UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02737

Fidelity Summer Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | October 31, 2021 |

Item 1.

Reports to Stockholders

Fidelity® Capital & Income Fund

Semi-Annual Report

October 31, 2021

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

Top Five Holdings as of October 31, 2021

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| CCO Holdings LLC/CCO Holdings Capital Corp. | 2.2 |

| Ally Financial, Inc. | 2.2 |

| TransDigm, Inc. | 1.9 |

| Caesars Entertainment, Inc. | 1.7 |

| JPMorgan Chase & Co. | 1.7 |

| | 9.7 |

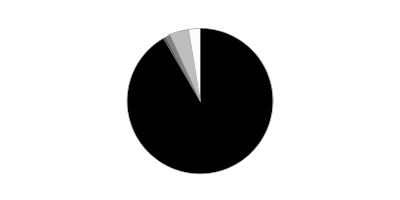

Top Five Market Sectors as of October 31, 2021

| | % of fund's net assets |

| Energy | 12.6 |

| Technology | 8.7 |

| Banks & Thrifts | 8.3 |

| Telecommunications | 7.3 |

| Healthcare | 6.4 |

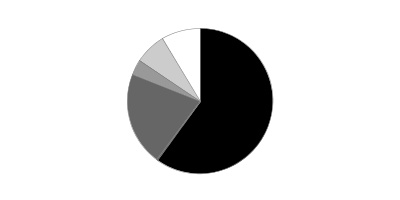

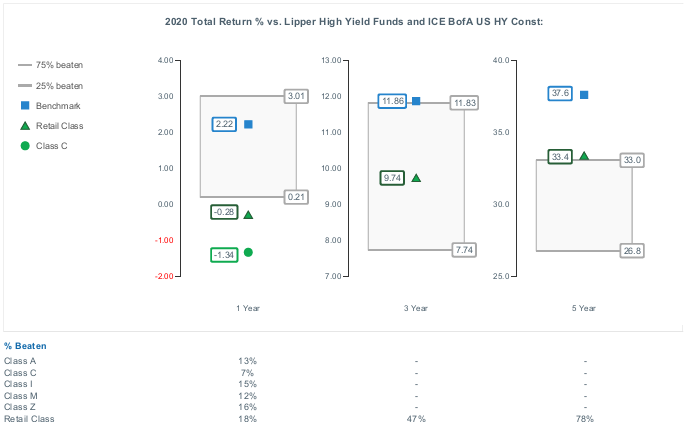

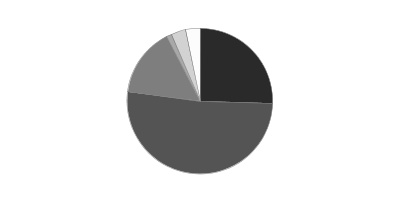

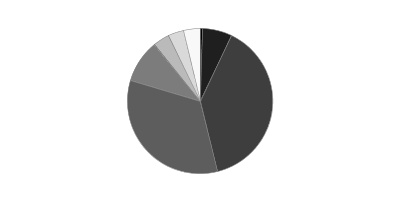

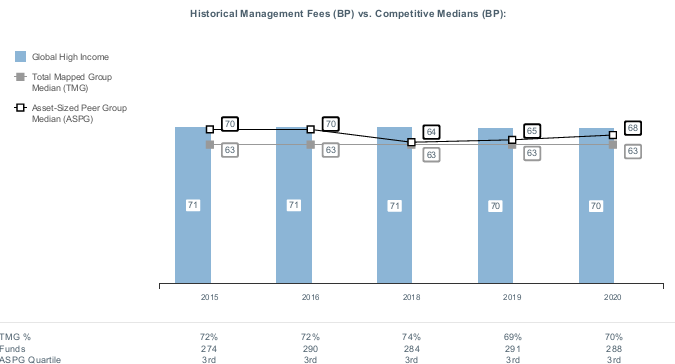

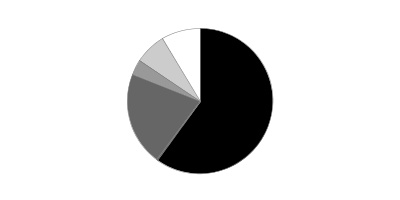

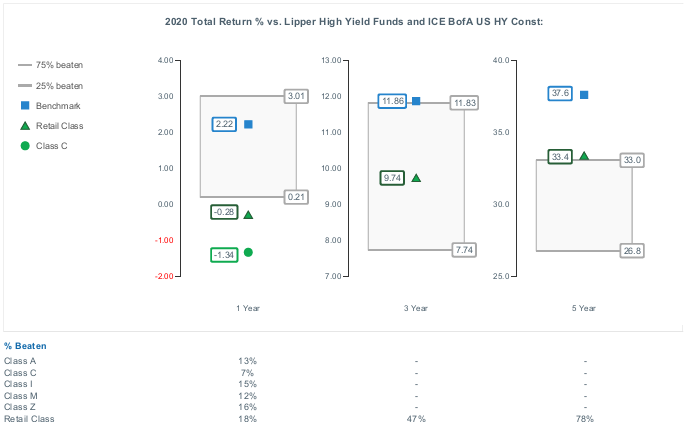

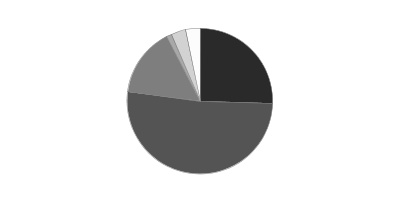

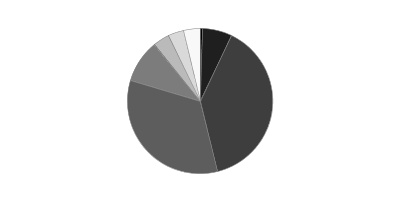

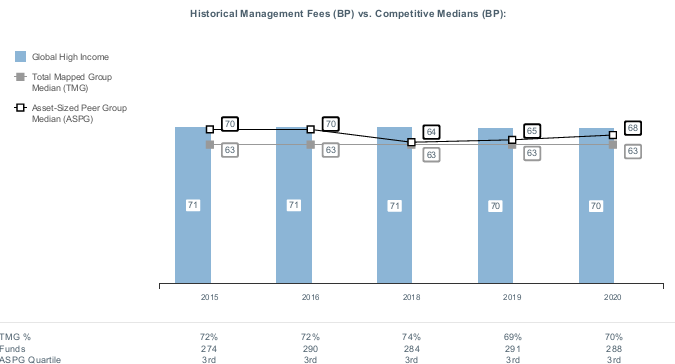

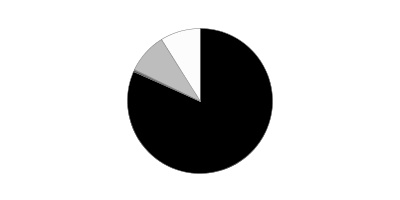

Quality Diversification (% of fund's net assets)

| As of October 31, 2021 |

| | BBB | 8.6% |

| | BB | 26.4% |

| | B | 28.4% |

| | CCC,CC,C | 6.0% |

| | Not Rated | 1.1% |

| | Equities | 20.9% |

| | Short-Term Investments and Net Other Assets | 8.6% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

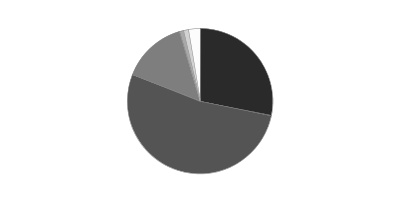

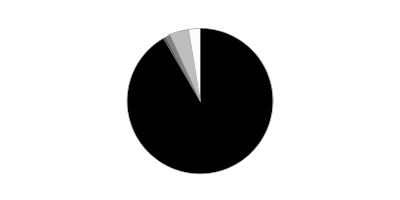

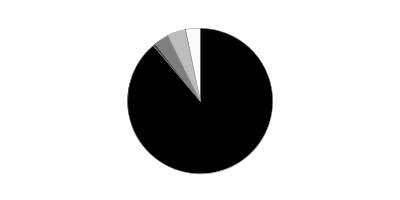

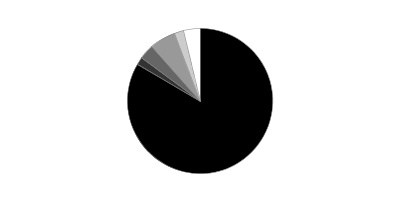

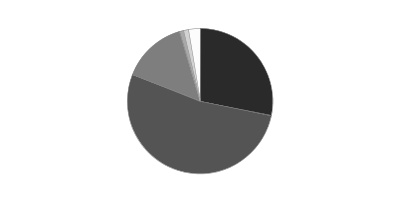

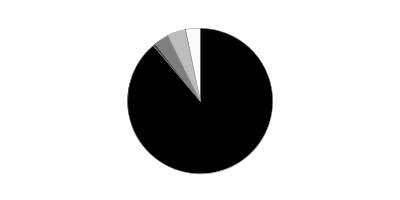

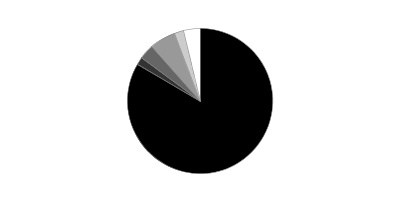

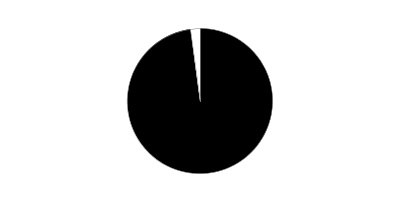

Asset Allocation (% of fund's net assets)

| As of October 31, 2021* |

| | Nonconvertible Bonds | 59.9% |

| | Convertible Bonds, Preferred Stocks | 0.2% |

| | Common Stocks | 20.9% |

| | Bank Loan Obligations | 3.5% |

| | Other Investments | 6.9% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 8.6% |

* Foreign investments - 12.5%

Schedule of Investments October 31, 2021 (Unaudited)

Showing Percentage of Net Assets

| Corporate Bonds - 60.1% | | | |

| | | Principal Amount (000s) | Value (000s) |

| Convertible Bonds - 0.2% | | | |

| Energy - 0.2% | | | |

| Mesquite Energy, Inc. 15% 7/15/23 (a)(b) | | $4,148 | $14,229 |

| Mesquite Energy, Inc. 15% 7/15/23 (a)(b) | | 2,404 | 9,134 |

| | | | 23,363 |

| Nonconvertible Bonds - 59.9% | | | |

| Aerospace - 3.0% | | | |

| Allegheny Technologies, Inc.: | | | |

| 4.875% 10/1/29 | | 6,080 | 6,076 |

| 5.125% 10/1/31 | | 5,395 | 5,374 |

| Bombardier, Inc.: | | | |

| 6% 2/15/28 (c) | | 6,075 | 6,128 |

| 7.125% 6/15/26 (c) | | 12,110 | 12,700 |

| 7.5% 12/1/24 (c) | | 8,870 | 9,236 |

| 7.5% 3/15/25 (c) | | 14,145 | 14,516 |

| 7.875% 4/15/27 (c) | | 45,265 | 47,046 |

| Kaiser Aluminum Corp. 4.625% 3/1/28 (c) | | 11,215 | 11,352 |

| Moog, Inc. 4.25% 12/15/27 (c) | | 3,455 | 3,557 |

| Rolls-Royce PLC 5.75% 10/15/27 (c) | | 10,870 | 12,028 |

| Spirit Aerosystems, Inc. 7.5% 4/15/25 (c) | | 15,000 | 15,836 |

| TransDigm UK Holdings PLC 6.875% 5/15/26 | | 35,725 | 37,626 |

| TransDigm, Inc.: | | | |

| 4.625% 1/15/29 | | 38,080 | 37,842 |

| 4.875% 5/1/29 | | 25,000 | 25,073 |

| 5.5% 11/15/27 | | 124,228 | 127,334 |

| 6.25% 3/15/26 (c) | | 17,925 | 18,709 |

| 6.375% 6/15/26 | | 61,985 | 64,077 |

| 7.5% 3/15/27 | | 18,012 | 18,890 |

| | | | 473,400 |

| Air Transportation - 1.5% | | | |

| Air Canada 3.875% 8/15/26 (c) | | 9,105 | 9,219 |

| Delta Air Lines, Inc. 7% 5/1/25 (c) | | 2,708 | 3,160 |

| Delta Air Lines, Inc. / SkyMiles IP Ltd.: | | | |

| 4.5% 10/20/25 (c) | | 48,285 | 51,523 |

| 4.75% 10/20/28 (c) | | 39,880 | 44,394 |

| Hawaiian Airlines pass-thru certificates Series 2013-1 Class B, 4.95% 7/15/23 | | 1,912 | 1,915 |

