Fidelity® Nasdaq Composite Index® Tracking Stock

Annual Report November 30, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-FIDELITY to request a free copy of the proxy voting guidelines.

Nasdaq®, OMX®, NASDAQ OMX®, Nasdaq Composite®, and The Nasdaq Stock Market®, Inc. are registered trademarks of The NASDAQ OMXGroup, Inc. (which with its Affiliates are the Corporations) and are licensed for use by Fidelity. The product has not been passed on by the Corporations as to its legality or suitability. The product is not issued, endorsed or sold by the Corporations. The Corporations make no warranties and bear no liability with respect to shares of the product.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

The fund's net asset value (NAV) performance is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing mutual fund shares as of the close of regular trading hours on The Nasdaq Stock Market, normally 4:00 p.m. Eastern time (or NYSE if NASDAQ is closed). The fund's market price performance is based on the daily closing price of the shares of the fund on The Nasdaq Stock Market.

Cumulative total returns reflect performance over the period shown generally by adding one year's return — positive or negative — to the next year's return. NAV and closing market price average annual returns reflect the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any), at NAV and Market Price, respectively, and assumes a constant rate of performance each year. The hypothetical investment and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Cumulative Total Returns

| Periods ended November 30, 2017 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Nasdaq Composite Index® Tracking Stock - NAV | 30.21% | 140.85% | 184.95% |

| Fidelity® Nasdaq Composite Index® Tracking Stock - Market Price | 29.92% | 140.62% | 186.23% |

| Nasdaq Composite Index® | 30.55% | 142.65% | 188.61% |

Average Annual Total Returns

| For the periods ended November 30, 2017 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Nasdaq Composite Index® Tracking Stock - NAV | 30.21% | 19.22% | 11.04% |

| Fidelity® Nasdaq Composite Index® Tracking Stock - Market Price | 29.92% | 19.20% | 11.09% |

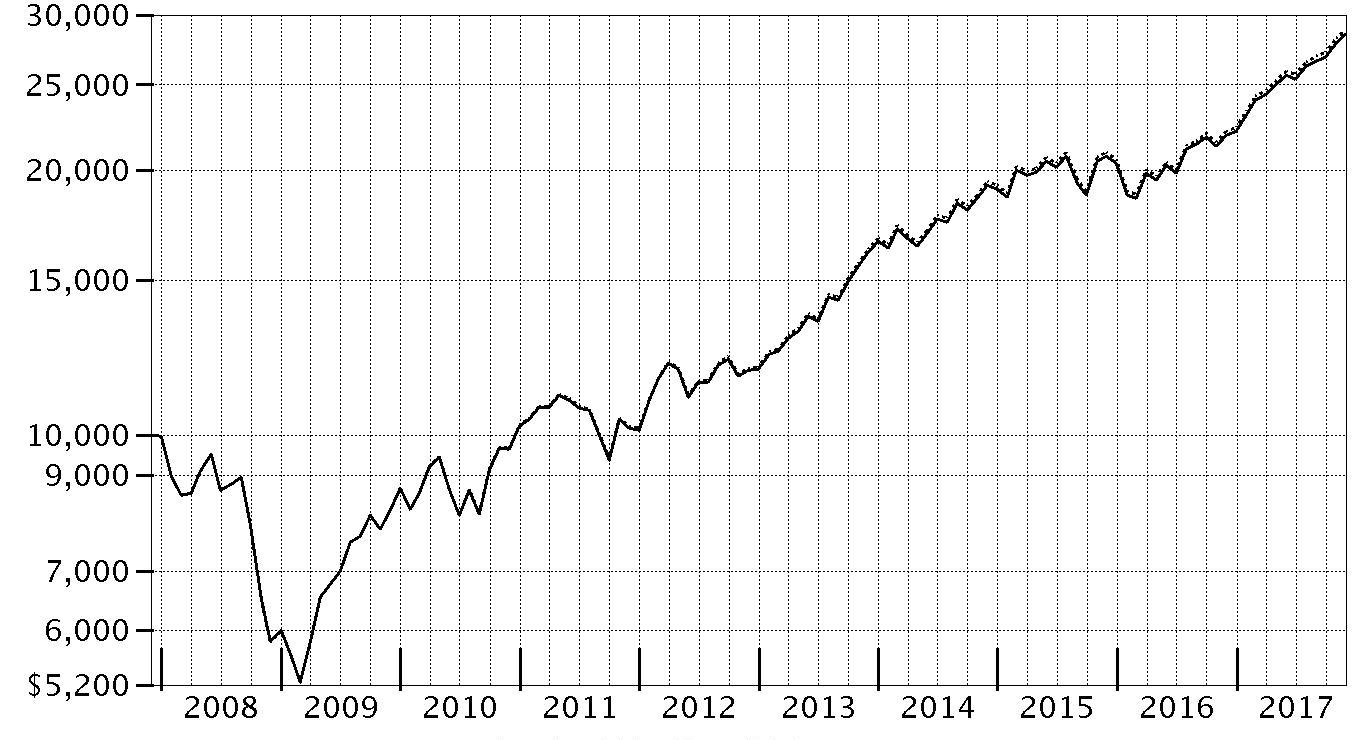

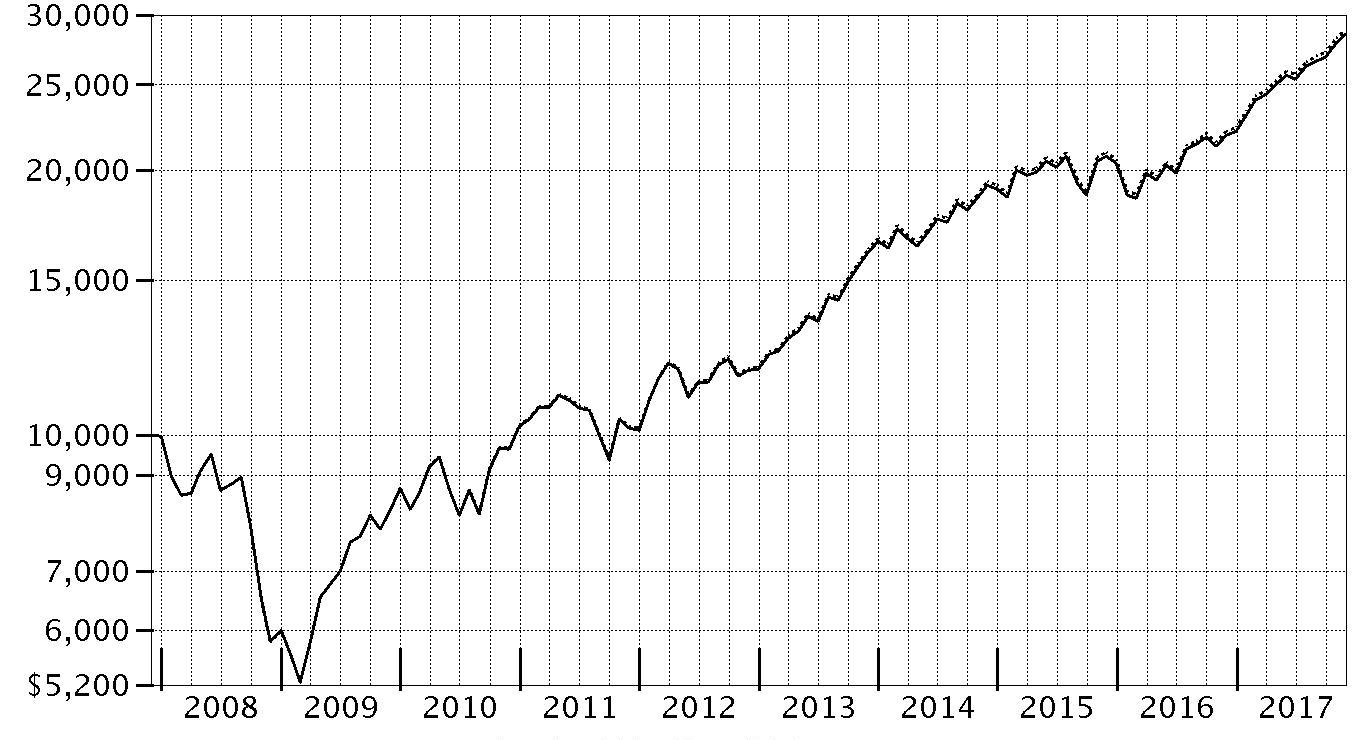

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Nasdaq Composite Index® Tracking Stock - NAV on November 30, 2007.

The chart shows how the value of your investment would have changed, and also shows how the Nasdaq Composite Index® performed over the same period.

| Period Ending Values |

| $28,495 | Fidelity® Nasdaq Composite Index® Tracking Stock - NAV |

| $28,861 | Nasdaq Composite Index® |

Management's Discussion of Fund Performance

Market Recap: The U.S. equity bellwether S&P 500

® index gained 22.87% for the year ending November 30, 2017, rising steadily and closing the period at an all-time high after a particularly strong three-month finish. Early on, equities rallied on optimism for President Trump’s pro-business agenda but leveled off in March amid fading optimism and stalled efforts by Congress to repeal and replace the Affordable Care Act. Upward momentum soon returned and continued through period end with consumer sentiment and other market indicators staying positive. The lone exception was a brief cooldown in August, when geopolitical tension escalated and uncertainty grew regarding the future of health care, tax reform and the debt ceiling. Sector-wise, info tech (+41%) led by a wide margin, surging amid strong earnings growth from several major index constituents. Utilities and financials each gained about 25%, the latter group riding an uptick in bond yields. Conversely, consumer discretionary (+20%) also rose solidly but lagged the broader market, as many brick-and-mortar retailers continued to suffer from increased online competition. Rising interest rates held back real estate (+16%), while consumer staples (+15%) and telecom (+1%) struggled due to investors’ general preference for risk assets. Lastly, sluggish oil prices pushed energy to a -4% return.

Comments from Patrick Waddell, Senior Portfolio Manager of the Geode Capital Management, LLC, investment management team: For the year, the exchange traded fund’s (ETF’s) net asset value gained 30.21%, versus 30.55% for the benchmark NASDAQ Composite Index

®. The ETF’s market price rose 29.92%. These strong results reflect the broad market rally, especially the robust performance of the technology sector, which made up nearly half of the index weighting and supplied most of the fund’s top individual contributors in absolute terms. For example, Alphabet added significant value, as the parent of Internet search giant Google maintained strong earnings growth. Other tech stocks that generated healthy financial results included Apple, which rode growing demand for its iPhone

® mobile devices; social-networking leader Facebook, which continued to generate strong advertising revenue; and software manufacturer Microsoft, whose shift in business strategy toward cloud computing and subscription-based software has proved profitable. Also, in consumer discretionary, internet retailer Amazon.com continued to solidify its dominant competitive position. In contrast, only the energy sector lost ground this period. The biggest individual detractor was Celgene, a biotech company whose stock plunged in October on weak quarterly sales and unfavorable results from a late-stage drug trial.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Premium/Discount Analysis (Unaudited)

Shares of Fidelity® Nasdaq Composite Index® Tracking Stock (the fund) are listed on The Nasdaq Stock Market® and can be bought and sold on the secondary market at market prices. Although the market price is expected to approximate the fund's NAV, it is possible that the market price and NAV will vary significantly. The closing market price is the daily closing price as reported on The Nasdaq Stock Market.

Premiums or discounts are the differences (expressed as a basis point differential with 1 basis point equaling 1/100 of 1%) between the fund's NAV and closing market price. A premium indicates that the closing market price is trading above the NAV. A discount indicates that the closing market price is trading below the NAV. A discrepancy may exist with respect to the timing of when the NAV is calculated and the determination of the closing market price.

The chart below presents information about the differences between the fund's daily closing market price and the fund's NAV.

