Strategic Transformational Transaction Update December 5, 2022 Exhibit 99.2

Forward-Looking Statements This presentation by TherapeuticsMD, Inc. (referred to as “we,” “our,” or the “Company”) may contain forward-looking statements. Forward-looking statements may include, without limitation, statements regarding the proposed transaction, expectations with regard to the financial impact of such transaction on the Company, future potential milestone and royalty payments, plans and objectives, and management’s beliefs, expectations or opinions. Such forward-looking statements relate to future, not past, events and often address expected future actions and expected future business and financial performance. Forward-looking statements may be identified by the use of words such as “believe,” “will,” “should,” “estimate,” “anticipate”, “potential,” “expect,” “intend,” “plan,” “may,” “subject to,” “continues,” “if” and similar words and phrases. These forward-looking statements are not guarantees of future events and involve risks, uncertainties and assumptions that are difficult to predict. Actual results, developments and business decisions may differ materially from those expressed or implied in any forward-looking statements as a result of numerous factors, risks and uncertainties over which the Company has no control. These factors, risks and uncertainties include, but are not limited to, the following: (1) the conditions to the completion of the proposed transaction may not be satisfied, and the possibility that if the agreements with Mayne Pharma are terminated, it will constitute an event of default under the Company’s Financing Agreement and the Company may not continue as a going concern; (2) the parties’ ability to complete the proposed transaction in the anticipated timeframe or at all; (3) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreements between the parties to the proposed transaction (including that if the agreements are terminated it is an event of default under the Company’s Financing Agreement and the Company may not continue as a going concern); (4) the effect of the announcement or pendency of the proposed transaction on business relationships, operating results, and business generally; (5) risks that the proposed transaction disrupts current plans and operations and potential difficulties in employee retention as a result of the proposed transaction; (6) risks related to diverting management’s attention from ongoing business operations; (7) the outcome of any legal proceedings that may be instituted related to the proposed transaction; (8) the amount of the costs, fees, expenses and other charges related to the proposed transaction; (9) the risk that competing offers or acquisition proposals will be made; (10) general economic conditions, particularly those in the life science and medical device industries; (11) stock trading prices, including the impact of the proposed transaction on the Company’s stock price and the corresponding impact that failure to close the proposed transaction would be expected to have on the Company’s stock price, particularly in relation to the Company’s current and future capital needs and its ability to raise additional funds to finance its future operations in the event the proposed transaction does not close; (12) the participation of third parties in the consummation of the proposed transaction; and (13) other factors discussed from time to time in the reports of the Company filed with the Securities and Exchange Commission (the “SEC”), including the risks and uncertainties contained in the sections titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s most recent Annual Report on Form 10-K, as filed with the SEC on March 23, 2022, and related sections in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which are available free of charge at http://www.sec.gov or under the “Investors & Media” section on the Company’s website at www.therapeuticsmd.com. Forward-looking statements reflect the views and assumptions of management as of the date of this presentation with respect to future events. The Company does not undertake, and hereby disclaims, any obligation, unless required to do so by applicable laws, to update any forward-looking statements as a result of new information, future events or other factors. The inclusion of any statement in this presentation does not constitute an admission by the Company or any other person that the events or circumstances described in such statement are material.

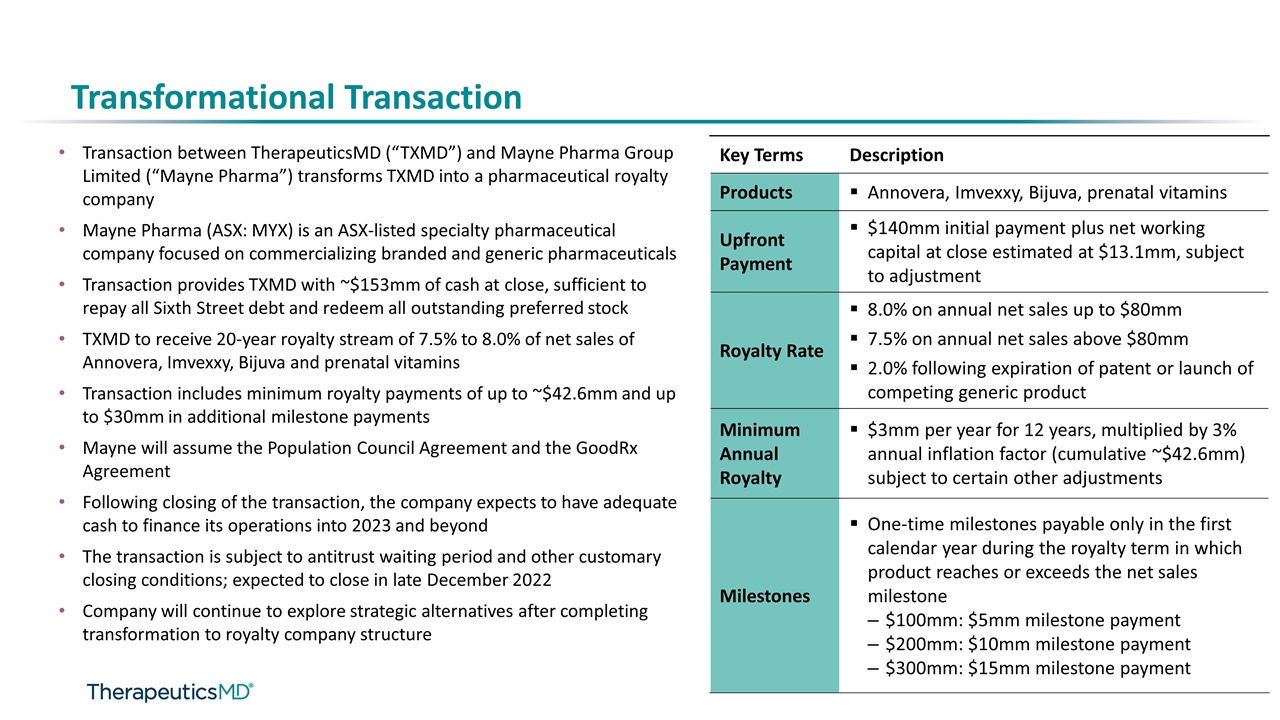

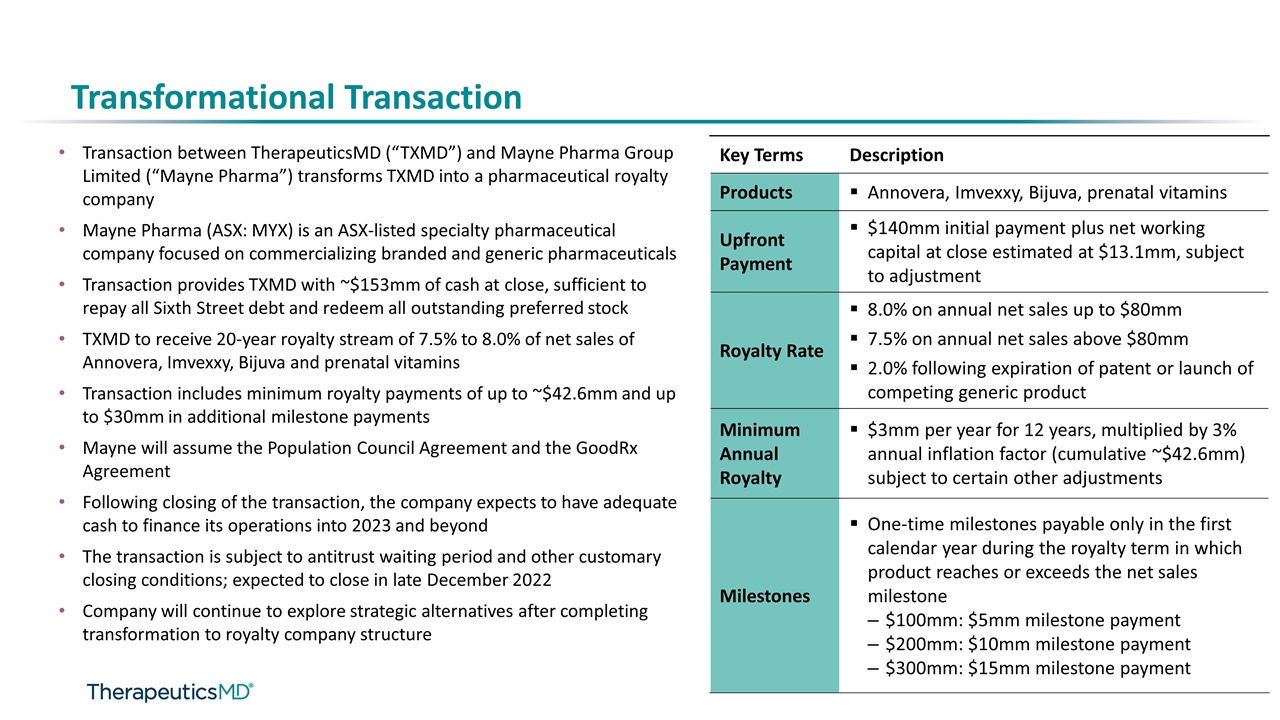

Transformational Transaction Transaction between TherapeuticsMD (“TXMD”) and Mayne Pharma Group Limited (“Mayne Pharma”) transforms TXMD into a pharmaceutical royalty company Mayne Pharma (ASX: MYX) is an ASX-listed specialty pharmaceutical company focused on commercializing branded and generic pharmaceuticals Transaction provides TXMD with ~$153mm of cash at close, sufficient to repay all Sixth Street debt and redeem all outstanding preferred stock TXMD to receive 20-year royalty stream of 7.5% to 8.0% of net sales of Annovera, Imvexxy, Bijuva and prenatal vitamins Transaction includes minimum royalty payments of up to ~$42.6mm and up to $30mm in additional milestone payments Mayne will assume the Population Council Agreement and the GoodRx Agreement Following closing of the transaction, the company expects to have adequate cash to finance its operations into 2023 and beyond The transaction is subject to antitrust waiting period and other customary closing conditions; expected to close in late December 2022 Company will continue to explore strategic alternatives after completing transformation to royalty company structure Key Terms Description Products Annovera, Imvexxy, Bijuva, prenatal vitamins Upfront Payment $140mm initial payment plus net working capital at close estimated at $13.1mm, subject to adjustment Royalty Rate 8.0% on annual net sales up to $80mm 7.5% on annual net sales above $80mm 2.0% following expiration of patent or launch of competing generic product Minimum Annual Royalty $3mm per year for 12 years, multiplied by 3% annual inflation factor (cumulative ~$42.6mm) subject to certain other adjustments Milestones One-time milestones payable only in the first calendar year during the royalty term in which product reaches or exceeds the net sales milestone $100mm: $5mm milestone payment $200mm: $10mm milestone payment $300mm: $15mm milestone payment

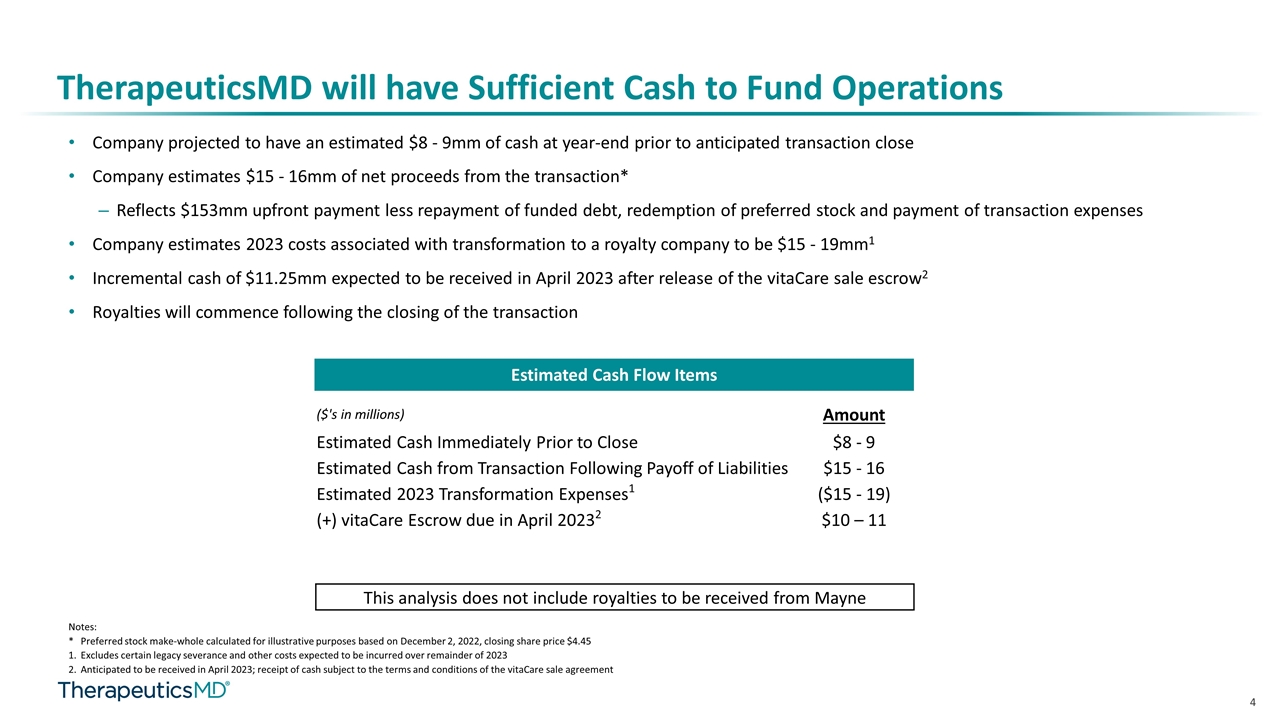

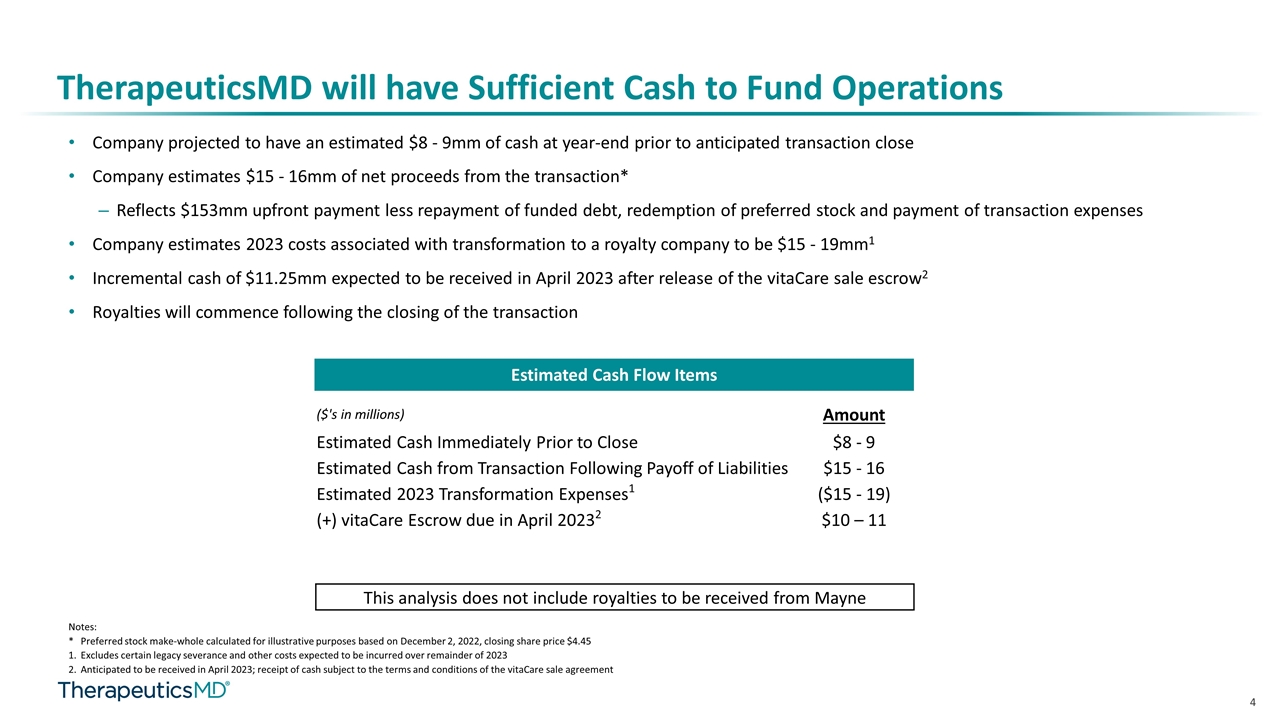

TherapeuticsMD will have Sufficient Cash to Fund Operations Company projected to have an estimated $8 - 9mm of cash at year-end prior to anticipated transaction close Company estimates $15 - 16mm of net proceeds from the transaction* Reflects $153mm upfront payment less repayment of funded debt, redemption of preferred stock and payment of transaction expenses Company estimates 2023 costs associated with transformation to a royalty company to be $15 - 19mm1 Incremental cash of $11.25mm expected to be received in April 2023 after release of the vitaCare sale escrow2 Royalties will commence following the closing of the transaction Estimated Cash Flow Items Notes: * Preferred stock make-whole calculated for illustrative purposes based on December 2, 2022, closing share price $4.45 Excludes certain legacy severance and other costs expected to be incurred over remainder of 2023 Anticipated to be received in April 2023; receipt of cash subject to the terms and conditions of the vitaCare sale agreement ($'s in millions) Amount Estimated Cash Immediately Prior to Close $8 - 9 Estimated Cash from Transaction Following Payoff of Liabilities $15 - 16 Estimated 2023 Transformation Expenses1 ($15 - 19) (+) vitaCare Escrow due in April 20232 $10 – 11 This analysis does not include royalties to be received from Mayne

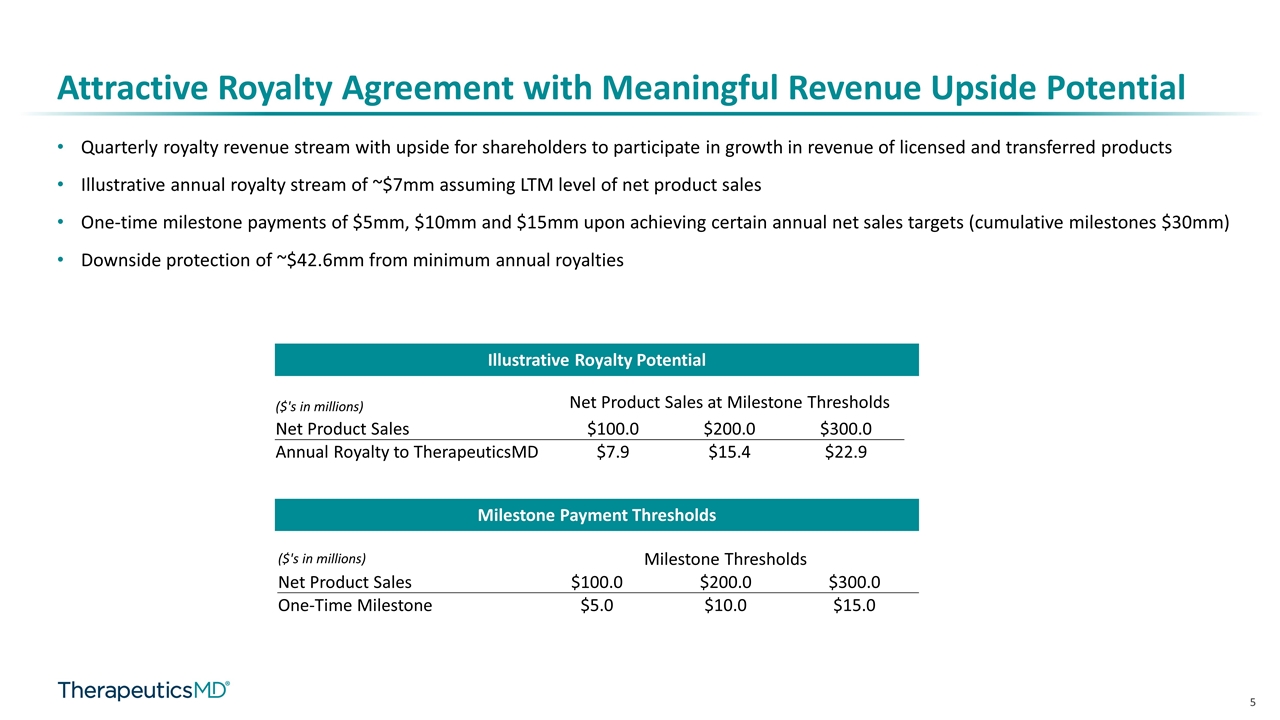

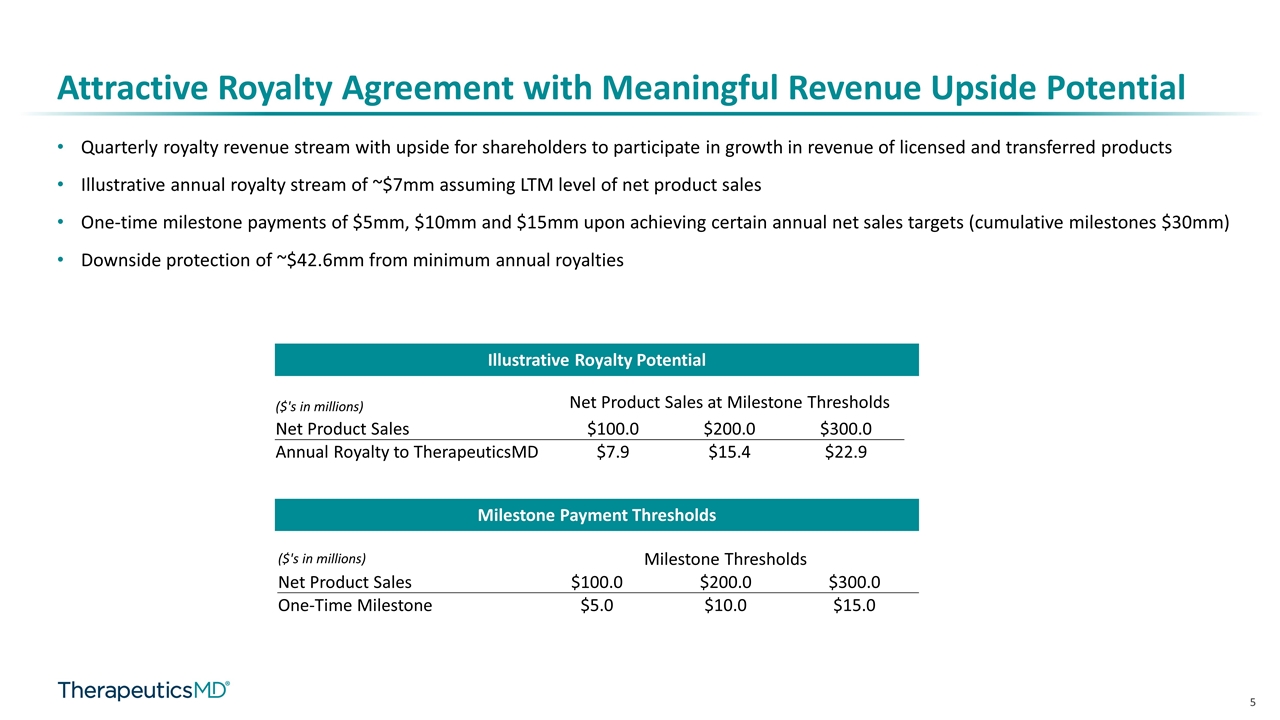

Attractive Royalty Agreement with Meaningful Revenue Upside Potential Quarterly royalty revenue stream with upside for shareholders to participate in growth in revenue of licensed and transferred products Illustrative annual royalty stream of ~$7mm assuming LTM level of net product sales One-time milestone payments of $5mm, $10mm and $15mm upon achieving certain annual net sales targets (cumulative milestones $30mm) Downside protection of ~$42.6mm from minimum annual royalties Illustrative Royalty Potential Milestone Payment Thresholds ($'s in millions) Net Product Sales at Milestone Thresholds Net Product Sales $100.0 $200.0 $300.0 Annual Royalty to TherapeuticsMD $7.9 $15.4 $22.9 ($'s in millions) Milestone Thresholds Net Product Sales $100.0 $200.0 $300.0 One-Time Milestone $5.0 $10.0 $15.0

Preliminary Pro Forma Operational Structure Committed to maximizing post-transaction value through operational efficiency Minimal headcount to support transformed business model Anticipated reduction in the number of Board of Directors No debt or preferred equity post-closing