- ADX Dashboard

-

Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Adams Diversified Equity Fund (ADX) DEF 14ADefinitive proxy

Filed: 23 Feb 21, 4:40pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

ADAMS DIVERSIFIED EQUITY FUND, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notes:

| | NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | |

| | By order of the Board of Directors, | |

| | Janis F. Kerns General Counsel, Secretary & Chief Compliance Officer | |

| | | | | | 2 | | | |

| | | | | | 2 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 4 | | | |

| | | | | | 5 | | | |

| | | | | | 9 | | | |

| | | | | | 9 | | | |

| | | | | | 10 | | | |

| | | | | | 10 | | | |

| | | | | | 10 | | | |

| | | | | | 10 | | | |

| | | | | | 11 | | | |

| | | | | | 11 | | | |

| | | | | | 13 | | | |

| | | | | | 14 | | | |

| | | | | | 16 | | | |

| | | | | | 16 | | | |

| | | | | | 16 | | | |

| | | | | | 16 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 18 | | | |

| | | | | | 18 | | |

| | Proxy Statement | |

| | Structure and Independence | | ||||||

| | • | | | 7 of 8 director nominees are independent | | |||

| | • | | | Annual election of all directors | | |||

| | • | | | Independent non-executive Chair | | |||

| | • | | | Annual Board and committee evaluations | | |||

| | • | | | Independent Audit, Compensation and Nominating & Governance committees | | |||

| | • | | | Risk and strategy oversight by the full Board and committees | | |||

| | • | | | Regular rotation of committee chairs and members | | |||

| | • | | | Executive session of independent directors at each regular meeting | | |||

| | Succession and Diversity | | ||||||

| | • | | | Mandatory director retirement age | | |||

| | • | | | Term limit of 15 years | | |||

| | • | | | 2 of 8 directors joined in the last 3 1/2 years | | |||

| | • | | | 7 of 8 directors with a background in finance or investing | | |||

| | • | | | Extensive leadership experience; 4 former or current CEOs | | |||

| | • | | | 3 female directors, including the Chair of the Board | | |||

| | • | | | 4 of 8 directors 64 years old or younger | | |||

| | Other Best Practices | | ||||||

| | • | | | 100% attendance at Board and committee meetings in 2020 | | |||

| | • | | | Active shareholder engagement with both institutional and individual investors | | |||

| | • | | | Significant share ownership requirements for directors and senior executives | | |||

| | • | | | Discussions between the Chair and each independent director supplement formal Board assessment | | |||

| | • | | | Open access for directors to all employees | | |||

| | • | | | Ability of the Board and its committees to engage independent advisors at their sole discretion | | |||

| | Enrique R. Arzac | | | Roger W. Gale | | | Kathleen T. McGahran | |

| | Kenneth J. Dale | | | Mary Chris Jammet | | | Mark E. Stoeckle* | |

| | Frederic A. Escherich | | | Lauriann C. Kloppenburg | | | | |

| | Name, Age, Positions with the Fund, Other Principal Occupations and Other Directorships | | | Has Been a Director Since | | | Number of Portfolios in Fund Complex Overseen by Director or Nominee for Director | | | Shares of Common Stock Beneficially Owned (a)(b)(c) | | |||||||||

| | Independent Directors | | | | | | | | | | | | | | | | | | | |

| | Enrique R. Arzac, Ph.D., 79, Professor Emeritus of Finance and Economics at the Graduate School of Business, Columbia University. Currently a director of PEO(d), Mirae Asset Discovery Funds (3 open-end funds), ETF Securities USA LLC, and Credit Suisse Next Investors, LLC. In addition, within the past five years, Dr. Arzac served as a director of Aberdeen Asset Management Funds (6 closed-end investment companies), Credit Suisse Asset Management Funds (2 closed-end investment companies and 8 open-end funds). | | | | | 1983 | | | | | | 2 | | | | | | 62,969 | | |

| | Name, Age, Positions with the Fund, Other Principal Occupations and Other Directorships | | | Has Been a Director Since | | | Number of Portfolios in Fund Complex Overseen by Director or Nominee for Director | | | Shares of Common Stock Beneficially Owned (a)(b)(c) | | |||||||||

