UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number: 811-3493

American Federation of Labor and

Congress of Industrial Organizations

Housing Investment Trust

(Exact name of registrant as specified in charter)

1227 25th Street, N.W., Suite 500

Washington, D.C. 20037

(Address of principal executive offices) (Zip code)

Corey F. Rose, Esq.

Dechert LLP

1900 K Street, NW

Washington, DC 20006-1110

(Name and address of agent for service)

(202) 331-8055

(Registrant’s telephone number, including area code)

Date of fiscal year end: December 31

Date of reporting period: January 1, 2022 – June 30, 2022

| Item 1. | Reports to Stockholders. |

A copy of the 2022 Semi-Annual Report (the “Report”) of the AFL-CIO Housing Investment Trust (the “Trust” or “Registrant”) transmitted to Trust participants pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (17 CFR 270.30e-1) (the “Act”), is included herewith.

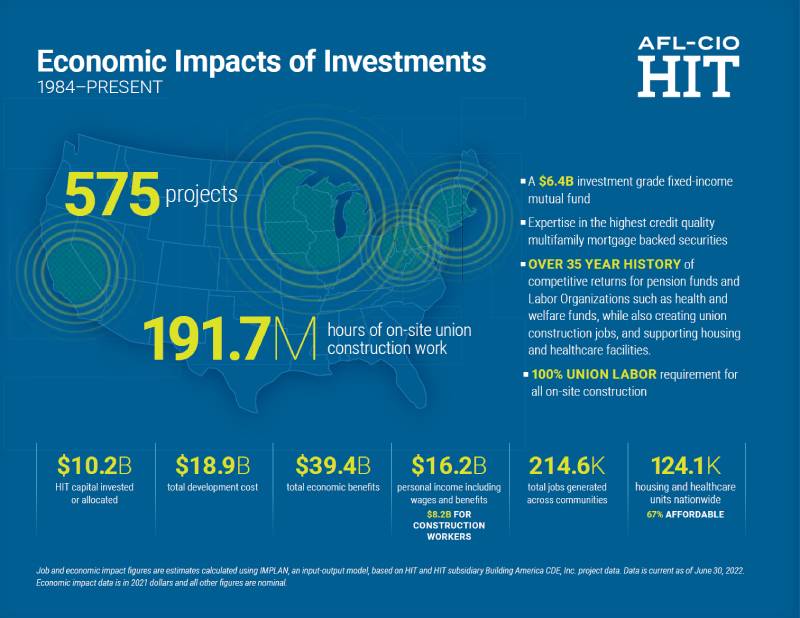

To Our Investors |  |

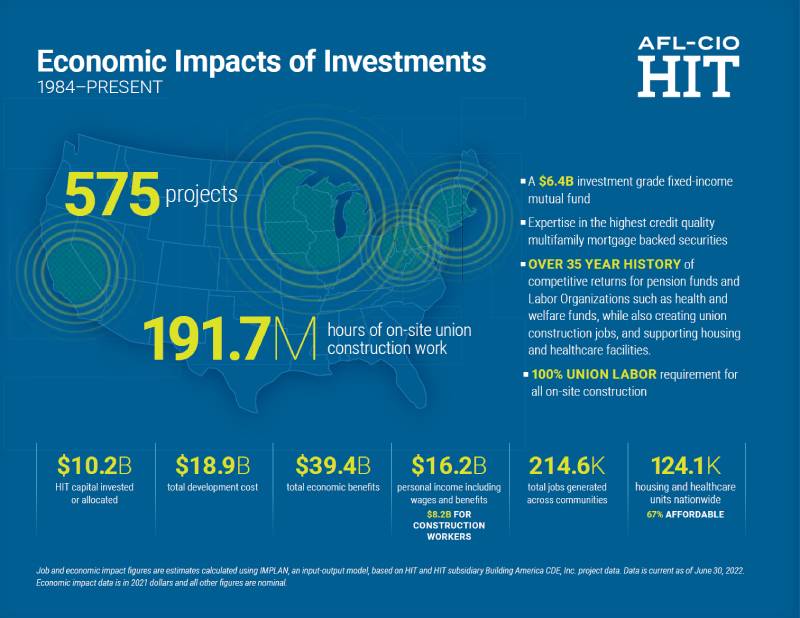

The significant and extraordinary level of inflation not seen in 40 years drove interest rates to their highest level in years during the first half of 2022. This pushed returns for investment grade fixed income deep into negative territory and negatively impacted fixed income market values. As a fixed income fund, the AFL-CIO Housing Investment Trust (HIT) is sensitive to interest rate movements. HIT’s return for the first six months of 2022 was -9.72% on a gross of fees basis and -9.86% on a net of fees1 basis as compared to -10.35% for its benchmark, the Bloomberg U.S. Aggregate Bond Index*. This strong relative performance, following last year’s outperformance, demonstrates that the HIT can deliver diversification benefits in volatile market environments. The HIT continues to increase its impact investing and currently has 44 projects under construction nationwide, generating an estimated $5.4 billion of economic activity and 7,208 housing units. The HIT has committed to nine projects year-to-date in the midst of higher rates and the challenges that poses. The HIT has a strong investment pipeline and expects the demand for additional affordable housing will continue to grow. However, higher interest rates will create bigger financing gaps that will need to be filled by external subsidies and efficient financing in order for projects to meet | | underwriting standards. We believe that the HIT’s ability to provide flexible and creative financing to housing projects should allow it to offset some of the challenges created by the higher interest rate environment and thus potentially capture more projects as compared to the competition. The HIT will continue to execute on its proven, longstanding strategy of generating competitive returns for its investors while positively impacting communities. It will also look to do more. Improvements in operations in recent years have better positioned the HIT to not only weather this storm, but to take advantage of the opportunities the current higher rate environment presents to add more yield. The growth of the HIT, lower operating expenses and the large volume of impact investments made in the past three and a half years have strengthened HIT’s position. We believe that the HIT’s mission continues to offer value to its investors and partners.

Chang Suh Chief Executive Officer and Chief Investment Officer |

1 The performance data quoted represents past performance and is no guarantee of future results. Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost. The HIT’s current performance data may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available from the HIT’s website at www.aflcio-hit.com. Gross performance figures do not reflect the deduction of HIT expenses. Net performance figures reflect the deduction of HIT expenses and are the performance returns that HIT’s investors obtain. Information about HIT expenses can be found on page 1 of the HIT’s current prospectus.

* Source: Bloomberg L.P.

Relative Returns As of June 30, 2022, periods over one year are annualized

| Comparison of a $50,000 Investment in the HIT and Bloomberg Aggregate* (10 Years)

| Past performance is no guarantee of future results. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that a participant’s units, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.aflcio-hit. com. Gross performance figures do not reflect the deduction of HIT expenses. Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT. Information about HIT expenses can be found on page 1 of the HIT’s current prospectus. The Bloomberg Aggregate is an unmanaged index and is not available for direct investment, although certain funds attempt to replicate this index. Returns for the index would be lower if they reflected the actual trading costs or expenses associated with management of an actual portfolio. |

| | | |

Discussion of Fund Performance

(unaudited)

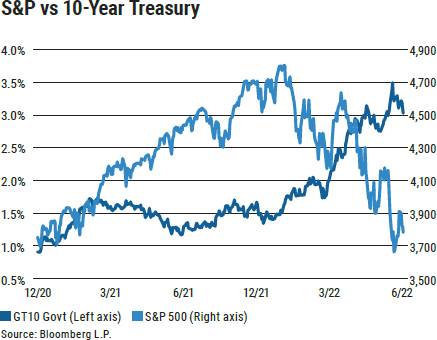

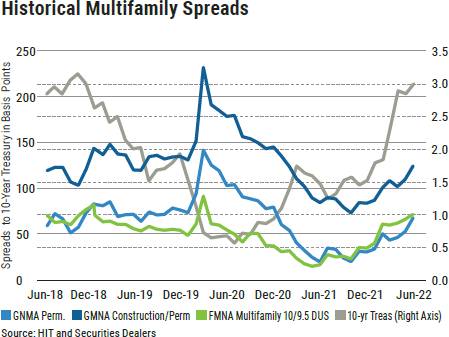

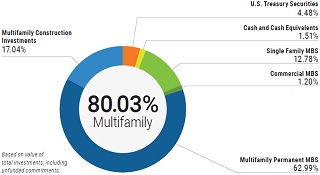

HIT Outperforms Benchmark in Challenging Fixed Income Environment 2022 Overview The HIT continues to deliver amid a volatile 2022. Against a backdrop of high inflation and rising rates in the first six months of 2022, the HIT generated competitive returns for its investors by outperforming its benchmark, the Bloomberg U.S. Aggregate Bond Index* (Bloomberg Aggregate or Benchmark) and committed $145.4 million1 to finance nine construction/substantial rehabilitation projects. These investments, with a total development cost of $276.5 million, were expected to generate 1.8 million hours of union construction work2 and create or rehabilitate 779 housing units, including 669 units of much-needed affordable housing. | 2022 Returns For the first half of 2022, the HIT outperformed the Benchmark by 63 and 49 basis points (bps) on a gross and net of fees basis, respectively, despite a challenging environment for fixed income. The HIT generated a gross return of -9.72% and net return of -9.86%, compared to the Benchmark’s -10.35% return. The HIT delivered competitive returns for the first six months of 2022 amid a difficult macroeconomic backdrop of elevated inflation and tightening of Federal Reserve monetary policy, both of which drove interest rates higher. Performance Attribution Summary Total returns for investment grade fixed income strategies were negative for the first two consecutive quarters of 2022 as interest rates rose across the curve, with the | 10-year U.S. Treasury closing June 2022 at a yield above 3% for the first time since 2018. In this volatile rising rate environment, the HIT outperformed the Benchmark and some of the largest core fixed income fund managers that invest in corporate credit—the worst performing sector in the Bloomberg Aggregate. In addition to the HIT’s lack of corporate bonds, the HIT’s relative performance for the first half of 2022 also benefitted from the HIT’s active interest rate risk management of short duration, overweight to adjustable-rate investments, and underweight to agency residential mortgages, which was the second worst performing asset class in the Benchmark after corporates. However, the HIT’s overweight to spread products and underweight to U.S. Treasuries hindered |

1 This includes New Markets Tax Credits allocated by HIT subsidiary Building America CDE, Inc.

2 Job and economic impact figures are estimates calculated using IMPLAN, an input-output model, based on HIT and HIT subsidiary Building America CDE, Inc. project data. Data is current as of June 30, 2022.

* Source: Bloomberg L.P.

| 2 |  |

relative performance. All fixed income spreads widened relative to U.S. Treasuries given the volatility caused by higher inflation and ongoing hawkish policy from the Federal Reserve. The HIT’s relative performance as compared to the AAA component of the Bloomberg Aggregate (which has a more comparable credit profile to the HIT than the Benchmark) lagged by 84 bps on a gross basis, and 98 bps on a net basis, given that U.S. Treasuries were the best performing sector in the Benchmark. 2022 Market Overview Global economic growth slowed in the first half of the year driven primarily by high inflation, supply chain disruptions, Russia’s war against Ukraine, and the continued impacts from the Covid-19 pandemic. Inflation reached its highest level in decades in many countries, with Russia’s invasion of | Ukraine contributing to the rise in energy and food prices. Central banks reacted by raising interest rates, even though higher borrowing costs could exacerbate the squeeze on real incomes that have resulted from higher prices, raising the risk of an eventual recession. While growth in the U.S. slowed, employment gains were strong in the first half of the year and the unemployment rate remained low at 3.6% throughout the second quarter. With the labor market continuing to show strength, the Federal Reserve has shifted its focus to fighting inflation, which currently stands at a 40-year high after the Consumer Price Index (CPI) increased 9.1% on a yearly basis in June 2022. To date, the Federal Reserve has raised the federal funds rate by 150 bps, and is expected to increase it by another 175 bps by year-end. Furthermore, the Federal | Reserve began shrinking its balance sheet in the second quarter by not fully reinvesting paydowns and announced that it will no longer reinvest principal received at maturity (a maximum runoff cap) come September 2022. Looking Ahead The outlook for the U.S. economy remains highly uncertain as the Federal Reserve continues to aggressively tighten monetary policy to combat inflation. By tightening policy, the Federal Reserve will likely further slow economic growth, raising the risk of a recession as businesses and consumers could be forced to adjust their investment and spending decisions at a time when many industries and individuals are already facing higher costs. We believe that in a rising rate environment, the HIT should benefit from its short relative duration position and increased allocation to adjustable-rate |

Sector Allocation

As of June 30, 2022

Risk Comparison

As of June 30, 2022

| | | HIT | | | Bloomberg* | | | | | HIT | | | Bloomberg* | |

| CREDIT PROFILE | | | | | | | | | | | | | | |

| U.S. Government/Agency/AAA/Cash | | 91.08 | % | | 73.48 | % | | A & Below/Not Rated | | 4.69 | % | | 23.40 | % |

| YIELD | | | | | | | | | | | | | | |

| Current Yield | | 2.79 | % | | 2.69 | % | | Yield to Worst | | 3.78 | % | | 3.66 | % |

| INTEREST RATE RISK | | | | | | | | | | | | | | |

| Effective Duration | | 6.06 | | | 6.43 | | | Convexity | | 0.23 | | | 0.25 | |

| CALL RISK | | | | | | | | | | | | | | |

| Call Protected | | 78% | | | 72% | | | Not Call Protected | | 22% | | | 28% | |

Source: HIT and Bloomberg US Aggregate Bond Index

The calculations of the HIT yield herein represent widely accepted portfolio characteristics information based on coupon rate, current price and, for yield to worst, certain prepayment assumptions, and are not current yield or other performance data as defined by the SEC in Rule 482.

PERFORMANCE OVERVIEW

continued

securities. In times of heightened market volatility, we believe that the HIT remains an attractive investment opportunity given its yield advantage, liquidity, diversification from corporate credit, and defensive positioning relative to other core fixed income managers.

Housing affordability for purchases and rentals remains a challenge for a significant number of households. Rental vacancy rates fell to a five-year low and asking rents rose 16.7% over the last year, according to Moody’s, supported by Gen Z household formation, as well as individuals and families being priced out of the single-family housing market and now facing higher mortgage rates. Housing starts, building permits, and mortgage applications have all fallen significantly, further supporting the notion that a recession is possibly on the horizon.

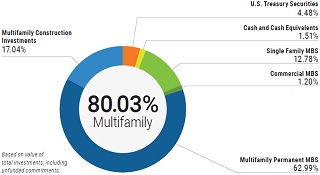

HIT’s Multifamily Investments

Notwithstanding higher mortgage rates, the HIT committed to nine new projects in the first half of 2022, committing $145.4 million3 in financing. With total development costs of $276.5 million, these investments are expected to contribute positively to HIT’s portfolio’s yield while generating 1.8 million hours of union construction work and financing the creation or rehabilitation of 779 housing units, of which 86% will be affordable. These developments will help revitalize their communities as the construction impacts ripple through local economies, generating an estimated $466.6 million in economic impacts4. At June 30, 2022, 44 projects receiving HIT financing were under construction. These projects are providing significant economic benefits and positively impacting communities in 27 cities across 12 states.

The national affordable and workforce housing supply shortage, made worse by the pandemic and rising inflation, should continue to spur development and provide opportunities for the HIT. We believe the HIT’s ability to offer multiple financing structures for both construction and permanent loans, including direct lending, gives it a competitive advantage as compared to many traditional fixed income managers that only purchase securities in the secondary market. The HIT remains focused on continually building an attractive portfolio consisting of fundamentally strong construction-related multifamily investments that generate attractive yield spreads over U.S. Treasuries and other credit-equivalent mortgage investments. In the current rising interest rate environment, the HIT will closely track its pipeline of projects, working with lending partners to finance affordable, workforce and market rate housing developments and bring to fruition opportunities to invest at higher yields.

3 This includes New Markets Tax Credits allocated by HIT subsidiary Building America CDE, Inc.

4 Job and economic impact figures are estimates calculated using IMPLAN, an input-output model, based on HIT and HIT subsidiary Building America CDE, Inc. project data. Data is current as of June 30, 2022.

* Source: Bloomberg L.P.

| 4 |  |

Other Important Information

(unaudited)

Expense Example

| | Beginning

Account Value

January 1, 2022 | Ending

Account Value

June 30, 2022 | Expenses Paid

During Six-Month

Period Ended* June 30, 2022 |

| Actual Expenses | $1,000.00 | $ 901.42 | $1.41 |

Hypothetical Expenses

(5% annual return before expenses) | $1,000.00 | $1,023.31 | $1.51 |

* Expenses are equal to the HIT’s annualized six-month expense ratio of 0.30%, as of June 30, 2022 multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Participants in the HIT incur ongoing expenses related to the management and distribution activities of the HIT, as well as certain other expenses. The expense example in the table above is intended to help participants understand the ongoing costs (in dollars) of investing in the HIT and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period, January 1, 2022, and held for the entire period ended June 30, 2022.

Actual Expenses: The first line of the table above provides information about actual account values and actual expenses. Participants may use the information in this line, together with the amount they invested, to estimate the expenses that they paid over the period. Simply divide the account value by $1,000 (for example, an $800,000 account value divided by $1,000 = 800), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Six-Month Period Ended June 30, 2022” to estimate the expenses paid on a particular account during this period.

Hypothetical Expenses (for Comparison Purposes Only): The second line of the table above provides information about hypothetical account values and hypothetical expenses based on the HIT’s actual expense ratio and an assumed rate of return

of 5% per year before expenses, which is not the HIT’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses a participant paid for the period. Participants may use this information to compare the ongoing costs of investing in the HIT and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that this example is useful in comparing funds’ ongoing costs only. It does not include any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. The HIT does not have such transactional costs, but many other funds do.

Availability of Quarterly Portfolio Schedule

In addition to disclosure in its Annual and Semi-Annual Reports to Participants, the HIT also files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The HIT’s Form N-PORT Part F is available on the SEC’s website at sec.gov. Participants may also obtain copies of the HIT’s Form N-PORT, without charge, upon request, by calling the HIT collect at 202-331-8055.

Proxy Voting

Except for its shares in its wholly owned subsidiary, HIT Advisers LLC, and shares in mutual funds holding short-term or overnight cash, if applicable, the HIT invests exclusively in nonvoting securities and has not deemed it necessary to adopt policies and procedures for the voting of portfolio securities. The HIT has reported information regarding how it voted in matters related to its subsidiary in its most recent filing with the SEC on Form N-PX. This filing is available on the SEC’s website at sec.gov. Participants may also obtain a copy of the HIT’s report on Form N-PX, without charge, upon request, by calling the HIT collect at 202-331-8055.

Statement Regarding Liquidity Risk Management Program

The HIT Board of Trustees (the Board or HIT Board) has previously approved and implemented policies and procedures for a Liquidity Risk Management Program (the Program) consistent with Rule 22e-4 under the Investment Company Act of 1940. The Program seeks to assess and manage the HIT’s liquidity risk. The Board designated the HIT’s Valuation Committee to serve as the Liquidity Program Administrator (the Administrator), which, among other duties, is required to provide a written report to the Board, at least annually, in order to assist the Board in assessing the adequacy and effectiveness of the Program. Certain aspects of the Program rely on third parties to perform certain functions, including the provision of liquidity classification determinations.

The Program is comprised of various components designed to support the assessment and/or management of liquidity risk, including: (1) the periodic assessment (no less frequently than annually) of certain factors that influence the HIT’s liquidity risk; (2) the periodic classification of the HIT’s investments into one of four liquidity categories that reflect an estimate of their liquidity under current market conditions; (3) a 15% limit on the acquisition of “illiquid investments” (as defined under Rule 22e-4); (4) the determination of whether the HIT requires a “highly liquid investment minimum” (as defined under Rule 22e-4); and, (5) periodic reporting to the Board.

At a March 3, 2022 meeting of the Board, the Administrator provided a written report to the Board addressing the operation and the adequacy and effectiveness of the implementation of the Program for the 2021 calendar year (the Reporting Period). Among other things, the report discussed liquidity classifications of the HIT’s portfolio and provided an assessment of the HIT’s liquidity risk and evaluation of the Program.

The report concluded that the Program continues to be reasonably designed to assess and manage liquidity risk and was adequately and effectively implemented during the Reporting Period.

| 6 |  |

Statement of Assets and Liabilities

June 30, 2022 (dollars in thousands, except per share data; unaudited)

| Assets | | |

| | Investments, at value (cost $7,105,770) | $ | 6,473,254 | |

| | Cash | | 40,929 | |

| | Accrued interest receivable | | 18,459 | |

| | Receivables for investments sold | | 3 | |

| | Right of use asset | | 3,803 | |

| | Other assets | | 4,312 | |

| | Total assets | | 6,540,760 | |

| | | | | |

| Liabilities | | | |

| | Payables for investments purchased | | 108,041 | |

| | Redemptions payable | | 307 | |

| | Income distribution and capital gains payable, net of dividends reinvested of $11,871 | | 905 | |

| | Refundable deposits | | 1,122 | |

| | Accrued salaries and fringe benefits | | 5,279 | |

| | Lease Liability | | 4,283 | |

| | Other liabilities and accrued expenses | | 969 | |

| | Total liabilities | | 120,906 | |

| | | | | |

| | Other commitments and contingencies (Note 5 of financial statements) | | — | |

| | | | |

| Net assets applicable to participants’ equity — | | | |

| | Certificates of participation—authorized unlimited; | | | |

| | Outstanding 6,333,386 units | $ | 6,419,854 | |

| | | | |

| Net asset value per unit of participation (in dollars) | $ | 1,013.65 | |

| | | | |

| Participants’ equity | | | |

| | Participants’ equity consisted of the following: | | | |

| | Amount invested and reinvested by current participants | $ | 7,071,435 | |

| | Distributable earnings (accumulated losses) | | (651,581 | ) |

| | Total participants’ equity | $ | 6,419,854 | |

See accompanying Notes to Financial Statements (unaudited).

| 8 |  |

Schedule of Portfolio Investments

June 30, 2022 (dollars in thousands, unaudited)

| FHA PERMANENT SECURITIES | | | | | |

| (2.1% OF NET ASSETS) | | | | | | |

| | | | | | | |

| | | Interest

Rate | | Maturity

Date | | Unfunded

Commitments1 | | Face

Amount | | | Amortized

Cost | | | Value | | |

| Multifamily | | 3.65% | | Dec-2037 | | $ | — | | | $ | 7,690 | | | $ | 7,800 | | | $ | 7,708 | | |

| | | 3.72% | | Feb-2062 | | | — | | | | 4,455 | | | | 4,460 | | | | 4,107 | | |

| | | 3.75% | | Aug-2048 | | | — | | | | 3,630 | | | | 3,626 | | | | 3,631 | | |

| | | 4.00% | | Dec-2053 | | | — | | | | 60,440 | | | | 60,416 | | | | 59,206 | | |

| | | 4.10% | | Dec-2060 | | | — | | | | 21,644 | | | | 21,665 | | | | 20,878 | | |

| | | 4.79% | | May-2053 | | | — | | | | 4,887 | | | | 5,082 | | | | 4,913 | | |

| | | 5.17% | | Feb-2050 | | | — | | | | 7,452 | | | | 7,930 | | | | 7,508 | | |

| | | 5.35% | | Mar-2047 | | | — | | | | 6,693 | | | | 6,702 | | | | 6,727 | | |

| | | 5.55% | | Aug-2042 | | | — | | | | 7,001 | | | | 7,004 | | | | 7,039 | | |

| | | 5.60% | | Jun-2038 | | | — | | | | 2,054 | | | | 2,057 | | | | 2,065 | | |

| | | 5.80% | | Jan-2053 | | | — | | | | 1,933 | | | | 1,941 | | | | 2,080 | | |

| | | 5.87% | | May-2044 | | | — | | | | 1,603 | | | | 1,602 | | | | 1,613 | | |

| | | 5.89% | | Apr-2038 | | | — | | | | 3,871 | | | | 3,874 | | | | 3,894 | | |

| | | 6.40% | | Aug-2046 | | | — | | | | 3,508 | | | | 3,509 | | | | 3,531 | | |

| | | 6.60% | | Jan-2050 | | | — | | | | 3,170 | | | | 3,189 | | | | 3,342 | | |

| | | | | | | | — | | | | 140,031 | | | | 140,857 | | | | 138,242 | | |

| Forward Commitments | | 2.50% | | Sep-2063 | | | 5,702 | | | | — | | | | — | | | | (1,006 | ) | |

| | | 3.90% | | Mar-2062 | | | 3,090 | | | | — | | | | — | | | | (197 | ) | |

| | | | | | | | 8,792 | | | | — | | | | — | | | | (1,203 | ) | |

| Total FHA Permanent Securities | | $ | 8,792 | | | $ | 140,031 | | | $ | 140,857 | | | $ | 137,039 | | |

GINNIE MAE CONSTRUCTION SECURITIES

(2.6% OF NET ASSETS)

| | | Interest Rates2 | | Maturity | | Unfunded | | Face | | | Amortized | | | | |

| | | Permanent | | Construction | | Date | | Commitments1 | | Amount | | | Cost | | | Value | |

| Multifamily | | 2.25% | | 4.10% | | Apr-2064 | | $ | 61,907 | | | $ | 4,021 | | | $ | 6,024 | | | $ | (6,354 | ) |

| | | 2.45% | | 2.45% | | Apr-2062 | | | 797 | | | | 15,705 | | | | 15,992 | | | | 13,950 | |

| | | 2.58% | | 2.58% | | May-2063 | | | 9,909 | | | | 18,591 | | | | 19,509 | | | | 15,552 | |

| | | 2.59% | | 3.59% | | Aug-2064 | | | 42,287 | | | | 25 | | | | 1,137 | | | | (5,651 | ) |

| | | 2.62% | | 2.62% | | Feb-2063 | | | 549 | | | | 13,251 | | | | 13,756 | | | | 12,010 | |

| | | 2.64% | | 2.64% | | Jan-2063 | | | 9,068 | | | | 9,307 | | | | 9,848 | | | | 7,755 | |

| | | 2.65% | | 2.65% | | Oct-2062 | | | 1,109 | | | | 5,391 | | | | 5,550 | | | | 4,867 | |

| | | 2.67% | | 2.67% | | Mar-2062 | | | 1,047 | | | | 33,936 | | | | 34,756 | | | | 30,686 | |

| | | 2.75% | | 2.75% | | Apr-2063 | | | 14,217 | | | | 7,446 | | | | 8,444 | | | | 5,392 | |

| | | 2.98% | | 2.98% | | Jun-2063 | | | 19,464 | | | | 14,246 | | | | 15,473 | | | | 11,776 | |

| | | 3.05% | | 3.05% | | Dec-2063 | | | 104,645 | | | | 100 | | | | 1,149 | | | | (8,732 | ) |

| | | 3.24% | | 3.24% | | Jan-2064 | | | 25,431 | | | | 1,000 | | | | 1,547 | | | | (1,538 | ) |

| | | 3.41% | | 3.41% | | Sep-2061 | | | 2,112 | | | | 40,173 | | | | 41,794 | | | | 39,185 | |

| | | 3.43% | | 3.43% | | Nov-2061 | | | 1,749 | | | | 51,741 | | | | 53,397 | | | | 50,556 | |

| | | | | | | | | | 294,291 | | | | 214,933 | | | | 228,376 | | | | 169,454 | |

| Forward Commitments | | 3.60% | | 5.70% | | Sep-2063 | | | 4,900 | | | | — | | | | 147 | | | | 51 | |

| | | 3.69% | | 4.75% | | Dec-2063 | | | 12,327 | | | | — | | | | 163 | | | | (279 | ) |

| | | 3.75% | | 5.35% | | Sep-2063 | | | 6,486 | | | | — | | | | 195 | | | | (93 | ) |

| | | 4.08% | | 4.08% | | Feb-2064 | | | 14,527 | | | | — | | | | 305 | | | | 181 | |

| | | 4.14% | | 4.14% | | Sep-2063 | | | 11,197 | | | | — | | | | 182 | | | | 164 | |

| | | | | | | | | | 49,437 | | | | — | | | | 992 | | | | 24 | |

| Total Ginnie Mae Construction Securities | | $ | 343,728 | | | $ | 214,933 | | | $ | 229,368 | | | $ | 169,478 | |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

| GINNIE MAE SECURITIES | | |

| (27.4% OF NET ASSETS) | | |

| | | | | | | | | | | | | | | |

| | | Interest Rate | | Maturity Date | | Face Amount | | | Amortized Cost | | | Value | | |

| Single Family | | | 4.00% | | Feb-2040–Jun-2040 | | $ | 1,132 | | | $ | 1,140 | | | $ | 1,144 | | |

| | | | 4.50% | | Aug-2040 | | | 567 | | | | 575 | | | | 586 | | |

| | | | 5.50% | | Jan-2033–Jun-2037 | | | 916 | | | | 913 | | | | 968 | | |

| | | | 6.00% | | Jan-2032–Aug-2037 | | | 632 | | | | 633 | | | | 682 | | |

| | | | 6.50% | | Jul-2028 | | | 36 | | | | 36 | | | | 39 | | |

| | | | 7.00% | | Apr-2026–Jan-2030 | | | 369 | | | | 371 | | | | 394 | | |

| | | | 7.50% | | Aug-2025–Aug-2030 | | | 183 | | | | 185 | | | | 196 | | |

| | | | 8.00% | | Sep-2026–Nov-2030 | | | 186 | | | | 186 | | | | 201 | | |

| | | | 8.50% | | Dec-2022–Aug-2027 | | | 51 | | | | 51 | | | | 54 | | |

| | | | 9.00% | | Dec-2022–Jun-2025 | | | 2 | | | | 2 | | | | 2 | | |

| | | | | | | | | 4,074 | | | | 4,092 | | | | 4,266 | | |

| Multifamily | | | 1.90% | | Feb-2061 | | | 22,712 | | | | 20,461 | | | | 17,833 | | |

| | | | 1.95% | | Mar-2064 | | | 39,626 | | | | 39,107 | | | | 35,956 | | |

| | | | 1.95% | | Mar-2064 | | | 35,249 | | | | 35,737 | | | | 31,984 | | |

| | | | 2.00% | | Apr-2062–Mar-2064 | | | 273,418 | | | | 276,132 | | | | 240,470 | | |

| | | | 2.00% | | Jul-2062 | | | 36,963 | | | | 38,000 | | | | 33,375 | | |

| | | | 2.00% | | Oct-2062 | | | 54,440 | | | | 56,304 | | | | 48,855 | | |

| | | | 2.00% | | Apr-2063 | | | 53,358 | | | | 54,270 | | | | 48,174 | | |

| | | | 2.00% | | Apr-2063 | | | 49,943 | | | | 51,005 | | | | 44,333 | | |

| | | | 2.00% | | Jun-2063 | | | 45,477 | | | | 45,890 | | | | 41,404 | | |

| | | | 2.00% | | Oct-2063 | | | 43,407 | | | | 42,977 | | | | 39,430 | | |

| | | | 2.08% | | Nov-2056 | | | 52,392 | | | | 54,432 | | | | 45,442 | | |

GINNIE MAE SECURITIES

continued

| | | | Interest Rate | | Maturity Date | | Face Amount | | | Amortized Cost | | | Value | |

| | | | 2.15% | | May-2056 | | | 810 | | | | 808 | | | | 796 | |

| | | | 2.20% | | Jun-2056 | | | 1,218 | | | | 1,216 | | | | 1,187 | |

| | | | 2.25% | | Dec-2048 | | | 3,388 | | | | 3,364 | | | | 3,250 | |

| | | | 2.30% | | Mar-2056–Oct-2056 | | | 4,692 | | | | 4,662 | | | | 4,564 | |

| | | | 2.31% | | Nov-2051 | | | 7,076 | | | | 7,076 | | | | 6,567 | |

| | | | 2.32% | | Sep-2060 | | | 27,043 | | | | 28,494 | | | | 24,347 | |

| | | | 2.35% | | Nov-2056–Feb-2061 | | | 30,934 | | | | 31,838 | | | | 29,105 | |

| | | | 2.40% | | Aug-2047–Dec-2057 | | | 21,674 | | | | 22,177 | | | | 19,629 | |

| | | | 2.40% | | Jan-2053 | | | 38,838 | | | | 39,093 | | | | 36,456 | |

| | | | 2.50% | | Dec-2052–Jan-2061 | | | 58,324 | | | | 59,220 | | | | 54,170 | |

| | | | 2.60% | | Apr-2048–Jun-2059 | | | 12,521 | | | | 12,559 | | | | 12,121 | |

| | | | 2.70% | | May-2048–Jul-2058 | | | 7,178 | | | | 7,205 | | | | 7,010 | |

| | | | 2.72% | | Feb-2044 | | | 124 | | | | 127 | | | | 123 | |

| | | | 2.74% | | Apr-2057 | | | 23,887 | | | | 25,941 | | | | 21,973 | |

| | | | 2.78% | | Aug-2058 | | | 10,720 | | | | 11,651 | | | | 9,896 | |

| | | | 2.79% | | Apr-2049 | | | 4,999 | | | | 5,041 | | | | 4,824 | |

| | | | 2.80% | | Feb-2053 | | | 60,000 | | | | 57,245 | | | | 53,944 | |

| | | | 2.80% | | Dec-2059 | | | 4,759 | | | | 4,697 | | | | 4,674 | |

| | | | 2.82% | | Apr-2050 | | | 1,300 | | | | 1,323 | | | | 1,263 | |

| | | | 2.94% | | Nov-2059 | | | 47,791 | | | | 53,153 | | | | 44,494 | |

| | | | 3.00% | | May-2062 | | | 68,312 | | | | 73,818 | | | | 64,753 | |

| | | | 3.03% | | Jan-2056 | | | 30,341 | | | | 32,286 | | | | 29,033 | |

| 10 |  |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

| GINNIE MAE SECURITIES | | | | |

| continued | | |

| | | | | | | | | | | | | | | | |

| | | | Interest Rate | | Maturity Date | | Face Amount | | | Amortized Cost | | | Value | | |

| | | | 3.05% | | May-2054 | | | 11,545 | | | | 11,591 | | | | 10,864 | | |

| | | | 3.17% | | Jul-2046 | | | 3,275 | | | | 3,357 | | | | 3,238 | | |

| | | | 3.17% | | Aug-2059 | | | 34,333 | | | | 37,962 | | | | 33,022 | | |

| | | | 3.20% | | Jul-2041–Sep-2051 | | | 3,466 | | | | 3,474 | | | | 3,451 | | |

| | | | 3.25% | | Sep-2054 | | | 18,480 | | | | 18,331 | | | | 18,013 | | |

| | | | 3.25% | | Apr-2059 | | | 34,100 | | | | 32,789 | | | | 33,277 | | |

| | | | 3.26% | | Nov-2043 | | | 1,854 | | | | 1,856 | | | | 1,824 | | |

| | | | 3.27% | | Apr-2046 | | | 24,505 | | | | 25,814 | | | | 22,574 | | |

| | | | 3.30% | | Sep-2060 | | | 8,293 | | | | 8,495 | | | | 8,056 | | |

| | | | 3.33% | | May-2055 | | | 6,988 | | | | 6,641 | | | | 6,668 | | |

| | | | 3.34% | | Sep-2059 | | | 16,892 | | | | 17,206 | | | | 16,527 | | |

| | | | 3.35% | | Mar-2044 | | | 10,000 | | | | 9,631 | | | | 9,820 | | |

| | | | 3.37% | | Feb-2044 | | | 318 | | | | 331 | | | | 318 | | |

| | | | 3.38% | | Jan-2060 | | | 58,756 | | | | 58,762 | | | | 57,345 | | |

| | | | 3.39% | | Feb-2059 | | | 14,099 | | | | 14,365 | | | | 13,795 | | |

| | | | 3.47% | | May-2042 | | | 1,856 | | | | 1,879 | | | | 1,851 | | |

| | | | 3.48% | | May-2059 | | | 10,757 | | | | 10,964 | | | | 10,632 | | |

| | | | 3.50% | | Jan-2054 | | | 4,141 | | | | 4,121 | | | | 4,120 | | |

| | | | 3.53% | | Apr-2042 | | | 15,853 | | | | 16,302 | | | | 15,742 | | |

| | | | 3.60% | | Sep-2052–Jun-2057 | | | 17,978 | | | | 18,579 | | | | 17,800 | | |

| | | | 3.60% | | Apr-2061 | | | 33,756 | | | | 34,833 | | | | 33,501 | | |

| | | | 3.62% | | Dec-2057 | | | 28,219 | | | | 28,695 | | | | 28,046 | | |

GINNIE MAE SECURITIES

continued

| | | Interest Rate | | Maturity Date | | Face Amount | | | Amortized Cost | | | Value | |

| | | | 3.63% | | Dec-2045 | | | 8,583 | | | | 8,281 | | | | 8,474 | |

| | | | 3.65% | | Oct-2058 | | | 10,162 | | | | 10,310 | | | | 10,128 | |

| | | | 3.67% | | Nov-2035 | | | 13,397 | | | | 13,750 | | | | 13,252 | |

| | | | 3.74% | | Aug-2059 | | | 15,449 | | | | 15,737 | | | | 15,441 | |

| | | | 3.75% | | Nov-2060 | | | 11,191 | | | | 11,535 | | | | 11,206 | |

| | | | 3.78% | | Aug-2060 | | | 39,175 | | | | 39,454 | | | | 39,248 | |

| | | | 3.92% | | Aug-2039 | | | 40,489 | | | | 42,469 | | | | 39,529 | |

| | | | 3.96% | | Apr-2046 | | | 383 | | | | 384 | | | | 383 | |

| | | | 4.10% | | May-2051 | | | 3,785 | | | | 4,080 | | | | 3,838 | |

| | | | 4.21% | | May-2061 | | | 51,420 | | | | 51,685 | | | | 56,636 | |

| | | | 4.25% | | Sep-2038 | | | 30,714 | | | | 30,831 | | | | 30,905 | |

| | | | 4.35% | | Dec-2060 | | | 2,269 | | | | 2,310 | | | | 2,359 | |

| | | | 4.37% | | Feb-2034 | | | 25,094 | | | | 27,472 | | | | 25,636 | |

| | | | 4.45% | | Jun-2055 | | | 2,467 | | | | 2,380 | | | | 2,529 | |

| | | | 4.53% | | Jan-2061 | | | 14,737 | | | | 15,179 | | | | 15,470 | |

| | | | 4.63%3 | | Sep-2037 | | | 1,500 | | | | 1,469 | | | | 1,502 | |

| | | | 4.90%3 | | Mar-2044 | | | 1,000 | | | | 992 | | | | 1,002 | |

| | | | 5.25% | | Apr-2037 | | | 16,400 | | | | 16,395 | | | | 16,473 | |

| | | | 5.34% | | Jul-2040 | | | 67 | | | | 67 | | | | 67 | |

| | | | | | | | | 1,820,660 | | | | 1,858,067 | | | | 1,705,997 | |

| When Issued4 | | | 3.36% | | May-2061 | | | 51,379 | | | | 57,031 | | | | 50,369 | |

| Total Ginnie Mae Securities | | $ | 1,876,113 | | | $ | 1,919,190 | | | $ | 1,760,632 | |

| 2022 SEMI-ANNUAL REPORT | 11 |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

| FANNIE MAE SECURITIES | | | | | | |

| (42.5% OF NET ASSETS) | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Interest Rate5 | | | Maturity Date | | Unfunded Commitments1 | | Face Amount | | | Amortize Cost | | | Value | | |

| Single Family | | 1.74% 12M LIBOR+149 | | | Jul-2033 | | $ | — | | | $ | 109 | | | $ | 109 | | | $ | 111 | | |

| | | 1.81% 12M LIBOR+152 | | | Feb-2045 | | | — | | | | 2,257 | | | | 2,292 | | | | 2,299 | | |

| | | 1.86% 6M LIBOR+161 | | | Aug-2033 | | | — | | | | 118 | | | | 118 | | | | 120 | | |

| | | 1.87% 1M LIBOR+25 | | | Mar-2037 | | | — | | | | 110 | | | | 109 | | | | 109 | | |

| | | 1.88% 12M LIBOR+163 | | | Nov-2034 | | | — | | | | 158 | | | | 160 | | | | 160 | | |

| | | 1.94% 1M LIBOR+32 | | | Jun-2037 | | | — | | | | 577 | | | | 577 | | | | 574 | | |

| | | 1.99% 12M LIBOR+169 | | | Oct-2042 | | | — | | | | 1,953 | | | | 1,986 | | | | 2,008 | | |

| | | 2.02% 1M LIBOR+40 | | | Apr-2037 | | | — | | | | 271 | | | | 270 | | | | 270 | | |

| | | 2.08% 1M LIBOR+46 | | | Oct-2042 | | | — | | | | 1,538 | | | | 1,543 | | | | 1,539 | | |

| | | 2.12% 1M LIBOR+50 | | | Jun-2042 | | | — | | | | 3,437 | | | | 3,439 | | | | 3,446 | | |

| | | 2.17% 1M LIBOR+55 | | | Mar-2042 | | | — | | | | 1,914 | | | | 1,916 | | | | 1,922 | | |

| | | 2.22% 1Y UST+222 | | | Aug-2033 | | | — | | | | 216 | | | | 216 | | | | 223 | | |

| | | 2.22% 1M LIBOR+60 | | | Oct-2043 | | | — | | | | 3,650 | | | | 3,664 | | | | 3,679 | | |

| | | 2.32% 1Y UST+220 | | | Aug-2033 | | | — | | | | 416 | | | | 416 | | | | 429 | | |

| | | 2.34% 1Y UST+222 | | | Jul-2033 | | | — | | | | 301 | | | | 302 | | | | 310 | | |

| | | 2.42% 6M LIBOR+155 | | | Nov-2033 | | | — | | | | 792 | | | | 792 | | | | 805 | | |

| | | 2.50% | | | May-2050–Jan-2052 | | | — | | | | 233,923 | | | | 243,784 | | | | 211,286 | | |

| | | 2.50% | | | Jan-2052 | | | — | | | | 47,424 | | | | 47,606 | | | | 42,791 | | |

| | | 2.77% 12M LIBOR+156 | | | Apr-2034 | | | — | | | | 402 | | | | 407 | | | | 407 | | |

| | | 3.00% | | | Apr-2031–Mar-2052 | | | — | | | | 200,988 | | | | 208,943 | | | | 188,639 | | |

| | | 3.00% | | | Oct-2051 | | | — | | | | 46,419 | | | | 48,753 | | | | 43,374 | | |

| | | 3.23% 1Y UST+223 | | | May-2033 | | | — | | | | 125 | | | | 125 | | | | 129 | | |

| | | 3.50% | | | Oct-2026–Mar-2052 | | | — | | | | 143,885 | | | | 147,794 | | | | 139,769 | | |

| | | 3.50% | | | Jan-2052 | | | — | | | | 41,150 | | | | 42,229 | | | | 39,645 | | |

| | | 4.00% | | | May-2024–Jun-2048 | | | — | | | | 35,787 | | | | 36,857 | | | | 35,946 | | |

| | | 4.50% | | | May-2024–Dec-2048 | | | — | | | | 25,819 | | | | 26,586 | | | | 26,415 | | |

| | | 5.00% | | | May-2034–Apr-2041 | | | — | | | | 5,274 | | | | 5,395 | | | | 5,535 | | |

| | | 5.50% | | | Sep-2032–Jun-2038 | | | — | | | | 2,237 | | | | 2,237 | | | | 2,384 | | |

| | | 6.00% | | | Nov-2028–Nov-2037 | | | — | | | | 1,658 | | | | 1,664 | | | | 1,804 | | |

| | | 6.50% | | | Sep-2028–Jul-2036 | | | — | | | | 292 | | | | 296 | | | | 317 | | |

| | | 7.00% | | | Sep-2027–May-2032 | | | — | | | | 469 | | | | 470 | | | | 512 | | |

| | | 7.50% | | | Jan-2027–Sep-2031 | | | — | | | | 35 | | | | 35 | | | | 37 | | |

| | | 8.00% | | | Aug-2030–May-2031 | | | — | | | | 34 | | | | 34 | | | | 34 | | |

| | | | | | | | | — | | | | 803,738 | | | | 831,124 | | | | 757,028 | | |

| Multifamily | | 0.92% 1M SOFR+20 | | | Nov-2031 | | | — | | | | 40,943 | | | | 40,949 | | | | 40,887 | | |

| | | 0.93% 1M SOFR+21 | | | Mar-2031 | | | — | | | | 23,855 | | | | 23,858 | | | | 23,802 | | |

| | | 0.94% 1M SOFR+22 | | | Mar-2031–Nov-2031 | | | — | | | | 35,075 | | | | 35,083 | | | | 35,015 | | |

| | | 0.95% 1M SOFR+23 | | | Apr-2031 | | | — | | | | 17,500 | | | | 17,500 | | | | 17,493 | | |

| | | 1.01% 1M SOFR+29 | | | Feb-2029 | | | — | | | | 20,000 | | | | 20,006 | | | | 19,976 | | |

FANNIE MAE SECURITIES

continued

| | | Interest Rate5 | | | Maturity Date | | Unfunded Commitments1 | | | Face Amount | | | Amortize Cost | | | Value | |

| | | 1.05% 1M SOFR+52 | | | Jun-2032 | | | — | | | | 30,975 | | | | 30,975 | | | | 30,831 | |

| | | 1.06% | | | Dec-2027 | | | — | | | | 21,424 | | | | 21,432 | | | | 19,022 | |

| | | 1.17% | | | Aug-2030–Nov-2030 | | | — | | | | 34,582 | | | | 34,585 | | | | 28,815 | |

| | | 1.18% 1M SOFR+47 | | | May-2032 | | | — | | | | 23,705 | | | | 23,705 | | | | 23,700 | |

| | | 1.21% 1M SOFR+49 | | | May-2032 | | | — | | | | 28,526 | | | | 28,530 | | | | 28,597 | |

| | | 1.22% | | | Aug-2028–Jul-2030 | | | — | | | | 35,610 | | | | 35,717 | | | | 30,760 | |

| | | 1.22% 1M SOFR+47 | | | Jun-2029 | | | — | | | | 70,000 | | | | 70,022 | | | | 70,059 | |

| | | 1.25% | | | Jul-2030 | | | — | | | | 37,950 | | | | 38,073 | | | | 31,899 | |

| | | 1.26% | | | Jan-2031 | | | — | | | | 25,000 | | | | 24,994 | | | | 21,252 | |

| | | 1.27% | | | Jul-2030 | | | — | | | | 14,235 | | | | 14,333 | | | | 12,224 | |

| | | 1.31% | | | Aug-2030 | | | — | | | | 4,403 | | | | 4,463 | | | | 3,753 | |

| | | 1.32% | | | Aug-2030 | | | — | | | | 21,000 | | | | 21,271 | | | | 18,075 | |

| | | 1.38% | | | Jul-2030 | | | — | | | | 10,500 | | | | 10,639 | | | | 9,090 | |

| | | 1.41% 1M LIBOR+29 | | | Feb-2028 | | | — | | | | 30,420 | | | | 30,420 | | | | 30,361 | |

| | | 1.41% | | | Jul-2030 | | | — | | | | 3,273 | | | | 3,306 | | | | 2,835 | |

| | | 1.43% 1M LIBOR+31 | | | Mar-2028 | | | — | | | | 38,275 | | | | 38,277 | | | | 38,224 | |

| | | 1.46% 1M LIBOR+34 | | | Jan-2028 | | | — | | | | 22,425 | | | | 22,425 | | | | 22,386 | |

| | | 1.46% | | | Jul-2030 | | | — | | | | 7,506 | | | | 7,606 | | | | 6,534 | |

| | | 1.47% 1M LIBOR+35 | | | Dec-2027 | | | — | | | | 18,100 | | | | 18,100 | | | | 18,100 | |

| | | 1.47% | | | Jul-2030–Dec-2030 | | | — | | | | 15,425 | | | | 15,556 | | | | 13,061 | |

| | | 1.50% | | | Aug-2030 | | | — | | | | 1,158 | | | | 1,186 | | | | 1,008 | |

| | | 1.52% 1M LIBOR+40 | | | Sep-2028 | | | — | | | | 1,822 | | | | 1,822 | | | | 1,819 | |

| | | 1.52% | | | Jul-2032 | | | — | | | | 16,529 | | | | 16,668 | | | | 14,019 | |

| | | 1.53% | | | Jul-2032 | | | — | | | | 10,500 | | | | 10,655 | | | | 8,898 | |

| | | 1.55% | | | Jul-2032 | | | — | | | | 20,500 | | | | 20,802 | | | | 17,423 | |

| | | 1.56% 1M LIBOR+0 | | | May-2027 | | | — | | | | 16,516 | | | | 16,516 | | | | 16,512 | |

| | | 1.57% | | | Jan-2031 | | | — | | | | 21,949 | | | | 22,023 | | | | 18,975 | |

| | | 1.57% | | | Aug-2037 | | | — | | | | 47,414 | | | | 47,624 | | | | 37,490 | |

| | | 1.58% | | | Oct-2031 | | | — | | | | 57,950 | | | | 58,218 | | | | 48,627 | |

| | | 1.65% | | | Jul-2030 | | | — | | | | 1,253 | | | | 1,283 | | | | 1,104 | |

| | | 1.68% | | | Sep-2032 | | | — | | | | 12,761 | | | | 12,971 | | | | 10,920 | |

| | | 1.70% 1M LIBOR+58 | | | May-2029 | | | — | | | | 25,000 | | | | 25,008 | | | | 25,019 | |

| | | 1.70% | | | Jun-2029 | | | — | | | | 41,302 | | | | 41,322 | | | | 41,336 | |

| | | 1.71% | | | Sep-2035–Nov-2035 | | | — | | | | 25,604 | | | | 25,905 | | | | 20,119 | |

| | | 1.74% | | | Mar-2033 | | | — | | | | 6,160 | | | | 6,244 | | | | 5,091 | |

| | | 1.76% | | | Aug-2031–Dec-2036 | | | — | | | | 54,842 | | | | 55,009 | | | | 46,889 | |

| | | 1.77% | | | Sep-2035 | | | — | | | | 3,270 | | | | 3,337 | | | | 2,701 | |

| | | 1.78% 1M LIBOR+85 | | | Jan-2023 | | | — | | | | 819 | | | | 819 | | | | 819 | |

| | | 1.82% | | | Jul-2035 | | | — | | | | 4,617 | | | | 4,655 | | | | 3,802 | |

| 12 |  |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

FANNIE MAE SECURITIES

continued

| | Interest Rate5 | Maturity Date | Unfunded

Commitments1 | Face

Amount | Amortize

Cost | Value |

| | 1.88% | Nov-2031 | — | 25,400 | 25,435 | 21,898 |

| | 1.94% | Apr-2035 | — | 6,400 | 6,499 | 5,432 |

| | 2.00% | Apr-2031 | — | 18,000 | 18,622 | 15,864 |

| | 2.09% | May-2032–Jul-2050 | — | 21,791 | 22,038 | 17,879 |

| | 2.16% | Sep-2050 | — | 14,200 | 14,359 | 9,829 |

| | 2.33% | Nov-2029–Feb-2030 | — | 18,123 | 18,165 | 16,769 |

| | 2.41% | Apr-2051 | — | 3,743 | 3,781 | 2,984 |

| | 2.43% | Nov-2031 | — | 18,655 | 18,662 | 17,140 |

| | 2.46% | Aug-2026–Jan-2038 | — | 56,280 | 56,370 | 50,907 |

| | 2.47% | Dec-2051 | — | 13,498 | 13,689 | 10,857 |

| | 2.49% | Dec-2026–Nov-2031 | — | 27,267 | 27,318 | 25,710 |

| | 2.50% | Jun-2026 | — | 60,000 | 60,000 | 58,266 |

| | 2.53% | Jan-2030 | — | 20,550 | 20,675 | 19,185 |

| | 2.55% | Sep-2026 | — | 14,210 | 14,313 | 13,746 |

| | 2.55% | Mar-2030 | — | 51,656 | 51,823 | 48,348 |

| | 2.56% | Dec-2051 | — | 12,685 | 12,717 | 10,346 |

| | 2.57% | Mar-2042 | — | 25,155 | 25,168 | 20,291 |

| | 2.61% | Nov-2026 | — | 9,800 | 9,844 | 9,512 |

| | 2.67% | Aug-2029 | — | 37,700 | 37,969 | 36,398 |

| | 2.70% | Nov-2025 | — | 14,536 | 14,538 | 14,271 |

| | 2.72% | Jul-2028 | — | 36,400 | 36,547 | 35,133 |

| | 2.76% | Oct-2031 | — | 10,189 | 10,318 | 9,603 |

| | 2.81% | Sep-2027 | — | 12,033 | 12,063 | 11,742 |

| | 2.85% | Aug-2031 | — | 8,760 | 8,802 | 8,278 |

| | 2.91% | Jun-2031 | — | 25,000 | 25,106 | 23,569 |

| | 2.92% | Jun-2027 | — | 66,143 | 66,178 | 64,926 |

| | 2.92% | Apr-2028 | — | 15,630 | 15,666 | 15,271 |

| | 2.93% | Apr-2038 | — | 36,239 | 36,262 | 32,414 |

| | 2.94% | Jun-2027–Jul-2039 | — | 30,846 | 30,889 | 30,313 |

| | 2.96% | Sep-2034 | — | 20,000 | 20,681 | 18,766 |

| | 2.97% | Nov-2032–Sep-2034 | — | 32,233 | 32,456 | 30,571 |

| | 2.99% | Jun-2025 | — | 2,565 | 2,566 | 2,542 |

| | 3.00% | May-2027–Mar-2028 | — | 15,672 | 15,681 | 15,360 |

| | 3.01% | Apr-2052 | — | 7,480 | 7,485 | 6,390 |

| | 3.02% | Jun-2027–Sep-2027 | — | 29,705 | 29,780 | 29,090 |

| | 3.04% | Apr-2030 | — | 25,030 | 25,077 | 24,353 |

| | 3.05% | Apr-2030 | — | 25,969 | 25,985 | 25,211 |

| | 3.09% | May-2026 | — | 5,125 | 5,167 | 5,054 |

| | 3.12% | Apr-2030 | — | 12,737 | 12,739 | 12,378 |

FANNIE MAE SECURITIES

continued

| | Interest Rate5 | Maturity Date | Unfunded

Commitments1 | Face

Amount | Amortize

Cost | Value |

| | 3.14% | Apr-2029 | — | 7,621 | 7,631 | 7,484 |

| | 3.17% | Jun-2029–Sep-2029 | — | 36,207 | 36,321 | 35,420 |

| | 3.18% | May-2035 | — | 9,381 | 9,478 | 9,123 |

| | 3.21% | May-2030 | — | 6,500 | 6,556 | 6,352 |

| | 3.24% | May-2052 | — | 6,492 | 6,625 | 5,736 |

| | 3.26% | Jan-2027 | — | 7,033 | 7,039 | 7,003 |

| | 3.31% | Oct-2027 | — | 15,117 | 15,172 | 15,085 |

| | 3.33% | May-2029 | — | 6,496 | 6,714 | 6,497 |

| | 3.36% | Oct-2029 | — | 10,648 | 10,651 | 10,583 |

| | 3.40% | Oct-2026 | — | 2,761 | 2,765 | 2,768 |

| | 3.41% | Sep-2023 | — | 10,509 | 10,509 | 10,514 |

| | 3.42% | Apr-2035 | — | 5,064 | 5,120 | 4,932 |

| | 3.46% | Dec-2023–Apr-2031 | — | 16,058 | 16,117 | 15,870 |

| | 3.50% | Aug-2039 | — | 13,206 | 13,206 | 12,548 |

| | 3.61% | Sep-2023 | — | 5,927 | 5,927 | 5,938 |

| | 3.63% | Jul-2035 | — | 21,372 | 21,395 | 21,141 |

| | 3.66% | Oct-2023 | — | 4,344 | 4,344 | 4,355 |

| | 3.68% | Jul-2028 | — | 12,011 | 12,407 | 12,095 |

| | 3.70% | Oct-2033 | — | 19,865 | 19,933 | 20,075 |

| | 4.69% | Jun-2035 | — | 534 | 544 | 550 |

| | 5.15% | Oct-2022 | — | 76 | 76 | 76 |

| | 5.30% | Aug-2029 | — | 3,891 | 3,868 | 4,140 |

| | 5.69% | Jun-2041 | — | 4,240 | 4,326 | 4,551 |

| | 5.75% | Jun-2041 | — | 2,059 | 2,107 | 2,213 |

| | 5.91% | Mar-2037 | — | 1,559 | 1,577 | 1,564 |

| | 5.96% | Jan-2029 | — | 229 | 229 | 229 |

| | 6.15% | Jan-2023 | — | 3,124 | 3,124 | 3,132 |

| | 8.40% | Jul-2023 | — | 64 | 64 | 65 |

| | | | — | 2,120,466 | 2,129,150 | 1,975,957 |

| Forward | | | | | | |

| Commitments | 2.21% | Dec-2039 | 41,587 | — | — | (10,153) |

| | 2.56% | Jul-2038 | 10,774 | — | — | (2,048) |

| | 2.58% | Jan-2040 | 11,700 | — | — | (2,510) |

| | 2.59% | Feb-2039–Mar-2039 | 35,409 | — | — | (7,068) |

| | 2.72% | Jul-2040 | 27,794 | — | 278 | (6,129) |

| | 4.47% | Jul-2041 | 10,058 | — | — | (610) |

| | | | 137,322 | — | 278 | (28,518) |

| When Issued4 | 3.91% | Aug-2032 | — | 25,000 | 25,320 | 25,375 |

| Total Fannie Mae Securities | $137,322 | $2,949,204 | $2,985,872 | $2,729,842 |

| 2022 SEMI-ANNUAL REPORT | 13 |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

FREDDIE MAC SECURITIES

(8.5% OF NET ASSETS)

| | Interest Rate5 | Maturity

Date | Unfunded

Commitments1 | Face

Amount | Amortized

Cost | Value |

| Single Family | 0.92%1M SOFR+20 | Aug-2031 | $ | — | $ 32,000 | $ 32,000 | $ 31,640 |

| | 0.96%1M SOFR+24 | Jan-2031 | | — | 42,864 | 42,864 | 42,412 |

| | 0.96%1M SOFR+24 | Jun-2031 | | — | 31,524 | 31,522 | 30,930 |

| | 0.97%1M SOFR+25 | Dec-2030 | | — | 21,797 | 21,797 | 21,578 |

| | 1.02%1M SOFR+30 | Dec-2030 | | — | 21,897 | 21,897 | 21,684 |

| | 1.08%1M SOFR+36 | Oct-2030 | | — | 10,562 | 10,562 | 10,505 |

| | 1.25%1M LIBOR+13 | Nov-2027 | | — | 18,573 | 18,573 | 18,299 |

| | 1.38%1M LIBOR+26 | Nov-2030 | | — | 15,308 | 15,308 | 15,259 |

| | 1.45%1M LIBOR+33 | Oct-2030 | | — | 5,985 | 5,985 | 5,970 |

| | 1.54%1M LIBOR+42 | May-2027 | | — | 5,954 | 5,954 | 5,942 |

| | 1.62%1M LIBOR+30 | Feb-2036 | | — | 329 | 329 | 328 |

| | 1.65%1M LIBOR+33 | May-2037 | | — | 71 | 71 | 70 |

| | 1.67%1M LIBOR+35 | Apr-2036–Jan-2043 | | — | 2,289 | 2,291 | 2,277 |

| | 1.72%1M LIBOR+40 | Aug-2043 | | — | 2,114 | 2,113 | 2,108 |

| | 1.77%1M LIBOR+65 | Jan-2023 | | — | 733 | 733 | 733 |

| | 1.80%1M LIBOR+48 | Oct-2040 | | — | 1,644 | 1,643 | 1,651 |

| | 1.82%1M LIBOR+50 | Oct-2040–Jun-2044 | | — | 6,138 | 6,143 | 6,151 |

| | 1.87%1M LIBOR+55 | Nov-2040 | | — | 1,482 | 1,492 | 1,489 |

| | 1.99%1M LIBOR+67 | Aug-2037 | | — | 1,943 | 1,960 | 1,961 |

| | 2.02%12M LIBOR+178 | Jul-2035 | | — | 100 | 99 | 102 |

| | 2.34%1Y UST+223 | Oct-2033 | | — | 164 | 163 | 168 |

| | 2.50% | Jan-2043–Aug-2046 | | — | 6,110 | 6,178 | 5,571 |

| | 3.00% | Aug-2042–Sep-2046 | | — | 25,817 | 26,268 | 24,653 |

| | 3.35%1Y UST+223 | Jun-2033 | | — | 51 | 51 | 52 |

| | 3.35% | Oct-2033 | | — | 33,450 | 33,322 | 32,529 |

| | 3.50% | Jan-2026–Oct-2046 | | — | 47,745 | 48,730 | 46,979 |

FREDDIE MAC SECURITIES

continued

| | Interest Rate5 | Maturity

Date | Unfunded

Commitments1 | Face

Amount | Amortized

Cost | Value |

| | 3.50% | Jan-2026 | — | 18,000 | 18,047 | 17,845 |

| | 3.68% | Oct-2025 | — | 10,000 | 10,063 | 10,049 |

| | 4.00% | Nov-2024–Aug-2047 | — | 45,449 | 47,109 | 45,709 |

| | 4.50% | Jan-2038–Dec-2044 | — | 12,547 | 13,038 | 12,967 |

| | 5.00% | Sep-2022–Mar-2041 | — | 1,943 | 1,936 | 2,040 |

| | 5.50% | Apr-2033–Jul-2038 | — | 1,862 | 1,856 | 1,989 |

| | 6.00% | Dec-2033–Oct-2037 | — | 2,526 | 2,546 | 2,751 |

| | 6.50% | Apr-2028–Nov-2037 | — | 462 | 465 | 514 |

| | 7.00% | Apr-2028–Mar-2030 | — | 20 | 19 | 22 |

| | 7.50% | Aug-2029–Apr-2031 | — | 28 | 28 | 31 |

| | 8.50% | Jul-2024–Jan-2025 | — | 13 | 13 | 14 |

| | | | — | 429,494 | 433,168 | 424,972 |

| Multifamily | 0.94%1M SOFR+23 | Jul-2027 | — | 3,924 | 3,925 | 3,918 |

| | 2.04% | May-2050 | — | 20,269 | 20,756 | 15,470 |

| | 2.40% | Jun-2031 | — | 7,444 | 7,528 | 6,770 |

| | 2.41% | Jun-2031 | — | 11,732 | 11,872 | 10,678 |

| | 2.42% | Jun-2031 | — | 11,768 | 11,917 | 10,720 |

| | 3.28% | Dec-2029 | — | 15,958 | 16,110 | 15,890 |

| | 3.34% | Dec-2029 | — | 9,434 | 9,545 | 9,248 |

| | 3.38% | Apr-2030 | — | 13,886 | 14,076 | 13,853 |

| | 3.48% | Jun-2030 | — | 18,138 | 18,465 | 18,224 |

| | 3.60% | Apr-2030 | — | 24,717 | 25,268 | 25,094 |

| | | | — | 137,270 | 139,462 | 129,865 |

| Forward Commitments | 2.38% | Feb-2034 | 43,500 | — | 163 | (6,278) |

| Total Freddie Mac Securities | $43,500 | $566,764 | $572,793 | $548,559 |

| 14 |  |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

STATE HOUSING FINANCE AGENCY SECURITIES

(7.2% OF NET ASSETS)

| | | Interest Rates2 | | | | | |

| | Issuer | Permanent | Construction | Maturity Date | Face Amount | Amortized Cost | Value |

| Multifamily | Illinois State Housing Finance Auth | — | 0.33% | Aug-2023 | $ | 20,000 | $ | 20,000 | $ | 19,987 |

| | Illinois Housing Development Auth | — | 0.40% | Dec-2024 | | 470 | | 470 | | 451 |

| | Mass Housing | — | 0.50% | Dec-2023 | | 10,020 | | 10,020 | | 9,818 |

| | Mass Housing6 | — | 1.50% | Dec-2022 | | 8,750 | | 8,751 | | 8,743 |

| | Mass Housing | — | 2.15% | Sep-2023 | | 32,282 | | 32,285 | | 31,834 |

| | Mass Housing | — | 2.15% | Sep-2023 | | 4,465 | | 4,468 | | 4,436 |

| | City of St. Louis Park, MN | — | 2.93% | Jan-2026 | | 20,577 | | 20,577 | | 20,460 |

| | Mass Housing6 | — | 3.55% | Oct-2022 | | 13,570 | | 13,570 | | 13,615 |

| | Connecticut Housing Finance Auth6 | — | 3.70% | Nov-2022 | | 17,800 | | 17,789 | | 17,797 |

| | Illinois Housing Development Auth | 2.06% | — | Jan-2042 | | 28,005 | | 28,009 | | 19,818 |

| | Illinois Housing Development Auth | 2.07% | — | Jul-2041 | | 84,895 | | 84,893 | | 60,896 |

| | Mass Housing | 2.60% | — | Jun-2063 | | 26,410 | | 26,410 | | 16,820 |

| | Illinois Housing Development Auth | 2.65% | — | Jul-2062 | | 21,810 | | 21,832 | | 14,448 |

| | NYC Housing Development Corp | 2.95% | — | Nov-2041–Nov-2045 | | 11,275 | | 11,275 | | 9,767 |

| | NYC Housing Development Corp | 3.05% | — | Nov-2046 | | 13,000 | | 13,000 | | 9,446 |

| | NYC Housing Development Corp | 3.10% | — | Oct-2046 | | 20,733 | | 20,734 | | 17,844 |

| | NYC Housing Development Corp | 3.25% | — | Nov-2049 | | 12,000 | | 12,000 | | 9,781 |

| | Connecticut Housing Finance Auth | 3.25% | — | May-2050 | | 12,200 | | 12,215 | | 10,097 |

| | Mass Housing6 | 3.30% | — | Dec-2059 | | 8,340 | | 8,345 | | 6,451 |

| | NYC Housing Development Corp | 3.35% | — | Nov-2054 | | 20,000 | | 20,000 | | 16,191 |

| | NYC Housing Development Corp | 3.45% | — | May-2059 | | 20,000 | | 20,000 | | 16,180 |

| | NYC Housing Development Corp | 3.75% | — | May-2035 | | 3,200 | | 3,200 | | 3,129 |

| | Mass Housing6 | 3.85% | — | Dec-2058 | | 9,570 | | 9,567 | | 8,959 |

| | NYC Housing Development Corp | 3.95% | — | Nov-2043 | | 14,555 | | 14,555 | | 13,903 |

| | NYC Housing Development Corp | 4.00% | — | Dec-2028–Nov-2048 | | 14,325 | | 14,428 | | 13,820 |

| | MassHousing | 4.13% | — | Dec-2036 | | 5,000 | | 5,000 | | 5,002 |

| | NYC Housing Development Corp | 4.13% | — | Nov-2053 | | 8,305 | | 8,305 | | 7,825 |

| | NYC Housing Development Corp | 4.20% | — | Dec-2039 | | 8,305 | | 8,305 | | 8,305 |

| | Chicago Housing Authority | 4.36% | — | Jan-2038 | | 25,000 | | 25,000 | | 24,506 |

| | MassHousing | 4.50% | — | Jun-2056 | | 45,000 | | 45,000 | | 44,463 |

| Total State Housing Finance Agency Securities | $ | 539,862 | $ | 540,003 | $ | 464,792 |

| 2022 SEMI-ANNUAL REPORT | 15 |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

OTHER MULTIFAMILY INVESTMENTS

(2.9% OF NET ASSETS)

| | Interest Rates2,5 | | Unfunded | | | | | | |

| Issuer | Permanent | | Construction | Maturity Date | Commitments1 | Face Amount | Amortized Cost | Value |

| Direct Loans | | | | | | | | | | | | |

| 53 Colton Street (Level 3) | — | 3.05% | | Dec-2023 | $ | 3,013 | $ | 13,004 | $ | 12,916 | $ | 12,793 |

| Wilder Square (Level 3) | — | 3.25% | | Mar-2023 | | 52 | | 11,448 | | 11,423 | | 11,333 |

| University and Fairview (Level 3) | — | 3.45% | | Jun-2024 | | — | | 15,000 | | 14,936 | | 14,510 |

| University and Fairview (Level 3) | — | 3.45% | | Dec-2023 | | 628 | | 21,886 | | 21,780 | | 21,234 |

| Old Cedar (Level 3) | — | 3.50% | | Dec-2023 | | — | | 11,000 | | 10,975 | | 10,724 |

| Peregrine Apartments (Level 3) | — | 3.60% | | Jun-2024–Dec-2024 | | 24,565 | | 3,229 | | 3,135 | | 2,023 |

| The Crest Apartments (Level 3) | — | 3.75% | | Jun-2024 | | 7,700 | | 1,800 | | 1,787 | | 1,466 |

| 18 Sixth Ave at Pacific Park (Level 3) | — | 3.81% | 1M LIBOR+220 | Dec-2024 | | 7,349 | | 9,873 | | 9,841 | | 9,733 |

| 18 Sixth Ave at Pacific Park (Level 3) | — | 3.81% | 1M LIBOR+220 | Dec-2024 | | 10,568 | | 72,210 | | 72,009 | | 71,537 |

| Ladder 260—Tax Exempt (Level 3) | — | 4.04% | | Nov-2025 | | 7,391 | | 770 | | 709 | | 602 |

| 99 Ocean (Level 3) | — | 4.05% | | Oct-2024 | | 29,752 | | 22,248 | | 21,795 | | 21,694 |

| Granada (Level 3) | — | 6.89% | | Jan-2024 | | 8,492 | | 4,508 | | 4,451 | | 4,554 |

| | | | | | | 99,510 | | 186,976 | | 185,757 | | 182,203 |

| Forward Commitments (Direct Loans) | | | | | | | | |

| 53 Colton Street (Level 3) | — | 3.25% | | Dec-2023 | | 3,042 | | — | | (8) | | (129) |

| The Crest Apartments (Level 3) | — | 3.75% | | Dec-2023 | | 3,815 | | — | | (33) | | (109) |

| 311 W 42nd Street (Level 3) | — | 4.20% | | Nov-2024 | | 50,000 | | — | | (184) | | (354) |

| | | | | | | 56,857 | | — | | (225) | | (592) |

| Privately Insured Construction/Permanent Mortgages7 | | | | | | | | |

| Illinois Housing Development Auth | 6.20% | — | | Dec-2047 | | — | | 2,881 | | 2,889 | | 2,874 |

| Illinois Housing Development Auth | 6.40% | — | | Nov-2048 | | — | | 877 | | 886 | | 875 |

| | | | | | | — | | 3,758 | | 3,775 | | 3,749 |

| Total Other Multifamily Investments | $ | 156,367 | $ | 190,734 | $ | 189,307 | $ | 185,360 |

| 16 |  |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

COMMERCIAL MORTGAGE-BACKED SECURITIES

(1.4% OF NET ASSETS)

| Issuer | Interest Rate | Maturity Date | Face Amount | Amortized Cost | Value |

| Nomura | 2.77% | Dec-2045 | $ | 9,587 | $ | 9,706 | $ | 9,544 |

| Nomura | 3.19% | Mar-2046 | | 18,985 | | 19,268 | | 18,856 |

| Citigroup | 3.62% | Jul-2047 | | 8,000 | | 8,165 | | 7,877 |

| Barclays/ JP Morgan | 3.81% | Jul-2047 | | 2,250 | | 2,297 | | 2,224 |

| RBS/ Wells Fargo | 3.82% | Aug-2050 | | 5,000 | | 5,110 | | 4,915 |

| Deutsche Bank/UBS | 3.96% | Mar-2047 | | 5,000 | | 5,104 | | 4,934 |

| Barclays/ JP Morgan | 4.00% | Apr-2047 | | 5,000 | | 5,104 | | 4,936 |

| Cantor/Deutsche Bank | 4.01% | Apr-2047 | | 20,000 | | 20,416 | | 19,788 |

| Barclays/ JP Morgan | 4.08% | Feb-2047 | | 6,825 | | 7,098 | | 6,741 |

| Cantor/Deutsche Bank | 4.24% | Feb-2047 | | 7,000 | | 7,144 | | 6,964 |

| Total Commercial Mortgage Backed Securities | $ | 87,647 | $ | 89,412 | $ | 86,779 |

UNITED STATES TREASURY SECURITIES

(5.0% OF NET ASSETS)

| | Interest Rate | Maturity Date | Face Amount | Amortized Cost | Value |

| | 0.63% | May-2030 | $ | 63,000 | $ | 62,449 | $ | 52,487 |

| | 0.63% | Aug-2030 | | 30,000 | | 29,802 | | 24,846 |

| | 1.13% | Feb-2031 | | 25,000 | | 24,129 | | 21,457 |

| | 1.25% | Apr-2028 | | 65,000 | | 64,840 | | 58,607 |

| | 1.50% | Feb-2030 | | 35,000 | | 36,403 | | 31,410 |

| | 1.75% | Nov-2029–Aug-2041 | | 50,000 | | 49,493 | | 42,647 |

| | 1.88% | Feb-2032 | | 15,000 | | 14,015 | | 13,571 |

| | 2.00% | Nov-2041 | | 7,000 | | 6,652 | | 5,533 |

| | 2.25% | May-2041 | | 42,000 | | 43,321 | | 34,880 |

| | 2.38% | Feb-2042 | | 15,000 | | 15,301 | | 12,661 |

| | 2.88% | Aug-2028–May-2032 | | 25,000 | | 24,762 | | 24,685 |

| Total United States Treasury Securities | $ | 372,000 | $ | 371,167 | $ | 322,784 |

| | | | | | |

| Total Fixed-Income Investments | $ | 6,937,288 | $ | 7,037,969 | $ | 6,405,265 |

EQUITY INVESTMENT IN WHOLLY-OWNED SUBSIDIARY

(LESS THAN 0.01% OF NET ASSETS)

| Issuer | Face Amount (Cost) | Amount of Dividends or Interest | Value |

| HIT Advisers8 (Level 3) | $1 | $— | $189 |

| Total Equity Investment | $1 | $— | $189 |

SHORT-TERM INVESTMENTS

(1.1% OF NET ASSETS)

| Issuer | Interest Rate | Maturity Date | Face Amount | Amortized Cost | Value |

| Commercial Paper | | | | | | | | |

| Societe Generale | 1.44%9 | Jul-2022 | $ | 40,000 | $ | 40,000 | $ | 40,000 |

| | | | | | | | | |

| BlackRock Federal Funds | 1.33%10 | Jul-2022 | | 27,800 | | 27,800 | | 27,800 |

| Total Short-Term Investments | $ | 67,800 | $ | 67,800 | $ | 67,800 |

| | | | | | | |

| Total Investments | $ | 7,005,089 | $ | 7,105,770 | $ | 6,473,254 |

| 2022 SEMI-ANNUAL REPORT | 17 |

SCHEDULE OF PORTFOLIO INVESTMENTS

June 30, 2022 (dollars in thousands, unaudited) continued

FOOTNOTES

| 1 | The HIT may make commitments in securities or loans that fund over time on a draw basis or forward commitments that fund at a single point in time. The unfunded amount of these commitments totaled $689.7 million at period end. Generally, GNMA construction securities fund over a 12- to 24-month period. Funding periods for State Housing Finance Agency construction securities and Direct Loans vary by project, but generally fund over a one- to 48-month period. Forward commitments generally settle within 12 months of the original commitment date. |

| 2 | Construction interest rates are the rates charged to the borrower during the construction phase of the project. The permanent interest rates are charged to the borrower during the amortization period of the loan, unless the U.S. Department of Housing and Urban Development requires that such rates be charged earlier. |

| 3 | Federally tax-exempt bonds collateralized by Ginnie Mae securities. |

| 4 | The HIT records when issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when issued basis are marked to market monthly and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract. |

| 5 | For floating and variable rate securities the rate indicated is for the period end. With respect to these securities, the schedule also includes the reference rate and spread in basis points. |

| 6 | Securities exempt from registration under the Securities Act of 1933 and were privately placed directly by a state housing agency (a not-for-profit public agency) with the HIT. The securities are backed by mortgages and are general obligations of the state housing agency, and therefore secured by the full faith and credit of said agency. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities are considered liquid, under procedures established by and under the general supervision of the HIT’s Board of Trustees. |

| 7 | Loans insured by Ambac Assurance Corporation, are additionally backed by a repurchase option from the mortgagee for the benefit of the HIT. The repurchase price is defined as the unpaid principal balance of the loan plus all accrued unpaid interest due through the remittance date. The repurchase option can be exercised by the HIT in the event of a payment failure by Ambac Assurance Corporation. |

| 8 | The HIT has a participation interest in HIT Advisers, a Delaware limited liability company. HIT Advisers is a New York based adviser currently exempt from investment adviser registration in New York. The investment in HIT Advisers is valued by the HIT’s valuation committee in accordance with the fair value procedures adopted by the HIT’s Board of Trustees, and approximates carrying value of HIT Advisors and its subsidiary on a consolidated basis. The participation interest is not registered under the federal securities laws. |

| 9 | Rate indicated is the effective yield at the time of purchase. |

| 10 | Rate indicated is the annualized 1-day yield as of June 30, 2022. |

KEY TO ABBREVIATIONS

| LIBOR | London Interbank Offered Rate |

| SOFR | Secured Overnight Financing Rate |

| 18 |  |

Statement of Operations

For the Six Months Ended June 30, 2022 (dollars in thousands; unaudited)

| Investment income | | $ | 74,534 |

| | | | |

| Expenses | | | |

| | Non-officer salaries and fringe benefits | | 4,040 |

| | Officer salaries and fringe benefits | | 2,530 |

| | Investment management | | 781 |

| | Marketing and sales promotion (12b-1) | | 683 |

| | Legal fees | | 248 |

| | Auditing, tax and accounting fees | | 198 |

| | Insurance | | 184 |

| | Consulting fees | | 156 |

| | Trustee expenses | | 57 |

| | Rental expenses | | 292 |

| | General expenses | | 1,040 |

| | Total expenses | | 10,209 |

| | | |

| Net investment income | | 64,325 |

| | | |

| Net realized and unrealized gains (losses) on investments | | |

| | Net realized gains (losses) on investments | | (7,881) |

| | Net change in unrealized appreciation (depreciation) on investments | | (757,608) |

| | Net realized and unrealized gains (losses) on investments | | (765,489) |

| | | |

| Net increase (decrease) in net assets resulting from operations | $ | (701,164) |

See accompanying Notes to Financial Statements (unaudited).

| 2022 SEMI-ANNUAL REPORT | 19 |

Statement of Changes in Net Assets

(dollars in thousands)

| | | Six Months Ended | | Year Ended |

| Increase (decrease) in net assets from operations | | June 30, 2022 (unaudited) | | December 31, 2021 |

| Net investment income | | $ | 64,325 | | | $ | 121,316 | |

| Net realized gains (losses) on investments | | | (7,881 | ) | | | 42,547 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (757,608 | ) | | | (233,148 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (701,164 | ) | | | (69,285 | ) |

| | | | | | | | | |

| Distribution to participants or reinvested | | | (73,749 | ) | | | (164,726 | ) |

| | | | | | | | | |

| Increase (decrease) in net assets from unit transactions | | | | | | | | |

| Proceeds from the sale of units of participation | | | 44,358 | | | | 494,038 | |

| Dividend reinvestment of units of participation | | | 68,485 | | | | 152,548 | |

| Payments for redemption of units of participation | | | (24,632 | ) | | | (55,307 | ) |

| Net increase from unit transactions | | | 88,211 | | | | 591,279 | |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | (686,702 | ) | | | 357,268 | |

| | | | | | | | | |

| Net assets | | | | | | | | |

| Beginning of period | | $ | 7,106,556 | | | $ | 6,749,288 | |

| End of period | | $ | 6,419,854 | | | $ | 7,106,556 | |

| | | | | | | | | |

| Unit information | | | | | | | | |

| Units sold | | | 41,818 | | | | 429,253 | |

| Distributions reinvested | | | 64,802 | | | | 132,574 | |

| Units redeemed | | | (23,189 | ) | | | (47,955 | ) |

| Increase in units outstanding | | | 83,431 | | | | 513,872 | |

See accompanying Notes to Financial Statements (unaudited).

| 20 |  |

Notes to Financial Statements

(unaudited)

Note 1. Summary of Significant Accounting Policies

The American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) Housing Investment Trust (HIT) is a common law trust created under the laws of the District of Columbia and is registered under the Investment Company Act of 1940, as amended (Investment Company Act), as a no-load, open-end investment company. The HIT has obtained certain exemptions from the requirements of the Investment Company Act that are described in the HIT’s Prospectus and Statement of Additional Information. Participation in the HIT is limited to eligible pension plans and labor organizations, including health and welfare, general, voluntary employees’ benefit associations and other funds that have beneficiaries who are represented by labor organizations. The following is a summary of significant accounting policies followed by the HIT in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles (GAAP) in the United States. The HIT follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services—Investment Companies.

INVESTMENT VALUATION

Net asset value per share (NAV) is determined as of the close of regular trading (normally 4:00 p.m.) of the New York Stock Exchange on the last business day of each calendar month. The HIT’s Board of Trustees is responsible for the valuation process and has delegated the supervision of the valuation process to a Valuation Committee. The Valuation Committee, in accordance with the policies and procedures adopted by the HIT’s Board of Trustees, is responsible for evaluating the effectiveness of the HIT’s pricing policies, determining the reliability of third-party pricing information and reporting to the Board of Trustees on valuation matters, including fair value determinations. Following is a description of the valuation methods and inputs applied to the HIT’s major categories of assets. Portfolio securities for which market quotations are readily available are valued by using independent pricing services. For U.S. Treasury securities, independent pricing services generally base prices on actual transactions as well as dealer-supplied market information. For State Housing Finance Agency securities, independent pricing services generally base prices using models that utilize trading spreads, new issue scales, verified bid information and credit ratings. For commercial mortgage-backed securities, independent pricing services generally base prices on cash flow models that take into consideration benchmark yields and utilize available trade information, dealer quotes and market color.

For U.S. agency and government-sponsored enterprise securities, including single family and multifamily mortgage-backed securities, construction mortgage securities and loans and collateralized mortgage obligations, independent pricing services generally base prices on an

active TBA (to-be-announced) market for mortgage pools, discounted cash flow models, or option-adjusted spread models. Independent pricing services examine reference data and use observable inputs such as issue name, issue size, ratings, maturity, call type and spread/ benchmark yields, as well as dealer-supplied market information. The discounted cash flow or option-adjusted spread models utilize inputs from matrix pricing, which consider observable market-based discount and prepayment rates, attributes of the collateral, and yield or price of bonds of comparable quality, coupon, maturity and type.

Investments in registered open-end investment management companies are valued based upon the NAV of such investments.

When the HIT finances the construction and permanent securities or participation interests, value is determined based upon the total amount, funded and/or unfunded, of the commitment.

Portfolio investments for which market quotations are not readily available or deemed unreliable are valued at their fair value determined in good faith by the HIT’s Valuation Committee using consistently applied procedures adopted by the HIT’s Board of Trustees. In determining fair market value, the Valuation Committee will employ a valuation method that it believes reflects fair value for that asset, which may include the use of an independent valuation consultant or the utilization of a discounted cash flow model based on broker and/or other market inputs. The frequency with which these fair value procedures may be used cannot be predicted. However, on June 30, 2022, the Valuation Committee fair valued less than 0.01% of the HIT’s net assets utilizing internally derived unobservable inputs.

Short-term investments acquired with a stated maturity of 60 days or less are generally valued at amortized cost, which approximates fair market value.

The HIT holds a 100% ownership interest, either directly or indirectly in HIT Advisers LLC (HIT Advisers). HIT Advisers is valued at its fair value determined in good faith under consistently applied procedures adopted by the HIT’s Board of Trustees, which approximates its respective carrying value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. The HIT classifies its assets and liabilities into three levels based on the method used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities, interest rates, prepayment speeds, credit risk and quoted prices in inactive markets. Level 3 values are based on significant unobservable inputs that reflect the HIT’s determination of assumptions that market participants might reasonably use in valuing the securities.

| 2022 SEMI-ANNUAL REPORT | 21 |

NOTES TO FINANCIAL STATEMENTS

(unaudited)—continued

The following table presents the HIT’s valuation levels as of June 30, 2022:

| | | Investment Securities | |

| (dollars in thousands) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| FHA Permanent Securities | | $ | — | | | $ | 138,242 | | | $ | — | | | $ | 138,242 | |

| Ginnie Mae Construction Securities | | | — | | | | 169,454 | | | | — | | | | 169,454 | |

| Ginnie Mae Securities | | | — | | | | 1,710,263 | | | | — | | | | 1,710,263 | |

| Fannie Mae Securities | | | — | | | | 2,732,985 | | | | — | | | | 2,732,985 | |

| Freddie Mac Securities | | | — | | | | 554,837 | | | | — | | | | 554,837 | |

| State Housing Finance Agency Securities | | | — | | | | 464,792 | | | | — | | | | 464,792 | |

| Other Multifamily Investments | | | | | | | | | | | | | | | | |

| Direct Loans | | | — | | | | — | | | | 182,203 | | | | 182,203 | |

| Privately Insured Construction/Permanent Mortgages | | | — | | | | 3,749 | | | | — | | | | 3,749 | |

| Total Other Multifamily Investments | | | — | | | | 3,749 | | | | 182,203 | | | | 185,952 | |

| Commercial Mortgage-Backed Securities | | | — | | | | 86,779 | | | | — | | | | 86,779 | |

| United States Treasury Securities | | | — | | | | 322,784 | | | | — | | | | 322,784 | |

| Equity Investments | | | — | | | | — | | | | 189 | | | | 189 | |

| Short-Term Investments | | | 67,800 | | | | — | | | | — | | | | 67,800 | |

| Other Financial Instruments* | | | — | | | | 39,769 | | | | (592 | ) | | | 39,177 | |

| Total | | $ | 67,800 | | | $ | 6,223,654 | | | $ | 181,800 | | | $ | 6,473,254 | |

* If held in the portfolio at report date, other financial instruments includes forward commitments, TBA and when-issued securities.

The following table reconciles the valuation of the HIT’s Level 3 investment securities and related transactions for the period ended June 30, 2022:

| | | Investments in Securities | |

| | | Other Multifamly | | | | | | Other Financial | | | | |

| (dollars in thousands) | | Investments | | | Equity Investment | | | Instruments | | | Total | |

| Beginning Balance, 12/31/2021 | | $126,769 | | | $104 | | | $112 | | | $126,985 | |

| Paydowns/Settlements | | (335 | ) | | — | | | — | | | (335 | ) |

| Total Unrealized Gain (Loss)* | | (5,077 | ) | | 85 | | | (704 | ) | | (5,696 | ) |

| Cost of Purchases | | 60,846 | | | — | | | — | | | 60,846 | |

| Ending Balance, 06/30/2022 | | $182,203 | | | $189 | | | $(592 | ) | | $181,800 | |

* Net change in unrealized gain (loss) attributable to Level 3 securities held at June 30, 2022 totaled ($5,696,000) and is included on the accompanying Statement of Operations.

For the six months ended June 30, 2022, there were no transfers in levels.

Level 3 securities primarily consists of Direct Loans which were valued by an independent pricing service as of June 30, 2022 utilizing a discounted cash flow model. Weighted average lives for the loans ranged from 0.67 to 2.92 years. Unobservable inputs include spreads to relevant U.S. Treasuries ranging from 66 to 325 basis points. A change in unobservable inputs may impact the value of the loans.

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

FEDERAL INCOME TAXES

The HIT’s policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended (Internal Revenue Code), that are applicable to regulated investment companies, and to distribute all of its taxable income to its participants. Therefore, no federal income tax provision is required.

Tax positions taken or expected to be taken in the course of preparing the HIT’s tax returns are evaluated to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Management has analyzed for all open years the HIT’s tax positions taken on federal income tax returns and has concluded that no provision for income tax is required in the HIT’s financial statements.

The HIT files U.S. federal, state and local tax returns as required. The HIT’s tax returns are subject to examination by the relevant tax authorities until the expiration of the applicable statutes of limitations, which is generally three years after the filing of the tax return but could be longer in certain circumstances.

DISTRIBUTIONS TO PARTICIPANTS

At the end of each calendar month, a pro-rata distribution is made to participants of the net investment income earned during the month. This pro-rata distribution is based on the participant’s number of units held as of the immediately preceding month-end and excludes realized gains (losses) which are distributed at year-end.