the Principal as aforesaid after the said expiration of the required three months’ notice of determination and all such obligations, liabilities and advances shall form part of the liability incurred by the Bank for account of the Principal as aforesaid during the currency of this Guarantee and I/we shall be fully liable therefor notwithstanding the determination of this Guarantee. |

| | | |

| 7. | No demand prior to determination : I/We hereby expressly agree that my/our obligations to guarantee and indemnify the Bank against the liabilities of the Principal in respect of the Guaranteed Obligations shall not in any way be affected by the Bank not making a demand on me/us before the determination of this Guarantee and that the Bank may make a demand on me/us at any time whether before or after the determination of this Guarantee whereupon I/we shall promptly pay the Bank the amount demanded. |

| | | |

| 8. | New accounts with Principal: In the event of this Guarantee ceasing from any cause whatsoever to be binding as a continuing guarantee on me/us, the Bank shall be at liberty without thereby affecting the Bank’s rights hereunder to open a fresh account or accounts and/or to continue any then existing account or accounts with the Principal and no moneys paid from time to time into any such fresh account or accounts so opened by or on behalf of the Principal (or the then existing account or accounts where no such fresh account or accounts are opened, as the case may be) shall on settlement of any claim in respect of this Guarantee be deemed appropriated towards or have the effect of payment of any part of the moneys due from the Principal at the time of this Guarantee ceasing to be so binding as a continuing guarantee or of the interest thereon. |

| | | |

| 9. | Conclusive evidence: |

| | (a) | Any admission or acknowledgment in writing by the Principal or by any person authorized by the Principal of the amount of indebtedness of the Principal in respect of the Guaranteed Obligations to the Bank and any judgment recovered by the Bank against the Principal in respect of such indebtedness shall be binding and conclusive on and against me/us in all courts of law and elsewhere. |

| | | |

| (b) | A certificate signed by any one of the Bank’s duly authorized officers as to the money, debts and liabilities for the time being due or owing to the Bank from or by the Principal in respect of the Guaranteed Obligations shall be binding on me/us as conclusive evidence in any legal proceedings against me/us in all courts of law and elsewhere. |

| 10. | Indulgence, dealing with Principal: The Bank shall be entitled without notice to and/or consent of me/us and without thereby discharging or affecting any of my/our liabilities hereunder at any time at the Bank’s sole and absolute discretion to deal freely with the Principal or any other party or parties liable in respect of any debts and/or liabilities guaranteed hereunder whether jointly, severally or jointly and severally with the Principal or as surety or as provider of securities, including but without limitation:- |

| (a) | to determine, reduce, limit, restrict, grant, enlarge, increase, vary, continue, renew or regrant any general banking facilities to the Principal in respect of the Guaranteed Obligations; and/or |

| | | |

| (b) | to vary, exchange, renew, discharge, release, give up, abstain from perfecting and/or hold over any securities (including but not limited to any bills, notes, mortgages, charges, liens or other securities), indemnities, guarantees and/or any other undertaking or arrangement of similar nature whether from the Principal or from any third patty or parties (in each case, jointly, severally or jointly and severally with any other party or parties) covering or in respect of any money, debts and liabilities hereby guaranteed; and/or |

| | | |

| (c) | to release, discharge, settle or compound with, grant indulgence, give time for payment or other accommodation, to accept compositions from and make any other arrangements with the Principal and/or any third party or parties including but not limited to any person or persons liable on any bills, notes, mortgages, charges, liens or other securities as aforesaid or any person liable jointly, severally or jointly and severally with or as surety of the Principal or any other person or persons. |

| (a) | Save and except expressly provided for in this Guarantee, this Guarantee shall be in addition to and not in substitution of and may be enforced despite the existence of any other guarantee or security in respect of any money, debt and/or liability of the Principal guaranteed hereunder whether given by me/us or by the Principal or by any other third party or parties. |

| | | |

| (b) | This Guarantee shall be in addition to and shall not merge with or in any way discharge, prejudice or affect any other guarantees, agreements, undertakings, rights, liens, collateral or other securities now or hereafter held by the Bank from me/us or any third party or parties for or in respect of all or any part of the money, debts and liabilities hereby guaranteed nor vice versa should this Guarantee be discharged, prejudiced or affected thereby. The Bank shall have absolute discretion to apply or appropriate any money received by the Bank for payment of any money, debts and/or liabilities owing to the Bank by the Principal without any notice or consent of me/us. |

| 12. | Enforcing other means of payment: The Bank is at liberty, but not bound, to resort for the Bank’s own benefit to any other means of obtaining payment or securing performance by the Principal or any other co-sureties at any time and in any manner or order the Bank thinks fit without affecting this Guarantee and/or without in consequence diminishing my/our liability hereunder. The Bank may exercise and enforce the Bank’s rights hereunder before resorting to other means of obtaining payment or securing performance or after such means have been resorted to in respect of any balance due or outstanding liabilities or obligations without entitling me/us to any benefit from such other means so long as any sum, liability or obligation remains due, owing or payable or outstanding (whether actual or contingent) from or by the Principal in respect of the Guaranteed Obligations to the Bank. |

| | |

| 13. | Invalidity of other security etc.: The liabilities of me/us shall not be affected by any failure by the Bank to take any security or by any invalidity of any security taken or by any existing or future agreement by the Bank as to the application of any general banking facilities made or to be made to the Principal. |

| | |

| 14. | Guarantee of whole debt: Although my/our ultimate liability hereunder cannot exceed the limit herein before provided in Proviso (ii) of Section B, if any, this Guarantee shall be construed and take effect as a guarantee of the whole and every part of all money, debts and liabilities now or at any time hereafter owing to the Bank by the Principal in respect of the Guaranteed Obligations. |

| | |

| 15. | Payment into suspense account: Any money paid to the Bank under this Guarantee may be placed and kept by the Bank in a non-interest bearing separate or suspense account for so long and in such name as the Bank may in the Bank’s absolute discretion think fit without applying the same or any part thereof in or towards discharge of any money, debts or liabilities due or incurred by the Principal in respect of the Guaranteed Obligations to the Bank so as to enable the Bank to preserve intact the liability of the Principal as aforesaid, me/us and/or any other person to the Bank and to sue or prove in arrangement, composition, liquidation, bankruptcy, winding up or such similar proceedings against the Principal, me/us and/or any other person the entirety of the money, debt or liabilities owing without taking into account any sum so paid under this Guarantee. I/We hereby irrevocably waive any right or power which I/we may have of appropriation in respect of any sum paid by me/us to the Bank pursuant to or in connection with this Guarantee. |

| | |