| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-280224-05 |

| | | |

| Dated February 10, 2025 | BMO 2025-C11 |

| Structural and Collateral Term Sheet |

BMO 2025-C11 Mortgage Trust |

$906,918,176 (Approximate Mortgage Pool Balance) |

| |

$809,877,000 (Approximate Offered Certificates) |

| |

BMO Commercial Mortgage Securities LLC Depositor |

| |

Commercial Mortgage Pass-Through Certificates, Series 2025-C11 |

| |

| |

Bank of Montreal Societe Generale Financial Corporation Starwood Mortgage Capital LLC UBS AG German American Capital Corporation National Cooperative Bank, N.A. Citi Real Estate Funding Inc. Barclays Capital Real Estate Inc. LMF Commercial, LLC LoanCore Capital Markets LLC Goldman Sachs Mortgage Company Greystone Commercial Mortgage Capital LLC Natixis Real Estate Capital LLC Sponsors and Mortgage Loan Sellers |

BMO Capital

Markets | Deutsche

Bank

Securities | Citigroup | Barclays | Goldman

Sachs &

Co. LLC | UBS

Securities

LLC | Société

Générale |

| |

| Co-Lead Managers and Joint Bookrunners |

| | | | | |

| Academy Securities | Bancroft Capital,

LLC | Drexel Hamilton | Mischler Financial | Natixis |

| Co-Managers |

| |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| Dated February 10, 2025 | BMO 2025-C11 |

This material is for your information, and none of BMO Capital Markets Corp., SG Americas Securities, LLC, Deutsche Bank Securities Inc., Citigroup Global Markets Inc., Barclays Capital Inc., Goldman Sachs & Co. LLC, UBS Securities LLC, Academy Securities, Inc., Bancroft Capital, LLC, Drexel Hamilton, LLC, Mischler Financial Group, Inc. and Natixis Securities Americas LLC (collectively, the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-280224) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or BMO Capital Markets Corp., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-888-200-0266. The Publicly Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2025-C11 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these Certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the Certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the Certificates. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Investment Industry Regulatory Organization of Canada and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorized and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in the UK and Australia.

Securities and investment banking activities in the United States are performed by Deutsche Bank Securities Inc., a member of NYSE, FINRA and SIPC, and its broker-dealer affiliates. Lending and other commercial banking activities in the United States are performed by Deutsche Bank AG and its banking affiliates.

Société Générale is the marketing name for SG Americas Securities, LLC.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Dated February 10, 2025 | BMO 2025-C11 |

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Summary of Transaction Terms |

| Offered Certificates | | | | | |

Classes of Certificates | Expected Ratings (Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial

Pass-

Through Rate(4) | Pass-Through

Rate Description | Expected Weighted Avg. Life (yrs.)(5) | Expected Principal Window(5) |

| Class A-1 | AAAsf/AAA(sf)/Aaa(sf) | $19,265,000 | | 30.000% | % | (6) | 2.83 | 03/25-02/30 |

| Class A-4 | AAAsf/AAA(sf)/Aaa(sf) | (7) | | 30.000% | % | (6) | (7) | (7) |

| Class A-5 | AAAsf/AAA(sf)/Aaa(sf) | (7) | | 30.000% | % | (6) | (7) | (7) |

| Class A-SB | AAAsf/AAA(sf)/Aaa(sf) | $26,909,000 | | 30.000% | % | (6) | 7.26 | 02/30-09/34 |

| Class X-A | AAAsf/AAA(sf)/Aaa(sf) | $634,842,000 | (8) | N/A | % | Variable IO(9) | N/A | N/A |

| Class X-B(10) | AAAsf/AAA(sf)/Aaa(sf) | $175,035,000 | (8) | N/A | % | Variable IO(9) | N/A | N/A |

| Class A-S | AAAsf/AAA(sf)/Aa1(sf) | $102,029,000 | | 18.750% | % | (6) | 9.96 | 02/35-02/35 |

| Class B | AA-sf/AA(sf)/NR | $41,944,000 | | 14.125% | % | (6) | 9.96 | 02/35-02/35 |

| Class C(10) | A-sf/A(sf)/NR | $31,062,000 | | 10.700% | % | (6) | 9.96 | 02/35-02/35 |

| Non-Offered Certificates(11) | | | | | |

Classes of Certificates | Expected Ratings (Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial Pass-

Through Rate(4) | Pass-Through Rate Description | Expected Weighted Avg. Life (yrs.)(5) | Expected Principal Window(5) |

| Class X-D(10) | BBB+sf/AAA(sf)/NR | $9,070,000(8) | N/A | % | Variable IO(9) | N/A | N/A |

| Class D(10) | BBB+sf/A-(sf)/NR | $9,070,000 | 9.700% | % | (6) | 9.96 | 02/35-02/35 |

| Class E-RR(10) | BBB-sf/BBB(sf)/NR | $19,952,000 | 7.500% | % | (6) | 9.96 | 02/35-02/35 |

| Class F-RR(10) | BB-sf/BB+(sf)/NR | $17,005,000 | 5.625% | % | (6) | 9.96 | 02/35-02/35 |

| Class G-RR(10) | B-sf/BB-(sf)/NR | $11,336,000 | 4.375% | % | (6) | 9.96 | 02/35-02/35 |

| Class J-RR(10) | NR/NR/NR | $39,678,175 | 0.000% | % | (6) | 9.96 | 02/35-02/35 |

| Class R(12) | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| | | | | | | |

| | | | | | | | |

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”), as indicated. Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Offered Certificates; Ratings of the Offered Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. Fitch, KBRA and Moody’s have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this structural and collateral term sheet (the “Term Sheet”) are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5% and further subject to any additional variances described in the footnotes below. In addition, the notional amounts of the Class X-A, Class X-B and Class X-D certificates (collectively, the “Class X certificates”) may vary depending upon the final pricing of the respective classes of principal balance certificates (as defined in footnote (6) below) whose certificate balances comprise such notional amounts, and, if as a result of such pricing (a) the pass-through rate of any class of Class X certificates would be equal to zero at all times, such class of Class X certificates will not be issued on the closing date of this securitization or (b) the pass-through rate of any class of principal balance certificates whose certificate balance comprises such notional amount is at all times equal to the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, the certificate balance of such class of principal balance certificates may not be part of, and there may be a corresponding reduction in, such notional amount of the related class of Class X certificates. |

| (3) | "Approximate Initial Credit Support" means, with respect to any class of principal balance certificates, the quotient, expressed as a percentage, of (i) the aggregate of the initial certificate balances of all classes of principal balance certificates, if any, junior to the subject class of principal balance certificates, divided by (ii) the aggregate of the initial certificate balances of all classes of principal balance certificates. The approximate initial credit support percentages set forth for the Class A-1, Class A-4, Class A-5 and Class A-SB certificates are represented in the aggregate. |

| (4) | Approximate per annum rate as of the closing date. |

| (5) | Determined assuming no prepayments prior to the maturity date or any anticipated repayment date, as applicable, for any mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Preliminary Prospectus. |

| (6) | For any distribution date, the pass-through rate for each class of the Class A-1, Class A-4, Class A-5, Class A-SB, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class J-RR certificates (collectively, the “principal balance certificates”, and collectively with the Class X certificates and the Class R certificates, the “certificates”) will generally be equal to one of (i) a fixed per annum rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, (iii) a rate equal to the lesser of a specified per annum rate and the weighted average rate described in clause (ii), or (iv) the weighted average rate described in clause (ii) less a specified percentage, but no less than 0.000%. See “Description of the Certificates—Distributions—Pass-Through Rates” in the Preliminary Prospectus |

| (7) | The exact initial certificate balances of the Class A-4 and Class A-5 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, weighted average lives and principal windows of the Class A-4 and Class A-5 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-4 and Class A-5 certificates is expected to be approximately $588,668,000 subject to a variance of plus or minus 5%. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Summary of Transaction Terms |

Class of Certificates | Expected Range of Initial Certificate Balances | Expected Range of Weighted Avg. Lives (Yrs) | Expected Range of Principal Windows |

| Class A-4 | $0 - $250,000,000 | N/A – 9.82 | N/A – 09/34-01/35 |

| Class A-5 | $338,668,000 - $588,668,000 | 9.90 – 9.96 | 09/34-02/35 – 01/35-02/35 |

| (8) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each class of Class X certificates at the related pass-through rate based upon the related notional amount. The notional amount of each class of the Class X certificates will be equal to the certificate balance or the aggregate of the certificate balances, as applicable, from time to time of the class or classes of principal balance certificates identified in the same row as such class of Class X certificates in the chart below (as to such class of Class X certificates, the “corresponding principal balance certificates”): |

| Class of Class X Certificates | Class(es) of Corresponding

Principal Balance Certificates |

| Class X-A | Class A-1, Class A-4, Class A-5 and Class A-SB |

| Class X-B | Class A-S, Class B and Class C |

| Class X-D | Class D |

| (9) | The pass-through rate for each class of Class X certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, over (ii) the pass-through rate (or, if applicable, the weighted average of the pass-through rates) of the class or classes of corresponding principal balance certificates as in effect from time to time, as described in the Preliminary Prospectus. |

| (10) | In satisfaction of Bank of Montreal’s risk retention obligations as retaining sponsor for this securitization transaction, all of the Class E-RR, Class F-RR, Class G-RR and Class J-RR certificates (collectively, the “HRR Certificates”), which will constitute an “eligible horizontal residual interest” with an aggregate fair value expected to represent at least 5.0% of the fair value, as of the closing date for this transaction, of all of the “ABS interests” (i.e., all of the Certificates (other than the Class R certificates) issued by the issuing entity. The certificate balances of the Class C, Class D and Class E-RR certificates may be reallocated between those classes based on the determination of the aggregate fair value, as of the closing date for this transaction, of all of the Certificates (other than the Class R certificates), in order to satisfy the foregoing. Any such reallocation would have a corresponding effect on the notional amounts of the Class X-B and Class X-D certificates, as applicable. However, the “Approximate Initial Credit Support” for the Class C certificates will have a minimum value of 10.625%, and the “Approximate Initial Credit Support” for the Class D certificates will have a minimum value of 9.625%. “Retaining sponsor,” “eligible horizontal residual interest” and “ABS interests” have the meanings given to such terms in Regulation RR. See “Credit Risk Retention” in the Preliminary Prospectus. |

