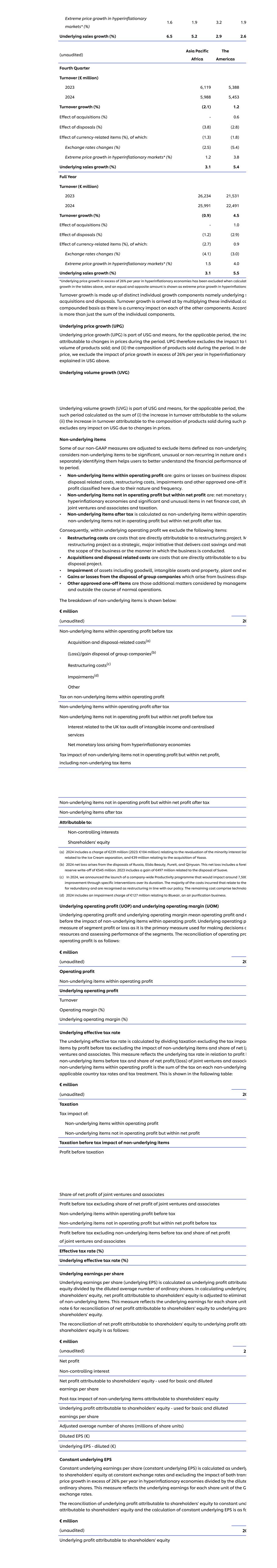

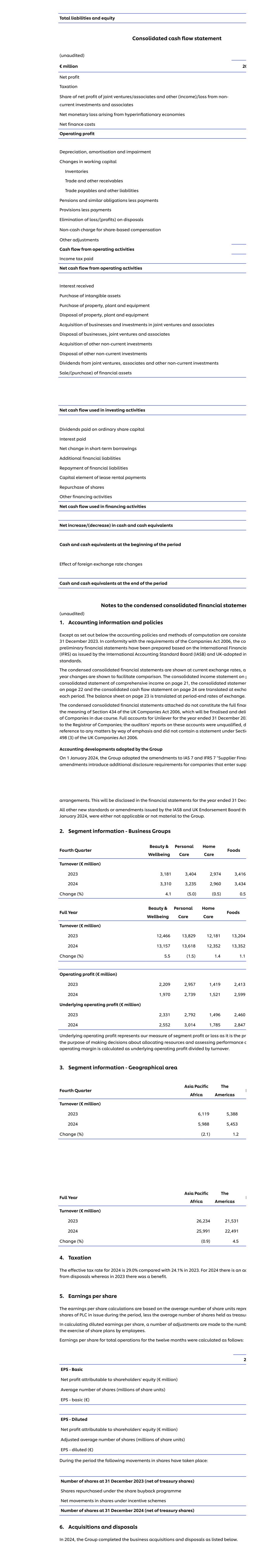

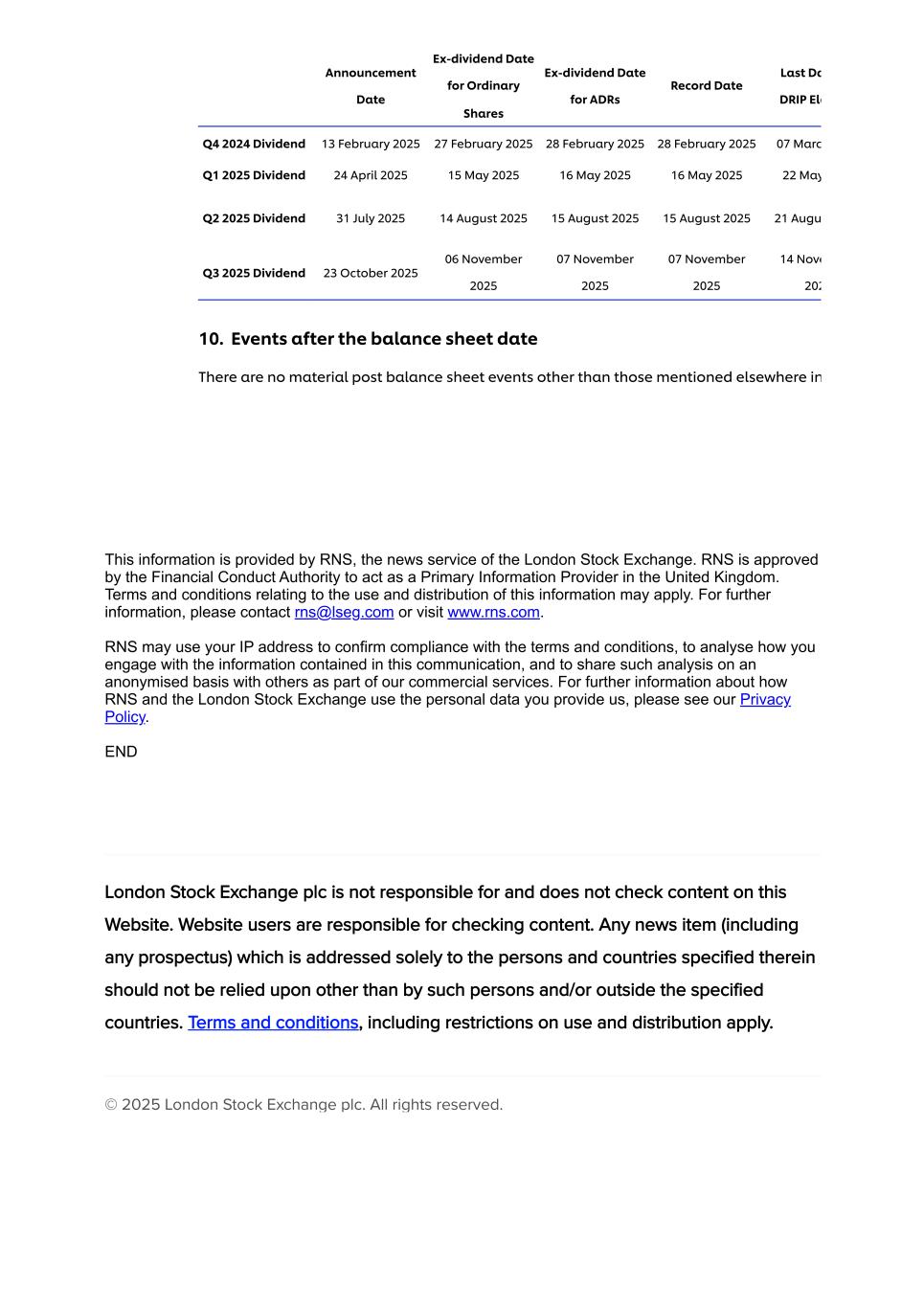

RNS Final Results FINAL RESULTS UNILEVER PLC Released 07:00:04 13 February 2025 RNS Number : 9241W Unilever PLC 13 February 2025 2024 Full Year Results Improved performance led by volume growth and gross margin e Underlying performance GAAP measu (unaudited) 2024 vs 2023 Full Year Underlying sales growth (USG) 4.2% Turnover Beauty & Wellbeing 6.5% Beauty & Wellbeing Personal Care 5.2% Personal Care Home Care 2.9% Home Care Foods(a) 2.6% Foods(a) Ice Cream 3.7% Ice Cream Underlying operating profit €11.2bn 12.6% Operating profit Underlying operating margin 18.4% 170bps Operating margin Underlying earnings per share €2.98 14.7% Diluted earnings per share Free cash flow €6.9bn €(0.2)bn Net profit Fourth Quarter USG 4.0% Turnover Quarterly dividend payable in March 2025 €0.4528 (a) Previously reported as Nutrition; (b) See note 9 for more information on dividends Financial and operational highlights • Underlying sales growth of 4.2%, led by 2.9% volume growth • Turnover increased 1.9% to €60.8 billion with (0.7)% impact from currency and (1.5)% f • Power Brands (>75% of turnover) leading growth with 5.3% USG and volumes up 3.8% • Brand and marketing investment up 120bps to 15.5%, its highest level in over a deca • Underlying operating margin up 170bps to 18.4%, with gross margin up 280bps • Underlying EPS increased 14.7%; diluted EPS decreased 10.6% due to loss on disposa productivity programme spend • Cash conversion of 106% with free cash flow of €6.9 billion; underlying ROIC up 190bp • Quarterly dividend raised by 6.1% vs Q4 2023; new €1.5 billion share buyback annou • Ice Cream separation on track Chief Executive Officer statement "Today's results reflect a year of significant activity as we focused on transforming Unilever higher performing business. Under the Growth Action Plan, we committed to doing fewer things, better and with greate the plan at pace and made progress in 2024. Underlying sales grew 4.2% with volumes up 2 Brands, with particularly strong performances from Dove, Comfort, Vaseline and Liquid I.V. innovations helped to deliver volume growth consistently above 2% in each quarter. All Bu positive volume growth for the year. Growth was underpinned by gross margin expansion increases in brand investment and profitability. We continue to sharpen our portfolio, allocating capital to premium segments by acquirin attractive markets, such as K18 and Minimalist, and announcing the divestment of local fo Unox and Conimex, as we focus our Foods portfolio on cooking aids and condiments categ comprehensive productivity programme we announced in March is being implemented at ahead of plan in helping to create a leaner and more accountable organisation. We are ta Indonesia, where long-standing challenges required a reset of the business, and China, w transforming our go-to-market approach during a market slowdown. We expect to see the actions from the second half of 2025. The separation of Ice Cream remains on track and we are making good progress on the ke announce today the appointment of the Chair Designate for the demerged Ice Cream bus listing structure. Market growth, which slowed throughout 2024, is expected to remain soft in the first half o have taken in 2024, including the launch of our refreshed GAP2030 strategy, further reinves and strong innovation pipelines leave us better positioned to deliver on our ambitions in t Hein Schumacher Outlook We expect underlying sales growth (USG) for full year 2025 to be within our multi-year rang growth slowed throughout 2024. We anticipate a slower start to 2025 with subdued marke term. We expect the market and our growth to improve during the year as price increases, commodity costs in 2025. We expect a more balanced split between volume and price. We anticipate a modest improvement in underlying operating margin for the full year vers expect this improvement to be realised in the second half given the very strong first half co which benefitted strongly from the combination of carry-over pricing and input cost deflat Full Year Review: Unilever Group (unaudited) Turnover USG UVG UPG A&D Cu Full Year €60.8bn 4.2% 2.9% 1.3% (1.5)% Fourth Quarter €14.2bn 4.0% 2.7% 1.3% (2.9)% Performance Underlying sales growth for the full year was 4.2%, led by volume of 2.9% and price of 1.3%. consecutive quarters of underlying volume growth above 2%, with all Business Groups driv growth for the year. As expected, underlying price growth moderated to 1.3%. Turnover was versus the prior year, with underlying sales growth of 4.2% more than offsetting the (0.7)% i and (1.5)% from disposals net of acquisitions. The Power Brands contributed >75% of turnover and performed strongly with 5.3% underlyi by volume growth of 3.8%. The rest of the business also delivered improved volumes with v the second half, up from (1.6)% in the first half of 2024. As guided with our first half 2024 results, our turnover-weighted market share movement(a competitive performance on a rolling 12 month-basis, sequentially improved in the second increasing benefits from the Growth Action Plan. Beauty & Wellbeing grew underlying sales by 6.5%, with volume growth of 5.1% driven by st Power Brands. Personal Care grew 5.2% with 3.1% volume growth, led by strong, innovation Deodorants. Home Care underlying sales increased 2.9%, with 4.0% volume growth more th decline linked to commodity cost deflation. Foods grew underlying sales 2.6%, with muted amidst a market slowdown and moderating prices. Ice Cream grew 3.7%, with a return to p of 1.6%. This reflected an improved performance in the second half supported by bigger inn operational improvements. Developed markets (42% of Group turnover) grew underlying sales 4.4%. Underlying volum reflected a strong performance in North America, led by Beauty & Wellbeing, and a big imp driven by Home Care and Personal Care. As expected, price growth moderated to 1.1%. Emerging markets (58% of Group turnover) grew underlying sales 4.1%, with 2.5% from volu price. India grew 1.8% with 2.4% underlying volume growth. Tonnage volume grew mid-sing partially offset by adverse mix due to the strong growth in Home Care. The business contin share during a period of modest market growth. Underlying price returned to positive in th back of rising input cost inflation. Latin America grew 6.0% with positive volume growth acr Argentina. Growth slowed in the second half, reflecting a deterioration of economic condit Africa and Turkey delivered double-digit growth with positive volumes and price in each qu China declined mid-single digit with market weakness across all categories apart from Foo softer markets, we are accelerating our portfolio premiumisation and transforming our go to effectively serve fast-growing e-commerce channels and smaller format stores in lower In South East Asia, volume-led growth in the Philippines and Thailand was offset by an 8.7% In the second half, we took decisive actions by correcting misaligned pricing across chann levels in retail, while also addressing our long-standing issues of portfolio, brand, and com take several quarters. As we have said previously, we expect to see the benefits of the chan China from the second half of 2025. (a) Turnover-weighted market share movement: global aggregate of Unilever value market share changes, weighted by the turnover of combinations Profitability (unaudited) UOP UOP growth UOM% Change in UOM OP OP growth Full Year €11.2bn 12.6% 18.4% 170bps €9.4bn (3.7)% Underlying operating profit was €11.2 billion, up 12.6% versus the prior year. Underlying op increased 170bps to 18.4%. This step-up in profitability contributed to a 190bps increase in 18.1%. We expanded gross margin by 280bps to 45.0%, the highest it has been in a decade. Contin margin remains a key focus for the business. Our gross margin improvement in 2024 reflec contributions from volume leverage, mix and net productivity gains in material, productio was also helped by input cost deflation in the first half, which turned into slight inflation in Improved gross margin fuelled further increases in brand and marketing investment behin innovation programme. Investment was up 120bps to 15.5% of turnover, an increase of €0.9 reduced by 10bps, as a result of tighter cost control and savings in the second half from th programme. Operating profit of €9.4 billion decreased 3.7% versus the prior year. This reduction was driv underlying charges, most notably a loss on disposals and higher restructuring costs as a re the productivity programme. Productivity programme In March 2024, we announced the launch of a major productivity programme to simplify th evolve our category-focused model. The programme is targeted to deliver €800 million of s reduction of 7,500 mainly office-based roles, creating a leaner and more accountable orga programme, we expect average restructuring costs to be around 1.2% of Group turnover ov period from 2024 to 2026. Following thorough consultation processes, the programme is ahead of plan with a reduc the end of 2024 and in-year savings close to €200 million. Restructuring costs, including the productivity programme, increased to €850 million, equivalent to 1.4% of Group turnover in similar restructuring cost of approximately 1.4% of Group turnover in 2025 with a lower spe The new organisation structure went live on 1 January 2025. This enables the Business Grou 24 markets, which represent approximately 85% of Group turnover, and the 30 Power Brand smaller markets are now run on a 'One Unilever' basis to benefit from scale and simplicity, portfolio prioritisation and focus. Ice Cream separation The separation of Ice Cream is on track to complete by the end of 2025. We are making pro workstreams, including the legal entities set up, implementing the standalone operating m the carve-out financials. Jean-Francois van Boxmeer has been appointed as Chair Designate for the separated Ice C Francois brings a wealth of experience both as a non-executive and as an executive opera consumer goods industry. Jean-Francois is currently Chair of Vodafone Group Plc and non- Heineken Holding N.V. having been Chief Executive of Heineken for 15 years. Ice Cream will be separated by way of demerger, through listing of the business in Amsterd York, the same three exchanges on which Unilever PLC shares are currently traded. The Ice incorporated in the Netherlands and will continue to be headquartered in Amsterdam. Thi review by the Board of separation options, focused on maximising returns for shareholder business up for success and execution certainty by the end of 2025. Capital allocation We continued to reshape our portfolio, allocating capital to premium segments through b divesting lower-growth businesses. In February 2024, we acquired K18, a premium biotech

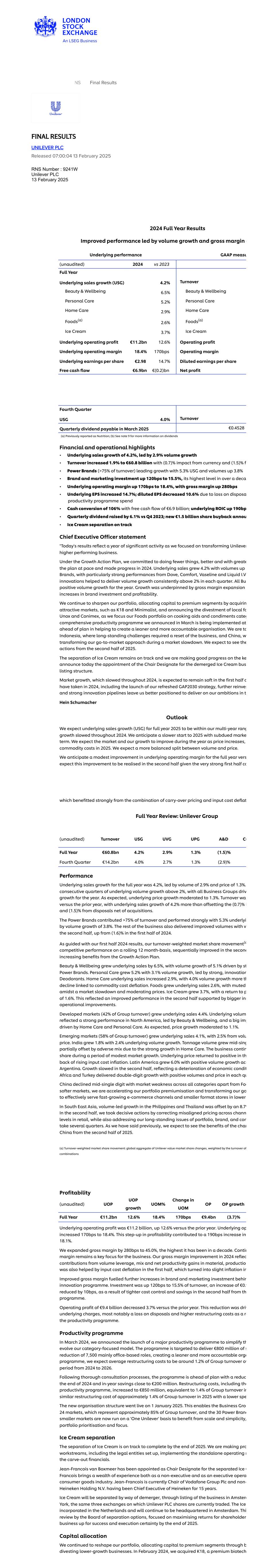

completed several disposals during the year. These included Elida Beauty, our stake in Qin "Truliva"), a water purification business in China, and Pureit, a water purification business i October, we completed the sale of our Russian subsidiary to Arnest Group. The sale include business in Russia and its four factories, as well as our business in Belarus. In addition, we disposals that we expect to complete during 2025, including the sale of the Foods brands Zwan, as well as the disposal of our laundry business in Central America. In January 2025, Hindustan Unilever Limited announced it has signed an agreement to acq actives-led beauty brand Minimalist, as we continue to evolve our Beauty & Wellbeing port growth and demand spaces in India. In 2024, we returned €5.8 billion to shareholders through dividends and share buybacks. Th dividend for the fourth quarter is raised to €0.4528, up 6.1% vs Q4 2023. Following the completion of a €1.5 billion share buyback programme in November, we ann buyback of up to €1.5 billion starting today and to be completed in the first half, well ahea Ice Cream. Conference Call Following the release of this trading statement on 13 February 2025 at 7:00 AM (UK time), t at 8:00 AM available on the website www.unilever.com/investor-relations/results-and-pres results. A replay of the webcast and the slides of the presentation will be made available after the Upcoming Events Date Events 24 April 2025 Q1 2025 trading statement Full Year Review: Business Groups Full Year 2024 Fourt (unaudited) Turnover USG UVG UPG UOM Change in UOM Turnover Unilever €60.8bn 4.2% 2.9% 1.3% 18.4% 170bps €14.2bn Beauty & Wellbeing €13.2bn 6.5% 5.1% 1.3% 19.4% 70bps €3.3bn Personal Care €13.6bn 5.2% 3.1% 2.1% 22.1% 190bps €3.3bn Home Care €12.3bn 2.9% 4.0% (1.1)% 14.5% 220bps €3.0bn Foods €13.4bn 2.6% 0.2% 2.4% 21.3% 270bps €3.4bn Ice Cream €8.3bn 3.7% 1.6% 2.1% 11.8% 100bps €1.2bn Beauty & Wellbeing (22% of Group turnover) In Beauty & Wellbeing, we focus on three key priorities: premiumising our core Hair and Ski emphasising brand superiority; fuelling the growth of our Prestige Beauty and Wellbeing p international expansion; and, continuing to strengthen our competitiveness through innov approach to consumer engagement. (unaudited) Turnover USG UVG UPG A&D Currency Turnove change Full Year €13.2bn 6.5% 5.1% 1.3% (0.3)% (0.6)% 5.5% Fourth Quarter €3.3bn 5.2% 3.9% 1.2% (0.7)% (0.4)% 4.1% Beauty & Wellbeing delivered a strong full year performance, with underlying sales up 6.5% 5.1% and price at 1.3%. Volume growth was broad-based with strong performances from its including Sunsilk, Dove, Vaseline, Ponds, Liquid I.V. and Nutrafol. In Q4, Beauty & Wellbe volume. The full year performance reflects the ongoing premiumisation of our core Hair Care and S the continued strength of our Prestige Beauty and Wellbeing portfolio, which combined ac Beauty & Wellbeing's turnover. Hair Care grew mid-single digit with balanced volume and price growth. Our largest hair c grew high-single digit reflecting the continued success of its 2023 relaunch and introductio Dove delivered high-single digit volume-led growth following the launch of Scalp + Hair Th improved scalp health and hair density. TRESemmé grew mid-single digit following the lau Shine collection. Clear grew low-single digit amidst low market growth in its primary mark Core Skin Care grew mid-single digit led by low-single digit volume and positive price. Vas with the expansion of its premium Gluta-Hya range to new markets and new formats. Glut markets and has introduced a new serum based suncare range. Dove skin care delivered d with the launch of its body serums and 3-in-1 face care treatments in Brazil, Mexico, and m Pond's grew double-digit led by volume following its successful relaunch in 2023. Wellbeing grew strong double-digit led by Liquid I.V., Nutrafol, and Olly. Liquid I.V. saw c sugar-free variant and ongoing international expansion, entering seven new markets duri extended into skin care with a daily supplement designed to address acne, while Olly saw led by its female health supplements. Prestige Beauty grew mid-single digit reflecting a slo beauty market. Hourglass and Tatcha grew double-digit while other brands including Pau low growth. During the year, we completed the acquisition of K18, a premium biotech hair grew double-digit and will be included in underlying sales growth from February 2025. Underlying operating margin improved 70bps with strong gross margin improvement part increased brand and marketing investment. Personal Care (22% of Group turnover) In Personal Care, we focus on winning with science-led brands that deliver unmissable sup consumers across Deodorants, Skin Cleansing, and Oral Care. Our priorities include develo technology and multi-year innovation platforms, leveraging partnerships with our custom into premium areas and digital channels. (unaudited) Turnover USG UVG UPG A&D Currency Turnove change Full Year €13.6bn 5.2% 3.1% 2.1% (5.3)% (1.1)% (1.5)% Fourth Quarter €3.3bn 5.3% 3.6% 1.6% (8.1)% (1.7)% (5.0)% Personal Care grew underlying sales 5.2% for the year with volume growth of 3.1%. This gro continued strength in Deodorants. In the fourth quarter, Personal Care grew 5.3% with Deo Cleansing, and Oral Care all delivering volume growth. Personal Care's full year performance was led by its Power Brands and science-backed inno innovations were supported by a step-up in marketing investment, including our five-year the Fédération Internationale de Football Association (FIFA), and our sponsorship of sever tournaments worldwide, including UEFA EURO 2024 and the CONMEBOL Copa America US Dove, which represents c. 40% of Personal Care's turnover, grew high-single digit with the s new range of whole-body deodorants and a serum shower collection, using active face ca wash formats. Deodorants grew double-digit led by mid-single digit volume growth. This included Rexon high-single digit, driven by ongoing success from multi-year innovations, including our bo technology and our Fine Fragrance collection. Skin Cleansing grew low-single digit with positive volume and price. Good growth in Dove declines in Lifebuoy and Lux, driven by challenges in Indonesia, China, and India. Oral Care grew mid-single digit led by price. Our Power Brands, Close up and Pepsodent, g with positive price and volume. Pepsodent launched its therapeutics range specifically for teeth. Underlying operating margin increased by 190bps, driven by a very strong gross margin im increased brand and marketing investment. Home Care (20% of Group turnover) In Home Care, we focus on delivering for consumers who want superior products that are s value. We drive growth through unmissable superiority in our biggest brands, in our key ma channels. We have a resilient business that spans price points and grows the market by pre trading consumers up to additional benefits. (unaudited) Turnover USG UVG UPG A&D Currency Turnove change Full Year €12.3bn 2.9% 4.0% (1.1)% (0.9)% (0.5)% 1.4% Fourth Quarter €3.0bn 3.0% 3.3% (0.3)% (2.4)% (1.0)% (0.5)% Home Care grew underlying sales 2.9%, with 4.0% from volume and (1.1)% from price. Home highest commodity cost deflation across Unilever which impacted laundry powders in seve In Home Care, we stepped up multi-year, scalable innovations with several key launches a successful 2023 launches. These Power Brand focused innovations drove a return to strong were supported by increased investments in brand and marketing and R&D to drive unmis superiority. Fabric Cleaning was flat with low-single digit volume growth fully offset by negative price. supported by the launch of Persil Wonder Wash, the first liquid detergent designed for sho Wonder Wash, powered by our patented Pro-S technology, has been launched in 8 market in 20 markets by the end of 2025. Europe grew double-digit with strong volumes. Brazil exp significant price declines among our key markets reflecting commodity deflation, notably portfolio. Home & Hygiene grew high-single digit with strong volume and positive price. Both Domes double-digit led by volume, with contributions from the Power Foam, cream and sprays po Fabric Enhancers grew high-single digit driven by strong volumes, slightly offset by negativ launch of our new Botanicals and Elixir ranges, utilising our patented CrystalFresh technol Comfort performance. Underlying operating margin increased by 220bps, driven by strong gross margin improve slightly offset by a step-up in brand and marketing investment. Foods (22% of Group turnover) In Foods (formerly known as Nutrition), our strategy is to deliver consistent, competitive gro unmissably superior products through our biggest brands. We do this by reaching more co on top dishes and high consumption seasons to satisfy consumer's preferences on taste, h sustainability; while delivering productivity and resilience in our supply chain. (unaudited) Turnover USG UVG UPG A&D Currency Turnove change Full Year €13.4bn 2.6% 0.2% 2.4% (0.5)% (1.0)% 1.1% Fourth Quarter €3.4bn 2.6% 0.5% 2.1% (0.7)% (1.4)% 0.5% Foods grew underlying sales 2.6% for the year, with 2.4% from price and 0.2% from volume. brands, Hellmann's and Knorr, which accounted for c. 60% of the Business Group, continu the Foods average. In the fourth quarter, Foods grew 2.6% while market growth remained m In Foods we are creating a more focused and simplified business concentrated on Cooking Mini Meals, Unilever Food Solutions, and our India local Foods portfolio. These categories and where we can best concentrate our investment behind our global Power Brands, Knor Cooking Aids grew mid-single digit with positive price and volume. Knorr performed well w growth driven by its leadership in bouillon and seasonings and its expansion of premium r ranges. Knorr grew double-digit in Latin America through its focus on local dishes and nex & seasoning ranges with enhanced flavours and micronutrients. Condiments grew low-single digit with balanced volume and price growth. Hellmann's gre by volume growth as it continued to expand its Flavoured Mayo range, now in 30 countries format variants, including new squeeze bottles. Unilever Food Solutions grew high-single digit led by volume with positive price. This grow the rollout of our operator solutions including the latest edition of our Future Menu's Trend over 50 countries, and expansion of our digital selling programme, which improved produ reach. Growth also benefited from the launch of Hellmann's Professional Mayo in Europe a professional kitchens. China grew high-single digit following a strong Chinese New Year in year. India Foods was flat, as tea and functional drinks maintained market leadership in subdue Underlying operating margin increased significantly, up 270bps, driven by strong gross ma which funded an increase in brand and marketing investment. Ice Cream (14% of Group turnover) In Ice Cream, we are focused on continuing to strengthen the business in preparation for Ic by the end of 2025. We are doing this by developing an exciting product pipeline, designing market strategies, optimising our supply chain, and building a dedicated sales team globa create a world-leading business, operating in a highly attractive category with five of the t cream brands. (unaudited) Turnover USG UVG UPG A&D Currency Turnove change Full Year €8.3bn 3.7% 1.6% 2.1% 0.9% (0.1)% 4.5% Fourth Quarter €1.2bn 4.3% 2.2% 2.0% (2.1)% (0.3)% 1.8% Ice Cream grew underlying sales 3.7%, with 1.6% from volume and 2.1% from price, marking volume growth. In the fourth quarter, Ice Cream grew by 4.3%, driven by 2.2% volume growt growth. The improving performance in 2024 was fuelled by strong innovations and operational imp ongoing improvements included a more efficient go-to-market strategy, improved distribu promotional activities. Share performance improved throughout the year and we sharpen productivity, which supported gross margin expansion and reinvestment in our brands. In-home Ice Cream (c. 60% of Ice Cream turnover) grew low-single digit led by volume grow by several snacking innovations with smaller portions. Magnum launched premium, bite-s designed to meet evolving snacking habits. The range is performing well and is now in 12 m rollout planned for next year. Joining the small indulgence format, Yasso introduced Popp based snack, while Ben & Jerry's expanded its Peaces range with new flavours like Salted C Out-of-home Ice Cream (c. 40% of Ice Cream turnover) grew mid-single digit fully led by pri several premium innovations this year including Magnum's Pleasure Express featuring flav Ben & Jerry's new oat base for its non-dairy ice creams. Cornetto celebrated its 60th annive global relaunch featuring enhanced formulation and new packaging. Underlying operating margin increased by 100bps, driven by improved gross margins whic increase in brand and marketing investment. This margin improvement was realised despi costs in cocoa and dairy. We expect rising inflation in cocoa and dairy costs to put pressure Full Year Review: Geographical Areas Full Year 2024 Fourth Q

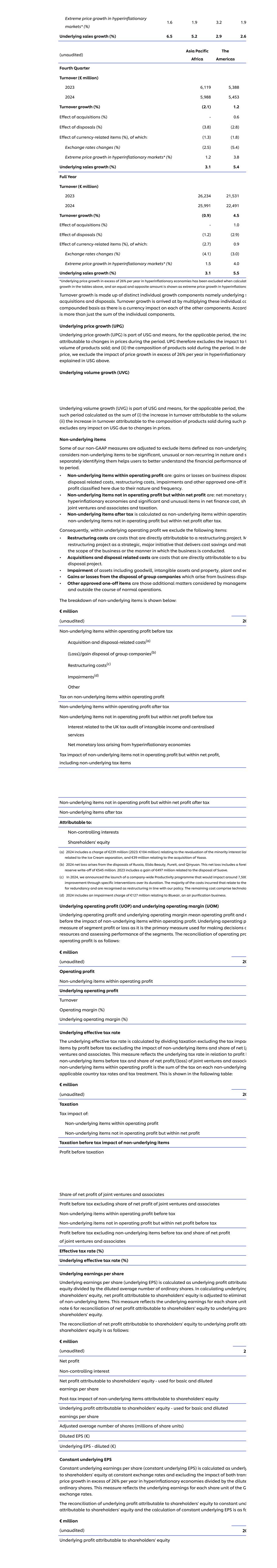

(unaudited) Turnover USG UVG UPG Turnover USG Unilever €60.8bn 4.2% 2.9% 1.3% €14.2bn 4.0% Asia Pacific Africa €26.0bn 3.1% 1.8% 1.3% €6.0bn 3.1% The Americas €22.5bn 5.5% 4.0% 1.4% €5.5bn 5.4% Europe €12.3bn 4.3% 3.0% 1.2% €2.7bn 3.5% Full Year 2024 Fourth Q (unaudited) Turnover USG UVG UPG Turnover USG Emerging markets €35.3bn 4.1% 2.5% 1.5% €8.1bn 3.0% Developed markets €25.5bn 4.4% 3.3% 1.1% €6.1bn 5.4% North America €13.4bn 5.3% 4.1% 1.1% €3.4bn 7.0% Latin America €9.1bn 6.0% 3.9% 2.0% €2.1bn 3.0% Asia Pacific Africa (43% of Group turnover) Underlying sales growth was 3.1% with 1.8% from volume and 1.3% from price. India grew 1.8% driven by underlying volume growth at 2.4%. This was primarily driven by H & Wellbeing while Personal Care declined. In the fourth quarter, UPG turned positive reflec movements, while UVG was flat with tonnage volume up mid-single digit, partially offset b strong growth in Home Care. China declined mid-single digit with market weakness across all categories apart from Foo softer markets, we are accelerating our portfolio premiumisation and transforming our go to effectively serve fast-growing e-commerce channels and smaller format stores in lower In South East Asia, volume-led growth in the Philippines and Thailand was offset by an 8.7% In the second half, we took decisive actions by correcting misaligned pricing across chann levels in retail, while also addressing our long-standing issues of portfolio, brand, and com take several quarters. As we have said previously, we expect to see the benefits of the chan China from the second half of 2025. Africa, which represents 3% of Group turnover, grew double-digit with positive volume and throughout the year. Turkey delivered double-digit volume growth, led by Ice Cream and P hyperinflationary environment. The Americas (37% of Group turnover) Underlying sales growth was 5.5% with 4.0% from volume and 1.4% from price. North America grew 5.3% with 4.1% volume growth, with all Business Groups delivering pos improved volume performance was led by strong growth in Beauty & Wellbeing. Growth in improved in the second half, helped by a strong performance of Deodorants in the fourth q showed good improvement and returned to volume-driven growth. Our Foods business de and volume growth, while category growth slowed during the year. Latin America grew 6.0% with 3.9% from volume. Beauty & Wellbeing and Personal Care gre Foods delivered mid-single digit growth. Home Care declined slightly, adversely affected b laundry powders market. Volume growth slowed in Brazil and Mexico in the second half, re volatile economic environment. In Argentina we delivered positive volume growth in each hyperinflationary pricing and continued to strengthen our market-leading positions and p challenging environment. Europe (20% of Group turnover) Underlying sales grew 4.3% with volume growth of 3.0% and price of 1.2%. Our return to pos Europe was underpinned by a strong innovation programme and increased levels of brand Care grew double-digit, while Beauty & Wellbeing and Personal Care grew high-single dig improved execution led to a step-up of the Ice Cream performance in the second half and year. Foods declined slightly as a result of active portfolio rationalisation and slowing mar was broad-based in Europe, led by mid-single digit growth in the United Kingdom and Ger double-digit growth in Poland. Additional commentary on the financial statements - Full Y Finance costs and tax Net finance costs increased by €118 million to €604 million in 2024. This was driven by high bonds and commercial paper and lower interest credit from pensions. Net finance costs we debt. For 2025, we expect net finance costs to be around 3% on average net debt. This refle refinancing maturing debt at higher rates and lower finance income versus 2024. The underlying effective tax rate for 2024 was 25.8% (2023: 25.6%), as increases, including i interest and withholding tax, were largely offset by benefits from tax settlements and othe guidance for 2025 for the underlying effective tax rate remains around 26%. The effective ta 29.0%, and included adverse impacts linked to disposals in 2024. This compares with 24.1% included a benefit related to the disposal of the Dollar Shave Club. Joint ventures, associates and other income from non-current investments Net profit from joint ventures and associates increased €24 million to €255 million, largely Lipton JVs. Other income from non-current investments was €13 million, versus €(22) millio Earnings per share Underlying earnings per share increased 14.7% to €2.98, including (0.7)% of adverse curren earnings per share increased by 15.4%, reflecting a strong operational performance. The re number of shares as a result of the share buyback programme contributed 1.0%. Diluted ea €2.29 decreased by 10.6% versus 2023 due to loss on disposals and the accelerated produc spend. Free cash flow We delivered strong cash conversion of 106%. Free cash flow was €6.9 billion versus €7.1 bil year comparator included a higher tax refund of €0.4 billion in India and a significant work improvement of €0.8 billion. Underlying return on invested capital Underlying return on invested capital improved 190bps to 18.1% (2023: 16.2%). This reflecte operating profit growth driven by turnover growth and underlying operating margin expan invested capital in 2024 was up €0.5 billion versus the prior year. Reported return on investe by 180bps to 14.5% driven by a decrease in operating profit from higher non-underlying ch loss on disposals and accelerated productivity programme spend. Net debt Closing net debt increased €0.9 billion to €24.5 billion in 2024. Net debt to underlying EBITD December 2024, versus the prior year at 2.1x and in line with our guidance of around 2x. Pensions Pension assets net of liabilities were in surplus of €3.0 billion at 31 December 2024 versus a at the end of 2023. The increase was primarily driven by strong investment returns in equiti term government bond yields led to reductions in both fixed income assets and pension lia Share buyback programme On 5 November 2024, we completed the second and final €800 million tranche of our share of up to €1.5 billion, initiated on 8 February 2024. The total consideration paid for the repur shares is recorded within other reserves and the shares are held by Unilever as treasury sh tranches of the programme, a total of 27,368,909 ordinary Unilever PLC shares were purcha Reflecting the Group's continued strong cash generation, the Board has approved a new s aggregate market value equivalent of up to €1.5 billion which will be bought back in the fo ordinary shares. The new share buyback will commence on 13 February 2025 and will complete on or before purpose of the share buyback is to reduce the capital of Unilever PLC and it will take place of the authority granted to the Board of Unilever PLC by its general meeting, held on 1 May which the maximum number of shares to be bought back by Unilever PLC is 222,831,091. Finance and liquidity In 2024, the following notes matured and were repaid: • March: $500 million 3.25% fixed rate notes • April: €500 million 0.50% fixed rate notes • May: $1,000 million 2.60% fixed rate notes • August: $500 million 0.626% fixed rate notes • September: £250 million 1.375% fixed rate notes The following notes were issued: • February: €600 million 3.25% fixed rate notes due 15 February 2032 and €600 million 3.5 15 February 2037 • March: €100 million 3.25% fixed rate notes to be consolidated and form a single series w 3.25% fixed rate notes issued in February and due 15 February 2032 • June: $170 million 4.75% fixed rate notes due 27 June 2031 • August: $750 million 4.25% fixed rate notes due 12 August 2027 and $1,000 million 4.625 12 August 2034 On 31 December 2024, Unilever had undrawn revolving 364-day bilateral credit facilities in million and €2,600 million with a 364-day term out. Non-GAAP measures Certain discussions and analyses set out in this announcement include measures which ar generally accepted accounting principles (GAAP) such as IFRS. We believe this information comparable GAAP measurements, is useful to investors because it provides a basis for me performance, ability to retire debt and invest in new business opportunities. Our managem financial measures, along with the most directly comparable GAAP financial measures, in operating performance and value creation. Non-GAAP financial measures should not be c from, or as a substitute for, financial information presented in compliance with GAAP. Whe practical, we provide reconciliations to relevant GAAP measures. Unilever uses 'constant rate', and 'underlying' measures primarily for internal performance purposes. We present certain items, percentages and movements, using constant exchang the impact of fluctuations in foreign currency exchange rates. We calculate constant curre translating both the current and the prior period local currency amounts using the prior ye rates into euro, except for the local currency of entities that operate in hyperinflationary ec currencies are translated into euros using the prior year closing exchange rate before the a The table below shows exchange rate movements in our key markets. Ann avera in 2 Brazilian Real (€1 = BRL) Chinese Yuan (€1 = CNY) Indian Rupee (€1 = INR) Indonesia Rupiah (€1 = IDR) Philippine Peso (€1 = PHP) Mexican Peso (€1 = MXN) Turkish Lira (€1 = TRY) UK Pound Sterling (€1 = GBP) US Dollar (€1 = US $) Underlying sales growth (USG) Underlying sales growth (USG) refers to the increase in turnover for the period, excluding a resulting from acquisitions, disposals, changes in currency and price growth in excess of 26 economies. Inflation of 26% per year compounded over three years is one of the key indica assess whether an economy is deemed to be hyperinflationary. We believe this measure p additional information on the underlying sales performance of the business and is a key m The impact of acquisitions and disposals (A&D) is excluded from USG for a period of 12 cal applicable closing date. Turnover from acquired brands that are launched in countries whe previously sold is included in USG as such turnover is more attributable to our existing sale network than the acquisition itself. The reconciliation of changes in the GAAP measure of turnover to USG is as follows: (unaudited) Beauty & Wellbeing Personal Care Home Care Foods Fourth Quarter Turnover (€ million) 2023 3,181 3,404 2,974 3,416 2024 3,310 3,235 2,960 3,434 Turnover growth (%) 4.1 (5.0) (0.5) 0.5 Effect of acquisitions (%) 0.9 - - - Effect of disposals (%) (1.6) (8.1) (2.4) (0.7) Effect of currency-related items (%), of which: (0.4) (1.7) (1.0) (1.4) Exchange rates changes (%) (1.8) (3.9) (3.8) (3.4) Extreme price growth in hyperinflationary markets* (%) 1.5 2.2 2.9 2.1 Underlying sales growth (%) 5.2 5.3 3.0 2.6 Full Year Turnover (€ million) 2023 12,466 13,829 12,181 13,204 2024 13,157 13,618 12,352 13,352 Turnover growth (%) 5.5 (1.5) 1.4 1.1 Effect of acquisitions (%) 0.9 - - - Effect of disposals (%) (1.2) (5.3) (0.9) (0.5) Effect of currency-related items (%), of which: (0.6) (1.1) (0.5) (1.0) Exchange rates changes (%) (2.2) (3.0) (3.6) (2.8)

Extreme price growth in hyperinflationary markets* (%) 1.6 1.9 3.2 1.9 Underlying sales growth (%) 6.5 5.2 2.9 2.6 (unaudited) Asia Pacific Africa The Americas Fourth Quarter Turnover (€ million) 2023 6,119 5,388 2024 5,988 5,453 Turnover growth (%) (2.1) 1.2 Effect of acquisitions (%) - 0.6 Effect of disposals (%) (3.8) (2.8) Effect of currency-related items (%), of which: (1.3) (1.8) Exchange rates changes (%) (2.5) (5.4) Extreme price growth in hyperinflationary markets* (%) 1.2 3.8 Underlying sales growth (%) 3.1 5.4 Full Year Turnover (€ million) 2023 26,234 21,531 2024 25,991 22,491 Turnover growth (%) (0.9) 4.5 Effect of acquisitions (%) - 1.0 Effect of disposals (%) (1.2) (2.9) Effect of currency-related items (%), of which: (2.7) 0.9 Exchange rates changes (%) (4.1) (3.0) Extreme price growth in hyperinflationary markets* (%) 1.5 4.0 Underlying sales growth (%) 3.1 5.5 *Underlying price growth in excess of 26% per year in hyperinflationary economies has been excluded when calculat growth in the tables above, and an equal and opposite amount is shown as extreme price growth in hyperinflationa Turnover growth is made up of distinct individual growth components namely underlying s acquisitions and disposals. Turnover growth is arrived at by multiplying these individual co compounded basis as there is a currency impact on each of the other components. Accord is more than just the sum of the individual components. Underlying price growth (UPG) Underlying price growth (UPG) is part of USG and means, for the applicable period, the inc attributable to changes in prices during the period. UPG therefore excludes the impact to U volume of products sold; and (ii) the composition of products sold during the period. In det price, we exclude the impact of price growth in excess of 26% per year in hyperinflationary explained in USG above. Underlying volume growth (UVG) Underlying volume growth (UVG) is part of USG and means, for the applicable period, the i such period calculated as the sum of (i) the increase in turnover attributable to the volume (ii) the increase in turnover attributable to the composition of products sold during such pe excludes any impact on USG due to changes in prices. Non-underlying items Some of our non-GAAP measures are adjusted to exclude items defined as non-underlying considers non-underlying items to be significant, unusual or non-recurring in nature and s separately identifying them helps users to better understand the financial performance of to period. • Non-underlying items within operating profit are: gains or losses on business disposa disposal related costs, restructuring costs, impairments and other approved one-off it profit classified here due to their nature and frequency. • Non-underlying items not in operating profit but within net profit are: net monetary g hyperinflationary economies and significant and unusual items in net finance cost, sh joint ventures and associates and taxation. • Non-underlying items after tax is calculated as non-underlying items within operating non-underlying items not in operating profit but within net profit after tax. Consequently, within underlying operating profit we exclude the following items: • Restructuring costs are costs that are directly attributable to a restructuring project. M restructuring project as a strategic, major initiative that delivers cost savings and mate the scope of the business or the manner in which the business is conducted. • Acquisitions and disposal related costs are costs that are directly attributable to a bu disposal project. • Impairment of assets including goodwill, intangible assets and property, plant and eq • Gains or losses from the disposal of group companies which arise from business dispo • Other approved one-off items are those additional matters considered by manageme and outside the course of normal operations. The breakdown of non-underlying items is shown below: € million (unaudited) 20 Non-underlying items within operating profit before tax Acquisition and disposal-related costs(a) (Loss)/gain disposal of group companies(b) Restructuring costs(c) Impairments(d) Other Tax on non-underlying items within operating profit Non-underlying items within operating profit after tax Non-underlying items not in operating profit but within net profit before tax Interest related to the UK tax audit of intangible income and centralised services Net monetary loss arising from hyperinflationary economies Tax impact of non-underlying items not in operating profit but within net profit, including non-underlying tax items Non-underlying items not in operating profit but within net profit after tax Non-underlying items after tax Attributable to: Non-controlling interests Shareholders' equity (a) 2024 includes a charge of €239 million (2023: €104 million) relating to the revaluation of the minority interest liab related to the Ice Cream separation, and €39 million relating to the acquisition of Yasso. (b) 2024 net loss arises from the disposals of Russia, Elida Beauty, PureIt, and Qinyuan. This net loss includes a forei reserve write-off of €545 million. 2023 includes a gain of €497 million related to the disposal of Suave. (c) In 2024, we announced the launch of a company-wide Productivity programme that would impact around 7,500 improvement through specific interventions over its duration. The majority of the costs incurred that relate to the for redundancy and are recognised as restructuring in line with our policy. The remaining cost comprise technolo (d) 2024 includes an impairment charge of €127 million relating to Blueair, an air purification business. Underlying operating profit (UOP) and underlying operating margin (UOM) Underlying operating profit and underlying operating margin mean operating profit and o before the impact of non-underlying items within operating profit. Underlying operating p measure of segment profit or loss as it is the primary measure used for making decisions a resources and assessing performance of the segments. The reconciliation of operating pro operating profit is as follows: € million (unaudited) 20 Operating profit Non-underlying items within operating profit Underlying operating profit Turnover Operating margin (%) Underlying operating margin (%) Underlying effective tax rate The underlying effective tax rate is calculated by dividing taxation excluding the tax impac items by profit before tax excluding the impact of non-underlying items and share of net (p ventures and associates. This measure reflects the underlying tax rate in relation to profit b non-underlying items before tax and share of net profit/(loss) of joint ventures and associa non-underlying items within operating profit is the sum of the tax on each non-underlying applicable country tax rates and tax treatment. This is shown in the following table: € million (unaudited) 20 Taxation Tax impact of: Non-underlying items within operating profit Non-underlying items not in operating profit but within net profit Taxation before tax impact of non-underlying items Profit before taxation Share of net profit of joint ventures and associates Profit before tax excluding share of net profit of joint ventures and associates Non-underlying items within operating profit before tax Non-underlying items not in operating profit but within net profit before tax Profit before tax excluding non-underlying items before tax and share of net profit of joint ventures and associates Effective tax rate (%) Underlying effective tax rate (%) Underlying earnings per share Underlying earnings per share (underlying EPS) is calculated as underlying profit attributa equity divided by the diluted average number of ordinary shares. In calculating underlying shareholders' equity, net profit attributable to shareholders' equity is adjusted to eliminate of non-underlying items. This measure reflects the underlying earnings for each share unit note 6 for reconciliation of net profit attributable to shareholders' equity to underlying pro shareholders' equity. The reconciliation of net profit attributable to shareholders' equity to underlying profit attr shareholders' equity is as follows: € million (unaudited) 2 Net profit Non-controlling interest Net profit attributable to shareholders' equity - used for basic and diluted earnings per share Post-tax impact of non-underlying items attributable to shareholders' equity Underlying profit attributable to shareholders' equity - used for basic and diluted earnings per share Adjusted average number of shares (millions of share units) Diluted EPS (€) Underlying EPS - diluted (€) Constant underlying EPS Constant underlying earnings per share (constant underlying EPS) is calculated as underly to shareholders' equity at constant exchange rates and excluding the impact of both trans price growth in excess of 26% per year in hyperinflationary economies divided by the dilute ordinary shares. This measure reflects the underlying earnings for each share unit of the G exchange rates. The reconciliation of underlying profit attributable to shareholders' equity to constant und attributable to shareholders' equity and the calculation of constant underlying EPS is as fo € million (unaudited) 20 Underlying profit attributable to shareholders' equity

Impact of translation from current to constant exchange rates and translational hedges Impact of price growth in excess of 26% per year in hyperinflationary economies Constant underlying earnings attributable to shareholders' equity Diluted average number of share units (millions of units) Constant underlying EPS (€) Net debt Net debt is a measure that provides valuable additional information on the summary pres net financial liabilities and is a measure in common use elsewhere. Net debt is defined as t financial liabilities, excluding trade payables and other current liabilities, over cash, cash e current financial assets, excluding trade and other current receivables, and non-current fin derivatives that relate to financial liabilities. The reconciliation of total financial liabilities to net debt is as follows: € million (unaudited) 20 Total financial liabilities ( Current financial liabilities Non-current financial liabilities Cash and cash equivalents as per balance sheet Cash and cash equivalents as per cash flow statement Add: bank overdrafts deducted therein Less: cash and cash equivalents held for sale Other current financial assets Non-current financial asset derivatives that relate to financial liabilities Net debt ( Underlying earnings before interest, taxation, depreciation and amortisation (UEBITDA) Underlying earnings before interest, taxation, depreciation and amortisation means opera impact of depreciation, amortisation and non-underlying items within operating profit. We assess our leverage level, which is expressed as net debt to UEBITDA. The reconciliation of UEBITDA is as follows: € million (unaudited) 20 Net profit Net finance costs Net monetary loss arising from hyperinflationary economies Share of net profit of joint ventures and associates Other (income)/loss from non-current investments and associates Taxation Operating profit Depreciation and amortisation Earnings before interest, taxes, depreciation and amortisation (EBITDA) Non-underlying items within operating profit Underlying earnings before interest, taxes, depreciation and amortisation (UEBITDA) Free cash flow (FCF) Within the Unilever Group, free cash flow (FCF) is defined as cash flow from operating activ paid, net capital expenditure and net interest payments. It does not represent residual cas available for discretionary purposes; for example, the repayment of principal amounts bor from FCF. FCF reflects an additional way of viewing our liquidity that we believe is useful to represents cash flows that could be used for distribution of dividends, repayment of debt o initiatives, including acquisitions, if any. The reconciliation of cash flow from operating activities to FCF is as follows: € million (unaudited) 20 Cash flow from operating activities Income tax paid Net capital expenditure Net interest paid Free cash flow Net cash flow (used in)/from investing activities Net cash flow used in financing activities Cash conversion Unilever defines cash conversion as free cash flow excluding tax on disposal as a proportio excluding gain/loss on disposal and income from JV, associates and non-current investme ability to convert profit to cash. € million (unaudited) 20 Net profit Loss/(gain) on disposal of group companies Share of net profit of joint ventures and associates Other (income)/loss from non-current investments and associates Tax on gain on disposal of group companies Net profit excluding P&L on disposals, JV, associates, NCI Cash flow from operating activities Free cash flow Cash impact of tax on disposal Free cash flow excluding cash impact of tax on disposal Cash conversion from operating activities (%) Cash conversion (%) Underlying return on invested capital (ROIC) Underlying return on invested capital (ROIC) is a measure of the return generated on capit Group. The measure provides a guard rail for long-term value creation and encourages co reinvestment within the business and discipline around acquisitions with low returns and l Underlying ROIC is calculated as underlying operating profit after tax divided by the annua intangible assets, property, plant and equipment, net assets held for sale, inventories, trad receivables, and trade payables and other current liabilities. € million (unaudited) 20 Operating profit Tax on operating profit(a) Operating profit after tax Operating profit Non-underlying items within operating profit Underlying operating profit before tax Tax on underlying operating profit(b) Underlying operating profit after tax Goodwill Intangible assets Property, plant and equipment Net assets held for sale Inventories Trade and other current receivables Trade payables and other current liabilities Period-end invested capital Average invested capital for the period Return on invested capital (%) Underlying return on invested capital (%) (a) Tax on operating profit is calculated as operating profit before tax multiplied by the effective tax rate of 29.0% (2023 note 4. (b) Tax on underlying operating profit is calculated as underlying operating profit before tax multiplied by the underlyi (2023: 25.6%) which is shown on page 16. Cautionary Statement This announcement may contain forward-looking statements, including 'forward-looking s meaning of the United States Private Securities Litigation Reform Act of 1995, concerning t results of operations and businesses of the Unilever Group (the 'Group'). All statements oth historical fact are, or may be deemed to be, forward-looking statements. Words and termi 'aim', 'expects', 'anticipates', 'intends', 'looks', 'believes', 'vision', 'ambition', 'target', 'goal', 'p towards', 'may', 'milestone', 'objectives', 'outlook', 'probably', 'project', 'risk', 'seek', 'continue 'estimate', 'achieve' or the negative of these terms, and other similar expressions of future actions or events, and their negatives, are intended to identify such forward-looking state looking statements also include, but are not limited to, statements and information regard acceleration of its Growth Action Plan, Unilever's portfolio optimisation towards global or s capabilities and potential of such brands, the various aspects of the separation of Ice Crea operational model, strategy, growth potential, performance and returns, Unilever's produ impacts and cost savings over the next three years and operation dis-synergies from the se the Group's emissions reduction targets and other climate change related matters (includ impacts and risks associated therewith). Forward-looking statements can be made in writi made verbally by directors, officers and employees of the Group (including during manage connection with this announcement. These forward-looking statements are based upon cu expectations and assumptions regarding anticipated developments and other factors affe are not historical facts, nor are they guarantees of future performance or outcomes. All for statements contained in this announcement are expressly qualified in their entirety by the contained or referred to in this section. Readers should not place undue reliance on forwar Because these forward-looking statements involve known and unknown risks and uncerta which may be beyond the Group's control, there are important factors that could cause ac materially from those expressed or implied by these forward-looking statements. Among o uncertainties, the material or principal factors which could cause actual results to differ m forward-looking statements expressed in this announcement are: Unilever's ability to succ Cream and realise the anticipated benefits of the separation; Unilever's ability to successfu consummate its productivity programme in line with expected costs to achieve expected s global brands not meeting consumer preferences; Unilever's ability to innovate and remai Unilever's investment choices in its portfolio management; the effect of climate change on Unilever's ability to find sustainable solutions to its plastic packaging; significant changes customer relationships; the recruitment and retention of talented employees; disruptions i chain and distribution; increases or volatility in the cost of raw materials and commodities and high quality products; secure and reliable IT infrastructure; execution of acquisitions, d business transformation projects; economic, social and political risks and natural disaster to meet high and ethical standards; and managing regulatory, tax and legal matters. The forward-looking statements speak only as of the date of this announcement. Except a applicable law or regulation, the Group expressly disclaims any intention, obligation or un publicly any updates or revisions to any forward-looking statements contained herein to re the Group's expectations with regard thereto or any change in events, conditions or circum such statement is based. New risks and uncertainties arise over time, and it is not possible events or how they may affect us. In addition, we cannot assess the impact of each factor o extent to which any factor, or combination of factors, may cause actual results to differ ma contained in any forward-looking statements. Further details of potential risks and uncertainties affecting the Group are described in the the London Stock Exchange, Euronext Amsterdam and the US Securities and Exchange Com the Annual Report on Form 20-F 2023 and the Unilever Annual Report and Accounts 2023. Enquiries Media: Media Relations Team Investors: Investor Relations Team UK +44 78 2527 3767 press-office.london@unilever.com investor.relations@unilever.com or +44 77 7999 9683 jonathan.sibun@teneo.com NL +31 62 191 3705 kiran.hofker@unilever.com or +31 61 500 8293 fleur-van.bruggen@unilever.com

After the conference call on 13 February 2025 at 8:00 AM (UK time), the webcast of the pres available at www.unilever.com/investor-relations/results-and-presentations/latest-results This Results Presentation has been submitted to the FCA National Storage Mechanism and inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism. Consolidated income statement € million (unaudited) 2024 Turnover 60,761 Operating profit 9,400 Net finance costs (604) Pensions and similar obligations 71 Finance income 438 Finance costs (1,113) Net monetary loss arising from hyperinflationary economies (195) Share of net profit of joint ventures and associates 255 Other income/(loss) from non-current investments and associates 13 Profit before taxation 8,869 Taxation (2,500) Net profit 6,369 Attributable to: Non-controlling interests 625 Shareholders' equity 5,744 Earnings per share Basic earnings per share (euros) 2.30 Diluted earnings per share (euros) 2.29 Consolidated statement of comprehensive income € million (unaudited) 20 Net profit Other comprehensive income Items that will not be reclassified to profit or loss, net of tax: Gains/(losses) on equity instruments measured at fair value through other comprehensive income Remeasurement of defined benefit pension plans Items that may be reclassified subsequently to profit or loss, net of tax: Gains/(losses) on cash flow hedges Currency retranslation gains/(losses) Total comprehensive income Attributable to: Non-controlling interests Shareholders' equity Consolidated statement of changes in equity (unaudited) € million Called up share capital Share premium account Unification reserve Other reserves Retained profit Tota 1 January 2023 92 52,844 (73,364) (10,804) 50,253 19, Profit or loss for the period - - - - 6,487 6 Other comprehensive income, net of tax: Losses on: Equity instruments - - - (27) - Cash flow hedges - - - (27) - Remeasurements of defined benefit pension plans - - - - (508) (5 Currency retranslation (losses)/gains(a) - - - (1,629) 294 (1,3 Total comprehensive income - - - (1,683) 6,273 4 Dividends on ordinary capital - - - - (4,327) (4,3 Cancellation of treasury shares(b) (4) - - 5,282 (5,278) Repurchase of shares(c) - - - (1,507) - (1,5 Movements in treasury shares(d) - - - 75 (98) Share-based payment credit(e) - - - - 212 Dividends paid to non-controlling interests - - - - - Hedging (gain)/loss transferred to non- financial assets - - - 117 - Other movements in equity - - - 2 17 31 December 2023 88 52,844 (73,364) (8,518) 47,052 18, Profit or loss for the period - - - - 5,744 5 Other comprehensive income, net of tax: Gains on: Equity instruments - - - 60 - Cash flow hedges - - - 210 - Remeasurements of defined benefit pension plans - - - - 269 Currency retranslation gains(a) - - - 406 891 1 Total comprehensive income - - - 676 6,904 7 Dividends on ordinary capital - - - - (4,320) (4,3 Cancellation of treasury shares - - - - - Repurchase of shares(c) - - - (1,508) - (1,5 Movements in treasury shares(d) - - - 25 (120) Share-based payment credit(e) - - - - 324 Dividends paid to non-controlling interests - - - - - Hedging (gain)/loss transferred to non- financial assets - - - (54) - Other movements in equity - - - 80 (119) 31 December 2024 88 52,844 (73,364) (9,299) 49,721 19, (a) Includes a hyperinflation adjustment of €880 million (2023: €308 million) in relation to Argentina and Turkey. (b) During 2023, 112,746,434 PLC ordinary shares held as treasury shares were cancelled. The amount paid to repurc initially recognised in other reserves and is transferred to retained profit on cancellation. (c) Repurchase of shares reflects the cost of acquiring ordinary shares as part of the share buyback programmes an 2022 and 8 February 2024. (d) Includes purchases and sales of treasury shares, other than the share buyback programme and the transfer from profit of share-settled schemes arising from prior years and differences between purchase and grant price of sha (e) The share-based payment credit relates to the non-cash charge recorded against operating profit in respect of t and awards granted to employees. Consolidated balance sheet (unaudited) € million As Dece 2 Non-current assets Goodwill Intangible assets Property, plant and equipment Pension asset for funded schemes in surplus Deferred tax assets Financial assets Other non-current assets Current assets Inventories Trade and other current receivables Current tax assets Cash and cash equivalents Other financial assets Assets held for sale Total assets Current liabilities Financial liabilities Trade payables and other current liabilities Current tax liabilities Provisions Liabilities held for sale Non-current liabilities Financial liabilities Non-current tax liabilities Pensions and post-retirement healthcare liabilities: Funded schemes in deficit Unfunded schemes Provisions Deferred tax liabilities Other non-current liabilities Total liabilities Equity Shareholders' equity Non-controlling interests Total equity

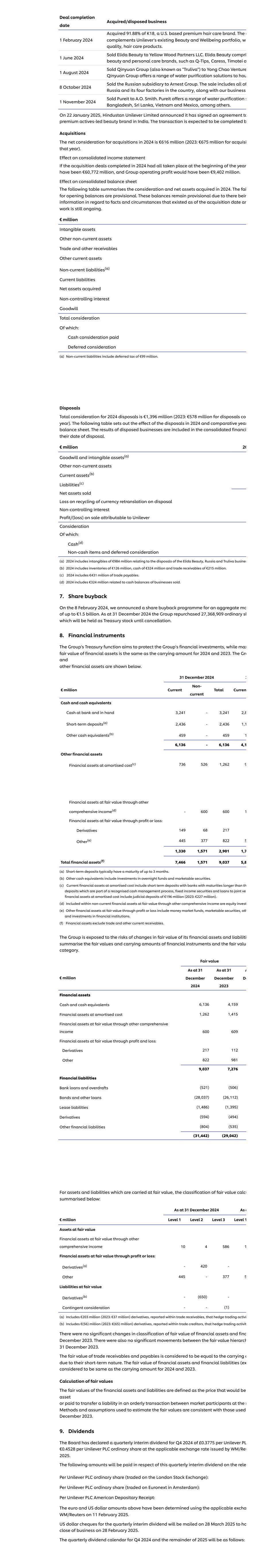

Total liabilities and equity Consolidated cash flow statement (unaudited) € million 20 Net profit Taxation Share of net profit of joint ventures/associates and other (income)/loss from non- current investments and associates Net monetary loss arising from hyperinflationary economies Net finance costs Operating profit Depreciation, amortisation and impairment Changes in working capital Inventories Trade and other receivables Trade payables and other liabilities Pensions and similar obligations less payments Provisions less payments Elimination of loss/(profits) on disposals Non-cash charge for share-based compensation Other adjustments Cash flow from operating activities Income tax paid Net cash flow from operating activities Interest received Purchase of intangible assets Purchase of property, plant and equipment Disposal of property, plant and equipment Acquisition of businesses and investments in joint ventures and associates Disposal of businesses, joint ventures and associates Acquisition of other non-current investments Disposal of other non-current investments Dividends from joint ventures, associates and other non-current investments Sale/(purchase) of financial assets Net cash flow used in investing activities Dividends paid on ordinary share capital Interest paid Net change in short-term borrowings Additional financial liabilities Repayment of financial liabilities Capital element of lease rental payments Repurchase of shares Other financing activities Net cash flow used in financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of the period Effect of foreign exchange rate changes Cash and cash equivalents at the end of the period Notes to the condensed consolidated financial statemen (unaudited) 1. Accounting information and policies Except as set out below the accounting policies and methods of computation are consiste 31 December 2023. In conformity with the requirements of the Companies Act 2006, the co preliminary financial statements have been prepared based on the International Financia (IFRS) as issued by the International Accounting Standard Board (IASB) and UK-adopted in standards. The condensed consolidated financial statements are shown at current exchange rates, a year changes are shown to facilitate comparison. The consolidated income statement on p consolidated statement of comprehensive income on page 21, the consolidated statemen on page 22 and the consolidated cash flow statement on page 24 are translated at excha each period. The balance sheet on page 23 is translated at period-end rates of exchange. The condensed consolidated financial statements attached do not constitute the full finan the meaning of Section 434 of the UK Companies Act 2006, which will be finalised and deliv of Companies in due course. Full accounts for Unilever for the year ended 31 December 202 to the Registrar of Companies; the auditors' reports on these accounts were unqualified, d reference to any matters by way of emphasis and did not contain a statement under Sectio 498 (3) of the UK Companies Act 2006. Accounting developments adopted by the Group On 1 January 2024, the Group adopted the amendments to IAS 7 and IFRS 7 "Supplier Finan amendments introduce additional disclosure requirements for companies that enter supp arrangements. This will be disclosed in the financial statements for the year ended 31 Dece All other new standards or amendments issued by the IASB and UK Endorsement Board tha January 2024, were either not applicable or not material to the Group. 2. Segment information - Business Groups Fourth Quarter Beauty & Wellbeing Personal Care Home Care Foods Turnover (€ million) 2023 3,181 3,404 2,974 3,416 2024 3,310 3,235 2,960 3,434 Change (%) 4.1 (5.0) (0.5) 0.5 Full Year Beauty & Wellbeing Personal Care Home Care Foods Turnover (€ million) 2023 12,466 13,829 12,181 13,204 2024 13,157 13,618 12,352 13,352 Change (%) 5.5 (1.5) 1.4 1.1 Operating profit (€ million) 2023 2,209 2,957 1,419 2,413 2024 1,970 2,739 1,521 2,599 Underlying operating profit (€ million) 2023 2,331 2,792 1,496 2,460 2024 2,552 3,014 1,785 2,847 Underlying operating profit represents our measure of segment profit or loss as it is the pr the purpose of making decisions about allocating resources and assessing performance o operating margin is calculated as underlying operating profit divided by turnover. 3. Segment information - Geographical area Fourth Quarter Asia Pacific Africa The Americas E Turnover (€ million) 2023 6,119 5,388 2024 5,988 5,453 Change (%) (2.1) 1.2 Full Year Asia Pacific Africa The Americas E Turnover (€ million) 2023 26,234 21,531 2024 25,991 22,491 Change (%) (0.9) 4.5 4. Taxation The effective tax rate for 2024 is 29.0% compared with 24.1% in 2023. For 2024 there is an ad from disposals whereas in 2023 there was a benefit. 5. Earnings per share The earnings per share calculations are based on the average number of share units repre shares of PLC in issue during the period, less the average number of shares held as treasur In calculating diluted earnings per share, a number of adjustments are made to the numb the exercise of share plans by employees. Earnings per share for total operations for the twelve months were calculated as follows: 2 EPS - Basic Net profit attributable to shareholders' equity (€ million) Average number of shares (millions of share units) EPS - basic (€) EPS - Diluted Net profit attributable to shareholders' equity (€ million) Adjusted average number of shares (millions of share units) EPS - diluted (€) During the period the following movements in shares have taken place: Number of shares at 31 December 2023 (net of treasury shares) Shares repurchased under the share buyback programme Net movements in shares under incentive schemes Number of shares at 31 December 2024 (net of treasury shares) 6. Acquisitions and disposals In 2024, the Group completed the business acquisitions and disposals as listed below.

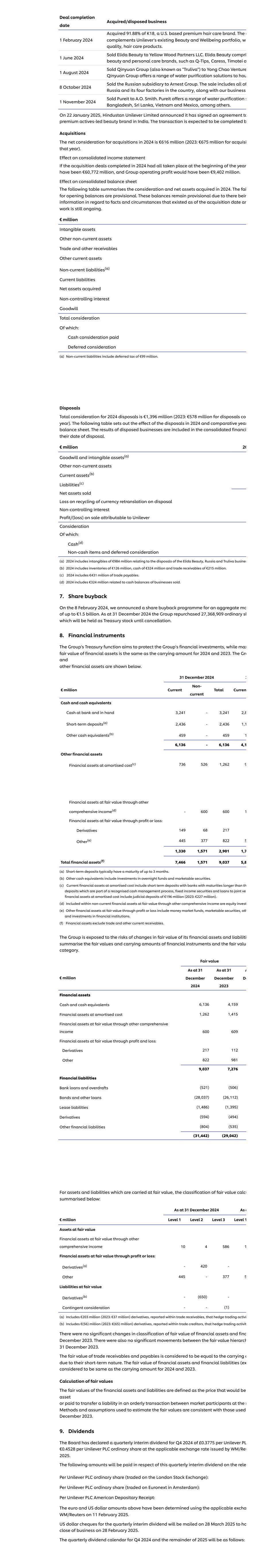

Deal completion date Acquired/disposed business 1 February 2024 Acquired 91.88% of K18, a U.S. based premium hair care brand. The a complements Unilever's existing Beauty and Wellbeing portfolio, wi quality, hair care products. 1 June 2024 Sold Elida Beauty to Yellow Wood Partners LLC. Elida Beauty compri beauty and personal care brands, such as Q-Tips, Caress, Timotei a 1 August 2024 Sold Qinyuan Group (also known as "Truliva") to Yong Chao Venture Qinyuan Group offers a range of water purification solutions to hou 8 October 2024 Sold the Russian subsidiary to Arnest Group. The sale includes all of Russia and its four factories in the country, along with our business 1 November 2024 Sold Pureit to A.O. Smith. Pureit offers a range of water purification s Bangladesh, Sri Lanka, Vietnam and Mexico, among others. On 22 January 2025, Hindustan Unilever Limited announced it has signed an agreement to premium actives-led beauty brand in India. The transaction is expected to be completed b Acquisitions The net consideration for acquisitions in 2024 is €616 million (2023: €675 million for acquisi that year). Effect on consolidated income statement If the acquisition deals completed in 2024 had all taken place at the beginning of the year have been €60,772 million, and Group operating profit would have been €9,402 million. Effect on consolidated balance sheet The following table summarises the consideration and net assets acquired in 2024. The fai for opening balances are provisional. These balances remain provisional due to there bein information in regard to facts and circumstances that existed as of the acquisition date an work is still ongoing. € million Intangible assets Other non-current assets Trade and other receivables Other current assets Non-current liabilities(a) Current liabilities Net assets acquired Non-controlling interest Goodwill Total consideration Of which: Cash consideration paid Deferred consideration (a) Non-current liabilities include deferred tax of €99 million. Disposals Total consideration for 2024 disposals is €1,396 million (2023: €578 million for disposals co year). The following table sets out the effect of the disposals in 2024 and comparative year balance sheet. The results of disposed businesses are included in the consolidated financi their date of disposal. € million 20 Goodwill and intangible assets(a) Other non-current assets Current assets(b) Liabilities(c) Net assets sold Loss on recycling of currency retranslation on disposal Non-controlling interest Profit/(loss) on sale attributable to Unilever Consideration Of which: Cash(d) Non-cash items and deferred consideration (a) 2024 includes intangibles of €984 million relating to the disposals of the Elida Beauty, Russia and Truliva busines (b) 2024 includes inventories of €126 million, cash of €324 million and trade receivables of €215 million. (c) 2024 includes €431 million of trade payables. (d) 2024 includes €324 million related to cash balances of businesses sold. 7. Share buyback On the 8 February 2024, we announced a share buyback programme for an aggregate ma of up to €1.5 billion. As at 31 December 2024 the Group repurchased 27,368,909 ordinary sh which will be held as Treasury stock until cancellation. 8. Financial instruments The Group's Treasury function aims to protect the Group's financial investments, while max fair value of financial assets is the same as the carrying amount for 2024 and 2023. The Gro and other financial assets are shown below. 31 December 2024 3 € million Current Non- current Total Curren Cash and cash equivalents Cash at bank and in hand 3,241 - 3,241 2,8 Short-term deposits(a) 2,436 - 2,436 1,1 Other cash equivalents(b) 459 - 459 1 6,136 - 6,136 4,1 Other financial assets Financial assets at amortised cost(c) 736 526 1,262 9 Financial assets at fair value through other comprehensive income(d) - 600 600 1 Financial assets at fair value through profit or loss: Derivatives 149 68 217 Other(e) 445 377 822 5 1,330 1,571 2,901 1,7 Total financial assets(f) 7,466 1,571 9,037 5,8 (a) Short-term deposits typically have a maturity of up to 3 months. (b) Other cash equivalents include investments in overnight funds and marketable securities. (c) Current financial assets at amortised cost include short term deposits with banks with maturities longer than th deposits which are part of a recognised cash management process, fixed income securities and loans to joint ven financial assets at amortised cost include judicial deposits of €196 million (2023: €227 million). (d) Included within non-current financial assets at fair value through other comprehensive income are equity invest (e) Other financial assets at fair value through profit or loss include money market funds, marketable securities, oth and investments in financial institutions. (f) Financial assets exclude trade and other current receivables. The Group is exposed to the risks of changes in fair value of its financial assets and liabiliti summarise the fair values and carrying amounts of financial instruments and the fair valu category. Fair value € million As at 31 December 2024 As at 31 December 2023 A De Financial assets Cash and cash equivalents 6,136 4,159 Financial assets at amortised cost 1,262 1,415 Financial assets at fair value through other comprehensive income 600 609 Financial assets at fair value through profit and loss: Derivatives 217 112 Other 822 981 9,037 7,276 Financial liabilities Bank loans and overdrafts (521) (506) Bonds and other loans (28,037) (26,112) Lease liabilities (1,486) (1,395) Derivatives (594) (494) Other financial liabilities (804) (535) (31,442) (29,042) For assets and liabilities which are carried at fair value, the classification of fair value calcu summarised below: As at 31 December 2024 As a € million Level 1 Level 2 Level 3 Level 1 Assets at fair value Financial assets at fair value through other comprehensive income 10 4 586 1 Financial assets at fair value through profit or loss: Derivatives(a) - 420 - Other 445 - 377 5 Liabilities at fair value Derivatives(b) - (650) - Contingent consideration - - (1) (a) Includes €203 million (2023: €37 million) derivatives, reported within trade receivables, that hedge trading activi (b) Includes €(56) million (2023: €(65) million) derivatives, reported within trade creditors, that hedge trading activit There were no significant changes in classification of fair value of financial assets and fina December 2023. There were also no significant movements between the fair value hierarch 31 December 2023. The fair value of trade receivables and payables is considered to be equal to the carrying a due to their short-term nature. The fair value of financial assets and financial liabilities (ex considered to be same as the carrying amount for 2024 and 2023. Calculation of fair values The fair values of the financial assets and liabilities are defined as the price that would be asset or paid to transfer a liability in an orderly transaction between market participants at the m Methods and assumptions used to estimate the fair values are consistent with those used December 2023. 9. Dividends The Board has declared a quarterly interim dividend for Q4 2024 of £0.3775 per Unilever PL €0.4528 per Unilever PLC ordinary share at the applicable exchange rate issued by WM/Reu 2025. The following amounts will be paid in respect of this quarterly interim dividend on the relev Per Unilever PLC ordinary share (traded on the London Stock Exchange): Per Unilever PLC ordinary share (traded on Euronext in Amsterdam): Per Unilever PLC American Depositary Receipt: The euro and US dollar amounts above have been determined using the applicable excha WM/Reuters on 11 February 2025. US dollar cheques for the quarterly interim dividend will be mailed on 28 March 2025 to ho close of business on 28 February 2025. The quarterly dividend calendar for Q4 2024 and the remainder of 2025 will be as follows:

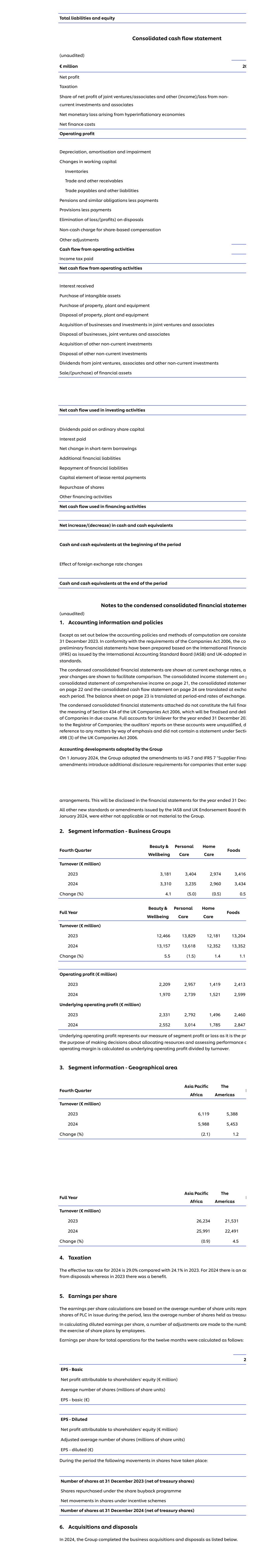

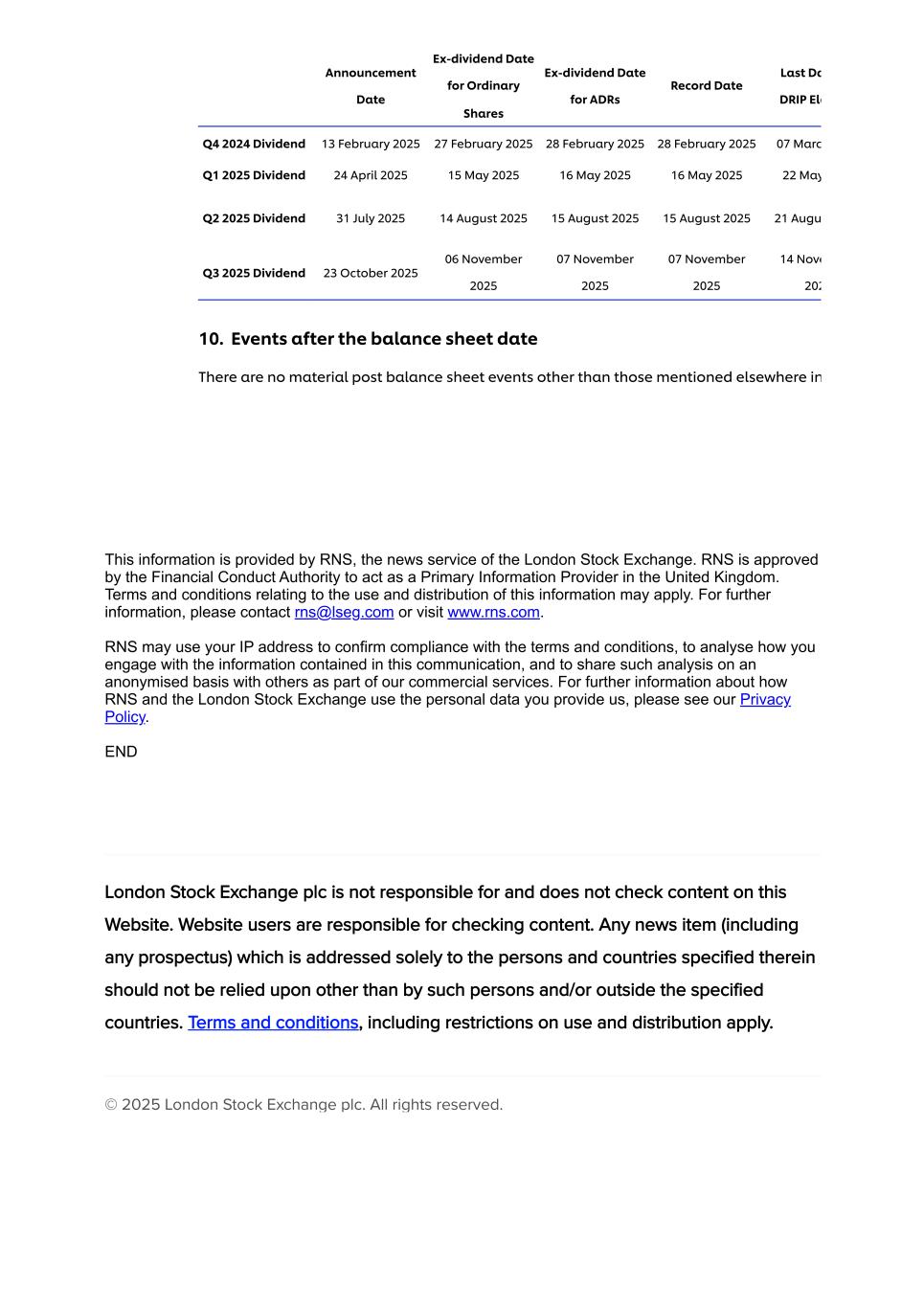

Announcement Date Ex-dividend Date for Ordinary Shares Ex-dividend Date for ADRs Record Date Last Da DRIP Ele Q4 2024 Dividend 13 February 2025 27 February 2025 28 February 2025 28 February 2025 07 Marc Q1 2025 Dividend 24 April 2025 15 May 2025 16 May 2025 16 May 2025 22 May Q2 2025 Dividend 31 July 2025 14 August 2025 15 August 2025 15 August 2025 21 Augu Q3 2025 Dividend 23 October 2025 06 November 2025 07 November 2025 07 November 2025 14 Nove 202 10. Events after the balance sheet date There are no material post balance sheet events other than those mentioned elsewhere in This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com. RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy. END London Stock Exchange plc is not responsible for and does not check content on this Website. Website users are responsible for checking content. Any news item (including any prospectus) which is addressed solely to the persons and countries specified therein should not be relied upon other than by such persons and/or outside the specified countries. Terms and conditions, including restrictions on use and distribution apply. © 2025 London Stock Exchange plc. All rights reserved.