UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Name of Fund:

| BlackRock Municipal Bond Fund, Inc. |

| BlackRock High Yield Municipal Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Municipal Bond Fund, Inc., 50 Hudson Yards, New York, NY 10001

Registrant's telephone number, including area code:

Date of reporting period:

Item 1 — Report to Stockholders

(a) The Report to Shareholders is attached herewith

BlackRock High Yield Municipal Fund

Institutional Shares | MAYHX

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about BlackRock High Yield Municipal Fund (the “Fund”) for the period of July 1, 2024 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period ?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares | $20(a) | 0.58%(b) |

(a) | Expenses for a full reporting period would be higher than the amount shown. |

(b) | Annualized. |

How did the Fund perform during the period ?

For the reporting period ended October 31, 2024, the Fund’s Institutional Shares returned 0.86%.

For the same period, the Bloomberg Municipal Bond Index returned 1.21% and the Bloomberg Municipal High Yield Bond Index returned 1.64%.

What contributed to performance?

At the sector level, allocations to tax-backed states, education and healthcare issues made the largest contributions to absolute performance. In terms of credit tiers, non-rated and AA rated bonds were the leading contributors. Bonds with maturities of 25 years and above also helped results.

What detracted from performance?

At a time of positive returns for the broader market, few aspects of the Fund’s positioning hurt absolute performance. With that said, the Fund’s use of U.S. Treasury futures to manage interest-rate risk was a modest detractor.

The Fund’s cash position was modestly elevated at the end of the period, largely to address liquidity needs and provide the flexibility to capitalize on opportunities as they arise. The cash position did not have a material impact on results.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

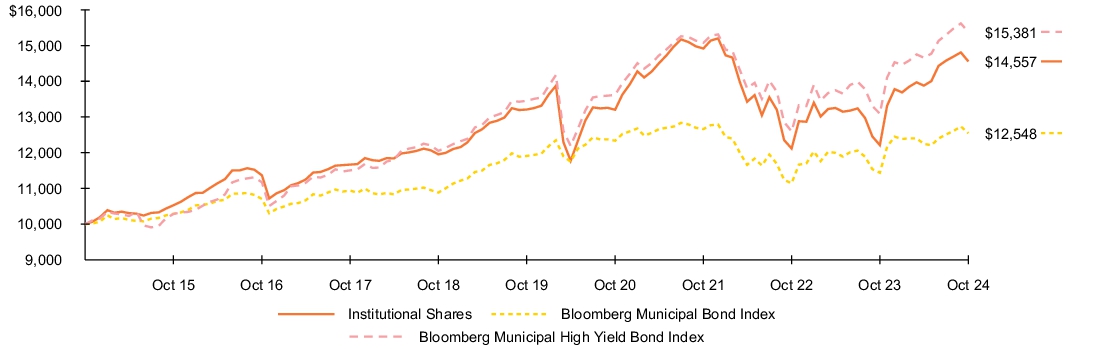

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Institutional Shares | 19.20 | % | 1.96 | % | 3.83 | % |

| Bloomberg Municipal Bond Index | 9.70 | | 1.05 | | 2.30 | |

| Bloomberg Municipal High Yield Bond Index | 17.47 | | 2.71 | | 4.40 | |

| High Yield Customized Reference Benchmark | 15.14 | | 2.22 | | N/A | |

| Key Fund statistics | |

| Net Assets | $1,585,113,158 |

| Number of Portfolio Holdings | 698 |

| Net Investment Advisory Fees | $2,481,961 |

| Portfolio Turnover Rate | 15% |

On September 13, 2024, the Fund’s Board approved to change the Fund’s fiscal year end from June 30 to October 31. The Institutional Shares’ total return is 0.86% for the period from July 1, 2024 to October 31, 2024.

The High Yield Customized Reference Benchmark (commenced on September 30, 2016) is comprised of Bloomberg Municipal Bond Rated Baa Index (20%), Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (60%) and Bloomberg Municipal Investment Grade ex BBB (20%).

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

| Sector allocation |

| Sector(a) | Percent of Total

Investments(b) | |

| State | 23.0 | % |

| Corporate | 16.2 | % |

| Education | 13.5 | % |

| County/City/Special District/School District | 12.0 | % |

| Health | 11.9 | % |

| Transportation | 10.5 | % |

| Utilities | 4.9 | % |

| Housing | 4.2 | % |

| Tobacco | 3.6 | % |

| Commercial Mortgage-Backed Securities | 0.2 | % |

| Credit quality allocation |

| Credit Rating(c) | Percent of Total

Investments(b) | |

| AAA/Aaa | 0.3 | % |

| AA/Aa | 6.9 | % |

| A | 9.0 | % |

| BBB/Baa | 9.0 | % |

| BB/Ba | 9.1 | % |

| B | 2.2 | % |

| CCC/Caa | 0.3 | % |

| N/R(d) | 63.2 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) | Excludes short-term securities. |

| (c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of October 31, 2024, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.0% of total investments. |

Material Fund changes

This is a summary of certain changes and planned changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s prospectus at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

On September 13, 2024, the Fund’s Board approved the reorganization of the Fund into a newly created ETF to be named iShares High Yield Muni Active ETF. The reorganization is expected to close as of the close of trading on the New York Stock Exchange on February 7, 2025. In connection with the reorganization, effective October 31, 2024, the Fund changed its fiscal year end from June 30 to October 31.

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock High Yield Municipal Fund

Institutional Shares | MAYHX

Annual Shareholder Report — October 31, 2024

MAYHX-10/24-AR

BlackRock High Yield Municipal Fund

Investor A Shares | MDYHX

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about BlackRock High Yield Municipal Fund (the “Fund”) for the period of July 1, 2024 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period ?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares | $28(a) | 0.83%(b) |

(a) | Expenses for a full reporting period would be higher than the amount shown. |

(b) | Annualized. |

How did the Fund perform during the period ?

For the reporting period ended October 31, 2024, the Fund’s Investor A Shares returned 0.78%.

For the same period, the Bloomberg Municipal Bond Index returned 1.21% and the Bloomberg Municipal High Yield Bond Index returned 1.64%.

What contributed to performance?

At the sector level, allocations to tax-backed states, education and healthcare issues made the largest contributions to absolute performance. In terms of credit tiers, non-rated and AA rated bonds were the leading contributors. Bonds with maturities of 25 years and above also helped results.

What detracted from performance?

At a time of positive returns for the broader market, few aspects of the Fund’s positioning hurt absolute performance. With that said, the Fund’s use of U.S. Treasury futures to manage interest-rate risk was a modest detractor.

The Fund’s cash position was modestly elevated at the end of the period, largely to address liquidity needs and provide the flexibility to capitalize on opportunities as they arise. The cash position did not have a material impact on results.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

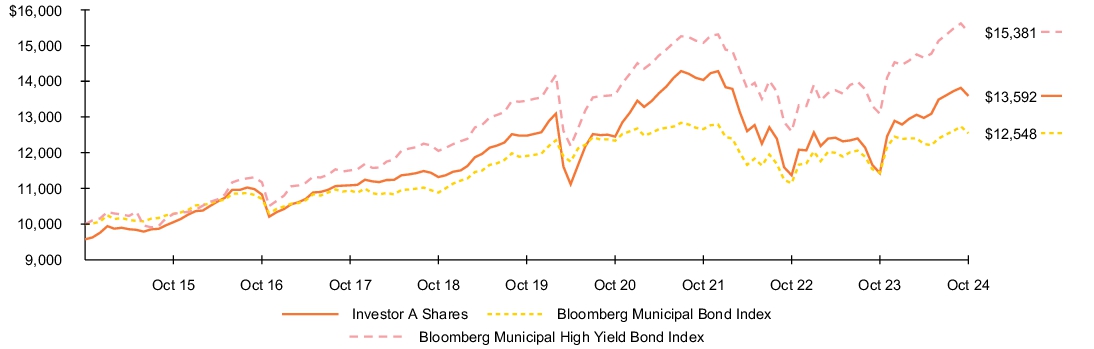

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Investor A Shares | 18.95 | % | 1.73 | % | 3.57 | % |

| Investor A Shares (with sales charge) | 13.89 | | 0.85 | | 3.12 | |

| Bloomberg Municipal Bond Index | 9.70 | | 1.05 | | 2.30 | |

| Bloomberg Municipal High Yield Bond Index | 17.47 | | 2.71 | | 4.40 | |

| High Yield Customized Reference Benchmark | 15.14 | | 2.22 | | N/A | |

| Key Fund statistics | |

| Net Assets | $1,585,113,158 |

| Number of Portfolio Holdings | 698 |

| Net Investment Advisory Fees | $2,481,961 |

| Portfolio Turnover Rate | 15% |

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

On September 13, 2024, the Fund’s Board approved to change the Fund’s fiscal year end from June 30 to October 31. The Investor A Shares’ total return is 0.78% for the period from July 1, 2024 to October 31, 2024.

The High Yield Customized Reference Benchmark (commenced on September 30, 2016) is comprised of Bloomberg Municipal Bond Rated Baa Index (20%), Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (60%) and Bloomberg Municipal Investment Grade ex BBB (20%).

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

| Sector allocation |

| Sector(a) | Percent of Total

Investments(b) | |

| State | 23.0 | % |

| Corporate | 16.2 | % |

| Education | 13.5 | % |

| County/City/Special District/School District | 12.0 | % |

| Health | 11.9 | % |

| Transportation | 10.5 | % |

| Utilities | 4.9 | % |

| Housing | 4.2 | % |

| Tobacco | 3.6 | % |

| Commercial Mortgage-Backed Securities | 0.2 | % |

| Credit quality allocation |

| Credit Rating(c) | Percent of Total

Investments(b) | |

| AAA/Aaa | 0.3 | % |

| AA/Aa | 6.9 | % |

| A | 9.0 | % |

| BBB/Baa | 9.0 | % |

| BB/Ba | 9.1 | % |

| B | 2.2 | % |

| CCC/Caa | 0.3 | % |

| N/R(d) | 63.2 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) | Excludes short-term securities. |

| (c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of October 31, 2024, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.0% of total investments. |

Material Fund changes

This is a summary of certain changes and planned changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s prospectus at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

On September 13, 2024, the Fund’s Board approved the reorganization of the Fund into a newly created ETF to be named iShares High Yield Muni Active ETF. The reorganization is expected to close as of the close of trading on the New York Stock Exchange on February 7, 2025. In connection with the reorganization, effective October 31, 2024, the Fund changed its fiscal year end from June 30 to October 31.

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock High Yield Municipal Fund

Investor A Shares | MDYHX

Annual Shareholder Report — October 31, 2024

MDYHX-10/24-AR

BlackRock High Yield Municipal Fund

Investor C Shares | MCYHX

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about BlackRock High Yield Municipal Fund (the “Fund”) for the period of July 1, 2024 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period ?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares | $53(a) | 1.58%(b) |

(a) | Expenses for a full reporting period would be higher than the amount shown. |

(b) | Annualized. |

How did the Fund perform during the period ?

For the reporting period ended October 31, 2024, the Fund’s Investor C Shares returned 0.42%.

For the same period, the Bloomberg Municipal Bond Index returned 1.21% and the Bloomberg Municipal High Yield Bond Index returned 1.64%.

What contributed to performance?

At the sector level, allocations to tax-backed states, education and healthcare issues made the largest contributions to absolute performance. In terms of credit tiers, non-rated and AA rated bonds were the leading contributors. Bonds with maturities of 25 years and above also helped results.

What detracted from performance?

At a time of positive returns for the broader market, few aspects of the Fund’s positioning hurt absolute performance. With that said, the Fund’s use of U.S. Treasury futures to manage interest-rate risk was a modest detractor.

The Fund’s cash position was modestly elevated at the end of the period, largely to address liquidity needs and provide the flexibility to capitalize on opportunities as they arise. The cash position did not have a material impact on results.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

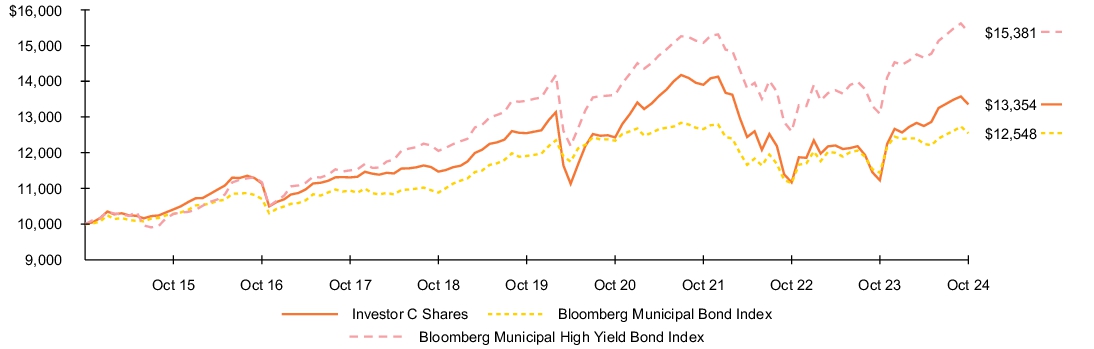

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Investor C Shares | 17.88 | % | 0.95 | % | 2.94 | % |

| Investor C Shares (with sales charge) | 16.88 | | 0.95 | | 2.94 | |

| Bloomberg Municipal Bond Index | 9.70 | | 1.05 | | 2.30 | |

| Bloomberg Municipal High Yield Bond Index | 17.47 | | 2.71 | | 4.40 | |

| High Yield Customized Reference Benchmark | 15.14 | | 2.22 | | N/A | |

| Key Fund statistics | |

| Net Assets | $1,585,113,158 |

| Number of Portfolio Holdings | 698 |

| Net Investment Advisory Fees | $2,481,961 |

| Portfolio Turnover Rate | 15% |

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees.

On September 13, 2024, the Fund’s Board approved to change the Fund’s fiscal year end from June 30 to October 31. The Investor C Shares’ total return is 0.42% for the period from July 1, 2024 to October 31, 2024.

The High Yield Customized Reference Benchmark (commenced on September 30, 2016) is comprised of Bloomberg Municipal Bond Rated Baa Index (20%), Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (60%) and Bloomberg Municipal Investment Grade ex BBB (20%).

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

| Sector allocation |

| Sector(a) | Percent of Total

Investments(b) | |

| State | 23.0 | % |

| Corporate | 16.2 | % |

| Education | 13.5 | % |

| County/City/Special District/School District | 12.0 | % |

| Health | 11.9 | % |

| Transportation | 10.5 | % |

| Utilities | 4.9 | % |

| Housing | 4.2 | % |

| Tobacco | 3.6 | % |

| Commercial Mortgage-Backed Securities | 0.2 | % |

| Credit quality allocation |

| Credit Rating(c) | Percent of Total

Investments(b) | |

| AAA/Aaa | 0.3 | % |

| AA/Aa | 6.9 | % |

| A | 9.0 | % |

| BBB/Baa | 9.0 | % |

| BB/Ba | 9.1 | % |

| B | 2.2 | % |

| CCC/Caa | 0.3 | % |

| N/R(d) | 63.2 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) | Excludes short-term securities. |

| (c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of October 31, 2024, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.0% of total investments. |

Material Fund changes

This is a summary of certain changes and planned changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s prospectus at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

On September 13, 2024, the Fund’s Board approved the reorganization of the Fund into a newly created ETF to be named iShares High Yield Muni Active ETF. The reorganization is expected to close as of the close of trading on the New York Stock Exchange on February 7, 2025. In connection with the reorganization, effective October 31, 2024, the Fund changed its fiscal year end from June 30 to October 31.

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock High Yield Municipal Fund

Investor C Shares | MCYHX

Annual Shareholder Report — October 31, 2024

MCYHX-10/24-AR

BlackRock High Yield Municipal Fund

Class K Shares | MKYHX

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about BlackRock High Yield Municipal Fund (the “Fund”) for the period of July 1, 2024 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period ?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class K Shares | $18(a) | 0.53%(b) |

(a) | Expenses for a full reporting period would be higher than the amount shown. |

(b) | Annualized. |

How did the Fund perform during the period ?

For the reporting period ended October 31, 2024, the Fund’s Class K Shares returned 0.88%.

For the same period, the Bloomberg Municipal Bond Index returned 1.21% and the Bloomberg Municipal High Yield Bond Index returned 1.64%.

What contributed to performance?

At the sector level, allocations to tax-backed states, education and healthcare issues made the largest contributions to absolute performance. In terms of credit tiers, non-rated and AA rated bonds were the leading contributors. Bonds with maturities of 25 years and above also helped results.

What detracted from performance?

At a time of positive returns for the broader market, few aspects of the Fund’s positioning hurt absolute performance. With that said, the Fund’s use of U.S. Treasury futures to manage interest-rate risk was a modest detractor.

The Fund’s cash position was modestly elevated at the end of the period, largely to address liquidity needs and provide the flexibility to capitalize on opportunities as they arise. The cash position did not have a material impact on results.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

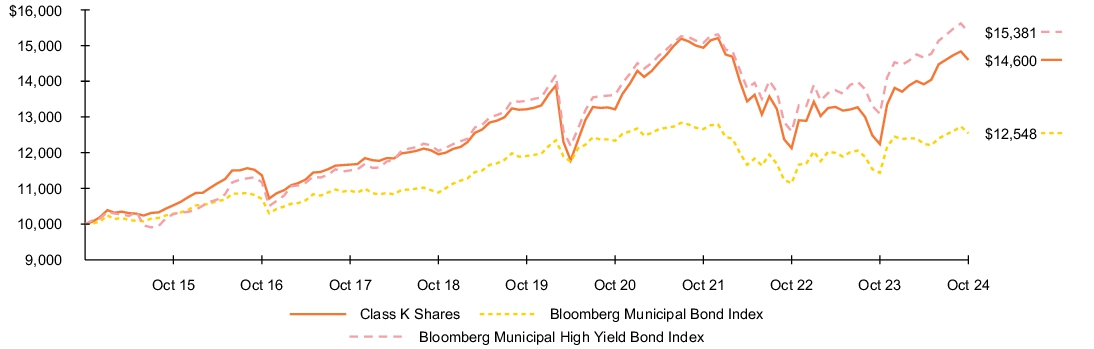

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Class K Shares | 19.27 | % | 2.01 | % | 3.86 | % |

| Bloomberg Municipal Bond Index | 9.70 | | 1.05 | | 2.30 | |

| Bloomberg Municipal High Yield Bond Index | 17.47 | | 2.71 | | 4.40 | |

| High Yield Customized Reference Benchmark | 15.14 | | 2.22 | | N/A | |

| Key Fund statistics | |

| Net Assets | $1,585,113,158 |

| Number of Portfolio Holdings | 698 |

| Net Investment Advisory Fees | $2,481,961 |

| Portfolio Turnover Rate | 15% |

On September 13, 2024, the Fund’s Board approved to change the Fund’s fiscal year end from June 30 to October 31. The Class K Shares’ total return is 0.88% for the period from July 1, 2024 to October 31, 2024.

The High Yield Customized Reference Benchmark (commenced on September 30, 2016) is comprised of Bloomberg Municipal Bond Rated Baa Index (20%), Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (60%) and Bloomberg Municipal Investment Grade ex BBB (20%).

Performance shown prior to the Class K Shares inception date of January 25, 2018 is that of Institutional Shares. The performance of Class K Shares would be substantially similar to Institutional Shares because Class K Shares and Institutional Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Institutional Shares have different expenses. The actual returns of Class K Shares would have been higher than those of the Institutional Shares because Class K Shares have lower expenses than the Institutional Shares.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

| Sector allocation |

| Sector(a) | Percent of Total

Investments(b) | |

| State | 23.0 | % |

| Corporate | 16.2 | % |

| Education | 13.5 | % |

| County/City/Special District/School District | 12.0 | % |

| Health | 11.9 | % |

| Transportation | 10.5 | % |

| Utilities | 4.9 | % |

| Housing | 4.2 | % |

| Tobacco | 3.6 | % |

| Commercial Mortgage-Backed Securities | 0.2 | % |

| Credit quality allocation |

| Credit Rating(c) | Percent of Total

Investments(b) | |

| AAA/Aaa | 0.3 | % |

| AA/Aa | 6.9 | % |

| A | 9.0 | % |

| BBB/Baa | 9.0 | % |

| BB/Ba | 9.1 | % |

| B | 2.2 | % |

| CCC/Caa | 0.3 | % |

| N/R(d) | 63.2 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) | Excludes short-term securities. |

| (c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of October 31, 2024, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.0% of total investments. |

Material Fund changes

This is a summary of certain changes and planned changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s prospectus at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

On September 13, 2024, the Fund’s Board approved the reorganization of the Fund into a newly created ETF to be named iShares High Yield Muni Active ETF. The reorganization is expected to close as of the close of trading on the New York Stock Exchange on February 7, 2025. In connection with the reorganization, effective October 31, 2024, the Fund changed its fiscal year end from June 30 to October 31.

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock High Yield Municipal Fund

Class K Shares | MKYHX

Annual Shareholder Report — October 31, 2024

MKYHX-10/24-AR

(b) Not Applicable

| Item 2 – | Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762. |

| Item 3 – | Audit Committee Financial Expert – The registrant’s board of directors (the “board of directors”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent: |

Lorenzo A. Flores

Catherine A. Lynch

Arthur P. Steinmetz

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors.

| Item 4 – | Principal Accountant Fees and Services |

The following table presents fees billed by Deloitte & Touche LLP (“D&T”) in each of the last two fiscal years for the services rendered to the Fund:

| | | | | | | | | | | | | | | | |

| | | (a) Audit Fees | | (b) Audit-Related Fees1 | | (c) Tax Fees2 | | (d) All Other Fees4 |

| Entity Name | | Current Fiscal Year End3 | | Previous Fiscal Year End | | Current Fiscal Year End3 | | Previous Fiscal Year End | | Current Fiscal Year End3 | | Previous Fiscal Year End | | Current Fiscal Year End3 | | Previous Fiscal Year End |

| BlackRock High Yield Municipal Fund | | $74,576 | | $39,576 | | $0 | | $44 | | $15,080 | | $16,900 | | $407 | | $0 |

The following table presents fees billed by D&T that were required to be approved by the registrant’s audit committee (the “Committee”) for services that relate directly to the operations or financial reporting of the Fund and that are rendered on behalf of BlackRock Advisors, LLC ( the “Investment Adviser” or “BlackRock”) and entities controlling, controlled by, or under common control with BlackRock (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund (“Affiliated Service Providers”):

1

| | | | |

| | | Current Fiscal Year End3 | | Previous Fiscal Year End |

(b) Audit-Related Fees1 | | $0 | | $0 |

(c) Tax Fees2 | | $0 | | $0 |

(d) All Other Fees4 | | $2,149,000 | | $2,154,000 |

1 The nature of the services includes assurance and related services reasonably related to the performance of the audit or review of financial statements not included in Audit Fees, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators.

2 The nature of the services includes tax compliance and/or tax preparation, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, taxable income and tax distribution calculations.

3 The registrant changed its fiscal year end from June 30 to October 31 effective October 31, 2024 whereby this fiscal year consists of the three months ended October 31, 2024.

4 Non-audit fees of $2,149,000 and $2,154,000 for the current fiscal year and previous fiscal year, respectively, were paid to the Fund’s principal accountant in their entirety by BlackRock, in connection with services provided to the Affiliated Service Providers of the Fund and of certain other funds sponsored and advised by BlackRock or its affiliates for a service organization review and an accounting research tool subscription. These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The Committee has adopted policies and procedures with regard to the pre-approval of services. Audit, audit-related and tax compliance services provided to the registrant on an annual basis require specific pre-approval by the Committee. The Committee also must approve other non-audit services provided to the registrant and those non-audit services provided to the Investment Adviser and Affiliated Service Providers that relate directly to the operations and the financial reporting of the registrant. Certain of these non-audit services that the Committee believes are (a) consistent with the SEC’s auditor independence rules and (b) routine and recurring services that will not impair the independence of the independent accountants may be approved by the Committee without consideration on a specific case-by-case basis (“general pre-approval”). The term of any general pre-approval is 12 months from the date of the pre-approval, unless the Committee provides for a different period. Tax or other non-audit services provided to the registrant which have a direct impact on the operations or financial reporting of the registrant will only be deemed pre-approved provided that any individual project does not exceed $10,000 attributable to the registrant or $50,000 per project. For this purpose, multiple projects will be aggregated to determine if they exceed the previously mentioned cost levels.

Any proposed services exceeding the pre-approved cost levels will require specific pre-approval by the Committee, as will any other services not subject to general pre-approval (e.g., unanticipated but permissible services). The Committee is informed of each service approved subject to general pre-approval at the next regularly scheduled in-person board meeting. At this meeting, an analysis of such services is presented to the Committee for ratification. The Committee may delegate to the Committee Chairman the authority to approve the provision of and fees for any specific engagement of permitted non-audit services, including services exceeding pre-approved cost levels.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the Committee pursuant to the de minimis exception in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not Applicable

(g) The aggregate non-audit fees, defined as the sum of the fees shown under “Audit-Related Fees,” “Tax Fees” and “All Other Fees,” paid to the accountant for services rendered by the accountant to the registrant, the Investment Adviser and the Affiliated Service Providers were:

2

| | | | |

| Entity Name | | Current Fiscal Year End1 | | Previous Fiscal Year End |

| BlackRock High Yield Municipal Fund | | $15,487 | | $16,944 |

1 The registrant changed its fiscal year end from June 30 to October 31 effective October 31, 2024 whereby this fiscal year consists of the three months ended October 31, 2024.

Additionally, the amounts billed by D&T in connection with services provided to the Affiliated Service Providers of the Fund and of other funds sponsored or advised by BlackRock or its affiliates during the current and previous fiscal years for a service organization review and an accounting research tool subscription were:

| | | | |

| Entity Name | | Current Fiscal Year End1 | | Previous Fiscal Year End |

| BlackRock High Yield Municipal Fund | | $2,149,000 | | $2,154,000 |

1 The registrant changed its fiscal year end from June 30 to October 31 effective October 31, 2024 whereby this fiscal year consists of the three months ended October 31, 2024.

These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(h) The Committee has considered and determined that the provision of non-audit services that were rendered to the Investment Adviser and the Affiliated Service Providers that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable

(j) Not Applicable

| Item 5 – | Audit Committee of Listed Registrant – Not Applicable |

(a) The registrant’s Schedule of Investments is included as part of the Financial Statement and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

| Item 7 – | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

3

October 31, 2024

2024 Annual Financial Statements and Additional Information |

BlackRock Municipal Bond Fund, Inc. |

• BlackRock High Yield Municipal Fund |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Benefits and Risks of Leveraging

The Fund may utilize leverage to seek to enhance returns and net asset value (“NAV”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

The Fund may leverage its assets through the use of proceeds received in tender option bond (“TOB”) transactions, as described in the Notes to Financial Statements. In a TOB Trust transaction, the Fund transfers municipal bonds or other municipal securities into a special purpose entity (a “TOB Trust”). TOB investments generally provide the Fund with economic benefits in periods of declining short-term interest rates but expose the Fund to risks during periods of rising short-term interest rates. Additionally, fluctuations in the market value of municipal bonds deposited into a TOB Trust may adversely affect the Fund’s NAV per share.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by the Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Fund’s shareholders benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to the Fund’s shareholders, and the value of these portfolio holdings is reflected in the Fund’s per share NAV. However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed the Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Fund had not used leverage.

Furthermore, the value of the Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence the Fund’s NAV positively or negatively in addition to the impact on the Fund’s performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that the Fund’s leveraging strategy will be successful.

The use of leverage also generally causes greater changes in the Fund’s NAV and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of the Fund’s shares than if the Fund were not leveraged. In addition, the Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of the leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit the Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. The Fund incurs expenses in connection with the use of leverage, all of which are borne by the Fund’s shareholders and may reduce income.

Derivative Financial Instruments

The Fund may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Fund must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Fund’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

BlackRock High Yield Municipal Fund

The Benefits and Risks of Leveraging / Derivative Financial Instruments3

Schedule of InvestmentsOctober 31, 2024

BlackRock High Yield Municipal Fund(Percentages shown are based on Net Assets)

| | | |

|

| |

Black Belt Energy Gas District, RB(a) | | | |

Series A, 5.25%, 01/01/54 | | | |

Series A, 5.25%, 05/01/55 | | | |

Series C-1, 5.25%, 02/01/53 | | | |

Series F, 5.50%, 11/01/53 | | | |

Chelsea Park Cooperative District, SAB, 5.00%, 05/01/48 | | | |

County of Jefferson Alabama Sewer Revenue, Refunding RB, 5.25%, 10/01/49 | | | |

Energy Southeast A Cooperative District, RB, Series B, 5.25%, 07/01/54(a) | | | |

Hoover Industrial Development Board, RB, AMT, Sustainability Bonds, 6.38%, 11/01/50(a) | | | |

MidCity Improvement District, SAB | | | |

| | | |

| | | |

| | | |

Mobile County Industrial Development Authority, RB, Series A, AMT, 5.00%, 06/01/54 | | | |

Southeast Energy Authority A Cooperative District, RB, Series B-1, 5.00%, 05/01/53(a) | | | |

Sumter County Industrial Development Authority, RB, AMT, Sustainability Bonds, 6.00%, 07/15/52(a) | | | |

Tuscaloosa County Industrial Development Authority, Refunding RB, Series A, 5.25%, 05/01/44(b) | | | |

| | | |

| |

Arizona Industrial Development Authority, RB(b) | | | |

| | | |

Series A, 5.00%, 12/15/39 | | | |

Series A, 5.00%, 07/01/49 | | | |

Series A, 5.00%, 07/01/54 | | | |

Series B, 5.13%, 07/01/47 | | | |

Series B, 5.25%, 07/01/51 | | | |

Sustainability Bonds, 5.00%, 07/01/45 | | | |

Sustainability Bonds, 5.00%, 07/01/55 | | | |

Arizona Industrial Development Authority, Refunding | | | |

Series A, 5.00%, 07/01/26 | | | |

Series A, 5.50%, 07/01/52 | | | |

Glendale Industrial Development Authority, RB, 5.00%, 05/15/56 | | | |

Industrial Development Authority of the County of Pima, RB | | | |

| | | |

| | | |

Industrial Development Authority of the County of | | | |

| | | |

| | | |

La Paz County Industrial Development Authority, RB, 5.88%, 06/15/48(b) | | | |

Maricopa County Industrial Development Authority, RB | | | |

| | | |

| | | |

Series A, 3.00%, 09/01/51 | | | |

| | | |

| | | |

| |

Sierra Vista Industrial Development Authority, RB(b) | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Arkansas Development Finance Authority, RB | | | |

| | | |

| | | |

AMT, Sustainability Bonds, 7.38%, 07/01/48(b) | | | |

AMT, Sustainability Bonds, 5.70%, 05/01/53 | | | |

Series A, AMT, Sustainability Bonds, 6.88%, 07/01/48(b) | | | |

| | | |

| |

California Infrastructure & Economic Development Bank, RB, Series A-4, AMT, 8.00%, 01/01/50(a)(b) | | | |

California Municipal Finance Authority, ARB, AMT, Senior Lien, 4.00%, 12/31/47 | | | |

California Municipal Finance Authority, RB(b) | | | |

| | | |

| | | |

Series A, 5.00%, 05/01/34 | | | |

Series A, 5.50%, 05/01/44 | | | |

Series A, 5.75%, 05/01/54 | | | |

Series A, 5.88%, 05/01/59 | | | |

California Municipal Finance Authority, ST | | | |

Series A, 5.00%, 09/01/44 | | | |

Series A, 5.00%, 09/01/49 | | | |

Series A, 5.00%, 09/01/54 | | | |

California Statewide Financing Authority, RB, Series L, 0.00%, 06/01/55(b)(c) | | | |

City of Los Angeles Department of Airports, Refunding ARB, AMT, 5.25%, 05/15/47 | | | |

CSCDA Community Improvement Authority, RB, M/F | | | |

Series A, 3.00%, 09/01/56 | | | |

Mezzanine Lien, 4.00%, 03/01/57 | | | |

Series B, Mezzanine Lien, Sustainability Bonds, 4.00%, 12/01/59 | | | |

Series B, Sub Lien, Sustainability Bonds, 4.00%, 12/01/59 | | | |

Sustainability Bonds, 4.00%, 07/01/56 | | | |

Sustainability Bonds, 4.00%, 07/01/58 | | | |

Series B, Sustainability Bonds, 4.00%, 07/01/58 | | | |

Golden State Tobacco Securitization Corp., Refunding RB, CAB, Series B-2, Subordinate, 0.00%, 06/01/66(c) | | | |

Hastings Campus Housing Finance Authority, RB, CAB, Sub-Series A, Sustainability Bonds, 6.75%, 07/01/61(b)(d) | | | |

Inland Empire Tobacco Securitization Corp., RB, Series C-1, 0.00%, 06/01/36(c) | | | |

Rancho Mirage Community Facilities District, ST | | | |

Series A, 5.00%, 09/01/49 | | | |

Series A, 5.00%, 09/01/54 | | | |

42024 BlackRock Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

BlackRock High Yield Municipal Fund(Percentages shown are based on Net Assets)

| | | |

| |

San Diego County Regional Airport Authority, ARB, Series B, AMT, Subordinate, 4.00%, 07/01/56 | | | |

San Francisco City & County Redevelopment Agency Successor Agency, TA, CAB, Series D, 0.00%, 08/01/31(b)(c) | | | |

| | | |

| |

Aurora Crossroads Metropolitan District No. 2, GOL | | | |

Series A, 5.00%, 12/01/40 | | | |

Series A, 5.00%, 12/01/50 | | | |

Aviation Station North Metropolitan District No. 2, GOL, Series A, 5.00%, 12/01/39 | | | |

Banning Lewis Ranch Metropolitan District No. 8, GOL, 4.88%, 12/01/51(b) | | | |

Baseline Metropolitan District No. 1, GO, Series B, 6.75%, 12/15/54 | | | |

Canyons Metropolitan District No 5 Refunding GOL, Series B, 6.50%, 12/01/54 | | | |

Cascade Ridge Metropolitan District, GOL, 5.00%, 12/01/51 | | | |

Centerra Metropolitan District No. 1, TA, 5.00%, 12/01/47(b) | | | |

City & County of Denver Colorado Airport System Revenue, Refunding ARB, Series A, AMT, 4.13%, 11/15/53 | | | |

Colorado Educational & Cultural Facilities Authority, Refunding RB, 4.00%, 12/01/30(b) | | | |

Colorado Health Facilities Authority, RB | | | |

| | | |

| | | |

Series A, 5.00%, 05/15/35 | | | |

Series A, 5.00%, 05/15/44 | | | |

Series A, 5.00%, 05/15/49 | | | |

Constitution Heights Metropolitan District, Refunding GOL, 5.00%, 12/01/49 | | | |

Eagle Brook Meadows Metropolitan District No. 3, GOL, Series 2021, 5.00%, 12/01/51 | | | |

Four Corners Business Improvement District, GOL, 6.00%, 12/01/52 | | | |

Green Valley Ranch East Metropolitan District No. 6, GOL, Series A, 5.88%, 12/01/50 | | | |

Home Place Metropolitan District, GOL, Series A, 5.75%, 12/01/50 | | | |

Horizon Metropolitan District No. 2, GOL, 4.50%, 12/01/51(b) | | | |

Jefferson Center Metropolitan District No. 1, RB | | | |

Series A-2, 4.13%, 12/01/40 | | | |

Series A-2, 4.38%, 12/01/47 | | | |

Karl’s Farm Metropolitan District No. 2, GOL(b)(e) | | | |

Series A, 5.38%, 09/01/25 | | | |

Series A, 5.63%, 09/01/25 | | | |

Lanterns Metropolitan District No. 2, GOL, Series A, 4.50%, 12/01/50 | | | |

Longs Peak Metropolitan District, GOL, 5.25%, 12/01/51(b) | | | |

Loretto Heights Community Authority, RB, 4.88%, 12/01/51 | | | |

North Holly Metropolitan District, GOL, Series A, 5.50%, 12/01/48 | | | |

| | | |

| |

North Range Metropolitan District No. 3, GOL, Series A, 5.25%, 12/01/50 | | | |

Palisade Metropolitan District No. 2, GOL, Subordinate, 7.25%, 12/15/49 | | | |

Pomponio Terrace Metropolitan District, GOL, Series A, 5.00%, 12/01/49 | | | |

Poudre Heights Valley Metropolitan District, GOL, Series A, 5.50%, 12/01/54(b) | | | |

Prairie Farm Metropolitan District, GOL, Series A, 5.25%, 12/01/48 | | | |

Pueblo Urban Renewal Authority, TA, 4.75%, 12/01/45(b) | | | |

Reunion Metropolitan District, RB, Series A, 3.63%, 12/01/44 | | | |

Riverpark Metropolitan District/Arapahoe County, GOL | | | |

| | | |

| | | |

Sky Ranch Community Authority Board, RB, Series A, 5.75%, 12/01/52 | | | |

St. Vrain Lakes Metropolitan District No. 4, GOL, Series A, 6.75%, 09/20/54(b)(d) | | | |

Sterling Ranch Community Authority Board, RB, Series B, Subordinate, 7.13%, 12/15/50 | | | |

Timberleaf Metropolitan District, GOL, Series A, 5.75%, 12/01/50 | | | |

Waters’ Edge Metropolitan District No. 2, GOL, 5.00%, 12/01/51 | | | |

Westcreek Metropolitan District No. 2, GOL, Series A, 5.38%, 12/01/48 | | | |

Wild Plum Metropolitan District, GOL, Series A, 5.00%, 12/01/24(e) | | | |

| | | |

| |

Connecticut State Health & Educational Facilities Authority, RB | | | |

Series A, 5.00%, 01/01/45(b) | | | |

Series A, 5.00%, 01/01/55(b) | | | |

Series A, Sustainability Bonds, 5.38%, 07/01/54 | | | |

Mohegan Tribal Finance Authority, RB, 7.00%, 02/01/45(b) | | | |

| | | |

| |

Affordable Housing Opportunities Trust, RB, Series AH-01, Class B, 6.88%, 05/01/39(b) | | | |

County of Kent Delaware, RB, Series A, 5.00%, 07/01/53 | | | |

Town of Bridgeville Delaware, ST(b) | | | |

| | | |

| | | |

Town of Milton Delaware, ST(b) | | | |

| | | |

| | | |

| | | |

District of Columbia — 1.5% | |

District of Columbia Tobacco Settlement Financing | | | |

Series B, 0.00%, 06/15/46 | | | |

Series C, 0.00%, 06/15/55 | | | |

Schedule of Investments (continued)October 31, 2024

BlackRock High Yield Municipal Fund(Percentages shown are based on Net Assets)

| | | |

District of Columbia (continued) | |

District of Columbia Tobacco Settlement Financing Corp., Refunding RB, 6.75%, 05/15/40 | | | |

District of Columbia, RB, Series A, AMT, Sustainability Bonds, 5.50%, 02/28/37 | | | |

District of Columbia, Refunding RB, 5.00%, 06/01/46 | | | |

Metropolitan Washington Airports Authority Dulles Toll Road Revenue, Refunding RB | | | |

Series B, 2nd Lien, (AGC), 0.00%, 10/01/30(c) | | | |

Series B, Subordinate, 4.00%, 10/01/49 | | | |

| | | |

| |

Antillia Community Development District, SAB | | | |

| | | |

| | | |

Avenir Community Development District, SAB, 4.75%, 11/01/50(b) | | | |

Babcock Ranch Community Independent Special District, SAB | | | |

Series 2022, 5.00%, 05/01/42 | | | |

Series 2022, 5.00%, 05/01/53 | | | |

Bella Collina Community Development District, SAB | | | |

| | | |

| | | |

Berry Bay II Community Development District, SAB | | | |

Series 2024, 5.20%, 05/01/44 | | | |

Series 2024, 5.45%, 05/01/54 | | | |

Boggy Creek Improvement District, Refunding SAB, Series 2013, 5.13%, 05/01/43 | | | |

Brevard County Health Facilities Authority, Refunding | | | |

| | | |

| | | |

Buckhead Trails Community Development District, SAB | | | |

| | | |

| | | |

Series 2022, 5.63%, 05/01/42 | | | |

Series 2022, 5.75%, 05/01/52 | | | |

Cabot Citrus Farms Community Development District, SAB, 5.25%, 03/01/29 | | | |

Capital Projects Finance Authority, RB(b) | | | |

| | | |

| | | |

Capital Region Community Development District, Refunding SAB, Series A-1, 5.13%, 05/01/39 | | | |

Capital Trust Agency, Inc., RB | | | |

| | | |

| | | |

Series A, 5.00%, 06/15/49(b) | | | |

Series A, 5.00%, 12/15/49 | | | |

Series A, 5.75%, 06/01/54(b) | | | |

Series A, 5.00%, 12/15/54 | | | |

Series B, 0.00%, 01/01/35(c) | | | |

Series B, 0.00%, 01/01/60(c) | | | |

Capital Trust Agency, Inc., RB, CAB, 0.00%, 07/01/61(b)(c) | | | |

Capital Trust Authority, RB(b) | | | |

| | | |

| | | |

| | | |

| |

Celebration Pointe Community Development District No. 1, SAB, 5.00%, 05/01/34 | | | |

Central Parc Community Development District, SAB | | | |

| | | |

| | | |

Charles Cove Community Development District, SAB, 4.38%, 05/01/50 | | | |

Charlotte County Industrial Development Authority, RB, 5.00%, 10/01/49(b) | | | |

City of Tampa Florida, Refunding SAB, Series 2015-2, 6.61%, 05/01/40(d) | | | |

Collier County Industrial Development Authority, Refunding RB, Series A, 8.13%, 05/15/44(b)(f)(g) | | | |

Coral Creek Community Development District, SAB, 5.75%, 05/01/54 | | | |

County of Lake Florida, RB, 5.00%, 01/15/49(b) | | | |

County of Osceola Florida Transportation Revenue, | | | |

Series A-2, 0.00%, 10/01/48 | | | |

Series A-2, 0.00%, 10/01/49 | | | |

Crossings Community Development District, SAB, 5.60%, 05/01/54 | | | |

Crosswinds East Community Development District, SAB, 5.75%, 05/01/54 | | | |

Darby Community Development District, SAB, Series A-2, 5.88%, 05/01/35 | | | |

Elevation Pointe Community Development District, SAB | | | |

Series A-1, 4.40%, 05/01/42 | | | |

Series A-1, 4.60%, 05/01/52 | | | |

Series A-2, 4.40%, 05/01/32 | | | |

Escambia County Health Facilities Authority, Refunding RB | | | |

| | | |

| | | |

Florida Development Finance Corp., RB | | | |

| | | |

| | | |

Series A, 5.75%, 06/15/29(b) | | | |

Series A, 6.00%, 06/15/34(b) | | | |

Series A, 4.00%, 06/15/52 | | | |

Series A, 5.00%, 06/15/56 | | | |

Series A, 5.13%, 06/15/55(b) | | | |

Series B, 4.50%, 12/15/56(b) | | | |

Series C, 5.75%, 12/15/56(b) | | | |

| | | |

AMT, 6.13%, 07/01/32(a)(b) | | | |

Class A, AMT, 4.38%, 10/01/54(a)(b) | | | |

Class A, AMT, 8.25%, 07/01/57(a)(b) | | | |

Florida Development Finance Corp., Refunding RB | | | |

Series A, 4.00%, 06/01/46(b) | | | |

Series A, 4.00%, 06/01/55(b) | | | |

AMT, 12.00%, 07/15/32(a)(b) | | | |

AMT, (AGM), 5.25%, 07/01/53 | | | |

Gardens at Hammock Beach Community Development District, SAB | | | |

Series 1, 4.80%, 05/01/31 | | | |

Series 1, 5.38%, 05/01/44 | | | |

Series 1, 5.65%, 05/01/54 | | | |

Series 2, 5.00%, 05/01/31 | | | |

62024 BlackRock Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

BlackRock High Yield Municipal Fund(Percentages shown are based on Net Assets)

| | | |

| |

Gardens at Hammock Beach Community Development District, SAB (continued) | | | |

Series 2, 5.60%, 05/01/44 | | | |

Series 2, 5.88%, 05/01/55 | | | |

Golden Gem Community Development District, SAB | | | |

| | | |

| | | |

| | | |

Grand Oaks Community Development District, SAB | | | |

| | | |

| | | |

Hammock Oaks Community Development District, SAB | | | |

| | | |

| | | |

Hills of Minneola Community Development District, | | | |

| | | |

| | | |

Hobe-St Lucie Conservancy District, SAB, 5.88%, 05/01/55 | | | |

Hyde Park Community Development District No. 1, SAB | | | |

Series A, 4.75%, 05/01/31 | | | |

Series A, 5.35%, 05/01/44 | | | |

Series A, 5.63%, 05/01/55 | | | |

Lakes of Sarasota Community Development District, SAB | | | |

Series A, 4.75%, 05/01/31 | | | |

Series A, 5.30%, 05/01/44 | | | |

Series A, 5.60%, 05/01/55 | | | |

Lakeside Preserve Community Development District, SAB, Series 2023, 6.38%, 05/01/54 | | | |

Lakewood Ranch Stewardship District, SAB | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Series 1A, 4.25%, 05/01/28 | | | |

Series 1A, 5.00%, 05/01/38 | | | |

Series 1A, 5.10%, 05/01/48 | | | |

Series 1B, 4.75%, 05/01/29 | | | |

Series 1B, 5.30%, 05/01/39 | | | |

Series 1B, 5.45%, 05/01/48 | | | |

Lee County Industrial Development Authority, RB, Series B-1, 4.75%, 11/15/29 | | | |

LT Ranch Community Development District, SAB | | | |

| | | |

| | | |

LTC Ranch West Residential Community Development District, Refunding SAB | | | |

| | | |

| | | |

LTC Ranch West Residential Community Development District, SAB | | | |

Series AA2, 5.70%, 05/01/44 | | | |

| | | |

| |

LTC Ranch West Residential Community Development District, SAB (continued) | | | |

Series AA2, 6.00%, 05/01/54 | | | |

Malabar Springs Community Development District, SAB | | | |

| | | |

| | | |

Marion Ranch Community Development District, SAB | | | |

| | | |

| | | |

| | | |

Midtown Miami Community Development District, Refunding SAB, Series A, 5.00%, 05/01/37 | | | |

Normandy Community Development District, SAB, 5.55%, 05/01/54(b) | | | |

North AR-1 Pasco Community Development District, SAB | | | |

Series A, 5.75%, 05/01/44 | | | |

Series A, 6.00%, 05/01/54 | | | |

North River Ranch Community Development District, SAB | | | |

Series A-1, 4.00%, 05/01/40 | | | |

Series A-1, 4.25%, 05/01/51 | | | |

Series A-2, 4.20%, 05/01/35 | | | |

Parrish Lakes Community Development District, SAB | | | |

| | | |

| | | |

| | | |

Parrish Plantation Community Development District, SAB | | | |

| | | |

| | | |

| | | |

Poitras East Community Development District, SAB | | | |

| | | |

| | | |

Sandridge Community Development District, SAB, Series A1, 4.00%, 05/01/51 | | | |

Sawyers Landing Community Development District, SAB, 4.25%, 05/01/53 | | | |

Seminole County Industrial Development Authority, Refunding RB, 5.75%, 11/15/54 | | | |

Seminole Palms Community Development District, SAB, 5.50%, 05/01/55(b) | | | |

Shadowlawn Community Development District, SAB, 5.85%, 05/01/54 | | | |

Somerset Bay Community Development District, | | | |

| | | |

| | | |

| | | |

South Broward Hospital District, RB, (BAM-TCRS), 3.00%, 05/01/51 | | | |

Southern Groves Community Development District No. 5, SAB | | | |

| | | |

| | | |

| | | |

Talavera Community Development District, SAB, 4.35%, 05/01/40 | | | |

Schedule of Investments (continued)October 31, 2024

BlackRock High Yield Municipal Fund(Percentages shown are based on Net Assets)

| | | |

| |

Tolomato Community Development District, Refunding SAB, Series A-2, 4.25%, 05/01/37 | | | |

Tolomato Community Development District, SAB, Series 2015-3, 6.61%, 05/01/40(f)(g) | | | |

Trout Creek Community Development District, SAB | | | |

| | | |

| | | |

Two Rivers West Community Development District, | | | |

Series 2024, 4.80%, 05/01/31 | | | |

Series 2024, 5.63%, 05/01/44 | | | |

Series 2024, 5.88%, 05/01/54 | | | |

V-Dana Community Development District, SAB, 4.00%, 05/01/40(b) | | | |

Village Community Development District No. 14, SAB | | | |

| | | |

| | | |

Village Community Development District No. 15, | | | |

| | | |

| | | |

Volusia County Educational Facility Authority, RB, 5.25%, 06/01/49 | | | |

West Villages Improvement District, SAB | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Westside Haines City Community Development District, SAB, 6.00%, 05/01/54 | | | |

| | | |

| |

Atlanta Development Authority, TA(b) | | | |

Series A, 5.00%, 04/01/34 | | | |

Series A, 5.50%, 04/01/39 | | | |

Atlanta Urban Redevelopment Agency, RB, 3.88%, 07/01/51(b) | | | |

Development Authority of Cobb County, RB, Series A, 6.38%, 06/15/58(b) | | | |

East Point Business & Industrial Development Authority, RB, Series A, 5.25%, 06/15/62(b) | | | |

Main Street Natural Gas, Inc., RB, Series A, 5.00%, 06/01/53(a) | | | |

Municipal Electric Authority of Georgia, RB | | | |

Series A, 5.00%, 01/01/49 | | | |

Series A, 5.00%, 07/01/52 | | | |

| | | |

| |

Idaho Health Facilities Authority, Refunding RB, 3.50%, 09/01/33 | | | |

Idaho Housing & Finance Association, RB(b) | | | |

Series A, 6.00%, 07/01/39 | | | |

Series A, 6.00%, 07/01/49 | | | |

Series A, 6.00%, 07/01/54 | | | |

Series A, 6.95%, 06/15/55 | | | |

| | | |

| |

Idaho Housing & Finance Association, RB(b) (continued) | | | |

Series C, 5.00%, 12/01/46 | | | |

Power County Industrial Development Corp., RB, 6.45%, 08/01/32 | | | |

| | | |

| |

Chicago Board of Education, GO | | | |

Series A, 5.00%, 12/01/42 | | | |

Series D, 5.00%, 12/01/46 | | | |

Chicago Board of Education, Refunding GO | | | |

Series B, 4.00%, 12/01/35 | | | |

Series B, 4.00%, 12/01/41 | | | |

Chicago Transit Authority Sales Tax Receipts Fund, Refunding RB, Series A, 2nd Lien, 5.00%, 12/01/57 | | | |

Illinois Finance Authority, Refunding RB | | | |

| | | |

| | | |

Illinois State Toll Highway Authority, RB, Series A, 5.00%, 01/01/46 | | | |

Metropolitan Pier & Exposition Authority, Refunding RB, 4.00%, 06/15/50 | | | |

State of Illinois, GO, 5.50%, 05/01/39 | | | |

| | | |

| |

City of Valparaiso Indiana, Refunding RB, AMT, 4.50%, 01/01/34(b) | | | |

City of Vincennes Indiana, Refunding RB, 6.25%, 01/01/29(b)(f)(g) | | | |

Indiana Finance Authority, RB, Series A, AMT, 6.75%, 05/01/39 | | | |

Indiana Finance Authority, Refunding RB, Series A, 5.50%, 09/15/44 | | | |

Indianapolis Local Public Improvement Bond Bank, RB, Series E, 6.00%, 03/01/53 | | | |

| | | |

| |

Iowa Higher Education Loan Authority, Refunding RB, 5.50%, 11/01/51 | | | |

| |

City of Shawnee Kansas, RB | | | |

| | | |

| | | |

| | | |

| |

City of Henderson Kentucky, RB | | | |

Series A, AMT, 4.70%, 01/01/52 | | | |

Series B, AMT, 4.45%, 01/01/42 | | | |

Series B, AMT, 4.70%, 01/01/52 | | | |

| | | |

| |

Louisiana Public Facilities Authority, RB | | | |

Series A, 5.25%, 06/01/51(b) | | | |

Series A, 5.25%, 06/01/60(b) | | | |

Series A, 6.50%, 06/01/62(b) | | | |

| | | |

82024 BlackRock Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

BlackRock High Yield Municipal Fund(Percentages shown are based on Net Assets)

| | | |

| |

Louisiana Public Facilities Authority, RB (continued) | | | |

Class R2, AMT, 6.50%, 10/01/53(a)(b) | | | |

Parish of St. James Louisiana, RB, Series 2, 6.35%, 07/01/40(b) | | | |

| | | |

| |

Finance Authority of Maine, RB, AMT, Sustainability Bonds, 8.00%, 12/01/51(b) | | | |

Maine Health & Higher Educational Facilities Authority, RB, Series A, 4.00%, 07/01/50 | | | |

Maine Health & Higher Educational Facilities Authority, Refunding RB, 4.00%, 07/01/37(b) | | | |

| | | |

| |

City of Baltimore Maryland, RB | | | |

| | | |

| | | |

City of Baltimore Maryland, Refunding RB, Convertible, 5.00%, 09/01/46 | | | |

Maryland Economic Development Corp., TA, 4.00%, 09/01/50 | | | |

Maryland Health & Higher Educational Facilities Authority, RB, 7.00%, 03/01/55(b) | | | |

| | | |

| |

Massachusetts Development Finance Agency, RB, Series D, Sustainability Bonds, 4.00%, 07/01/45 | | | |

Massachusetts Development Finance Agency, | | | |

| | | |

| | | |

| | | |

| |

Advanced Technology Academy, 3.50%, 11/01/24 | | | |

Advanced Technology Academy, Refunding RB, 5.00%, 11/01/44 | | | |

Michigan Strategic Fund, RB | | | |

| | | |

| | | |

AMT, Sustainability Bonds, 4.00%, 10/01/61(a) | | | |

| | | |

| |

Duluth Economic Development Authority, Refunding RB, Series A, 5.25%, 02/15/58 | | | |

| |

Industrial Development Authority of the City of St. Louis Missouri, Refunding RB | | | |

Series A, 4.88%, 06/15/34 | | | |

Series A, 4.38%, 11/15/35 | | | |

Series A, 5.75%, 06/15/54 | | | |

Kansas City Industrial Development Authority, RB | | | |

Series A-1, 5.00%, 06/01/46(b) | | | |

Series A-1, 5.00%, 06/01/54(b) | | | |

Series C, 7.50%, 11/15/46 | | | |

| | | |

| |

Kansas City Industrial Development Authority, Refunding RB | | | |

| | | |

| | | |

Kansas City Land Clearance Redevelopment Authority, TA, Series B, 5.00%, 02/01/40(b) | | | |

| | | |

| |

Central Plains Energy Project, 5.00%, (a) | | | |

| |

City of Las Vegas Nevada Special Improvement District No. 613, SAB | | | |

| | | |

| | | |

City of Las Vegas Nevada Special Improvement District No. 815, SAB, 5.00%, 12/01/49 | | | |

State of Nevada Department of Business & Industry, RB, Series A4, AMT, 8.13%, 01/01/50(a) | | | |

Tahoe-Douglas Visitors Authority, RB | | | |

| | | |

| | | |

| | | |

| |

New Hampshire Business Finance Authority, RB | | | |

| | | |

| | | |

Series A, 4.13%, 08/15/40 | | | |

Series A, 4.25%, 08/15/46 | | | |

Series A, 4.50%, 08/15/55 | | | |

New Hampshire Business Finance Authority, RB, M/F Housing, Series 2, Sustainability Bonds, 4.25%, 07/20/41 | | | |

| | | |

| |

Industrial Pollution Control Financing Authority of Gloucester County, Refunding RB, Series A, AMT, 5.00%, 12/01/24(h) | | | |

New Jersey Economic Development Authority, RB | | | |

| | | |

Series A, 5.00%, 07/01/37 | | | |

Series A, 5.25%, 11/01/54(b) | | | |

Series B, 6.50%, 04/01/31 | | | |

New Jersey Health Care Facilities Financing Authority, RB, 4.00%, 07/01/51 | | | |

New Jersey Higher Education Student Assistance Authority, RB, Series B, AMT, 4.25%, 12/01/45 | | | |

| | | |

| |

Albany Capital Resource Corp., Refunding RB, 4.00%, 07/01/41(f)(g) | | | |

Build NYC Resource Corp., RB | | | |

Series A, 5.00%, 07/01/32 | | | |

Series A, 5.13%, 07/01/33 | | | |

Series A, 6.13%, 07/01/43 | | | |

Series A, 6.38%, 07/01/53 | | | |

Schedule of Investments (continued)October 31, 2024

BlackRock High Yield Municipal Fund(Percentages shown are based on Net Assets)

| | | |

| |

Build NYC Resource Corp., Refunding RB, AMT, 5.00%, 01/01/35(b) | | | |

Huntington Local Development Corp., RB, Series A, 5.25%, 07/01/56 | | | |

New York City Housing Development Corp., RB, M/F Housing | | | |

Series C-1A, 4.20%, 11/01/44 | | | |

Series C-1A, 4.30%, 11/01/47 | | | |

New York Liberty Development Corp., Refunding RB | | | |

| | | |

Series 1, 2.75%, 02/15/44 | | | |

Series A, Sustainability Bonds, 3.00%, 11/15/51 | | | |

New York State Dormitory Authority, Refunding RB, Series A, 3.00%, 03/15/51 | | | |

New York Transportation Development Corp., ARB | | | |

| | | |

| | | |

| | | |

New York Transportation Development Corp., RB | | | |

| | | |

| | | |

AMT, Sustainability Bonds, 5.50%, 06/30/54 | | | |

New York Transportation Development Corp., Refunding ARB, Series A, AMT, 5.38%, 08/01/36 | | | |

Oneida Indian Nation of New York, RB, Series B, 6.00%, 09/01/43(b) | | | |

Suffolk Regional Off-Track Betting Co., RB | | | |

| | | |

| | | |

| | | |

Westchester County Local Development Corp., Refunding RB | | | |

| | | |

| | | |

Series A, 5.13%, 07/01/55 | | | |

Westchester Tobacco Asset Securitization Corp., Refunding RB | | | |

Sub-Series C, 4.00%, 06/01/42 | | | |

Sub-Series C, 5.13%, 06/01/51 | | | |

| | | |

| |

City of Grand Forks North Dakota, RB, Series A, (AGM), 5.00%, 12/01/48 | | | |

County of Cass North Dakota, Refunding RB, Series B, 5.25%, 02/15/58 | | | |

| | | |

| |

Buckeye Tobacco Settlement Financing Authority Refunding RB, 0.00%, 06/01/57(c) | | | |

County of Hamilton Ohio, Refunding RB, 5.00%, 01/01/46 | | | |

County of Hardin Ohio, Refunding RB | | | |

| | | |

| | | |

| | | |

Hickory Chase Community Authority, Refunding RB, 5.00%, 12/01/40(b) | | | |

| | | |

| |

Ohio Air Quality Development Authority, RB, AMT, 5.00%, 07/01/49(b) | | | |

Ohio Higher Educational Facility Commission, Refunding RB, 4.00%, 10/01/47 | | | |

Port of Greater Cincinnati Development Authority, RB, 4.25%, 12/01/50(b) | | | |

| | | |

| |

Oklahoma Development Finance Authority, RB | | | |

| | | |