UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2546

Fidelity Commonwealth Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | November 30 |

| |

Date of reporting period: | November 30, 2015 |

Item 1.

Reports to Stockholders

Fidelity® Series 100 Index Fund - Fidelity® Series 100 Index Fund

Class F

Annual Report November 30, 2015 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544, or for Class F, call 1-800-835-5092, to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year.

The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred.

How a fund did yesterday is no guarantee of how it will do tomorrow.

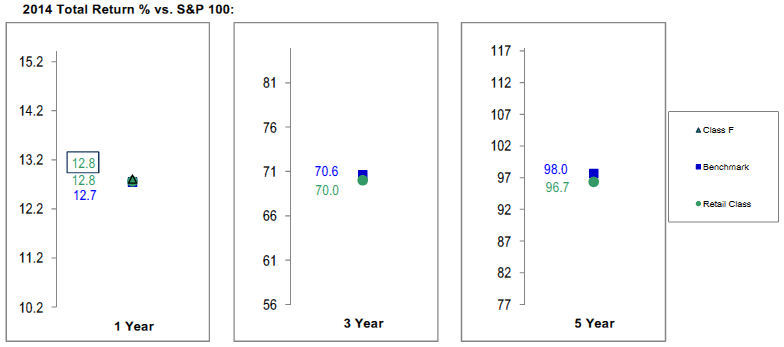

Average Annual Total Returns

| For the periods ended November 30, 2015 | Past 1 year | Past 5 years | Life of FundA |

| Fidelity® Series 100 Index Fund | 3.48% | 14.31% | 6.53% |

| Class F | 3.45% | 14.32% | 6.53% |

A From March 29, 2007

The initial offering of Class F shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Fidelity® Series 100 Index Fund, the original class of the fund.