| Hawaiian Brand Intellectual Property Ltd. / HawaiianMiles Loyalty Ltd. 5.75% 1/20/26 (c) | | 22,205 | 23,315 |

| Mileage Plus Holdings LLC 6.5% 6/20/27 (c) | | 34,530 | 37,581 |

| Spirit Loyalty Cayman Ltd. / Spirit IP Cayman Ltd. 8% 9/20/25 (c) | | 7,779 | 8,707 |

| United Airlines, Inc.: | | | |

| 4.375% 4/15/26 (c) | | 30,025 | 31,060 |

| 4.625% 4/15/29 (c) | | 18,025 | 18,583 |

| | | | 229,457 |

| Automotive - 0.1% | | | |

| Ford Motor Credit Co. LLC 3.625% 6/17/31 | | 15,745 | 15,922 |

| Automotive & Auto Parts - 1.2% | | | |

| Allison Transmission, Inc. 5.875% 6/1/29 (c) | | 7,960 | 8,567 |

| Arko Corp. 5.125% 11/15/29 (c) | | 9,105 | 8,887 |

| Dana, Inc. 4.25% 9/1/30 | | 8,870 | 8,976 |

| Exide Technologies: | | | |

| 11% 10/31/24 pay-in-kind (b)(c)(d)(e) | | 1,760 | 0 |

| 11% 10/31/24 pay-in-kind (b)(c)(d)(e) | | 891 | 401 |

| Ford Motor Co. 7.45% 7/16/31 | | 1,215 | 1,608 |

| Ford Motor Credit Co. LLC: | | | |

| 3.375% 11/13/25 | | 26,505 | 27,234 |

| 4% 11/13/30 | | 42,253 | 44,102 |

| 5.113% 5/3/29 | | 10,330 | 11,479 |

| LCM Investments Holdings 4.875% 5/1/29 (c) | | 24,415 | 25,070 |

| McLaren Finance PLC 7.5% 8/1/26 (c) | | 8,290 | 8,269 |

| Nesco Holdings II, Inc. 5.5% 4/15/29 (c) | | 14,525 | 14,707 |

| Rivian Holdco & Rivian LLC & Rivian Automotive LLC 1 month U.S. LIBOR + 6.000% 0% 10/8/26 (b)(e)(f) | | 30,350 | 29,754 |

| | | | 189,054 |

| Banks & Thrifts - 2.2% | | | |

| Ally Financial, Inc.: | | | |

| 8% 11/1/31 | | 20,638 | 28,911 |

| 8% 11/1/31 | | 206,609 | 295,835 |

| CQP Holdco LP / BIP-V Chinook Holdco LLC 5.5% 6/15/31 (c) | | 15,120 | 15,725 |

| | | | 340,471 |

| Broadcasting - 1.7% | | | |

| Clear Channel Outdoor Holdings, Inc. 7.5% 6/1/29 (c) | | 12,070 | 12,346 |

| Diamond Sports Group LLC/Diamond Sports Finance Co. 5.375% 8/15/26 (c) | | 46,565 | 26,309 |

| Gray Escrow II, Inc. 5.375% 11/15/31 (c)(g) | | 18,765 | 18,953 |

| Lions Gate Capital Holdings LLC 5.5% 4/15/29 (c) | | 8,990 | 9,192 |

| Netflix, Inc.: | | | |

| 4.875% 4/15/28 | | 19,535 | 22,380 |

| 5.375% 11/15/29 (c) | | 11,075 | 13,358 |

| 5.875% 11/15/28 | | 29,825 | 36,310 |

| Nexstar Broadcasting, Inc.: | | | |

| 4.75% 11/1/28 (c) | | 22,300 | 22,783 |

| 5.625% 7/15/27 (c) | | 23,735 | 25,040 |

| Scripps Escrow II, Inc. 3.875% 1/15/29 (c) | | 2,820 | 2,806 |

| Sirius XM Radio, Inc.: | | | |

| 3.125% 9/1/26 (c) | | 9,100 | 9,111 |

| 3.875% 9/1/31 (c) | | 12,130 | 11,652 |

| 4% 7/15/28 (c) | | 23,630 | 23,800 |

| 5% 8/1/27 (c) | | 14,525 | 15,160 |

| Townsquare Media, Inc. 6.875% 2/1/26 (c) | | 5,645 | 5,899 |

| Univision Communications, Inc. 4.5% 5/1/29 (c) | | 12,060 | 12,201 |

| | | | 267,300 |

| Building Materials - 0.4% | | | |

| Advanced Drain Systems, Inc. 5% 9/30/27 (c) | | 2,325 | 2,418 |

| Brundage-Bone Concrete Pumping Holdings, Inc. 6% 2/1/26 (c) | | 6,555 | 6,863 |

| CP Atlas Buyer, Inc. 7% 12/1/28 (c) | | 5,480 | 5,302 |

| James Hardie International Finance Ltd. 5% 1/15/28 (c) | | 4,136 | 4,301 |

| SRS Distribution, Inc.: | | | |

| 4.625% 7/1/28 (c) | | 11,605 | 11,864 |

| 6.125% 7/1/29 (c) | | 6,380 | 6,563 |

| Summit Materials LLC/Summit Materials Finance Corp. 5.25% 1/15/29 (c) | | 10,525 | 11,025 |

| Victors Merger Corp. 6.375% 5/15/29 (c) | | 12,060 | 11,336 |

| | | | 59,672 |

| Cable/Satellite TV - 3.6% | | | |

| Block Communications, Inc. 4.875% 3/1/28 (c) | | 7,830 | 7,987 |

| CCO Holdings LLC/CCO Holdings Capital Corp.: | | | |

| 4.25% 2/1/31 (c) | | 16,515 | 16,441 |

| 4.5% 8/15/30 (c) | | 21,660 | 22,047 |

| 4.5% 5/1/32 | | 46,575 | 46,795 |

| 4.75% 3/1/30 (c) | | 63,365 | 65,424 |

| 5% 2/1/28 (c) | | 91,490 | 95,150 |

| 5.125% 5/1/27 (c) | | 69,885 | 72,418 |

| 5.375% 6/1/29 (c) | | 18,080 | 19,427 |

| 5.5% 5/1/26 (c) | | 8,759 | 9,048 |

| CSC Holdings LLC: | | | |

| 3.375% 2/15/31 (c) | | 14,140 | 12,878 |

| 4.5% 11/15/31 (c) | | 30,110 | 29,174 |

| 5.375% 2/1/28 (c) | | 23,655 | 24,365 |

| 5.75% 1/15/30 (c) | | 27,385 | 27,021 |

| 6.5% 2/1/29 (c) | | 24,795 | 26,593 |

| Dolya Holdco 18 DAC 5% 7/15/28 (c) | | 6,600 | 6,703 |

| Radiate Holdco LLC/Radiate Financial Service Ltd.: | | | |

| 4.5% 9/15/26 (c) | | 8,350 | 8,484 |

| 6.5% 9/15/28 (c) | | 22,260 | 22,260 |

| Ziggo Bond Co. BV: | | | |

| 5.125% 2/28/30 (c) | | 6,000 | 6,072 |

| 6% 1/15/27 (c) | | 11,435 | 11,807 |

| Ziggo BV: | | | |

| 4.875% 1/15/30 (c) | | 7,990 | 8,121 |

| 5.5% 1/15/27 (c) | | 18,188 | 18,643 |

| | | | 556,858 |

| Capital Goods - 0.1% | | | |

| ATS Automation Tooling System, Inc. 4.125% 12/15/28 (c) | | 7,895 | 7,964 |

| Stevens Holding Co., Inc. 6.125% 10/1/26 (c) | | 3,245 | 3,496 |

| | | | 11,460 |

| Chemicals - 1.9% | | | |

| Compass Minerals International, Inc. 6.75% 12/1/27 (c) | | 24,600 | 26,045 |

| Consolidated Energy Finance SA 6.5% 5/15/26 (c) | | 53,531 | 55,538 |

| Gpd Companies, Inc. 10.125% 4/1/26 (c) | | 14,980 | 16,029 |

| Ingevity Corp. 3.875% 11/1/28 (c) | | 11,105 | 10,910 |

| Kraton Polymers LLC/Kraton Polymers Capital Corp. 4.25% 12/15/25 (c) | | 7,330 | 7,577 |

| Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.: | | | |

| 5% 12/31/26 (c) | | 3,835 | 3,797 |

| 7% 12/31/27 (c) | | 12,385 | 11,977 |

| LSB Industries, Inc. 6.25% 10/15/28 (c) | | 9,510 | 9,599 |

| OCI NV 5.25% 11/1/24 (c) | | 14,870 | 15,260 |

| Olympus Water U.S. Holding Corp. 4.25% 10/1/28 (c) | | 12,145 | 11,942 |

| SCIH Salt Holdings, Inc. 4.875% 5/1/28 (c) | | 18,035 | 17,629 |

| SCIL IV LLC / SCIL U.S.A. Holdings LLC 5.375% 11/1/26 (c)(g) | | 14,015 | 14,129 |

| The Chemours Co. LLC: | | | |

| 5.375% 5/15/27 | | 32,330 | 34,108 |

| 5.75% 11/15/28 (c) | | 16,765 | 17,226 |

| Tronox, Inc.: | | | |

| 4.625% 3/15/29 (c) | | 13,295 | 13,033 |

| 6.5% 5/1/25 (c) | | 8,760 | 9,209 |

| Valvoline, Inc. 4.25% 2/15/30 (c) | | 8,315 | 8,440 |

| W.R. Grace Holding LLC 5.625% 8/15/29 (c) | | 15,035 | 15,167 |

| | | | 297,615 |

| Consumer Products - 1.3% | | | |

| Angi Group LLC 3.875% 8/15/28 (c) | | 5,530 | 5,406 |

| Diamond BC BV 4.625% 10/1/29 (c) | | 7,285 | 7,336 |

| Foundation Building Materials, Inc. 6% 3/1/29 (c) | | 5,845 | 5,659 |

| Gannett Holdings LLC 6% 11/1/26 (c) | | 8,785 | 8,765 |

| Michaels Companies, Inc.: | | | |

| 5.25% 5/1/28 (c) | | 14,150 | 14,292 |

| 7.875% 5/1/29 (c) | | 14,995 | 15,145 |

| Millennium Escrow Corp. 6.625% 8/1/26 (c) | | 12,120 | 12,317 |

| Nordstrom, Inc.: | | | |

| 4.25% 8/1/31 | | 25,145 | 25,136 |

| 4.375% 4/1/30 | | 3,790 | 3,856 |

| 5% 1/15/44 | | 1,785 | 1,767 |

| 6.95% 3/15/28 | | 550 | 644 |

| PetSmart, Inc. / PetSmart Finance Corp.: | | | |

| 4.75% 2/15/28 (c) | | 10,160 | 10,439 |

| 7.75% 2/15/29 (c) | | 8,880 | 9,597 |

| Spectrum Brands Holdings, Inc. 3.875% 3/15/31 (c) | | 8,380 | 8,212 |

| Tempur Sealy International, Inc.: | | | |

| 3.875% 10/15/31 (c) | | 15,965 | 15,821 |

| 4% 4/15/29 (c) | | 15,925 | 16,177 |

| The Scotts Miracle-Gro Co. 4% 4/1/31 (c) | | 11,945 | 11,848 |

| TKC Holdings, Inc.: | | | |

| 6.875% 5/15/28 (c) | | 12,040 | 12,371 |

| 10.5% 5/15/29 (c) | | 12,040 | 13,003 |

| | | | 197,791 |

| Containers - 0.4% | | | |

| ARD Finance SA 6.5% 6/30/27 pay-in-kind (c)(e) | | 11,200 | 11,732 |

| Crown Cork & Seal, Inc.: | | | |

| 7.375% 12/15/26 | | 4,845 | 5,959 |

| 7.5% 12/15/96 | | 12,871 | 15,960 |

| Graham Packaging Co., Inc. 7.125% 8/15/28 (c) | | 6,000 | 6,172 |

| Intelligent Packaging Ltd. Finco, Inc. 6% 9/15/28 (c) | | 4,230 | 4,352 |

| LABL, Inc. 5.875% 11/1/28 (c) | | 14,730 | 14,818 |

| Trivium Packaging Finance BV 5.5% 8/15/26 (c) | | 6,930 | 7,198 |

| | | | 66,191 |

| Diversified Financial Services - 2.0% | | | |

| Broadstreet Partners, Inc. 5.875% 4/15/29 (c) | | 15,505 | 15,234 |

| Cargo Aircraft Management, Inc. 4.75% 2/1/28 (c) | | 6,915 | 7,045 |

| Coinbase Global, Inc.: | | | |

| 3.375% 10/1/28 (c) | | 9,110 | 8,791 |

| 3.625% 10/1/31 (c) | | 9,110 | 8,677 |

| Compass Group Diversified Holdings LLC 5.25% 4/15/29 (c) | | 17,730 | 18,439 |

| Hightower Holding LLC 6.75% 4/15/29 (c) | | 5,945 | 6,064 |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | |

| 4.375% 2/1/29 | | 11,165 | 11,214 |

| 5.25% 5/15/27 | | 41,665 | 43,332 |

| 6.25% 5/15/26 | | 24,085 | 25,229 |

| 6.375% 12/15/25 | | 28,275 | 28,841 |

| 6.75% 2/1/24 | | 10,075 | 10,226 |

| LPL Holdings, Inc. 4% 3/15/29 (c) | | 17,730 | 18,085 |

| MSCI, Inc.: | | | |

| 3.25% 8/15/33 (c) | | 9,110 | 9,145 |

| 4% 11/15/29 (c) | | 6,385 | 6,672 |

| OEC Finance Ltd.: | | | |

| 4.375% 10/25/29 pay-in-kind (c) | | 6,486 | 478 |

| 5.25% 12/27/33 pay-in-kind (c) | | 5,904 | 469 |

| 7.125% 12/26/46 pay-in-kind (c) | | 3,041 | 242 |

| OneMain Finance Corp.: | | | |

| 4% 9/15/30 | | 5,610 | 5,449 |

| 5.375% 11/15/29 | | 9,400 | 10,035 |

| 6.625% 1/15/28 | | 7,305 | 8,200 |

| 6.875% 3/15/25 | | 19,480 | 21,745 |

| 7.125% 3/15/26 | | 38,380 | 43,561 |

| Shift4 Payments LLC / Shift4 Payments Finance Sub, Inc. 4.625% 11/1/26 (c) | | 3,750 | 3,886 |

| | | | 311,059 |

| Diversified Media - 0.3% | | | |

| Nielsen Finance LLC/Nielsen Finance Co.: | | | |

| 4.5% 7/15/29 (c) | | 6,050 | 5,915 |

| 4.75% 7/15/31 (c) | | 6,040 | 5,887 |

| Terrier Media Buyer, Inc. 8.875% 12/15/27 (c) | | 40,645 | 42,982 |

| | | | 54,784 |

| Energy - 8.1% | | | |

| Antero Midstream Partners LP/Antero Midstream Finance Corp.: | | | |

| 5.375% 6/15/29 (c) | | 9,060 | 9,467 |

| 5.75% 1/15/28 (c) | | 17,645 | 18,461 |

| Atlantica Sustainable Infrastructure PLC 4.125% 6/15/28 (c) | | 7,820 | 7,967 |

| Callon Petroleum Co. 6.125% 10/1/24 | | 4,090 | 4,035 |

| CGG SA 8.75% 4/1/27 (c) | | 11,985 | 11,800 |

| Cheniere Energy Partners LP: | | | |

| 3.25% 1/31/32 (c) | | 9,110 | 9,030 |

| 4% 3/1/31 (c) | | 31,040 | 32,282 |

| Cheniere Energy, Inc. 4.625% 10/15/28 | | 22,300 | 23,386 |

| Chesapeake Energy Corp.: | | | |

| 5.875% 2/1/29 (c) | | 5,840 | 6,205 |

| 7% 10/1/24 (b)(d) | | 6,915 | 0 |

| 8% 1/15/25 (b)(d) | | 3,385 | 0 |

| 8% 6/15/27 (b)(d) | | 2,132 | 0 |

| Citgo Holding, Inc. 9.25% 8/1/24 (c) | | 27,185 | 27,593 |

| Citgo Petroleum Corp.: | | | |

| 6.375% 6/15/26 (c) | | 8,760 | 9,023 |

| 7% 6/15/25 (c) | | 22,045 | 22,720 |

| CNX Midstream Partners LP 4.75% 4/15/30 (c) | | 6,435 | 6,443 |

| CNX Resources Corp. 6% 1/15/29 (c) | | 5,345 | 5,639 |

| Colgate Energy Partners III LLC 5.875% 7/1/29 (c) | | 8,645 | 8,850 |

| Comstock Resources, Inc.: | | | |

| 5.875% 1/15/30 (c) | | 25,285 | 26,291 |

| 6.75% 3/1/29 (c) | | 20,060 | 21,565 |

| 7.5% 5/15/25 (c) | | 3,722 | 3,862 |

| Continental Resources, Inc.: | | | |

| 4.375% 1/15/28 | | 4,930 | 5,380 |

| 4.9% 6/1/44 | | 12,240 | 13,888 |

| Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp.: | | | |

| 5.625% 5/1/27 (c) | | 18,015 | 18,443 |

| 5.75% 4/1/25 | | 4,790 | 4,912 |

| 6% 2/1/29 (c) | | 25,785 | 26,723 |

| CrownRock LP/CrownRock Finance, Inc. 5% 5/1/29 (c) | | 5,055 | 5,207 |

| CVR Energy, Inc.: | | | |

| 5.25% 2/15/25 (c) | | 16,990 | 16,783 |

| 5.75% 2/15/28 (c) | | 22,655 | 22,315 |

| DCP Midstream Operating LP 5.85% 5/21/43 (c)(e) | | 18,335 | 17,088 |

| Delek Logistics Partners LP 7.125% 6/1/28 (c) | | 17,655 | 18,494 |

| DT Midstream, Inc.: | | | |

| 4.125% 6/15/29 (c) | | 9,070 | 9,135 |

| 4.375% 6/15/31 (c) | | 9,070 | 9,189 |

| Endeavor Energy Resources LP/EER Finance, Inc.: | | | |

| 5.75% 1/30/28 (c) | | 21,251 | 22,314 |

| 6.625% 7/15/25 (c) | | 5,510 | 5,810 |

| Energy Transfer LP 5.5% 6/1/27 | | 16,735 | 18,563 |

| EQT Corp.: | | | |

| 3.125% 5/15/26 (c) | | 6,035 | 6,080 |

| 3.625% 5/15/31 (c) | | 6,035 | 6,163 |

| 3.9% 10/1/27 | | 27,454 | 29,307 |

| Exterran Energy Solutions LP 8.125% 5/1/25 | | 11,280 | 10,913 |

| Hess Midstream Partners LP: | | | |

| 4.25% 2/15/30 (c) | | 9,875 | 9,875 |

| 5.125% 6/15/28 (c) | | 11,235 | 11,670 |

| 5.625% 2/15/26 (c) | | 15,535 | 16,098 |

| Hilcorp Energy I LP/Hilcorp Finance Co. 6.25% 11/1/28 (c) | | 12,280 | 12,603 |

| Holly Energy Partners LP/Holly Energy Finance Corp. 5% 2/1/28 (c) | | 7,615 | 7,634 |

| MEG Energy Corp. 7.125% 2/1/27 (c) | | 11,335 | 11,902 |

| Mesquite Energy, Inc. 7.25% 2/15/23 (b)(c)(d) | | 21,977 | 0 |

| Nabors Industries Ltd.: | | | |

| 7.25% 1/15/26 (c) | | 11,260 | 10,922 |

| 7.5% 1/15/28 (c) | | 9,715 | 9,229 |

| New Fortress Energy, Inc.: | | | |

| 6.5% 9/30/26 (c) | | 20,960 | 20,370 |

| 6.75% 9/15/25 (c) | | 46,001 | 44,793 |

| NGL Energy Operating LLC/NGL Energy Finance Corp. 7.5% 2/1/26 (c) | | 11,090 | 11,246 |

| NGL Energy Partners LP/NGL Energy Finance Corp. 6.125% 3/1/25 | | 11,961 | 10,163 |

| Nine Energy Service, Inc. 8.75% 11/1/23 (c) | | 6,245 | 3,216 |

| NuStar Logistics LP 6% 6/1/26 | | 12,025 | 12,777 |

| Occidental Petroleum Corp.: | | | |

| 3.5% 8/15/29 | | 14,690 | 14,910 |

| 4.4% 4/15/46 | | 9,300 | 9,409 |

| 4.4% 8/15/49 | | 23,525 | 23,518 |

| 4.625% 6/15/45 | | 7,660 | 7,928 |

| 5.875% 9/1/25 | | 11,055 | 12,271 |

| 6.125% 1/1/31 | | 23,465 | 28,099 |

| 6.2% 3/15/40 | | 5,785 | 7,009 |

| 6.375% 9/1/28 | | 18,145 | 21,268 |

| 6.45% 9/15/36 | | 19,110 | 24,317 |

| 6.6% 3/15/46 | | 15,305 | 19,583 |

| 6.625% 9/1/30 | | 22,115 | 27,061 |

| 7.2% 3/15/29 | | 3,964 | 4,678 |

| 7.5% 5/1/31 | | 1,100 | 1,432 |

| 8.875% 7/15/30 | | 12,405 | 16,809 |

| PBF Holding Co. LLC/PBF Finance Corp.: | | | |

| 6% 2/15/28 | | 27,530 | 19,954 |

| 7.25% 6/15/25 | | 22,875 | 17,912 |

| 9.25% 5/15/25 (c) | | 24,810 | 24,190 |

| PBF Logistics LP/PBF Logistics Finance, Inc. 6.875% 5/15/23 | | 8,455 | 8,216 |

| PDC Energy, Inc.: | | | |

| 6.125% 9/15/24 | | 3,555 | 3,604 |

| 6.25% 12/1/25 | | 7,435 | 7,584 |

| Renewable Energy Group, Inc. 5.875% 6/1/28 (c) | | 6,340 | 6,665 |

| SM Energy Co.: | | | |

| 5.625% 6/1/25 | | 6,330 | 6,346 |

| 6.625% 1/15/27 | | 21,320 | 22,013 |

| 6.75% 9/15/26 | | 4,550 | 4,664 |

| Southern Natural Gas Co. LLC: | | | |

| 7.35% 2/15/31 | | 23,497 | 31,295 |

| 8% 3/1/32 | | 12,475 | 17,429 |

| Southwestern Energy Co.: | | | |

| 5.375% 3/15/30 | | 12,145 | 12,813 |

| 6.45% 1/23/25 (e) | | 970 | 1,057 |

| 7.75% 10/1/27 | | 12,945 | 13,900 |

| Suburban Propane Partners LP/Suburban Energy Finance Corp. 5% 6/1/31 (c) | | 12,070 | 12,372 |

| Summit Midstream Holdings LLC: | | | |

| 5.75% 4/15/25 | | 5,390 | 4,807 |

| 8.5% (c)(g)(h) | | 9,110 | 9,158 |

| Sunoco LP/Sunoco Finance Corp.: | | | |

| 4.5% 5/15/29 | | 10,170 | 10,284 |

| 4.5% 4/30/30 (c) | | 12,185 | 12,292 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp.: | | | |

| 6% 9/1/31 (c) | | 9,110 | 8,962 |

| 7.5% 10/1/25 (c) | | 8,350 | 9,028 |

| Targa Resources Partners LP/Targa Resources Partners Finance Corp. 4.875% 2/1/31 | | 10,360 | 11,170 |

| Teine Energy Ltd. 6.875% 4/15/29 (c) | | 8,990 | 9,147 |

| Tennessee Gas Pipeline Co. 7.625% 4/1/37 | | 5,445 | 7,841 |

| Ultra Resources, Inc. 11% 7/12/24 pay-in-kind (b)(d) | | 10,734 | 537 |

| Venture Global Calcasieu Pass LLC: | | | |

| 3.875% 8/15/29 (c) | | 7,585 | 7,718 |

| 4.125% 8/15/31 (c) | | 7,585 | 7,850 |

| Vine Energy Holdings LLC 6.75% 4/15/29 (c) | | 8,995 | 9,658 |

| | | | 1,250,582 |

| Environmental - 0.4% | | | |

| Covanta Holding Corp.: | | | |

| 5% 9/1/30 | | 11,060 | 11,005 |

| 5.875% 7/1/25 | | 3,205 | 3,303 |

| 6% 1/1/27 | | 12,335 | 12,751 |

| GFL Environmental, Inc.: | | | |

| 4% 8/1/28 (c) | | 9,105 | 8,877 |

| 4.75% 6/15/29 (c) | | 12,095 | 12,201 |

| Madison IAQ LLC: | | | |

| 4.125% 6/30/28 (c) | | 11,390 | 11,331 |

| 5.875% 6/30/29 (c) | | 9,085 | 9,017 |

| | | | 68,485 |

| Food & Drug Retail - 1.0% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC: | | | |

| 3.5% 3/15/29 (c) | | 36,160 | 35,642 |

| 4.625% 1/15/27 (c) | | 25,300 | 26,478 |

| 4.875% 2/15/30 (c) | | 44,700 | 47,912 |

| Murphy Oil U.S.A., Inc.: | | | |

| 3.75% 2/15/31 (c) | | 5,300 | 5,214 |

| 4.75% 9/15/29 | | 6,860 | 7,227 |

| 5.625% 5/1/27 | | 6,030 | 6,264 |

| Parkland Corp. 4.5% 10/1/29 (c) | | 8,995 | 9,051 |

| SEG Holding LLC/SEG Finance Corp. 5.625% 10/15/28 (c) | | 11,130 | 11,714 |

| | | | 149,502 |

| Food/Beverage/Tobacco - 2.0% | | | |

| C&S Group Enterprises LLC 5% 12/15/28 (c) | | 8,615 | 8,012 |

| Chobani LLC/Finance Corp., Inc. 4.625% 11/15/28 (c) | | 6,285 | 6,426 |

| Del Monte Foods, Inc. 11.875% 5/15/25 (c) | | 6,310 | 7,079 |

| JBS U.S.A. Food Co.: | | | |

| 5.75% 1/15/28 (c) | | 10,705 | 11,160 |

| 7% 1/15/26 (c) | | 11,630 | 12,095 |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc. 6.75% 2/15/28 (c) | | 18,350 | 19,772 |

| JBS U.S.A. Lux SA / JBS Food Co.: | | | |

| 5.5% 1/15/30 (c) | | 20,180 | 22,097 |

| 6.5% 4/15/29 (c) | | 29,320 | 32,509 |

| KeHE Distributors LLC / KeHE Finance Corp. 8.625% 10/15/26 (c) | | 7,777 | 8,360 |

| Lamb Weston Holdings, Inc.: | | | |

| 4.125% 1/31/30 (c)(g) | | 12,150 | 12,162 |

| 4.375% 1/31/32 (c)(g) | | 6,075 | 6,084 |

| 4.625% 11/1/24 (c) | | 7,660 | 7,847 |

| 4.875% 11/1/26 (c) | | 7,740 | 7,936 |

| Performance Food Group, Inc.: | | | |

| 4.25% 8/1/29 (c) | | 8,495 | 8,495 |

| 5.5% 10/15/27 (c) | | 8,855 | 9,231 |

| Pilgrim's Pride Corp. 4.25% 4/15/31 (c) | | 21,020 | 22,176 |

| Post Holdings, Inc.: | | | |

| 4.5% 9/15/31 (c) | | 47,500 | 46,547 |

| 4.625% 4/15/30 (c) | | 15,630 | 15,708 |

| 5.5% 12/15/29 (c) | | 14,975 | 15,930 |

| Simmons Foods, Inc. 4.625% 3/1/29 (c) | | 8,340 | 8,423 |

| TreeHouse Foods, Inc. 4% 9/1/28 | | 3,695 | 3,529 |

| Triton Water Holdings, Inc. 6.25% 4/1/29 (c) | | 6,360 | 6,349 |

| United Natural Foods, Inc. 6.75% 10/15/28 (c) | | 7,750 | 8,389 |

| | | | 306,316 |

| Gaming - 2.4% | | | |

| Affinity Gaming LLC 6.875% 12/15/27 (c) | | 4,295 | 4,453 |

| Boyd Gaming Corp. 4.75% 6/15/31 (c) | | 15,120 | 15,555 |

| Caesars Entertainment, Inc.: | | | |

| 4.625% 10/15/29 (c) | | 18,245 | 18,333 |

| 6.25% 7/1/25 (c) | | 41,240 | 43,378 |

| 8.125% 7/1/27 (c) | | 54,990 | 61,592 |

| Caesars Resort Collection LLC 5.75% 7/1/25 (c) | | 13,750 | 14,448 |

| MCE Finance Ltd.: | | | |

| 4.875% 6/6/25 (c) | | 30,275 | 30,075 |

| 5.25% 4/26/26 (c) | | 12,015 | 11,871 |

| 5.375% 12/4/29 (c) | | 8,160 | 8,027 |

| 5.75% 7/21/28 (c) | | 5,530 | 5,509 |

| MGM Growth Properties Operating Partnership LP 3.875% 2/15/29 (c) | | 11,195 | 11,856 |

| MGM Resorts International 4.75% 10/15/28 | | 11,125 | 11,564 |

| Peninsula Pacific Entertainment LLC 8.5% 11/15/27 (c) | | 19,045 | 20,319 |

| Premier Entertainment Sub LLC: | | | |

| 5.625% 9/1/29 (c) | | 35,005 | 35,618 |

| 5.875% 9/1/31 (c) | | 24,325 | 24,812 |

| Studio City Finance Ltd. 5% 1/15/29 (c) | | 5,700 | 5,116 |

| VICI Properties, Inc.: | | | |

| 4.25% 12/1/26 (c) | | 21,450 | 22,219 |

| 4.625% 12/1/29 (c) | | 12,240 | 13,059 |

| Wynn Macau Ltd. 5.125% 12/15/29 (c) | | 16,800 | 15,036 |

| | | | 372,840 |

| Healthcare - 3.8% | | | |

| 180 Medical, Inc. 3.875% 10/15/29 (c) | | 6,495 | 6,532 |

| AMN Healthcare 4.625% 10/1/27 (c) | | 2,765 | 2,841 |

| Avantor Funding, Inc. 3.875% 11/1/29 (c) | | 6,075 | 6,073 |

| Cano Health, Inc. 6.25% 10/1/28 (c) | | 4,050 | 4,073 |

| Catalent Pharma Solutions: | | | |

| 3.5% 4/1/30 (c) | | 6,070 | 6,024 |

| 5% 7/15/27 (c) | | 3,765 | 3,887 |

| Centene Corp. 4.25% 12/15/27 | | 11,560 | 12,109 |

| Charles River Laboratories International, Inc.: | | | |

| 3.75% 3/15/29 (c) | | 9,500 | 9,595 |

| 4% 3/15/31 (c) | | 12,085 | 12,493 |

| 4.25% 5/1/28 (c) | | 3,400 | 3,502 |

| Community Health Systems, Inc.: | | | |

| 4.75% 2/15/31 (c) | | 16,055 | 16,055 |

| 5.625% 3/15/27 (c) | | 5,640 | 5,902 |

| 6% 1/15/29 (c) | | 8,490 | 8,936 |

| 6.125% 4/1/30 (c) | | 24,105 | 23,694 |

| 6.625% 2/15/25 (c) | | 13,150 | 13,676 |

| 8% 3/15/26 (c) | | 61,410 | 64,788 |

| DaVita HealthCare Partners, Inc.: | | | |

| 3.75% 2/15/31 (c) | | 4,180 | 3,961 |

| 4.625% 6/1/30 (c) | | 31,515 | 31,671 |

| Encompass Health Corp. 5.125% 3/15/23 | | 2,146 | 2,146 |

| Grifols Escrow Issuer SA 4.75% 10/15/28 (c) | | 6,075 | 6,166 |

| HealthEquity, Inc. 4.5% 10/1/29 (c) | | 6,410 | 6,482 |

| Horizon Pharma U.S.A., Inc. 5.5% 8/1/27 (c) | | 12,050 | 12,698 |

| IQVIA, Inc. 5% 5/15/27 (c) | | 12,070 | 12,511 |

| Jaguar Holding Co. II/Pharmaceutical Product Development LLC 5% 6/15/28 (c) | | 11,590 | 12,430 |

| Jazz Securities DAC 4.375% 1/15/29 (c) | | 12,305 | 12,643 |

| ModivCare Escrow Issuer, Inc. 5% 10/1/29 (c) | | 7,010 | 7,130 |

| Modivcare, Inc. 5.875% 11/15/25 (c) | | 8,105 | 8,510 |

| Molina Healthcare, Inc.: | | | |

| 3.875% 11/15/30 (c) | | 10,465 | 10,792 |

| 4.375% 6/15/28 (c) | | 7,525 | 7,788 |

| Mozart Debt Merger Sub, Inc. 3.875% 4/1/29 (c) | | 18,210 | 18,119 |

| Option Care Health, Inc. 4.375% 10/31/29 (c) | | 6,680 | 6,745 |

| Organon & Co. / Organon Foreign Debt Co-Issuer BV: | | | |

| 4.125% 4/30/28 (c) | | 21,010 | 21,299 |

| 5.125% 4/30/31 (c) | | 18,260 | 18,834 |

| Owens & Minor, Inc. 4.5% 3/31/29 (c) | | 8,310 | 8,341 |

| Radiology Partners, Inc. 9.25% 2/1/28 (c) | | 20,865 | 22,117 |

| RP Escrow Issuer LLC 5.25% 12/15/25 (c) | | 10,405 | 10,405 |

| Syneos Health, Inc. 3.625% 1/15/29 (c) | | 8,395 | 8,286 |

| Tenet Healthcare Corp.: | | | |

| 4.25% 6/1/29 (c) | | 17,640 | 17,857 |

| 4.625% 7/15/24 | | 2,495 | 2,526 |

| 4.625% 9/1/24 (c) | | 12,045 | 12,301 |

| 4.875% 1/1/26 (c) | | 30,115 | 30,868 |

| 5.125% 11/1/27 (c) | | 18,070 | 18,883 |

| 6.125% 10/1/28 (c) | | 19,415 | 20,385 |

| 6.25% 2/1/27 (c) | | 35,815 | 37,203 |

| Vizient, Inc. 6.25% 5/15/27 (c) | | 2,760 | 2,893 |

| | | | 592,170 |

| Homebuilders/Real Estate - 2.1% | | | |

| Arcosa, Inc. 4.375% 4/15/29 (c) | | 8,410 | 8,584 |

| Ashton Woods U.S.A. LLC/Ashton Woods Finance Co. 4.625% 4/1/30 (c) | | 8,940 | 8,784 |

| Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp. 4.875% 2/15/30 (c) | | 7,775 | 7,791 |

| Century Communities, Inc. 3.875% 8/15/29 (c) | | 9,110 | 9,079 |

| DTZ U.S. Borrower LLC 6.75% 5/15/28 (c) | | 10,555 | 11,267 |

| MPT Operating Partnership LP/MPT Finance Corp.: | | | |

| 3.5% 3/15/31 | | 11,190 | 11,275 |

| 4.625% 8/1/29 | | 18,080 | 19,120 |

| 5% 10/15/27 | | 25,968 | 27,312 |

| Realogy Group LLC/Realogy Co-Issuer Corp.: | | | |

| 5.75% 1/15/29 (c) | | 36,785 | 38,118 |

| 7.625% 6/15/25 (c) | | 33,090 | 35,355 |

| Shea Homes Ltd. Partnership/Corp. 4.75% 4/1/29 (c) | | 8,020 | 8,060 |

| Taylor Morrison Communities, Inc./Monarch Communities, Inc.: | | | |

| 5.125% 8/1/30 (c) | | 10,725 | 11,369 |

| 5.625% 3/1/24 (c) | | 1,312 | 1,402 |

| 5.875% 6/15/27 (c) | | 9,260 | 10,360 |

| TopBuild Corp. 3.625% 3/15/29 (c) | | 5,910 | 5,941 |

| TRI Pointe Group, Inc./TRI Pointe Holdings, Inc. 5.875% 6/15/24 | | 16,130 | 17,868 |

| TRI Pointe Homes, Inc. 5.7% 6/15/28 | | 14,380 | 15,638 |

| Uniti Group LP / Uniti Group Finance, Inc.: | | | |

| 4.75% 4/15/28 (c) | | 31,410 | 31,533 |

| 6.5% 2/15/29 (c) | | 39,880 | 40,342 |

| Weekley Homes LLC/Weekley Finance Corp. 4.875% 9/15/28 (c) | | 5,045 | 5,222 |

| | | | 324,420 |

| Hotels - 0.2% | | | |

| Choice Hotels International, Inc. 5.75% 7/1/22 | | 3,035 | 3,134 |

| Hilton Domestic Operating Co., Inc.: | | | |

| 3.75% 5/1/29 (c) | | 5,595 | 5,595 |

| 4% 5/1/31 (c) | | 8,395 | 8,435 |

| 4.875% 1/15/30 | | 6,900 | 7,366 |

| Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp. 4.875% 4/1/27 | | 8,435 | 8,730 |

