UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

|

| |

| ☐ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☒ | Definitive Information Statement |

Commonwealth Edison Company

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| ☒ | | No fee required |

| ☐ | | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

|

| | |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

Notice of Action by Written Consent of Majority Shareholder

In Lieu of a Meeting of Shareholders to Elect Directors

and Information Statement

April 27, 2018

To the Shareholders of Commonwealth Edison Company:

Notice is hereby given in accordance with Section 7.10 of the Illinois Business Corporation Act of 1983, as amended (the “Act”), that on or about June 11, 2018, the majority shareholder of Commonwealth Edison Company will take action by written consent in lieu of a meeting to elect the following directors: James W. Compton, Christopher M. Crane, A. Steven Crown, Nicholas DeBenedictis, Peter Fazio, Michael Moskow, Denis O’Brien and Anne Pramaggiore.

In accordance with Section 7.10 of the Act, notice of the action by written consent will be delivered to the shareholders promptly after the action is taken.

Very truly yours,

Thomas S. O’Neill

Corporate Secretary

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being provided to you in connection with the action by written consent of the majority shareholder of Commonwealth Edison Company (“ComEd” or the “Company”) to be taken on or about June 11, 2018.

ComEd is an indirect majority-owned subsidiary of Exelon Corporation (“Exelon”). As of March 31, 2018, ComEd had 127,021,264 shares of Common Stock outstanding, $12.50 par value (the “ComEd Common Stock”), of which 127,002,904, or over 99%, are owned by Exelon Energy Delivery Company, a wholly-owned subsidiary of Exelon. Exelon intends to cause its subsidiary to take action by written consent to elect the nominees for director named under “Election of Directors” below. Consequently, the election of these directors is expected to be approved.

Exelon is an integrated utility services holding company engaged in the energy delivery business through its subsidiaries, ComEd in northern Illinois, Baltimore Gas and Electric Company (BGE) in Baltimore and central Maryland, PECO Energy Company (PECO) in Philadelphia and southeastern Pennsylvania, Atlantic City Electric Company (ACE) in southern New Jersey, Delmarva Power & Light Company (DPL) in Delaware and Maryland, and Potomac Electric Power Company (Pepco) in the District of Columbia and Maryland. Through its subsidiary, Exelon Generation Company, Exelon is also engaged in the generation, physical delivery and marketing of power across multiple regions, including renewable energy and other energy related products and services.

TABLE OF CONTENTS

Composition of the Board

ComEd is a controlled subsidiary of Exelon and does not have a separate nominating committee. Instead, those functions are fulfilled by the Corporate Governance Committee of the Exelon Board of Directors. Because ComEd is a controlled subsidiary of Exelon, there is no policy with regard to the consideration of any director candidates recommended by ComEd shareholders other than Exelon.

The Board of Directors of ComEd consists of eight members. All directors are being elected because they have been previously elected or appointed by the Board of Directors on the recommendation of the Corporate Governance Committee of Exelon.

ComEd’s bylaws and Corporate Governance Principles require that at least one of the ComEd directors be “independent,” defined for this purpose as not being a director, officer or employee of Exelon, ComEd or any other Exelon affiliate. Four directors are “independent” directors under this standard. The current membership of the ComEd Board represents a range of backgrounds, experience, and diversity. The Board consists of eight directors who range in age from 58 to 80, with an average age of 69 and a median age of 69. The directors have a wide diversity of experience that fills the needs of the Board. Three directors are current or former CEOs of corporations, one has served in government, and two have experience in banking. Individual directors have expertise in utility matters and law and three of the directors have operational responsibility for Exelon or ComEd. All but two of the directors live or have lived in ComEd’s service territory and have extensive knowledge of the characteristics of the service territory and the needs of ComEd’s customers.

Biographical information about each of the directors follows.

Election of Directors

The persons listed below, each of whom is a current member of the Board, will be elected as director to serve until their successors are elected.

James Compton, Age 80. Mr. Compton has served as a Director of ComEd since 2006. Mr. Compton served as the President and Chief Executive Officer of the Chicago Urban League from 1978 through 2006. He also served as the President and Chief Executive Officer of the Chicago Urban League Development Corporation from 1980 through 2006. Mr. Compton also serves on the Board of Trustees of Ariel Investment Trust. Mr. Compton has extensive knowledge of ComEd and its business, having previously served as a Director of ComEd from 1989 through 2000 and having served as a Director of a community-based bank. In addition, Mr. Compton is very familiar with ComEd’s customers and as an African-American man contributes to ComEd’s outreach to diverse groups in Chicago.

Christopher M. Crane, Age 59. Mr. Crane has served as a Director and the chair of the ComEd Board since 2012. Mr. Crane is President and Chief Executive Officer of Exelon Corporation. Previously, he served as President and Chief Operating Officer of Exelon and Exelon Generation from 2008 to 2012. In that role, he oversaw one of the U.S. industry’s largest portfolios of electric generating capacity, with a multi-regional reach and the nation’s largest fleet of nuclear power plants. He directed a broad range of activities including major acquisitions, transmission strategy, cost management initiatives, major capital programs, generation asset optimization and generation development. Mr. Crane is one of the leading executives in the electric utility and power industries. Mr. Crane is vice-chairman and a member of the executive committee of the Edison Electric Institute. He also serves as vice-chairman of the Institute of Nuclear Power Operations, the industry organization promoting the highest levels of safety and reliability in nuclear plant operation. Mr. Crane previously served as vice chairman of the Nuclear Energy Institute, the nation’s nuclear industry trade association. Mr. Crane served as a Director of Aleris International Inc. from 2010 to 2013. Mr. Crane also serves as Chair of the Boards of Directors of Exelon subsidiaries BGE, PECO and Pepco Holdings LLC (PHI).

A. Steven Crown, Age 66. Mr. Crown has served as a Director since 2011. He is a general partner of Henry Crown and Company, and has served in such capacity for more than five years. Henry Crown and Company is a private investment group that manages investments in banking, transportation, oil and gas, manufacturing, resort properties and other industries. Mr. Crown has extensive knowledge of the Chicago economy and his experience contributes to his effectiveness as a member of the ComEd Board.

Nicholas DeBenedictis, Age 72. Mr. DeBenedicitis has served as a Director of ComEd since 2013 and a Director of Exelon since 2002. Mr. DeBenedictis serves on the Exelon Corporate Governance, Finance and Risk, and Generation Oversight Committees. Mr. DeBenedictis currently serves as Chairman Emeritus of Aqua America Inc. (water utility operating in eight

states) and served as its Chairman and Chief Executive Officer from 1993 to 2015. As CEO of Aqua America, Mr. DeBenedictis gained experience in dealing with many of the same development, land use, and utility regulatory issues that affect Exelon and its subsidiaries. Mr. DeBenedictis also has extensive experience in environmental regulation and economic development, having served in two cabinet positions in the Pennsylvania government: Secretary of the Pennsylvania Department of Environmental Resources and Director of the Office of Economic Development. He also spent eight years with the U.S. Environmental Protection Agency and was President of the Greater Philadelphia Chamber of Commerce for three years. In addition to serving as Chairman Emeritus of Aqua America, Mr. DeBenedictis has served as a Director of MISTRAS Group (asset protection solutions) since 2015 and as a Director of P.H. Glatfelter, Inc. (global supplier of specialty papers and engineered products) since 1995. Previously, Mr. DeBenedictis served as a Director of Met-Pro Corporation from 1997 to 2010. Mr. DeBenedictis also serves on the Board of Exelon subsidiary PECO.

Peter Fazio, Age 78. Mr. Fazio has been a Director of ComEd since 2007. Mr. Fazio is a partner of the law firm of Schiff Hardin, LLP and served as past chairman, executive committee member and managing partner of Schiff Hardin. In addition to his general legal expertise, Mr. Fazio previously served as general counsel of another electric and gas utility and brings to the ComEd Board knowledge of utility regulatory and legal issues.

Michael Moskow, Age 80. Mr. Moskow has served as a Director of ComEd since 2008. Mr. Moskow is the vice chair and a distinguished fellow at the Chicago Council on Global Affairs. He served as president and chief executive officer of the Federal Reserve Bank of Chicago from 1994 to 2007. He is a Director of Discover Financial Services, Northern Trust Mutual Funds and Taylor Capital Group and served as a Director of Diamond Technology from 2008 through 2011. Mr. Moskow is a recognized leader in the Chicago business community with knowledge of the economy of the midwestern United States and the northern Illinois communities that ComEd serves.