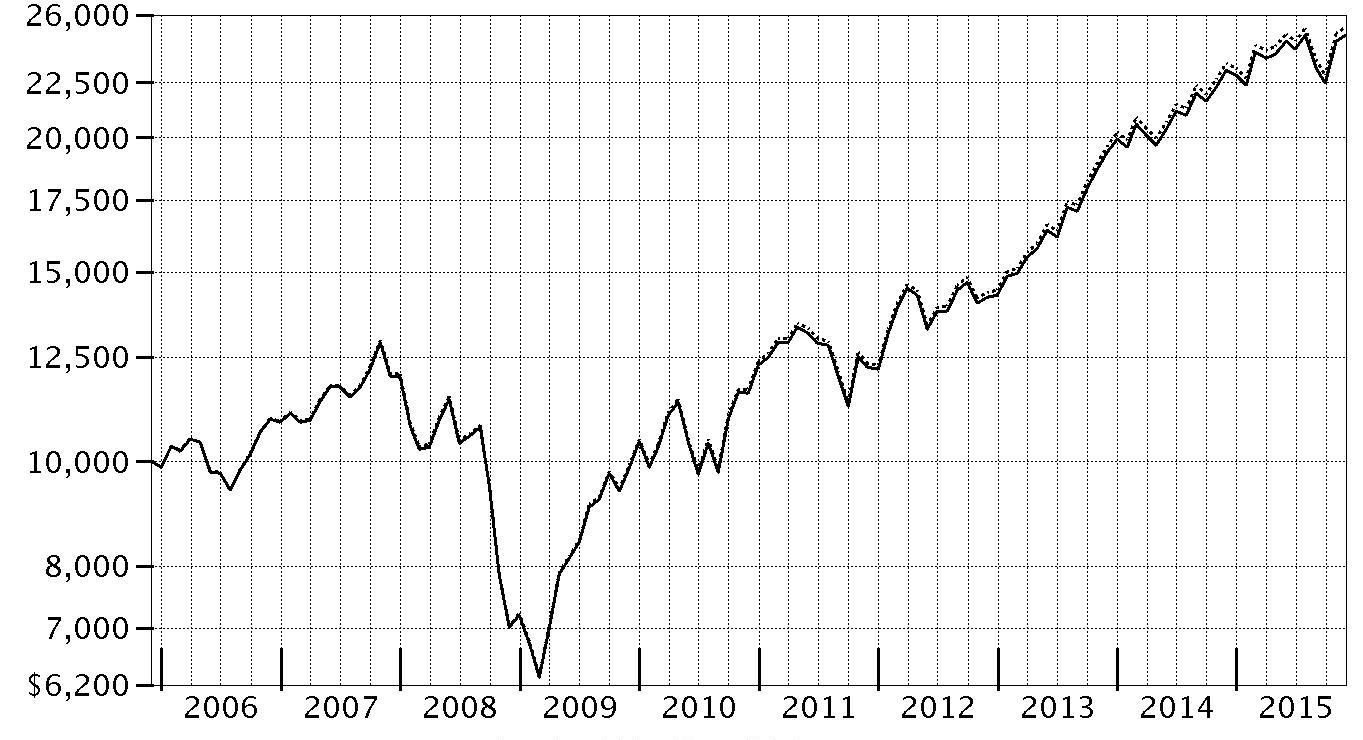

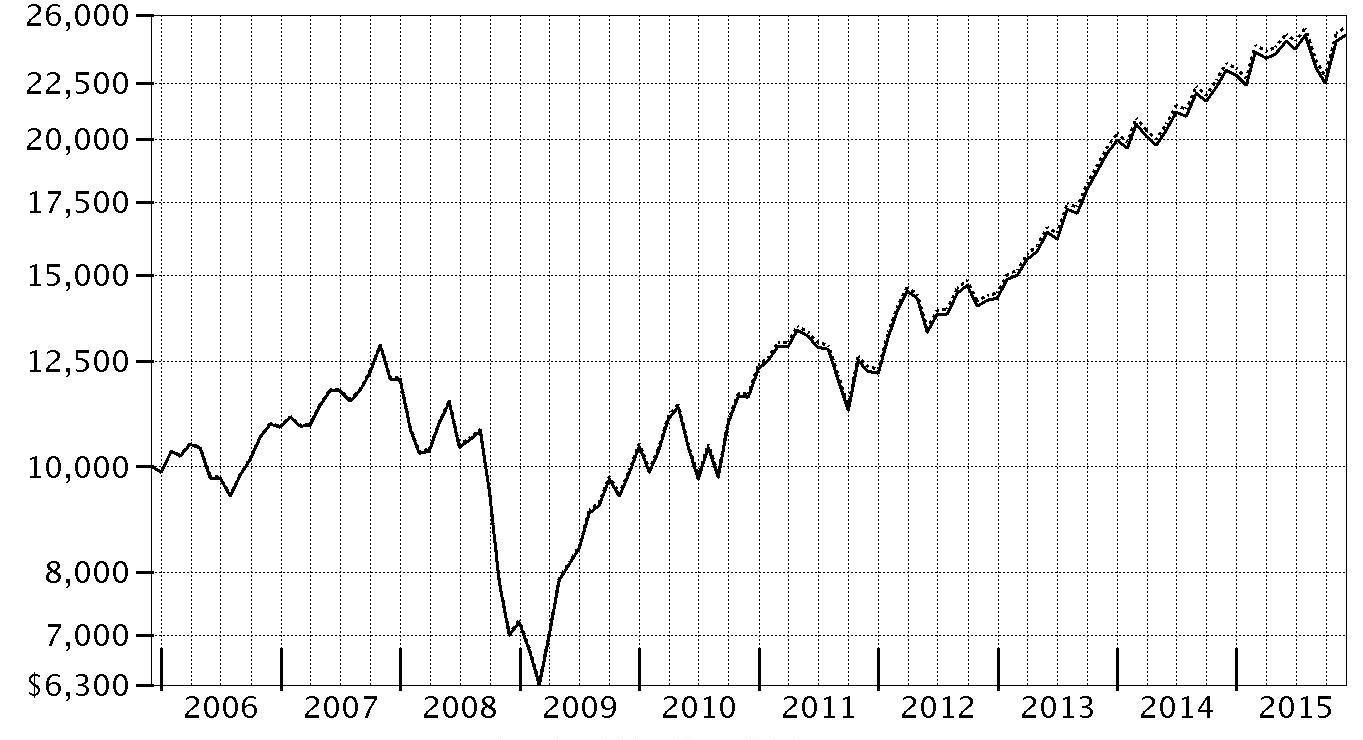

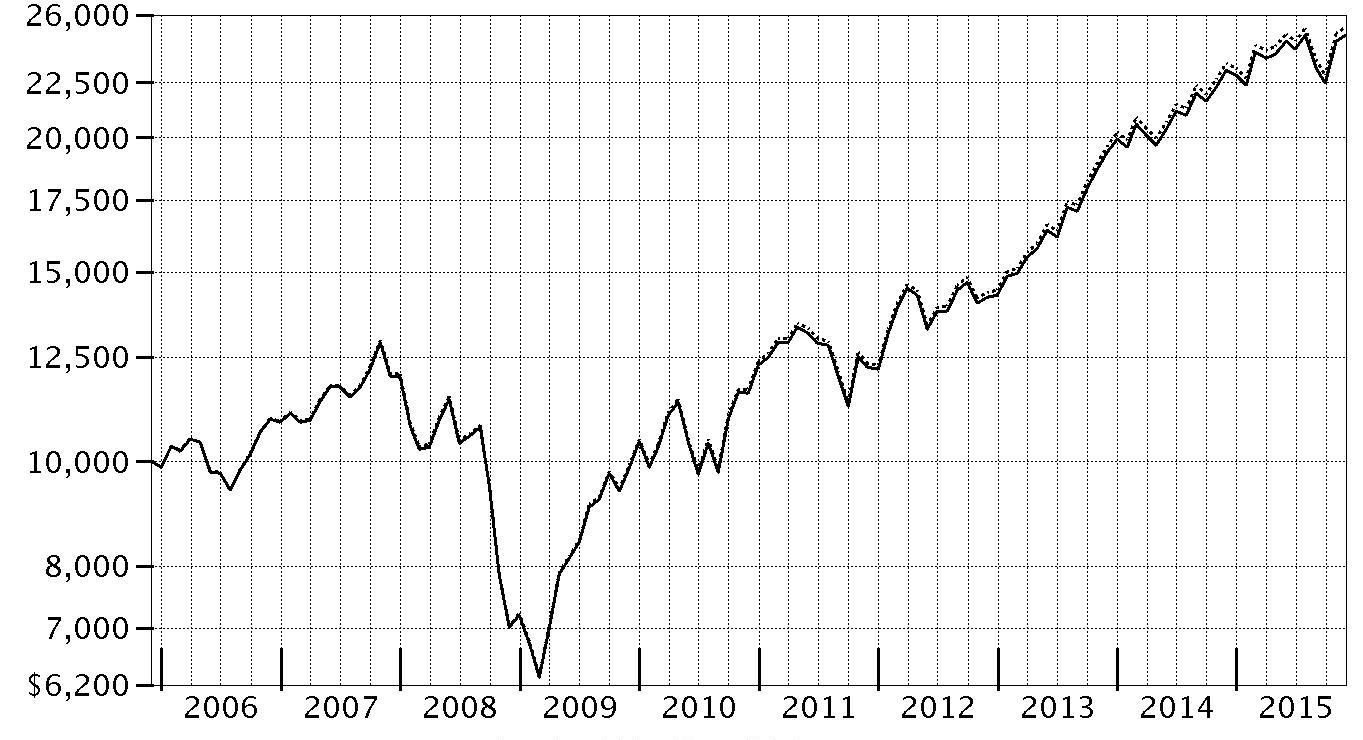

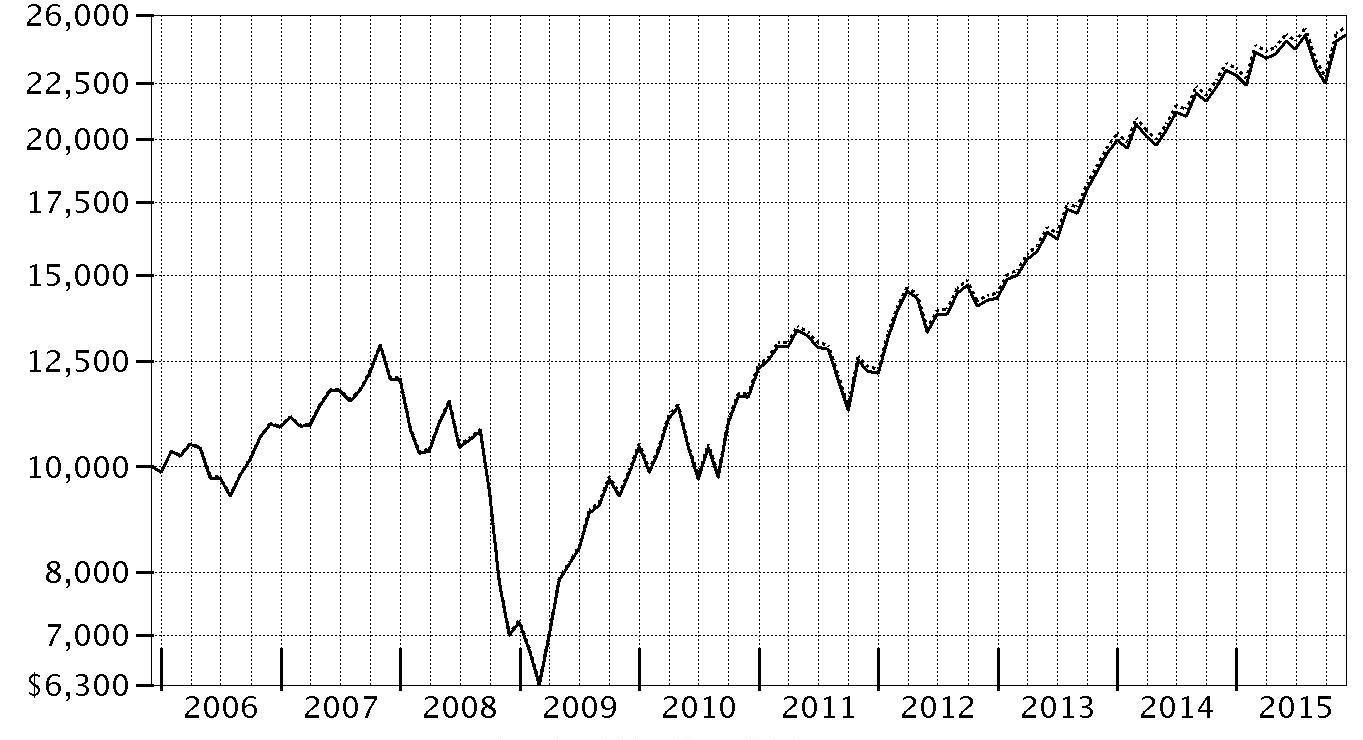

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Series 100 Index Fund, a class of the fund, on March 29, 2007, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 100® Index performed over the same period.

| Period Ending Values |

| $17,313 | Fidelity® Series 100 Index Fund |

| $17,478 | S&P 100® Index |

Management's Discussion of Fund Performance

Market Recap: U.S. stocks gained modestly for the 12 months ending November 30, 2015, despite a steep decline in August and September on concern about slowing economic growth in China. The S&P 500

® index rebounded in October and gained 2.75% for the year. Stocks benefited late in the period amid waning expectations for a near-term interest-rate hike by the U.S. Federal Reserve, more economic stimulus in Europe and an interest-rate cut in China. Growth stocks in the benchmark far outpaced their value counterparts, as investors continued to seek growth in a subpar economic environment. Sector performance varied widely, with more than 26 percentage points separating the leader from the laggard. Consumer discretionary (+14%) secured the top spot, benefiting from a combination of rising personal income and still-benign inflation. Information technology (+7%) and health care (+4%) also outpaced the broad market. Conversely, the energy sector (-12%) performed worst, stymied by depressed commodity prices that also hit materials (-5%). Telecommunication services (-5%) and utilities (-4%), considered defensive sectors less sensitive to the economy, also lost ground. At period end, investors remained focused on the potential global implications of a stronger U.S. dollar and how China’s transition toward a consumption-led economy may affect corporate earnings.

Comments from Patrick Waddell, Senior Portfolio Manager of the Geode Capital Management, LLC, investment management team: For the year, the fund's share classes performed roughly in line with the 3.44% gain of the S&P 100

® index. By a wide margin, the top sector in the index was consumer discretionary, whereas energy stocks struggled in light of the sharp drop in the price of oil. The biggest absolute contributor by far was online retail giant Amazon.com. Its shares nearly doubled, driven by better-than-expected financial results. In information technology, software maker Microsoft – one of the largest weightings in the index – added value, as did social-networking leader Facebook and Internet search giant Alphabet, which late in the period was established as a parent company for Google and its sister businesses. Elsewhere, home-improvement retailer Home Depot and industrial conglomerate General Electric boosted returns. Litigation income received during the period added to the fund's return. In contrast, the biggest individual detractor was retailer Wal-Mart Stores, which posted weak earnings in a difficult business environment. Among various energy-related stocks to hamper results this period were Kinder Morgan, Exxon Mobil and Chevron, whose shares returned about -41%, -7% and -12%, respectively. Other detractors included wireless communications equipment manufacturer QUALCOMM and branded consumer products company Procter & Gamble.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of November 30, 2015

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Apple, Inc. | 5.8 | 6.5 |

| Microsoft Corp. | 3.7 | 3.3 |

| Exxon Mobil Corp. | 2.9 | 3.1 |

| General Electric Co. | 2.4 | 2.3 |

| Johnson & Johnson | 2.4 | 2.4 |

| Wells Fargo & Co. | 2.2 | 2.2 |

| Amazon.com, Inc. | 2.2 | 1.4 |

| Berkshire Hathaway, Inc. Class B | 2.2 | 2.2 |

| JPMorgan Chase & Co. | 2.1 | 2.1 |

| Facebook, Inc. Class A | 2.0 | 1.4 |

| | 27.9 | |

Market Sectors as of November 30, 2015

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Information Technology | 24.8 | 24.5 |

| Health Care | 15.1 | 16.1 |

| Financials | 14.8 | 14.7 |

| Consumer Discretionary | 12.4 | 10.5 |

| Consumer Staples | 10.6 | 10.6 |

| Industrials | 9.2 | 9.4 |

| Energy | 7.4 | 8.4 |

| Telecommunication Services | 3.4 | 3.3 |

| Materials | 1.4 | 1.5 |

| Utilities | 0.6 | 0.6 |

Investments November 30, 2015

Showing Percentage of Net Assets

| Common Stocks - 99.7% | | | |

| | | Shares | Value |

| CONSUMER DISCRETIONARY - 12.4% | | | |

| Automobiles - 0.9% | | | |

| Ford Motor Co. | | 1,135,116 | $16,266,212 |

| General Motors Co. | | 419,862 | 15,199,004 |

| | | | 31,465,216 |

| Hotels, Restaurants & Leisure - 1.7% | | | |

| McDonald's Corp. | | 274,331 | 31,317,627 |

| Starbucks Corp. | | 432,318 | 26,540,002 |

| | | | 57,857,629 |

| Internet & Catalog Retail - 2.8% | | | |

| Amazon.com, Inc. (a) | | 111,713 | 74,266,802 |

| Priceline Group, Inc. (a) | | 14,768 | 18,443,017 |

| | | | 92,709,819 |

| Media - 3.7% | | | |

| Comcast Corp.: | | | |

| Class A | | 615,995 | 37,489,456 |

| Class A (special) (non-vtg.) | | 101,170 | 6,175,417 |

| The Walt Disney Co. | | 452,309 | 51,323,502 |

| Time Warner, Inc. | | 237,563 | 16,624,659 |

| Twenty-First Century Fox, Inc.: | | | |

| Class A | | 355,636 | 10,494,818 |

| Class B | | 125,600 | 3,761,720 |

| | | | 125,869,572 |

| Multiline Retail - 0.4% | | | |

| Target Corp. | | 183,049 | 13,271,053 |

| Specialty Retail - 2.1% | | | |

| Home Depot, Inc. | | 374,034 | 50,075,672 |

| Lowe's Companies, Inc. | | 269,502 | 20,643,853 |

| | | | 70,719,525 |

| Textiles, Apparel & Luxury Goods - 0.8% | | | |

| NIKE, Inc. Class B | | 197,457 | 26,119,612 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 418,012,426 |

|

| CONSUMER STAPLES - 10.6% | | | |

| Beverages - 2.7% | | | |

| PepsiCo, Inc. | | 427,889 | 42,857,362 |

| The Coca-Cola Co. | | 1,140,364 | 48,602,314 |

| | | | 91,459,676 |

| Food & Staples Retailing - 2.9% | | | |

| Costco Wholesale Corp. | | 128,014 | 20,664,020 |

| CVS Health Corp. | | 324,628 | 30,544,249 |

| Wal-Mart Stores, Inc. | | 459,661 | 27,046,453 |

| Walgreens Boots Alliance, Inc. | | 254,529 | 21,388,072 |

| | | | 99,642,794 |

| Food Products - 0.6% | | | |

| Mondelez International, Inc. | | 469,342 | 20,491,472 |

| Household Products - 2.3% | | | |

| Colgate-Palmolive Co. | | 262,191 | 17,220,705 |

| Procter & Gamble Co. | | 790,116 | 59,132,281 |

| | | | 76,352,986 |

| Tobacco - 2.1% | | | |

| Altria Group, Inc. | | 571,112 | 32,896,051 |

| Philip Morris International, Inc. | | 451,248 | 39,434,563 |

| | | | 72,330,614 |

|

| TOTAL CONSUMER STAPLES | | | 360,277,542 |

|

| ENERGY - 7.4% | | | |

| Energy Equipment & Services - 1.1% | | | |

| Halliburton Co. | | 248,972 | 9,921,534 |

| Schlumberger Ltd. | | 368,600 | 28,437,490 |

| | | | 38,359,024 |

| Oil, Gas & Consumable Fuels - 6.3% | | | |

| Anadarko Petroleum Corp. | | 147,974 | 8,863,643 |

| Chevron Corp. | | 548,113 | 50,053,679 |

| ConocoPhillips Co. | | 359,282 | 19,419,192 |

| Devon Energy Corp. | | 112,533 | 5,177,643 |

| Exxon Mobil Corp. | | 1,214,479 | 99,174,355 |

| Kinder Morgan, Inc. | | 523,544 | 12,339,932 |

| Occidental Petroleum Corp. | | 222,524 | 16,820,589 |

| | | | 211,849,033 |

|

| TOTAL ENERGY | | | 250,208,057 |

|

| FINANCIALS - 14.8% | | | |

| Banks - 7.9% | | | |

| Bank of America Corp. | | 3,049,282 | 53,148,985 |

| Citigroup, Inc. | | 876,709 | 47,421,190 |

| JPMorgan Chase & Co. | | 1,077,174 | 71,825,962 |

| U.S. Bancorp | | 482,169 | 21,162,397 |

| Wells Fargo & Co. | | 1,360,675 | 74,973,193 |

| | | | 268,531,727 |

| Capital Markets - 1.9% | | | |

| Bank of New York Mellon Corp. | | 322,307 | 14,129,939 |

| BlackRock, Inc. Class A | | 37,316 | 13,572,576 |

| Goldman Sachs Group, Inc. | | 117,261 | 22,281,935 |

| Morgan Stanley | | 443,807 | 15,222,580 |

| | | | 65,207,030 |

| Consumer Finance - 0.9% | | | |

| American Express Co. | | 247,906 | 17,759,986 |

| Capital One Financial Corp. | | 157,999 | 12,404,501 |

| | | | 30,164,487 |

| Diversified Financial Services - 2.2% | | | |

| Berkshire Hathaway, Inc. Class B (a) | | 545,684 | 73,170,768 |

| Insurance - 1.4% | | | |

| Allstate Corp. | | 116,626 | 7,319,448 |

| American International Group, Inc. | | 376,884 | 23,962,285 |

| MetLife, Inc. | | 325,326 | 16,620,905 |

| | | | 47,902,638 |

| Real Estate Investment Trusts - 0.5% | | | |

| Simon Property Group, Inc. | | 90,125 | 16,784,880 |

|

| TOTAL FINANCIALS | | | 501,761,530 |

|

| HEALTH CARE - 15.1% | | | |

| Biotechnology - 4.5% | | | |

| AbbVie, Inc. | | 482,149 | 28,036,964 |

| Amgen, Inc. | | 220,863 | 35,581,029 |

| Biogen, Inc. (a) | | 64,927 | 18,624,959 |

| Celgene Corp. (a) | | 230,269 | 25,202,942 |

| Gilead Sciences, Inc. | | 427,485 | 45,296,311 |

| | | | 152,742,205 |

| Health Care Equipment & Supplies - 1.5% | | | |

| Abbott Laboratories | | 434,136 | 19,501,389 |

| Medtronic PLC | | 411,926 | 31,034,505 |

| | | | 50,535,894 |

| Health Care Providers & Services - 0.9% | | | |

| UnitedHealth Group, Inc. | | 277,754 | 31,305,653 |

| Pharmaceuticals - 8.2% | | | |

| Allergan PLC (a) | | 114,658 | 35,990,000 |

| Bristol-Myers Squibb Co. | | 485,711 | 32,547,494 |

| Eli Lilly & Co. | | 284,149 | 23,311,584 |

| Johnson & Johnson | | 806,586 | 81,658,767 |

| Merck & Co., Inc. | | 820,431 | 43,491,047 |

| Pfizer, Inc. | | 1,796,428 | 58,868,946 |

| | | | 275,867,838 |

|

| TOTAL HEALTH CARE | | | 510,451,590 |

|

| INDUSTRIALS - 9.2% | | | |

| Aerospace & Defense - 3.4% | | | |

| General Dynamics Corp. | | 88,364 | 12,941,791 |

| Honeywell International, Inc. | | 227,712 | 23,670,662 |

| Lockheed Martin Corp. | | 77,789 | 17,048,237 |

| Raytheon Co. | | 88,418 | 10,966,485 |

| The Boeing Co. | | 186,048 | 27,060,682 |

| United Technologies Corp. | | 241,255 | 23,172,543 |

| | | | 114,860,400 |

| Air Freight & Logistics - 1.0% | | | |

| FedEx Corp. | | 76,508 | 12,129,578 |

| United Parcel Service, Inc. Class B | | 203,444 | 20,956,766 |

| | | | 33,086,344 |

| Electrical Equipment - 0.3% | | | |

| Emerson Electric Co. | | 191,412 | 9,570,600 |

| Industrial Conglomerates - 3.2% | | | |

| 3M Co. | | 181,976 | 28,493,802 |

| General Electric Co. (b) | | 2,745,443 | 82,198,563 |

| | | | 110,692,365 |

| Machinery - 0.4% | | | |

| Caterpillar, Inc. | | 175,535 | 12,752,618 |

| Road & Rail - 0.9% | | | |

| Norfolk Southern Corp. | | 87,788 | 8,345,127 |

| Union Pacific Corp. | | 252,742 | 21,217,691 |

| | | | 29,562,818 |

|

| TOTAL INDUSTRIALS | | | 310,525,145 |

|

| INFORMATION TECHNOLOGY - 24.8% | | | |

| Communications Equipment - 1.9% | | | |

| Cisco Systems, Inc. | | 1,481,420 | 40,368,695 |

| QUALCOMM, Inc. | | 457,660 | 22,329,231 |

| | | | 62,697,926 |

| Internet Software & Services - 5.8% | | | |

| Alphabet, Inc.: | | | |

| Class A (a) | | 84,438 | 64,413,528 |

| Class C | | 86,155 | 63,978,703 |

| Facebook, Inc. Class A (a) | | 658,217 | 68,612,540 |

| | | | 197,004,771 |

| IT Services - 4.2% | | | |

| Accenture PLC Class A | | 181,798 | 19,492,382 |

| IBM Corp. | | 262,492 | 36,596,635 |

| MasterCard, Inc. Class A | | 290,697 | 28,465,050 |

| PayPal Holdings, Inc. (a) | | 323,044 | 11,390,531 |

| Visa, Inc. Class A | | 568,401 | 44,909,363 |

| | | | 140,853,961 |

| Semiconductors & Semiconductor Equipment - 1.9% | | | |

| Intel Corp. | | 1,384,747 | 48,147,653 |

| Texas Instruments, Inc. | | 298,966 | 17,375,904 |

| | | | 65,523,557 |

| Software - 4.8% | | | |

| Microsoft Corp. | | 2,329,655 | 126,616,749 |

| Oracle Corp. | | 947,261 | 36,914,761 |

| | | | 163,531,510 |

| Technology Hardware, Storage & Peripherals - 6.2% | | | |

| Apple, Inc. | | 1,661,091 | 196,507,068 |

| EMC Corp. | | 560,635 | 14,206,491 |

| | | | 210,713,559 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 840,325,284 |

|

| MATERIALS - 1.4% | | | |

| Chemicals - 1.4% | | | |

| E.I. du Pont de Nemours & Co. | | 263,562 | 17,748,265 |

| Monsanto Co. | | 128,116 | 12,191,519 |

| The Dow Chemical Co. | | 337,332 | 17,585,117 |

| | | | 47,524,901 |

| TELECOMMUNICATION SERVICES - 3.4% | | | |

| Diversified Telecommunication Services - 3.4% | | | |

| AT&T, Inc. | | 1,791,666 | 60,325,394 |

| Verizon Communications, Inc. | | 1,184,256 | 53,824,435 |

| | | | 114,149,829 |

| UTILITIES - 0.6% | | | |

| Electric Utilities - 0.6% | | | |

| Exelon Corp. | | 267,851 | 7,315,011 |

| Southern Co. | | 264,606 | 11,785,551 |

| | | | 19,100,562 |

| TOTAL COMMON STOCKS | | | |

| (Cost $3,040,678,274) | | | 3,372,336,866 |

| | | Principal Amount | Value |

|

| U.S. Treasury Obligations - 0.1% | | | |

| U.S. Treasury Bills, yield at date of purchase 0.2% 2/4/16 (c) | | | |

| (Cost $1,999,262) | | 2,000,000 | 1,999,530 |

| | | Shares | Value |

|

| Money Market Funds - 1.5% | | | |

| Fidelity Cash Central Fund, 0.18% (d) | | 19,034,262 | $19,034,262 |

| Fidelity Securities Lending Cash Central Fund, 0.22% (d)(e) | | 31,000,000 | 31,000,000 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $50,034,262) | | | 50,034,262 |

| TOTAL INVESTMENT PORTFOLIO - 101.3% | | | |

| (Cost $3,092,711,798) | | | 3,424,370,658 |

| NET OTHER ASSETS (LIABILITIES) - (1.3)% | | | (43,122,905) |

| NET ASSETS - 100% | | | $3,381,247,753 |

| Futures Contracts | | | |

| | Expiration Date | Underlying Face Amount at Value | Unrealized Appreciation/(Depreciation) |

| Purchased | | | |

| Equity Index Contracts | | | |

| 1 CME E-mini S&P 500 Index Contracts (United States) | Dec. 2015 | 103,990 | $(1,175) |

| 17 CME S&P 500 Index Contracts (United States) | Dec. 2015 | 8,839,150 | (60,423) |

| TOTAL FUTURES CONTRACTS | | | $(61,598) |

The face value of futures purchased as a percentage of Net Assets is 0.3%

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $1,355,681.

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(e) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $17,021 |

| Fidelity Securities Lending Cash Central Fund | 26,998 |

| Total | $44,019 |

Investment Valuation

The following is a summary of the inputs used, as of November 30, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $418,012,426 | $418,012,426 | $-- | $-- |

| Consumer Staples | 360,277,542 | 360,277,542 | -- | -- |

| Energy | 250,208,057 | 250,208,057 | -- | -- |

| Financials | 501,761,530 | 501,761,530 | -- | -- |

| Health Care | 510,451,590 | 510,451,590 | -- | -- |

| Industrials | 310,525,145 | 310,525,145 | -- | -- |

| Information Technology | 840,325,284 | 840,325,284 | -- | -- |

| Materials | 47,524,901 | 47,524,901 | -- | -- |

| Telecommunication Services | 114,149,829 | 114,149,829 | -- | -- |

| Utilities | 19,100,562 | 19,100,562 | -- | -- |

| U.S. Government and Government Agency Obligations | 1,999,530 | -- | 1,999,530 | -- |

| Money Market Funds | 50,034,262 | 50,034,262 | -- | -- |

| Total Investments in Securities: | $3,424,370,658 | $3,422,371,128 | $1,999,530 | $-- |

| Derivative Instruments: | | | | |

| Liabilities | | | | |

| Futures Contracts | $(61,598) | $(61,598) | $-- | $-- |

| Total Liabilities | $(61,598) | $(61,598) | $-- | $-- |

| Total Derivative Instruments: | $(61,598) | $(61,598) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of November 30, 2015. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| Equity Risk | | |

| Futures Contracts(a) | $0 | $(61,598) |

| Total Equity Risk | 0 | (61,598) |

| Total Value of Derivatives | $0 | $(61,598) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. Only the period end receivable or payable for daily variation margin and net unrealized appreciation (depreciation) are presented in the Statement of Assets and Liabilities.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | November 30, 2015 |

| Assets | | |

Investment in securities, at value (including securities loaned of $29,940,000) — See accompanying schedule:

Unaffiliated issuers (cost $3,042,677,536) | $3,374,336,396 | |

| Fidelity Central Funds (cost $50,034,262) | 50,034,262 | |

| Total Investments (cost $3,092,711,798) | | $3,424,370,658 |

| Cash | | 745 |

| Receivable for investments sold | | 9,945,322 |

| Receivable for fund shares sold | | 42,412 |

| Dividends receivable | | 8,551,303 |

| Distributions receivable from Fidelity Central Funds | | 11,167 |

| Total assets | | 3,442,921,607 |

| Liabilities | | |

| Payable for fund shares redeemed | 30,318,965 | |

| Accrued management fee | 142,094 | |

| Payable for daily variation margin for derivative instruments | 142,580 | |

| Other affiliated payables | 70,215 | |

| Collateral on securities loaned, at value | 31,000,000 | |

| Total liabilities | | 61,673,854 |

| Net Assets | | $3,381,247,753 |

| Net Assets consist of: | | |

| Paid in capital | | $3,444,412,411 |

| Undistributed net investment income | | 70,638,423 |

| Accumulated undistributed net realized gain (loss) on investments | | (465,400,343) |

| Net unrealized appreciation (depreciation) on investments | | 331,597,262 |

| Net Assets | | $3,381,247,753 |

| Series 100 Index: | | |

| Net Asset Value, offering price and redemption price per share ($1,670,998,039 ÷ 120,499,847 shares) | | $13.87 |

| Class F: | | |

| Net Asset Value, offering price and redemption price per share ($1,710,249,714 ÷ 123,287,803 shares) | | $13.87 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended November 30, 2015 |

| Investment Income | | |

| Dividends | | $78,760,720 |

| Interest | | 3,368 |

| Income from Fidelity Central Funds | | 44,019 |

| Total income | | 78,808,107 |

| Expenses | | |

| Management fee | $1,719,944 | |

| Transfer agent fees | 871,877 | |

| Independent trustees' compensation | 14,784 | |

| Interest | 951 | |

| Miscellaneous | 5,008 | |

| Total expenses before reductions | 2,612,564 | |

| Expense reductions | (13) | 2,612,551 |

| Net investment income (loss) | | 76,195,556 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 134,451,366 | |

| Futures contracts | 600,935 | |

| Total net realized gain (loss) | | 135,052,301 |

Change in net unrealized appreciation (depreciation) on:

Investment securities | (89,129,930) | |

| Futures contracts | (689,736) | |

| Total change in net unrealized appreciation (depreciation) | | (89,819,666) |

| Net gain (loss) | | 45,232,635 |

| Net increase (decrease) in net assets resulting from operations | | $121,428,191 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended November 30, 2015 | Year ended November 30, 2014 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $76,195,556 | $65,171,984 |

| Net realized gain (loss) | 135,052,301 | 68,853,752 |

| Change in net unrealized appreciation (depreciation) | (89,819,666) | 336,326,291 |

| Net increase (decrease) in net assets resulting from operations | 121,428,191 | 470,352,027 |

| Distributions to shareholders from net investment income | (70,740,615) | – |

| Share transactions - net increase (decrease) | (254,445,510) | 404,368,983 |

| Total increase (decrease) in net assets | (203,757,934) | 874,721,010 |

| Net Assets | | |

| Beginning of period | 3,585,005,687 | 2,710,284,677 |

| End of period (including undistributed net investment income of $70,638,423 and undistributed net investment income of $65,171,985, respectively) | $3,381,247,753 | $3,585,005,687 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Series 100 Index Fund Series 100 Index

| | | | | | |

| Years ended November 30, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $13.67 | $11.77 | $10.19 | $8.85 | $8.33 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .29 | .27 | .25 | .21 | .18 |

| Net realized and unrealized gain (loss) | .18 | 1.63 | 2.35 | 1.31 | .51 |

| Total from investment operations | .47 | 1.90 | 2.60 | 1.52 | .69 |

| Distributions from net investment income | (.27) | – | (1.02) | (.18) | (.17) |

| Net asset value, end of period | $13.87 | $13.67 | $11.77 | $10.19 | $8.85 |

| Total ReturnB | 3.48% | 16.14% | 27.56% | 17.49% | 8.34% |

| Ratios to Average Net AssetsC,D | | | | | |

| Expenses before reductions | .10% | .10% | .18% | .20% | .20% |

| Expenses net of fee waivers, if any | .10% | .10% | .17% | .20% | .20% |

| Expenses net of all reductions | .10% | .10% | .17% | .20% | .20% |

| Net investment income (loss) | 2.17% | 2.11% | 2.34% | 2.17% | 2.05% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $1,670,998 | $1,814,733 | $2,710,285 | $8,019,529 | $6,413,368 |

| Portfolio turnover rateE | 10% | 8% | 19% | 10% | 6% |

A Calculated based on average shares outstanding during the period.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Series 100 Index Fund Class F

| Years ended November 30, | 2015 | 2014 A |

| Selected Per–Share Data | | |

| Net asset value, beginning of period | $13.68 | $11.69 |

| Income from Investment Operations | | |

| Net investment income (loss)B | .30 | .27 |

| Net realized and unrealized gain (loss) | .16 | 1.72 |

| Total from investment operations | .46 | 1.99 |

| Distributions from net investment income | (.27) | – |

| Net asset value, end of period | $13.87 | $13.68 |

| Total ReturnC,D | 3.45% | 17.02% |

| Ratios to Average Net AssetsE,F | | |

| Expenses before reductions | .05% | .05%G |

| Expenses net of fee waivers, if any | .05% | .05%G |

| Expenses net of all reductions | .05% | .05%G |

| Net investment income (loss) | 2.22% | 2.16%G |

| Supplemental Data | | |

| Net assets, end of period (000 omitted) | $1,710,250 | $1,770,273 |

| Portfolio turnover rateH | 10% | 8% |

A For the period December 4, 2013 (commencement of sale of shares) to November 30, 2014.

B Calculated based on average shares outstanding during the period.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended November 30, 2015

1. Organization.

Fidelity Series 100 Index Fund (the Fund) is a fund of Fidelity Commonwealth Trust (the Trust) and is authorized to issue an unlimited number of shares. Shares of the Fund are only available for purchase by mutual funds for which Fidelity Management & Research Company (FMR) or an affiliate serves as an investment manager. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund commenced sale of Class F shares and the existing class was designated Series 100 Index on December 4, 2013. The Fund offers Series 100 Index and Class F shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the FMR Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of November 30, 2015, is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of November 30, 2015, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to contribution in-kind, futures contracts, market discount, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $728,649,840 |

| Gross unrealized depreciation | (415,142,655) |

| Net unrealized appreciation (depreciation) on securities | $313,507,185 |

| Tax Cost | $3,110,863,473 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $70,635,340 |

| Capital loss carryforward | $(447,307,183) |

| Net unrealized appreciation (depreciation) on securities and other investments | $313,507,185 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

| Fiscal year of expiration | |

| 2017 | $(149,988,603) |

| 2018 | (297,318,580) |

| Total capital loss carryforward | $(447,307,183) |

The tax character of distributions paid was as follows:

| | November 30, 2015 | November 30, 2014 |

| Ordinary Income | $70,740,615 | $ - |

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin for derivative instruments in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The underlying face amount at value reflects each contract's exposure to the underlying instrument or index at period end and is representative of volume of activity during the period. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

During the period the Fund recognized net realized gain (loss) of $600,935 and a change in net unrealized appreciation (depreciation) of $(689,736) related to its investment in futures contracts. These amounts are included in the Statement of Operations.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $336,089,291 and $558,787,778, respectively.

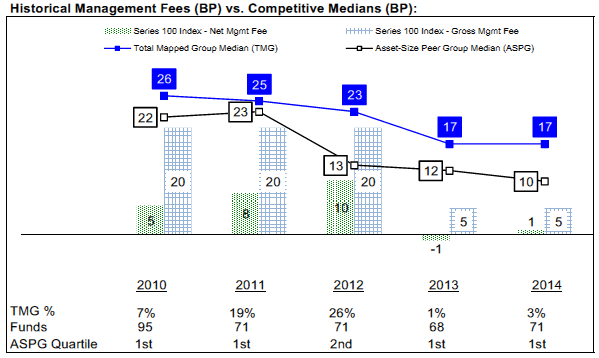

6. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee that is based on an annual rate of .05% of the Fund's average net assets. Under the management contract, the investment adviser pays all other fund-level expenses, except the compensation of the independent Trustees and certain other expenses such as transfer agent and interest expense, including commitment fees. The management fee is reduced by an amount equal to the fees and expenses paid by the Fund to the independent Trustees.

In addition, under the expense contract, the investment adviser pays class-level expenses for Series 100 Index so that the total expenses do not exceed .10%, expressed as a percentage of class average net assets, with certain exceptions such as interest expense, including commitment fees.

Sub-Adviser. Geode Capital Management, LLC (Geode), serves as sub-adviser for the Fund. Geode provides discretionary investment advisory services to the Fund and is paid by the investment adviser for providing these services.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives transfer agent fees at an annual rate of .075% of average net assets for Series 100 Index. FIIOC receives no fees for providing transfer agency services to Class F. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

Under the expense contract, Series 100 Index pays a portion of the transfer agent fees at an annual rate of .05% of average net assets.

For the period, transfer agent fees for each applicable class were as follows:

| | Amount |

| Series 100 Index | $871,877 |

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other registered investment companies having management contracts with FMR or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The Fund's activity in this program during the period for which loans were outstanding was as follows:

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense |

| Borrower | $24,241,500 | .35% | $951 |

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $5,008 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $26,998.

9. Expense Reductions.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $13.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Years ended November 30, | 2015 | 2014 |

| From net investment income | | |

| Series 100 Index | $35,250,235 | $– |

| Class F | 35,490,380 | – |

| Total | $70,740,615 | $– |

11. Share Transactions.

Transactions for each class of shares were as follows:

| | Shares | Shares | Dollars | Dollars |

| Years ended November 30, | 2015 | 2014(a) | 2015 | 2014(a) |

| Series 100 Index | | | | |

| Shares sold | 11,702,848 | 36,645,496 | $156,655,563 | $454,477,901 |

| Reinvestment of distributions | 2,630,615 | – | 35,250,235 | – |

| Shares redeemed | (26,569,388) | (134,267,685) | (359,046,239) | (1,585,941,743) |

| Net increase (decrease) | (12,235,925) | (97,622,189) | $(167,140,441) | $(1,131,463,842) |

| Class F | | | | |

| Shares sold | 16,342,253 | 146,734,305 | $218,162,260 | $1,751,474,454 |

| Reinvestment of distributions | 2,648,536 | – | 35,490,380 | – |

| Shares redeemed | (25,150,141) | (17,287,150) | (340,957,709) | (215,641,629) |

| Net increase (decrease) | (6,159,352) | 129,447,155 | $(87,305,069) | $1,535,832,825 |

(a) Share transactions for Class F are for the period December 4, 2013 (commencement of sale of shares) to November 30, 2014.

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, mutual funds managed by the investment adviser or its affiliates were the owners of record of all of the outstanding shares of the Fund.

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Commonwealth Trust and Shareholders of Fidelity® Series 100 Index Fund:

We have audited the accompanying statement of assets and liabilities of Fidelity® Series 100 Index Fund (the Fund), a fund of Fidelity Commonwealth Trust, including the schedule of investments, as of November 30, 2015, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2015, by correspondence with the custodians and brokers. We believe our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Fidelity® Series 100 Index Fund as of November 30, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for the each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

January 19, 2016

Trustees and Officers

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Each of the Trustees oversees 170 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-8544, or for Class F, call 1-800-835-5092.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. James C. Curvey is an interested person and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Ned C. Lautenbach serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity® funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's high income and certain equity funds, and other Boards oversee Fidelity's investment-grade bond, money market, asset allocation, and sector funds. The asset allocation funds may invest in Fidelity® funds overseen by the fund's Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through FMR, its affiliates, and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations, Audit, and Compliance Committees. In addition, the Independent Trustees have worked with FMR to enhance the Board's oversight of investment and financial risks, legal and regulatory risks, technology risks, and operational risks, including the development of additional risk reporting to the Board. For example, a working group comprised of Independent Trustees and FMR has worked and continues to work to review the Fidelity® funds' valuation-related activities, reporting and risk management. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate, including an annual review of Fidelity's risk management program for the Fidelity® funds. The responsibilities of each standing committee, including their oversight responsibilities, are described further under "Standing Committees of the Trustees."

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

James C. Curvey (1935)

Year of Election or Appointment: 2007

Trustee

Chairman of the Board of Trustees

Mr. Curvey also serves as Trustee of other Fidelity® funds. Mr. Curvey is a Director of Fidelity Research & Analysis Co. (investment adviser firm, 2009-present), and Vice Chairman (2007-present) and Director of FMR LLC (diversified financial services company). In addition, Mr. Curvey serves as an Overseer for the Boston Symphony Orchestra and a member of the board of Artis-Naples, Naples, Florida, and as a Trustee for Brewster Academy, Wolfeboro, New Hampshire. Previously, Mr. Curvey served as a Director of Fidelity Investments Money Management, Inc. (investment adviser firm, 2009-2014) and a Director of FMR and FMR Co., Inc. (investment adviser firms, 2007-2014).

Charles S. Morrison (1960)

Year of Election or Appointment: 2014

Trustee

Mr. Morrison also serves as Trustee of other funds. He serves as a Director of Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2014-present), Director of Fidelity SelectCo, LLC (investment adviser firm, 2014-present), President, Asset Management (2014-present), and is an employee of Fidelity Investments. Previously, Mr. Morrison served as Vice President of Fidelity's Fixed Income and Asset Allocation Funds (2012-2014), President, Fixed Income (2011-2014), Vice President of Fidelity's Money Market Funds (2005-2009), President, Money Market Group Leader of FMR (investment adviser firm, 2009), and Senior Vice President, Money Market Group of FMR (2004-2009). Mr. Morrison also served as Vice President of Fidelity's Bond Funds (2002-2005), certain Balanced Funds (2002-2005), and certain Asset Allocation Funds (2002-2007), and as Senior Vice President (2002-2005) of Fidelity's Bond Division.

* Determined to be an “Interested Trustee” by virtue of, among other things, his or her affiliation with the trust or various entities under common control with FMR.

