To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

| Bank Loan Obligations - 90.7% | | | |

| | | Principal Amount | Value |

| Aerospace - 1.7% | | | |

| ADS Tactical, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.750% 6.75% 3/4/26 (a)(b)(c) | | $565,000 | $559,350 |

| AI Convoy Luxembourg SARL Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 1/20/27 (a)(b)(c) | | 569,250 | 568,254 |

| Jazz Acquisition, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.36% 6/19/26 (a)(b)(c) | | 123,125 | 116,955 |

| TransDigm, Inc.: | | | |

| Tranche E 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3585% 5/30/25 (a)(b)(c) | | 1,518,547 | 1,486,126 |

| Tranche F 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3585% 12/9/25 (a)(b)(c) | | 370,313 | 362,288 |

| Tranche G 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3585% 8/22/24 (a)(b)(c) | | 1,207,911 | 1,184,333 |

| WP CPP Holdings LLC: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 4/30/25 (a)(b)(c) | | 491,514 | 477,383 |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 7.750% 8.75% 4/30/26 (a)(b)(c) | | 235,000 | 207,192 |

|

| TOTAL AEROSPACE | | | 4,961,881 |

|

| Air Transportation - 1.6% | | | |

| AAdvantage Loyalty IP Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 3/10/28 (b)(c)(d) | | 960,000 | 982,502 |

| Dynasty Acquisition Co., Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.7025% 4/8/26 (a)(b)(c) | | 486,852 | 471,053 |

| Tranche B2 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.7025% 4/4/26 (a)(b)(c) | | 261,748 | 253,255 |

| JetBlue Airways Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.250% 6.25% 6/17/24 (a)(b)(c) | | 293,563 | 300,168 |

| Mileage Plus Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.250% 6.25% 7/2/27 (a)(b)(c) | | 930,000 | 987,111 |

| SkyMiles IP Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 10/20/27 (a)(b)(c) | | 820,000 | 860,180 |

| WestJet Airlines Ltd. 1LN, term loan 3 month U.S. LIBOR + 2.750% 4% 12/11/26 (a)(b)(c) | | 617,188 | 598,092 |

|

| TOTAL AIR TRANSPORTATION | | | 4,452,361 |

|

| Automotive & Auto Parts - 0.9% | | | |

| Clarios Global LP Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 4/30/26 (a)(b)(c) | | 289,275 | 286,021 |

| Les Schwab Tire Centers Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.25% 11/2/27 (a)(b)(c) | | 568,575 | 568,103 |

| Midas Intermediate Holdco II LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.750% 7.5% 12/16/25 (a)(b)(c) | | 249,375 | 255,298 |

| North American Lifting Holdings, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 6.500% 7.5% 10/16/24 (a)(b)(c) | | 681,526 | 708,787 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 11.000% 12% 3/1/25 (a)(b)(c) | | 178,179 | 167,934 |

| Truck Hero, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 1/29/28 (a)(b)(c) | | 460,000 | 458,533 |

| UOS LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.3645% 4/18/25 (a)(b)(c) | | 262,989 | 262,660 |

|

| TOTAL AUTOMOTIVE & AUTO PARTS | | | 2,707,336 |

|

| Banks & Thrifts - 1.3% | | | |

| Blackstone CQP Holdco LP Tranche B, term loan 3 month U.S. LIBOR + 3.500% 3.6866% 9/30/24 (a)(b)(c) | | 755,284 | 752,928 |

| Citadel Securities LP Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6085% 2/27/28 (a)(b)(c) | | 1,570,000 | 1,551,678 |

| Deerfield Dakota Holding LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 4/9/27 (a)(b)(c) | | 662,298 | 662,192 |

| eResearchTechnology, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 2/4/27 (b)(c)(d) | | 335,000 | 335,157 |

| Russell Investments U.S. Institutional Holdco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 4% 5/30/25 (a)(b)(c) | | 242,689 | 241,248 |

| Victory Capital Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.4386% 7/1/26 (a)(b)(c) | | 288,316 | 285,312 |

|

| TOTAL BANKS & THRIFTS | | | 3,828,515 |

|

| Broadcasting - 2.2% | | | |

| AppLovin Corp. Tranche B, term loan 3 month U.S. LIBOR + 3.500% 3.6085% 8/15/25 (a)(b)(c) | | 1,252,049 | 1,249,845 |

| Cumulus Media New Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 3/31/26 (a)(b)(c) | | 23,871 | 23,532 |

| Diamond Sports Group LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.36% 8/24/26 (a)(b)(c) | | 1,694,200 | 1,156,292 |

| E.W. Scripps Co. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.75% 1/7/28 (a)(b)(c) | | 423,938 | 422,017 |

| Entercom Media Corp. Tranche B 2LN, term loan 3 month U.S. LIBOR + 2.500% 2.6091% 11/17/24 (a)(b)(c) | | 376,665 | 367,907 |

| iHeartCommunications, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 5/1/26 (a)(b)(c) | | 306,125 | 302,155 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 5/1/26 (a)(b)(c) | | 228,275 | 228,346 |

| Nexstar Broadcasting, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.6151% 9/19/26 (a)(b)(c) | | 750,482 | 744,201 |

| Nielsen Finance LLC Tranche B5 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 6/4/25 (a)(b)(c) | | 301,276 | 301,795 |

| Sinclair Television Group, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.61% 9/30/26 (a)(b)(c) | | 472,800 | 465,117 |

| Springer Nature Deutschland GmbH Tranche B18 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 8/14/26 (a)(b)(c) | | 702,587 | 701,709 |

| Univision Communications, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 3/15/26 (a)(b)(c) | | 243,738 | 243,324 |

|

| TOTAL BROADCASTING | | | 6,206,240 |

|

| Building Materials - 1.4% | | | |

| APi Group DE, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6085% 10/1/26 (a)(b)(c) | | 617,188 | 613,719 |

| Hamilton Holdco LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.21% 1/4/27 (a)(b)(c) | | 344,684 | 342,960 |

| Ingersoll-Rand Services Co. Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8645% 2/28/27 (a)(b)(c) | | 653,400 | 644,416 |

| LEB Holdings U.S.A., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 11/2/27 (a)(b)(c) | | 254,363 | 254,680 |

| Traverse Midstream Partners Ll Tranche B, term loan 3 month U.S. LIBOR + 5.500% 6.5% 9/27/24 (a)(b)(c) | | 589,150 | 583,553 |

| Ventia Deco LLC Tranche B, term loan 3 month U.S. LIBOR + 4.000% 5% 5/21/26 (a)(b)(c) | | 1,094,248 | 1,094,248 |

| White Capital Buyer LLC Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 4.000% 4.5% 10/19/27 (a)(b)(c) | | 364,226 | 363,316 |

| 3 month U.S. LIBOR + 4.000% 4.5% 10/19/27 (a)(b)(c) | | 124,549 | 124,237 |

|

| TOTAL BUILDING MATERIALS | | | 4,021,129 |

|

| Cable/Satellite TV - 3.0% | | | |

| Charter Communication Operating LLC Tranche B2 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.86% 2/1/27 (a)(b)(c) | | 2,465,507 | 2,451,947 |

| Coral-U.S. Co.-Borrower LLC Tranche B, term loan 3 month U.S. LIBOR + 2.250% 2.3585% 1/31/28 (a)(b)(c) | | 1,340,000 | 1,318,949 |

| CSC Holdings LLC: | | | |

| Tranche B 5LN, term loan 3 month U.S. LIBOR + 2.500% 2.606% 4/15/27 (a)(b)(c) | | 1,237,500 | 1,221,153 |

| Tranche B3 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.356% 1/15/26 (a)(b)(c) | | 490,000 | 482,650 |

| LCPR Loan Financing LLC 1LN, term loan 3 month U.S. LIBOR + 3.750% 9/25/28 (b)(c)(d)(e) | | 305,000 | 305,381 |

| Neptune Finco Corp. Tranche B, term loan 3 month U.S. LIBOR + 2.250% 2.356% 7/17/25 (a)(b)(c) | | 930,016 | 916,261 |

| Virgin Media Bristol LLC Tranche N, term loan 3 month U.S. LIBOR + 2.500% 2.606% 1/31/28 (a)(b)(c) | | 500,000 | 495,115 |

| WideOpenWest Finance LLC Tranche B, term loan 3 month U.S. LIBOR + 3.250% 4.25% 8/19/23 (a)(b)(c) | | 1,255,775 | 1,251,305 |

|

| TOTAL CABLE/SATELLITE TV | | | 8,442,761 |

|

| Capital Goods - 0.6% | | | |

| Altra Industrial Motion Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 10/1/25 (a)(b)(c) | | 189,258 | 187,696 |

| CPM Holdings, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 8.250% 8.3651% 11/15/26 (a)(b)(c) | | 135,000 | 131,895 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6151% 11/15/25 (a)(b)(c) | | 430,100 | 417,949 |

| MHI Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.1085% 9/20/26 (a)(b)(c) | | 524,067 | 525,104 |

| Resideo Funding, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.75% 2/9/28 (a)(b)(c) | | 280,000 | 278,950 |

| Vertical U.S. Newco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.4776% 7/31/27 (a)(b)(c) | | 303,477 | 303,932 |

|

| TOTAL CAPITAL GOODS | | | 1,845,526 |

|

| Chemicals - 2.2% | | | |

| Aruba Investment Holdings LLC: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 7.750% 8.5% 11/24/28 (a)(b)(c) | | 85,000 | 85,213 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 11/24/27 (a)(b)(c) | | 320,000 | 319,200 |

| Element Solutions, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 1/31/26 (a)(b)(c) | | 366,605 | 364,405 |

| Hexion, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.74% 7/1/26 (a)(b)(c) | | 255,450 | 255,292 |

| INEOS U.S. Petrochem LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 3.25% 1/20/26 (a)(b)(c) | | 1,070,000 | 1,065,988 |

| Messer Industries U.S.A., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.7025% 3/1/26 (a)(b)(c) | | 524,706 | 520,052 |

| NIC Acquisition Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 1/14/28 (a)(b)(c) | | 275,000 | 274,772 |

| Oxea Corp. Tranche B2, term loan 3 month U.S. LIBOR + 3.500% 3.625% 10/11/24 (a)(b)(c) | | 527,379 | 518,645 |

| SCIH Salt Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 5.5% 3/16/27 (a)(b)(c) | | 248,125 | 248,125 |

| Starfruit U.S. Holdco LLC Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.8602% 10/1/25 (a)(b)(c) | | 1,680,810 | 1,653,850 |

| The Chemours Co. LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.86% 4/3/25 (a)(b)(c) | | 394,114 | 381,963 |

| Tronox Finance LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6397% 3/2/28 (a)(b)(c) | | 274,839 | 273,179 |

| W. R. Grace & Co.-Conn.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.9525% 4/3/25 (a)(b)(c) | | 136,049 | 134,816 |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 1.750% 1.9525% 4/3/25 (a)(b)(c) | | 233,226 | 231,113 |

|

| TOTAL CHEMICALS | | | 6,326,613 |

|

| Consumer Products - 1.3% | | | |

| BCPE Empire Holdings, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1085% 6/11/26 (a)(b)(c) | | 246,403 | 244,711 |

| term loan 3 month U.S. LIBOR + 4.250% 5% 6/12/26 (a)(b)(c) | | 250,000 | 249,375 |

| Bombardier Recreational Products, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 5/23/27 (a)(b)(c) | | 205,000 | 202,470 |

| Buzz Merger Sub Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 1/29/27 (a)(b)(c) | | 123,750 | 122,822 |

| CNT Holdings I Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 11/8/27 (a)(b)(c) | | 500,000 | 498,595 |

| Energizer Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.75% 12/16/27 (a)(b)(c) | | 365,000 | 363,022 |

| Gannett Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 7.000% 7.75% 1/29/26 (a)(b)(c) | | 213,222 | 214,555 |

| Kronos Acquisition Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.25% 12/22/26 (a)(b)(c) | | 473,813 | 466,535 |

| Mattress Firm, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.250% 6.25% 11/25/27 (a)(b)(c) | | 287,625 | 291,220 |

| Petco Health & Wellness Co., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 2/25/28(a)(b)(c) | | 335,000 | 333,482 |

| Rodan & Fields LLC Tranche B, term loan 3 month U.S. LIBOR + 4.000% 4.106% 6/15/25 (a)(b)(c) | | 364,688 | 308,161 |

| Woof Holdings LLC: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 12/21/27 (a)(b)(c) | | 330,000 | 328,350 |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 7.250% 8% 12/21/28 (a)(b)(c) | | 85,000 | 86,169 |

|

| TOTAL CONSUMER PRODUCTS | | | 3,709,467 |

|

| Containers - 2.9% | | | |

| Aot Packaging Products Acquisi: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 3/3/28 (a)(b)(c) | | 485,742 | 480,681 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 3/3/28 (a)(b)(c)(f) | | 109,258 | 108,119 |

| Berlin Packaging, LLC Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.000% 3.1208% 11/7/25 (a)(b)(c) | | 866,000 | 849,451 |

| 3 month U.S. LIBOR + 3.250% 3.75% 3/5/28 (a)(b)(c) | | 90,000 | 89,025 |

| Berry Global, Inc. Tranche Z 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8981% 7/1/26 (a)(b)(c) | | 528,394 | 523,686 |

| BWAY Holding Co. Tranche B, term loan 3 month U.S. LIBOR + 3.250% 3.4426% 4/3/24 (a)(b)(c) | | 240,625 | 235,211 |

| Canister International Group, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.750% 4.8585% 12/21/26 (a)(b)(c) | | 247,500 | 247,809 |

| Charter NEX U.S., Inc. 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 12/1/27 (a)(b)(c) | | 470,000 | 470,588 |

| Flex Acquisition Co., Inc. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.000% 3.2375% 6/29/25 (a)(b)(c) | | 725,298 | 712,605 |

| 3 month U.S. LIBOR + 3.500% 4% 3/2/28 (a)(b)(c) | | 1,078,632 | 1,063,974 |

| Graham Packaging Co., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.75% 8/4/27 (a)(b)(c) | | 778,831 | 773,433 |

| Kloeckner Pentaplast of America, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.25% 2/4/26 (a)(b)(c) | | 319,200 | 318,003 |

| Pixelle Specialty Solutions LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.500% 7.5% 10/31/24 (a)(b)(c) | | 122,633 | 122,505 |

| Pregis TopCo Corp.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 7/31/26 (a)(b)(c) | | 246,875 | 244,663 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 8/1/26 (a)(b)(c) | | 250,000 | 250,000 |

| Printpack Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 4% 7/26/23 (a)(b)(c) | | 202,876 | 201,608 |

| Reynolds Consumer Products LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 1/30/27 (a)(b)(c) | | 603,808 | 600,487 |

| Reynolds Group Holdings, Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 2/16/26 (a)(b)(c) | | 374,063 | 369,574 |

| Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 2/5/23 (a)(b)(c) | | 629,894 | 626,846 |

|

| TOTAL CONTAINERS | | | 8,288,268 |

|

| Diversified Financial Services - 2.8% | | | |

| ACNR Holdings, Inc. term loan 17% 9/21/27 (a)(c)(e) | | 356,738 | 356,738 |

| AlixPartners LLP Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 3.25% 2/4/28 (a)(b)(c) | | 590,000 | 587,457 |

| Alpine Finance Merger Sub LLC Tranche B, term loan 3 month U.S. LIBOR + 3.000% 4% 7/12/24 (a)(b)(c) | | 811,120 | 806,861 |

| Avolon TLB Borrower 1 (U.S.) LLC Tranche B3 1LN, term loan 3 month U.S. LIBOR + 1.750% 2.5% 1/15/25 (a)(b)(c) | | 277,628 | 276,465 |

| AVSC Holding Corp. Tranche B2 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.4988% 10/15/26 (a)(b)(c) | | 372,186 | 336,597 |

| BCP Renaissance Parent LLC Tranche B, term loan 3 month U.S. LIBOR + 3.500% 4.5% 10/31/24 (a)(b)(c) | | 463,819 | 453,188 |

| Finco I LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6072% 6/27/25 (a)(b)(c) | | 124,375 | 123,481 |

| Fly Funding II SARL Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.95% 8/9/25 (a)(b)(c) | | 704,793 | 688,054 |

| Focus Financial Partners LLC Tranche B3 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 7/3/24 (a)(b)(c) | | 438,397 | 433,334 |

| GT Polaris, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 5% 9/24/27 (a)(b)(c) | | 319,200 | 318,801 |

| HarbourVest Partners LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3561% 3/1/25 (a)(b)(c) | | 825,061 | 818,362 |

| Kingpin Intermediate Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 7/3/24 (a)(b)(c) | | 246,212 | 240,365 |

| KREF Holdings X LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.75% 9/1/27 (a)(b)(c) | | 369,075 | 369,998 |

| Recess Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.750% 4.75% 9/29/24 (a)(b)(c) | | 259,185 | 256,075 |

| RPI Intermediate Finance Trust Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 2/11/27 (a)(b)(c) | | 1,031,850 | 1,029,270 |

| TransUnion LLC Tranche B5 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 11/16/26 (a)(b)(c) | | 757,822 | 752,139 |

| UFC Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.75% 4/29/26 (a)(b)(c) | | 216,065 | 215,052 |

|

| TOTAL DIVERSIFIED FINANCIAL SERVICES | | | 8,062,237 |

|

| Diversified Media - 1.4% | | | |

| Advantage Sales & Marketing, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.250% 6% 10/28/27 (a)(b)(c) | | 847,875 | 845,603 |

| Allen Media LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.500% 5.7025% 2/10/27 (a)(b)(c) | | 1,133,369 | 1,129,969 |

| Lamar Media Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.500% 1.6035% 1/30/27 (a)(b)(c) | | 250,000 | 247,735 |

| Terrier Media Buyer, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6085% 12/17/26 (a)(b)(c) | | 1,835,400 | 1,817,303 |

|

| TOTAL DIVERSIFIED MEDIA | | | 4,040,610 |

|

| Energy - 4.0% | | | |

| Apro LLC Tranche B, term loan 3 month U.S. LIBOR + 4.000% 5% 11/14/26 (a)(b)(c) | | 494,025 | 492,484 |

| Array Technologies, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 10/14/27 (a)(b)(c) | | 568,547 | 567,484 |

| BCP Raptor II LLC Tranche B, term loan 3 month U.S. LIBOR + 4.750% 4.8572% 11/3/25 (a)(b)(c) | | 487,283 | 463,528 |

| BCP Raptor LLC Tranche B, term loan 3 month U.S. LIBOR + 4.250% 5.25% 6/24/24 (a)(b)(c) | | 638,124 | 612,957 |

| Brazos Delaware II LLC Tranche B, term loan 3 month U.S. LIBOR + 4.000% 4.1109% 5/21/25 (a)(b)(c) | | 272,426 | 253,922 |

| BW Gas & Convenience Holdings LLC Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.500% 3/17/28 (b)(c)(d)(e) | | 280,000 | 279,650 |

| 3 month U.S. LIBOR + 6.250% 6.37% 11/18/24 (a)(b)(c) | | 278,795 | 280,886 |

| ChampionX Holding, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 6% 6/3/27 (a)(b)(c) | | 351,000 | 357,143 |

| Citgo Holding, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 7.000% 8% 8/1/23 (a)(b)(c) | | 305,350 | 292,983 |

| Citgo Petroleum Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.250% 7.25% 3/28/24 (a)(b)(c) | | 1,116,730 | 1,117,657 |

| EG America LLC: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 8.000% 9% 3/23/26 (a)(b)(c) | | 124,010 | 123,700 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.2025% 2/6/25 (a)(b)(c) | | 382,680 | 376,052 |

| Epic Crude Services LP Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.26% 3/1/26 (a)(b)(c) | | 746,250 | 541,651 |

| GIP III Stetson I LP Tranche B, term loan 3 month U.S. LIBOR + 4.250% 4.3645% 7/18/25 (a)(b)(c) | | 1,055,697 | 1,009,247 |

| Gulf Finance LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.250% 6.25% 8/25/23 (a)(b)(c) | | 628,023 | 518,565 |

| Hamilton Projs. Acquiror LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.75% 6/17/27 (a)(b)(c) | | 674,900 | 676,871 |

| Lower Cadence Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1145% 5/22/26 (a)(b)(c) | | 331,864 | 323,339 |

| Matador Bidco SARL Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 4.8585% 10/15/26 (a)(b)(c) | | 148,500 | 147,943 |

| Murphy U.S.A., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 2.25% 1/29/28 (a)(b)(c) | | 450,000 | 451,688 |

| Natgasoline LLC Tranche B, term loan 3 month U.S. LIBOR + 3.500% 3.625% 11/14/25 (a)(b)(c) | | 845,538 | 837,082 |

| Oregon Clean Energy LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 3/1/26 (a)(b)(c) | | 75,681 | 74,230 |

| Oxbow Carbon LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 10/19/25 (a)(b)(c) | | 185,250 | 185,157 |

| Rockwood Service Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.3585% 1/23/27 (a)(b)(c) | | 679,229 | 679,793 |

| Terra-Gen Finance Co. LLC Tranche B, term loan 3 month U.S. LIBOR + 4.250% 5.25% 12/9/21 (a)(b)(c) | | 509,197 | 504,741 |

| WaterBridge Operating LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.750% 6.75% 6/21/26 (a)(b)(c) | | 369,375 | 349,521 |

|

| TOTAL ENERGY | | | 11,518,274 |

|

| Entertainment/Film - 0.1% | | | |

| SMG U.S. Midco 2, Inc. 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6815% 1/23/25(a)(b)(c) | | 322,332 | 306,216 |

| Environmental - 0.1% | | | |

| Erm Emerald U.S., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.6085% 7/10/26 (a)(b)(c) | | 245,625 | 243,721 |

| Food & Drug Retail - 1.3% | | | |

| Froneri U.S., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3585% 1/29/27 (a)(b)(c) | | 660,013 | 650,475 |

| GOBP Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 10/22/25 (a)(b)(c) | | 222,882 | 222,394 |

| JBS U.S.A. Lux SA Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 5/1/26 (a)(b)(c) | | 1,363,431 | 1,354,064 |

| JP Intermediate B LLC Tranche B, term loan 3 month U.S. LIBOR + 5.500% 6.5% 11/20/25 (a)(b)(c) | | 509,087 | 485,756 |

| Lannett Co., Inc. Tranche B, term loan 3 month U.S. LIBOR + 5.370% 6.375% 11/25/22 (a)(b)(c) | | 900,354 | 858,713 |

|

| TOTAL FOOD & DRUG RETAIL | | | 3,571,402 |

|

| Food/Beverage/Tobacco - 1.6% | | | |

| 8th Avenue Food & Provisions, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 7.750% 7.8609% 10/1/26 (a)(b)(c) | | 80,000 | 79,066 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6109% 10/1/25 (a)(b)(c) | | 234,600 | 234,164 |

| Atkins Nutritional Holdings II, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 7/7/24 (a)(b)(c) | | 241,957 | 242,259 |

| BellRing Brands LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 10/21/24 (a)(b)(c) | | 591,596 | 594,305 |

| Chobani LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 10/23/27 (a)(b)(c) | | 676,600 | 675,585 |

| EG Finco Ltd. Tranche B, term loan 3 month U.S. LIBOR + 4.000% 4.2539% 2/6/25 (a)(b)(c) | | 305,550 | 300,258 |

| Saffron Borrowco LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.750% 6.8585% 6/20/25 (a)(b)(c) | | 242,813 | 243,269 |

| Shearer's Foods, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.25% 9/23/27 (a)(b)(c) | | 595,091 | 593,508 |

| Triton Water Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4% 3/16/28 (a)(b)(c) | | 710,000 | 706,670 |

| U.S. Foods, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 9/13/26 (a)(b)(c) | | 295,500 | 289,306 |

| Tranche B, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 6/27/23 (a)(b)(c) | | 702,438 | 692,485 |

|

| TOTAL FOOD/BEVERAGE/TOBACCO | | | 4,650,875 |

|

| Gaming - 4.9% | | | |

| AP Gaming I LLC Tranche B, term loan 3 month U.S. LIBOR + 3.500% 4.5% 2/15/24 (a)(b)(c) | | 563,777 | 551,092 |

| Aristocrat International Pty Ltd.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 10/19/24 (a)(b)(c) | | 153,838 | 154,254 |

| Tranche B 3LN, term loan 3 month U.S. LIBOR + 1.750% 1.9734% 10/19/24 (a)(b)(c) | | 74,897 | 74,439 |

| Bally's Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 8.000% 9% 5/10/26 (a)(b)(c) | | 431,738 | 461,959 |

| Boyd Gaming Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3309% 9/15/23 (a)(b)(c) | | 450,313 | 448,953 |

| Caesars Resort Collection LLC: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 12/22/24 (a)(b)(c) | | 3,097,997 | 3,050,226 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 4.6085% 7/20/25 (a)(b)(c) | | 1,970,100 | 1,972,563 |

| Churchill Downs, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.12% 3/10/28 (a)(b)(c) | | 300,000 | 298,125 |

| CityCenter Holdings LLC Tranche B, term loan 3 month U.S. LIBOR + 2.250% 3% 4/18/24 (a)(b)(c) | | 417,003 | 411,327 |

| Golden Entertainment, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.75% 10/20/24 (a)(b)(c) | | 1,212,708 | 1,194,517 |

| Golden Nugget LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 3.25% 10/4/23 (a)(b)(c) | | 1,947,162 | 1,914,547 |

| PCI Gaming Authority 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6085% 5/29/26 (a)(b)(c) | | 320,568 | 318,045 |

| Penn National Gaming, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.250% 3% 10/15/25 (a)(b)(c) | | 355,083 | 353,140 |

| Playtika Holding Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 3/11/28 (a)(b)(c) | | 705,000 | 700,594 |

| Scientific Games Corp. Tranche B 5LN, term loan 3 month U.S. LIBOR + 2.750% 2.8597% 8/14/24 (a)(b)(c) | | 450,357 | 441,318 |

| Stars Group Holdings BV Tranche B, term loan 3 month U.S. LIBOR + 3.500% 3.7025% 7/10/25 (a)(b)(c) | | 607,928 | 608,268 |

| Station Casinos LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.5% 2/7/27 (a)(b)(c) | | 1,089,962 | 1,071,379 |

|

| TOTAL GAMING | | | 14,024,746 |

|

| Healthcare - 5.5% | | | |

| Aldevron LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4.25% 10/11/26 (a)(b)(c) | | 1,060,230 | 1,058,460 |

| Avantor Funding, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 3.25% 11/6/27 (a)(b)(c) | | 249,375 | 249,250 |

| Catalent Pharma Solutions Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.5% 2/22/28 (a)(b)(c) | | 140,000 | 139,941 |

