QuickLinks -- Click here to rapidly navigate through this documentExhibit 99.C.2

Hon Dr Michael Cullen

MINISTER OF FINANCE

BUDGET POLICY STATEMENT 2004

18 DECEMBER 2003

ISBN 0-478-18255-4

The Public Finance (State Sector Management) Bill

This Bill integrates the Fiscal Responsibility Act into the Public Finance Act. This will consolidate the legislation regarding public finances.

As well as incorporating additional transparency practices, the Bill also proposes changes to distinguish the Budget Policy Statement (BPS) and Fiscal Strategy Report (FSR). Under the existing legislation:

- •

- the BPS requires the Government to set out its long-term fiscal objectives (eg, for the operating balance and debt), and its short-term fiscal intentions with regard to these objectives for the next three years. The BPS must also outline the broad strategic priorities for the coming Budget

- •

- the FSR tabled with the Budget requires the Government to include a comparison of the Budget fiscal forecasts with the short-term fiscal intentions. The FSR also includes longer-term projections for the key fiscal aggregates and an assessment of these projections with the Government's long-term fiscal objectives.

These reporting requirements mean that the BPS tends to be quite broad in scope, and similar to the FSR in content. Both documents currently deal with high-level fiscal strategy, which is a description of the Government's broad tax and spending objectives. Effectively this means that the two documents cover the same ground and are published within six months of each other.

The intended change removes the requirement for every BPS to cover high-level fiscal strategy, so that it focuses more on the priorities for the upcoming Budget. The FSR will then become the main vehicle for setting out high-level fiscal strategy. The exception would be when the Government is explicitly changing its high-level fiscal strategy, in which case the BPS would have to indicate this.

Budget Policy Statement

Introduction

The 2004 Budget Policy Statement (BPS) sets out the overarching fiscal parameters that will guide Budget 2004, and outlines the Government's policy focus.

Our fiscal strategy is unchanged. The 2003 Fiscal Strategy Report (FSR) signalled that if conditions permitted we would deliver a social dividend from growth to low- and middle-income families. We can now confirm that we will proceed with these policies, incorporating slightly more expenditure than previously signalled because the overall fiscal position and outlook are better than forecast at the Budget.

Budget 2004 will also advance the Government's policy programme in health, education and growth and innovation while maintaining appropriate levels of capital investment.

It will continue our strategy of promoting economic growth, investing in people, and improving opportunities and security for all New Zealanders so that the benefits of progress can be widely shared, within a fair, decent and prosperous society.

At the same time we continue to meet our long-term fiscal objectives:

- •

- run operating surpluses on average across the economic cycle sufficient to meet New Zealand Superannuation (NZS) Fund contributions

- •

- meet capital pressures and priorities, and

- •

- maintain debt at prudent levels, trending down below 30% of Gross Domestic Product (GDP) over the longer term.

Budget 2004 Will Deliver on our Policy Commitments

Lifting New Zealand's economic performance through growth and innovation

Economic growth remains a top policy priority, not as an end in itself but to lift the living standards of New Zealanders. The Government's Growth and Innovation Framework identifies the policy ingredients for growth, including an open and competitive economy, macro-economic stability, global connectedness, and the role of skills, talent and innovation. Meeting our fiscal objectives supports growth.

We will also contribute to economic performance by enhancing New Zealand's international linkages and assisting firms to take advantage of potential gains from these linkages. This requires a world-class innovation system, access to the necessary skills and talent, and improving New Zealand's infrastructure.

Improving opportunities and security for all New Zealanders

Good economic and fiscal conditions mean that Budget 2004 can give priority to low- and middle-income families, enhancing their living standards and their ability to give their children real opportunity and security. The Future Directions package will be the centrepiece of the 2004 Budget. It will significantly increase direct income support and incentives to move from welfare benefits into paid employment, and will make housing more affordable for low-income families and single adults.

In education, we will increase both operating and capital spending to continue developing a collaborative and responsive education system. We will progress the Early Childhood Education strategy and improve the quality of teaching in schools. In the tertiary education sector, the focus will be on bedding in the tertiary education reforms and on improving the student support system.

We will maintain the health funding plan, as committed in previous Budgets, continuing the roll-out of our Primary Health Care Strategy and providing substantial investment in District Health Boards. This will move District Health Boards toward their population-based funding share, enabling them to better meet the health needs of their communities.

