UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02737

Fidelity Summer Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | October 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity® Short Duration High Income Fund

Semi-Annual Report

October 31, 2023

Includes Fidelity and Fidelity Advisor share classes

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you're an individual investing directly with Fidelity, call 1-800-835-5092 if you're a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you're an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

| Top Bond Issuers (% of Fund's net assets) |

(with maturities greater than one year) |

| TransDigm, Inc. | 3.5 | |

| Ford Motor Credit Co. LLC | 2.2 | |

| Community Health Systems, Inc. | 1.6 | |

| Royal Caribbean Cruises Ltd. | 1.5 | |

| SBA Communications Corp. | 1.2 | |

| NOVA Chemicals Corp | 1.1 | |

| Univision Communications, Inc. | 1.1 | |

| DISH Network Corp. | 1.1 | |

| Centennial Resource Production LLC | 1.0 | |

| WASH Multifamily Acquisition Inc. | 1.0 | |

| | 15.3 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Energy | 15.4 | |

| Services | 8.1 | |

| Healthcare | 6.0 | |

| Chemicals | 5.9 | |

| Telecommunications | 5.9 | |

| |

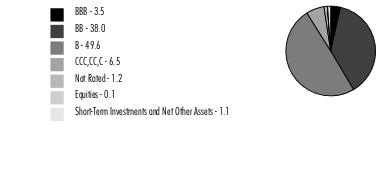

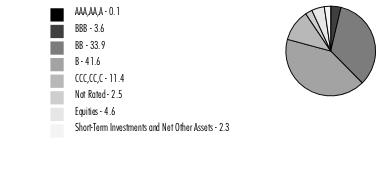

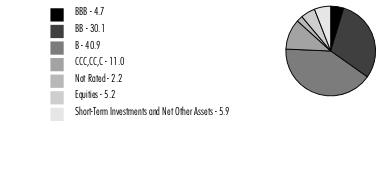

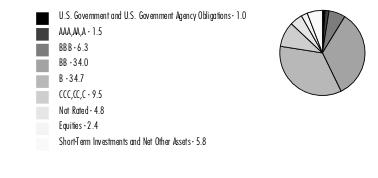

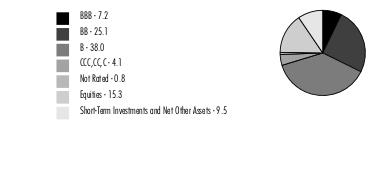

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

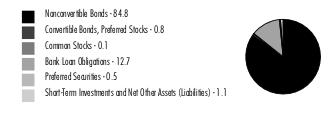

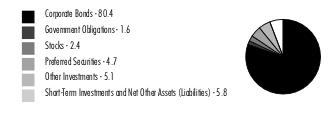

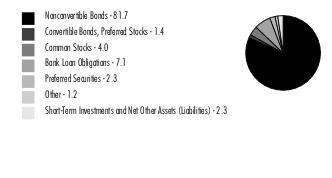

Asset Allocation (% of Fund's net assets) |

|

|

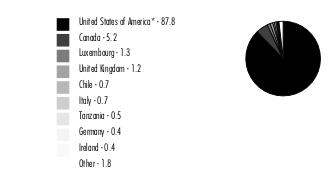

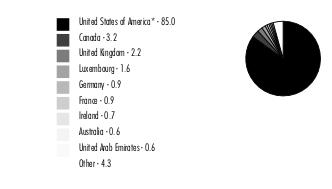

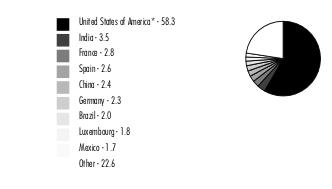

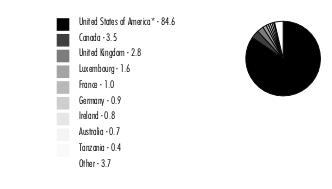

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| |

Showing Percentage of Net Assets

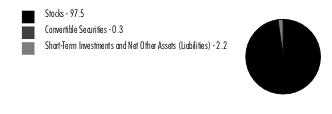

| Corporate Bonds - 85.6% |

| | | Principal Amount (a) | Value ($) |

| Convertible Bonds - 0.8% | | | |

| Broadcasting - 0.8% | | | |

| DISH Network Corp. 3.375% 8/15/26 | | 4,710,000 | 2,413,875 |

| Nonconvertible Bonds - 84.8% | | | |

| Aerospace - 5.8% | | | |

| Bombardier, Inc.: | | | |

| 6% 2/15/28 (b) | | 125,000 | 110,610 |

| 7.125% 6/15/26 (b) | | 2,000,000 | 1,924,831 |

| 7.875% 4/15/27 (b) | | 1,000,000 | 962,134 |

| Howmet Aerospace, Inc.: | | | |

| 5.9% 2/1/27 | | 1,255,000 | 1,237,396 |

| 6.875% 5/1/25 | | 1,248,000 | 1,252,420 |

| Rolls-Royce PLC 5.75% 10/15/27 (b) | | 1,300,000 | 1,231,930 |

| Spirit Aerosystems, Inc. 7.5% 4/15/25 (b) | | 650,000 | 648,397 |

| TransDigm, Inc.: | | | |

| 5.5% 11/15/27 | | 1,235,000 | 1,147,006 |

| 6.25% 3/15/26 (b) | | 7,365,000 | 7,191,611 |

| 6.75% 8/15/28 (b) | | 2,935,000 | 2,849,836 |

| 7.5% 3/15/27 | | 25,000 | 24,969 |

| | | | 18,581,140 |

| Air Transportation - 1.8% | | | |

| American Airlines, Inc. 7.25% 2/15/28 (b) | | 380,000 | 353,333 |

| American Airlines, Inc. / AAdvantage Loyalty IP Ltd. 5.5% 4/20/26 (b) | | 2,333,333 | 2,269,047 |

| Forward Air Corp. 9.5% 10/15/31 (b) | | 410,000 | 399,750 |

| Rand Parent LLC 8.5% 2/15/30 (b) | | 1,570,000 | 1,433,718 |

| United Airlines, Inc. 4.375% 4/15/26 (b) | | 1,325,000 | 1,229,089 |

| Western Global Airlines LLC 10.375% (b)(c) | | 250,000 | 1,875 |

| | | | 5,686,812 |

| Automotive & Auto Parts - 2.6% | | | |

| Clarios Global LP / Clarios U.S. Finance Co. 6.75% 5/15/28 (b) | | 180,000 | 175,475 |

| Ford Motor Credit Co. LLC: | | | |

| 2.3% 2/10/25 | | 540,000 | 509,739 |

| 3.375% 11/13/25 | | 4,700,000 | 4,386,052 |

| 4.687% 6/9/25 | | 455,000 | 440,298 |

| 5.125% 6/16/25 | | 250,000 | 243,253 |

| 7.35% 11/4/27 | | 1,420,000 | 1,437,286 |

| Macquarie AirFinance Holdings: | | | |

| 8.125% 3/30/29 (b) | | 485,000 | 477,749 |

| 8.375% 5/1/28 (b) | | 600,000 | 598,050 |

| Real Hero Merger Sub 2 6.25% 2/1/29 (b) | | 30,000 | 23,864 |

| | | | 8,291,766 |

| Banks & Thrifts - 0.6% | | | |

| Ally Financial, Inc. 3.875% 5/21/24 | | 970,000 | 953,819 |

| VistaJet Malta Finance PLC / XO Management Holding, Inc. 7.875% 5/1/27 (b) | | 1,035,000 | 796,950 |

| Western Alliance Bancorp. 3% 6/15/31 (d) | | 315,000 | 240,660 |

| | | | 1,991,429 |

| Broadcasting - 2.2% | | | |

| Clear Channel Outdoor Holdings, Inc.: | | | |

| 5.125% 8/15/27 (b) | | 1,000,000 | 888,796 |

| 9% 9/15/28 (b) | | 1,025,000 | 998,330 |

| Diamond Sports Group LLC/Diamond Sports Finance Co. 5.375% (b)(c) | | 410,000 | 4,223 |

| DISH Network Corp. 11.75% 11/15/27 (b) | | 1,130,000 | 1,119,333 |

| iHeartCommunications, Inc. 4.75% 1/15/28 (b) | | 1,400,000 | 989,774 |

| Sirius XM Radio, Inc. 3.125% 9/1/26 (b) | | 1,995,000 | 1,789,056 |

| Univision Communications, Inc. 6.625% 6/1/27 (b) | | 1,375,000 | 1,255,920 |

| | | | 7,045,432 |

| Building Materials - 0.4% | | | |

| Advanced Drain Systems, Inc. 5% 9/30/27 (b) | | 245,000 | 228,463 |

| AmeriTex Holdco Intermediate LLC 10.25% 10/15/28 (b) | | 355,000 | 335,653 |

| Beacon Roofing Supply, Inc. 6.5% 8/1/30 (b) | | 545,000 | 520,392 |

| Global Infrastructure Solutions, Inc. 5.625% 6/1/29 (b) | | 185,000 | 148,000 |

| SRS Distribution, Inc. 4.625% 7/1/28 (b) | | 95,000 | 82,873 |

| | | | 1,315,381 |

| Cable/Satellite TV - 1.9% | | | |

| CCO Holdings LLC/CCO Holdings Capital Corp. 5.125% 5/1/27 (b) | | 2,425,000 | 2,232,690 |

| CSC Holdings LLC 5.25% 6/1/24 | | 1,450,000 | 1,355,740 |

| DISH DBS Corp.: | | | |

| 5.25% 12/1/26 (b) | | 800,000 | 645,321 |

| 5.875% 11/15/24 | | 1,000,000 | 920,261 |

| 7.75% 7/1/26 | | 650,000 | 435,546 |

| Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (b) | | 600,000 | 535,500 |

| | | | 6,125,058 |

| Capital Goods - 0.4% | | | |

| Vertical U.S. Newco, Inc. 5.25% 7/15/27 (b) | | 1,300,000 | 1,183,581 |

| Chemicals - 4.7% | | | |

| Compass Minerals International, Inc. 6.75% 12/1/27 (b) | | 205,000 | 193,100 |

| INEOS Finance PLC 6.75% 5/15/28 (b) | | 1,485,000 | 1,386,592 |

| Kobe U.S. Midco 2, Inc. 9.25% 11/1/26 pay-in-kind (b)(d) | | 270,000 | 195,750 |

| LSB Industries, Inc. 6.25% 10/15/28 (b) | | 1,990,000 | 1,765,352 |

| Methanex Corp. 5.125% 10/15/27 | | 2,400,000 | 2,188,819 |

| NOVA Chemicals Corp.: | | | |

| 4.875% 6/1/24 (b) | | 300,000 | 294,817 |

| 5% 5/1/25 (b) | | 3,205,000 | 3,027,000 |

| 5.25% 6/1/27 (b) | | 400,000 | 337,866 |

| Rhodia Acetow Management GmbH 10.5% 2/15/27 (b) | | 130,000 | 127,799 |

| SCIH Salt Holdings, Inc.: | | | |

| 4.875% 5/1/28 (b) | | 1,995,000 | 1,722,437 |

| 6.625% 5/1/29 (b) | | 300,000 | 251,468 |

| SPCM SA 3.125% 3/15/27 (b) | | 395,000 | 349,530 |

| The Chemours Co. LLC 5.375% 5/15/27 | | 2,900,000 | 2,619,905 |

| Tronox, Inc. 4.625% 3/15/29 (b) | | 530,000 | 417,498 |

| W.R. Grace Holding LLC 7.375% 3/1/31 (b) | | 180,000 | 166,729 |

| | | | 15,044,662 |

| Consumer Products - 1.0% | | | |

| Coty, Inc. 5% 4/15/26 (b) | | 1,100,000 | 1,050,907 |

| Gannett Holdings LLC 6% 11/1/26 (b) | | 75,000 | 63,000 |

| Kohl's Corp. 4.25% 7/17/25 | | 70,000 | 65,379 |

| Mattel, Inc. 5.875% 12/15/27 (b) | | 460,000 | 441,009 |

| Newell Brands, Inc. 4.7% 4/1/26 | | 675,000 | 637,303 |

| Tempur Sealy International, Inc. 4% 4/15/29 (b) | | 865,000 | 709,641 |

| TKC Holdings, Inc. 10.5% 5/15/29 (b) | | 335,000 | 267,918 |

| | | | 3,235,157 |

| Containers - 2.9% | | | |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc.: | | | |

| 4.125% 8/15/26 (b) | | 610,000 | 536,127 |

| 5.25% 8/15/27 (b) | | 400,000 | 290,644 |

| 5.25% 8/15/27 (b) | | 500,000 | 363,305 |

| Ball Corp.: | | | |

| 4% 11/15/23 | | 400,000 | 399,005 |

| 5.25% 7/1/25 | | 1,900,000 | 1,870,354 |

| Berry Global, Inc. 4.875% 7/15/26 (b) | | 1,175,000 | 1,121,173 |

| BWAY Holding Co.: | | | |

| 7.875% 8/15/26 (b) | | 525,000 | 491,725 |

| 9.25% 4/15/27 (b) | | 550,000 | 458,045 |

| Owens-Brockway Glass Container, Inc. 7.25% 5/15/31 (b) | | 750,000 | 686,250 |

| Sealed Air Corp. 5% 4/15/29 (b) | | 1,500,000 | 1,330,252 |

| Sealed Air Corp./Sealed Air Cor 6.125% 2/1/28 (b) | | 515,000 | 490,187 |

| Trivium Packaging Finance BV 8.5% 8/15/27 (b) | | 1,250,000 | 1,042,865 |

| | | | 9,079,932 |

| Diversified Financial Services - 3.1% | | | |

| Cargo Aircraft Management, Inc. 4.75% 2/1/28 (b) | | 225,000 | 198,000 |

| Freedom Mortgage Corp. 6.625% 1/15/27 (b) | | 250,000 | 216,373 |

| GGAM Finance Ltd. 7.75% 5/15/26 (b) | | 1,240,000 | 1,230,105 |

| Hightower Holding LLC 6.75% 4/15/29 (b) | | 150,000 | 127,942 |

| HTA Group Ltd. 7% 12/18/25 (b) | | 1,700,000 | 1,637,389 |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | |

| 4.75% 9/15/24 | | 690,000 | 661,776 |

| 5.25% 5/15/27 | | 1,310,000 | 1,121,688 |

| 6.25% 5/15/26 | | 750,000 | 685,526 |

| Navient Corp.: | | | |

| 6.125% 3/25/24 | | 2,000,000 | 1,989,968 |

| 6.75% 6/15/26 | | 250,000 | 236,875 |

| OneMain Finance Corp.: | | | |

| 3.5% 1/15/27 | | 235,000 | 198,575 |

| 6.125% 3/15/24 | | 375,000 | 374,029 |

| 6.875% 3/15/25 | | 1,090,000 | 1,075,388 |

| | | | 9,753,634 |

| Diversified Media - 0.1% | | | |

| Advantage Sales & Marketing, Inc. 6.5% 11/15/28 (b) | | 425,000 | 346,375 |

| Energy - 15.1% | | | |

| Berry Petroleum Co. LLC 7% 2/15/26 (b) | | 100,000 | 96,000 |

| Buckeye Partners LP: | | | |

| 4.125% 3/1/25 (b) | | 525,000 | 499,958 |

| 4.125% 12/1/27 | | 1,400,000 | 1,216,320 |

| California Resources Corp. 7.125% 2/1/26 (b) | | 250,000 | 250,938 |

| Calumet Specialty Products Partners LP/Calumet Finance Corp.: | | | |

| 9.75% 7/15/28 (b) | | 315,000 | 294,012 |

| 11% 4/15/25 (b) | | 5,000 | 5,009 |

| Centennial Resource Production LLC 5.875% 7/1/29 (b) | | 3,570,000 | 3,320,100 |

| Cheniere Energy, Inc. 4.625% 10/15/28 | | 625,000 | 571,059 |

| Chesapeake Energy Corp. 5.5% 2/1/26 (b) | | 180,000 | 174,740 |

| Chord Energy Corp. 6.375% 6/1/26 (b) | | 100,000 | 98,174 |

| Citgo Petroleum Corp. 6.375% 6/15/26 (b) | | 525,000 | 515,790 |

| Comstock Resources, Inc. 6.75% 3/1/29 (b) | | 120,000 | 109,203 |

| Continental Resources, Inc. 2.268% 11/15/26 (b) | | 100,000 | 88,614 |

| Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp.: | | | |

| 6% 2/1/29 (b) | | 560,000 | 541,800 |

| 7.375% 2/1/31 (b) | | 525,000 | 529,205 |

| CrownRock LP/CrownRock Finance, Inc. 5.625% 10/15/25 (b) | | 2,300,000 | 2,262,217 |

| CVR Energy, Inc. 5.25% 2/15/25 (b) | | 1,615,000 | 1,584,267 |

| DCP Midstream Operating LP 5.375% 7/15/25 | | 525,000 | 518,693 |

| Delek Logistics Partners LP 7.125% 6/1/28 (b) | | 80,000 | 72,800 |

| Energy Ventures GoM LLC / EnVen Finance Corp. 11.75% 4/15/26 (b) | | 58,500 | 60,548 |

| EnLink Midstream Partners LP 4.85% 7/15/26 | | 1,400,000 | 1,316,023 |

| EQM Midstream Partners LP: | | | |

| 6% 7/1/25 (b) | | 147,000 | 143,756 |

| 7.5% 6/1/27 (b) | | 2,550,000 | 2,525,468 |

| EQT Corp. 3.125% 5/15/26 (b) | | 175,000 | 162,073 |

| Genesis Energy LP/Genesis Energy Finance Corp. 8% 1/15/27 | | 1,145,000 | 1,099,488 |