| CPI Holdco LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1091% 11/4/26 (a)(b)(c) | | 143,550 | 143,335 |

| Da Vinci Purchaser Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 5% 12/13/26 (a)(b)(c) | | 665,597 | 665,391 |

| Elanco Animal Health, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8651% 8/1/27 (a)(b)(c) | | 1,699,073 | 1,675,405 |

| Gainwell Acquisition Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 10/1/27 (a)(b)(c) | | 2,161,375 | 2,150,568 |

| HCA Holdings, Inc.: | | | |

| Tranche B12 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 3/13/25 (a)(b)(c) | | 970,225 | 969,187 |

| Tranche B13, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 3/18/26 (a)(b)(c) | | 305,301 | 305,014 |

| Horizon Pharma U.S.A., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.5% 2/25/28 (a)(b)(c) | | 285,000 | 284,003 |

| Maravai Intermediate Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 5.25% 10/19/27 (a)(b)(c) | | 598,364 | 601,355 |

| MED ParentCo LP: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.3585% 8/31/26 (a)(b)(c) | | 224,633 | 222,632 |

| 2LN, term loan 3 month U.S. LIBOR + 8.250% 8.3585% 8/30/27 (a)(b)(c) | | 180,000 | 178,425 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.3585% 8/31/26 (a)(b)(c) | | 56,332 | 55,830 |

| MPH Acquisition Holdings LLC Tranche B, term loan 3 month U.S. LIBOR + 2.750% 3.75% 6/7/23 (a)(b)(c) | | 198,683 | 197,487 |

| Ortho-Clinical Diagnostics, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3592% 6/30/25 (a)(b)(c) | | 501,842 | 500,712 |

| Packaging Coordinators Midco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 11/30/27 (a)(b)(c) | | 375,000 | 374,531 |

| Pathway Vet Alliance LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 3/31/27 (a)(b)(c) | | 480,340 | 476,839 |

| PPD, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.75% 1/6/28 (a)(b)(c) | | 835,000 | 830,082 |

| Radiology Partners, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.79% 7/9/25 (a)(b)(c) | | 70,000 | 69,388 |

| RegionalCare Hospital Partners Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.750% 3.8645% 11/16/25 (a)(b)(c) | | 488,602 | 487,205 |

| Surgery Center Holdings, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 8.000% 9% 8/31/24 (a)(b)(c) | | 99,000 | 100,919 |

| Tranche B, term loan 3 month U.S. LIBOR + 3.250% 4.25% 8/31/24 (a)(b)(c) | | 244,291 | 241,658 |

| U.S. Anesthesia Partners, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 4% 6/23/24 (a)(b)(c) | | 636,024 | 627,278 |

| U.S. Radiology Specialists, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.25% 12/15/27 (a)(b)(c) | | 284,288 | 284,555 |

| U.S. Renal Care, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.125% 6/13/26 (a)(b)(c) | | 1,196,775 | 1,188,924 |

| Upstream Newco, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.500% 4.6085% 11/20/26 (a)(b)(c) | | 247,500 | 246,728 |

| Valeant Pharmaceuticals International, Inc.: | | | |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 11/27/25 (a)(b)(c) | | 937,500 | 931,528 |

| Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 6/1/25 (a)(b)(c) | | 601,696 | 599,415 |

|

| TOTAL HEALTHCARE | | | 15,856,045 |

|

| Homebuilders/Real Estate - 1.2% | | | |

| DTZ U.S. Borrower LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8645% 8/21/25 (a)(b)(c) | | 976,647 | 955,689 |

| Landry's Finance Acquisition Co. Tranche B 1LN, term loan 3 month U.S. LIBOR + 12.000% 13% 10/4/23 (a)(b)(c) | | 180,000 | 204,300 |

| Lightstone Holdco LLC: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 1/30/24 (a)(b)(c) | | 678,660 | 531,804 |

| Tranche C 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 1/30/24 (a)(b)(c) | | 38,277 | 29,995 |

| RS Ivy Holdco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.5% 12/23/27 (a)(b)(c) | | 229,425 | 229,425 |

| Ryan Specialty Group LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 9/1/27 (a)(b)(c) | | 646,750 | 645,670 |

| VICI Properties, LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8609% 12/22/24 (a)(b)(c) | | 858,636 | 848,290 |

|

| TOTAL HOMEBUILDERS/REAL ESTATE | | | 3,445,173 |

|

| Hotels - 1.2% | | | |

| Aimbridge Acquisition Co., Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.000% 6.75% 10/1/27 (a)(b)(c) | | 124,375 | 124,375 |

| Tranche B, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 2/1/26 (a)(b)(c) | | 535,594 | 519,526 |

| Four Seasons Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 11/30/23 (a)(b)(c) | | 1,140,624 | 1,136,882 |

| Hilton Worldwide Finance LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8586% 6/21/26 (a)(b)(c) | | 126,445 | 125,213 |

| Marriott Ownership Resorts, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 8/31/25 (a)(b)(c) | | 178,650 | 173,291 |

| Travelport Finance Luxembourg SARL 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 5.000% 5.2025% 5/30/26 (a)(b)(c) | | 791,729 | 641,918 |

| 3 month U.S. LIBOR + 8.000% 9% 2/28/25 (a)(b)(c) | | 616,597 | 627,129 |

|

| TOTAL HOTELS | | | 3,348,334 |

|

| Insurance - 4.6% | | | |

| Acrisure LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.7025% 2/13/27 (a)(b)(c) | | 1,368,943 | 1,350,695 |

| Alliant Holdings Intermediate LLC: | | | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.250% 3.3645% 5/10/25 (a)(b)(c) | | 668,847 | 660,091 |

| Tranche B-2 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3645% 5/9/25 (a)(b)(c) | | 245,625 | 242,191 |

| Tranche B3 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.25% 11/5/27 (a)(b)(c) | | 283,137 | 282,276 |

| AmeriLife Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1085% 3/18/27 (a)(b)(c) | | 719,621 | 718,124 |

| AmWINS Group, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 3% 2/16/28 (a)(b)(c) | | 498,750 | 494,700 |

| AssuredPartners, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6085% 2/13/27 (a)(b)(c) | | 449,313 | 443,885 |

| Asurion LLC: | | | |

| Tranche B 6LN, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 11/3/23 (a)(b)(c) | | 2,176,072 | 2,168,826 |

| Tranche B 7LN, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 11/3/24 (a)(b)(c) | | 486,250 | 484,047 |

| Tranche B3 2LN, term loan 3 month U.S. LIBOR + 5.250% 5.3585% 2/5/28 (a)(b)(c) | | 1,005,000 | 1,022,588 |

| Tranche B8 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 12/23/26 (a)(b)(c) | | 997,500 | 990,557 |

| Tranche B9 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 7/31/27 (a)(b)(c) | | 605,000 | 600,335 |

| HUB International Ltd.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 4/25/25 (a)(b)(c) | | 864,084 | 862,857 |

| Tranche B, term loan 3 month U.S. LIBOR + 3.000% 4.6934% 4/25/25 (a)(b)(c) | | 1,499,594 | 1,477,445 |

| USI, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.4525% 12/2/26 (a)(b)(c) | | 123,438 | 122,137 |

| Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.2025% 5/16/24 (a)(b)(c) | | 1,297,001 | 1,281,489 |

|

| TOTAL INSURANCE | | | 13,202,243 |

|

| Leisure - 2.5% | | | |

| Alterra Mountain Co. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 2.750% 2.8585% 7/31/24 (a)(b)(c) | | 212,764 | 208,908 |

| 3 month U.S. LIBOR + 4.500% 5.5% 8/3/26 (a)(b)(c) | | 451,694 | 452,823 |

| Callaway Golf Co. Tranche B, term loan 3 month U.S. LIBOR + 3.500% 4.6109% 1/4/26 (a)(b)(c) | | 376,175 | 377,586 |

| Carnival Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 7.500% 8.5% 6/30/25 (a)(b)(c) | | 411,888 | 424,244 |

| Crown Finance U.S., Inc. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 2.500% 3.5% 2/28/25 (a)(b)(c) | | 879,367 | 749,678 |

| 3 month U.S. LIBOR + 2.750% 3.75% 9/30/26 (a)(b)(c) | | 370,303 | 312,558 |

| 15.25% 5/23/24 (c) | | 167,164 | 210,836 |

| Delta 2 SARL Tranche B, term loan 3 month U.S. LIBOR + 2.500% 3.5% 2/1/24 (a)(b)(c) | | 1,540,956 | 1,524,098 |

| Equinox Holdings, Inc.: | | | |

| Tranche 2LN, term loan 3 month U.S. LIBOR + 7.000% 8% 9/8/24 (a)(b)(c) | | 250,000 | 203,750 |

| Tranche B-1, term loan 3 month U.S. LIBOR + 3.000% 4% 3/8/24 (a)(b)(c) | | 720,131 | 670,737 |

| Herschend Entertainment Co. LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.750% 6.75% 8/18/25 (a)(b)(c) | | 218,900 | 222,184 |

| NASCAR Holdings, Inc. 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8645% 10/18/26 (a)(b)(c) | | 420,000 | 416,800 |

| PlayPower, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.500% 5.699% 5/10/26 (a)(b)(c) | | 119,182 | 117,543 |

| Seminole Tribe of Florida Tranche B, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 7/6/24 (a)(b)(c) | | 411,915 | 410,885 |

| SP PF Buyer LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 4.6085% 12/21/25 (a)(b)(c) | | 367,500 | 354,024 |

| United PF Holdings LLC: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.2025% 12/30/26 (a)(b)(c) | | 365,831 | 352,478 |

| 2LN, term loan 3 month U.S. LIBOR + 8.500% 8.7539% 12/30/27 (a)(b)(c)(e) | | 125,000 | 125,000 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 8.500% 9.5% 12/30/26 (a)(b)(c)(e) | | 134,325 | 134,661 |

|

| TOTAL LEISURE | | | 7,268,793 |

|

| Metals/Mining - 0.1% | | | |

| American Rock Salt Co. LLC Tranche B, term loan 3 month U.S. LIBOR + 3.500% 4.5% 3/21/25 (a)(b)(c) | | 254,414 | 254,287 |

| Paper - 0.1% | | | |

| Clearwater Paper Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.2217% 7/26/26 (a)(b)(c) | | 53,854 | 53,720 |

| Neenah, Inc. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.500% 3/18/28 (b)(c)(d)(e) | | 85,000 | 84,788 |

| 3 month U.S. LIBOR + 4.000% 5% 6/30/27 (a)(b)(c) | | 163,763 | 163,763 |

|

| TOTAL PAPER | | | 302,271 |

|

| Publishing/Printing - 0.9% | | | |

| Cengage Learning, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.250% 5.25% 6/7/23 (a)(b)(c) | | 893,324 | 882,720 |

| Getty Images, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 4.625% 2/19/26 (a)(b)(c) | | 242,356 | 239,617 |

| Harland Clarke Holdings Corp. Tranche B 7LN, term loan 3 month U.S. LIBOR + 4.750% 5.75% 11/3/23 (a)(b)(c) | | 589,955 | 522,276 |

| Learning Care Group (U.S.) No 2, Inc. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.250% 4.25% 3/13/25 (a)(b)(c) | | 110,128 | 107,811 |

| 3 month U.S. LIBOR + 8.500% 9.5% 3/13/25 (a)(b)(c) | | 337,450 | 337,450 |

| Proquest LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 10/17/26 (a)(b)(c) | | 471,805 | 468,502 |

|

| TOTAL PUBLISHING/PRINTING | | | 2,558,376 |

|

| Railroad - 0.2% | | | |

| Genesee & Wyoming, Inc. 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.2025% 12/30/26 (a)(b)(c) | | 529,650 | 527,500 |

| Restaurants - 0.8% | | | |

| Burger King Worldwide, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 11/19/26 (a)(b)(c) | | 736,894 | 722,849 |

| CEC Entertainment, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 9.250% 10.25% 12/29/25 (a)(b)(c) | | 71,313 | 96,272 |

| 2LN, term loan 3 month U.S. LIBOR + 6.500% 7.5% 12/30/27 (a)(b)(c) | | 75,699 | 73,049 |

| PFC Acquisition Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.250% 6.3585% 3/1/26 (a)(b)(c) | | 367,500 | 349,493 |

| Whatabrands LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8622% 8/2/26 (a)(b)(c) | | 995,284 | 988,098 |

|

| TOTAL RESTAURANTS | | | 2,229,761 |

|

| Services - 7.5% | | | |

| ABG Intermediate Holdings 2 LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.250% 6.25% 9/29/24 (a)(b)(c) | | 134,325 | 134,325 |

| Adtalem Global Education, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 2/12/28 (b)(c)(d) | | 690,000 | 682,527 |

| APX Group, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.1105% 12/31/25 (a)(b)(c) | | 253,457 | 253,140 |

| Aramark Services, Inc.: | | | |

| Tranche B 3LN, term loan 3 month U.S. LIBOR + 1.750% 1.8645% 3/11/25 (a)(b)(c) | | 614,325 | 607,033 |

| Tranche B-4 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 1/15/27 (a)(b)(c) | | 628,650 | 618,434 |

| Ascend Learning LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 7/12/24 (a)(b)(c) | | 248,750 | 248,596 |

| Brand Energy & Infrastructure Services, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.250% 5.25% 6/21/24 (a)(b)(c) | | 1,337,888 | 1,315,652 |

| Cast & Crew Payroll LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 2/7/26 (a)(b)(c) | | 479,140 | 471,206 |

| Conservice Midco LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.4525% 5/13/27 (a)(b)(c) | | 313,425 | 312,955 |

| CoreCivic, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 5.5% 12/18/24 (a)(b)(c) | | 339,906 | 327,017 |

| Creative Artists Agency LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 11/26/26 (a)(b)(c) | | 370,313 | 365,884 |

| Dun & Bradstreet Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3591% 2/8/26 (a)(b)(c) | | 69,825 | 69,389 |

| Ensemble RCM LLC 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.9615% 8/1/26 (a)(b)(c) | | 618,742 | 617,003 |

| Filtration Group Corp. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.1145% 3/29/25 (a)(b)(c) | | 457,071 | 450,101 |

| Finastra U.S.A., Inc.: | | | |

| Tranche 2LN, term loan 3 month U.S. LIBOR + 7.250% 8.25% 6/13/25 (a)(b)(c) | | 940,000 | 943,525 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 6/13/24 (a)(b)(c) | | 2,077,328 | 2,033,787 |

| Flexera Software LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 1/26/28 (a)(b)(c) | | 199,500 | 199,608 |

| Franchise Group, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.5% 3/10/26 (a)(b)(c) | | 640,000 | 640,403 |

| GEMS MENASA Cayman Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 6% 7/30/26 (a)(b)(c) | | 848,278 | 847,218 |

| Greeneden U.S. Holdings II LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 12/1/27 (a)(b)(c) | | 375,000 | 374,719 |

| IAA Spinco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.375% 6/29/26 (a)(b)(c) | | 360,938 | 358,230 |

| Ion Trading Finance Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 3/26/28 (b)(c)(d) | | 1,245,000 | 1,243,444 |

| KUEHG Corp. Tranche B, term loan 3 month U.S. LIBOR + 3.750% 4.75% 2/21/25 (a)(b)(c) | | 1,187,396 | 1,159,362 |

| Life Time, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.75% 12/15/24 (a)(b)(c) | | 837,900 | 835,805 |

| Maverick Purchaser Sub LLC Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.500% 3.6125% 1/23/27 (a)(b)(c) | | 699,712 | 692,135 |

| 3 month U.S. LIBOR + 4.750% 5.5% 2/3/27 (a)(b)(c) | | 125,000 | 125,156 |

| Nielsen Holdings PLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.103% 2/5/28 (a)(b)(c) | | 340,000 | 338,470 |

| Sabert Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 5.5% 12/10/26 (a)(b)(c) | | 602,891 | 602,137 |

| Sotheby's Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.5% 1/15/27 (a)(b)(c) | | 592,053 | 594,274 |

| Spin Holdco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 2/26/28 (a)(b)(c) | | 1,500,000 | 1,486,065 |

| Staples, Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.205% 4/16/26 (a)(b)(c) | | 309,469 | 301,476 |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 4.500% 4.705% 9/12/24 (a)(b)(c) | | 62,490 | 61,370 |

| The GEO Group, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.75% 3/23/24 (a)(b)(c) | | 246,154 | 218,506 |

| Uber Technologies, Inc. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.500% 3.6086% 4/4/25 (a)(b)(c) | | 728,128 | 724,182 |

| 3 month U.S. LIBOR + 3.500% 3.6086% 2/19/27 (a)(b)(c) | | 503,146 | 500,550 |

| WASH Multifamily Acquisition, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 7.000% 8% 5/15/23 (a)(b)(c) | | 29,063 | 27,901 |

| Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.250% 4.25% 5/14/22 (a)(b)(c) | | 61,217 | 60,911 |

| 3 month U.S. LIBOR + 3.250% 4.25% 5/14/22 (a)(b)(c) | | 547,768 | 545,029 |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 7.000% 8% 5/14/23 (a)(b)(c) | | 165,937 | 159,299 |

|

| TOTAL SERVICES | | | 21,546,824 |

|

| Steel - 0.2% | | | |

| JMC Steel Group, Inc. 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1102% 1/24/27 (a)(b)(c) | | 485,387 | 478,713 |

| Super Retail - 4.6% | | | |

| Academy Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.75% 11/6/27 (a)(b)(c) | | 623,438 | 623,699 |

| Bass Pro Group LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 2/26/28 (a)(b)(c) | | 7,401,450 | 7,405,137 |

| BJ's Wholesale Club, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1061% 2/3/24 (a)(b)(c) | | 620,156 | 619,499 |

| David's Bridal, Inc. 2LN, term loan 3 month U.S. LIBOR + 8.000% 9% 1/18/24 (a)(b)(c)(e) | | 0 | 0 |

| Harbor Freight Tools U.S.A., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.75% 10/19/27 (a)(b)(c) | | 997,500 | 995,685 |

| LBM Acquisition LLC Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.750% 12/18/27 (b)(c)(d) | | 90,909 | 90,471 |

| 3 month U.S. LIBOR + 3.750% 4.5% 12/18/27 (a)(b)(c) | | 409,091 | 407,119 |

| Michaels Stores, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.25% 10/1/27 (a)(b)(c) | | 517,400 | 516,624 |

| Red Ventures LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6085% 11/8/24 (a)(b)(c) | | 848,480 | 825,546 |

| Rent-A-Center, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 2/17/28 (a)(b)(c) | | 415,000 | 416,731 |

| Sports Authority, Inc. Tranche B, term loan 3 month U.S. LIBOR + 6.000% 0% 11/16/17 (b)(c)(e)(g) | | 1,144,897 | 0 |

| The Hillman Group, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.000% 4.1085% 5/31/25 (a)(b)(c) | | 458,221 | 457,432 |

| WW International, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.750% 5.5% 11/29/24 (a)(b)(c) | | 733,034 | 731,201 |

|

| TOTAL SUPER RETAIL | | | 13,089,144 |

|

| Technology - 16.1% | | | |

| Acuris Finance U.S., Inc. 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.5% 2/16/28 (a)(b)(c) | | 355,000 | 351,894 |

| Allegro MicroSystems LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.5% 9/30/27 (a)(b)(c) | | 9,615 | 9,591 |

| Anastasia Parent LLC Tranche B, term loan 3 month U.S. LIBOR + 3.750% 3.9525% 8/10/25 (a)(b)(c) | | 642,525 | 437,187 |

| Aptean, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.3585% 4/23/26 (a)(b)(c) | | 364,695 | 361,219 |

| Arches Buyer, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 12/6/27 (a)(b)(c) | | 738,150 | 732,245 |

| athenahealth, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.4525% 2/11/26 (a)(b)(c) | | 2,245,845 | 2,247,709 |

| Big Ass Fans LLC 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 5/21/24 (a)(b)(c) | | 348,817 | 347,362 |

| Boxer Parent Co., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 10/2/25 (a)(b)(c) | | 541,892 | 539,182 |

| Bracket Intermediate Holding Corp. 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.4875% 9/5/25 (a)(b)(c) | | 487,500 | 483,234 |

| Brave Parent Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1085% 4/19/25 (a)(b)(c) | | 243,734 | 243,532 |

| Camelot Finance SA: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 4% 10/31/26 (a)(b)(c) | | 1,246,875 | 1,245,628 |

| Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 10/31/26 (a)(b)(c) | | 591,170 | 586,181 |

| CCC Information Services, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 4% 4/27/24 (a)(b)(c) | | 980,393 | 978,991 |

| Ceridian HCM Holding, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.500% 2.5809% 4/30/25 (a)(b)(c) | | 975,000 | 959,644 |

| Cloudera, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 3.25% 12/22/27 (a)(b)(c) | | 225,000 | 224,438 |

| CMI Marketing, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.5% 3/19/28 (a)(b)(c) | | 275,000 | 272,423 |

| CommerceHub, Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 12/29/27 (a)(b)(c) | | 314,213 | 314,410 |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 7.000% 7.75% 12/29/28 (a)(b)(c) | | 85,000 | 86,806 |

| CommScope, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 4/4/26 (a)(b)(c) | | 1,314,975 | 1,305,178 |

| Cvent, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.750% 3.9001% 11/29/24 (a)(b)(c) | | 241,038 | 234,175 |

| DCert Buyer, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1085% 10/16/26 (a)(b)(c) | | 1,336,500 | 1,332,972 |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 7.000% 7.1085% 2/19/29 (a)(b)(c) | | 250,000 | 251,095 |

| Dell International LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 2% 9/19/25 (a)(b)(c) | | 413,569 | 413,015 |

| DG Investment Intermediate Holdings, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 6.750% 3/18/29 (b)(c)(d) | | 95,000 | 95,000 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3/18/28 (b)(c)(d) | | 343,139 | 341,210 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 3.750% 3/17/28 (b)(c)(d) | | 71,861 | 71,458 |

| Dynatrace LLC 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3585% 8/23/25 (a)(b)(c) | | 138,494 | 137,513 |

| Electro Rent Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 6% 1/31/24 (a)(b)(c) | | 188,411 | 188,096 |

| Emerald TopCo, Inc. 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.7112% 7/22/26 (a)(b)(c) | | 245,941 | 243,605 |

| Epicor Software Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4% 7/30/27 (a)(b)(c) | | 611,925 | 609,685 |

| EPV Merger Sub, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 3/8/25 (a)(b)(c) | | 369,550 | 362,344 |

| EXC Holdings III Corp. Tranche B, term loan 3 month U.S. LIBOR + 3.500% 4.5% 12/2/24 (a)(b)(c) | | 620,415 | 618,827 |

| Go Daddy Operating Co. LLC: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.1085% 8/10/27 (a)(b)(c) | | 372,188 | 369,783 |

| Tranche B, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 2/15/24 (a)(b)(c) | | 800,370 | 793,743 |

| Hyland Software, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.25% 7/1/24 (a)(b)(c) | | 672,349 | 671,300 |

| Imprivata, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.25% 12/1/27 (a)(b)(c) | | 470,000 | 468,604 |

| ION Trading Technologies Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 5% 11/21/24 (a)(b)(c) | | 963,653 | 962,978 |

| Liftoff Mobile, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.25% 2/17/28 (a)(b)(c) | | 214,463 | 213,390 |

| MA FinanceCo. LLC: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 5.25% 6/5/25 (a)(b)(c) | | 246,875 | 247,801 |

| Tranche B 3LN, term loan: | | | |

| 3 month U.S. LIBOR + 2.500% 2.8585% 6/21/24 (a)(b)(c) | | 321,091 | 317,613 |

| 3 month U.S. LIBOR + 2.750% 2.8585% 6/21/24 (a)(b)(c) | | 2,226,903 | 2,202,786 |

| McAfee LLC Tranche B, term loan 3 month U.S. LIBOR + 3.750% 3.8591% 9/29/24 (a)(b)(c) | | 1,077,164 | 1,076,894 |

| MH Sub I LLC: | | | |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 6.250% 6.3585% 2/23/29 (a)(b)(c) | | 85,000 | 85,425 |

| Tranche B, term loan 3 month U.S. LIBOR + 3.500% 3.6085% 9/15/24 (a)(b)(c) | | 416,574 | 411,575 |

| NAVEX TopCo, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 7.000% 7.11% 9/4/26 (a)(b)(c) | | 85,000 | 82,079 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.36% 9/4/25 (a)(b)(c) | | 336,375 | 332,843 |

| Northwest Fiber LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8571% 4/30/27 (a)(b)(c) | | 705,250 | 703,191 |

| Peraton Corp. Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.750% 3/2/28 (b)(c)(d) | | 1,651,563 | 1,650,192 |

| 3 month U.S. LIBOR + 3.750% 4.5% 2/22/28 (a)(b)(c) | | 938,438 | 937,659 |

| Pitney Bowes, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.11% 3/12/28 (a)(b)(c) | | 195,000 | 194,594 |

| PointClickCare Technologies, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.75% 12/29/27 (a)(b)(c) | | 235,000 | 234,413 |

| Project Boost Purchaser LLC 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6085% 5/30/26 (a)(b)(c) | | 369,375 | 364,008 |

| Rackspace Hosting, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 3.5% 2/2/28 (a)(b)(c) | | 1,030,000 | 1,020,019 |

| RealPage, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 2/18/28 (b)(c)(d) | | 710,000 | 706,351 |

| Renaissance Holding Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 5/31/25 (a)(b)(c) | | 424,037 | 413,084 |

| Severin Acquisition LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3561% 8/1/25 (a)(b)(c) | | 575,491 | 567,722 |

| Solera LLC Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 3/3/23 (a)(b)(c) | | 563,123 | 559,502 |

| Sophia LP 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.9525% 10/7/27 (a)(b)(c) | | 947,625 | 946,440 |

| SS&C Technologies, Inc.: | | | |

| Tranche B 3LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 4/16/25 (a)(b)(c) | | 402,976 | 398,313 |

| Tranche B 4LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 4/16/25 (a)(b)(c) | | 300,883 | 297,402 |

| Tranche B 5LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 4/16/25 (a)(b)(c) | | 1,656,648 | 1,638,011 |

| STG-Fairway Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 1/31/27 (a)(b)(c) | | 303,486 | 301,033 |

| SUSE Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 10/19/27 (a)(b)(c) | | 230,000 | 230,145 |

| Sybil Software LLC. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 3/15/28 (b)(c)(d) | | 305,000 | 304,619 |

| Tempo Acquisition LLC Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 5/1/24 (a)(b)(c) | | 953,364 | 951,104 |

| TTM Technologies, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.500% 2.6151% 9/28/24 (a)(b)(c) | | 661,092 | 657,786 |

| UKG, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 1/22/28 (a)(b)(c) | | 1,547,235 | 1,547,235 |

| Ultimate Software Group, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 5/4/26 (a)(b)(c) | | 792,925 | 791,577 |

| 2LN, term loan 3 month U.S. LIBOR + 6.750% 7.5% 5/3/27 (a)(b)(c) | | 570,000 | 582,825 |

| Verscend Holding Corp.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1151% 8/27/25 (a)(b)(c) | | 500,000 | 499,435 |

| Tranche B, term loan 3 month U.S. LIBOR + 4.500% 4.6085% 8/27/25 (a)(b)(c) | | 369,239 | 368,822 |

| VFH Parent LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1102% 3/1/26 (a)(b)(c) | | 1,211,784 | 1,207,506 |

| Virgin Pulse, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 3/30/28 (b)(c)(d) | | 280,000 | 277,900 |

| VM Consolidated, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.4451% 3/19/28 (a)(b)(c) | | 470,689 | 466,768 |

| VS Buyer LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 2/28/27 (a)(b)(c) | | 524,700 | 522,297 |

| Weber-Stephen Products LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 10/30/27 (a)(b)(c) | | 418,950 | 418,426 |

| WEX, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 4/1/28 (b)(c)(d) | | 270,000 | 268,988 |

| Xperi Holding Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.1085% 6/1/25 (a)(b)(c) | | 512,277 | 512,492 |

| Zelis Payments Buyer, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6151% 9/30/26 (a)(b)(c) | | 617,203 | 614,376 |

|

| TOTAL TECHNOLOGY | | | 46,016,898 |

|

| Telecommunications - 7.0% | | | |

| Altice Financing SA Tranche B, term loan: | | | |

| 3 month U.S. LIBOR + 2.750% 2.856% 7/15/25 (a)(b)(c) | | 481,250 | 470,956 |

| 3 month U.S. LIBOR + 2.750% 2.9525% 1/31/26 (a)(b)(c) | | 483,750 | 473,620 |

| Blucora, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.000% 5% 5/22/24 (a)(b)(c) | | 249,398 | 248,774 |

| Cablevision Lightpath LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 11/30/27 (a)(b)(c) | | 369,075 | 368,152 |

| Connect Finco SARL Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 12/12/26 (a)(b)(c) | | 618,750 | 616,170 |

| Consolidated Communications, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.75% 10/2/27 (a)(b)(c) | | 264,182 | 264,044 |

| Evo Payments International LLC Tranche B, term loan 3 month U.S. LIBOR + 3.250% 3.36% 12/22/23 (a)(b)(c) | | 442,610 | 441,229 |

| Frontier Communications Corp. 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.75% 10/8/21 (a)(b)(c) | | 1,000,000 | 995,830 |

| GTT Communications, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 5.000% 8.5% 12/31/21 (a)(b)(c) | | 61,756 | 62,605 |

| Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.86% 5/31/25 (a)(b)(c) | | 972,500 | 815,480 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 5.000% 8.5% 12/31/21 (a)(b)(c) | | 76,038 | 77,084 |

| Intelsat Jackson Holdings SA: | | | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.750% 8% 11/27/23 (a)(b)(c) | | 2,535,000 | 2,573,025 |

| Tranche B-4, term loan 3 month U.S. LIBOR + 5.500% 8.75% 1/2/24 (a)(b)(c) | | 1,000,000 | 1,019,460 |

| Tranche B-5, term loan 8.625% 1/2/24 (c) | | 1,525,000 | 1,554,067 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.5% 7/13/22 (a)(b)(c) | | 1,255,074 | 1,268,252 |

| Iridium Satellite LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 3.75% 11/4/26 (a)(b)(c) | | 465,300 | 466,133 |

| Level 3 Financing, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 1.8585% 3/1/27 (a)(b)(c) | | 457,985 | 451,687 |

| Lumen Technologies, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 2.3585% 3/15/27 (a)(b)(c) | | 158,396 | 156,544 |

| Radiate Holdco LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.25% 9/10/26 (a)(b)(c) | | 1,321,688 | 1,320,339 |

| Sabre Industries, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.3585% 4/15/26 (a)(b)(c) | | 341,251 | 340,398 |

| Securus Technologies Holdings Tranche B, term loan: | | | |

| 3 month U.S. LIBOR + 4.500% 5.5% 11/1/24 (a)(b)(c) | | 726,684 | 670,947 |

| 3 month U.S. LIBOR + 8.250% 9.25% 11/1/25 (a)(b)(c) | | 1,100,000 | 906,884 |

| SFR Group SA: | | | |

| Tranche B 11LN, term loan 3 month U.S. LIBOR + 2.750% 2.8585% 7/31/25 (a)(b)(c) | | 23,886 | 23,396 |

| Tranche B 13LN, term loan 3 month U.S. LIBOR + 4.000% 4.1976% 8/14/26 (a)(b)(c) | | 1,221,875 | 1,217,598 |

| Telesat LLC Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.86% 11/22/26 (a)(b)(c) | | 406,816 | 390,624 |

| Windstream Services LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.250% 7.25% 9/21/27 (a)(b)(c) | | 590,854 | 590,298 |

| Xplornet Communications, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.750% 4.8585% 6/10/27 (a)(b)(c) | | 377,150 | 376,856 |

| Zayo Group Holdings, Inc. 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1085% 3/9/27 (a)(b)(c) | | 1,763,763 | 1,748,295 |

|

| TOTAL TELECOMMUNICATIONS | | | 19,908,747 |

|

| Textiles/Apparel - 0.1% | | | |

| Canada Goose, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 10/7/27 (a)(b)(c) | | 244,388 | 244,285 |

| Utilities - 2.8% | | | |

| Brookfield WEC Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 3.25% 8/1/25 (a)(b)(c) | | 1,798,486 | 1,781,850 |

| Granite Generation LLC 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 11/1/26 (a)(b)(c) | | 350,411 | 349,608 |

| Green Energy Partners/Stonewall LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.5% 11/13/21 (a)(b)(c) | | 834,725 | 777,864 |

| Limetree Bay Terminals LLC term loan 3 month U.S. LIBOR + 4.000% 5% 2/15/24 (a)(b)(c) | | 930,710 | 905,944 |

| LMBE-MC HoldCo II LLC Tranche B, term loan 3 month U.S. LIBOR + 4.000% 5% 12/3/25 (a)(b)(c) | | 209,728 | 208,680 |

| PG&E Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.5% 6/23/25 (a)(b)(c) | | 1,007,388 | 1,005,181 |

| Pike Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.13% 1/21/28 (a)(b)(c) | | 375,000 | 373,459 |

| UGI Energy Services LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8585% 8/13/26 (a)(b)(c) | | 245,625 | 244,704 |

| Vertiv Group Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 2.8685% 3/2/27 (a)(b)(c) | | 1,156,573 | 1,146,696 |

| Vistra Operations Co. LLC Tranche B 3LN, term loan 3 month U.S. LIBOR + 1.750% 1.8583% 12/31/25 (a)(b)(c) | | 1,317,479 | 1,307,242 |

|

| TOTAL UTILITIES | | | 8,101,228 |

|

| TOTAL BANK LOAN OBLIGATIONS | | | |

| (Cost $262,006,550) | | | 259,586,800 |

|

| Nonconvertible Bonds - 4.3% | | | |

| Aerospace - 0.2% | | | |

| TransDigm, Inc.: | | | |

| 6.25% 3/15/26 (h) | | 500,000 | 530,100 |

| 8% 12/15/25 (h) | | 55,000 | 59,895 |

|

| TOTAL AEROSPACE | | | 589,995 |

|

| Air Transportation - 0.1% | | | |

| American Airlines, Inc. / AAdvantage Loyalty IP Ltd. 5.5% 4/20/26 (h) | | 165,000 | 171,714 |

| Delta Air Lines, Inc. / SkyMiles IP Ltd. 4.5% 10/20/25 (h) | | 115,000 | 122,751 |

|

| TOTAL AIR TRANSPORTATION | | | 294,465 |

|

| Broadcasting - 0.1% | | | |

| Univision Communications, Inc.: | | | |

| 6.625% 6/1/27 (h) | | 170,000 | 181,547 |

| 9.5% 5/1/25 (h) | | 170,000 | 186,150 |

|

| TOTAL BROADCASTING | | | 367,697 |

|

| Chemicals - 0.6% | | | |

| Consolidated Energy Finance SA: | | | |

| 3 month U.S. LIBOR + 3.750% 3.9339% 6/15/22 (a)(b)(h) | | 1,335,000 | 1,321,766 |

| 6.875% 6/15/25 (h) | | 420,000 | 427,875 |

| Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc. 5% 12/31/26 (h) | | 5,000 | 5,000 |

|

| TOTAL CHEMICALS | | | 1,754,641 |

|

| Containers - 0.2% | | | |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc. 4.125% 8/15/26 (h) | | 415,000 | 426,018 |