Building a strong public sector

This Government is committed to strengthening the public sector. We are taking steps to reinforce ethics and good governance by implementing recommendations flowing from the 2001 Review of the Centre. We will build the capability of the public service to deliver on the expectations of Ministers and the public. Budget 2004 will provide funding to strengthen the Department of Child, Youth and Family Services and improve its services. The Budget will also provide funding to maintain services in the justice sector, as well as implementing legislative priorities.

The recently announced state sector retirement savings scheme demonstrates our commitment to building a strong public service and to promoting retirement savings amongst employees. This will be implemented in 2004.

Capital expenditure will continue to be a priority

We will set aside funding for additional capital spending over the period 2004 to 2008. Funding will be directed at initiatives in the areas of education, corrections, housing and defence. We will also consider a potential contribution of up to $900 million over 10 years for Auckland transport.

We can move forward on our policy commitments and maintain our approach to fiscal strategy...

The Government's fiscal strategy has been to rebuild structural surpluses from the low levels prevailing in the late 1990s as part of the transition to the full contribution requirements of the NZS Fund.

Our fiscal strategy was set in structural terms because of the important role of automatic fiscal stabilisers. Automatic stabilisers are the change in tax revenue and unemployment spending that occurs directly in response to the economic cycle, without any government decision to alter revenue or expenditure. These stabilisers need to be allowed to operate on both downturns and upswings. It is important to avoid the temptation to spend cyclical windfalls, with the effect of increasing debt once the economy turns down. Expenditure decisions therefore should take account of the structural position of the economy.

As outlined in the 2003 FSR, estimates at the time were that the structural balance has increased. The accompanying 2004 December Economic and Fiscal Update forecasts continue to support this assessment, now and in the medium-term.

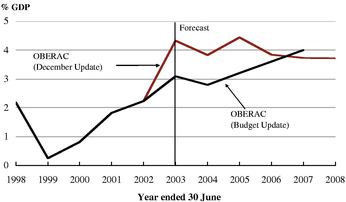

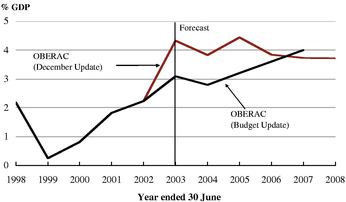

At the time of the Budget Economic and Fiscal Update, the operating balance excluding revaluations and accounting policy changes (OBERAC) was forecast to rise to 4% of GDP by 2006/07. We stated in the FSR that our short-term fiscal intentions were to run OBERAC surpluses of around 3% of GDP (around 21/2% excluding NZS Fund returns) and have gross debt-to-GDP reduce less quickly than the Budget forecasts suggested (see Annex). This implied there could be scope to alter the operating balance and debt tracks by under 1/2% of GDP in each of the 2004, 2005 and 2006 Budgets.

... because the strong fiscal position and sound economic outlook form the backdrop for the 2004 Budget...

The fiscal surplus has increased since the Budget. This reflects the performance of the New Zealand economy and higher tax revenue. For the fiscal year ended June 2003, the OBERAC was $5.6 billion (4.3% of GDP), or around $1.5 billion higher than expected.

