Item 1. Report to Stockholders:

- -------------------------------

The following is a copy of the report transmitted to stockholders pursuant

to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their advisors can build diversified portfolios.

A commitment to doing what’s right for investors

We have below-average expenses and stringent investor protections, and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial advisors, make informed investment decisions with confidence.

| Putnam | |

| High Yield | |

| Trust | |

| 8 | 31 | 05 | |

| Annual Report | |

| Message from the Trustees | 2 |

| About the fund | 4 |

| Report from the fund managers | 7 |

| Performance | 12 |

| Expenses | 15 |

| Portfolio turnover | 17 |

| Risk | 18 |

| Your fund’s management | 19 |

| Terms and definitions | 22 |

| Trustee approval of management contract | 24 |

| Other information for shareholders | 29 |

| Financial statements | 30 |

| Federal tax information | 76 |

| About the Trustees | 77 |

| Officers | 83 |

Cover photograph: North Middle Falls, Silver Creek State Park, Oregon © ; Richard H. Johnson

| Message from the Trustees |

Dear Fellow Shareholder

During the period ended August 31, 2005, stock and bond markets continued to reflect the moderate growth of the U.S. economy and the strength of corporate profits. The initial impact of the unusually active 2005 hurricane season on the markets appeared relatively minor, but there is widespread concern about the effect the devastation will have on the economy going forward. The Federal Reserve Board’s more restrictive monetary policy, along with high energy prices, had already begun to influence the U.S. markets. Whether this policy will be adjusted in the aftermath of the hurricanes remains to be seen. Amid the uncertainties of this environment, the professional research, diversification, and active management that mutual funds provide continue to make them an intelligent choice for investors.

We want you to know that Putnam Investments’ management team, under the leadership of Chief Executive Officer Ed Haldeman, continues to focus on investment performance and remains committed to putting the interests of shareholders first. In keeping with these goals, we have redesigned and expanded our shareholder reports to make it easier for you to learn more about your fund. Furthermore, on page 24 we provide information about the 2005 approval by the Trustees of your fund’s management contract with Putnam.

We would also like to take this opportunity to announce the retirement of one of your fund’s Trustees, Ronald J. Jackson, who has been an independent Trustee of the Putnam funds since 1996. We thank him for his service.

2

In the following pages, members of your fund’s management team discuss the fund’s performance and strategies, and their outlook for the months ahead. As always, we thank you for your support of the Putnam funds.

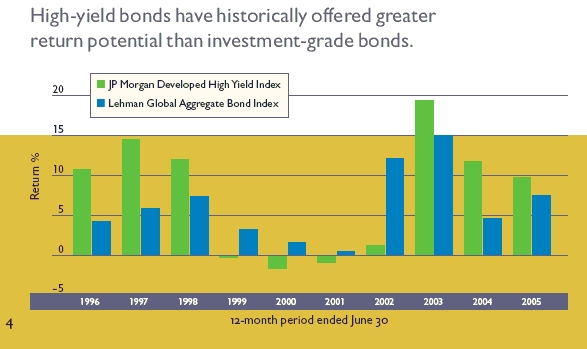

Putnam High Yield Trust: a disciplined approach to seeking high current income and capital growth

Unlike most types of fixed-income investments, high-yield bonds are more dependent on the performance of issuing companies than on interest rates. For this reason, distinguishing between opportunities and pitfalls requires a rigorous investment process. With Putnam High Yield Trust, this process is highlighted by exhaustive research, investment diversification, and timely portfolio adjustments.

Because of the risks of high-yield bond investing, in-depth credit research is essential. The fund’s research team — more than 20 professionals, including analysts who specialize by industry — visits with the management of issuing companies and analyzes each company’s profitability. The team then compares this information, along with each bond’s independent credit rating, to the bond’s stated yield before deciding whether it is an appropriate investment for the fund.

The fund’s portfolio typically consists of a broad range of industries and companies. Holdings are diversified across industry sectors and among bonds with different credit ratings. While the fund invests primarily in the bonds of U.S. companies, its diversified approach allows it to include foreign bonds as well. Among these securities, investments in emerging-market bonds can enhance the fund’s appreciation potential. Although diversification does not ensure a profit or protect against a loss and it is possible to lose money in a diversified portfolio, the fund’s diversification can help reduce the volatility that typically comes with higher-risk investments.

As the bond markets shift over time, the fund’s management team looks for ways to capitalize on developments that affect fixed-income securities in general and high-yield bonds in particular. For example, when interest

rates are low, the fund may pursue the higher income potential offered by lower-quality issues. On the other hand, when interest rates are on the rise, yield spreads — that is, the difference in yield between higher- and lower-rated bonds of comparable maturities —typically narrow. In response, the fund may shift its emphasis to higher-quality high-yield bonds.

Lower-rated bonds may offer higher yields in return for more risk. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

What makes a bond “high yield”?

High-yield bonds are fixed-income investments typically issued by companies that lack an established earnings track record or a solid credit history. In general, high-yield bonds offer higher interest rates than investment-grade bonds to compensate for their increased risk. Because of this added risk, these bonds are rated below investment grade by an independent rating agency (for example, the lowest Moody’s Investors Service rating of investment-grade bonds is Baa). The lower the rating, the greater the possibility that a bond’s issuer will be unable to make interest payments or repay the principal.

| BOND RATINGS | |

| Moody’s | Grade |

| Aaa | Investment |

| Aa | Investment |

| Baa | Investment |

| Ba, B | High yield |

| Caa/Ca | High yield |

| C | High yield |

Putnam High Yield Trust seeks high current income through a portfolio of higher-yielding, lower-rated corporate bonds diversified across different industry sectors. It has a secondary objective of capital growth when consistent with high current income. This fund may be suitable for investors who can accept a higher level of risk in exchange for a potentially higher level of income than that available from higher-quality bonds.

| Highlights |

- For the 12 months ended August 31, 2005, Putnam High Yield Trust’s class A shares returned 9.28% without sales charges.

- The fund’s new benchmark, the JP Morgan Developed High Yield Index, returned 8.83%, while its old benchmark, the JP Morgan Global High Yield Index, returned 9.20%.

- The average return for the fund’s Lipper category, High Current Yield Funds, was 8.28%.

- See the Performance Summary beginning on page 12 for additional fund performance, comparative performance, and Lipper data.

| Performance |

Total return for class A shares for periods ended 8/31/05

| Since the fund's inception (2/14/78), average annual return is 9.24% at NAV and 9.06% at POP. | ||||

| Average annual return | Cumulative return | |||

| NAV | POP | NAV | POP | |

| 10 years | 6.10% | 5.61% | 80.74% | 72.55% |

| 5 years | 6.70 | 5.71 | 38.30 | 32.03 |

| 1 year | 9.28 | 4.31 | 9.28 | 4.31 |

Data is historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Returns at NAV do not reflect a sales charge of 4.50% . For the most recent month-end performance, visit www.putnam.com. A short-term trading fee of up to 2% may apply.

6

Report from the fund managers

The year in review

During the 2005 fiscal year, your fund posted solid results in line with its old benchmark, the JP Morgan Global High Yield Index, and slightly led its new benchmark, the JP Morgan Developed High Yield Index, based on results at net asset value (NAV, or without sales charges). Your fund’s results were also ahead of the average for the fund’s Lipper peer group of High Current Yield Funds. Overall, your fund benefited from successful security selection and from underweighting industries that underperformed, such as airlines, autos, and paper and packaging. An overweight position relative to the index in energy exploration and production companies boosted performance, as did the fund’s small allocations to emerging-market bonds and senior-secured floating-rate bank loans.

| Market overview |

High-yield bonds enjoyed a relatively strong run during your fund’s fiscal year, propelled by consistently solid corporate business fundamentals. For most of the year, the gradual tightening of the yield spread — or advantage — offered by high-yield bonds over Treasury bonds with comparable maturities also contributed to the favorable environment. The Federal Reserve Board (the Fed) continued its steady program of boosting short-term interest rates, although these moves did not translate into any meaningful increases in yields for longer-term bonds. Furthermore, the Fed’s monetary policy — as is often the case — had less influence on the high-yield market than the underlying positive health of corporate business fundamentals. Performance among high-yield bonds also was helped by steady consolidation activity, as several high-yield companies were acquired by investment-grade firms, resulting in an upgrade of their credit ratings, which typically leads to price appreciation.

Although returns for the fiscal year were healthy, high-yield bonds struggled from mid-March to mid-May when yield spreads widened significantly.

7

This sell-off was sparked by two factors. First, strong global economic activity coupled with record-high energy prices fueled fears that inflationary pressures might build to the point where the Fed might act more aggressively, raising short-term rates more quickly than anticipated. In addition, market participants sought to come to terms with the downgrades of General Motors and Ford bonds, and the automakers’ subsequent entry into the high-yield universe. In the end, these concerns subsided and the high-yield market recovered from the middle of May through the end of August, with yield spreads ending at narrower levels than they were at the beginning of the fund’s fiscal year.

Strategy overview

After having emphasized the lower-quality tiers of the high-yield bond universe during the past two fiscal years, we gradually worked to upgrade the overall credit quality of the portfolio during the year just ended. We did so in response to the Fed’s continued tightening of short-term interest rates —which we felt would start to dampen economic growth — and because the narrowing of yield spreads meant that high-yield bond investors were not, in our opinion, being compensated appropriately for the additional risk inherent in owning these securities. In terms of industries, the fund had an overweighted position in the energy industry, which enjoyed positive supply/demand dynamics, as well in telecommunications,

Market sector performance

These indexes provide an overview of performance in different market sectors for the 12 months ended 8/31/05.

| Bonds | |

| JP Morgan Developed High Yield Index (high-yield corporate bonds) | 8.83% |

| JP Morgan Global High Yield Index (global high-yield corporate bonds) | 9.20% |

| Lehman Aggregate Bond Index (broad bond market) | 4.15% |

| Lehman Government/Credit Bond Index | |

| (U.S. Treasury and agency securities and corporate bonds) | 4.30% |

| Equities | |

| S&P 500 Index (broad stock market) | 12.56% |

| Russell 2000 Value Index (small-company value stocks) | 22.61% |

| Russell 2500 Growth Index (growth stocks of small and midsize companies) | 25.25% |

8

where strong subscriber growth, attractive valuations, and consolidation activity offered a favorable backdrop. We also focused on bonds issued by media companies, due to their attractive prices and an improving advertising environment.

At the same time, we underweighted transportation issues, particularly those of auto suppliers. These companies faced high steel prices that they could not pass through to their customers, the auto manufacturers. We also avoided paper and forest products companies, because their bonds were selling at unattractive valuations, and, at the same time, the firms were encountering weakening business prospects. While business prospects for many technology firms have improved, we maintained an underweighted position in the sector because we felt that securities there were overvalued.

Your fund’s holdings

During your fund’s fiscal year, there was a notable increase in merger and acquisition (M&A) activity. Frequently, larger investment-grade firms acquired smaller companies with lower credit ratings. Generally, in these cases, bond-holders in the acquired companies enjoyed significant capital appreciation, because the bond prices tended to rise meaningfully as these companies’ credit quality improved. This occurred with one of your fund’s holdings, Doane Pet Care. Other bonds that helped fund

Comparison of top sector weightings

This chart shows how the fund’s top weightings have changed over the last six months. Weightings are shown as a percentage of net assets. Holdings will vary over time.

9

performance included two oil and gas pipeline companies, El Paso Corporation and The Williams Companies, both of which benefited from rising oil and gas prices as well as their respective corporate turnarounds. Bonds issued by retailer JC Penney and clothing manufacturer Levi Strauss appreciated as well, the first due to continued credit improvements and the second as it progressed in its turnaround.

Your fund also profited from its small stake in senior-secured floating-rate bank loans. These are bank loans whose interest is reset in accordance with changes in short-term interest rates. The loans’ “senior-secured” status means that they are fully backed by each issuing company’s assets, such as plants, equipment, and inventory. Moreover, senior-secured loan lenders are entitled to be paid before any non-secured-debt holders in the event of a liquidation of the company’s assets due to bankruptcy. During your fund’s fiscal year, the market for these types of loans was very strong, due to continued, steady increases in short-term interest rates, solid demand from fixed-income investors looking for additional yield, and the historical stability of such

Top holdings

This table shows the fund's top holdings, and the percentage of the fund's net assets that each comprised, as of 8/31/05. The fund's holdings will change over time.

| Holding (percent of fund's net assets) | Coupon (%) and maturity date | Industry |

| AT&T Corp. (0.7%) | 9.75%, 2031 | Communications services |

| Qwest Corp. (0.7%) | 8.875%, 2012 | Communications services |

| Lehman Brothers HY 144A TRAINS | 7.651%, 2015 | Other |

| (Targeted Return Index Securities) | ||

| FRN Ser. 2005-1 | ||

| Nextel Communications, Inc. (0.7%) | 5.95%, 2014 | Communications services |

| CanWest Media, Inc. (Canada) (0.6%) | 8%, 2012 | Consumer cyclicals |

| Equistar Chemicals LP/Equistar | 10.125%, 2008 | Basic materials |

| Funding Corp. (0.6%) | ||

| NRG Energy, Inc. (0.6%) | 8%, 2013 | Utilities and power |

| Tenneco Automotive, Inc. (0.5%) | 10.25%, 2013 | Consumer cyclicals |

| John Q. Hammons Hotels LP/ | 8.875%, 2012 | Consumer cyclicals |

| John Q. Hammons Hotels | ||

| Finance Corp. III (0.5%) | ||

| Legrand SA (France) (0.5%) | 8.5%, 2025 | Capital goods |

10

loans. The fund’s small allocation to emerging-market bonds also made a positive contribution to performance, because these securities appreciated as the U.S. dollar declined relative to foreign currencies. Within this asset class, the fund held bonds from Brazil and Mexico.

Every period brings with it some disappointments, and this fiscal year was no exception. Among the holdings that detracted from the fund’s performance were publishing company Vertis, which faced operational challenges, and radio broadcaster Paxson Communications, which suffered from less-than-stellar business fundamentals as well as mixed operating performance. Finally, oil distributor Stargas Oil lagged because it was not effective at controlling other costs at a time when its distribution expenses increased.

Please note that all holdings discussed in this report are subject to review in accordance with the fund’s investment strategy and may vary in the future.

| The outlook for your fund |

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

During the past two years, high-yield corporate bonds generally enjoyed strong returns due to a general global economic recovery. Recently, however, bond investors have become more cautious as the recovery matured and because of the expectation that short-term interest rates would likely rise through the end of 2005. We believe that economic growth should remain steady and we expect a slight increase in inflation. Given this kind of environment, we believe the Fed is likely to implement more short-term rate increases, which should, in turn, eventually push long-term bond yields upward. As such, we anticipate that total returns in the high-yield market will not reach the strong levels seen in 2003 and 2004, and that they will be driven by further spread tightening, positive corporate fundamentals, and continued M&A activity. The higher-credit-quality profile that we’ve adopted for your fund is designed to benefit from such a scenario, given our analysis of how the market historically has behaved at similar, late stages of the credit cycle.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice. Lower-rated bonds may offer higher yields in return for more risk. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

11

| Your fund’s performance |

This section shows your fund’s performance during its fiscal year, which ended August 31, 2005. In accordance with regulatory requirements, we also include performance for the most current calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally available only to corporate clients that, for example, maintain large balances on behalf of retirement plan participants. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

| Fund performance | ||||||||||

| Total return for periods ended 8/31/05 | ||||||||||

| Class A | Class B | Class C | Class M | Class R | Class Y | |||||

| (inception dates) | (2/14/78) | (3/1/93) | (3/19/02) | (7/3/95) | (1/21/03) (12/31/98) | |||||

| NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV | |

| Annual average | ||||||||||

| (life of fund) | 9.24% | 9.06% | 8.31% | 8.31% | 8.41% | 8.41% | 8.85% | 8.72% | 8.96% | 9.30% |

| 10 years | 80.74 | 72.55 | 67.99 | 67.99 | 67.06 | 67.06 | 76.36 | 70.67 | 76.01 | 83.28 |

| Annual average | 6.10 | 5.61 | 5.32 | 5.32 | 5.27 | 5.27 | 5.84 | 5.49 | 5.82 | 6.25 |

| 5 years | 38.30 | 32.03 | 33.22 | 31.52 | 32.86 | 32.86 | 36.42 | 31.95 | 36.42 | 39.71 |

| Annual average | 6.70 | 5.71 | 5.91 | 5.63 | 5.85 | 5.85 | 6.41 | 5.70 | 6.41 | 6.92 |

| 1 year | 9.28 | 4.31 | 8.49 | 3.49 | 8.39 | 7.39 | 8.95 | 5.39 | 8.79 | 9.37 |

Performance assumes reinvestment of distributions and does not account for taxes. Returns at public offering price (POP) for class A and M shares reflect a sales charge of 4.50% and 3.25%, respectively (which for class A shares does not reflect a reduction in sales charges that went into effect on April 1, 2005; if this reduction had been in place for all periods indicated, returns would have been higher). Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for Y shares, the higher operating expenses for such shares.

A 2% short-term trading fee may be applied to shares exchanged or sold within 5 days of purchase. In addition, there is a 1% short-term trading fee for this fund on shares sold or exchanged between 6 and 90 days after purchase.

12

Change in the value of a $10,000 investment ($9,550 after sales charge)

Cumulative total return from 8/31/95 to 8/31/05

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $16,799 and $16,706, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares would have been valued at $17,636 ($17,067 at public offering price). A $10,000 investment in the fund’s class R and class Y shares would have been valued at $17,601 and $18,328, respectively. See first page of performance section for performance calculation method.

Comparative index returns

For periods ended 8/31/05

| JP Morgan | JP Morgan | Lipper High Current | |

| Global High | Developed High | Yield Funds | |

| Yield Index* | Yield Index†‡ | category average § | |

| Annual average | |||

| (life of fund) | — | — | 8.97% |

| 10 years | 106.01% | 103.95% | 78.93 |

| Annual average | 7.50 | 7.39 | 5.85 |

| 5 years | 48.12 | 47.20 | 32.61 |

| Annual average | 8.17 | 8.04 | 5.67 |

| 1 year | 9.20 | 8.83 | 8.28 |

Index and Lipper results should be compared to fund performance at net asset value.

* This index began operations on 12/31/93.

† This index began operations on 12/31/94.

‡ Putnam Management has recently undertaken a review of the fund’s benchmark. The JP Morgan Developed High Yield Index replaces the JP Morgan Global High Yield Index as your fund’s benchmark because, in Putnam Management’s opinion, the securities tracked by this index more accurately reflect the types of securities that will be held by the fund.

§ Over the 1-, 5-, and 10-year periods ended 8/31/05, there were 424, 295, and 98 funds, respectively, in this Lipper category.

13

| Fund price and distribution information | ||||||||

| For the 12-month period ended 8/31/05 | ||||||||

| Class A | Class B | Class C | Class M | Class R | Class Y | |||

| Distributions | ||||||||

| (number) | 12 | 12 | 12 | 12 | 12 | 12 | ||

| Income | $0.597 | $0.535 | $0.538 | $0.573 | $0.580 | $0.621 | ||

| Capital gains | — | — | — | — | — | — | ||

| Total | $0.597 | $0.535 | $0.538 | $0.573 | $0.580 | $0.621 | ||

| Share value: | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

| 8/31/04 | $7.98 | $8.36 | $7.94 | $7.95 | $7.98 | $8.25 | $7.98 | $7.96 |

| 8/31/05 | 8.10 | 8.42* | 8.06 | 8.06 | 8.10 | 8.37 | 8.08 | 8.06 |

| Current return | ||||||||

| (end of period) | ||||||||

| Current | ||||||||

| dividend rate1 | 7.26% | 6.98% | 6.40% | 6.55% | 6.96% | 6.74% | 6.98% | 7.59% |

| Current 30-day | ||||||||

| SEC yield2 | 6.35 | 6.11 | 5.59 | 5.60 | 6.10 | 5.90 | 6.10 | 6.61 |

| * | Reflects a reduction in sales charges that took effect on April 1, 2005. | |

| 1 | Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period. | |

| 2 | Based only on investment income, calculated using SEC guidelines. | |

Fund performance for most recent calendar quarter

| Total return for periods ended 9/30/05 |

| Class A | Class B | Class C | Class M | Class R | Class Y | |||||

| (inception dates) | (2/14/78) | (3/1/93) | (3/19/02) | (7/3/95) | (1/21/03) (12/31/98) | |||||

| NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV | |

| Annual average | ||||||||||

| (life of fund) | 9.19% | 9.01% | 8.26% | 8.26% | 8.36% | 8.36% | 8.80% | 8.67% | 8.91% | 9.25% |

| 10 years | 78.12 | 70.05 | 65.54 | 65.54 | 64.86 | 64.86 | 73.99 | 68.38 | 73.41 | 80.66 |

| Annual average | 5.94 | 5.45 | 5.17 | 5.17 | 5.13 | 5.13 | 5.69 | 5.35 | 5.66 | 6.09 |

| 5 years | 39.05 | 32.75 | 33.95 | 32.22 | 33.62 | 33.62 | 37.31 | 32.87 | 37.10 | 40.47 |

| Annual average | 6.82 | 5.83 | 6.02 | 5.75 | 5.97 | 5.97 | 6.55 | 5.85 | 6.51 | 7.03 |

| 1 year | 6.99 | 2.17 | 6.20 | 1.24 | 6.24 | 5.25 | 6.80 | 3.34 | 6.50 | 7.20 |

14

| Your fund’s expenses |

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial advisor.

| Review your fund’s expenses |

The table below shows the expenses you would have paid on a $1,000 investment in Putnam High Yield Trust from March 1, 2005, to August 31, 2005. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Class A | Class B | Class C | Class M | Class R | Class Y | |

| Expenses paid per $1,000* | $ 5.03 | $ 8.83 | $ 8.83 | $ 6.30 | $ 6.30 | $ 3.77 |

| Ending value (after expenses) | $1,017.30 | $1,013.50 | $1,013.80 | $1,015.80 | $1,016.20 | $1,018.90 |

| * | Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of net assets for the six months ended 8/31/05. The expense ratio may differ for each share class (see the table at the bottom of the next page). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year. |

| Estimate the expenses you paid |

To estimate the ongoing expenses you paid for the six months ended August 31, 2005, use the calculation method below. To find the value of your investment on March 1, 2005, go to www.putnam.com and log on to your account. Click on the “Transaction History” tab in your Daily Statement and enter 03/01/2005 in both the “from” and “to” fields. Alternatively, call Putnam at 1-800-225-1581.

15

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Class A | Class B | Class C | Class M | Class R | Class Y | |

| Expenses paid per $1,000* | $ 5.04 | $ 8.84 | $ 8.84 | $ 6.31 | $ 6.31 | $ 3.77 |

| Ending value (after expenses) | $1,020.21 | $1,016.43 | $1,016.43 | $1,018.95 | $1,018.95 | $1,021.48 |

| * | Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of net assets for the six months ended 8/31/05. The expense ratio may differ for each share class (see the table at the bottom of this page). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year. |

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s net assets have been used to pay ongoing expenses during the period.

| Class A | Class B | Class C | Class M | Class R | Class Y | |

| Your fund's annualized | ||||||

| expense ratio† | 0.99% | 1.74% | 1.74% | 1.24% | 1.24% | 0.74% |

| Average annualized expense ratio | ||||||

| for Lipper peer group‡ | 1.12% | 1.87% | 1.87% | 1.37% | 1.37% | 0.87% |

| † | For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights. |

| ‡ | Simple average of the expenses of all front-end load funds in the fund’s Lipper peer group, calculated in accordance with |

| Lipper’s standard method for comparing fund expenses (excluding 12b-1 fees and without giving effect to any expense offset | |

| and brokerage service arrangements that may reduce fund expenses). This average reflects each fund’s expenses for its | |

| most recent fiscal year available to Lipper as of 6/30/05. To facilitate comparison, Putnam has adjusted this average to | |

| reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. The peer group | |

| may include funds that are significantly smaller or larger than the fund, which may limit the comparability of the fund’s | |

| expenses to the simple average, which typically is higher than the asset-weighted average. |

16

| Your fund’s portfolio turnover |

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s assets within a one-year period. Funds with high turnover may be more likely to generate capital gains and dividends that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the table below to compare your fund’s turnover with the average turnover for funds in its Lipper category.

| Turnover comparisons | |||||

| Percentage of holdings that change every year | |||||

| 2005 | 2004 | 2003 | 2002 | 2001 | |

| Putnam High Yield Trust | 41% | 62% | 75% | 74%* | 77% |

| Lipper High Current | |||||

| Yield Funds category average | 94% | 94% | 107% | 100% | 108% |

Turnover data for the fund is calculated based on the fund's fiscal-year period, which ends on August 31. Turnover data for the fund's Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund's portfolio turnover rate to the Lipper average. Comparative data for 2005 is based on information available as of 6/30/05.

* Portfolio turnover excludes the impact of assets received from the acquisition of Putnam High Yield Trust II.

17

Your fund’s risk

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Overall Morningstar Risk.

Morningstar determines a fund’s Overall Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over 3-, 5-, and 10-year periods, if available. Those measures are weighted and averaged to produce the fund’s Overall Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Overall Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Overall Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2004 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

18

| Your fund’s management |

Your fund is managed by the members of the Putnam Core Fixed-Income High-Yield Team. Paul Scanlon is the Portfolio Leader, and Norman Boucher, Geoffrey Kelley, and Robert Salvin are Portfolio Members of your fund. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Core Fixed-Income High-Yield Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Fund ownership by the Portfolio Leader and Portfolio Members

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund (in dollar ranges). Information shown is as of August 31, 2005, and August 31, 2004.

| $1 – | $10,001 – | $50,001 – | $100,001 – | $500,001 – | $1,000,001 | ||

| Year $0 | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | and over | |

| Paul Scanlon | 2005 | * | |||||

| Portfolio Leader | 2004 | * | |||||

| Norman Boucher | 2005 | * | |||||

| Portfolio Member | N/A | ||||||

| Geoffrey Kelley | 2005 | * | |||||

| Portfolio Member | N/A | ||||||

| Robert Salvin | 2005 | * | |||||

| Portfolio Member | N/A | ||||||

| N/A indicates the individual was not a Portfolio Leader or Portfolio Member as of 8/31/04. | |||||||

19

| Fund manager compensation |

The total 2004 fund manager compensation that is attributable to your fund is approximately $1,3o0,000. This amount includes a portion of 2004 compensation paid by Putnam Management to the fund managers mentioned in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2004 compensation paid to the Group Chief Investment Officer of the fund’s broader investment category for his oversight responsibilities, calculated based on the fund assets he oversees taken as a percentage of the total assets he oversees. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fiscal period-end. For personnel who joined Putnam Management during or after 2004, the calculation reflects annualized 2004 compensation or an estimate of 2005 compensation, as applicable.

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

Paul Scanlon is also a Portfolio Leader of Putnam Floating Rate Income Fund, Putnam High Yield Advantage Fund, and Putnam Managed High Yield Trust. He is also a Portfolio Member of Putnam Diversified Income Trust, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

Norman Boucher is also a Portfolio Member of Putnam High Yield Advantage Fund and Putnam Managed High Yield Trust.

Geoffrey Kelley is also a Portfolio Member of Putnam High Yield Advantage Fund and Putnam Managed High Yield Trust.

Robert Salvin is also a Portfolio Leader of Putnam High Income Securities Fund, and a Portfolio Member of Putnam High Yield Advantage Fund and Putnam Managed High Yield Trust. Paul Scanlon, Norman Boucher, Geoffrey Kelley, and Robert Salvin may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

During the year ended August 31, 2005, Paul Scanlon became Portfolio Leader and Robert Salvin became a Portfolio Member of your fund. In addition, Portfolio Leader Stephen Peacher and Portfolio Member Rosemary Thomsen left your fund’s management team. Furthermore, Norman Boucher and Geoffrey Kelley became Portfolio Members of your fund.

20

Fund ownership by Putnam’s Executive Board

The table below shows how much the members of Putnam’s Executive Board have invested in the fund (in dollar ranges). Information shown is as of August 31, 2005, and August 31, 2004.

| $1 – | $10,001 – | $50,001– | $100,001 | ||||

| Year | $0 | $10,000 | $50,000 | $100,000 | and over | ||

| Philippe Bibi | 2005 | * | |||||

| Chief Technology Officer | 2004 | * | |||||

| Joshua Brooks | 2005 | * | |||||

| Deputy Head of Investments | N/A | ||||||

| William Connolly | 2005 | * | |||||

| Head of Retail Management | N/A | ||||||

| Kevin Cronin | 2005 | * | |||||

| Head of Investments | 2004 | * | |||||

| Charles Haldeman, Jr. | 2005 | * | |||||

| President and CEO | 2004 | * | |||||

| Amrit Kanwal | 2005 | * | |||||

| Chief Financial Officer | 2004 | * | |||||

| Steven Krichmar | 2005 | * | |||||

| Chief of Operations | 2004 | * | |||||

| Francis McNamara, III | 2005 | * | |||||

| General Counsel | 2004 | * | |||||

| Richard Robie, III | 2005 | * | |||||

| Chief Administrative Officer | 2004 | * | |||||

| Edward Shadek | 2005 | * | |||||

| Deputy Head of Investments | N/A | ||||||

| Sandra Whiston | 2005 | * | |||||

| Head of Institutional Management | N/A | ||||||

N/A indicates the individual was not a member of Putnam’s Executive Board as of 8/31/04.

21

| Terms and definitions |

| Important terms |

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.50% maximum sales charge for class A shares (since reduced to 3.75%) and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

| Share classes |

Class A shares are generally subject to an initial sales charge and no sales charge on redemption (except on certain redemptions of shares bought without an initial sales charge).

Class B shares may be subject to a sales charge upon redemption.

Class C shares are not subject to an initial sales charge and are subject to a contingent deferred sales charge only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no sales charge on redemption (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to eligible purchasers, including eligible defined contribution plans or corporate IRAs.

22

| Comparative indexes |

JP Morgan Developed High Yield Index is an unmanaged index of high-yield fixed-income securities issued in developed countries.

JP Morgan Global High Yield Index is an unmanaged index of global high-yield fixed-income securities.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman Government/Credit Bond Index is an unmanaged index of U.S. Treasuries, agency securities, and investment-grade corporate bonds.

Russell 2000 Value Index is an unmanaged index of those companies in the small-cap Russell 2000 Index chosen for their value orientation.

Russell 2500 Growth Index is an unmanaged index of those companies in the small/mid-cap Russell 2500 Index chosen for their growth orientation.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry ranking entity that ranks funds (without sales charges) with similar current investment styles or objectives as determined by Lipper. Lipper category averages reflect performance trends for funds within a category and are based on total return at net asset value.

23

| Trustee approval of management contract |

| General conclusions |

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Management and its sub-management contract with Putnam Management’s affiliate, Putnam Investments Limited (“PIL”). In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months beginning in March and ending in June 2005, the Contract Committee met five times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. Upon completion of this review, the Contract Committee recommended and the Independent Trustees approved the continuance of your fund’s management contract and sub-management contract, effective July 1, 2005. Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context. This approval was based on the following conclusions:

- That the fee schedule currently in effect for your fund represents reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

- That such fee schedule represents an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

24

Model fee schedules and categories; total expenses

The Trustees’ review of the management fees and total expenses of the Putnam funds focused on three major themes:

- Consistency. The Trustees, working in cooperation with Putnam Management, have devel- oped and implemented a series of model fee schedules for the Putnam funds designed to ensure that each fund’s management fee is consistent with the fees for similar funds in the Putnam family of funds and compares favorably with fees paid by competitive funds spon- sored by other investment advisors. Under this approach, each Putnam fund is assigned to one of several fee categories based on a combination of factors, including competitive fees and perceived difficulty of management, and a common fee schedule is implemented for all funds in a given fee category. The Trustees reviewed the model fee schedule currently in effect for your fund, including fee levels and breakpoints, and the assignment of the fund to a particular fee category under this structure. (“Breakpoints” refer to reductions in fee rates that apply to additional assets once specified asset levels are reached.) The Trustees concluded that no changes should be made in the fund’s current fee schedule at this time.

- Competitiveness. The Trustees also reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 34th percentile in management fees and in the 21st percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2004 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense comparison may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints. They noted that such expense ratio increases were currently being controlled by expense limita- tions implemented in January 2004 and which Putnam Management, in consultation with the Contract Committee, has committed to maintain at least through 2006. The Trustees expressed their intention to monitor this information closely to ensure that fees and expenses of the Putnam funds continue to meet evolving competitive standards.

- Economies of scale. The Trustees concluded that the fee schedule currently in effect for your fund represents an appropriate sharing of economies of scale at current asset levels. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. The Trustees examined the existing breakpoint structure of the Putnam funds’ management fees in light of competitive industry practices. The Trustees considered

25

various possible modifications to the Putnam Funds’ current breakpoint structure, but ultimately concluded that the current breakpoint structure continues to serve the interests of fund shareholders. Accordingly, the Trustees continue to believe that the fee schedules currently in effect for the funds represent an appropriate sharing of economies of scale at current asset levels. The Trustees noted that significant redemptions in many Putnam funds, together with significant changes in the cost structure of Putnam Management, have altered the economics of Putnam Management’s business in significant ways. In view of these changes, the Trustees intend to consider whether a greater sharing of the economies of scale by fund shareholders would be appropriate if and when aggregate assets in the Putnam funds begin to experience meaningful growth.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

| Investment performance |

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the funds’ investment process and performance by the work of the Investment Oversight Committees of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognize that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing the fund’s performance with various benchmarks and with the performance of competitive funds. The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and continued to discuss with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. The Trustees indicated their intention to continue to

26

monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional remedial changes are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share performance at net asset value was in the following percentiles of its Lipper Inc. peer group for the one-, three-and five-year periods ended December 31, 2004 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| One-year period | Three-year period | Five-year period |

| 24th | 24th | 47th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report.)

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees believe that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees believe that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment advisor for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment advisor. The Trustees believe that soft-dollar credits and other potential benefits associated with the allocation of fund brokerage, which pertains mainly to funds investing in equity securities, represent assets of the funds that should be used for the benefit of fund shareholders. This area has been marked by significant change in recent years. In July 2003, acting upon the Contract Committee’s recommendation, the Trustees directed that allocations of brokerage to reward firms that sell fund shares be discontinued no later than December 31, 2003. In addition, commencing in 2004, the allocation of brokerage commissions by Putnam Management to acquire research services from third-party service providers has been significantly reduced, and continues at a modest level only to acquire research that is customarily not available for cash. The Trustees will continue to monitor the allocation of the funds’ brokerage to ensure that the principle of “best price and execution” remains paramount in the portfolio trading process.

27

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company, all of which provide benefits to affiliates of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but have not relied on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

28

| Other information for shareholders |

| Putnam’s policy on confidentiality |

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ addresses, telephone numbers, Social Security numbers, and the names of their financial advisors. We use this information to assign an account number and to help us maintain accurate records of transactions and account balances. It is our policy to protect the confidentiality of your information, whether or not you currently own shares of our funds, and in particular, not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use. Under certain circumstances, we share this information with outside vendors who provide services to us, such as mailing and proxy solicitation. In those cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. We may also share this information with our Putnam affiliates to service your account or provide you with information about other Putnam products or services. It is also our policy to share account information with your financial advisor, if you’ve listed one on your Putnam account. If you would like clarification about our confidentiality policies or have any questions or concerns, please don’t hesitate to contact us at 1-800-225-1581, Monday through Friday, 8:30 a.m. to 7:00 p.m., or Saturdays from 9:00 a.m. to 5:00 p.m. Eastern Time.

| Proxy voting |

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2005, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

| Fund portfolio holdings |

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s public reference room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the public reference room.

29

| Financial statements |

| A guide to financial statements |

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund's investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the net assets allocated to remarketed preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period. For open-end funds, a separate table is provided for each share class.

30

Report of Independent Registered Public Accounting Firm

| The Board of Trustees and Shareholders Putnam High Yield Trust: |

We have audited the accompanying statement of assets and liabilities of Putnam High Yield Trust, including the fund’s portfolio, as of August 31, 2005, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years or periods in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2005 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam High Yield Trust as of August 31, 2005, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years or periods in the period then ended in conformity with U.S. generally accepted accounting principles.

31

| The fund’s portfolio 8/31/05 | ||||

| CORPORATE BONDS AND NOTES (87.3%)* | ||||

| Principal amount | Value | |||

| Advertising and Marketing Services (0.2%) | ||||

| Lamar Media Corp. company guaranty 7 1/4s, 2013 | $ | 3,950,000 | $ | 4,157,375 |

| Automotive (3.3%) | ||||

| Affinia Group, Inc. 144A sr. sub. notes 9s, 2014 | 2,350,000 | 1,938,750 | ||

| ArvinMeritor, Inc. notes 8 3/4s, 2012 | 2,615,000 | 2,713,063 | ||

| Dana Corp. notes 10 1/8s, 2010 | 1,475,000 | 1,549,131 | ||

| Dana Corp. notes 9s, 2011 | 8,177,000 | 8,923,151 | ||

| Dana Corp. notes 7s, 2029 | 1,199,000 | 1,056,951 | ||

| Delco Remy International, Inc. company | ||||

| guaranty 11s, 2009 | 1,598,000 | 1,126,590 | ||

| Delco Remy International, Inc. sr. sub. | ||||

| notes 9 3/8s, 2012 | 4,240,000 | 2,724,200 | ||

| Delphi Corp. notes 6 1/2s, 2013 | 3,235,000 | 2,466,688 | ||

| Dura Operating Corp. company guaranty | ||||

| Ser. B, 8 5/8s,2012 | 3,599,000 | 3,329,075 | ||

| Ford Motor Co. notes 7.45s, 2031 | 8,145,000 | 6,512,986 | ||

| Ford Motor Credit Corp. bonds 7 3/8s, 2011 | 10,870,000 | 10,718,516 | ||

| Ford Motor Credit Corp. notes 7 7/8s, 2010 | 10,840,000 | 10,897,560 | ||

| General Motors Acceptance Corp. bonds 8s, 2031 | 5,430,000 | 5,023,554 | ||

| Meritor Automotive, Inc. notes 6.8s, 2009 | 3,785,000 | 3,728,225 | ||

| Tenneco Automotive, Inc. company | ||||

| guaranty 8 5/8s, 2014 | 4,170,000 | 4,326,375 | ||

| Tenneco Automotive, Inc. sec. notes | ||||

| Ser. B, 10 1/4s, 2013 | 12,200,000 | 13,847,000 | ||

| TRW Automotive Inc. sr. sub. notes 11s, 2013 | 8,658,000 | 9,956,700 | ||

| 90,838,515 | ||||

| Basic Materials (9.5%) | ||||

| Abitibi-Consolidated Finance LP company | ||||

| guaranty 7 7/8s, 2009 | 3,000 | 3,008 | ||

| AK Steel Corp. company guaranty 7 3/4s, 2012 | 5,699,000 | 5,285,823 | ||

| ALROSA Finance SA 144A company | ||||

| guaranty 8 7/8s, 2014 (Luxembourg) | 5,060,000 | 5,907,550 | ||

| BCP Crystal US Holdings Corp. sr. | ||||

| sub. notes 9 5/8s, 2014 | 5,780,000 | 6,553,075 | ||

| Century Aluminum Co. company | ||||

| guaranty 7 1/2s, 2014 | 2,725,000 | 2,820,375 | ||

| Chaparral Steel Co. 144A sr. unsecd. notes 10s, 2013 | 8,310,000 | 8,725,500 | ||

| Chesapeake Corp. sr. sub. notes 7s, 2014 | EUR | 1,865,000 | 2,292,244 | |

| Cognis Holding GmbH & Co. 144A | ||||

| sr. notes 9 1/2s, 2014 (Germany) | EUR | 2,250,000 | 3,071,176 | |

| Compass Minerals Group, Inc. company | ||||

| guaranty 10s, 2011 | $ | 2,692,000 | 2,961,200 | |

32

| CORPORATE BONDS AND NOTES (87.3%)* continued | ||||

| Principal amount | Value | |||

| Basic Materials continued | ||||

| Compass Minerals International, Inc. sr. disc. | ||||

| notes stepped-coupon Ser. B, zero % | ||||

| (12s, 6/1/08), 2013 †† | $ | 2,540,000 | $ | 2,171,700 |

| Compass Minerals International, Inc. | ||||

| sr. notes stepped-coupon zero % | ||||

| (12 3/4s, 12/15/07), 2012 †† | 10,532,000 | 9,268,160 | ||

| Crystal US Holdings, LLC sr. disc. | ||||

| notes stepped-coupon Ser. A, zero % | ||||

| (10s, 10/1/09), 2014 †† | 3,365,000 | 2,439,625 | ||

| Equistar Chemicals LP notes 8 3/4s, 2009 | 7,020,000 | 7,458,750 | ||

| Equistar Chemicals LP/Equistar Funding Corp. company | ||||

| guaranty 10 1/8s, 2008 | 14,008,000 | 15,426,310 | ||

| Georgia-Pacific Corp. bonds 7 3/4s, 2029 | 2,650,000 | 2,951,438 | ||

| Georgia-Pacific Corp. company guaranty 8 7/8s, 2010 | 2,985,000 | 3,343,200 | ||

| Georgia-Pacific Corp. debs. 7.7s, 2015 | 4,269,000 | 4,834,643 | ||

| Georgia-Pacific Corp. sr. notes 8s, 2024 | 3,860,000 | 4,390,750 | ||

| Gerdau Ameristeel Corp. sr. notes 10 3/8s, | ||||

| 2011 (Canada) | 7,150,000 | 7,954,375 | ||

| Hercules, Inc. company guaranty 11 1/8s, 2007 | 4,978,000 | 5,575,360 | ||

| Hercules, Inc. company guaranty 6 3/4s, 2029 | 6,055,000 | 5,994,450 | ||

| Huntsman Advanced Materials, LLC sec. | ||||

| FRN 11.83s,2008 | 427,000 | 447,816 | ||

| Huntsman Advanced Materials, LLC sec. notes 11s, 2010 | 310,000 | 351,850 | ||

| Huntsman International, LLC company | ||||

| guaranty 10 1/8s, 2009 | 8,227,000 | 8,473,810 | ||

| Huntsman, LLC company guaranty 11 5/8s, 2010 | 2,408,000 | 2,820,370 | ||

| Huntsman, LLC company guaranty 11 1/2s, 2012 | 1,774,000 | 2,080,015 | ||

| Innophos, Inc. 144A sr. sub. notes 8 7/8s, 2014 | 6,915,000 | 7,113,806 | ||

| ISP Chemco, Inc. company guaranty | ||||

| Ser. B, 10 1/4s,2011 | 6,609,000 | 7,129,459 | ||

| Jefferson Smurfit Corp. company guaranty 8 1/4s, 2012 | 76,000 | 75,050 | ||

| Jefferson Smurfit Corp. company guaranty 7 1/2s, 2013 | 200,000 | 190,500 | ||

| JSG Holding PLC 144A sr. notes 11 1/2s, | ||||

| 2015 (Ireland) ‡‡ | EUR | 4,426,584 | 5,075,943 | |

| Kappa Beheer BV company guaranty Ser. EUR, | ||||

| 12 1/2s, 2009 (Netherlands) | EUR | 360,000 | 461,506 | |

| Lyondell Chemical Co. bonds 11 1/8s, 2012 | $ | 660,000 | 750,750 | |

| Lyondell Chemical Co. company guaranty 9 1/2s, 2008 | 7,294,000 | 7,676,935 | ||

| Lyondell Chemical Co. notes Ser. A, 9 5/8s, 2007 | 5,849,000 | 6,170,695 | ||

| MDP Acquisitions PLC sr. notes 9 5/8s, 2012 (Ireland) | 9,695,000 | 9,913,138 | ||

| MDP Acquisitions PLC sr. notes Ser. EUR, | ||||

| 10 1/8s, 2012 (Ireland) | EUR | 322,000 | 432,194 | |

| Millennium America, Inc. company | ||||

| guaranty 9 1/4s, 2008 | $ | 7,858,000 | 8,466,995 | |

| Nalco Co. sr. notes 7 3/4s, 2011 | EUR | 685,000 | 916,471 | |

| Nalco Co. sr. sub. notes 9s, 2013 | EUR | 2,975,000 | 3,996,756 | |

| Nalco Co. sr. sub. notes 8 7/8s, 2013 | $ | 8,055,000 | 8,669,194 | |

33

| CORPORATE BONDS AND NOTES (87.3%)* continued | ||||

| Principal amount | Value | |||

| Basic Materials continued | ||||

| Nell AF S.a.r.l. 144A sr. notes 8 3/8s, 2015 (Luxembourg) | $ | 5,095,000 | $ | 5,152,319 |

| Nell AF S.a.r.l. 144A sr. notes 8 3/8s, | ||||

| 2015 (Luxembourg) | EUR | 1,180,000 | 1,500,019 | |

| Norske Skog Canada, Ltd. sr. notes 7 3/8s, | ||||

| 2014 (Canada) | $ | 3,345,000 | 3,311,550 | |

| Novelis, Inc. 144A sr. notes 7 1/4s, 2015 (Canada) | 12,970,000 | 13,002,425 | ||

| PCI Chemicals Canada sec. sr. notes 10s, | ||||

| 2008 (Canada) | 2,553,936 | 2,719,942 | ||

| PQ Corp. 144A company guaranty 7 1/2s, 2013 | 2,450,000 | 2,462,250 | ||

| Rockwood Specialties Group, Inc. company | ||||

| guaranty 7 5/8s, 2014 | EUR | 3,400,000 | 4,364,943 | |

| Rockwood Specialties Group, Inc. 144A | ||||

| sub. notes 7 1/2s, 2014 | $ | 1,350,000 | 1,377,000 | |

| SGL Carbon Luxembourg SA 144A | ||||

| sr. notes 8 1/2s, 2012 (Luxembourg) | EUR | 2,385,000 | 3,208,521 | |

| Smurfit Capital Funding PLC notes 6 3/4s, | ||||

| 2005 (Ireland) | $ | 400,000 | 400,000 | |

| Steel Dynamics, Inc. company guaranty 9 1/2s, 2009 | 4,379,000 | 4,674,583 | ||

| Sterling Chemicals, Inc. sec. notes 10s, 2007 ‡‡ | 1,334,122 | 1,320,781 | ||

| Stone Container Corp. sr. notes 9 3/4s, 2011 | 8,090,000 | 8,433,825 | ||

| Stone Container Corp. sr. notes 8 3/8s, 2012 | 3,555,000 | 3,537,225 | ||

| Stone Container Finance company guaranty 7 3/8s, | ||||

| 2014 (Canada) | 1,385,000 | 1,305,363 | ||

| Tembec Industries, Inc. company guaranty 7 3/4s, | ||||

| 2012 (Canada) | 1,390,000 | 1,028,600 | ||

| Texas Industries, Inc. 144A sr. notes 7 1/4s, 2013 | 1,825,000 | 1,902,563 | ||

| Ucar Finance, Inc. company guaranty 10 1/4s, 2012 | 3,860,000 | 4,130,200 | ||

| United States Steel Corp. sr. notes 9 3/4s, 2010 | 1,396,000 | 1,528,620 | ||

| United States Steel, LLC sr. notes 10 3/4s, 2008 | 1,607,000 | 1,807,875 | ||

| Wheeling-Pittsburgh Steel Corp. sr. notes 6s, 2010 ‡‡ | 403,137 | 322,510 | ||

| Wheeling-Pittsburgh Steel Corp. sr. notes 5s, 2011 ‡‡ | 761,535 | 609,228 | ||

| WHX Corp. sr. notes 10 1/2s, | ||||

| 2005 (In default) (F) † *** | 1,646,000 | 165 | ||

| 258,742,472 | ||||

| Beverage (0.1%) | ||||

| Constellation Brands, Inc. company guaranty Ser. B, | ||||

| 8s, 2008 | 3,088,000 | 3,250,120 | ||

| Constellation Brands, Inc. sr. sub. notes Ser. B, | ||||

| 8 1/8s, 2012 | 338,000 | 359,548 | ||

| 3,609,668 | ||||

| Broadcasting (2.6%) | ||||

| DirecTV Holdings, LLC 144A sr. notes 6 3/8s, 2015 | 11,515,000 | 11,486,213 | ||

| Diva Systems Corp. sr. disc. notes Ser. B, 12 5/8s, | ||||

| 2008 (In default) † | 23,030,000 | 115,150 | ||

| Echostar DBS Corp. company guaranty 6 5/8s, 2014 | 6,960,000 | 6,899,100 | ||

| Echostar DBS Corp. sr. notes 6 3/8s, 2011 | 12,880,000 | 12,799,500 | ||

34

| CORPORATE BONDS AND NOTES (87.3%)* continued | ||||

| Principal amount | Value | |||

| Broadcasting continued | ||||

| Emmis Communications Corp. sr. notes FRN 9.314s, 2012 | $ | 3,780,000 | $ | 3,827,250 |

| Granite Broadcasting Corp. sec. notes 9 3/4s, 2010 | 10,780,000 | 10,173,625 | ||

| Gray Television, Inc. company guaranty 9 1/4s, 2011 | 1,783,000 | 1,939,013 | ||

| Paxson Communications Corp. company guaranty | ||||

| 10 3/4s, 2008 | 1,330,000 | 1,330,000 | ||

| Rainbow National Services, LLC 144A sr. notes | ||||

| 8 3/4s, 2012 | 8,810,000 | 9,591,888 | ||

| Sirius Satellite Radio, Inc. 144A sr. notes | ||||

| 9 5/8s, 2013 | 5,470,000 | 5,374,275 | ||

| Young Broadcasting, Inc. company guaranty 10s, 2011 | 3,668,000 | 3,530,450 | ||

| Young Broadcasting, Inc. sr. sub. notes 8 3/4s, 2014 | 3,385,000 | 3,063,425 | ||

| 70,129,889 | ||||

| Building Materials (0.6%) | ||||

| Associated Materials, Inc. company guaranty | ||||

| 9 3/4s, 2012 | 2,720,000 | 2,781,200 | ||

| Building Materials Corp. company guaranty 8s, 2008 | 2,869,000 | 2,861,828 | ||

| Owens Corning bonds 7 1/2s, 2018 (In default) † | 4,000 | 3,500 | ||

| Owens Corning notes 7 1/2s, 2006 (In default) † | 5,755,000 | 5,064,400 | ||

| THL Buildco, Inc. (Nortek Holdings, Inc.) | ||||

| sr. sub. notes 8 1/2s, 2014 | 5,945,000 | 5,781,513 | ||

| 16,492,441 | ||||

| Cable Television (2.8%) | ||||

| Adelphia Communications Corp. sr. notes 10 7/8s, | ||||

| 2010 (In default) † | 3,211,000 | 2,701,254 | ||

| Adelphia Communications Corp. sr. notes 7 7/8s, | ||||

| 2009 (In default) † | 2,918,000 | 2,425,588 | ||

| Adelphia Communications Corp. sr. notes Ser. B, | ||||

| 9 7/8s, 2007 (In default) † | 2,431,000 | 2,057,234 | ||

| Atlantic Broadband Finance, LLC 144A | ||||

| sr. sub. notes 9 3/8s, 2014 | 3,950,000 | 3,831,500 | ||

| Cablevision Systems Corp. sr. notes Ser. B, 8s, 2012 | 2,600,000 | 2,583,750 | ||

| Charter Communications Holdings, LLC/Capital Corp. | ||||

| sr. disc. notes stepped-coupon zero % (12 1/8s, | ||||