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for an Independent Trustee may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Dennis J. Dirks (1948)

Year of Election or Appointment: 2005

Trustee

Mr. Dirks also serves as Trustee of other Fidelity® funds. Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) and President and Board member of the National Securities Clearing Corporation (NSCC). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation, Chief Executive Officer and Board member of the Mortgage-Backed Securities Clearing Corporation, as a Trustee and a member of the Finance Committee of Manhattan College (2005-2008), as a Trustee and a member of the Finance Committee of AHRC of Nassau County (2006-2008), and as a member of the Independent Directors Council (IDC) Governing Council (2010-2015). Mr. Dirks is a member of the Board of Directors for The Brookville Center for Children's Services, Inc. (2009-present).

Alan J. Lacy (1953)

Year of Election or Appointment: 2008

Trustee

Mr. Lacy also serves as Trustee of other Fidelity® funds. Mr. Lacy serves as a member of the Board of Directors of Dave & Buster's Entertainment, Inc. (restaurant and entertainment complexes, 2010-present) and Bristol-Myers Squibb Company (global pharmaceuticals, 2008-present). In addition, Mr. Lacy served as Senior Adviser (2007-2014) of Oak Hill Capital Partners, L.P. (private equity) and also served as Chief Executive Officer (2000-2005) and Vice Chairman (2005-2006) of Sears Holdings Corporation and Sears, Roebuck and Co. (retail). Mr. Lacy is a member of the Board of Trustees of The National Parks Conservation Association (2006-present). Previously, Mr. Lacy served as Chairman of the Board of Trustees of the National Parks Conservation Association (2008-2011) and as a member of the Board of Directors for The Western Union Company (global money transfer, 2006-2011), The Hillman Companies, Inc. (hardware wholesalers, 2010-2014), and Earth Fare, Inc. (retail grocery, 2010-2014).

Ned C. Lautenbach (1944)

Year of Election or Appointment: 2000

Trustee

Chairman of the Independent Trustees

Mr. Lautenbach also serves as Trustee of other Fidelity® funds. Mr. Lautenbach currently serves as the Lead Director of the Eaton Corporation Board of Directors (diversified industrial, 1997-present). Mr. Lautenbach is Chairman of the Board of Directors of Artis-Naples in Naples, Florida (2012-present), a member of the Council on Foreign Relations (1994-present), and a member of the Board of Governors, State University System of Florida (2013-present). Previously, Mr. Lautenbach was a Partner/Advisory Partner at Clayton, Dubilier & Rice, LLC (private equity investment, 1998-2010), as well as a Director of Sony Corporation (2006-2007).

Joseph Mauriello (1944)

Year of Election or Appointment: 2008

Trustee

Mr. Mauriello also serves as Trustee of other Fidelity® funds. Prior to his retirement in January 2006, Mr. Mauriello served in numerous senior management positions including Deputy Chairman and Chief Operating Officer (2004-2005), and Vice Chairman of Financial Services (2002-2004) of KPMG LLP US (professional services, 1965-2005). Mr. Mauriello currently serves as a member of the Board of Directors of XL Group plc. (global insurance and re-insurance, 2006-present) and the Independent Directors Council (IDC) Governing Council (2015-present). Previously, Mr. Mauriello served as a Director of the Hamilton Funds of the Bank of New York (2006-2007) and of Arcadia Resources Inc. (health care services and products, 2007-2012).

Robert W. Selander (1950)

Year of Election or Appointment: 2011

Trustee

Mr. Selander also serves as Trustee of other Fidelity® funds. Mr. Selander serves as a Director of The Western Union Company (global money transfer, 2014-present). Previously, Mr. Selander served as a Member of the Advisory Board of other Fidelity® funds (2011), and Executive Vice Chairman (2010), Chief Executive Officer (2009-2010), and President and Chief Executive Officer (1997-2009) of Mastercard, Inc.

Cornelia M. Small (1944)

Year of Election or Appointment: 2005

Trustee

Ms. Small also serves as Trustee of other Fidelity® funds. Ms. Small is a member of the Board of Directors (2009-present) and Chair of the Investment Committee (2010-present) of the Teagle Foundation. Ms. Small also serves on the Investment Committee of the Berkshire Taconic Community Foundation (2008-present). Previously, Ms. Small served as Chairperson (2002-2008) and a member of the Investment Committee and Chairperson (2008-2012) and a member of the Board of Trustees of Smith College. In addition, Ms. Small served as Chief Investment Officer, Director of Global Equity Investments, and a member of the Board of Directors of Scudder, Stevens & Clark and Scudder Kemper Investments.

William S. Stavropoulos (1939)

Year of Election or Appointment: 2002

Trustee

Vice Chairman of the Independent Trustees

Mr. Stavropoulos also serves as Trustee of other Fidelity® funds. Mr. Stavropoulos serves as President and Founder of the Michigan Baseball Foundation, the Great Lakes Loons (2007-present). Mr. Stavropoulos is Chairman Emeritus of the Board of Directors of The Dow Chemical Company, where he previously served in numerous senior management positions, including President, CEO (1995-2000; 2002-2004), Chairman of the Executive Committee (2000-2006), and as a member of the Board of Directors (1990-2006). Currently, Mr. Stavropoulos is Chairman of the Board of Directors of Univar Inc. (global distributor of commodity and specialty chemicals), a Director of Teradata Corporation (data warehousing and technology solutions), and Maersk Inc. (industrial conglomerate), and a member of the Advisory Board for Metalmark Capital LLC (private equity investment, 2005-present). Mr. Stavropoulos is an operating advisor to Clayton, Dubilier & Rice, LLC (private equity investment). In addition, Mr. Stavropoulos is a member of the University of Notre Dame Advisory Council for the College of Science, a Trustee of the Rollin L. Gerstacker Foundation, and a Director of the Naples Philharmonic Center for the Arts. Previously, Mr. Stavropoulos served as a Director of Chemical Financial Corporation (bank holding company, 1993-2012) and Tyco International, Ltd. (multinational manufacturing and services, 2007-2012).

David M. Thomas (1949)

Year of Election or Appointment: 2008

Trustee

Mr. Thomas also serves as Trustee of other Fidelity® funds. Mr. Thomas serves as Non-Executive Chairman of the Board of Directors of Fortune Brands Home and Security (home and security products, 2011-present), as a member of the Board of Directors (2004-present) and Presiding Director (2013-present) of Interpublic Group of Companies, Inc. (marketing communication), and as a member of the Board of Trustees of the University of Florida (2013-present). Previously, Mr. Thomas served as Executive Chairman (2005-2006) and Chairman and Chief Executive Officer (2000-2005) of IMS Health, Inc. (pharmaceutical and healthcare information solutions), and a Director of Fortune Brands, Inc. (consumer products, 2000-2011).

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Advisory Board Members and Officers:

Correspondence intended for an officer or Peter S. Lynch may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210. Officers appear below in alphabetical order.