Statement of Responsibility

On the basis of the economic and fiscal information available to it, the Treasury has used its best professional judgement in supplying the Minister of Finance with this Economic and Fiscal Update. The Update incorporates the fiscal and economic implications both of Government decisions and circumstances as at 9 May 2005 that were communicated to me, and of other economic and fiscal information available to the Treasury in accordance with the provisions of the Public Finance Act 1989.

John Whitehead

Secretary to the Treasury

12 May 2005

This Economic and Fiscal Update has been prepared in accordance with the Public Finance Act 1989. I accept overall responsibility for the integrity of the disclosures contained in this Update, and the consistency and completeness of the Update information in accordance with the requirements of the Public Finance Act 1989.

To enable the Treasury to prepare this Update, I have ensured that the Secretary to the Treasury has been advised of all Government decisions and other circumstances as at 9 May 2005 of which I was aware and that had material economic or fiscal implications.

Hon Dr Michael Cullen

Minister of Finance

12 May 2005

1

Economic Outlook

• The New Zealand economy has averaged 4.0% annual growth in the past six years, well above the OECD average of 2.6%. The drivers of this growth have included both cyclical and structural factors.

Figure 1.1 – Growth in real GDP

Source: Statistics New Zealand, OECD

• Growth in 2004 was sustained by continuing income growth and rising household wealth stemming from the strong labour and housing markets and high international commodity prices. Consumption expenditure remained strong but residential investment fell in the second half of 2004.

• Growth slowed in the second half of 2004 partly as a result of temporary factors and we expect some rebound in the first quarter of 2005. However, the economy appears to be at a turning point and we are forecasting slower growth for the next two years, with a recovery in the year to March 2008.

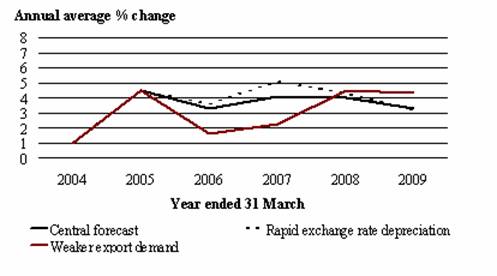

• High exchange and interest rates, declining net migration inflows, slower trading partner growth and a forecast decline in the terms of trade are the main drivers of lower growth. Further out, a projected fall in exchange and interest rates and a return to trend growth in the global economy are expected to lead to stronger growth.

• Employment growth is forecast to slow from its recent record rate and the unemployment rate to rise slightly. Wage growth is expected to pick up as a result of pressures in the labour market and as the mix of employment rebalances.

• We expect lower net migration inflows to have a negative effect on growth in consumption and residential investment. Higher interest rates and cyclical factors are expected to compound the slowdown in residential investment.

• Business investment growth is expected to remain robust in the near term but to decline as demand and profitability decline, labour shortages ease and the price of capital goods increases with the projected fall in the exchange rate.

• Government consumption and investment are expected to make a positive contribution to growth in the economy throughout the forecast period. Increased transfers are also expected to sustain private consumption.

• The global economy is strengthening again after a period of weaker growth, but growth is assumed to be lower (on an annual average basis) in calendar year 2005 than in 2004. Areas of concern in the global economy are the growth differential between the United States and other advanced economies and the resulting financial imbalances.

• We expect export volume growth to decline in the March 2006 year as a result of the delayed impact of the high exchange rate and slower world growth. A recovery is forecast for the following two years as the projected lower exchange rate has a positive impact.

• Import volume growth is expected to decline as the domestic economy cools and the exchange rate falls. Growth in imports is expected to strengthen again later in the forecast period as the domestic economy recovers.

• We expect annual CPI inflation to remain just below the top of the Reserve Bank’s target band for the next year as tradables inflation increases but non-tradables inflation pressures ease. Short-term interest rates are forecast to remain at current levels until the end of 2005 and then to revert to their assumed neutral level of 5.8% by March 2009 in line with forecast inflation.

• Growth in nominal GDP is forecast to decline from 8.4% in calendar year 2004 to 4.3% in the year to March 2006. In the near term, the higher growth in nominal GDP is expected to be reflected in higher corporate profits, but this component is likely to decline as the economy slows.

Figure 1.2 – Growth in real and nominal GDP

Sources: Statistics New Zealand, The Treasury

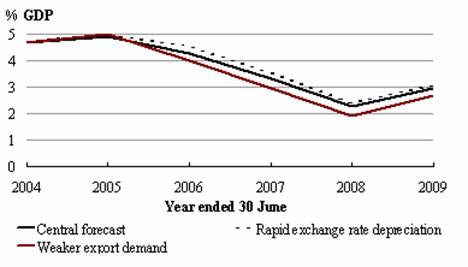

• The deficit on the current account is expected to increase further, peaking at around 7.0% of GDP in late 2006 – early 2007, driven by an increase in the deficit on goods as a result of high import growth, while export growth slows as a result of the high exchange rate and slower global growth. The deficit is expected to decline slightly over the remainder of the forecast period, but to remain at 6.1% of GDP in March 2009.

• There are both upside and downside risks to this central scenario, including a more cyclical path for real and nominal GDP growth. Some of the risks on the downside, while of low probability, could have a greater impact on the economy than the upside risks, if they were to eventuate. (See chapter 3 page 87 for a discussion of some of the risks associated with the forecasts and the elaboration of two other scenarios.)

Table 1.1 – Economic outlook: central forecast(1)

(Annual average % change,

March years) | | 2004

Actual | | 2005

Estimate | | 2006

Forecast | | 2007

Forecast | | 2008

Forecast | | 2009

Forecast | |

| | | | | | | | | | | | | |

Private consumption | | 5.6 | | 5.3 | | 2.8 | | 2.2 | | 3.0 | | 2.7 | |

Public consumption(2) | | 3.1 | | 7.1 | | 6.3 | | 4.4 | | 3.8 | | 3.3 | |

Total Consumption | | 5.1 | | 5.7 | | 3.6 | | 2.7 | | 3.2 | | 2.8 | |

Residential investment | | 15.9 | | 0.7 | | -8.6 | | -4.1 | | 0.8 | | 1.2 | |

Central Government Investment | | 0.5 | | 4.1 | | 6.6 | | 4.3 | | 7.0 | | 1.5 | |

Other Investment | | 14.3 | | 12.9 | | 4.3 | | 0.3 | | 2.1 | | 3.4 | |

Total Investment | | 13.7 | | 8.8 | | 1.4 | | -0.4 | | 2.1 | | 2.8 | |

Stock change(3) | | 0.2 | | 0.5 | | -0.5 | | 0.0 | | 0.0 | | 0.0 | |

Gross National Expenditure | | 7.0 | | 7.1 | | 2.4 | | 1.9 | | 2.9 | | 2.8 | |

Exports | | 1.0 | | 4.5 | | 3.3 | | 4.1 | | 4.0 | | 3.3 | |

Imports | | 11.9 | | 12.8 | | 4.1 | | 2.4 | | 2.5 | | 2.6 | |

GDP (Production Measure) | | 3.6 | | 4.2 | | 2.3 | | 2.5 | | 3.5 | | 3.0 | |

- annual % change | | 5.0 | | 2.8 | | 2.0 | | 3.0 | | 3.3 | | 2.9 | |

| | | | | | | | | | | | | |

Real GDP per capita | | 1.9 | | 3.0 | | 1.3 | | 1.6 | | 2.6 | | 2.1 | |

Nominal GDP (expenditure basis) | | 6.3 | | 8.2 | | 4.3 | | 3.0 | | 4.8 | | 5.0 | |

GDP deflator | | 2.8 | | 4.1 | | 2.0 | | 0.5 | | 1.3 | | 1.9 | |

| | | | | | | | | | | | | |

Employment(4) | | 2.9 | | 3.6 | | 1.5 | | 0.6 | | 1.1 | | 1.2 | |

Unemployment(5) | | 4.3 | | 3.4 | | 3.8 | | 4.2 | | 4.3 | | 4.5 | |

| | | | | | | | | | | | | |

Wages(6) | | 3.4 | | 3.3 | | 4.2 | | 4.0 | | 3.5 | | 3.5 | |

CPI inflation | | 1.5 | | 2.8 | | 2.8 | | 2.7 | | 2.4 | | 2.0 | |

Export prices(7) | | -8.2 | | 3.6 | | 0.3 | | 3.7 | | 1.3 | | 1.1 | |

Import prices(7) | | -11.6 | | -1.9 | | 2.0 | | 7.1 | | 3.0 | | 1.0 | |

| | | | | | | | | | | | | |

Current account balance | | | | | | | | | | | | | |

- $ million | | -6,326 | | -9,881 | | -10,316 | | -10,952 | | -11,011 | | -10,731 | |

- % of GDP | | -4.6 | | -6.6 | | -6.7 | | -6.9 | | -6.6 | | -6.1 | |

| | | | | | | | | | | | | |

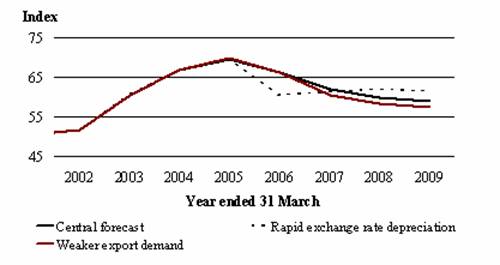

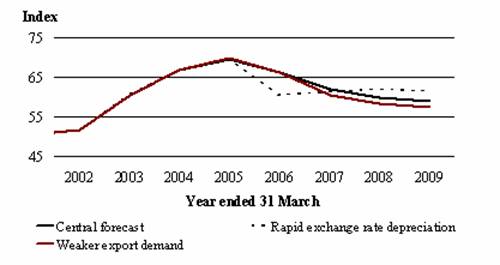

TWI(8) | | 66.9 | | 69.6 | | 66.2 | | 62.1 | | 59.9 | | 58.8 | |

90-day bank bill rate(8) | | 5.5 | | 6.9 | | 6.8 | | 6.3 | | 5.8 | | 5.8 | |

10-year bond rate(8) | | 5.8 | | 6.0 | | 6.4 | | 6.4 | | 6.0 | | 6.0 | |

Sources: Statistics New Zealand, Reserve Bank of New Zealand, The Treasury

NOTES: | (1) | Forecasts finalised on 18 April 2005. Text finalised on 12 May 2005. |

| (2) | The forecast profile for public consumption is influenced by government defence spending. |

| (3) | Contribution to GDP growth. |

| (4) | Household Labour Force Survey, full-time equivalent employment. |

| (5) | Household Labour Force Survey, percentage of the labour force, March quarter, seasonally adjusted. |

| (6) | Quarterly Employment Survey, average hourly ordinary time earnings. |

| (7) | Overseas Trade Index basis, annual average percentage change, March quarter. |

| (8) | Average for the March quarter. |

Assumptions Underlying the Central Forecast

Global economic activity – global economic growth, inflation and interest rate forecasts are assumed to conform to those presented in the March 2005 Consensus Forecasts and Asia Pacific Consensus Forecasts. Economic growth for New Zealand’s top 14 trading partners is forecast at 3.2% for calendar 2005, a fall from the estimate of 4.1% for 2004. Growth then returns to trend of around 3.5% from 2006 onwards. The forecast for 2005 has been revised down since the December Economic and Fiscal Update 2004 (December Update) as a result of a weaker outlook for Australia and Japan.

• In Australia recent quarterly growth has been slow and the central bank has raised interest rates to forestall inflation pressures. This has been translated into forecasts of a lower annual growth rate over the next year.

• In Japan downward revisions to historical data have led to an adjustment of forecasts. Private consumption has again become the main source of weakness, following evidence of a long-awaited recovery over the three quarters to mid-2004.

See The Global Economic Outlook box on page 53 for further discussion.

Oil prices – Brent crude oil prices have increased since the December Update and are assumed to rise from their estimated level of US$47.80 per barrel in the March quarter 2005 to US$56 per barrel in the third quarter of 2005 before declining gradually over the remainder of the forecast period to US$47 per barrel in the March quarter 2009. This outlook is based on futures pricing at the time the forecasts were finalised.

Net migration – net migrant inflows have continued to decline and are assumed to fall to 5,000 in calendar year 2005, before increasing again to their assumed long-term average of 10,000 per annum in calendar year 2006.

Monetary conditions – the New Zealand dollar exchange rate as measured by the Trade Weighted Index (TWI) is assumed to remain at around 70 until the third quarter of 2005, before declining steadily to its estimated equilibrium level of around 59. A neutral short-term interest rate of 5.8% is assumed.

Climate – agricultural growing conditions and the level of hydro electricity storage lakes are assumed to be normal over the forecast period.

The economy has enjoyed a period of sustained expansion…

The New Zealand economy has grown strongly in the past six years after emerging from the 1997/98 recession. Annual GDP growth averaged 4.0% in the period from 1999 to 2004, well above the average for OECD member countries of 2.6%. The drivers of this strong performance have been well canvassed in the past (see December Update, pages 17-20) and include a range of cyclical and structural factors.

… but growth eased in the second half of 2004…

The rate of growth in the economy slowed sharply in the second half of 2004 to 2.2% (annual rate) from 5.2% in the first half. The first half-year’s growth was broad-based, with robust domestic and external demand. Strong consumption and investment led to rapid growth in imports, detracting from the positive contribution of exports. In the second half of the year all of the components of final domestic demand made a smaller contribution to growth, with a decline in residential investment. Exports fell in the third quarter and were negative for the second half as a whole. An increase in inventory levels and a smaller negative contribution from imports provided only a partial offset.

Figure 1.3 – Contributions to GDP growth 2004 (six-month annualised)

Sources: Statistics New Zealand, The Treasury

… and will slow further

The slower growth in real GDP in the final quarter of 2004 was partly due to temporary factors, such as poor weather affecting consumer spending. Although we expect a rebound in this component in the first quarter of 2005, the economy appears to be at a turning point, with many of the drivers of slower growth already apparent. We are forecasting growth to be weaker for the next two years before a recovery begins in the year to March 2008.

Recent growth sustained by robust employment growth…

Final domestic demand sustained growth in the economy in 2004 despite making a smaller contribution to overall growth in the second half of the year. The main factors supporting the domestic economy in 2004 were continuing household and corporate

income growth and rising household wealth stemming from the strength of the labour and housing markets and international commodity prices.

Robust growth in employment in 2004 and continuing wage growth combined to boost household incomes and sustain private consumption growth. Total gross earnings increased by 7.0% in 2004, while real private consumption expenditure increased by 6.1%. (See the Labour Market Performance box on page 46.)

… a buoyant housing market…

Rapid population growth (arising from high net migration inflows since late 2001) and relatively low interest rates (especially in 2003) led to a buoyant housing market and accompanying strong growth in residential investment in the past three years. Although the housing market peaked in late 2003 in terms of the number of sales, it has remained strong, with prices continuing to show gains (but at a slower rate) and the number of sales remaining high. Growth in residential investment was just under 20% in both 2002 and 2003, but it declined in the final two quarters of 2004. Residential building consents fell 17.5% in the year to November 2004 (on a trend basis), but the rate of decline eased to 6.2% in the year to March 2005.

Figure 1.4 – Housing market indicators

Sources: Statistics New Zealand, REINZ

Increasing house prices have seen household wealth continue to rise over the past few years, fuelling some of the growth in consumer expenditure. Household debt as a percentage of current income has increased rapidly in the past three years and the savings rate has become more negative (ie, in aggregate households are spending more than they are earning). However, rising asset prices have more than offset this increase, leading to significant increases in household net wealth over the same period. The increase in residential investment also led to an increase in consumption, particularly of durables to complement the new investment in housing.

… and external factors

Favourable terms of trade and strong trading partner growth also contributed to growth in the second half of 2004, especially growth in nominal GDP. Prices for New Zealand’s main export commodities remained at high levels in this period, as a result of strong demand and – in the case of dairy, beef and lamb – supply factors. High prices for these products, which together account for nearly 50% of commodity exports, sustained the terms of trade. The strong growth in some of our trading partner economies, particularly

China, has also lifted prices for a number of raw materials, including oil, over the past year.

Figure 1.5 – Commodity prices

Source: ANZ Banking Group

Strong growth has resulted in spare capacity being used up…

Capacity utilisation in the manufacturing and construction industries reached a 43-year high of 92.6% in the December 2004 quarter according to the Quarterly Survey of Business Opinion (QSBO) and remained just below this level in the March 2005 quarter. More than half of the respondents to the QSBO in recent quarters identified supply factors as the main constraint on the expansion of their output. In the March 2005 survey, more than a quarter stated that labour was the main constraint on expansion of their business.

… emerging inflation pressures…

High capacity utilisation, strong employment growth and low unemployment have led to increased inflation pressures. In the March 2005 QSBO, a net 40% of firms reported facing higher costs in the quarter, up from a net 35% in the previous quarter. A net 23% of firms raised their prices in the March quarter and 31% intended to do so in the following quarter. These figures point to increasing inflation pressure and declining profit margins as firms are squeezed by increased input costs, and competitive markets, the strong exchange rate and lower manufacturing costs in Asia restrict their ability to raise prices to final consumers.

… higher non-tradables inflation…

The rate of inflation, measured by the Consumers’ Price Index (CPI), has remained within the Reserve Bank’s target band of 1% to 3% in the recent period, despite increasing inflation pressures. The annual increase in the CPI in the year to March 2005 was 2.8%, up from 1.5% the year before. There has been a wide disparity between tradables and non-tradables inflation, with the high exchange rate holding down tradables inflation but the strong domestic economy leading to higher non-tradables inflation.

Figure 1.6 – Consumer price inflation

Source: Statistics New Zealand

… and an increase in the current account deficit

The continuing strong growth in the economy has also resulted in an increase in the current account deficit from 4.2% of GDP in 2003 to 6.4% in 2004. This is mainly due to the increased deficit on investment income resulting from the high profits of foreign-owned companies in New Zealand, and a decline in the balance on goods and services as imports increased with the rapid growth in domestic demand and the high exchange rate. (See Current Account Adjustment box on page 57.)

Labour Market Performance

Recent developments

The labour market has performed well in the recent period, reflecting strong growth in the economy as a whole. The number of people employed has grown by an average of 2.8% per annum in the past six years and by 4.4% in 2004, lifting the labour force participation rate to 67.7% of the working age population and lowering the unemployment rate to 3.6%. Both these results were a record for the Household Labour Force Survey (which began in 1986) and the unemployment rate was the lowest amongst the OECD member countries that calculate a comparable rate.(5)

Figure 1.7 – Participation and unemployment rates

Sources: Statistics New Zealand, The Treasury

The rapid expansion in employment and fall in unemployment have increased the difficulty of finding both skilled and unskilled staff to record levels, according to the QSBO. In the March 2005 quarter, a net 60% of firms reported increased difficulty finding skilled staff and a net 49% reported increased difficulty finding unskilled staff, the second highest and highest levels (respectively) in the 30-year series.

Figure 1.8 – Wage growth

Sources: Statistics New Zealand, The Treasury

(5) | Employment increased slightly in the March 2005 quarter but the participation rate dipped to 67.6% and the unemployment rate increased to 3.9%. |

Wage growth has also increased as spare labour resources have reduced. The broadest measure of wage growth, the unadjusted Labour Cost Index (LCI), which captures merit increases but holds the composition of employment constant, rose by 4.6% in the year to March 2005, its highest year-on-year increase since the start of the series in 1996. The adjusted LCI, which excludes merit increases while holding the composition of employment constant, increased by 2.4% in the same period, and average hourly earnings, measured by the Quarterly Employment Survey (QES) which includes changes in the composition of employment, increased by 3.4% in the year to March 2005 from the previous March year.

Total gross earnings have increased by an average of 6.1% per annum in the past six years, driven equally by growth in employment and growth in average hourly earnings, and indicating that the benefit of the strong labour market has been evenly split between more people working and higher earnings for those in employment. Compensation of employees increased at a similar rate to total gross earnings (5.0% per annum over the six years to March 2004) and labour’s share of national income over this period has been relatively steady at an average of 42.5% of GDP.

Outlook

We expect employment growth to ease in the forecast period as the economy slows, but because labour supply growth will also be low (as a result of the assumed easing in net migration inflows), the unemployment rate is expected to remain below 4.0% until the third quarter of 2006, before rising to around 4.5% by the end of the forecast period. Wage growth, as measured by the QES, is projected to increase because of the increased difficulty finding labour and as it recovers from its recent dip (which reflects changes in the composition of employment as more low-paid jobs were added). Further out, firms’ ability to pay higher wages will be limited by declining profitability as economic growth slows. Growth in non-farm net operating surplus (a measure of business profits) is forecast to decline from an estimated 12.6% in the year to March 2005 to average less than 3.0% per annum in the next four years.

We expect the strong business investment of the past two years to lead to further growth in labour productivity as the benefits of new plant and equipment are realised and the effects of the recent rapid expansion in employment pass. (There is some evidence that the addition of more low-skill and low-paid jobs recently has lowered productivity growth.) Slower employment growth also implies that growth in labour input makes a smaller contribution to real GDP growth than in recent years.

Figure 1.9 – Labour productivity and real wage growth

Sources: Statistics New Zealand, The Treasury

Over the forecast period, we expect labour productivity to increase to around 2% per annum in the year to March 2007 as recent entrants to the labour force become more productive and as continuing business investment leads to an increase in the capital-to-labour ratio. By the end of the forecast period, labour productivity growth is expected to be around our assessment of trend productivity growth of 1.5%. Real wage growth (measured by the unadjusted Labour Cost Index deflated by the Consumers’ Price Index) has been positive over the past six years and has broadly reflected productivity growth.

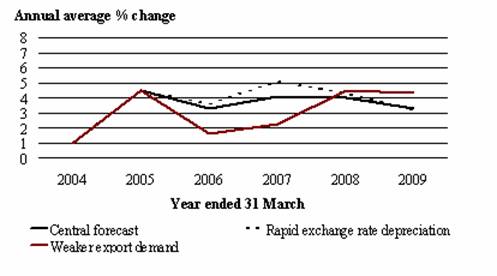

We expect growth to ease further…

The easing in growth in the second half of 2004 was mainly due to a reversal of some of the factors which sustained growth over the previous six years. In our central forecast, we expect the rate of year-on-year growth in the New Zealand economy to slow in the next two years as the effects of these cyclical factors – most of which are already in place – flow through. The chief amongst them are high exchange and interest rates, the continuing slowdown in net migration inflows, slower trading partner growth in 2005 and a forecast decline in the terms of trade. We estimate that growth in real GDP peaked at 4.8% in calendar year 2004 and will slow to 2.3% in the March 2006 year and 2.5% in the March 2007 year, but will then pick up to 3.5% in the following year and 3.0% in the year to March 2009.

Figure 1.10 – Growth in real GDP

Sources: Statistics New Zealand, The Treasury

… with some renewed strength possible in the first half of 2005…

We estimate that growth was stronger in the first quarter of 2005 as the economy recovered from the temporary factors which slowed growth in the final quarter of 2004. Some recovery in private consumption is expected to have occurred in the first quarter of 2005 as part of a pick-up from weak retail sales in the final quarter of 2004 (sales volumes were affected by poor weather pre-Christmas), although the timing of Easter may have affected the seasonal pattern of sales in the first quarter of 2005.

Meat production and exports recovered in the March 2005 quarter after farmers held stock over for slaughter at the end of 2004; dairy exports also increased in the March 2005 quarter. We estimate that a recovery in business investment occurred in early 2005 as investment intentions remained high; non-residential construction is estimated to have grown strongly with increased business investment and infrastructure projects, while residential investment continued to fall.

... but signs of the slowdown are becoming more apparent

Signs of the slower growth have become more apparent recently with falls in consumer and business confidence in the latest monthly surveys. Although these are only single observations, they point to weaker growth in private consumption and business investment in the period ahead. As always, there is a wide distribution of possible outcomes around our central forecast, with different probabilities associated with different risks. (See chapter 3 page 87 for a full discussion of the risks associated with our forecasts and the development of two other scenarios.)

Private consumption growth expected to ease…

We expect slower employment growth, falling net migration and the effects of higher interest rates to lead to a fall in private consumption growth from an estimated 5.3% in the year to March 2005 to 2.8% in the year to March 2006 and 2.2% in the following year. Increasing labour and export incomes and a projected fall in interest rates will lead to a recovery in private consumption growth to just under 3.0% by the end of the forecast period.

… as the labour market slows…

We forecast employment growth to slow in the next two years as the economy slows, but there will be some offset to total labour income from increased wage growth. Growth in full-time equivalent employment is forecast to fall to a low of 0.5% in the year to June 2006, but to recover to 1.2% by the end of 2007. Some recovery from the recent weakness in the QES wage growth measure is likely in the near term as the mix of employment rebalances and employers pay higher wages because of the increased difficulty of finding labour. Wage growth is forecast to peak in late 2006 at 4.7% on an annual average basis and then to ease back to around 3.5%.

Annual growth in compensation of employees is forecast to peak at 7.8% in mid-2005 and to fall below 4.0% in 2006, leading to slower private consumption growth. In the short term, the risks are skewed to employment growth holding up for longer and the participation rate increasing further than forecast, lending more support to consumption.

… and net migration declines

Net migration gains have been declining from a peak in mid-2003. This is the result of an increasing number of New Zealanders travelling overseas for a year or more, declining numbers of young people coming to New Zealand to study, and increased outflows of young people who have completed courses in New Zealand. Departures of New Zealanders have increased as safety concerns have subsided and employment conditions have become more attractive in the main destination countries (Australia and the United Kingdom). These trends are expected to continue, with net migration inflows falling from 10,000 in the year to March 2005 to 5,000 in calendar year 2005. Net inflows are expected to recover again to 10,000 by the end of 2006.

The housing market is also expected to cool

A weaker labour market and continued slowing in net migration inflows are expected to lead to a fall in residential investment in the next two years. The impact of higher

mortgage interest rates (albeit delayed because of the high proportion of home loans which are at fixed rates) will also contribute to the fall. In addition, residential rents have not kept pace with construction costs and house prices, reducing the returns from investment in housing; and rapid growth in the number of apartments, combined with a downturn in the numbers of foreign students, has increased the risk of an over-supply in that part of the market.

Figure 1.11 – Net migration and house sales

Sources: Statistics New Zealand, REINZ

Residential investment growth is estimated to have fallen to zero in the March 2005 year and is forecast to be negative in the 2006 and 2007 March years before stabilising. The fall in residential investment will also contribute to slower consumption growth, especially for consumer durables which are associated with residential investment.

Residential investment in the second half of 2004 was weaker than we expected in the December Update and there may be a catch-up in the first half of 2005. The continued buoyancy in house sales (a leading indicator of residential investment) may also portend a short-term resurgence in residential investment, although the increase in house sales may merely reflect the mortgage rate war in late 2004. The anecdotes of a backlog of work which has built up in the housing construction industry (chiefly because of the shortage of skilled trades people) provides a further risk of higher than forecast residential investment for a period. For these reasons, residential investment in the first half of 2005 may be higher than envisaged in the central scenario, although if this is the case there would be lower activity later.

Business investment is expected to hold up in the near term

Business investment strengthened considerably from annual average growth between 1999 and 2003 of 7.7% to 17.9% in 2004 as a result of a combination of continuing robust demand, rising firm profitability, increased difficulty finding labour and lower prices for imported capital goods resulting from the high exchange rate. Investment intentions remain positive, and so we expect business investment to hold up in the near term. Thereafter, however, we expect growth in business investment to slow as the supportive factors just mentioned are reversed. We forecast investment growth to fall to 0.3% in the March 2007 year, and then to recover to 3.4% in the year to March 2009 as the determinants of investment stabilise.

Figure 1.12 – Plant and machinery investment

Sources: Statistics New Zealand, NZIER

Government spending and transfers will add to demand

Increased government transfers as part of the Working for Families package (announced in the 2004 Budget) have previously been incorporated in the consumption forecasts. As these transfers go to households with a higher propensity to consume (because they spend a high proportion of their total income), the package is likely to have a positive effect on consumption.

Sustained growth over the forecast period in government spending on goods and services, particularly in the areas of health and education, will also provide some offset to easing private consumption. Government defence spending, much of which is counted as current expenditure, is also set to continue to grow in the forecast period. On current plans, public consumption growth is forecast to decline from an estimated 7.1% in the year to March 2005 to 3.3% per annum at the end of the forecast period, but is above the growth rate in total GDP throughout that period.

Central government investment growth is forecast to increase from an estimated 4.1% in the March 2005 year to 6.6% in the March 2006 year and will make a positive contribution to growth in the forecast period. This item includes budgeted investment in non-weapons military equipment and other capital spending in the health and housing areas.

The contribution from exports is forecast to decline

December 2004 quarter export volumes remained below December Update forecasts, despite their recovery from a weak September quarter. Unseasonal patterns in dairy export volumes as a result of climatic factors and changes in stock-holding policies were the main causes of the variability in exports in the second half of 2004. We are forecasting export volume growth of 4.5% in the year to March 2005 to slow to 3.3% in the following year due to the delayed impact of the high exchange rate and slower world growth. The lower exchange rate and strengthening world growth in subsequent years are expected to lead to export growth of around 4.0% in the March 2007 and 2008 years.

There is uncertainty about the track for the exchange rate…

Our forecasts assume that the New Zealand dollar (TWI basis) will remain at its March 2005 quarter average for the June and September quarters, before declining to our estimate of its long-run equilibrium value by the end of the forecast period. Factors that could contribute to a fall in the exchange rate from its current level include a slowing in economic growth, the growing current account deficit and forecast decline in the terms of trade. The forecast narrowing of the positive differential between New Zealand and global interest rates may also reduce the attractiveness of the New Zealand dollar. However, there is considerable uncertainty surrounding the timing and extent of any depreciation in the exchange rate. This is particularly the case at the present time given uncertainties about the path of global currencies, especially the United States dollar. Indeed, some further exchange rate appreciation in the short term cannot be ruled out.

Figure 1.13 – New Zealand dollar exchange rate (TWI)

Sources: Reserve Bank of New Zealand, The Treasury

… and its impact on exports

There is also uncertainty about how negatively the high exchange rate will impact on export receipts in the near term. For some commodity exports, notably dairy, beef and lamb, the exchange rate has been offset by historically high international prices, leaving prices above their decade average in New Zealand dollar terms. Forestry products are a notable exception to this commodity picture. For manufactured product exporters, the effect of the exchange rate depends on the markets they export to; while the New Zealand dollar has appreciated strongly against the United States dollar, it has not posted such large gains against other currencies. Some manufacturing exporters have a natural hedge in imported raw materials or componentry and some took out long-term forward contracts to protect their returns. However, many of these forward contracts are about to expire, leaving firms to face a potentially abrupt transition to current exchange rates.

In the services sector, especially inbound tourism, the appreciation of the New Zealand dollar has only limited impact on the number of visitors in the short term, but it does reduce the amount travellers are prepared to spend once they arrive in New Zealand. In the longer term the high exchange rate begins to affect the number of visitor arrivals as New Zealand loses competitiveness as a holiday destination. The strong exchange rate also encourages more New Zealanders to travel overseas for holidays, detracting from services export receipts. (For the development of alternative scenarios associated with the exchange rate and weaker demand for New Zealand’s exports, see chapter 3 page 90.)

Import volume growth is expected to decline

Strong consumption and investment growth led to an acceleration in import volume growth from 8.1% in calendar year 2003 to 15.7% in 2004. The forecast falls in these major components of domestic demand will lead to a decline in import growth from an estimated 12.8% in the year to March 2005, to 4.1% in the year to March 2006, and then to average 2.5% growth in the following three years. March 2005 quarter trade data suggest that import volume growth may be stronger than in our central forecast as a result of the stronger domestic economy and high exchange rate. However, we consider that this strength in the domestic economy is a rebound from temporary weakness in late 2004 and is unlikely to be sustained.

We expect the net contribution of the export sector to GDP growth to be positive in the March 2006 year as export growth exceeds import growth, and this pattern will continue in subsequent years as export growth outpaces import growth as the exchange rate depreciates. (See The Global Economic Outlook box on the following two pages for more discussion.)

The Global Economic Outlook

Recent and current developments

Global economic growth slowed steadily between September 2003 and September 2004, but quickened slightly in the December quarter of 2004. The quarterly growth rate (New Zealand-export weighted) was most influenced – up until the December quarter of 2004 – by a sharp slowing of Australian growth, but growth rates were in fact declining in most of New Zealand’s major export markets.

Figure 1.14 – New Zealand trading partner growth, export weighted

Sources: Datastream, IMF, The Treasury

Consensus Forecasts point to quarterly growth recovering over the remainder of 2005, building on the rebound seen in the final quarter of 2004. Nevertheless, annual average growth rates for 2005 will remain below those recorded in late 2003 and early 2004. In subsequent years, steady growth of about 3½% per year is expected. However, there is considerable uncertainty about these predictions, largely stemming from large growth and current account imbalances and high oil prices. There have also been commentaries suggesting a more rapid increase in global interest rates than forecast as the United States Federal Reserve moves to control inflationary pressures. Another source of uncertainty is slower GDP growth in Australia.

Global GDP growth (annual average % change)

Calendar year | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

Consensus Forecasts (March 2005, October 2004 for 2007-2009) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Australia | | 3.4 | | 3.2 | | 2.6 | | 3.2 | | 3.4 | | 3.7 | | 3.4 | |

United States | | 3.0 | | 4.4 | | 3.7 | | 3.4 | | 3.3 | | 3.2 | | 3.2 | |

Europe | | 1.1 | | 2.3 | | 1.8 | | 2.0 | | 1.9 | | 1.7 | | 1.8 | |

Japan | | 1.4 | | 2.6 | | 1.0 | | 1.7 | | 1.5 | | 1.7 | | 1.7 | |

Non-Japan Asia | | 5.1 | | 7.3 | | 5.8 | | 5.8 | | 6.0 | | 6.2 | | 5.9 | |

Trading partner average | | 3.0 | | 4.1 | | 3.2 | | 3.4 | | 3.4 | | 3.5 | | 3.4 | |

| | | | | | | | | | | | | | | |

IMF (April 2005) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Advanced Economies | | 2.0 | | 3.4 | | 2.6 | | 3.0 | | | | | | | |

World | | 4.0 | | 5.1 | | 4.3 | | 4.4 | | | | | | | |

Sources: Consensus Economics, IMF, The Treasury

Weight of risks points to weaker outlook

In considering the uncertainties which affect the Consensus Forecasts, it is notable that the most widely discussed alternative scenarios all imply slower global growth.

A major concern is the large growth differential and increasing imbalances between countries. Although the US current account deficit is similar to New Zealand’s as a percentage of GDP, such a large deficit in dollar terms places much higher demands on the supply of world investment funds. While there is currently a plentiful supply of global capital, it is possible that this will not be sustained. Either a reduction in supply or withdrawal of investor support for US assets could lead to an unruly decline in the US dollar and a turbulent growth adjustment. In turn, any decline in the value of US dollar assets has the potential to put pressure on official balance sheets in Asian countries, possibly transmitting financial difficulties.

Figure 1.15 – US current account deficit

Source: Datastream

Oil prices are another source of uncertainty in global economic forecasts. Based on futures data, spot prices are expected to decline from current levels of about US$50 per barrel over the next five years, but to remain considerably higher than the long-term average of US$20. Should oil prices not decline as expected, the potential would increase for more widespread inflation or for oil-intensive industries to cut output in order to contain costs.

Both the global imbalances and oil price uncertainty raise the prospect of problems for monetary policy makers. In the former case, high current account surpluses in Asia are increasing liquidity in the region and making it more difficult to contain domestic demand. As a result, price movements in Asia have typically moved from deflation to inflation. Keeping this inflation under control without exchange rate adjustment will be difficult and there is a possibility that inflation will spread, through higher commodity prices, to other countries.

Finally, forecasts of GDP growth in the economy of New Zealand’s main export destination, Australia, show a quick return to annual growth rates of about 3½% following the recent quarterly slowing. Certainly, growth rates in excess of 3% per year have been typical in Australia, at least for non-farm GDP, for the past decade. But some commentators have raised the possibility that recent official interest rate increases at a time of apparently slowing domestic demand growth could prolong the period of slow GDP growth.

Terms of trade are forecast to decline from recent high levels

We forecast the terms of trade (measured as the ratio of export to import prices) to decline from their recent record levels as a result of adverse developments in both export and import prices. The terms of trade continued to increase in the second half of 2004 on the back of strong export prices, offset to some degree by higher oil prices. Export commodity prices are forecast to decline in the second half of 2005 as positive supply factors are reversed and demand eases with slower trading partner growth. Import prices, on the other hand, are forecast to increase in world price terms until the September quarter 2005, largely because of further projected increases in oil prices in the second and third quarters of 2005. Thereafter, oil prices are assumed to decline, but to remain approximately one third higher than in the December Update.

Figure 1.16 – Terms of trade

Sources: Statistics New Zealand, The Treasury

Inflation pressures are expected to be moderate but persistent

We expect annual CPI inflation to remain within the Reserve Bank’s target zone of 1% to 3% “on average over the medium term” in the next year despite the current high capacity utilisation and economic activity only just coming back to its potential level. Aggregate inflation has been suppressed by low tradables inflation (as a result of the appreciation of the exchange rate) and contributions from temporary factors such as declines in international airfares. Non-tradables inflation has been boosted by high rates of growth in construction costs, price increases in transportation (largely as a result of oil price increases) and rising costs of household operations (chiefly energy costs). We expect the first two of these to ease over the forecast period, but there will be a degree of persistence as the economy slows only gradually. Tradables inflation will increase as the fall in the exchange rate translates into increasing import prices.

Figure 1.17 – Consumer price inflation

Sources: Statistics New Zealand, The Treasury

Short-term interest rates are expected to remain around current levels of 7.0% until the first quarter of 2006 in order to lean against current inflation pressures. Interest rates are then forecast to decline towards their assumed neutral level of around 5.8% by the end of the period in line with forecast inflation.

Nominal GDP is expected to be higher in the near term

We expect nominal GDP to increase by more than forecast in the December Update in the year to March 2006 because of the high terms of trade in the current period and slightly higher inflation, reflecting the strength of the economy. In income terms, much of the additional nominal GDP appears as operating surplus, or profits. Corporates are currently performing well and profit growth has been strong, boosting corporate tax revenue. However, as the economy slows we expect profit growth to slow markedly as cost pressures remain (particularly in the labour market) and competition limits price increases. Nominal GDP growth is forecast to decline from an estimated 8.2% in the March 2005 year to 4.3% in the March 2006 year and 3.0% in the March 2007 year, but then to recover to 5.0% growth in the March 2009 year.

The current account deficit increases further

We expect the current account deficit to continue to increase, peaking at 7.0% of nominal GDP in late 2006 – early 2007. After that, it will decline gradually to 6.1% of GDP in March quarter 2009. The increase in the deficit is initially driven by an increase in the deficit on goods as a result of the continuing momentum in the domestic economy maintaining import growth, while export growth slows as a result of the high exchange rate and slower trading partner growth.

Figure 1.18 – Current account deficit

Sources: Statistics New Zealand, The Treasury

Subsequently, import prices are expected to increase more than export prices as the terms of trade deteriorate, further contributing to the deficit on goods. The balance on investment income remains negative throughout the forecast period, as the profits that accrue to foreign investors in New Zealand continue to exceed returns from New Zealand’s overseas investments, but this component of the current account deficit decreases in the forecast period as business profitability declines. (See the Current Account Adjustment box on the following pages for further discussion.)

Current Account Adjustment

International experience

The widening of a current account deficit may be associated with either cyclical – and therefore temporary – changes in the economy or changes in the underlying, fundamental determinants of the current account balance. Examples of the former include changes in demand relative to supply in response to interest rate and exchange rate movements. Examples of the latter include improvements in an economy’s growth potential, and thus its attractiveness as an investment destination, and improvements in global financial intermediation that facilitate investment across borders.

When cyclical factors drive the widening deficit, at some point the deficit will be unwound; in contrast, where the drivers are structural, higher deficits may persist for much longer periods. Recent international research confirms the importance of different cyclical drivers in determining the economic outcomes associated with a narrowing of the current account balance.

Output growth is an important determinant of cyclical movements in the current account. As an economy booms, domestic demand may exceed domestic output growth. This will be reflected in a rise in domestic investment relative to national saving, that is, an increased reliance on foreign saving, and an increase in imports and thereby a deterioration in the current account deficit. If the boom leads to a rise in inflation, monetary policy will tighten to slow the growth in domestic demand and to counter the rise in inflation. The combination of a slowing economy and the expected easing in monetary policy will tend to reduce the attractiveness of the domestic economy as an investment destination and to depreciate the exchange rate, which helps restore the trade balance, and thereby narrows the deficit.

The exchange rate is another important determinant of fluctuations in the current account deficit. An exchange rate appreciation that is not supported by underlying economic conditions will tend to slow overall economic growth through a reduction in export growth and a rise in imports, which also causes the trade balance and the current account balance to deteriorate. Monetary policy will respond to weaker price pressures through reduced interest rates and (as above) the exchange rate will tend to depreciate and the current account balance will improve. The expected tightening of monetary policy limits the extent of depreciation and helps restrain the growth in demand, but in contrast to the previous scenario, the growth rate improves.

New Zealand experience

New Zealand’s experience in two recent episodes appears to confirm the importance of the drivers of the deficit to the outcomes associated with adjustment. (In each of the accompanying charts, period 0 corresponds to the peak in the current account deficit in March 1986 and March 2000 respectively.)

Figure 1.19 maps the widening and subsequent narrowing of the deficit from its peaks in March 1986 and March 2000 respectively.

Figure 1.19 – Current account deficit reductions

Source: The Treasury

Figure 1.20 illustrates the markedly different growth experiences associated with each episode. In 1986, real GDP growth was weak following the peak in the current account deficit, whereas in 2000 growth was strong.

Figure 1.20 – Real GDP growth

Sources: Statistics New Zealand, The Treasury

Figure 1.21 shows how the real exchange rate depreciated in the lead-up to, and after, the 2000 peak. In contrast the real exchange rate appreciated after 1986, a reflection of New Zealand’s high inflation rate and other structural rigidities at that time.

Figure 1.21 – Real exchange rate

Sources: Statistics New Zealand, The Treasury

Figure 1.22 uses the output gap, or the difference between current output and the hypothetical potential output, as a measure of general excess demand in the economy. In contrast to 1986, when the economy was characterised by excess demand, there was a lack of demand in the period around the 2000 peak, which provided room for a period of non-inflationary growth.

Figure 1.22 – Output gap

Sources: Statistics New Zealand, The Treasury

Future prospects

Today’s growing current account deficit may reflect some fundamental changes in New Zealand’s growth prospects and in international financial flows, but it also reflects some temporary and cyclical phenomena. These include a degree of excess demand in the economy and an exchange rate above that expected to prevail over the medium term.

While we expect these cyclical factors to unwind in coming years, the current account deficit is projected to remain elevated over the forecast horizon. This reflects the assumption that the exchange rate will decline only gradually, limiting the extent of growth in the export and import-competing sectors, and a view that New Zealand’s sound macroeconomic policy-setting will continue to underpin investor confidence.

Clearly, a different path is possible. A more rapid exchange rate depreciation would likely see the deficit return toward historical levels (around 4½% of GDP) more quickly. Experience both in New Zealand and elsewhere confirms the importance of real exchange rate adjustment and the maintenance of sustainable growth rates to the smooth adjustment of the current account. How benign the adjustment path turns out to be depends on the mix of economic conditions at the time.

Fiscal Forecasts – Finalisation Dates and Key Assumptions

Finalisation Dates

Economic outlook (refer Chapter 1) | | 18 April | |

Tax revenue forecasts | | 29 April | |

Fiscal forecasts | | 9 May | |

Government decisions and circumstances | | 9 May | |

Actual asset revaluations | | 31 March | |

Foreign exchange rates | | 28 February | |

Specific fiscal risks (refer Chapter 4) | | 9 May | |

Contingent liabilities and commitments (refer Chapter 4) | | 31 March | |

Key assumptions

The fiscal forecasts have been prepared in accordance with the Public Finance Act 1989. They are based on the Crown’s accounting policies and assumptions (refer page 120 of the GAAP tables). As with all assumptions, there is a degree of uncertainty surrounding them. This uncertainty increases as the forecast horizon extends. A summary of the key economic assumptions that are particularly relevant to the fiscal forecasts is provided below (on a June-year-end basis to align with the Crown’s balance date of 30 June):

| | 2004/05 | | 2005/06 | | 2006/07 | | 2007/08 | | 2008/09 | |

June years | | BEFU 04 | | BEFU | | BEFU | | BEFU | | BEFU | | BEFU | |

Real GDP (P) (ann avg % chg) | | 2.4 | | 3.4 | | 2.2 | | 2.8 | | 3.4 | | 3.0 | |

Nominal GDP (E) ($m) | | 144,441 | | 150,714 | | 156,065 | | 161,582 | | 169,470 | | 178,172 | |

CPI (annual % change) | | 2.5 | | 2.8 | | 2.6 | | 2.7 | | 2.3 | | 2.0 | |

Govt 10-year bonds (qty avg %) | | 6.3 | | 6.4 | | 6.4 | | 6.3 | | 6.0 | | 6.0 | |

90-day bill rate (qty avg %) | | 5.8 | | 7.0 | | 6.5 | | 6.0 | | 5.8 | | 5.8 | |

Unemployment rate ((HLFS) basis ann avg %) | | 4.7 | | 3.5 | | 3.7 | | 4.1 | | 4.3 | | 4.5 | |

Full-time equivalent employment (ann avg %) | | 1.0 | | 3.5 | | 0.9 | | 0.7 | | 1.1 | | 1.2 | |

Current account (% of GDP) | | -5.9 | | -6.8 | | -6.7 | | -6.9 | | -6.4 | | -6.0 | |

Source: The Treasury

New Zealand Superannuation (NZS) Fund

The contribution to the NZS Fund for the year ending 30 June 2006 is $2.337 billion. The contribution to the NZS Fund is calculated over a 40-year rolling horizon to ensure that superannuation entitlements over the next 40 years can be met if the contribution rate were to be held constant at that level. The Government is making the required minimum annual contribution for 2004/05 as calculated by the formula set out in the NZS Act.

$ billion (June year end) | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | |

Required contribution | | N/A | | 1.879 | | 2.107 | | 2.337 | | 2.375 | | 2.533 | | 2.744 | |

Actual/Budgeted contribution | | 1.200 | | 1.879 | | 2.107 | | 2.337 | | 2.375 | | 2.533 | | 2.744 | |

Source: The Treasury

The underlying assumptions in calculating the contributions are the nominal GDP series to 2046, the NZS expense series to 2046 and the expected long-term, net after-tax annual return of the NZS Fund (6.1%) (6.8% December Update). The forecast rate of return is based on the Treasury’s assumptions for the rate of return on financial portfolios of Crown financial institutions. The GDP and NZS expense series were projected using the assumptions stated on page 33 of the 2005 Fiscal Strategy Report.

The Treasury website contains further information on the NZS Fund, as well as a copy of the NZS Fund model.

2

Fiscal Outlook

The fiscal position remains strong with the Government continuing to make progress towards its long-term objectives.

As stated in the Fiscal Strategy Report (FSR) “the Government’s fiscal strategy is to strengthen public finances to prepare for future fiscal costs associated with an ageing population”.

The Government has focused on two complementary elements to reach its objective, being:

• the accumulation of financial assets through contributions to the New Zealand Superannuation (NZS) Fund

• managing debt at prudent levels with gross sovereign-issued debt as a percentage of GDP slowly reducing over time.

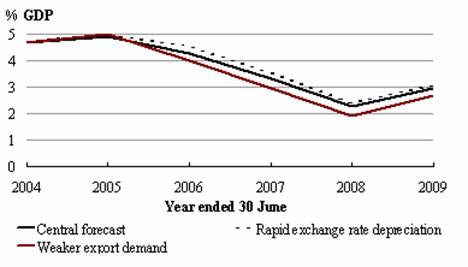

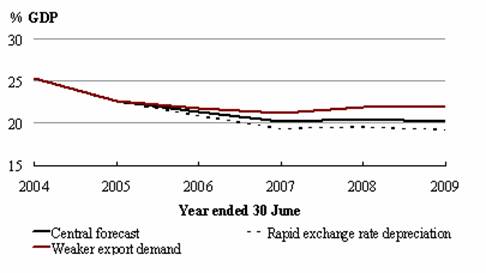

The forecast fiscal outlook for the Budget Update shows:

• revenue sufficient to meet operating expenses with the residual (operating balance/OBERAC) forecast to be on average around 3.6% of GDP over the forecast period

• net worth increasing by around $27.7 billion over the forecast period, largely resulting from the accumulation of assets

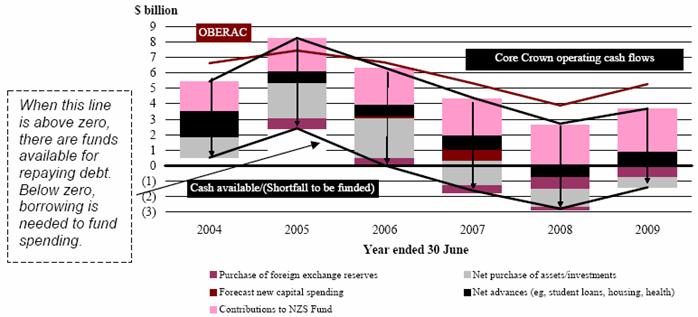

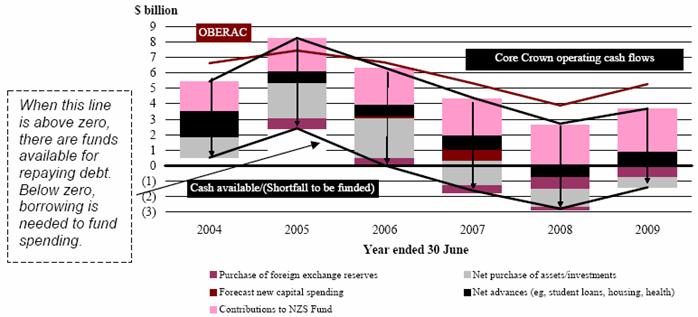

• the cash equivalent of the OBERAC being applied to the Government’s investment strategy (such as contributions to the NZS Fund and purchasing physical assets). Over the forecast period the cash generated is not sufficient to fund all of the Government’s investing activity, leaving an expected cash shortfall

• gross sovereign-issued debt as a percentage of GDP slowly reducing over the forecast period, while in nominal terms gross debt rises near the end of the forecast period.

Fiscal Indicators

There are a number of indicators that are important in understanding the state of the Government’s fiscal position. No single indicator provides an all-purpose measure of the financial performance of the Crown and its impact on the economy. For example:

• the total Crown operating balance reflects the difference between current revenues (tax revenue, investment income etc) and current expenses (salaries, benefit payments etc). The operating balance shows whether the Government has generated enough revenue to cover expenses

• the total Crown OBERAC reflects the difference between current revenues and current expenses adjusted for valuation movements and accounting policy changes. The OBERAC provides a measure of the Government’s underlying stewardship

• the total Crown net worth reflects the difference between total assets and total liabilities. The change in net worth in any given forecast year is primarily driven by the operating balance

• the cash available/(shortfall to be funded) reflects the net effect of the Government’s core Crown operating (cash equivalent of the OBERAC) and investing activities (such as contributions to the NZS Fund and purchases of physical assets). It shows whether the cash generated is sufficient to meet all government spending (both operating and investing)

• gross sovereign-issued debt reflects the debt burden of the core Crown (excluding the activity of the NZS Fund and GSF). The movement over the forecast period is primarily driven by the cash available/(shortfall to be funded)

• net core Crown debt reflects borrowings (financial liabilities) less cash and bank balances, marketable securities and deposits, and advances (financial assets). Net debt excludes the financial assets of the NZS Fund and GSF as these assets are restricted in nature.

Table 2.1 – Summary fiscal indicators(6)

| | Year ended 30 June | |

($ million) | | 2004

Actual | | 2005

Forecast | | 2006

Forecast | | 2007

Forecast | | 2008

Forecast | | 2009

Forecast | |

Total revenue | | 60,387 | | 65,265 | | 68,770 | | 71,238 | | 73,856 | | 78,156 | |

% of GDP | | 43.0 | | 43.3 | | 44.1 | | 44.1 | | 43.6 | | 43.9 | |

Total expenses | | 53,057 | | 59,513 | | 62,244 | | 66,047 | | 70,101 | | 73,020 | |

% of GDP | | 37.8 | | 39.5 | | 39.9 | | 40.9 | | 41.4 | | 41.0 | |

Operating balance | | 7,424 | | 5,891 | | 6,665 | | 5,330 | | 3,894 | | 5,275 | |

% of GDP | | 5.3 | | 3.9 | | 4.3 | | 3.3 | | 2.3 | | 3.0 | |

OBERAC | | 6,629 | | 7,445 | | 6,665 | | 5,330 | | 3,894 | | 5,275 | |

% of GDP | | 4.7 | | 4.9 | | 4.3 | | 3.3 | | 2.3 | | 3.0 | |

Net worth | | 35,463 | | 41,972 | | 48,637 | | 53,967 | | 57,861 | | 63,136 | |

% of GDP | | 25.2 | | 27.8 | | 31.2 | | 33.4 | | 34.1 | | 35.4 | |

Cash available/(shortfall to be funded) | | 520 | | 2,413 | | 30 | | (1,606 | ) | (2,776 | ) | (1,391 | ) |

% of GDP | | 0.4 | | 1.6 | | 0.0 | | (1.0 | ) | (1.6 | ) | (0.8 | ) |

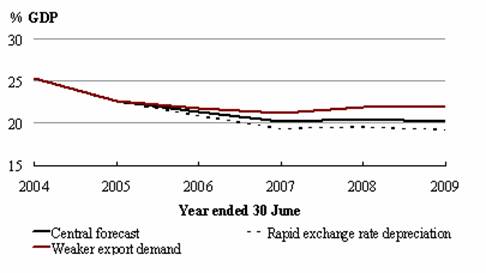

Gross sovereign-issued debt | | 35,527 | | 34,111 | | 33,284 | | 32,583 | | 34,629 | | 35,925 | |

% of GDP | | 25.3 | | 22.6 | | 21.3 | | 20.2 | | 20.4 | | 20.2 | |

Net core Crown debt | | 15,204 | | 11,533 | | 10,257 | | 10,640 | | 12,527 | | 13,439 | |

% of GDP | | 10.8 | | 7.7 | | 6.6 | | 6.6 | | 7.4 | | 7.5 | |

Source: The Treasury

(6) | Detailed tables of the key indicators for the Budget Update and December Update are located on pages 80 and 81. |

Revenues are forecast to exceed operating expenses…

In each of the forecast years the revenue generated is expected to be more than sufficient to meet the Government’s operating expenses (salaries, benefit payments, depreciation costs etc). This translates into an operating balance of $5.9 billion in 2004/05 reducing to $5.3 billion by 2008/09.

Figure 2.1 – Core Crown revenue and expense growth (excluding GSF valuation)

Source: The Treasury

Figure 2.2 – Final forecast year impact of net Budget packages

Source: The Treasury

In recent years revenue growth has exceeded expense growth, largely due to strong economic growth. This trend is expected to reverse over the initial stage of the forecast period, before both expense and revenue growth converge towards the end of the forecast period. This reflects:

• the impact of the 2004 and 2005 Budgets. The allowance for new initiatives in future Budgets is expected to be smaller than the previous two Budgets, so forecast expense growth decreases from 2006/07 onwards

• the impact of the forecast economic cycle on tax revenue. Tax revenue growth decreases due to an expected slowdown in economic growth in the early part of the forecasts, before rebounding by 2008/09.

This translates into an OBERAC that is forecast to fall from $7.4 billion (4.9% of GDP) in the current year to $3.9 billion (2.3% of GDP) by 2007/08(7), before rising to $5.3 billion (3% of GDP) by 2008/09.

… as a result the Government is expected to strengthen its fiscal position…

Net worth is forecast at $42 billion (27.8% of GDP) in the current year and is expected to rise to $63.1 billion (35.4% of GDP) by 2008/09. The forecast increase in net worth is driven by the operating surpluses the Government is expected to run over the forecast horizon.

Figure 2.3 – Core Crown investments on a year-by-year basis

Source: The Treasury

… by accumulating assets…

In line with the Government’s fiscal objectives the OBERAC has been applied to fund the Government’s investments. Over the forecast period total assets are expected to increase by around $35.8 billion.

The OBERAC cannot be fully used by the Government to help finance its capital programme. This is because some components of the OBERAC are non-cash (ie, depreciation) or retained by entities within the Crown (ie, SOE/Crown entity surpluses and NZS Fund returns) for the purpose of achieving their long-term objectives. Adjusting for these items gives the core Crown operating cash flows. Figure 2.3 shows how these cash flows are applied across the forecast years. Table 2.2 shows the cumulated balance sheet impact.

(7) | The decrease in 2007/08 is due to the change in provisional tax dates as part of the Business package having a one-off impact of $760 million. |

Table 2.2 – Impact of Crown operating surpluses on the balance sheet from 2004/05 to 2008/09 inclusive

Source: The Treasury

As outlined in Table 2.2, the accumulated operating balance is expected to be $27.1 billion over the forecast period. Adjusting for non-cash items ($8.3 billion) and returns retained by entities within the Crown ($10 billion) gives a cash flow from operations which generates around $25.4 billion over the forecast horizon.

Figure 2.4 – Gross sovereign-issued debt

Source: The Treasury

This will be invested primarily in NZS Fund contributions of $12.1 billion, advances of $4 billion (mainly student loans and refinancing existing private sector debt of the health and housing sectors), purchases of physical assets of $9.1 billion (for example, schools and defence equipment), injections into Crown entities for hospitals and housing of $1.6 billion and the purchase of foreign exchange reserves of $1.9 billion.

There is a residual financing requirement of around $3.3 billion, which will be partially met by reducing the holdings of marketable securities and deposits which have accumulated from 2003/04 and 2004/05, and by raising some debt.

… while gross debt as a percentage of GDP slowly reduces over the forecast period

As a percentage of GDP, gross debt is expected to fall from 25.3% in 2003/04 to 20.2% by 2008/09. In nominal terms, gross debt is also forecast to fall to $32.6 billion by 2006/07 and then rise to $35.9 billion by the end of the forecast horizon.

The initial decrease in debt in nominal terms reflects residual assets from the strong results in 2003/04 and 2004/05. Gross debt is then expected to slowly rise, reflecting the fact that capital spending will be greater than the funding available due to the OBERAC as shown in Table 2.2.

The increased asset position expected in 2004/05 has led to a change in the Government’s 2005/06 bond programme which has been reduced to $2.2 billion, compared with $2.5 billion at the December Update. The domestic bond programme is set at $2.8 billion per annum for the remainder of the forecast period.

Net debt is also expected to fall before flattening by the end of the forecast horizon

Net debt(8) in nominal terms and as a percentage of GDP is forecast to fall in the current year, reflecting the strong asset position achieved in 2004/05. Net debt is expected to remain relatively flat as a percentage of GDP between 2005/06 and 2008/09. The difference in the trend of gross debt arises because some of the expected borrowing will be used to fund financial assets including student loans and reserves.

Figure 2.5 – Net debt

Source: The Treasury

Net core Crown debt with the financial assets of the NZS Fund is forecast to be below zero by 2006/07.

(8) | Net debt excludes the assets of the NZS Fund and GSF. |

Table 2.3 – Revenue and expenses comparison with December Update

| | Year ended 30 June | |

(% of GDP) | | 2004

Actual | | 2005

Forecast | | 2006

Forecast | | 2007

Forecast | | 2008

Forecast | | 2009

Forecast | |

Total Revenue | | | | | | | | | | | | | |

Budget Update | | 43.0 | | 43.3 | | 44.1 | | 44.1 | | 43.6 | | 43.9 | |

December Update | | | | 43.0 | | 43.7 | | 43.9 | | 43.9 | | 44.0 | |

| | | | | | | | | | | | | |

Total Expenses | | | | | | | | | | | | | |

Budget Update | | 37.8 | | 39.5 | | 39.9 | | 40.9 | | 41.4 | | 41.0 | |

December Update | | | | 39.3 | | 39.8 | | 40.7 | | 41.1 | | 41.0 | |

| | | | | | | | | | | | | |

Core Crown Revenue | | | | | | | | | | | | | |

Budget Update | | 33.4 | | 33.9 | | 34.2 | | 34.0 | | 33.7 | | 34.1 | |

December Update | | | | 33.6 | | 33.9 | | 34.0 | | 34.1 | | 34.3 | |

| | | | | | | | | | | | | |

Core Crown Expenses | | | | | | | | | | | | | |

Budget Update | | 29.6 | | 30.1 | | 30.9 | | 31.8 | | 32.3 | | 32.1 | |

December Update | | | | 30.4 | | 30.9 | | 31.7 | | 32.2 | | 32.3 | |

| | | | | | | | | | | | | |

SOE Revenue | | | | | | | | | | | | | |

Budget Update | | 6.4 | | 6.4 | | 6.9 | | 7.1 | | 6.9 | | 6.9 | |

December Update | | | | 6.6 | | 6.9 | | 7.0 | | 6.9 | | 6.8 | |

| | | | | | | | | | | | | |

SOE Expenses | | | | | | | | | | | | | |

Budget Update | | 5.9 | | 5.8 | | 6.4 | | 6.5 | | 6.4 | | 6.3 | |

December Update | | | | 6.1 | | 6.3 | | 6.5 | | 6.4 | | 6.3 | |

| | | | | | | | | | | | | |

Crown Entities’ Revenue | | | | | | | | | | | | | |

Budget Update | | 15.1 | | 14.6 | | 14.9 | | 14.9 | | 14.5 | | 14.0 | |

December Update | | | | 14.3 | | 14.5 | | 14.4 | | 14.0 | | 13.5 | |

| | | | | | | | | | | | | |

Crown Entities’ Expenses | | | | | | | | | | | | | |

Budget Update | | 14.0 | | 15.0 | | 14.3 | | 14.3 | | 13.9 | | 13.4 | |

December Update | | | | 14.1 | | 14.0 | | 13.9 | | 13.5 | | 12.9 | |

Source: The Treasury

Over the forecast period, total revenue to GDP is expected to increase initially before dropping in 2007/08 due to a tax policy decision resulting in a change to provisional tax dates (page 67) before returning to previous levels by 2008/09. Total expenses to GDP are also forecast to rise initially before flattening by 2008/09.

The trend in total revenue and expenses over the forecast horizon will largely be driven by activity in the core Crown segment of reported government activity.

The following section discusses revenue and expenses of the Crown by segment of reported government activity (ie, core Crown, SOEs and Crown entities).

Tax revenue is the major source of core Crown revenue.

Table 2.4 – Tax revenue indicators

Tax Revenue | | 2004

Actual | | 200

Forecast | | 2006

Forecast | | 2007

Forecast | | 2008

Forecast | | 2009

Forecast | |

($ billion) | | | | | | | | | | | | | |

Total Crown | | 42.5 | | 46.0 | | 48.1 | | 49.4 | | 51.1 | | 54.3 | |

Core Crown | | 43.0 | | 46.5 | | 48.6 | | 50.0 | | 51.7 | | 54.9 | |

| | | | | | | | | | | | | |

(% of GDP) | | | | | | | | | | | | | |

Total Crown | | 30.3 | | 30.5 | | 30.8 | | 30.6 | | 30.1 | | 30.5 | |

Core Crown | | 30.6 | | 30.8 | | 31.2 | | 30.9 | | 30.5 | | 30.8 | |

Source: The Treasury

Tax revenue will display some cyclicality relative to GDP throughout the forecast period, but by 2008/09 tax revenue as a percentage of GDP is expected to be back to the same level as in 2004/05. However, during the forecast period, the various tax types follow quite different paths.

Figure 2.6 – Tax revenue forecasts

Source: The Treasury

The small lift in the tax-to-GDP ratio in 2004/05 comes mainly through growth in corporate taxes that is not closely related to components of nominal GDP, eg, investment funds returning to tax-paying positions. Because of such effects, company tax not only is pro-cyclical, but tends to have larger growth swings than GDP. This is the main reason behind the profile of tax revenue in Figure 2.6. A change in provisional tax dates is also expected to contribute to the decline in 2007/08.

Source deductions as a percentage of GDP increases in 2005/06 and 2006/07, mainly due to the progressive nature of the personal income tax scale, but decline in 2007/08 and 2008/09. The latter reflects the decision to index personal tax rate thresholds every three years in line with the mid-point of the Reserve Bank’s inflation target band from 1 April 2008.

Countering the upward influences of corporate tax and source deductions, net GST is forecast to slightly reduce tax revenue relative to GDP. Although total domestic consumption accounts for an ever-increasing portion of GDP throughout the forecast period, the increase is driven by the public component of consumption. The private

component of consumption will grow more slowly than GDP. Because most GST generated from public consumption, or GST that the Crown pays to itself, is eliminated from total tax under line-by-line consolidation of the Crown accounts, net GST is expected to reduce its share of GDP throughout the forecast period.

The pro-cyclical nature of company tax presents a significant risk to the tax forecasts. It is difficult to estimate the magnitude of the response of corporate tax to the business cycle. This can mean that there may be upside risks to the tax forecasts when profits are growing strongly eg, in 2004/05, and downside risks when profit growth is weak eg, in 2006/07 or 2007/08.

Effects of Tax Policy Changes on the Tax Forecasts

Table 2.5 – Material changes in tax revenue forecasts owing to changes in tax policy since December Update

($ million) | | 2005

Forecast | | 2006

Forecast | | 2007

Forecast | | 2008

Forecast | | 2009

Forecast | |

Material policy changes | | | | | | | | | | | |

Carbon tax | | — | | — | | 90 | | 362 | | 359 | |

Depreciation | | — | | (219 | ) | (276 | ) | (260 | ) | (222 | ) |

Financial intermediaries | | — | | — | | — | | (120 | ) | (100 | ) |

Fringe benefit tax | | — | | (7 | ) | (28 | ) | (28 | ) | (28 | ) |

Provisional tax dates | | — | | — | | — | | (600 | ) | — | |

GST-based provisional tax | | — | | — | | — | | (160 | ) | — | |

Triennial tax threshold adjustment | | — | | — | | — | | (68 | ) | (360 | ) |

International recruitment | | — | | — | | (12 | ) | (12 | ) | (12 | ) |

GST base maintenance | | — | | 15 | | 15 | | 15 | | 15 | |

Total Changes | | — | | (211 | ) | (211 | ) | (871 | ) | (348 | ) |

Source: The Treasury and Inland Revenue

The details of each policy change are as follows:

Carbon tax

A carbon tax of $15/tonne of CO2-equivalent comes into force on 1 April 2007. The figures in Table 2.5 include GST and are net of rebates resulting from Negotiated Greenhouse Agreements (NGAs).

Depreciation

Includes adjustment of certain tax depreciation rates and an increase to the low-value asset write-off threshold.

Financial intermediaries

Removes the overtaxation of portfolio investment through financial intermediaries relative to direct investments.

Fringe benefit tax

A range of changes to the fringe benefit tax rules, including lowering the valuation rate for motor vehicles and increasing the exemption thresholds for minor fringe benefits.

Provisional tax dates

Aligning the payment dates for provisional tax and GST will result in payment deferral. For some taxpayers, the deferral pushes a provisional tax payment out of 2007/08 and into the following fiscal year.

GST-based provisional tax

Small businesses will be able to base their provisional tax calculation on GST turnover. This is expected to shift $160 million from provisional tax to terminal tax from 2007/08 onwards.

Triennial tax threshold adjustment

From 1 April 2008, personal tax rate thresholds are to be indexed every three years in line with the mid-point of the Reserve Bank’s inflation target band.

International recruitment

A temporary tax exemption on foreign income will be made available to certain people who come to work in New Zealand.

GST base maintenance

Changes will ensure that GST is applied at the standard rate on imports of goods that are consumed in New Zealand but are located outside New Zealand at the time of supply.

Inland Revenue’s tax forecasts

In line with established practice, Inland Revenue has prepared an independent set of tax forecasts, based in the short term on more detailed analysis of taxpayer information, and in the long term on the same underlying macroeconomic trends that underpin the Treasury’s tax forecasts.

Inland Revenue’s forecasts are quite similar to the Treasury’s for 2004/05. However, for 2005/06, 2006/07 and 2007/08, Inland Revenue’s forecasts are up to $300 million higher than the Treasury’s in each year, with differences spread across several major tax types. These differences are similar in magnitude to differences between the forecasts in previous forecasting rounds. Detailed comparisons of Treasury and Inland Revenue forecasts can be found at www.treasury.govt.nz/forecasts/befu/2005.

Table 2.6 – Expenses indicators

Expenses | | 2004

Actual | | 2005

Forecast | | 2006

Forecast | | 2007

Forecast | | 2008

Forecast | | 2009

Forecast | |

($ billion) | | | | | | | | | | | | | |

Core Crown | | 41.6 | | 45.3 | | 48.2 | | 51.3 | | 54.8 | | 57.2 | |

Core Crown (excluding GSF valuation) | | 41.9 | | 44.8 | | 48.2 | | 51.3 | | 54.8 | | 57.2 | |

| | | | | | | | | | | | | |

(% of GDP) | | | | | | | | | | | | | |

Core Crown | | 29.6 | | 30.1 | | 30.9 | | 31.8 | | 32.3 | | 32.1 | |

Core Crown (excluding GSF valuation) | | 29.8 | | 29.7 | | 30.9 | | 31.8 | | 32.3 | | 32.1 | |

Source: The Treasury

Core Crown operating expenses (excluding valuation items) are expected to rise by around 2% of GDP from 29.7% in 2004/05 to 32.1% of GDP by 2008/09. This represents the continuing impact of the 2004 Budget (which has a larger impact on expenses going forward, reflecting the implementation phase of the Working for Families initiative), the 2005 Budget and spending allocated for future Budgets.

Figure 2.7 – Core Crown expenses (excluding valuations)

Source: The Treasury

As indicated in the FSR, the core Crown spending areas of health and education have been allocated a significant portion of the 2005 Budget. In part this reflects the current spending pressures within these sectors.

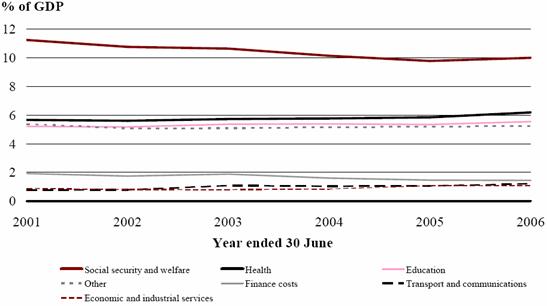

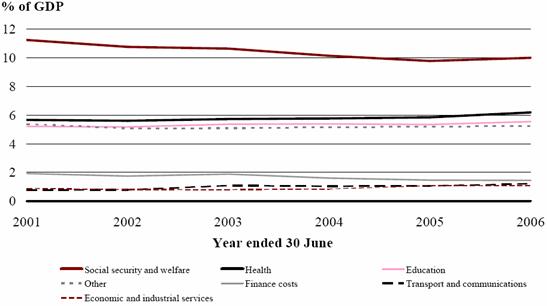

Health expenses as a percentage of GDP are forecast to increase from 5.7% to 6.2% between 2000/01 and 2005/06, while education expenses as a percentage of GDP are forecast to increase from 5.2% to 5.6% over the same period. By contrast, social security and welfare expenses are expected to decrease as a percentage of GDP due to minimal growth in beneficiary numbers.

Finance costs have also decreased as a percentage of GDP, due to a decrease in the level of borrowings and changes in interest rates between 2000/01 and 2005/06.

Figure 2.8 – Core Crown functional expenses (excluding valuations)

Source: The Treasury

Health spending as a proportion of core Crown expenses are forecast to increase from 18.2% in 2000/01 to 20% by 2005/06. Education spending as a proportion of core Crown spending is also expected to increase from 16.8% in 2000/01 to 18% by 2005/06.

Figure 2.9 – Core Crown functional expenses as a percentage of total expenses (excluding valuations)

Source: The Treasury

In nominal terms, core Crown expenses are expected to increase by around $11.9 billion between 2004/05 and 2008/09. Removing the GSF liability movements, expenses are forecast to increase by $12.4 billion over the same period. The major drivers of these expense increases are indexation of benefits, the 2005 Budget package and forecast new spending for future Budgets.

Forecast new spending

A detailed breakdown of the 2005 Budget package is provided on page 71. In summary, the 2005 Budget commits new operating resources of around $2 billion (GST exclusive) for 2005/06, rising to $2.7 billion (GST exclusive) in 2008/09. This is higher than indicated

in the 2005 Budget Policy Statement (BPS) although the BPS signalled there may be scope for additional spending to advance initiatives around savings and business(9).

Figure 2.10 – Net Allowance for new operating initiatives (GST exclusive)

Source: The Treasury

Figure 2.10 represents the cumulative operating impact of the 2005 Budget through to Budget 2008. It shows: