UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02676

Fidelity School Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

William C. Coffey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | June 30, 2019 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Multi-Asset Income Fund

Semi-Annual Report June 30, 2019 Includes Fidelity and Fidelity Advisor share classes |

|

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Five Holdings as of June 30, 2019

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| U.S. Treasury Obligations | 10.4 |

| Brazilian Federative Republic | 3.1 |

| Liberty Media Corp. | 2.0 |

| DISH Network Corp. | 1.7 |

| Microsoft Corp. | 1.7 |

| | 18.9 |

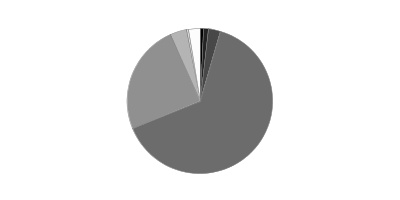

Top Five Market Sectors as of June 30, 2019

| | % of fund's net assets |

| Consumer Discretionary | 12.0 |

| Financials | 11.7 |

| Industrials | 10.0 |

| Energy | 9.8 |

| Communication Services | 9.8 |

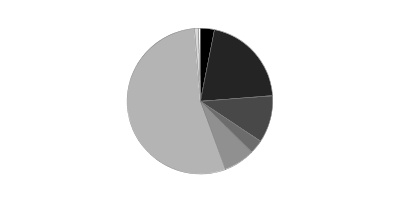

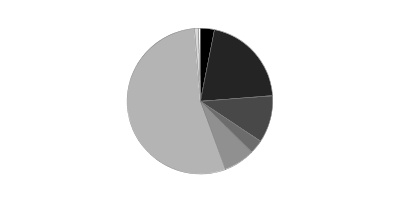

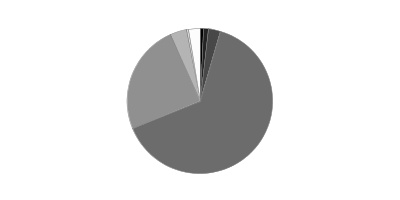

Quality Diversification (% of fund's net assets)

| As of June 30, 2019 |

| | U.S. Government and U.S. Government Agency Obligations | 10.4% |

| | BBB | 2.9% |

| | BB | 11.5% |

| | B | 10.7% |

| | CCC,CC,C | 4.8% |

| | Not Rated | 4.0% |

| | Equities | 55.4% |

| | Short-Term Investments and Net Other Assets | 0.3% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

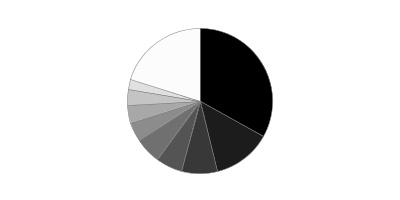

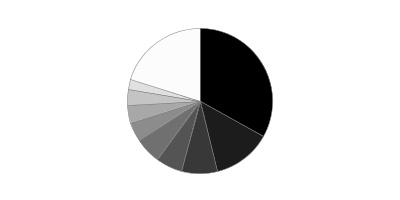

Asset Allocation (% of fund's net assets)

| As of June 30, 2019* |

| | Preferred Securities | 3.2% |

| | Corporate Bonds | 20.7% |

| | U.S. Government and U.S. Government Agency Obligations | 10.4% |

| | Foreign Government & Government Agency Obligations | 3.1% |

| | Bank Loan Obligations | 6.9% |

| | Stocks | 54.4% |

| | Other Investments | 1.0% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 0.3% |

* Foreign investments - 25.5%

Schedule of Investments June 30, 2019 (Unaudited)

Showing Percentage of Net Assets

| Corporate Bonds - 20.7% | | | |

| | | Principal Amount | Value |

| Convertible Bonds - 7.6% | | | |

| COMMUNICATION SERVICES - 3.7% | | | |

| Media - 3.7% | | | |

| DISH Network Corp. 3.375% 8/15/26 | | $1,424,000 | $1,384,390 |

| Liberty Media Corp.: | | | |

| 1.375% 10/15/23 | | 914,000 | 1,025,915 |

| 2.25% 9/30/46 | | 1,210,000 | 646,663 |

| | | | 3,056,968 |

| CONSUMER DISCRETIONARY - 2.0% | | | |

| Hotels, Restaurants & Leisure - 1.6% | | | |

| Caesars Entertainment Corp. 5% 10/1/24 | | 610,399 | 1,044,805 |

| Sea Ltd. 2.25% 7/1/23 | | 161,000 | 292,572 |

| | | | 1,337,377 |

| Internet & Direct Marketing Retail - 0.4% | | | |

| MercadoLibre, Inc. 2% 8/15/28 (a) | | 238,000 | 366,623 |

| TOTAL CONSUMER DISCRETIONARY | | | 1,704,000 |

| HEALTH CARE - 0.7% | | | |

| Life Sciences Tools & Services - 0.7% | | | |

| Illumina, Inc. 0.5% 6/15/21 | | 356,000 | 549,047 |

| INFORMATION TECHNOLOGY - 1.2% | | | |

| Semiconductors & Semiconductor Equipment - 1.2% | | | |

| Micron Technology, Inc. 3.125% 5/1/32 | | 159,000 | 612,240 |

| ON Semiconductor Corp. 1% 12/1/20 | | 287,000 | 352,578 |

| | | | 964,818 |

|

| TOTAL CONVERTIBLE BONDS | | | 6,274,833 |

|

| Nonconvertible Bonds - 13.1% | | | |

| COMMUNICATION SERVICES - 2.6% | | | |

| Diversified Telecommunication Services - 1.7% | | | |

| Cumulus Media New Holdings, Inc. 6.75% 7/1/26 (a) | | 265,000 | 264,338 |

| Intelsat Luxembourg SA 8.125% 6/1/23 | | 640,000 | 494,400 |

| Sprint Capital Corp. 8.75% 3/15/32 | | 565,000 | 653,988 |

| | | | 1,412,726 |

| Entertainment - 0.5% | | | |

| Viacom, Inc. 6.25% 2/28/57 (b) | | 425,000 | 439,875 |

| Media - 0.4% | | | |

| Altice SA 7.625% 2/15/25 (a) | | 285,000 | 268,078 |

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp. 4.908% 7/23/25 | | 5,000 | 5,425 |

