| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811- 02796) |

| | |

| Exact name of registrant as specified in charter: | Putnam High Yield Trust |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | August 31, 2013 |

| | |

| Date of reporting period: | September 1, 2012 — February 28, 2013 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

High Yield

Trust

Semiannual report

2 | 28 | 13

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio manager | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 12 | | |

| | |

| Terms and definitions | 14 | | |

| | |

| Other information for shareholders | 15 | | |

| | |

| Financial statements | 16 | | |

| | |

Consider these risks before investing: Lower-rated bonds may offer higher yields in return for more risk. Derivatives also involve the risk, in the case of many over-the-counter instruments, of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. The prices of bonds in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer. You can lose money by investing in the fund.

Message from the Trustees

Dear Fellow Shareholder:

The U.S. stock market has set record highs recently, thanks to steadily improving housing and employment data and the Federal Reserve’s pledge to continue to add stimulus until it believes the economy has meaningfully improved. The federal budget battle continues among Washington lawmakers, but investors appear to believe that a resolution will eventually take place.

The by-now familiar risks that have buffeted markets for a few years have not gone away entirely, but they appear to be steadily abating. Europe, while having slumped further into recession, is slowly addressing its sovereign debt problem; China’s economy appears to be improving; and here in the United States economic recovery is underway.

Times like these require a measured, balanced approach to investing. At Putnam, our investment team is actively focused on managing risk while pursuing returns. The guidance of your financial advisor is also important in helping to ensure that your portfolio remains in line with your individual goals and tolerance for risk.

We would like to extend a welcome to new shareholders of the fund and to thank all of our investors for your continued confidence in Putnam.

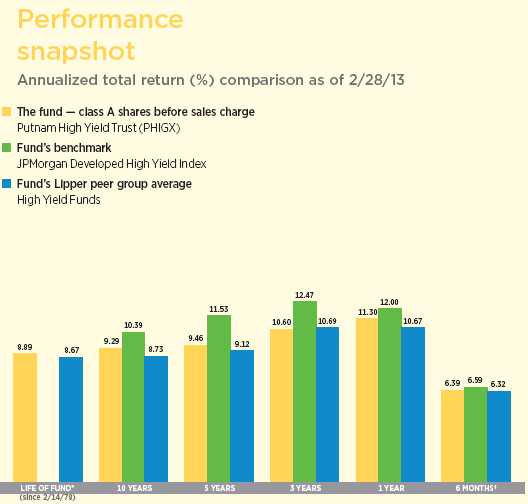

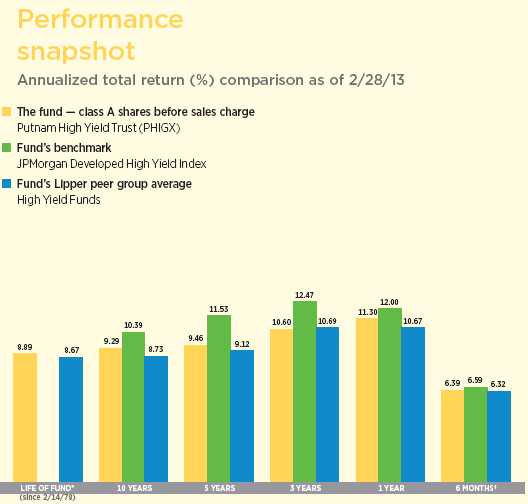

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the JPMorgan Developed High Yield Index, was introduced on 12/31/94, which post-dates the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

Interview with your fund’s portfolio manager

What was the market environment like for high-yield bonds during the first half of the fund’s fiscal year?

The high-yield bond market was somewhat choppy during the first months of the reporting period, as uncertainty surrounding the U.S. presidential election and pending fiscal cliff weighed on investors. With President Obama’s reelection on the books and investors confident that Federal Reserve chairman Ben Bernanke would remain at the helm — and, therefore, that the central bank’s accommodative monetary policy would continue — the market rallied from the middle of November through the end of January. In February, the market gave back some of its earlier gains, but the end result was a strong start to the fund’s fiscal year.

Against this backdrop, the fund’s performance generally was in line with that of its benchmark, which it trailed slightly, and its Lipper peer group, which it outperformed.

What factors influenced the fund’s relative performance during the period?

At the sector/industry level, overweighting the financials, telecommunications, and chemicals industries contributed positively to the fund’s results versus the fund’s benchmark. Conversely, adverse security selection and underweight positions in metals and mining, technology, and transportation detracted from the fund’s relative returns. From a credit-quality standpoint, modestly overweighting CCC-rated securities helped

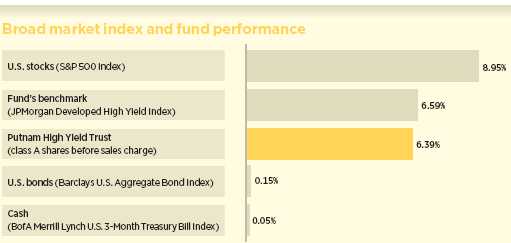

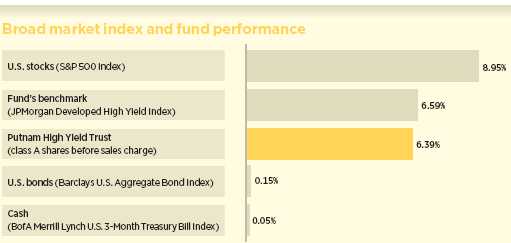

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 2/28/13. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on pages 14–15.

the fund’s relative performance, as they outperformed BB-rated and B-rated bonds. Underweighting BB-rated and “crossover” securities provided a further boost to results, because bonds in these ratings tiers lagged the index. Crossover bonds are those that straddle the gap between investment grade and high yield, often receiving an investment-grade rating from one rating agency and a below-investment-grade rating from another.

Which holdings helped fund performance versus the benchmark?

Wireless carrier Sprint Nextel was the top individual contributor, as the company posted strong results on improved profit margins, lower expenses, and reduced roaming costs. In addition, the firm has maintained solid momentum in adding subscribers to its network. Our overweight position also contributed positively to relative results.

Our position in automotive finance provider Ally Financial proved beneficial, as investors became more confident in the firm’s ability to extricate itself from mortgage liabilities at its Residential Capital subsidiary.

Travelport also contributed positively to results. The company provides transaction processing services to the travel industry, and owns nearly half of Orbitz Worldwide. With business and consumer spending showing signs of life during the past six months, investor interest pushed prices higher for Travelport’s debt during the period.

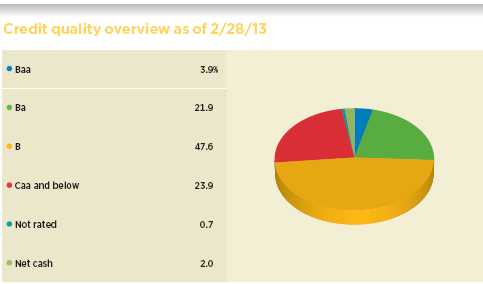

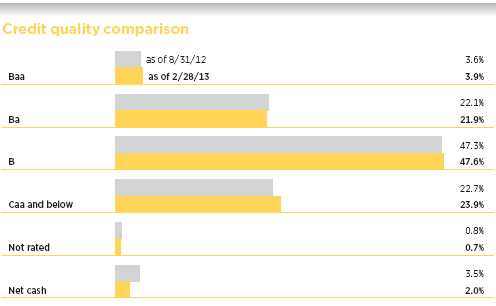

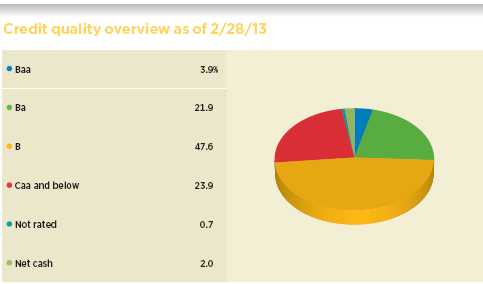

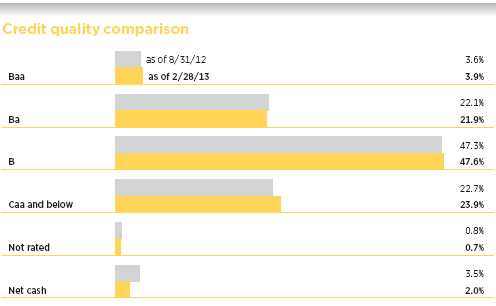

Credit qualities are shown as a percentage of the fund’s net assets. Net cash, if any, represents the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. A bond rated Baa or higher (Prime-3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but rated by Standard & Poor’s (S&P) or, if unrated by S&P, by Fitch ratings, and then included in the closest equivalent Moody’s rating. Ratings will vary over time.

Credit quality includes bonds and represents only the fixed-income portion of the portfolio. Derivative instruments, including forward currency contracts, are only included to the extent of any unrealized gain or loss on such instruments and are shown in the net cash category. The fund itself has not been rated by an independent rating agency.

Which investments weren’t as productive?

Residential Capital, which I mentioned earlier, while still working through write-offs associated with the housing bubble, has actually been attracting investors’ attention in recent months and posted a solid gain over the period. The fund had only a small position in the company, which we sold before the end of the period, and our limited exposure detracted from relative performance.

Underweight positions in EDP, a Portugal-based energy provider, and ArcelorMittal, a world-leading steel miner, also detracted from the fund’s performance relative to the benchmark, as securities from both companies posted solid gains during the period. We sold our position in EDP before period-end.

What is your outlook for the high-yield market over the coming months?

We evaluate the high-yield market by looking at three key factors: fundamentals, valuation, and technicals, or the balance of supply and demand. As of now, we are neutral on all three. Looking first at fundamentals, we see an economic landscape marked by countervailing trends. GDP figures in the

This table shows the fund’s top 10 holdings and the percentage of the fund’s net assets that each represented as of 2/28/13. Short-term holdings, derivatives, and TBA commitments are excluded. Holdings will vary over time.

United States continued to be frustratingly low, compared with past post-recession recoveries. Nonetheless, corporate fundamentals still appear to be reasonably solid, although earnings in various early-cycle industries are showing signs of softening. At the same time, the housing market appears to be mounting a solid recovery in many parts of the country, which could provide a nice boost to certain sectors of the economy.

As for valuation, the yield advantage that high-yield bonds offered versus Treasuries continued to fall during the period. While this yield advantage — or spread — is no longer wide by historical measures, we believe it may still compress further, given the below-average default rate in the market, which ended the period at 1.3% — well below the long-term average of 4.2%. Ultimately, we believe the income offered in the high-yield market still appears attractive relative to the other lower-yielding alternatives in other segments of the fixed-income universe.

Looking at market technicals, high-yield mutual funds continued to experience robust investment inflows in recent months, while new debt issuance in this sector reached record levels, with corporations seeking to lock in attractive long-term rates. These conditions suggest both heightened supply and demand, which leads us to our neutral view of the technical factors in the market.

This chart shows how the fund’s credit quality has changed over the past six months. Credit qualities are shown as a percentage of the fund’s net assets. Net cash, if any, represents the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. A bond rated Baa or higher (Prime-3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but rated by Standard & Poor’s (S&P) or, if unrated by S&P, by Fitch ratings, and then included in the closest equivalent Moody’s rating. Ratings will vary over time.

Credit quality includes bonds and represents only the fixed-income portion of the portfolio. Derivative instruments, including forward currency contracts, are only included to the extent of any unrealized gain or loss on such instruments and are shown in the net cash category. The fund itself has not been rated by an independent rating agency.

Given this outlook, how have you positioned the fund?

The amount of refinancing that has occurred during the past two-and-a-half years has extended the maturity profile of many high-yield issuers, which helps reduce their current debt load. As a result, we believe the prospects for the default rate to remain below the historical average for some time are quite good.

That said, given the continuing uncertainty surrounding potential macroeconomic factors, U.S. fiscal policy, and geopolitical developments, we have modestly reduced the fund’s overall market risk by, among other measures, moderately increasing our cash position. In our view, holding a cash cushion may also help the fund should marketplace liquidity remain constrained.

Thank you for bringing us up to date, Paul.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Paul D. Scanlon is Co-Head of Fixed Income at Putnam. He has an M.B.A. from The University of Chicago Booth School of Business and a B.A. from Colgate University. A CFA charterholder, Paul joined Putnam in 1999 and has been in the investment industry since 1986.

In addition to Paul, your fund’s portfolio managers are Norman P. Boucher and Robert L. Salvin.

IN THE NEWS

The global economy continues to expand, but the rate of expansion slowed recently. Manufacturing production and services activity worldwide both eased in February, according to data compiled by JPMorgan and Market Economics. Economic growth was led by the United States, followed by China, Germany, the United Kingdom, Brazil, India, Russia, and Ireland. The rate of increase, however, dropped in most of those countries, with the United States and Russia being the exceptions. Japan’s economic output, meanwhile, was stagnant. In the still-troubled eurozone, conditions weakened substantially in France, Italy, and Spain, with output contracting sharply in these countries’ manufacturing and services sectors. While the global economic deceleration was considered slight by most observers, the expansion rate hit a four-month low in February. As the employment picture improves in the United States and around the world, economists hope that jobs growth will spur further demand.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 28, 2013, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 2/28/13

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (2/14/78) | (3/1/93) | (3/19/02) | (7/3/95) | (1/21/03) | (12/31/98) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.89% | 8.76% | 7.99% | 7.99% | 8.06% | 8.06% | 8.52% | 8.42% | 8.58% | 8.98% |

|

| 10 years | 143.01 | 133.29 | 126.21 | 126.21 | 125.07 | 125.07 | 136.71 | 129.01 | 134.40 | 147.58 |

| Annual average | 9.29 | 8.84 | 8.51 | 8.51 | 8.45 | 8.45 | 9.00 | 8.64 | 8.89 | 9.49 |

|

| 5 years | 57.17 | 50.88 | 51.76 | 49.76 | 51.31 | 51.31 | 55.15 | 50.11 | 54.32 | 58.54 |

| Annual average | 9.46 | 8.57 | 8.70 | 8.41 | 8.64 | 8.64 | 9.18 | 8.46 | 9.06 | 9.65 |

|

| 3 years | 35.27 | 29.86 | 32.25 | 29.25 | 32.10 | 32.10 | 34.26 | 29.90 | 33.96 | 36.12 |

| Annual average | 10.60 | 9.10 | 9.76 | 8.93 | 9.72 | 9.72 | 10.32 | 9.11 | 10.24 | 10.83 |

|

| 1 year | 11.30 | 6.84 | 10.49 | 5.49 | 10.42 | 9.42 | 10.95 | 7.35 | 10.97 | 11.53 |

|

| 6 months | 6.39 | 2.13 | 6.13 | 1.13 | 6.04 | 5.04 | 6.21 | 2.76 | 6.40 | 6.53 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 4.00% and 3.25% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus.

Fund price and distribution information For the six-month period ended 2/28/13

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.240 | $0.210 | $0.210 | $0.228 | $0.231 | $0.252 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.240 | $0.210 | $0.210 | $0.228 | $0.231 | $0.252 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 8/31/12 | $7.76 | $8.08 | $7.74 | $7.69 | $7.78 | $8.04 | $7.61 | $7.63 |

|

| 2/28/13 | 8.01 | 8.34 | 8.00 | 7.94 | 8.03 | 8.30 | 7.86 | 7.87 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Current rate (end of period) | charge | charge | value | value | charge | charge | value | value |

|

| Current dividend rate 1 | 5.99% | 5.76% | 5.25% | 5.29% | 5.68% | 5.49% | 5.80% | 6.40% |

|

| Current 30-day SEC yield 2 | N/A | 4.51 | 3.93 | 3.94 | N/A | 4.29 | 4.44 | 4.91 |

|

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (4.00% for class A shares and 3.25% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by share price before or after sales charge at period-end.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Comparative index returns For periods ended 2/28/13

| | |

| | JPMorgan Developed High | Lipper High Yield Funds |

| | Yield Index | category average* |

|

| Annual average (life of fund) | —† | 8.67% |

|

| 10 years | 168.71% | 131.90 |

| Annual average | 10.39 | 8.73 |

|

| 5 years | 72.60 | 55.02 |

| Annual average | 11.53 | 9.12 |

|

| 3 years | 42.26 | 35.66 |

| Annual average | 12.47 | 10.69 |

|

| 1 year | 12.00 | 10.67 |

|

| 6 months | 6.59 | 6.32 |

|

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 2/28/13, there were 556, 528, 437, 385, 265, and 10 funds, respectively, in this Lipper category.

† The fund’s benchmark, the JPMorgan Developed High Yield Index, was introduced on 12/31/94, which post-dates the inception of the fund’s class A shares.

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/13

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (2/14/78) | (3/1/93) | (3/19/02) | (7/3/95) | (1/21/03) | (12/31/98) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.90% | 8.78% | 8.01% | 8.01% | 8.07% | 8.07% | 8.54% | 8.44% | 8.59% | 8.99% |

|

| 10 years | 140.35 | 130.74 | 123.71 | 123.71 | 122.92 | 122.92 | 134.38 | 126.76 | 131.61 | 145.30 |

| Annual average | 9.17 | 8.72 | 8.38 | 8.38 | 8.35 | 8.35 | 8.89 | 8.53 | 8.76 | 9.39 |

|

| 5 years | 59.36 | 52.98 | 53.68 | 51.68 | 53.23 | 53.23 | 57.29 | 52.18 | 56.31 | 60.78 |

| Annual average | 9.77 | 8.87 | 8.97 | 8.69 | 8.91 | 8.91 | 9.48 | 8.76 | 9.34 | 9.96 |

|

| 3 years | 32.85 | 27.53 | 30.04 | 27.04 | 29.89 | 29.89 | 32.00 | 27.71 | 31.55 | 33.68 |

| Annual average | 9.93 | 8.44 | 9.15 | 8.30 | 9.11 | 9.11 | 9.70 | 8.50 | 9.57 | 10.16 |

|

| 1 year | 12.61 | 8.11 | 11.78 | 6.78 | 11.73 | 10.73 | 12.39 | 8.73 | 12.32 | 12.88 |

|

| 6 months | 6.08 | 1.84 | 5.83 | 0.83 | 5.73 | 4.73 | 6.04 | 2.59 | 5.95 | 6.22 |

|

See the discussion following the Fund performance table on page 10 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses | | | | | | |

| for the fiscal year ended 8/31/12 | 1.02% | 1.77% | 1.77% | 1.27% | 1.27% | 0.77% |

|

| Annualized expense ratio for the | | | | | | |

| six-month period ended 2/28/13 | 1.01% | 1.76% | 1.76% | 1.26% | 1.26% | 0.76% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

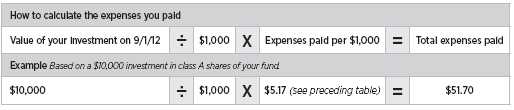

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from September 1, 2012, to February 28, 2013. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $5.17 | $9.00 | $8.99 | $6.44 | $6.45 | $3.89 |

|

| Ending value (after expenses) | $1,063.90 | $1,061.30 | $1,060.40 | $1,062.10 | $1,064.00 | $1,065.30 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

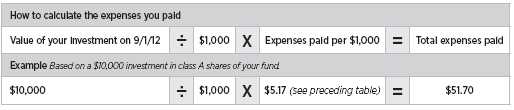

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended February 28, 2013, use the following calculation method. To find the value of your investment on September 1, 2012, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $5.06 | $8.80 | $8.80 | $6.31 | $6.31 | $3.81 |

|

| Ending value (after expenses) | $1,019.79 | $1,016.07 | $1,016.07 | $1,018.55 | $1,018.55 | $1,021.03 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Fixed-income terms

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Yield curve is a graph that plots the yields of bonds with equal credit quality against their differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

JPMorgan Developed High Yield Index is an unmanaged index of high-yield fixed-income securities issued in developed countries.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2012, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2013, Putnam employees had approximately $366,000,000 and the Trustees had approximately $87,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

The fund’s portfolio 2/28/13 (Unaudited)

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* | | Principal amount | Value |

|

| Advertising and marketing services (0.6%) | | | |

| Affinion Group, Inc. company guaranty sr. unsec. notes | | | |

| 7 7/8s, 2018 | | $2,995,000 | $2,276,200 |

|

| Affinion Group, Inc. company guaranty sr. unsec. sub. notes | | | |

| 11 1/2s, 2015 | | 1,977,000 | 1,551,945 |

|

| Griffey Intermediate, Inc./Griffey Finance Sub LLC 144A sr. | | | |

| notes 7s, 2020 | | 1,680,000 | 1,701,000 |

|

| Lamar Media Corp. company guaranty sr. sub. notes | | | |

| 7 7/8s, 2018 | | 900,000 | 981,000 |

|

| Lamar Media Corp. company guaranty sr. sub. notes | | | |

| 5 7/8s, 2022 | | 1,465,000 | 1,589,525 |

|

| | | | 8,099,670 |

| Automotive (1.4%) | | | |

| Chrysler Group, LLC/CG Co-Issuer, Inc. company guaranty notes | | | |

| 8 1/4s, 2021 | | 3,130,000 | 3,466,474 |

|

| Ford Motor Credit Co., LLC sr. unsec. unsub. notes 5 7/8s, 2021 | | 5,155,000 | 5,874,989 |

|

| Ford Motor Credit Co., LLC sr. unsec. unsub. notes 5 3/4s, 2021 | | 875,000 | 990,028 |

|

| General Motors Escrow escrow notes 8 1/4s, 2023 | | 2,555,000 | 38,325 |

|

| Jaguar Land Rover Automotive PLC 144A company guaranty sr. | | | |

| unsec. unsub. notes 5 5/8s, 2023 (United Kingdom) | | 675,000 | 687,136 |

|

| Motors Liquidation Co. Escrow escrow notes 8 3/8s, 2033 | | 2,390,000 | 35,850 |

|

| Navistar International Corp. sr. notes 8 1/4s, 2021 | | 3,334,000 | 3,217,310 |

|

| Schaeffler Finance BV sr. notes Ser. REGS, 8 3/4s, | | | |

| 2019 (Germany) | EUR | 345,000 | 516,851 |

|

| Schaeffler Finance BV 144A company guaranty sr. notes 8 1/2s, | | | |

| 2019 (Germany) | | $2,910,000 | 3,302,850 |

|

| Schaeffler Finance BV 144A company guaranty sr. notes 7 3/4s, | | | |

| 2017 (Germany) | | 945,000 | 1,067,850 |

|

| TRW Automotive, Inc. 144A company guaranty sr. notes | | | |

| 7 1/4s, 2017 | | 1,055,000 | 1,213,250 |

|

| TRW Automotive, Inc. 144A company guaranty sr. unsec. notes | | | |

| 4 1/2s, 2021 | | 680,000 | 686,800 |

|

| | | | 21,097,713 |

| Basic materials (8.1%) | | | |

| Ainsworth Lumber Co., Ltd. 144A sr. notes 7 1/2s, | | | |

| 2017 (Canada) | | 950,000 | 1,015,502 |

|

| ArcelorMittal sr. unsec. unsub. notes 10.35s, 2019 (France) | | 805,000 | 1,015,910 |

|

| ArcelorMittal sr. unsec. unsub. notes 7 1/2s, 2039 (France) | | 990,000 | 1,026,296 |

|

| Ashland, Inc. 144A company guaranty sr. unsec. unsub. notes | | | |

| 4 3/4s, 2022 | | 1,510,000 | 1,536,425 |

|

| Ashland, Inc. 144A sr. unsec. notes 4 3/4s, 2022 | | 625,000 | 634,375 |

|

| Ashland, Inc. 144A sr. unsec. unsub. notes 6 7/8s, 2043 | | 1,025,000 | 1,073,688 |

|

| Atkore International, Inc. company guaranty sr. notes | | | |

| 9 7/8s, 2018 | | 4,755,000 | 5,242,387 |

|

| Axiall Corp. 144A company guaranty sr. unsec. notes | | | |

| 4 7/8s, 2023 | | 235,000 | 238,525 |

|

| Boise Cascade LLC/Boise Cascade Finance Corp. 144A sr. | | | |

| unsec. notes 6 3/8s, 2020 (United Kingdom) | | 420,000 | 443,625 |

|

| Celanese US Holdings, LLC company guaranty sr. unsec. unsub. | | | |

| notes 4 5/8s, 2022 (Germany) | | 1,510,000 | 1,515,662 |

|

| Celanese US Holdings, LLC sr. notes 5 7/8s, 2021 (Germany) | | 2,818,000 | 3,078,664 |

|

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | | Principal amount | Value |

|

| Basic materials cont. | | | |

| Cemex Finance, LLC 144A company guaranty sr. bonds | | | |

| 9 1/2s, 2016 | | $1,975,000 | $2,142,874 |

|

| Cemex Finance, LLC 144A company guaranty sr. notes | | | |

| 9 3/8s, 2022 | | 1,595,000 | 1,854,187 |

|

| Compass Minerals International, Inc. company guaranty sr. | | | |

| unsec. notes 8s, 2019 | | 2,532,000 | 2,734,560 |

|

| Eagle Spinco, Inc. 144A company guaranty sr. unsec. notes | | | |

| 4 5/8s, 2021 | | 290,000 | 294,713 |

|

| Edgen Murray Corp. 144A company guaranty sr. notes | | | |

| 8 3/4s, 2020 | | 1,425,000 | 1,460,624 |

|

| Eldorado Gold Corp. 144A sr. unsec. notes 6 1/8s, | | | |

| 2020 (Canada) | | 865,000 | 901,936 |

|

| Ferro Corp. sr. unsec. notes 7 7/8s, 2018 | | 3,425,000 | 3,399,312 |

|

| FMG Resources August 2006 Pty, Ltd. 144A sr. notes 8 1/4s, | | | |

| 2019 (Australia) | | 1,635,000 | 1,806,674 |

|

| FMG Resources August 2006 Pty, Ltd. 144A sr. notes 7s, | | | |

| 2015 (Australia) | | 15,000 | 15,713 |

|

| FMG Resources August 2006 Pty, Ltd. 144A sr. notes 6 7/8s, | | | |

| 2018 (Australia) | | 2,677,000 | 2,837,620 |

|

| FMG Resources August 2006 Pty, Ltd. 144A sr. unsec. notes | | | |

| 6 7/8s, 2022 (Australia) | | 1,515,000 | 1,617,262 |

|

| HD Supply, Inc. 144A company guaranty sr. unsec. notes | | | |

| 11 1/2s, 2020 | | 3,371,000 | 3,885,077 |

|

| HD Supply, Inc. 144A company guaranty sr. unsec. sub. notes | | | |

| 10 1/2s, 2021 | | 1,330,000 | 1,369,900 |

|

| HD Supply, Inc. 144A sr. unsec. notes 7 1/2s, 2020 | | 2,115,000 | 2,117,643 |

|

| Hexion U.S. Finance Corp. company guaranty sr. notes | | | |

| 6 5/8s, 2020 | | 120,000 | 118,200 |

|

| Hexion U.S. Finance Corp. 144A sr. notes 6 5/8s, 2020 | | 685,000 | 674,725 |

|

| Hexion U.S. Finance Corp./Hexion Nova Scotia Finance, ULC | | | |

| company guaranty sr. notes 8 7/8s, 2018 | | 2,050,000 | 2,060,250 |

|

| Hexion U.S. Finance Corp./Hexion Nova Scotia Finance, ULC | | | |

| 144A company guaranty sr. notes 8 7/8s, 2018 | | 1,017,000 | 1,024,627 |

|

| Huntsman International, LLC company guaranty sr. unsec. sub. | | | |

| notes 8 5/8s, 2021 | | 1,903,000 | 2,150,390 |

|

| Huntsman International, LLC company guaranty sr. unsec. sub. | | | |

| notes 8 5/8s, 2020 | | 2,465,000 | 2,748,474 |

|

| Huntsman International, LLC company guaranty sr. unsec. | | | |

| unsub. notes 4 7/8s, 2020 | | 1,515,000 | 1,499,850 |

|

| Huntsman International, LLC 144A sr. unsec. notes 4 7/8s, 2020 | | 950,000 | 935,750 |

|

| IAMGOLD Corp. 144A company guaranty sr. unsec. notes | | | |

| 6 3/4s, 2020 (Canada) | | 2,755,000 | 2,665,463 |

|

| INEOS Finance PLC 144A company guaranty sr. notes 8 3/8s, | | | |

| 2019 (United Kingdom) | | 1,380,000 | 1,511,100 |

|

| INEOS Finance PLC 144A company guaranty sr. notes 7 1/2s, | | | |

| 2020 (United Kingdom) | | 615,000 | 662,663 |

|

| INEOS Group Holdings, Ltd. company guaranty sr. unsec. notes | | | |

| Ser. REGS, 7 7/8s, 2016 (Luxembourg) | EUR | 2,150,000 | 2,818,300 |

|

| Inmet Mining Corp. 144A company guaranty sr. unsec. notes | | | |

| 7 1/2s, 2021 (Canada) | | $600,000 | 636,000 |

|

| JM Huber Corp. 144A sr. unsec. notes 9 7/8s, 2019 | | 2,750,000 | 3,107,500 |

|

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | | Principal amount | Value |

|

| Basic materials cont. | | | |

| Louisiana-Pacific Corp. company guaranty sr. unsec. unsub. | | | |

| notes 7 1/2s, 2020 | | $1,310,000 | $1,486,850 |

|

| LyondellBasell Industries NV sr. unsec. notes 6s, 2021 | | 2,340,000 | 2,749,500 |

|

| LyondellBasell Industries NV sr. unsec. unsub. notes | | | |

| 5 3/4s, 2024 | | 2,955,000 | 3,435,187 |

|

| LyondellBasell Industries NV sr. unsec. unsub. notes 5s, 2019 | | 5,320,000 | 5,931,800 |

|

| Momentive Performance Materials, Inc. company guaranty | | | |

| notes 9 1/2s, 2021 | EUR | 785,000 | 741,832 |

|

| Momentive Performance Materials, Inc. company guaranty sr. | | | |

| notes 10s, 2020 | | $915,000 | 919,575 |

|

| Momentive Performance Materials, Inc. company guaranty sr. | | | |

| notes 8 7/8s, 2020 | | 1,130,000 | 1,161,074 |

|

| New Gold, Inc. 144A company guaranty sr. unsec. unsub. notes | | | |

| 7s, 2020 (Canada) | | 1,510,000 | 1,630,800 |

|

| New Gold, Inc. 144A sr. unsec. notes 6 1/4s, 2022 (Canada) | | 760,000 | 798,152 |

|

| Novelis, Inc. company guaranty sr. unsec. notes 8 3/4s, 2020 | | 1,770,000 | 1,982,400 |

|

| Nufarm Australia Ltd. 144A company guaranty sr. notes 6 3/8s, | | | |

| 2019 (Australia) | | 830,000 | 875,650 |

|

| Orion Engineered Carbons Bondco GmbH 144A company | | | |

| guaranty sr. notes 9 5/8s, 2018 (Germany) | | 226,000 | 248,600 |

|

| Perstorp Holding AB 144A company guaranty sr. notes 8 3/4s, | | | |

| 2017 (Sweden) | | 2,380,000 | 2,499,000 |

|

| PQ Corp. 144A sr. notes 8 3/4s, 2018 | | 1,915,000 | 2,022,718 |

|

| Roofing Supply Group, LLC/Roofing Supply Finance, Inc. 144A | | | |

| company guaranty sr. unsec. notes 10s, 2020 | | 2,183,000 | 2,466,790 |

|

| Ryerson, Inc./Joseph T Ryerson & Son, Inc. 144A company | | | |

| guaranty sr. notes 9s, 2017 | | 2,000,000 | 2,190,000 |

|

| Sealed Air Corp. 144A sr. unsec. notes 6 1/2s, 2020 | | 465,000 | 503,363 |

|

| Smurfit Kappa Acquisition company guaranty sr. bonds 7 1/4s, | | | |

| 2017 (Ireland) | EUR | 200,000 | 277,547 |

|

| Smurfit Kappa Acquisitions 144A company guaranty sr. notes | | | |

| 4 7/8s, 2018 (Ireland) | | $980,000 | 1,029,000 |

|

| Smurfit Kappa Treasury company guaranty sr. unsec. unsub. | | | |

| debs 7 1/2s, 2025 (Ireland) | | 1,231,000 | 1,347,944 |

|

| Steel Dynamics, Inc. company guaranty sr. unsec. notes | | | |

| 7 5/8s, 2020 | | 630,000 | 699,300 |

|

| Steel Dynamics, Inc. company guaranty sr. unsec. unsub. notes | | | |

| 6 3/4s, 2015 | | 2,682,000 | 2,682,000 |

|

| Steel Dynamics, Inc. 144A company guaranty sr. unsec. notes | | | |

| 6 3/8s, 2022 | | 435,000 | 465,450 |

|

| Steel Dynamics, Inc. 144A company guaranty sr. unsec. notes | | | |

| 6 1/8s, 2019 | | 580,000 | 620,600 |

|

| Taminco Acquisition Corp. 144A sr. unsec. notes 9 1/8s, 2017 | | | |

| (Belgium) ‡‡ | | 1,070,000 | 1,068,662 |

|

| Taminco Global Chemical Corp. 144A sr. notes 9 3/4s, | | | |

| 2020 (Belgium) | | 2,815,000 | 3,110,574 |

|

| TPC Group, Inc. 144A company guaranty sr. notes 8 3/4s, 2020 | | 2,335,000 | 2,364,187 |

|

| Tronox Finance, LLC 144A company guaranty sr. unsec. notes | | | |

| 6 3/8s, 2020 | | 2,880,000 | 2,862,000 |

|

| | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | Principal amount | Value |

|

| Basic materials cont. | | |

| US Coatings Acquisition, Inc./Flash Dutch 2 BV 144A company | | |

| guaranty sr. unsec. notes 7 3/8s, 2021 (Netherlands) | $680,000 | $704,480 |

|

| USG Corp. sr. unsec. notes 9 3/4s, 2018 | 1,989,000 | 2,339,561 |

|

| Verso Paper Holdings, LLC/Verso Paper, Inc. company guaranty | | |

| sr. notes 8 3/4s, 2019 | 597,000 | 241,785 |

|

| Weekley Homes, LLC/Weekley Finance Corp. 144A sr. unsec. | | |

| notes 6s, 2023 | 775,000 | 790,500 |

|

| Weyerhaeuser Co. sr. unsec. unsub. debs. 7 1/8s, 2023 R | 1,530,000 | 1,845,731 |

|

| | | 119,965,058 |

| Broadcasting (2.2%) | | |

| Clear Channel Communications, Inc. company guaranty sr. | | |

| notes 9s, 2021 | 1,391,000 | 1,258,854 |

|

| Clear Channel Communications, Inc. 144A company guaranty sr. | | |

| notes 9s, 2019 | 3,725,000 | 3,464,250 |

|

| Clear Channel Worldwide Holdings, Inc. company guaranty sr. | | |

| unsec. notes 7 5/8s, 2020 | 4,250,000 | 4,388,125 |

|

| Clear Channel Worldwide Holdings, Inc. 144A company | | |

| guaranty sr. unsec. unsub. notes 6 1/2s, 2022 | 2,775,000 | 2,920,688 |

|

| Cumulus Media Holdings, Inc. company guaranty sr. unsec. | | |

| unsub. notes 7 3/4s, 2019 | 2,745,000 | 2,751,863 |

|

| Entercom Radio, LLC company guaranty sr. unsec. sub. notes | | |

| 10 1/2s, 2019 | 2,520,000 | 2,853,900 |

|

| Gray Television, Inc. company guaranty sr. unsec. notes | | |

| 7 1/2s, 2020 | 1,800,000 | 1,881,000 |

|

| LIN Television Corp. 144A company guaranty sr. unsec. notes | | |

| 6 3/8s, 2021 | 965,000 | 1,022,900 |

|

| Nexstar Broadcasting, Inc. 144A company guaranty sr. unsec. | | |

| unsub. notes 6 7/8s, 2020 | 2,300,000 | 2,403,500 |

|

| Nexstar Broadcasting, Inc./Mission Broadcasting, Inc. company | | |

| guaranty sr. notes 8 7/8s, 2017 | 2,330,000 | 2,563,000 |

|

| Sinclair Television Group, Inc. 144A sr. notes 6 1/8s, 2022 | 1,010,000 | 1,078,175 |

|

| Univision Communications, Inc. 144A company guaranty sr. | | |

| unsec. notes 8 1/2s, 2021 | 2,515,000 | 2,744,494 |

|

| Univision Communications, Inc. 144A sr. notes 7 7/8s, 2020 | 1,475,000 | 1,631,719 |

|

| XM Satellite Radio, Inc. 144A sr. unsec. notes 7 5/8s, 2018 | 1,305,000 | 1,438,763 |

|

| | | 32,401,231 |

| Building materials (1.1%) | | |

| Building Materials Corp. 144A company guaranty sr. notes | | |

| 7 1/2s, 2020 | 2,170,000 | 2,349,025 |

|

| Building Materials Corp. 144A sr. notes 7s, 2020 | 1,385,000 | 1,499,263 |

|

| Building Materials Corp. 144A sr. notes 6 3/4s, 2021 | 955,000 | 1,025,431 |

|

| Jeld-Wen Escrow Corp. 144A sr. notes 12 1/4s, 2017 | 3,575,000 | 4,200,625 |

|

| Masonite International Corp., 144A company guaranty sr. notes | | |

| 8 1/4s, 2021 (Canada) | 2,844,000 | 3,163,950 |

|

| Nortek, Inc. company guaranty sr. unsec. notes 10s, 2018 | 3,111,000 | 3,464,876 |

|

| Owens Corning company guaranty sr. unsec. notes 9s, 2019 | 642,000 | 812,130 |

|

| | | 16,515,300 |

| Cable television (3.1%) | | |

| Adelphia Communications Corp. escrow bonds zero %, 2013 | 4,000 | 25 |

|

| Adelphia Communications Corp. escrow bonds zero %, 2013 | 4,000 | 25 |

|

| Adelphia Communications Corp. escrow bonds zero %, 2013 | 81,000 | 510 |

|

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | | Principal amount | Value |

|

| Cable television cont. | | | |

| Adelphia Communications Corp. escrow bonds zero %, 2013 | | $2,906,000 | $18,308 |

|

| Adelphia Communications Corp. escrow bonds zero %, 2014 | | 2,223,000 | 14,005 |

|

| Bresnan Broadband Holdings, LLC 144A company guaranty sr. | | | |

| unsec. unsub. notes 8s, 2018 | | 1,627,000 | 1,773,430 |

|

| Cablevision Systems Corp. sr. unsec. unsub. notes 8 5/8s, 2017 | | 2,947,000 | 3,418,520 |

|

| Cablevision Systems Corp. sr. unsec. unsub. notes 8s, 2020 | | 755,000 | 838,050 |

|

| Cablevision Systems Corp. sr. unsec. unsub. notes 7 3/4s, 2018 | | 903,000 | 993,300 |

|

| CCO Holdings, LLC/CCO Holdings Capital Corp. company | | | |

| guaranty sr. unsec. notes 7 7/8s, 2018 | | 2,255,000 | 2,407,212 |

|

| CCO Holdings, LLC/CCO Holdings Capital Corp. company | | | |

| guaranty sr. unsec. notes 6 1/2s, 2021 | | 2,142,000 | 2,281,230 |

|

| CCO Holdings, LLC/CCO Holdings Capital Corp. company | | | |

| guaranty sr. unsec. notes 5 1/4s, 2022 | | 1,205,000 | 1,183,912 |

|

| CCO Holdings, LLC/CCO Holdings Capital Corp. company | | | |

| guaranty sr. unsec. unsub. notes 7 3/8s, 2020 | | 1,885,000 | 2,078,212 |

|

| CCO Holdings, LLC/CCO Holdings Capital Corp. company | | | |

| guaranty sr. unsec. unsub. notes 6 5/8s, 2022 | | 835,000 | 903,888 |

|

| CCO Holdings, LLC/CCO Holdings Capital Corp. company | | | |

| guaranty sr. unsec. unsub. notes 5 1/8s, 2023 | | 1,000,000 | 977,500 |

|

| CCO Holdings, LLC/CCO Holdings Capital Corp. company | | | |

| guaranty sr. unsub. notes 7s, 2019 | | 2,351,000 | 2,533,202 |

|

| Cequel Communications Escrow Capital Corp. 144A sr. unsec. | | | |

| notes 6 3/8s, 2020 | | 565,000 | 584,069 |

|

| CSC Holdings, LLC sr. unsec. unsub. notes 6 3/4s, 2021 | | 1,540,000 | 1,684,374 |

|

| DISH DBS Corp. company guaranty notes 7 1/8s, 2016 | | 6,000 | 6,675 |

|

| DISH DBS Corp. company guaranty sr. unsec. notes 7 7/8s, 2019 | | 2,050,000 | 2,426,687 |

|

| DISH DBS Corp. company guaranty sr. unsec. notes 6 3/4s, 2021 | | 2,795,000 | 3,109,437 |

|

| Mediacom, LLC/Mediacom Capital Corp. sr. unsec. notes | | | |

| 9 1/8s, 2019 | | 1,275,000 | 1,415,250 |

|

| Mediacom, LLC/Mediacom Capital Corp. sr. unsec. unsub. notes | | | |

| 7 1/4s, 2022 | | 2,040,000 | 2,208,300 |

|

| Quebecor Media, Inc. 144A sr. unsec. notes 7 3/8s, | | | |

| 2021 (Canada) | CAD | 1,680,000 | 1,772,694 |

|

| Quebecor Media, Inc. 144A sr. unsec. notes 5 3/4s, | | | |

| 2023 (Canada) | | $1,810,000 | 1,850,724 |

|

| Unitymedia Hessen GmbH & Co. KG/Unitymedia NRW GmbH | | | |

| 144A company guaranty sr. notes 7 1/2s, 2019 (Germany) | | 1,275,000 | 1,383,784 |

|

| Videotron Ltee company guaranty sr. unsec. unsub. notes 5s, | | | |

| 2022 (Canada) | | 3,210,000 | 3,266,174 |

|

| Virgin Media Finance PLC company guaranty sr. unsec. unsub. | | | |

| notes 5 1/4s, 2022 (United Kingdom) | | 1,000,000 | 1,014,228 |

|

| Virgin Media Finance PLC company guaranty sr. unsec. unsub. | | | |

| notes 4 7/8s, 2022 (United Kingdom) | | 1,065,000 | 1,077,540 |

|

| WideOpenWest Finance, LLC/WideOpenWest Capital Corp. | | | |

| 144A company guaranty sr. unsec. notes 10 1/4s, 2019 | | 4,634,000 | 5,051,060 |

|

| | | | 46,272,325 |

| Capital goods (6.0%) | | | |

| ADS Waste Holdings, Inc. 144A sr. notes 8 1/4s, 2020 | | 1,905,000 | 2,047,874 |

|

| American Axle & Manufacturing, Inc. company guaranty sr. | | | |

| unsec. notes 7 3/4s, 2019 | | 5,825,000 | 6,378,374 |

|

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | | Principal amount | Value |

|

| Capital goods cont. | | | |

| ARD Finance SA sr. notes Ser. REGS, 11 1/8s, 2018 | | | |

| (Luxembourg) ‡‡ | EUR | 334,302 | $474,833 |

|

| Ardagh Packaging Finance PLC sr. notes Ser. REGS, 7 3/8s, | | | |

| 2017 (Ireland) | EUR | 2,020,000 | 2,855,544 |

|

| Ardagh Packaging Finance PLC 144A company guaranty sr. | | | |

| notes 7 3/8s, 2017 (Ireland) | EUR | 790,000 | 1,116,771 |

|

| Ardagh Packaging Finance PLC/Ardagh MP Holdings USA, Inc. | | | |

| 144A company guaranty sr. notes 7 3/8s, 2017 (Ireland) | | $350,000 | 383,250 |

|

| Ardagh Packaging Finance PLC/Ardagh MP Holdings USA, Inc. | | | |

| 144A sr. notes 4 7/8s, 2022 (Ireland) | | 1,115,000 | 1,098,274 |

|

| Ardagh Packaging Finance PLC/Ardagh MP Holdings USA, Inc. | | | |

| 144A sr. unsec. notes 7s, 2020 (Ireland) | | 2,200,000 | 2,205,500 |

|

| B/E Aerospace, Inc. sr. unsec. unsub. notes 5 1/4s, 2022 | | 825,000 | 855,938 |

|

| Berry Plastics Corp. company guaranty notes 9 1/2s, 2018 | | 1,695,000 | 1,885,687 |

|

| Berry Plastics Corp. company guaranty sr. unsec. sub. notes | | | |

| 10 1/4s, 2016 | | 1,445,000 | 1,471,732 |

|

| Berry Plastics Corp. company guaranty unsub. notes | | | |

| 9 3/4s, 2021 | | 1,627,000 | 1,879,184 |

|

| BOE Merger Corp. 144A sr. unsec. notes 9 1/2s, 2017 ‡‡ | | 985,000 | 1,044,100 |

|

| Bombardier, Inc. 144A sr. notes 6 1/8s, 2023 (Canada) | | 690,000 | 706,388 |

|

| Bombardier, Inc. 144A sr. unsec. notes 7 3/4s, 2020 (Canada) | | 1,325,000 | 1,503,874 |

|

| Briggs & Stratton Corp. company guaranty sr. unsec. notes | | | |

| 6 7/8s, 2020 | | 3,025,000 | 3,418,250 |

|

| Consolidated Container Co. LLC/Consolidated Container | | | |

| Capital, Inc. 144A company guaranty sr. unsec. notes | | | |

| 10 1/8s, 2020 | | 360,000 | 391,050 |

|

| Crown Americas LLC/Crown Americas Capital Corp. IV 144A | | | |

| company guaranty sr. unsec. notes 4 1/2s, 2023 | | 825,000 | 806,438 |

|

| Crown Euro Holdings SA 144A sr. notes 7 1/8s, 2018 (France) | EUR | 610,000 | 859,140 |

|

| Delphi Corp. company guaranty sr. unsec. unsub. notes 5s, 2023 | | $2,035,000 | 2,111,312 |

|

| Dematic SA/DH Services Luxembourg Sarl 144A company | | | |

| guaranty sr. unsec. notes 7 3/4s, 2020 (Luxembourg) | | 3,185,000 | 3,256,662 |

|

| Exide Technologies sr. notes 8 5/8s, 2018 | | 3,100,000 | 2,588,500 |

|

| GrafTech International, Ltd. 144A company guaranty sr. unsec. | | | |

| notes 6 3/8s, 2020 | | 2,295,000 | 2,438,437 |

|

| Kratos Defense & Security Solutions, Inc. company guaranty sr. | | | |

| notes 10s, 2017 | | 1,690,000 | 1,865,337 |

|

| Legrand France SA sr. unsec. unsub. debs 8 1/2s, 2025 (France) | | 5,431,000 | 7,235,638 |

|

| Manitowoc Co., Inc. (The) company guaranty sr. unsec. notes | | | |

| 5 7/8s, 2022 | | 710,000 | 727,750 |

|

| Pittsburgh Glass Works, LLC 144A sr. notes 8 1/2s, 2016 | | 4,105,000 | 4,135,787 |

|

| Polypore International, Inc. company guaranty sr. unsec. notes | | | |

| 7 1/2s, 2017 | | 2,640,000 | 2,838,000 |

|

| Rexel SA 144A company guaranty sr. unsec. unsub. notes | | | |

| 6 1/8s, 2019 (France) | | 2,825,000 | 3,015,437 |

|

| Reynolds Group Issuer, Inc./Reynolds Group Issuer, LLC/Reynolds | | |

| Group Issuer Lu company guaranty sr. notes 7 7/8s, 2019 | | 1,235,000 | 1,366,218 |

|

| Reynolds Group Issuer, Inc./Reynolds Group Issuer, LLC/Reynolds | | |

| Group Issuer Lu company guaranty sr. notes 7 1/8s, 2019 | | 1,585,000 | 1,701,894 |

|

| Reynolds Group Issuer, Inc./Reynolds Group Issuer, LLC/Reynolds | | | |

| Group Issuer Lu company guaranty sr. unsec. unsub. notes 9 7/8s, 2019 | 2,870,000 | 3,142,650 |

|

| | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | Principal amount | Value |

|

| Capital goods cont. | | |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer, LLC/Reynolds | | |

| Group Issuer Lu company guaranty sr. unsec. unsub. notes 9s, 2019 | $195,000 | $206,700 |

|

| Reynolds Group Issuer, Inc./Reynolds Group Issuer, LLC/Reynolds | | |

| Group Issuer Lu company guaranty sr. unsec. unsub. notes 8 1/4s, 2021 | 785,000 | 810,513 |

|

| Reynolds Group Issuer, Inc./Reynolds Group Issuer, LLC/ | | |

| Reynolds Group Issuer Lu company guaranty sr. notes | | |

| 5 3/4s, 2020 | 1,430,000 | 1,476,474 |

|

| Silver II Borrower/Silver II US Holdings, LLC 144A company | | |

| guaranty sr. unsec. unsub. notes 7 3/4s, 2020 (Luxembourg) | 825,000 | 858,000 |

|

| Tenneco, Inc. company guaranty sr. unsec. unsub. notes | | |

| 7 3/4s, 2018 | 1,040,000 | 1,142,700 |

|

| Tenneco, Inc. company guaranty sr. unsub. notes 6 7/8s, 2020 | 2,130,000 | 2,327,024 |

|

| Terex Corp. company guaranty sr. unsec. unsub. notes 6s, 2021 | 2,825,000 | 2,930,937 |

|

| Thermadyne Holdings Corp. company guaranty sr. | | |

| notes 9s, 2017 | 4,410,000 | 4,784,850 |

|

| Thermon Industries, Inc. company guaranty sr. notes | | |

| 9 1/2s, 2017 | 1,737,000 | 1,928,070 |

|

| TransDigm, Inc. company guaranty unsec. sub. notes | | |

| 7 3/4s, 2018 | 2,845,000 | 3,122,387 |

|

| Triumph Group, Inc. 144A sr. unsec. notes 4 7/8s, 2021 | 2,040,000 | 2,050,200 |

|

| | | 89,443,678 |

| Coal (1.0%) | | |

| Alpha Natural Resources, Inc. company guaranty sr. unsec. | | |

| notes 6 1/4s, 2021 | 1,040,000 | 923,000 |

|

| Alpha Natural Resources, Inc. company guaranty sr. unsec. | | |

| notes 6s, 2019 | 1,550,000 | 1,410,500 |

|

| Arch Coal, Inc. company guaranty sr. unsec. notes 7 1/4s, 2020 | 630,000 | 540,225 |

|

| Arch Coal, Inc. company guaranty sr. unsec. unsub. | | |

| notes 7s, 2019 | 2,010,000 | 1,733,625 |

|

| CONSOL Energy, Inc. company guaranty sr. unsec. notes | | |

| 8 1/4s, 2020 | 4,445,000 | 4,900,613 |

|

| CONSOL Energy, Inc. company guaranty sr. unsec. | | |

| notes 8s, 2017 | 3,535,000 | 3,844,313 |

|

| Peabody Energy Corp. company guaranty sr. unsec. notes | | |

| 7 3/8s, 2016 | 218,000 | 248,520 |

|

| Peabody Energy Corp. company guaranty sr. unsec. unsub. | | |

| notes 6 1/2s, 2020 | 262,000 | 278,375 |

|

| Peabody Energy Corp. company guaranty sr. unsec. unsub. | | |

| notes 6s, 2018 | 1,310,000 | 1,391,875 |

|

| | | 15,271,046 |

| Commercial and consumer services (1.8%) | | |

| Ashtead Capital, Inc. 144A company guaranty sr. notes | | |

| 6 1/2s, 2022 | 1,080,000 | 1,166,400 |

|

| Igloo Holdings Corp. 144A sr. unsec. unsub. notes | | |

| 8 1/4s, 2017 ‡‡ | 4,155,000 | 4,258,875 |

|

| Interactive Data Corp. company guaranty sr. unsec. notes | | |

| 10 1/4s, 2018 | 2,280,000 | 2,584,950 |

|

| Lender Processing Services, Inc. company guaranty sr. unsec. | | |

| unsub. notes 5 3/4s, 2023 | 3,040,000 | 3,184,400 |

|

| Rural/Metro Corp. 144A sr. unsec. notes 10 1/8s, 2019 | 2,435,000 | 2,422,825 |

|

| Sabre Holdings Corp. sr. unsec. unsub. notes 8.35s, 2016 | 3,875,000 | 4,204,375 |

|

| Sabre, Inc. 144A sr. notes 8 1/2s, 2019 | 2,739,000 | 2,971,815 |

|

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | | Principal amount | Value |

|

| Commercial and consumer services cont. | | | |

| Travelport, LLC company guaranty sr. unsec. sub. notes | | | |

| 11 7/8s, 2016 | | $1,404,000 | $1,081,080 |

|

| Travelport, LLC company guaranty sr. unsec. unsub. notes | | | |

| 9 7/8s, 2014 | | 104,000 | 99,840 |

|

| Travelport, LLC 144A sr. notes Ser. B, 6.308s, 2016 ‡‡ | | 3,088,947 | 2,919,055 |

|

| Travelport, LLC/Travelport, Inc. company guaranty sr. unsec. | | | |

| notes 9s, 2016 | | 1,410,000 | 1,290,150 |

|

| | | | 26,183,765 |

| Consumer (0.5%) | | | |

| BC Mountain, LLC/BC Mountain Finance, Inc. 144A company | | | |

| guaranty sr. unsec. notes 7s, 2021 | | 370,000 | 380,638 |

|

| Jarden Corp. company guaranty sr. unsec. notes 8s, 2016 | | 1,120,000 | 1,174,600 |