Period Ended November 30, 2017

| From December 1, 2012 to November 30, 2017 | Closing Price Below NAV | Closing Price Above or Equal to NAV |

| Basis Point Differential | Number of Days | % of Total Days | Number of Days | % of Total Days |

| 0 - <25 | 335 | 26.59% | 823 | 65.32% |

| 25 - <50 | 29 | 2.30% | 63 | 5.00% |

| 50 - <75 | 1 | 0.08% | 2 | 0.16% |

| 75 - <100 | 4 | 0.32% | 2 | 0.15% |

| 100 or above | 0 | -- | 1 | 0.08% |

| Total | 369 | 29.29% | 891 | 70.71% |

Investment Summary (Unaudited)

Top Ten Stocks as of November 30, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Apple, Inc. | 8.4 | 8.6 |

| Microsoft Corp. | 6.1 | 5.8 |

| Amazon.com, Inc. | 4.9 | 4.9 |

| Facebook, Inc. Class A | 4.0 | 3.8 |

| Alphabet, Inc. Class C | 3.4 | 3.6 |

| Alphabet, Inc. Class A | 2.9 | 3.2 |

| Intel Corp. | 2.0 | 1.8 |

| Cisco Systems, Inc. | 1.8 | 1.7 |

| Comcast Corp. Class A | 1.7 | 2.1 |

| Amgen, Inc. | 1.2 | 1.2 |

| | 36.4 | |

Top Market Sectors as of November 30, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Information Technology | 49.8 | 49.7 |

| Consumer Discretionary | 17.3 | 19.0 |

| Health Care | 11.9 | 12.0 |

| Financials | 7.0 | 6.5 |

| Industrials | 4.3 | 4.3 |

| Consumer Staples | 4.1 | 4.9 |

| Real Estate | 1.1 | 1.1 |

| Telecommunication Services | 0.8 | 1.0 |

| Energy | 0.6 | 0.5 |

| Materials | 0.5 | 0.5 |

Asset Allocation (% of fund's net assets)

| As of November 30, 2017 * |

| | Stocks and Equity Futures | 100.0% |

* Foreign investments - 7.8%

| As of May 31, 2017 * |

| | Stocks and Equity Futures | 100.0% |

* Foreign investments - 8.0%

Investments November 30, 2017

Showing Percentage of Net Assets

| Common Stocks - 97.5% | | | |

| | | Shares | Value |

| CONSUMER DISCRETIONARY - 17.3% | | | |

| Auto Components - 0.2% | | | |

| ADOMANI, Inc. (a) | | 14,744 | $47,918 |

| Dorman Products, Inc. (b) | | 5,344 | 365,049 |

| Fox Factory Holding Corp. (b) | | 6,606 | 257,634 |

| Gentex Corp. | | 43,778 | 896,573 |

| Gentherm, Inc. (b) | | 8,278 | 298,008 |

| The Goodyear Tire & Rubber Co. | | 32,582 | 1,054,679 |

| | | | 2,919,861 |

| Automobiles - 0.5% | | | |

| Tesla, Inc. (a)(b) | | 23,433 | 7,237,282 |

| Distributors - 0.2% | | | |

| Core-Mark Holding Co., Inc. | | 8,207 | 272,144 |

| LKQ Corp. (b) | | 45,098 | 1,777,763 |

| Pool Corp. | | 4,947 | 621,541 |

| | | | 2,671,448 |

| Diversified Consumer Services - 0.1% | | | |

| Capella Education Co. | | 2,915 | 248,650 |

| Career Education Corp. (b) | | 24,181 | 320,882 |

| Grand Canyon Education, Inc. (b) | | 6,269 | 595,304 |

| Houghton Mifflin Harcourt Co. (b) | | 22,094 | 215,417 |

| Strayer Education, Inc. | | 2,983 | 296,003 |

| | | | 1,676,256 |

| Hotels, Restaurants & Leisure - 2.3% | | | |

| Bloomin' Brands, Inc. | | 17,000 | 364,990 |

| Buffalo Wild Wings, Inc. (b) | | 2,523 | 393,462 |

| Caesars Entertainment Corp. (b) | | 56,132 | 743,749 |

| China Lodging Group Ltd. ADR | | 4,794 | 511,568 |

| Churchill Downs, Inc. | | 2,306 | 541,910 |

| Cracker Barrel Old Country Store, Inc. (a) | | 2,552 | 398,954 |

| Dave & Buster's Entertainment, Inc. (b) | | 5,267 | 279,309 |

| Denny's Corp. (b) | | 21,286 | 288,425 |

| Dunkin' Brands Group, Inc. | | 11,357 | 678,013 |

| Eldorado Resorts, Inc. (b) | | 8,843 | 270,596 |

| Empire Resorts, Inc. (a)(b) | | 10,237 | 268,721 |

| Golden Entertainment, Inc. (b) | | 8,878 | 304,693 |

| ILG, Inc. | | 16,696 | 468,991 |

| International Speedway Corp. Class A | | 7,402 | 305,333 |

| Jack in the Box, Inc. | | 4,453 | 460,930 |

| Marriott International, Inc. Class A | | 51,868 | 6,587,236 |

| Melco Crown Entertainment Ltd. sponsored ADR | | 25,444 | 664,343 |

| Monarch Casino & Resort, Inc. (b) | | 6,420 | 301,291 |

| Norwegian Cruise Line Holdings Ltd. (b) | | 31,991 | 1,732,633 |

| Papa John's International, Inc. | | 5,810 | 339,653 |

| Penn National Gaming, Inc. (b) | | 13,000 | 373,880 |

| Pinnacle Entertainment, Inc. (b) | | 11,886 | 364,662 |

| Playa Hotels & Resorts NV | | 20,012 | 212,928 |

| Red Robin Gourmet Burgers, Inc. (b) | | 2,054 | 107,630 |

| Ruth's Hospitality Group, Inc. | | 11,335 | 243,136 |

| Scientific Games Corp. Class A (b) | | 12,751 | 671,340 |

| Sonic Corp. (a) | | 7,858 | 200,536 |

| Starbucks Corp. | | 201,051 | 11,624,769 |

| Texas Roadhouse, Inc. Class A | | 9,983 | 509,832 |

| The Cheesecake Factory, Inc. (a) | | 6,869 | 336,856 |

| The Stars Group, Inc. (b) | | 27,363 | 627,367 |

| Wendy's Co. | | 32,302 | 480,977 |

| Wingstop, Inc. (a) | | 6,085 | 238,471 |

| Wynn Resorts Ltd. | | 15,020 | 2,374,362 |

| | | | 34,271,546 |

| Household Durables - 0.2% | | | |

| Cavco Industries, Inc. (b) | | 1,768 | 270,769 |

| Garmin Ltd. (a) | | 24,324 | 1,510,034 |

| GoPro, Inc. Class A (a)(b) | | 20,812 | 177,734 |

| Helen of Troy Ltd. (b) | | 4,533 | 405,250 |

| iRobot Corp. (a)(b) | | 3,736 | 256,364 |

| LGI Homes, Inc. (a)(b) | | 4,122 | 289,406 |

| SodaStream International Ltd. (b) | | 3,539 | 249,075 |

| Universal Electronics, Inc. (b) | | 3,375 | 179,213 |

| | | | 3,337,845 |

| Internet & Direct Marketing Retail - 7.6% | | | |

| Amazon.com, Inc. (b) | | 61,643 | 72,538,400 |

| Cnova NV (b) | | 51,096 | 281,028 |

| Ctrip.com International Ltd. ADR (b) | | 64,413 | 2,968,151 |

| Expedia, Inc. | | 18,829 | 2,306,553 |

| Groupon, Inc. (a)(b) | | 96,040 | 541,666 |

| HSN, Inc. | | 9,460 | 384,549 |

| JD.com, Inc. sponsored ADR (b) | | 131,035 | 4,907,261 |

| Liberty Expedia Holdings, Inc. | | 8,469 | 381,783 |

| Liberty Interactive Corp. QVC Group: | | | |

| (Venture Group) Series A (b) | | 11,255 | 628,142 |

| Series A (b) | | 59,763 | 1,458,217 |

| Liberty TripAdvisor Holdings, Inc. (b) | | 18,538 | 173,330 |

| MakeMyTrip Ltd. (a)(b) | | 10,045 | 305,368 |

| Netflix, Inc. (b) | | 60,381 | 11,326,268 |

| NutriSystem, Inc. | | 4,584 | 232,638 |

| Overstock.com, Inc. (a)(b) | | 8,256 | 388,858 |

| PetMed Express, Inc. (a) | | 3,487 | 137,213 |

| Priceline Group, Inc. (b) | | 6,818 | 11,861,343 |

| Shutterfly, Inc. (b) | | 7,008 | 309,613 |

| TripAdvisor, Inc. (b) | | 19,211 | 665,085 |

| | | | 111,795,466 |

| Leisure Products - 0.2% | | | |

| American Outdoor Brands Corp. (a)(b) | | 10,284 | 144,285 |

| Hasbro, Inc. | | 17,640 | 1,640,873 |

| Mattel, Inc. (a) | | 47,379 | 864,667 |

| | | | 2,649,825 |

| Media - 4.5% | | | |

| AMC Networks, Inc. Class A (b) | | 8,205 | 422,886 |

| Charter Communications, Inc. Class A (b) | | 36,285 | 11,836,530 |

| Comcast Corp. Class A | | 658,909 | 24,735,444 |

| Discovery Communications, Inc.: | | | |

| Class A (a)(b) | | 22,115 | 420,627 |

| Class C (non-vtg.) (b) | | 32,030 | 579,102 |

| DISH Network Corp. Class A (b) | | 31,478 | 1,594,361 |

| Liberty Broadband Corp.: | | | |

| Class A (b) | | 3,586 | 307,356 |

| Class C (b) | | 21,627 | 1,880,468 |

| Liberty Global PLC: | | | |

| Class A (b) | | 31,985 | 1,015,844 |

| Class C (b) | | 83,870 | 2,585,712 |

| LiLAC Class A (a)(b) | | 7,490 | 155,792 |

| LiLAC Class C (b) | | 17,472 | 362,544 |

| Liberty Media Corp.: | | | |

| Liberty Braves Class C (b) | | 9,873 | 223,525 |

| Liberty Formula One Group Series C (b) | | 29,610 | 1,077,804 |

| Liberty SiriusXM Series A (b) | | 17,539 | 715,065 |

| Liberty SiriusXM Series C (b) | | 32,118 | 1,310,736 |

| Loral Space & Communications Ltd. (b) | | 6,195 | 289,307 |

| MDC Partners, Inc. Class A (b) | | 16,910 | 196,156 |

| News Corp.: | | | |

| Class A | | 53,452 | 863,784 |

| Class B | | 27,488 | 450,803 |

| Nexstar Broadcasting Group, Inc. Class A | | 7,713 | 523,713 |

| Scholastic Corp. | | 8,313 | 341,831 |

| Scripps Networks Interactive, Inc. Class A | | 12,654 | 1,035,603 |

| Sinclair Broadcast Group, Inc. Class A (a) | | 11,765 | 400,598 |

| Sirius XM Holdings, Inc. (a) | | 664,307 | 3,653,689 |

| Twenty-First Century Fox, Inc.: | | | |

| Class A | | 148,305 | 4,736,862 |

| Class B | | 112,635 | 3,508,580 |

| Viacom, Inc.: | | | |

| Class A (a) | | 7,365 | 250,778 |

| Class B (non-vtg.) | | 49,871 | 1,412,347 |

| VisionChina Media, Inc. ADR (b)(c) | | 436 | 990 |

| | | | 66,888,837 |

| Multiline Retail - 0.3% | | | |

| Dollar Tree, Inc. (b) | | 33,824 | 3,475,754 |

| Ollie's Bargain Outlet Holdings, Inc. (b) | | 9,987 | 473,883 |

| Sears Holdings Corp. (a)(b) | | 19,723 | 80,470 |

| | | | 4,030,107 |

| Specialty Retail - 1.0% | | | |

| Bed Bath & Beyond, Inc. | | 22,300 | 499,297 |

| Conn's, Inc. (a)(b) | | 6,738 | 208,204 |

| Five Below, Inc. (b) | | 9,155 | 565,779 |

| Michaels Companies, Inc. (b) | | 31,997 | 691,135 |

| Monro, Inc. | | 7,455 | 376,105 |

| O'Reilly Automotive, Inc. (b) | | 12,866 | 3,039,078 |

| Office Depot, Inc. | | 80,478 | 263,163 |

| Rent-A-Center, Inc. (a) | | 10,808 | 121,482 |

| Ross Stores, Inc. | | 56,785 | 4,317,364 |

| Sleep Number Corp. (b) | | 7,115 | 250,377 |

| The Children's Place Retail Stores, Inc. | | 3,036 | 403,484 |

| Tile Shop Holdings, Inc. | | 12,658 | 105,061 |

| Tractor Supply Co. | | 19,486 | 1,329,725 |

| Ulta Beauty, Inc. | | 9,029 | 2,001,820 |

| Urban Outfitters, Inc. (a)(b) | | 22,728 | 707,295 |

| | | | 14,879,369 |

| Textiles, Apparel & Luxury Goods - 0.2% | | | |

| Columbia Sportswear Co. | | 12,229 | 859,821 |

| Crocs, Inc. (b) | | 25,338 | 276,944 |

| G-III Apparel Group Ltd. (b) | | 8,555 | 263,494 |

| lululemon athletica, Inc. (b) | | 17,984 | 1,204,209 |

| Steven Madden Ltd. (b) | | 11,747 | 502,184 |

| | | | 3,106,652 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 255,464,494 |

|

| CONSUMER STAPLES - 4.1% | | | |

| Beverages - 0.4% | | | |

| Coca-Cola Bottling Co. Consolidated | | 1,353 | 291,856 |

| MGP Ingredients, Inc. (a) | | 3,518 | 261,563 |

| Monster Beverage Corp. (b) | | 81,074 | 5,080,908 |

| National Beverage Corp. | | 6,748 | 736,342 |

| | | | 6,370,669 |

| Food & Staples Retailing - 1.7% | | | |

| Andersons, Inc. | | 7,725 | 249,518 |

| Casey's General Stores, Inc. | | 5,571 | 672,698 |

| Costco Wholesale Corp. | | 62,309 | 11,491,649 |

| PriceSmart, Inc. | | 5,699 | 487,265 |

| SpartanNash Co. | | 11,022 | 279,408 |

| Sprouts Farmers Market LLC (b) | | 22,444 | 524,741 |

| United Natural Foods, Inc. (b) | | 10,242 | 491,821 |

| Walgreens Boots Alliance, Inc. | | 151,639 | 11,033,254 |

| | | | 25,230,354 |

| Food Products - 1.9% | | | |

| Blue Buffalo Pet Products, Inc. (a)(b) | | 25,573 | 785,347 |

| Bob Evans Farms, Inc. | | 2,667 | 208,133 |

| Bridgford Foods Corp. (b) | | 2,509 | 31,488 |

| Cal-Maine Foods, Inc. (a)(b) | | 7,577 | 376,956 |

| Calavo Growers, Inc. (a) | | 2,908 | 222,171 |

| Hostess Brands, Inc. Class A (b) | | 14,986 | 210,703 |

| J&J Snack Foods Corp. | | 2,244 | 339,091 |

| Lancaster Colony Corp. | | 3,673 | 489,537 |

| Mondelez International, Inc. | | 214,453 | 9,208,612 |

| Pilgrim's Pride Corp. (a)(b) | | 35,078 | 1,286,310 |

| Sanderson Farms, Inc. | | 3,056 | 518,573 |

| Snyders-Lance, Inc. | | 12,724 | 492,164 |

| SunOpta, Inc. (a)(b) | | 15,550 | 122,845 |

| The Hain Celestial Group, Inc. (b) | | 14,108 | 579,839 |

| The Kraft Heinz Co. | | 169,991 | 13,832,168 |

| | | | 28,703,937 |

| Household Products - 0.1% | | | |

| Central Garden & Pet Co. Class A (non-vtg.) (b) | | 9,464 | 365,026 |

| WD-40 Co. | | 2,266 | 270,560 |

| | | | 635,586 |

| Personal Products - 0.0% | | | |

| Inter Parfums, Inc. | | 5,746 | 254,548 |

|

| TOTAL CONSUMER STAPLES | | | 61,195,094 |

|

| ENERGY - 0.6% | | | |

| Energy Equipment & Services - 0.1% | | | |

| Archrock Partners LP | | 19,592 | 214,532 |

| Mammoth Energy Services, Inc. (b) | | 10,888 | 205,239 |

| NCS Multistage Holdings, Inc. | | 12,704 | 213,427 |

| Patterson-UTI Energy, Inc. | | 33,642 | 726,331 |

| | | | 1,359,529 |

| Oil, Gas & Consumable Fuels - 0.5% | | | |

| Alliance Holdings GP, LP | | 10,556 | 260,944 |

| Alliance Resource Partners LP | | 18,008 | 328,646 |

| Amplify Energy Corp. warrants 5/4/22 | | 322 | 0 |

| Calumet Specialty Products Partners LP (b) | | 22,298 | 191,763 |

| Carrizo Oil & Gas, Inc. (b) | | 15,752 | 304,486 |

| Centennial Resource Development, Inc. Class A (b) | | 34,034 | 690,550 |

| Diamondback Energy, Inc. (b) | | 13,417 | 1,466,612 |

| Extraction Oil & Gas, Inc. (a)(b) | | 32,124 | 483,787 |

| Golar LNG Ltd. (a) | | 16,747 | 413,818 |

| Golar LNG Partners LP | | 10,734 | 214,573 |

| Green Plains, Inc. | | 7,493 | 126,257 |

| Gulfport Energy Corp. (b) | | 33,496 | 428,749 |

| Hongli Clean Energy Technologies Corp. (a)(b)(c) | | 225 | 1,042 |

| Nextdecade Corp. (a)(b) | | 30,212 | 287,316 |

| PDC Energy, Inc. (b) | | 11,210 | 515,100 |

| Tellurian, Inc. (a)(b) | | 30,157 | 380,581 |

| Ultra Petroleum Corp. (a) | | 29,722 | 285,034 |

| Viper Energy Partners LP | | 20,395 | 427,887 |

| | | | 6,807,145 |

|

| TOTAL ENERGY | | | 8,166,674 |

|

| FINANCIALS - 7.0% | | | |

| Banks - 3.3% | | | |

| 1st Source Corp. | | 6,377 | 328,097 |

| Ameris Bancorp | | 8,514 | 422,294 |

| BancFirst Corp. | | 7,121 | 404,473 |

| Bank of the Ozarks, Inc. | | 15,508 | 747,796 |

| Banner Corp. | | 7,203 | 414,821 |

| Blue Hills Bancorp, Inc. | | 11,203 | 239,184 |

| BOK Financial Corp. | | 7,713 | 686,457 |

| Boston Private Financial Holdings, Inc. | | 20,474 | 334,750 |

| Bridge Bancorp, Inc. | | 7,255 | 260,817 |

| Brookline Bancorp, Inc., Delaware | | 18,622 | 299,814 |

| Camden National Corp. | | 5,701 | 260,479 |

| Capital Bank Financial Corp. Series A | | 5,291 | 220,899 |

| Cathay General Bancorp | | 12,784 | 554,698 |

| Centerstate Banks of Florida, Inc. | | 14,196 | 385,137 |

| Chemical Financial Corp. | | 11,145 | 628,467 |

| City Holding Co. | | 4,178 | 297,557 |

| CoBiz, Inc. | | 14,090 | 298,426 |

| Columbia Banking Systems, Inc. | | 11,988 | 552,647 |

| Commerce Bancshares, Inc. | | 12,808 | 725,189 |

| Community Trust Bancorp, Inc. | | 5,729 | 285,018 |

| ConnectOne Bancorp, Inc. | | 10,667 | 289,609 |

| CVB Financial Corp. | | 21,632 | 531,931 |

| Eagle Bancorp, Inc. (b) | | 6,930 | 458,420 |

| East West Bancorp, Inc. | | 18,392 | 1,131,844 |

| Enterprise Financial Services Corp. | | 6,896 | 312,044 |

| Fifth Third Bancorp | | 103,155 | 3,147,259 |

| First Bancorp, North Carolina | | 7,985 | 302,632 |

| First Busey Corp. | | 11,254 | 358,215 |

| First Citizen Bancshares, Inc. | | 1,726 | 736,122 |

| First Financial Bancorp, Ohio | | 13,596 | 385,447 |

| First Financial Bankshares, Inc. (a) | | 12,463 | 591,369 |

| First Financial Corp., Indiana | | 4,894 | 235,891 |

| First Hawaiian, Inc. | | 24,913 | 729,204 |

| First Merchants Corp. | | 10,577 | 463,273 |

| First Midwest Bancorp, Inc., Delaware | | 18,224 | 455,053 |

| Flushing Financial Corp. | | 9,178 | 259,554 |

| Fulton Financial Corp. | | 21,371 | 406,049 |

| German American Bancorp, Inc. | | 7,378 | 277,487 |

| Glacier Bancorp, Inc. | | 14,543 | 582,447 |

| Great Southern Bancorp, Inc. | | 4,694 | 253,711 |

| Green Bancorp, Inc. (b) | | 7,052 | 157,965 |

| Grupo Financiero Galicia SA sponsored ADR | | 6,967 | 398,025 |

| Guaranty Bancorp | | 9,378 | 272,431 |

| Hancock Holding Co. | | 11,335 | 582,052 |

| Hanmi Financial Corp. | | 9,670 | 307,023 |

| HarborOne Bancorp, Inc. (b) | | 12,464 | 241,552 |

| Heartland Financial U.S.A., Inc. | | 7,401 | 373,751 |

| Home Bancshares, Inc. | | 20,933 | 498,205 |

| Hope Bancorp, Inc. | | 26,068 | 487,993 |

| Huntington Bancshares, Inc. | | 152,959 | 2,202,610 |

| IBERIABANK Corp. | | 5,852 | 454,993 |

| Independent Bank Corp., Massachusetts | | 5,897 | 428,712 |

| Independent Bank Group, Inc. | | 6,174 | 425,389 |

| International Bancshares Corp. | | 13,042 | 537,983 |

| Investors Bancorp, Inc. | | 34,641 | 494,327 |

| Lakeland Bancorp, Inc. | | 14,272 | 298,285 |

| Lakeland Financial Corp. | | 6,409 | 324,808 |

| LegacyTexas Financial Group, Inc. | | 10,567 | 442,440 |

| Live Oak Bancshares, Inc. | | 8,050 | 207,288 |

| MainSource Financial Group, Inc. | | 7,764 | 307,066 |

| MB Financial, Inc. | | 12,458 | 579,920 |

| NBT Bancorp, Inc. | | 9,624 | 373,796 |

| Old National Bancorp, Indiana | | 26,345 | 480,796 |

| Opus Bank (b) | | 7,926 | 221,135 |

| Pacific Premier Bancorp, Inc. (b) | | 9,689 | 383,684 |

| PacWest Bancorp | | 15,757 | 750,979 |

| People's Utah Bancorp | | 7,531 | 237,227 |

| Peoples United Financial, Inc. | | 41,731 | 793,724 |

| Pinnacle Financial Partners, Inc. | | 10,845 | 744,509 |

| Popular, Inc. | | 14,388 | 508,760 |

| Preferred Bank, Los Angeles | | 4,679 | 292,905 |

| Renasant Corp. | | 10,546 | 453,900 |

| Republic Bancorp, Inc., Kentucky Class A | | 6,515 | 277,278 |

| S&T Bancorp, Inc. | | 8,578 | 358,217 |

| Sandy Spring Bancorp, Inc. (a) | | 7,011 | 276,163 |

| Seacoast Banking Corp., Florida (b) | | 12,469 | 324,568 |

| ServisFirst Bancshares, Inc. (a) | | 10,865 | 456,221 |

| Signature Bank (b) | | 6,921 | 950,115 |

| Simmons First National Corp. Class A | | 6,930 | 401,247 |

| South State Corp. | | 4,793 | 441,196 |

| Southside Bancshares, Inc. | | 7,919 | 286,668 |

| State Bank Financial Corp. | | 10,423 | 317,276 |

| Stock Yards Bancorp, Inc. | | 7,250 | 288,550 |

| SVB Financial Group (b) | | 6,751 | 1,536,798 |

| Texas Capital Bancshares, Inc. (b) | | 7,417 | 670,126 |

| TowneBank | | 13,160 | 440,860 |

| Trico Bancshares | | 7,172 | 301,439 |

| Trustmark Corp. | | 13,675 | 464,130 |

| UMB Financial Corp. | | 7,708 | 579,333 |

| Umpqua Holdings Corp. | | 23,971 | 529,999 |

| Union Bankshares Corp. | | 10,642 | 401,097 |

| United Bankshares, Inc., West Virginia (a) | | 14,721 | 552,774 |