| Time Warner Cable, Inc. 6.55% 5/1/37 | | 5,000 | 5,772 |

| | | | 279,275 |

| Wireless Telecommunication Services - 0.0% | | | |

| Sprint Communications, Inc. 7% 3/1/20 (a) | | 25,000 | 25,625 |

| TOTAL COMMUNICATION SERVICES | | | 2,157,501 |

| CONSUMER DISCRETIONARY - 1.0% | | | |

| Diversified Consumer Services - 1.0% | | | |

| Laureate Education, Inc. 8.25% 5/1/25 (a) | | 778,000 | 849,965 |

| CONSUMER STAPLES - 2.9% | | | |

| Food Products - 2.9% | | | |

| CF Industries Holdings, Inc. 4.95% 6/1/43 | | 705,000 | 630,975 |

| JBS Investments II GmbH 7% 1/15/26 (a) | | 735,000 | 796,005 |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc. 6.75% 2/15/28 (a) | | 920,000 | 999,350 |

| | | | 2,426,330 |

| ENERGY - 2.8% | | | |

| Oil, Gas & Consumable Fuels - 2.8% | | | |

| California Resources Corp. 8% 12/15/22 (a) | | 355,000 | 267,581 |

| Comstock Escrow Corp. 9.75% 8/15/26 | | 355,000 | 272,463 |

| Consolidated Energy Finance SA 6.5% 5/15/26 (a) | | 450,000 | 446,625 |

| DCP Midstream LLC 5.85% 5/21/43 (a)(b) | | 505,000 | 473,438 |

| MEG Energy Corp.: | | | |

| 6.375% 1/30/23 (a) | | 365,000 | 347,663 |

| 7% 3/31/24 (a) | | 515,000 | 489,250 |

| Petroleos Mexicanos 6.75% 9/21/47 | | 14,000 | 12,419 |

| The Williams Companies, Inc. 5.75% 6/24/44 | | 20,000 | 23,319 |

| | | | 2,332,758 |

| FINANCIALS - 0.7% | | | |

| Banks - 0.0% | | | |

| Royal Bank of Scotland Group PLC 6% 12/19/23 | | 30,000 | 32,658 |

| Capital Markets - 0.1% | | | |

| Goldman Sachs Group, Inc. 5.15% 5/22/45 | | 30,000 | 34,284 |

| Morgan Stanley 5% 11/24/25 | | 30,000 | 33,193 |

| | | | 67,477 |

| Consumer Finance - 0.2% | | | |

| Ally Financial, Inc. 8% 11/1/31 | | 150,000 | 196,500 |

| Diversified Financial Services - 0.4% | | | |

| Financial & Risk U.S. Holdings, Inc. 8.25% 11/15/26 (a) | | 280,000 | 287,980 |

| TOTAL FINANCIALS | | | 584,615 |

| HEALTH CARE - 0.3% | | | |

| Health Care Providers & Services - 0.3% | | | |

| Community Health Systems, Inc. 6.25% 3/31/23 | | 180,000 | 173,250 |

| CVS Health Corp.: | | | |

| 4.1% 3/25/25 | | 5,000 | 5,271 |

| 4.3% 3/25/28 | | 4,000 | 4,216 |

| 4.78% 3/25/38 | | 2,000 | 2,085 |

| 5.05% 3/25/48 | | 3,000 | 3,191 |

| HCA Holdings, Inc. 6.5% 2/15/20 | | 10,000 | 10,230 |

| | | | 198,243 |

| INDUSTRIALS - 2.3% | | | |

| Aerospace & Defense - 1.0% | | | |

| Bombardier, Inc. 7.5% 12/1/24 (a) | | 500,000 | 510,000 |

| TransDigm, Inc. 7.5% 3/15/27 (a) | | 330,000 | 344,438 |

| | | | 854,438 |

| Air Freight & Logistics - 0.7% | | | |

| Aercap Global Aviation Trust 6.5% 6/15/45 (a)(b) | | 570,000 | 595,650 |

| Commercial Services & Supplies - 0.3% | | | |

| LBC Tank Terminals Holding Netherlands BV 6.875% 5/15/23 (a) | | 240,000 | 237,600 |

| Road & Rail - 0.3% | | | |

| Hertz Corp. 5.5% 10/15/24 (a) | | 215,000 | 205,390 |

| TOTAL INDUSTRIALS | | | 1,893,078 |

| INFORMATION TECHNOLOGY - 0.5% | | | |

| Electronic Equipment & Components - 0.2% | | | |

| TTM Technologies, Inc. 5.625% 10/1/25 (a) | | 165,000 | 161,330 |

| IT Services - 0.3% | | | |

| Banff Merger Sub, Inc. 9.75% 9/1/26 (a) | | 265,000 | 229,888 |

| TOTAL INFORMATION TECHNOLOGY | | | 391,218 |

| REAL ESTATE - 0.0% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.0% | | | |

| Omega Healthcare Investors, Inc. 4.5% 4/1/27 | | 17,000 | 17,769 |

| UTILITIES - 0.0% | | | |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| Dolphin Subsidiary II, Inc. 7.25% 10/15/21 | | 14,000 | 15,050 |

|

| TOTAL NONCONVERTIBLE BONDS | | | 10,866,527 |

|

| TOTAL CORPORATE BONDS | | | |

| (Cost $16,332,049) | | | 17,141,360 |

|

| U.S. Government and Government Agency Obligations - 10.4% | | | |

| U.S. Treasury Inflation-Protected Obligations - 0.2% | | | |

| U.S. Treasury Inflation-Indexed Bonds 0.75% 2/15/45 | | 21,704 | 21,491 |

| U.S. Treasury Inflation-Indexed Notes: | | | |

| 0.375% 7/15/25 | | $32,328 | $32,680 |

| 0.625% 1/15/26 | | 64,529 | 66,070 |

|

| TOTAL U.S. TREASURY INFLATION-PROTECTED OBLIGATIONS | | | 120,241 |

|

| U.S. Treasury Obligations - 10.2% | | | |

| U.S. Treasury Bonds: | | | |

| 3% 2/15/49 | | 81,000 | 88,834 |

| 3.375% 11/15/48 | | 6,685,000 | 7,858,001 |

| U.S. Treasury Notes: | | | |

| 2% 12/31/21 | | 99,000 | 99,638 |

| 2.125% 12/31/22 | | 80,000 | 81,066 |

| 2.125% 3/31/24 | | 99,000 | 100,605 |

| 2.625% 2/15/29 | | 100,000 | 105,395 |

| 2.75% 2/28/25 | | 110,000 | 115,504 |

|

| TOTAL U.S. TREASURY OBLIGATIONS | | | 8,449,043 |

|

| TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS | | | |

| (Cost $7,914,911) | | | 8,569,284 |

|

| Municipal Securities - 0.0% | | | |

| Illinois Gen. Oblig. Series 2003, 5.1% 6/1/33 | | | |

| (Cost $14,032) | | 15,000 | 15,796 |

|

| Foreign Government and Government Agency Obligations - 3.1% | | | |

Brazilian Federative Republic 5.625% 2/21/47

(Cost $2,363,233) | | $2,370,000 | $2,529,975 |

| | | Shares | Value |

|

| Common Stocks - 52.2% | | | |

| COMMUNICATION SERVICES - 3.5% | | | |

| Diversified Telecommunication Services - 0.2% | | | |

| Verizon Communications, Inc. | | 2,720 | 155,394 |

| Entertainment - 0.8% | | | |

| The Walt Disney Co. | | 4,856 | 678,092 |

| Interactive Media & Services - 1.5% | | | |

| Alphabet, Inc. Class A (c) | | 495 | 535,986 |

| Facebook, Inc. Class A (c) | | 3,450 | 665,850 |

| | | | 1,201,836 |

| Media - 0.4% | | | |

| Comcast Corp. Class A | | 7,800 | 329,784 |

| Wireless Telecommunication Services - 0.6% | | | |

| T-Mobile U.S., Inc. (c) | | 6,861 | 508,675 |

|

| TOTAL COMMUNICATION SERVICES | | | 2,873,781 |

|

| CONSUMER DISCRETIONARY - 5.4% | | | |

| Hotels, Restaurants & Leisure - 0.9% | | | |

| Marriott International, Inc. Class A | | 2,900 | 406,841 |

| McDonald's Corp. | | 1,425 | 295,916 |

| Royal Caribbean Cruises Ltd. | | 78 | 9,454 |

| | | | 712,211 |

| Household Durables - 0.6% | | | |

| Sony Corp. sponsored ADR | | 9,600 | 502,944 |

| Internet & Direct Marketing Retail - 1.4% | | | |

| Amazon.com, Inc. (c) | | 515 | 975,219 |

| Pinduoduo, Inc. ADR | | 10,900 | 224,867 |

| | | | 1,200,086 |

| Leisure Products - 0.6% | | | |

| BRP, Inc. | | 13,000 | 464,587 |

| Multiline Retail - 0.7% | | | |

| Dollarama, Inc. | | 16,400 | 576,952 |

| Specialty Retail - 0.7% | | | |

| Lowe's Companies, Inc. | | 2,904 | 293,043 |

| TJX Companies, Inc. | | 5,533 | 292,585 |

| | | | 585,628 |

| Textiles, Apparel & Luxury Goods - 0.5% | | | |

| PVH Corp. | | 33 | 3,123 |

| Tapestry, Inc. | | 13,800 | 437,874 |

| | | | 440,997 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 4,483,405 |

|

| CONSUMER STAPLES - 6.0% | | | |

| Beverages - 0.5% | | | |

| Diageo PLC | | 156 | 6,714 |

| PepsiCo, Inc. | | 2,953 | 387,227 |

| | | | 393,941 |

| Food & Staples Retailing - 1.2% | | | |

| Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | | 4,300 | 270,599 |

| Sysco Corp. | | 4,000 | 282,880 |

| Walmart, Inc. | | 4,004 | 442,402 |

| | | | 995,881 |

| Food Products - 3.1% | | | |

| Archer Daniels Midland Co. | | 7,600 | 310,080 |

| Bunge Ltd. | | 11,900 | 662,949 |

| Darling International, Inc. (c) | | 25,600 | 509,184 |

| JBS SA | | 65,900 | 364,171 |

| McCormick & Co., Inc. (non-vtg.) | | 27 | 4,185 |

| Nestle SA sponsored ADR | | 4,550 | 470,470 |

| The Kraft Heinz Co. | | 8,256 | 256,266 |

| | | | 2,577,305 |

| Household Products - 0.7% | | | |

| Colgate-Palmolive Co. | | 4,300 | 308,181 |

| Procter & Gamble Co. | | 2,100 | 230,265 |

| | | | 538,446 |

| Personal Products - 0.5% | | | |

| Unilever NV: | | | |

| (Certificaten Van Aandelen) (Bearer) | | 155 | 9,418 |

| (NY Reg.) | | 6,850 | 415,932 |

| | | | 425,350 |

| Tobacco - 0.0% | | | |

| Altria Group, Inc. | | 134 | 6,345 |

| Philip Morris International, Inc. | | 134 | 10,523 |

| | | | 16,868 |

|

| TOTAL CONSUMER STAPLES | | | 4,947,791 |

|

| ENERGY - 5.7% | | | |

| Oil, Gas & Consumable Fuels - 5.7% | | | |

| BP PLC sponsored ADR | | 9,100 | 379,470 |

| Cheniere Energy, Inc. (c) | | 7,300 | 499,685 |

| Chevron Corp. | | 146 | 18,168 |

| ConocoPhillips Co. | | 6,112 | 372,832 |

| DHT Holdings, Inc. | | 125,500 | 741,705 |

| Enterprise Products Partners LP | | 24,200 | 698,654 |

| Phillips 66 Co. | | 78 | 7,296 |

| PrairieSky Royalty Ltd. | | 17,400 | 244,481 |

| Scorpio Tankers, Inc. | | 24,500 | 723,240 |

| Suncor Energy, Inc. | | 225 | 7,019 |

| Targa Resources Corp. | | 12,000 | 471,120 |

| The Williams Companies, Inc. | | 20,800 | 583,232 |

| Valero Energy Corp. | | 78 | 6,678 |

| | | | 4,753,580 |

| FINANCIALS - 7.9% | | | |

| Banks - 5.4% | | | |

| Bank of America Corp. | | 25,828 | 749,012 |

| Citigroup, Inc. | | 9,400 | 658,282 |

| JPMorgan Chase & Co. | | 8,704 | 973,107 |

| M&T Bank Corp. | | 2,794 | 475,176 |

| PNC Financial Services Group, Inc. | | 4,750 | 652,080 |

| SunTrust Banks, Inc. | | 6,178 | 388,287 |

| U.S. Bancorp | | 10,200 | 534,480 |

| Wells Fargo & Co. | | 384 | 18,171 |

| | | | 4,448,595 |

| Capital Markets - 1.1% | | | |

| BM&F BOVESPA SA | | 96,500 | 941,390 |

| Diversified Financial Services - 0.6% | | | |

| Berkshire Hathaway, Inc. Class B (c) | | 2,227 | 474,730 |

| Insurance - 0.8% | | | |

| Chubb Ltd. | | 4,704 | 692,852 |

| Marsh & McLennan Companies, Inc. | | 78 | 7,781 |

| MetLife, Inc. | | 152 | 7,550 |

| | | | 708,183 |

|

| TOTAL FINANCIALS | | | 6,572,898 |

|

| HEALTH CARE - 3.9% | | | |

| Biotechnology - 0.3% | | | |

| Amgen, Inc. | | 1,532 | 282,317 |

| Health Care Equipment & Supplies - 0.3% | | | |

| Alcon, Inc. (c) | | 25 | 1,551 |

| Becton, Dickinson & Co. | | 875 | 220,509 |

| | | | 222,060 |

| Health Care Providers & Services - 1.0% | | | |

| Cigna Corp. | | 24 | 3,781 |

| HCA Holdings, Inc. | | 2,800 | 378,476 |

| UnitedHealth Group, Inc. | | 1,662 | 405,545 |

| | | | 787,802 |

| Pharmaceuticals - 2.3% | | | |

| AstraZeneca PLC (United Kingdom) | | 104 | 8,502 |

| Bristol-Myers Squibb Co. | | 6,066 | 275,093 |

| Corteva, Inc. | | 73 | 2,159 |

| Eli Lilly & Co. | | 5 | 554 |

| Johnson & Johnson | | 3,775 | 525,782 |

| Merck & Co., Inc. | | 4,300 | 360,555 |

| Roche Holding AG: | | | |

| (participation certificate) | | 41 | 11,529 |

| sponsored ADR (c) | | 12,450 | 436,995 |

| Sanofi SA sponsored ADR | | 7,478 | 323,573 |

| | | | 1,944,742 |

|

| TOTAL HEALTH CARE | | | 3,236,921 |

|

| INDUSTRIALS - 6.1% | | | |

| Aerospace & Defense - 1.8% | | | |

| CAE, Inc. | | 11,300 | 303,824 |

| General Dynamics Corp. | | 2,121 | 385,640 |

| Northrop Grumman Corp. | | 1,559 | 503,728 |

| The Boeing Co. | | 700 | 254,807 |

| United Technologies Corp. | | 71 | 9,244 |

| | | | 1,457,243 |

| Air Freight & Logistics - 0.5% | | | |

| Deutsche Post AG | | 57 | 1,873 |

| FedEx Corp. | | 2,400 | 394,056 |

| | | | 395,929 |

| Airlines - 0.3% | | | |

| Delta Air Lines, Inc. | | 5,100 | 289,425 |

| Electrical Equipment - 0.5% | | | |

| Fortive Corp. | | 5,200 | 423,904 |

| Industrial Conglomerates - 1.5% | | | |

| General Electric Co. | | 56,269 | 590,825 |

| Honeywell International, Inc. | | 3,575 | 624,159 |

| | | | 1,214,984 |

| Machinery - 1.1% | | | |

| Deere & Co. | | 3,600 | 596,556 |

| Ingersoll-Rand PLC | | 2,606 | 330,102 |

| | | | 926,658 |

| Professional Services - 0.0% | | | |

| Equifax, Inc. | | 29 | 3,922 |

| Road & Rail - 0.4% | | | |

| Norfolk Southern Corp. | | 1,865 | 371,750 |

|

| TOTAL INDUSTRIALS | | | 5,083,815 |

|

| INFORMATION TECHNOLOGY - 6.7% | | | |

| Communications Equipment - 1.5% | | | |

| Cisco Systems, Inc. | | 14,036 | 768,190 |

| Telefonaktiebolaget LM Ericsson (B Shares) sponsored ADR | | 47,600 | 452,200 |

| | | | 1,220,390 |

| Electronic Equipment & Components - 0.5% | | | |

| Corning, Inc. | | 12,900 | 428,667 |

| IT Services - 0.0% | | | |

| Amdocs Ltd. | | 29 | 1,801 |

| Paychex, Inc. | | 42 | 3,456 |

| | | | 5,257 |

| Semiconductors & Semiconductor Equipment - 1.6% | | | |

| Lam Research Corp. | | 1,900 | 356,896 |

| NXP Semiconductors NV | | 5,158 | 503,472 |

| Qualcomm, Inc. | | 6,361 | 483,881 |

| | | | 1,344,249 |

| Software - 1.7% | | | |

| Microsoft Corp. | | 10,308 | 1,380,860 |

| Technology Hardware, Storage & Peripherals - 1.4% | | | |

| Apple, Inc. | | 5,851 | 1,158,030 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 5,537,453 |

|

| MATERIALS - 5.3% | | | |

| Chemicals - 0.5% | | | |

| CF Industries Holdings, Inc. | | 9,400 | 439,074 |

| Dow, Inc. (c) | | 73 | 3,600 |

| DowDuPont, Inc. | | 73 | 5,480 |

| | | | 448,154 |

| Containers & Packaging - 0.5% | | | |

| Ardagh Group SA | | 23,227 | 406,473 |

| Metals & Mining - 3.9% | | | |

| Barrick Gold Corp. (Canada) | | 22,000 | 347,249 |

| BHP Billiton Ltd. sponsored ADR (d) | | 9,300 | 540,423 |

| Franco-Nevada Corp. | | 7,400 | 628,086 |

| Newmont Goldcorp Corp. | | 9,300 | 357,771 |

| Royal Gold, Inc. | | 5,900 | 604,691 |

| Wheaton Precious Metals Corp. | | 30,100 | 727,935 |

| | | | 3,206,155 |

| Paper & Forest Products - 0.4% | | | |

| Louisiana-Pacific Corp. | | 13,200 | 346,104 |

|

| TOTAL MATERIALS | | | 4,406,886 |

|

| REAL ESTATE - 1.7% | | | |

| Equity Real Estate Investment Trusts (REITs) - 1.7% | | | |

| American Tower Corp. | | 99 | 20,241 |

| Equinix, Inc. | | 615 | 310,138 |

| Simon Property Group, Inc. | | 2,635 | 420,968 |

| Weyerhaeuser Co. | | 23,000 | 605,820 |

| | | | 1,357,167 |

| UTILITIES - 0.0% | | | |

| Electric Utilities - 0.0% | | | |

| Exelon Corp. | | 269 | 12,896 |

| Vistra Energy Corp. | | 311 | 7,041 |

| | | | 19,937 |

| Multi-Utilities - 0.0% | | | |

| Ameren Corp. | | 124 | 9,314 |

|

| TOTAL UTILITIES | | | 29,251 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $39,407,548) | | | 43,282,948 |

|

| Convertible Preferred Stocks - 2.2% | | | |

| HEALTH CARE - 0.6% | | | |

| Health Care Technology - 0.6% | | | |

| Change Healthcare, Inc. 6.00% (c) | | 8,500 | 472,175 |

| INDUSTRIALS - 0.6% | | | |

| Trading Companies & Distributors - 0.6% | | | |

| Avantor, Inc. Series A 6.25% | | 8,100 | 533,466 |

| UTILITIES - 1.0% | | | |

| Electric Utilities - 1.0% | | | |

| Vistra Energy Corp. 7.00% | | 8,650 | 798,828 |

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $1,741,785) | | | 1,804,469 |

| | | Principal Amount | Value |

|

| Bank Loan Obligations - 6.9% | | | |

| CONSUMER DISCRETIONARY - 3.6% | | | |

| Diversified Consumer Services - 1.6% | | | |

| Spin Holdco, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.250% 5.851% 11/14/22 (b)(e) | | 1,022,268 | 1,000,729 |

| WASH Multifamily Acquisition, Inc. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.250% 5.6524% 5/14/22 (b)(e) | | 280,008 | 274,408 |

| 3 month U.S. LIBOR + 3.250% 5.6524% 5/14/22 (b)(e) | | 43,386 | 42,518 |

| | | | 1,317,655 |

| Hotels, Restaurants & Leisure - 0.5% | | | |

| Delta 2 SARL Tranche B, term loan 3 month U.S. LIBOR + 2.500% 4.9024% 2/1/24 (b)(e) | | 415,000 | 404,833 |

| Internet & Direct Marketing Retail - 1.5% | | | |

| Bass Pro Shops LLC. Tranche B, term loan 3 month U.S. LIBOR + 5.000% 7.4024% 9/25/24 (b)(e) | | 1,363,581 | 1,300,229 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 3,022,717 |

|

| ENERGY - 0.9% | | | |

| Oil, Gas & Consumable Fuels - 0.9% | | | |

| California Resources Corp.: | | | |

| Tranche 1LN, term loan 3 month U.S. LIBOR + 10.375% 12.7774% 12/31/21 (b)(e) | | 435,000 | 440,655 |

| Tranche B, term loan 3 month U.S. LIBOR + 4.750% 7.1524% 12/31/22 (b)(e) | | 320,000 | 305,373 |

| | | | 746,028 |

| FINANCIALS - 0.5% | | | |

| Diversified Financial Services - 0.5% | | | |

| Financial & Risk U.S. Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.750% 6.1524% 10/1/25 (b)(e) | | 412,925 | 400,149 |

| INDUSTRIALS - 0.7% | | | |

| Commercial Services & Supplies - 0.7% | | | |

| Lineage Logistics Holdings, LLC. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 5.4024% 2/27/25 (b)(e) | | 591,693 | 585,592 |

| INFORMATION TECHNOLOGY - 0.9% | | | |

| IT Services - 0.4% | | | |

| Web.com Group, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 7.750% 10.1606% 10/11/26 (b)(e) | | 178,753 | 175,178 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 6.1606% 10/11/25 (b)(e) | | 212,217 | 209,034 |

| | | | 384,212 |

| Software - 0.5% | | | |

| Landesk Group, Inc. term loan 3 month U.S. LIBOR + 4.250% 6.67% 1/20/24 (b)(e) | | 199,038 | 198,292 |

| Vertafore, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 5.6524% 7/2/25 (b)(e) | | 199,000 | 190,956 |

| | | | 389,248 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 773,460 |

|

| MATERIALS - 0.3% | | | |

| Containers & Packaging - 0.3% | | | |

| Flex Acquisition Co., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 5.44% 12/29/23 (b)(e) | | 232,365 | 220,456 |

| TOTAL BANK LOAN OBLIGATIONS | | | |

| (Cost $5,833,385) | | | 5,748,402 |

| | | Shares | Value |

|

| Fixed-Income Funds - 1.0% | | | |

| iShares JPMorgan USD Emerging Markets Bond ETF | | | |

| (Cost $780,378) | | 7,480 | 847,409 |

| | | Principal Amount | Value |

|

| Preferred Securities - 3.2% | | | |

| ENERGY - 0.3% | | | |

| Oil, Gas & Consumable Fuels - 0.3% | | | |

| Energy Transfer Partners LP 6.25% (b)(f) | | 280,000 | 266,938 |

| FINANCIALS - 2.6% | | | |

| Banks - 2.3% | | | |

| Bank of America Corp. 5.125% (b)(f) | | 300,000 | 302,337 |

| Barclays PLC 8% (b)(f) | | 205,000 | 219,265 |

| Citigroup, Inc. 5.9% (b)(f) | | 280,000 | 296,409 |

| JPMorgan Chase & Co. 5.15% (b)(f) | | 210,000 | 214,680 |

| Lloyds Bank PLC 6.75% (b)(f) | | 235,000 | 241,229 |

| Wachovia Capital Trust III 3 month U.S. LIBOR + 0.930% 5.5698% (b)(e)(f) | | 590,000 | 591,549 |

| | | | 1,865,469 |

| Capital Markets - 0.3% | | | |

| Goldman Sachs Group, Inc. 5.5% (b)(f) | | 275,000 | 282,107 |

|

| TOTAL FINANCIALS | | | 2,147,576 |

|

| INDUSTRIALS - 0.3% | | | |

| Industrial Conglomerates - 0.3% | | | |

| General Electric Co. 5% (b)(f) | | 270,000 | 259,590 |

| TOTAL PREFERRED SECURITIES | | | |

| (Cost $2,558,456) | | | 2,674,104 |

| | | Shares | Value |

|

| Money Market Funds - 1.8% | | | |

| Fidelity Cash Central Fund 2.42% (g) | | 1,100,813 | 1,101,034 |

| Fidelity Securities Lending Cash Central Fund 2.42% (g)(h) | | 404,569 | 404,610 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $1,505,642) | | | 1,505,644 |

| TOTAL INVESTMENT IN SECURITIES - 101.5% | | | |

| (Cost $78,451,419) | | | 84,119,391 |

| NET OTHER ASSETS (LIABILITIES) - (1.5)% | | | (1,204,978) |

| NET ASSETS - 100% | | | $82,914,413 |

Security Type Abbreviations

ETF – Exchange-Traded Fund

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $8,166,817 or 9.8% of net assets.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Non-income producing

(d) Security or a portion of the security is on loan at period end.

(e) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(f) Security is perpetual in nature with no stated maturity date.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $11,553 |

| Fidelity Securities Lending Cash Central Fund | 1,550 |

| Total | $13,103 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of payments to and from borrowers of securities.

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2019, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $2,873,781 | $2,873,781 | $-- | $-- |

| Consumer Discretionary | 4,483,405 | 4,483,405 | -- | -- |

| Consumer Staples | 4,947,791 | 4,931,659 | 16,132 | -- |

| Energy | 4,753,580 | 4,753,580 | -- | -- |

| Financials | 6,572,898 | 6,572,898 | -- | -- |

| Health Care | 3,709,096 | 3,216,890 | 492,206 | -- |

| Industrials | 5,617,281 | 5,083,815 | 533,466 | -- |

| Information Technology | 5,537,453 | 5,537,453 | -- | -- |

| Materials | 4,406,886 | 4,406,886 | -- | -- |

| Real Estate | 1,357,167 | 1,357,167 | -- | -- |

| Utilities | 828,079 | 29,251 | 798,828 | -- |

| Corporate Bonds | 17,141,360 | -- | 17,141,360 | -- |

| U.S. Government and Government Agency Obligations | 8,569,284 | -- | 8,569,284 | -- |

| Municipal Securities | 15,796 | -- | 15,796 | -- |

| Foreign Government and Government Agency Obligations | 2,529,975 | -- | 2,529,975 | -- |

| Bank Loan Obligations | 5,748,402 | -- | 5,748,402 | -- |

| Fixed-Income Funds | 847,409 | 847,409 | -- | -- |

| Preferred Securities | 2,674,104 | -- | 2,674,104 | -- |

| Money Market Funds | 1,505,644 | 1,505,644 | -- | -- |

| Total Investments in Securities: | $84,119,391 | $45,599,838 | $38,519,553 | $-- |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 74.5% |

| Canada | 6.0% |

| Brazil | 4.6% |

| Luxembourg | 2.6% |

| Switzerland | 1.9% |

| Marshall Islands | 1.8% |

| Netherlands | 1.4% |

| Multi-National | 1.2% |

| United Kingdom | 1.1% |

| Others (Individually Less Than 1%) | 4.9% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | June 30, 2019 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $395,148) — See accompanying schedule:

Unaffiliated issuers (cost $76,945,777) | $82,613,747 | |

| Fidelity Central Funds (cost $1,505,642) | 1,505,644 | |

| Total Investment in Securities (cost $78,451,419) | | $84,119,391 |

| Cash | | 424,784 |

| Receivable for investments sold | | 2,014,248 |

| Receivable for fund shares sold | | 156,736 |

| Dividends receivable | | 50,987 |

| Interest receivable | | 339,158 |

| Distributions receivable from Fidelity Central Funds | | 1,265 |

| Receivable from investment adviser for expense reductions | | 4,323 |

| Other receivables | | 1,191 |

| Total assets | | 87,112,083 |

| Liabilities | | |

| Payable for investments purchased | $3,622,560 | |

| Payable for fund shares redeemed | 71,101 | |

| Distributions payable | 5,128 | |

| Accrued management fee | 35,902 | |

| Distribution and service plan fees payable | 8,072 | |

| Other affiliated payables | 10,443 | |

| Other payables and accrued expenses | 39,864 | |

| Collateral on securities loaned | 404,600 | |

| Total liabilities | | 4,197,670 |

| Net Assets | | $82,914,413 |

| Net Assets consist of: | | |

| Paid in capital | | $77,532,821 |

| Total distributable earnings (loss) | | 5,381,592 |

| Net Assets | | $82,914,413 |

| Net Asset Value and Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($18,398,247 ÷ 1,684,994 shares)(a) | | $10.92 |

| Maximum offering price per share (100/96.00 of $10.92) | | $11.38 |

| Class M: | | |

| Net Asset Value and redemption price per share ($8,533,980 ÷ 781,542 shares)(a) | | $10.92 |

| Maximum offering price per share (100/96.00 of $10.92) | | $11.38 |

| Class C: | | |

| Net Asset Value and offering price per share ($3,370,225 ÷ 309,053 shares)(a) | | $10.91 |

| Fidelity Multi-Asset Income Fund: | | |

| Net Asset Value, offering price and redemption price per share ($27,432,072 ÷ 2,511,104 shares) | | $10.92 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($25,014,030 ÷ 2,290,374 shares) | | $10.92 |

| Class Z: | | |

| Net Asset Value, offering price and redemption price per share ($165,859 ÷ 15,184 shares) | | $10.92 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended June 30, 2019 (Unaudited) |

| Investment Income | | |

| Dividends | | $554,730 |

| Interest | | 688,192 |

| Income from Fidelity Central Funds (including $1,550 from security lending) | | 13,103 |

| Total income | | 1,256,025 |

| Expenses | | |

| Management fee | $180,654 | |

| Transfer agent fees | 40,928 | |

| Distribution and service plan fees | 55,560 | |

| Accounting and security lending fees | 16,083 | |

| Custodian fees and expenses | 14,618 | |

| Independent trustees' fees and expenses | 110 | |

| Registration fees | 59,479 | |

| Audit | 53,275 | |

| Legal | 2,143 | |

| Miscellaneous | 158 | |

| Total expenses before reductions | 423,008 | |

| Expense reductions | (97,281) | |

| Total expenses after reductions | | 325,727 |

| Net investment income (loss) | | 930,298 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 931,539 | |

| Fidelity Central Funds | (14) | |

| Foreign currency transactions | (2,519) | |

| Total net realized gain (loss) | | 929,006 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 5,743,206 | |

| Fidelity Central Funds | 1 | |

| Assets and liabilities in foreign currencies | (1,582) | |

| Total change in net unrealized appreciation (depreciation) | | 5,741,625 |

| Net gain (loss) | | 6,670,631 |

| Net increase (decrease) in net assets resulting from operations | | $7,600,929 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended June 30, 2019 (Unaudited) | Year ended December 31, 2018 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $930,298 | $1,051,343 |

| Net realized gain (loss) | 929,006 | (572,901) |

| Change in net unrealized appreciation (depreciation) | 5,741,625 | (2,191,825) |

| Net increase (decrease) in net assets resulting from operations | 7,600,929 | (1,713,383) |

| Distributions to shareholders | (919,718) | (1,284,010) |

| Share transactions - net increase (decrease) | 23,405,204 | 6,963,706 |

| Total increase (decrease) in net assets | 30,086,415 | 3,966,313 |

| Net Assets | | |

| Beginning of period | 52,827,998 | 48,861,685 |

| End of period | $82,914,413 | $52,827,998 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Multi-Asset Income Fund Class A

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 A |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $9.81 | $10.41 | $10.14 | $9.91 | $10.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | .145 | .223 | .243 | .438C | .097 |

| Net realized and unrealized gain (loss) | 1.108 | (.558) | .348 | .584 | (.060) |

| Total from investment operations | 1.253 | (.335) | .591 | 1.022 | .037 |

| Distributions from net investment income | (.143) | (.207)D | (.210) | (.439) | (.096) |

| Distributions from net realized gain | – | (.058)D | (.069) | (.353) | (.031) |

| Tax return of capital | – | – | (.042) | – | – |

| Total distributions | (.143) | (.265) | (.321) | (.792) | (.127) |

| Net asset value, end of period | $10.92 | $9.81 | $10.41 | $10.14 | $9.91 |

| Total ReturnE,F,G | 12.83% | (3.25)% | 5.94% | 10.55% | .36% |

| Ratios to Average Net AssetsH,I | | | | | |

| Expenses before reductions | 1.38%J | 1.38% | 1.38% | 1.73% | 2.10%J |

| Expenses net of fee waivers, if any | 1.10%J | 1.10% | 1.10% | 1.10% | 1.10%J |

| Expenses net of all reductions | 1.09%J | 1.08% | 1.09% | 1.10% | 1.10%J |

| Net investment income (loss) | 2.80%J | 2.19% | 2.38% | 4.32%C | 3.10%J |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $18,398 | $9,513 | $10,443 | $9,524 | $6,284 |

| Portfolio turnover rateK | 365%J | 367% | 299% | 239% | 71%L |

A For the period September 9, 2015 (commencement of operations) to December 31, 2015.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.031 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 4.01%.

D The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Annualized

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

L Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class M

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 A |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $9.81 | $10.41 | $10.14 | $9.91 | $10.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | .146 | .223 | .243 | .439C | .097 |

| Net realized and unrealized gain (loss) | 1.107 | (.558) | .348 | .583 | (.060) |

| Total from investment operations | 1.253 | (.335) | .591 | 1.022 | .037 |

| Distributions from net investment income | (.143) | (.207)D | (.210) | (.439) | (.096) |

| Distributions from net realized gain | – | (.058)D | (.069) | (.353) | (.031) |

| Tax return of capital | – | – | (.042) | – | – |

| Total distributions | (.143) | (.265) | (.321) | (.792) | (.127) |

| Net asset value, end of period | $10.92 | $9.81 | $10.41 | $10.14 | $9.91 |

| Total ReturnE,F,G | 12.83% | (3.25)% | 5.94% | 10.55% | .36% |

| Ratios to Average Net AssetsH,I | | | | | |

| Expenses before reductions | 1.44%J | 1.40% | 1.40% | 1.75% | 2.11%J |

| Expenses net of fee waivers, if any | 1.10%J | 1.10% | 1.10% | 1.10% | 1.10%J |

| Expenses net of all reductions | 1.09%J | 1.08% | 1.09% | 1.10% | 1.10%J |

| Net investment income (loss) | 2.80%J | 2.19% | 2.38% | 4.32%C | 3.10%J |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $8,534 | $7,441 | $7,511 | $7,171 | $5,578 |

| Portfolio turnover rateK | 365%J | 367% | 299% | 239% | 71%L |

A For the period September 9, 2015 (commencement of operations) to December 31, 2015.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.031 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 4.01%.

D The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Annualized

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

L Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class C

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 A |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $9.80 | $10.41 | $10.14 | $9.91 | $10.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | .107 | .147 | .166 | .363C | .074 |

| Net realized and unrealized gain (loss) | 1.108 | (.561) | .351 | .583 | (.059) |

| Total from investment operations | 1.215 | (.414) | .517 | .946 | .015 |

| Distributions from net investment income | (.105) | (.138)D | (.148) | (.363) | (.074) |

| Distributions from net realized gain | – | (.058)D | (.069) | (.353) | (.031) |

| Tax return of capital | – | – | (.030) | – | – |

| Total distributions | (.105) | (.196) | (.247) | (.716) | (.105) |

| Net asset value, end of period | $10.91 | $9.80 | $10.41 | $10.14 | $9.91 |

| Total ReturnE,F,G | 12.44% | (4.00)% | 5.18% | 9.74% | .14% |

| Ratios to Average Net AssetsH,I | | | | | |

| Expenses before reductions | 2.30%J | 2.14% | 2.14% | 2.50% | 2.86%J |

| Expenses net of fee waivers, if any | 1.85%J | 1.85% | 1.85% | 1.85% | 1.85%J |

| Expenses net of all reductions | 1.84%J | 1.83% | 1.84% | 1.85% | 1.85%J |

| Net investment income (loss) | 2.05%J | 1.44% | 1.63% | 3.57%C | 2.35%J |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $3,370 | $8,003 | $8,683 | $7,162 | $5,468 |

| Portfolio turnover rateK | 365%J | 367% | 299% | 239% | 71%L |

A For the period September 9, 2015 (commencement of operations) to December 31, 2015.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.031 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 3.26%.

D The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the contingent deferred sales charge.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Annualized

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

L Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, |

| | 2019 | 2018 A |

| Selected Per–Share Data | | |

| Net asset value, beginning of period | $9.81 | $10.00 |

| Income from Investment Operations | | |

| Net investment income (loss)B | .158 | .168 |

| Net realized and unrealized gain (loss) | 1.107 | (.135) |

| Total from investment operations | 1.265 | .033 |

| Distributions from net investment income | (.155) | (.165)C |

| Distributions from net realized gain | – | (.058)C |

| Total distributions | (.155) | (.223) |

| Net asset value, end of period | $10.92 | $9.81 |

| Total ReturnD,E | 12.96% | .30% |

| Ratios to Average Net AssetsF,G | | |

| Expenses before reductions | 1.07%H | 1.05%H |

| Expenses net of fee waivers, if any | .85%H | .85%H |

| Expenses net of all reductions | .84%H | .84%H |

| Net investment income (loss) | 3.05%H | 2.17%H |

| Supplemental Data | | |

| Net assets, end of period (000 omitted) | $27,432 | $5,819 |

| Portfolio turnover rateI | 365%H | 367% |

A For the period March 28, 2018 (commencement of sale of shares) to December 31, 2018.

B Calculated based on average shares outstanding during the period.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class I

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 A |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $9.81 | $10.41 | $10.14 | $9.92 | $10.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | .159 | .249 | .268 | .464C | .104 |

| Net realized and unrealized gain (loss) | 1.107 | (.558) | .349 | .573 | (.050) |

| Total from investment operations | 1.266 | (.309) | .617 | 1.037 | .054 |

| Distributions from net investment income | (.156) | (.233)D | (.231) | (.464) | (.103) |

| Distributions from net realized gain | – | (.058)D | (.069) | (.353) | (.031) |

| Tax return of capital | – | – | (.047) | – | – |

| Total distributions | (.156) | (.291) | (.347) | (.817) | (.134) |

| Net asset value, end of period | $10.92 | $9.81 | $10.41 | $10.14 | $9.92 |

| Total ReturnE,F | 12.96% | (3.01)% | 6.20% | 10.72% | .54% |

| Ratios to Average Net AssetsG,H | | | | | |

| Expenses before reductions | 1.13%I | 1.08% | 1.10% | 1.47% | 1.80%I |

| Expenses net of fee waivers, if any | .85%I | .85% | .85% | .85% | .85%I |

| Expenses net of all reductions | .84%I | .83% | .84% | .85% | .85%I |

| Net investment income (loss) | 3.05%I | 2.44% | 2.63% | 4.57%C | 3.35%I |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $25,014 | $21,904 | $22,224 | $20,092 | $21,614 |

| Portfolio turnover rateJ | 365%I | 367% | 299% | 239% | 71%K |

A For the period September 9, 2015 (commencement of operations) to December 31, 2015.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.031 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 4.26%.

D The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

K Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class Z

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, |

| | 2019 | 2018 A |

| Selected Per–Share Data | | |

| Net asset value, beginning of period | $9.81 | $10.37 |

| Income from Investment Operations | | |

| Net investment income (loss)B | .163 | .052 |

| Net realized and unrealized gain (loss) | 1.107 | (.515) |

| Total from investment operations | 1.270 | (.463) |

| Distributions from net investment income | (.160) | (.039)C |

| Distributions from net realized gain | – | (.058)C |

| Total distributions | (.160) | (.097) |

| Net asset value, end of period | $10.92 | $9.81 |

| Total ReturnD,E | 13.01% | (4.46)% |

| Ratios to Average Net AssetsF,G | | |

| Expenses before reductions | 1.09%H | .89%H |

| Expenses net of fee waivers, if any | .76%H | .76%H |

| Expenses net of all reductions | .75%H | .74%H |

| Net investment income (loss) | 3.13%H | 2.04%H |

| Supplemental Data | | |

| Net assets, end of period (000 omitted) | $166 | $148 |

| Portfolio turnover rateI | 365%H | 367% |

A For the period October 2, 2018 (commencement of sale of shares) to December 31, 2018.

B Calculated based on average shares outstanding during the period.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2019

1. Organization.

Fidelity Advisor Multi-Asset Income Fund (the Fund) is a fund of Fidelity School Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, Fidelity Multi-Asset Income Fund, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Effective March 1, 2019, Class C shares will automatically convert to Class A shares after a holding period of ten years from the initial date of purchase, with certain exceptions.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, bank loan obligations, foreign government and government agency obligations, municipal securities, preferred securities, and U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

ETFs are valued at their last sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of June 30, 2019 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. The principal amount on inflation-indexed securities is periodically adjusted to the rate of inflation and interest is accrued based on the principal amount. The adjustments to principal due to inflation are reflected as increases or decreases to Interest in the accompanying Statement of Operations. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain conversion ratio adjustments, equity-debt classifications, partnerships and losses deferred due to wash sales and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $5,938,968 |

| Gross unrealized depreciation | (631,200) |

| Net unrealized appreciation (depreciation) | $5,307,768 |

| Tax cost | $78,811,623 |

The Fund elected to defer to its next fiscal year approximately $662,077 of capital losses recognized during the period November 1, 2018 to December 31, 2018.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Loans and Other Direct Debt Instruments. The Fund invests in direct debt instruments which are interests in amounts owed to lenders by corporate or other borrowers. These instruments may be in the form of loans, trade claims or other receivables and may include standby financing commitments such as revolving credit facilities that obligate the Fund to supply additional cash to the borrower on demand. Loans may be acquired through assignment or participation. The Fund did not have any unfunded loan commitments, which are contractual obligations for future funding, at period end.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $118,356,253 and $85,253,590, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and an annualized group fee rate that averaged .10% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annualized management fee rate was .55% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution Fee | Service Fee | Total Fees | Retained by FDC |

| Class A | -% | .25% | $17,223 | $10,966 |

| Class M | -% | .25% | 9,914 | 7,174 |

| Class C | .75% | .25% | 28,423 | 15,755 |

| | | | $55,560 | $33,895 |

Sales Load. FDC may receive a front-end sales charge of up to 4.00% for selling Class A shares and Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained by FDC |

| Class A | $1,829 |

| Class M | 418 |

| Class C(a) | 48 |

| | $2,295 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund, except for Class Z. FIIOC receives an asset-based fee of Class Z's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets(a) |