UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number: 811-3493

American Federation of Labor and

Congress of Industrial Organizations

Housing Investment Trust

(Exact name of registrant as specified in charter)

1227 25th Street, N.W., Suite 500

Washington, D.C. 20037

(Address of principal executive offices) (Zip code)

Corey F. Rose, Esq.

Dechert LLP

1900 K Street, NW

Washington, DC 20006-1110

(Name and address of agent for service)

(202) 331-8055

(Registrant’s telephone number, including area code)

Date of fiscal year end: December 31

Date of reporting period: January 1, 2023 - December 31, 2023

Item 1. Reports to Stockholders.

A copy of the 2023 Annual Report (the “Report”) of the AFL-CIO Housing Investment Trust (the “Trust” or “Registrant”) transmitted to Trust participants pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (17 CFR 270.30e-1) (the “Act”), is included herewith.

TO OUR INVESTORS |  |

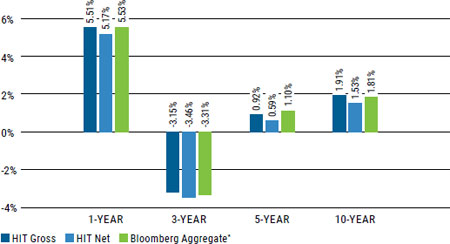

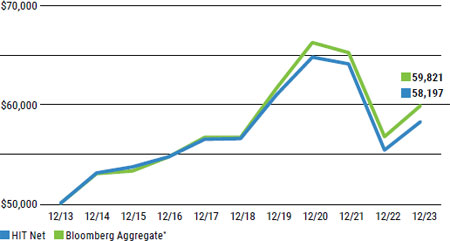

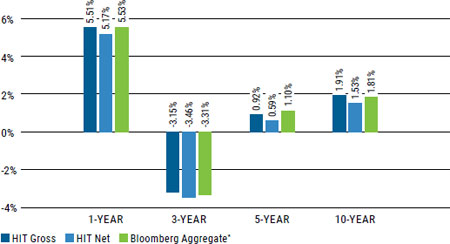

During much of 2023, the Federal Reserve (the Fed) continued hiking interest rates in its ongoing effort to bring down persistently high inflation. By the latter part of the year, rates had reached their highest level in years, broadly hurting the value of rate-sensitive fixed income investments. However, the Fed’s pausing of its rate hike program and market expectations of a pivot to rate cuts in 2024 helped fixed income markets rally in the fourth quarter. The HIT’s return for 2023 was 5.51% gross of fees and 5.17% net of fees compared to 5.53% for its benchmark, the Bloomberg U.S. Aggregate Bond Index* (Bloomberg Aggregate or Benchmark).1 The HIT ended 2023 with a yield-to-worst of 5.36%, an advantage of 82 basis points over the Benchmark, which we expect will be a positive harbinger going into 2024.2

The HIT continues to increase its impact investing and committed to 15 projects in 2023, despite the challenges posed by higher rates in the earlier part of the year. Currently, the HIT has 40 projects under construction nationwide, which are expected to generate an estimated $6.2 billion of economic activity and create or rehabilitate 6,534 housing units. Looking forward to 2024, the HIT will seek to secure more investments that finance new housing development as we expect the demand for additional housing, particularly affordable housing, will continue to grow. Despite 2023’s difficult interest rate environment, the HIT was able to provide financing for 15 projects without sacrificing credit quality: 92% of the portfolio was guaranteed by the government,

a Government-Sponsored Enterprise or a state housing finance agency. We believe that the HIT’s ability to provide flexible and creative financing to housing projects, as well as the return of longer-term interest rates to levels seen at the start of 2023, should allow it to be an attractive financing source as borrowers may confront challenges in the coming year.

Continuing its strategy of maintaining a high credit quality portfolio with a very attractive yield, the HIT persists in seeking competitive returns for its investors while building much-needed housing in communities across the U.S. The HIT also strives to do more as a record number of renters were cost-burdened and home purchase affordability in 99% of counties was worse than its historical average in 2023. We believe that the HIT’s commitment to constantly improving operations allows the HIT to help fill financing gaps that could lead to more attractive investments, jobs and housing. The growth of the HIT, lower operating expenses and the large volume of impact investments made in the past four years have strengthened the HIT’s position. We believe the HIT’s higher yield and its impact investments will bring value to its investors and partners.

Chang Suh

Chief Executive Officer and Chief Investment Officer

*Source: Bloomberg

| 1. | The performance data quoted represents past performance and is no guarantee of future results. Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost. The HIT’s current performance data may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available from the HIT’s website at www.aflcio-hit.com. Gross performance figures do not reflect the deduction of HIT expenses. Net performance figures reflect the deduction of HIT expenses and are the performance returns that HIT’s investors obtain. Information about HIT expenses can be found on page 1 of the HIT’s current prospectus. |

| 2. | Yield-to-Worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. It does not represent the performance yield. It is calculated by using the lower of either the yield to maturity or the yield to call on every possible call date. |

MESSAGE FROM THE AFL-CIO PRESIDENT |  |

“Over the course of 2023, the HIT proved that a long-established union-friendly investment strategy really is a model for modern, impactful investments.”

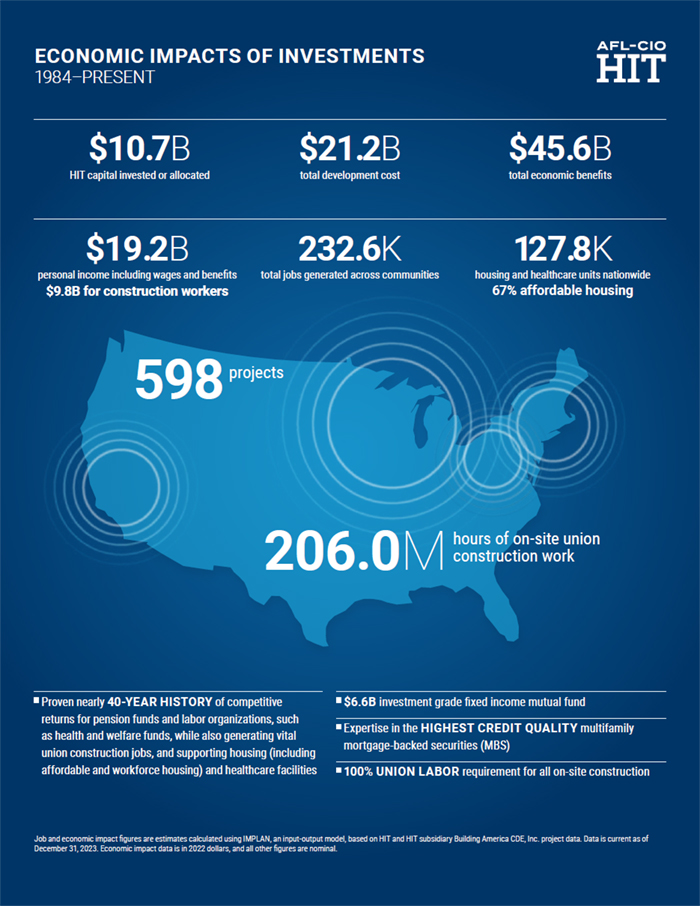

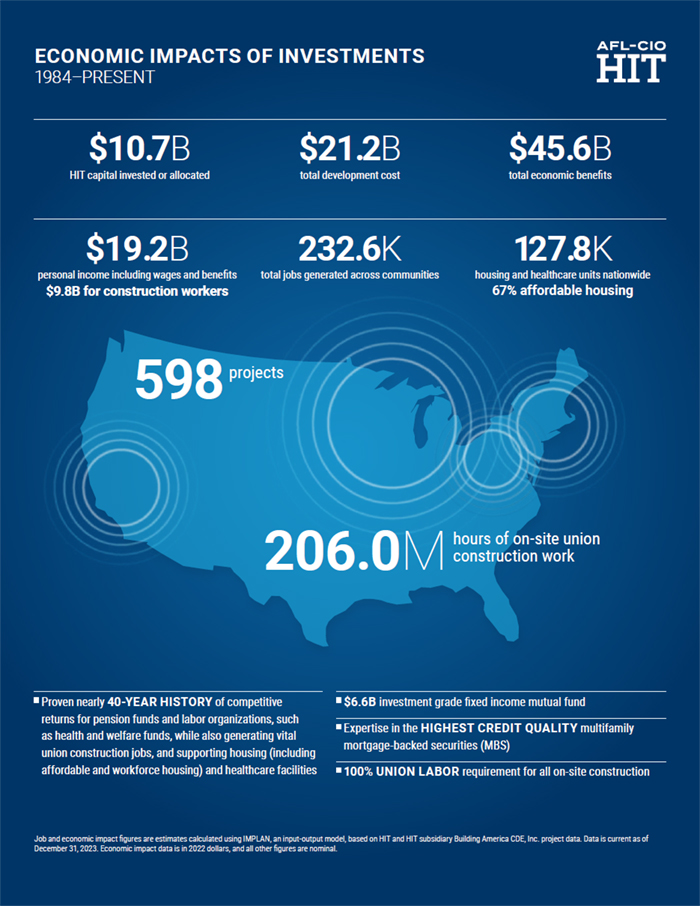

During 2023, the HIT remained true to its guiding principle to create additional employment for the construction trades and help address America’s tremendous unmet housing need. By all measures, it succeeded: investing $357.2 million in 15 projects nationwide in 2023, with $1.9 billion in total development costs, creating or rehabilitating 2,873 housing units (45% affordable), and generating an estimated 13,554 jobs across communities.

The history of the American labor movement is woven through the very streets and neighborhoods in which the HIT invests; and while every city is distinct, the HIT’s investments are uniformly aligned with creating local opportunities. By seeking to generate competitive returns for investors while promoting the creation of union jobs, affordable housing and sustainable development, the HIT responded to some of the most critical challenges Americans face. Then, by engaging and educating

stakeholders in key markets, the HIT put the power of union capital center stage and encouraged others to join its efforts. In short, over the course of 2023, the HIT proved that a long-established union-friendly investment strategy really is a model for modern, impactful investments.

I welcome another year working alongside the HIT and the labor movement as we forge solutions, weather change, and create real opportunity for union members nationwide.

In Solidarity,

Elizabeth H. Shuler

President, AFL-CIO; Trustee, AFL-CIO Housing Investment Trust

| 2 |  |

DISCUSSION OF FUND PERFORMANCE

(unaudited)