Denis O’Brien, Age 58. Mr. O’Brien has served as a Director and vice chair of the ComEd Board since 2012. As the Chief Executive Officer of Exelon Utilities, Mr. O’Brien oversees the utility businesses of Exelon at ComEd, BGE, PECO, and PHI. Mr. O’Brien is also a Senior Executive Vice President of Exelon. Previously, Mr. O’Brien served as Executive Vice President of Exelon and Chief Executive Officer of Philadelphia-based PECO, Pennsylvania’s largest electric and natural gas utility.

Anne Pramaggiore, Age 59. Ms. Pramaggiore has served as a Director of ComEd since 2012. In February 2012, Ms. Pramaggiore became the President and Chief Executive Officer of ComEd. Prior to her appointment, Ms. Pramaggiore served as President and Chief Operating Officer of ComEd from 2009 through 2012, where she was responsible for overseeing the day-to-day operations of ComEd. Before being named as President and Chief Operating Officer, Ms. Pramaggiore served as Executive Vice President of Customer Operations, Regulatory and External Affairs. Ms. Pramaggiore also serves as a board member of the Chicago Federal Reserve Board and Motorola Solutions, Inc., and several civic and community organizations.

ComEd Governance

Independence Standards

As noted above, ComEd’s Corporate Governance Principles require that at least one of the ComEd directors be “independent,” defined for this purpose as not being a director, officer or employee of Exelon, BGE, PECO, PHI or any other Exelon affiliate. Messrs. Compton, Crown, Fazio and Moskow are independent directors under this standard. The Corporate Governance Principles further require that the independent director or directors approve certain actions, including the declaration of dividends, the purchase of electric energy and seeking protection from creditors under bankruptcy or related laws.

Board Leadership Structure

Christopher M. Crane, the Chief Executive Officer of Exelon, serves as Chair of the ComEd Board of Directors. Denis P. O’Brien serves as the Chief Executive Officer of Exelon Utilities, a Senior Executive Vice President of Exelon, and the Vice Chair of the ComEd Board. Because ComEd is a controlled subsidiary of Exelon, the ComEd Board of Directors has not seen any need to adopt a policy with respect to whether or not the positions of chair of the ComEd Board of Directors and chief executive officer should be held by the same person.

Attendance at Meetings

During 2017, ComEd’s Board of Directors held four meetings. In 2018, the ComEd Board has held one meeting to date. The directors had an average attendance of 97 percent for all Board meetings in 2017. Each incumbent director nominee attended at least 75% of the Board meetings.

Board Committees

ComEd is a controlled subsidiary of Exelon and does not have separate audit, nominating and compensation committees. Instead, those functions are fulfilled by the Audit, Corporate Governance, and Compensation and Leadership Development Committees of the Exelon Board of Directors. The ComEd Board established an Executive Committee in January 2014 that meets only as needed. The Executive Committee is authorized to act when it is not convenient to call a meeting of the full ComEd Board. The members of the Executive Committee are Ms. Pramaggiore and Messrs. Crane, O’Brien and Fazio.

Board Oversight of Risk

As a controlled company, ComEd’s risk is managed by its Board of Directors in conjunction with Exelon’s overall risk oversight and risk management structure. Exelon and ComEd operate in a market and regulatory environment that involves significant risks, many of which are beyond our control. Exelon has an Enterprise Risk Management group consisting of a Chief Enterprise Risk Officer, a Chief Commercial Risk Officer, a Chief Credit Officer, a Vice President of Enterprise Risk Management Operations, a Vice President of Enterprise Risk Management Analytics and a full-time staff of 124. The Enterprise Risk Management group draws upon other Company personnel for additional support on various matters related to identification, assessment, management, mitigation and monitoring through established key risk indicators of enterprise risks. The Company also has a Risk Management Committee comprising select senior officers of the Company who meet regularly to discuss matters related to enterprise risk management generally and particular risks associated with new developments or proposed transactions under consideration. The Chief Enterprise Risk Officer and the Risk Management Committee regularly meet with management of the Company to identify and evaluate the most significant risks of the businesses and appropriate steps to manage and mitigate those risks. In addition, the Chief Enterprise Risk Officer and the Enterprise Risk Management group perform a regular assessment of enterprise risks, drawing upon resources throughout the Company for an assessment of the probability and severity of identified risks as well as control effectiveness. These risk assessments, which also include the review of operating company-specific key risk indicators, are discussed at operating company risk management committees before being aggregated and discussed with the Exelon Board’s Finance and Risk Committee and Audit Committee and, when appropriate, the ComEd Boards of Directors. The Finance and Risk, Audit, and Generation Oversight Committees regularly report on the Committees’ discussions of enterprise risks to the Exelon Board. Furthermore, the Exelon Board regularly discusses enterprise risks in connection with consideration of emerging trends or developments and in connection with the evaluation of capital investments and other business opportunities and business strategies.

Board/Committee/Director Evaluation and Director Education

The ComEd Board does not have a separate process for board, committee or director evaluation. Because ComEd is a controlled subsidiary, the ComEd Board is evaluated by the Exelon Corporate Governance Committee.

The Exelon Office of Corporate Governance oversees an orientation program that is tailored to the needs of each new Director depending on his or her level of experience serving on other boards and knowledge of the company or industry acquired before joining the Board. New directors receive materials about ComEd, the Board and Board policies and operations and attend meetings with the CEO and other officers for a briefing on the executives’ responsibilities, programs and challenges. New directors are also scheduled for tours of various company facilities, depending on their orientation needs.

Continuing director education is provided during portions of regular Board meetings and focuses on the topics necessary to enable the Board to consider effectively issues before them at that time (such as new regulatory standards). The education sometimes takes the form of “white papers,” covering timely subjects or topics, which a director can review before the meeting and ask questions about during the meeting. The Company pays the cost for any director to attend outside director education seminars on topics relevant to their service as directors.

Independent Auditor

ComEd is an indirect subsidiary of Exelon and does not have a separate audit committee. Instead the Exelon Audit Committee fulfills that function for ComEd. In July 2002, the Exelon Audit Committee adopted a policy for pre-approval of services to be performed by the independent auditor. The Exelon Audit Committee has a policy for pre-approval of audit and non-audit services. Under this policy, the Audit Committee pre-approves all audit and non-audit services to be provided by the independent auditor taking into account the nature, scope, and projected fees of each service as well any potential implications for auditor independence. The policy specifically sets forth services that the independent auditor is prohibited from performing by applicable law or regulation. Further, the Exelon Audit Committee may prohibit other services that in its view may compromise, or appear to compromise, the independence and objectivity of the independent auditor. Predictable and recurring audit and permitted non-audit services are considered for pre-approval by the Exelon Audit Committee on an annual basis. For any services not covered by these initial pre-approvals, the Audit Committee has delegated authority to the Exelon Audit Committee Chair to pre-approve any audit or permitted non-audit service with fees in amounts less than $500,000. Services with fees exceeding $500,000 require full Committee pre-approval. The Exelon Audit Committee receives quarterly reports on the actual services provided by and fees incurred with the independent auditor. No services were provided pursuant to the de minimis exception to the pre-approval requirements contained in the SEC’s rules.

In 2017 the Exelon Audit Committee reviewed the PricewaterhouseCoopers 2017 Audit Plan and proposed fees and concluded that the scope of audit was appropriate and the proposed fees were reasonable.

The following table presents the fees (in thousands of dollars) for professional services rendered by PricewaterhouseCoopers LLP for the audit of ComEd’s annual financial statements for the years ended December 31, 2017 and December 31, 2016, and fees billed for other services provided during those periods. These fees include an allocation of amounts billed directly to Exelon. The fees include amounts related to the year indicated, which may differ from amounts billed.

|

| | | | | | | | | | |

| | | | | | | | | | | |

| | | Year Ended Dec. 31, 2017 | | | | | Year Ended Dec. 31, 2016 | |

Audit Fees(1) | | $ | 1,897 | | | | | $ | 2,094 | |

Audit-Related Fees(2) | | | 4 | | | | | | 44 | |

Tax Fees(3) | | | 31 | | | | | | 14 | |

All Other Fees(4) | | | 3 | | | | | | 259 | |

| Total | | $ | 1,935 | | | | | $ | 2,411 | |

| |

| (1) | Audit fees include financial statement audits and reviews under statutory or regulatory requirements and services that generally only the auditor reasonably can provide, including issuance of comfort letters and consents for debt and equity issuances and other attest services required by statute or regulation. |

| |

| (2) | Audit-related fees consist of assurance and related services that are traditionally performed by the auditor such as accounting assistance and due diligence in connection with proposed acquisitions or sales, consultations concerning financial accounting and reporting standards, and audits of stand-alone financial statements or other assurance services not required by statue or regulation. |

| |

| (3) | Tax fees consist of tax compliance, tax planning, and tax advice and consulting services including assistance and representation in connection with tax audits and appeals, tax advice related to proposed acquisitions or sales, employee benefit plans and requests for rulings or technical advice from taxing authorities. |

| |

| (4) | All other fees reflect work performed primarily in connection with research and audit software licenses. |

Report of the Exelon Audit Committee

The Audit Committee’s primary responsibility is to assist the Board of Directors in fulfilling its responsibility to oversee and review the quality and integrity of Exelon’s financial statements and internal controls over financial reporting, the independent auditor’s qualifications and independence, and the performance of Exelon’s internal audit function and of its independent auditor.

The Audit Committee is composed entirely of independent Directors and satisfies the independence, financial experience and other qualification requirements of the New York Stock Exchange (NYSE) and applicable securities laws and regulations. The Board of Directors has determined that each of the members of the Audit Committee is an “audit committee financial expert” for purposes of the SEC’s rules and also that each of the members of the Audit Committee is independent as defined by the rules of the NYSE and Exelon’s Corporate Governance Principles.

Under its charter, the Audit Committee’s principal duties include:

| |

| • | Having sole authority to appoint, retain, or replace the independent auditor, subject to shareholder ratification, and to oversee the independence, compensation and performance of the independent auditor; |

| |

| • | Reviewing financial reporting and accounting policies and practices; |

| |

| • | Overseeing the work of the internal auditor and reviewing internal controls; |

| |

| • | With the advice and assistance of the Finance and Risk Committee, reviewing in a general manner the processes by which Exelon assesses and manages enterprise risk; and |

| |

| • | Reviewing policies and procedures with respect to internal audits of officers’ and Directors’ expenses, compliance with Exelon’s Code of Business Conduct, and the receipt and response to complaints regarding accounting, internal controls or auditing matters. |

Each member of the Audit Committee also serves on the Finance and Risk Committee. On occasion, the Audit and Finance and Risk Committees meet jointly to review areas of mutual interest between the two Committees.

The Audit Committee meets outside the presence of management for portions of its meetings to hold separate discussions with the independent auditor, the internal auditors, and the General Counsel.

The Audit Committee met six times in 2017, fulfilling its duties and responsibilities as outlined in its charter, as well as receiving periodic updates on Exelon’s financial performance and strategic initiatives, as well as other matters germane to its responsibilities.

Management has primary responsibility for preparing Exelon’s financial statements and establishing effective internal controls over financial reporting. PricewaterhouseCoopers LLP (PwC), Exelon’s independent auditor, is responsible for auditing those financial statements and expressing an opinion on the conformity of Exelon’s audited financial statements with generally accepted accounting principles and on the effectiveness of Exelon’s internal controls over financial reporting based on criteria established in 2013 by the Committee of Sponsoring Organizations of the Treadway Commission.

The Audit Committee has reviewed and discussed with management and PwC Exelon’s audited financial statements contained in the 2017 Annual Report on SEC Form 10-K, including the critical accounting policies applied by Exelon in the preparation of these financial statements. The Audit Committee discussed with PwC the requirements of the Public Company Accounting Oversight Board (PCAOB), and had the opportunity to ask PwC questions relating to such matters. These discussions included the quality, and not just the acceptability, of the accounting principles utilized, the reasonableness of significant accounting judgments, and the clarity of disclosures in the financial statements.

At each of its meetings in 2017, the Audit Committee met with Exelon’s Chief Financial Officer and other senior members of Exelon’s financial management. The Audit Committee reviewed with PwC and Exelon’s internal auditor the overall scope and plans for their respective audits in 2017. The Audit Committee also received regular updates from Exelon’s internal auditor on internal controls and business risks and from Exelon’s General Counsel on compliance and ethics issues.

The Audit Committee met with the internal auditor and PwC, with and without management present, to discuss their evaluations of Exelon’s internal controls and the overall quality of Exelon’s financial reporting. The Audit Committee also met with Exelon’s General Counsel and Chief Compliance and Ethics Officer, with and without management present, to review and discuss compliance and ethics matters, including compliance with Exelon’s Code of Business Conduct.

On an ongoing basis, the Audit Committee considers the independence, qualifications, compensation and performance of PwC. Such consideration includes reviewing the written disclosures and the letter provided by PwC in accordance with applicable requirements of the PCAOB regarding PwC’s communications with the Audit Committee concerning independence, and discussing with PwC their independence.

The Audit Committee is responsible for the approval of audit fees, and the Committee reviewed and pre-approved all fees paid to PwC in 2017. The Audit Committee has adopted a policy for pre-approval of services to be performed by the independent auditor. Further information on this policy and on the fees paid to PwC in 2017 and 2016 can be found in the section of this information statement titled “Independent Auditor.” The Audit Committee periodically reviews the level of fees approved for payment to PwC and the pre-approved non-audit services PwC has provided to the Company to ensure their compatibility with independence. The Audit Committee also monitors Exelon’s hiring of former employees of PwC.

The Audit Committee monitors the performance of PwC’s lead partner responsible for the audit, oversees the required rotation of PwC’s lead audit partner and, through the Audit Committee Chair, reviews and approves the selection of the lead audit partner. In addition, to help ensure auditor independence, the Audit Committee periodically considers whether there should be a rotation of the independent auditor.

PwC has served as Exelon’s independent auditor since Exelon’s formation in 2000. As in prior years, the Audit Committee and management engaged in a review of PwC in connection with the Audit Committee’s consideration of whether to recommend that shareholders ratify the selection of PwC as Exelon’s independent auditor for 2018. In that review, the Audit Committee considered both the continued independence of PwC and whether retaining PwC is in the best interests of Exelon and its shareholders. In addition to independence, other factors considered by the Audit Committee included:

| |

| • | PwC’s historical and recent overall performance on the audit, including the quality of the Audit Committee’s ongoing discussions with PwC; |

| |

| • | PwC’s expertise and capability in handling the accounting, internal control, process and system risks and practices present in Exelon’s utility and energy generation businesses, including relative to the corresponding expertise and capabilities of other audit firms; the quality, quantity and geographic location of PwC staff, and PwC’s ability to provide responsive service; |

| |

| • | PwC’s tenure as Exelon’s independent auditor and its familiarity with its operations and businesses, accounting policies and practices, and internal control over financial reporting; |

| |

| • | the significant time commitment required to onboard and educate a new audit firm that could distract management’s focus on financial reporting and internal control; |

| |

| • | the appropriateness of PwC’s fees, relative to Exelon’s financial statement risk and the size and complexity of its business and related internal control environment, and compared to fees incurred by peer companies; |

| |

| • | an assessment of PwC’s identification of its known significant legal risks and proceedings that may impair PwC’s ability to perform the audit; and |

| |

| • | external information on audit quality and performance, including recent PCAOB reports on PwC and its peer firms. |

The Audit Committee concluded that PwC is independent from Exelon and its management, and has retained PwC as Exelon’s independent auditor for 2018. The Audit Committee and the Board believe that the continued retention of PwC is in the best interests of Exelon and its shareholders and have recommended that shareholders ratify the appointment of PwC as Exelon’s independent auditor for 2018.

In addition, in reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board approved, that the audited financial statements be included in Exelon Corporation’s Annual Report on Form 10-K for the year ended December 31, 2017, for filing with the SEC.

THE AUDIT COMMITTEE

Anthony K. Anderson, Chair

Ann C. Berzin

Paul L. Joskow

Richard W. Mies

Stephen D. Steinour

Related Person Transactions

Exelon has a written policy for the review and approval or ratification of related person transactions. Transactions covered by the policy include commercial transactions for goods and services and the purchase of electricity or gas at non-tariffed rates from Exelon or any of its subsidiaries by an entity affiliated with a Director or officer of Exelon. The retail purchase of electricity or gas from ComEd, ACE, BGE, DPL, PECO or Pepco at rates set by tariff, and transactions between or among Exelon or its subsidiaries are not considered. Charitable contributions approved in accordance with Exelon’s Charitable Contribution Guidelines are deemed approved or ratified under the related persons transaction policy and do not require separate consideration and ratification.

As required by the policy, the Exelon Board reviewed all commercial, charitable, civic and other relationships with Exelon in 2017 that were disclosed by Directors and executive officers of Exelon, ACE, BGE, ComEd, DPL, PECO and Pepco, and by executive officers of Exelon Generation that required separate consideration and ratification. Exelon’s Office of Corporate Governance conducted due diligence on each of these transactions to determine the specific circumstances of the particular transaction, including whether it was competitively bid or whether the consideration paid was based on tariffed rates.

The Corporate Governance Committee and the Exelon Board reviewed the analysis prepared by Exelon’s Office of Corporate Governance, which identified those transactions that required approval or ratification under the policy, or disclosure under U.S. Securities and Exchange Commission rules. The Committee recommended the Exelon Board’s ratification of all transactions because the related person served only as a director of the affiliated company, was not an officer or employee of the affiliated company and did not have a pecuniary or material interest in the transaction. For some transactions, the value or cost of the transaction was very small, and the Exelon Board considered the de minimis nature of the transaction as a further reason for ratifying it. The Board ratified other transactions that were the result of a competitive bidding process and therefore were considered fairly priced, or arms-length, regardless of any relationship. The remaining transactions were approved by the Board, even though the Director is an executive officer of the affiliated company, because the transactions involved only retail electricity or gas purchases under tariffed rates, the price and terms were determined to be the result of a competitive bidding process, or were provided at market terms generally available. Only two of the related person transactions are required to be disclosed in this Information Statement:

| |

| • | Drinker Biddle & Reath LLP provided legal services to Exelon and ComEd during 2017. Mr. Jesse H. Ruiz, a member of the ComEd Board of Directors until October 18, 2017, is a partner of Drinker Biddle & Reath LLP. Mr. Ruiz does not provide any legal services to Exelon or ComEd and is not compensated for the services provided by Drinker Biddle & Reath LLP. |

| |

| • | Sidley Austin LLP provided legal services to Exelon and ComEd during 2017. The spouse of Mr. Ruiz, a member of the ComEd Board of Directors until October 18, 2017, is a partner of Sidley Austin LLP, though she does not provide any services to Exelon or ComEd and is not compensated for the services provided by Sidley Austin LLP. |

Executive Compensation

The compensation of ComEd’s named executive officers (NEOs) is set under the direction of the Compensation and Leadership Development Committee of the Board of Directors of Exelon, generally consistent with Exelon’s overall compensation and benefits programs and policies, and is subject to review by the ComEd Board of Directors. A notable difference is that the annual incentive program for ComEd does not include a goal based on Exelon’s operating earnings. The compensation discussion and analysis and compensation disclosure that follows is adapted from the compensation discussion and analysis and compensation disclosure that was included in the 2018 proxy statement for Exelon and includes the information pertaining to ComEd executive compensation. The Compensation and Leadership Development Committee of Exelon provided a report on the compensation discussion and analysis that was included in the proxy statement for Exelon’s 2018 annual meeting and is presented below just before Compensation Discussion and Analysis.

The Compensation and Leadership Development Committee is responsible for setting the Company’s general policy regarding executive compensation to ensure that compensation levels and performance targets for Exelon and its subsidiaries are consistent with Exelon’s compensation philosophy and aligns with its strategic and operating objectives.

The Committee is careful to set goals that are sufficiently difficult to meaningfully incent management performance. In setting the goals, the Committee takes into account input from the Company’s executive officers.

The Compensation and Leadership Development Committee has delegated authority to the Exelon CEO to make off-cycle equity awards to eligible employees of up to 600,000 shares in the aggregate, and 20,000 shares per recipient in any year. Eligible employees include those below the level of Executive Vice President of Exelon and who are not subject to reporting obligations under Section 16 of the Securities Exchange Act of 1934, or were subject to the limitations of Internal Revenue Code Section 162(m) prior to the Tax Cuts and Jobs Act of 2017. Any awards made under this delegated authority are reviewed and ratified by the Compensation and Leadership Development Committee.

Compensation Consultant

The Compensation and Leadership Development Committee is authorized to retain and terminate, without Exelon Board or management approval, the services of an independent compensation consultant to provide advice and assistance, as the Committee deems appropriate. The Committee has sole authority to approve the consultant’s fees and other retention terms, and reviews the independence of the consultant and any other services that the consultant or the consultant’s firm may provide to Exelon. The compensation consultant reports directly to the Committee.

The Committee first engaged Meridian Compensation Partners, LLC (Meridian) in 2016 as its consultant after conducting a request for proposal process. In reviewing the engagement in 2017, the Committee considered the following factors and determined that Meridian continued to be an independent consultant and had no conflicts of interest:

| |

| • | Meridian performed no other services for Exelon or its affiliates and received no other fees from Exelon other than for executive compensation consulting for the Committee and director compensation consulting for the Corporate Governance Committee; |

| |

| • | The amount of fees paid by Exelon to Meridian in 2017 was less than 1% of Meridian’s gross annual revenues; |

| |

| • | Meridian has formal written policies designed to prevent conflicts of interest, including an insider trading and stock ownership policy; and |

| |

| • | There were no relationships between Meridian and its consultants and Exelon and its officers, directors or affiliates. |

As part of its ongoing services to the Committee, Meridian supports the Committee in executing its duties and responsibilities with respect to Exelon’s executive compensation programs by providing information and advice regarding market trends and competitive compensation programs and strategies that include:

| |

| • | Market data for each senior executive position, including evaluating Exelon’s compensation strategy and reviewing and confirming the peer group used to prepare the market data; |

| |

| • | An independent assessment of management recommendations for changes in the compensation structure; |

| |

| • | Assisting management to ensure that Exelon’s executive compensation programs are designed and administered consistent with the Committee’s requirements; and |

| |

| • | Ad hoc support, including executive compensation and related corporate governance trends. |

Meridian attends meetings of the Committee when requested. The Committee may directly or indirectly request Meridian to advise on other executive and non-executive compensation-related projects. The Committee has established a process for determining whether any significant additional services will be needed and whether a separate engagement for such services is necessary.

Compensation and Leadership Development Committee Interlocks and Insider Participation

During 2017 no officers or employees or former officers of ComEd participated in deliberations of the ComEd Board concerning executive officer compensation except Messrs. Crane and O’Brien and Ms. Pramaggiore. Ms. Pramaggiore was involved in deliberations concerning the compensation of ComEd executive officers other than herself.

Report of the Exelon Compensation and Leadership Development Committee

The Compensation and Leadership Development Committee is accountable for ensuring that the decisions made about executive compensation are in the best long-term interests of our shareholders. We accomplish this objective by having robust executive compensation principles in place and considering feedback received from shareholders to continuously improve and strengthen our executive compensation programs. Input received from investors representing over 45% of Exelon’s outstanding shares in 2017 was positive and resulted in no significant changes to our executive compensation program. Shareholders indicated continued satisfaction with the modifications implemented in 2016 that addressed concerns and better aligned the program with the Company’s strategy.

The Compensation and Leadership Development Committee has reviewed and discussed with management the Compensation Discussion and Analysis contained on pages 45-61 of the Exelon proxy statement. Based on such review and discussion, the Committee recommended to the Board that the Compensation Discussion and Analysis be included in the 2018 Proxy Statement.

THE COMPENSATION AND LEADERSHIP

DEVELOPMENT COMMITTEE

Yves C. de Balmann, Chair

Robert J. Lawless

Linda P. Jojo

Compensation Discussion & Analysis

This Compensation Discussion and Analysis (CD&A) discusses ComEd’s 2017 executive compensation program. The program covers compensation for our named executive officers (NEOs) listed below:

ComEd’s Named Executive Officers

|

| | | | |

| ANNE PRAMAGGIORE | JOSEPH R. TRPIK, JR. | TERENCE R. DONNELLY | FIDEL MARQUEZ, JR. | VERONICA GOMEZ |

President and Chief Executive Officer, ComEd | Senior VP, Chief Financial Officer and Treasurer, ComEd | Executive VP and Chief Operating Officer, ComEd | Senior VP, Governmental and External Affairs, ComEd | Senior VP, Regulatory and Energy Policy and General Counsel, ComEd |

Ms. Pramaggiore is a named executive officer of ComEd and she is also considered an executive officer of Exelon. Ms. Pramaggiore’s compensation is structured like the compensation of Exelon’s executive officers, based in part on overall Exelon goals as well as ComEd goals. Ms. Pramaggiore’s compensation is not recovered in ComEd’s rates. The other ComEd named executive officers participate in compensation programs designed to align their interests with ComEd’s customers and other stakeholders.

Executive Summary

Business and Strategy Overview, Value Proposition and Performance Highlights

ComEd’s Business Overview

Commonwealth Edison, better known as ComEd, is one of the largest electric utility companies in the nation, responsible for delivering safe and reliable power to 3.8 million homes and businesses across northern Illinois. The company manages a network of 90,000 miles of power lines, 1.3 million poles and 1,300 substations that make up the electrical infrastructure of the nation’s third largest metropolitan region. ComEd has a dedicated workforce of more than 6,000 employees.

ComEd's service territory borders Iroquois County to the south (roughly Interstate 80), the Wisconsin border to the north, the Iowa border to the west and the Indiana border to the east.

ComEd’s Values

We are dedicated to safety.

We actively pursue excellence.

We innovate to better serve our customers.

We act with integrity and are accountable to our communities and the environment.

We succeed as an inclusive and diverse team.

ComEd’s Company Performance

For the last five years, ComEd, has worked on upgrading and modernizing its electrical grid to improve the reliability of its service to customers. The work has resulted in record-setting performance. In 2017, ComEd customers experienced a 10 percent reduction in the frequency of outages compared to 2016. Since investments began in 2012, frequency of outages has been reduced by nearly 46 percent and the duration of outages has decreased by 47 percent.

From 2012 through 2017, there have been more than 7.7 million avoided customer interruptions, including 1.5 million in 2017 due to additional investments in distribution automation or digital "smart switches" that automatically reroute power around potential problem areas. These 7.7 million avoided outages have resulted in $1.5 billion in societal savings.

The Illinois Commerce Commission (ICC) has given the green light to a proposal by ComEd that allows companies and researchers access to anonymous energy usage data in order to enable the development of new products and services that will add value to Illinois energy consumers. ComEd has installed 3 million smart meters in northern Illinois since deployment began in 2013 and it will complete the installation of 4 million smart meters in 2018. The Anonymous Data offering builds upon the Green Button Initiative, a joint effort among utilities and technology companies launched in 2012 that enables customers to download their energy usage data and use it to take advantage of online energy management services.

ComEd experienced record reliability for the sixth straight year and best-on-record service level and customer satisfaction. All this helped produce record customer satisfaction, as highlighted by our highest scores ever and recognition by the US Environmental Protection Agency (2017 ENERGY STAR® Partner of the Year - Sustained Excellence Award) and Market Strategies International (Most Trusted Brand).

Sustainable Business Practices

Exelon’s sustainability practices - including our environmental and social initiatives - are a fundamental component of our strategy and operations. We achieved significant progress against our objectives in 2017, including:

| |

| • | Expanded paid leave policy to allow both women and men to meet the dual demands of work and family; |

| |

| • | Signed the White House Equal Pay Pledge affirming our commitment to uphold fair treatment for all of our employees and aligning with our values; |

| |

| • | Increased diversity spending with suppliers by $432 million (a 29% increase from the prior year) demonstrating our strong commitment to diversity and inclusion initiatives; |

| |

| • | 2017 awards and recognitions include: Billion Dollar Roundtable, Civic 50, Top 50 Companies for Diversity, Best Places to Work in 2017, CEO Action for Diversity & Inclusion, and UN’s HeForShe; |

| |

| • | Exelon and our employees set a new record in corporate philanthropy and volunteerism, committing over $52 million in giving and volunteering 210,000 hours; |

| |

| • | Recognized as having the lowest carbon dioxide emissions of the top 20 investor owned utilities; and |

| |

| • | Named to the Dow Jones Sustainability Index North America for the 12th consecutive year and by Newsweek Green rankings for 9th consecutive year. |

Executive Compensation Program Highlights

|

| | | |

| What We Do | | What We Don’t Do |

üPay for performance üSignificant stock ownership requirements üMitigate undue risk in compensation programs (e.g., incentive awards are capped) and conduct an annual risk assessment of the compensation programs

üRequire double-trigger for change-in-control benefits - change-in-control plus termination

üRetain an independent compensation consultant to advise the Compensation Committee

üEvaluate management succession and leadership development efforts annually

üProvide limited perquisites based on sound business rationale | üSeek shareholder feedback on executive compensation programs, engaged with holders of approximately 45% of our shares in 2017

üProhibit hedging transactions, short sales, derivative transactions or pledging of Company stock

üRequire executive officers to trade through 10b5-1 trading plans or obtain pre-approval before trading Exelon stock

üAnnually assess our programs against peer companies and best practices

üSet appropriate levels of “stretch” in incentive targets, based on industry performance and/or Exelon’s business plan

üProvide for discretionary clawbacks of incentive compensation paid or payable to current and former executives under certain circumstances

| | ûNo guaranteed minimum payout of AIP or LTIP programs

ûNo employment agreements

ûNo excise tax gross-ups for change-in-control agreements No dividend-equivalents on PShares

ûNo inclusion of the value of LTIP awards in pension or severance calculations

ûNo additional credited service under supplemental pension plans since 2004

ûNo option re-pricing or buyouts

|

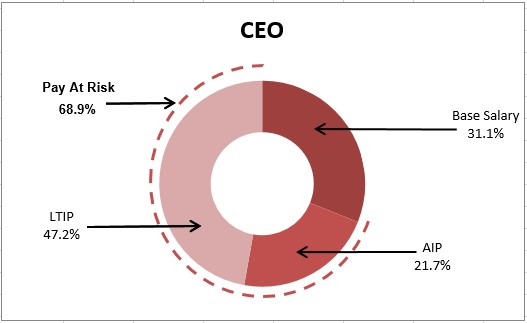

CEO

The Compensation Committee approved the following compensation for the ComEd CEO:

NEOs

The majority of target compensation paid to ComEd’s NEOs is tied to the achievement of short- and long-term financial and operational goals. A significant portion is paid in the form of Exelon equity with all components except for salary being “at-risk.”

Goal Rigor

The 2017 Exelon EPS “Target” goal for the ComEd CEO was set at $2.75, 7 cents above the 2016 actual results and 10 cents above the midpoint of our publicly disclosed 2017 earnings guidance range. 2017 operational metrics were set at challenging levels that corresponded to top quartile performance compared to industry standards.

Building on the 2017 goal rigor, the Compensation Committee set the adjusted (non-GAAP) operating EPS AIP target for 2018 at a level significantly higher than the Company’s actual performance in 2017, which is generally aligned with the midpoint of our publicly disclosed 2018 financial guidance.

Compensation Philosophy and Practices

Exelon’s Executive Compensation Program Philosophy

The goal of our executive compensation program is to retain and reward leaders who create long-term value for our shareholders, customers and stakeholders by delivering on objectives that support the Company’s long-term strategic plan. The executive compensation program is constructed to attract, motivate, engage and retain the high quality leaders who can effectively manage a company of Exelon’s size and complexity.

In designing the Company’s executive compensation program, the Compensation Committee strives to align the incentives of our NEOs with the interests of our shareholders, customers and stakeholders. This is accomplished by using metrics and adopting goals directly linked to Exelon’s and ComEd’s strategy. We believe consistent execution of our strategy over multi-year periods will drive long-term shareholder value creation and improved service for ComEd’s customers. Moreover our program is structured to motivate measured but sustainable and appropriate risk-taking.

Robust Goal Setting Process

|

| | | |

| Goal-setting process is competitive and well-defined | | ŸThe Compensation Committee annually reviews components, targets and payouts to ensure that they are challenging, contain appropriate stretch, and are designed to mitigate excessive risk ŸThe Committee considers short- and long-term financial and operational results relative to our internal goals ŸGoals for the AIP, including Adjusted Operating EPS for the ComEd CEO, are set in January |

| | | ŸExelon provides full-year guidance for EPS and other key financial metrics around the same time |

| | | | |

| Target levels are challenging to achieve and drive long-term growth and success | | ŸEPS metric is aligned generally with external financial guidance |

| | | ŸTarget goals are generally set near the mid-point of Exelon’s full-year EPS guidance ŸDistinguished goals are generally set above Exelon’s full-year EPS guidance |

| | ŸOperational metrics are set at challenging levels (i.e., target typically corresponds to top quartile performance) compared to industry standards ŸReturn and cash flow metrics are set based on internal business plan |

Guiding Principles

The following principles guide and inform the Compensation Committee’s efforts to deliver a highly effective executive compensation program that drives shareholder value, operational performance, and fosters the attraction, motivation, of key talent.

|

| | | | |

Manage for the Long-term The Board manages for the long-term and makes pay decisions that are in the best long-term interests of the Company and shareholders. | | Alignment with Shareholders Compensation is directly linked to performance and is aligned with shareholders by having a majority of NEO pay at risk in both short- and long-term incentives. | | Extensive Shareholder Engagement We engage directly with shareholders and take responsive actions to improve our compensation programs based on year-round feedback from shareholders. |

| | | | | |

Market Competitive Our NEOs’ pay levels are set by taking into consideration multiple factors, including peer group market data, internal equity comparisons, experience, succession planning, performance and retention. | | Stock Ownership Guidelines Executives are required to meet and maintain significant stock ownership requirements. ComEd’s CEO’s and other NEO’s requirement is 2X base salary. | | Balance The portion of NEO pay at risk rewards the appropriate balance of short- and long-term financial and strategic business results. |

Compensation Decisions - Roles of Board, Compensation Committee and CEO

|

|

ComEd CEO compensation decisions are made by the Compensation Committee, based on several factors including input from Exelon Executives and the independent compensation consultant. Other NEO compensation decisions are made by the ComEd CEO. |

Setting Target Total Direct Compensation (TDC) for the CEO…

One of the Compensation Committee’s most important responsibilities is to approve the compensation of Exelon executive officers, including the ComEd CEO. The Compensation Committee fulfills this responsibility by analyzing peer group compensation and performance data with its independent compensation consultant. The Committee also reviews the various elements of the executive officer’s compensation in the context of the target TDC which includes base salary, annual and long-term incentive target opportunities.

…and for Our NEOs

The ComEd CEO uses a variety of data to gauge market competitiveness, including peer group data and regression analysis. TDC can vary based on competencies and skills, scope of responsibilities, the executive’s experience and performance, retention, succession planning and the organizational structure of the businesses (e.g., internal alignment and reporting relationships).

Peer Groups Used for Benchmarking Executive Compensation

We use a blended peer group for assessing our executive compensation program that consists of two sub-groups: energy services peers and general industry peers. We use a blended peer group because (1) there are not enough energy services peers with size, scale and complexity comparable to Exelon to create a robust energy services-only peer group, and (2) Exelon’s market for attracting talent includes general industry peers, with recent key executives hired from companies such as Johnson & Johnson and Proctor & Gamble. When selecting general industry peers, we look for capital asset-intensive companies with size, scale and complexity similar to Exelon, and we also consider the extent to which they may be subject to the effects of volatile commodity prices similar to Exelon’s sensitivity to commodity price volatility. Exelon’s revenues are at the 85th percentile of the following blended peer group comprising 20 companies.

| |

| • | Energy Services - Beginning in 2017, we included the following 11 energy services companies in our peer group even though seven of these companies had 2016 revenues that were less than half of Exelon's revenues: |

|

| | | | | |

| | American Electric Power Company, Inc. | Dominion Energy, Inc. | Duke Energy Corporation | Edison International | Entergy Corporation |

| | FirstEnergy Corporation | NextEra Energy, Inc. | PG&E Corporation | Public Service Enterprise Group Inc. | Sempra Energy |

| | The Southern Company | | | | |

| |

| • | General Industry - Beginning in 2017, we included the following general industry peers in our peer group: |

|

| | | | | |

| | 3M Company | Deere & Company | DowDuPont | General Dynamics Corporation | Honeywell International Inc. |

| | International Paper Company | Marathon Petroleum Company | Northrop Grumman Corporation | Valero Energy Corporation | |

In 2017, a change was made to our general industry peer sub-group. Alcoa, Hess, and Johnson Controls were removed due to corporate transactions that significantly altered their comparability to Exelon. These companies were replaced with Marathon Petroleum and Valero Energy Corporation in the general industry peer group and Sempra Energy in the energy services peer group, which the Compensation Committee deemed to better reflect the overall composition and profile of the peer group.

To account for differences in the size of the compensation peer group companies, market data is statistically adjusted using a regression analysis by the Committee’s independent consultant allowing for a comparison of the compensation levels to similarly-sized companies. Each element of our NEOs’ compensation is then targeted to the median of the peer group. To the extent an NEO’s total compensation exceeds the peer group median, it is due to outstanding performance, critical skills, experience and tenure. If an NEO’s compensation is below the median, it is generally due to underperformance against relevant metrics or reflective of an individual who is newer in his or her role.

How the Peer Group is used

| |

| • | As an input in developing compensation targets and pay mix |

| |

| • | To assess the competitiveness of compensation and benefit programs |

| |

| • | Benchmarks for incentive program design |

| |

| • | Benchmarks for stock ownership guidelines |

2017 Say-on-Pay Vote Outcome and Shareholder Engagement

The Compensation Committee regularly reviews Exelon executive compensation, including that of the ComEd CEO, taking into consideration the input received through Exelon’s robust engagement program with its investors. Feedback is typically solicited throughout the year in connection with the annual meeting of shareholders and the Compensation Committee’s review of the executive compensation program.

During 2017, Exelon contacted the holders of nearly 50% of our outstanding shares, representing almost two-thirds of the Company’s institutional investors. We engaged with portfolio managers and governance professionals from a significant cross-section of our shareholder base, representing approximately 45% of Exelon’s outstanding shares. Mr. Yves de Balmann, Chair of the Compensation Committee, participated in most of the discussions held with shareholders, and feedback received was shared with the Compensation Committee, the Corporate Governance Committee, and the Exelon Board.

Feedback received in 2017 indicated that investors remain supportive of the extensive changes made to the executive compensation program in 2016. This support was reflected in our 2017 say-on-pay vote results. At the Company’s annual meeting of shareholders held in April 2017, approximately 86% of the votes cast on the Company’s say-on-pay proposal voted in favor of the proposal (up from approximately 38% in 2016). No additional substantive changes were made to the executive compensation program as a result of this feedback.

Actions Implemented in 2016 Demonstrate Responsiveness to Shareholders

|

| | |

| Annual Incentive Plan (AIP) | | Long-Term Incentive Plan (LTIP) |

üCapped future payouts at target if absolute TSR is negative for 12 months

üMoved operational metrics to AIP from PShare metrics to eliminate duplicate metrics used in LTIP

üEliminated the individual performance multiplier component

| | üChanged PShare performance periods from annual to three-year periods to align with long-term strategic goals and initiatives and shareholder interests

üMoved EPS and operational metrics from LTIP to AIP to parallel market practices and eliminate duplicate metrics used in annual and long-term plans; adopted new PShare financial and credit metrics connected with goal to support and drive utility performance

üAmended TSR modifier to compare to UTY market index to more closely correspond with shareholder return experience, and capped payouts at target where TSR is negative for the final 12 months of the measurement period

|

Compensation Decisions and Rationale

2017 Compensation Program Structure

The Compensation Committee designed Exelon’s 2017 compensation program to motivate and reward leaders who create long-term value for our shareholders. The primary compensation elements include fixed and variable components that include:

|

| | | | | | |

Pay Element | Form | Performance | Purpose |

| Salary | Cash | Merit Based | ŸProvides portion of income stability at competitive, market-based levels |

Annual Incentive Plan | Cash | Ÿ1 Year ŸFor Ms. Pramaggiore, based on 25% Exelon adjusted non-GAAP operating EPS and 75% ComEd metrics ŸFor all other NEOs, based solely on ComEd metrics ŸTSR Cap if negative 1-year absolute TSR | ŸMotivates executives to achieve key annual financial and operational objectives using adjusted operating EPS and operational goals that reflect commitment to become the leading diversified energy provider ŸAligns with shareholder interests by capping payouts at target if 1-year absolute TSR is negative |

Long-Term Incentive Plan | Performance Shares (67% of LTIP) | Cumulative Performance | 2017-2019 Scorecard | | ŸUtility Earned ROE (33.3%) ŸUtility Net Income (33.3%) ŸExelon FFO/Debt (33.4%) | ŸDrives executive focus on long-term goals supporting utility growth, financial results, and capital stewardship to drive behavior and align with shareholder interests ŸIncludes relative comparison of TSR to market index and caps payout at target if absolute TSR is negative to further align with shareholder interests |

2017-2019 Modifier | | ŸPoint- for-point relative TSR Modifier (3-year period) ŸTSR Cap if negative 1-year absolute TSR |

Restricted Stock (33% of LTIP) | Vest One-Third Per Year Over 3 Years | |

2017 Target Compensation

The table below lists the target value of the compensation elements for each NEO as of December 31, 2017.

|

| | | | | | | | | | | | | | |

| | | Cash Compensation | | Long-Term Incentives | | Target Total Direct Compensation |

| Name | | Base | | AIP Target | | Target Total Cash | | RSUs 33% of LTIP | | PShares 67% of LTIP | | Target Total LTIP | |

| Pramaggiore | | $640,800 | | 70% | | $1,089,360 | | $321,301 | | $652,339 | | $973,640 | | $2,063,000 |

| Trpik | | 361,626 | | 45% | | 524,358 | | 112,530 | | 228,470 | | 341,000 | | 865,358 |

| Donnelly | | 444,801 | | 55% | | 689,442 | | 161,040 | | 326,960 | | 488,000 | | 1,177,442 |

| Marquez | | 359,871 | | 45% | | 521,813 | | 112,530 | | 228,470 | | 341,000 | | 862,813 |

| Gomez | | 330,000 | | 50% | | 495,000 | | 112,530 | | 228,470 | | 341,000 | | 836,000 |

Total Cash Compensation (Base Salary and Annual Incentive Program)

2017 Base Salary Review and Adjustments

Base salaries for Exelon’s executive officers, including the ComEd CEO, are set by the Compensation Committee and adjusted following an annual market assessment of peer group compensation. Base salaries may be adjusted (1) as part of the annual merit review or (2) based on a promotion or significant change in job scope. The Compensation Committee considers the results of the annual market assessment in addition to the following factors when contemplating a merit review: individual performance, scope of responsibility, leadership skills and values, current compensation, internal equity, and legacy matters.

In January 2017, the Compensation Committee and the ComEd CEO (with respect to the other NEOs) approved a 2.5%-3.5% increase in base salary for each ComEd NEO effective March 1, 2017, as part of the annual merit review. Ms. Gomez was not eligible for merit increase due to the timing of her appointment as Senior Vice President, Regulatory and Energy Policy and General Counsel.

2017 Annual Incentive Program (AIP) Award Determinations

ComEd’s AIP metrics are linked to ComEd’s business goals and strategic focus areas. They include:

| |

| • | Financial discipline (total operations and maintenance (O&M) expense and capital expenditures) (35%); |

| |

| • | Operational excellence (adopting safety best practices, outage duration and frequency) (30%); and |

| |

| • | Customer and key stakeholder satisfaction (EIMA reliability metrics index, service levels, call center satisfaction and customer satisfaction index) (35%) |

In prior years, the AIP process included the application of an individual performance multiplier to the final award determination. Some shareholders voiced concern about the use of the discretionary individual performance multiplier, so this multiplier was removed in 2016 for AIP payout determinations made in 2017 for the ComEd CEO.

Accordingly, for 2017 the Compensation Committee used the following process to determine 2017 AIP awards for each NEO:

|

| | | | | | | | | | | |

Step 1 | | | Step 2 | | | Step 3 | | | Step 4 | | |

| | | | | |

| Set AIP Target | Determine Performance Factor | Determine Individual Performance Multiplier (IPM) and Negative TSR Cap | Apply Final Multiplier |

ŸExpressed as percentage of base salary, as of 12/31/17

ŸCEO annual incentive target of 70%

ŸOther NEO annual incentive targets range from 45% to 55%

| ŸFor Ms. Pramaggiore, based on 25% Exelon adjusted non-GAAP operating EPS and 75% ComEd metrics.

ŸFor all other NEOs, based solely on ComEd metrics.

| ŸMeasures individual performance

ŸRanges from 50% to 110% (target of 100%)

ŸMs. Pramaggiore is not eligible for an IPM. IPMs are determined by Ms. Pramaggiore for other NEOs.

ŸIf Exelon’s absolute TSR for the year is negative, AIP payout will be capped at target (100%)

| ŸMultiply the target award by the lesser of (i) the performance factor or (ii) the negative TSR cap if applicable

ŸMultiply the outcome by the IPM

ŸAward can range from 0% to 200% of target (target of 100%)

|

2017 Performance. The following table includes the threshold, target, and distinguished or maximum performance goals and results achieved under the 2017 annual incentive plan (AIP).

|

| | | | | | | |

| Goals | | Threshold | Target | Distinguished | 2017 Results | Unadjusted Payout as a % of Target |

|

| Adjusted (non-GAAP) Operating Earnings Per Share (EPS)* | | $2.56 | $2.75 | $3.04 | $2.60 | 60.53 | % |

| ComEd Operating Net Income (NI) ($M) 2017* | | $560.9 | $603.1 | $663.4 | $591.5 | 86.26 | % |

| ComEd Total O&M Expense 2017 ($M) | | $1,050.8 | $1,000.7 | $900.7 | $960.8 | 139.90 | % |

| ComEd Capital Expenditures 2017 ($M) | | $2,063.9 | $1,965.6 | $1,769.0 | $1,960.2 | 102.75 | % |

| ComEd OSHA Recordable Rate 2017 | | 6.0 | 8.0 | 9.0 | 7.0 | 75.00 | % |

| ComEd Outage Frequency (SAIFI) 2017 | | 0.83 | 0.69 | 0.67 | 0.56 | 200.00 | % |

| ComEd Outage Duration (CAIDI) 2017 | | 93 | 84 | 82 | 81 | 200.00 | % |

| ComEd Service Level 2017 | | 86.6 | 89.0 | 92.7 | 93.7 | 200.00 | % |

| ComEd Call Center Satisfaction 2017 | | 76.1 | 82.8 | 86.1 | 85.1 | 169.70 | % |

| ComEd Customer Satisfaction Index 2017 | | 78 | 84.4 | 84.8 | 84.8 | 200.00 | % |

| ComEd EIMA Reliability Metrics Index 2017 | | 50% | 100% | 200% | 200% | 200.00 | % |

*Ms. Pramaggiore is the only NEO with an Adjusted (non-GAAP) Operating Earnings Per Share (EPS) and ComEd Operating Net Income measurement components.

The following table shows how the formula was applied and the actual amounts awarded. The Compensation Committee made no changes to the NEOs targets for the AIP. The Compensation Committee applied negative discretion to limit ComEd NEO payouts to 120% of target.

|

| | | | | | | | | | |

| NEO | AIP Target |

| Formulaic Performance Factor |

| Individual Performance Multiplier (IPM) |

| Actual Award |

|

| Pramaggiore | $ | 448,560 |

| 114.71% |

| Not Eligible |

| $ | 514,543 |

|

| Trpik, Jr. | 162,732 |

| 120 | % | 105 | % | 205,042 |

|

| Donnelly | 244,641 |

| 120 | % | 110 | % | 322,926 |

|

| Marquez, Jr. | 161,942 |

| 120 | % | 100 | % | 194,330 |

|

| Gomez | 165,000 |

| 120 | % | 110 | % | 217,800 |

|

2017 Long-Term Incentive Program (LTIP)

The Compensation Committee annually grants equity incentive awards at its meeting in January. On January 30, 2017, the Compensation Committee approved awards of restricted stock units (RSUs) and performance shares (PShares) shown in detail in the Grants of Plan-Based Awards table on page 29.

Restricted Stock Units. RSUs vest ratably over three years. Dividend equivalents with respect to RSUs are reinvested as additional RSUs, subject to the same vesting conditions as the underlying RSUs.

Performance Share Units. A target number of PShares is granted, the earning of which is contingent on performance for the subsequent three-years. Performance measures for the currently open cycles are summarized in the tables below. In addition to these financial measures, any earned award is subject to a total shareholder return modifier to compensate for relative performance achieved against the performance of the UTY index. See page 17 for the rationale behind the selection of the performance goals used for PShares.

|

| | | | | |

| | 2015 | 2016 | 2017 | 2018 | 2019 |

| 2015-2017 | Operational Excellence (40%) | Earned ROE at Exelon (50%) | Utility Net Income (33.3%) | | |

| | | |

| | Utility Earned ROE (33.3%) | | |

| | Financial Management (60%) | FFO/Debt at ExGen (50%) | | |

| | Exelon FFO/Debt (33.4%) | | |

| | | |

| | Average of three years of performance | | |

| 2016-2018 | | Earned ROE at Exelon (50%) | Utility Net Income (33.3%) | |

| | | |

| | | Utility Earned ROE (33.3%) | |

| | | FFO/Debt at ExGen (50%) | |

| | | Exelon FFO/Debt (33.4%) | |

| | | |

| | | Weighted average of two performance periods | |

| 2017-2019 | | | Utility Net Income (33.3%) |

| and future | | |

| | | | Utility Earned ROE (33.3%) |

| | | |

| | | | Exelon FFO/Debt (33.4%) |

| | | |

| | | | Straight performance, no average |

The following table shows how the formula was applied and the actual amounts awarded.

Performance Share (PShare) Award Determinations

In prior years, the PShare determination process included the application of an individual performance multiplier to the final award determination. Some shareholders voiced concern about the use of the discretionary individual performance multiplier, so this multiplier was not applied to PShare payout determinations made in 2017.

Accordingly, the Compensation Committee uses the following process to determine PShare targets and awards:

|

| | | | | | | | | | | | | | | | | | |

| Step | | Step | | Step | | Step | | Step |

| 1 | | | | 2 | | | | 3 | | | | 4 | | | | 5 | | |

| | | | | | | | | |

Establish PShare Target Target set in January of the first year of the performance cycle | | Determine Performance Multiplier Based on performance achieved over the cycle Performance can range from 0% to 150% of target (target of 100%) | | Determine TSR Modifier Subtract the performance of the UTY from Exelon’s absolute TSR performance over the three-year performance period (e.g., 2017-2019) | | Calculate Final Multiplier Multiply the performance multiplier by (1 + the TSR multiplier) If Exelon’s absolute TSR for the final 12 months of the measurement period is negative, PShare payout will be capped at target | | Apply Final Multiplier Apply the final multiplier to determine the number of shares issued Award can range from 0% to 200% of target (target of 100%) after application of the TSR modifier |

2015-2017 PShare Program Payout Determination

The Compensation Committee approved a payout of 111.25%, based on the average performance of 117.03% for the 2015, 2016 and 2017 scorecards and a TSR modifier of negative 4.94% based on 2015-2017 TSR performance. The 2015, 2016 and 2017 scorecards are presented in the Appendix beginning at A-2; the 2017 award payout calculation is presented below:

|

| | | | | | | | |

| Year | | Scorecard Performance | | Average Performance | | TSR Modifier | | Overall Award Payout |

| 2015 | | 122.48% | | | | | | |

| 2016 | | 125.00% | | 117.03% | | -4.94% | | 111.25%* |

| 2017 | | 103.61% | | | | | | |

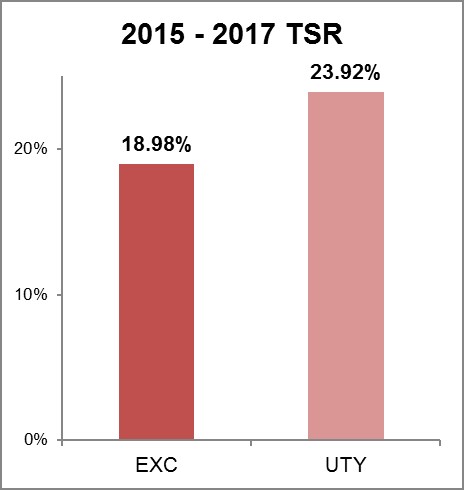

2015-2017 TSR Modifier and Cap Determination

|

| | |

| | To address shareholder concerns received in 2016, the following modifications were made to the TSR modifier and a TSR cap was added: ŸChanged TSR modifier peer group from the competitive integrated companies (Entergy, FirstEnergy, NextEra Energy, and PSEG) to the UTY ŸChanged to a point-for-point approach, where the UTY’s absolute TSR performance is subtracted from Exelon’s absolute TSR over the three-year period ŸThe modifier is no longer capped (positive or negative) Cap payout at target if TSR is negative for the final 12 months of the measurement period For the 2015-2017 performance period, the TSR modifier was 18.98% for Exelon minus 23.92% for the UTY, resulting in a TSR modifier of negative 4.94%. Exelon’s 2017 one-year absolute TSR was 15.11% so the TSR cap was not applicable. |

|

| | | | | | | | | | |

| NEO | | Target Shares | | | | Performance Factor | | | | Actual Award |

| Pramaggiore | | 17,463 | | x | | 111.25% | | = | | 19,428 |

| Trpik | | 6,119 | | x | | 111.25% | | = | | 6,807 |

| Donnelly | | 8,757 | | x | | 111.25% | | = | | 9,742 |

| Marquez | | 6,119 | | x | | 111.25% | | = | | 6,807 |

| Gomez | | 6,281 | | x | | 111.25% | | = | | 6,988 |

Settlement of PShares is 50% in shares with the balance in cash. However, participants who have achieved 200% or more of their stock ownership target as of September 30 of the year prior to payout will have their PShares settled 100% in cash.

Robust Goal-Setting Process and Rigorous Targets

The Compensation Committee strives to set challenging operational and financial performance targets that drive and motivate executives to achieve short- and long-term success and to help ensure key talent is retained. The Compensation Committee selects metrics that are directly tied to the Company’s operational and financial strategies and are proven measures of long-term value creation. Operational targets are benchmarked and set at the top quartile or higher as compared to industry standards. Financial targets are based on our internal business plans and external market factors.

Goal-Setting for 2018

Exelon’s goal-setting process employs a multi-layer approach and analysis that incorporates a blend of objective and subjective business considerations and other analytical methods to ensure that the goals are sufficiently rigorous. Such considerations include:

| |

| • | Recent History: Goals generally reflect a logical progression of results from the recent past |

| |

| • | Relative Performance: Performance is evaluated against a relevant group of the Company’s peers |

| |

| • | Strategic Aspirations: Near- and intermediate-term goals follow a trend line consistent with long-term aspirations |

| |

| • | Shareholder Expectations: Goals are aligned with externally communicated financial guidance and shareholder expectations |

| |

| • | Sustainable Sharing: Earned awards reflect a balanced degree of shared benefits between shareholders and participants |

To ensure adequate rigor for the financial targets applicable to the PShares, we conducted statistical simulations to understand the level of difficulty of our payout range. We also conducted a sensitivity analysis of reasonable value ranges for several internal and external variables that are significant drivers of performance. We also examined historical levels of deviation of Company performance compared to plan.

|

|

Example: AIP Goal Rigor The Compensation Committee set the adjusted (non-GAAP) operating EPS AIP target for Exelon executive officers (including the ComEd CEO) for 2018 at a level significantly higher than Exelon’s actual performance in 2017, which is generally aligned with the midpoint of our publicly disclosed 2018 financial guidance. For 2018, maximum targets were set at levels that outperform Exelon or ComEd historical performance for three of the four operational metrics: Ÿbest-ever for Dispatch Match Ÿbest-ever for Nuclear Fleetwide Capacity Factor Ÿbest-ever for outage frequency results (best-in-class) Ÿfirst decile of industry standards for outage duration goals |

PShare Goal Setting

The three-performance metrics underlying the 2018-2020 PShare awards include the following:

|

| | | | | | | | |

Utility Earned ROE (33.3%) | Utility Net Income (33.3%) | Exelon FFO/Debt (33.4%) |