| (11) | The classes of certificates set forth below “Non-Offered Certificates” in the table are not offered hereby. |

| (12) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two (2) separate REMICs, as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Summary of Transaction Terms |

| Publicly Offered Certificates: | $809,877,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | BMO Capital Markets Corp., SG Americas Securities, LLC, Deutsche Bank Securities Inc., Citigroup Global Markets Inc., Barclays Capital Inc., Goldman Sachs & Co. LLC and UBS Securities LLC |

| Co-Managers: | Academy Securities, Inc., Bancroft Capital, LLC, Drexel Hamilton, LLC, Mischler Financial Group, Inc. and Natixis Securities Americas LLC |

| Mortgage Loan Sellers: | Bank of Montreal (“BMO”) (14.6%); Societe Generale Financial Corporation (“SGFC”) (18.1%); Starwood Mortgage Capital LLC (“SMC”) (11.9%); UBS AG (“UBS”) (11.9%); German American Capital Corporation (“GACC”) (11.2%); National Cooperative Bank, N.A. (“NCB”) (8.4%); Citi Real Estate Funding Inc. (“CREFI”) (6.7%); Barclays Capital Real Estate Inc. (“Barclays”) (5.4%); LMF Commercial, LLC (“LMF”) (3.3%); LoanCore Capital Markets LLC (“LCM”) (2.8%); Goldman Sachs Mortgage Company (“GSMC”) (2.2%); Greystone Commercial Mortgage Capital LLC (“GCMC”) (2.0%); and Natixis Real Estate Capital LLC (“Natixis”) (1.5%). |

| Master Servicer: | Midland Loan Servicer, a Division of PNC Bank, National Association, with respect to all mortgage loans other than the mortgage loans being contributed to the issuing entity by National Cooperative Bank, N.A. (the “NCB Mortgage Loans”), and National Cooperative Bank, N.A., with respect to the NCB Mortgage Loans |

| Special Servicer: | KeyBank National Association, with respect to all mortgage loans other than the NCB Mortgage Loans, and National Cooperative Bank, N.A., with respect to the NCB Mortgage Loans |

| Directing Holder/Controlling Class Representative: | SDOF III MB, L.P. |

| Trustee: | Computershare Trust Company, National Association and, with respect to certain specified duties with respect to the NCB Mortgage Loans, Deutsche Bank National Trust Company. |

| Certificate Administrator: | Computershare Trust Company, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| Rating Agencies: | Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”). |

| U.S. Credit Risk Retention: | For a discussion on the manner in which BMO, as retaining sponsor, intends to satisfy the U.S. credit risk retention requirements, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction is not structured to satisfy the EU risk retention and due diligence requirements. |

| Closing Date: | On or about February 28, 2025. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in February 2025, or in the case of any mortgage loan that has its first due date after February 2025, the date that would have been its due date in February 2025 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in March 2025. |

| Determination Date: | 11th day of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in March 2025. |

| Assumed Final Distribution Date: | The Distribution Date in February 2035 which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in February 2058. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-4, Class A-5, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class X-D, Class D, Class E-RR, Class F-RR, Class G-RR, Class J-RR and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors (other than the Class R Certificates) and to institutions that are not U.S. Persons pursuant to Regulation S (other than the Class R Certificates). |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the cut-off date (excluding for the purposes of this calculation, the unpaid principal balance of any mortgage loan(s) that is/are ARD loan(s), but in any such case, only if the option described below is exercised after the distribution date related to the collection period in which the corresponding anticipated repayment date occurs), certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Retirement of Certificates” and “—Optional Termination; Optional Mortgage Loan Purchase” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Summary of Transaction Terms |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, Markit Group Limited, RealINSIGHT, Thompson Reuters Corporation, Intercontinental Exchange | ICE Data Services, KBRA Analytics, LLC. DealView Technologies Ltd., Recursion Co and CRED iQ. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO THE “SUMMARY OF RISK FACTORS” AND “RISK FACTORS” SECTIONS OF THE PRELIMINARY PROSPECTUS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance | | Roll-up Aggregate Cut-off Date Balance | Roll-up Aggregate % of Cut-off Date Balance |

| SGFC | 7 | 8 | $139,408,845 | 15.4% | $164,408,845 | 18.1% |

| BMO | 4 | 10 | $83,025,000 | 9.2% | $132,275,000 | 14.6% |

| SMC | 7 | 9 | $108,150,000 | 11.9% | $108,150,000 | 11.9% |

| UBS AG | 3 | 3 | $107,575,000 | 11.9% | $107,575,000 | 11.9% |

| GACC | 2 | 2 | $50,660,000 | 5.6% | $101,410,000 | 11.2% |

| NCB | 26 | 26 | $75,947,785 | 8.4% | $75,947,785 | 8.4% |

| CREFI | 2 | 2 | $61,000,000 | 6.7% | $61,000,000 | 6.7% |

| Barclays | 1 | 1 | $9,400,000 | 1.0% | $49,400,000 | 5.4% |

| LMF | 2 | 2 | $29,975,000 | 3.3% | $29,975,000 | 3.3% |

| LCM | 1 | 1 | $25,000,000 | 2.8% | $25,000,000 | 2.8% |

| GSMC | 1 | 1 | $19,956,546 | 2.2% | $19,956,546 | 2.2% |

| GCMC | 3 | 4 | $18,570,000 | 2.0% | $18,570,000 | 2.0% |

| Natixis | 1 | 1 | $13,250,000 | 1.5% | $13,250,000 | 1.5% |

| BMO, GACC | 2 | 2 | $100,000,000 | 11.0% | - | - |

| Barclays, SGFC | 1 | 1 | $65,000,000 | 7.2% | - | - |

| Total: | 63 | 73 | $906,918,176 | 100.0% | $906,918,176 | 100.0% |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $906,918,176 |

| | Number of Mortgage Loans: | 63 |

| | Number of Mortgaged Properties: | 73 |

| | Average Cut-off Date Balance per Mortgage Loan: | $14,395,527 |

| | Weighted Average Current Mortgage Rate: | 6.73129% |

| | 10 Largest Mortgage Loans as % of IPB: | 50.8% |

| | Weighted Average Remaining Term to Maturity: | 119 months |

| | Weighted Average Seasoning: | 1 month |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(1)(2): | 2.10x |

| | Weighted Average UW NOI Debt Yield(1): | 15.8% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(1)(3): | 54.9% |

| | Weighted Average Maturity Date/ARD LTV(1)(3): | 52.6% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt(4): | 5.9% |

| | % of Mortgage Loans with Single Tenants(5): | 8.6% |

| | % of Mortgage Loans secured by Multiple Properties: | 12.0% |

| | |

| Amortization | |

| | Weighted Average Original Amortization Term(6): | 338 months |

| | Weighted Average Remaining Amortization Term(6): | 337 months |

| | % of Mortgage Loans with Interest-Only: | 65.1% |

| | % of Mortgage Loans with Amortizing Balloon: | 15.4% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 11.2% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon and Partial Interest-Only: | 6.5% |

| | % of Mortgage Loans with Fully Amortizing: | 1.8% |

| | | |

| Lockboxes(7) | |

| | % of Mortgage Loans with Hard Lockboxes: | 43.7% |

| | % of Mortgage Loans with Springing Lockboxes: | 36.9% |

| | % of Mortgage Loans with Soft Lockbox: | 11.0% |

| | % of Mortgage Loans with No Lockbox: | 8.4% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 69.9% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 40.9% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves: | 59.8% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 39.2% |

(See footnotes on following page)

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| (1) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). For mortgaged properties securing residential cooperative mortgage loans, UW NCF DSCR and UW NOI Debt Yield calculations for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. The Cut-off Date LTV and Maturity Date/ARD LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Certain Characteristics of Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 11, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as is portfolio” assumption. In the case of Loan No. 21, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as stabilized” assumption. Refer to the definition of “Appraised Value” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for additional details. |

| (4) | Seventeen (17) of the mortgage loans, each of which are secured by a residential cooperative property, currently have either (i) subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”) or (ii) a subordinate wraparound mortgage to the related borrower that is currently held by the cooperative sponsor (such loan, the “Subordinate Wrap Mortgage”). The percentage figure expressed as “% of Mortgage Loans with Additional Debt” is determined as a percentage of the initial pool balance. See “Other Secured Debt—Additional Debt Financing For Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. |

| (5) | Excludes mortgage loans that are secured by multiple properties leased to separate single tenants. |

| (6) | Excludes 32 mortgage loans that are interest-only for the entire term or until the anticipated repayment date. |

| (7) | For a more detailed description of lockboxes, refer to “Description of the Mortgage Pool—Certain Calculations and Definitions” and “—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, industrial, mixed use, leased fee and multifamily (with commercial tenants) properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| Ten Largest Mortgage Loans |

| No. | Loan Name | City, State | Mortgage Loan Seller | No.

of Prop. | Cut-off Date Balance | % of IPB | Square Feet / Units | Property Type | UW

NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1)(3) | Maturity Date/ARD LTV(1)(3) |

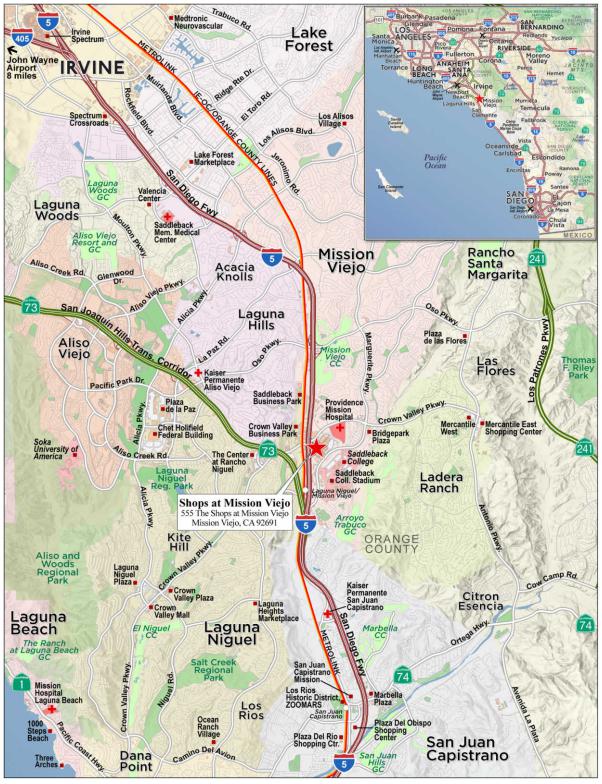

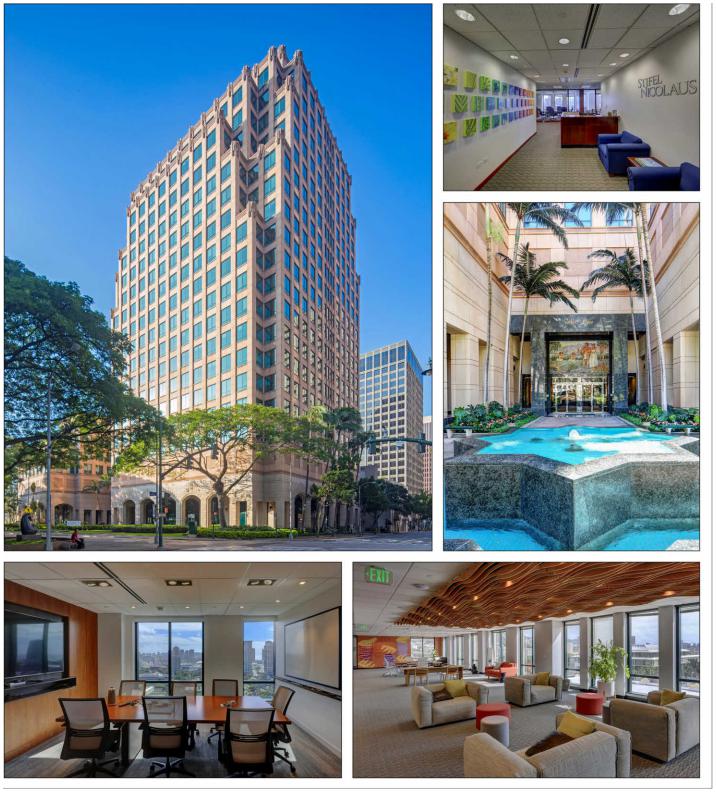

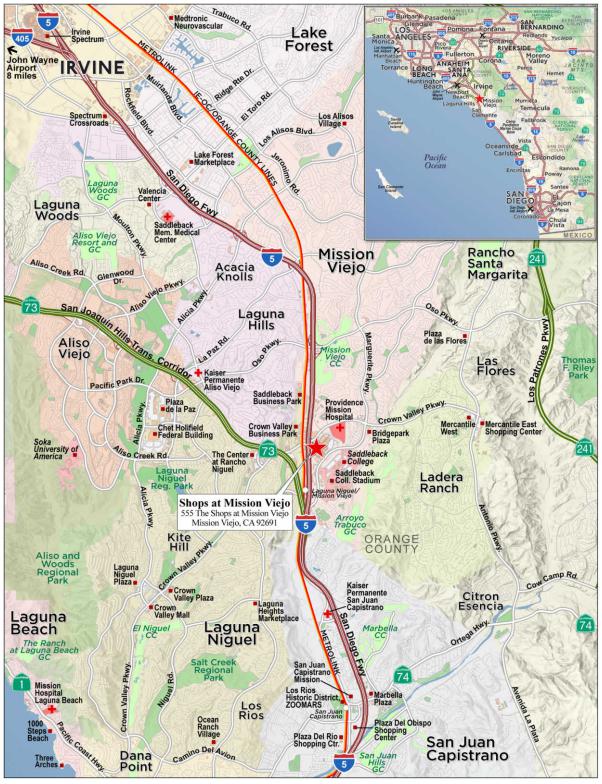

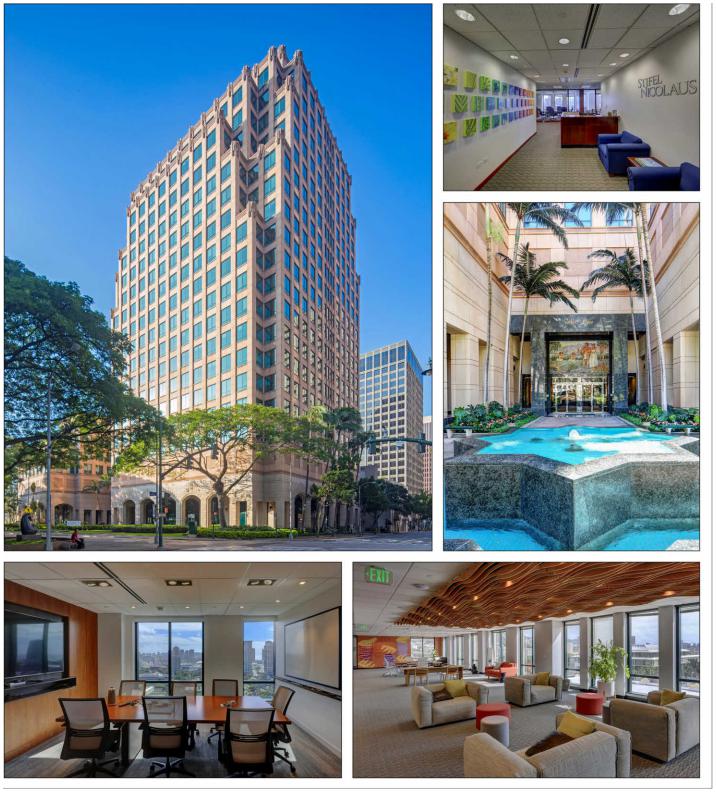

| 1 | Shops at Mission Viejo | Mission Viejo, CA | Barclays, SGFC | 1 | $65,000,000 | 7.2% | 1,012,005 | Retail | 1.69x | 13.4% | 52.4% | 49.5% |

| 2 | UOVO QPN | Long Island City, NY | BMO, GACC | 1 | $65,000,000 | 7.2% | 281,494 | Self Storage | 1.47x | 9.7% | 60.9% | 60.9% |

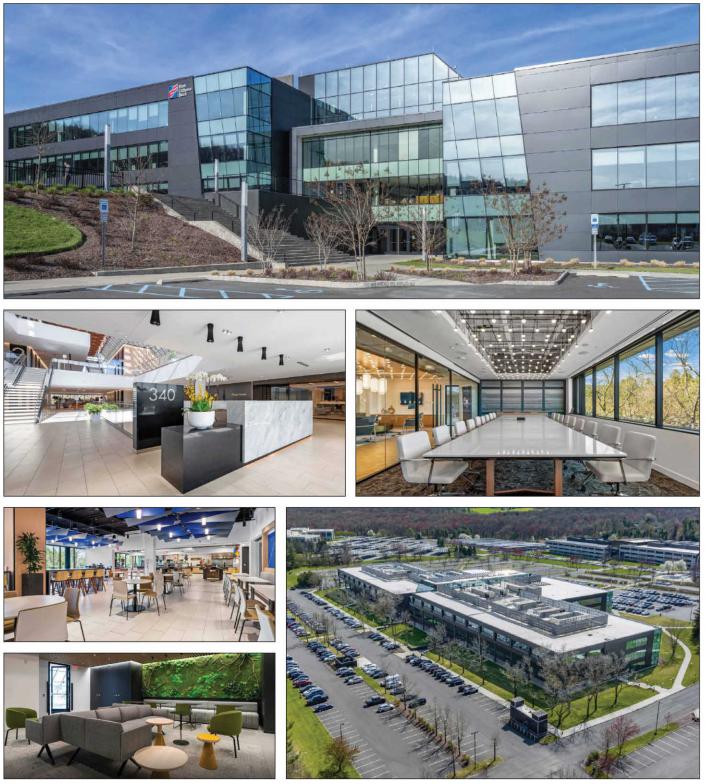

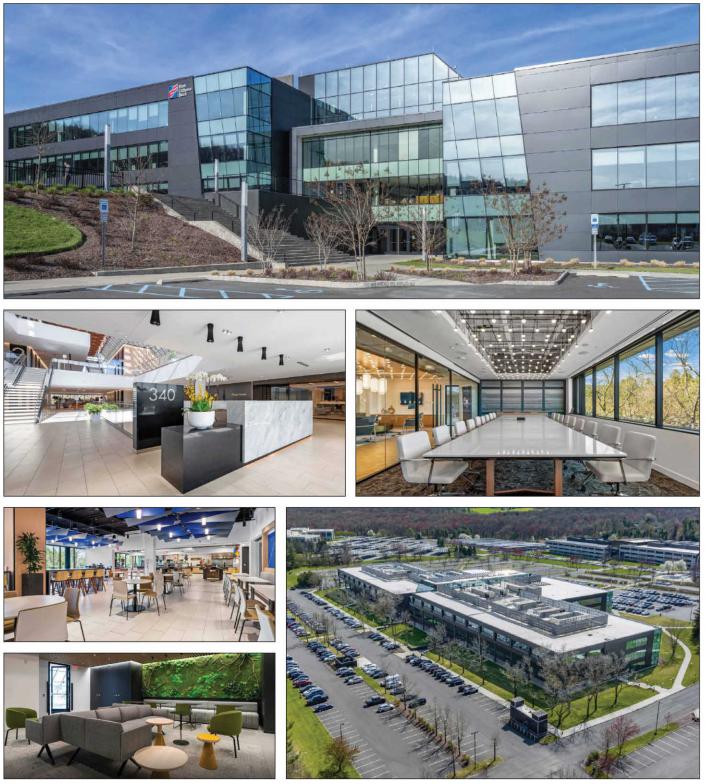

| 3 | 340 Mt Kemble | Morris Township, NJ | SGFC | 1 | $59,000,000 | 6.5% | 413,261 | Office | 1.61x | 14.3% | 61.8% | 54.5% |

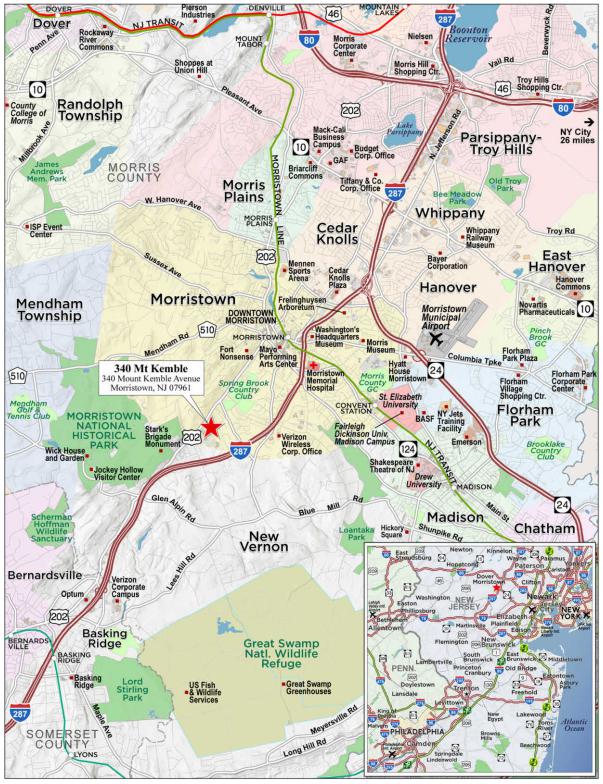

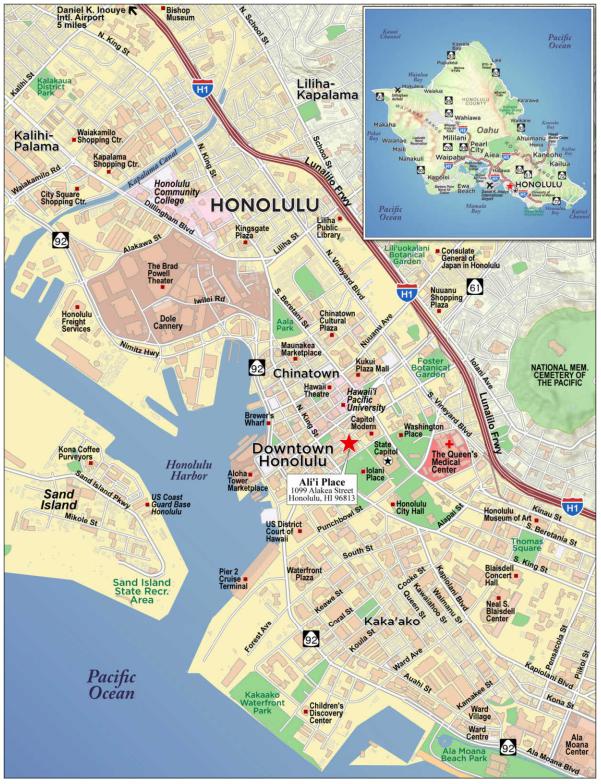

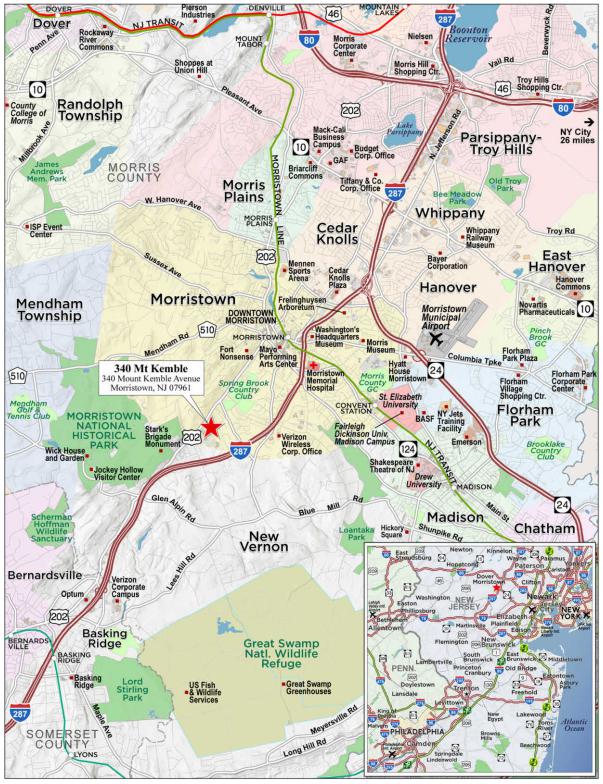

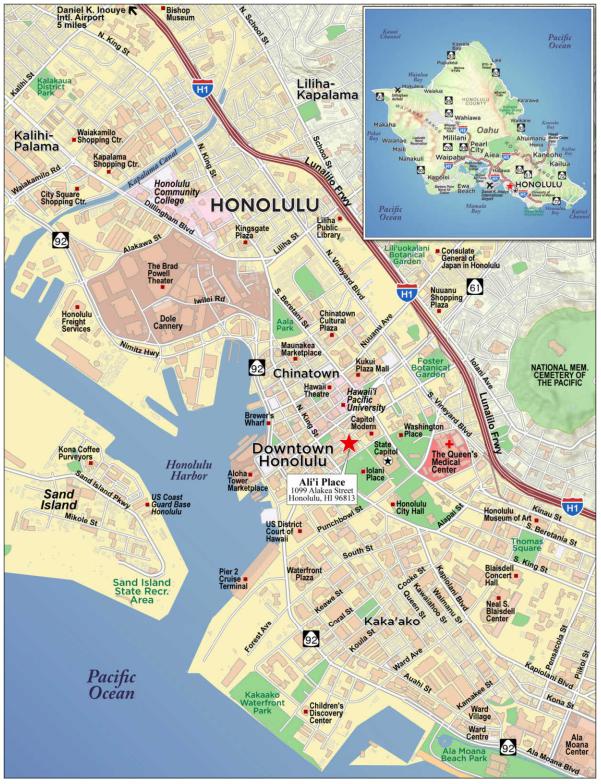

| 4 | Ali'i Place | Honolulu, HI | UBS AG | 1 | $46,575,000 | 5.1% | 337,370 | Office | 1.92x | 15.3% | 67.1% | 67.1% |