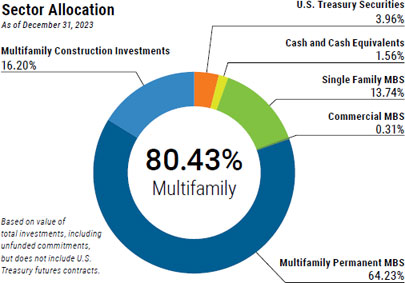

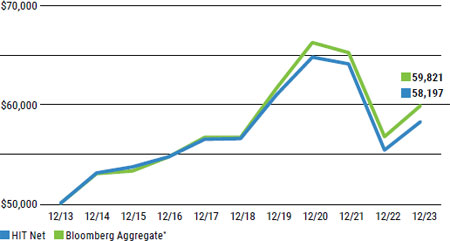

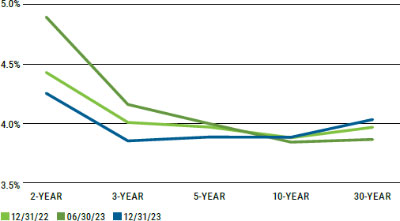

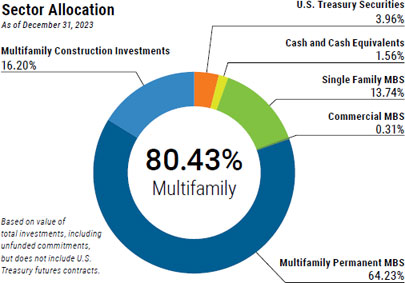

2023 OVERVIEW The AFL-CIO Housing Investment Trust (HIT) continued to put labor’s capital to work through high credit-quality multifamily investments in 2023, a year with continuing restrictive monetary policy as the Federal Open Market Committee (FOMC) raised the Federal Funds Rate by 100 basis points (bps) after raising it by 400 bps the prior year.1 The HIT committed $357.2 million to finance the construction, substantial rehabilitation or affordability preservation of 15 projects during the year.2 These investments, with a total development cost of $1.9 billion, are expected to generate approximately 5,726 union construction jobs and an estimated $2.8 billion in economic impacts.3 Fixed income strategies rebounded from a difficult 2022 by generating positive returns in 2023; and the HIT performed in-line with its benchmark, the Bloomberg U.S. Aggregate Bond Index* (Bloomberg Aggregate or Benchmark). The HIT ended 2023 with a yield-to-worst of 5.36%, 82 bps higher than the Benchmark, and we believe this yield advantage reflects the relative value of the HIT’s portfolio.4 2023 RETURNS For 2023, the HIT generated a gross return of 5.51% and net return of 5.17%, compared to the Benchmark’s 5.53% return. The HIT narrowly trailed the Benchmark despite a structural underweight to corporate | | credit, the best performing sector in investment grade fixed income for 2023. The HIT delivered competitive returns as the portfolio yield continued to rise alongside interest rates. PERFORMANCE ATTRIBUTION SUMMARY Total returns for investment grade fixed income strategies were positive for 2023 as interest rates fell from their highs in the fourth quarter. The 10-year U.S. Treasury closed the year with a yield of 3.88%, which was exactly the same as the yield at the end of the previous year. Interest rates fluctuated greatly throughout the year, reaching their highest levels in 15 years in October before closing the year over 100 bps lower. By adding higher coupon assets into its portfolio, the HIT was able to generate a meaningful income return of 3.88%, a 63-bp advantage to the Benchmark. In this volatile rate environment, the HIT delivered competitive returns that narrowly underperformed the Benchmark by 2 bps on a gross of fees basis despite not holding any corporate credit, which was the best performing sector for the year in investment grade fixed income on both an excess and total return basis, by a wide margin. The HIT’s relative performance for 2023 benefitted from the HIT’s overweight to conventional agency multifamily mortgage-backed securities, overweight to adjustable-rate investments, and underweight to U.S. Treasuries, which |

| | | |

Relative Returns As of December 31, 2023, periods over one year are annualized | | Comparison of a $50,000 Investment in the HIT and Bloomberg Aggregate (10 Years) |

| | | |

| |  |

Past performance is no guarantee of future results. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that a participant’s units, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.aflcio-hit. com. Gross performance figures do not reflect the deduction of HIT expenses. Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT. Information about HIT expenses can be found on page 1 of the HIT’s current prospectus. The Bloomberg Aggregate is an unmanaged index and is not available for direct investment, although certain funds attempt to replicate this index. Returns for the index would be lower if they reflected the actual trading costs or expenses associated with management of an actual portfolio.

| 2. | This includes New Markets Tax Credits allocated by HIT subsidiary Building America CDE, Inc. |

| 3. | Job and economic impact figures are estimates calculated using IMPLAN, an input]output model, based on HIT and HIT subsidiary Building America CDE, Inc. project data. Data is current as of December 31, 2023. |

| 4. | Yield-to-Worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. It does not represent the performance yield. It is calculated by using the lower of either the yield to maturity or the yield to call on every possible call date. |

DISCUSSION OF FUND PERFORMANCE

continued

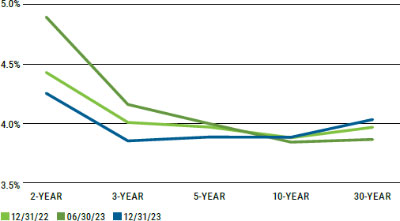

Treasury Yield Curve Shift

Source: Bloomberg L.P.

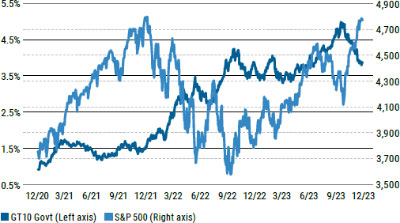

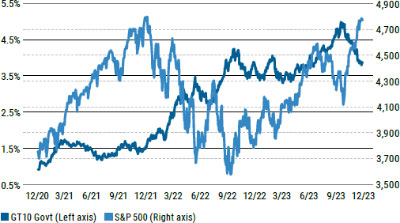

S&P vs 10-Year Treasury

Source: Bloomberg L.P.

Historical Multifamily Spreads

Source: HIT and Securities Dealers

was the worst performing asset class in the Benchmark on an excess and total return basis. In addition to the HIT’s lack of corporate bonds, the HIT’s underweight to the lower credit quality sectors of the investment grade universe hindered relative returns.

2023 MARKET OVERVIEW

The U.S. economy continued to expand in 2023, backed by strong consumer spending, steady job growth and growing real wages. Despite a slight softening in the fourth quarter, the U.S. labor market ended 2023 with an unemployment rate of only 3.7%.5 Following its peak in the summer of 2022, inflation demonstrated a persistent downward trend for the year, although it remains well above the Federal Reserve’s long run 2% target. Shelter prices, however, remained elevated throughout 2023, fueled by high home prices and rents.

To address heightened inflation, the Federal Reserve (the Fed) hiked the Federal Funds rate 100 bps during the first seven months of the year.6 The Fed did not change interest rates for the rest of the year to assess the lagged impact of its increasingly restrictive monetary policy.

Housing affordability continued to erode in 2023 due to elevated mortgage rates and home prices. Median-priced single-family homes and condos were less affordable in 2023 compared to historical averages in 99% of counties around the nation.7 While the national apartment vacancy rate rose half a percentage point and rents softened from record highs, the average American renter remains cost burdened. The share of American household income needed to rent an average-priced apartment crossed the rent-burdening 30% threshold in 2023 for the first time in nearly 25 years of tracking.8

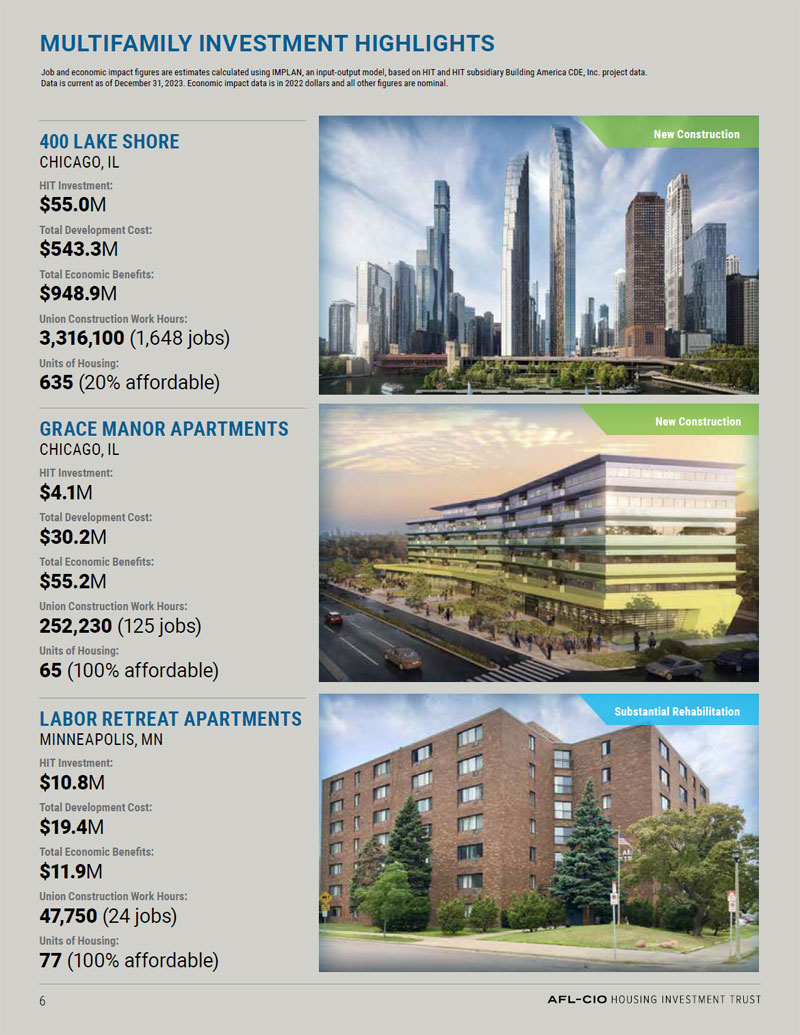

HIT’S MULTIFAMILY INVESTMENTS

The HIT committed $357.2 million in financing across 15 investments in 2023, which will generate, rehabilitate or preserve 2,873 housing units, of which approximately 45% will be affordable.9 These projects have development costs totaling over $1.9 billion, marking the highest in the HIT’s nearly 40-year history. These investments are expected to contribute positively to the HIT’s portfolio’s yield while generating approximately 5,726 union construction jobs and an estimated $2.8 billion in economic impacts, revitalizing communities across the U.S. as spending on these projects circulate through local economies.10

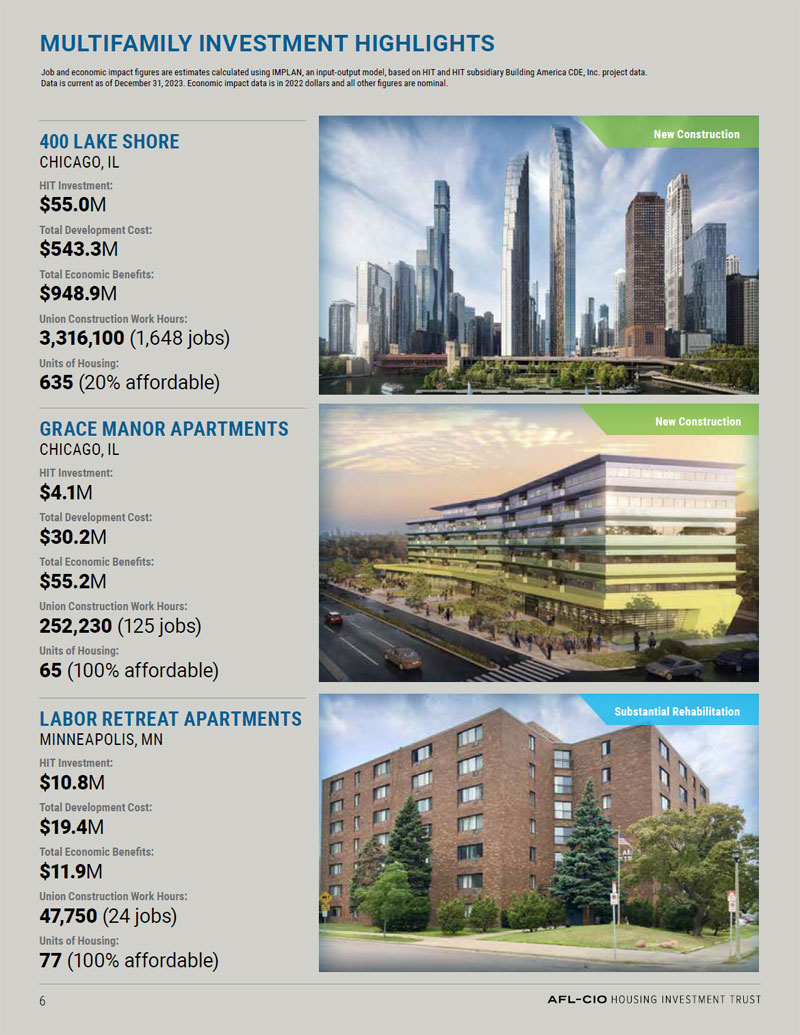

In 2023, the HIT continued to utilize its varied financing products, primarily utilizing its Federal Housing Administration (FHA)-insured construction and permanent lending program, and its direct and bridge lending authorities. The HIT committed to three direct loans in 2023, including 400 Lake Shore, a mixed-income, 72-story housing project located at the intersection of the Chicago River and Lake Michigan, which will redefine the Chicago skyline.

| 5. | Bureau of Labor Statistics |

| 9. | This includes New Markets Tax Credits allocated by HIT subsidiary Building America CDE, Inc. |

| 10. | Job and economic impact figures are estimates calculated using IMPLAN, an input]output model, based on HIT and HIT subsidiary Building America CDE, Inc. project data. Data is current as of December 31, 2023. |

| 4 |  |

DISCUSSION OF FUND PERFORMANCE

continued

| “As the housing shortage and housing costs continue to rise, the HIT is doing its part to grow, rehabilitate and maintain the supply across the U.S. In 2023, the HIT provided financing for 2,873 units of housing, with 1,290 of those affordable.” Chris Coleman President and CEO, Twin Cities Habitat for Humanity; Chair of the Board, AFL-CIO Housing Investment Trust |

The HIT continued to be very active in some of its key markets during 2023. In addition to 400 Lake Shore, the HIT closed on six Chicago developments, which will create 652 units of housing, of which approximately 96% will be affordable. Additionally, the HIT committed to provide financing for projects in Massachusetts, Minnesota, New Jersey, and Pennsylvania; and to preserve affordability in New York City.

At year-end, 40 projects receiving HIT financing were under construction. These projects are providing significant economic benefits and positively impacting communities in 19 cities across 10 states. With a positive outlook on interest rates heading into 2024, the HIT is tracking an extensive pipeline of projects and continues to work with its numerous lending partners to finance affordable, workforce, and market rate housing developments.

LOOKING AHEAD

The U.S. economy is expected to slow in the coming months as the lagged effects of higher interest rates and a slowing labor market could weigh on consumer spending. Ongoing turmoil in the Middle East, including the unrest in the Red Sea, could impact supply chains and cause oil prices to rise. Higher oil and gas prices act as a tax on consumers, who are already experiencing strained budgets from still elevated inflation.

Risk Comparison

As of December 31, 2022

| | HIT | Bloomberg

Aggregate* |

Credit Profile U.S. Government/Agency/AAA/Cash | 88.80% | 74.37% |

| A & Below/Not Rated | 6.25% | 24.18% |

| Yield |

| Current Yield | 3.93% | 3.38% |

| Yield to Worst | 5.36% | 4.54% |

| Interest Rate Risk |

| Effective Duration | 6.01 | 6.12 |

| Convexity | 0.24 | 0.28 |

| Call Risk |

| Call Protected | 75% | 73% |

| Not Call Protected | 25% | 27% |

| Source: HIT and Bloomberg* |

Disinflation, as well as the slower job growth in the fourth quarter, has raised market expectations for more cuts in short-term rates in 2024. Currently, the Fed is forecasting three quarter-point rate cuts by the end of 2024, with the Federal Funds Effective Rate futures market predicting a much more aggressive policy of at least six quarter-point cuts by the end of 2024.

Additionally, there continues to be a high degree of political uncertainty going into the new year. The latest budget agreement, passed in mid-January, is just a stopgap measure that now pushes the possibility of a government shutdown into March 2024.

Single family home prices remain near record highs and are expected to be out of reach for many in 2024, so multifamily rental housing should continue to be in high demand. At the same time, a record number of renters are cost burdened, demonstrating the critical need for more affordable housing in the U.S. The HIT has a proven track record of investing in affordable and market rate housing, often using flexible financing tools that can create a competitive advantage. In times of heightened market uncertainty, the HIT’s portfolio continues to offer an attractive yield advantage, liquidity, diversification from corporate credit, and defensive positioning relative to other core fixed income managers.

| * | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. |

OTHER IMPORTANT INFORMATION

(unaudited)

| Expense Example | Beginning | Ending | Expenses Paid During |

| | Account Value | Account Value | Six Month Period Ended |

| | July 1, 2023 | December 31, 2023 | December 31, 2023* |

| Actual Expenses | $1,000.00 | $1,031.60 | $1.74 |

Hypothetical Expenses

(5% annual return before expenses) | $1,000.00 | $1,023.49 | $1.73 |

| * | Expenses are equal to the HIT’s annualized six-month expense ratio of 0.340%, as of December 31, 2023, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half period). |

Annual Meeting of Participants: Class I Trustees Results

| Trustee | | Votes For | | Votes Against | | Votes Abstaining* |

| Paul A. Noble | | 4,290,114.485 | | 0 | | 0 |

| Fredrick Redmond | | 4,290,114.485 | | 0 | | 0 |

| Anthony Shelton | | 4,290,114.485 | | 0 | | 0 |

| James A. Williams, Jr. | | 4,290,114.485 | | 0 | | 0 |

| Bridget Gainer | | 4,290,114.485 | | 0 | | 0 |

| Jack F. Quinn, Jr. | | 4,290,114.485 | | 0 | | 0 |

| Deidre L. Schmidt | | 4,290,114.485 | | 0 | | 0 |

| William C. Thompson, Jr. | | 4,290,114.485 | | 0 | | 0 |

* Votes not cast: 2,415,635.711

Expense Example

Participants in the HIT incur ongoing expenses related to the management and distribution activities of the HIT, as well as certain other expenses. The expense example in the table above is intended to help participants understand the ongoing costs (in dollars) of investing in the HIT and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period, July 1, 2023, and held for the entire period ended December 31, 2023.

Actual Expenses The first line of the table above provides information about actual account values and actual expenses. Participants may use the information in this line, together with the amount they invested, to estimate the expenses that they paid over the period. Simply divide the account value by $1,000 (for example, an $800,000 account value divided by $1,000=$800), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Six-Month Period Ended December 31, 2023” to estimate the expenses paid on a particular account during this period.

Hypothetical Expenses (for Comparison Purposes Only): The second line of the table above provides information about hypothetical account values and hypothetical expenses based on the HIT’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the HIT’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses a participant paid for the period. Participants may use this information to compare the ongoing costs of investing in the HIT and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that this example is useful in comparing funds’ ongoing costs only. It does not include any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. The HIT does not have such transactional costs, but many other funds do.

Availability of Quarterly Portfolio Schedule

In addition to disclosure in its Annual and Semi-Annual Reports to Participants, the HIT also files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The HIT’s Forms N-PORT are available on the SEC’s website at http://www.sec.gov.

Participants may also obtain copies of the information on HIT’s Form N-PORT, without charge, upon request, by calling the HIT at 202-331-8055.

Proxy Voting

Except for its interest in its wholly owned subsidiary, HIT Advisers LLC, and shares in mutual funds holding short-term or overnight cash, if applicable, the HIT invests exclusively in nonvoting securities and has not deemed it necessary to adopt policies and procedures for the voting of portfolio securities. The HIT has reported information regarding how it voted in matters related to its subsidiary in its most recent filing with the SEC on Form N-PX. This filing is available on the SEC’s website at http://www.sec. gov. Participants may also obtain a copy of the HIT’s report on Form N-PX, without charge, upon request, by calling the HIT at 202-331-8055.

2023 HIT Participants Meeting

The HIT’s 2023 Annual Meeting of Participants was held on Tuesday, December 19, 2023. The following matters were put to a vote of the participants at the meeting through the solicitation of proxies:

Election of Chair of the Board of Trustees Chris Coleman was elected to chair the Board of Trustees by: votes for 4,290,114.485; votes against 0; votes abstaining 0; votes not cast 2,415,635.711.

Election of Class I Trustees (See table above).

Ernst & Young LLP was ratified as the HIT’s Independent Registered Public Accounting Firm by: votes for 4,290,114.485; votes against 0; votes abstaining 0; votes not cast 2,415,635.711.

The following Trustees were not up for reelection and their terms of office continued after the meeting: Vincent Alvarez, Timothy J. Driscoll, Sean McGarvey, Terry O’Sullivan, Elizabeth Shuler, Kevin Filter, Tony Stanley, Harry W. Thompson.

| 8 |  |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Participants of American Federation of Labor and Congress of

Industrial Organizations Housing Investment Trust:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of American Federation of Labor and Congress of Industrial Organizations Housing Investment Trust (the “Trust”), including the schedule of portfolio investments, as of December 31, 2023, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Trust at December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Trust’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the custodian and counterparties. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the HIT’s auditor since 2002.

Tysons, Virginia

February 29, 2024

| 10 |  |

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2023 (dollars in thousands, except per share data)

| Assets |

| | Investments, at value (cost $7,337,164) | $ | 6,541,881 |

| | Cash | 330 |

| | Accrued interest receivable | 25,823 |

| | Receivables for investments sold | 189 |

| | Cash collateral held with broker | 2,532 |

| | Variation margin due from broker | 5,071 |

| | Right of use asset | 3,856 |

| | Other assets | 4,610 |

| | Total assets | 6,584,292 |

| | | |

| Liabilities |

| | Payables for investments purchased | 3,915 |

| | Redemptions payable | 7,007 |

| | Income distribution and capital gains payable, net of dividends reinvested of $17,613 | 1,749 |

| | Refundable deposits | 1,082 |

| | Accrued salaries and fringe benefits | 6,164 |

| | Lease Liability | 4,387 |

| | Other liabilities and accrued expenses | 1,157 |

| | Total liabilities | 25,461 |

| | | |

| | Other commitments and contingencies (Note 5 of financial statements) | - |

| | | |

| Net assets applicable to participants’ equity — | |

| | Certificates of participation—authorized unlimited; | |

| | Outstanding 6,736,060 units | $ | 6,558,831 |

| | | |

| Net asset value per unit of participation (in dollars) | $ | 973.69 |

| | | |

| | | |

| Participants’ equity | |

| | Participants’ equity consisted of the following: | |

| | Amount invested and reinvested by current participants | $ | 7,453,767 |

| | Distributable earnings (accumulated losses) | (894,936) |

| | Total participants’ equity | $ | 6,558,831 |

See accompanying Notes to Financial Statements.

SCHEDULE OF PORTFOLIO INVESTMENTS

December 31, 2023 (dollars in thousands)

FHA Permanent Securities | 1.8% of net assets

| | | Interest Rate | | Maturity Date | | Face Amount | | Amortized Cost | | Value |

| Multifamily | | 2.50% | | Apr-2063 | | $ | 5,650 | | | $ | 5,658 | | | $ | 4,556 | |

| | | 3.65% | | Dec-2037 | | | 7,121 | | | | 7,207 | | | | 7,088 | |

| | | 3.72% | | Feb-2062 | | | 4,384 | | | | 4,394 | | | | 3,966 | |

| | | 3.90% | | Mar-2062 | | | 3,056 | | | | 3,059 | | | | 2,796 | |

| | | 4.00% | | Dec-2053 | | | 59,076 | | | | 59,051 | | | | 56,632 | |

| | | 4.10% | | Dec-2060 | | | 21,285 | | | | 21,303 | | | | 19,204 | |

| | | 4.70% | | May-2053 | | | 4,475 | | | | 4,643 | | | | 3,645 | |

| | | 5.17% | | Feb-2050 | | | 7,262 | | | | 7,696 | | | | 7,095 | |

| | | 5.60% | | Jun-2038 | | | 1,930 | | | | 1,932 | | | | 1,927 | |

| | | 5.80% | | Jan-2053 | | | 1,897 | | | | 1,905 | | | | 1,933 | |

| | | 5.87% | | May-2044 | | | 1,547 | | | | 1,547 | | | | 1,545 | |

| | | 5.89% | | Apr-2038 | | | 3,638 | | | | 3,641 | | | | 3,634 | |

| | | 6.40% | | Aug-2046 | | | 3,412 | | | | 3,413 | | | | 3,411 | |

| | | 6.60% | | Jan-2050 | | | 3,106 | | | | 3,123 | | | | 3,099 | |

| Total FHA Permanent Securities | | | | | | $ | 127,839 | | | $ | 128,572 | | | $ | 120,531 | |