| | Kenneth J. Dale, 64, Senior Vice President and Chief Financial Officer of The Associated Press. Formerly, Vice President, J.P. Morgan Chase & Co. Inc. Currently, a director of PEO(d). | | | | | 2008 | | | | | | 2 | | | | | | 18,339 | | |

| | Frederic A. Escherich, 68, Private Investor. Formerly, Managing Director and head of Mergers and Acquisitions Research and the Financial Advisory Department of J.P. Morgan & Co. Inc. Currently, a director of PEO(d). | | | | | 2006 | | | | | | 2 | | | | | | 58,837 | | |

| | Roger W. Gale, Ph.D., 74, President & CEO of GF Energy, LLC (consultants to electric power companies). Formerly, member of management group of PA Consulting Group (energy consultants). Currently, a director of PEO(d). | | | | | 2005 | | | | | | 2 | | | | | | 20,279 | | |

| | Mary Chris Jammet, 53, Principal with Bristol Partners LLC. Previously served as Senior Vice President and Portfolio Manager at Legg Mason, Inc. (now Franklin Templeton). Currently, a director of PEO(d) and a director of MGM Resorts International. In addition, within the past five years, Ms.Jammet served as a director of Payless ShoeSource Inc. | | | | | 2020 | | | | | | 2 | | | | | | 2,895 | | |

| | Lauriann C. Kloppenburg, 60, Retired Chief Strategy Officer and former Chief Investment Officer - Equity Group of Loomis Sayles & Company, LP (a U.S. investment management firm). Currently, a member of the investment committee of 1911 Office, LLC (a family office offering trust services) and Executive in Residence, Champlain College. Formerly, Executive in Residence, Hughey Center for Financial Services, Bentley University. Currently, a director of PEO(d). | | | | | 2017 | | | | | | 2 | | | | | | 7,045 | | |

| | Kathleen T. McGahran, Ph.D., J.D., CPA, 70, President Emeritus & former CEO of Pelham Associates, Inc. (an executive education provider). Formerly, Associate Dean and Director of Executive Education and Associate Professor, Columbia University. Currently, the Chair of the Board and a director of PEO(d) and a director of Scor Global Life Reinsurance and Scor Reinsurance of New York. | | | | | 2003 | | | | | | 2 | | | | | | 24,033 | | |

| | Interested Director | | | | | | | | | | | | | | | | | | | |

| | Mark E. Stoeckle, 64, CEO and President of the Fund. Currently, also the CEO and a director of PEO(d). Formerly, Chief Investment Officer, U.S. Equities and Global Sector Funds, BNP Paribas Investment Partners. | | | | | 2013 | | | | | | 2 | | | | | | 72,768 | | |

| | Directors and executive officers of the Fund as a group. | | | | | | | | | | | | | | | | | 267,165 | | |

| Independent Directors | | | Dollar Value of Shares Owned(1) | |

| Enrique R. Arzac | | | greater than $100,000 | |

| Kenneth J. Dale | | | greater than $100,000 | |

| Frederic A. Escherich | | | greater than $100,000 | |

| Roger W. Gale | | | greater than $100,000 | |

| Mary Chris Jammet | | | $50,001 - $100,000 | |

| Lauriann C. Kloppenburg | | | greater than $100,000 | |

| Kathleen T. McGahran | | | greater than $100,000 | |

| Interested Director | | | | |

| Mark E. Stoeckle | | | greater than $100,000 | |

| Security Ownership of Management of the Fund(a) | | | Shares of Common Stock Beneficially Owned (b)(c) | | |||

| Name | | ||||||

| James P. Haynie | | | | | 123,592 | | |

| Brian S. Hook | | | | | 29,298 | | |

| Janis F. Kerns | | | | | 13,457 | | |

| D. Cotton Swindell | | | | | 45,829 | | |

| Title of Class | | | Name and Address of Beneficial Owner | | | Amount and Nature of Beneficial Ownership | | | Percent of Class | |

| Common Stock | | | Edith H. Bergstrom P.O. Box 126 Palo Alto, CA 94302 | | | 9,115,000 shares held directly and indirectly(1) | | | 8.2% | |

| | | | | Kenneth J. Dale, Chair Frederic A. Escherich Roger W. Gale Lauriann C. Kloppenburg | |

| Name | | | Position | | | Aggregate Compensation from the Fund (1)(2)(3)(4) | | | Total Compensation from Fund and Fund Complex paid to Directors(5) | | ||||||

| Mark E. Stoeckle | | | Chief Executive Officer and President(a) | | | | $ | 1,084,894 | | | | | | N/A | | |

| James P. Haynie | | | Executive Vice President | | | | | 703,211 | | | | | | N/A | | |

| D. Cotton Swindell | | | Executive Vice President | | | | | 712,683 | | | | | | N/A | | |

| Independent Directors | | | | | ||||||||||||

| Enrique R. Arzac | | | Director (c)(d) | | | | | 65,000 | | | | | $ | 130,000 | | |

| Kenneth J. Dale | | | Director(a)(b)(d) | | | | | 68,000 | | | | | | 136,000 | | |

| Frederic A. Escherich | | | Director(a)(b)(d) | | | | | 68,000 | | | | | | 136,000 | | |

| Roger W. Gale | | | Director (b)(c) | | | | | 66,500 | | | | | | 133,000 | | |

| Mary Chris Jammet | | | Director (d) | | | | | 5,417 | | | | | | 10,834 | | |

| Lauriann C. Kloppenburg | | | Director(a)(b)(c) | | | | | 66,500 | | | | | | 133,000 | | |

| Kathleen T. McGahran | | | Chair of the Board(a) | | | | | 85,000 | | | | | | 170,000 | | |

| Craig R. Smith* | | | Director(c)(d) | | | | | 65,000 | | | | | | 130,000 | | |

| | 2020 | | | 2019 | | | 2018 | |

| | 58.7% | | | 61.6% | | | 58.4% | |

| | 2020 | | | 2019 | | | 2018 | |

| | 0.60% | | | 0.65% | | | 0.56% | |

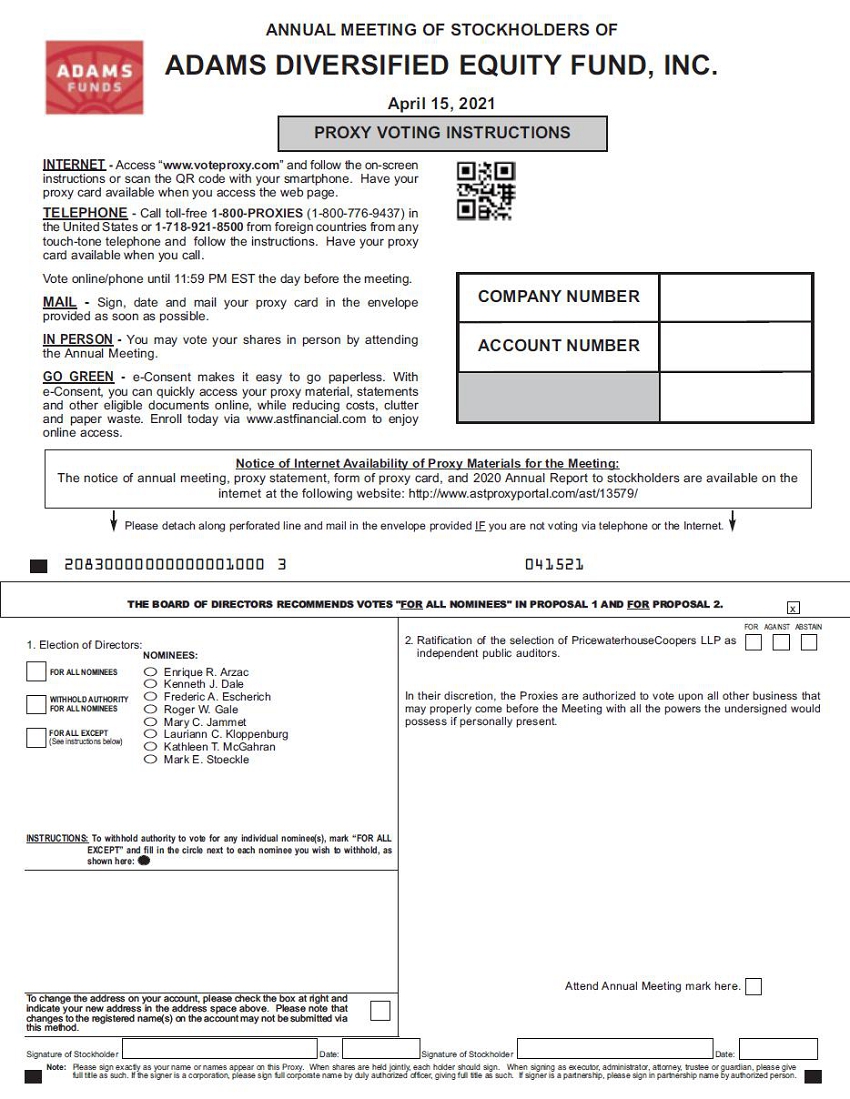

| ANNUAL MEETING OF STOCKHOLDERS OF ADAMS DIVERSIFIED EQUITY April 15, 2021 FUND, INC. INTERNET - Access “www.voteproxy.com” and follow the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page. TELEPHONE - Call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call. Vote online/phone until 11:59 PM EST the day before the meeting. MAIL - Sign, date and mail your proxy card in the envelope provided as soon as possible. IN PERSON - You may vote your shares in person by attending the Annual Meeting. GO GREEN - e-Consent makes it easy to go paperless. With e-Consent, you can quickly access your proxy material, statements and other eligible documents online, while reducing costs, clutter and paper waste. Enroll today via www.astfinancial.com to enjoy online access. Please detach along perforated line and mail in the envelope provided IF you are not voting via telephone or the Internet. 20830000000000001000 3 041521 independent public auditors. may properly come before the Meeting with all the powers the undersigned would (See instructions below) O Kathleen T. McGahran indicate your new address in the address space above. Please note that this method. Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. THE BOARD OF DIRECTORS RECOMMENDS VOTES "FOR ALL NOMINEES" IN PROPOSAL 1 AND FOR PROPOSAL 2. x 1. Election of Directors: NOMINEES: FOR ALL NOMINEESO Enrique R. Arzac O Kenneth J. Dale WITHHOLD AUTHORITYO Frederic A. Escherich FOR ALL NOMINEESO Roger W. Gale O Mary C. Jammet FOR ALL EXCEPTO Lauriann C. Kloppenburg O Mark E. Stoeckle INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: FOR AGAINST ABSTAIN 2. Ratification of the selection of PricewaterhouseCoopers LLP as In their discretion, the Proxies are authorized to vote upon all other business that possess if personally present. Attend Annual Meeting mark here. To change the address on your account, please check the box at right and changes to the registered name(s) on the account may not be submitted via Signature of Stockholder Date: Signature of StockholderDate: Notice of Internet Availability of Proxy Materials for the Meeting: The notice of annual meeting, proxy statement, form of proxy card, and 2020 Annual Report to stockholders are available on the internet at the following website: http://www.astproxyportal.com/ast/13579/ COMPANY NUMBER ACCOUNT NUMBER PROXY VOTING INSTRUCTIONS |

| - 0 ADAMS DIVERSIFIED EQUITY FUND, INC. PROXY FOR 2021 ANNUAL MEETING THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF ADAMS DIVERSIFIED EQUITY FUND, INC. The undersigned stockholder of Adams Diversified Equity Fund, Inc., a Maryland corporation (the “Fund”), hereby appoints James P. Haynie and Janis F. Kerns, or either of them, as proxies for the undersigned, with full power of substitution in each of them, to attend the Annual Meeting of Stockholders of the Fund to be held at 9:00 a.m., local time, on Thursday, April 15, 2021, at the offices of the Fund, 500 East Pratt Street, Suite 1300, Baltimore, Maryland 21202 and at any adjournment or postponement thereof, to cast on behalf of the undersigned all votes that the undersigned is entitled to cast at such meeting and otherwise to represent the undersigned at the meeting with all powers possessed by the undersigned if personally present at the meeting. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting and Proxy Statement, the terms of each of which are incorporated by reference, and revokes any proxy heretofore given with respect to such meeting. The votes entitled to be cast by the undersigned will be cast as instructed on the reverse side. If this proxy is executed but no instruction is given, the votes entitled to be cast by the undersigned will be cast “FOR ALL NOMINEES" in Proposal 1 and "FOR" Proposal 2, as described in the Proxy Statement. The votes entitled to be cast by the undersigned will be cast in the discretion of the Proxy holder on any other matter that may properly come before the meeting or any adjournment or postponement thereof. (over) ADAMS DIVERSIFIED EQUITY FUND, INC. 14475 1.1 |