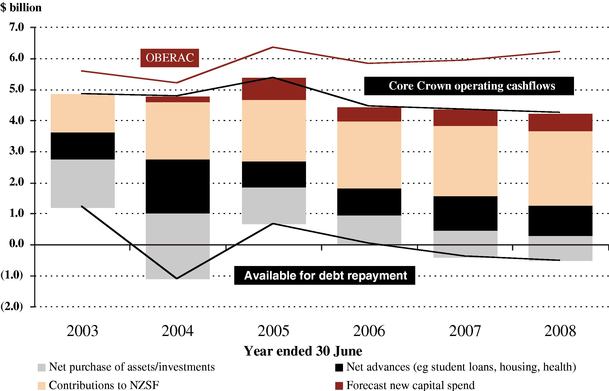

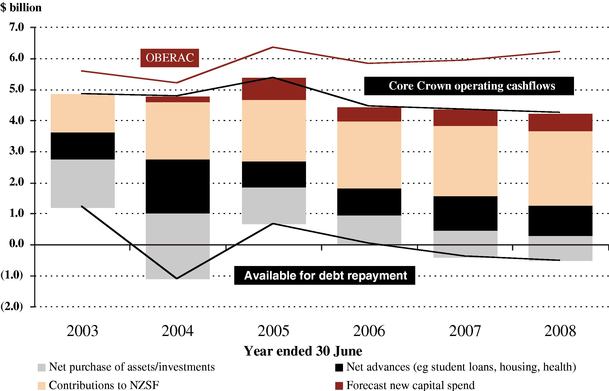

However, the OBERAC does not represent the total amount available for extra spending. While the OBERAC was $5.6 billion for the 2002/03 year, the actual cash surplus was $1.2 billion. The difference is made up of funds allocated to the capital programme, retained earnings for State-owned enterprises and Crown Entities, NZS Fund contributions, and advances such as student loans and loans to District Health Boards. Looking ahead, the forecast surpluses will be utilised in a similar fashion. Overall, we expect to utilise fully the operating surpluses to fund the capital programme. In 2004/05 there is a significant amount of planned capital spending (see Figure 1).

The fiscal outlook is underpinned by the performance of the economy. The December Update economic forecasts indicate that the economy will track ahead of the Budget forecasts for 2003/04, underpinned by the current strength of domestic spending, particularly in the existing and new housing markets. However, the tradables sector, which includes exporters and import-competing firms, is under pressure.

While growth is expected to moderate over 2004/05 as some of the factors supporting domestic demand ease, the higher forecast for the current year feeds through into a stronger fiscal position than anticipated at Budget time. This is reinforced by the assessment that the increase in tax revenue we have seen over the past few years is likely to be more sustained than previously thought.

Figure 1—Use of OBERAC—December Update forecasts

Source: The Treasury

This leaves us in a good position to adjust our spending plans...

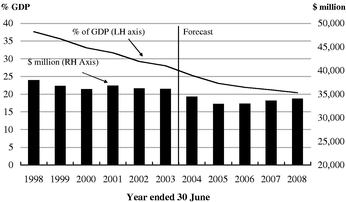

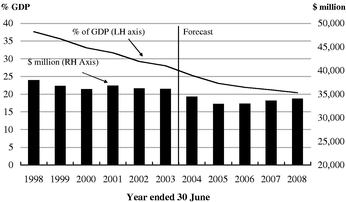

The higher tax revenue forecast means that although we plan to spend more than we signalled in the FSR, fiscal surpluses will still be robust. Factoring in our spending plans, the OBERAC remains over 3% of GDP and the debt-to-GDP ratio continues to fall (see Figures 2 and 3).

Figure 2—OBERAC

Source: The Treasury

In terms of forecast new amounts in Budget 2004, we intend to commit $2.1 billion of new operating spending in the first year, rising to $3.3 billion in future years. Of this, $1.1 billion had already been signalled and incorporated into previous fiscal forecasts. The investment in the Future Directions package is relatively modest in 2004/05 but steadily builds in subsequent years. The additional funding allocated to the areas of health and education is of a similar magnitude to that provided in last year's Budget, as is the amount of funding allocated to the Growth and Innovation Framework. Other spending includes investment in public sector capability, and an appropriate contingency for spending between budgets and unexpected costs.

This translates into the expense-to-GDP ratio remaining around current levels, rather than falling as signalled in the FSR.

Figure 3—Gross debt

Source: The Treasury

Budget 2004 also includes increased capital expenditure. Forecasts of capital spending have increased by $500 million since the Budget, to a total of $2.2 billion spread over the next four years, plus the legislatively required NZS Fund contributions.

Consistent with our measured approach to fiscal policy, at this stage we plan to fund smaller increases to Budgets in 2005 and 2006. We are incorporating forecast operating amounts of $1.8 billion in the 2005 Budget and $1.6 billion in the 2006 Budget (which in each case includes the $1.1 billion already signalled and incorporated into previous fiscal forecasts). These amounts are indicative and we retain the option of revisiting them should the economic and fiscal outlook not evolve as expected, including if the economy follows a weaker growth path going forward.

Our approach is also informed by a number of risks. In particular, these include:

- •

- Corporate tax, which is traditionally very volatile, is a key contributor to the upward revisions to tax revenue forecasts since the Budget Update. The December Update forecasts incorporate the view that company profits will continue to increase steadily each year, and the corporate tax forecasts reflect this.

- •

- The economic outlook imposes constraints on how much we can safely increase spending. There are risks in adding to demand in an economy that is operating close to capacity and which is likely to continue to do so for some time. Too much additional fiscal stimulus would only add to the current tensions on monetary policy, and to pressure on the current account.

Although we are in a position to make decisions now, we need to be careful about over-committing future revenue that is not yet certain, bearing in mind that economic growth is forecast to slow somewhat. Too often, both in our own history and abroad, we have seen so-called structural fiscal surpluses disappear very quickly.

... and take a measured approach to preserve our options for future Budgets

The forecasts indicate the OBERAC (excluding Fund returns) and debt-to-GDP tracks are better than the short-term intentions indicated in the FSR. The OBERAC (excluding Fund returns) is forecast to remain higher than 3% of GDP, and the debt-to-GDP ratio is below 30% of GDP.

Given this we will consider all our options looking forward. Our approach to fiscal policy is to assess regularly our plans in light of the economic and fiscal outlook. If the fiscal position improves, and economic conditions allow it, we have the option of further investment in new initiatives. In addition, we will look at lowering the long-term gross debt objective, and revising the short-term fiscal intentions to reflect this. We expect to be in a position to announce decisions about changes to the objective at the time of the 2004 Budget and 2004 FSR.

In doing this we will carefully assess the merits of changing the objective, and take account of the Government's longer-term policy goals. These include putting arrangements in place to enable the Crown's finances to cope with the impact of longer-term demographic changes on social and health services. This is the strategy behind the NZS Fund. We need to make sensible decisions now to avoid adding to the tax burden on future generations.

Table 1—Fiscal indicators (% GDP)

| | Actual

| | Forecast

|

|---|

Year end June

(% of GDP)

|

|---|

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

| | 2006

| | 2007

| | 2008

|

|---|

| Financial Performance | | | | | | | | | | | | | | | | |

| Total Crown revenue | | 39.1 | | 40.3 | | 44.3 | | 43.7 | | 44.2 | | 43.9 | | 43.6 | | 43.3 |

| Total tax revenue | | 29.9 | | 29.2 | | 30.9 | | 31.0 | | 30.9 | | 30.5 | | 30.2 | | 30.1 |

| Core Crown revenue | | 32.7 | | 32.1 | | 33.9 | | 34.0 | | 34.1 | | 33.9 | | 33.8 | | 33.7 |

| Total Crown expenses | | 38.0 | | 38.4 | | 42.9 | | 39.3 | | 39.8 | | 40.1 | | 39.9 | | 39.6 |

| Core Crown expenses (excluding GSF unfunded liability movement) | | 31.4 | | 30.4 | | 31.1 | | 31.0 | | 30.7 | | 31.2 | | 31.2 | | 31.1 |

Operating balance |

|

1.2 |

|

1.9 |

|

1.5 |

|

4.5 |

|

4.4 |

|

3.8 |

|

3.7 |

|

3.7 |

| OBERAC | | 1.8 | | 2.2 | | 4.3 | | 3.8 | | 4.4 | | 3.8 | | 3.7 | | 3.7 |

Core Crown expenses + NZS Fund contributions |

|

31.5 |

|

31.1 |

|

33.3 |

|

32.1 |

|

32.1 |

|

32.6 |

|

32.6 |

|

32.5 |

| OBERAC ex Fund returns | | 1.8 | | 2.2 | | 4.3 | | 3.7 | | 4.2 | | 3.5 | | 3.3 | | 3.2 |

Financial position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net worth | | 9.9 | | 15.2 | | 18.5 | | 22.0 | | 25.4 | | 27.9 | | 30.3 | | 32.5 |

| Total Crown debt | | 29.8 | | 29.6 | | 29.7 | | 26.5 | | 24.6 | | 23.1 | | 21.5 | | 19.9 |

| Gross sovereign-issued debt | | 31.6 | | 29.2 | | 28.0 | | 25.3 | | 23.0 | | 21.9 | | 21.2 | | 20.4 |

| Net Crown debt | | 14.6 | | 14.3 | | 13.1 | | 12.4 | | 10.8 | | 9.7 | | 8.8 | | 8.1 |

| Net Crown debt with NZS Fund assets | | 14.6 | | 13.8 | | 11.7 | | 9.6 | | 6.5 | | 3.8 | | 1.3 | | -1.0 |

NZS Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contributions | | 0.0 | | 0.5 | | 0.9 | | 1.4 | | 1.4 | | 1.4 | | 1.4 | | 1.4 |

| NZS Fund returns (after tax) | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.2 | | 0.3 | | 0.4 | | 0.5 |

| Accumulated assets | | 0.0 | | 0.5 | | 1.5 | | 2.9 | | 4.3 | | 5.9 | | 7.4 | | 9.0 |

Conclusion

Our fiscal strategy is unchanged. The 2003 FSR signalled that if conditions permitted we would deliver a social dividend from growth to low and middle income families. We can now confirm that we will proceed with this, while maintaining our fiscal strategy, with the increase in expenditure slightly more than previously signalled. We have the flexibility to do this because the overall fiscal position and outlook is better than forecast at Budget. We can deliver on policies and continue to run operating surpluses and reduce debt as a proportion of GDP.

In terms of our policy priorities, we can confirm that we will proceed with our plans to provide assistance for low- to middle-income families in the Future Directions package. This forms the centrepiece of the 2004 Budget. We will also continue to move forward in health, education and growth and innovation, as well as maintain capital investment.

This Government puts a high value on consistency and prudence and on governing for the long term. Budget 2004 will reflect that, blending a prudent fiscal stance with continued steady progress on our policy objectives.

Hon Dr Michael Cullen

Minister of Finance

11 December 2003

Annex: Long-term Fiscal Objectives and Short-term Fiscal Intentions

The Government's fiscal approach of running operating surpluses on average across the cycle sufficient to meet NZS Fund contributions, while meeting capital pressures and priorities, and managing debt at prudent levels embodies the principles of responsible fiscal management set out in the Fiscal Responsibility Act 1994.

The Government's long-term fiscal objectives are unchanged from the 2003 FSR.

Table A1—Long-term fiscal objectives

Long-term fiscal objectives

| | To achieve the objectives of fiscal policy, the

Government's high-level focus is on:

|

|---|

| Operating balance: | | | | |

| |

Operating surplus on average over the economic cycle sufficient to meet the requirements for contributions to the NZS Fund and ensure consistency with the long-term debt objective. |

|

• |

Rising surpluses(1) (measured by the OBERAC) during the transition and build-up phase of the NZS Fund, with a focus on core Crown revenue and expenses, including: |

|

|

|

• |

tax-to-GDP around current levels, |

|

|

|

• |

core Crown expenses (plus the net payment/withdrawal to the NZS Fund) averaging around 35% of GDP over the horizon used to calculate NZS Fund contributions. |

Revenue: |

|

|

|

|

| |

Ensure sufficient revenue to meet the operating balance objective. |

|

• |

A robust, broad-based tax system that raises revenue in a fair and efficient way. |

Expenses: |

|

|

|

|

| |

Ensure expenses are consistent with the operating balance objective. |

|

• |

State Owned Enterprises (SOEs) and Crown entities contributing to surpluses, consistent with their enabling legislation and Government policy. |

Net worth: |

|

|

|

|

| |

Increase net worth consistent with the operating balance objective. |

|

• |

Focus on building the NZS Fund assets rather than reducing debt. Increasing net worth consistent with the operating balance objective will see net worth at above 30% of GDP by 2011. |

|

|

• |

Consistent with the net worth objective, there will also be a focus on quality investment. |

Debt: |

|

|

|

|

| |

Manage total debt at prudent levels. In the longer term, gross sovereign-issued debt below 30% of GDP on average over the economic cycle.(2) |

|

• |

SOEs will have debt structures that reflect best commercial practice. Changes in the level of debt will reflect specific circumstances. |

|

|

• |

Net debt will be at levels that are consistent with the gross debt objective and the Government policy of holding financial assets.Net debt, including NZS Fund assets, is expected to fall towards 0% of GDP by the end of the decade. |

- (1)

- The surplus includes the net (after-tax) return on the NZS Fund, which the NZS Fund will retain. Effectively the Government is targeting operating surpluses excluding the NZS Fund's retained investment returns.

- (2)

- Sovereign-issued debt is debt issued by the New Zealand Debt Management Office (NZDMO) and the Reserve Bank; it excludes debt issued by SOEs and Crown entities and the sovereign-guaranteed debt of SOEs and Crown entities. Gross sovereign-issued debt includes any New Zealand government stock held by the NZS Fund and the Government Superannuation Fund.

The short-term fiscal forecasts show surpluses rising and gross sovereign-issued debt falling (as a percentage of GDP). This is consistent with making progress towards our long-term objectives. Depending on decisions regarding the debt objective, these intentions may change in the 2004 FSR.

Table A2—Short-term fiscal intentions

Short-term fiscal intentions

| | 2004 Budget Policy Statement

| | 2003 Fiscal Strategy Report

|

|---|

| Operating balance: | | | | |

| |

Operating surplus on average over the economic cycle sufficient to meet the requirements for contributions to the NZS Fund and ensure consistency with the long-term debt objective. |

|

Based on new operating amounts for the 2004 Budget, and indicative amounts for the next two Budgets, the operating balance is forecast to be 3.7% of GDP in 2006/07

If the economic and fiscal outlook evolves as expected, the Government will make changes to its expense and revenue plans. Operating surpluses (on an OBERAC basis) will be lower than current forecasts, at around 3% of GDP, and operating surpluses excluding returns on the NZS Fund (on an OBERAC basis) would be around 21/2% of GDP, remaining consistent with the long-term objective for the operating balance. |

|

Based on new operating amounts for the 2003 Budget, and indicative amounts for the next two Budgets, the operating balance is forecast to be 3.6% of GDP in 2005/06.

If the economic and fiscal outlook evolves as expected, the Government will make changes to its expense and revenue plans. Operating surpluses (on an OBERAC basis) will be lower than current forecasts, at around 3% of GDP, and operating surpluses excluding returns on the NZS Fund (on an OBERAC basis) would be around 21/2% of GDP, remaining consistent with the long-term objective for the operating balance. |

Debt: |

|

|

|

|

| |

Manage total debt at prudent levels. In the longer term, gross sovereign-issued debt below 30% of GDP on average over the economic cycle. |

|

Gross sovereign-issued debt is forecast to be 21.2% of GDP in 2006/07.

The Government will set forecast new capital spending amounts that ensure progress is made toward the long-term objective for debt. The Government's bias is towards lowering rather than raising debt-to-GDP, so there will be a tendency for the ratio to trend downward over time. |

|

Gross sovereign-issued debt is forecast to be 24% of GDP in 2005/06. In 2005/06 Crown gross debt is forecast to be 25.1% of GDP.

The Government will set forecast new capital spending amounts that ensure progress is made toward the long-term objective for debt. The Government's bias is towards lowering rather than raising debt-to-GDP, so there will be a tendency for the ratio to trend downward over time. |

Crown expenses: |

|

|

|

|

| |

Ensure expenses are consistent with the operating balance objective. |

|

In 2006/07 total Crown expenses are forecast to be 39.9% of GDP. Within this, core Crown expenses are forecast to be 31.2% of GDP. NZS Fund contributions are forecast to be 1.4% of GDP in 2006/07.

Based on new operating expense amounts for the 2004 Budget, and indicative amounts for the next two Budgets, total Crown expenses are forecast to be $63.2 billion in 2006/07, and core Crown expenses to be $49.4 billion in 2006/07.

The Government will set revenue plans that ensure progress is made towards the long-term revenue objective. |

|

In 2005/06 total Crown expenses are forecast to be 39.1% of GDP. Within this, core Crown expenses are forecast to be 30.4% of GDP. NZS Fund contributions are forecast to be 1.6% of GDP in 2005/06.

Based on new operating expense amounts for the 2003 Budget, and indicative amounts for the next two Budgets, total Crown expenses are forecast to be $57.7 billion in 2005/06, and core Crown expenses are forecast to be $45.0 billion in 2005/06.

The Government will set revenue plans that ensure progress is made towards the long-term revenue objective. |

Crown revenue: |

|

|

|

|

| |

Ensure sufficient revenue to meet the operating balance objective. |

|

Total Crown revenues are forecast to be 42.6% of GDP in 2006/07. Within this, core Crown revenues are forecast to be 33.8% of GDP in 2006/07.

The Government will set revenue plans that ensure progress is made towards the long-term revenue objective |

|

Total Crown revenues are forecast to be 43.6% of GDP in 2005/06. Within this, core Crown revenues are forecast to be 33.0% of GDP in 2005/06.

The Government will set revenue plans that ensure progress is made towards the long-term revenue objective |

Crown net worth: |

|

|

|

|

| |

Increase net worth consistent with the operating balance objective. |

|

Net worth is forecast to be 30.3% of GDP, including NZS Fund assets of 7.4% of GDP, in 2006/07. |

|

Net worth is forecast to be 22.8% of GDP, including NZS Fund assets of 6.2% of GDP, in 2005/06. |

QuickLinks

The Public Finance (State Sector Management) BillBudget Policy Statement