Ginnie Mae Securities | 25.7% of net assets

| | | Interest Rate | | Maturity Date | | Face Amount | | Amortized Cost | | Value |

| Single Family | | 4.00% | | Feb-2040 - Jun-2040 | | $ | 906 | | | $ | 912 | | | $ | 880 | |

| | | 4.50% | | Aug-2040 | | | 483 | | | | 489 | | | | 478 | |

| | | 5.50% | | Jan-2033 - Jun-2037 | | | 745 | | | | 746 | | | | 765 | |

| | | 6.00% | | Jan-2032 - Aug-2037 | | | 514 | | | | 516 | | | | 535 | |

| | | 6.50% | | Jul-2028 | | | 29 | | | | 29 | | | | 30 | |

| | | 7.00% | | Apr-2026 - Jan-2030 | | | 230 | | | | 230 | | | | 235 | |

| | | 7.50% | | Aug-2025 - Aug-2030 | | | 107 | | | | 107 | | | | 108 | |

| | | 8.00% | | Sep-2026 - Nov-2030 | | | 105 | | | | 105 | | | | 108 | |

| | | 8.50% | | Aug-2024 - Aug-2027 | | | 20 | | | | 21 | | | | 21 | |

| | | 9.00% | | Sep-2024 - Jun-2025 | | | 1 | | | | 1 | | | | 1 | |

| | | | | | | | 3,140 | | | | 3,156 | | | | 3,161 | |

| Multifamily | | 1.90% | | Feb-2061 | | | 22,712 | | | | 20,582 | | | | 13,604 | |

| | | 1.95% | | Mar-2064 | | | 37,504 | | | | 37,037 | | | | 30,145 | |

| | | 1.95% | | Mar-2064 | | | 34,068 | | | | 34,516 | | | | 27,493 | |

| | | 2.00% | | Oct-2062 | | | 52,855 | | | | 54,569 | | | | 41,816 | |

| | | 2.00% | | Apr-2063 | | | 51,246 | | | | 52,076 | | | | 41,244 | |

| | | 2.00% | | Apr-2063 | | | 48,497 | | | | 49,475 | | | | 38,651 | |

| | | 2.00% | | Jul-2063 | | | 44,283 | | | | 44,665 | | | | 35,710 | |

| | | 2.00% | | Oct-2063 | | | 42,011 | | | | 41,616 | | | | 33,120 | |

| | | 2.00% | | Jul-2062 - Mar-2064 | | | 299,790 | | | | 303,092 | | | | 234,997 | |

| | | 2.08% | | Nov-2056 | | | 50,876 | | | | 52,723 | | | | 42,720 | |

| | | 2.15% | | May-2056 | | | 423 | | | | 422 | | | | 413 | |

| | | 2.20% | | Jun-2056 | | | 828 | | | | 826 | | | | 791 | |

| | | 2.25% | | Dec-2048 | | | 2,683 | | | | 2,665 | | | | 2,506 | |

| | | 2.30% | | Mar-2056 - Oct-2056 | | | 3,081 | | | | 3,054 | | | | 2,919 | |

| | | 2.31% | | Nov-2051 | | | 7,076 | | | | 7,076 | | | | 6,300 | |

| | | 2.32% | | Sep-2060 | | | 26,408 | | | | 27,743 | | | | 22,618 | |

| | | 2.35% | | Nov-2056 - Feb-2061 | | | 28,191 | | | | 28,990 | | | | 23,805 | |

| 12 |  |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Ginnie Mae Securities continued

| | | Interest Rate | | Maturity Date | | Face Amount | | Amortized Cost | | Value |

| | | 2.37% | | Jan-2053 | | | 22,024 | | | | 22,158 | | | | 19,853 | |

| | | 2.40% | | Aug-2047 - Dec-2057 | | | 18,370 | | | | 18,769 | | | | 15,375 | |

| | | 2.45% | | Apr-2062 | | | 14,398 | | | | 14,621 | | | | 12,014 | |

| | | 2.50% | | Dec-2052 - Jan-2061 | | | 52,670 | | | | 53,435 | | | | 44,863 | |

| | | 2.58% | | May-2063 | | | 28,274 | | | | 29,146 | | | | 23,394 | |

| | | 2.60% | | Dec-2055 - Jun-2059 | | | 8,415 | | | | 8,437 | | | | 7,749 | |

| | | 2.62% | | Feb-2063 | | | 13,646 | | | | 14,122 | | | | 11,381 | |

| | | 2.64% | | Jan-2063 | | | 18,073 | | | | 18,578 | | | | 15,250 | |

| | | 2.65% | | Oct-2062 | | | 6,345 | | | | 6,493 | | | | 5,382 | |

| | | 2.67% | | Mar-2062 | | | 34,597 | | | | 35,369 | | | | 29,693 | |

| | | 2.70% | | May-2048 - Jul-2058 | | | 4,842 | | | | 4,844 | | | | 4,629 | |

| | | 2.72% | | Feb-2044 | | | 91 | | | | 93 | | | | 89 | |

| | | 2.74% | | Apr-2057 | | | 23,289 | | | | 25,167 | | | | 20,555 | |

| | | 2.75% | | Apr-2063 | | | 21,474 | | | | 22,325 | | | | 18,134 | |

| | | 2.78% | | Aug-2058 | | | 10,407 | | | | 11,258 | | | | 9,208 | |

| | | 2.79% | | Apr-2049 | | | 4,393 | | | | 4,427 | | | | 4,116 | |

| | | 2.80% | | Feb-2053 | | | 60,000 | | | | 57,386 | | | | 46,354 | |

| | | 2.80% | | Dec-2059 | | | 4,223 | | | | 4,170 | | | | 4,077 | |

| | | 2.82% | | Apr-2050 | | | 738 | | | | 750 | | | | 705 | |

| | | 2.94% | | Nov-2059 | | | 46,459 | | | | 51,382 | | | | 40,611 | |

| | | 2.98% | | Jun-2063 | | | 31,540 | | | | 32,626 | | | | 26,998 | |

| | | 3.00% | | May-2062 | | | 58,984 | | | | 63,505 | | | | 51,384 | |

| | | 3.03% | | Jan-2056 | | | 29,436 | | | | 31,205 | | | | 26,960 | |

| | | 3.05% | | May-2054 | | | 11,545 | | | | 11,588 | | | | 10,227 | |

| | | 3.17% | | Aug-2059 | | | 33,627 | | | | 36,988 | | | | 30,041 | |

| | | 3.25% | | Apr-2059 | | | 30,996 | | | | 29,861 | | | | 29,558 | |

| | | 3.25% | | Sep-2054 | | | 17,188 | | | | 17,058 | | | | 16,404 | |

| | | 3.26% | | Nov-2043 | | | 18 | | | | 18 | | | | 18 | |

| | | 3.27% | | Apr-2046 | | | 23,493 | | | | 24,628 | | | | 20,961 | |

| | | 3.30% | | Sep-2060 | | | 7,460 | | | | 7,633 | | | | 6,850 | |

| | | 3.33% | | May-2055 | | | 6,753 | | | | 6,437 | | | | 6,132 | |

| | | 3.34% | | Sep-2059 | | | 16,496 | | | | 16,787 | | | | 15,274 | |

| | | 3.35% | | Mar-2044 | | | 9,639 | | | | 9,319 | | | | 9,349 | |

| | | 3.36% | | May-2061 | | | 50,498 | | | | 55,800 | | | | 45,626 | |

| | | 3.38% | | Jan-2060 | | | 57,656 | | | | 57,661 | | | | 53,961 | |

| | | 3.39% | | Feb-2059 | | | 13,816 | | | | 14,063 | | | | 12,925 | |

| | | 3.41% | | Sep-2061 | | | 40,983 | | | | 42,482 | | | | 37,620 | |

| | | 3.43% | | Nov-2061 | | | 51,731 | | | | 53,259 | | | | 46,794 | |

| | | 3.48% | | Sep-2052 | | | 2,843 | | | | 2,929 | | | | 2,705 | |

| | | 3.50% | | Jan-2054 | | | 3,168 | | | | 3,155 | | | | 3,122 | |

| | | 3.53% | | Apr-2042 | | | 15,024 | | | | 15,400 | | | | 14,344 | |

| | | 3.60% | | Apr-2061 | | | 33,175 | | | | 34,185 | | | | 30,542 | |

| | | 3.60% | | Jun-2057 | | | 13,203 | | | | 13,625 | | | | 12,720 | |

| | | 3.62% | | Dec-2057 | | | 27,647 | | | | 28,089 | | | | 26,377 | |

| | | 3.63% | | Dec-2045 | | | 8,257 | | | | 7,993 | | | | 8,030 | |

| | | 3.65% | | Oct-2058 | | | 9,966 | | | | 10,103 | | | | 9,535 | |

| | | 3.67% | | Nov-2035 | | | 12,227 | | | | 12,489 | | | | 11,881 | |

| | | 3.74% | | Aug-2059 | | | 15,169 | | | | 15,438 | | | | 14,492 | |

| | | 3.75% | | Nov-2060 | | | 11,001 | | | | 11,323 | | | | 10,295 | |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Ginnie Mae Securities continued

| | | Interest Rate | | | Maturity Date | | Face Amount | | Amortized Cost | | Value |

| | | 3.78 | % | | | | | Aug-2060 | | | 38,506 | | | | 38,769 | | | | 35,920 | |

| | | 3.92 | % | | | | | Aug-2039 | | | 37,989 | | | | 39,591 | | | | 36,867 | |

| | | 4.00 | % | | | | | Nov-2057 | | | 24,162 | | | | 25,104 | | | | 22,742 | |

| | | 4.10 | % | | | | | May-2051 | | | 3,684 | | | | 3,951 | | | | 3,617 | |

| | | 4.35 | % | | | | | Dec-2060 | | | 2,236 | | | | 2,274 | | | | 2,179 | |

| | | 4.37 | % | | | | | Feb-2034 | | | 22,572 | | | | 24,253 | | | | 21,781 | |

| | | 4.45 | % | | | | | Jun-2055 | | | 2,420 | | | | 2,338 | | | | 2,413 | |

| | | 4.53 | % | | | | | Jan-2061 | | | 14,535 | | | | 14,952 | | | | 14,207 | |

| | | 4.63 | %1 | | | | | Sep-2037 | | | 1,500 | | | | 1,471 | | | | 1,501 | |

| | | 4.90 | %1 | | | | | Mar-2044 | | | 1,000 | | | | 992 | | | | 1,000 | |

| | | 5.25 | % | | | | | Apr-2037 | | | 15,290 | | | | 15,286 | | | | 15,256 | |

| | | | | | | | | | | | 1,952,693 | | | | 1,998,685 | | | | 1,680,892 | |

| Total Ginnie Mae Securities | | | | | | $ | 1,955,833 | | | $ | 2,001,841 | | | $ | 1,684,053 | |

Ginnie Mae Construction Securities | 2.6% of net assets

| | | Interest Rates2 | | | | Unfunded | | | | | | |

| | | Permanent | | Construction | | Maturity Date | | Commitments3 | | Face Amount | | Amortized Cost | | Value |

| Multifamily | | 2.25 | % | | 4.10 | % | | Apr-2064 | | $ | 43,979 | | | $ | 21,949 | | | $ | 23,958 | | | $ | 8,403 | |

| | | 2.59 | % | | 3.59 | % | | Aug-2064 | | | 26,047 | | | | 16,266 | | | | 17,222 | | | | 8,281 | |

| | | 3.05 | % | | 3.05 | % | | Dec-2063 | (Level 3) | | 52,651 | | | | 52,092 | | | | 53,133 | | | | 45,828 | |

| | | 3.24 | % | | 3.24 | % | | Jan-2064 | | | 2,327 | | | | 24,104 | | | | 24,637 | | | | 20,587 | |

| | | 3.60 | % | | 5.70 | % | | Jan-2064 | | | 259 | | | | 4,649 | | | | 4,815 | | | | 4,159 | |

| | | 3.69 | % | | 4.75 | % | | Nov-2063 | | | 2,619 | | | | 9,885 | | | | 10,052 | | | | 8,700 | |

| | | 3.75 | % | | 5.35 | % | | Jan-2064 | | | 290 | | | | 5,512 | | | | 5,705 | | | | 4,999 | |

| | | 4.08 | % | | 4.08 | % | | Feb-2064 | | | 1,150 | | | | 14,277 | | | | 14,617 | | | | 13,268 | |

| | | 4.14 | % | | 4.14 | % | | Sep-2063 | | | — | | | | 11,197 | | | | 11,398 | | | | 10,539 | |

| | | 5.17 | % | | 8.75 | % | | Jul-2064 | | | 280 | | | | 10,470 | | | | 10,600 | | | | 11,069 | |

| | | 5.90 | % | | 5.90 | % | | Aug-2065 | | | 4,085 | | | | 25 | | | | 135 | | | | 300 | |

| | | 6.15 | % | | 6.15 | % | | Apr-2065 - Aug-2065 | | | 5,871 | | | | 28,501 | | | | 29,232 | | | | 31,828 | |

| | | | | | | | | | | | 139,558 | | | | 198,927 | | | | 205,504 | | | | 167,961 | |

| Forward Commitments | | 5.34 | % | | 9.75 | % | | Sep-2065 | | | 20,957 | | | | — | | | | 733 | | | | 1,362 | |

| | | 5.92 | % | | 5.92 | % | | May-2065 - Jan-2066 | | | 22,479 | | | | — | | | | (825 | ) | | | 1,672 | |

| | | 6.10 | % | | 7.65 | % | | Aug-2065 | | | 2,171 | | | | — | | | | 66 | | | | 224 | |

| | | | | | | | | | | | 45,607 | | | | — | | | | (26 | ) | | | 3,258 | |

| Total Ginnie Mae Construction Securities | | | | $ | 185,165 | | | $ | 198,927 | | | $ | 205,478 | | | $ | 171,219 | |

Fannie Mae Securities | 44.3% of net assets

| | | | | | | | | Unfunded | | | | | | |

| | | Interest Rate4 | | | Maturity Date | | Commitments3 | | Face Amount | | Amortized Cost | | Value |

| Single Family | | 2.50 | % | | | | | May-2050 - Jan-2052 | | $ | — | | | $ | 111,309 | | | $ | 115,403 | | | $ | 95,411 | |

| | | 2.50 | % | | | | | Jan-2052 | | | — | | | | 43,281 | | | | 43,435 | | | | 37,180 | |

| | | 3.00 | % | | | | | Apr-2031 - Mar-2052 | | | — | | | | 129,519 | | | | 133,933 | | | | 116,096 | |

| | | 3.00 | % | | | | | Oct-2051 | | | — | | | | 42,756 | | | | 44,748 | | | | 38,049 | |

| | | 3.50 | % | | | | | Jan-2042 - Feb-2052 | | | — | | | | 93,007 | | | | 95,654 | | | | 86,462 | |

| | | 3.50 | % | | | | | Jan-2052 | | | — | | | | 36,320 | | | | 37,208 | | | | 33,330 | |

| | | 4.00 | % | | | | | Jul-2024 - Jul-2052 | | | — | | | | 45,072 | | | | 45,708 | | | | 43,191 | |

| | | 4.00 | % | | | | | Jun-2052 | | | — | | | | 32,725 | | | | 32,317 | | | | 31,028 | |

| | | 4.50 | % | | | | | May-2024 - Oct-2052 | | | — | | | | 123,506 | | | | 122,869 | | | | 120,764 | |

| | | 4.76 | %12M SOFR+227 | | | Apr-2034 | | | — | | | | 347 | | | | 350 | | | | 351 | |

| 14 |  |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Fannie Mae Securities continued

| | | | | | | | Unfunded | | | | | | |

| | | Interest Rate4 | | Maturity Date | | Commitments3 | | Face Amount | | Amortized Cost | | Value |

| | 4.86% | | 6M SOFR+204 | | Aug-2033 | | | — | | | | 106 | | | | 105 | | | | 106 | |

| | | 5.00% | | | | May-2034 - Jun-2053 | | | — | | | | 132,038 | | | | 132,760 | | | | 131,418 | |

| | | 5.23% | | 1Y UST+223 | | May-2033 | | | — | | | | 111 | | | | 111 | | | | 112 | |

| | | 5.37% | | 12M SOFR+224 | | Feb-2045 | | | — | | | | 1,662 | | | | 1,685 | | | | 1,686 | |

| | | 5.50% | | | | Sep-2032 - Jul-2053 | | | — | | | | 41,937 | | | | 41,870 | | | | 42,382 | |

| | | 5.70% | | 1M SOFR+36 | | Mar-2037 | | | — | | | | 90 | | | | 89 | | | | 88 | |

| | | 5.74% | | 12M SOFR+221 | | Jul-2033 | | | — | | | | 98 | | | | 97 | | | | 99 | |

| | | 5.77% | | 1M SOFR+43 | | Jun-2037 | | | — | | | | 438 | | | | 438 | | | | 430 | |

| | | 5.81% | | 1Y UST+220 | | Aug-2033 | | | — | | | | 322 | | | | 322 | | | | 326 | |

| | | 5.85% | | 1M SOFR+51 | | Apr-2037 | | | — | | | | 212 | | | | 212 | | | | 208 | |

| | | 5.87% | | 12M SOFR+234 | | Nov-2034 | | | — | | | | 127 | | | | 128 | | | | 128 | |

| | | 5.91% | | 1M SOFR+57 | | Oct-2042 | | | — | | | | 1,279 | | | | 1,283 | | | | 1,244 | |

| | | 5.91% | | 12M SOFR+241 | | Oct-2042 | | | — | | | | 1,161 | | | | 1,179 | | | | 1,182 | |

| | | 5.95% | | 1M SOFR+61 | | Jun-2042 | | | — | | | | 2,876 | | | | 2,877 | | | | 2,805 | |

| | | 5.97% | | 1Y UST+222 | | Jul-2033 | | | — | | | | 236 | | | | 237 | | | | 239 | |

| | | 6.00% | | | | Nov-2028 - Aug-2053 | | | — | | | | 27,785 | | | | 27,880 | | | | 28,274 | |

| | | 6.00% | | 1M SOFR+66 | | Mar-2042 | | | — | | | | 1,520 | | | | 1,521 | | | | 1,492 | |

| | | 6.05% | | 1M SOFR+71 | | Oct-2043 | | | — | | | | 3,018 | | | | 3,029 | | | | 2,955 | |

| | | 6.22% | | 1Y UST+222 | | Aug-2033 | | | — | | | | 157 | | | | 157 | | | | 159 | |

| | | 6.50% | | | | Sep-2028 - Nov-2053 | | | — | | | | 20,174 | | | | 20,047 | | | | 20,743 | |

| | | 7.00% | | | | Sep-2027 - May-2032 | | | — | | | | 381 | | | | 381 | | | | 396 | |

| | | 7.41% | | 6M SOFR+198 | | Nov-2033 | | | — | | | | 596 | | | | 596 | | | | 600 | |

| | | 7.50% | | | | Mar-2030 - Jun-2030 | | | — | | | | 4 | | | | 4 | | | | 4 | |

| | | 8.00% | | | | Aug-2030 - May-2031 | | | — | | | | 29 | | | | 29 | | | | 31 | |

| | | | | | | | | | — | | | | 894,199 | | | | 908,662 | | | | 838,969 | |

| Multifamily | | 1.06% | | | | Dec-2027 | | | — | | | | 20,959 | | | | 20,963 | | | | 18,388 | |

| | | 1.17% | | | | Aug-2030 - Nov-2030 | | | — | | | | 34,290 | | | | 34,292 | | | | 27,865 | |

| | | 1.22% | | | | Aug-2028 - Jul-2030 | | | — | | | | 35,610 | | | | 35,679 | | | | 29,753 | |

| | | 1.25% | | | | Jul-2030 | | | — | | | | 37,949 | | | | 38,033 | | | | 31,142 | |

| | | 1.26% | | | | Jan-2031 | | | — | | | | 25,000 | | | | 24,996 | | | | 20,579 | |

| | | 1.27% | | | | Jul-2030 | | | — | | | | 14,235 | | | | 14,301 | | | | 11,725 | |

| | | 1.31% | | | | Aug-2030 | | | — | | | | 4,319 | | | | 4,359 | | | | 3,585 | |

| | | 1.32% | | | | Aug-2030 | | | — | | | | 21,000 | | | | 21,184 | | | | 17,420 | |

| | | 1.38% | | | | Jul-2030 | | | — | | | | 10,500 | | | | 10,594 | | | | 8,711 | |

| | | 1.41% | | | | Jul-2030 | | | — | | | | 3,168 | | | | 3,189 | | | | 2,669 | |

| | | 1.46% | | | | Jul-2030 | | | — | | | | 7,244 | | | | 7,309 | | | | 6,129 | |

| | | 1.47% | | | | Jul-2030 - Dec-2030 | | | — | | | | 15,425 | | | | 15,515 | | | | 12,502 | |

| | | 1.50% | | | | Aug-2030 | | | — | | | | 1,122 | | | | 1,140 | | | | 948 | |

| | | 1.52% | | | | Jul-2032 | | | — | | | | 14,158 | | | | 14,245 | | | | 11,332 | |

| | | 1.53% | | | | Jul-2032 | | | — | | | | 10,500 | | | | 10,614 | | | | 8,446 | |

| | | 1.55% | | | | Jul-2032 | | | — | | | | 20,333 | | | | 20,555 | | | | 16,455 | |

| | | 1.57% | | | | Aug-2037 | | | — | | | | 46,073 | | | | 46,242 | | | | 33,503 | |

| | | 1.57% | | | | Jan-2031 | | | — | | | | 21,950 | | | | 22,001 | | | | 18,280 | |

| | | 1.58% | | | | Oct-2031 | | | — | | | | 57,950 | | | | 58,143 | | | | 45,969 | |

| | | 1.65% | | | | Jul-2030 | | | — | | | | 1,215 | | | | 1,234 | | | | 1,038 | |

| | | 1.71% | | | | Sep-2035 - Nov-2035 | | | — | | | | 25,605 | | | | 25,846 | | | | 19,200 | |

| | | 1.74% | | | | Mar-2033 | | | — | | | | 6,160 | | | | 6,224 | | | | 4,906 | |

| | | 1.76% | | | | Aug-2031 - Dec-2036 | | | — | | | | 52,899 | | | | 53,026 | | | | 43,165 | |

| | | 1.77% | | | | Sep-2035 | | | — | | | | 3,270 | | | | 3,324 | | | | 2,468 | |

| | | 1.82% | | | | Jul-2035 | | | — | | | | 4,508 | | | | 4,537 | | | | 3,535 | |

| | | 1.88% | | | | Nov-2031 | | | — | | | | 25,400 | | | | 25,426 | | | | 20,640 | |

| | | 1.94% | | | | Apr-2035 | | | — | | | | 6,400 | | | | 6,479 | | | | 5,124 | |

| | | 2.00% | | | | Apr-2031 | | | — | | | | 18,000 | | | | 18,437 | | | | 15,260 | |

| | | 2.09% | | | | May-2032 - Jul-2050 | | | — | | | | 21,792 | | | | 22,002 | | | | 16,411 | |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Fannie Mae Securities continued

| | | | | | | | | Unfunded | | | | | | |

| | | Interest Rate4 | | | | Maturity Date | | Commitments3 | | Face Amount | | Amortized Cost | | Value |

| | | 2.16% | | | | Sep-2050 | | | — | | | | 14,200 | | | | 14,346 | | | | 8,482 | |

| | | 2.21% | | | | Nov-2039 | | | — | | | | 45,530 | | | | 45,530 | | | | 34,029 | |

| | | 2.33% | | | | Nov-2029 - Feb-2030 | | | — | | | | 17,774 | | | | 17,800 | | | | 15,734 | |

| | | 2.41% | | | | Apr-2051 | | | — | | | | 3,645 | | | | 3,679 | | | | 2,644 | |

| | | 2.43% | | | | Nov-2031 | | | — | | | | 18,655 | | | | 18,660 | | | | 15,968 | |

| | | 2.46% | | | | Aug-2026 - Jan-2038 | | | — | | | | 55,890 | | | | 55,960 | | | | 49,274 | |

| | | 2.47% | | | | Dec-2051 | | | — | | | | 13,128 | | | | 13,300 | | | | 9,601 | |

| | | 2.49% | | | | Dec-2026 - Nov-2031 | | | — | | | | 26,703 | | | | 26,738 | | | | 24,108 | |

| | | 2.53% | | | | Jan-2030 | | | — | | | | 20,550 | | | | 20,633 | | | | 18,174 | |

| | | 2.55% | | | | Sep-2026 - Mar-2030 | | | — | | | | 25,164 | | | | 25,204 | | | | 23,193 | |

| | | 2.56% | | | | Sep-2038 - Dec-2051 | | | — | | | | 24,075 | | | | 24,104 | | | | 18,507 | |

| | | 2.57% | | | | Mar-2042 | | | — | | | | 25,155 | | | | 25,165 | | | | 18,458 | |

| | | 2.61% | | | | Nov-2026 | | | — | | | | 9,785 | | | | 9,805 | | | | 9,217 | |

| | | 2.67% | | | | Aug-2029 | | | — | | | | 37,700 | | | | 37,873 | | | | 34,595 | |

| | | 2.70% | | | | Nov-2025 | | | — | | | | 13,985 | | | | 13,985 | | | | 13,475 | |

| | | 2.76% | | | | Oct-2031 | | | — | | | | 10,189 | | | | 10,282 | | | | 9,118 | |

| | | 2.85% | | | | Aug-2031 | | | — | | | | 8,760 | | | | 8,790 | | | | 7,767 | |

| | | 2.91% | | | | Jun-2031 | | | — | | | | 25,000 | | | | 25,076 | | | | 22,560 | |

| | | 2.92% | | | | Jun-2027 | | | — | | | | 64,036 | | | | 64,055 | | | | 60,954 | |

| | | 2.92% | | | | Apr-2028 | | | — | | | | 15,195 | | | | 15,216 | | | | 14,329 | |

| | | 2.93% | | | | Sep-2027 - Apr-2038 | | | — | | | | 58,189 | | | | 58,241 | | | | 51,302 | |

| | | 2.94% | | | | Jun-2027 - Jul-2039 | | | — | | | | 28,843 | | | | 28,863 | | | | 27,450 | |

| | | 2.96% | | | | Sep-2034 | | | — | | | | 20,000 | | | | 20,540 | | | | 16,960 | |

| | | 2.97% | | | | Sep-2034 | | | — | | | | 12,756 | | | | 12,900 | | | | 11,229 | |

| | | 2.99% | | | | Jun-2025 | | | — | | | | 2,487 | | | | 2,487 | | | | 2,418 | |

| | | 3.00% | | | | May-2027 | | | — | | | | 6,187 | | | | 6,190 | | | | 5,885 | |

| | | 3.01% | | | | Apr-2052 | | | — | | | | 7,293 | | | | 7,297 | | | | 5,712 | |

| | | 3.02% | | | | Jun-2027 | | | — | | | | 3,507 | | | | 3,509 | | | | 3,350 | |

| | | 3.04% | | | | Apr-2030 | | | — | | | | 24,378 | | | | 24,409 | | | | 22,668 | |

| | | 3.05% | | | | Apr-2030 | | | — | | | | 25,030 | | | | 25,041 | | | | 23,278 | |

| | | 3.12% | | | | Apr-2030 | | | — | | | | 12,313 | | | | 12,315 | | | | 11,428 | |

| | | 3.13% | | | | May-2026 | | | — | | | | 3,100 | | | | 3,110 | | | | 2,985 | |

| | | 3.14% | | | | Apr-2029 | | | — | | | | 7,419 | | | | 7,425 | | | | 7,003 | |

| | | 3.17% | | | | Jun-2029 | | | — | | | | 22,345 | | | | 22,399 | | | | 21,030 | |

| | | 3.18% | | | | May-2035 | | | — | | | | 8,562 | | | | 8,634 | | | | 7,927 | |

| | | 3.21% | | | | May-2030 | | | — | | | | 6,247 | | | | 6,284 | | | | 5,828 | |

| | | 3.24% | | | | May-2052 | | | — | | | | 6,333 | | | | 6,454 | | | | 5,111 | |

| | | 3.30% | | | | May-2029 | | | — | | | | 3,518 | | | | 3,593 | | | | 3,386 | |

| | | 3.31% | | | | Oct-2027 | | | — | | | | 14,669 | | | | 14,697 | | | | 14,098 | |

| | | 3.36% | | | | Oct-2029 | | | — | | | | 10,212 | | | | 10,214 | | | | 9,720 | |

| | | 3.40% | | | | Oct-2026 | | | — | | | | 2,655 | | | | 2,657 | | | | 2,578 | |

| | | 3.42% | | | | Apr-2035 | | | — | | | | 4,899 | | | | 4,943 | | | | 4,469 | |

| | | 3.50% | | | | Aug-2039 | | | — | | | | 13,029 | | | | 13,029 | | | | 11,531 | |

| | | 3.63% | | | | Jul-2035 | | | — | | | | 20,848 | | | | 20,866 | | | | 19,233 | |

| | | 3.68% | | | | Jul-2028 | | | — | | | | 11,769 | | | | 11,996 | | | | 11,262 | |

| | | 3.70% | | | | Oct-2033 | | | — | | | | 19,865 | | | | 19,919 | | | | 18,756 | |

| | | 3.91% | | | | Aug-2032 | | | — | | | | 26,250 | | | | 26,511 | | | | 25,256 | |

| | | 4.05% | | | | Jun-2030 | | | — | | | | 10,632 | | | | 10,522 | | | | 10,423 | |

| | | 4.11% | | | | Aug-2032 | | | — | | | | 15,627 | | | | 15,690 | | | | 15,090 | |

| | | 4.31% | | | | Jun-2033 | | | — | | | | 8,587 | | | | 8,612 | | | | 8,517 | |

| | | 4.32% | | | | Mar-2028 | | | — | | | | 41,707 | | | | 41,813 | | | | 41,070 | |

| | | 4.37% | | | | Jun-2033 | | | — | | | | 21,805 | | | | 21,830 | | | | 21,712 | |

| | | 4.39% | | | | Feb-2030 | | | — | | | | 21,148 | | | | 21,098 | | | | 20,766 | |

| | | 4.48% | | | | Aug-2030 | | | — | | | | 20,915 | | | | 20,915 | | | | 21,006 | |

| 16 |  |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Fannie Mae Securities continued

| | | | | | | | | Unfunded | | | | | | |

| | | Interest Rate4 | | Maturity Date | | Commitments3 | | Face Amount | | Amortized Cost | | Value |

| | | 4.52% | | | | Sep-2033 | | | — | | | | 11,361 | | | | 11,257 | | | | 11,447 | |

| | | 4.55% | | | | Jul-2030 | | | — | | | | 10,699 | | | | 10,720 | | | | 10,787 | |

| | | 4.56% | | | | Feb-2028 | | | — | | | | 29,834 | | | | 29,889 | | | | 29,650 | |

| | | 4.69% | | | | Feb-2030 - Jun-2035 | | | — | | | | 19,343 | | | | 19,388 | | | | 19,492 | |

| | | 4.74% | | | | Sep-2033 | | | — | | | | 13,405 | | | | 13,439 | | | | 13,734 | |

| | | 4.76% | | | | Sep-2030 | | | — | | | | 7,757 | | | | 7,760 | | | | 7,904 | |

| | | 4.80% | | | | Oct-2052 | | | — | | | | 12,296 | | | | 12,332 | | | | 11,821 | |

| | | 4.82% | | | | Jul-2030 | | | — | | | | 4,860 | | | | 4,864 | | | | 4,973 | |

| | | 4.86% | | | | Jun-2033 | | | — | | | | 10,000 | | | | 10,077 | | | | 10,070 | |

| | | 4.88% | | | | Jul-2030 | | | — | | | | 11,665 | | | | 11,853 | | | | 11,981 | |

| | | 4.96% | | | | Aug-2033 | | | — | | | | 3,465 | | | | 3,465 | | | | 3,510 | |

| | | 4.99% | | | | Apr-2033 | | | — | | | | 22,738 | | | | 23,055 | | | | 23,113 | |

| | | 5.00% | | | | Sep-2033 | | | — | | | | 15,366 | | | | 15,400 | | | | 16,054 | |

| | | 5.02% | | | | Dec-2033 | | | — | | | | 5,222 | | | | 5,189 | | | | 5,472 | |

| | | 5.05% | | | | Oct-2030 | | | — | | | | 14,596 | | | | 14,668 | | | | 15,159 | |

| | | 5.06% | | | | Dec-2032 | | | — | | | | 46,805 | | | | 48,262 | | | | 48,967 | |

| | | 5.13% | | | | Sep-2028 | | | — | | | | 14,584 | | | | 14,753 | | | | 15,042 | |

| | | 5.16% | | | | Oct-2030 | | | — | | | | 8,020 | | | | 8,097 | | | | 8,375 | |

| | | 5.30% | | | | Aug-2029 - Sep-2033 | | | — | | | | 6,958 | | | | 7,018 | | | | 7,273 | |

| | | 5.35% | | | | Dec-2032 | | | — | | | | 11,954 | | | | 12,588 | | | | 12,710 | |

| | | 5.47% | | | | Nov-2033 | | | — | | | | 6,140 | | | | 6,235 | | | | 6,651 | |

| | | 5.52% | | | | Oct-2033 | | | — | | | | 3,860 | | | | 3,957 | | | | 4,193 | |

| | | 5.53% | | 1M SOFR+20 | | Nov-2031 | | | — | | | | 40,943 | | | | 40,947 | | | | 40,057 | |

| | | 5.54% | | 1M SOFR+21 | | Mar-2031 | | | — | | | | 23,855 | | | | 23,855 | | | | 23,366 | |

| | | 5.62% | | 1M SOFR+29 | | Feb-2029 | | | — | | | | 20,000 | | | | 20,004 | | | | 19,603 | |

| | | 5.69% | | | | Jun-2041 | | | — | | | | 4,077 | | | | 4,151 | | | | 4,128 | |

| | | 5.74% | | 1M SOFR+40 | | Feb-2028 | | | — | | | | 30,013 | | | | 30,013 | | | | 29,548 | |

| | | 5.75% | | | | Jun-2041 | | | — | | | | 1,981 | | | | 2,022 | | | | 2,026 | |

| | | 5.76% | | 1M SOFR+42 | | Mar-2028 | | | — | | | | 37,793 | | | | 37,792 | | | | 37,228 | |

| | | 5.79% | | 1M SOFR+45 | | Jan-2028 | | | — | | | | 22,425 | | | | 22,425 | | | | 22,120 | |

| | | 5.80% | | 1M SOFR+46 | | Dec-2027 | | | — | | | | 17,727 | | | | 17,727 | | | | 17,497 | |

| | | 5.80% | | 1M SOFR+47 | | Jun-2029 | | | — | | | | 70,000 | | | | 70,014 | | | | 69,879 | |

| | | 5.82% | | 1M SOFR+49 | | May-2032 | | | — | | | | 28,526 | | | | 28,529 | | | | 28,520 | |

| | | 5.85% | | 1M SOFR+52 | | Jun-2032 | | | — | | | | 30,975 | | | | 30,975 | | | | 30,985 | |

| | | 5.94% | | 1M SOFR+60 | | Apr-2034 | | | — | | | | 24,882 | | | | 24,370 | | | | 24,613 | |

| | | 5.96% | | | | Jan-2029 | | | — | | | | 185 | | | | 185 | | | | 184 | |

| | | 6.03% | | 1M SOFR+69 | | Jun-2029 | | | — | | | | 41,302 | | | | 41,302 | | | | 41,327 | |

| | | 6.03% | | 1M SOFR+69 | | May-2029 | | | — | | | | 17,364 | | | | 17,368 | | | | 17,373 | |

| | | 6.18% | | 1M SOFR+85 | | Nov-2032 | | | — | | | | 15,800 | | | | 15,804 | | | | 15,775 | |

| | | | | | | | | | — | | | | 2,284,053 | | | | 2,292,842 | | | | 2,080,379 | |

| Forward Commitments | | 2.58% | | | | Jul-2040 | | | 11,700 | | | | — | | | | — | | | | (2,505 | ) |

| | | 2.59% | | | | Feb-2039 - Mar-2040 | | | 35,409 | | | | — | | | | — | | | | (7,365 | ) |

| | | 2.72% | | | | Jul-2040 | | | 27,794 | | | | — | | | | 278 | | | | (5,765 | ) |

| | | 4.47% | | | | Jul-2041 | | | 10,058 | | | | — | | | | — | | | | (618 | ) |

| | | | | | | | | | 84,961 | | | | — | | | | 278 | | | | (16,253 | ) |

| Total Fannie Mae Securities | | | | | | | $84,961 | | | | $3,178,252 | | | | $3,201,782 | | | | $2,903,095 | |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Freddie Mac Securities | 7.8% of net assets

| | | | | | | Unfunded | | | | | | |

| | | Interest Rate4 | | Maturity Date | | Commitments3 | | Face Amount | | Amortized Cost | | Value |

| Single Family | | 2.50% | | | | Jan-2043 - Aug-2046 | | | $ — | | | | $ 5,350 | | | | $ 5,403 | | | | $ 4,688 | |

| | | 3.00% | | | | Aug-2042 - Sep-2046 | | | — | | | | 21,948 | | | | 22,290 | | | | 20,147 | |

| | | 3.50% | | | | Jan-2026 - Oct-2046 | | | — | | | | 40,232 | | | | 40,994 | | | | 37,881 | |

| | | 4.00% | | | | Nov-2024 - Aug-2047 | | | — | | | | 37,987 | | | | 39,256 | | | | 36,616 | |

| | | 4.50% | | | | Jan-2038 - Dec-2044 | | | — | | | | 10,392 | | | | 10,750 | | | | 10,377 | |

| | | 5.00% | | | | Jun-2026 - Mar-2041 | | | — | | | | 1,596 | | | | 1,592 | | | | 1,625 | |

| | | 5.35% | | 1Y UST+223 | | Jun-2033 | | | — | | | | 27 | | | | 27 | | | | 28 | |

| | | 5.50% | | | | Apr-2033 - Jul-2038 | | | — | | | | 1,362 | | | | 1,360 | | | | 1,405 | |

| | | 5.75% | | 1M SOFR+41 | | Feb-2036 | | | — | | | | 202 | | | | 202 | | | | 199 | |

| | | 5.78% | | 1M SOFR+44 | | May-2037 | | | — | | | | 66 | | | | 66 | | | | 65 | |

| | | 5.80% | | 1M SOFR+46 | | Apr-2036 - Jan-2043 | | | — | | | | 1,948 | | | | 1,949 | | | | 1,885 | |

| | | 5.85% | | 1M SOFR+51 | | Aug-2043 | | | — | | | | 1,773 | | | | 1,772 | | | | 1,722 | |

| | | 5.93% | | 1M SOFR+59 | | Oct-2040 | | | — | | | | 1,349 | | | | 1,348 | | | | 1,324 | |

| | | 5.95% | | 1M SOFR+61 | | Oct-2040 - Jun-2044 | | | — | | | | 4,777 | | | | 4,779 | | | | 4,661 | |

| | | 6.00% | | | | Dec-2033 - Oct-2037 | | | — | | | | 2,074 | | | | 2,087 | | | | 2,151 | |

| | | 6.00% | | 1M SOFR+66 | | Nov-2040 | | | — | | | | 1,214 | | | | 1,220 | | | | 1,187 | |

| | | 6.02% | | 12M SOFR+250 | | Jul-2035 | | | — | | | | 91 | | | | 91 | | | | 92 | |

| | | 6.12% | | 1M SOFR+78 | | Aug-2037 | | | — | | | | 1,470 | | | | 1,480 | | | | 1,463 | |

| | | 6.34% | | 1Y UST+223 | | Oct-2033 | | | — | | | | 116 | | | | 116 | | | | 117 | |

| | | 6.50% | | | | Apr-2028 - Nov-2037 | | | — | | | | 268 | | | | 270 | | | | 282 | |

| | | 7.00% | | | | Apr-2028 - Mar-2030 | | | — | | | | 14 | | | | 14 | | | | 15 | |

| | | 7.50% | | | | Aug-2029 - Apr-2031 | | | — | | | | 13 | | | | 13 | | | | 14 | |

| | | 8.50% | | | | Jul-2024 | | | — | | | | 3 | | | | 3 | | | | 3 | |

| | | | | | | | | | — | | | | 134,272 | | | | 137,082 | | | | 127,947 | |

| Multifamily | | 2.04% | | | | May-2050 | | | — | | | | 19,700 | | | | 20,136 | | | | 13,840 | |

| | | 2.40% | | | | Jun-2031 | | | — | | | | 7,444 | | | | 7,504 | | | | 6,523 | |

| | | 2.42% | | | | Jun-2031 | | | — | | | | 11,768 | | | | 11,874 | | | | 10,326 | |

| | | 3.28% | | | | Dec-2029 | | | — | | | | 15,551 | | | | 15,649 | | | | 14,557 | |

| | | 3.34% | | | | Dec-2029 | | | — | | | | 9,230 | | | | 9,302 | | | | 8,666 | |

| | | 3.35% | | | | Oct-2033 | | | — | | | | 33,450 | | | | 33,349 | | | | 30,970 | |

| | | 3.50% | | | | Jan-2026 | | | — | | | | 17,677 | | | | 17,693 | | | | 17,244 | |

| | | 3.60% | | | | Apr-2030 | | | — | | | | 24,106 | | | | 24,470 | | | �� | 22,838 | |

| | | 3.68% | | | | Oct-2025 | | | — | | | | 10,000 | | | | 10,019 | | | | 9,798 | |

| | | 4.19% | | | | Jul-2033 | | | — | | | | 13,015 | | | | 12,036 | | | | 12,399 | |

| | | 4.25% | | | | Jan-2028 | | | — | | | | 93,650 | | | | 92,809 | | | | 92,076 | |

| | | 4.36% | | | | Dec-2029 | | | — | | | | 9,198 | | | | 9,147 | | | | 9,093 | |

| | | 4.83% | | | | Jan-2039 | | | — | | | | 9,935 | | | | 10,027 | | | | 10,107 | |

| | | 4.90% | | | | Dec-2032 | | | — | | | | 10,207 | | | | 10,186 | | | | 10,240 | |

| | | 5.53% | | 1M SOFR+20 | | Aug-2031 | | | — | | | | 23,345 | | | | 23,345 | | | | 22,919 | |

| | | 5.55% | | 1M SOFR+23 | | Jul-2027 | | | — | | | | 3,873 | | | | 3,873 | | | | 3,859 | |

| | | 5.57% | | 1M SOFR+24 | | Nov-2027 - Jun-2031 | | | — | | | | 57,111 | | | | 57,111 | | | | 56,145 | |

| | | 5.58% | | 1M SOFR+25 | | Dec-2030 | | | — | | | | 14,299 | | | | 14,299 | | | | 14,177 | |

| | | 5.63% | | 1M SOFR+30 | | Dec-2030 | | | — | | | | 12,248 | | | | 12,248 | | | | 12,132 | |

| | | 5.69% | | 1M SOFR+36 | | Oct-2030 | | | — | | | | 4,937 | | | | 4,937 | | | | 4,893 | |

| | | 5.71% | | 1M SOFR+37 | | Nov-2030 | | | — | | | | 8,849 | | | | 8,849 | | | | 8,797 | |

| | | 5.78% | | 1M SOFR+44 | | Oct-2030 | | | — | | | | 2,798 | | | | 2,798 | | | | 2,779 | |

| | | | | | | | | | — | | | | 412,391 | | | | 411,661 | | | | 394,378 | |

| Forward Commitments | | 2.38% | | | | Feb-2034 | | | 43,500 | | | | — | | | | 171 | | | | (6,383 | ) |

| | | 3.86% | | | | May-2040 | | | 27,450 | | | | — | | | | — | | | | (2,289 | ) |

| | | | | | | | | | 70,950 | | | | — | | | | 171 | | | | (8,672 | ) |

| Total Freddie Mac Securities | | | | | $70,950 | | | | $546,663 | | | | $548,914 | | | | $513,653 | |

| 18 |  |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

State Housing Finance Agency Securities | 7.2% of net assets

| | | Interest Rates2 | | | | |

| | Issuer | Permanent | Construction | Maturity Date | Face Amount | Amortized Cost | Value |

| Multifamily | Illinois Housing Development Auth | – | 0.40% | Dec-2024 | $ 470 | $ 470 | $ 460 |

| | City of St. Louis Park, MN | – | 2.93% | Jan-2026 | 20,577 | 20,576 | 20,435 |

| | Illinois Housing Development Auth | 2.06% | – | Jan-2042 | 27,175 | 27,178 | 20,300 |

| | Illinois Housing Development Auth | 2.07% | – | Jul-2041 | 84,895 | 84,894 | 60,149 |

| | Mass Housing | 2.60% | – | Jun-2063 | 26,250 | 26,250 | 16,287 |

| | Illinois Housing Development Auth | 2.65% | – | Jul-2062 | 21,455 | 21,484 | 14,082 |

| | NYC Housing Development Corp | 2.95% | – | Nov-2041 - Nov-2045 | 11,275 | 11,275 | 9,577 |

| | NYC Housing Development Corp | 3.05% | – | Nov-2046 | 13,000 | 13,000 | 9,008 |

| | NYC Housing Development Corp | 3.10% | – | Oct-2046 | 20,133 | 20,133 | 15,528 |

| | NYC Housing Development Corp | 3.25% | – | May-2050 | 11,845 | 11,870 | 9,504 |

| | Connecticut Housing Finance Auth | 3.25% | – | Nov-2049 | 10,240 | 10,240 | 8,635 |

| | Mass Housing5 | 3.30% | – | Dec-2059 | 8,340 | 8,345 | 6,272 |

| | NYC Housing Development Corp | 3.35% | – | Nov-2054 | 20,000 | 20,000 | 16,328 |

| | NYC Housing Development Corp | 3.45% | – | May-2059 | 20,000 | 20,000 | 16,519 |

| | NYC Housing Development Corp | 3.75% | – | May-2035 | 3,200 | 3,200 | 3,200 |

| | Mass Housing5 | 3.85% | – | Dec-2058 | 9,390 | 9,387 | 7,489 |

| | NYC Housing Development Corp | 3.95% | – | Nov-2043 | 12,800 | 12,800 | 12,537 |

| | NYC Housing Development Corp | 4.00% | – | Dec-2028 - Nov-2048 | 14,315 | 14,418 | 14,259 |

| | MassHousing | 4.13% | – | Dec-2036 | 5,000 | 5,000 | 5,000 |

| | NYC Housing Development Corp | 4.13% | – | Nov-2040 - Nov-2053 | 13,305 | 13,305 | 13,265 |

| | NYC Housing Development Corp | 4.20% | – | Dec-2039 | 8,305 | 8,305 | 8,306 |

| | NYC Housing Development Corp | 4.30% | – | Nov-2045 | 3,000 | 3,000 | 3,021 |

| | Chicago Housing Authority | 4.36% | – | Jan-2038 | 25,000 | 25,000 | 22,309 |

| | MassHousing | 4.50% | – | Jun-2056 | 45,000 | 45,000 | 44,999 |

| | MassHousing | 4.50% | – | Dec-2065 | 30,060 | 30,092 | 29,979 |

| | Mass Housing5 | 4.90% | – | Jun-2066 | 26,645 | 26,682 | 27,410 |

| | Mass Housing5 | 5.11% | – | Jun-2066 | 53,425 | 53,467 | 56,168 |

| Total State Housing Finance Agency Securities | $545,100 | $545,371 | $471,026 |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Commercial Mortgage-Backed Securities | 0.3% of net assets

| Issuer | Interest Rate | Maturity Date | Face Amount | Amortized Cost | Value |

| Citigroup | 3.62% | Jul-2047 | $ 8,000 | $ 8,151 | $ 7,863 |

| Deutsche Bank/UBS | 3.96% | Mar-2047 | 1,992 | 2,032 | 1,969 |

| Barclays/ JP Morgan | 4.00% | Apr-2047 | 1,129 | 1,150 | 1,123 |

| Cantor/Deutsche Bank | 4.01% | Apr-2047 | 10,481 | 10,682 | 10,363 |

| Cantor/Deutsche Bank | 4.24% | Feb-2047 | 970 | 988 | 968 |

| Total Commercial Mortgage Backed Securities | $22,572 | $23,003 | $22,286 |

Other Mutifamily Investments | 4.1% of net assets

| | Interest Rates2,4 | | Unfunded | Face | | |

| Issuer | Permanent | Construction | Maturity Date | Commitments3 | Amount | Amortized Cost | Value |

| Direct Loans | | | | | | | |

| Peregrine Apartments (Level 3) | – | 3.60% | | Jun-2024 - Dec-2024 | $ 2,419 | $ 19,337 | $ 19,356 | $ 18,940 |

| The Crest Apartments (Level 3) | – | 3.75% | | Dec-2023 - Jun-2024 | 1,478 | 11,837 | 11,833 | 11,561 |

| Ladder 260 - Tax Exempt (Level 3) | – | 4.04% | | Nov-2025 | 1,930 | 6,232 | 6,227 | 5,963 |

| 99 Ocean (Level 3) | – | 4.05% | | Oct-2024 | 2,086 | 49,914 | 49,702 | 48,805 |

| Wilder Square (Level 3) | – | 5.26% | | Mar-2024 | – | 8,023 | 8,023 | 7,977 |

| Hudson Exchange (Level 3) | – | 5.50% | | Jun-2027 | 42,857 | 7,143 | 7,037 | 7,478 |

| 400 Lake Shore (Level 3) | – | 7.26% | 80% of Overnight SOFR+300 | Dec-20586 | 39,276 | 10 | (282) | (130) |

| Soul (Level 3) | – | 7.34% | 1M SOFR+225 | Apr-2025 | 4,991 | 19,759 | 19,604 | 19,577 |

| San Cristina (Level 3) | – | 7.69% | 1M SOFR+260 | Sep-2024 | 3,472 | 14,000 | 13,915 | 13,926 |

| 18 Sixth Ave at Pacific Park (Level 3) | – | 7.69% | 1M Term SOFR+231 | Dec-2024 | 6,666 | 76,111 | 76,026 | 75,670 |

| 18 Sixth Ave at Pacific Park (Level 3) | – | 7.69% | 1M Term SOFR+231 | Dec-2024 | 2,829 | 14,393 | 14,379 | 14,301 |

| 311 W 42nd Street (Level 3) | – | 8.45% | 1M Term SOFR+311 | Nov-2024 | 23,667 | 26,333 | 26,192 | 26,373 |

| Granada (Level 3) | – | 11.44% | 1M SOFR+635 | Jan-2024 | – | 13,000 | 12,998 | 12,880 |

| | | | | 131,671 | 266,092 | 265,010 | 263,321 |

| Forward Commitments (Direct Loans) | | | | | | | |

| 400 Lake Shore (Level 3) | – | 7.26% | 80% of Overnight SOFR+300 | Dec-20536 | 15,714 | – | (116) | (56) |

| Soul (Level 3) | – | 7.94% | 1M SOFR+285 | Apr-2025 | 12,501 | – | (101) | (12) |

| Landmark Tower (Level 3) | – | 7.71% | | Jun-2027 | 18,660 | – | (93) | (103) |

| | | | | 46,875 | – | (310) | (171) |

| Privately Insured Construction/Permanent Mortgages7 | | | | | |

| Illinois Housing Development Auth | 6.20% | – | | Dec-2047 | – | 2,808 | 2,815 | 2,788 |

| Illinois Housing Development Auth | 6.40% | – | | Nov-2048 | – | 857 | 865 | 851 |

| | | – | 3,665 | 3,680 | 3,639 |

| Total Other Multifamily Investments | | $178,546 | $269,757 | $268,380 | $266,789 |

| 20 |  |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

United States Treasury Securities | 4.3% of net assets

| Interest Rate | Maturity Date | Face Amount | Amortized Cost | Value |

| 1.75% | Aug-2041 | $ 20,000 | $ 19,499 | $ 13,928 |

| 2.00% | Nov-2041 | 7,000 | 6,674 | 5,073 |

| 2.25% | May-2041 | 42,000 | 43,234 | 32,045 |

| 2.38% | Feb-2042 | 15,000 | 15,282 | 11,529 |

| 2.88% | May-2032 | 15,000 | 14,900 | 13,906 |

| 3.00% | Aug-2052 | 20,000 | 18,169 | 16,391 |

| 3.63% | Feb-2053 | 10,000 | 9,696 | 9,256 |

| 3.88% | Feb-2043 | 105,000 | 105,192 | 100,314 |

| 4.00% | Nov-2042 | 15,000 | 14,766 | 14,605 |

| 4.13% | Aug-2053 | 40,000 | 37,021 | 40,532 |

| 4.75% | Nov-2043 - Nov-2053 | 20,000 | 20,062 | 21,989 |

| Total United States Treasury Securities | | $ 309,000 | $ 304,495 | $ 279,568 |

| | | | | |

| Total Fixed Income Investments | | $7,153,943 | $7,227,836 | $6,432,220 |

Equity Investment in Wholly-Owned Subsidiary | Less than 0.01% of net assets

| Issuer | Face Amount (Cost) | Amount of Dividends or Interest | Value |

| HIT Advisers8 (Level 3) | $1 | $– | $334 |

| Total Equity Investment | $1 | $– | $334 |

Short-Term Investments | 1.7% of net assets

| Issuer | Interest Rate | Maturity Date | Face Amount | Amortized Cost | Value |

| Commercial Paper | | | | | |

| Halkin Finance | 5.33%9 | Jan-2024 | $ 40,000 | $ 39,994 | $ 39,994 |

| | | | | | |

| Blackrock Federal Funds | 5.26%10 | Jan-2024 | 69,333 | 69,333 | 69,333 |

| Total Short-Term Investments | | $ 109,333 | $ 109,327 | $ 109,327 |

| | | | | | |

| Total Investments | | | $7,263,277 | $7,337,164 | $6,541,881 |

Futures Contracts | Notional Amount 1.2% of net assets

| Description | Number of Contracts | Expiration Date | Notional Amount | Market Value | Unrealized Appreciation (Depreciation) |

| Futures Long | | | | | |

| CBOT Ultra 10-Year U.S. Treasury | 200 | Mar-2024 | $22,451 | $23,603 | $1,152 |

| CBOT U.S. Treasury Bond | 460 | Mar-2024 | 56,156 | 57,471 | 1,315 |

| Total Futures Contracts | | | | | $2,467 |

Schedule of Portfolio Investments

December 31, 2023 (dollars in thousands) continued

Footnotes

| 1 | Federally tax-exempt bonds collateralized by Ginnie Mae securities. |

| 2 | Construction interest rates are the rates charged to the borrower during the construction phase of the project. The permanent interest rates are charged to the borrower during the amortization period of the loan, unless the U.S. Department of Housing and Urban Development requires that such rates be charged earlier. |

| 3 | The HIT may make commitments, including forward commitments, in securities or loans that fund over time on a draw basis or fund at a single point in time. Generally, GNMA construction securities fund over a 12-to-24 month period. Funding periods for State Housing Agency construction securities and Direct Loans vary by project, but generally fund over a one-to-48 month period. Forward commitments generally settle within 12 months of the original commitment date. At period end, unfunded commitments totaled $519.6 million for which unrealized losses of $38.9 million are included in the related Value column of the Schedule of Portfolio Investments for such commitments. |

| 4 | For floating and variable rate securities the rate indicated is for the period end. With respect to these securities, the schedule also includes the reference rate and spread in basis points. |

| 5 | Securities exempt from registration under the Securities Act of 1933 and were privately placed directly by a state housing agency (a not-for-profit public agency) with the HIT. The securities are backed by mortgages and are general obligations of the state housing agency, and therefore secured by the full faith and credit of said agency. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities are considered liquid, under procedures established by and under the general supervision of the HIT’s Board of Trustees. |

| 6 | Date reflects the stated maturity date of the bond. However, the bond is subject to a mandatory tender for purchase in December 2027, which may be extended to December 2028 under certain conditions. |

| 7 | Loans insured by Ambac Assurance Corporation, are additionally backed by a repurchase option from the mortgagee for the benefit of the HIT. The repurchase price is defined as the unpaid principal balance of the loan plus all accrued unpaid interest due through the remittance date. The repurchase option can be exercised by the HIT in the event of a payment failure by Ambac Assurance Corporation. |

| 8 | The HIT has a participation interest in HIT Advisers, a Delaware limited liability company. HIT Advisers is a New York based adviser currently exempt from investment adviser registration in New York. The investment in HIT Advisers is valued by the HIT’s valuation committee in accordance with the fair value procedures adopted by the HIT’s Board of Trustees, and approximates carrying value of HIT Advisers and its subsidiary on a consolidated basis. The participation interest is not registered under the federal securities laws. |

| 9 | Rate indicated is the effective yield at the time of purchase. |

| 10 | Rate indicated is the annualized 1-day yield as of December 29, 2023. |

Key to Abbreviations

| SOFR | Secured Overnight Financing Rate |

| 22 |  |

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2023 (dollars in thousands)

| Investment income | $231,852 |

| | |

| Expenses | |

| | Non-officer salaries and fringe benefits | 8,544 |

| | Officer salaries and fringe benefits | 5,128 |

| | Investment management | 1,430 |

| | Marketing and sales promotion (12b-1) | 1,091 |

| | Legal fees | 458 |

| | Auditing, tax and accounting fees | 418 |

| | Consulting fees | 388 |

| | Insurance | 350 |

| | Trustee expenses | 81 |

| | Rental expenses | 590 |

| | General expenses | 2,099 |

| | Total expenses | 20,577 |

| | |

| Net investment Income | 211,275 |

| | |

| Net realized and unrealized gains (losses) on investments | |

| | Net realized gains (losses) on investments | (31,737) |

| | Net realized gains (losses) on futures | (3,897) |

| | Total net realized gains (losses) | (35,634) |

| | |

| | Net change in unrealized appreciation (depreciation) on investments | 143,313 |

| | Net change in unrealized appreciation (depreciation) on futures | 1,276 |

| | Total net change in unrealized gains (losses) | 144,589 |

| | Net realized and unrealized gains (losses) on investments | 108,955 |

| | |

| Net increase (decrease) in net assets resulting from operations | $320,230 |

See accompanying Notes to Financial Statements.

STATEMENT OF CHANGES IN NET ASSETS

For the Years Ended December 31, 2023 and 2022 (dollars in thousands)

Increase (decrease) in net assets from operations | 2023 | 2022 |

| | Net investment income | $ 211,275 | $ 145,844 |

| | Net realized gains (losses) | (35,634) | (46,299) |

| | Net change in unrealized appreciation (depreciation) | 144,589 | (1,062,497) |

| | Net increase (decrease) in net assets resulting from operations | 320,230 | (962,952) |

| | | |

| Distributions to participants or reinvested | (215,874) | (160,154) |

| | | |

| Increase (decrease) in net assets from unit transactions | | |

| | Proceeds from the sale of units of participation | 311,874 | 93,068 |

| | Dividend reinvestment of units of participation | 199,710 | 148,507 |

| | Payments for redemption of units of participation | (82,172) | (199,962) |

| | Net increase (decrease) from unit transactions | 429,412 | 41,613 |

| | | |

| | | |

| Total increase (decrease) in net assets | 533,768 | (1,081,493) |

| | | |

| Net assets | | |

| | Beginning of period | $ 6,025,063 | $ 7,106,556 |

| | End of period | $ 6,558,831 | $ 6,025,063 |

| | | |

| Unit information | | |

| | Units sold | 326,967 | 92,026 |

| | Distributions reinvested | 209,393 | 147,014 |

| | Units redeemed | (86,124) | (203,171) |

| | Increase in units outstanding | 450,236 | 35,869 |

See accompanying Notes to Financial Statements.

| 24 |  |

NOTES TO FINANCIAL STATEMENTS

Note 1. Summary of Significant Accounting Policies

The American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) Housing Investment Trust (HIT) is a common law trust created under the laws of the District of Columbia and is registered under the Investment Company Act of 1940, as amended (Investment Company Act), as a no-load, open-end investment company. The HIT has obtained certain exemptions from the requirements of the Investment Company Act that are described in the HIT’s Prospectus and Statement of Additional Information. Participation in the HIT is limited to eligible pension plans, state public funds and labor organizations, including health and welfare, general, voluntary employees’ benefit associations and other funds that have beneficiaries who are represented by labor organizations. The following is a summary of significant accounting policies followed by the HIT in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles (GAAP) in the United States. The HIT follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services—Investment Companies.

Investment Valuation