| Trivium Packaging Finance BV 5.5% 8/15/26 (h) | | 145,000 | 152,069 |

|

| TOTAL CONTAINERS | | | 578,087 |

|

| Energy - 0.2% | | | |

| Citgo Petroleum Corp. 7% 6/15/25 (h) | | 150,000 | 154,313 |

| New Fortress Energy LLC 6.75% 9/15/25 (h) | | 75,000 | 77,055 |

| PBF Holding Co. LLC/PBF Finance Corp. 9.25% 5/15/25 (h) | | 165,000 | 168,300 |

| Transocean Poseidon Ltd. 6.875% 2/1/27 (h) | | 140,000 | 129,403 |

|

| TOTAL ENERGY | | | 529,071 |

|

| Food & Drug Retail - 0.0% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC 3.5% 2/15/23 (h) | | 35,000 | 35,700 |

| Gaming - 0.4% | | | |

| Golden Entertainment, Inc. 7.625% 4/15/26 (h) | | 250,000 | 265,938 |

| Stars Group Holdings BV 7% 7/15/26 (h) | | 495,000 | 517,275 |

| Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp. 5.875% 5/15/25 (h) | | 300,000 | 292,500 |

| VICI Properties, Inc.: | | | |

| 3.5% 2/15/25 (h) | | 35,000 | 35,634 |

| 4.25% 12/1/26 (h) | | 50,000 | 51,154 |

|

| TOTAL GAMING | | | 1,162,501 |

|

| Healthcare - 0.8% | | | |

| Bausch Health Companies, Inc. 5.5% 11/1/25 (h) | | 235,000 | 241,434 |

| Tenet Healthcare Corp.: | | | |

| 4.625% 7/15/24 | | 1,500,000 | 1,531,035 |

| 5.125% 5/1/25 | | 500,000 | 507,025 |

|

| TOTAL HEALTHCARE | | | 2,279,494 |

|

| Hotels - 0.1% | | | |

| Marriott Ownership Resorts, Inc. 6.125% 9/15/25 (h) | | 265,000 | 281,464 |

| Leisure - 0.1% | | | |

| NCL Corp. Ltd. 12.25% 5/15/24 (h) | | 35,000 | 42,398 |

| Royal Caribbean Cruises Ltd.: | | | |

| 9.125% 6/15/23 (h) | | 40,000 | 44,077 |

| 10.875% 6/1/23 (h) | | 190,000 | 218,557 |

|

| TOTAL LEISURE | | | 305,032 |

|

| Paper - 0.0% | | | |

| Ardagh Metal Packaging Finance U.S.A. LLC/Ardagh Metal Packaging Finance PLC 3.25% 9/1/28 (h) | | 135,000 | 133,430 |

| Publishing/Printing - 0.1% | | | |

| Clear Channel International BV 6.625% 8/1/25 (h) | | 200,000 | 209,022 |

| Services - 0.2% | | | |

| Adtalem Global Education, Inc. 5.5% 3/1/28 (h) | | 165,000 | 162,906 |

| Aramark Services, Inc. 6.375% 5/1/25 (h) | | 90,000 | 95,400 |

| Sotheby's 7.375% 10/15/27 (h) | | 200,000 | 216,272 |

|

| TOTAL SERVICES | | | 474,578 |

|

| Super Retail - 0.1% | | | |

| EG Global Finance PLC: | | | |

| 6.75% 2/7/25 (h) | | 125,000 | 127,813 |

| 8.5% 10/30/25 (h) | | 260,000 | 275,600 |

|

| TOTAL SUPER RETAIL | | | 403,413 |

|

| Technology - 0.1% | | | |

| CommScope, Inc.: | | | |

| 5.5% 3/1/24 (h) | | 150,000 | 154,688 |

| 6% 3/1/26 (h) | | 150,000 | 158,053 |

| SSL Robotics LLC 9.75% 12/31/23 (h) | | 60,588 | 68,131 |

|

| TOTAL TECHNOLOGY | | | 380,872 |

|

| Telecommunications - 0.8% | | | |

| Altice Financing SA 7.5% 5/15/26 (h) | | 900,000 | 940,500 |

| Frontier Communications Corp. 5% 5/1/28 (h) | | 160,000 | 162,941 |

| SFR Group SA: | | | |

| 5.125% 1/15/29 (h) | | 25,000 | 25,313 |

| 7.375% 5/1/26 (h) | | 855,000 | 889,200 |

| T-Mobile U.S.A., Inc. 2.25% 2/15/26 | | 140,000 | 141,007 |

|

| TOTAL TELECOMMUNICATIONS | | | 2,158,961 |

|

| Transportation Ex Air/Rail - 0.2% | | | |

| Avolon Holdings Funding Ltd. 5.125% 10/1/23 (h) | | 455,000 | 485,040 |

| TOTAL NONCONVERTIBLE BONDS | | | |

| (Cost $12,012,119) | | | 12,423,463 |

| | | Shares | Value |

|

| Common Stocks - 1.9% | | | |

| Capital Goods - 0.2% | | | |

| TNT Crane & Rigging LLC (e) | | 22,401 | 487,894 |

| TNT Crane & Rigging LLC warrants 10/31/25 (e)(i) | | 3,037 | 10,022 |

|

| TOTAL CAPITAL GOODS | | | 497,916 |

|

| Diversified Financial Services - 0.0% | | | |

| ACNR Holdings, Inc. (e) | | 1,891 | 13,072 |

| Energy - 1.1% | | | |

| California Resources Corp. (i) | | 57,179 | 1,375,727 |

| California Resources Corp. warrants 10/27/24 (i) | | 920 | 4,186 |

| Chesapeake Energy Corp. (i) | | 27,902 | 1,210,668 |

| Chesapeake Energy Corp. (j) | | 137 | 5,350 |

| Denbury, Inc. (i) | | 9,205 | 440,827 |

| EP Energy Corp. (e) | | 3,190 | 168,017 |

|

| TOTAL ENERGY | | | 3,204,775 |

|

| Entertainment/Film - 0.0% | | | |

| Cineworld Group PLC warrants 11/23/25 (i) | | 53,143 | 42,520 |

| Publishing/Printing - 0.1% | | | |

| Cenveo Corp. (e)(i) | | 7,037 | 205,199 |

| Restaurants - 0.1% | | | |

| CEC Entertainment, Inc. (e) | | 15,069 | 256,173 |

| Super Retail - 0.0% | | | |

| David's Bridal, Inc. rights (e)(i) | | 156 | 0 |

| Utilities - 0.4% | | | |

| TexGen Power LLC (e)(i) | | 25,327 | 1,064,747 |

| TOTAL COMMON STOCKS | | | |

| (Cost $5,074,487) | | | 5,284,402 |

|

| Nonconvertible Preferred Stocks - 0.1% | | | |

| Diversified Financial Services - 0.1% | | | |

| ACNR Holdings, Inc. (e) | | | |

| (Cost $135,375) | | 1,083 | 135,375 |

|

| Other - 0.0% | | | |

| Other - 0.0% | | | |

| Tribune Co. Claim (e)(i) | | | |

| (Cost $29,756) | | 30,115 | 30,115 |

|

| Money Market Funds - 5.5% | | | |

| Fidelity Cash Central Fund 0.06% (k) | | | |

| (Cost $15,704,023) | | 15,702,189 | 15,705,330 |

| TOTAL INVESTMENT IN SECURITIES - 102.5% | | | |

| (Cost $294,962,310) | | | 293,165,485 |

| NET OTHER ASSETS (LIABILITIES) - (2.5)% | | | (7,035,364) |

| NET ASSETS - 100% | | | $286,130,121 |

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(b) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(c) Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty.

(d) The coupon rate will be determined upon settlement of the loan after period end.

(f) Position or a portion of the position represents an unfunded loan commitment. At period end, the total principal amount and market value of unfunded commitments totaled $105,616 and $104,515, respectively.

(g) Non-income producing - Security is in default.

(h) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $10,244,396 or 3.6% of net assets.

(j) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $5,350 or 0.0% of net assets.

(k) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

The value, beginning of period, for the Fidelity Cash Central Fund was $13,618,084. Net realized gain (loss) and change in net unrealized appreciation (depreciation) on Fidelity Cash Central Fund is presented in the Statement of Operations, if applicable. Purchases and sales of the Fidelity Cash Central Fund were $45,457,016 and $43,369,632, respectively, during the period.

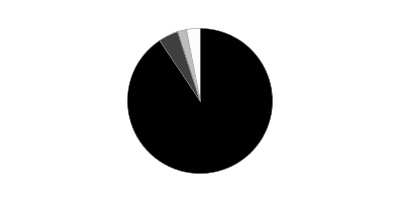

The following is a summary of the inputs used, as of March 31, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations.

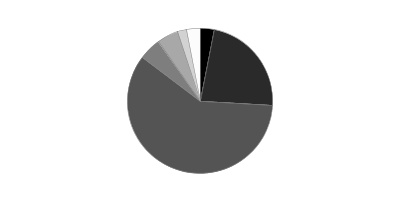

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

1. Organization.

Fidelity Series Floating Rate High Income Fund (the Fund) is a fund of Fidelity Summer Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Shares are offered only to certain other Fidelity funds and Fidelity managed 529 plans. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds and bank loan obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.