| Gulfport Energy Corp. 8% 5/17/26 | | 100,000 | 99,828 |

| Hess Midstream Partners LP 5.625% 2/15/26 (b) | | 2,450,000 | 2,372,676 |

| Holly Energy Partners LP/Holly Energy Finance Corp. 6.375% 4/15/27 (b) | | 105,000 | 101,649 |

| Magnolia Oil & Gas Operating LLC 6% 8/1/26 (b) | | 475,000 | 456,000 |

| Mesquite Energy, Inc. 7.25% (b)(c)(e) | | 135,000 | 0 |

| Nabors Industries, Inc. 5.75% 2/1/25 | | 2,550,000 | 2,473,500 |

| New Fortress Energy, Inc.: | | | |

| 6.5% 9/30/26 (b) | | 615,000 | 550,854 |

| 6.75% 9/15/25 (b) | | 1,290,000 | 1,196,777 |

| NGL Energy Operating LLC/NGL Energy Finance Corp. 7.5% 2/1/26 (b) | | 1,450,000 | 1,415,462 |

| Northern Oil & Gas, Inc. 8.75% 6/15/31 (b) | | 285,000 | 283,560 |

| NuStar Logistics LP 6% 6/1/26 | | 150,000 | 144,729 |

| Occidental Petroleum Corp.: | | | |

| 5.875% 9/1/25 | | 1,650,000 | 1,644,275 |

| 6.95% 7/1/24 | | 424,000 | 425,781 |

| 8.5% 7/15/27 | | 750,000 | 799,103 |

| PBF Holding Co. LLC/PBF Finance Corp. 7.875% 9/15/30 (b) | | 1,580,000 | 1,531,510 |

| PDC Energy, Inc. 5.75% 5/15/26 | | 1,750,000 | 1,742,563 |

| Precision Drilling Corp. 7.125% 1/15/26 (b) | | 1,660,000 | 1,635,548 |

| Range Resources Corp. 4.875% 5/15/25 | | 1,250,000 | 1,215,625 |

| Seadrill Finance Ltd. 8.375% 8/1/30 (b) | | 430,000 | 430,138 |

| Sitio Royalties OP / Sitio Finance Corp. 7.875% 11/1/28 (b) | | 1,002,000 | 988,373 |

| SM Energy Co. 6.625% 1/15/27 | | 1,156,000 | 1,123,324 |

| Southwestern Energy Co. 5.7% 1/23/25 (f) | | 1,128,000 | 1,112,016 |

| Sunnova Energy Corp. 5.875% 9/1/26 (b) | | 2,210,000 | 1,790,166 |

| Sunoco LP/Sunoco Finance Corp. 6% 4/15/27 | | 1,010,000 | 972,521 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp. 6% 3/1/27 (b) | | 2,000,000 | 1,829,791 |

| Transocean Aquila Ltd. 8% 9/30/28 (b) | | 540,000 | 531,220 |

| Transocean, Inc. 8.75% 2/15/30 (b) | | 617,500 | 615,678 |

| U.S.A. Compression Partners LP 6.875% 4/1/26 | | 550,000 | 534,107 |

| Valaris Ltd. 8.375% 4/30/30 (b) | | 305,000 | 299,281 |

| Venture Global Calcasieu Pass LLC 6.25% 1/15/30 (b) | | 265,000 | 249,990 |

| Western Gas Partners LP 4.65% 7/1/26 | | 1,300,000 | 1,242,935 |

| | | | 47,865,235 |

| Entertainment/Film - 0.4% | | | |

| Live Nation Entertainment, Inc. 4.75% 10/15/27 (b) | | 1,450,000 | 1,325,025 |

| Environmental - 0.6% | | | |

| Clean Harbors, Inc. 6.375% 2/1/31 (b) | | 210,000 | 199,597 |

| Madison IAQ LLC 4.125% 6/30/28 (b) | | 1,900,000 | 1,587,413 |

| | | | 1,787,010 |

| Food & Drug Retail - 0.6% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC: | | | |

| 3.25% 3/15/26 (b) | | 1,100,000 | 1,016,059 |

| 6.5% 2/15/28 (b) | | 985,000 | 967,066 |

| | | | 1,983,125 |

| Food/Beverage/Tobacco - 0.8% | | | |

| C&S Group Enterprises LLC 5% 12/15/28 (b) | | 1,005,000 | 777,619 |

| Performance Food Group, Inc. 5.5% 10/15/27 (b) | | 1,100,000 | 1,028,582 |

| Post Holdings, Inc.: | | | |

| 5.625% 1/15/28 (b) | | 125,000 | 116,171 |

| 5.75% 3/1/27 (b) | | 596,000 | 568,171 |

| Turning Point Brands, Inc. 5.625% 2/15/26 (b) | | 100,000 | 91,750 |

| United Natural Foods, Inc. 6.75% 10/15/28 (b) | | 95,000 | 74,754 |

| | | | 2,657,047 |

| Gaming - 4.6% | | | |

| Affinity Gaming LLC 6.875% 12/15/27 (b) | | 1,030,000 | 839,539 |

| Boyd Gaming Corp. 4.75% 12/1/27 | | 1,300,000 | 1,182,994 |

| Caesars Entertainment, Inc.: | | | |

| 6.25% 7/1/25 (b) | | 1,350,000 | 1,328,248 |

| 8.125% 7/1/27 (b) | | 900,000 | 891,787 |

| Caesars Resort Collection LLC 5.75% 7/1/25 (b) | | 495,000 | 487,089 |

| Carnival Corp. 10.5% 6/1/30 (b) | | 245,000 | 248,583 |

| Churchill Downs, Inc.: | | | |

| 4.75% 1/15/28 (b) | | 300,000 | 268,658 |

| 6.75% 5/1/31 (b) | | 495,000 | 456,638 |

| Golden Entertainment, Inc. 7.625% 4/15/26 (b) | | 500,000 | 500,001 |

| International Game Technology PLC 4.125% 4/15/26 (b) | | 2,200,000 | 2,070,151 |

| Las Vegas Sands Corp. 3.5% 8/18/26 | | 1,100,000 | 1,006,985 |

| Melco Resorts Finance Ltd. 5.25% 4/26/26 (b) | | 200,000 | 182,994 |

| Ontario Gaming GTA LP 8% 8/1/30 (b) | | 275,000 | 268,823 |

| Raptor Acquisition Corp. / Raptor Co-Issuer LLC 4.875% 11/1/26 (b) | | 95,000 | 88,398 |

| Scientific Games Corp. 7% 5/15/28 (b) | | 1,000,000 | 974,788 |

| Studio City Finance Ltd. 5% 1/15/29 (b) | | 225,000 | 160,521 |

| VICI Properties LP / VICI Note Co.: | | | |

| 3.5% 2/15/25 (b) | | 715,000 | 681,947 |

| 4.625% 6/15/25 (b) | | 300,000 | 288,144 |

| 5.625% 5/1/24 (b) | | 1,000,000 | 993,144 |

| Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp.: | | | |

| 5.25% 5/15/27 (b) | | 900,000 | 831,392 |

| 5.5% 3/1/25 (b) | | 1,025,000 | 1,006,329 |

| | | | 14,757,153 |

| Healthcare - 5.0% | | | |

| 1375209 BC Ltd. 9% 1/30/28 (b) | | 562,000 | 544,795 |

| Bausch Health Companies, Inc.: | | | |

| 5.5% 11/1/25 (b) | | 1,085,000 | 935,813 |

| 11% 9/30/28 (b) | | 850,000 | 518,500 |

| 14% 10/15/30 (b) | | 197,000 | 106,096 |

| Centene Corp. 3% 10/15/30 | | 210,000 | 166,147 |

| Community Health Systems, Inc.: | | | |

| 5.625% 3/15/27 (b) | | 6,050,000 | 4,915,224 |

| 6.875% 4/15/29 (b) | | 750,000 | 309,683 |

| HCA Holdings, Inc. 5.875% 2/15/26 | | 650,000 | 644,281 |

| IQVIA, Inc. 5% 5/15/27 (b) | | 1,675,000 | 1,575,813 |

| Modivcare, Inc. 5.875% 11/15/25 (b) | | 650,000 | 614,250 |

| Molina Healthcare, Inc. 3.875% 5/15/32 (b) | | 235,000 | 184,653 |

| Organon & Co. / Organon Foreign Debt Co-Issuer BV 4.125% 4/30/28 (b) | | 1,500,000 | 1,295,640 |

| Owens & Minor, Inc. 4.5% 3/31/29 (b) | | 65,000 | 52,152 |

| RegionalCare Hospital Partners Holdings, Inc. 11% 10/15/30 (b) | | 790,000 | 743,451 |