| United Community Bank, Inc. | | 15,477 | 444,809 |

| Univest Corp. of Pennsylvania | | 8,577 | 241,014 |

| Washington Trust Bancorp, Inc. | | 5,158 | 293,232 |

| WesBanco, Inc. | | 9,540 | 401,348 |

| Westamerica Bancorp. (a) | | 6,097 | 376,978 |

| Wintrust Financial Corp. | | 6,198 | 519,702 |

| Xenith Bankshares, Inc. (b) | | 8,083 | 284,117 |

| Zions Bancorporation | | 25,927 | 1,284,683 |

| | | | 49,218,752 |

| Capital Markets - 2.0% | | | |

| BGC Partners, Inc. Class A | | 31,427 | 513,203 |

| Brighthouse Financial, Inc. | | 14,662 | 861,979 |

| Carlyle Group LP | | 12,377 | 248,778 |

| CBOE Holdings, Inc. | | 10,327 | 1,274,662 |

| CME Group, Inc. | | 48,073 | 7,188,836 |

| Diamond Hill Investment Group, Inc. | | 1,185 | 250,106 |

| E*TRADE Financial Corp. (b) | | 40,286 | 1,939,368 |

| Financial Engines, Inc. | | 9,878 | 275,596 |

| Interactive Brokers Group, Inc. | | 13,040 | 744,062 |

| LPL Financial | | 11,851 | 614,356 |

| MarketAxess Holdings, Inc. | | 4,971 | 970,687 |

| Morningstar, Inc. | | 7,307 | 674,436 |

| Northern Trust Corp. | | 33,659 | 3,291,177 |

| SEI Investments Co. | | 20,289 | 1,427,534 |

| T. Rowe Price Group, Inc. | | 35,352 | 3,638,428 |

| TD Ameritrade Holding Corp. | | 76,391 | 3,908,927 |

| The NASDAQ OMX Group, Inc. | | 22,020 | 1,743,103 |

| WisdomTree Investments, Inc. (a) | | 23,159 | 266,329 |

| | | | 29,831,567 |

| Consumer Finance - 0.2% | | | |

| Credit Acceptance Corp. (a)(b) | | 2,979 | 902,339 |

| Encore Capital Group, Inc. (b) | | 6,189 | 283,456 |

| Navient Corp. | | 47,619 | 600,476 |

| PRA Group, Inc. (a)(b) | | 7,855 | 273,354 |

| SLM Corp. (b) | | 69,477 | 803,849 |

| World Acceptance Corp. (b) | | 1,470 | 121,981 |

| | | | 2,985,455 |

| Diversified Financial Services - 0.1% | | | |

| GTY Technology Holdings, Inc. Class A (b) | | 5,935 | 58,638 |

| Quantenna Communications, Inc. (a)(b) | | 7,458 | 91,211 |

| Silver Run Acquisition Corp. II Class A | | 11,048 | 110,038 |

| Varex Imaging Corp. | | 6,735 | 249,666 |

| | | | 509,553 |

| Insurance - 0.9% | | | |

| American National Insurance Co. | | 4,989 | 625,371 |

| Amerisafe, Inc. | | 4,002 | 262,731 |

| AmTrust Financial Services, Inc. (a) | | 25,825 | 248,953 |

| Arch Capital Group Ltd. (b) | | 17,330 | 1,640,978 |

| Argo Group International Holdings, Ltd. | | 5,992 | 367,010 |

| Cincinnati Financial Corp. | | 21,690 | 1,620,894 |

| Enstar Group Ltd. (b) | | 2,073 | 459,480 |

| Erie Indemnity Co. Class A | | 7,209 | 893,123 |

| Infinity Property & Casualty Corp. | | 3,119 | 336,228 |

| James River Group Holdings Ltd. | | 7,431 | 300,807 |

| Kinsale Capital Group, Inc. | | 4,897 | 218,357 |

| Maiden Holdings Ltd. | | 30,433 | 197,815 |

| National General Holdings Corp. | | 21,231 | 448,611 |

| National Western Life Group, Inc. | | 455 | 160,838 |

| Navigators Group, Inc. | | 6,682 | 344,123 |

| Safety Insurance Group, Inc. | | 4,347 | 357,975 |

| Selective Insurance Group, Inc. | | 8,983 | 549,760 |

| State Auto Financial Corp. | | 11,144 | 311,029 |

| Trupanion, Inc. (a)(b) | | 9,642 | 287,139 |

| United Fire Group, Inc. | | 6,922 | 332,671 |

| United Insurance Holdings Corp. | | 12,587 | 210,077 |

| Willis Group Holdings PLC | | 18,521 | 2,978,177 |

| | | | 13,152,147 |

| Mortgage Real Estate Investment Trusts - 0.1% | | | |

| AGNC Investment Corp. | | 44,739 | 890,306 |

| American Capital Mortgage Investment Corp. | | 13,921 | 258,235 |

| | | | 1,148,541 |

| Real Estate Management & Development - 0.0% | | | |

| The RMR Group, Inc. | | 4,930 | 297,033 |

| Thrifts & Mortgage Finance - 0.4% | | | |

| Beneficial Bancorp, Inc. | | 19,416 | 329,101 |

| BofI Holding, Inc. (a)(b) | | 10,722 | 296,356 |

| Capitol Federal Financial, Inc. | | 29,742 | 418,173 |

| HomeStreet, Inc. (b) | | 9,194 | 280,417 |

| Kearny Financial Corp. | | 21,635 | 320,198 |

| Lendingtree, Inc. (b) | | 1,746 | 527,205 |

| Meridian Bancorp, Inc. Maryland | | 15,178 | 305,837 |

| Meta Financial Group, Inc. | | 1,538 | 144,495 |

| NMI Holdings, Inc. (b) | | 21,023 | 358,442 |

| Northfield Bancorp, Inc. | | 15,625 | 277,188 |

| Northwest Bancshares, Inc. | | 23,290 | 394,300 |

| OceanFirst Financial Corp. | | 10,296 | 285,714 |

| TFS Financial Corp. | | 48,540 | 739,264 |

| Trustco Bank Corp., New York | | 31,240 | 292,094 |

| United Financial Bancorp, Inc. New | | 15,458 | 288,137 |

| Washington Federal, Inc. | | 10,410 | 362,268 |

| WSFS Financial Corp. | | 7,325 | 370,645 |

| | | | 5,989,834 |

|

| TOTAL FINANCIALS | | | 103,132,882 |

|

| HEALTH CARE - 11.9% | | | |

| Biotechnology - 7.3% | | | |

| Abeona Therapeutics, Inc. (a)(b) | | 8,697 | 150,458 |

| AC Immune SA (a)(b) | | 17,571 | 206,459 |

| ACADIA Pharmaceuticals, Inc. (b) | | 19,599 | 592,870 |

| Acceleron Pharma, Inc. (b) | | 7,769 | 283,491 |

| Achaogen, Inc. (a)(b) | | 7,490 | 89,580 |

| Acorda Therapeutics, Inc. (a)(b) | | 9,504 | 192,931 |

| Aduro Biotech, Inc. (b) | | 21,374 | 203,053 |

| Advanced Accelerator Applications SA sponsored ADR (b) | | 6,973 | 567,254 |

| Agios Pharmaceuticals, Inc. (a)(b) | | 7,989 | 491,723 |

| Aimmune Therapeutics, Inc. (a)(b) | | 12,286 | 469,325 |

| Akebia Therapeutics, Inc. (b) | | 12,654 | 196,896 |

| Alder Biopharmaceuticals, Inc. (b) | | 12,208 | 134,288 |

| Alexion Pharmaceuticals, Inc. (b) | | 31,629 | 3,473,180 |

| Alkermes PLC (b) | | 22,738 | 1,188,970 |

| Alnylam Pharmaceuticals, Inc. (b) | | 13,133 | 1,766,914 |

| AMAG Pharmaceuticals, Inc. (a)(b) | | 7,875 | 109,856 |

| Amarin Corp. PLC ADR (a)(b) | | 57,895 | 189,317 |

| Amgen, Inc. | | 101,954 | 17,909,240 |

| Amicus Therapeutics, Inc. (a)(b) | | 25,013 | 348,181 |

| AnaptysBio, Inc. | | 6,021 | 506,065 |

| Arena Pharmaceuticals, Inc. (b) | | 8,920 | 276,431 |

| Array BioPharma, Inc. (b) | | 27,792 | 312,660 |

| Ascendis Pharma A/S sponsored ADR (b) | | 6,228 | 231,059 |

| Audentes Therapeutics, Inc. (b) | | 7,952 | 229,495 |

| Axovant Sciences Ltd. (a)(b) | | 14,706 | 81,177 |

| BeiGene Ltd. ADR (a)(b) | | 3,923 | 313,840 |

| Biogen, Inc. (b) | | 29,903 | 9,633,850 |

| BioMarin Pharmaceutical, Inc. (b) | | 25,447 | 2,183,353 |

| Bioverativ, Inc. | | 15,616 | 781,112 |

| bluebird bio, Inc. (a)(b) | | 6,067 | 1,048,378 |

| Blueprint Medicines Corp. (b) | | 6,588 | 494,495 |

| Calyxt, Inc. (a) | | 6,418 | 122,841 |

| Celgene Corp. (b) | | 108,989 | 10,989,361 |

| China Biologic Products Holdings, Inc. | | 4,615 | 385,768 |

| Clovis Oncology, Inc. (b) | | 6,599 | 414,879 |

| Coherus BioSciences, Inc. (a)(b) | | 10,130 | 90,664 |

| CRISPR Therapeutics AG(b) | | 8,347 | 158,510 |

| Cytokinetics, Inc. (b) | | 9,487 | 81,588 |

| CytomX Therapeutics, Inc. (b) | | 12,054 | 249,518 |

| DBV Technologies SA sponsored ADR (b) | | 5,608 | 128,087 |

| Dyax Corp. rights 12/31/19 (b)(c) | | 12,922 | 43,547 |

| Dynavax Technologies Corp. (b) | | 8,591 | 171,820 |

| Eagle Pharmaceuticals, Inc. (a)(b) | | 2,589 | 152,906 |

| Editas Medicine, Inc. (b) | | 8,990 | 259,541 |

| Enanta Pharmaceuticals, Inc. (b) | | 4,490 | 222,973 |

| Epizyme, Inc. (a)(b) | | 11,750 | 141,000 |

| Esperion Therapeutics, Inc. (a)(b) | | 3,781 | 232,569 |

| Exact Sciences Corp. (b) | | 14,294 | 850,207 |

| Exelixis, Inc. (b) | | 43,107 | 1,167,338 |

| FibroGen, Inc. (b) | | 13,007 | 617,833 |

| Five Prime Therapeutics, Inc. (b) | | 8,044 | 211,959 |

| Flexion Therapeutics, Inc. (a)(b) | | 8,633 | 223,681 |

| Foundation Medicine, Inc. (b) | | 5,849 | 311,167 |

| Genomic Health, Inc. (b) | | 8,987 | 272,216 |

| Gilead Sciences, Inc. | | 182,362 | 13,637,030 |

| Global Blood Therapeutics, Inc. (b) | | 7,294 | 287,748 |

| Grifols SA ADR | | 23,631 | 537,605 |

| Halozyme Therapeutics, Inc. (b) | | 23,036 | 430,082 |

| Ignyta, Inc. (b) | | 12,786 | 209,690 |

| ImmunoGen, Inc. (b) | | 19,434 | 123,406 |

| Immunomedics, Inc. (a)(b) | | 17,310 | 187,987 |

| Incyte Corp. (b) | | 29,665 | 2,936,538 |

| Inovio Pharmaceuticals, Inc. (a)(b) | | 20,112 | 92,314 |

| Insmed, Inc. (b) | | 12,608 | 393,244 |

| Insys Therapeutics, Inc. (a)(b) | | 13,999 | 74,195 |

| Intellia Therapeutics, Inc. (a)(b) | | 9,132 | 205,653 |

| Intercept Pharmaceuticals, Inc. (a)(b) | | 4,281 | 262,896 |

| Ionis Pharmaceuticals, Inc. (a)(b) | | 18,148 | 1,007,033 |

| Ironwood Pharmaceuticals, Inc. Class A (a)(b) | | 25,948 | 448,122 |

| Jounce Therapeutics, Inc. | | 7,520 | 118,515 |

| Juno Therapeutics, Inc. (b) | | 17,622 | 962,514 |

| Keryx Biopharmaceuticals, Inc. (a)(b) | | 22,789 | 109,159 |

| La Jolla Pharmaceutical Co. (b) | | 5,134 | 171,219 |

| Lexicon Pharmaceuticals, Inc. (a)(b) | | 20,858 | 213,169 |

| Ligand Pharmaceuticals, Inc.: | | | |

| Class B (b) | | 2,681 | 353,490 |

| General CVR (b) | | 1,530 | 18 |

| Glucagon CVR (b) | | 1,530 | 145 |

| rights (b) | | 1,530 | 11 |

| TR Beta CVR (b) | | 1,530 | 17 |

| Loxo Oncology, Inc. (b) | | 4,090 | 313,908 |

| Macrogenics, Inc. (b) | | 13,180 | 254,638 |

| MiMedx Group, Inc. (a)(b) | | 19,618 | 226,980 |

| Momenta Pharmaceuticals, Inc. (b) | | 13,708 | 189,170 |

| Myriad Genetics, Inc. (b) | | 10,831 | 375,078 |

| Natera, Inc. (b) | | 14,945 | 145,415 |

| Neurocrine Biosciences, Inc. (b) | | 13,858 | 996,252 |

| Novelion Therapeutics, Inc. (b) | | 25 | 95 |

| Novelion Therapeutics, Inc.: | | | |

| warrants (c) | | 5,463 | 0 |

| warrants (c) | | 5,463 | 0 |

| Opko Health, Inc. (a)(b) | | 91,149 | 478,532 |

| Portola Pharmaceuticals, Inc. (b) | | 8,847 | 448,985 |

| Prothena Corp. PLC (a)(b) | | 7,199 | 334,682 |

| PTC Therapeutics, Inc. (a)(b) | | 6,855 | 109,337 |

| Puma Biotechnology, Inc. (b) | | 4,764 | 504,508 |

| Radius Health, Inc. (a)(b) | | 7,831 | 221,696 |

| Regeneron Pharmaceuticals, Inc. (b) | | 14,915 | 5,397,142 |

| REGENXBIO, Inc. (b) | | 7,463 | 209,710 |

| Repligen Corp. (b) | | 5,889 | 208,765 |

| Retrophin, Inc. (b) | | 11,272 | 254,071 |

| Sage Therapeutics, Inc. (b) | | 5,872 | 542,632 |

| Sangamo Therapeutics, Inc. (b) | | 15,490 | 250,938 |

| Sarepta Therapeutics, Inc. (b) | | 9,349 | 520,459 |

| Seattle Genetics, Inc. (b) | | 20,906 | 1,273,803 |

| Shire PLC sponsored ADR | | 10,440 | 1,552,950 |

| Spark Therapeutics, Inc. (a)(b) | | 5,795 | 424,368 |

| Spectrum Pharmaceuticals, Inc. (b) | | 17,664 | 346,214 |

| Synergy Pharmaceuticals, Inc. (a)(b) | | 44,795 | 93,174 |

| TESARO, Inc. (a)(b) | | 7,786 | 658,696 |

| TG Therapeutics, Inc. (a)(b) | | 10,394 | 89,388 |

| Tobira Therapeutics, Inc. rights (a)(c) | | 1,750 | 12,338 |

| Ultragenyx Pharmaceutical, Inc. (b) | | 7,442 | 375,747 |

| United Therapeutics Corp. (b) | | 6,212 | 807,498 |

| Versartis, Inc. (b) | | 8,299 | 16,183 |

| Vertex Pharmaceuticals, Inc. (b) | | 35,635 | 5,141,774 |

| Xencor, Inc. (b) | | 11,348 | 246,365 |

| ZIOPHARM Oncology, Inc. (a)(b) | | 31,230 | 142,721 |

| | | | 108,081,886 |

| Health Care Equipment & Supplies - 1.8% | | | |

| Abaxis, Inc. | | 4,804 | 234,147 |

| Abiomed, Inc. (b) | | 5,961 | 1,161,441 |

| Align Technology, Inc. (b) | | 11,393 | 2,972,206 |

| Analogic Corp. | | 3,578 | 296,258 |

| Anika Therapeutics, Inc. (b) | | 4,058 | 223,677 |

| Atrion Corp. | | 325 | 219,245 |

| AxoGen, Inc. (b) | | 12,125 | 323,738 |

| Cardiovascular Systems, Inc. (b) | | 5,786 | 144,997 |

| CONMED Corp. | | 5,873 | 314,206 |

| Dentsply Sirona, Inc. | | 33,270 | 2,229,423 |

| DexCom, Inc. (a)(b) | | 12,483 | 729,382 |

| Heska Corp. (b) | | 1,294 | 111,064 |

| Hologic, Inc. (b) | | 40,277 | 1,680,356 |

| ICU Medical, Inc. (b) | | 2,557 | 545,664 |

| IDEXX Laboratories, Inc. (b) | | 12,644 | 1,977,648 |

| Inogen, Inc. (b) | | 3,170 | 408,106 |

| Insulet Corp. (b) | | 9,553 | 685,237 |

| Integra LifeSciences Holdings Corp. (b) | | 10,332 | 502,342 |

| Intuitive Surgical, Inc. (b) | | 15,273 | 6,105,840 |

| iRhythm Technologies, Inc. (b) | | 4,180 | 231,990 |

| K2M Group Holdings, Inc. (b) | | 9,630 | 189,326 |

| Lantheus Holdings, Inc. (b) | | 7,356 | 164,774 |

| LeMaitre Vascular, Inc. | | 5,229 | 172,191 |

| LivaNova PLC (b) | | 6,593 | 574,778 |

| Masimo Corp. (b) | | 6,385 | 567,243 |

| Mazor Robotics Ltd. sponsored ADR (b) | | 4,080 | 237,252 |

| Meridian Bioscience, Inc. (a) | | 15,707 | 236,390 |

| Merit Medical Systems, Inc. (b) | | 6,995 | 303,933 |

| Natus Medical, Inc. (b) | | 6,598 | 264,250 |

| Neogen Corp. (b) | | 7,374 | 618,679 |

| Novocure Ltd. (a)(b) | | 15,554 | 299,415 |

| NuVasive, Inc. (b) | | 6,838 | 394,484 |

| NxStage Medical, Inc. (b) | | 11,101 | 285,185 |

| OraSure Technologies, Inc. (b) | | 9,880 | 163,514 |

| Orthofix International NV (b) | | 4,752 | 257,653 |

| Quidel Corp. (b) | | 8,316 | 315,925 |

| Synergetics U.S.A., Inc. (b)(c) | | 3,200 | 0 |

| Tactile Systems Technology, Inc. (b) | | 4,553 | 135,816 |

| Wright Medical Group NV (a)(b) | | 15,521 | 377,316 |

| | | | 26,655,091 |

| Health Care Providers & Services - 0.8% | | | |

| Acadia Healthcare Co., Inc. (a)(b) | | 13,698 | 436,007 |

| Almost Family, Inc. (b) | | 2,773 | 164,716 |

| Amedisys, Inc. (b) | | 6,145 | 331,830 |

| BioTelemetry, Inc. (b) | | 4,296 | 124,584 |

| Corvel Corp. (b) | | 5,388 | 297,687 |

| Express Scripts Holding Co. (b) | | 79,581 | 5,187,090 |

| G1 Therapeutics, Inc. | | 7,472 | 153,550 |

| HealthEquity, Inc. (b) | | 9,004 | 467,037 |

| Henry Schein, Inc. (b) | | 23,756 | 1,697,366 |

| iKang Healthcare Group, Inc. sponsored ADR (b) | | 13,973 | 204,565 |

| LHC Group, Inc. (b) | | 3,376 | 222,040 |

| LifePoint Hospitals, Inc. (b) | | 7,765 | 371,167 |

| Magellan Health Services, Inc. (b) | | 4,170 | 352,365 |

| National Research Corp. Class A | | 6,421 | 217,993 |

| National Vision Holdings, Inc. | | 9,572 | 311,951 |

| Patterson Companies, Inc. | | 11,306 | 413,234 |

| Premier, Inc. (b) | | 7,459 | 216,460 |

| Surgery Partners, Inc. (a)(b) | | 9,610 | 90,334 |

| The Ensign Group, Inc. | | 10,693 | 259,519 |

| Tivity Health, Inc. (b) | | 5,125 | 188,600 |

| | | | 11,708,095 |

| Health Care Technology - 0.4% | | | |

| Allscripts Healthcare Solutions, Inc. (b) | | 30,134 | 430,916 |

| athenahealth, Inc. (b) | | 5,603 | 744,583 |

| Cerner Corp. (b) | | 44,507 | 3,146,200 |

| HMS Holdings Corp. (b) | | 17,718 | 292,879 |

| Inovalon Holdings, Inc. Class A (b) | | 14,940 | 237,546 |

| Medidata Solutions, Inc. (b) | | 8,526 | 568,173 |

| NantHealth, Inc. (a)(b) | | 30,943 | 99,946 |

| Omnicell, Inc. (b) | | 7,495 | 392,738 |

| Quality Systems, Inc. (b) | | 14,555 | 210,029 |

| | | | 6,123,010 |

| Life Sciences Tools & Services - 0.7% | | | |

| Accelerate Diagnostics, Inc. (a)(b) | | 8,759 | 258,828 |

| Bio-Techne Corp. | | 4,211 | 567,432 |

| Bruker Corp. | | 21,738 | 764,743 |

| ICON PLC (b) | | 7,250 | 846,873 |

| Illumina, Inc. (b) | | 20,726 | 4,767,602 |

| INC Research Holdings, Inc. Class A (b) | | 14,265 | 546,350 |

| Luminex Corp. | | 9,422 | 201,254 |

| Medpace Holdings, Inc. (b) | | 6,495 | 216,348 |

| NeoGenomics, Inc. (a)(b) | | 19,613 | 181,224 |

| Pacific Biosciences of California, Inc. (a)(b) | | 30,233 | 96,443 |

| PRA Health Sciences, Inc. (b) | | 7,456 | 614,151 |

| QIAGEN NV (b) | | 28,723 | 916,264 |

| | | | 9,977,512 |

| Pharmaceuticals - 0.9% | | | |

| Aclaris Therapeutics, Inc. (b) | | 8,231 | 195,157 |

| Aerie Pharmaceuticals, Inc. (b) | | 5,554 | 356,845 |

| Akcea Therapeutics, Inc. (a) | | 12,355 | 235,857 |

| Akorn, Inc. (b) | | 15,357 | 499,870 |

| Amphastar Pharmaceuticals, Inc. (b) | | 10,208 | 199,975 |

| ANI Pharmaceuticals, Inc. rights (b)(c) | | 739 | 0 |

| AstraZeneca PLC rights (b)(c) | | 1,845 | 0 |

| Athenex, Inc. (a) | | 12,232 | 209,290 |

| Avexis, Inc. (b) | | 4,470 | 423,801 |

| BeyondSpring, Inc. (a) | | 4,430 | 144,019 |

| Corcept Therapeutics, Inc. (b) | | 19,851 | 356,127 |

| Dermira, Inc. (b) | | 7,940 | 203,264 |

| Dova Pharmaceuticals, Inc. (a) | | 7,069 | 211,151 |

| Endo International PLC (b) | | 35,682 | 261,906 |

| GW Pharmaceuticals PLC ADR (b) | | 4,395 | 547,134 |

