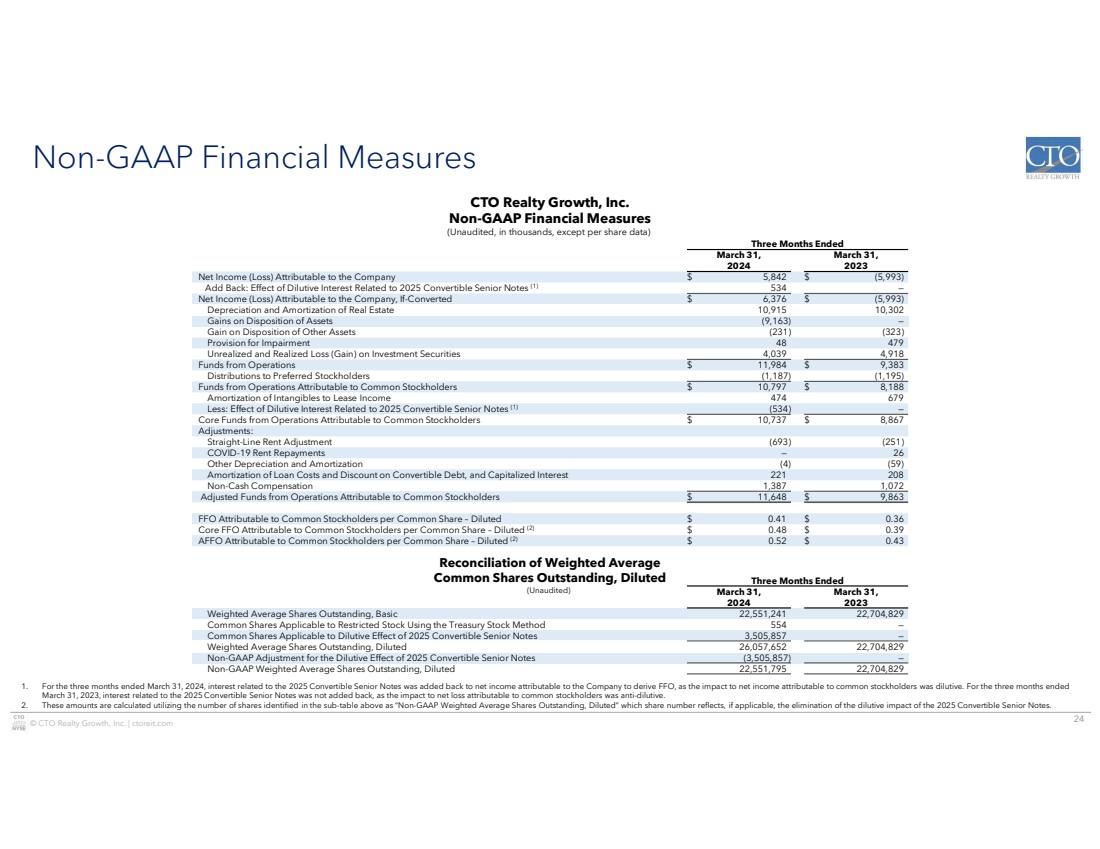

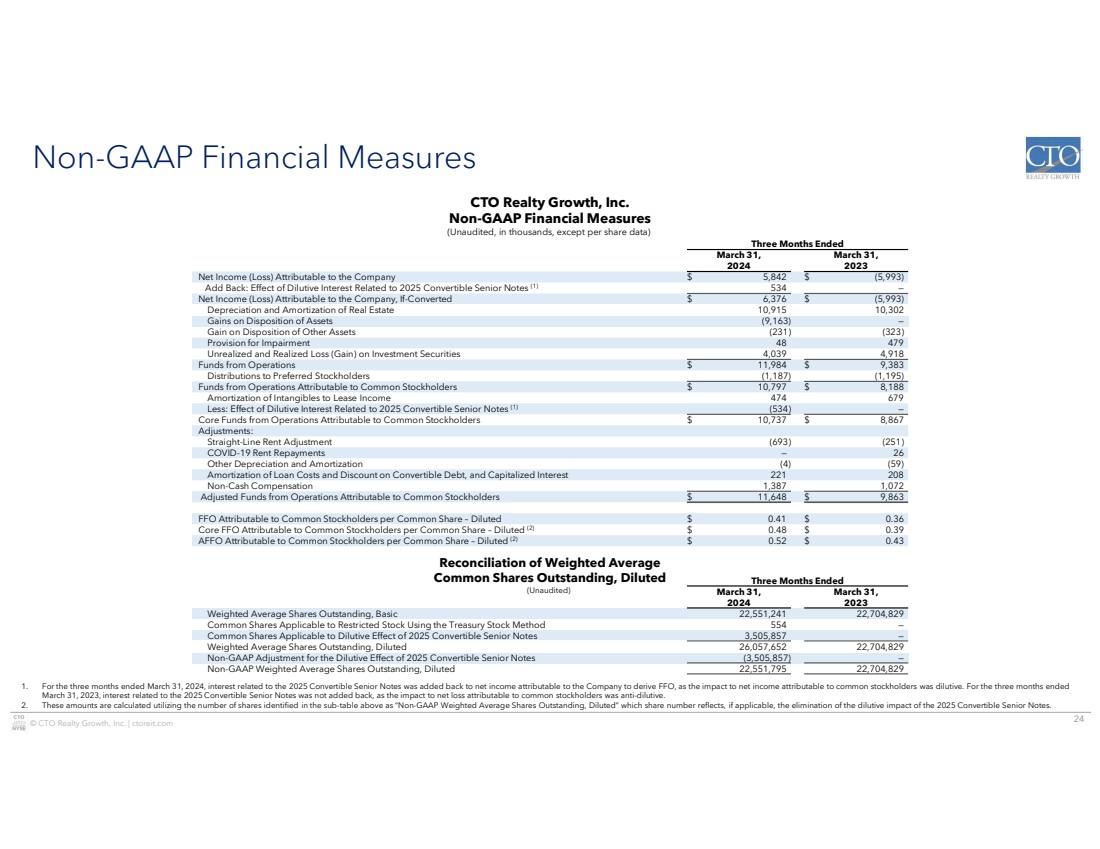

| 24 © CTO Realty Growth, Inc. | ctoreit.com Non-GAAP Financial Measures CTO Realty Growth, Inc. Non-GAAP Financial Measures (Unaudited, in thousands, except per share data) Three Months Ended March 31, 2023 March 31, 2024 Net Income (Loss) Attributable to the Company $ 5,842 $ (5,993) Add Back: Effect of Dilutive Interest Related to 2025 Convertible Senior Notes 534 — (1) Net Income (Loss) Attributable to the Company, If-Converted $ 6,376 $ (5,993) Depreciation and Amortization of Real Estate 10,915 10,302 Gains on Disposition of Assets (9,163) — Gain on Disposition of Other Assets (231) (323) Provision for Impairment 48 479 Unrealized and Realized Loss (Gain) on Investment Securities 4,039 4,918 Funds from Operations $ 11,984 $ 9,383 Distributions to Preferred Stockholders (1,187) (1,195) Funds from Operations Attributable to Common Stockholders $ 10,797 $ 8,188 Amortization of Intangibles to Lease Income 474 679 Less: Effect of Dilutive Interest Related to 2025 Convertible Senior Notes (534) — (1) Core Funds from Operations Attributable to Common Stockholders $ 10,737 $ 8,867 Adjustments: Straight-Line Rent Adjustment (693) (251) COVID-19 Rent Repayments — 26 Other Depreciation and Amortization (4) (59) Amortization of Loan Costs and Discount on Convertible Debt, and Capitalized Interest 221 208 Non-Cash Compensation 1,387 1,072 Adjusted Funds from Operations Attributable to Common Stockholders $ 11,648 $ 9,863 FFO Attributable to Common Stockholders per Common Share – Diluted $ 0.41 $ 0.36 Core FFO Attributable to Common Stockholders per Common Share – Diluted $ 0.48 $ 0.39 (2) AFFO Attributable to Common Stockholders per Common Share – Diluted $ 0.52 $ 0.43 (2) 1. For the three months ended March 31, 2024, interest related to the 2025 Convertible Senior Notes was added back to net income attributable to the Company to derive FFO, as the impact to net income attributable to common stockholders was dilutive. For the three months ended March 31, 2023, interest related to the 2025 Convertible Senior Notes was not added back, as the impact to net loss attributable to common stockholders was anti-dilutive. 2. These amounts are calculated utilizing the number of shares identified in the sub-table above as “Non-GAAP Weighted Average Shares Outstanding, Diluted” which share number reflects, if applicable, the elimination of the dilutive impact of the 2025 Convertible Senior Notes. Three Months Ended March 31, 2023 March 31, 2024 Weighted Average Shares Outstanding, Basic 22,551,241 22,704,829 Common Shares Applicable to Restricted Stock Using the Treasury Stock Method 554 — Common Shares Applicable to Dilutive Effect of 2025 Convertible Senior Notes 3,505,857 — Weighted Average Shares Outstanding, Diluted 26,057,652 22,704,829 Non-GAAP Adjustment for the Dilutive Effect of 2025 Convertible Senior Notes (3,505,857) — Non-GAAP Weighted Average Shares Outstanding, Diluted 22,551,795 22,704,829 Reconciliation of Weighted Average Common Shares Outstanding, Diluted (Unaudited) |