| RP Escrow Issuer LLC 5.25% 12/15/25 (b) | | 200,000 | 142,500 |

| Surgery Center Holdings, Inc. 6.75% 7/1/25 (b) | | 877,000 | 858,364 |

| Tenet Healthcare Corp. 5.125% 11/1/27 | | 2,300,000 | 2,123,170 |

| | | | 15,730,532 |

| Homebuilders/Real Estate - 3.0% | | | |

| Brookfield Property REIT, Inc./BPR Nimbus LLC/BPR Cumulus LLC/GGSI Sellco LLC 5.75% 5/15/26 (b) | | 1,050,000 | 961,434 |

| Greystar Real Estate Partners 7.75% 9/1/30 (b) | | 230,000 | 225,975 |

| MPT Operating Partnership LP/MPT Finance Corp.: | | | |

| 5% 10/15/27 | | 1,700,000 | 1,312,625 |

| 5.25% 8/1/26 | | 1,285,000 | 1,106,402 |

| Railworks Holdings LP 8.25% 11/15/28 (b) | | 230,000 | 218,737 |

| Service Properties Trust: | | | |

| 4.35% 10/1/24 | | 400,000 | 383,055 |

| 7.5% 9/15/25 | | 800,000 | 777,257 |

| Starwood Property Trust, Inc. 4.75% 3/15/25 | | 1,500,000 | 1,435,345 |

| Uniti Group LP / Uniti Group Finance, Inc.: | | | |

| 4.75% 4/15/28 (b) | | 2,700,000 | 2,182,066 |

| 6.5% 2/15/29 (b) | | 1,400,000 | 909,171 |

| | | | 9,512,067 |

| Insurance - 0.3% | | | |

| Acrisure LLC / Acrisure Finance, Inc. 7% 11/15/25 (b) | | 720,000 | 698,065 |

| Alliant Holdings Intermediate LLC 6.75% 10/15/27 (b) | | 30,000 | 27,398 |

| Enact Holdings, Inc. 6.5% 8/15/25 (b) | | 200,000 | 196,452 |

| | | | 921,915 |

| Leisure - 3.3% | | | |

| Carnival Corp. 7.625% 3/1/26 (b) | | 2,430,000 | 2,362,914 |

| NCL Corp. Ltd.: | | | |

| 5.875% 3/15/26 (b) | | 400,000 | 359,000 |

| 5.875% 2/15/27 (b) | | 525,000 | 483,241 |

| Royal Caribbean Cruises Ltd.: | | | |

| 5.375% 7/15/27 (b) | | 120,000 | 110,589 |

| 5.5% 8/31/26 (b) | | 1,435,000 | 1,354,181 |

| 5.5% 4/1/28 (b) | | 1,600,000 | 1,459,225 |

| 7.25% 1/15/30 (b) | | 445,000 | 438,981 |

| 11.625% 8/15/27 (b) | | 1,500,000 | 1,627,133 |

| Six Flags Entertainment Corp. 5.5% 4/15/27 (b) | | 1,500,000 | 1,365,555 |

| Viking Cruises Ltd. 9.125% 7/15/31 (b) | | 1,000,000 | 982,500 |

| | | | 10,543,319 |

| Metals/Mining - 2.0% | | | |

| Arsenal AIC Parent LLC 8% 10/1/30 (b) | | 110,000 | 108,625 |

| Cleveland-Cliffs, Inc. 6.75% 4/15/30 (b) | | 195,000 | 180,802 |

| ERO Copper Corp. 6.5% 2/15/30 (b) | | 340,000 | 288,419 |

| First Quantum Minerals Ltd. 6.875% 3/1/26 (b) | | 960,000 | 842,160 |

| Howmet Aerospace, Inc. 5.125% 10/1/24 | | 166,000 | 164,008 |

| HudBay Minerals, Inc. 4.5% 4/1/26 (b) | | 2,355,000 | 2,191,832 |

| Mineral Resources Ltd. 9.25% 10/1/28 (b) | | 185,000 | 185,000 |

| Novelis Corp. 3.25% 11/15/26 (b) | | 2,550,000 | 2,269,862 |

| | | | 6,230,708 |

| Paper - 0.7% | | | |

| Ardagh Metal Packaging Finance U.S.A. LLC/Ardagh Metal Packaging Finance PLC 6% 6/15/27 (b) | | 2,500,000 | 2,362,490 |

| Restaurants - 0.9% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc.: | | | |

| 3.875% 1/15/28 (b) | | 675,000 | 602,638 |

| 5.75% 4/15/25 (b) | | 1,000,000 | 991,830 |

| Garden SpinCo Corp. 8.625% 7/20/30 (b) | | 55,000 | 56,747 |

| Yum! Brands, Inc. 3.875% 11/1/23 | | 1,225,000 | 1,225,000 |

| | | | 2,876,215 |

| Services - 6.6% | | | |

| AECOM 5.125% 3/15/27 | | 2,505,000 | 2,364,973 |

| APX Group, Inc. 6.75% 2/15/27 (b) | | 1,505,000 | 1,452,942 |

| Aramark Services, Inc. 5% 4/1/25 (b) | | 1,025,000 | 1,001,951 |

| Brand Energy & Infrastructure Services, Inc. 10.375% 8/1/30 (b) | | 2,065,000 | 2,049,513 |

| CoreCivic, Inc.: | | | |

| 4.75% 10/15/27 | | 35,000 | 30,406 |

| 8.25% 4/15/26 | | 1,465,000 | 1,483,208 |

| CoreLogic, Inc. 4.5% 5/1/28 (b) | | 590,000 | 467,575 |

| Iron Mountain, Inc. 4.875% 9/15/27 (b) | | 1,300,000 | 1,188,366 |

| Life Time, Inc. 5.75% 1/15/26 (b) | | 1,125,000 | 1,089,437 |

| Neptune BidCo U.S., Inc. 9.29% 4/15/29 (b) | | 360,000 | 317,718 |

| PowerTeam Services LLC 9.033% 12/4/25 (b) | | 365,000 | 328,500 |

| Prime Securities Services Borrower LLC/Prime Finance, Inc. 5.75% 4/15/26 (b) | | 875,000 | 848,844 |

| Sabre GLBL, Inc. 7.375% 9/1/25 (b) | | 2,200,000 | 1,972,950 |

| Sotheby's 7.375% 10/15/27 (b) | | 465,000 | 415,285 |

| TriNet Group, Inc. 7.125% 8/15/31 (b) | | 510,000 | 493,078 |

| Uber Technologies, Inc. 7.5% 9/15/27 (b) | | 925,000 | 927,324 |

| United Rentals North America, Inc. 3.875% 11/15/27 | | 1,500,000 | 1,376,833 |

| WASH Multifamily Acquisition, Inc. 5.75% 4/15/26 (b) | | 3,440,000 | 3,182,000 |

| | | | 20,990,903 |

| Super Retail - 1.3% | | | |

| At Home Group, Inc. 4.875% 7/15/28 (b) | | 60,000 | 20,400 |

| Carvana Co.: | | | |

| 4.875% 9/1/29 (b) | | 80,000 | 45,032 |

| 5.5% 4/15/27 (b) | | 200,000 | 132,608 |

| 5.875% 10/1/28 (b) | | 115,000 | 66,671 |

| EG Global Finance PLC: | | | |

| 6.75% 2/7/25 (b) | | 817,000 | 808,340 |

| 8.5% 10/30/25 (b) | | 741,000 | 728,959 |

| Hanesbrands, Inc. 4.875% 5/15/26 (b) | | 900,000 | 826,933 |

| Staples, Inc. 7.5% 4/15/26 (b) | | 1,900,000 | 1,549,818 |

| Upbound Group, Inc. 6.375% 2/15/29 (b) | | 30,000 | 25,800 |

| | | | 4,204,561 |

| Technology - 4.3% | | | |

| Acuris Finance U.S. 5% 5/1/28 (b) | | 1,280,000 | 1,008,000 |

| Camelot Finance SA 4.5% 11/1/26 (b) | | 2,600,000 | 2,403,412 |

| CNT PRNT/CDK GLO II/FIN 8% 6/15/29 (b) | | 1,005,000 | 992,671 |

| CommScope, Inc. 6% 3/1/26 (b) | | 775,000 | 650,985 |

| Elastic NV 4.125% 7/15/29 (b) | | 225,000 | 189,622 |

| GrafTech Global Enterprises, Inc. 9.875% 12/15/28 (b) | | 175,000 | 156,710 |

| MicroStrategy, Inc. 6.125% 6/15/28 (b) | | 85,000 | 76,925 |

| Open Text Corp. 3.875% 2/15/28 (b) | | 1,700,000 | 1,477,427 |

| Qorvo, Inc. 4.375% 10/15/29 | | 1,350,000 | 1,172,169 |

| Seagate HDD Cayman 8.25% 12/15/29 (b) | | 165,000 | 167,677 |

| Sensata Technologies BV 5% 10/1/25 (b) | | 2,300,000 | 2,236,217 |

| SS&C Technologies, Inc. 5.5% 9/30/27 (b) | | 2,000,000 | 1,876,544 |

| Veritas U.S., Inc./Veritas Bermuda Ltd. 7.5% 9/1/25 (b) | | 625,000 | 511,609 |

| Virtusa Corp. 7.125% 12/15/28 (b) | | 50,000 | 39,565 |

| VM Consolidated, Inc. 5.5% 4/15/29 (b) | | 875,000 | 774,874 |

| | | | 13,734,407 |

| Telecommunications - 5.5% | | | |

| Altice Financing SA 5% 1/15/28 (b) | | 1,400,000 | 1,138,573 |

| Altice France SA 8.125% 2/1/27 (b) | | 410,000 | 345,629 |

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (b) | | 25,000 | 21,370 |

| Cogent Communications Group, Inc. 7% 6/15/27 (b) | | 1,800,000 | 1,701,000 |

| Consolidated Communications, Inc. 5% 10/1/28 (b) | | 1,060,000 | 798,509 |

| Hughes Satellite Systems Corp. 5.25% 8/1/26 | | 1,400,000 | 1,258,978 |

| Level 3 Financing, Inc. 10.5% 5/15/30 (b) | | 260,000 | 260,204 |

| Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc. 4.75% 4/30/27 (b) | | 95,000 | 84,788 |

| Sable International Finance Ltd. 5.75% 9/7/27 (b) | | 2,402,000 | 2,150,126 |

| Sabre GLBL, Inc. 9.25% 4/15/25 (b) | | 25,000 | 23,732 |

| SBA Communications Corp. 3.875% 2/15/27 | | 4,200,000 | 3,824,919 |

| T-Mobile U.S.A., Inc.: | | | |

| 2.25% 2/15/26 | | 1,210,000 | 1,112,935 |

| 2.625% 4/15/26 | | 320,000 | 295,731 |

| Telecom Italia SpA 5.303% 5/30/24 (b) | | 2,150,000 | 2,108,359 |

| ViaSat, Inc. 5.625% 9/15/25 (b) | | 1,500,000 | 1,393,485 |

| Zayo Group Holdings, Inc. 4% 3/1/27 (b) | | 1,200,000 | 903,171 |

| | | | 17,421,509 |

| Transportation Ex Air/Rail - 0.4% | | | |

| Great Lakes Dredge & Dock Corp. 5.25% 6/1/29 (b) | | 70,000 | 57,225 |

| Seaspan Corp. 5.5% 8/1/29 (b) | | 790,000 | 606,056 |

| XPO, Inc. 6.25% 6/1/28 (b) | | 470,000 | 450,288 |

| | | | 1,113,569 |

| Utilities - 1.9% | | | |

| Calpine Corp. 5.125% 3/15/28 (b) | | 750,000 | 671,199 |

| Global Partners LP/GLP Finance Corp. 7% 8/1/27 | | 2,157,000 | 2,033,102 |

| NextEra Energy Partners LP: | | | |

| 4.25% 7/15/24 (b) | | 500,000 | 490,383 |

| 4.25% 9/15/24 (b) | | 41,000 | 38,745 |

| PG&E Corp. 5% 7/1/28 | | 1,210,000 | 1,096,194 |

| Solaris Midstream Holdings LLC 7.625% 4/1/26 (b) | | 120,000 | 114,474 |

| Vistra Operations Co. LLC: | | | |

| 5% 7/31/27 (b) | | 825,000 | 754,699 |

| 5.625% 2/15/27 (b) | | 805,000 | 757,516 |

| 7.75% 10/15/31 (b) | | 30,000 | 28,957 |

| | | | 5,985,269 |

TOTAL NONCONVERTIBLE BONDS | | | 269,682,418 |

| TOTAL CORPORATE BONDS (Cost $281,485,653) | | | 272,096,293 |

| | | | |

| Common Stocks - 0.1% |

| | | Shares | Value ($) |

| Diversified Financial Services - 0.0% | | | |

| Lime Tree Bay Ltd. (e)(g) | | 80 | 4,095 |

| Energy - 0.1% | | | |

| California Resources Corp. warrants 10/27/24 (g) | | 2 | 36 |

| Forbes Energy Services Ltd. (e)(g) | | 6,468 | 0 |

| Mesquite Energy, Inc. (e)(g) | | 1,922 | 152,615 |

TOTAL ENERGY | | | 152,651 |

| TOTAL COMMON STOCKS (Cost $364,526) | | | 156,746 |

| | | | |

| Bank Loan Obligations - 12.7% |

| | | Principal Amount (a) | Value ($) |

| Automotive & Auto Parts - 0.3% | | | |

| CWGS Group LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.500% 7.9485% 6/3/28 (d)(h)(i) | | 1,190,840 | 1,095,573 |

| Broadcasting - 0.7% | | | |

| Diamond Sports Group LLC 2LN, term loan CME Term SOFR 1 Month Index + 3.250% 10.6625% (c)(d)(h)(i) | | 196,992 | 2,094 |

| Univision Communications, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.6886% 1/31/29 (d)(h)(i) | | 2,335,984 | 2,294,381 |

TOTAL BROADCASTING | | | 2,296,475 |

| Building Materials - 0.6% | | | |

| Acproducts Holdings, Inc. Tranche B 1LN, term loan CME Term SOFR 3 Month Index + 4.250% 9.9017% 5/17/28 (d)(h)(i) | | 615,648 | 487,390 |

| Oscar AcquisitionCo LLC 1LN, term loan CME Term SOFR 3 Month Index + 4.500% 9.9901% 4/29/29 (d)(h)(i) | | 495,000 | 481,595 |

| SRS Distribution, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.9386% 6/4/28 (d)(h)(i) | | 857,248 | 835,816 |

TOTAL BUILDING MATERIALS | | | 1,804,801 |

| Chemicals - 1.2% | | | |

| ARC Falcon I, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.1741% 9/30/28 (d)(h)(i) | | 397,212 | 381,736 |

| Aruba Investment Holdings LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 9.4241% 11/24/27 (d)(h)(i) | | 367,405 | 360,975 |

| Discovery Purchaser Corp. 1LN, term loan CME Term SOFR 3 Month Index + 4.370% 9.7651% 10/4/29 (d)(h)(i) | | 367,500 | 340,658 |

| Hexion Holdings Corp. 1LN, term loan CME Term SOFR 3 Month Index + 4.500% 10.0332% 3/15/29 (d)(h)(i) | | 397,222 | 366,239 |

| Olympus Water U.S. Holding Corp. Tranche B 1LN, term loan CME Term SOFR 3 Month Index + 3.750% 9.4017% 11/9/28 (d)(h)(i) | | 714,702 | 695,941 |

| SCIH Salt Holdings, Inc. Tranche B 1LN, term loan CME Term SOFR 3 Month Index + 4.000% 9.6307% 3/16/27 (d)(h)(i) | | 32,076 | 31,615 |

| W.R. Grace Holding LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 9.4017% 9/22/28 (d)(h)(i) | | 1,509,449 | 1,478,007 |

TOTAL CHEMICALS | | | 3,655,171 |

| Consumer Products - 0.0% | | | |

| Conair Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 9.4017% 5/17/28 (d)(h)(i) | | 24,500 | 22,650 |

| TKC Holdings, Inc. 1LN, term loan 13.5% 2/14/27 (d)(i) | | 227,378 | 102,320 |

TOTAL CONSUMER PRODUCTS | | | 124,970 |

| Diversified Financial Services - 0.8% | | | |

| Broadstreet Partners, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.4386% 1/27/27 (d)(h)(i) | | 341,162 | 337,293 |

| Hightower Holding LLC Tranche B 1LN, term loan CME Term SOFR 3 Month Index + 4.000% 9.3796% 4/21/28 (d)(h)(i) | | 2,286,568 | 2,234,160 |

TOTAL DIVERSIFIED FINANCIAL SERVICES | | | 2,571,453 |

| Energy - 0.0% | | | |

| Forbes Energy Services LLC Tranche B, term loan 0% (c)(e)(i) | | 60,604 | 0 |

| Mesquite Energy, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 8.000% 0% (c)(e)(h)(i) | | 35,876 | 0 |

| term loan 3 month U.S. LIBOR + 0.000% 0% (c)(e)(h)(i) | | 15,000 | 0 |

TOTAL ENERGY | | | 0 |

| Environmental - 0.2% | | | |

| LRS Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 9.6886% 6/28/28 (d)(h)(i) | | 687,750 | 672,276 |

| Food/Beverage/Tobacco - 0.3% | | | |

| Del Monte Foods, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.250% 9.6769% 5/16/29 (d)(h)(i) | | 990,000 | 955,350 |

| Triton Water Holdings, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.9017% 3/31/28 (d)(h)(i) | | 53,763 | 50,855 |

TOTAL FOOD/BEVERAGE/TOBACCO | | | 1,006,205 |

| Gaming - 0.1% | | | |

| Fertitta Entertainment LLC NV Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 9.3241% 1/27/29 (d)(h)(i) | | 319,217 | 311,757 |

| Healthcare - 1.0% | | | |

| Cano Health, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 9.53% 11/23/27 (d)(h)(i) | | 1,756,276 | 1,011,106 |

| Confluent Health LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 9.4306% 11/30/28 (d)(h)(i) | | 14,790 | 13,921 |

| Insulet Corp. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.6886% 5/4/28 (d)(h)(i) | | 19,550 | 19,460 |

| Jazz Financing Lux SARL Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.9386% 5/5/28 (d)(h)(i) | | 48,440 | 48,413 |

| MED ParentCo LP 1LN, term loan CME Term SOFR 1 Month Index + 4.250% 9.6886% 8/31/26 (d)(h)(i) | | 440,698 | 415,172 |

| Medical Solutions Holdings, Inc. 1LN, term loan CME Term SOFR 3 Month Index + 3.250% 8.7725% 11/1/28 (d)(h)(i) | | 394,317 | 366,715 |

| Mozart Borrower LP Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.6886% 10/23/28 (d)(h)(i) | | 113,275 | 112,497 |

| Organon & Co. Tranche B 1LN, term loan CME Term SOFR 3 Month Index + 3.000% 8.4505% 6/2/28 (d)(h)(i) | | 804,266 | 801,652 |

| Packaging Coordinators Midco, Inc. Tranche B 1LN, term loan CME Term SOFR 3 Month Index + 3.500% 9.1517% 11/30/27 (d)(h)(i) | | 14,698 | 14,496 |

| Phoenix Newco, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.6886% 11/15/28 (d)(h)(i) | | 59,100 | 58,346 |

| RadNet Management, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.4306% 4/23/28 (d)(h)(i) | | 327,642 | 326,096 |

| U.S. Anesthesia Partners, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.250% 9.6791% 10/1/28 (d)(h)(i) | | 29,400 | 25,464 |

TOTAL HEALTHCARE | | | 3,213,338 |

| Homebuilders/Real Estate - 0.5% | | | |

| Breakwater Energy Partners LLC Tranche B 1LN, term loan 11.25% 9/1/26 (d)(e)(h)(i) | | 1,505,418 | 1,454,685 |

| Hotels - 0.0% | | | |

| Hilton Grand Vacations Borrower LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.1886% 8/2/28 (d)(h)(i) | | 49,000 | 48,947 |

| Insurance - 0.7% | | | |

| Alliant Holdings Intermediate LLC: | | | |

| Tranche B3 1LN, term loan 1 month U.S. LIBOR + 3.500% 8.9386% 11/5/27 (d)(h)(i) | | 287,748 | 286,618 |

| Tranche B5 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.8347% 11/6/27 (d)(h)(i) | | 179,178 | 178,488 |

| AssuredPartners, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.9386% 2/13/27 (d)(h)(i) | | 480,856 | 476,317 |

| Asurion LLC 1LN, term loan CME Term SOFR 3 Month Index + 4.000% 9.4241% 8/19/28 (d)(h)(i) | | 367,481 | 350,077 |

| USI, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.1401% 11/22/29 (d)(h)(i) | | 992,481 | 988,968 |

TOTAL INSURANCE | | | 2,280,468 |

| Leisure - 0.1% | | | |

| Hayward Industries, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.750% 8.1894% 5/28/28 (d)(h)(i) | | 391,000 | 383,528 |

| MajorDrive Holdings IV LLC 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 9.6517% 5/12/28 (d)(h)(i) | | 24,438 | 23,684 |

TOTAL LEISURE | | | 407,212 |

| Paper - 0.9% | | | |

| Clydesdale Acquisition Holdings, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 4.170% 9.5991% 4/13/29 (d)(h)(i) | | 3,027,844 | 2,924,655 |

| Railroad - 0.1% | | | |

| Genesee & Wyoming, Inc. 1LN, term loan CME Term SOFR 3 Month Index + 2.000% 7.4901% 12/30/26 (d)(h)(i) | | 322,674 | 322,271 |

| Services - 1.5% | | | |

| ABG Intermediate Holdings 2 LLC Tranche B1 LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.9241% 12/21/28 (d)(h)(i) | | 563,068 | 561,357 |

| Allied Universal Holdco LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.1741% 5/14/28 (d)(h)(i) | | 1,460,746 | 1,384,612 |

| Ascend Learning LLC: | | | |

| 2LN, term loan CME Term SOFR 1 Month Index + 5.750% 11.1741% 12/10/29 (d)(h)(i) | | 20,000 | 16,817 |

| Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.9241% 12/10/28 (d)(h)(i) | | 884,092 | 820,827 |

| Brand Energy & Infrastructure Services, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.500% 10.8719% 8/1/30 (d)(h)(i) | | 265,000 | 255,063 |

| CHG Healthcare Services, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.6886% 9/30/28 (d)(h)(i) | | 14,700 | 14,533 |

| CoreLogic, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.9386% 6/2/28 (d)(h)(i) | | 49,000 | 44,485 |

| Neptune BidCo U.S., Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.000% 10.5067% 4/11/29 (d)(h)(i) | | 999,425 | 871,379 |

| Spin Holdco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 9.6639% 3/4/28 (d)(h)(i) | | 895,010 | 762,996 |

TOTAL SERVICES | | | 4,732,069 |

| Super Retail - 0.9% | | | |

| Bass Pro Group LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.4017% 3/5/28 (d)(h)(i) | | 1,156,333 | 1,145,972 |

| Empire Today LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.000% 10.4531% 4/1/28 (d)(h)(i) | | 489,975 | 377,075 |

| LBM Acquisition LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.1741% 12/18/27 (d)(h)(i) | | 1,356,528 | 1,288,701 |

TOTAL SUPER RETAIL | | | 2,811,748 |

| Technology - 1.2% | | | |

| Acuris Finance U.S., Inc. 1LN, term loan CME Term SOFR 3 Month Index + 4.000% 9.5401% 2/16/28 (d)(h)(i) | | 10,156 | 9,991 |

| Aptean, Inc. 2LN, term loan 1 month U.S. LIBOR + 7.000% 12.4241% 4/23/27 (d)(h)(i) | | 200,000 | 186,000 |

| Athenahealth Group, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.5769% 2/15/29 (d)(h)(i) | | 2,328,348 | 2,252,258 |

| Ceridian HCM Holding, Inc. Tranche B, term loan CME Term SOFR 1 Month Index + 2.500% 7.9386% 4/30/25 (d)(h)(i) | | 367,167 | 366,708 |

| DG Investment Intermediate Holdings, Inc.: | | | |

| 2LN, term loan CME Term SOFR 1 Month Index + 6.750% 12.1886% 3/31/29 (d)(h)(i) | | 80,000 | 71,100 |

| Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.1998% 3/31/28 (d)(h)(i) | | 14,663 | 14,171 |

| Electro Rent Corp. 1LN, term loan CME Term SOFR 1 Month Index + 5.500% 11.0023% 11/1/24 (d)(h)(i) | | 388,512 | 361,316 |

| Maverick Bidco, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.2832% 5/18/28 (d)(h)(i) | | 294,019 | 286,913 |

| Park Place Technologies LLC 1LN, term loan CME Term SOFR 1 Month Index + 5.000% 10.4241% 11/10/27 (d)(h)(i) | | 341,250 | 333,429 |

TOTAL TECHNOLOGY | | | 3,881,886 |

| Telecommunications - 0.4% | | | |

| Cablevision Lightpath LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.699% 11/30/27 (d)(h)(i) | | 480,147 | 474,246 |

| Consolidated Communications, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.9386% 10/2/27 (d)(h)(i) | | 250,000 | 224,095 |

| Northwest Fiber LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.3898% 4/30/27 (d)(h)(i) | | 151,125 | 148,551 |

| Windstream Services LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 6.250% 11.6741% 9/21/27 (d)(h)(i) | | 341,049 | 314,475 |

TOTAL TELECOMMUNICATIONS | | | 1,161,367 |

| Textiles/Apparel - 0.5% | | | |

| Tory Burch LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.6886% 4/16/28 (d)(h)(i) | | 1,604,819 | 1,571,391 |

| Utilities - 0.7% | | | |

| Brookfield WEC Holdings, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.0741% 8/1/25 (d)(h)(i) | | 603,800 | 603,969 |

| Limetree Bay Terminals LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 10.6517% 2/15/24 (d)(h)(i) | | 458,407 | 420,446 |

| PG&E Corp. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.4386% 6/23/25 (d)(h)(i) | | 1,118,619 | 1,115,822 |

TOTAL UTILITIES | | | 2,140,237 |

| TOTAL BANK LOAN OBLIGATIONS (Cost $41,236,184) | | | 40,488,955 |

| | | | |

| Preferred Securities - 0.5% |

| | | Principal Amount (a) | Value ($) |

| Banks & Thrifts - 0.2% | | | |

| Ally Financial, Inc.: | | | |

| 4.7% (d)(j) | | 220,000 | 144,993 |

| 4.7% (d)(j) | | 230,000 | 136,567 |

| Wells Fargo & Co. 7.625% (d)(j) | | 290,000 | 293,126 |

TOTAL BANKS & THRIFTS | | | 574,686 |

| Diversified Financial Services - 0.1% | | | |

| Charles Schwab Corp. 5.375% (d)(j) | | 515,000 | 493,661 |

| Energy - 0.2% | | | |

| Energy Transfer LP 3 month U.S. LIBOR + 4.020% 9.6542% (d)(h)(j) | | 625,000 | 602,033 |

| TOTAL PREFERRED SECURITIES (Cost $1,598,663) | | | 1,670,380 |

| | | | |

| Money Market Funds - 0.3% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 5.40% (k) (Cost $810,744) | | 810,621 | 810,783 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 99.2% (Cost $325,495,770) | 315,223,157 |

NET OTHER ASSETS (LIABILITIES) - 0.8% | 2,696,556 |

| NET ASSETS - 100.0% | 317,919,713 |

| | |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $195,144,776 or 61.4% of net assets. |

| (c) | Non-income producing - Security is in default. |

| (d) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (f) | Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

| (h) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (i) | Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. |

| (j) | Security is perpetual in nature with no stated maturity date. |

| (k) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.40% | 35,169,742 | 88,424,340 | 122,783,299 | 827,776 | - | - | 810,783 | 0.0% |

| Total | 35,169,742 | 88,424,340 | 122,783,299 | 827,776 | - | - | 810,783 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Energy | 152,651 | 36 | - | 152,615 |

Financials | 4,095 | - | - | 4,095 |

|

| Corporate Bonds | 272,096,293 | - | 272,096,293 | - |

|

| Bank Loan Obligations | 40,488,955 | - | 39,034,270 | 1,454,685 |

|

| Preferred Securities | 1,670,380 | - | 1,670,380 | - |

|

| Money Market Funds | 810,783 | 810,783 | - | - |

| Total Investments in Securities: | 315,223,157 | 810,819 | 312,800,943 | 1,611,395 |

| Statement of Assets and Liabilities |

| | | | October 31, 2023 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $324,685,026) | $ | 314,412,374 | | |

Fidelity Central Funds (cost $810,744) | | 810,783 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $325,495,770) | | | $ | 315,223,157 |

| Cash | | | | 265,947 |

| Receivable for investments sold | | | | 66,596,022 |

| Receivable for fund shares sold | | | | 2,828,743 |

| Interest receivable | | | | 5,461,877 |

| Distributions receivable from Fidelity Central Funds | | | | 130,690 |

| Prepaid expenses | | | | 685 |

| Receivable from investment adviser for expense reductions | | | | 12,772 |

| Other receivables | | | | 728 |

Total assets | | | | 390,520,621 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 786,014 | | |

| Payable for fund shares redeemed | | 29,107,306 | | |

| Distributions payable | | 209,466 | | |

| Accrued management fee | | 237,419 | | |

| Distribution and service plan fees payable | | 7,661 | | |

| Notes payable to affiliates | | 42,146,000 | | |

| Other affiliated payables | | 57,468 | | |

| Other payables and accrued expenses | | 49,574 | | |

| Total Liabilities | | | | 72,600,908 |

| Net Assets | | | $ | 317,919,713 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 339,792,821 |

| Total accumulated earnings (loss) | | | | (21,873,108) |

| Net Assets | | | $ | 317,919,713 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($24,238,420 ÷ 2,851,139 shares)(a) | | | $ | 8.50 |

| Maximum offering price per share (100/96.00 of $8.50) | | | $ | 8.85 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($2,006,777 ÷ 236,084 shares)(a) | | | $ | 8.50 |

| Maximum offering price per share (100/96.00 of $8.50) | | | $ | 8.85 |

| Class C : | | | | |

Net Asset Value and offering price per share ($2,822,605 ÷ 331,971 shares)(a) | | | $ | 8.50 |

| Short Duration High Income : | | | | |

Net Asset Value, offering price and redemption price per share ($273,925,947 ÷ 32,219,564 shares) | | | $ | 8.50 |

| Class I : | | | | |

Net Asset Value, offering price and redemption price per share ($6,163,510 ÷ 724,922 shares) | | | $ | 8.50 |

| Class Z : | | | | |

Net Asset Value, offering price and redemption price per share ($8,762,454 ÷ 1,030,271 shares) | | | $ | 8.50 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Six months ended October 31, 2023 (Unaudited) |

| Investment Income | | | | |

| Dividends | | | $ | 95,971 |

| Interest | | | | 19,230,913 |

| Income from Fidelity Central Funds | | | | 827,776 |

| Total Income | | | | 20,154,660 |

| Expenses | | | | |

| Management fee | $ | 1,397,583 | | |

| Transfer agent fees | | 231,501 | | |

| Distribution and service plan fees | | 45,523 | | |

| Accounting fees and expenses | | 105,480 | | |

| Custodian fees and expenses | | 6,638 | | |

| Independent trustees' fees and expenses | | 1,252 | | |

| Registration fees | | 94,391 | | |

| Audit | | 35,036 | | |

| Legal | | (5,949) | | |

| Interest | | 6,515 | | |

| Miscellaneous | | 813 | | |

| Total expenses before reductions | | 1,918,783 | | |

| Expense reductions | | (20,164) | | |

| Total expenses after reductions | | | | 1,898,619 |

| Net Investment income (loss) | | | | 18,256,041 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (7,688,886) | | |

| Foreign currency transactions | | (1) | | |

| Total net realized gain (loss) | | | | (7,688,887) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | (6,363,081) |

| Net gain (loss) | | | | (14,051,968) |

| Net increase (decrease) in net assets resulting from operations | | | $ | 4,204,073 |

| Statement of Changes in Net Assets |

| |

| | Six months ended October 31, 2023 (Unaudited) | | Year ended April 30, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 18,256,041 | $ | 18,111,555 |

| Net realized gain (loss) | | (7,688,887) | | (2,582,867) |

| Change in net unrealized appreciation (depreciation) | | (6,363,081) | | 2,108,837 |

| Net increase (decrease) in net assets resulting from operations | | 4,204,073 | | 17,637,525 |

| Distributions to shareholders | | (14,393,905) | | (15,367,826) |

| | | | | |

| Share transactions - net increase (decrease) | | (174,398,529) | | 372,738,743 |

| Total increase (decrease) in net assets | | (184,588,361) | | 375,008,442 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 502,508,074 | | 127,499,632 |

| End of period | $ | 317,919,713 | $ | 502,508,074 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity Advisor® Short Duration High Income Fund Class A |

| |

| | Six months ended (Unaudited) October 31, 2023 | | Years ended April 30, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 | $ | 9.42 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .296 | | .502 | | .307 | | .300 | | .348 | | .409 |

| Net realized and unrealized gain (loss) | | (.224) | | (.429) | | (.546) | | .651 | | (.571) | | .004 |

| Total from investment operations | | .072 | | .073 | | (.239) | | .951 | | (.223) | | .413 |

| Distributions from net investment income | | (.232) | | (.393) | | (.301) | | (.301) | | (.347) | | (.393) |

| Total distributions | | (.232) | | (.393) | | (.301) | | (.301) | | (.347) | | (.393) |

| Net asset value, end of period | $ | 8.50 | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 |

Total Return C,D,E | | .83% | | .93% | | (2.60)% | | 10.83% | | (2.47)% | | 4.52% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.04% H | | 1.10% | | 1.13% | | 1.15% | | 1.15% | | 1.15% |

| Expenses net of fee waivers, if any | | 1.00% H | | 1.00% | | 1.01% | | 1.05% | | 1.05% | | 1.05% |

| Expenses net of all reductions | | 1.00% H | | 1.00% | | 1.01% | | 1.05% | | 1.05% | | 1.05% |

| Net investment income (loss) | | 6.86% H | | 5.81% | | 3.27% | | 3.21% | | 3.74% | | 4.37% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 24,238 | $ | 21,379 | $ | 22,554 | $ | 17,126 | $ | 12,603 | $ | 15,050 |

Portfolio turnover rate I | | 31% H | | 14% | | 42% | | 74% | | 77% | | 33% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns for periods of less than one year are not annualized.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

ETotal returns do not include the effect of the sales charges.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Short Duration High Income Fund Class M |

| |

| | Six months ended (Unaudited) October 31, 2023 | | Years ended April 30, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.86 | $ | 9.44 | $ | 9.42 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .297 | | .502 | | .307 | | .300 | | .348 | | .408 |

| Net realized and unrealized gain (loss) | | (.225) | | (.429) | | (.546) | | .661 | | (.581) | | .005 |

| Total from investment operations | | .072 | | .073 | | (.239) | | .961 | | (.233) | | .413 |

| Distributions from net investment income | | (.232) | | (.393) | | (.301) | | (.301) | | (.347) | | (.393) |

| Total distributions | | (.232) | | (.393) | | (.301) | | (.301) | | (.347) | | (.393) |

| Net asset value, end of period | $ | 8.50 | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.86 | $ | 9.44 |

Total Return C,D,E | | .83% | | .93% | | (2.60)% | | 10.96% | | (2.58)% | | 4.52% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.05% H | | 1.12% | | 1.13% | | 1.17% | | 1.16% | | 1.16% |

| Expenses net of fee waivers, if any | | 1.00% H | | 1.00% | | 1.01% | | 1.05% | | 1.05% | | 1.05% |

| Expenses net of all reductions | | 1.00% H | | 1.00% | | 1.01% | | 1.05% | | 1.05% | | 1.05% |

| Net investment income (loss) | | 6.86% H | | 5.81% | | 3.27% | | 3.21% | | 3.74% | | 4.37% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 2,007 | $ | 2,318 | $ | 2,812 | $ | 2,289 | $ | 2,106 | $ | 2,537 |

Portfolio turnover rate I | | 31% H | | 14% | | 42% | | 74% | | 77% | | 33% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns for periods of less than one year are not annualized.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

ETotal returns do not include the effect of the sales charges.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Short Duration High Income Fund Class C |

| |

| | Six months ended (Unaudited) October 31, 2023 | | Years ended April 30, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 | $ | 9.42 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .265 | | .439 | | .237 | | .230 | | .278 | | .338 |

| Net realized and unrealized gain (loss) | | (.226) | | (.430) | | (.546) | | .651 | | (.571) | | .005 |

| Total from investment operations | | .039 | | .009 | | (.309) | | .881 | | (.293) | | .343 |

| Distributions from net investment income | | (.199) | | (.329) | | (.231) | | (.231) | | (.277) | | (.323) |

| Total distributions | | (.199) | | (.329) | | (.231) | | (.231) | | (.277) | | (.323) |

| Net asset value, end of period | $ | 8.50 | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 |

Total Return C,D,E | | .45% | | .18% | | (3.33)% | | 10.01% | | (3.20)% | | 3.74% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.82% H | | 1.90% | | 1.91% | | 1.94% | | 1.93% | | 1.92% |

| Expenses net of fee waivers, if any | | 1.75% H | | 1.75% | | 1.76% | | 1.80% | | 1.80% | | 1.80% |

| Expenses net of all reductions | | 1.75% H | | 1.75% | | 1.76% | | 1.80% | | 1.80% | | 1.80% |

| Net investment income (loss) | | 6.11% H | | 5.06% | | 2.52% | | 2.46% | | 2.99% | | 3.61% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 2,823 | $ | 2,795 | $ | 3,884 | $ | 4,018 | $ | 4,017 | $ | 4,541 |

Portfolio turnover rate I | | 31% H | | 14% | | 42% | | 74% | | 77% | | 33% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns for periods of less than one year are not annualized.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

ETotal returns do not include the effect of the contingent deferred sales charge.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity® Short Duration High Income Fund |

| |

| | Six months ended (Unaudited) October 31, 2023 | | Years ended April 30, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 | $ | 9.42 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .310 | | .523 | | .331 | | .323 | | .372 | | .431 |

| Net realized and unrealized gain (loss) | | (.226) | | (.428) | | (.546) | | .651 | | (.572) | | .006 |

| Total from investment operations | | .084 | | .095 | | (.215) | | .974 | | (.200) | | .437 |

| Distributions from net investment income | | (.244) | | (.415) | | (.325) | | (.324) | | (.370) | | (.417) |

| Total distributions | | (.244) | | (.415) | | (.325) | | (.324) | | (.370) | | (.417) |

| Net asset value, end of period | $ | 8.50 | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 |

Total Return C,D | | .96% | | 1.18% | | (2.35)% | | 11.11% | | (2.23)% | | 4.78% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | | | |

| Expenses before reductions | | .73% G | | .76% | | .83% | | .87% | | .86% | | .86% |

| Expenses net of fee waivers, if any | | .72% G | | .75% | | .75% | | .80% | | .80% | | .80% |

| Expenses net of all reductions | | .72% G | | .75% | | .75% | | .80% | | .80% | | .80% |

| Net investment income (loss) | | 7.13% G | | 6.06% | | 3.52% | | 3.46% | | 3.99% | | 4.61% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 273,926 | $ | 460,873 | $ | 87,949 | $ | 83,066 | $ | 63,703 | $ | 88,429 |

Portfolio turnover rate H | | 31% G | | 14% | | 42% | | 74% | | 77% | | 33% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns for periods of less than one year are not annualized.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAnnualized.

HAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Short Duration High Income Fund Class I |

| |

| | Six months ended (Unaudited) October 31, 2023 | | Years ended April 30, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 | $ | 9.42 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .306 | | .524 | | .331 | | .323 | | .372 | | .430 |

| Net realized and unrealized gain (loss) | | (.223) | | (.429) | | (.546) | | .651 | | (.572) | | .007 |

| Total from investment operations | | .083 | | .095 | | (.215) | | .974 | | (.200) | | .437 |

| Distributions from net investment income | | (.243) | | (.415) | | (.325) | | (.324) | | (.370) | | (.417) |

| Total distributions | | (.243) | | (.415) | | (.325) | | (.324) | | (.370) | | (.417) |

| Net asset value, end of period | $ | 8.50 | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.44 |

Total Return C,D | | .95% | | 1.18% | | (2.35)% | | 11.11% | | (2.23)% | | 4.78% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | | | |

| Expenses before reductions | | .76% G | | .84% | | .88% | | .92% | | .89% | | .89% |

| Expenses net of fee waivers, if any | | .75% G | | .75% | | .76% | | .80% | | .80% | | .80% |

| Expenses net of all reductions | | .75% G | | .75% | | .76% | | .80% | | .80% | | .80% |

| Net investment income (loss) | | 7.11% G | | 6.06% | | 3.52% | | 3.46% | | 3.99% | | 4.60% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 6,164 | $ | 4,855 | $ | 5,055 | $ | 5,023 | $ | 3,950 | $ | 4,060 |

Portfolio turnover rate H | | 31% G | | 14% | | 42% | | 74% | | 77% | | 33% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns for periods of less than one year are not annualized.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAnnualized.

HAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Short Duration High Income Fund Class Z |

| |

| | Six months ended (Unaudited) October 31, 2023 | | Years ended April 30, 2023 | | 2022 | | 2021 | | 2020 | | 2019 A |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.45 | $ | 9.46 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) B,C | | .312 | | .531 | | .339 | | .331 | | .378 | | .261 |

| Net realized and unrealized gain (loss) | | (.226) | | (.428) | | (.546) | | .652 | | (.579) | | (.016) |

| Total from investment operations | | .086 | | .103 | | (.207) | | .983 | | (.201) | | .245 |

| Distributions from net investment income | | (.246) | | (.423) | | (.333) | | (.333) | | (.379) | | (.255) |

| Total distributions | | (.246) | | (.423) | | (.333) | | (.333) | | (.379) | | (.255) |

| Net asset value, end of period | $ | 8.50 | $ | 8.66 | $ | 8.98 | $ | 9.52 | $ | 8.87 | $ | 9.45 |

Total Return D,E | | 1.00% | | 1.27% | | (2.27)% | | 11.21% | | (2.24)% | | 2.67% |

Ratios to Average Net Assets C,F,G | | | | | | | | | | | | |

| Expenses before reductions | | .69% H | | .75% | | .78% | | .80% | | .80% | | .82% H |

| Expenses net of fee waivers, if any | | .66% H | | .66% | | .66% | | .71% | | .71% | | .71% H |

| Expenses net of all reductions | | .66% H | | .66% | | .66% | | .71% | | .71% | | .71% H |

| Net investment income (loss) | | 7.20% H | | 6.15% | | 3.61% | | 3.55% | | 4.08% | | 4.86% H |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 8,762 | $ | 10,289 | $ | 5,246 | $ | 3,815 | $ | 2,031 | $ | 425 |

Portfolio turnover rate I | | 31% H | | 14% | | 42% | | 74% | | 77% | | 33% H |

AFor the period October 2, 2018 (commencement of sale of shares) through April 30, 2019.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended October 31, 2023

1. Organization.

Fidelity Short Duration High Income Fund (the Fund) is a fund of Fidelity Summer Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, Short Duration High Income, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Class A, Class M, Class C, Class I and Class Z are Fidelity Advisor classes. Each class has exclusive voting rights with respect to matters that affect that class. Class C shares will automatically convert to Class A shares after a holding period of eight years from the initial date of purchase, with certain exceptions.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows: