UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

| ¨ | Preliminary Information Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| x | Definitive Information Statement |

Commonwealth Edison Company

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notice of Action by Written Consent of Majority Shareholder

In Lieu of a Meeting of Stockholders to Elect Directors

and Information Statement

April 28, 2014

To the Stockholders of Commonwealth Edison Company:

Notice is hereby given in accordance with Section 7.10 of the Illinois Business Corporation Act of 1983, as amended (the “Act”), that on or about June 10, 2014, the majority shareholder of Commonwealth Edison Company will take action by written consent in lieu of a meeting to elect the following directors: James W. Compton, Christopher M. Crane, A. Steven Crown, Nicholas DeBenedictis, Peter Fazio, Sue L. Gin, Michael Moskow, Denis O’Brien, Anne Pramaggiore, and Jesse H. Ruiz.

In accordance with Section 7.10 of the Act, notice of the action by written consent will be delivered to the shareholders promptly after the action is taken.

Very truly yours,

Bruce G. Wilson

Corporate Secretary

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being provided to you in connection with the action by written consent of the majority stockholder of Commonwealth Edison Company (“ComEd” or the “Company”) to be taken on or about June 10, 2014.

As of March 31, 2014, ComEd had outstanding 127,016,912 shares of Common Stock, $12.50 par value (the “ComEd Common Stock”), 127,002,905, or over 99%, of which are owned by a subsidiary of Exelon Corporation (“Exelon”). Exelon intends to cause its subsidiary to take action by written consent to elect the nominees for director named under “Election of Directors” below. Consequently, the election of these directors is expected to be approved.

ii

TABLE OF CONTENTS

iii

Composition of the Board

ComEd is a controlled subsidiary of Exelon and does not have a separate nominating committee. Instead, those functions are fulfilled by the corporate governance committee of the Exelon board of directors. There is no policy with regard to the consideration of any director candidates recommended by ComEd shareholders other than Exelon because ComEd is a controlled subsidiary of Exelon.

The board of directors of ComEd consists of ten members. All directors are being elected because they have been previously elected or appointed by the board of directors on the recommendation of the corporate governance committee of Exelon.

ComEd’s Bylaws and Corporate Governance Principles require that at least one of the ComEd directors be “independent,” defined for this purpose as not being a director, officer or employee of Exelon, ComEd or any other Exelon affiliate. Five of the directors are “independent” directors under this standard. The current membership of the ComEd board represents a range of backgrounds and experience and diversity. The board consists of ten directors who range in age from 49 to 76, with an average age of 64 and a median age of 65. Two directors are women, one is African-American, one is Asian-American and one is Hispanic.

The directors have a wide diversity of experience that fills the needs of the board. Four directors are current or former CEOs of corporations. Two have served in government. Two have experience in banking. Individual directors have expertise in utility matters and law. Three of the directors have operational responsibility for Exelon or ComEd. All but two of the directors live or have lived in ComEd’s service territory and have extensive knowledge of the characteristics of the service territory and the needs of ComEd’s customers.

Biographical information about each of the directors follows.

Election of Directors

The persons listed below, each of whom is a current member of the board, will be elected as director to serve until their successors are elected.

James Compton,Age 76. Mr. Compton has served as a director of ComEd since 2006. Mr. Compton served as the President and Chief Executive Officer of the Chicago Urban League from 1978 through 2006. He also served as the President and Chief Executive Officer of the Chicago Urban League Development Corporation from 1980 through 2006. Mr. Compton also serves on the Board of Trustees of Ariel Investment Trust. Mr. Compton has extensive knowledge of ComEd and its business, having previously served as a director of ComEd from 1989 through 2000 and having served as a director of a community-based bank. In addition, Mr. Compton is very familiar with ComEd’s customers and as an African-American man contributes to ComEd’s outreach to diverse groups in Chicago.

Christopher M. Crane, Age 55. Mr. Crane has served as a director and the chair of the ComEd board since 2012. Mr. Crane is President and Chief Executive Officer of Exelon Corporation since March 12, 2012. Previously, he served as President and Chief Operating Officer, Exelon, and President and Chief Operating Officer, Exelon Generation since 2008. Mr. Crane served as a director of Aleris International Inc. from 2010 through 2013 (manufacture and sale of aluminum rolled and extruded products), where he served on the compensation committee and as the chair of the nominating and corporate governance committee. He is a member of the executive committee of the Edison Electric Institute and the board of directors of the Institute of Nuclear Power Operations, the industry organization promoting the highest levels of safety and reliability in nuclear plant operation.

1

A. Steven Crown, Age 62, has served as a director since 2011. He is a general partner of Henry Crown and Company, and has served in such capacity for more than five years. Henry Crown and Company is a private investment group that manages investments in banking, transportation, oil and gas, manufacturing, resort properties and other industries. Mr. Crown has extensive knowledge of the Chicago economy and his experience contributes to his effectiveness as a member of the ComEd board.

Nicholas DeBenedictis,Age 68, has served as a director of ComEd since 2013 and a director of Exelon since 2002. Mr. DeBenedictis serves on the Exelon corporate governance, finance and risk, and generation oversight committees. Mr. DeBenedictis is the chairman (since 1993), president and chief executive officer of Aqua America, Inc. a water utility with operations in 10 states. Mr. DeBenedictis also has extensive experience in environmental regulation and economic development, having served in two cabinet positions in the Pennsylvania government, as Secretary of the Pennsylvania Department of Environmental Resources and as Director of the Office of Economic Development. He also spent eight years with the U.S. Environmental Protection Agency. Mr. DeBenedictis has also served as a director of P.H. Glatfelter, Inc. (global supplier of specialty papers and engineered products) since 1995, where he has served on the audit, compensation & finance, and nominating and corporate governance committees. As CEO of a public company, Mr. DeBenedictis has experience in dealing with many of the same development, land use and utility regulatory issues that affect ComEd. His experience with environmental regulation also contributes to his service to the ComEd board.

Peter Fazio, Age 74. Mr. Fazio has been a director of ComEd since 2007. Mr. Fazio is a partner of the law firm of Schiff Hardin, LLP and served as past chairman, Executive Committee member and managing partner of Schiff Hardin. In addition to his general legal expertise, Mr. Fazio previously served as general counsel of another electric and gas utility and brings to the ComEd board knowledge of utility regulatory and legal issues.

Sue Gin,Age 72. Ms. Gin has served as a director of ComEd and Exelon since 2000. Ms. Gin chairs the Exelon audit committee and serves on the Exelon finance and risk committee. Ms. Gin also serves on the board of Servair, the global Air France catering arm. A Chicago-based entrepreneur, Ms. Gin is the founder (1983), owner, chair and CEO of Flying Food Group LLC, a leading wholesale food production company with 17 U.S. kitchens providing passenger meals to over 70 leading airlines – primarily international – and to retail partners in grocery, food service and specialty markets. She is also president and founder of New Management Ltd., a real estate sales, management and development firm with strategic Chicago-area commercial and residential holdings. Ms. Gin brings diversity to the ComEd board and helps advance the company’s diversity initiatives and community outreach.

Michael Moskow,Age 76. Mr. Moskow has served as a director of ComEd since 2008. Mr. Moskow is the Vice Chair and a Senior Fellow at the Chicago Council on Global Affairs. He served as president and chief executive officer of the Federal Reserve Bank of Chicago from 1994 to 2007. He is a director of Discover Financial Services, Northern Trust Mutual Funds and Taylor Capital Group and served as a director of Diamond Technology from 2008 through 2011. Mr. Moskow is a recognized leader in the Chicago business community with knowledge of the economy of the Midwestern United States and the northern Illinois communities that ComEd serves.

Denis O’Brien,Age 54. Mr. O’Brien has served as a director and vice chair of the ComEd board since 2012. As the chief executive officer of Exelon Utilities, Mr. O’Brien oversees the utility businesses of Exelon at ComEd, PECO Energy Company (“PECO”) and Baltimore Gas and Electric Company (“BGE”). Mr. O’Brien is also a senior executive vice president of Exelon. Previously, Mr. O’Brien served as executive vice president of Exelon and chief executive officer of Philadelphia-based PECO, Pennsylvania’s largest electric and natural gas utility.

2

Anne Pramaggiore,Age 55. Ms. Pramaggiore has served as a director of ComEd since 2012. In February 2012, Ms. Pramaggiore became the president and chief executive officer of ComEd. Prior to her appointment, Ms. Pramaggiore served as president and chief operating officer of ComEd from 2009 through 2012, where she was responsible for overseeing the day-to-day operations of ComEd. Before being named as president and chief operating officer, Ms. Pramaggiore served as executive vice president of Customer Operations, Regulatory and External Affairs.

Jesse Ruiz,Age 49. Mr. Ruiz has served as a director of ComEd since 2006. He is a corporate and securities partner at the law firm of Drinker Biddle & Reath, LLP and serves as the Vice President of the Chicago Board of Education. Mr. Ruiz is also the former chairman of the Illinois State Board of Education. Mr. Ruiz’s legal and government experience in the state and city where ComEd conducts its business has enabled him to contribute to the ComEd board on multiple levels. Mr. Ruiz also contributes to ComEd’s outreach to diverse groups.

ComEd Governance

Independence Standards

As noted above, ComEd’s Corporate Governance Principles require that at least one of the ComEd directors be “independent,” defined for this purpose as not being a director, officer or employee of Exelon, PECO or any other Exelon affiliate. Messrs. Compton, Crown, Fazio, Moskow and Ruiz are independent directors under this standard. The Corporate Governance Principles further require that the independent director or directors approve certain actions, including the declaration of dividends, the purchase of electric energy and seeking protection from creditors under bankruptcy or related laws.

Board Leadership Structure

Christopher M. Crane, the chief executive officer of Exelon, serves as chair of the ComEd board of directors. Denis P. O’Brien serves as the chief executive officer of Exelon Utilities, a senior executive vice president of Exelon, and the vice chair of the ComEd board. Because ComEd is a controlled subsidiary of Exelon, the ComEd board of directors has not seen any need to adopt a policy with respect to whether or not the positions of chair of the ComEd board of directors and chief executive officer should be held by the same person.

Attendance at Meetings

During 2013, ComEd’s board of directors held four meetings. In 2014, the ComEd board has held one meeting to date. All directors attended 100% of all board meetings.

Board Committees

ComEd is a controlled subsidiary of Exelon and does not have separate audit, nominating and compensation committees. Instead, those functions are fulfilled by the audit, corporate governance and compensation committees of the Exelon board of directors. The ComEd board established an executive committee in January 2014 that meets only as needed. The executive committee is authorized to act when it is not convenient to call a meeting of the full ComEd board. The members of the executive committee are Ms. Pramaggiore and Messrs. Crane, O’Brien and Fazio.

3

Board Oversight of Risk

As a controlled company, ComEd’s risk is managed by its board of directors in conjunction with Exelon’s overall risk oversight and risk management structure. Exelon and ComEd operate in a market and regulatory environment that involves significant risks, many of which are beyond its control. Exelon has a risk management group consisting of a Chief Enterprise Risk Officer, a Chief Commercial Risk Officer, and a full-time staff of 170. The risk management group draws upon other company personnel for additional support on various matters related to the identification, assessment and management of enterprise risks. Exelon also has an executive risk committee of company officers who meet regularly to discuss matters related to enterprise risk management generally and particular risks associated with new developments or proposed transactions under consideration. Management of the company regularly meets with the Chief Enterprise Risk Officer and the executive risk committee to identify and evaluate the most significant risks of the businesses and appropriate steps to manage and mitigate those risks. In addition, the Chief Enterprise Risk Officer and the risk management group perform an annual assessment of enterprise risks, drawing upon resources throughout the company for an assessment of the probability and severity of the identified risks. The Chief Enterprise Risk Officer and senior executives of the company discuss those risks with the finance and risk as well as the audit committees of the Exelon board of directors and, when appropriate, the BGE, the ComEd and PECO boards of directors. The committees of the Exelon board regularly report to the full board on the committees’ discussions of enterprise risks. In addition, the Exelon board regularly discusses enterprise risks in connection with consideration of emerging trends or developments and in connection with the evaluation of capital investments and other business opportunities.

Board/Committee/Director Evaluation and Director Education

The ComEd board does not have a separate process for board, committee or director evaluation. Because ComEd is a controlled subsidiary, the ComEd board is evaluated by the Exelon corporate governance committee.

The Exelon Office of Corporate Governance oversees an orientation program that is tailored to the needs of each new director depending on his or her level of experience serving on other boards and knowledge of the company or industry acquired before joining the board. New directors receive materials about ComEd, the board and board policies and operations and attend meetings with the CEO and other officers for a briefing on the executives’ responsibilities, programs and challenges. New directors are also scheduled for tours of various company facilities, depending on their orientation needs.

Continuing director education is provided during portions of regular board meetings and focuses on the topics necessary to enable the board to consider effectively issues before them at that time (such as new regulatory standards). The education sometimes takes the form of “white papers,” covering timely subjects or topics, which a director can review before the meeting and ask questions about during the meeting. The company pays the cost for any director to attend outside director education seminars on topics relevant to their service as directors.

Independent Public Accountants

ComEd is an indirect subsidiary of Exelon and does not have a separate audit committee. Instead the Exelon audit committee fulfills that function for ComEd. Ms. Sue Gin, a ComEd director, is also a director of Exelon and serves as the chair of the Exelon audit committee. In July 2002, the Exelon audit committee adopted a policy for pre-approval of services to be performed by the independent accountants. The committee pre-approves annual budgets for audit, audit-related and tax compliance and planning services. The services that the committee will consider include services that do not impair the accountant’s independence and add value to the audit, including audit services such as attest services and scope changes in the audit of the financial statements, the issuance of comfort letters and consents in relation to financings, audit-related services such as accounting advisory services related to proposed transactions and new accounting pronouncements, the provision of attest services in relation to regulatory filings and contractual obligations, and tax compliance and planning services. With respect to non-budgeted services in amounts less than $500,000, the committee delegated authority to the committee’s chair to pre-approve such services. All other services must be pre-approved by the committee. The committee receives quarterly reports on all fees paid to the independent accountants. None of the services provided by the independent accountants was provided pursuant to the de minimis exception to the pre-approval requirements contained in the SEC’s rules.

4

In 2013 the audit committee reviewed the PricewaterhouseCoopers 2013 Audit Plan and proposed fees and concluded that the scope of audit was appropriate and the proposed fees were reasonable.

The following table presents the fees (in thousands of dollars) for professional services rendered by PricewaterhouseCoopers LLP for the audit of ComEd’s annual financial statements for the years ended December 31, 2013 and December 31, 2012, and fees billed for other services provided during those periods. These fees include an allocation of amounts billed directly to Exelon. The fees include amounts related to the year indicated, which may differ from amounts billed.

| | | | | | | | |

| | | Year Ended

Dec. 31,

2013 | | | Year Ended

Dec. 31,

2012 | |

Audit Fees | | | 1,939 | | | | 2,241 | |

Audit-Related Fees | | | 20 | | | | 26 | |

Tax Fees | | | 76 | | | | 103 | |

All Other Fees | | | 3 | | | | 5 | |

| | | | | | | | |

Total | | | 2,038 | | | | 2,375 | |

| | | | | | | | |

Audit fees include financial statement audits and reviews under statutory or regulatory requirements and services that generally only the auditor reasonably can provide, including issuance of comfort letters and consents for debt and equity issuances and other attest services required by statute or regulation.

Audit-related fees consist of assurance and related services that are traditionally performed by the auditor such as accounting assistance and due diligence in connection with proposed acquisitions or sales, consultations concerning financial accounting and reporting standards, and audits of stand-alone financial statements or other assurance services not required by statue or regulation.

Tax fees consist of tax compliance, tax planning, and tax advice and consulting services including assistance and representation in connection with tax audits and appeals, tax advice related to proposed acquisitions or sales, employee benefit plans and requests for rulings or technical advice from taxing authorities.

All other fees reflect work performed primarily in connection with research and audit software licenses.

5

Report of the Exelon Audit Committee

In fulfilling its responsibilities, the Exelon audit committee has reviewed and discussed the audited financial statements contained in the 2013 Annual Report on SEC Form 10-K with Exelon Corporation’s management and the independent registered public accounting firm (independent accountant). The Exelon audit committee discussed with the independent accountant the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, as superseded by Auditing Standard No. 16, as adopted by the Public Company Accounting Oversight Board in PCAOB Release No. 2012-004 and approved by the Securities and Exchange Commission in Release No. 34-68453. In addition, the Exelon audit committee has received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee regarding independence, and has discussed with the independent accountant the independent accountant’s independence.

In reliance on the reviews and discussions referred to above, the Exelon audit committee recommended to the Exelon board of directors (and the Exelon board of directors has approved) that the audited financial statements be included in Exelon Corporation’s Annual Report on Form 10-K for the year ended December 31, 2013, for filing with the SEC.

The committee has a charter that has been approved by the Exelon board of directors.

February 10, 2014

The Audit Committee

Sue L. Gin, Chair

Anthony K. Anderson

Ann C. Berzin

Yves C. de Balmann

Paul L. Joskow

Richard W. Mies

William C. Richardson

Stephen D. Steinour

Related Person Transactions

Exelon has a written policy for the review and approval or the ratification of related person transactions. Transactions covered by the policy include commercial transactions for goods and services and the purchase of electricity or gas at non-tariffed rates from Exelon or any of its subsidiaries by an entity affiliated with a director or officer of Exelon. The retail purchase of electricity or gas from BGE, ComEd or PECO at rates set by tariff, and transactions between or among Exelon or its subsidiaries are not considered. Charitable contributions approved in accordance with Exelon’s Charitable Contribution Guidelines are deemed approved or ratified under the Related Persons Transaction policy and do not require separate consideration and ratification.

As required by the policy, the Exelon board reviewed all commercial, charitable, civic and other relationships with Exelon in 2013 that were disclosed by directors and executive officers of Exelon, BGE, ComEd and PECO, and by executive officers of Exelon Generation Company that required separate consideration and ratification. The Exelon Office of Corporate Governance collected information about each of these transactions, including the related persons and entities involved and the dollar amounts either paid by or received by Exelon. The Office of Corporate Governance also conducted additional due diligence, where required to determine the specific circumstances of the particular transaction, including whether it was competitively bid or whether the consideration paid was based on tariffed rates.

6

The Exelon corporate governance committee and the board reviewed the analysis prepared by the Office of Corporate Governance, which identified those related person transactions which required ratification or approval, under the terms of the policy, or disclosure under the SEC regulations. The Exelon corporate governance committee and the board considered the facts and circumstances of each of these related person transactions, including the amounts involved, the nature of the director’s or officer’s relationship with the other party to the transaction, whether the transaction was competitively bid and whether the price was fixed or determined by a tariffed rate.

The committee recommended that the Exelon board ratify all of the transactions. On the basis of the committee’s recommendation, the board did so. Several transactions were ratified because the related person served only as a director of the affiliated company, was not an officer or employee of the affiliated company and did not have a pecuniary or material interest in the transaction. For some of these transactions, the value or cost of the transaction was very small, and the board considered the de minimis nature of the transaction as further reason for ratifying it. The board approved and ratified other transactions that were the result of a competitive bidding process, and therefore were considered fairly priced, or arms length, regardless of any relationship. The remaining transactions were approved by the board, even though the director is an executive officer of the affiliated company, because the transactions involved only retail electricity or gas purchases under set, tariffed rates or the price and terms were determined as a result of a competitive bidding process. Only one of the related person transactions is required to be disclosed in this Information Statement

Sidley Austin LLP provided legal services to Exelon and ComEd during 2013. The spouse of Mr. Ruiz, a member of the ComEd board of directors, is a partner of Sidley Austin LLP.

Process for Stockholder Communications with the Board

Stockholders and other interested persons can communicate with the directors by writing to them, c/o Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. The Corporate Secretary will review communications initially and transmit a summary to the directors and will exclude from transmittal any communications that are commercial advertisements, other forms of solicitation, general shareholder service matters or individual service or billing complaints. The Corporate Secretary will forward to the directors any communication raising substantial issues. All communications are available to the directors upon request. Shareholders may also report an ethics concern with the Exelon Ethics Hotline by calling 1-800-23-Ethic (1-800-233-8442). You may also report an ethics concern via the Internet at EthicsOffice@ExelonCorp.com. These processes may also be used to communicate with the ComEd board of directors or to report ethics concerns relating to ComEd.

Availability of Corporate Documents

The Exelon Code of Business Conduct, which is the code of conduct applicable to ComEd, is available on the Exelon website at www.exeloncorp.com, on the corporate governance page under the Investors tab. Copies may be printed from the Exelon website and copies are available without charge to any shareholder who requests them by writing to Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. In addition, Exelon’s Compensation Consultant Independence Policy and all of Exelon’s and ComEd’s filings submitted to the SEC are available on the website. Access to this information is free of charge to any user with internet access. Information contained on our website is not part of this information statement.

7

Delivery of Documents to Stockholders Sharing an Address

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name and do not participate in electronic delivery of materials will receive only one copy of this Information Statement, unless we are notified that one or more of these stockholders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Executive Compensation

The compensation of ComEd’s named executive officers is set by the compensation and leadership development committee of the board of directors of Exelon Corporation, generally consistent with Exelon’s overall compensation and benefits programs and policies, and is subject to review by the ComEd board of directors. A notable difference is that the annual incentive program for ComEd does not include a goal based on Exelon’s operating earnings. The compensation discussion and analysis and compensation disclosure that follows is adapted from the compensation discussion and analysis and compensation disclosure that was included in the 2014 proxy statement for Exelon Corporation and includes the information pertaining to ComEd executive compensation. The compensation and leadership development committee of Exelon provided a report on the compensation discussion and analysis that was included in the proxy statement for Exelon’s 2014 annual meeting and is presented below just before Compensation Discussion and Analysis.

Executive officers may be involved in evaluation of the performance and development of initial recommendations with respect to compensation adjustments; however, the Exelon compensation and leadership development committee makes the determinations with respect to compensation programs and adjustments. The Exelon chairman and the Exelon CEO are considered invited guests and are welcome to attend the meetings of the compensation and leadership development committee. The chairman and the CEO cannot call meetings of the compensation and leadership development committee.

Management, including the executive officers, makes recommendations as to goals for the incentive compensation programs that are aligned with Exelon’s and ComEd’s business plan. The compensation and leadership development committee reviews the recommendations and establishes the final goals. The compensation and leadership development committee strives to ensure that the goals are consistent with the overall strategic goals set by the board of directors (including the individual goals of subsidiaries, as appropriate), that they are sufficiently difficult to meaningfully incent management performance, and, if the targets are met, that the payouts will be consistent with the design for the overall compensation program. Executive officers take an active role in evaluating the performance of the executives who report to them, directly or indirectly, and in recommending the amount of compensation their subordinate executives receive. Executive officers review peer group compensation data for each of their subordinates in conjunction with their annual performance reviews to formulate a recommendation for base salary and whether to apply an individual performance multiplier to the subordinate executive’s incentive payouts, and if so, the amount of the multiplier. Executive officers generally do not make recommendations with respect to annual and long-term incentive target percentages or payouts. The Exelon CEO reviews all of the recommendations of the executive officers before they are presented to the compensation and leadership development committee. The human resources function provides to the compensation and leadership development committee data showing the history of the compensation of the executive officers and data that analyzes the cost of a range of several alternatives for changes to the compensation of the executive officers.

8

The compensation and leadership development committee has delegated to the Exelon CEO the authority to make off-cycle awards to employees who are not subject to the limitations of Section 162(m), are not executive officers for purposes of reporting under Section 16 of the Securities Exchange Act of 1934, and are not executive vice presidents or higher officers of Exelon, provided that such authority is limited to making grants of up to 600,000 shares in the aggregate, and 20,000 shares per recipient in any year. The compensation and leadership development committee reviews and ratifies these grants.

Compensation Consultant

Pursuant to the compensation and leadership development committee’s charter, the committee is authorized to retain and terminate, without board or management approval, the services of an independent compensation consultant to provide advice and assistance, as the committee deems appropriate. The committee has the sole authority to approve the consultant’s fees and other retention terms, and reviews the independence of the consultant and any other services that the consultant or the consultant’s firm may provide to the company. The chair of the compensation and leadership development committee reviews, negotiates and executes an engagement letter with the compensation consultant. The compensation consultant directly reports to the committee.

The committee determined in November 2012 to engage Semler Brossy Consulting Group, LLC and its Managing Principal Ms. Blair Jones as its consultant. The compensation and leadership development committee members who screened and interviewed the candidates determined that Semler Brossy offered the strongest and most responsive team and would provide the most reliable and cost-competitive advice through experience, research and benchmarking. In engaging Semler Brossy in November 2012 and in reviewing the engagement in December 2013, the compensation and leadership development committee considered the following factors in determining that Ms. Jones and the firm are independent consultants and do not have any conflicts of interest:

| | • | | Semler Brossy performs no other services for the company or its affiliates and received no other fees from the company (aside from fees associated with a director compensation study performed for the corporate governance committee); |

| | • | | the firm’s policies would preclude any of the firm’s consultants providing services to the committee from owning any Exelon stock and none of the persons identified for the consulting team owned any Exelon stock; |

| | • | | the firm has formal written policies designed to prevent conflicts of interest; and |

| | • | | there were no relationships of the firm and its consultants and Exelon and its officers, directors or affiliates except that Dr. Richardson had known another consultant from the firm in connection with his consulting for the compensation committee at another company where Dr. Richardson had previously served as a director. |

As part of its ongoing services to the compensation and leadership development committee, the compensation consultant supports the committee in executing its duties and responsibilities with respect to Exelon’s executive compensation programs by providing information regarding market trends and competitive compensation programs and strategies. In supporting the compensation and leadership development committee, the compensation consultant does the following:

| | • | | Prepares market data for each senior executive position, including evaluating Exelon’s compensation strategy and reviewing and confirming the peer group used to prepare the market data; |

9

| | • | | Provides the committee with an independent assessment of management recommendations for changes in the compensation structure; |

| | • | | Works with management to ensure that the company’s executive compensation programs are designed and administered consistent with the committee’s requirements; and |

| | • | | Provides ad hoc support to the committee, including discussing executive compensation and related corporate governance trends. |

Exelon’s human resources staff and senior management use the data provided by the compensation consultant to prepare documents for use by the compensation and leadership development committee in preparing their recommendations to the full board of directors or, in the case of the CEO, the independent directors, on compensation for the senior executives. In addition to its general responsibilities, the compensation consultant attends the compensation and leadership development committee’s meetings, if requested. The committee, or Exelon’s management on behalf of the committee, may also ask the compensation consultant to perform other executive and non-executive compensation-related projects. The committee has established a process for determining whether any significant additional services will be needed and whether a separate engagement for such services is necessary.

The committee has a formal compensation consultant independence policy that codifies its past practices. The compensation consultant independence policy is available on the Exelon website at www.exeloncorp.com, under the investor relations tab. The purpose of the policy is to ensure that the advisers or consultants retained by the committee are independent of the company and its management, as determined by the committee using its reasonable business judgment. The committee considers all facts and circumstances it deems relevant, such as the nature of any relationship between a compensation consultant, the compensation consultant’s firm, and the company and the nature of any services provided by the compensation consultant’s firm to the company that are unrelated to the compensation consultant’s work for the committee. Under the policy, a compensation consultant shall not be considered independent if the compensation consultant or the compensation consultant’s firm receives more than one percent of its annual gross revenues for services provided to the company. Under the policy, the compensation consultant reports directly to the chair of the compensation and leadership development committee, and the committee approves the aggregate amount of fees to be paid to the compensation consultant or the compensation consultant’s firm. The policy requires that the compensation consultant and any associates providing services to the compensation and leadership development committee have no direct involvement with any other aspects of the compensation consultant’s firm’s relationship with Exelon (other than any director compensation services that may be performed for the corporate governance committee), and that no element of the compensation consultant’s compensation may be based on any consideration of the revenues for other services that the firm may provide to Exelon. For 2013, the total fees paid to Semler Brossy were $349,822; no fees were paid to Semler Brossy for additional services beyond its work as consultant to the compensation and leadership development committee except for a director compensation study prepared for the corporate governance committee.

Compensation Committee Interlocks and Insider Participation

During 2013 no officers or employees or former officers of ComEd participated in deliberations of the ComEd board concerning executive officer compensation except Messrs. Crane and O’Brien and Ms. Pramaggiore. Ms. Pramaggiore was involved in deliberations concerning the compensation of executive officers other than herself.

10

Report of the Exelon Compensation and Leadership Development Committee

The Exelon compensation and leadership development committee is composed solely of independent directors, and we are accountable for ensuring that the decisions we make about executive compensation are in the best interests of shareholders. We accomplish this objective by having a robust compensation framework that emphasizes pay-for-performance, resulting in a majority of pay being at risk and contingent on the achievement of financial and operational goals. In fact, about 90% of Exelon’s CEO compensation is at risk, which is higher than the peer group average and strongly aligns with shareholders interests.

The committee considers shareholder feedback as part of our annual review of the executive compensation programs and we proactively seek shareholder feedback. Last year, slightly over 75% of the say-on-pay votes cast approved the compensation of Exelon’s Named Executive Officers (NEOs). We listened to your feedback and have taken significant actions to bolster the effectiveness of our programs and ensure shareholder alignment. We retooled our 2013 executive compensation program, taking into consideration your feedback and alignment with market practice.

Exelon exhibited exemplary operational performance in 2013; however, we realize that shareholder returns were less than we would have liked. Part of the board’s overarching strategy is to manage for the future, not the short-term, and management and the board are committed to making decisions that are in the best long-term interests of Exelon’s shareholders. We believe that Exelon has a strong portfolio of assets, and that the management team has been executing extremely well by controlling the things it can, such as achieving operational excellence and maintaining a strong balance sheet through disciplined financial management. The board believes that management is making the right long-term decisions to reverse the share price declines of the recent past by remaining focused on diversified growth and asset rationalization.

The compensation and leadership development committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussion, the committee recommended to the board that the Compensation Discussion and Analysis be included in the 2014 Proxy Statement.

March 18, 2014

The Exelon Compensation and Leadership Development Committee

John A. Canning, Jr., Chair

Yves C. de Balmann

Robert J. Lawless

William C. Richardson

11

Compensation Discussion and Analysis

| | |

| Section I: | | Executive Summary |

| |

| Section II: | | Investor Feedback: We Heard You; We Responded |

| |

| Section III: | | How We Design Our Executive Compensation Programs to Pay for Performance |

| |

| Section IV: | | What We Pay and Why We Pay it |

| |

| Section V: | | Governance Features of Our Executive Compensation Programs |

Section I: Executive Summary

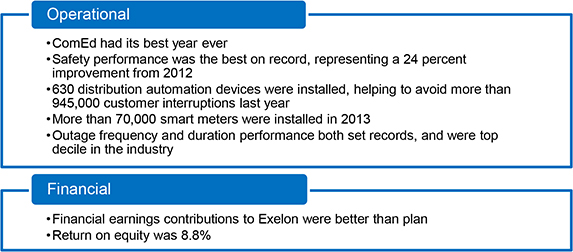

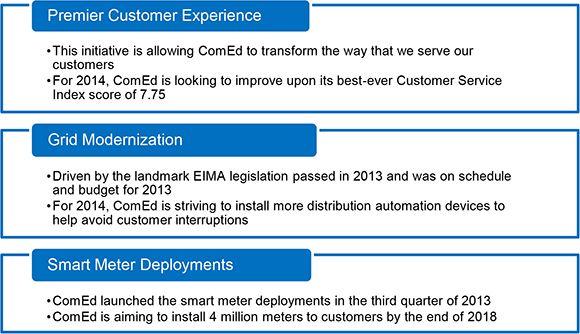

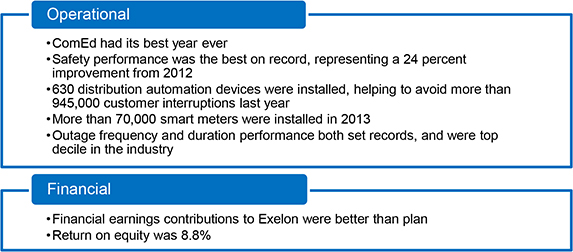

2013 was marked by ComEd’s best-ever performance as we delivered exceptional value and service to our customers. Operational performance was outstanding, with many key metrics achieving all-time best performance (e.g., safety, outage duration, outage frequency), while financial earnings contributions to Exelon were better than plan.

Central Themes of our Executive Compensation Program

| | | | |

We Manage for the Long-term The board manages for the long-term and makes pay decisions that are in the best long-term interests of the company and shareholders. | | Strong Compensation Framework We have a strong compensation framework that is market-based and drives pay for performance and alignment with shareholders based on having a majority of NEO pay at risk in the form of annual incentives and equity. | | Strong Investor Outreach We engage directly with Exelon’s investors and take actions to improve our compensation programs based on feedback from shareholders. |

| | |

Competitiveness Our NEO pay is generally calibrated to market median, which the committee and board believe appropriate based on sound business rationale and positioning relative to our market assessment peer group. | | Target Total Direct Compensation We believe that target “TDC” (base salary, annual bonus and equity) provides the best basis for comparison of executive compensation. | | Balance Since we manage for the long-term, we believe pay at risk should reward the appropriate balance of short- and long-term financial and strategic business results. |

Recap of 2013 Company Performance

2013 ComEd performance was outstanding, resulting in a record-setting year in safety, reliability and customer satisfaction based on an absolute basis, with performance relative to industry benchmarks being well within the top decile. In fact, President and Chief Executive Officer of ComEd, Anne R. Pramaggiore, was named Utility Industry CEO of the Year by Energy Central.

Notable accomplishments in 2013 include:

12

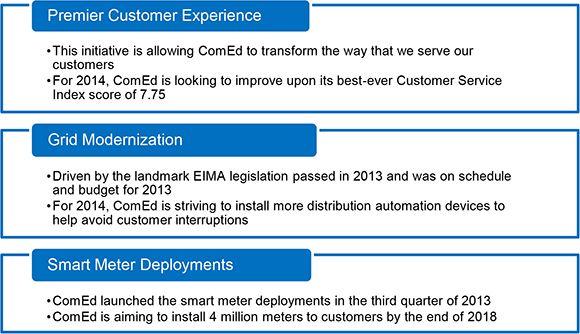

Building on the very strong operational performance and solid financial results for 2013, ComEd management continues to take the following actions to improve the ability to deliver exceptional value and service to customers.

Our Executive Compensation Framework is built on Pay-for-Performance and Pay-at-Risk

The goal of our executive compensation program is to retain and reward leaders who create long-term value for our shareholders by delivering on objectives set forth in the company’s long-term strategic plan. This goal affects the compensation elements we use and drives our compensation decisions. We embrace three key executive compensation principles outlined below that align the executives’ long-term interests with those of shareholders and motivate executives to remain with ComEd to create long-term shareholder value.

| | |

Principle | | Objective |

| Attract, motivate and retain high caliber leadership by providing competitive compensation opportunities | | • The program assesses total compensation opportunities against appropriate peer companies to enable us to attract and retain executives with the experience and talent required to achieve our strategic objectives. |

| |

| Pay for Performance | | • A majority of executive pay is not guaranteed, and is in the form of annual incentives and equity in order to drive and reward strong operational and financial performance and the creation of shareholder value. |

| |

| Pay at Risk | | • A majority of NEO pay is at risk and linked to changes in the stock price and/or achievement of short-term and long-term company financial and operational goals that build shareholder value. |

| | • Executives are required to meet and maintain significant stock ownership requirements throughout the term of their employment with the company (2X base salary for all ComEd NEOs). |

13

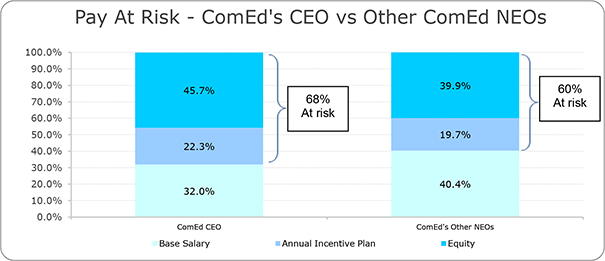

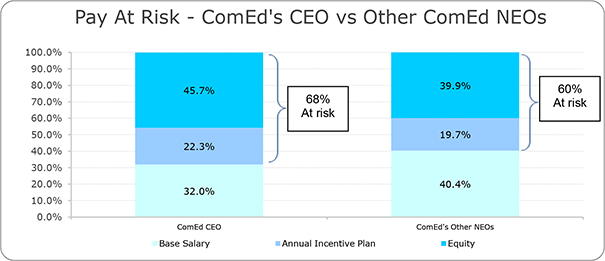

Pay at Risk for Our NEOs. As shown in the following chart, approximately 68% of the ComEd CEO and almost 60% of other ComEd NEOs 2013 target total direct compensation is considered at risk and based on changes in Exelon’s stock price and/or the achievement of short-term and long-term financial and operational goals.

The Committee’s Responsiveness to Shareholder Feedback

Exelon provided shareholders an advisory vote to approve its executive compensation in 2013. At its 2013 Annual Meeting of Shareholders, shareholders approved the advisory vote on executive compensation with 75% of the votes cast in favor of the proposal.

The committee greatly values feedback from investors. As explained in Section II, the chairman of the compensation and leadership development committee in conjunction with leaders from Exelon’s human resources, investor relations, and office of corporate governance groups, participated in outreach meetings that included many of the top 30 institutional investors to solicit feedback on the effectiveness of our executive compensation program and corporate governance. Outreach calls were held with the holders of 35% of outstanding common shares. The results of the shareholder outreach were summarized and presented to the full compensation and leadership development committee with a copy being provided to the Exelon board. The committee took action on several of the recommendations that helped reconfigure the executive compensation program to better align with shareholder interests and market practice, while taking into account the specific circumstances under which Exelon operates as described underRecap of 2013 Company Performance.

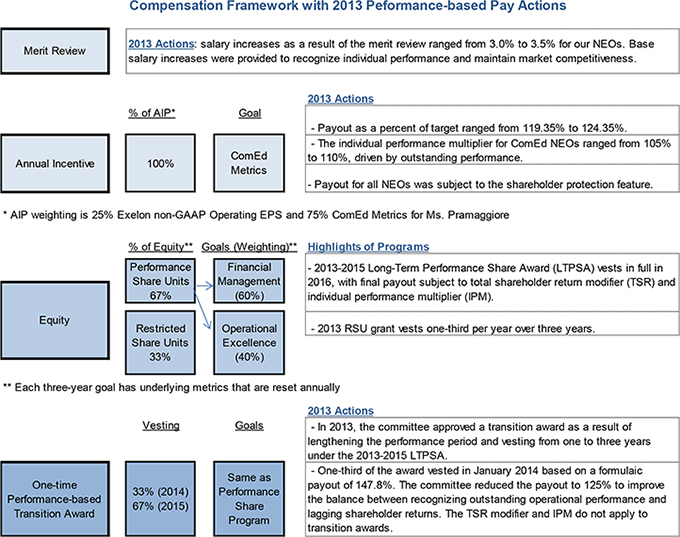

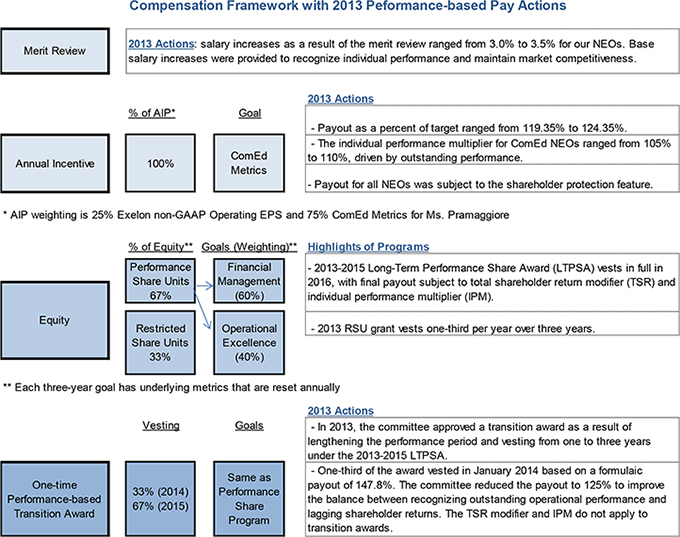

Feedback from Exelon shareholders has influenced certain aspects of the 2013 executive compensation program, largely focused on aligning our performance share program more closely with shareholder interests and market practice. Significant changes for 2013 include:

| | • | | Lengthened the performance share program performance period from one to three years, |

| | • | | Reinstated total shareholder return as a modifier under our performance share program, |

| | • | | Reduced the number of goals in our performance share program from six to two, |

| | • | | Changed the goals under the performance share program to quantitative from qualitative, and |

| | • | | Eliminated stock options and changed the mix of equity for NEOs to 67% performance share units and 33% restricted stock units. |

14

ComEd’s CEO Pay At-a-Glance

The total compensation for Ms. Pramaggiore, increased in 2013 as compared to 2012, primarily due to the grant of a performance-based transition award in connection with the transition from a one-year to a three-year performance period for performance share units.

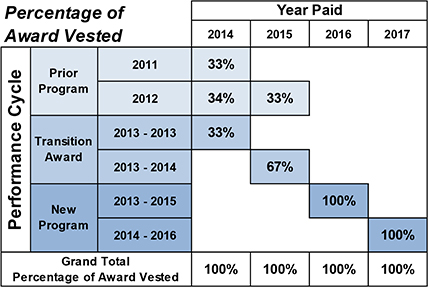

One-time Performance-based Transition Award

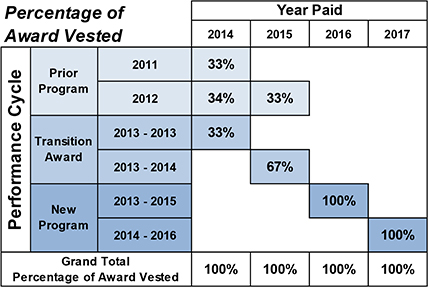

Commencing in 2013, the committee approved the transition award as a result of lengthening the performance period from one year to three years for the 2013-2015 LTPSA (as shown in the chart below), which significantly decreases the targeted equity payments that executives can expect to vest in 2014 and 2015. The committee believes this refinement ensures fair treatment of participants during the transition. The committee determined that it was appropriate to address these transition issues by making a performance-based transition award grant in 2013 to executives impacted by this change. One-third of these transition awards vested in January 2014, with the remaining balance vesting in January 2015, based on the same goals as the performance shares, but excluding the relative total shareholder return modifier and the individual performance multiplier.

We Believe Target TDC Provides the Most Accurate Depiction of CEO Pay

The Exelon board believes that target total direct compensation is the most useful method for comparing CEO pay because it dampens volatility that can otherwise occur when making annual and year-over-year CEO pay decisions using summary compensation table reported data. The summary compensation table is influenced by actuarial assumptions that impact the change in pension value and accounting assumptions mandated by SEC rules that require companies to reflect the grant date value for thefullaward in the year in which it is granted. For this reason, the committee and the Exelon board rely on target total direct compensation market data to get the most realistic perspective on CEO pay.

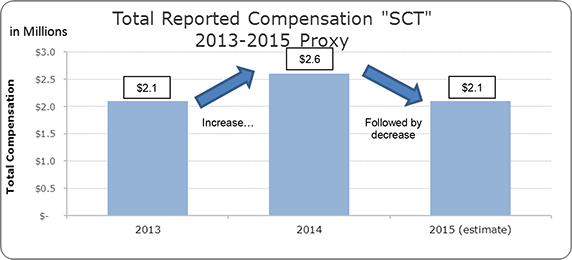

15

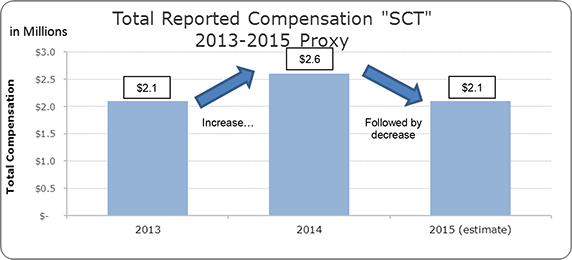

Total Reported Compensation Varies Significantly. As illustrated in the chart below, total reported compensation as shown in the summary compensation table varies from year-to-year based on actuarial and accounting assumptions. As depicted below, CEO total compensation will increase to about $2.6 million (based on 2013 compensation as reported in this proxy statement), whereas it is estimated to decrease to about $2.1 million (based on 2014 compensation for next year’s proxy statement). This fluctuation is largely attributed to the one-time performance-based transition award, which is fully reflected in this year’s proxy statement.

The committee believes that Ms. Pramaggiore’s target total direct compensation is appropriately calibrated against the peer group and the pay mix is aligned strongly with shareholder interests.

2013 Performance and How Payouts were Determined

The committee approved the following at the January 2014 meeting: (1) base salary increases as part of the annual merit review, and (2) payouts for both the 2013 annual incentive plan and the first one-third of the performance-based transition award payout. The committee determined that it was appropriate to reduce the payout from 147.8% to 125% through exercise of the committee’s negative discretion in order to balance outstanding operational performance and solid financial management with a lagging stock price.

| | |

Element | | 2013 Action |

| Base salary | | • Base salary increases averaged 3.1% for our NEOs (ranging from 3.0% to 3.5%). |

| Annual Incentive Program | | • Payout approved at 104.35% of target based on operating EPS of $2.50 versus a target of $2.49. |

| | • The individual performance multiplier (IPM) was 110% for Ms. Pramaggiore and Mr. Donnelly and 105% for the other three NEOs. |

| Restricted Stock Units | | • Awards granted at target. |

| | • Consists of 33% of equity portfolio, vesting ratably over three years. |

| Performance Share Units – 2013-2015 Long-Term Performance Share Award (LTPSA) | | • Awards granted at grant date value of $31.18 per share. |

| | • Consists of 67% of equity portfolio, vesting in full after three years. |

| | • Awards based on two three-year goals (financial management (60%) and operational excellence (40%)). |

| | • Payout based on average of 2013, 2014 and 2015 performance. |

| | • 2013 performance achieved at 147.8% (reduced to 125%). |

| One-time performance-based transition award | | • First installment (one-third of award) paid in 2014 based on 2013 performance share goals, which paid out at 125%. Second installment (two-thirds of award) payable in 2015 based on the average of 2013 (125%) and 2014 (TBD) performance share performance. |

16

Section II: Investor Feedback: We Heard You; We Responded

We actively engage with our shareholders throughout the year. Since 2006 Exelon has maintained a shareholder engagement program in which we proactively reach out to Exelon’s top shareholders and leading proxy advisory services firms with the objective of educating them about the corporate governance and executive compensation changes we have implemented as well as seeking their feedback on other potential executive compensation and corporate governance enhancements. Our engagement team consists of leaders from human resources, investor relations and the office of corporate governance. Additionally, Exelon’s compensation and leadership development committee chair participated with the team on several calls in 2013.

In the spring of 2013 we met with top Exelon shareholders and sought input from others. These meetings, which comprised about 35% of common shares outstanding, were invaluable as we were able to discuss the 2013 proxy statement and key executive compensation and corporate governance matters contained within the document as well as preview executive compensation changes that were implemented in 2013 and are reflected in the 2014 proxy statement. We also structured a similar outreach in the fall which included the chairman of Exelon’s compensation and leadership development committee participating in several telephonic meetings with top investors and proxy advisory services firms. The investors with whom we spoke were largely supportive of the changes we made for our 2013 executive compensation program, providing us with suggestions relating to emerging trends in executive compensation practices and our disclosures about our program. In addition, the committee and management reviewed correspondence submitted by individual and institutional shareholders, analyzed market practices at peer companies and sought advice from the committee’s independent compensation consultant.

In 2013, we revamped our executive compensation programs by making the following changes:

| | |

Change | | Purpose |

| Modified the mix of equity vehicles. | | The committee believes that performance-based awards more closely align shareholder interests with executive decision making. Performance share units and restricted stock units now account for 67% and 33% of target equity opportunity, respectively. Stock options are no longer granted. |

| |

| Changed performance criteria from qualitative achievement to quantitative performance measures. | | The committee believes that transparent, objective goals create a more actionable performance environment and aligns strongly with shareholder interests. |

| |

| Increased the duration of the performance share unit performance period from one year to three years. | | Lengthening the duration of performance periods from one year to three years aligns with market practice and tightens the linkage with long-term shareholder interests. |

| |

| Streamlined the goals for the performance share unit plan. | | Reduced the number of goals from six to two. This program aligns with best practice and sharpens the focus of each executive on two key strategic imperatives, protecting our credit rating, and continuing to generate and deliver reliable energy to our customers. The committee evaluates goals under the annual and long-term incentive programs to ensure that they are rigorous, contain appropriate challenges, and are designed to mitigate excessive risk. |

| |

| Reinstated Total Shareholder Return (TSR) as a component in the performance share unit plan. | | To strengthen the alignment with shareholders, awards can be increased or decreased by up to 25% based on TSR performance relative to other competitive integrated companies with business models most similar to ours (i.e., more than 25% of assets are unregulated). |

17

Section III: How We Design Our Executive Compensation Programs to Pay for Performance

Our approach to compensating our NEOs is to align the long-term interests of executives with those of Exelon shareholders. Our compensation framework is based on providing market-competitive programs that attract and retain top talent. The framework is also designed so that a majority of our pay is at risk and directly linked to shareholder returns and to other performance factors that measure our progress against the financial management and operational excellence goals in our strategic and operating plans to promote pay for performance.

In order to reaffirm the link between pay and performance, the committee annually reviews the executive compensation components, targets and payouts and approves compensation for Ms. Pramaggiore. The committee evaluates goals under the annual and long-term incentive programs to ensure that they are challenging, contain appropriate stretch, and are designed to mitigate excessive risk. Goals are selected and evaluated based on support for the long-term business plan.

The committee believes it essential to reward executives equitably in order to establish an environment conducive to creating long-term shareholder value, realizing that at certain points in the market cycle there may be times when the CEO pay does not track to shareholder returns. Some of the value creation from outstanding operational performance may not be reflected in the stock price at a given time, but the committee is confident that our performance will result in value creation for shareholders over the long-term. The committee remains firmly committed to taking a holistic view of performance and making the right long-term decisions that motivate and engage our executives to drive our company forward and deliver optimal shareholder returns.

Elements of Executive Compensation

Executive compensation consists of the following key elements:

| | | | |

Type | | Form | | Purpose |

| Fixed | | Base salary | | • Provides income certainty so that executives can focus on achieving key business priorities and objectives. |

| Annual Incentive Program | | AIP | | • Holds executives accountable for performance against near-term business objectives. |

| Equity Awards | | Restricted Stock Units (RSUs) | | • Enhances the retention of key talent and provides an ongoing alignment of executive interests with those of shareholders. |

| | Performance Share Units (PSUs) | | • Aligns the interest of executives with shareholders by providing awards contingent on achieving pre-established three year financial and operational goals. |

| | Transition Award (one-time award) | | • Aligns the interest of executives with shareholders by providing awards contingent on achieving pre-established financial and operational goals over three-year performance period. |

| Retirement | | Pension | | • Qualified defined benefit pension plan intended to provide retirement income. |

| | Supplemental Pension (SERP) | | • Provides income security for retirement. |

| Other Compensation | | Perquisites | | • Exelon provides modest perquisites to serve specific business needs. |

| | 401(K) | | • Tax-efficient retirement savings plan. |

18

How Pay-for-Performance Works

Overview. We have a long-standing commitment to linking pay and performance by providing a majority of compensation that is tied to stock price increase or contingent on achieving our short and long-term objectives.

| | • | | Program Design:More than 60 percent of NEO pay at ComEd is variable, which directly ties pay to company performance, including financial results, operational goals, and stock performance relative to the peer group. |

| | • | | Performance Assessment:The committee uses a comprehensive and well-defined process to assess performance, which encompasses an assessment of both short and long-term financial and operational results relative to the goals. The committee ensures that the goal-setting process is rigorous and contains appropriate stretch for both internal measures and operational metrics that generally are set at achieving industry first quartile performance as the target (For more information refer to the 2013 performance share scorecard in Section IV). |

What We Do and Don’t Do

Our executive compensation philosophy focuses on pay-for-performance and reflects appropriate governance practices aligned with the needs of our business. Below is a summary of our executive compensation practices that are aligned with best practice, as well as a list of those practices we avoid because they do not align with shareholders’ long-term interests.

What We Do

| | • | Pay-for-performance – 68% of CEO pay (and 60% for other NEOs) is at risk in the form of AIP and equity |

| | • | Stock ownership – 2X base salary for all ComEd NEOs |

| | • | Mitigation of undue risk in executive compensation programs |

| | • | Double-trigger change-in-control benefits – requires involuntary termination plus change-in-control |

| | • | Independent compensation consultant – works directly with the committee |

| | • | We provide limited, modest perquisites based on sound business rationale |

| | • | We proactively seek investor feedback on executive compensation programs |

| | • | We prohibit hedging transactions, short sales, derivative transactions or pledging of company stock |

| | • | We require executive officers and directors to obtain pre-approval before trading stock |

| | • | We annually assess our programs against peer companies and best practices |

| | • | Incentive targets contain appropriate stretch based on industry performance and/or the business plan |

What We Don’t Do

| | • | No minimum payout of AIP or equity programs |

| | • | No employment agreements |

| | • | No dividend-equivalents on unearned Performance Share Units |

| | • | No excise tax gross-ups upon change-in-control for change-in-control agreements entered into after April 2009 |

| | • | No inclusion of the value of equity awards in pension or severance calculations |

| | • | No additional credited service under supplemental pension plans since 2004 |

19

Assessing Executive Compensation Programs

Overview. Assessing our executives’ compensation levels against our peer group is one of several factors considered in the pay setting process. Peer group practices are analyzed annually for target TDC and for other pay practices, such as perquisites and the mix of equity vehicles. Because Exelon is one of the largest energy services companies, we compare executive compensation against a blended peer group with which we compete for talent that includes 10 energy services companies and 10 high-performing asset intensive general industry companies (with an emphasis when appropriate on companies that are subject to commodity prices such as Exelon) that have comparable annual sales (.5x to 2x) and market capitalizations (generally above $10 billion). Each year the compensation and leadership development committee, working with its independent consultant, reviews the composition of the peer group and determines whether any changes should be made. The peer group for 2013 was unchanged from 2012. Exelon’s peer group consists of the following 20 companies:

| | | | | | |

General Industry | | Energy Services |

| 3M | | Honeywell | | AEP Co., Inc. | | FirstEnergy Corp. |

| | | |

| Alcoa | | International Paper Co. | | Dominion Resources, Inc. | | NextEra Energy, Inc. |

| | | |

| Caterpillar | | Johnson Controls Inc. | | Duke Energy Corp. | | PG&E Corp. |

| | | |

| EI DuPont | | Murphy Oil | | Edison International | | PSEG, Inc. |

| | | |

| Hess Corporation | | PepsiCo Inc. | | Entergy Corporation | | Southern Company |

Comparing Exelon to its Peer Group. The median revenue of Exelon’s peer group for the year ended December 31, 2013 was approximately $19.7 billion as compared to our revenues of $24.9 billion. As of December 31, 2013, the median market capitalization of Exelon’s peer group was $30.8 billion as compared to our market capitalization of $22.7 billion. Individual executive pay is generally targeted at the median of our peer group, but can vary based on job requirements (competencies and skills), scope of responsibilities, the executive’s experience and performance, retention, succession planning and the organizational structure of the businesses (internal alignment and pay relationships).

20

Section IV: What We Pay and Why We Pay it

Pay at Risk

Pay at risk in action. In order to drive a pay-for-performance culture and align with shareholder interests, we take a holistic approach that is generally based on the core compensation principle of putting the majority of pay adjustments in the form of variable pay that is at risk.

NEOs for 2013 are shown below:

| | |

Name | | Title |

| Anne R. Pramaggiore | | President and Chief Executive Officer |

| |

| Joseph R. Trpik Jr. | | Senior Vice President, Chief Financial Officer and Treasurer |

| |

| Terence R. Donnelly | | Executive Vice President and Chief Operating Officer |

| |

| Thomas S. O’Neill | | Senior Vice President, Regulatory and Energy Policy and General Counsel |

| |

| Fidel Marquez Jr. | | Senior Vice President, Governmental and External Affairs |

21

Base Salary

Overview. We pay base salaries to attract talented executives and to provide a fixed level of cash compensation. Base salaries for our NEOs are set by the committee and adjusted following an annual market assessment of peer group compensation. Base salaries may be adjusted (1) as part of the annual merit review, or (2) based on a promotion or significant change in job scope. The committee considers the results of the annual market assessment in addition to the following factors when contemplating a merit review: individual performance, scope of responsibility, leadership skills and values, current compensation, internal equity, and legacy matters.

2013 base salary adjustments. The table below depicts 2013 base salary adjustments that were effective March 1, 2013.

| | | | |

Name | | Merit

Review | |

Pramaggiore | | | 3.00 | % |

Trpik Jr. | | | 3.00 | % |

Donnelly | | | 3.00 | % |

O’Neill | | | 3.00 | % |

Marquez Jr. | | | 3.50 | % |

Performance-based Annual Incentive Plan (“AIP”)

Overview. We grant performance-based annual incentive awards to compensate our NEOs for achieving the company’s annual performance goals.

Performance Goals. One of the performance goals used to determine the annual bonus for Ms. Pramaggiore was Exelon’s non-GAAP operating earnings per share (EPS), which management believes represents earnings directly related to ongoing operations of the business. Ms. Pramaggiore’s performance was also based on operational goals, as were the other NEOs as shown in the AIP table below. These goals were chosen because they reflect financial management and operational excellence goals that are associated with the creation of value for shareholders. Financial and operational goals are set at threshold (50%), target (100%) and distinguished (200%) levels based on objectives in the company’s internal strategic business plan. The 2013 non-GAAP operating EPS target approved by the committee contains stretch goals based on the company’s internal business plan (for example, $360 million in merger synergies for 2013). The committee set the operational goals based on industry performance (where available).

| | | | | | | | | | | | |

Target Annual Incentive Award | | X | | Company/Business Unit Performance | | X | | Individual Performance Multiplier (IPM) | | = | | Actual Annual Incentive Award |

• % of base salary (as of 12/31/13) • ComEd CEO annual incentive target of 70% of salary • Other NEO annual incentive targets range from 45% to 55% of salary | | | | • Performance is 0% to 200% (target of 100%) • Ms. Pramaggiore’s payout is based on 25% Exelon EPS, with the balance based on ComEd metrics • All other ComEd NEOs, have 100% of their award based on ComEd metrics | | | | • Measures individual performance • Ranges from 50% to 110% of target for NEOs • The committee approves Ms. Pramaggiore’s IPM while she approves the IPMs of the other NEOs | | | | • Maximum award of 200% of target Shareholder Protection Feature (SPF) limits award to 20 percentage points above EPS |

22

2013 Performance. The committee approved a payout of 119.35% for Ms. Pramaggiore, which was reduced from 150.11% as a result of the shareholder protection feature. The other ComEd NEOs, received a payout of 124.35%, which was reduced from 140.39% as a result of the shareholder protection feature. Individual performance multipliers (ranging from 105% to 110%) were then applied to the final awards based on achieving key strategic goals and objectives. The following table describes the performance scales and results for the 2013 goals:

| | | | | | | | | | | | | | | | | | | | |

Goals | | Threshold | | | Target | | | Distinguished | | | 2013

Results | | | Unadjusted

Payout as a

% of

Target | |

Adjusted (non-GAAP) Operating Earnings Per Share (EPS)* | | $ | 2.22 | | | $ | 2.49 | | | $ | 2.72 | | | $ | 2.50 | | | | 104.35 | % |

ComEd outage duration 2013 | | | 94 | | | | 86 | | | | 84 | | | | 81 | | | | 200.00 | % |

ComEd Capital Expenditures 2013 ($M) | | $ | 824.60 | | | $ | 785.30 | | | $ | 706.80 | | | $ | 802.70 | | | | 77.86 | % |

ComEd Customer Operations Index 2013 | | | 79.2 | | | | 81 | | | | 84 | | | | 82.1 | | | | 136.67 | % |

ComEd Customer Satisfaction Index 2013 | | | 7.27 | | | | 7.47 | | | | 7.67 | | | | 7.75 | | | | 200.00 | % |

ComEd EIMA Reliability Metrics Index 2013 | |

| Performance scale is a composite of

multiple measures |

| | | 150.00 | % |

ComEd Operating Net Income (NI) ($M) 2013* | | $ | 331.90 | | | $ | 372.10 | | | $ | 406.30 | | | $ | 420.90 | | | | 200.00 | % |

ComEd OSHA Recordable (safety) Rate 2013 | | | 1.49 | | | | 0.91 | | | | 0.86 | | | | 0.71 | | | | 200.00 | % |

ComEd outage frequency 2013 | | | 1.02 | | | | 0.89 | | | | 0.84 | | | | 0.76 | | | | 200.00 | % |

ComEd Total O&M Expense 2013 ($M) | | $ | 932.40 | | | $ | 888.00 | | | $ | 799.20 | | | $ | 871.10 | | | | 119.03 | % |

| * | Ms. Pramaggiore is the only NEO with an Exelon Adjusted (non-GAAP) Operating Earnings Per Share (EPS) measurement component as well as a ComEd Operating Net Income (NI) component. |

Note: Adjusted (non-GAAP) Operating Earnings

Adjusted (non-GAAP) operating earnings for Exelon are provided as a supplement to results reported in accordance with GAAP. The adjustments generally exclude significant one-time charges or credits that are not normally associated with ongoing operations, mark-to-market adjustments from economic hedging activities and unrealized gains or losses from nuclear decommissioning trust fund adjustments. Management uses such adjusted (non-GAAP) operating earnings internally to evaluate the company’s performance and manage its operations and externally to report performance to investors. Accordingly, management also uses adjusted (non-GAAP) operating earnings as a goal in its annual incentive plan. A reconciliation of adjusted (non-GAAP) operating earnings per share to reported GAAP earnings for 2013 is presented below; amounts may not add due to rounding:

| | | | |

2013 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share | | $ | 2.50 | |

Adjustments: | | | | |

Mark-to-Market Impact of Economic Hedging Activities | | | 0.35 | |

Unrealized Gains Related to NDT Fund Investments | | | 0.09 | |

Plant Retirements and Divestitures | | | 0.02 | |

Asset Retirement Obligation | | | (0.01 | ) |

Merger and Integration Costs | | | (0.10 | ) |

Amortization of Commodity Contract Intangibles | | | (0.41 | ) |

Amortization of the Fair Value of Certain Debt | | | 0.01 | |

Reassessment of State Deferred Income Taxes | | | — | |

Midwest Generation Bankruptcy Charges | | | (0.02 | ) |

Remeasurement of Like-Kind Exchange Tax Position | | | (0.31 | ) |

Long-lived asset impairments | | | (0.14 | ) |

FY 2013 GAAP Earnings (Loss) Per Share | | $ | 2.00 | |

23

2013 AIP Summary Payments. The following table shows how the formula was applied and the actual amounts awarded.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NEO | | Salary | | | | | Target

AIP% | | | | | Performance

Factor | | | | | Total Award

for 2013

Performance | | | | | IPM% | | | | | Actual

Award | |

Pramaggiore | | $ | 566,500 | | | x | | | 70 | % | | x | | | 119.35 | % | | = | | $ | 473,280 | | | x | | | 110 | % | | = | | $ | 520,608 | |

Trpik Jr | | $ | 324,450 | | | x | | | 45 | % | | x | | | 124.35 | % | | = | | $ | 181,554 | | | x | | | 105 | % | | = | | $ | 190,632 | |

Donnelly | | $ | 391,400 | | | x | | | 55 | % | | x | | | 124.35 | % | | = | | $ | 267,688 | | | x | | | 110 | % | | = | | $ | 294,457 | |

O’Neill | | $ | 361,015 | | | x | | | 50 | % | | x | | | 124.35 | % | | = | | $ | 224,461 | | | x | | | 105 | % | | = | | $ | 235,684 | |

Marquez Jr | | $ | 326,025 | | | x | | | 45 | % | | x | | | 124.35 | % | | = | | $ | 182,435 | | | x | | | 105 | % | | = | | $ | 191,557 | |

Annual Equity Awards for 2013

In 2013, based on shareholder feedback and alignment to market practice, the committee approved using two equity vehicles: restricted stock units (RSUs) and performance share units (PSUs), targeting a mix of 33% RSUs and 67% PSUs. The committee also approved a one-time performance-based transition award that replaces lost targeted equity payments based on lengthening the performance period to three years from one year.

Our equity grant timing policy is for the committee to approve the annual equity grants at its meeting in January. On January 28, 2013, the committee approved the 2013 grants for RSUs, PSUs and transition awards, which are shown in detail in the Grants of Plan-Based Awards table.

The number of shares subject to each award type was based on the 2013 target awards that were approved by the committee. The grant date fair value of the awards based on the January 28, 2013 closing stock price of $31.18 is shown in the Summary Compensation Table, and the amounts of equity awards granted to each NEO are listed below as well as in the Grants of Plan-Based Awards table, which also includes accumulated dividends. Outstanding equity awards are shown in the Outstanding Equity Awards table.

Restricted Stock Units. Starting in 2013, the committee decided to grant RSUs that vest ratably over three years in place of stock options to align more strongly with market practice. The committee also considered it important for purposes of executive retention that one-third of the equity portfolio should be RSUs which offer greater stability and less volatility but are still linked to changes in shareholder value. Dividend-equivalents with respect to RSUs are reinvested as additional RSUs, subject to the same vesting conditions as the underlying RSUs.

Special Equity Awards. The committee periodically provides equity awards consisting of RSUs vesting in full after up to five years on a selective basis to key executives based on factors such as retention and succession planning. These retention awards have vesting and other provisions designed to promote retention of the services and skills of key executives.

24

Performance Share Units.Commencing in 2013, the committee approved a redesign of the PSU program to include vesting in full after three years, compared with ratable vesting of three years under the former design.