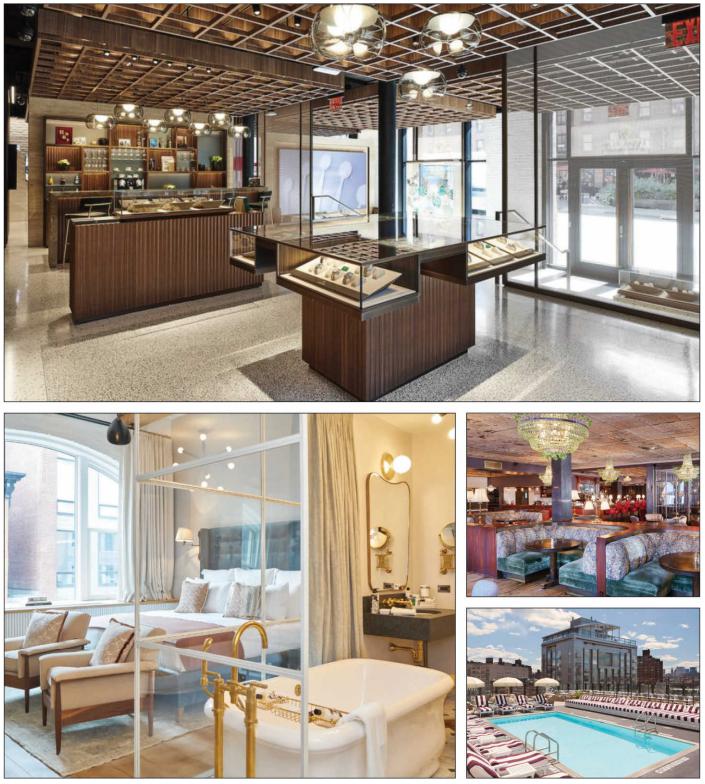

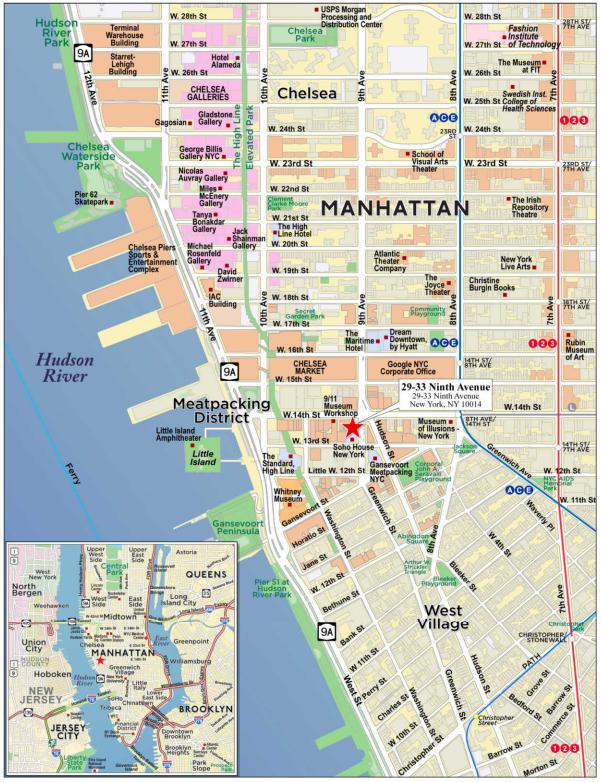

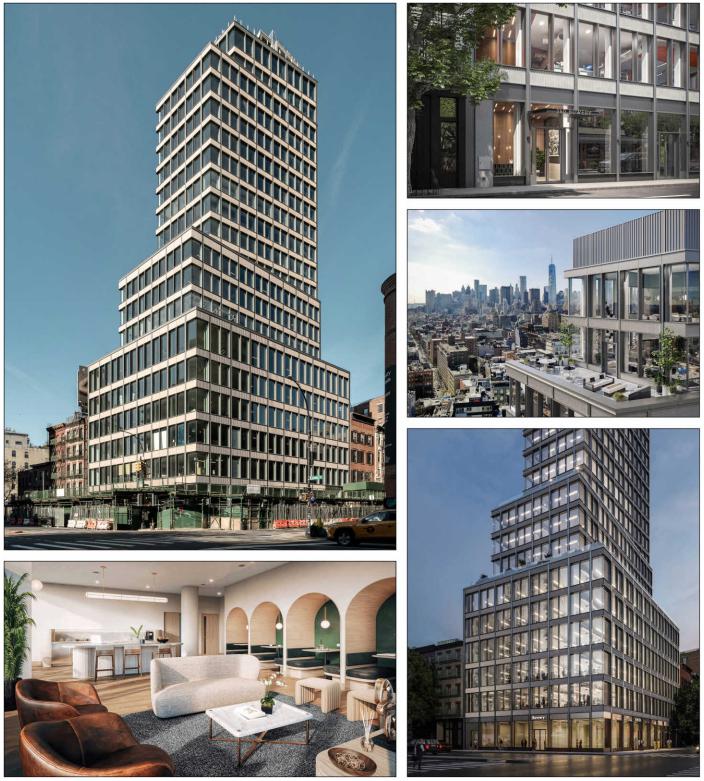

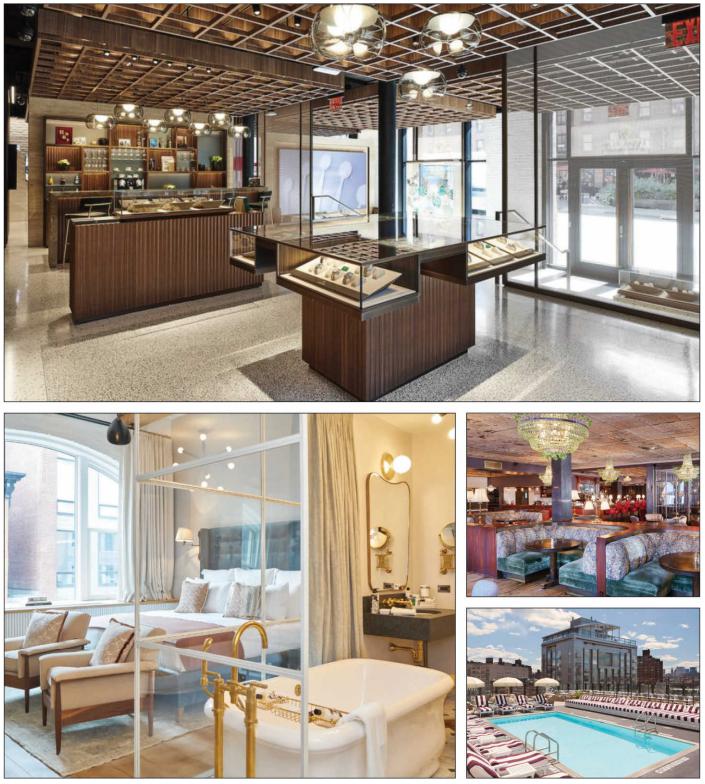

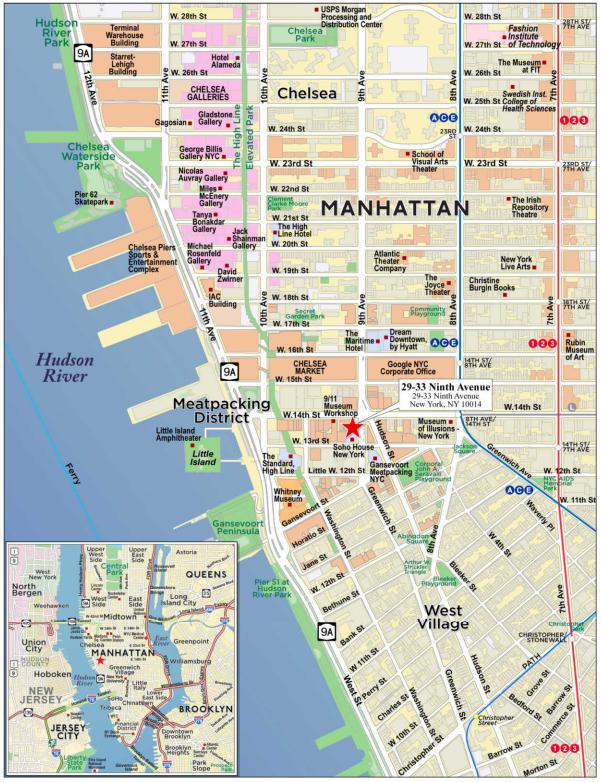

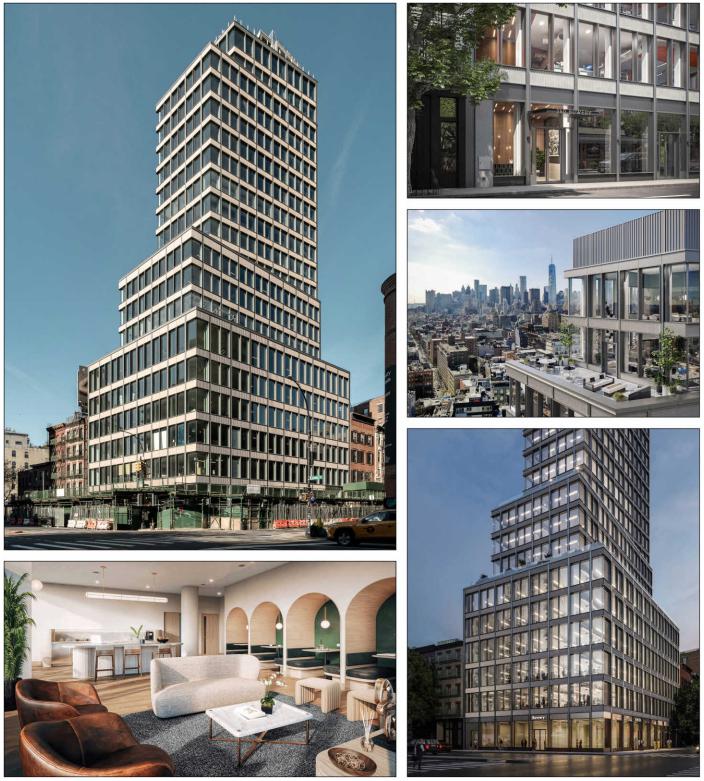

| 5 | 29-33 Ninth Avenue | New York, NY | UBS AG | 1 | $45,000,000 | 5.0% | 87,537 | Mixed Use | 1.30x | 9.0% | 58.4% | 58.4% |

| 6 | 360 Bowery | New York, NY | GACC | 1 | $40,000,000 | 4.4% | 8,707 | Other | 1.11x | 7.3% | 62.5% | 62.5% |