| Horizon Pharma PLC (b) | | 28,095 | 404,006 |

| Impax Laboratories, Inc. (b) | | 12,942 | 215,484 |

| Innoviva, Inc. (a)(b) | | 22,836 | 299,608 |

| Intersect ENT, Inc. (b) | | 5,164 | 157,760 |

| Intra-Cellular Therapies, Inc. (b) | | 9,807 | 152,009 |

| Jazz Pharmaceuticals PLC (b) | | 8,683 | 1,213,362 |

| Kala Pharmaceuticals, Inc. (a) | | 4,768 | 91,307 |

| Mylan N.V. (b) | | 78,836 | 2,879,879 |

| MyoKardia, Inc. (b) | | 6,286 | 231,011 |

| Nektar Therapeutics (b) | | 24,822 | 1,340,140 |

| Omeros Corp. (a)(b) | | 7,196 | 149,317 |

| Pacira Pharmaceuticals, Inc. (b) | | 7,145 | 330,099 |

| Paratek Pharmaceuticals, Inc. (a)(b) | | 6,885 | 129,782 |

| Reata Pharmaceuticals, Inc. (b) | | 5,382 | 136,703 |

| Revance Therapeutics, Inc. (a)(b) | | 7,285 | 202,159 |

| Supernus Pharmaceuticals, Inc. (b) | | 8,257 | 312,115 |

| The Medicines Company (a)(b) | | 11,814 | 342,606 |

| TherapeuticsMD, Inc. (a)(b) | | 26,980 | 169,974 |

| Theravance Biopharma, Inc. (a)(b) | | 9,864 | 280,631 |

| WAVE Life Sciences (a)(b) | | 7,982 | 296,930 |

| | | | 13,179,278 |

|

| TOTAL HEALTH CARE | | | 175,724,872 |

|

| INDUSTRIALS - 4.3% | | | |

| Aerospace & Defense - 0.2% | | | |

| AeroVironment, Inc. (b) | | 4,574 | 208,483 |

| Axon Enterprise, Inc. (a)(b) | | 10,124 | 251,885 |

| Elbit Systems Ltd. (a) | | 6,766 | 943,857 |

| KLX, Inc. (b) | | 9,027 | 506,505 |

| Kratos Defense & Security Solutions, Inc. (b) | | 17,204 | 179,438 |

| Mercury Systems, Inc. (b) | | 8,399 | 438,344 |

| | | | 2,528,512 |

| Air Freight & Logistics - 0.3% | | | |

| Air Transport Services Group, Inc. (b) | | 9,233 | 223,900 |

| Atlas Air Worldwide Holdings, Inc. (b) | | 4,734 | 273,389 |

| C.H. Robinson Worldwide, Inc. (a) | | 18,340 | 1,589,161 |

| Expeditors International of Washington, Inc. | | 23,469 | 1,520,322 |

| Forward Air Corp. | | 6,400 | 364,160 |

| Hub Group, Inc. Class A (b) | | 6,107 | 291,915 |

| | | | 4,262,847 |

| Airlines - 0.5% | | | |

| Allegiant Travel Co. | | 2,745 | 417,240 |

| American Airlines Group, Inc. | | 68,613 | 3,464,270 |

| Hawaiian Holdings, Inc. | | 7,822 | 337,519 |

| JetBlue Airways Corp. (b) | | 42,029 | 902,363 |

| Ryanair Holdings PLC sponsored ADR (b) | | 14,241 | 1,736,548 |

| SkyWest, Inc. | | 8,941 | 465,379 |

| Spirit Airlines, Inc. (b) | | 9,081 | 387,123 |

| | | | 7,710,442 |

| Building Products - 0.2% | | | |

| AAON, Inc. | | 10,986 | 400,440 |

| American Woodmark Corp. (b) | | 2,483 | 247,307 |

| Apogee Enterprises, Inc. | | 4,083 | 204,272 |

| Builders FirstSource, Inc. (b) | | 16,810 | 342,924 |

| Caesarstone Sdot-Yam Ltd. (b) | | 7,203 | 179,355 |

| Gibraltar Industries, Inc. (b) | | 5,868 | 193,057 |

| Patrick Industries, Inc. (b) | | 3,332 | 337,198 |

| Universal Forest Products, Inc. | | 9,590 | 375,544 |

| | | | 2,280,097 |

| Commercial Services & Supplies - 0.6% | | | |

| Casella Waste Systems, Inc. Class A (b) | | 12,636 | 269,400 |

| Cintas Corp. | | 15,329 | 2,413,398 |

| Copart, Inc. (b) | | 28,808 | 1,243,353 |

| Healthcare Services Group, Inc. | | 11,175 | 580,318 |

| Herman Miller, Inc. | | 10,778 | 385,314 |

| Interface, Inc. | | 15,590 | 388,971 |

| Kimball International, Inc. Class B | | 13,300 | 246,582 |

| Matthews International Corp. Class A | | 6,630 | 375,590 |

| McGrath RentCorp. | | 6,817 | 325,853 |

| Mobile Mini, Inc. | | 10,697 | 384,022 |

| Multi-Color Corp. | | 3,168 | 242,352 |

| SP Plus Corp. (b) | | 6,259 | 245,353 |

| Stericycle, Inc. (b) | | 11,528 | 764,422 |

| Tetra Tech, Inc. | | 9,362 | 468,100 |

| U.S. Ecology, Inc. | | 5,395 | 277,573 |

| | | | 8,610,601 |

| Construction & Engineering - 0.0% | | | |

| Aegion Corp. (b) | | 11,164 | 308,461 |

| Primoris Services Corp. | | 12,221 | 342,066 |

| | | | 650,527 |

| Electrical Equipment - 0.1% | | | |

| Ballard Power Systems, Inc. (a)(b) | | 46,173 | 220,459 |

| Encore Wire Corp. | | 5,582 | 260,121 |

| Sunrun, Inc. (a)(b) | | 23,636 | 132,362 |

| TPI Composites, Inc. (b) | | 8,566 | 162,240 |

| | | | 775,182 |

| Industrial Conglomerates - 0.1% | | | |

| Icahn Enterprises LP | | 25,371 | 1,350,498 |

| Raven Industries, Inc. | | 7,293 | 278,593 |

| | | | 1,629,091 |

| Machinery - 0.7% | | | |

| Altra Industrial Motion Corp. | | 6,612 | 321,343 |

| American Railcar Industries, Inc. (a) | | 6,609 | 267,797 |

| Astec Industries, Inc. | | 5,555 | 307,580 |

| Chart Industries, Inc. (b) | | 8,088 | 393,724 |

| Columbus McKinnon Corp. (NY Shares) | | 6,713 | 268,117 |

| Franklin Electric Co., Inc. | | 9,529 | 441,193 |

| Kornit Digital Ltd. (a)(b) | | 6,648 | 118,334 |

| Lincoln Electric Holdings, Inc. | | 7,958 | 725,292 |

| Middleby Corp. (b) | | 7,201 | 918,272 |

| NN, Inc. | | 5,712 | 159,650 |

| Nordson Corp. | | 7,237 | 928,941 |

| Omega Flex, Inc. | | 3,302 | 213,243 |

| PACCAR, Inc. | | 49,998 | 3,516,359 |

| RBC Bearings, Inc. (b) | | 3,403 | 454,130 |

| Sun Hydraulics Corp. | | 6,348 | 385,070 |

| TriMas Corp. (b) | | 10,402 | 269,412 |

| Woodward, Inc. | | 7,292 | 564,036 |

| | | | 10,252,493 |

| Marine - 0.0% | | | |

| Golden Ocean Group Ltd. (b) | | 29,090 | 235,922 |

| Star Bulk Carriers Corp. (a)(b) | | 13,868 | 139,651 |

| | | | 375,573 |

| Professional Services - 0.4% | | | |

| 51job, Inc. sponsored ADR (b) | | 4,789 | 275,368 |

| Exponent, Inc. | | 4,232 | 319,516 |

| Forrester Research, Inc. | | 5,957 | 276,703 |

| Huron Consulting Group, Inc. (b) | | 7,414 | 303,233 |

| ICF International, Inc. (b) | | 4,405 | 238,090 |

| IHS Markit Ltd. (b) | | 54,284 | 2,422,152 |

| Kelly Services, Inc. Class A (non-vtg.) | | 11,235 | 327,500 |

| Verisk Analytics, Inc. (b) | | 23,140 | 2,231,159 |

| | | | 6,393,721 |

| Road & Rail - 0.9% | | | |

| AMERCO | | 2,768 | 1,026,015 |

| ArcBest Corp. | | 7,702 | 291,521 |

| Avis Budget Group, Inc. (a)(b) | | 13,231 | 504,101 |

| CSX Corp. | | 127,908 | 7,130,871 |

| Heartland Express, Inc. | | 7,438 | 169,884 |

| J.B. Hunt Transport Services, Inc. | | 14,566 | 1,618,865 |

| Landstar System, Inc. | | 4,553 | 469,870 |

| Marten Transport Ltd. | | 14,083 | 283,772 |

| Old Dominion Freight Lines, Inc. | | 10,442 | 1,349,524 |

| Saia, Inc. (b) | | 4,440 | 292,152 |

| Universal Logistics Holdings, Inc. | | 11,756 | 274,503 |

| Werner Enterprises, Inc. | | 12,299 | 469,822 |

| | | | 13,880,900 |

| Trading Companies & Distributors - 0.3% | | | |

| Beacon Roofing Supply, Inc. (b) | | 7,527 | 482,330 |

| BMC Stock Holdings, Inc. (b) | | 9,064 | 209,378 |

| Fastenal Co. (a) | | 40,498 | 2,121,690 |

| H&E Equipment Services, Inc. | | 8,948 | 332,776 |

| HD Supply Holdings, Inc. (b) | | 26,401 | 976,309 |

| Rush Enterprises, Inc. Class A (b) | | 7,692 | 374,677 |

| | | | 4,497,160 |

| Transportation Infrastructure - 0.0% | | | |

| Yangtze River Development Ltd. (b) | | 26,684 | 413,335 |

|

| TOTAL INDUSTRIALS | | | 64,260,481 |

|

| INFORMATION TECHNOLOGY - 49.8% | | | |

| Communications Equipment - 2.4% | | | |

| ADTRAN, Inc. | | 12,727 | 293,994 |

| Applied Optoelectronics, Inc. (a)(b) | | 2,880 | 125,741 |

| Arris International PLC (b) | | 26,528 | 795,044 |

| Cisco Systems, Inc. | | 699,112 | 26,076,878 |

| CommScope Holding Co., Inc. (b) | | 26,745 | 962,553 |

| EchoStar Holding Corp. Class A (b) | | 6,951 | 416,017 |

| Extreme Networks, Inc. (b) | | 17,308 | 222,408 |

| F5 Networks, Inc. (b) | | 8,491 | 1,139,492 |

| Finisar Corp. (b) | | 16,813 | 336,428 |

| Infinera Corp. (b) | | 26,327 | 190,607 |

| InterDigital, Inc. | | 5,134 | 390,697 |

| Ituran Location & Control Ltd. | | 7,435 | 264,686 |

| Lumentum Holdings, Inc. (a)(b) | | 9,034 | 488,288 |

| Mitel Networks Corp. (b) | | 33,989 | 265,794 |

| NETGEAR, Inc. (b) | | 6,320 | 325,480 |

| NetScout Systems, Inc. (b) | | 14,241 | 442,183 |

| Oclaro, Inc. (a)(b) | | 25,167 | 179,189 |

| Radware Ltd. (b) | | 14,500 | 293,480 |

| Sierra Wireless, Inc. (b) | | 5,724 | 129,285 |

| Telefonaktiebolaget LM Ericsson (B Shares) sponsored ADR (a) | | 65,113 | 406,956 |

