UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02676

Fidelity School Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | June 30, 2021 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Multi-Asset Income Fund

Semi-Annual Report

June 30, 2021

Includes Fidelity and Fidelity Advisor share classes

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

Top Five Holdings as of June 30, 2021

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| U.S. Treasury Obligations | 11.4 |

| Petroleos Mexicanos | 1.8 |

| Albertsons Companies LLC/Safeway Inc./New Albertson's, Inc./Albertson's LLC | 1.4 |

| DHT Holdings, Inc. | 1.3 |

| Wheaton Precious Metals Corp. | 1.3 |

| | 17.2 |

Top Five Market Sectors as of June 30, 2021

| | % of fund's net assets |

| Energy | 16.3 |

| Financials | 13.1 |

| Consumer Discretionary | 10.7 |

| Real Estate | 10.0 |

| Communication Services | 8.4 |

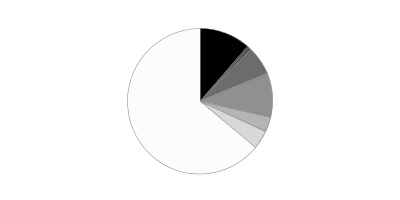

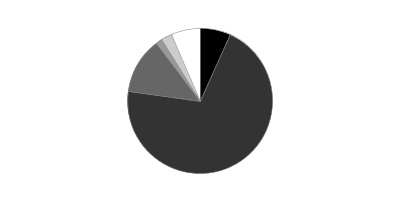

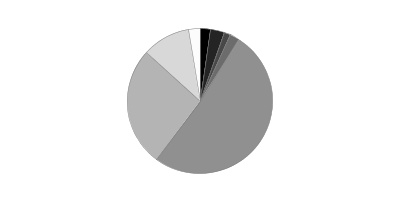

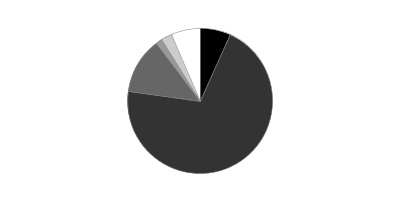

Quality Diversification (% of fund's net assets)

| As of June 30, 2021 |

| | U.S. Government and U.S. Government Agency Obligations | 11.4% |

| | AAA,AA,A | 0.4% |

| | BBB | 0.6% |

| | BB | 6.4% |

| | B | 9.9% |

| | CCC,CC,C | 3.3% |

| | Not Rated | 4.1% |

| | Equities | 64.1% |

| | Short-Term Investments and Net Other Assets* | (0.2)% |

* Short-Term Investments and Net Other Assets (Liabilities) are not included in the pie chart

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

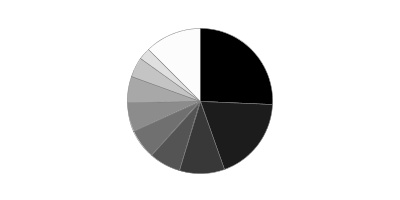

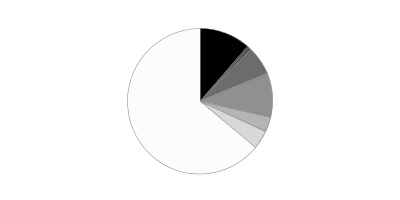

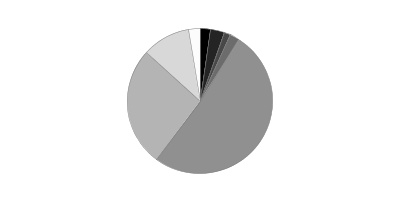

Asset Allocation (% of fund's net assets)

| As of June 30, 2021* |

| | Preferred Securities | 0.8% |

| | Corporate Bonds | 19.7% |

| | U.S. Government and U.S. Government Agency Obligations | 11.4% |

| | Bank Loan Obligations | 4.2% |

| | Stocks | 64.1% |

| | Short-Term Investments and Net Other Assets (Liabilities)** | (0.2)% |

* Foreign investments – 28.8%

** Short-Term Investments and Net Other Assets (Liabilities) are not included in the pie chart

Schedule of Investments June 30, 2021 (Unaudited)

Showing Percentage of Net Assets

| Corporate Bonds - 19.7% | | | |

| | | Principal Amount | Value |

| Convertible Bonds - 4.4% | | | |

| COMMUNICATION SERVICES - 1.4% | | | |

| Entertainment - 0.4% | | | |

| World Wrestling Entertainment, Inc. 3.375% 12/15/23 | | $2,183,000 | $5,193,357 |

| Interactive Media & Services - 0.8% | | | |

| Twitter, Inc. 0.25% 6/15/24 | | 6,763,000 | 9,278,160 |

| Media - 0.2% | | | |

| DISH Network Corp. 0% 12/15/25 (a) | | 1,747,000 | 2,034,382 |

| TOTAL COMMUNICATION SERVICES | | | 16,505,899 |

| CONSUMER DISCRETIONARY - 0.7% | | | |

| Hotels, Restaurants & Leisure - 0.6% | | | |

| Booking Holdings, Inc. 0.75% 5/1/25 | | 2,980,000 | 4,213,720 |

| Penn National Gaming, Inc. 2.75% 5/15/26 | | 739,000 | 2,465,969 |

| | | | 6,679,689 |

| Specialty Retail - 0.1% | | | |

| Shift Technologies, Inc. 4.75% 5/15/26 (a) | | 1,500,000 | 1,828,200 |

| TOTAL CONSUMER DISCRETIONARY | | | 8,507,889 |

| ENERGY - 0.5% | | | |

| Oil, Gas & Consumable Fuels - 0.5% | | | |

| Antero Resources Corp. 4.25% 9/1/26 (a) | | 823,000 | 2,950,455 |

| Cheniere Energy, Inc. 4.25% 3/15/45 | | 3,299,000 | 2,778,444 |

| | | | 5,728,899 |

| HEALTH CARE - 0.7% | | | |

| Biotechnology - 0.7% | | | |

| Novavax, Inc. 3.75% 2/1/23 | | 4,602,000 | 8,203,065 |

| INDUSTRIALS - 0.8% | | | |

| Construction & Engineering - 0.2% | | | |

| Granite Construction, Inc. 2.75% 11/1/24 | | 1,183,000 | 1,708,230 |

| Machinery - 0.2% | | | |

| The Greenbrier Companies, Inc. 2.875% 4/15/28 (a) | | 2,330,000 | 2,431,355 |

| Professional Services - 0.4% | | | |

| FTI Consulting, Inc. 2% 8/15/23 | | 1,439,000 | 2,053,453 |

| KBR, Inc. 2.5% 11/1/23 | | 1,608,000 | 2,521,344 |

| | | | 4,574,797 |

| TOTAL INDUSTRIALS | | | 8,714,382 |

| INFORMATION TECHNOLOGY - 0.3% | | | |

| Semiconductors & Semiconductor Equipment - 0.3% | | | |

| Micron Technology, Inc. 3.125% 5/1/32 (b) | | 418,000 | 3,558,569 |

|

| TOTAL CONVERTIBLE BONDS | | | 51,218,703 |

|

| Nonconvertible Bonds - 15.3% | | | |

| COMMUNICATION SERVICES - 0.9% | | | |

| Diversified Telecommunication Services - 0.5% | | | |

| Altice France SA 5.125% 7/15/29 (a) | | 2,500,000 | 2,512,250 |

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (a) | | 150,000 | 160,313 |

| Sable International Finance Ltd. 5.75% 9/7/27 (a) | | 1,925,000 | 2,020,673 |

| Sprint Capital Corp. 8.75% 3/15/32 | | 595,000 | 904,400 |

| Windstream Escrow LLC 7.75% 8/15/28 (a) | | 245,000 | 252,350 |

| | | | 5,849,986 |

| Entertainment - 0.0% | | | |

| Allen Media LLC 10.5% 2/15/28 (a) | | 500,000 | 531,250 |

| Media - 0.2% | | | |

| CCO Holdings LLC/CCO Holdings Capital Corp. 4.5% 8/15/30 (a) | | 235,000 | 244,685 |

| CSC Holdings LLC 5% 11/15/31 (a) | | 600,000 | 602,880 |

| Diamond Sports Group LLC/Diamond Sports Finance Co. 5.375% 8/15/26 (a) | | 1,540,000 | 997,150 |

| Radiate Holdco LLC/Radiate Financial Service Ltd. 6.5% 9/15/28 (a) | | 350,000 | 367,728 |

| Time Warner Cable LLC 6.55% 5/1/37 | | 5,000 | 6,811 |

| | | | 2,219,254 |

| Wireless Telecommunication Services - 0.2% | | | |

| Telesat Canada/Telesat LLC 5.625% 12/6/26 (a) | | 2,050,000 | 2,057,688 |

| TOTAL COMMUNICATION SERVICES | | | 10,658,178 |

| CONSUMER DISCRETIONARY - 3.2% | | | |

| Automobiles - 0.6% | | | |

| Aston Martin Capital Holdings Ltd. 10.5% 11/30/25 (a) | | 3,605,000 | 4,019,575 |

| Ford Motor Co.: | | | |

| 5.291% 12/8/46 | | 1,750,000 | 1,954,540 |

| 7.4% 11/1/46 | | 575,000 | 755,061 |

| 8.5% 4/21/23 | | 585,000 | 652,831 |

| | | | 7,382,007 |

| Distributors - 0.1% | | | |

| BCPE Empire Holdings, Inc. 7.625% 5/1/27 (a) | | 900,000 | 921,690 |

| Diversified Consumer Services - 0.4% | | | |

| Adtalem Global Education, Inc. 5.5% 3/1/28 (a) | | 750,000 | 761,663 |

| BidFair Holdings, Inc. 5.875% 6/1/29 (a) | | 2,000,000 | 2,030,000 |

| Sotheby's 7.375% 10/15/27 (a) | | 495,000 | 533,981 |

| WASH Multifamily Acquisition, Inc. 5.75% 4/15/26 (a) | | 1,910,000 | 1,994,231 |

| | | | 5,319,875 |

| Hotels, Restaurants & Leisure - 0.5% | | | |

| Affinity Gaming LLC 6.875% 12/15/27 (a) | | 955,000 | 1,013,494 |

| Caesars Entertainment, Inc. 6.25% 7/1/25 (a) | | 1,910,000 | 2,024,600 |

| Peninsula Pacific Entertainment LLC 8.5% 11/15/27 (a) | | 1,090,000 | 1,170,660 |

| Raptor Acquisition Corp. / Raptor Co-Issuer LLC 4.875% 11/1/26 (a) | | 895,000 | 907,512 |

| SeaWorld Parks & Entertainment, Inc. 9.5% 8/1/25 (a) | | 340,000 | 364,650 |

| | | | 5,480,916 |

| Specialty Retail - 1.6% | | | |

| Carvana Co.: | | | |

| 5.5% 4/15/27 (a) | | 1,950,000 | 2,013,824 |

| 5.875% 10/1/28 (a) | | 1,595,000 | 1,678,259 |

| Ken Garff Automotive LLC 4.875% 9/15/28 (a) | | 4,620,000 | 4,712,400 |

| L Brands, Inc. 6.75% 7/1/36 | | 5,270,000 | 6,600,675 |

| Magic MergerCo, Inc.: | | | |

| 5.25% 5/1/28 (a) | | 750,000 | 769,448 |

| 7.875% 5/1/29 (a) | | 3,250,000 | 3,351,563 |

| | | | 19,126,169 |

| TOTAL CONSUMER DISCRETIONARY | | | 38,230,657 |

| CONSUMER STAPLES - 1.7% | | | |

| Food & Staples Retailing - 1.4% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC: | | | |

| 3.5% 3/15/29 (a) | | 4,750,000 | 4,696,563 |

| 4.875% 2/15/30 (a) | | 10,670,000 | 11,379,662 |

| SEG Holding LLC/SEG Finance Corp. 5.625% 10/15/28 (a) | | 400,000 | 419,880 |

| | | | 16,496,105 |

| Food Products - 0.1% | | | |

| Del Monte Foods, Inc. 11.875% 5/15/25 (a) | | 975,000 | 1,111,500 |

| Tobacco - 0.2% | | | |

| Turning Point Brands, Inc. 5.625% 2/15/26 (a) | | 2,930,000 | 3,025,225 |

| TOTAL CONSUMER STAPLES | | | 20,632,830 |

| ENERGY - 4.9% | | | |

| Oil, Gas & Consumable Fuels - 4.9% | | | |

| Alliance Resource Operating Partners LP / Alliance Resource Finance Corp. 7.5% 5/1/25 (a) | | 5,150,000 | 5,027,688 |

| Antero Resources Corp. 5.375% 3/1/30 (a) | | 2,495,000 | 2,546,472 |

| CNX Resources Corp. 6% 1/15/29 (a) | | 220,000 | 237,868 |

| Colgate Energy Partners III LLC 5.875% 7/1/29 (a) | | 645,000 | 669,188 |

| Comstock Resources, Inc.: | | | |

| 5.875% 1/15/30 (a) | | 1,990,000 | 2,029,800 |

| 6.75% 3/1/29 (a) | | 635,000 | 676,421 |

| Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp. 6% 2/1/29 (a) | | 975,000 | 1,021,313 |

| Delek Logistics Partners LP 7.125% 6/1/28 (a) | | 1,420,000 | 1,498,100 |

| New Fortress Energy, Inc.: | | | |

| 6.5% 9/30/26 (a) | | 1,000,000 | 1,021,800 |

| 6.75% 9/15/25 (a) | | 450,000 | 460,688 |

| Northern Oil & Gas, Inc. 8.125% 3/1/28 (a) | | 4,735,000 | 5,101,963 |

| Occidental Petroleum Corp. 7.2% 4/1/28 | | 550,000 | 640,750 |

| Parkland Corp. 4.5% 10/1/29 (a) | | 2,200,000 | 2,235,618 |

| Petroleos Mexicanos 7.69% 1/23/50 | | 22,000,000 | 21,092,500 |

| Range Resources Corp. 8.25% 1/15/29 (a) | | 2,550,000 | 2,875,125 |

| Renewable Energy Group, Inc. 5.875% 6/1/28 (a) | | 985,000 | 1,031,118 |

| Rockies Express Pipeline LLC: | | | |

| 4.8% 5/15/30 (a) | | 1,900,000 | 1,895,953 |

| 7.5% 7/15/38 (a) | | 1,245,000 | 1,375,725 |

| SFL Corp. Ltd. 7.25% 5/12/26 (a) | | 2,400,000 | 2,412,000 |

| Teekay Corp. 9.25% 11/15/22 (a) | | 2,945,000 | 3,044,394 |

| The Williams Companies, Inc. 5.75% 6/24/44 | | 20,000 | 26,233 |

| Viper Energy Partners LP 5.375% 11/1/27 (a) | | 370,000 | 385,433 |

| | | | 57,306,150 |

| FINANCIALS - 0.2% | | | |

| Consumer Finance - 0.1% | | | |

| Ally Financial, Inc.: | | | |

| 8% 11/1/31 | | 350,000 | 502,967 |

| 8% 11/1/31 | | 275,000 | 386,820 |

| Ford Motor Credit Co. LLC 5.125% 6/16/25 | | 345,000 | 379,931 |

| | | | 1,269,718 |

| Diversified Financial Services - 0.1% | | | |

| Compass Group Diversified Holdings LLC 5.25% 4/15/29 (a) | | 1,030,000 | 1,071,200 |

| TOTAL FINANCIALS | | | 2,340,918 |

| HEALTH CARE - 0.1% | | | |

| Health Care Providers & Services - 0.1% | | | |

| Community Health Systems, Inc. 6.125% 4/1/30 (a) | | 1,495,000 | 1,517,425 |

| INDUSTRIALS - 2.0% | | | |

| Aerospace & Defense - 0.5% | | | |

| Bombardier, Inc.: | | | |

| 7.125% 6/15/26 (a) | | 1,000,000 | 1,042,500 |

| 7.45% 5/1/34 (a) | | 1,000,000 | 1,070,000 |

| 7.5% 12/1/24 (a) | | 1,590,000 | 1,661,550 |

| 7.875% 4/15/27 (a) | | 1,415,000 | 1,468,063 |

| Howmet Aerospace, Inc. 5.95% 2/1/37 | | 750,000 | 907,613 |

| | | | 6,149,726 |

| Commercial Services & Supplies - 0.4% | | | |

| APX Group, Inc.: | | | |

| 6.75% 2/15/27 (a) | | 365,000 | 389,163 |

| 7.625% 9/1/23 | | 475,000 | 488,063 |

| Atlas Luxco 4 SARL / Allied Universal Holdco LLC / Allied Universal Finance Corp.: | | | |

| 4.625% 6/1/28 (a) | | 604,000 | 604,473 |

| 4.625% 6/1/28 (a) | | 396,000 | 397,430 |

| Pitney Bowes, Inc.: | | | |

| 6.875% 3/15/27 (a) | | 725,000 | 765,781 |

| 7.25% 3/15/29 (a) | | 500,000 | 531,250 |

| PowerTeam Services LLC 9.033% 12/4/25 (a) | | 1,760,000 | 1,936,000 |

| | | | 5,112,160 |

| Construction & Engineering - 0.3% | | | |

| Great Lakes Dredge & Dock Corp. 5.25% 6/1/29 (a) | | 1,090,000 | 1,122,809 |

| Pike Corp. 5.5% 9/1/28 (a) | | 1,895,000 | 1,970,800 |

| | | | 3,093,609 |

| Marine - 0.8% | | | |

| Navios Maritime Acquisition Corp./Navios Acquisition Finance U.S., Inc. 8.125% 11/15/21 (a) | | 4,300,000 | 3,698,000 |

| Navios Maritime Holdings, Inc.: | | | |

| 7.375% 1/15/22 (a) | | 1,725,000 | 1,483,384 |

| 11.25% 8/15/22 (a) | | 1,350,000 | 1,350,000 |

| Seaspan Corp.: | | | |

| 6.5% 2/5/24 (a) | | 400,000 | 416,000 |

| 6.5% 4/29/26 (a) | | 2,200,000 | 2,318,250 |

| | | | 9,265,634 |

| Professional Services - 0.0% | | | |

| ASGN, Inc. 4.625% 5/15/28 (a) | | 250,000 | 261,868 |

| TOTAL INDUSTRIALS | | | 23,882,997 |

| INFORMATION TECHNOLOGY - 0.2% | | | |

| IT Services - 0.1% | | | |

| Acuris Finance U.S. 5% 5/1/28 (a) | | 1,500,000 | 1,495,290 |

| Unisys Corp. 6.875% 11/1/27 (a) | | 250,000 | 273,210 |

| | | | 1,768,500 |

| Software - 0.1% | | | |

| Clarivate Science Holdings Corp. 4.875% 6/30/29 (a) | | 740,000 | 759,425 |

| TOTAL INFORMATION TECHNOLOGY | | | 2,527,925 |

| MATERIALS - 1.3% | | | |

| Chemicals - 0.2% | | | |

| CVR Partners LP 6.125% 6/15/28 (a) | | 1,000,000 | 1,025,000 |

| The Chemours Co. LLC: | | | |

| 5.375% 5/15/27 | | 430,000 | 466,365 |

| 5.75% 11/15/28 (a) | | 875,000 | 936,049 |

| | | | 2,427,414 |

| Containers & Packaging - 0.1% | | | |

| ARD Finance SA 6.5% 6/30/27 pay-in-kind (a)(c) | | 350,000 | 367,500 |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc. 5.25% 8/15/27 (a) | | 325,000 | 331,500 |

| | | | 699,000 |

| Metals & Mining - 1.0% | | | |

| Allegheny Technologies, Inc. 5.875% 12/1/27 | | 150,000 | 157,125 |

| Coeur d'Alene Mines Corp. 5.125% 2/15/29 (a) | | 5,010,000 | 4,959,900 |

| First Quantum Minerals Ltd.: | | | |

| 6.875% 3/1/26 (a) | | 325,000 | 340,594 |

| 6.875% 10/15/27 (a) | | 325,000 | 352,528 |

| 7.25% 4/1/23 (a) | | 435,000 | 442,613 |

| Infrabuild Australia Pty Ltd. 12% 10/1/24 (a) | | 5,167,000 | 5,457,644 |

| Joseph T. Ryerson & Son, Inc. 8.5% 8/1/28 (a) | | 136,000 | 150,960 |

| TMS International Corp. 6.25% 4/15/29 (a) | | 500,000 | 525,000 |

| | | | 12,386,364 |

| TOTAL MATERIALS | | | 15,512,778 |

| REAL ESTATE - 0.3% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.3% | | | |

| The GEO Group, Inc. 6% 4/15/26 | | 1,500,000 | 1,215,000 |

| Uniti Group LP / Uniti Group Finance, Inc. 6.5% 2/15/29 (a) | | 1,710,000 | 1,714,275 |

| | | | 2,929,275 |

| UTILITIES - 0.5% | | | |

| Electric Utilities - 0.4% | | | |

| PG&E Corp. 5.25% 7/1/30 | | 4,765,000 | 4,810,268 |

| Water Utilities - 0.1% | | | |

| Solaris Midstream Holdings LLC 7.625% 4/1/26 (a) | | 795,000 | 842,700 |

| TOTAL UTILITIES | | | 5,652,968 |

|

| TOTAL NONCONVERTIBLE BONDS | | | 181,192,101 |

|

| TOTAL CORPORATE BONDS | | | |

| (Cost $222,132,935) | | | 232,410,804 |

|

| U.S. Treasury Obligations - 11.4% | | | |

| U.S. Treasury Bonds: | | | |

| 1.375% 8/15/50 | | $62,800,000 | $52,940,890 |

| 2.375% 5/15/51 | | 76,829,000 | 82,026,944 |

| TOTAL U.S. TREASURY OBLIGATIONS | | | |

| (Cost $128,873,458) | | | 134,967,834 |

|

| Commercial Mortgage Securities - 0.0% | | | |

BANK Series 2020-BN30 Class MCDG, 3.0155% 12/15/53

(Cost $176,693)(c) | | $200,000 | $177,161 |

| | | Shares | Value |

|

| Common Stocks - 58.7% | | | |

| COMMUNICATION SERVICES - 5.4% | | | |

| Diversified Telecommunication Services - 0.9% | | | |

| AT&T, Inc. | | 50 | 1,439 |

| BCE, Inc. (d) | | 109,700 | 5,410,404 |

| Verizon Communications, Inc. | | 102,009 | 5,715,564 |

| | | | 11,127,407 |

| Entertainment - 0.5% | | | |

| Score Media & Gaming, Inc. (d)(e) | | 276,070 | 5,536,544 |

| The Walt Disney Co. (e) | | 63 | 11,074 |

| | | | 5,547,618 |

| Interactive Media & Services - 1.9% | | | |

| Alphabet, Inc. Class A (e) | | 3,353 | 8,187,322 |

| Facebook, Inc. Class A (e) | | 22,900 | 7,962,559 |

| Genius Sports Ltd. (e) | | 305,900 | 5,741,743 |

| | | | 21,891,624 |

| Media - 1.6% | | | |

| Comcast Corp. Class A | | 37,081 | 2,114,359 |

| Interpublic Group of Companies, Inc. | | 133 | 4,321 |

| Meredith Corp. (e) | | 165,942 | 7,208,520 |

| Shaw Communications, Inc. Class B | | 162,151 | 4,697,356 |

| ViacomCBS, Inc. Class B | | 108,200 | 4,890,640 |

| WPP PLC | | 214 | 2,893 |

| | | | 18,918,089 |

| Wireless Telecommunication Services - 0.5% | | | |

| Rogers Communications, Inc.: | | | |

| Class B (d) | | 113,800 | 6,047,332 |

| Class B (non-vtg.) | | 11 | 585 |

| T-Mobile U.S., Inc. | | 46 | 6,662 |

| | | | 6,054,579 |

|

| TOTAL COMMUNICATION SERVICES | | | 63,539,317 |

|

| CONSUMER DISCRETIONARY - 2.9% | | | |

| Hotels, Restaurants & Leisure - 1.4% | | | |

| A&W Revenue Royalties Income Fund | | 189,000 | 5,810,576 |

| Boston Pizza Royalties Income Fund | | 207,200 | 2,356,825 |

| Caesars Entertainment, Inc. (e) | | 19,800 | 2,054,250 |

| McDonald's Corp. | | 29 | 6,699 |

| Pizza Pizza Royalty Corp. | | 612,100 | 5,347,727 |

| The Keg Royalties Income Fund | | 40,700 | 482,976 |

| | | | 16,059,053 |

| Household Durables - 1.0% | | | |

| LG Electronics, Inc. | | 53,770 | 7,779,996 |

| Sony Group Corp. sponsored ADR | | 43,400 | 4,219,348 |

| Tempur Sealy International, Inc. | | 77 | 3,018 |

| | | | 12,002,362 |

| Internet & Direct Marketing Retail - 0.0% | | | |

| eBay, Inc. | | 22 | 1,545 |

| Multiline Retail - 0.0% | | | |

| Kohl's Corp. | | 56 | 3,086 |

| Nordstrom, Inc. (e) | | 34 | 1,243 |

| Target Corp. | | 20 | 4,835 |

| | | | 9,164 |

| Specialty Retail - 0.5% | | | |

| Best Buy Co., Inc. | | 16 | 1,840 |

| Burlington Stores, Inc. (e) | | 9 | 2,898 |

| Dick's Sporting Goods, Inc. | | 16 | 1,603 |

| L Brands, Inc. | | 71,700 | 5,166,702 |

| Lowe's Companies, Inc. | | 5,458 | 1,058,688 |

| The Home Depot, Inc. | | 5 | 1,594 |

| TJX Companies, Inc. | | 22 | 1,483 |

| | | | 6,234,808 |

| Textiles, Apparel & Luxury Goods - 0.0% | | | |

| PVH Corp. (e) | | 16 | 1,721 |

| Tapestry, Inc. (e) | | 70 | 3,044 |

| | | | 4,765 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 34,311,697 |

|

| CONSUMER STAPLES - 1.8% | | | |

| Beverages - 1.1% | | | |

| Diageo PLC | | 72,961 | 3,496,913 |

| Keurig Dr. Pepper, Inc. | | 121 | 4,264 |

| PepsiCo, Inc. | | 9,125 | 1,352,051 |

| The Coca-Cola Co. | | 156,511 | 8,468,810 |

| | | | 13,322,038 |

| Food & Staples Retailing - 0.0% | | | |

| BJ's Wholesale Club Holdings, Inc. (e) | | 64 | 3,045 |

| Costco Wholesale Corp. | | 6 | 2,374 |

| Walmart, Inc. | | 50 | 7,051 |

| | | | 12,470 |

| Food Products - 0.0% | | | |

| Bunge Ltd. | | 20 | 1,563 |

| Lamb Weston Holdings, Inc. | | 34 | 2,742 |

| Mondelez International, Inc. | | 85 | 5,307 |

| Nestle SA (Reg. S) | | 14 | 1,745 |

| | | | 11,357 |

| Household Products - 0.2% | | | |

| Procter & Gamble Co. | | 14,576 | 1,966,740 |

| Tobacco - 0.5% | | | |

| Altria Group, Inc. | | 114,800 | 5,473,664 |

|

| TOTAL CONSUMER STAPLES | | | 20,786,269 |

|

| ENERGY - 10.5% | | | |

| Oil, Gas & Consumable Fuels - 10.5% | | | |

| Canadian Natural Resources Ltd. | | 199,430 | 7,239,714 |

| Cheniere Energy Partners LP | | 144,500 | 6,399,905 |

| Cheniere Energy, Inc. (e) | | 27,900 | 2,420,046 |

| Chesapeake Energy Corp. (f) | | 100 | 5,192 |

| Chevron Corp. | | 22,300 | 2,335,702 |

| ConocoPhillips Co. | | 49 | 2,984 |

| DHT Holdings, Inc. | | 2,363,426 | 15,338,635 |

| Enbridge, Inc. | | 135,000 | 5,405,010 |

| Energy Transfer LP | | 567,729 | 6,034,959 |

| Enterprise Products Partners LP | | 273,921 | 6,609,714 |

| Enviva Partners LP | | 157,600 | 8,259,816 |

| EOG Resources, Inc. | | 72,600 | 6,057,744 |

| Exxon Mobil Corp. | | 133,778 | 8,438,716 |

| Freehold Royalties Ltd. (d) | | 562,600 | 4,434,174 |

| Hess Corp. | | 23 | 2,008 |

| Hess Midstream LP | | 54,300 | 1,371,075 |

| Imperial Oil Ltd. | | 90 | 2,743 |

| Magellan Midstream Partners LP | | 121,400 | 5,937,674 |

| Marathon Petroleum Corp. | | 22,300 | 1,347,366 |

| MPLX LP | | 215,600 | 6,383,916 |

| Parkland Corp. | | 69,300 | 2,239,560 |

| Phillips 66 Co. | | 38 | 3,261 |

| PrairieSky Royalty Ltd. | | 432,300 | 5,234,610 |

| Rattler Midstream LP (d) | | 96,000 | 1,048,320 |

| SFL Corp. Ltd. | | 607,524 | 4,647,559 |

| Suncor Energy, Inc. | | 177 | 4,239 |

| Sunoco Logistics Partners, LP | | 133,998 | 5,051,725 |

| Targa Resources Corp. | | 128,569 | 5,714,892 |

| Teekay LNG Partners LP | | 317,596 | 4,792,524 |

| Thungela Resources Ltd. (e) | | 4 | 11 |

| Valero Energy Corp. | | 15,939 | 1,244,517 |

| | | | 124,008,311 |

| FINANCIALS - 11.3% | | | |

| Banks - 4.3% | | | |

| Bank of America Corp. | | 70,779 | 2,918,218 |

| Barclays PLC | | 1,027,700 | 2,438,812 |

| Canadian Imperial Bank of Commerce | | 24,550 | 2,794,652 |

| Citigroup, Inc. | | 40,416 | 2,859,432 |

| Comerica, Inc. | | 39,700 | 2,832,198 |

| Huntington Bancshares, Inc. | | 244 | 3,482 |

| JPMorgan Chase & Co. | | 18,904 | 2,940,328 |

| KBC Groep NV | | 65,200 | 4,971,091 |

| Lloyds Banking Group PLC | | 7,415,400 | 4,796,702 |

| M&T Bank Corp. | | 19,447 | 2,825,844 |

| Mitsubishi UFJ Financial Group, Inc. | | 401,500 | 2,162,583 |

| Mitsubishi UFJ Financial Group, Inc. sponsored ADR (d) | | 287,500 | 1,558,250 |

| PNC Financial Services Group, Inc. | | 45 | 8,584 |

| Societe Generale Series A | | 175,100 | 5,179,706 |

| Sumitomo Mitsui Financial Group, Inc. | | 57,700 | 1,989,033 |

| Sumitomo Mitsui Financial Group, Inc. ADR | | 433,600 | 2,987,504 |

| Wells Fargo & Co. | | 170,731 | 7,732,407 |

| | | | 50,998,826 |

| Capital Markets - 3.0% | | | |

| AGF Management Ltd. Class B (non-vtg.) | | 454,600 | 2,911,846 |

| AllianceBernstein Holding LP | | 86,100 | 4,008,816 |

| BlackRock, Inc. Class A | | 2,106 | 1,842,687 |

| CI Financial Corp. | | 250,100 | 4,590,009 |

| Holicity, Inc. Class A (d)(e) | | 225,907 | 2,789,951 |

| IGM Financial, Inc. (d) | | 97,400 | 3,438,387 |

| KKR & Co. LP | | 68 | 4,028 |

| Lazard Ltd. Class A | | 37,600 | 1,701,400 |

| Morgan Stanley | | 24,300 | 2,228,067 |

| Raymond James Financial, Inc. | | 14,200 | 1,844,580 |

| Sixth Street Specialty Lending, Inc. | | 232,800 | 5,165,832 |

| TMX Group Ltd. | | 49,000 | 5,175,912 |

| | | | 35,701,515 |

| Consumer Finance - 0.0% | | | |

| Capital One Financial Corp. | | 58 | 8,972 |

| Diversified Financial Services - 1.6% | | | |

| Ajax I Class A (d)(e) | | 205,300 | 2,044,788 |

| Beachbody Co., Inc./The (d)(e) | | 208,400 | 2,167,360 |

| dMY Technology Group, Inc. III Class A (e) | | 170,900 | 1,826,921 |

| Equitable Holdings, Inc. | | 75,300 | 2,292,885 |

| Payoneer Global, Inc. (d)(e) | | 199,600 | 2,069,852 |

| Sports Entertainment Acquisition Corp. Class A (e) | | 685,324 | 6,908,066 |

| Starboard Value Acquisition Corp. Class A (e) | | 129,951 | 1,299,510 |

| | | | 18,609,382 |

| Insurance - 2.4% | | | |

| AEGON NV | | 700,500 | 2,913,461 |

| AEGON NV rights (e)(g) | | 805,500 | 57,307 |

| American Financial Group, Inc. | | 20,625 | 2,572,350 |

| American International Group, Inc. | | 41 | 1,952 |

| AXA SA | | 141,000 | 3,580,320 |

| Chubb Ltd. | | 30 | 4,768 |

| Hartford Financial Services Group, Inc. | | 64,743 | 4,012,124 |

| Legal & General Group PLC | | 888,000 | 3,164,282 |

| Old Republic International Corp. | | 54,001 | 1,345,165 |

| Power Corp. of Canada (sub. vtg.) (d) | | 200,600 | 6,340,358 |

| The Travelers Companies, Inc. | | 26 | 3,892 |

| Zurich Insurance Group Ltd. | | 9,440 | 3,791,722 |

| | | | 27,787,701 |

|

| TOTAL FINANCIALS | | | 133,106,396 |

|

| HEALTH CARE - 2.4% | | | |

| Biotechnology - 0.5% | | | |

| AbbVie, Inc. | | 19,064 | 2,147,369 |

| Amgen, Inc. | | 16,248 | 3,960,450 |

| | | | 6,107,819 |

| Health Care Equipment & Supplies - 0.0% | | | |

| Danaher Corp. | | 43 | 11,539 |

| Health Care Providers & Services - 0.4% | | | |

| Cigna Corp. | | 22 | 5,216 |

| UnitedHealth Group, Inc. | | 11,331 | 4,537,386 |

| | | | 4,542,602 |

| Pharmaceuticals - 1.5% | | | |

| AstraZeneca PLC (United Kingdom) | | 50 | 6,007 |

| Bristol-Myers Squibb Co. | | 85,552 | 5,716,585 |

| Eli Lilly & Co. | | 25,339 | 5,815,807 |

| Johnson & Johnson | | 76 | 12,520 |

| Merck & Co., Inc. | | 72,309 | 5,623,471 |

| Roche Holding AG (participation certificate) | | 19 | 7,160 |

| Sanofi SA | | 77 | 8,090 |

| | | | 17,189,640 |

|

| TOTAL HEALTH CARE | | | 27,851,600 |

|

| INDUSTRIALS - 3.8% | | | |

| Aerospace & Defense - 0.5% | | | |

| Huntington Ingalls Industries, Inc. | | 7 | 1,475 |

| Northrop Grumman Corp. | | 15,213 | 5,528,861 |

| The Boeing Co. (e) | | 26 | 6,229 |

| | | | 5,536,565 |

| Air Freight & Logistics - 0.6% | | | |

| Deutsche Post AG | | 86,642 | 5,900,729 |

| FedEx Corp. | | 4,300 | 1,282,819 |

| United Parcel Service, Inc. Class B | | 28 | 5,823 |

| | | | 7,189,371 |

| Building Products - 0.0% | | | |

| Johnson Controls International PLC | | 63 | 4,324 |

| Construction & Engineering - 0.2% | | | |

| Quanta Services, Inc. | | 26,200 | 2,372,934 |

| Electrical Equipment - 0.4% | | | |

| AMETEK, Inc. | | 35 | 4,673 |

| Babcock & Wilcox Enterprises, Inc. (e) | | 578,597 | 4,559,344 |

| | | | 4,564,017 |

| Industrial Conglomerates - 0.7% | | | |

| General Electric Co. | | 537 | 7,228 |

| Hitachi Ltd. | | 103,500 | 5,926,131 |

| Honeywell International, Inc. | | 10,525 | 2,308,659 |

| Roper Technologies, Inc. | | 11 | 5,172 |

| Siemens AG | | 18 | 2,858 |

| | | | 8,250,048 |

| Machinery - 0.1% | | | |

| Crane Co. | | 17 | 1,570 |

| Fortive Corp. | | 26,039 | 1,815,960 |

| ITT, Inc. | | 35 | 3,206 |

| Nordson Corp. | | 11 | 2,415 |

| Otis Worldwide Corp. | | 48 | 3,925 |

| | | | 1,827,076 |

| Marine - 0.0% | | | |

| A.P. Moller - Maersk A/S Series B | | 1 | 2,879 |

| Road & Rail - 0.4% | | | |

| Norfolk Southern Corp. | | 8,665 | 2,299,778 |

| Union Pacific Corp. | | 11,400 | 2,507,202 |

| | | | 4,806,980 |

| Trading Companies & Distributors - 0.0% | | | |

| Watsco, Inc. | | 6 | 1,720 |

| Transportation Infrastructure - 0.9% | | | |

| Aena SME SA (a)(e) | | 22,308 | 3,658,272 |

| Aeroports de Paris SA | | 25,800 | 3,360,570 |

| Auckland International Airport Ltd. (e) | | 623,800 | 3,169,983 |

| | | | 10,188,825 |

|

| TOTAL INDUSTRIALS | | | 44,744,739 |

|

| INFORMATION TECHNOLOGY - 3.3% | | | |

| Communications Equipment - 0.6% | | | |

| Cisco Systems, Inc. | | 125,788 | 6,666,764 |

| IT Services - 0.2% | | | |

| Accenture PLC Class A | | 13 | 3,832 |

| Amdocs Ltd. | | 79 | 6,111 |

| Genpact Ltd. | | 67 | 3,044 |

| IBM Corp. | | 20,025 | 2,935,465 |

| Visa, Inc. Class A | | 6 | 1,403 |

| | | | 2,949,855 |

| Semiconductors & Semiconductor Equipment - 0.5% | | | |

| Micron Technology, Inc. (e) | | 17,000 | 1,444,660 |

| NVIDIA Corp. | | 2,645 | 2,116,265 |

| NXP Semiconductors NV | | 8,710 | 1,791,821 |

| Qualcomm, Inc. | | 19 | 2,716 |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 50 | 6,008 |

| | | | 5,361,470 |

| Software - 1.0% | | | |

| Adobe, Inc. (e) | | 4,200 | 2,459,688 |

| ironSource Ltd. Class A (e) | | 212,300 | 2,229,150 |

| Microsoft Corp. | | 28,614 | 7,751,533 |

| NortonLifeLock, Inc. | | 65 | 1,769 |

| Open Text Corp. | | 58 | 2,945 |

| | | | 12,445,085 |

| Technology Hardware, Storage & Peripherals - 1.0% | | | |

| Apple, Inc. | | 57,561 | 7,883,555 |

| Samsung Electronics Co. Ltd. | | 60,281 | 4,305,024 |

| | | | 12,188,579 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 39,611,753 |

|

| MATERIALS - 4.5% | | | |

| Chemicals - 0.5% | | | |

| Linde PLC | | 20 | 5,782 |

| Nutrien Ltd. | | 10 | 606 |

| Olin Corp. | | 58,600 | 2,710,836 |

| The Chemours Co. LLC | | 49,757 | 1,731,544 |

| Tronox Holdings PLC | | 51,400 | 1,151,360 |

| Westlake Chemical Partners LP | | 45,800 | 1,232,936 |

| | | | 6,833,064 |

| Containers & Packaging - 0.5% | | | |

| Avery Dennison Corp. | | 5,200 | 1,093,248 |

| Crown Holdings, Inc. | | 41 | 4,191 |

| O-I Glass, Inc. (e) | | 281,229 | 4,592,470 |

| Packaging Corp. of America | | 24 | 3,250 |

| | | | 5,693,159 |

| Metals & Mining - 3.5% | | | |

| Agnico Eagle Mines Ltd. (United States) (d) | | 121,300 | 7,332,585 |

| Anglo American PLC (United Kingdom) | | 42 | 1,669 |

| Endeavour Mining PLC | | 263,300 | 5,654,280 |

| Franco-Nevada Corp. | | 3,100 | 449,870 |

| Lundin Mining Corp. | | 65 | 586 |

| Newmont Corp. | | 206,300 | 13,075,294 |

| Wheaton Precious Metals Corp. | | 333,700 | 14,709,074 |

| | | | 41,223,358 |

|

| TOTAL MATERIALS | | | 53,749,581 |

|

| REAL ESTATE - 9.4% | | | |

| Equity Real Estate Investment Trusts (REITs) - 9.4% | | | |

| Alexandria Real Estate Equities, Inc. | | 31,900 | 5,803,886 |

| American Tower Corp. | | 10,914 | 2,948,308 |

| Boardwalk (REIT) (d) | | 69,400 | 2,288,700 |

| Canadian Apartment Properties (REIT) unit (d) | | 48,800 | 2,288,041 |

| Cousins Properties, Inc. | | 163,400 | 6,009,852 |

| Crown Castle International Corp. | | 14,700 | 2,867,970 |

| CubeSmart | | 41,600 | 1,926,912 |

| CyrusOne, Inc. | | 69,100 | 4,942,032 |

| First Capital (REIT) unit | | 149,300 | 2,119,781 |

| Four Corners Property Trust, Inc. | | 75,500 | 2,084,555 |

| Gaming & Leisure Properties | | 147,300 | 6,824,409 |

| InterRent REIT (d) | | 160,400 | 2,181,626 |

| Lamar Advertising Co. Class A | | 20,057 | 2,094,352 |

| MGM Growth Properties LLC | | 171,900 | 6,294,978 |

| National Retail Properties, Inc. | | 128,300 | 6,014,704 |

| Northwest Healthcare Properties REIT | | 200,800 | 2,062,104 |

| Postal Realty Trust, Inc. | | 305,100 | 5,565,024 |

| Prologis (REIT), Inc. | | 38,900 | 4,649,717 |

| Public Storage | | 11 | 3,308 |

| Realty Income Corp. | | 82,300 | 5,492,702 |

| RioCan (REIT) (d) | | 316,600 | 5,639,342 |

| Simon Property Group, Inc. | | 43,400 | 5,662,832 |

| Smart (REIT) (d) | | 256,300 | 6,072,548 |

| Spirit Realty Capital, Inc. | | 150,300 | 7,190,352 |

| Store Capital Corp. | | 159,000 | 5,487,090 |

| VICI Properties, Inc. (d) | | 215,700 | 6,691,014 |

| | | | 111,206,139 |

| UTILITIES - 3.4% | | | |

| Electric Utilities - 2.3% | | | |

| Allete, Inc. | | 35,235 | 2,465,745 |

| Duke Energy Corp. | | 60,300 | 5,952,816 |

| Enel SpA | | 194,100 | 1,803,747 |

| Energias de Portugal SA | | 105,099 | 557,056 |

| Evergy, Inc. | | 37,600 | 2,272,168 |

| Exelon Corp. | | 132,574 | 5,874,354 |

| Iberdrola SA | | 196,000 | 2,390,153 |

| NextEra Energy, Inc. | | 103 | 7,548 |

| NRG Energy, Inc. | | 82 | 3,305 |

| PG&E Corp. (e) | | 101 | 1,027 |

| Southern Co. | | 96,100 | 5,815,011 |

| | | | 27,142,930 |

| Gas Utilities - 0.2% | | | |

| Brookfield Infrastructure Corp. Class A | | 30,100 | 2,268,670 |

| Independent Power and Renewable Electricity Producers - 0.9% | | | |

| Clearway Energy, Inc. Class C | | 177,200 | 4,692,256 |

| NextEra Energy Partners LP | | 83,600 | 6,383,696 |

| Vistra Corp. | | 141 | 2,616 |

| | | | 11,078,568 |

| Multi-Utilities - 0.0% | | | |

| Ameren Corp. | | 32 | 2,561 |

| CenterPoint Energy, Inc. | | 100 | 2,452 |

| Dominion Energy, Inc. | | 62 | 4,561 |

| WEC Energy Group, Inc. | | 32 | 2,846 |

| | | | 12,420 |

|

| TOTAL UTILITIES | | | 40,502,588 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $627,965,047) | | | 693,418,390 |

|

| Preferred Stocks - 5.4% | | | |

| Convertible Preferred Stocks - 2.6% | | | |

| COMMUNICATION SERVICES - 0.6% | | | |

| Wireless Telecommunication Services - 0.6% | | | |

| T-Mobile U.S., Inc. 5.25% (a) | | 5,425 | 6,835,934 |

| HEALTH CARE - 0.5% | | | |

| Health Care Equipment & Supplies - 0.5% | | | |

| Boston Scientific Corp. Series A, 5.50% | | 51,200 | 5,908,480 |

| INDUSTRIALS - 0.2% | | | |

| Construction & Engineering - 0.2% | | | |

| Fluor Corp. 6.50% (a) | | 2,300 | 2,440,070 |

| MATERIALS - 0.3% | | | |

| Metals & Mining - 0.3% | | | |

| ArcelorMittal SA 5.50% | | 54,150 | 3,925,334 |

| UTILITIES - 1.0% | | | |

| Gas Utilities - 0.3% | | | |

| UGI Corp. 7.125% (e) | | 35,500 | 3,773,650 |

| Independent Power and Renewable Electricity Producers - 0.3% | | | |

| The AES Corp. 6.875% | | 38,500 | 4,090,625 |

| Multi-Utilities - 0.4% | | | |

| Algonquin Power & Utilities Corp. 7.75% (e) | | 84,900 | 4,215,956 |

| TOTAL UTILITIES | | | 12,080,231 |

|

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | 31,190,049 |

|

| Nonconvertible Preferred Stocks - 2.8% | | | |

| COMMUNICATION SERVICES - 0.1% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| BCE, Inc. Series R | | 51,500 | 758,208 |

| CONSUMER DISCRETIONARY - 0.2% | | | |

| Automobiles - 0.2% | | | |

| Porsche Automobil Holding SE (Germany) | | 23,475 | 2,520,060 |

| ENERGY - 0.2% | | | |

| Oil, Gas & Consumable Fuels - 0.2% | | | |

| DCP Midstream Partners LP Series B, 7.875% (c) | | 200 | 4,990 |

| Energy Transfer LP Series C, 7.375% (c) | | 26,400 | 666,600 |

| Global Partners LP Series B, 9.50% | | 61,000 | 1,668,350 |

| | | | 2,339,940 |

| FINANCIALS - 1.0% | | | |

| Banks - 0.2% | | | |

| CIT Group, Inc. Series B 5.625% | | 42,400 | 1,156,248 |

| Cullen/Frost Bankers, Inc. Series B 4.45% | | 7,000 | 180,040 |

| First Citizens Bancshares, Inc. | | 4,300 | 117,949 |

| First Republic Bank Series L, 4.375% | | 8,000 | 213,600 |

| JPMorgan Chase & Co. 4.625% | | 26,000 | 692,380 |

| Truist Financial Corp. Series O, 5.25% | | 6,000 | 171,120 |

| Wells Fargo & Co.: | | | |

| Series CC, 4.375% | | 8,000 | 203,120 |

| Series Z, 4.75% | | 9,300 | 243,195 |

| | | | 2,977,652 |

| Capital Markets - 0.5% | | | |

| B. Riley Financial, Inc.: | | | |

| 5.50% | | 66,000 | 1,655,940 |

| 6.00% | | 3,700 | 96,015 |

| 6.375% | | 68,100 | 1,744,722 |

| 6.50% | | 17,800 | 463,585 |

| 6.75% | | 5,307 | 137,372 |

| 6.875% | | 6,753 | 174,903 |

| Canaccord Genuity Group, Inc.: | | | |

| CANADIAN GOVT BOND 5YR NT INDX + 3.210% 3.885% (c)(h) | | 74,800 | 1,095,208 |

| CANADIAN GOVT BOND 5YR NT INDX + 4.030% 4.993% (c)(h) | | 21,900 | 385,140 |

| | | | 5,752,885 |

| Consumer Finance - 0.0% | | | |

| Capital One Financial Corp. Series J, 5.00% | | 19,300 | 509,134 |

| Diversified Financial Services - 0.1% | | | |

| Carlyle Finance LLC 4.625% | | 20,000 | 510,000 |

| Equitable Holdings, Inc. 4.30% | | 10,700 | 270,175 |

| | | | 780,175 |

| Insurance - 0.1% | | | |

| Athene Holding Ltd.: | | | |

| Series A, 6.35% (c) | | 4,300 | 126,420 |

| Series B, 5.625% | | 7,923 | 216,932 |

| Series D, 4.875% | | 8,000 | 206,880 |

| MetLife, Inc. Series F 4.75% | | 7,300 | 196,808 |

| W.R. Berkley Corp. 5.70% | | 2,922 | 79,186 |

| | | | 826,226 |

| Mortgage Real Estate Investment Trusts - 0.1% | | | |

| KKR Real Estate Finance Trust, Inc. 6.50% | | 40,000 | 1,098,000 |

| TOTAL FINANCIALS | | | 11,944,072 |

| INDUSTRIALS - 0.9% | | | |

| Commercial Services & Supplies - 0.0% | | | |

| Pitney Bowes, Inc. 6.70% | | 1,674 | 42,017 |

| Electrical Equipment - 0.8% | | | |

| Babcock & Wilcox Enterprises, Inc.: | | | |

| 8.125% | | 308,437 | 7,991,603 |

| Series A, 7.75% | | 43,000 | 1,095,855 |

| | | | 9,087,458 |

| Marine - 0.1% | | | |

| Global Ship Lease, Inc. 8.00% | | 31,984 | 829,345 |

| TOTAL INDUSTRIALS | | | 9,958,820 |

| REAL ESTATE - 0.3% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.2% | | | |

| Pebblebrook Hotel Trust 6.375% | | 18,000 | 495,000 |

| Summit Hotel Properties, Inc. Series E, 6.25% | | 30,802 | 807,320 |

| Sunstone Hotel Investors, Inc. Series F, 6.45% | | 37,653 | 974,460 |

| | | | 2,276,780 |

| Real Estate Management & Development - 0.1% | | | |

| Brookfield Property Partners LP 5.75% | | 47,300 | 1,186,757 |

| TOTAL REAL ESTATE | | | 3,463,537 |

| UTILITIES - 0.1% | | | |

| Electric Utilities - 0.0% | | | |

| Emera, Inc. Series J 4.25% (e) | | 25,000 | 534,648 |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| Brookfield Renewable Partners LP 5.25% | | 13,000 | 340,600 |

| Multi-Utilities - 0.1% | | | |

| Brookfield Infrastructure Partners LP: | | | |

| 5.125% | | 3,000 | 78,675 |

| Class A 5.00% | | 19,100 | 496,218 |

| | | | 574,893 |

| TOTAL UTILITIES | | | 1,450,141 |

|

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | 32,434,778 |

|

| TOTAL PREFERRED STOCKS | | | |

| (Cost $58,274,855) | | | 63,624,827 |

| | | Principal Amount | Value |

|

| Bank Loan Obligations - 4.2% | | | |

| CONSUMER DISCRETIONARY - 3.7% | | | |

| Diversified Consumer Services - 1.1% | | | |

| Spin Holdco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 3/4/28 (c)(h)(i) | | 13,256,775 | 13,258,498 |

| Hotels, Restaurants & Leisure - 0.3% | | | |

| Caesars Resort Collection LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 4.6043% 7/20/25 (c)(h)(i) | | 456,550 | 457,691 |

| Raptor Acquisition Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 11/1/26 (h)(i)(j) | | 3,660,000 | 3,664,575 |

| | | | 4,122,266 |

| Household Durables - 0.7% | | | |

| TGP Holdings III LLC: | | | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6/25/28 (h)(i)(j) | | 7,923,214 | 7,933,118 |

| Tranche DD 1LN, term loan 1 month U.S. LIBOR + 3.500% 6/25/28 (h)(i)(j) | | 776,786 | 777,757 |

| | | | 8,710,875 |

| Internet & Direct Marketing Retail - 1.2% | | | |

| Bass Pro Group LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 3/5/28 (c)(h)(i) | | 13,445,492 | 13,479,106 |

| Terrier Media Buyer, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6043% 12/17/26 (c)(h)(i) | | 153,477 | 152,624 |

| | | | 13,631,730 |

| Specialty Retail - 0.4% | | | |

| Michaels Companies, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 4/15/28 (c)(h)(i) | | 4,250,000 | 4,265,470 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 43,988,839 |

|

| FINANCIALS - 0.1% | | | |

| Insurance - 0.1% | | | |

| Alliant Holdings Intermediate LLC Tranche B3 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.25% 11/5/27 (c)(h)(i) | | 1,052,786 | 1,053,659 |

| HEALTH CARE - 0.1% | | | |

| Health Care Technology - 0.1% | | | |

| Virgin Pulse, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 4/6/28 (c)(h)(i) | | 999,532 | 998,283 |

| INDUSTRIALS - 0.2% | | | |

| Air Freight & Logistics - 0.0% | | | |

| Hanjin International Corp. 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.5% 12/23/22 (b)(c)(h)(i) | | 350,000 | 349,125 |

| Commercial Services & Supplies - 0.2% | | | |

| AVSC Holding Corp. Tranche B2 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.5% 10/15/26 (c)(h)(i) | | 1,605,075 | 1,513,361 |

| CoreCivic, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 5.5% 12/18/24 (c)(h)(i) | | 274,362 | 266,033 |

| KNS Acquisitions, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.250% 7% 4/21/27 (c)(h)(i) | | 75,000 | 74,719 |

| | | | 1,854,113 |

|

| TOTAL INDUSTRIALS | | | 2,203,238 |

|

| INFORMATION TECHNOLOGY - 0.1% | | | |

| Electronic Equipment & Components - 0.0% | | | |

| DG Investment Intermediate Holdings, Inc. 2LN, term loan 3 month U.S. LIBOR + 6.750% 7.5% 3/31/29 (c)(h)(i) | | 520,000 | 518,050 |

| IT Services - 0.1% | | | |

| Acuris Finance U.S., Inc. 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.5% 2/16/28 (c)(h)(i) | | 338,542 | 339,388 |

| GTT Communications, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.9% 5/31/25 (c)(h)(i) | | 450,256 | 353,676 |

| | | | 693,064 |

| Software - 0.0% | | | |

| DCert Buyer, Inc. Tranche B 2LN, term loan 3 month U.S. LIBOR + 7.000% 7.1043% 2/19/29 (c)(h)(i) | | 45,000 | 45,310 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 1,256,424 |

|

| UTILITIES - 0.0% | | | |

| Multi-Utilities - 0.0% | | | |

| Osmose Utilities Services, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6/17/28 (h)(i)(j) | | 185,000 | 184,075 |

| TOTAL BANK LOAN OBLIGATIONS | | | |

| (Cost $49,616,957) | | | 49,684,518 |

|

| Preferred Securities - 0.8% | | | |

| ENERGY - 0.2% | | | |

| Oil, Gas & Consumable Fuels - 0.2% | | | |

| DCP Midstream Partners LP 7.375% (c)(k) | | 300,000 | 294,967 |

| Energy Transfer LP: | | | |

| 6.25% (c)(k) | | 500,000 | 452,990 |

| 6.5% (c)(k) | | 1,600,000 | 1,635,732 |

| 6.625% (c)(k) | | 400,000 | 401,456 |

| | | | 2,785,145 |

| FINANCIALS - 0.5% | | | |

| Banks - 0.3% | | | |

| Bank of America Corp. 5.125% (c)(k) | | 150,000 | 159,960 |

| CIT Group, Inc. 5.8% (c)(k) | | 775,000 | 802,439 |

| Citigroup, Inc. 4% (c)(k) | | 175,000 | 181,306 |

| JPMorgan Chase & Co.: | | | |

| 3.65% (c)(k) | | 1,000,000 | 1,006,334 |

| 4.6% (c)(k) | | 200,000 | 211,062 |

| 5% (c)(k) | | 230,000 | 247,833 |

| 5.15% (c)(k) | | 135,000 | 140,502 |

| Truist Financial Corp.: | | | |

| 5.05% (c)(k) | | 205,000 | 212,115 |

| 5.1% (c)(k) | | 200,000 | 228,132 |

| Wells Fargo & Co. 3.9% (c)(k) | | 200,000 | 207,399 |

| | | | 3,397,082 |

| Capital Markets - 0.0% | | | |

| Charles Schwab Corp. 5.375% (c)(k) | | 150,000 | 166,452 |

| Consumer Finance - 0.2% | | | |

| Ally Financial, Inc. 4.7% (c)(k) | | 2,470,000 | 2,580,359 |

| Diversified Financial Services - 0.0% | | | |

| Equitable Holdings, Inc. 4.95% (c)(k) | | 250,000 | 272,416 |

|

| TOTAL FINANCIALS | | | 6,416,309 |

|

| INDUSTRIALS - 0.1% | | | |

| Industrial Conglomerates - 0.1% | | | |

| General Electric Co. 3.4489% (c)(h)(k) | | 575,000 | 564,381 |

| TOTAL PREFERRED SECURITIES | | | |

| (Cost $9,126,701) | | | 9,765,835 |

| | | Shares | Value |

|

| Money Market Funds - 4.7% | | | |

| Fidelity Cash Central Fund 0.06% (l) | | 11,582,321 | 11,584,638 |

| Fidelity Securities Lending Cash Central Fund 0.06% (l)(m) | | 44,478,397 | 44,482,844 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $56,067,482) | | | 56,067,482 |

| TOTAL INVESTMENT IN SECURITIES - 104.9% | | | |

| (Cost $1,152,234,128) | | | 1,240,116,851 |

| NET OTHER ASSETS (LIABILITIES) - (4.9)% | | | (58,032,559) |

| NET ASSETS - 100% | | | $1,182,084,292 |

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $161,422,816 or 13.7% of net assets.

(b) Level 3 security

(c) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(d) Security or a portion of the security is on loan at period end.

(e) Non-income producing

(f) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $5,192 or 0.0% of net assets.

(g) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(h) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(i) Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty.

(j) The coupon rate will be determined upon settlement of the loan after period end.

(k) Security is perpetual in nature with no stated maturity date.

(l) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(m) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| Chesapeake Energy Corp. | 2/10/21 | $947 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $4,919 |

| Fidelity Securities Lending Cash Central Fund | 211,908 |

| Total | $216,827 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.06% | $3,451,678 | $396,413,008 | $388,280,385 | $337 | $-- | $11,584,638 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 0.06% | 1,531,231 | 112,954,356 | 70,002,743 | -- | -- | 44,482,844 | 0.1% |

| Total | $4,982,909 | $509,367,364 | $458,283,128 | $337 | $-- | $56,067,482 | |

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

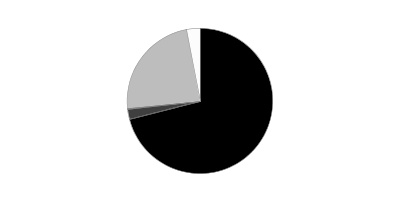

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $71,133,459 | $64,294,632 | $6,838,827 | $-- |

| Consumer Discretionary | 36,831,757 | 34,311,697 | 2,520,060 | -- |

| Consumer Staples | 20,786,269 | 17,287,611 | 3,498,658 | -- |

| Energy | 126,348,251 | 126,348,251 | -- | -- |

| Financials | 145,050,468 | 117,630,822 | 27,419,646 | -- |

| Health Care | 33,760,080 | 27,830,343 | 5,929,737 | -- |

| Industrials | 57,143,629 | 48,797,093 | 8,346,536 | -- |

| Information Technology | 39,611,753 | 39,611,753 | -- | -- |

| Materials | 57,674,915 | 53,749,581 | 3,925,334 | -- |

| Real Estate | 114,669,676 | 114,669,676 | -- | -- |

| Utilities | 54,032,960 | 41,974,785 | 12,058,175 | -- |

| Corporate Bonds | 232,410,804 | -- | 228,852,235 | 3,558,569 |

| U.S. Government and Government Agency Obligations | 134,967,834 | -- | 134,967,834 | -- |

| Commercial Mortgage Securities | 177,161 | -- | 177,161 | -- |

| Bank Loan Obligations | 49,684,518 | -- | 49,335,393 | 349,125 |

| Preferred Securities | 9,765,835 | -- | 9,765,835 | -- |

| Money Market Funds | 56,067,482 | 56,067,482 | -- | -- |

| Total Investments in Securities: | $1,240,116,851 | $742,573,726 | $493,635,431 | $3,907,694 |

Other Information

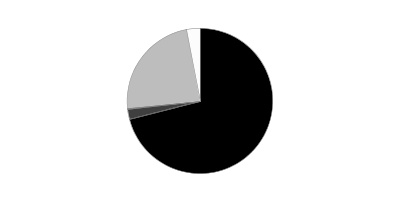

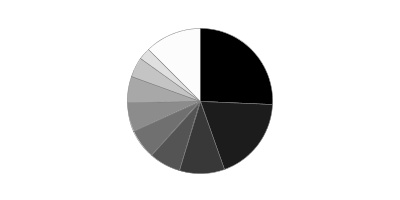

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 71.2% |

| Canada | 12.7% |

| Marshall Islands | 2.4% |

| Mexico | 1.8% |

| United Kingdom | 1.8% |

| Japan | 1.6% |

| France | 1.2% |

| Korea (South) | 1.0% |

| Others (Individually Less Than 1%) | 6.3% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | June 30, 2021 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $42,273,644) — See accompanying schedule:

Unaffiliated issuers (cost $1,096,166,646) | $1,184,049,369 | |

| Fidelity Central Funds (cost $56,067,482) | 56,067,482 | |

| Total Investment in Securities (cost $1,152,234,128) | | $1,240,116,851 |

| Foreign currency held at value (cost $153,986) | | 153,986 |

| Receivable for investments sold | | 1,729,503 |

| Receivable for fund shares sold | | 8,309,894 |

| Dividends receivable | | 1,450,971 |

| Interest receivable | | 4,310,445 |

| Distributions receivable from Fidelity Central Funds | | 77,926 |

| Other receivables | | 37,378 |

| Total assets | | 1,256,186,954 |

| Liabilities | | |

| Payable to custodian bank | $1,765 | |

| Payable for investments purchased | | |

| Regular delivery | 26,153,015 | |

| Delayed delivery | 57,307 | |

| Payable for fund shares redeemed | 2,389,996 | |

| Distributions payable | 279,410 | |

| Accrued management fee | 505,888 | |

| Distribution and service plan fees payable | 42,637 | |

| Other affiliated payables | 133,139 | |

| Other payables and accrued expenses | 56,816 | |

| Collateral on securities loaned | 44,482,689 | |

| Total liabilities | | 74,102,662 |

| Net Assets | | $1,182,084,292 |

| Net Assets consist of: | | |

| Paid in capital | | $1,076,868,300 |

| Total accumulated earnings (loss) | | 105,215,992 |

| Net Assets | | $1,182,084,292 |

| Net Asset Value and Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($74,131,555 ÷ 5,077,744 shares)(a) | | $14.60 |

| Maximum offering price per share (100/96.00 of $14.60) | | $15.21 |

| Class M: | | |

| Net Asset Value and redemption price per share ($13,805,192 ÷ 945,344 shares)(a) | | $14.60 |

| Maximum offering price per share (100/96.00 of $14.60) | | $15.21 |

| Class C: | | |

| Net Asset Value and offering price per share ($32,408,570 ÷ 2,223,439 shares)(a) | | $14.58 |

| Fidelity Multi-Asset Income Fund: | | |

| Net Asset Value, offering price and redemption price per share ($772,852,023 ÷ 52,909,919 shares) | | $14.61 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($231,423,195 ÷ 15,847,357 shares) | | $14.60 |

| Class Z: | | |

| Net Asset Value, offering price and redemption price per share ($57,463,757 ÷ 3,934,206 shares) | | $14.61 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended June 30, 2021 (Unaudited) |

| Investment Income | | |

| Dividends | | $7,096,332 |

| Interest | | 5,939,541 |

| Income from Fidelity Central Funds (including $211,908 from security lending) | | 216,827 |

| Total income | | 13,252,700 |

| Expenses | | |

| Management fee | $2,050,865 | |

| Transfer agent fees | 435,666 | |

| Distribution and service plan fees | 178,573 | |

| Accounting fees | 165,867 | |

| Custodian fees and expenses | 36,881 | |

| Independent trustees' fees and expenses | 737 | |

| Registration fees | 135,580 | |

| Audit | 30,922 | |

| Legal | 905 | |

| Miscellaneous | 560 | |

| Total expenses before reductions | 3,036,556 | |

| Expense reductions | (78,445) | |

| Total expenses after reductions | | 2,958,111 |

| Net investment income (loss) | | 10,294,589 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 20,424,304 | |

| Fidelity Central Funds | 337 | |

| Foreign currency transactions | (33,063) | |

| Total net realized gain (loss) | | 20,391,578 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 47,445,660 | |

| Assets and liabilities in foreign currencies | (1,893) | |

| Total change in net unrealized appreciation (depreciation) | | 47,443,767 |

| Net gain (loss) | | 67,835,345 |

| Net increase (decrease) in net assets resulting from operations | | $78,129,934 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended June 30, 2021 (Unaudited) | Year ended December 31, 2020 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $10,294,589 | $6,346,713 |

| Net realized gain (loss) | 20,391,578 | 811,927 |

| Change in net unrealized appreciation (depreciation) | 47,443,767 | 27,214,446 |

| Net increase (decrease) in net assets resulting from operations | 78,129,934 | 34,373,086 |

| Distributions to shareholders | (13,019,264) | (6,825,061) |

| Share transactions - net increase (decrease) | 775,183,616 | 184,286,400 |

| Total increase (decrease) in net assets | 840,294,286 | 211,834,425 |

| Net Assets | | |

| Beginning of period | 341,790,006 | 129,955,581 |

| End of period | $1,182,084,292 | $341,790,006 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Multi-Asset Income Fund Class A

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $13.15 | $11.72 | $9.81 | $10.41 | $10.14 | $9.91 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .192 | .384 | .293 | .223 | .243 | .438B |

| Net realized and unrealized gain (loss) | 1.491 | 1.464 | 1.922 | (.558) | .348 | .584 |

| Total from investment operations | 1.683 | 1.848 | 2.215 | (.335) | .591 | 1.022 |

| Distributions from net investment income | (.198) | (.401) | (.298) | (.207)C | (.210) | (.439) |

| Distributions from net realized gain | (.035) | (.017) | (.007) | (.058)C | (.069) | (.353) |

| Tax return of capital | – | – | – | – | (.042) | – |

| Total distributions | (.233) | (.418) | (.305) | (.265) | (.321) | (.792) |

| Net asset value, end of period | $14.60 | $13.15 | $11.72 | $9.81 | $10.41 | $10.14 |

| Total ReturnD,E,F | 12.88% | 16.26% | 22.84% | (3.25)% | 5.94% | 10.55% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | 1.04%I | 1.13% | 1.26% | 1.38% | 1.38% | 1.73% |

| Expenses net of fee waivers, if any | 1.04%I | 1.10% | 1.10% | 1.10% | 1.10% | 1.10% |

| Expenses net of all reductions | 1.02%I | 1.08% | 1.09% | 1.08% | 1.09% | 1.10% |

| Net investment income (loss) | 2.77%I | 3.27% | 2.69% | 2.19% | 2.38% | 4.32%B |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $74,132 | $30,583 | $23,438 | $9,513 | $10,443 | $9,524 |

| Portfolio turnover rateJ | 173%I | 308% | 298% | 367% | 299% | 239% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.031 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been 4.01%.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class M

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $13.15 | $11.72 | $9.81 | $10.41 | $10.14 | $9.91 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .194 | .383 | .292 | .223 | .243 | .439B |

| Net realized and unrealized gain (loss) | 1.491 | 1.463 | 1.923 | (.558) | .348 | .583 |

| Total from investment operations | 1.685 | 1.846 | 2.215 | (.335) | .591 | 1.022 |

| Distributions from net investment income | (.200) | (.399) | (.298) | (.207)C | (.210) | (.439) |

| Distributions from net realized gain | (.035) | (.017) | (.007) | (.058)C | (.069) | (.353) |

| Tax return of capital | – | – | – | – | (.042) | – |

| Total distributions | (.235) | (.416) | (.305) | (.265) | (.321) | (.792) |

| Net asset value, end of period | $14.60 | $13.15 | $11.72 | $9.81 | $10.41 | $10.14 |

| Total ReturnD,E,F | 12.89% | 16.24% | 22.84% | (3.25)% | 5.94% | 10.55% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | 1.03%I | 1.13% | 1.30% | 1.40% | 1.40% | 1.75% |

| Expenses net of fee waivers, if any | 1.03%I | 1.10% | 1.10% | 1.10% | 1.10% | 1.10% |

| Expenses net of all reductions | 1.00%I | 1.08% | 1.09% | 1.08% | 1.09% | 1.10% |

| Net investment income (loss) | 2.78%I | 3.27% | 2.69% | 2.19% | 2.38% | 4.32%B |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $13,805 | $11,048 | $9,719 | $7,441 | $7,511 | $7,171 |

| Portfolio turnover rateJ | 173%I | 308% | 298% | 367% | 299% | 239% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.031 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been 4.01%.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class C

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $13.13 | $11.70 | $9.80 | $10.41 | $10.14 | $9.91 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .139 | .298 | .210 | .147 | .166 | .363B |

| Net realized and unrealized gain (loss) | 1.494 | 1.463 | 1.915 | (.561) | .351 | .583 |

| Total from investment operations | 1.633 | 1.761 | 2.125 | (.414) | .517 | .946 |

| Distributions from net investment income | (.148) | (.314) | (.218) | (.138)C | (.148) | (.363) |

| Distributions from net realized gain | (.035) | (.017) | (.007) | (.058)C | (.069) | (.353) |

| Tax return of capital | – | – | – | – | (.030) | – |

| Total distributions | (.183) | (.331) | (.225) | (.196) | (.247) | (.716) |

| Net asset value, end of period | $14.58 | $13.13 | $11.70 | $9.80 | $10.41 | $10.14 |

| Total ReturnD,E,F | 12.50% | 15.44% | 21.87% | (4.00)% | 5.18% | 9.74% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | 1.80%I | 1.84% | 2.13% | 2.14% | 2.14% | 2.50% |

| Expenses net of fee waivers, if any | 1.80%I | 1.84% | 1.85% | 1.85% | 1.85% | 1.85% |

| Expenses net of all reductions | 1.78%I | 1.82% | 1.84% | 1.83% | 1.84% | 1.85% |

| Net investment income (loss) | 2.01%I | 2.53% | 1.94% | 1.44% | 1.63% | 3.57%B |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $32,409 | $13,015 | $4,634 | $8,003 | $8,683 | $7,162 |

| Portfolio turnover rateJ | 173%I | 308% | 298% | 367% | 299% | 239% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.031 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been 3.26%.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | |

| | 2021 | 2020 | 2019 | 2018 A |

| Selected Per–Share Data | | | | |

| Net asset value, beginning of period | $13.15 | $11.72 | $9.81 | $10.00 |

| Income from Investment Operations | | | | |

| Net investment income (loss)B | .210 | .417 | .322 | .168 |

| Net realized and unrealized gain (loss) | 1.503 | 1.460 | 1.919 | (.135) |

| Total from investment operations | 1.713 | 1.877 | 2.241 | .033 |

| Distributions from net investment income | (.218) | (.430) | (.324) | (.165)C |

| Distributions from net realized gain | (.035) | (.017) | (.007) | (.058)C |

| Total distributions | (.253) | (.447) | (.331) | (.223) |

| Net asset value, end of period | $14.61 | $13.15 | $11.72 | $9.81 |

| Total ReturnD,E | 13.11% | 16.55% | 23.14% | .30% |

| Ratios to Average Net AssetsF,G | | | | |

| Expenses before reductions | .77%H | .85% | .94% | 1.05%H |

| Expenses net of fee waivers, if any | .77%H | .85% | .85% | .85%H |

| Expenses net of all reductions | .75%H | .83% | .84% | .84%H |

| Net investment income (loss) | 3.04%H | 3.53% | 2.94% | 2.17%H |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $772,852 | $211,236 | $60,534 | $5,819 |

| Portfolio turnover rateI | 173%H | 308% | 298% | 367% |

A For the period March 28, 2018 (commencement of sale of shares) to December 31, 2018.

B Calculated based on average shares outstanding during the period.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class I

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $13.15 | $11.72 | $9.81 | $10.41 | $10.14 | $9.92 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .209 | .417 | .319 | .249 | .268 | .464B |

| Net realized and unrealized gain (loss) | 1.493 | 1.461 | 1.922 | (.558) | .349 | .573 |

| Total from investment operations | 1.702 | 1.878 | 2.241 | (.309) | .617 | 1.037 |

| Distributions from net investment income | (.217) | (.431) | (.324) | (.233)C | (.231) | (.464) |

| Distributions from net realized gain | (.035) | (.017) | (.007) | (.058)C | (.069) | (.353) |

| Tax return of capital | – | – | – | – | (.047) | – |

| Total distributions | (.252) | (.448) | (.331) | (.291) | (.347) | (.817) |

| Net asset value, end of period | $14.60 | $13.15 | $11.72 | $9.81 | $10.41 | $10.14 |

| Total ReturnD,E | 13.03% | 16.56% | 23.14% | (3.01)% | 6.20% | 10.72% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | .78%H | .83% | 1.00% | 1.08% | 1.10% | 1.47% |

| Expenses net of fee waivers, if any | .78%H | .83% | .85% | .85% | .85% | .85% |

| Expenses net of all reductions | .76%H | .81% | .84% | .83% | .84% | .85% |

| Net investment income (loss) | 3.03%H | 3.54% | 2.94% | 2.44% | 2.63% | 4.57%B |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $231,423 | $55,206 | $26,507 | $21,904 | $22,224 | $20,092 |

| Portfolio turnover rateI | 173%H | 308% | 298% | 367% | 299% | 239% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.031 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been 4.26%.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Multi-Asset Income Fund Class Z

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | |

| | 2021 | 2020 | 2019 | 2018 A |

| Selected Per–Share Data | | | | |