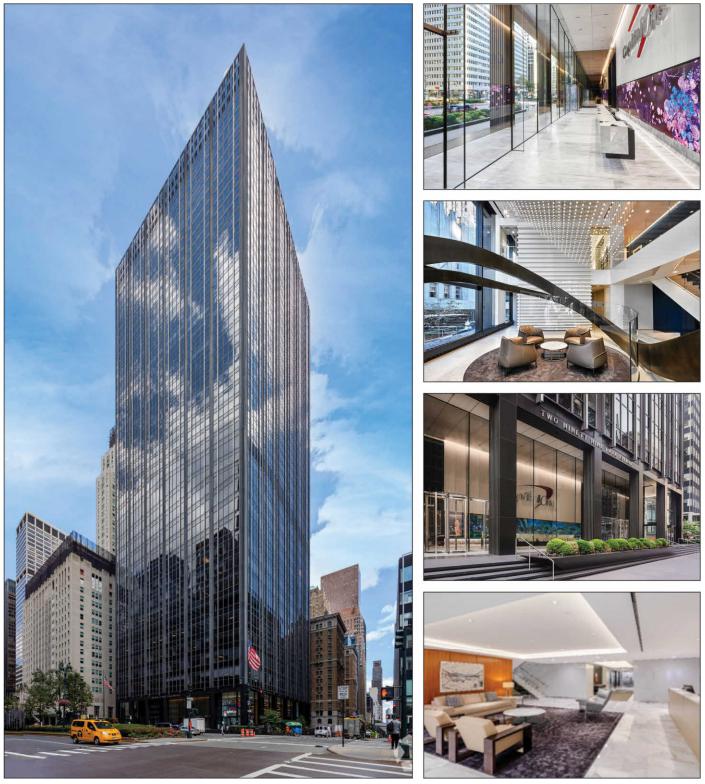

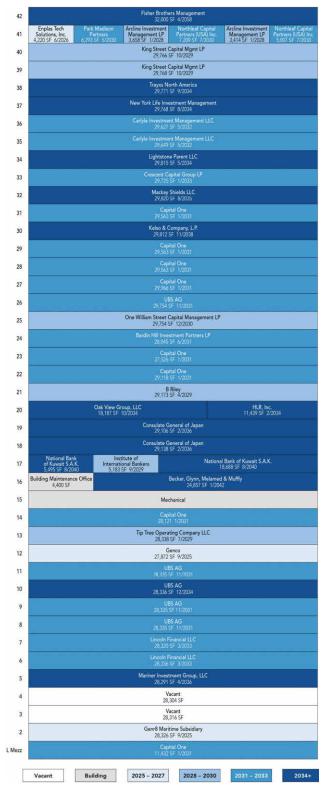

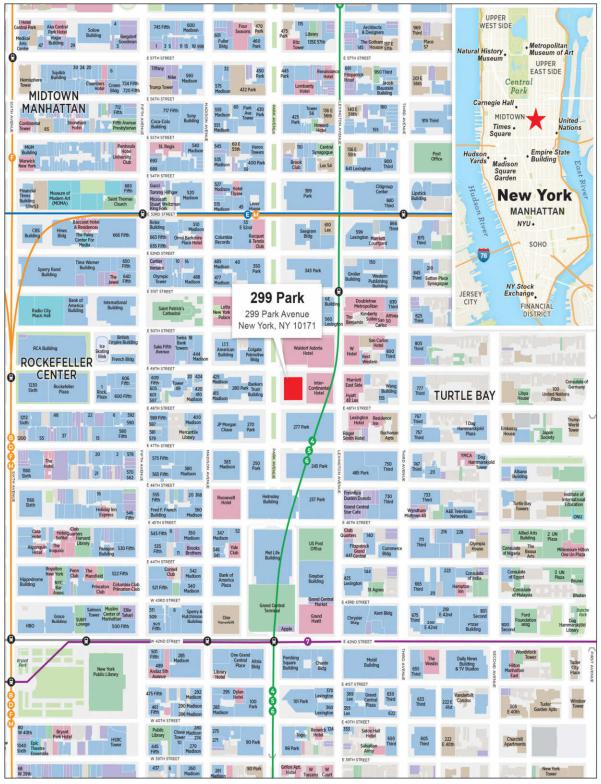

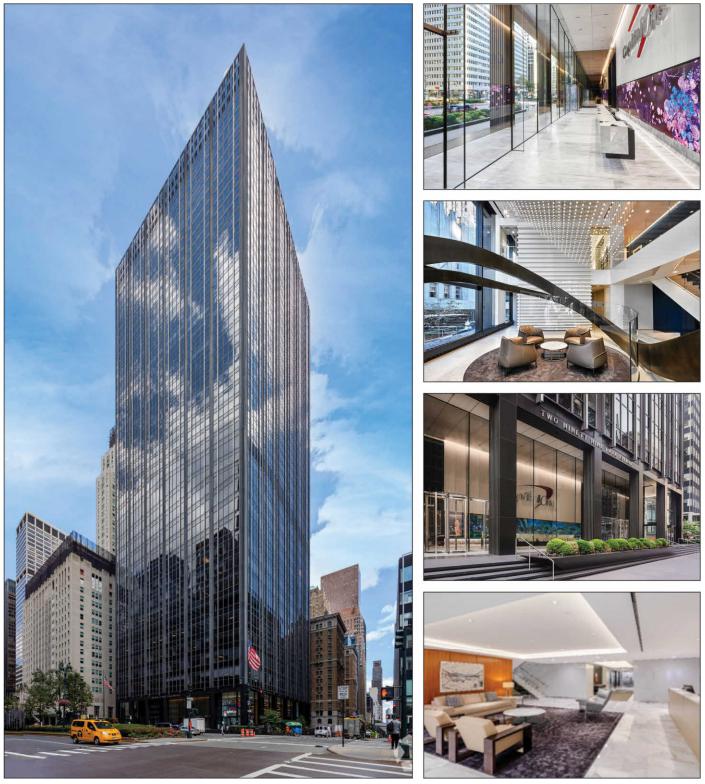

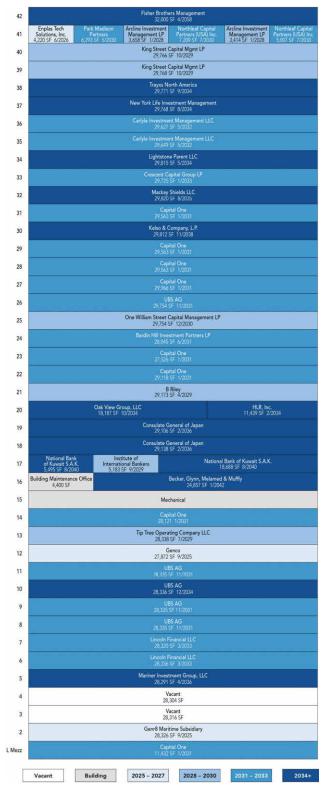

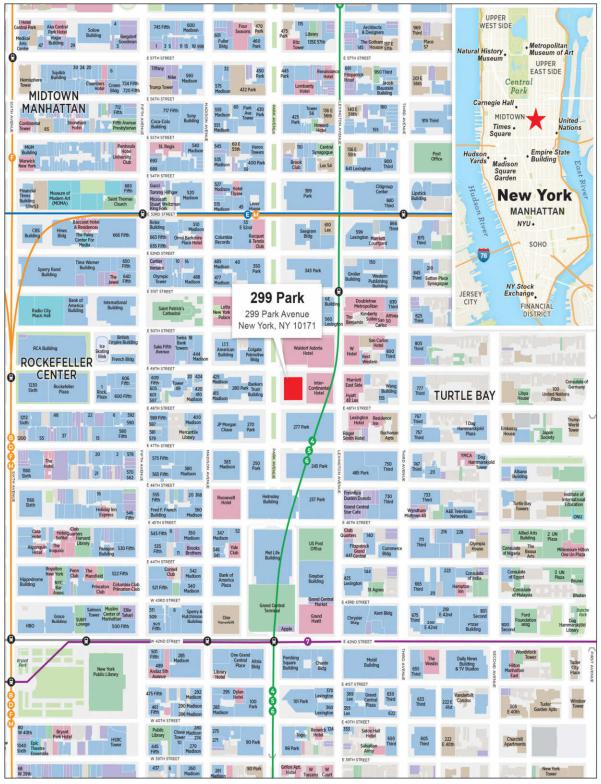

| 7 | 299 Park Avenue | New York, NY | CREFI | 1 | $36,000,000 | 4.0% | 1,176,837 | Office | 2.35x | 14.4% | 45.6% | 45.6% |

| 8 | FedEx Portfolio | Various, Various | BMO | 4 | $36,000,000 | 4.0% | 438,592 | Industrial | 1.51x | 10.9% | 69.8% | 69.8% |

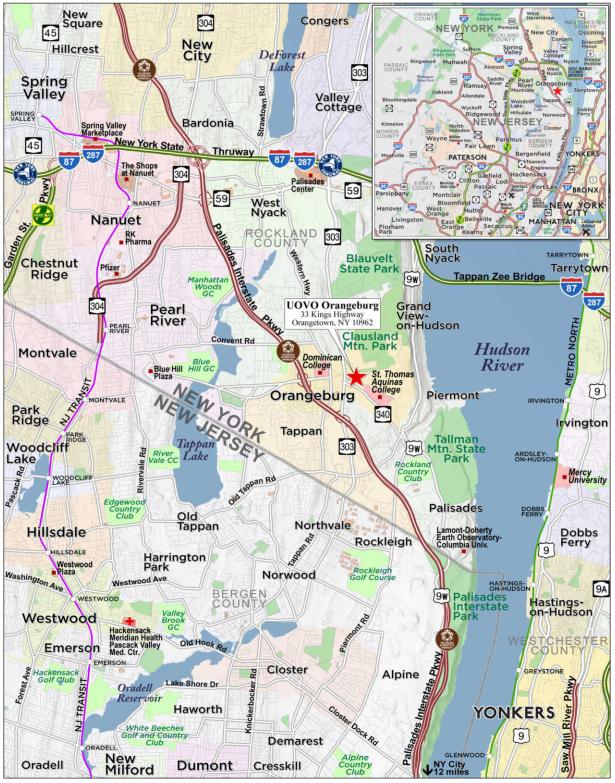

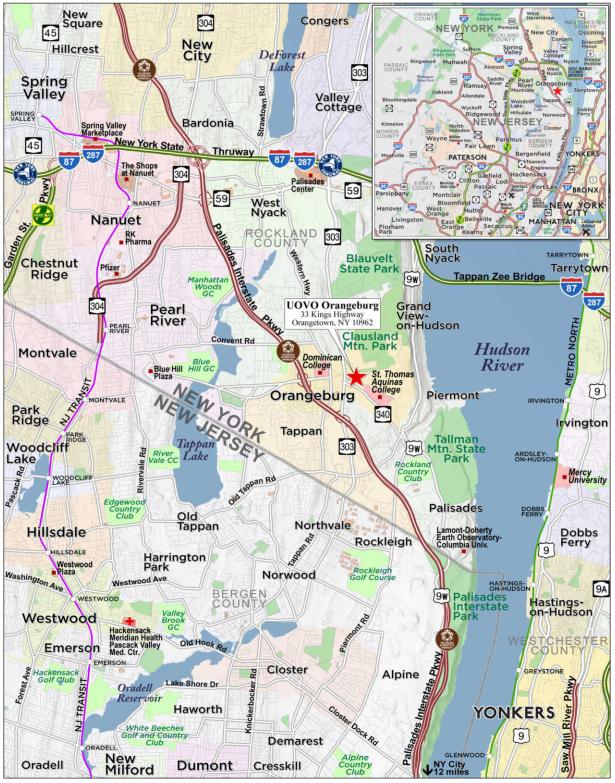

| 9 | UOVO Orangeburg | Orangetown, NY | BMO, GACC | 1 | $35,000,000 | 3.9% | 102,446 | Self Storage | 1.67x | 11.0% | 59.5% | 59.5% |

| 10 | 2481 Crotona Avenue | Bronx, NY | SMC | 1 | $33,250,000 | 3.7% | 90 | Multifamily | 1.25x | 9.7% | 59.3% | 54.2% |

| | | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 3 | $189,000,000 | 20.8% | | | 1.59x | 12.4% | 58.3% | 55.0% |

| | Top 5 Total/Weighted Average | 5 | $280,575,000 | 30.9% | | | 1.60x | 12.3% | 59.7% | 57.5% |

| | Top 10 Total/Weighted Average | 13 | $460,825,000 | 50.8% | | | 1.59x | 11.7% | 59.6% | 57.9% |

| | Non-Top 10 Total/Weighted Average(2)(3)(4) | 60 | $446,093,176 | 49.2% | | | 2.63x | 20.1% | 50.1% | 47.1% |

| (1) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 11, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as is portfolio” assumption. In the case of Loan No. 21, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as stabilized” assumption. Refer to the definition of “Appraised Value” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for additional details. |

| (4) | For mortgaged properties securing residential cooperative mortgage loans, UW NCF DSCR and UW NOI Debt Yield calculations for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. The Cut-off Date LTV and Maturity Date/ARD LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Certain Characteristics of Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