| | | | 33,260 |

| Insurance - 0.8% | | | |

| Acrisure LLC / Acrisure Finance, Inc.: | | | |

| 6% 8/1/29 (c) | | 9,105 | 8,934 |

| 7% 11/15/25 (c) | | 34,880 | 35,229 |

| Alliant Holdings Intermediate LLC: | | | |

| 4.25% 10/15/27 (c) | | 11,125 | 11,119 |

| 5.875% 11/1/29 (c)(g) | | 9,115 | 9,160 |

| 6.75% 10/15/27 (c) | | 16,680 | 17,222 |

| AmWINS Group, Inc. 4.875% 6/30/29 (c) | | 8,805 | 8,778 |

| AssuredPartners, Inc.: | | | |

| 5.625% 1/15/29 (c) | | 6,550 | 6,501 |

| 7% 8/15/25 (c) | | 4,865 | 4,932 |

| HUB International Ltd. 7% 5/1/26 (c) | | 11,770 | 12,138 |

| MGIC Investment Corp. 5.25% 8/15/28 | | 7,710 | 8,203 |

| | | | 122,216 |

| Leisure - 1.3% | | | |

| Boyne U.S.A., Inc. 4.75% 5/15/29 (c) | | 6,360 | 6,503 |

| Carnival Corp.: | | | |

| 4% 8/1/28 (c) | | 18,190 | 18,190 |

| 7.625% 3/1/26 (c) | | 8,415 | 8,866 |

| 9.875% 8/1/27 (c) | | 16,600 | 19,111 |

| 10.5% 2/1/26 (c) | | 11,990 | 13,932 |

| Merlin Entertainments PLC 5.75% 6/15/26 (c) | | 7,725 | 7,998 |

| NCL Corp. Ltd.: | | | |

| 5.875% 3/15/26 (c) | | 12,585 | 12,616 |

| 12.25% 5/15/24 (c) | | 14,720 | 17,364 |

| NCL Finance Ltd. 6.125% 3/15/28 (c) | | 5,265 | 5,311 |

| Royal Caribbean Cruises Ltd.: | | | |

| 10.875% 6/1/23 (c) | | 13,720 | 15,349 |

| 11.5% 6/1/25 (c) | | 11,874 | 13,477 |

| SeaWorld Parks & Entertainment, Inc. 5.25% 8/15/29 (c) | | 12,145 | 12,373 |

| Vail Resorts, Inc. 6.25% 5/15/25 (c) | | 6,250 | 6,583 |

| Viking Cruises Ltd.: | | | |

| 5.875% 9/15/27 (c) | | 11,595 | 11,204 |

| 13% 5/15/25 (c) | | 9,250 | 10,591 |

| Viking Ocean Cruises Ship VII Ltd. 5.625% 2/15/29 (c) | | 4,965 | 4,928 |

| Voc Escrow Ltd. 5% 2/15/28 (c) | | 10,755 | 10,674 |

| | | | 195,070 |

| Metals/Mining - 1.5% | | | |

| Alcoa Nederland Holding BV: | | | |

| 4.125% 3/31/29 (c) | | 15,485 | 16,104 |

| 6.125% 5/15/28 (c) | | 3,565 | 3,822 |

| Arconic Corp.: | | | |

| 6% 5/15/25 (c) | | 6,630 | 6,937 |

| 6.125% 2/15/28 (c) | | 16,695 | 17,592 |

| Cleveland-Cliffs, Inc.: | | | |

| 4.625% 3/1/29 (c) | | 23,720 | 24,580 |

| 4.875% 3/1/31 (c) | | 11,440 | 11,912 |

| 5.875% 6/1/27 | | 18,030 | 18,751 |

| Eldorado Gold Corp. 6.25% 9/1/29 (c) | | 9,110 | 9,258 |

| First Quantum Minerals Ltd.: | | | |

| 6.5% 3/1/24 (c) | | 10,955 | 11,119 |

| 6.875% 3/1/26 (c) | | 28,325 | 29,440 |

| 7.25% 4/1/23 (c) | | 3,465 | 3,529 |

| 7.5% 4/1/25 (c) | | 20,585 | 21,228 |

| FMG Resources (August 2006) Pty Ltd.: | | | |

| 4.375% 4/1/31 (c) | | 8,990 | 9,102 |

| 4.5% 9/15/27 (c) | | 9,015 | 9,421 |

| 5.125% 5/15/24 (c) | | 9,780 | 10,425 |

| HudBay Minerals, Inc. 4.5% 4/1/26 (c) | | 7,020 | 7,002 |

| Mineral Resources Ltd. 8.125% 5/1/27 (c) | | 18,015 | 19,449 |

| Murray Energy Corp.: | | | |

| 11.25% (b)(c)(d) | | 8,915 | 0 |

| 12% 4/15/24 pay-in-kind (b)(c)(d)(e) | | 10,343 | 0 |

| | | | 229,671 |

| Paper - 0.5% | | | |

| Ardagh Metal Packaging Finance U.S.A. LLC/Ardagh Metal Packaging Finance PLC: | | | |

| 3.25% 9/1/28 (c) | | 5,915 | 5,789 |

| 4% 9/1/29 (c) | | 11,830 | 11,764 |

| Cascades, Inc.: | | | |

| 5.125% 1/15/26 (c) | | 5,600 | 5,908 |

| 5.375% 1/15/28 (c) | | 5,600 | 5,859 |

| Enviva Partners LP / Enviva Partners Finance Corp. 6.5% 1/15/26 (c) | | 11,230 | 11,615 |

| Glatfelter Corp. 4.75% 11/15/29 (c) | | 9,105 | 9,276 |

| Intertape Polymer Group, Inc. 4.375% 6/15/29 (c) | | 9,050 | 9,073 |

| Mercer International, Inc. 5.125% 2/1/29 | | 15,060 | 14,973 |

| | | | 74,257 |

| Publishing/Printing - 0.1% | | | |

| Clear Channel International BV 6.625% 8/1/25 (c) | | 15,860 | 16,494 |

| Railroad - 0.1% | | | |

| First Student Bidco, Inc./First Transit Parent, Inc. 4% 7/31/29 (c) | | 9,095 | 8,890 |

| Restaurants - 0.5% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc.: | | | |

| 3.875% 1/15/28 (c) | | 12,115 | 12,086 |

| 4% 10/15/30 (c) | | 39,005 | 37,785 |

| 4.375% 1/15/28 (c) | | 10,600 | 10,656 |

| Bloomin Brands, Inc. / OSI Restaurant Partners LLC 5.125% 4/15/29 (c) | | 5,565 | 5,501 |

| Papa John's International, Inc. 3.875% 9/15/29 (c) | | 5,560 | 5,435 |

| Yum! Brands, Inc. 4.625% 1/31/32 | | 11,975 | 12,484 |

| | | | 83,947 |

| Services - 2.4% | | | |

| AECOM 5.125% 3/15/27 | | 11,885 | 13,118 |

| Allied Universal Holdco LLC / Allied Universal Finance Corp. 6% 6/1/29 (c) | | 14,195 | 13,970 |

| Ascend Learning LLC: | | | |

| 6.875% 8/1/25 (c) | | 4,115 | 4,182 |

| 6.875% 8/1/25 (c) | | 11,865 | 12,058 |

| Atlas Luxco 4 SARL / Allied Universal Holdco LLC / Allied Universal Finance Corp.: | | | |

| 4.625% 6/1/28 (c) | | 21,690 | 21,515 |

| 4.625% 6/1/28 (c) | | 14,365 | 14,235 |

| Booz Allen Hamilton, Inc.: | | | |

| 3.875% 9/1/28 (c) | | 10,240 | 10,387 |

| 4% 7/1/29 (c) | | 5,920 | 5,994 |

| CoreCivic, Inc. 8.25% 4/15/26 | | 32,260 | 32,971 |

| Fair Isaac Corp. 4% 6/15/28 (c) | | 2,910 | 2,939 |

| Gartner, Inc.: | | | |

| 3.625% 6/15/29 (c) | | 8,610 | 8,653 |

| 3.75% 10/1/30 (c) | | 11,495 | 11,653 |

| GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (c) | | 8,765 | 9,072 |

| H&E Equipment Services, Inc. 3.875% 12/15/28 (c) | | 16,800 | 16,674 |

| Hertz Corp.: | | | |

| 5.5% 10/15/24 (b)(c)(d) | | 10,890 | 0 |

| 6% 1/15/28 (b)(c)(d) | | 10,285 | 0 |

| 6.25% 10/15/22 (b)(d) | | 11,875 | 0 |

| 7.125% 8/1/26 (b)(c)(d) | | 10,285 | 0 |

| IAA, Inc. 5.5% 6/15/27 (c) | | 4,680 | 4,861 |

| Iron Mountain, Inc.: | | | |

| 4.5% 2/15/31 (c) | | 22,025 | 22,245 |

| 4.875% 9/15/29 (c) | | 24,110 | 24,908 |

| KAR Auction Services, Inc. 5.125% 6/1/25 (c) | | 10,355 | 10,381 |

| Service Corp. International 4% 5/15/31 | | 12,070 | 12,326 |

| Sotheby's 7.375% 10/15/27 (c) | | 4,960 | 5,227 |

| Sotheby's/Bidfair Holdings, Inc. 5.875% 6/1/29 (c) | | 9,045 | 9,249 |

| The Brink's Co. 4.625% 10/15/27 (c) | | 12,180 | 12,567 |

| The GEO Group, Inc.: | | | |

| 5.125% 4/1/23 | | 9,625 | 9,284 |

| 5.875% 10/15/24 | | 14,053 | 12,714 |

| 6% 4/15/26 | | 9,655 | 8,376 |

| TriNet Group, Inc. 3.5% 3/1/29 (c) | | 8,865 | 8,888 |

| Uber Technologies, Inc.: | | | |

| 4.5% 8/15/29 (c) | | 27,335 | 27,511 |

| 6.25% 1/15/28 (c) | | 9,175 | 9,852 |

| WASH Multifamily Acquisition, Inc. 5.75% 4/15/26 (c) | | 9,760 | 10,089 |

| | | | 365,899 |

| Steel - 0.1% | | | |

| Algoma Steel SCA 0% 12/31/23 (b) | | 1,982 | 0 |

| Commercial Metals Co. 3.875% 2/15/31 | | 6,135 | 6,074 |

| Infrabuild Australia Pty Ltd. 12% 10/1/24 (c) | | 10,980 | 11,611 |

| Roller Bearing Co. of America, Inc. 4.375% 10/15/29 (c) | | 4,375 | 4,457 |

| | | | 22,142 |

| Super Retail - 1.1% | | | |

| Ambience Merger Sub, Inc.: | | | |

| 4.875% 7/15/28 (c) | | 6,055 | 5,945 |

| 7.125% 7/15/29 (c) | | 9,035 | 8,706 |

| Asbury Automotive Group, Inc.: | | | |

| 4.5% 3/1/28 | | 3,534 | 3,596 |

| 4.75% 3/1/30 | | 3,523 | 3,593 |

| Bath & Body Works, Inc.: | | | |

| 6.625% 10/1/30 (c) | | 5,555 | 6,215 |

| 6.75% 7/1/36 | | 27,016 | 32,430 |

| 6.875% 11/1/35 | | 7,304 | 8,874 |

| 7.5% 6/15/29 | | 8,335 | 9,414 |

| Carvana Co.: | | | |

| 4.875% 9/1/29 (c) | | 21,255 | 20,564 |

| 5.5% 4/15/27 (c) | | 11,975 | 12,065 |

| EG Global Finance PLC 8.5% 10/30/25 (c) | | 16,085 | 16,648 |

| Gap, Inc.: | | | |

| 3.625% 10/1/29 (c) | | 12,145 | 11,902 |

| 3.875% 10/1/31 (c) | | 12,145 | 11,902 |

| Lithia Motors, Inc. 3.875% 6/1/29 (c) | | 13,230 | 13,710 |

| | | | 165,564 |

| Technology - 2.8% | | | |

| Acuris Finance U.S. 5% 5/1/28 (c) | | 9,045 | 8,909 |

| Black Knight InfoServ LLC 3.625% 9/1/28 (c) | | 11,390 | 11,333 |

| CA Magnum Holdings 5.375% (c)(h) | | 4,870 | 4,998 |

| Camelot Finance SA 4.5% 11/1/26 (c) | | 10,590 | 10,978 |

| Clarivate Science Holdings Corp.: | | | |

| 3.875% 7/1/28 (c) | | 10,695 | 10,575 |

| 4.875% 7/1/29 (c) | | 10,115 | 10,072 |

| Crowdstrike Holdings, Inc. 3% 2/15/29 | | 8,870 | 8,759 |

| Elastic NV 4.125% 7/15/29 (c) | | 17,090 | 17,003 |

| Go Daddy Operating Co. LLC / GD Finance Co., Inc.: | | | |

| 3.5% 3/1/29 (c) | | 11,810 | 11,426 |

| 5.25% 12/1/27 (c) | | 9,345 | 9,695 |

| ION Trading Technologies Ltd. 5.75% 5/15/28 (c) | | 12,040 | 12,341 |

| MicroStrategy, Inc. 6.125% 6/15/28 (c) | | 11,065 | 11,354 |

| NCR Corp.: | | | |

| 5% 10/1/28 (c) | | 5,530 | 5,599 |

| 5.125% 4/15/29 (c) | | 8,870 | 9,070 |

| 5.25% 10/1/30 (c) | | 5,530 | 5,696 |

| 5.75% 9/1/27 (c) | | 9,035 | 9,509 |

| 6.125% 9/1/29 (c) | | 9,035 | 9,707 |

| Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc. 10.75% 6/1/28 (c) | | 5,930 | 6,523 |

| NortonLifeLock, Inc. 5% 4/15/25 (c) | | 10,050 | 10,125 |

| ON Semiconductor Corp. 3.875% 9/1/28 (c) | | 11,065 | 11,189 |

| Open Text Corp.: | | | |

| 3.875% 2/15/28 (c) | | 5,690 | 5,733 |

| 5.875% 6/1/26 (c) | | 8,535 | 8,812 |

| Open Text Holdings, Inc. 4.125% 2/15/30 (c) | | 5,690 | 5,784 |

| Pitney Bowes, Inc.: | | | |

| 6.875% 3/15/27 (c) | | 5,980 | 6,189 |

| 7.25% 3/15/29 (c) | | 5,980 | 6,174 |

| PTC, Inc.: | | | |

| 3.625% 2/15/25 (c) | | 6,650 | 6,758 |

| 4% 2/15/28 (c) | | 6,575 | 6,665 |

| Rackspace Hosting, Inc. 5.375% 12/1/28 (c) | | 6,425 | 6,184 |

| Roblox Corp. 3.875% 5/1/30 (c) | | 9,120 | 9,086 |

| Sensata Technologies BV 4% 4/15/29 (c) | | 11,970 | 12,157 |

| Square, Inc. 3.5% 6/1/31 (c) | | 12,070 | 12,372 |

| Synaptics, Inc. 4% 6/15/29 (c) | | 7,015 | 7,085 |

| TTM Technologies, Inc. 4% 3/1/29 (c) | | 8,870 | 8,791 |

| Twilio, Inc.: | | | |

| 3.625% 3/15/29 | | 9,995 | 10,095 |

| 3.875% 3/15/31 | | 10,460 | 10,562 |

| Uber Technologies, Inc.: | | | |

| 7.5% 9/15/27 (c) | | 35,255 | 38,564 |

| 8% 11/1/26 (c) | | 51,060 | 54,348 |

| Unisys Corp. 6.875% 11/1/27 (c) | | 6,095 | 6,644 |

| Veritas U.S., Inc./Veritas Bermuda Ltd. 7.5% 9/1/25 (c) | | 19,400 | 20,103 |

| | | | 436,967 |

| Telecommunications - 6.3% | | | |

| Altice Financing SA: | | | |

| 5% 1/15/28 (c) | | 11,280 | 10,870 |

| 5.75% 8/15/29 (c) | | 24,290 | 23,895 |

| Altice France SA: | | | |

| 5.125% 7/15/29 (c) | | 79,325 | 77,257 |

| 5.5% 1/15/28 (c) | | 24,740 | 24,796 |

| 5.5% 10/15/29 (c) | | 106,150 | 104,050 |

| 8.125% 2/1/27 (c) | | 7,635 | 8,208 |

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (c) | | 42,100 | 44,258 |

| Cablevision Lightpath LLC: | | | |

| 3.875% 9/15/27 (c) | | 5,500 | 5,355 |

| 5.625% 9/15/28 (c) | | 4,350 | 4,300 |

| Frontier Communications Holdings LLC: | | | |

| 5% 5/1/28 (c) | | 19,575 | 19,893 |

| 5.875% 10/15/27 (c) | | 10,375 | 10,868 |

| 6% 1/15/30 (c) | | 12,185 | 12,243 |

| 6.75% 5/1/29 (c) | | 12,535 | 12,895 |

| Intelsat Jackson Holdings SA 8% 2/15/24 (c) | | 20,755 | 21,222 |

| LCPR Senior Secured Financing DAC: | | | |

| 5.125% 7/15/29 (c) | | 14,860 | 14,971 |

| 6.75% 10/15/27 (c) | | 11,285 | 11,849 |

| Level 3 Financing, Inc.: | | | |

| 3.625% 1/15/29 (c) | | 24,590 | 23,267 |

| 3.75% 7/15/29 (c) | | 24,670 | 23,313 |

| Lumen Technologies, Inc. 5.375% 6/15/29 (c) | | 15,130 | 15,187 |

| Millicom International Cellular SA 4.5% 4/27/31 (c) | | 1,725 | 1,769 |

| NGL Energy Partners LP/NGL Energy Finance Corp. 7.5% 4/15/26 | | 15,705 | 13,423 |

| Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc.: | | | |

| 4.75% 4/30/27 (c) | | 6,070 | 5,926 |

| 6% 2/15/28 (c) | | 4,490 | 4,310 |

| Qwest Corp. 7.25% 9/15/25 | | 1,480 | 1,766 |

| Sable International Finance Ltd. 5.75% 9/7/27 (c) | | 18,690 | 19,438 |

| SBA Communications Corp.: | | | |

| 3.125% 2/1/29 (c) | | 13,305 | 12,773 |

| 3.875% 2/15/27 | | 17,015 | 17,547 |

| Sprint Capital Corp.: | | | |

| 6.875% 11/15/28 | | 76,454 | 96,671 |

| 8.75% 3/15/32 | | 66,716 | 99,857 |

| Sprint Corp. 7.625% 3/1/26 | | 10,895 | 13,062 |

| T-Mobile U.S.A., Inc.: | | | |

| 2.625% 2/15/29 | | 16,895 | 16,747 |

| 2.875% 2/15/31 | | 26,040 | 25,877 |

| 3.375% 4/15/29 | | 11,975 | 12,304 |

| 3.5% 4/15/31 | | 11,975 | 12,393 |

| Telesat Canada/Telesat LLC 5.625% 12/6/26 (c) | | 17,665 | 16,489 |

| Uniti Group, Inc.: | | | |

| 6% 1/15/30 (c) | | 15,190 | 15,000 |

| 7.875% 2/15/25 (c) | | 17,650 | 18,563 |

| Virgin Media Finance PLC 5% 7/15/30 (c) | | 21,860 | 21,736 |

| VMED O2 UK Financing I PLC 4.75% 7/15/31 (c) | | 21,200 | 21,306 |

| Windstream Escrow LLC 7.75% 8/15/28 (c) | | 43,795 | 46,323 |

| Zayo Group Holdings, Inc. 4% 3/1/27 (c) | | 17,180 | 16,686 |

| | | | 978,663 |

| Textiles/Apparel - 0.3% | | | |

| Crocs, Inc.: | | | |

| 4.125% 8/15/31 (c) | | 6,075 | 6,113 |

| 4.25% 3/15/29 (c) | | 8,675 | 8,783 |

| Foot Locker, Inc. 4% 10/1/29 (c) | | 6,070 | 6,018 |

| Victoria's Secret & Co. 4.625% 7/15/29 (c) | | 22,560 | 22,659 |

| | | | 43,573 |

| Transportation Ex Air/Rail - 0.1% | | | |

| Seaspan Corp. 5.5% 8/1/29 (c) | | 9,095 | 9,185 |

| Utilities - 2.3% | | | |

| Clearway Energy Operating LLC: | | | |

| 3.75% 2/15/31 (c) | | 13,295 | 13,162 |

| 3.75% 1/15/32 (c) | | 6,075 | 6,046 |

| 4.75% 3/15/28 (c) | | 6,920 | 7,321 |

| NRG Energy, Inc.: | | | |

| 3.375% 2/15/29 (c) | | 5,145 | 5,016 |

| 3.625% 2/15/31 (c) | | 10,215 | 9,942 |

| 3.875% 2/15/32 (c) | | 15,190 | 14,886 |

| 5.75% 1/15/28 | | 9,410 | 9,975 |

| 6.625% 1/15/27 | | 8,283 | 8,578 |

| Pacific Gas & Electric Co.: | | | |

| 3.45% 7/1/25 | | 2,868 | 2,989 |

| 3.75% 7/1/28 | | 2,868 | 3,006 |

| 3.75% 8/15/42 | | 10,400 | 9,851 |

| 3.95% 12/1/47 | | 53,930 | 53,266 |

| 4% 12/1/46 | | 24,380 | 24,218 |

| 4.25% 3/15/46 | | 2,400 | 2,441 |

| 4.3% 3/15/45 | | 5,995 | 6,068 |

| 4.55% 7/1/30 | | 60,820 | 66,253 |

| PG&E Corp.: | | | |

| 5% 7/1/28 | | 22,000 | 22,880 |

| 5.25% 7/1/30 | | 8,330 | 8,703 |

| Pike Corp. 5.5% 9/1/28 (c) | | 8,695 | 8,847 |

| Vistra Operations Co. LLC: | | | |

| 4.375% 5/1/29 (c) | | 23,230 | 22,998 |

| 5% 7/31/27 (c) | | 22,585 | 23,150 |

| 5.5% 9/1/26 (c) | | 3,485 | 3,589 |

| 5.625% 2/15/27 (c) | | 28,195 | 29,050 |

| | | | 362,235 |

|

| TOTAL NONCONVERTIBLE BONDS | | | 9,283,382 |

|

| TOTAL CORPORATE BONDS | | | |

| (Cost $8,905,429) | | | 9,306,745 |

| | | Shares | Value (000s) |

|

| Common Stocks - 20.9% | | | |

| Air Transportation - 0.2% | | | |

| Air Canada (i) | | 511,000 | 9,162 |

| GXO Logistics, Inc. (i) | | 176,900 | 15,709 |

|

| TOTAL AIR TRANSPORTATION | | | 24,871 |

|

| Automotive & Auto Parts - 0.1% | | | |

| Allison Transmission Holdings, Inc. | | 241,300 | 8,050 |

| Exide Technologies (b)(i) | | 9,824 | 10 |

| Exide Technologies (b)(i) | | 580,031 | 0 |

| Exide Technologies (b) | | 385 | 250 |

| UC Holdings, Inc. (b)(i) | | 677,217 | 4,090 |

|

| TOTAL AUTOMOTIVE & AUTO PARTS | | | 12,400 |

|

| Broadcasting - 0.3% | | | |

| iHeartMedia, Inc. (i) | | 104 | 2 |

| Nexstar Broadcasting Group, Inc. Class A | | 329,429 | 49,391 |

|

| TOTAL BROADCASTING | | | 49,393 |

|

| Building Materials - 0.3% | | | |

| Builders FirstSource, Inc. (i) | | 435,000 | 25,347 |

| Carrier Global Corp. | | 517,100 | 27,008 |

|

| TOTAL BUILDING MATERIALS | | | 52,355 |

|

| Cable/Satellite TV - 0.1% | | | |

| Altice U.S.A., Inc. Class A (i) | | 833,000 | 13,578 |

| Capital Goods - 0.7% | | | |

| Thermo Fisher Scientific, Inc. | | 98,300 | 62,231 |

| Zebra Technologies Corp. Class A (i) | | 88,400 | 47,201 |

|

| TOTAL CAPITAL GOODS | | | 109,432 |

|

| Chemicals - 0.4% | | | |

| CF Industries Holdings, Inc. | | 608,800 | 34,580 |

| The Chemours Co. LLC | | 1,144,240 | 32,062 |

|

| TOTAL CHEMICALS | | | 66,642 |

|

| Consumer Products - 0.9% | | | |

| BJ's Wholesale Club Holdings, Inc. (i) | | 454,100 | 26,538 |

| Reddy Ice Holdings, Inc. (b)(i) | | 199,717 | 11 |

| Reddy Ice Holdings, Inc. (b)(i) | | 496,439 | 0 |

| Tapestry, Inc. | | 344,400 | 13,425 |

| Tempur Sealy International, Inc. | | 2,160,700 | 96,086 |

|

| TOTAL CONSUMER PRODUCTS | | | 136,060 |

|

| Containers - 0.4% | | | |

| Berry Global Group, Inc. (i) | | 342,000 | 22,415 |

| WestRock Co. | | 660,100 | 31,751 |

|

| TOTAL CONTAINERS | | | 54,166 |

|

| Diversified Financial Services - 0.4% | | | |

| Axis Energy Services, LLC Class A (b) | | 11,616 | 4 |

| MasterCard, Inc. Class A | | 81,000 | 27,177 |

| OneMain Holdings, Inc. | | 792,600 | 41,857 |

| Penson Worldwide, Inc. Class A (b)(i) | | 10,322,034 | 0 |

| PJT Partners, Inc. | | 5,092 | 416 |

|

| TOTAL DIVERSIFIED FINANCIAL SERVICES | | | 69,454 |

|

| Energy - 3.4% | | | |

| Array Technologies, Inc. | | 208,059 | 4,442 |

| California Resources Corp. (i) | | 4,064,439 | 187,493 |

| California Resources Corp. warrants 10/27/24 (i) | | 57,076 | 884 |

| Chaparral Energy, Inc.: | | | |

| Series A warrants 10/1/24 (b)(i) | | 392 | 1 |

| Series B warrants 10/1/25 (b)(i) | | 392 | 1 |

| Cheniere Energy, Inc. | | 349,900 | 36,180 |

| Chesapeake Energy Corp. (j) | | 1,519,400 | 96,847 |

| Chesapeake Energy Corp. (a) | | 22,818 | 1,454 |

| Chesapeake Energy Corp.: | | | |

| warrants 2/9/26 (i) | | 117,493 | 4,502 |

| warrants 2/9/26 (i) | | 130,548 | 4,360 |

| warrants 2/9/26 (i) | | 81,798 | 2,501 |

| Denbury, Inc. (i) | | 550,480 | 46,604 |

| Denbury, Inc. warrants 9/18/25 (i) | | 439,788 | 23,084 |

| Diamond Offshore Drilling, Inc. (b)(i) | | 118,485 | 605 |

| EP Energy Corp. (b) | | 841,775 | 75,549 |

| Extraction Oil & Gas, Inc. (i) | | 50,742 | 3,381 |

| Forbes Energy Services Ltd. (i) | | 193,218 | 3 |

| Jonah Energy Parent LLC (b) | | 304,505 | 15,764 |

| Mesquite Energy, Inc. (b)(i) | | 317,026 | 12,259 |

| Superior Energy Services, Inc. Class A (b) | | 110,370 | 2,826 |

| Unit Corp. (i) | | 37,978 | 1,295 |

|

| TOTAL ENERGY | | | 520,035 |

|

| Entertainment/Film - 0.0% | | | |

| New Cotai LLC/New Cotai Capital Corp. (a)(b)(i) | | 3,366,626 | 7,541 |

| Environmental - 0.5% | | | |

| Darling Ingredients, Inc. (i) | | 909,117 | 76,839 |

| Food & Drug Retail - 0.1% | | | |

| Southeastern Grocers, Inc. (a)(b)(i) | | 793,345 | 17,922 |

| Food/Beverage/Tobacco - 0.6% | | | |

| JBS SA | | 12,343,900 | 85,409 |

| Gaming - 1.7% | | | |

| Boyd Gaming Corp. (i) | | 1,088,300 | 69,412 |

| Caesars Entertainment, Inc. (i) | | 1,335,236 | 146,155 |

| Penn National Gaming, Inc. (i) | | 654,000 | 46,826 |

| Studio City International Holdings Ltd. ADR (i) | | 695,700 | 5,730 |

|

| TOTAL GAMING | | | 268,123 |

|

| Healthcare - 1.9% | | | |

| Bristol-Myers Squibb Co. | | 274,100 | 16,007 |

| Charles River Laboratories International, Inc. (i) | | 56,800 | 25,485 |

| Encompass Health Corp. | | 34 | 2 |

| HCA Holdings, Inc. | | 154,200 | 38,621 |

| Humana, Inc. | | 87,800 | 40,665 |

| IQVIA Holdings, Inc. (i) | | 344,400 | 90,033 |

| Regeneron Pharmaceuticals, Inc. (i) | | 63,600 | 40,700 |

| Rotech Healthcare, Inc. (b)(i) | | 185,710 | 1,933 |

| UnitedHealth Group, Inc. | | 92,600 | 42,640 |

|

| TOTAL HEALTHCARE | | | 296,086 |

|

| Homebuilders/Real Estate - 0.5% | | | |

| Arthur J. Gallagher & Co. | | 196,100 | 32,880 |

| Lennar Corp. Class A | | 209,300 | 20,915 |

| PulteGroup, Inc. | | 365,200 | 17,559 |

|

| TOTAL HOMEBUILDERS/REAL ESTATE | | | 71,354 |

|

| Metals/Mining - 0.2% | | | |

| Elah Holdings, Inc. (i) | | 906 | 88 |

| First Quantum Minerals Ltd. | | 1,544,300 | 36,561 |

|

| TOTAL METALS/MINING | | | 36,649 |

|

| Services - 0.6% | | | |

| ASGN, Inc. (i) | | 226,400 | 27,091 |

| Penhall Acquisition Co.: | | | |

| Class A (b)(i) | | 26,163 | 3,618 |

| Class B (b)(i) | | 8,721 | 1,206 |

| United Rentals, Inc. (i) | | 98,494 | 37,340 |

| Visa, Inc. Class A | | 126,540 | 26,797 |

|

| TOTAL SERVICES | | | 96,052 |

|

| Steel - 0.0% | | | |

| Algoma Steel GP (i) | | 198,162 | 3,911 |

| Algoma Steel SCA (b)(i) | | 198,162 | 0 |

|

| TOTAL STEEL | | | 3,911 |

|

| Super Retail - 1.2% | | | |

| Amazon.com, Inc. (i) | | 4,600 | 15,513 |

| Arena Brands Holding Corp. Class B (a)(b)(i) | | 659,302 | 2,472 |

| Bath & Body Works, Inc. | | 298,900 | 20,651 |

| eBay, Inc. | | 434,500 | 33,335 |

| Lowe's Companies, Inc. | | 187,000 | 43,724 |

| PVH Corp. | | 210,600 | 23,025 |

| RH (i) | | 35,500 | 23,417 |

| Williams-Sonoma, Inc. | | 121,600 | 22,585 |

|

| TOTAL SUPER RETAIL | | | 184,722 |

|

| Technology - 5.1% | | | |

| Adobe, Inc. (i) | | 134,800 | 87,669 |

| Alphabet, Inc. Class A (i) | | 36,500 | 108,074 |

| CDW Corp. | | 131,500 | 24,544 |

| EPAM Systems, Inc. (i) | | 73,200 | 49,281 |

| Global Payments, Inc. | | 227,524 | 32,534 |

| GoDaddy, Inc. (i) | | 246,400 | 17,043 |

| Lam Research Corp. | | 134,500 | 75,800 |

| Marvell Technology, Inc. | | 350,700 | 24,023 |

| Meta Platforms, Inc. Class A (i) | | 271,400 | 87,817 |

| Microchip Technology, Inc. | | 502,600 | 37,238 |

| Microsoft Corp. | | 308,500 | 102,305 |

| NVIDIA Corp. | | 107,800 | 27,561 |

| ON Semiconductor Corp. (i) | | 748,538 | 35,982 |

| PayPal Holdings, Inc. (i) | | 177,000 | 41,168 |

| SS&C Technologies Holdings, Inc. | | 426,282 | 33,877 |

|

| TOTAL TECHNOLOGY | | | 784,916 |

|

| Telecommunications - 0.7% | | | |

| Alibaba Group Holding Ltd. sponsored ADR (i) | | 109,200 | 18,011 |

| GTT Communications, Inc. rights (b)(i) | | 472,864 | 473 |

| Palo Alto Networks, Inc. (i) | | 103,500 | 52,691 |

| T-Mobile U.S., Inc. (i) | | 176,000 | 20,245 |

| Tencent Holdings Ltd. sponsored ADR (j) | | 332,900 | 20,237 |

|

| TOTAL TELECOMMUNICATIONS | | | 111,657 |

|

| Textiles/Apparel - 0.0% | | | |

| Victoria's Secret & Co. (i) | | 99,633 | 5,028 |

| Transportation Ex Air/Rail - 0.1% | | | |

| Tricer Holdco SCA: | | | |

| Class A1 (a)(b)(i) | | 598,287 | 1 |

| Class A2 (a)(b)(i) | | 598,287 | 1 |

| Class A3 (a)(b)(i) | | 598,287 | 1 |

| Class A4 (a)(b)(i) | | 598,287 | 1 |

| Class A5 (a)(b)(i) | | 598,287 | 1 |

| Class A6 (a)(b)(i) | | 598,287 | 1 |

| Class A7 (a)(b)(i) | | 598,287 | 1 |

| Class A8 (a)(b)(i) | | 598,287 | 1 |

| Class A9 (a)(b)(i) | | 598,287 | 1 |

| XPO Logistics, Inc. (i) | | 176,900 | 15,178 |

|

| TOTAL TRANSPORTATION EX AIR/RAIL | | | 15,187 |

|

| Utilities - 0.5% | | | |

| NRG Energy, Inc. | | 863,100 | 34,429 |

| PG&E Corp. (i) | | 3,288,096 | 38,142 |

| Portland General Electric Co. | | 14,817 | 731 |

|

| TOTAL UTILITIES | | | 73,302 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $1,725,369) | | | 3,243,084 |

|

| Nonconvertible Preferred Stocks - 0.0% | | | |

| Automotive & Auto Parts - 0.0% | | | |

| Exide Technologies (b) | | 858 | 799 |

| Transportation Ex Air/Rail - 0.0% | | | |

| Tricer Holdco SCA (a)(b)(i) | | 287,159,690 | 97 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $11,049) | | | 896 |

| | | Principal Amount (000s) | Value (000s) |

|

| Bank Loan Obligations - 3.5% | | | |

| Air Transportation - 0.3% | | | |

| Air Canada Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 4.25% 8/11/28 (e)(f)(k) | | 9,105 | 9,194 |

| Dynasty Acquisition Co., Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6315% 4/8/26 (e)(f)(k) | | 2,591 | 2,529 |

| Tranche B2 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6315% 4/4/26 (e)(f)(k) | | 1,393 | 1,359 |

| SkyMiles IP Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 10/20/27 (e)(f)(k) | | 3,490 | 3,715 |

| United Airlines, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 4/21/28 (e)(f)(k) | | 26,368 | 26,721 |

|

| TOTAL AIR TRANSPORTATION | | | 43,518 |

|

| Automotive & Auto Parts - 0.1% | | | |

| Midas Intermediate Holdco II LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 7.750% 7.5% 12/16/25 (e)(f)(k) | | 867 | 849 |

| Wand NewCo 3, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.087% 2/5/26 (e)(f)(k) | | 18,078 | 17,794 |

|

| TOTAL AUTOMOTIVE & AUTO PARTS | | | 18,643 |

|

| Banks & Thrifts - 0.1% | | | |

| Citadel Securities LP Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.587% 2/27/28 (e)(f)(k) | | 9,796 | 9,710 |

| Broadcasting - 0.1% | | | |

| Nexstar Broadcasting, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.500% 2.5824% 9/19/26 (e)(f)(k) | | 3,835 | 3,827 |

| Univision Communications, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 5/21/28 (f)(k)(l) | | 7,500 | 7,489 |

|

| TOTAL BROADCASTING | | | 11,316 |

|

| Building Materials - 0.2% | | | |

| Acproducts Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 4.75% 5/17/28 (e)(f)(k) | | 23,950 | 23,875 |

| SRS Distribution, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 4.25% 6/4/28 (e)(f)(k) | | 6,489 | 6,487 |

|

| TOTAL BUILDING MATERIALS | | | 30,362 |

|

| Chemicals - 0.0% | | | |

| Olympus Water U.S. Holding Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 9/21/28 (f)(k)(l) | | 3,705 | 3,699 |

| W.R. Grace Holding LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 4.25% 9/22/28 (e)(f)(k) | | 2,785 | 2,791 |

|

| TOTAL CHEMICALS | | | 6,490 |

|

| Consumer Products - 0.2% | | | |

| Kronos Acquisition Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.25% 12/22/26 (e)(f)(k) | | 22,034 | 21,353 |

| Michaels Companies, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 4/15/28 (e)(f)(k) | | 5,546 | 5,536 |

|

| TOTAL CONSUMER PRODUCTS | | | 26,889 |

|

| Containers - 0.0% | | | |

| Kloeckner Pentaplast of America, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.25% 2/12/26 (e)(f)(k) | | 1,497 | 1,489 |

| Diversified Financial Services - 0.0% | | | |

| New Cotai LLC 1LN, term loan 3 month U.S. LIBOR + 12.000% 14% 9/9/25 (b)(e)(f)(k) | | 1,027 | 1,027 |

| Energy - 0.0% | | | |

| Citgo Holding, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 7.000% 8% 8/1/23 (e)(f)(k) | | 1,377 | 1,370 |

| Forbes Energy Services LLC Tranche B, term loan 0% (b)(d)(e)(k) | | 2,190 | 0 |

| Mesquite Energy, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 8.000% 0% (b)(d)(f)(k) | | 5,861 | 0 |

| term loan 3 month U.S. LIBOR + 0.000% 0% (b)(d)(f)(k) | | 2,528 | 0 |

|

| TOTAL ENERGY | | | 1,370 |

|

| Environmental - 0.0% | | | |

| Madison IAQ LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 3.75% 6/21/28 (e)(f)(k) | | 3,022 | 3,015 |

| Gaming - 0.1% | | | |

| Bally's Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 3.75% 8/6/28 (e)(f)(k) | | 15,190 | 15,171 |

| Healthcare - 0.7% | | | |

| CPI Holdco LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.837% 11/4/26 (e)(f)(k) | | 591 | 591 |

| Gainwell Acquisition Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 10/1/27 (e)(f)(k) | | 17,765 | 17,795 |

| Jazz Financing Lux SARL Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 4% 5/5/28 (e)(f)(k) | | 6,978 | 6,986 |

| Mozart Borrower LP Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 3.75% 9/30/28 (e)(f)(k) | | 12,970 | 12,983 |

| Organon & Co. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.5% 6/2/28 (e)(f)(k) | | 17,511 | 17,544 |

| Phoenix Newco, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 8/10/28 (f)(k)(l) | | 7,195 | 7,200 |

| PRA Health Sciences, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 3% 7/1/28 (e)(f)(k) | | 2,358 | 2,357 |

| U.S. Renal Care, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.125% 6/13/26 (e)(f)(k) | | 42,806 | 42,496 |

| Valeant Pharmaceuticals International, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.087% 6/1/25 (e)(f)(k) | | 1,437 | 1,433 |

|

| TOTAL HEALTHCARE | | | 109,385 |

|

| Hotels - 0.0% | | | |

| Carnival Finance LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 4% 10/18/28 (e)(f)(k) | | 8,055 | 8,045 |

| Insurance - 0.2% | | | |

| Alliant Holdings Intermediate LLC Tranche B3 1LN, term loan: | | | |

| 1 month U.S. LIBOR + 3.500% 11/6/27 (f)(k)(l) | | 13,520 | 13,486 |

| 3 month U.S. LIBOR + 3.750% 4.25% 11/5/27 (e)(f)(k) | | 13,517 | 13,490 |

|

| TOTAL INSURANCE | | | 26,976 |

|

| Services - 0.2% | | | |

| KUEHG Corp. Tranche B 2LN, term loan 3 month U.S. LIBOR + 8.250% 9.25% 8/22/25 (e)(f)(k) | | 6,055 | 6,070 |

| Sabert Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 5.5% 12/10/26 (e)(f)(k) | | 7,915 | 7,911 |

| Sotheby's Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.500% 5% 1/15/27 (e)(f)(k) | | 11,029 | 11,048 |

|

| TOTAL SERVICES | | | 25,029 |

|

| Technology - 0.8% | | | |

| Acuris Finance U.S., Inc. 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.5% 2/16/28 (e)(f)(k) | | 1,131 | 1,134 |

| athenahealth, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.250% 4.3773% 2/11/26 (e)(f)(k) | | 2,214 | 2,219 |

| Boxer Parent Co., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8815% 10/2/25 (e)(f)(k) | | 32,071 | 31,833 |

| Camelot Finance SA Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.087% 10/31/26 (e)(f)(k) | | 1,130 | 1,123 |

| DG Investment Intermediate Holdings, Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 3/31/28 (e)(f)(k) | | 1,674 | 1,677 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.4425% 3/31/28 (e)(f)(k)(m) | | 351 | 351 |

| Hunter U.S. Bidco, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 4.75% 8/19/28 (e)(f)(k) | | 18,225 | 18,248 |

| Icon Luxembourg Sarl Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 3% 7/1/28 (e)(f)(k) | | 9,463 | 9,462 |

| McAfee LLC Tranche B, term loan 3 month U.S. LIBOR + 3.750% 3.837% 9/29/24 (e)(f)(k) | | 3,803 | 3,805 |

| ON Semiconductor Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 2.087% 9/19/26 (e)(f)(k) | | 7,688 | 7,679 |

| Peraton Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 2/1/28 (e)(f)(k) | | 14,134 | 14,149 |

| Polaris Newco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 4.5% 6/2/28 (e)(f)(k) | | 6,775 | 6,788 |

| Proofpoint, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 3.75% 8/31/28 (e)(f)(k) | | 6,605 | 6,575 |

| RealPage, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 4/22/28 (e)(f)(k) | | 6,030 | 6,016 |

| STG-Fairway Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 2.837% 1/31/27 (e)(f)(k) | | 3,110 | 3,102 |

| UKG, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 6.750% 7.5% 5/3/27 (e)(f)(k) | | 2,310 | 2,349 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 5/4/26 (e)(f)(k) | | 10,895 | 10,907 |

| VS Buyer LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.087% 2/28/27 (e)(f)(k) | | 2,320 | 2,307 |

|

| TOTAL TECHNOLOGY | | | 129,724 |

|

| Telecommunications - 0.3% | | | |

| Connect Finco SARL Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 12/12/26 (e)(f)(k) | | 8,914 | 8,914 |

| Frontier Communications Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 10/8/27 (e)(f)(k) | | 5,149 | 5,139 |

| GTT Communications, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.88% 5/31/25 (e)(f)(k) | | 12,942 | 10,948 |

| Intelsat Jackson Holdings SA Tranche DD 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.3917% 7/13/22 (e)(f)(k)(m) | | 9,044 | 9,107 |

| Securus Technologies Holdings Tranche B, term loan 3 month U.S. LIBOR + 4.500% 5.5% 11/1/24 (e)(f)(k) | | 7,007 | 6,685 |

| Zayo Group Holdings, Inc. 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.087% 3/9/27 (e)(f)(k) | | 7,821 | 7,693 |

|

| TOTAL TELECOMMUNICATIONS | | | 48,486 |

|

| Utilities - 0.2% | | | |

| PG&E Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.5% 6/23/25 (e)(f)(k) | | 27,161 | 26,847 |

| TOTAL BANK LOAN OBLIGATIONS | | | |

| (Cost $548,158) | | | 543,492 |

|

| Preferred Securities - 6.9% | | | |

| Banks & Thrifts - 6.0% | | | |

| Ally Financial, Inc. 4.7% (e)(h) | | 17,635 | 18,119 |

| Bank of America Corp.: | | | |

| 5.125% (e)(h) | | 36,030 | 38,728 |

| 5.2% (e)(h) | | 61,440 | 64,388 |

| 5.875% (e)(h) | | 102,630 | 115,674 |

| 6.25% (e)(h) | | 28,555 | 31,396 |

| Citigroup, Inc.: | | | |

| 4.7% (e)(h) | | 15,285 | 15,678 |

| 5% (e)(h) | | 60,300 | 62,766 |

| 5.9% (e)(h) | | 27,015 | 28,294 |

| 5.95% (e)(h) | | 51,015 | 53,572 |

| 6.3% (e)(h) | | 5,610 | 6,135 |

| Goldman Sachs Group, Inc.: | | | |

| 4.4% (e)(h) | | 8,035 | 8,235 |

| 4.95% (e)(h) | | 13,335 | 14,184 |

| 5% (e)(h) | | 70,565 | 72,419 |

| Huntington Bancshares, Inc. 5.7% (e)(h) | | 12,990 | 13,349 |

| JPMorgan Chase & Co.: | | | |

| 3 month U.S. LIBOR + 3.320% 3.4509% (e)(f)(h) | | 43,545 | 43,693 |

| 3 month U.S. LIBOR + 3.800% 3.9258% (e)(f)(h) | | 16,855 | 17,130 |

| 4% (e)(h) | | 34,340 | 34,457 |

| 4.6% (e)(h) | | 23,365 | 24,165 |

| 5% (e)(h) | | 30,845 | 32,306 |

| 6% (e)(h) | | 69,385 | 73,502 |

| 6.125% (e)(h) | | 17,585 | 18,767 |

| 6.75% (e)(h) | | 8,330 | 9,244 |

| Wells Fargo & Co.: | | | |

| 5.875% (e)(h) | | 50,420 | 56,650 |

| 5.9% (e)(h) | | 63,075 | 68,661 |

|

| TOTAL BANKS & THRIFTS | | | 921,512 |

|

| Diversified Financial Services - 0.0% | | | |

| OEC Finance Ltd. 7.5% pay-in-kind (c)(h) | | 1,701 | 140 |

| Energy - 0.9% | | | |

| DCP Midstream Partners LP 7.375% (e)(h) | | 15,260 | 15,726 |

| Energy Transfer LP: | | | |

| 6.25% (e)(h) | | 70,123 | 64,807 |

| 6.625% (e)(h) | | 27,290 | 26,820 |

| 7.125% (e) | | 4,260 | 4,598 |

| MPLX LP 6.875% (e)(h) | | 30,450 | 31,345 |

| Summit Midstream Partners LP 9.5% (e)(h) | | 2,912 | 2,434 |

|

| TOTAL ENERGY | | | 145,730 |

|

| TOTAL PREFERRED SECURITIES | | | |

| (Cost $1,022,466) | | | 1,067,382 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 8.4% | | | |

| Fidelity Cash Central Fund 0.06% (n) | | 1,281,221,692 | 1,281,478 |

| Fidelity Securities Lending Cash Central Fund 0.06% (n)(o) | | 20,212,354 | 20,214 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $1,301,646) | | | 1,301,692 |

| TOTAL INVESTMENT IN SECURITIES - 99.8% | | | |

| (Cost $13,514,117) | | | 15,463,291 |

| NET OTHER ASSETS (LIABILITIES) - 0.2% | | | 34,365 |

| NET ASSETS - 100% | | | $15,497,656 |

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $52,858,000 or 0.3% of net assets.

(b) Level 3 security

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $6,594,366,000 or 42.6% of net assets.

(d) Non-income producing - Security is in default.

(e) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(f) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(g) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(h) Security is perpetual in nature with no stated maturity date.

(i) Non-income producing

(j) Security or a portion of the security is on loan at period end.

(k) Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty.

(l) The coupon rate will be determined upon settlement of the loan after period end.

(m) Position or a portion of the position represents an unfunded loan commitment. At period end, the total principal amount and market value of unfunded commitments totaled $1,534,000 and $1,545,000, respectively.

(n) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(o) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| Arena Brands Holding Corp. Class B | 6/18/97 - 1/12/99 | $21,592 |

| Chesapeake Energy Corp. | 2/10/21 | $216 |

| Mesquite Energy, Inc. 15% 7/15/23 | 11/5/20 - 10/15/21 | $4,149 |

| Mesquite Energy, Inc. 15% 7/15/23 | 7/10/20 - 10/15/21 | $2,405 |

| New Cotai LLC/New Cotai Capital Corp. | 9/11/20 | $16,677 |

| Southeastern Grocers, Inc. | 6/1/18 | $5,580 |

| Tricer Holdco SCA | 10/16/09 - 12/30/17 | $10,250 |

| Tricer Holdco SCA Class A1 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A2 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A3 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A4 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A5 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A6 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A7 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A8 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A9 | 10/16/09 - 10/29/09 | $1,654 |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.06% | $1,367,979 | $1,837,603 | $1,924,104 | $337 | $-- | $-- | $1,281,478 | 2.1% |

| Fidelity Securities Lending Cash Central Fund 0.06% | -- | 212,068 | 191,854 | 9 | -- | -- | 20,214 | 0.1% |

| Total | $1,367,979 | $2,049,671 | $2,115,958 | $346 | $-- | $-- | $1,301,692 | |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| California Resources Corp. | $120,620 | $-- | $39,834 | $-- | $(13,936) | $120,643 | $-- |

| California Resources Corp. warrants 10/27/24 | 228 | -- | -- | -- | -- | 656 | -- |

| Total | $120,848 | $-- | $39,834 | $-- | $(13,936) | $121,299 | $-- |

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $306,885 | $299,344 | $-- | $7,541 |

| Consumer Discretionary | 629,018 | 621,397 | -- | 7,621 |

| Consumer Staples | 206,719 | 188,786 | -- | 17,933 |

| Energy | 515,593 | 408,588 | -- | 107,005 |

| Financials | 75,157 | 75,153 | -- | 4 |

| Health Care | 358,317 | 356,384 | -- | 1,933 |

| Industrials | 174,257 | 169,327 | -- | 4,930 |

| Information Technology | 743,364 | 742,891 | -- | 473 |

| Materials | 161,368 | 157,457 | 3,911 | -- |

| Utilities | 73,302 | 73,302 | -- | -- |

| Corporate Bonds | 9,306,745 | -- | 9,252,690 | 54,055 |

| Bank Loan Obligations | 543,492 | -- | 542,465 | 1,027 |

| Preferred Securities | 1,067,382 | -- | 1,067,382 | -- |

| Money Market Funds | 1,301,692 | 1,301,692 | -- | -- |

| Total Investments in Securities: | $15,463,291 | $4,394,321 | $10,866,448 | $202,522 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| (Amounts in thousands) | |

| Investments in Securities: | |

| Beginning Balance | $135,377 |

| Net Realized Gain (Loss) on Investment Securities | 10,182 |

| Net Unrealized Gain (Loss) on Investment Securities | 43,171 |

| Cost of Purchases | 32,777 |

| Proceeds of Sales | (65,107) |

| Amortization/Accretion | (82) |

| Transfers into Level 3 | 46,204 |

| Transfers out of Level 3 | -- |

| Ending Balance | $202,522 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at October 31, 2021 | $29,425 |