| Ubiquiti Networks, Inc. (a)(b) | | 11,629 | 777,166 |

| ViaSat, Inc. (a)(b) | | 8,688 | 644,997 |

| Viavi Solutions, Inc. (b) | | 36,047 | 337,760 |

| | | | 35,505,123 |

| Electronic Equipment & Components - 1.3% | | | |

| Cardtronics PLC (b) | | 7,353 | 137,722 |

| CDW Corp. | | 20,404 | 1,428,484 |

| Cognex Corp. | | 11,682 | 1,618,775 |

| Coherent, Inc. (b) | | 3,454 | 1,008,430 |

| Control4 Corp. (b) | | 6,612 | 219,783 |

| ePlus, Inc. (b) | | 3,224 | 261,789 |

| Flextronics International Ltd. (b) | | 74,123 | 1,339,403 |

| FLIR Systems, Inc. | | 16,581 | 772,343 |

| Hollysys Automation Technologies Ltd. | | 15,341 | 380,764 |

| II-VI, Inc. (b) | | 10,449 | 495,283 |

| Insight Enterprises, Inc. (b) | | 6,194 | 241,566 |

| IPG Photonics Corp. (b) | | 7,434 | 1,702,237 |

| Itron, Inc. (b) | | 6,739 | 434,329 |

| Littelfuse, Inc. | | 3,484 | 706,904 |

| MTS Systems Corp. (a) | | 5,228 | 292,245 |

| National Instruments Corp. | | 16,866 | 741,261 |

| Novanta, Inc. (b) | | 5,799 | 278,932 |

| Orbotech Ltd. (b) | | 8,843 | 447,986 |

| OSI Systems, Inc. (b) | | 3,648 | 316,136 |

| PC Connection, Inc. | | 9,145 | 250,664 |

| Plexus Corp. (b) | | 7,453 | 465,887 |

| Sanmina Corp. (b) | | 14,261 | 484,874 |

| ScanSource, Inc. (b) | | 6,940 | 249,840 |

| Tech Data Corp. (b) | | 5,922 | 572,657 |

| Trimble, Inc. (b) | | 37,366 | 1,568,998 |

| TTM Technologies, Inc. (b) | | 17,582 | 287,114 |

| Universal Display Corp. | | 6,733 | 1,218,673 |

| Zebra Technologies Corp. Class A (b) | | 7,364 | 812,396 |

| | | | 18,735,475 |

| Internet Software & Services - 13.0% | | | |

| 2U, Inc. (a)(b) | | 8,896 | 570,234 |

| Akamai Technologies, Inc. (b) | | 24,490 | 1,366,052 |

| Alarm.com Holdings, Inc. (b) | | 7,212 | 295,620 |

| Alphabet, Inc.: | | | |

| Class A (b) | | 41,780 | 43,291,183 |

| Class C (b) | | 48,719 | 49,762,074 |

| ANGI Homeservices, Inc. Class A (a)(b) | | 12,582 | 145,700 |

| Baidu.com, Inc. sponsored ADR (b) | | 39,141 | 9,338,260 |

| Baozun, Inc. sponsored ADR (a)(b) | | 5,807 | 164,628 |

| Benefitfocus, Inc. (b) | | 6,137 | 166,313 |

| BlackLine, Inc. (a)(b) | | 8,509 | 312,025 |

| Blucora, Inc. (b) | | 9,501 | 195,246 |

| Carbonite, Inc. (b) | | 6,038 | 145,214 |

| CarGurus, Inc. Class A (a) | | 10,360 | 305,413 |

| Cimpress NV (a)(b) | | 4,825 | 587,685 |

| CommerceHub, Inc. Series C (b) | | 10,535 | 226,081 |

| Cornerstone OnDemand, Inc. (b) | | 11,551 | 427,040 |

| CoStar Group, Inc. (b) | | 4,228 | 1,289,413 |

| Coupa Software, Inc. (b) | | 8,304 | 294,211 |

| Criteo SA sponsored ADR (a)(b) | | 9,847 | 328,397 |

| eBay, Inc. (b) | | 151,684 | 5,258,884 |

| Endurance International Group Holdings, Inc. (b) | | 27,168 | 254,021 |

| Etsy, Inc. (b) | | 18,420 | 303,193 |

| Facebook, Inc. Class A (b) | | 331,487 | 58,732,867 |

| Five9, Inc. (b) | | 9,907 | 242,821 |

| Gogo, Inc. (a)(b) | | 17,210 | 189,482 |

| Hortonworks, Inc. (b) | | 13,726 | 260,931 |

| IAC/InterActiveCorp (b) | | 9,667 | 1,230,319 |

| j2 Global, Inc. | | 6,573 | 495,999 |

| LivePerson, Inc. (b) | | 14,015 | 155,567 |

| LogMeIn, Inc. | | 7,818 | 930,342 |

| Match Group, Inc. (a)(b) | | 9,062 | 266,423 |

| MercadoLibre, Inc. | | 6,318 | 1,738,335 |

| Mimecast Ltd. (b) | | 9,129 | 277,522 |

| MINDBODY, Inc. (a)(b) | | 7,232 | 235,763 |

| Momo, Inc. ADR (b) | | 19,221 | 461,304 |

| NetEase, Inc. ADR | | 10,845 | 3,564,860 |

| NIC, Inc. | | 15,491 | 257,151 |

| Nutanix, Inc. Class A (a)(b) | | 8,907 | 292,150 |

| SINA Corp. (b) | | 10,270 | 1,004,098 |

| Sohu.com, Inc. (b) | | 7,167 | 346,811 |

| SPS Commerce, Inc. (b) | | 3,533 | 178,275 |

| Stamps.com, Inc. (b) | | 2,530 | 426,052 |

| The Trade Desk, Inc. (a)(b) | | 3,444 | 169,238 |

| TrueCar, Inc. (a)(b) | | 13,500 | 164,565 |

| Tucows, Inc. (a)(b) | | 2,059 | 130,541 |

| VeriSign, Inc. (a)(b) | | 13,080 | 1,505,508 |

| Web.com Group, Inc. (b) | | 10,951 | 251,873 |

| Weibo Corp. sponsored ADR (a)(b) | | 8,021 | 870,760 |

| Wix.com Ltd. (b) | | 6,669 | 366,128 |

| Yandex NV Series A (b) | | 41,171 | 1,363,172 |

| YY, Inc. ADR (b) | | 4,525 | 466,935 |

| Zillow Group, Inc.: | | | |

| Class A (b) | | 5,090 | 208,995 |

| Class C (a)(b) | | 20,612 | 845,916 |

| | | | 192,657,590 |

| IT Services - 2.7% | | | |

| Acxiom Corp. (b) | | 14,496 | 395,016 |

| Amdocs Ltd. | | 18,900 | 1,233,981 |

| Automatic Data Processing, Inc. | | 61,500 | 7,039,290 |

| Blackhawk Network Holdings, Inc. (b) | | 8,900 | 327,075 |

| Cass Information Systems, Inc. | | 3,862 | 263,041 |

| Cognizant Technology Solutions Corp. Class A | | 80,741 | 5,835,959 |

| CSG Systems International, Inc. | | 8,427 | 386,715 |

| Euronet Worldwide, Inc. (b) | | 6,418 | 586,284 |

| ExlService Holdings, Inc. (b) | | 6,453 | 396,085 |

| Fiserv, Inc. (b) | | 28,714 | 3,774,455 |

| Jack Henry & Associates, Inc. | | 9,853 | 1,136,248 |

| ManTech International Corp. Class A | | 5,300 | 270,194 |

| MoneyGram International, Inc. (b) | | 6,427 | 91,520 |

| Paychex, Inc. | | 50,600 | 3,405,886 |

| PayPal Holdings, Inc. (b) | | 170,247 | 12,892,805 |

| Presidio, Inc. | | 16,593 | 256,196 |

| QIWI PLC Class B sponsored ADR (a) | | 7,486 | 110,269 |

| Sabre Corp. | | 38,426 | 765,062 |

| Sykes Enterprises, Inc. (b) | | 11,342 | 360,902 |

| Syntel, Inc. (b) | | 16,973 | 434,679 |

| Teletech Holdings, Inc. | | 8,117 | 328,739 |

| Virtusa Corp. (b) | | 5,768 | 267,347 |

| | | | 40,557,748 |

| Semiconductors & Semiconductor Equipment - 10.4% | | | |

| Acacia Communications, Inc. (a)(b) | | 6,409 | 247,900 |

| Advanced Energy Industries, Inc. (b) | | 5,768 | 432,427 |

| Advanced Micro Devices, Inc. (a)(b) | | 135,325 | 1,473,689 |

| Ambarella, Inc. (a)(b) | | 5,221 | 283,344 |

| Amkor Technology, Inc. (b) | | 42,059 | 444,564 |

| Analog Devices, Inc. | | 51,890 | 4,468,248 |

| Applied Materials, Inc. | | 147,964 | 7,808,060 |

| ASML Holding NV | | 11,034 | 1,936,688 |

| Axcelis Technologies, Inc. (b) | | 5,530 | 176,960 |

| Broadcom Ltd. | | 56,917 | 15,819,511 |

| Brooks Automation, Inc. | | 11,239 | 279,739 |

| Cabot Microelectronics Corp. | | 4,845 | 466,670 |

| Canadian Solar, Inc. (a)(b) | | 11,318 | 203,384 |

| Cavium, Inc. (b) | | 10,027 | 857,108 |

| Ceva, Inc. (b) | | 4,463 | 211,993 |

| Cirrus Logic, Inc. (b) | | 9,164 | 506,219 |

| Cree, Inc. (b) | | 15,417 | 547,920 |

| Cypress Semiconductor Corp. (a) | | 49,565 | 793,536 |

| Diodes, Inc. (b) | | 11,914 | 349,080 |

| Entegris, Inc. | | 20,501 | 621,180 |

| Experi Corp. | | 9,106 | 175,746 |

| First Solar, Inc. (b) | | 15,454 | 959,693 |

| FormFactor, Inc. (b) | | 14,129 | 231,716 |

| Himax Technologies, Inc. sponsored ADR (a) | | 19,556 | 268,504 |

| Impinj, Inc. (a)(b) | | 3,559 | 90,648 |

| Integrated Device Technology, Inc. (b) | | 21,636 | 651,027 |

| Intel Corp. | | 657,507 | 29,482,614 |

| KLA-Tencor Corp. | | 21,683 | 2,216,870 |

| Kulicke & Soffa Industries, Inc. (b) | | 12,296 | 305,310 |

| Lam Research Corp. | | 22,258 | 4,280,881 |

| M/A-COM Technology Solutions Holdings, Inc. (a)(b) | | 9,571 | 311,919 |

| Marvell Technology Group Ltd. | | 65,734 | 1,468,498 |

| Maxim Integrated Products, Inc. | | 42,209 | 2,208,797 |

| Mellanox Technologies Ltd. (a)(b) | | 8,752 | 517,243 |

| Microchip Technology, Inc. | | 33,502 | 2,914,339 |

| Micron Technology, Inc. (b) | | 156,836 | 6,648,278 |

| Microsemi Corp. (b) | | 16,412 | 867,374 |

| MKS Instruments, Inc. | | 7,179 | 676,980 |

| Monolithic Power Systems, Inc. | | 6,453 | 763,713 |

| Nova Measuring Instruments Ltd. (b) | | 5,625 | 156,431 |

| NVIDIA Corp. | | 83,651 | 16,789,592 |

| NXP Semiconductors NV (b) | | 48,387 | 5,486,602 |

| ON Semiconductor Corp. (b) | | 59,112 | 1,186,969 |

| Power Integrations, Inc. | | 4,827 | 378,920 |

| Qorvo, Inc. (b) | | 17,996 | 1,378,134 |

| Qualcomm, Inc. | | 208,984 | 13,863,999 |

| Rambus, Inc. (b) | | 26,202 | 387,790 |

| Semtech Corp. (b) | | 12,848 | 437,474 |

| Silicon Laboratories, Inc. (b) | | 6,839 | 623,033 |

| Silicon Motion Technology Corp. sponsored ADR (a) | | 5,792 | 299,794 |

| Skyworks Solutions, Inc. | | 25,617 | 2,683,125 |

| SolarEdge Technologies, Inc. (b) | | 8,403 | 305,869 |

| SunPower Corp. (a)(b) | | 26,059 | 215,247 |

| Synaptics, Inc. (b) | | 5,696 | 214,967 |

| Texas Instruments, Inc. | | 139,130 | 13,535,958 |

| Tower Semiconductor Ltd. (b) | | 14,434 | 508,221 |

| Ultra Clean Holdings, Inc. (b) | | 5,535 | 116,124 |

| Veeco Instruments, Inc. (b) | | 7,852 | 126,810 |

| Xilinx, Inc. | | 35,555 | 2,471,428 |

| | | | 154,134,857 |

| Software - 11.0% | | | |

| 8x8, Inc. (b) | | 18,254 | 257,381 |

| ACI Worldwide, Inc. (b) | | 19,416 | 444,238 |

| Activision Blizzard, Inc. | | 106,753 | 6,661,387 |

| Adobe Systems, Inc. (b) | | 69,004 | 12,522,156 |

| ANSYS, Inc. (b) | | 11,102 | 1,645,205 |

| Aspen Technology, Inc. (b) | | 9,693 | 648,656 |

| Atlassian Corp. PLC (b) | | 9,938 | 464,005 |

| Autodesk, Inc. (b) | | 31,399 | 3,444,470 |

| Blackbaud, Inc. | | 6,236 | 613,934 |

| Bottomline Technologies, Inc. (b) | | 10,254 | 341,766 |

| BroadSoft, Inc. (b) | | 5,258 | 289,190 |

| CA Technologies, Inc. | | 60,558 | 2,002,653 |

| Cadence Design Systems, Inc. (b) | | 37,641 | 1,652,816 |

| Callidus Software, Inc. (b) | | 12,447 | 364,386 |

| CDK Global, Inc. | | 18,674 | 1,290,187 |

| Changyou.com Ltd. (A Shares) ADR (b) | | 3,112 | 113,526 |

| Check Point Software Technologies Ltd. (b) | | 22,910 | 2,389,284 |

| Citrix Systems, Inc. (b) | | 21,644 | 1,896,664 |

| CommVault Systems, Inc. (b) | | 7,507 | 404,627 |

| CyberArk Software Ltd. (b) | | 5,288 | 248,853 |

| Descartes Systems Group, Inc. (b) | | 15,879 | 440,745 |

| Ebix, Inc. (a) | | 5,052 | 390,520 |

| Electronic Arts, Inc. (b) | | 43,949 | 4,673,976 |

| Everbridge, Inc. (b) | | 6,211 | 164,592 |

| FireEye, Inc. (a)(b) | | 27,149 | 383,887 |