No. | Loan Name | | Trust Cut-off Date Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | Shops at Mission Viejo | Barclays, SGFC | $65,000,000 | $115,000,000 | BBCMS 2025-C32 | Midland | Argentic | BBCMS 2025-C32

Future Securitization(s) | $90,000,000

$25,000,000 |

| 2 | UOVO QPN | BMO, GACC | $65,000,000 | $78,000,000 | WFCM 2025-C64 | Wells Fargo | Rialto | WFCM 2025-C64

Future Securitization(s) | $45,000,000

$33,000,000 |

| 3 | 340 Mt Kemble | SGFC | $59,000,000 | $13,950,000 | BMO 2025-C11 | Midland | KeyBank | Future Securitization(s) | $13,950,000 |

| 5 | 29-33 Ninth Avenue | UBS AG | $45,000,000 | $90,000,000 | BMO 2025-C11(1) | Midland(1) | KeyBank(1) | Future Securitization(s) | $90,000,000 |

| 7 | 299 Park Avenue | CREFI | $36,000,000 | $464,000,000 | NY 2025-299P | Wells Fargo | KeyBank | NY 2025-299P

Future Securitization(s) | $435,000,000

$29,000,000 |

| 17 | Outlet Shoppes of the Bluegrass | GSMC | $19,956,546 | $45,900,055 | WFCM 2025-C64 | Wells Fargo | Rialto | WFCM 2025-C64 | $46,000,000 |

| 23 | Twin Cities Premium Outlets | Natixis | $13,250,000 | $81,750,000 | BBCMS 2024-C30 | Midland | Rialto | BBCMS 2024-C30 WFCM 2025-C64 | $61,750,000 $20,000,000 |

| (1) | In the case of Loan No. 5, until the securitization of the related controlling pari passu companion loan, the related whole loan will be serviced and administered pursuant to the pooling and servicing agreement for the BMO 2025-C11 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related whole loan will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the Controlling Pooling/Trust & Servicing Agreement. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW

NCF DSCR(2)(3)(4) | UW

NOI DY(2)(4) | Cut-off Date LTV(2)(4)(5) | Maturity Date/ARD LTV(2)(4)(5) |

| Multifamily | Garden | 12 | $107,678,845 | 11.9% | 1.30x | 10.4% | 59.4% | 55.6% |

| | Cooperative | 26 | 75,947,785 | 8.4 | 7.79x | 58.3% | 12.9% | 11.6% |

| | Mid Rise | 2 | 39,700,000 | 4.4 | 1.43x | 9.7% | 65.5% | 65.5% |

| | High Rise | 1 | 33,250,000 | 3.7 | 1.25x | 9.7% | 59.3% | 54.2% |

| | Townhomes | 1 | 3,750,000 | 0.4 | 1.20x | 10.1% | 62.2% | 59.1% |

| | Subtotal: | 42 | $260,326,630 | 28.7% | 3.21x | 24.2% | 46.8% | 44.1% |

| Office | CBD | 2 | $82,575,000 | 9.1% | 2.11x | 14.9% | 57.7% | 57.7% |

| | Suburban | 1 | 59,000,000 | 6.5 | 1.61x | 14.3% | 61.8% | 54.5% |

| | Urban | 1 | 10,000,000 | 1.1 | 1.78x | 12.6% | 47.4% | 47.4% |

| | Subtotal: | 4 | $151,575,000 | 16.7% | 1.89x | 14.5% | 58.6% | 55.8% |

| Retail | Super Regional Mall | 1 | $65,000,000 | 7.2% | 1.69x | 13.4% | 52.4% | 49.5% |

| | Anchored | 3 | 48,535,000 | 5.4 | 1.43x | 10.8% | 62.4% | 62.4% |

| | Outlet Center | 2 | 33,206,546 | 3.7 | 1.84x | 14.2% | 55.1% | 50.3% |

| | Subtotal: | 6 | $146,741,546 | 16.2% | 1.64x | 12.7% | 56.3% | 54.0% |

| Self Storage | Self Storage | 3 | $105,100,000 | 11.6% | 1.61x | 10.6% | 59.1% | 59.1% |

| Industrial | Warehouse/Distribution | 6 | $48,700,000 | 5.4% | 1.51x | 11.1% | 67.1% | 67.1% |

| | Distribution/Manufacturing | 4 | 28,925,000 | 3.2 | 1.91x | 12.9% | 61.5% | 61.5% |

| | Subtotal: | 10 | $77,625,000 | 8.6% | 1.66x | 11.8% | 65.0% | 65.0% |

| Mixed Use | Retail | 1 | $45,000,000 | 5.0% | 1.30x | 9.0% | 58.4% | 58.4% |

| | Retail/Office | 1 | 22,250,000 | 2.5 | 1.42x | 10.2% | 60.0% | 60.0% |

| | Multifamily/Retail | 1 | 6,000,000 | 0.7 | 1.28x | 10.6% | 66.7% | 58.6% |

| | Subtotal: | 3 | $73,250,000 | 8.1% | 1.33x | 9.5% | 59.6% | 58.9% |

| Hospitality | Full Service | 2 | $41,000,000 | 4.5% | 2.06x | 20.4% | 42.7% | 28.0% |

| Other | Leased Fee | 1 | $40,000,000 | 4.4% | 1.11x | 7.3% | 62.5% | 62.5% |

| Manufactured Housing | RV Park | 1 | $6,027,000 | 0.7% | 1.73x | 12.5% | 53.8% | 53.8% |

| | Manufactured Housing/RV Park | 1 | 5,273,000 | 0.6 | 1.73x | 12.5% | 53.8% | 53.8% |

| | Subtotal: | 2 | $11,300,000 | 1.2% | 1.73x | 12.5% | 53.8% | 53.8% |

| Total / Weighted Average: | 73 | $906,918,176 | 100.0% | 2.10x | 15.8% | 54.9% | 52.6% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts, individual appraised values, net cash flow or net operating income with respect to such individual mortgaged properties, as applicable. |

| (2) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). |

| (3) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | For mortgaged properties securing residential cooperative mortgage loans, UW NCF DSCR and UW NOI DY calculations for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. The Cut-off Date LTV and Maturity Date/ARD LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Certain Characteristics of Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (5) | In the case of Loan No. 11, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as is portfolio” assumption. In the case of Loan No. 21, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as stabilized” assumption. Refer to the definition of “Appraised Value” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| Mortgaged Properties by Location(1) |

| | | | | Weighted Average |

State (or Province) | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW

NCF DSCR(2)(3)(4) | UW

NOI DY(2)(4) | Cut-off Date LTV(2)(4)(5) | Maturity Date/ARD LTV(2)(4)(5) |

| New York | 37 | $408,147,785 | 45.0% | 2.67x | 19.1% | 50.4% | 49.6% |

| California | 3 | 102,875,000 | 11.3 | 1.56x | 12.1% | 55.8% | 54.0% |

| Texas | 12 | 81,295,000 | 9.0 | 1.55x | 11.4% | 61.3% | 61.3% |

| New Jersey | 1 | 59,000,000 | 6.5 | 1.61x | 14.3% | 61.8% | 54.5% |

| Wisconsin | 4 | 54,408,845 | 6.0 | 1.28x | 10.4% | 58.6% | 50.9% |

| Hawaii | 1 | 46,575,000 | 5.1 | 1.92x | 15.3% | 67.1% | 67.1% |

| Washington | 1 | 25,000,000 | 2.8 | 2.17x | 15.8% | 45.9% | 45.9% |

| Kentucky | 1 | 19,956,546 | 2.2 | 1.72x | 14.2% | 60.4% | 52.5% |

| Puerto Rico | 1 | 16,000,000 | 1.8 | 1.88x | 27.6% | 37.6% | 0.0% |

| Georgia | 2 | 14,946,751 | 1.6 | 2.03x | 13.4% | 57.4% | 57.4% |

| Pennsylvania | 1 | 13,513,094 | 1.5 | 1.51x | 10.9% | 69.8% | 69.8% |

| Minnesota | 1 | 13,250,000 | 1.5 | 2.01x | 14.3% | 47.0% | 47.0% |

| Florida | 2 | 11,300,000 | 1.2 | 1.73x | 12.5% | 53.8% | 53.8% |

| Idaho | 1 | 10,660,000 | 1.2 | 1.78x | 14.1% | 65.0% | 65.0% |

| Indiana | 1 | 9,400,000 | 1.0 | 1.44x | 10.9% | 49.5% | 49.5% |

| Massachusetts | 1 | 7,821,532 | 0.9 | 1.51x | 10.9% | 69.8% | 69.8% |

| Ohio | 1 | 4,818,623 | 0.5 | 1.51x | 10.9% | 69.8% | 69.8% |

| Oklahoma | 1 | 4,200,000 | 0.5 | 1.30x | 9.7% | 69.9% | 69.9% |

| Alaska | 1 | 3,750,000 | 0.4 | 1.20x | 10.1% | 62.2% | 59.1% |

| Total / Weighted Average: | 73 | $906,918,176 | 100.0% | 2.10x | 15.8% | 54.9% | 52.6% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts, individual appraised values, net cash flow or net operating income with respect to such individual mortgaged properties, as applicable. |

| (2) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). |

| (3) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | For mortgaged properties securing residential cooperative mortgage loans, UW NCF DSCR and UW NOI DY calculations for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. The Cut-off Date LTV and Maturity Date/ARD LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Certain Characteristics of Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (5) | In the case of Loan No. 11, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as is portfolio” assumption. In the case of Loan No. 21, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as stabilized” assumption. Refer to the definition of “Appraised Value” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | Weighted Average |

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| $998,545 | - | $4,999,999 | 26 | | $71,487,332 | 7.9 | % | 6.65056% | 119 | 6.24x | 47.5% | 23.5% | 22.2% |

| $5,000,000 | - | $9,999,999 | 10 | | 69,160,453 | 7.6 | | 6.93937% | 119 | 3.50x | 25.4% | 45.0% | 43.1% |

| $10,000,000 | - | $19,999,999 | 11 | | 154,995,391 | 17.1 | | 6.89154% | 119 | 1.58x | 13.5% | 55.7% | 48.5% |

| $20,000,000 | - | $29,999,999 | 6 | | 150,450,000 | 16.6 | | 6.78150% | 119 | 1.60x | 11.5% | 59.2% | 59.2% |

| $30,000,000 | - | $39,999,999 | 4 | | 140,250,000 | 15.5 | | 6.52006% | 120 | 1.70x | 11.5% | 58.5% | 57.3% |

| $40,000,000 | - | $65,000,000 | 6 | | 320,575,000 | 35.3 | | 6.69578% | 120 | 1.54x | 11.7% | 60.1% | 58.2% |

| Total / Weighted Average: | 63 | | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| 5.84000% | - | 5.99999% | 4 | $45,850,352 | 5.1 | % | 5.94130% | 119 | 2.87x | 19.7% | 40.4% | 40.0% |

| 6.00000% | - | 6.49999% | 14 | 226,051,980 | 24.9 | | 6.43541% | 120 | 2.40x | 16.7% | 52.7% | 52.5% |

| 6.50000% | - | 6.99999% | 32 | 448,060,844 | 49.4 | | 6.77383% | 119 | 2.12x | 16.7% | 53.7% | 49.6% |

| 7.00000% | - | 7.49999% | 11 | 154,055,000 | 17.0 | | 7.08559% | 120 | 1.57x | 12.1% | 64.9% | 63.5% |

| 7.50000% | - | 7.70000% | 2 | 32,900,000 | 3.6 | | 7.62695% | 119 | 1.29x | 10.4% | 60.5% | 60.5% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| Original Term to Maturity in Months |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| 120 | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| Remaining Term to Maturity in Months |

| | | | | Weighted Average |

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| 116 | - | 120 | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| (1) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | For mortgaged properties securing residential cooperative mortgage loans, UW NCF DSCR and UW NOI DY calculations for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. The Cut-off Date LTV and Maturity Date/ARD LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Certain Characteristics of Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (4) | In the case of Loan No. 11, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as is portfolio” assumption. In the case of Loan No. 21, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as stabilized” assumption. Refer to the definition of “Appraised Value” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

Original

Amortization

Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| Interest Only | 32 | $590,245,000 | 65.1 | % | 6.70816% | 120 | 1.85x | 12.9% | 58.1% | 58.1% |

| 120 | 1 | 16,000,000 | 1.8 | | 6.99000% | 120 | 1.88x | 27.6% | 37.6% | 0.0% |

| 180 | 1 | 3,205,937 | 0.4 | | 5.84000% | 116 | 6.29x | 65.2% | 10.1% | 4.5% |

| 240 | 1 | 4,990,937 | 0.6 | | 6.67000% | 119 | 8.76x | 80.6% | 7.9% | 5.3% |

| 272 | 1 | 59,000,000 | 6.5 | | 6.94100% | 120 | 1.61x | 14.3% | 61.8% | 54.5% |

| 360 | 19 | 206,405,041 | 22.8 | | 6.76067% | 119 | 2.39x | 18.7% | 51.3% | 46.4% |

| 480 | 8 | 27,071,261 | 3.0 | | 6.51860% | 119 | 4.89x | 34.8% | 22.2% | 20.9% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| Interest Only | 32 | $590,245,000 | 65.1 | % | 6.70816% | 120 | 1.85x | 12.9% | 58.1% | 58.1% |

| 120 | - | 240 | 3 | 24,196,874 | 2.7 | | 6.77163% | 119 | 3.88x | 43.5% | 27.8% | 1.7% |

| 241 | - | 359 | 12 | 133,470,041 | 14.7 | | 6.80923% | 119 | 2.80x | 22.6% | 52.3% | 45.8% |

| 360 | - | 360 | 8 | 131,935,000 | 14.5 | | 6.79219% | 120 | 1.62x | 12.9% | 55.1% | 50.7% |

| 361 | - | 480 | 8 | 27,071,261 | 3.0 | | 6.51860% | 119 | 4.89x | 34.8% | 22.2% | 20.9% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| | | | | Weighted Average |

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| Interest Only | 32 | $590,245,000 | 65.1 | % | 6.70816% | 120 | 1.85x | 12.9% | 58.1% | 58.1% |

| Amortizing Balloon | 26 | 139,673,176 | 15.4 | | 6.71969% | 118 | 3.81x | 30.0% | 40.5% | 35.4% |

| Interest Only, Amortizing Balloon | 3 | 102,000,000 | 11.2 | | 6.71917% | 119 | 1.53x | 12.1% | 55.0% | 51.4% |

| Interest Only, Amortizing Balloon, Interest Only | 1 | 59,000,000 | 6.5 | | 6.94100% | 120 | 1.61x | 14.3% | 61.8% | 54.5% |

| Fully Amortizing | 1 | 16,000,000 | 1.8 | | 6.99000% | 120 | 1.88x | 27.6% | 37.6% | 0.0% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| (1) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | For mortgaged properties securing residential cooperative mortgage loans, UW NCF DSCR and UW NOI DY calculations for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. The Cut-off Date LTV and Maturity Date/ARD LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Certain Characteristics of Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (4) | In the case of Loan No. 11, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as is portfolio” assumption. In the case of Loan No. 21, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as stabilized” assumption. Refer to the definition of “Appraised Value” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2)(3) |

| | | | | Weighted Average |

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| 1.11x | - | 1.49x | 21 | $404,703,845 | 44.6 | % | 6.77548% | 120 | 1.33x | 9.6% | 60.9% | 59.3% |

| 1.50x | - | 1.99x | 12 | 346,916,546 | 38.3 | | 6.84935% | 120 | 1.72x | 13.9% | 59.4% | 55.4% |

| 2.00x | - | 2.99x | 5 | 81,876,742 | 9.0 | | 6.26025% | 119 | 2.29x | 15.4% | 44.7% | 44.6% |

| 3.00x | - | 9.99x | 17 | 56,563,425 | 6.2 | | 6.39470% | 118 | 6.71x | 50.8% | 14.3% | 13.0% |

| 10.00x | - | 17.46x | 8 | 16,857,618 | 1.9 | | 6.65823% | 119 | 12.24x | 88.4% | 5.3% | 5.0% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| | | | | | | | | | |

| LTV Ratios as of the Cut-off Date(1)(3)(4) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| 3.6% | - | 49.9% | 33 | $190,697,785 | 21.0 | % | 6.47394% | 119 | 4.38x | 33.0% | 32.0% | 28.3% |

| 50.0% | - | 59.9% | 12 | 291,658,845 | 32.2 | | 6.78532% | 119 | 1.45x | 11.0% | 57.1% | 54.4% |

| 60.0% | - | 64.9% | 9 | 287,856,546 | 31.7 | | 6.68278% | 120 | 1.49x | 11.0% | 61.9% | 59.8% |

| 65.0% | - | 69.9% | 9 | 136,705,000 | 15.1 | | 7.07717% | 120 | 1.61x | 12.4% | 67.7% | 67.3% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| LTV Ratios as of the Maturity Date(1)(3)(4) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| 0.0% | - | 49.9% | 34 | $255,697,785 | 28.2 | % | 6.53776% | 119 | 3.69x | 28.0% | 37.2% | 33.7% |

| 50.0% | - | 59.9% | 15 | 315,365,391 | 34.8 | | 6.84617% | 119 | 1.44x | 11.3% | 59.4% | 55.5% |

| 60.0% | - | 64.9% | 6 | 205,150,000 | 22.6 | | 6.58177% | 120 | 1.43x | 9.7% | 62.0% | 62.0% |

| 65.0% | - | 69.9% | 8 | 130,705,000 | 14.4 | | 7.06740% | 120 | 1.63x | 12.5% | 67.7% | 67.7% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| | | | | Weighted Average |

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| Defeasance | 19 | $376,936,546 | 41.6 | % | 6.70591% | 119 | 1.54x | 11.3% | 57.1% | 55.8% |

| Yield Maintenance | 38 | 324,856,630 | 35.8 | | 6.89306% | 119 | 2.99x | 23.8% | 49.3% | 44.3% |

| Defeasance or Yield Maintenance | 6 | 205,125,000 | 22.6 | | 6.52175% | 120 | 1.72x | 11.4% | 59.8% | 59.8% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| (1) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | For mortgaged properties securing residential cooperative mortgage loans, UW NCF DSCR and UW NOI DY calculations for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. The Cut-off Date LTV and Maturity Date/ARD LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Certain Characteristics of Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (4) | In the case of Loan No. 11, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as is portfolio” assumption. In the case of Loan No. 21, the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an “as stabilized” assumption. Refer to the definition of “Appraised Value” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Structural and Collateral Term Sheet | | BMO 2025-C11 |

| Collateral Characteristics |

| | | | | Weighted Average |

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF DSCR(1)(2)(3) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| Refinance | 54 | $736,699,154 | 81.2 | % | 6.68088% | 119 | 2.12x | 15.7% | 53.3% | 51.0% |

| Acquisition | 6 | 134,805,000 | 14.9 | | 7.02419% | 120 | 1.69x | 14.0% | 64.6% | 61.5% |

| Recapitalization | 3 | 35,414,022 | 3.9 | | 6.66509% | 120 | 3.22x | 25.3% | 51.5% | 51.1% |

| Total / Weighted Average: | 63 | $906,918,176 | 100.0 | % | 6.73129% | 119 | 2.10x | 15.8% | 54.9% | 52.6% |

| (1) | In the case of Loan Nos. 1, 2, 3, 5, 7, 17 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |