UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

| ¨ | Preliminary Information Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| x | Definitive Information Statement |

Commonwealth Edison Company

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notice of Action by Written Consent of Majority Shareholder

In Lieu of a Meeting of Stockholders to Elect Directors

and Information Statement

April 29, 2016

To the Stockholders of Commonwealth Edison Company:

Notice is hereby given in accordance with Section 7.10 of the Illinois Business Corporation Act of 1983, as amended (the “Act”), that on or about June 10, 2016, the majority shareholder of Commonwealth Edison Company will take action by written consent in lieu of a meeting to elect the following directors: James W. Compton, Christopher M. Crane, A. Steven Crown, Nicholas DeBenedictis, Peter Fazio, Michael Moskow, Denis O’Brien, Anne Pramaggiore, and Jesse H. Ruiz.

In accordance with Section 7.10 of the Act, notice of the action by written consent will be delivered to the shareholders promptly after the action is taken.

Very truly yours,

Bruce G. Wilson

Corporate Secretary

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being provided to you in connection with the action by written consent of the majority stockholder of Commonwealth Edison Company (“ComEd” or the “Company”) to be taken on or about June 10, 2016.

ComEd is an indirect majority-owned subsidiary of Exelon Corporation (“Exelon”). As of March 31, 2016, ComEd had outstanding 127,017,042 shares of Common Stock, $12.50 par value (the “ComEd Common Stock”), 127,002,904, or over 99%, of which are owned by Exelon Energy Delivery Company, a wholly-owned subsidiary of Exelon. Exelon intends to cause its subsidiary to take action by written consent to elect the nominees for director named under “Election of Directors” below. Consequently, the election of these directors is expected to be approved.

Exelon is a utility services holding company engaged in the energy delivery business through its subsidiaries, ComEd in northern Illinois, Baltimore Gas and Electric Company (“BGE”) in Baltimore and central Maryland, PECO Energy Company (“PECO”) in Philadelphia and southeastern Pennsylvania, Atlantic City Electric Company in southern New Jersey, Delmarva Power & Light Company in Delaware and Maryland, and Potomac Electric Power Company in the District of Columbia and Maryland. Through its subsidiary, Exelon Generation Company, Exelon is also engaged in the generation, physical delivery and marketing of power across multiple regions, including renewable energy and other energy related products and services.

ii

TABLE OF CONTENTS

iii

Composition of the Board

ComEd is a controlled subsidiary of Exelon and does not have a separate nominating committee. Instead, those functions are fulfilled by the corporate governance committee of the Exelon board of directors. Because ComEd is a controlled subsidiary of Exelon, there is no policy with regard to the consideration of any director candidates recommended by ComEd shareholders other than Exelon.

The board of directors of ComEd consists of nine members. All directors are being elected because they have been previously elected or appointed by the board of directors on the recommendation of the corporate governance committee of Exelon.

ComEd’s Bylaws and Corporate Governance Principles require that at least one of the ComEd directors be “independent,” defined for this purpose as not being a director, officer or employee of Exelon, ComEd or any other Exelon affiliate. Five of the directors are “independent” directors under this standard. The current membership of the ComEd board represents a range of backgrounds and experience and diversity. The board consists of nine directors who range in age from 51 to 78, with an average age of 65.2 and a median age of 64.

The directors have a wide diversity of experience that fills the needs of the board. Three directors are current or former CEOs of corporations. Two have served in government. Two have experience in banking. Individual directors have expertise in utility matters and law. Three of the directors have operational responsibility for Exelon or ComEd. All but two of the directors live or have lived in ComEd’s service territory and have extensive knowledge of the characteristics of the service territory and the needs of ComEd’s customers.

Biographical information about each of the directors follows.

Election of Directors

The persons listed below, each of whom is a current member of the board, will be elected as director to serve until their successors are elected.

James Compton,Age 78. Mr. Compton has served as a director of ComEd since 2006. Mr. Compton served as the President and Chief Executive Officer of the Chicago Urban League from 1978 through 2006. He also served as the President and Chief Executive Officer of the Chicago Urban League Development Corporation from 1980 through 2006. Mr. Compton also serves on the Board of Trustees of Ariel Investment Trust. Mr. Compton has extensive knowledge of ComEd and its business, having previously served as a director of ComEd from 1989 through 2000 and having served as a director of a community-based bank. In addition, Mr. Compton is very familiar with ComEd’s customers and as an African-American man contributes to ComEd’s outreach to diverse groups in Chicago.

Christopher M. Crane, Age 57. Mr. Crane has served as a director and the chair of the ComEd board since 2012. Mr. Crane is President and Chief Executive Officer of Exelon Corporation since March 2012. Previously, he served as President and Chief Operating Officer, Exelon and Exelon Generation from 2008 to 2012. In that role, he oversaw one of the U.S. industry’s largest portfolios of electric generating capacity, with a multi-regional reach and the nation’s largest fleet of nuclear power plants. He directed a broad range of activities including major acquisitions, transmission strategy, cost management initiatives, major capital programs, generation asset optimization and generation development. Mr. Crane is one of the leading executives in the electric utility and power industries. He is vice chairman of the Edison Electric Institute and chairman of the board of directors of the Institute of Nuclear Power Operations, the industry organization promoting the highest levels of safety and reliability in nuclear plant operation. He is an executive committee member and immediate past chairman of the Nuclear Energy Institute, the nation’s nuclear industry trade association, where he has also served as chairman of the New Plant Oversight Committee and as a member of the Nuclear Strategic Issues Advisory Committee, the Nuclear Fuel Supply Committee and the Materials Initiative Group. He is also a member of the board of governors of the World Association of Nuclear Operators. Mr. Crane served as a director of Aleris International Inc. from 2010 through 2013 (manufacture and sale of aluminum rolled and extruded products), where he served on the compensation committee and as the chair of the nominating and corporate governance committee. Mr. Crane also serves as chair of the boards of directors of Exelon subsidiaries BGE, PECO and Pepco Holdings LLC.

A. Steven Crown, Age 64, has served as a director since 2011. He is a general partner of Henry Crown and Company, and has served in such capacity for more than five years. Henry Crown and Company is a private investment group that manages investments in banking, transportation, oil and gas, manufacturing, resort properties and other industries. Mr. Crown has extensive knowledge of the Chicago economy and his experience contributes to his effectiveness as a member of the ComEd board.

Nicholas DeBenedictis,Age 70, has served as a director of ComEd since 2013 and a director of Exelon since 2002. Mr. DeBenedictis serves on the Exelon corporate governance, finance and risk, and generation oversight committees. Mr. DeBenedictis is the chairman of Aqua America, Inc. a water utility with operations in 10 states. Mr. DeBenedictis also has extensive experience in environmental regulation and economic development, having served in two cabinet positions in the Pennsylvania government, as Secretary of the Pennsylvania Department of Environmental Resources and as Director of the Office of Economic Development. He also spent eight years with the U.S. Environmental Protection Agency. Mr. DeBenedictis has been a director of P.H. Glatfelter, Inc. (global supplier of specialty papers and engineered products) since 1995, where he has served on the audit, compensation & finance, and nominating and corporate governance committees, and a director of MISTRAS Group (non-destructive testing) since October 2015, where he serves on the Audit Committee. As a former CEO of a

1

public company, Mr. DeBenedictis has experience in dealing with many of the same development, land use and utility regulatory issues that affect ComEd. His experience with environmental regulation also contributes to his service to the ComEd board.

Peter Fazio, Age 76. Mr. Fazio has been a director of ComEd since 2007. Mr. Fazio is a partner of the law firm of Schiff Hardin, LLP and served as past chairman, Executive Committee member and managing partner of Schiff Hardin. In addition to his general legal expertise, Mr. Fazio previously served as general counsel of another electric and gas utility and brings to the ComEd board knowledge of utility regulatory and legal issues.

Michael Moskow,Age 78. Mr. Moskow has served as a director of ComEd since 2008. Mr. Moskow is the Vice Chair and a Distinguished Fellow at the Chicago Council on Global Affairs. He served as president and chief executive officer of the Federal Reserve Bank of Chicago from 1994 to 2007. He is a director of Discover Financial Services, Northern Trust Mutual Funds and Taylor Capital Group and served as a director of Diamond Technology from 2008 through 2011. Mr. Moskow is a recognized leader in the Chicago business community with knowledge of the economy of the Midwestern United States and the northern Illinois communities that ComEd serves.

Denis O’Brien,Age 56. Mr. O’Brien has served as a director and vice chair of the ComEd board since 2012. As the chief executive officer of Exelon Utilities, Mr. O’Brien oversees the utility businesses of Exelon at ComEd, BGE, PECO, and PHI. Mr. O’Brien is also a senior executive vice president of Exelon. Previously, Mr. O’Brien served as executive vice president of Exelon and chief executive officer of Philadelphia-based PECO, Pennsylvania’s largest electric and natural gas utility.

Anne Pramaggiore,Age 57. Ms. Pramaggiore has served as a director of ComEd since 2012. In February 2012, Ms. Pramaggiore became the president and chief executive officer of ComEd. Prior to her appointment, Ms. Pramaggiore served as president and chief operating officer of ComEd from 2009 through 2012, where she was responsible for overseeing the day-to-day operations of ComEd. Before being named as president and chief operating officer, Ms. Pramaggiore served as executive vice president of Customer Operations, Regulatory and External Affairs.

Jesse Ruiz,Age 51. Mr. Ruiz has served as a director of ComEd since 2006. He is a corporate and securities partner at the law firm of Drinker Biddle & Reath, LLP and serves as the Vice President of the Chicago Board of Education. Mr. Ruiz is also the former chairman of the Illinois State Board of Education. Mr. Ruiz’s legal and government experience in the state and city where ComEd conducts its business has enabled him to contribute to the ComEd board on multiple levels. Mr. Ruiz also contributes to ComEd’s outreach to diverse groups.

ComEd Governance

Independence Standards

As noted above, ComEd’s Corporate Governance Principles require that at least one of the ComEd directors be “independent,” defined for this purpose as not being a director, officer or employee of Exelon, BGE, PECO or any other Exelon affiliate. Messrs. Compton, Crown, Fazio, Moskow and Ruiz are independent directors under this standard. The Corporate Governance Principles further require that the independent director or directors approve certain actions, including the declaration of dividends, the purchase of electric energy and seeking protection from creditors under bankruptcy or related laws.

Board Leadership Structure

Christopher M. Crane, the chief executive officer of Exelon, serves as chair of the ComEd board of directors. Denis P. O’Brien serves as the chief executive officer of Exelon Utilities, a senior executive vice president of Exelon, and the vice chair of the ComEd board. Because ComEd is a controlled subsidiary of Exelon, the ComEd board of directors has not seen any need to adopt a policy with respect to whether or not the positions of chair of the ComEd board of directors and chief executive officer should be held by the same person.

Attendance at Meetings

During 2015, ComEd’s board of directors held four meetings. In 2016, the ComEd board has held two meetings to date. The directors had an average attendance of approximately 94.44 percent for all board meetings in 2015.

Board Committees

ComEd is a controlled subsidiary of Exelon and does not have separate audit, nominating and compensation committees. Instead, those functions are fulfilled by the audit, corporate governance and compensation committees of the Exelon board of directors. The ComEd board established an executive committee in January 2014 that meets only as needed. The executive committee is authorized to act when it is not convenient to call a meeting of the full ComEd board. The members of the executive committee are Ms. Pramaggiore and Messrs. Crane, O’Brien and Fazio.

2

Board Oversight of Risk

As a controlled company, ComEd’s risk is managed by its board of directors in conjunction with Exelon’s overall risk oversight and risk management structure. Exelon and ComEd operate in a market and regulatory environment that involves significant risks, many of which are beyond our control. Exelon has a risk management group consisting of a Chief Enterprise Risk Officer, a Chief Commercial Risk Officer, a Chief Credit Officer and a full-time staff of 130. The risk management group draws upon other company personnel for additional support on various matters related to the identification, assessment and management of enterprise risks. Exelon also has a Risk Management Committee comprising company officers who meet regularly to discuss matters related to enterprise risk management generally and particular risks associated with new developments or proposed transactions under consideration. Management of Exelon regularly meets with the Chief Enterprise Risk Officer and the Risk Management Committee to identify and evaluate the most significant risks of the businesses and appropriate steps to manage and mitigate those risks. In addition, the Chief Enterprise Risk Officer and the risk management group perform an annual assessment of enterprise risks, drawing upon resources throughout the company for an assessment of the probability and severity of the identified risks. The Chief Enterprise Risk Officer and senior executives of Exelon discuss those risks with the board’s finance and risk committee as well as the audit committee and, when appropriate, the BGE, ComEd, PECO and PHI boards of directors. In addition, the Exelon board’s generation oversight committee evaluates risks related to the company’s generation business. The committees of the Exelon board regularly report to the full board on the committees’ discussions of enterprise risks. In addition, the Exelon board regularly discusses enterprise risks in connection with consideration of emerging trends or developments and in connection with the evaluation of capital investments and other business opportunities and business strategies.

Board/Committee/Director Evaluation and Director Education

The ComEd board does not have a separate process for board, committee or director evaluation. Because ComEd is a controlled subsidiary, the ComEd board is evaluated by the Exelon corporate governance committee.

The Exelon Office of Corporate Governance oversees an orientation program that is tailored to the needs of each new director depending on his or her level of experience serving on other boards and knowledge of the company or industry acquired before joining the board. New directors receive materials about ComEd, the board and board policies and operations and attend meetings with the CEO and other officers for a briefing on the executives’ responsibilities, programs and challenges. New directors are also scheduled for tours of various company facilities, depending on their orientation needs.

Continuing director education is provided during portions of regular board meetings and focuses on the topics necessary to enable the board to consider effectively issues before them at that time (such as new regulatory standards). The education sometimes takes the form of “white papers,” covering timely subjects or topics, which a director can review before the meeting and ask questions about during the meeting. The company pays the cost for any director to attend outside director education seminars on topics relevant to their service as directors.

Independent Auditor

ComEd is an indirect subsidiary of Exelon and does not have a separate audit committee. Instead the Exelon audit committee fulfills that function for ComEd. In July 2002, the Exelon audit committee adopted a policy for pre-approval of services to be performed by the independent auditor. The committee pre-approves annual budgets for audit, audit-related and tax compliance and planning services. The services that the committee will consider include services that do not impair the auditor’s independence and add value to the audit, including audit services such as attest services and scope changes in the audit of the financial statements, the issuance of comfort letters and consents in relation to financings, audit-related services such as accounting advisory services related to proposed transactions and new accounting pronouncements, the provision of attest services in relation to regulatory filings and contractual obligations, and tax compliance and planning services. With respect to non-budgeted services in amounts less than $500,000, the committee delegated authority to the committee’s chair to pre-approve such services. All other services must be pre-approved by the committee. The committee receives quarterly reports on all fees paid to the independent auditor. None of the services provided by the independent auditor was provided pursuant to the de minimis exception to the pre-approval requirements contained in the SEC’s rules.