| Fortinet, Inc. (b) | | 24,235 | 1,019,324 |

| Imperva, Inc. (b) | | 5,564 | 229,515 |

| Intuit, Inc. | | 35,070 | 5,513,705 |

| Magic Software Enterprises Ltd. | | 6,398 | 52,464 |

| Manhattan Associates, Inc. (b) | | 10,577 | 469,090 |

| Microsoft Corp. | | 1,077,773 | 90,716,153 |

| MicroStrategy, Inc. Class A (b) | | 1,675 | 229,073 |

| Monotype Imaging Holdings, Inc. | | 13,010 | 327,852 |

| NICE Systems Ltd. sponsored ADR | | 5,641 | 493,644 |

| Nuance Communications, Inc. (b) | | 40,101 | 623,170 |

| Open Text Corp. | | 33,955 | 1,107,489 |

| Parametric Technology Corp. (b) | | 15,163 | 965,580 |

| Paylocity Holding Corp. (b) | | 8,775 | 404,879 |

| Pegasystems, Inc. | | 10,712 | 540,420 |

| Progress Software Corp. | | 8,905 | 368,133 |

| Proofpoint, Inc. (a)(b) | | 6,699 | 603,245 |

| Qualys, Inc. (b) | | 6,739 | 396,927 |

| Rapid7, Inc. (b) | | 14,188 | 268,295 |

| RealPage, Inc. (b) | | 12,801 | 580,525 |

| Sapiens International Corp. NV (a) | | 18,253 | 218,306 |

| Splunk, Inc. (b) | | 18,788 | 1,504,731 |

| SS&C Technologies Holdings, Inc. | | 26,085 | 1,077,050 |

| Symantec Corp. | | 86,212 | 2,497,562 |

| Synchronoss Technologies, Inc. (b) | | 14,787 | 148,461 |

| Synopsys, Inc. (b) | | 19,803 | 1,789,795 |

| Take-Two Interactive Software, Inc. (b) | | 15,493 | 1,728,244 |

| Talend SA ADR (b) | | 5,892 | 235,503 |

| TiVo Corp. | | 20,343 | 362,105 |

| Ultimate Software Group, Inc. (b) | | 3,961 | 835,890 |

| Varonis Systems, Inc. (b) | | 4,851 | 244,005 |

| Verint Systems, Inc. (b) | | 9,952 | 435,400 |

| Workday, Inc. Class A (b) | | 18,092 | 1,863,476 |

| Zynga, Inc. (b) | | 121,562 | 498,404 |

| | | | 162,097,519 |

| Technology Hardware, Storage & Peripherals - 9.0% | | | |

| Apple, Inc. | | 723,002 | 124,247,859 |

| Cray, Inc. (b) | | 12,072 | 274,638 |

| Electronics for Imaging, Inc. (b) | | 6,883 | 211,721 |

| Logitech International SA (a) | | 22,599 | 783,281 |

| NetApp, Inc. | | 39,871 | 2,253,110 |

| Seagate Technology LLC (a) | | 41,669 | 1,606,757 |

| Stratasys Ltd. (a)(b) | | 9,007 | 196,172 |

| Super Micro Computer, Inc. (b) | | 9,894 | 218,163 |

| Western Digital Corp. | | 41,628 | 3,282,784 |

| | | | 133,074,485 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 736,762,797 |

|

| MATERIALS - 0.5% | | | |

| Chemicals - 0.2% | | | |

| A. Schulman, Inc. | | 6,812 | 258,515 |

| Balchem Corp. | | 5,083 | 443,593 |

| Innophos Holdings, Inc. | | 5,302 | 245,642 |

| Innospec, Inc. | | 5,081 | 362,783 |

| Methanex Corp. | | 13,148 | 700,738 |

| | | | 2,011,271 |

| Construction Materials - 0.0% | | | |

| U.S. Concrete, Inc. (b) | | 2,451 | 198,163 |

| Containers & Packaging - 0.0% | | | |

| Silgan Holdings, Inc. | | 12,972 | 374,631 |

| Metals & Mining - 0.3% | | | |

| Century Aluminum Co. (b) | | 13,611 | 180,346 |

| Ferroglobe PLC | | 28,773 | 469,575 |

| Ferroglobe Representation & Warranty Insurance (c) | | 7,187 | 0 |

| Kaiser Aluminum Corp. | | 3,722 | 360,513 |

| Pan American Silver Corp. (a) | | 24,715 | 374,185 |

| Randgold Resources Ltd. sponsored ADR | | 5,550 | 509,268 |

| Royal Gold, Inc. | | 9,705 | 802,798 |

| Schnitzer Steel Industries, Inc. Class A | | 9,037 | 263,880 |

| Ssr Mining, Inc. (b) | | 24,663 | 205,196 |

| Steel Dynamics, Inc. | | 33,943 | 1,306,806 |

| | | | 4,472,567 |

| Paper & Forest Products - 0.0% | | | |

| Mercer International, Inc. (SBI) | | 21,940 | 310,451 |

|

| TOTAL MATERIALS | | | 7,367,083 |

|

| REAL ESTATE - 1.1% | | | |

| Equity Real Estate Investment Trusts (REITs) - 1.0% | | | |

| CareTrust (REIT), Inc. | | 18,091 | 329,618 |

| CIM Commercial Trust Corp. | | 15,416 | 274,405 |

| CyrusOne, Inc. | | 11,304 | 686,831 |

| Equinix, Inc. | | 11,082 | 5,147,478 |

| Gaming & Leisure Properties | | 26,123 | 948,787 |

| Government Properties Income Trust | | 21,341 | 398,010 |

| Hospitality Properties Trust (SBI) | | 24,968 | 748,790 |

| Lamar Advertising Co. Class A | | 11,556 | 869,358 |

| Potlatch Corp. | | 8,119 | 418,940 |

| Retail Opportunity Investments Corp. | | 22,081 | 432,125 |

| Sabra Health Care REIT, Inc. | | 24,784 | 476,844 |

| SBA Communications Corp. Class A (b) | | 17,244 | 2,927,169 |

| Select Income REIT | | 18,083 | 453,702 |

| Senior Housing Properties Trust (SBI) | | 34,465 | 660,005 |

| Uniti Group, Inc. (a) | | 28,114 | 452,635 |

| | | | 15,224,697 |

| Real Estate Management & Development - 0.1% | | | |

| Colliers International Group, Inc. | | 6,188 | 378,048 |

| Cresud S.A.C.I.F. y A. sponsored ADR | | 12,628 | 275,417 |

| FirstService Corp. | | 6,979 | 475,328 |

| Redfin Corp. (a) | | 10,589 | 241,217 |

| | | | 1,370,010 |

|

| TOTAL REAL ESTATE | | | 16,594,707 |

|

| TELECOMMUNICATION SERVICES - 0.8% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| Atlantic Tele-Network, Inc. | | 3,386 | 202,347 |

| B Communications Ltd. (b) | | 8,045 | 124,295 |

| Cogent Communications Group, Inc. | | 7,995 | 374,566 |

| Consolidated Communications Holdings, Inc. | | 11,119 | 157,223 |

| Frontier Communications Corp. (a) | | 13,221 | 112,379 |

| General Communications, Inc. Class A (b) | | 4,954 | 197,714 |

| Iridium Communications, Inc. (a)(b) | | 17,040 | 210,444 |

| Windstream Holdings, Inc. (a) | | 44,985 | 118,311 |

| | | | 1,497,279 |

| Wireless Telecommunication Services - 0.7% | | | |

| Boingo Wireless, Inc. (b) | | 8,960 | 221,312 |

| Shenandoah Telecommunications Co. | | 9,441 | 362,062 |

| T-Mobile U.S., Inc. (b) | | 116,460 | 7,112,212 |

| VimpelCom Ltd. sponsored ADR | | 192,214 | 776,545 |

| Vodafone Group PLC sponsored ADR | | 67,178 | 2,067,739 |

| | | | 10,539,870 |

|

| TOTAL TELECOMMUNICATION SERVICES | | | 12,037,149 |

|

| UTILITIES - 0.1% | | | |

| Electric Utilities - 0.0% | | | |

| MGE Energy, Inc. | | 5,182 | 342,012 |

| Otter Tail Corp. | | 6,231 | 300,957 |

| | | | 642,969 |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| Atlantica Yield PLC | | 15,597 | 350,465 |

| Pattern Energy Group, Inc. | | 14,131 | 318,513 |

| | | | 668,978 |

| Water Utilities - 0.0% | | | |

| Connecticut Water Service, Inc. | | 4,150 | 262,737 |

| Middlesex Water Co. | | 5,923 | 273,169 |

| | | | 535,906 |

|

| TOTAL UTILITIES | | | 1,847,853 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $991,611,284) | | | 1,442,554,086 |

| | | Principal Amount | Value |

|

| U.S. Treasury Obligations - 0.1% | | | |

| U.S. Treasury Bills, yield at date of purchase 1.06% to 1.31% 12/14/17 to 5/10/18 (d) | | | |

| (Cost $1,198,458) | | 1,200,000 | 1,198,469 |

| | | Shares | Value |

|

| Money Market Funds - 6.4% | | | |

| Fidelity Cash Central Fund, 1.13% (e) | | 33,662,685 | $33,669,418 |

| Fidelity Securities Lending Cash Central Fund 1.13% (e)(f) | | 60,998,505 | 61,004,605 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $94,671,342) | | | 94,674,023 |

| TOTAL INVESTMENT IN SECURITIES - 104.0% | | | |

| (Cost $1,087,481,084) | | | 1,538,426,578 |

| NET OTHER ASSETS (LIABILITIES) - (4.0)% | | | (58,981,660) |

| NET ASSETS - 100% | | | $1,479,444,918 |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini NASDAQ 100 Index Contracts (United States) | 291 | Dec. 2017 | $37,067,580 | $1,667,411 | $1,667,411 |

The notional amount of futures purchased as a percentage of Net Assets is 2.5%

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Non-income producing

(c) Level 3 security

(d) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $1,198,469.

(e) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(f) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $135,668 |

| Fidelity Securities Lending Cash Central Fund | 901,971 |

| Total | $1,037,639 |

Investment Valuation

The following is a summary of the inputs used, as of November 30, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $255,464,494 | $255,463,504 | $-- | $990 |

| Consumer Staples | 61,195,094 | 61,195,094 | -- | -- |

| Energy | 8,166,674 | 8,165,632 | -- | 1,042 |

| Financials | 103,132,882 | 103,132,882 | -- | -- |

| Health Care | 175,724,872 | 175,668,987 | -- | 55,885 |

| Industrials | 64,260,481 | 64,260,481 | -- | -- |

| Information Technology | 736,762,797 | 736,762,797 | -- | -- |

| Materials | 7,367,083 | 7,367,083 | -- | -- |

| Real Estate | 16,594,707 | 16,594,707 | -- | -- |

| Telecommunication Services | 12,037,149 | 12,037,149 | -- | -- |

| Utilities | 1,847,853 | 1,847,853 | -- | -- |

| U.S. Government and Government Agency Obligations | 1,198,469 | -- | 1,198,469 | -- |

| Money Market Funds | 94,674,023 | 94,674,023 | -- | -- |

| Total Investments in Securities: | $1,538,426,578 | $1,537,170,192 | $1,198,469 | $57,917 |

| Derivative Instruments: | | | | |

| Assets | | | | |

| Futures Contracts | $1,667,411 | $1,667,411 | $-- | $-- |

| Total Assets | $1,667,411 | $1,667,411 | $-- | $-- |

| Total Derivative Instruments: | $1,667,411 | $1,667,411 | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of November 30, 2017. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| Equity Risk | | |

| Futures Contracts(a) | $1,667,411 | $0 |

| Total Equity Risk | 1,667,411 | 0 |

| Total Value of Derivatives | $1,667,411 | $0 |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in net unrealized appreciation (depreciation).

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | November 30, 2017 |

| Assets | | |

Investment in securities, at value (including securities loaned of $59,360,911) — See accompanying schedule:

Unaffiliated issuers (cost $992,809,742) | $1,443,752,555 | |

| Fidelity Central Funds (cost $94,671,342) | 94,674,023 | |

| Total Investment in Securities (cost $1,087,481,084) | | $1,538,426,578 |

| Segregated cash with brokers for derivative instruments | | 123,104 |

| Receivable for investments sold | | 222,759 |

| Dividends receivable | | 1,713,570 |