|

| Jarden Corp. company guaranty sr. unsec. sub. notes Ser. 1, | | | |

| 7 1/2s, 2020 | EUR | 410,000 | 576,283 |

|

| Spectrum Brands Escrow Corp. 144A sr. unsec. notes | | | |

| 6 5/8s, 2022 | | $140,000 | 150,150 |

|

| Spectrum Brands Escrow Corp. 144A sr. unsec. notes | | | |

| 6 3/8s, 2020 | | 175,000 | 184,625 |

|

| Spectrum Brands Holdings, Inc. company guaranty sr. notes | | | |

| 9 1/2s, 2018 | | 2,442,000 | 2,768,618 |

|

| Spectrum Brands Holdings, Inc. 144A sr. notes 6 3/4s, 2020 | | 1,914,000 | 2,062,335 |

|

| | | | 7,297,249 |

| Consumer staples (6.0%) | | | |

| Avis Budget Car Rental, LLC company guaranty sr. unsec. | | | |

| unsub. notes 9 3/4s, 2020 | | 730,000 | 843,150 |

|

| Avis Budget Car Rental, LLC company guaranty sr. unsec. | | | |

| unsub. notes 9 5/8s, 2018 | | 675,000 | 745,875 |

|

| Avis Budget Car Rental, LLC company guaranty sr. unsec. | | | |

| unsub. notes 8 1/4s, 2019 | | 705,000 | 770,213 |

|

| Burger King Corp. company guaranty sr. unsec. notes | | | |

| 9 7/8s, 2018 | | 1,830,000 | 2,086,200 |

|

| Carrols Restaurant Group, Inc. company guaranty sr. notes | | | |

| 11 1/4s, 2018 | | 1,125,000 | 1,262,813 |

|

| CKE Holdings, Inc. 144A sr. unsec. notes 10 1/2s, 2016 ‡‡ | | 1,703,319 | 1,828,939 |

|

| Claire’s Stores, Inc. company guaranty sr. notes 8 7/8s, 2019 | | 1,745,000 | 1,747,181 |

|

| Claire’s Stores, Inc. 144A sr. notes 9s, 2019 | | 4,150,000 | 4,606,500 |

|

| Constellation Brands, Inc. company guaranty sr. unsec. unsub. | | | |

| notes 7 1/4s, 2016 | | 3,123,000 | 3,540,701 |

|

| Constellation Brands, Inc. company guaranty sr. unsec. unsub. | | | |

| notes 6s, 2022 | | 1,205,000 | 1,316,463 |

|

| Corrections Corporation of America company guaranty sr. notes | | | |

| 7 3/4s, 2017 | | 3,440,000 | 3,620,600 |

|

| Dave & Buster’s, Inc. company guaranty sr. unsec. unsub. | | | |

| notes 11s, 2018 | | 2,962,000 | 3,339,655 |

|

| Dean Foods Co. company guaranty sr. unsec. unsub. notes | | | |

| 9 3/4s, 2018 | | 583,000 | 658,790 |

|

| Dean Foods Co. company guaranty sr. unsec. unsub. | | | |

| notes 7s, 2016 | | 2,215,000 | 2,450,344 |

|

| DineEquity, Inc. company guaranty sr. unsec. notes 9 1/2s, 2018 | | 3,435,000 | 3,898,725 |

|

| Dole Food Co., Inc. sr. notes 13 7/8s, 2014 | | 672,000 | 720,720 |

|

| Dole Food Co., Inc. 144A sr. notes 8s, 2016 | | 765,000 | 798,469 |

|

| Elizabeth Arden, Inc. sr. unsec. unsub. notes 7 3/8s, 2021 | | 1,455,000 | 1,615,050 |

|

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | | Principal amount | Value |

|

| Consumer staples cont. | | | |

| ESAL GmbH 144A company guaranty sr. unsec. notes 6 1/4s, | | | |

| 2023 (Austria) | | $1,845,000 | $1,826,762 |

|

| HDTFS, Inc. 144A company guaranty sr. notes 6 1/4s, 2022 | | 1,315,000 | 1,413,625 |

|

| HDTFS, Inc. 144A company guaranty sr. notes 5 7/8s, 2020 | | 1,605,000 | 1,669,200 |

|

| Hertz Corp. (The) company guaranty sr. unsec. notes | | | |

| 7 1/2s, 2018 | | 920,000 | 1,005,100 |

|

| Hertz Holdings Netherlands BV 144A sr. bonds 8 1/2s, | | | |

| 2015 (Netherlands) | EUR | 2,245,000 | 3,120,299 |

|

| JBS USA, LLC/JBS USA Finance, Inc. company guaranty sr. | | | |

| unsec. notes 11 5/8s, 2014 | | $1,050,000 | 1,161,563 |

|

| JBS USA, LLC/JBS USA Finance, Inc. 144A sr. unsec. notes | | | |

| 8 1/4s, 2020 | | 900,000 | 969,750 |

|

| JBS USA, LLC/JBS USA Finance, Inc. 144A sr. unsec. notes | | | |

| 7 1/4s, 2021 | | 3,390,000 | 3,508,650 |

|

| Landry’s, Inc. 144A sr. unsec. notes 9 3/8s, 2020 | | 1,610,000 | 1,726,725 |

|

| Landry’s Holdings II, Inc. 144A sr. unsec. notes 10 1/4s, 2018 | | 1,520,000 | 1,580,800 |

|

| Libbey Glass, Inc. company guaranty sr. notes 6 7/8s, 2020 | | 1,406,000 | 1,504,420 |

|

| Michael Foods, Inc. company guaranty sr. unsec. notes | | | |

| 9 3/4s, 2018 | | 1,200,000 | 1,335,000 |

|

| Post Holdings, Inc. company guaranty sr. unsec. notes | | | |

| 7 3/8s, 2022 | | 1,250,000 | 1,350,000 |

|

| Prestige Brands, Inc. company guaranty sr. unsec. notes | | | |

| 8 1/4s, 2018 | | 3,090,000 | 3,383,550 |

|

| Revlon Consumer Products Corp. 144A company guaranty sr. | | | |

| unsec. notes 5 3/4s, 2021 | | 2,750,000 | 2,739,688 |

|

| Rite Aid Corp. company guaranty sr. notes 10 1/4s, 2019 | | 880,000 | 1,018,600 |

|

| Rite Aid Corp. company guaranty sr. notes 7 1/2s, 2017 | | 1,951,000 | 2,009,530 |

|

| Rite Aid Corp. company guaranty sr. unsec. unsub. notes | | | |

| 9 1/2s, 2017 | | 4,267,000 | 4,485,684 |

|

| Rite Aid Corp. company guaranty sr. unsec. unsub. notes | | | |

| 9 1/4s, 2020 | | 2,300,000 | 2,576,000 |

|

| Rite Aid Corp. company guaranty sr. unsub. notes 8s, 2020 | | 740,000 | 839,900 |

|

| Smithfield Foods, Inc. sr. unsec. unsub. notes 6 5/8s, 2022 | | 1,960,000 | 2,131,500 |

|

| United Rentals North America, Inc. company guaranty sr. notes | | | |

| 5 3/4s, 2018 | | 765,000 | 823,331 |

|

| United Rentals North America, Inc. company guaranty sr. unsec. | | | |

| notes 7 5/8s, 2022 | | 2,520,000 | 2,790,900 |

|

| United Rentals North America, Inc. company guaranty sr. unsec. | | | |

| unsub. notes 9 1/4s, 2019 | | 2,560,000 | 2,918,400 |

|

| United Rentals North America, Inc. company guaranty sr. unsec. | | | |

| unsub. notes 6 1/8s, 2023 | | 560,000 | 588,000 |

|

| Wells Enterprises, Inc. 144A sr. notes 6 3/4s, 2020 | | 979,000 | 1,031,621 |

|

| West Corp. company guaranty sr. unsec. notes 8 5/8s, 2018 | | 1,180,000 | 1,256,700 |

|

| West Corp. company guaranty sr. unsec. notes 7 7/8s, 2019 | | 1,959,000 | 2,047,155 |

|

| Wok Acquisition Corp. 144A sr. unsec. notes 10 1/4s, 2020 | | 360,000 | 385,200 |

|

| | | | 89,048,041 |

| Energy (oil field) (0.8%) | | | |

| FTS International Services, LLC/FTS International Bonds, Inc. | | | |

| 144A company guaranty sr. unsec. unsub. notes 8 1/8s, 2018 | | 1,832,000 | 1,896,120 |

|

| Hiland Partners LP/Hiland Partners Finance Corp. 144A | | | |

| company guaranty sr. notes 7 1/4s, 2020 | | 1,140,000 | 1,231,200 |

|

| | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | Principal amount | Value |

|

| Energy (oil field) cont. | | |

| Key Energy Services, Inc. company guaranty unsec. unsub. | | |

| notes 6 3/4s, 2021 | $2,308,000 | $2,354,160 |

|

| Key Energy Services, Inc. 144A company guaranty sr. unsec. | | |

| notes 6 3/4s, 2021 | 610,000 | 619,150 |

|

| Offshore Group Investment, Ltd. company guaranty sr. notes | | |

| 11 1/2s, 2015 (Cayman Islands) | 2,544,000 | 2,772,960 |

|

| Offshore Group Investment, Ltd. 144A company guaranty sr. | | |

| notes 7 1/2s, 2019 (Cayman Islands) | 2,800,000 | 2,887,500 |

|

| Trinidad Drilling, Ltd. 144A sr. unsec. notes 7 7/8s, | | |

| 2019 (Canada) | 505,000 | 541,613 |

|

| | | 12,302,703 |

| Entertainment (1.0%) | | |

| AMC Entertainment, Inc. company guaranty sr. sub. notes | | |

| 9 3/4s, 2020 | 2,680,000 | 3,088,700 |

|

| Carmike Cinemas, Inc. company guaranty notes 7 3/8s, 2019 | 1,160,000 | 1,273,100 |

|

| Cedar Fair LP/Canada’s Wonderland Co./Magnum Management | | |

| Corp. company guaranty sr. unsec. notes 9 1/8s, 2018 | 420,000 | 470,400 |

|

| Cedar Fair LP/Canada’s Wonderland Co./Magnum Management | | |

| Corp. 144A company guaranty sr. unsec. notes 5 1/4s, 2021 | 1,360,000 | 1,360,000 |

|

| Cinemark USA, Inc. company guaranty sr. unsec. notes | | |

| 8 5/8s, 2019 | 345,000 | 382,519 |

|

| Cinemark USA, Inc. company guaranty sr. unsec. sub. notes | | |

| 7 3/8s, 2021 | 1,345,000 | 1,492,950 |

|

| Cinemark USA, Inc. 144A company guaranty sr. unsec. notes | | |

| 5 1/8s, 2022 | 770,000 | 773,850 |

|

| Regal Entertainment Group company guaranty sr. unsec. notes | | |

| 9 1/8s, 2018 | 3,115,000 | 3,496,588 |

|

| Regal Entertainment Group sr. unsec. notes 5 3/4s, 2025 | 1,020,000 | 999,600 |

|

| Six Flags Entertainment Corp. 144A company guaranty sr. | | |

| unsec. unsub. notes 5 1/4s, 2021 | 1,880,000 | 1,842,400 |

|

| | | 15,180,107 |

| Financials (8.4%) | | |

| A-S Co-Issuer Subsidiary, Inc./A-S Merger Sub., LLC 144A sr. | | |

| unsec. notes 7 7/8s, 2020 | 2,720,000 | 2,713,200 |

|

| ACE Cash Express, Inc. 144A sr. notes 11s, 2019 | 1,573,000 | 1,557,270 |

|

| Air Lease Corp. company guaranty sr. unsec. unsub. notes | | |

| 4 3/4s, 2020 | 1,250,000 | 1,243,750 |

|

| Air Lease Corp. sr. unsec. notes 5 5/8s, 2017 | 1,320,000 | 1,399,200 |

|

| Ally Financial, Inc. company guaranty sr. unsec. unsub. | | |

| notes 8s, 2020 | 1,270,000 | 1,558,925 |

|

| Ally Financial, Inc. company guaranty sr. unsec. unsub. notes | | |

| 7 1/2s, 2020 | 1,350,000 | 1,633,500 |

|

| Ally Financial, Inc. unsec. sub. notes 8s, 2018 | 1,542,000 | 1,831,125 |

|

| American International Group, Inc. jr. sub. FRB bonds | | |

| 8.175s, 2068 | 2,202,000 | 2,909,393 |

|

| BBVA International Preferred SAU bank guaranty jr. unsec. sub. | | |

| FRN notes 5.919s, Perpetual maturity (Spain) | 1,140,000 | 957,600 |

|

| Brookfield Residential Properties, Inc. 144A company guaranty | | |

| sr. unsec. notes 6 1/2s, 2020 (Canada) | 2,680,000 | 2,840,800 |

|

| CB Richard Ellis Services, Inc. company guaranty sr. unsec. notes | | |

| 6 5/8s, 2020 | 1,732,000 | 1,870,560 |

|

| | | |

| CORPORATE BONDS AND NOTES (86.6%)* cont. | | Principal amount | Value |

|

| Financials cont. | | | |

| CB Richard Ellis Services, Inc. company guaranty sr. unsec. sub. | | | |

| notes 11 5/8s, 2017 | | $1,322,000 | $1,432,718 |

|

| CIT Group, Inc. sr. unsec. notes 5s, 2022 | | 850,000 | 909,500 |

|

| CIT Group, Inc. sr. unsec. unsub. notes 5 3/8s, 2020 | | 1,875,000 | 2,043,750 |

|

| CIT Group, Inc. sr. unsec. unsub. notes 5 1/4s, 2018 | | 2,100,000 | 2,257,500 |

|

| CIT Group, Inc. 144A company guaranty notes 6 5/8s, 2018 | | 2,390,000 | 2,712,650 |

|

| CIT Group, Inc. 144A company guaranty notes 5 1/2s, 2019 | | 1,800,000 | 1,957,500 |

|

| Citigroup, Inc. unsec. sub. notes 4 3/4s, 2019 | EUR | 870,000 | 1,117,780 |

|

| CNG Holdings, Inc./OH 144A sr. notes 9 3/8s, 2020 | | $1,115,000 | 1,099,669 |

|

| CNO Financial Group, Inc. 144A company guaranty sr. notes | | | |

| 6 3/8s, 2020 | | 1,500,000 | 1,593,750 |

|

| Community Choice Financial, Inc. company guaranty sr. notes | | | |

| 10 3/4s, 2019 | | 2,950,000 | 2,773,000 |

|

| Dresdner Funding Trust I 144A bonds 8.151s, 2031 | | 4,775,000 | 4,846,625 |

|

| E*Trade Financial Corp. sr. unsec. unsub. notes 6 3/8s, 2019 | | 3,910,000 | 4,076,175 |

|

| HBOS Capital Funding LP 144A bank guaranty jr. unsec. sub. | | | |

| FRB bonds 6.071s, Perpetual maturity (Jersey) | | 1,975,000 | 1,718,250 |

|

| HBOS PLC 144A sr. unsec. sub. notes 6 3/4s, 2018 | | | |

| (United Kingdom) | | 2,655,000 | 2,942,247 |

|

| HBOS PLC 144A unsec. sub. bonds 6s, 2033 (United Kingdom) | | 1,050,000 | 1,017,492 |

|

| Hub International Ltd. 144A company guaranty sr. notes | | | |

| 8 1/8s, 2018 | | 920,000 | 954,500 |

|

| Icahn Enterprises LP/Icahn Enterprises Finance Corp. company | | | |

| guaranty sr. unsec. notes 8s, 2018 | | 4,945,000 | 5,297,331 |

|

| International Lease Finance Corp. sr. unsec. notes 6 1/4s, 2019 | | 490,000 | 536,550 |

|

| International Lease Finance Corp. sr. unsec. unsub. notes | | | |

| 5 7/8s, 2022 | | 2,715,000 | 2,905,050 |

|

| International Lease Finance Corp. sr. unsec. unsub. notes | | | |

| 4 7/8s, 2015 | | 1,045,000 | 1,092,548 |

|

| iStar Financial, Inc. sr. unsec. notes 7 1/8s, 2018 R | | 1,605,000 | 1,671,206 |

|

| iStar Financial, Inc. sr. unsec. unsub. notes Ser. B, 9s, 2017 R | | 1,985,000 | 2,213,275 |

|

| LBG Capital No. 1 PLC 144A jr. unsec. sub. FRN notes 8s, | | | |

| Perpetual maturity (United Kingdom) | | 990,000 | 1,045,688 |

|

| Liberty Mutual Group, Inc. 144A company guaranty jr. unsec. | | | |

| sub. FRN notes 7s, 2037 | | 550,000 | 561,000 |

|

| Liberty Mutual Group, Inc. 144A company guaranty jr. unsec. | | | |

| sub. bonds 7.8s, 2037 | | 1,565,000 | 1,803,663 |

|

| Lloyds TSB Bank PLC jr. sub. FRN notes Ser. EMTN, 13s, | | | |

| Perpetual maturity (United Kingdom) | GBP | 1,765,000 | 3,927,842 |

|

| MPT Operating Partnership LP/MPT Finance Corp. company | | | |

| guaranty sr. unsec. unsub. notes 6 3/8s, 2022 R | | $1,530,000 | 1,629,450 |

|

| National Money Mart Co. company guaranty sr. unsec. unsub. | | | |

| notes 10 3/8s, 2016 (Canada) | | 1,317,000 | 1,455,285 |

|

| Nationstar Mortgage, LLC/Nationstar Capital Corp. 144A | | | |

| company guaranty sr. unsec. notes 9 5/8s, 2019 | | 675,000 | 769,500 |

|

| Nationstar Mortgage, LLC/Nationstar Capital Corp. 144A | | | |

| company guaranty sr. unsec. notes 7 7/8s, 2020 | | 2,270,000 | 2,479,975 |

|

| Nationstar Mortgage, LLC/Nationstar Capital Corp. 144A | | | |

| company guaranty sr. unsec. unsub. notes 9 5/8s, 2019 | | 430,000 | 488,050 |

|

| Nationstar Mortgage, LLC/Nationstar Capital Corp. 144A | | | |