In 2015 the audit committee reviewed the PricewaterhouseCoopers 2015 Audit Plan and proposed fees and concluded that the scope of audit was appropriate and the proposed fees were reasonable.

3

The following table presents the fees (in thousands of dollars) for professional services rendered by PricewaterhouseCoopers LLP for the audit of ComEd’s annual financial statements for the years ended December 31, 2015 and December 31, 2014, and fees billed for other services provided during those periods. These fees include an allocation of amounts billed directly to Exelon. The fees include amounts related to the year indicated, which may differ from amounts billed.

| | | | | | | | |

| | | Year Ended

Dec. 31,

2015 | | | Year Ended

Dec. 31,

2014 | |

Audit Fees | | | 1,805 | | | | 2,008 | |

Audit-Related Fees | | | 66 | | | | 17 | |

Tax Fees | | | 8 | | | | 23 | |

All Other Fees | | | 2 | | | | 5 | |

| | | | | | | | |

Total | | | 1,881 | | | | 2,053 | |

| | | | | | | | |

Audit fees include financial statement audits and reviews under statutory or regulatory requirements and services that generally only the auditor reasonably can provide, including issuance of comfort letters and consents for debt and equity issuances and other attest services required by statute or regulation.

Audit-related fees consist of assurance and related services that are traditionally performed by the auditor such as accounting assistance and due diligence in connection with proposed acquisitions or sales, consultations concerning financial accounting and reporting standards, and audits of stand-alone financial statements or other assurance services not required by statue or regulation.

Tax fees consist of tax compliance, tax planning, and tax advice and consulting services including assistance and representation in connection with tax audits and appeals, tax advice related to proposed acquisitions or sales, employee benefit plans and requests for rulings or technical advice from taxing authorities.

All other fees reflect work performed primarily in connection with research and audit software licenses.

Report of the Exelon Audit Committee

The audit committee’s primary responsibility is to assist the board of directors in fulfilling its responsibility to oversee and review the quality and integrity of the company’s financial statements and internal controls over financial reporting, the independent auditor’s qualifications and independence, and the performance of the company’s internal audit function and of its independent auditor.

The audit committee is comprised entirely of independent directors and is governed by a board-approved, written charter stating its responsibilities. The charter is reviewed annually and updated, as appropriate, to address changes in regulatory requirements, authoritative guidance, evolving oversight practices and investor feedback. The audit committee charter was last amended on January 26, 2016, and is available on the Exelon website at www.exeloncorp.com on the corporate governance page under the Investors tab, and is available in print to any shareholder who requests a copy from Exelon’s corporate secretary as described on page 7 of this Information Statement.

The audit committee satisfies the independence, financial experience and other qualification requirements of the New York Stock Exchange (NYSE) and applicable securities laws and regulations. The board of directors has determined that each of the members of the audit committee is an “audit committee financial expert” for purposes of the SEC’s rules and also that each of the members of the audit committee is independent as defined by the rules of the NYSE and Exelon’s Corporate Governance Principles.

Under its charter, the audit committee’s principal duties include:

| • | | Having sole authority to appoint, retain, or replace the independent auditor, subject to shareholder ratification, and to oversee the independence, compensation and performance of the independent auditor; |

| • | | Reviewing financial reporting and accounting policies and practices; |

| • | | Overseeing the work of the internal auditor and reviewing internal controls; |

| • | | With the advice and assistance of the finance and risk committee, reviewing in a general manner the processes by which Exelon assesses and manages enterprise risk; and |

| • | | Reviewing policies and procedures with respect to internal audits of officers’ and directors’ expenses, compliance with Exelon’s Code of Business Conduct, and the receipt and response to complaints regarding accounting, internal controls or auditing matters. |

4

Each member of the audit committee also serves on the finance and risk committee. On occasion, the audit and finance and risk committees have met jointly to review areas of mutual interest between the two committees.

The audit committee meets outside the presence of management for portions of its meetings to hold separate discussions with the independent auditor, the internal auditors, and the chief legal officer.

The audit committee met eight times in 2015, fulfilling its duties and responsibilities as outlined in its charter, as well as receiving periodic updates on the company’s financial performance and strategic initiatives, as well as other matters germane to its responsibilities.

Management has primary responsibility for preparing the company’s financial statements and establishing effective internal controls over financial reporting. PricewaterhouseCoopers LLP (PwC), the company’s independent auditor, is responsible for auditing those financial statements and expressing an opinion on the conformity of the company’s audited financial statements with generally accepted accounting principles and on the effectiveness of the company’s internal controls over financial reporting based on criteria established in 2013 by the Committee of Sponsoring Organizations of the Treadway Commission.

In this context, the audit committee has reviewed and discussed with management and PwC the company’s audited financial statements contained in the 2015 Annual Report on SEC Form 10-K, including the critical accounting policies applied by the company in the preparation of these financial statements. The audit committee discussed with PwC the requirements of the Public Company Accounting Oversight Board (PCAOB), and had the opportunity to ask PwC questions relating to such matters. These discussions included the quality, and not just the acceptability, of the accounting principles utilized, the reasonableness of significant accounting judgments, and the clarity of disclosures in the financial statements.

At each of its meetings in 2015, the audit committee met with the company’s chief financial officer and other senior members of the company’s financial management. The audit committee reviewed with PwC and the company’s internal auditor the overall scope and plans for their respective audits in 2015. The audit committee also received regular updates from the company’s internal auditor on internal controls and business risks and from the company’s general counsel on compliance and ethics issues.

The audit committee met with the internal auditor and PwC, with and without management present, to discuss their evaluations of the company’s internal controls and the overall quality of the company’s financial reporting. The audit committee also met with the company’s general counsel and deputy general counsel, with and without management present, to review and discuss compliance and ethics matters, including compliance with the company’s Code of Business Conduct.

On an ongoing basis, the audit committee considers the independence, qualifications, compensation and performance of PwC. Such consideration includes reviewing the written disclosures and the letter provided by PwC in accordance with applicable requirements of the PCAOB regarding PwC’s communications with the audit committee concerning independence, and discussing with PwC their independence.

The audit committee is responsible for the approval of audit fees, and the committee reviewed and pre-approved all fees paid to PwC in 2015. The audit committee has adopted a policy for pre-approval of services to be performed by the independent auditor. Further information on this policy and on the fees paid to PwC in 2015 and 2014 can be found in the section of this proxy statement titled “Ratification of PriceWaterhouseCoopers LLP as Exelon’s Independent Auditor for 2016.” The audit committee periodically reviews the level of fees approved for payment to PwC and the pre-approved non-audit services PwC has provided to the company to ensure their compatibility with independence. The audit committee also monitors the company’s hiring of former employees of PwC.

The audit committee monitors the performance of PwC’s lead partner responsible for the audit, oversees the required rotation of PwC’s lead audit partner and, through the audit committee chair, reviews and approves the selection of the lead audit partner. In addition, to help ensure auditor independence, the audit committee periodically considers whether there should be a rotation of the independent auditor.

5

PwC has served as the company’s independent auditor since the company’s formation in 2000. As in prior years, the audit committee and management have engaged in a review of PwC in connection with the audit committee’s consideration of whether to recommend that shareholders ratify the selection of PwC as the company’s independent auditor for 2016. In that review, the audit committee considered both the continued independence of PwC and whether retaining PwC is in the best interests of the company and its shareholders. In addition to independence, other factors considered by the audit committee included:

| • | | PwC’s historical and recent overall performance on the audit, including the quality of the audit committee’s ongoing discussions with PwC; |

| • | | PwC’s expertise and capability in handling the accounting, internal control, process and system risks and practices present in the company’s energy generation and utility businesses, including relative to the corresponding expertise and capabilities of other audit firms; |

| • | | the quality, quantity and geographic location of PwC staff, and PwC’s ability to provide responsive service; |

| • | | PwC’s tenure as the company’s independent auditor and its familiarity with the company’s operations and businesses, accounting policies and practices and internal control over financial reporting; |

| • | | the significant time commitment required to onboard and educate a new audit firm that could distract management’s focus on financial reporting and internal control; |

| • | | the appropriateness of PwC’s fees, on both an absolute basis and as compared to services provided by other auditing firms to peer companies; |

| • | | an assessment of PwC’s identification of its known significant legal risks and proceedings that may impair PwC’s ability to perform the audit; and |

| • | | external information on audit quality and performance, including recent PCAOB reports on PwC and its peer firms. |

The audit committee has concluded that PwC is independent from the company and its management, and has retained PwC as the company’s independent auditor for 2016. The audit committee and the board believe that the continued retention of PwC is in the best interests of the company and its shareholders and have recommended that shareholders ratify the appointment of PwC as the company’s independent auditor for 2016.

In addition, in reliance on the reviews and discussions referred to above, the Exelon audit committee recommended to the Exelon board of directors (and the Exelon board of directors approved) that the audited financial statements be included in Exelon Corporation’s Annual Report on Form 10-K for the year ended December 31, 2015, for filing with the SEC.

|

| February 8, 2016 |

|

| The Exelon Audit Committee |

|

| Anthony K. Anderson, Chair |

| Ann C. Berzin |

| Yves C. de Balmann |

| Paul L. Joskow |

| Richard W. Mies |

|

| Stephen D. Steinour |

6

Related Person Transactions

Exelon has a written policy for the review and approval or the ratification of related person transactions. Transactions covered by the policy include commercial transactions for goods and services and the purchase of electricity or gas at non-tariffed rates from Exelon or any of its subsidiaries by an entity affiliated with a director or officer of Exelon. The retail purchase of electricity or gas from BGE, ComEd, PECO or PHI at rates set by tariff, and transactions between or among Exelon or its subsidiaries are not considered. Charitable contributions approved in accordance with Exelon’s Charitable Contribution Guidelines are deemed approved or ratified under the Related Persons Transaction policy and do not require separate consideration and ratification.

As required by the policy, the Exelon board reviewed all commercial, charitable, civic and other relationships with Exelon in 2015 that were disclosed by directors and executive officers of Exelon, BGE, ComEd, and PECO, and by executive officers of Exelon Generation Company that required separate consideration and ratification. The Exelon Office of Corporate Governance collected information about each of these transactions, including the related persons and entities involved and the dollar amounts either paid by or received by Exelon. The Office of Corporate Governance also conducted additional due diligence, where required to determine the specific circumstances of the particular transaction, including whether it was competitively bid or whether the consideration paid was based on tariffed rates.

The Exelon corporate governance committee and the board reviewed the analysis prepared by the Office of Corporate Governance, which identified those related person transactions which required ratification or approval, under the terms of the policy, or disclosure under the SEC regulations. The Exelon corporate governance committee and the board considered the facts and circumstances of each of these related person transactions, including the amounts involved, the nature of the director’s or officer’s relationship with the other party to the transaction, whether the transaction was competitively bid and whether the price was fixed or determined by a tariffed rate.

The committee recommended that the Exelon board ratify all of the transactions. On the basis of the committee’s recommendation, the board did so. Several transactions were ratified because the related person served only as a director of the affiliated company, was not an officer or employee of the affiliated company and did not have a pecuniary or material interest in the transaction. For some of these transactions, the value or cost of the transaction was very small, and the board considered the de minimis nature of the transaction as further reason for ratifying it. The board approved and ratified other transactions that were the result of a competitive bidding process, and therefore were considered fairly priced, or arms- length, regardless of any relationship. The remaining transactions were approved by the board, even though the director is an executive officer of the affiliated company, because the transactions involved only retail electricity or gas purchases under set, tariffed rates or the price and terms were determined as a result of a competitive bidding process. Only two of the related person transactions are required to be disclosed in this Information Statement.

Drinker Biddle & Reath LLP provided legal services to Exelon and ComEd during 2015. Mr. Ruiz, a member of the ComEd board of directors, is a partner of Drinker Biddle & Reath LLP. Mr. Ruiz does not provide any services to Exelon or ComEd and is not compensated for the services provided by Drinker Biddle & Reath LLP.

Sidley Austin LLP provided legal services to Exelon and ComEd during 2015. The spouse of Mr. Ruiz, a member of the ComEd board of directors, is a partner of Sidley Austin LLP.

Process for Stockholder Communications with the Board

Stockholders and other interested persons can communicate with the directors by writing to them, c/o Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. The Corporate Secretary will review communications initially and transmit a summary to the directors and will exclude from transmittal any communications that are commercial advertisements, other forms of solicitation, general shareholder service matters or individual service or billing complaints. The Corporate Secretary will forward to the directors any communication raising substantial issues. All communications are available to the directors upon request. Shareholders may also report an ethics concern with the Exelon Ethics Hotline by calling 1-800-23-Ethic (1-800-233-8442). You may also report an ethics concern via the Internet at EthicsOffice@ExelonCorp.com. These processes may also be used to communicate with the ComEd board of directors or to report ethics concerns relating to ComEd.

Availability of Corporate Documents

The Exelon Code of Business Conduct, which is the code of conduct applicable to ComEd, is available on the Exelon website at www.exeloncorp.com, on the corporate governance page under the Investors tab. Copies may be printed from the Exelon website and copies are available without charge to any shareholder who requests them by writing to Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. In addition, Exelon’s Compensation Consultant Independence Policy and all of Exelon’s and ComEd’s filings submitted to the SEC are available on the website. Access to this information is free of charge to any user with internet access. Information contained on our website is not part of this information statement.

7

Delivery of Documents to Stockholders Sharing an Address

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name and do not participate in electronic delivery of materials will receive only one copy of this Information Statement, unless we are notified that one or more of these stockholders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Executive Compensation

The compensation of ComEd’s named executive officers is set under the direction of the compensation and leadership development committee of the board of directors of Exelon, generally consistent with Exelon’s overall compensation and benefits programs and policies, and is subject to review by the ComEd board of directors. A notable difference is that the annual incentive program for ComEd does not include a goal based on Exelon’s operating earnings. The compensation discussion and analysis and compensation disclosure that follows is adapted from the compensation discussion and analysis and compensation disclosure that was included in the 2016 proxy statement for Exelon and includes the information pertaining to ComEd executive compensation. The compensation and leadership development committee of Exelon provided a report on the compensation discussion and analysis that was included in the proxy statement for Exelon’s 2016 annual meeting and is presented below just before Compensation Discussion and Analysis.

Executive officers may be involved in evaluation of the performance and development of initial recommendations with respect to compensation adjustments; however, the Exelon compensation and leadership development committee makes the determinations with respect to compensation programs and adjustments. The Exelon chairman and the Exelon CEO are considered invited guests and are welcome to attend the meetings of the compensation and leadership development committee. The chairman and the CEO cannot call meetings of the compensation and leadership development committee.

Management, including the executive officers, makes recommendations as to goals for the incentive compensation programs that are aligned with Exelon’s and ComEd’s business plan. The compensation and leadership development committee reviews the recommendations and establishes the final goals. The compensation and leadership development committee strives to ensure that the goals are consistent with the overall strategic goals set by the board of directors (including the individual goals of subsidiaries, as appropriate), that they are sufficiently difficult to meaningfully incent management performance, and, if the targets are met, that the payouts will be consistent with the design for the overall compensation program. Executive officers take an active role in evaluating the performance of the executives who report to them, directly or indirectly, and in recommending the amount of compensation their subordinate executives receive. Executive officers review peer group compensation data for each of their subordinates in conjunction with their annual performance reviews to formulate a recommendation for base salary and whether to apply an individual performance multiplier to the subordinate executive’s incentive payouts, and if so, the amount of the multiplier. Executive officers generally do not make recommendations with respect to annual and long-term incentive target percentages or payouts. The Exelon CEO reviews all of the recommendations of the executive officers before they are presented to the compensation and leadership development committee. The human resources function provides to the compensation and leadership development committee data showing the history of the compensation of the executive officers and data that analyzes the cost of a range of several alternatives for changes to the compensation of the executive officers.

The compensation and leadership development committee has delegated to the Exelon CEO the authority to make off-cycle awards to employees who are not subject to the limitations of Section 162(m), are not executive officers for purposes of reporting under Section 16 of the Securities Exchange Act of 1934, and are not executive vice presidents or higher officers of Exelon, provided that such authority is limited to making grants of up to 600,000 shares in the aggregate, and 20,000 shares per recipient in any year. The compensation and leadership development committee reviews and ratifies these grants.

Compensation Consultant

Pursuant to the compensation and leadership development committee’s charter, the committee is authorized to retain and terminate, without board or management approval, the services of an independent compensation consultant to provide advice and assistance, as the committee deems appropriate. The committee has the sole authority to approve the consultant’s fees and other retention terms, and reviews the independence of the consultant and any other services that the consultant or the consultant’s firm may provide to the company. The chair of the compensation and leadership development committee reviews, negotiates and executes an engagement letter with the compensation consultant. The compensation consultant directly reports to the committee.

8

The compensation and leadership development committee has engaged Semler Brossy Consulting Group, LLC and its Managing Principal Ms. Blair Jones as its consultant. The committee determined that Semler Brossy offered the strongest and most responsive team and would provide the most reliable and cost-competitive advice through experience, research and benchmarking. In reviewing the engagement in December 2015, the committee considered the following factors in determining that Ms. Jones and the firm are independent consultants and do not have any conflicts of interest:

| • | | Semler Brossy performs no other services for the company or its affiliates and received no other fees from the company; |

| • | | the firm has formal written policies designed to prevent conflicts of interest; and |

| • | | there were no relationships of the firm and its consultants and Exelon and its officers, directors or affiliates except that Dr. William C. Richardson, an Exelon director through December 2015, had known another consultant from the firm in connection with his consulting for the compensation committee at another company where Dr. Richardson had previously served as a director. |

As part of its ongoing services to the compensation and leadership development committee, the compensation consultant supports the committee in executing its duties and responsibilities with respect to Exelon’s executive compensation programs by providing information regarding market trends and competitive compensation programs and strategies. In supporting the committee, the compensation consultant does the following:

| • | | Prepares market data for each senior executive position, including evaluating Exelon’s compensation strategy and reviewing and confirming the peer group used to prepare the market data; |

| • | | Provides the committee with an independent assessment of management recommendations for changes in the compensation structure; |

| • | | Works with management to ensure that the company’s executive compensation programs are designed and administered consistent with the committee’s requirements; and |

| • | | Provides ad hoc support to the committee, including discussing executive compensation and related corporate governance trends. |

Exelon’s human resources staff and senior management use the data provided by the compensation consultant to prepare documents for use by the compensation and leadership development committee in preparing their recommendations to the full board of directors or, in the case of the Exelon CEO, the independent Exelon directors, on compensation for the senior executives. In addition to its general responsibilities, the compensation consultant attends the compensation and leadership development committee’s meetings, if requested. The committee, or Exelon’s management on behalf of the committee, may also ask the compensation consultant to perform other executive and non-executive compensation-related projects. The committee has established a process for determining whether any significant additional services will be needed and whether a separate engagement for such services is necessary.

The committee has a formal compensation consultant independence policy that codifies its past practices. The compensation consultant independence policy is available on the Exelon website at www.exeloncorp.com, on the corporate governance page under the Investors tab. The purpose of the policy is to ensure that the advisers or consultants retained by the committee are independent of the company and its management, as determined by the committee using its reasonable business judgment. The committee considers all facts and circumstances it deems relevant, such as the nature of any relationship between a compensation consultant, the compensation consultant’s firm, and the company and the nature of any services provided by the compensation consultant’s firm to the company that are unrelated to the compensation consultant’s work for the committee. Under the policy, a compensation consultant shall not be considered independent if the compensation consultant or the compensation consultant’s firm receives more than one percent of its annual gross revenues for services provided to the company. Under the policy, the compensation consultant reports directly to the chair of the compensation and leadership development committee, and the committee approves the aggregate amount of fees to be paid to the compensation consultant or the compensation consultant’s firm. The policy requires that the compensation consultant and any associates providing services to the compensation and leadership development committee have no direct involvement with any other aspects of the compensation consultant’s firm’s relationship with Exelon (other than any director compensation services that may be performed for the corporate governance committee), and that no element of the compensation consultant’s compensation may be based on any consideration of the revenues for other services that the firm may provide to Exelon. For 2015, no fees were paid to Semler Brossy for additional services beyond its work as consultant to the compensation and leadership development committee.

9

Compensation Committee Interlocks and Insider Participation

During 2015 no officers or employees or former officers of ComEd participated in deliberations of the ComEd board concerning executive officer compensation except Messrs. Crane and O’Brien and Ms. Pramaggiore. Ms. Pramaggiore was involved in deliberations concerning the compensation of ComEd executive officers other than herself.

Report of the Exelon Compensation and Leadership Development Committee

The committee is composed solely of independent directors, and we are accountable for ensuring that the decisions we make about executive compensation are in the best long-term interests of shareholders. We accomplish this objective by having robust executive compensation principles. One of the tenets is having a strong compensation framework that drives pay for performance and aligns executive pay with shareholder interests. For Exelon’s CEO, 90 percent of his compensation is at risk in the form of annual and long-term incentives, with 78 percent of total pay tied directly to Exelon’s stock price performance. Therefore, as the stock rises or falls, the CEO’s compensation is aligned with shareholders’ interests.

The committee proactively seeks shareholder feedback as part of its year-round engagement program, which includes reaching out to our top shareholders to listen to feedback regarding our executive compensation program, disclosure practices and corporate governance. The committee values our shareholders’ insights and considers their feedback in addition to other factors such as emerging market practices, when formulating our executive compensation programs and making pay decisions. A full description of our shareholder outreach efforts and the changes we have made based on your feedback is detailed under “Shareholder Engagement” below.

The compensation and leadership development committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussion, the committee recommended to the board that the Compensation Discussion and Analysis be included in the 2016 Proxy Statement. Dr. William C. Richardson, a long-time member of the committee, retired from the board of directors on December 31, 2015, and Linda Jojo was appointed to the committee as of February 1, 2016, after the 2015 compensation decisions had been made.

|

| February 25, 2016 |

|

The Exelon Compensation and Leadership Development Committee |

|

| John A. Canning, Jr., Chair |

| Yves C. de Balmann |

| Robert J. Lawless |

10

Compensation Discussion & Analysis

| Section II: | How We Design Our Executive Compensation Programs to Pay for Performance |

| Section III: | What We Pay and Why We Pay it |

| Section IV: | Governance Features of Our Executive Compensation Programs |

Section I: Overview

ComEd Business Overview and Strategic Business Results

ComEd is engaged principally in the purchase and regulated retail sale of electricity and the provision of electricity distribution and transmission services to a diverse base of residential, commercial and industrial customers in northern Illinois. ComEd is a public utility under the Illinois Public Utilities Act subject to regulation by the ICC related to distribution rates and service, the issuance of securities, and certain other aspects of ComEd’s business. ComEd is a public utility under the Federal Power Act subject to regulation by FERC related to transmission rates and certain other aspects of ComEd’s business. Specific operations of ComEd are also subject to the jurisdiction of various other Federal, state, regional and local agencies. Additionally, ComEd is subject to NERC mandatory reliability standards.

ComEd’s retail service territory has an area of approximately 11,400 square miles and an estimated population of 9 million. The service territory includes the City of Chicago, an area of about 225 square miles with an estimated population of 2.7 million. ComEd has approximately 3.8 million customers.

ComEd achieved significant milestones in 2015:

| | • | | For the first time ever and including major events, ComEd achieved a SAIFI (“Outage Frequency”) below 0.90 and 9 percent better than the previous best (0.98 in 2013). ComEd’s 2.5 Beta All-In SAIFI hit target. |

| | • | | ComEd replaced or treated 976 miles of URD cable, replaced 176 miles of mainline cable, assessed over 5,300 manholes and completed refurbishment of over 5,400 manholes, converted approximately 37 miles of overhead wire to underground cable, installed approximately 90 miles of tree-resistant Spacer Cable, and conducted 163 miles of enhanced vegetation management with a removal rate of 66 percent (EIMA and GRIP). |

| | • | | Over 1,077,000 smart meters were installed in 2015. |

| | • | | In 2015, 302 wood transmission structures were replaced with 257 steel structures reducing ComEd’s footprint and improving reliability. |

| | • | | Storm Hardening, GRIP, Distribution Automation and other system improvement programs have reduced storm related customer interruptions by approximately 30 percent in 2015. And ComEd’s new storm processes and skilled storm teams and crews have made us 30 percent faster at restoration. |

Other important milestones reached in 2015 were:

| | • | | Customer Satisfaction – JD Power & Associates – most improved utility in the U.S. over four years |

| | • | | Employee Survey – 84 percent participation (best participation rate in ComEd history and best participation across Exelon) |

| | • | | Recognized for Energy Efficiency/Storm work |

| | • | | Recognized for innovation - Winner of two 2015 Fierce Innovation Awards |

| | • | | Recognized for environmental stewardship – Illinois Governor’s Sustainability Award |

| | • | | Recognized for Diversity & Inclusion |

11

Exelon’s Strategy

Exelon’s key objectives are to employ our competitive integrated business model to deliverstable growth, sustainable earnings and anattractive dividend.

| | • | | Stable Growth – Grow our regulated and contracted businesses and optimize our existing generation portfolio |

| | • | | Sustainable Earnings – Profits from utilities, contracted assets, and balanced generation to load strategy are an engine for predictable earnings, and our generation business positions us to capture market upside |

| | • | | Attractive Dividend – Dividend will be covered by the utilities, insulated from the earnings volatility of the generation business |

Exelon will continue to do what it does best: operate its generation, transmission and distribution assets at the highest levels of excellence and reliability; find and deliver innovative and responsive solutions for customer priorities; invest for stable and reliable returns; and work to ensure a fair and competitive environment for our assets. The pace of change in our business is unprecedented. Exelon’s culture of innovation and excellence is designed to ensure that we keep this pace, and that we never take our eye off the essentials – keeping the lights on and the gas flowing.

Executive Compensation Goals are aligned with the Company’s Strategy: In designing the company’s executive compensation programs, the committee strives to align the goals and underlying metrics with the company’s strategy, while including compensation risk-mitigating design features to discourage our executives and employees from taking excessive risks for short-term benefits that may harm the company and our shareholders. We believe consistent execution of our strategy over multi-year periods will lead to long-term value creation for our shareholders.

Base Salary increases are modest and averaged 2.6 percent in 2015 for our NEOs, which was lower than the 3.0 percent market data for executives.

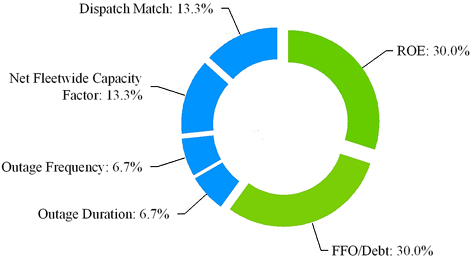

For the company’s Annual Incentive Program (“AIP”), AIP weighting is 100% ComEd metrics for all NEOs, with the exception of Ms. Pramaggiore whose weighting is 25% Exelon adjusted non-GAAP Operating EPS and 75% ComEd metrics. For the Long-Term Incentive (“LTI”) Program, our NEOs receive both Performance Share Units (“PShares”) and Restricted Stock Units (“RSUs”). The PShares are contingent on achieving a threshold level of performance over a three-year period based on two goals — financial management and operational excellence — that are aligned with driving long-term shareholder value creation. A full scorecard for the PShare goals, underlying metrics, and 2013-2015 performance, including the total shareholder return (“TSR”) modifier is set forth below.

12

Key Take-Aways for 2015

1. STRONG FINANCIAL AND OPERATIONAL PERFORMANCE

| | • | | Exelon’s adjusted non-GAAP operating earnings per share (EPS) beat the annual incentive program (AIP) target by 8 cents, despite a difficult year in the markets, and was at approximately the mid-point of the upward adjusted earnings guidance range. |

| | • | | ComEd completed the year with high performance across key operating areas including safety (top decile) and top quartile performance for both outage frequency and duration. |

2. STRONG PAY FOR PERFORMANCE ALIGNMENT ON 2013-2015 PSHARE PAYOUT

| | • | | The lagging TSR performance due to continued low power prices was reflected in the 10 percent reduction in the payout of the 2013-2015 PShares as a result of the TSR modifier in the program design. |

| | • | | Exelon’s 2015 TSR (including reinvested dividends) was down 22 percent for the year, tracking natural gas prices at Henry Hub, which were down 41 percent from the prior year. |

| | • | | The impact of low power prices on Exelon is significant as our exposure to power prices is greater compared with that of our peers. |

| | • | | Despite Exelon’s strong financial and operational performance, its lagging stock price was largely driven by factors outside of management’s control such as low power prices, low gas prices, and weak load growth. |

3. KEY STRATEGIC INTIATIVES

| | • | | Smart Grid Work: 2015 saw the beginning of the final stretch for much of the smart grid work ComEd began in 2012. By the end of the year, 74 percent of smart grid work had been completed. |

| | • | | Top Safety Performance: ComEd’s performance was the best safety performance on record with an OSHA recordable rate of 0.57. This represents a 12 percent improvement from 2014. |

| | • | | Commitment to Innovation: ComEd saw widespread innovation throughout the company as we work to shape an environmentally sound, and prosperous energy future for Illinois. |

4. COMMITMENT TO ENGAGEMENT WITH EXELON SHAREHOLDERS

| | • | | Exelon met with investors holding approximately 46 percent of Exelon’s outstanding shares, consistent with the prior year. |

| | • | | Shareholders largely expressed support for the design changes that we implemented in 2013 and recommended that we stay the course, with the exception of replacing one of the financial metrics (FFO/Debt) with Operating EPS, starting with the 2016-2018 PShare program. This new metric will align more closely with the company’s overall growth strategy. |

Looking Forward to 2016 and Beyond:

The continued investments in ComEd’s smart grid and grid modernization initiatives, and significant infrastructure improvements, are designed to improve reliability, customer service and shareholder return, despite continued weak load growth. The investments also include commitments to innovative technology and customer-oriented systems. ComEd along with Exelon’s other utiliites, are transforming the way they interact with customers through innovative online and mobile-based applications, and with strategic partnerships to leverage the capabilities of the smart grid network.

Executive Compensation Framework and Central Themes

The goal of our executive compensation program is to retain and reward leaders who create long-term value for our shareholders by delivering on objectives set forth in the company’s long-term strategic plan. This goal affects the compensation

13

elements we use and drives our compensation decisions. The primary compensation elements are depicted in the table below, with all except for base salary being “pay-at-risk” and linked to changes in the stock price and achievement of short and long-term company financial and operational goals that build shareholder value.

| | | | | | | | |

PAY ELEMENT | | SALARY | | AIP | | PSHARES | | RSUs |

| WHO RECEIVES | | All named executive officersè |

| | |

| PAY-AT-RISK | | Fixed | | Variableè |

| | | | |

| WHEN GRANTED | | Bi-weekly with annual review | | Annually in January

for prior year | | Annually in January | | Annually in January |

| | |

| TYPE OF PERFORMANCE | | Short-term emphasisè | | Long-term emphasisè |

| | | | |

| PERFORMANCE PERIOD | | Ongoing | | 1 year | | 3 years | | Vest one-third per year

over 3 years |

| | | | |

| HOW PAYOUT DETERMINED | | Market assessment, individual performance and internal equity | | Corporate/Business

Unit performance, and

individual performance | | Average performance

on company

performance measures,

relative TSR modifier

and individual

performance | | Market assessment,

individual performance

and internal equity |

| | | | |

| MOST RECENT PERFORMANCE MEASURES | | Individual performance relative to objectives | | ComEd Operational

Goals (All), Financial

Management Goals

(All), Operating EPS

(Pramaggiore Only) | | Financial management

goals (60%),

operational excellence

goals (40%) and

relative three-year TSR

modifier | | Individual performance

and potential |

| | | | |

| PURPOSE | | Provide income certainty so that executives can focus on achieving key business priorities and objectives | | Holds executives

accountable for

performance against

near-term business

objectives | | Aligns the interest of

executives with

shareholders by

providing awards

contingent on

achieving pre-

established three-year

financial and

operational goals | | Enhances the retention

of key talent and

provides an ongoing

alignment of executive

interest with those of

shareholders |

14

Executive Compensation Principles

The following principles help guide and inform the committee in delivering highly effective executive compensation programs that drive performance, mitigate risk, and foster the attraction, motivation and retention of top leadership talent in order to enable the company to execute against its strategic business plan and ultimately deliver long-term shareholder value.

| | | | |

We Manage for the Long-term The board manages for the long-term and makes pay decisions that are in the best long-term interests of the company and shareholders. | | Strong Compensation Framework We have a strong compensation framework that is market-based and drives pay for performance and alignment with shareholders based on having a majority of NEO pay at risk in the form of annual incentives and stock awards. | | Strong Shareholder Engagement We engage directly with shareholders and take actions to improve our compensation programs based on year-round feedback from shareholders. |

| | |

Competitiveness Our NEOs’ pay levels are set by taking into consideration multiple factors, including peer group market data, internal equity comparisons, experience, performance and retention. | | Robust Stock Ownership Guidelines Executives are required to meet and maintain significant stock ownership requirements (2X base salary for ComEd’s CEO and other NEOs). | | Balance Since we manage for the long-term, we believe pay at risk should reward the appropriate balance of short- and long-term financial and strategic business results. |

CEO Pay at-a-Glance

2015 Target Total Direct Compensation (TDC): In determining target TDC for the CEO, the compensation and leadership development committee considered her individual performance and assessed market competitiveness before it set Ms. Pramaggiore’s 2015 target TDC at $2.00 million (up 6.3 percent from the prior year) as shown in the table below.

| | | | | | | | | | | | | | | | |

| Component | | Percent Increase | | | Dollar Increase | | | Percent of Total

Increase | | | Approved 2015 Level | |

Base Salary | | | 2.5 | % | | $ | 14,800 | | | | 12.5 | % | | $ | 604,000 | |

AIP Target | | | 2.5 | % | | $ | 10,360 | | | | 8.7 | % | | $ | 422,800 | |

LTI | | | 10.6 | % | | $ | 93,360 | | | | 78.8 | % | | $ | 973,200 | |

Target TDC | | | 6.3 | % | | $ | 118,520 | | | | N/A | | | $ | 2,000,000 | |

|

A large amount (87.5 percent) of Ms. Pramaggiore’s 2015 TDC increase was in the form of AIP and LTI, with 12.5 percent of the total amount in the form of a base salary increase. |

2015 ComEd CEO Payouts:

Strong financial performance drives above-target 2015 AIP: For Ms. Pramaggiore, the Exelon compensation and leadership development committee awarded a 2015 AIP payout of $534,644 based on both operating EPS performance of $2.39 and business unit performance with a total performance multiplier of 114.96%, multiplied by an individual performance modifier (“IPM”) of 110%. The committee utilized an IPM to recognize Ms. Pramaggiore’s outstanding execution against ComEd’s strategic business plan as well as strong financial, operational, and regulatory performance and best ever participation and engagement scores in the ComEd employee survey.

2013-2015 PShare payout slightly above target:The compensation and leadership development committee also approved the 2013-2015 PShare award of 20,017 shares based on an overall performance of 105.91 percent (average of 2013, 2014 and 2015 PShare performance, including a 10 percent reduction as a result of the TSR modifier) multiplied by an IPM of 105%, valued at

15

$543,662 based on the closing stock price of $27.16 on January 25, 2016. The committee utilized an IPM to recognize Ms. Pramaggiore’s outstanding execution against ComEd’s strategic business plan as well as strong financial, operational, and regulatory performance and best ever participation and engagement scores in the ComEd employee survey.

Shareholder Engagement

2015 Advisory Vote on Executive Compensation. Shareholders approved Exelon’s advisory vote on executive compensation with 82 percent of the votes cast FOR the compensation of Exelon’s NEOs, which was a 13 percentage point increase from the prior year. Based on our conversations with shareholders, the higher vote in favor of executive compensation was primarily a result of:

| | • | | Positive 2014 total shareholder return (over 40.6 percent), and |

| | • | | Strong compensation framework and disclosure, and robust goals, with eight of the ten underlying PShare metrics increasing in difficulty from the prior year. |

We actively engage Exelon’s shareholders throughout the year. Since 2006, we have maintained a shareholder engagement program in which we proactively contact Exelon’s top shareholders and leading proxy advisory services firms and educate them about the corporate governance and executive compensation changes we have implemented, while also seeking feedback on executive compensation and corporate governance matters. Our engagement team comprises leaders from human resources, investor relations and the office of corporate governance. For 2015, the company offered the participation of the committee chair.

Robust 2015 Shareholder Outreach. In the spring and fall of 2015, we spoke with holders of about 46 percent of Exelon’s outstanding common shares. These discussions were highly valuable, as we were able to summarize and answer questions about the 2015 Exelon proxy statement and key executive compensation and corporate governance matters, as well as review executive compensation changes that were implemented based on prior shareholder input. Overall, the feedback we received was positive and supported our programs.

Exelon’s and ComEd’s 2015 executive compensation program was largely unchanged from 2014 as the committee believes the program is aligned strongly with shareholder interests and market practice. The shareholder feedback we received, including the higher level of support on the Exelon say on pay vote in 2015, was positive. Even though the committee believes the program is meeting its objectives in rewarding financial, operational, and strategic success, it is always seeking ways to improve the executive compensation program and disclosure. During 2015, the company assessed trends in executive compensation practices and looked for ways to improve disclosures about our program. In addition, the committee and management reviewed correspondence submitted by individual and institutional shareholders, analyzed market practices at peer companies, and sought advice from the committee’s independent compensation consultant. Based on shareholder discussions and recommendations, the committee, during its annual evaluation of the company’s executive compensation programs made only slight modifications to our programs, and disclosures:

| | |

2015 Shareholder Feedback on Exelon NEOs | | Exelon Actions as a result of 2015 Shareholder Feedback |

| Replace FFO/Debt with a growth metric for the PShare program | | Starting with the 2016-2018 PShare program, Operating EPS will replace FFO/Debt, aligning with the company’s growth story of 3 percent - 5 percent CAGR through 2018 |

| |

| Requested a greater focus on performance goals and transparency | | The company added a detailed performance scorecard for each year of the2013-2015 PShare program |

16

Section II: How We Design Our Executive Compensation Programs to Pay for Performance

Our approach to compensating our NEOs is to align the long-term interests of Exelon’s executives with those of our shareholders. Our compensation framework is based on providing market-competitive programs that attract and retain top talent necessary to effectively lead a company with the scale and technical complexity of Exelon throughout all phases of the business cycle. The framework promotes pay for performance by putting a majority of pay at risk and directly linking it to Exelon’s shareholder returns and to other performance factors that measure our progress against the financial management and operational excellence goals in our strategic and operating plans. This means when excellent performance is achieved, pay will be above target. Failure to achieve objectives will result in below-market pay.

In order to reaffirm the link between pay and performance, the compensation and leadership development committee annually reviews the executive compensation components, targets and payouts and approves compensation for Ms. Pramaggiore. The committee evaluates goals under the annual and long-term incentive programs to ensure that they are challenging, contain appropriate stretch, and are designed to mitigate excessive risk. Goals are selected and evaluated based on support for Exelon’s long-term business plan.

How Pay-for-Performance Works

Overview.Exelon has a long-standing commitment to link pay and performance by providing a majority of compensation that is tied to stock price or contingent on achieving short and long-term objectives.

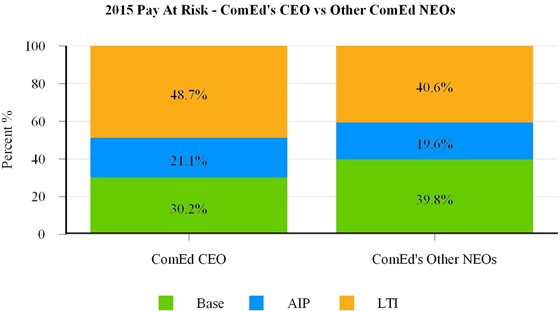

| | • | | Program Design: Over 60% of NEO pay at ComEd is variable as depicted in the chart below, which directly ties pay to Exelon’s and ComEd’s performance, including financial results, operational goals, and stock performance relative to Exelon’s peer group. |

| | • | | Performance Assessment: The committee uses a comprehensive and well-defined process to assess performance, which encompasses both short and long-term financial and operational results relative to our goals. The committee ensures that the goal setting process is rigorous and contains appropriate stretch for both internal measures and operational metrics that generally set achieving industry first quartile performance as the target. For more information, refer to the 2015 performance share scorecard below. |

17

What We Do and Don’t Do

Exelon’s executive compensation philosophy focuses on pay-for-performance and reflects appropriate governance practices aligned with the needs of our business. Below is a summary of our executive compensation practices that are aligned with best practices, as well as a list of those practices we avoid because they do not align with shareholders’ long-term interests.

What We Do

| ü | Pay-for-performance – 70% of ComEd CEO pay (and above 60% for other NEOs) is at risk in the form of AIP and LTI |

| ü | Stock ownership – 2X base salary for ComEd’s CEO and other NEOs |

| ü | Mitigate undue risk in executive compensation programs (e.g., incentive awards are capped at 200 percent) |

| ü | Require double-trigger for change-in-control benefits – change-in-control plus involuntary termination |

| ü | Retain an independent compensation consultant to advise the committee |

| ü | Evaluate management succession and leadership development efforts annually |

| ü | Provide limited, modest perquisites based on sound business rationale |

| ü | Proactively seek investor feedback on executive compensation programs, reaching 46 percent in 2015 |

| ü | Prohibit hedging transactions, short sales, derivative transactions or pledging of company stock |

| ü | Require executive officers to trade through 10b5-1 trading plans or obtain pre-approval before trading Exelon stock |

| ü | Annually assess our programs against peer companies and best practices |

| ü | Include appropriate stretch in incentive targets based on industry performance and/or Exelon’s business plan |

| ü | Clawback incentive compensation paid to an executive who has engaged in fraud or intentional misconduct |

What We Don’t Do

| × | No guaranteed minimum payout of AIP or LTI programs |

| × | No employment agreements |

| × | No dividend-equivalents on unearned PShares |

| × | No excise tax gross-ups for change-in-control agreements entered into after April 2009 |

| × | No inclusion of the value of LTI awards in pension or severance calculations |

| × | No additional credited service under supplemental pension plans since 2004 |

| × | No option re-pricing or buyouts |

18

Assessing Exelon’s Executive Compensation Programs

Overview. An assessment of our executives’ compensation levels against our peer group is one of several considerations in the pay setting process. Peer group practices are analyzed each year for target total direct compensation and for other pay practices, such as perquisites and the mix of LTI vehicles. Because Exelon is one of the largest energy services companies, we compare executive compensation against a blended peer group with which we compete for talent. Each year the compensation and leadership development committee, working with its independent consultant, reviews the composition of the peer group and determines whether any changes should be made. For 2015, the committee approved a change to the peer group to remove PepsiCo Inc., which was larger than the company’s criteria of 0.5X to 2.0X for both revenue and market capitalization. Additionally, Caterpillar and PPG Industries did not participate in the TowersWatson executive compensation survey. As a result, the committee approved replacing these three companies with Deere & Company, General Dynamics and Northrup Grumman. These companies all fit within our parameters for both revenue and market capitalization and those averages did not materially change as a result of these changes. The peer group has the following general characteristics:

| | • | | Includes 10 energy services companies and 10 general industry companies |

| | • | | General industry peers include an emphasis on companies that are capital asset-intensive and may be subject to effects of commodity prices |

| | • | | Energy Services peers include an emphasis on companies that have at least 25 percent of their assets in unregulated businesses |

| | • | | These Competitive Integrated peers include Entergy, FirstEnergy, NextEra, and Public Service Enterprise Group and form our TSR peer group as well. |

| | • | | Comparable annual sales (.5x to 2x) and market capitalizations generally above $10 billion |

| | • | | Median revenue of our peer group for the year ended December 31, 2015 was approximately $18.5 billion |

| | • | | As compared to Exelon’s revenues of $29.4 billion |

| | • | | Median market capitalization of our peer group was $29.7 billion at December 31, 2015 |

| | • | | As compared to Exelon’s market capitalization of $25.5 billion |

The peer group for 2015 is shown in the table below:

| | | | | | |

General Industry | | Energy Services |

| 3M | | Hess Corporation | | AEP Co., Inc. | | FirstEnergy Corp. |

| Alcoa | | Honeywell Co. | | Dominion Resources, Inc. | | NextEra Energy, Inc. |

| Deere & Company | | International Paper | | Duke Energy Corp. | | PG&E Corp. |

| EI DuPont | | Johnson Controls Inc. | | Edison International | | PSEG, Inc. |

| General Dynamics | | Northrop Grumman | | Entergy Corporation | | Southern Company |