UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-2183

Babson Capital Corporate Investors

(Exact name of registrant as specified in charter)

1500 Main Street, P.O. Box 15189, Springfield, MA 01115-5189

(Address of principal executive offices) (Zip code)

Christopher A. DeFrancis, Vice President and Secretary

1500 Main Street, Suite 2800, P.O. Box 15189, Springfield, MA 01115-5189

(Name and address of agent for service)

Registrant's telephone number, including area code: 413-226-1000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/12

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Attached hereto is the semi-annual shareholder report transmitted to shareholders pursuant to Rule 30e-1 of the Investment Company Act of 1940, as amended.

Adviser Babson Capital Management LLC 1500 Main Street, P.O. Box 15189 Springfield, Massachusetts 01115-5189 | | Transfer Agent & Registrar DST Systems, Inc. P.O. Box 219086 Kansas City, MO 64121-9086 1-800-647-7374 |

| | | |

Independent Registered Public Accounting Firm KPMG LLP Boston, Massachusetts 02110 | | Internet Website www.babsoncapital.com/mci |

| | | | Babson Capital Corporate Investors |

| Counsel to the Trust | | c/o Babson Capital Management LLC |

| | | 1500 Main Street, Suite 2200 |

| Ropes & Gray LLP | | Springfield, Massachusetts 01115 |

| Boston, Massachusetts 02110 | | (413) 226-1516 |

| | | |

| Custodian | | |

| | | |

| State Street Bank and Trust Company | | |

| Boston, Massachusetts 02116 | | |

| | | |

| | | |

| Investment Objective and Policy | | Form N-Q |

| | | |

Babson Capital Corporate Investors (the “Trust”) is a closed-end management investment company, first offered to the public in 1971, whose shares are traded on the New York Stock Exchange under the trading symbol “MCI”. The Trust’s share price can be found in the financial section of most newspapers under either the New York Stock Exchange listings or Closed-End Fund Listings. The Trust’s investment objective is to maintain a portfolio of securities providing a fixed yield and at the same time offering an opportunity for capital gains. The Trust’s principal investments are privately placed, below-investment grade, long-term debt obligations with equity features such as common stock, warrants, conversion rights, or other equity features and, occasionally, preferred stocks. The Trust typically purchases these investments, which are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically mezzanine debt instruments with accompanying private equity securities made to small or middle market companies. In addition, the Trust may temporarily invest, subject to certain limitations, in marketable investment grade debt securities, other marketable debt securities (including high yield securities) and marketable common stocks. Below-investment grade or high yield securities have predominantly speculative characteristics with respect to the capacity of the issuer to pay interest and repay principal. Babson Capital Management LLC (“Babson Capital”) manages the Trust on a total return basis. The Trust distributes substantially all of its net income to shareholders each year. Accordingly, the Trust pays dividends to shareholders in January, May, August, and November. The Trust pays dividends to its shareholders in cash, unless the shareholder elects to participate in the Dividend Reinvestment and Share Purchase Plan. | | The Trust files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. This information is available (i) on the SEC’s website at http://www.sec.gov; and (ii) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available upon request by calling, toll-free, 866-399-1516. Proxy Voting Policies & Procedures; Proxy Voting Record The Trustees of the Trust have delegated proxy voting responsibilities relating to the voting of securities held by the Trust to Babson Capital. A description of Babson Capitals proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 866-399-1516; (2) on the Trusts website: http://www.babsoncapital.com/mci; and (3) on the SECs website at http://www.sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (1) on the Trusts website: http://www.babsoncapital.com/mci; and (2) on the SECs website at http://www.sec.gov. |

| |

| |

| |

| |

| | | |

Babson Capital Corporate Investors

TO OUR SHAREHOLDERS

July 31, 2012

We are pleased to present the June 30, 2012 Quarterly Report of Babson Capital Corporate Investors (the “Trust”).

The Board of Trustees declared a quarterly dividend of 30 cents per share, payable on August 10, 2012 to shareholders of record on July 30, 2012. The Trust paid a 30 cent per share dividend for the preceding quarter. The Trust earned 31 cents per share of net investment income for the second quarter of 2012, compared to 32 cents per share in the previous quarter.

During the second quarter, the net assets of the Trust increased to $250,797,661 or $13.08 per share compared to $247,683,642 or $12.95 per share on March 31, 2012. This translates into a 3.3% total return for the quarter, based on the change in the Trust’s net assets assuming the reinvestment of all dividends. Longer term, the Trust returned 9.4%, 15.1%, 8.3%, 12.8%, and 12.9% for the 1-, 3-, 5-, 10-, and 25-year time periods, respectively, based on the change in the Trust’s net assets assuming the reinvestment of all dividends.

The Trust’s share price decreased 7.7% during the quarter, from $16.61 per share as of March 31, 2012 to $15.33 per share as of June 30, 2012. The Trust’s market price of $15.33 per share equates to a 17.2% premium over the June 30, 2012 net asset value per share of $13.08. The Trust’s average quarter-end premium for the 3, 5 and 10-year periods was 18.9%, 12.1% and 11.4%, respectively. U.S. equity markets, as approximated by the Russell 2000 Index, decreased 3.5% for the quarter. U.S. fixed income markets, as approximated by the Barclays Capital U.S. Corporate High Yield Index, increased 1.8% for the quarter.

The Trust closed two new private placement investments during the second quarter. The two new investments were in Baby Jogger Holdings LLC and DPL Holding Corporation. A brief description of these investments can be found in the Consolidated Schedule of Investments. The total amount invested by the Trust in these two transactions was $5,915,491.

U.S. middle market buyout activity continued at a sluggish pace during the second quarter of 2012. While there is a shortage of quality deal flow, there is plenty of equity capital and senior and mezzanine debt looking to be invested. The result is that attractive companies are being aggressively pursued by buyers and lenders alike, pushing both purchase price multiples and leverage levels up. As we head into the third quarter of 2012, most market participants expect deal flow to improve over the remainder of the year, due to the abundant supply of debt and equity capital, and the proposed changes in capital-gains tax rates due to be enacted in 2013. Our deal flow did pick up late in the second quarter and has remained strong early in the third quarter. We have a number of deals under review and anticipate that our new investment activity in the third and fourth quarters will increase from the second quarter. We continue to be cautious, though, in light of the more aggressive leverage multiples and mezzanine pricing we are seeing in the market. We intend to maintain the same discipline and investment philosophy, based on taking prudent levels of risk and getting paid appropriately for the risks taken, that has served us well for so many years.

We continue to be pleased with the operating performance of most of our portfolio companies. Realization activity for the Trust also remains strong. We had two companies sold for nice gains in the second quarter, OakRiver Technology, Inc. and Xaloy Superior Holdings, Inc. The Xaloy realization is particularly noteworthy. Due to the company’s weak performance, at year-end 2009 we valued our subordinated notes at 50% of par, and our equity investment at zero. Due to the efforts of the private equity sponsor and Xaloy’s management team, and a recovery in the economy, the company’s performance improved dramatically. When the company was sold in June, our

(Continued)

subordinated notes were repaid in full and we received over three times the cost of our equity investment. We have a healthy backlog of companies in the process of being sold and we expect 2012 to be a good year for realizations. Refinancing activities, in which the Trust’s subordinated note holdings are fully or partially prepaid, continues at a high level, as companies seek to take advantage of lower interest rates and credit availability. We had four full prepayments and one partial prepayment during the second quarter. As mentioned in prior reports, strong realization and refinancing activity is a double-edged sword, as the resulting loss of income-producing investments could adversely impact the Trust’s ability to sustain its dividend level. We have been fortunate that our new investment activity in recent periods has been strong and has had a positive impact on net investment income. We will need to maintain a robust level of new investment activity in the face of expected high levels of realization and refinancing activity.

Thank you for your continued interest in and support of Babson Capital Corporate Investors.

| Sincerely, |

| | |

| |

| Michael L. Klofas | |

| President | |

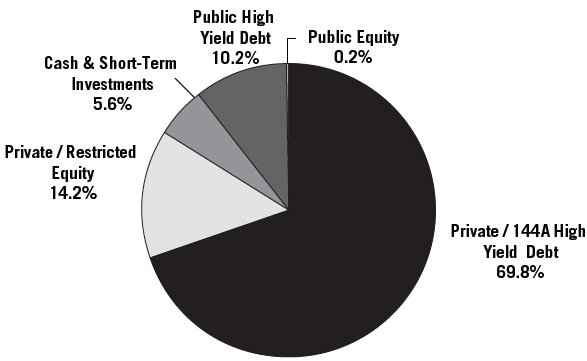

Portfolio Composition as of 6/30/2012 *

* Based on market value of total investments (including cash)

Cautionary Notice: Certain statements contained in this report may be “forward looking” statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management’s current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results to differ materially. These statements are subject to change at any time based upon economic, market or other conditions and may not be relied upon as investment advice or an indication of the Trust’s trading intent. References to specific securities are not recommendations of such securities, and may not be representative of the Trust’s current or future investments. We undertake no obligation to publicly update forward looking statements, whether as a result of new information, future events, or otherwise.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES | | Babson Capital Corporate Investors |

| Assets: | | | |

| Investments | | | |

| (See Consolidated Schedule of Investments) | | | |

| Corporate restricted securities at fair value | | | |

| (Cost - $248,392,925) | | $ | 227,018,432 | |

| Corporate restricted securities at market value | | | | |

| (Cost - $12,542,193) | | | 12,780,885 | |

| Corporate public securities at market value | | | | |

| (Cost - $28,734,878) | | | 29,438,882 | |

| Short-term securities at amortized cost | | | 7,499,700 | |

| Total investments (Cost - $297,169,696) | | | 276,737,899 | |

| Cash | | | 8,301,055 | |

| Interest receivable | | | 2,592,749 | |

| Recievable for investments sold | | | 710,794 | |

| Other assets | | | 69,251 | |

| | | | | |

| Total assets | | | 288,411,748 | |

| | | | | |

| Liabilities: | | | | |

| Note payable | | | 30,000,000 | |

| Payable for investments purchased | | | 5,747,620 | |

| Investment advisory fee payable | | | 783,743 | |

| Deferred tax liability | | | 668,382 | |

| Interest payable | | | 202,400 | |

| Accrued expenses | | | 211,942 | |

| | | | | |

| Total liabilities | | | 37,614,087 | |

| | | | | |

| Total net assets | | $ | 250,797,661 | |

| | | | | |

| Net Assets: | | | | |

| Common shares, par value $1.00 per share | | $ | 19,167,534 | |

| Additional paid-in capital | | | 109,652,451 | |

| Retained net realized gain on investments, prior years | | | 127,807,139 | |

| Undistributed net investment income | | | 9,100,500 | |

| Accumulated net realized gain on investments | | | 6,170,216 | |

| Net unrealized depreciation of investments | | | (21,100,179 | ) |

| | | | | |

| Total net assets | | $ | 250,797,661 | |

| | | | | |

| Common shares issued and outstanding (23,761,068 authorized) | | | 19,167,534 | |

| | | | | |

| Net asset value per share | | $ | 13.08 | |

See Notes to Consolidated Financial Statements

CONSOLIDATED STATEMENT OF OPERATIONSFor the six months ended June 30, 2012 (Unaudited) |

| Investment Income: | | | |

| Interest | | $ | 13,952,255 | |

| Dividends | | | 660,835 | |

| Other | | | 177,137 | |

| | | | | |

| Total investment income | | | 14,790,227 | |

| | | | | |

| Expenses: | | | | |

| Investment advisory fees | | | 1,557,754 | |

| Interest | | | 792,295 | |

| Trustees’ fees and expenses | | | 240,000 | |

| Professional fees | | | 133,271 | |

| Reports to shareholders | | | 54,000 | |

| Custodian fees | | | 16,800 | |

| Other | | | 29,078 | |

| | | | | |

| Total expenses | | | 2,823,198 | |

| | | | | |

| Investment income - net | | | 11,967,029 | |

| | | | | |

| Net realized and unrealized gain/loss on investments: | | | | |

| Net realized gain on investments before taxes | | | 4,151,945 | |

| Income tax expense | | | (175 | ) |

| Net realized gain on investments after taxes | | | 4,151,770 | |

| Net change in unrealized depreciation of investments before taxes | | | (3,380,662 | ) |

| Net change in deferred income tax expense | | | 325,353 | |

| Net change in unrealized depreciation of investments after taxes | | | (3,055,309 | ) |

| | | | | |

| Net gain on investments | | | 1,096,461 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 13,063,490 | |

See Notes to Consolidated Financial Statements

CONSOLIDATED STATEMENT OF CASH FLOWS For the six months ended June 30, 2012 (Unaudited) | | Babson Capital Corporate Investors |

| Net increase in cash: | | | |

| Cash flows from operating activities: | | | |

| Purchases/Proceeds/Maturities from short-term portfolio securities, net | | $ | (3,224,924 | ) |

| Purchases of portfolio securities | | | (32,948,022 | ) |

| Proceeds from disposition of portfolio securities | | | 41,604,207 | |

| Interest, dividends and other income received | | | 11,664,121 | |

| Interest expense paid | | | (792,000 | ) |

| Operating expenses paid | | | (2,012,029 | ) |

| Income taxes paid | | | (175 | ) |

| | | | | |

| Net cash provided by operating activities | | | 14,291,178 | |

| | | | | |

| Cash flows from financing activities: | | | | |

| Cash dividends paid from net investment income | | | (14,319,136 | ) |

| Receipts for shares issued on reinvestment of dividends | | | 1,528,178 | |

| | | | | |

| Net cash used for financing activities | | | (12,790,958 | ) |

| | | | | |

| Net increase in cash | | | 1,500,220 | |

| Cash - beginning of year | | | 6,800,835 | |

| | | | | |

| Cash - end of period | | $ | 8,301,055 | |

| | | | | |

Reconciliation of net increase in net assets to net cash provided by operating activities: | | | | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 13,063,490 | |

| Increase in investments | | | (3,689,683 | ) |

| Decrease in interest receivable | | | 81,087 | |

| Increase in receivable for investments sold | | | (710,794 | ) |

| Decrease in other assets | | | 105,642 | |

| Increase in payable for investments purchased | | | 5,747,620 | |

| Increase in investment advisory fee payable | | | 27,669 | |

| Decrease in deferred tax liability | | | (325,353 | ) |

| Increase in interest payable | | | 295 | |

| Decrease in accrued expenses | | | (8,795 | ) |

| Total adjustments to net assets from operations | | | 1,227,688 | |

| | | | | |

| Net cash provided by operating activities | | $ | 14,291,178 | |

See Notes to Consolidated Financial Statements

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

| | | For the six | | | | |

| | | months ended | | | For the | |

| | | 06/30/2012 | | | year ended | |

| | | (Unaudited) | | | 12/31/2011 | |

| Increase in net assets: | | | | | | |

| | | | | | | |

| Operations: | | | | | | |

| Investment income - net | | $ | 11,967,029 | | | $ | 24,417,226 | |

| Net realized gain on investments after taxes | | | 4,151,770 | | | | 848,378 | |

| Net change in unrealized depreciation of investments after taxes | | | (3,055,309 | ) | | | 2,341,410 | |

| Net increase in net assets resulting from operations | | | 13,063,490 | | | | 27,607,014 | |

| | | | | | | | | |

| Increase from common shares issued on reinvestment of dividends | | | | | | | | |

| Common shares issued (2012 - 97,324; 2011 - 156,934) | | | 1,528,178 | | | | 2,426,607 | |

| | | | | | | | | |

| Dividends to shareholders from: | | | | | | | | |

| Net investment income (2012 - $0.30 per share; 2011 - $1.34 per share) | | | (5,737,541 | ) | | | (25,488,812 | ) |

| Net realized gains (2012 - $0.00; 2011 - $0.01 per share) | | | - | | | | (186,150 | ) |

| Total increase in net assets | | | 8,854,127 | | | | 4,358,659 | |

| | | | | | | | | |

| Net assets, beginning of year | | | 241,943,534 | | | | 237,584,875 | |

| | | | | | | | | |

Net assets, end of period/year (including undistributed net investment income of $9,100,500 and $2,871,012, respectively) | | $ | 250,797,661 | | | $ | 241,943,534 | |

See Notes to Consolidated Financial Statements

CONSOLIDATED SELECTED FINANCIAL HIGHLIGHTS Selected data for each share of beneficial interest outstanding: | | Babson Capital Corporate Investors |

| | | For the six months | | | | | | | | | | | | | | | | |

| | | ended 06/30/2012 | | | | | | For the years ended December 31, | | | | |

| | | (Unaudited)(a) | | | 2011(a) | | | 2010(a) | | | 2009(a) | | | 2008(a) | | | 2007(a) | |

| Net asset value: | | | | | | | | | | | | | | | | | | |

| Beginning of year | | $ | 12.69 | | | $ | 12.56 | | | $ | 11.45 | | | $ | 11.17 | | | $ | 13.60 | | | $ | 13.76 | |

| Net investment income (b) | | | 0.63 | | | | 1.29 | | | | 1.13 | | | | 1.03 | | | | 1.16 | | | | 1.28 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.06 | | | | 0.17 | | | | 1.06 | | | | 0.33 | | | | (2.51 | ) | | | (0.17 | ) |

| Total from investment operations | | | 0.69 | | | | 1.46 | | | | 2.19 | | | | 1.36 | | | | (1.35 | ) | | | 1.11 | |

| Dividends from net investment | | | | | | | | | | | | | | | | | | | | | | | | |

| income to common shareholders | | | (0.30 | ) | | | (1.34 | ) | | | (1.08 | ) | | | (1.08 | ) | | | (1.08 | ) | | | (1.29 | ) |

| Dividends from net investment | | | | | | | | | | | | | | | | | | | | | | | | |

| income to common shareholders | | | - | | | | (0.01 | ) | | | - | | | | - | | | | - | | | | - | |

| Increase from dividends reinvested | | | 0.00 | (c) | | | 0.02 | | | | 0.00 | (c) | | | 0.00 | (c) | | | 0.00 | (c) | | | 0.02 | |

| Total dividends | | | (0.30 | ) | | | (1.33 | ) | | | (1.08 | ) | | | (1.08 | ) | | | (1.08 | ) | | | (1.27 | ) |

| Net asset value: End of period/year | | $ | 13.08 | | | $ | 12.69 | | | $ | 12.56 | | | $ | 11.45 | | | $ | 11.17 | | | $ | 13.60 | |

| Per share market value: | | | | | | | | | | | | | | | | | | | | | | | | |

| End of period/year | | $ | 15.33 | | | $ | 17.99 | | | $ | 15.28 | | | $ | 12.55 | | | $ | 9.63 | | | $ | 15.10 | |

| Total investment return | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value (d) | | | 5.46 | % | | | 12.00 | % | | | 19.81 | % | | | 12.64 | % | | | (10.34 | %) | | | 8.72 | % |

| Market value (d) | | | (12.98 | %) | | | 27.92 | % | | | 31.73 | % | | | 39.89 | % | | | (30.44 | %) | | | (8.78 | %) |

| Net assets (in millions): | | | | | | | | | | | | | | | | | | | | | | | | |

| End of period/year | | $ | 250.80 | | | $ | 241.94 | | | $ | 237.58 | | | $ | 214.44 | | | $ | 208.14 | | | $ | 251.16 | |

| Ratio of operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.65 | %(f) | | | 1.62 | % | | | 1.60 | % | | | 1.58 | % | | | 1.49 | % | | | 1.55 | % |

| Ratio of interest expense | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 0.64 | %(f) | | | 0.64 | % | | | 0.70 | % | | | 0.75 | % | | | 0.67 | % | | | 0.59 | % |

| Ratio of income tax expense | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets (e) | | | 0.00 | %(f) | | | 0.16 | % | | | 0.27 | % | | | 0.00 | % | | | 0.00 | % | | | 0.35 | % |

| Ratio of total expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.29 | %(f) | | | 2.42 | % | | | 2.57 | % | | | 2.33 | % | | | 2.16 | % | | | 2.49 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 9.74 | %(f) | | | 9.91 | % | | | 9.46 | % | | | 9.06 | % | | | 9.01 | % | | | 9.17 | % |

| Portfolio turnover | | | 15 | % | | | 21 | % | | | 39 | % | | | 23 | % | | | 32 | % | | | 35 | % |

| (a) | Per share amounts were adjusted to reflect a 2:1 stock split effective February 18, 2011. |

| (b) | Calculated using average shares. |

| (c) | Rounds to less than $0.01 per share. |

| (d) | Net asset value return represents portfolio returns based on change in the Trust’s net asset value assuming the reinvestment of all dividends and distributions which differs from the total investment return based on the Trust’s market value due to the difference between the Trust’s net asset value and the market value of its shares outstanding; past performance is no guarantee of future results. |

| (e) | As additional information, this ratio is included to reflect the taxes paid on retained long-term gains. These taxes paid are netted against realized capital gains in the Statement of Operations. The taxes paid are treated as deemed distributions and a credit for the taxes paid is passed on to shareholders. |

| Senior borrowings: | | | | | | | | | | | | | | | | | | |

| Total principal amount (in millions) | | $ | 30 | | | $ | 30 | | | $ | 30 | | | $ | 30 | | | $ | 30 | | | $ | 30 | |

| Asset coverage per $1,000 | | | | | | | | | | | | | | | | | | | | | | | | |

| of indebtedness | | $ | 9,360 | | | $ | 9,065 | | | $ | 8,919 | | | $ | 8,148 | | | $ | 7,938 | | | $ | 9,372 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

See Notes to Consolidated Financial Statements

CONSOLIDATED SCHEDULE OF INVESTMENTS | |

| June 30, 2012 | |

| (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities - 95.61%: (A) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Private Placement Investments - 90.52% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| A E Company, Inc. | | | | | | | | | | | | |

| A designer and manufacturer of machined parts and assembly structures for the commercial and military aerospace industries. | | |

| Common Stock (B) | | 323,077 shs. | | | 11/10/09 | | | $ | 323,077 | | | $ | 229,402 | |

| Warrant, exercisable until 2019, to purchase | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 161,538 shs. | | | 11/10/09 | | | | 119,991 | | | | 114,701 | |

| | | | | | | | | | 443,068 | | | | 344,103 | |

| A H C Holding Company, Inc. | | | | | | | | | | | | | | |

| A designer and manufacturer of boilers and water heaters for the commercial sector. | | |

| 15% Senior Subordinated Note due 2015 | | $ | 2,673,890 | | | 11/21/07 | | | | 2,644,497 | | | | 2,673,890 | |

| Limited Partnership Interest (B) | | 23.16% int. | | | 11/21/07 | | | | 224,795 | | | | 288,739 | |

| | | | | | | | | | | 2,869,292 | | | | 2,962,629 | |

| A S A P Industries LLC | | | | | | | | | | | | | | | |

| A designer and manufacturer of components used on oil and natural gas wells. | | |

| Limited Liability Company Unit Class A-2 (B) | | 1,276 uts. | | | 12/31/08 | | | | 140,406 | | | | 577,892 | |

| Limited Liability Company Unit Class A-3 (B) | | 1,149 uts. | | | 12/31/08 | | | | 126,365 | | | | 520,103 | |

| | | | | | | | | | | 266,771 | | | | 1,097,995 | |

| A S C Group, Inc. | | | | | | | | | | | | | | | |

A designer and manufacturer of high reliability encryption equipment, communications products, computing systems and electronic components primarily for the military and aerospace sectors.

| 12.75% Senior Subordinated Note due 2016 | | $ | 2,318,182 | | | 10/09/09 | | | | 2,075,126 | | | | 2,341,364 | |

| Limited Liability Company Unit Class A (B) | | 4,128 uts. | | | * | | | | 405,691 | | | | 446,909 | |

| Limited Liability Company Unit Class B (B) | | 2,782 uts. | | | 10/09/09 | | | | 273,352 | | | | 301,187 | |

| * 10/09/09 and 10/27/10. | | | | | | | | | | 2,754,169 | | | | 3,089,460 | |

A W X Holdings Corporation

A provider of aerial equipment rental, sales and repair services to non-residential construction and maintenance contractors operating in the State of Indiana.

| 10.5% Senior Secured Term Note due 2014 (D) | | $ | 735,000 | | | 05/15/08 | | | | 724,402 | | | | 661,500 | |

| 13% Senior Subordinated Note due 2015 (D) | | $ | 735,000 | | | 05/15/08 | | | | 673,096 | | | | - | |

| Common Stock (B) | | 105,000 shs. | | | 05/15/08 | | | | 105,000 | | | | - | |

| Warrant, exercisable until 2015, to purchase | | | | | | | | | | | | | | |

common stock at $.01 per share (B) | | 36,923 shs. | | | 05/15/08 | | | | 62,395 | | | | - | |

| | | | | | | | | | | 1,564,893 | | | | 661,500 | |

| Advanced Technologies Holdings | | | | | | | | | | | | | | | |

| A provider of factory maintenance services to industrial companies. | | | | | | | | | | | | | | | |

| Preferred Stock Series A (B) | | 1,031 shs. | | | 12/27/07 | | | | 510,000 | | | | 1,188,985 | |

| Convertible Preferred Stock Series B (B) | | 52 shs. | | | 01/04/11 | | | | 40,800 | | | | 60,557 | |

| | | | | | | | | | | 550,800 | | | | 1,249,542 | |

8

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) June 30, 2012 (Unaudited) | Babson Capital Corporate Investors |

| | | Principal Amount,Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Aero Holdings, Inc. | | | | | | | | | | | | |

| A provider of geospatial services to corporate and government clients. | | | | | | | | | | |

| 10.5% Senior Secured Term Note due 2014 | | $ | 813,750 | | | 03/09/07 | | | $ | 809,928 | | | $ | 813,750 | |

| 14% Senior Subordinated Note due 2015 | | $ | 1,260,000 | | | 03/09/07 | | | | 1,193,646 | | | | 1,260,000 | |

| Common Stock (B) | 262,500 shs. | | | 03/09/07 | | | | 262,500 | | | | 656,392 | |

| Warrant, exercisable until 2015, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 66,116 shs. | | | 03/09/07 | | | | 111,527 | | | | 165,326 | |

| | | | | | | | | | | 2,377,601 | | | | 2,895,468 | |

| All Current Holding Company | | | | | | | | | | | | | | | |

| A specialty re-seller of essential electrical parts and components primarily serving wholesale distributors. | | |

| 12% Senior Subordinated Note due 2015 | | $ | 1,140,317 | | | 09/26/08 | | | | 1,079,146 | | | | 1,140,317 | |

| Common Stock (B) | | 1,347 shs. | | | 09/26/08 | | | | 134,683 | | | | 157,392 | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 958 shs. | | | 09/26/08 | | | | 87,993 | | | | 111,938 | |

| | | | | | | | | | | 1,301,822 | | | | 1,409,647 | |

| American Hospice Management Holding LLC | | | | | | | | | | |

| A for-profit hospice care provider in the United States. | | | | | | | | | | | | | | | |

| 12% Senior Subordinated Note due 2013 | | $ | 3,187,495 | | | * | | | | 3,137,898 | | | | 3,187,495 | |

| Preferred Class A Unit (B) | | 3,223 uts. | | | ** | | | | 322,300 | | | | 622,367 | |

| Preferred Class B Unit (B) | | 1,526 uts. | | | 06/09/08 | | | | 152,626 | | | | 279,355 | |

| Common Class B Unit (B) | | 30,420 uts. | | | 01/22/04 | | | | 1 | | | | - | |

| Common Class D Unit (B) | | 6,980 uts. | | | 09/12/06 | | | | 1 | | | | - | |

| * 01/22/04 and 06/09/08. | | | | | | | | | | 3,612,826 | | | | 4,089,217 | |

| ** 01/22/04 and 09/12/06. | | | | | | | | | | | | | | | |

Apex Analytix Holding Corporation

A provider of audit recovery and fraud detection services and software to commercial and retail businesses in the U.S. and Europe.

| 12.5% Senior Subordinated Note due 2017 | | $ | 1,912,500 | | | 04/28/09 | | | | 1,728,489 | | | | 1,912,500 | |

| Preferred Stock Series B (B) | | 3,065 shs. | | | 04/28/09 | | | | 306,507 | | | | 223,974 | |

| Common Stock (B) | | 1,366 shs. | | | 04/28/09 | | | | 1,366 | | | | 99,823 | |

| | | | | | | | | | | 2,036,362 | | | | 2,236,297 | |

| Arch Global Precision LLC | | | | | | | | | | | | | | | |

| A leading manufacturer of high tolerance precision components and consumable tools. | | | | | | | | | | | | |

| 14.75% Senior Subordinated Note due 2018 | | $ | 2,282,601 | | | 12/21/11 | | | | 2,225,791 | | | | 2,357,888 | |

| Limited Liability Company Unit Class B (B) | | 85 uts. | | | 12/21/11 | | | | 85,250 | | | | 70,264 | |

| Limited Liability Company Unit Class C (B) | | 665 uts. | | | 12/21/11 | | | | 664,750 | | | | 547,891 | |

| | | | | | | | | | | 2,975,791 | | | | 2,976,043 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | |

| June 30, 2012 | |

| (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Arrow Tru-Line Holdings, Inc. | | | | | | | | | | | | |

| A manufacturer of hardware for residential and commercial overhead garage doors in North America. | | | | | | | |

| 8% Senior Subordinated Note due 2014 (D) | | $ | 1,990,935 | | | 05/18/05 | | | $ | 1,823,261 | | | $ | 1,692,295 | |

| Preferred Stock (B) | | 63 shs. | | | 10/16/09 | | | | 62,756 | | | | - | |

| Common Stock (B) | | 497 shs. | | | 05/18/05 | | | | 497,340 | | | | - | |

| Warrant, exercisable until 2014, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 130 shs. | | | 05/18/05 | | | | 112,128 | | | | - | |

| | | | | | | | | | | 2,495,485 | | | | 1,692,295 | |

| Associated Diversified Services | | | | | | | | | | | | | | | |

A provider of routine maintenance and repair services primarily to electric utility companies predominantly on electric power distribution lines. | |

| 10% Senior Secured Term Note due 2016 (C) | | $ | 750,857 | | | 09/30/10 | | | | 736,420 | | | | 756,061 | |

| 13% Senior Subordinated Note due 2017 | | $ | 853,714 | | | 09/30/10 | | | | 776,412 | | | | 862,251 | |

| Limited Liability Company Unit Class B (B) | | 92,571 uts. | | | 09/30/10 | | | | 92,571 | | | | 128,300 | |

| Limited Liability Company Unit Class B (B) | | 70,765 uts. | | | 09/30/10 | | | | 70,765 | | | | 98,078 | |

| | | | | | | | | | | 1,676,168 | | | | 1,844,690 | |

| Baby Jogger Holdings LLC | | | | | | | | | | | | | | | |

| A designer and marketer of premium baby strollers and stroller accessories. | | | | | | | | | | | | |

| 14% Senior Subordinated Note due 2019 | | $ | 2,784,655 | | | 04/20/12 | | | | 2,730,140 | | | | 2,793,140 | |

| Common Stock (B) | | 2,261 shs. | | | 04/20/12 | | | | 226,132 | | | | 214,825 | |

| | | | | | | | | | | 2,956,272 | | | | 3,007,965 | |

| Barcodes Group, Inc. | | | | | | | | | | | | | | | |

A distributor and reseller of automatic identification and data capture equipment, including mobile computers, scanners, point-of-sale systems, labels, and accessories.

| 13.5% Senior Subordinated Note due 2016 | | $ | 1,950,221 | | | 07/27/10 | | | | 1,876,690 | | | | 1,989,225 | |

| Preferred Stock (B) | | 39 shs. | | | 07/27/10 | | | | 394,487 | | | | 394,500 | |

| Common Stock Class A (B) | | 131 shs. | | | 07/27/10 | | | | 1,310 | | | | 225,649 | |

| Warrant, exercisable until 2020, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 23 shs. | | | 07/27/10 | | | | 227 | | | | 39,135 | |

| | | | | | | | | | | 2,272,714 | | | | 2,648,509 | |

| Bravo Sports Holding Corporation | | | | | | | | | | | | | | | |

A designer and marketer of niche branded consumer products including canopies, trampolines, in-line skates, skateboards, and urethane wheels. | |

| 12.5% Senior Subordinated Note due 2014 | | $ | 2,281,593 | | | 06/30/06 | | | | 2,232,317 | | | | 570,398 | |

| Preferred Stock Class A (B) | | 879 shs. | | | 06/30/06 | | | | 268,121 | | | | - | |

| Common Stock (B) | | 1 sh. | | | 06/30/06 | | | | 286 | | | | - | |

| Warrant, exercisable until 2014, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 309 shs. | | | 06/30/06 | | | | 92,102 | | | | - | |

| | | | | | | | | | | 2,592,826 | | | | 570,398 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) June 30, 2012 (Unaudited) | Babson Capital Corporate Investors |

Corporate Restricted Securities: (A) (Continued) | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| C D N T, Inc. | | | | | | | | | | | | |

| A value-added converter and distributor of specialty pressure sensitive adhesives, foams, films, and foils. | | |

| 10.5% Senior Secured Term Note due 2014 | | $ | 375,436 | | | 08/07/08 | | | $ | 372,272 | | | $ | 375,436 | |

| 12.5% Senior Subordinated Note due 2015 | | $ | 750,872 | | | 08/07/08 | | | | 709,797 | | | | 750,872 | |

| Common Stock (B) | | 73,256 shs. | | | 08/07/08 | | | | 73,256 | | | | 65,079 | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 57,600 shs. | | | 08/07/08 | | | | 57,689 | | | | 51,170 | |

| | | | | | | | | | | 1,213,014 | | | | 1,242,557 | |

| Capital Specialty Plastics, Inc. | | | | | | | | | | | | | | | |

| A producer of desiccant strips used for packaging pharmaceutical products. | | | | | | | | | | | | |

| Common Stock (B) | | 109 shs. | | | * | | | | 503 | | | | 879,134 | |

| *12/30/97 and 05/29/99. | | | | | | | | | | | | | | | |

CHG Alternative Education Holding Company

A leading provider of publicly-funded, for profit pre-K-12 education services targeting special needs children at therapeutic day schools and “at risk” youth through alternative education programs.

| 13.5% Senior Subordinated Note due 2018 | | $ | 2,184,958 | | | 01/19/11 | | | | 2,072,514 | | | | 2,215,633 | |

| Common Stock (B) | | 1,125 shs. | | | 01/19/11 | | | | 112,500 | | | | 97,288 | |

| Warrant, exercisable until 2021, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 884 shs. | | | 01/19/11 | | | | 87,750 | | | | 76,474 | |

| | | | | | | | | | | 2,272,764 | | | | 2,389,395 | |

| Church Services Holding Company | | | | | | | | | | | | | | | |

| A provider of diversified residential services to homeowners in the Houston, Dallas, and Austin markets. | | |

| 14.5% Senior Subordinated Note due 2018 | | $ | 1,206,267 | | | 03/26/12 | | | | 1,166,245 | | | | 1,216,547 | |

| Common Stock (B) | | 3,981 shs. | | | * | | | | 398,100 | | | | 318,163 | |

| Warrant, exercisable until 2022, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 172 shs. | | | 03/26/12 | | | | 17,220 | | | | 13,746 | |

| *03/26/12, 5/25/12 and 06/19/12. | | | | | | | | | | 1,581,565 | | | | 1,548,456 | |

| | | | | | | | | | | | | | | | |

| Clough, Harbour and Associates | | | | | | | | | | | | | | | |

| An engineering service firm that is located in Albany, NY. | | | | | | | | | | | | | | | |

| Preferred Stock (B) | | 277 shs. | | | 12/02/08 | | | | 276,900 | | | | 443,703 | |

| | | | | | | | | | | | | | | | |

| Coeur, Inc. | | | | | | | | | | | | | | | |

| A producer of proprietary, disposable power injection syringes. | | | | | | | | | | | | | | | |

| 12% Senior Subordinated Note due 2016 | | $ | 1,214,286 | | | 10/10/08 | | | | 1,137,464 | | | | 1,214,286 | |

| Common Stock (B) | | 607 shs. | | | 10/10/08 | | | | 60,714 | | | | 84,772 | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 934 shs. | | | 10/10/08 | | | | 91,071 | | | | 130,420 | |

| | | | | | | | | | | 1,289,249 | | | | 1,429,478 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | |

| June 30, 2012 | |

| (Unaudited) | |

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount, Shares, Units or Ownership Percentage | | | | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| Connecticut Electric, Inc. | | | | | | | | | | | | |

| A supplier and distributor of electrical products sold into the retail and wholesale markets. | | | | | |

| 10% Senior Subordinated Note due 2014 (D) | | $ | 1,456,429 | | | 01/12/07 | | | $ | 1,358,675 | | | $ | 1,310,786 | |

| Limited Liability Company Unit Class A (B) | | 156,046 uts. | | | 01/12/07 | | | | 156,046 | | | | 21,647 | |

| Limited Liability Company Unit Class C (B) | | 112,873 uts. | | | 01/12/07 | | | | 112,873 | | | | 15,658 | |

| Limited Liability Company Unit Class D (B) | | 1,268,437 uts. | | | 05/03/10 | | | | - | | | | 175,963 | |

| Limited Liability Company Unit Class E (B) | | 2,081 uts. | | | 05/03/10 | | | | - | | | | 289 | |

| | | | | | | | | | | 1,627,594 | | | | 1,524,343 | |

| Connor Sport Court International, Inc. | | | | | | | | | | | | | | | |

| A designer and manufacturer of outdoor and indoor synthetic sports flooring and other temporary flooring products. | | | | | |

| Preferred Stock Series B-2 (B) | | 17,152 shs. | | | 07/05/07 | | | | 700,392 | | | | 1,715,247 | |

| Preferred Stock Series C (B) | | 8,986 shs. | | | 07/05/07 | | | | 300,168 | | | | 898,560 | |

| Common Stock (B) | | 718 shs. | | | 07/05/07 | | | | 7 | | | | 56 | |

| Limited Partnership Interest (B) | | 12.64% int. | | | * | | | | 189,586 | | | | - | |

| *08/12/04 and 01/14/05. | | | | | | | | | | 1,190,153 | | | | 2,613,863 | |

| | | | | | | | | | | | | | | | |

| CorePharma LLC | | | | | | | | | | | | | | | |

| A manufacturer of oral dose generic pharmaceuticals targeted at niche applications. | | | | | | | | | | | | |

| Warrant, exercisable until 2013, to purchase | | | | | | | | | | | | | | | |

| common stock at $.001 per share (B) | | 20 shs. | | | 08/04/05 | | | | 137,166 | | | | 815,919 | |

| | | | | | | | | | | | | | | |

| Crane Rental Corporation | | | | | | | | | | | | | | | |

| A crane rental company since 1960, headquartered in Florida. | | | | | | | | | | | | | | | |

| 13% Senior Subordinated Note due 2015 | | $ | 2,295,000 | | | 08/21/08 | | | | 2,155,682 | | | | 2,232,710 | |

| Common Stock (B) | | 255,000 shs. | | | 08/21/08 | | | | 255,000 | | | | - | |

| Warrant, exercisable until 2016, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 136,070 shs. | | | 08/21/08 | | | | 194,826 | | | | - | |

| | | | | | | | | | | 2,605,508 | | | | 2,232,710 | |

Custom Engineered Wheels, Inc.

A manufacturer of custom engineered, non-pneumatic plastic wheels and plastic tread cap tires used primarily for lawn and garden products and wheelchairs.

| 12.5% Senior Subordinated Note due 2016 | | $ | 2,182,212 | | | 10/27/09 | | | | 1,969,223 | | | | 2,178,611 | |

| Preferred Stock PIK (B) | | 296 shs. | | | 10/27/09 | | | | 295,550 | | | | 91,590 | |

| Preferred Stock Series A (B) | | 216 shs. | | | 10/27/09 | | | | 197,152 | | | | 66,919 | |

| Common Stock (B) | | 72 shs. | | | 10/27/09 | | | | 72,238 | | | | - | |

| Warrant, exercisable until 2016, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 53 shs. | | | 10/27/09 | | | | 48,608 | | | | - | |

| | | | | | | | | | | 2,582,771 | | | | 2,337,120 | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | Babson Capital Corporate Investors |

June 30, 2012 (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| DPC Holdings LLC | | | | | | | | | | | | |

| A provider of accounts receivable management and revenue cycle management services to customers in the healthcare, financial and utility industries. | |

| 14% Senior Subordinated Note due 2017 | | $ | 2,703,875 | | | 10/21/11 | | | $ | 2,654,802 | | | $ | 2,729,058 | |

| Limited Liability Company Unit Class A (B) | | 33,333 uts. | | | 10/21/11 | | | | 333,333 | | | | 267,187 | |

| | | | | | | | | | | 2,988,135 | | | | 2,996,245 | |

| DPL Holding Corporation | | | | | | | | | | | | | | | |

| A distributor and manufacturer of aftermarket undercarriage parts for medium and heavy duty trucks and trailers. | | |

| 14% Senior Subordinated Note due 2019 | | $ | 2,462,181 | | | 05/04/12 | | | | 2,413,763 | | | | 2,465,404 | |

| Preferred Stock (B) | | 49 shs. | | | 05/04/12 | | | | 490,910 | | | | 466,381 | |

| Common Stock (B) | | 49 shs. | | | 05/04/12 | | | | 54,546 | | | | 51,820 | |

| | | | | | | | | | | 2,959,219 | | | | 2,983,605 | |

| Duncan Systems, Inc. | | | | | | | | | | | | | | | |

| A distributor of windshields and side glass for the recreational vehicle market. | | | | | | | | | | | | |

| 10% Senior Secured Term Note due 2013 | | $ | 270,000 | | | 11/01/06 | | | | 268,996 | | | | 268,204 | |

| 13% Senior Subordinated Note due 2014 | | $ | 855,000 | | | 11/01/06 | | | | 814,682 | | | | 843,513 | |

| Common Stock (B) | 180,000 shs. | | | 11/01/06 | | | | 180,000 | | | | 11,177 | |

| Warrant, exercisable until 2014, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 56,514 shs. | | | 11/01/06 | | | | 78,160 | | | | 3,509 | |

| | | | | | | | | | | 1,341,838 | | | | 1,126,403 | |

E S P Holdco, Inc.

A manufacturer of power protection technology for commercial office equipment, primarily supplying the office equipment dealer network.

| 14% Senior Subordinated Note due 2015 | | $ | 2,427,728 | | | 01/08/08 | | | | 2,401,359 | | | | 2,427,728 | |

| Common Stock (B) | | 660 shs. | | | 01/08/08 | | | | 329,990 | | | | 385,847 | |

| | | | | | | | | | | 2,731,349 | | | | 2,813,575 | |

| E X C Acquisition Corporation | | | | | | | | | | | | | | | |

| A manufacturer of pre-filled syringes and pump systems used for intravenous drug delivery. | | | | | | | | | |

| Warrant, exercisable until 2014, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 22 shs. | | | 06/28/04 | | | | 77,208 | | | | 19,704 | |

Eatem Holding Company

A developer and manufacturer of savory flavor systems for soups, sauces, gravies, and other products produced by food manufacturers for retail and foodservice end products.

| 12.5% Senior Subordinated Note due 2018 | | $ | 2,850,000 | | | 02/01/10 | | | | 2,542,641 | | | | 2,836,443 | |

| Common Stock (B) | | 150 shs. | | | 02/01/10 | | | | 150,000 | | | | 113,375 | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 358 shs. | | | 02/01/10 | | | | 321,300 | | | | 270,325 | |

| | | | | | | | | | | 3,013,941 | | | | 3,220,143 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | |

| June 30, 2012 | |

| (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| ELT Holding Company | | | | | | | | | | | | |

| A provider of web-based ethics and compliance training solutions for companies in the United States. | |

| 14% Senior Subordinated Note due 2019 | | $ | 2,745,606 | | | 03/01/12 | | | $ | 2,692,643 | | | $ | 2,749,144 | |

| Common Stock (B) | | 122 shs. | | | 03/01/12 | | | | 272,727 | | | | 208,217 | |

| | | | | | | | | | | 2,965,370 | | | | 2,957,361 | |

| F C X Holdings Corporation | | | | | | | | | | | | | | | |

A distributor of specialty/technical valves, actuators, accessories, and process instrumentation supplying a number of industrial, high purity, and energy end markets in North America.

| 15% Senior Subordinated Note due 2017 | | $ | 2,362,470 | | | 10/06/08 | | | | 2,337,836 | | | | 2,362,470 | |

| 14% Senior Subordinated Note due 2017 | | $ | 641,720 | | | 03/02/12 | | | | 629,592 | | | | 641,932 | |

| Preferred Stock Series A (B) | | 441 shs. | | | * | | | | 44,100 | | | | 46,391 | |

| Preferred Stock Series B (B) | | 4,341 shs. | | | 10/06/08 | | | | 434,074 | | | | 456,656 | |

| Common Stock (B) | | 3,069 shs. | | | 10/06/08 | | | | 3,069 | | | | - | |

| * 12/30/10 and 07/01/11. | | | | | | | | | | 3,448,671 | | | | 3,507,449 | |

| | | | | | | | | | | | | | | | |

| F F C Holding Corporation | | | | | | | | | | | | | | | |

| A leading U.S. manufacturer of private label frozen novelty and ice cream products. | | | | | | |

| 16% Senior Subordinated Note due 2017 | | $ | 2,645,261 | | | 09/27/10 | | | | 2,605,138 | | | | 2,698,166 | |

| Limited Liability Company Units Preferred (B) | | 512 uts. | | | 09/27/10 | | | | 460,976 | | | | 520,390 | |

| Limited Liability Company Units (B) | | 512 uts. | | | 09/27/10 | | | | 51,220 | | | | 16,378 | |

| | | | | | | | | | | 3,117,334 | | | | 3,234,934 | |

| F G I Equity LLC | | | | | | | | | | | | | | | |

A manufacturer of a broad range of filters and related products that are used in commercial, light industrial, healthcare, gas turbine, nuclear, laboratory, clean room, hotel, educational system, and food processing settings.

| 14.25% Senior Subordinated Note due 2016 | | $ | 2,677,381 | | | 12/15/10 | | | | 2,616,637 | | | | 2,730,929 | |

| 14.25% Senior Subordinated Note due 2016 | | $ | 665,040 | | | 02/29/12 | | | | 665,140 | | | | 684,991 | |

| Limited Liability Company Unit Class B-1 (B) | | 394,737 uts. | | | 12/15/10 | | | | 394,737 | | | | 680,718 | |

| Limited Liability Company Unit Class B-2 (B) | | 49,488 uts. | | | 12/15/10 | | | | 49,488 | | | | 85,341 | |

| | | | | | | | | | | 3,726,002 | | | | 4,181,979 | |

| F H Equity LLC | | | | | | | | | | | | | | | |

| A designer and manufacturer of a full line of automatic transmission filters and filtration systems for passenger vehicles. | | |

| 14% Senior Subordinated Note due 2017 | | $ | 3,094,209 | | | 12/20/10 | | | | 2,987,772 | | | | 3,200,266 | |

| Limited Liability Company Unit Class C (B) | | 9,449 uts. | | | 12/20/10 | | | | 96,056 | | | | 81,965 | |

| | | | | | | | | | | 3,083,828 | | | | 3,282,231 | |

Flutes, Inc.

An independent manufacturer of micro fluted corrugated sheet material for the food and consumer products packaging industries.

| 10% Senior Secured Term Note due 2013 (D) | | $ | 918,385 | | | 04/13/06 | | | | 908,339 | | | | 367,354 | |

| 14% Senior Subordinated Note due 2013 (D) | | $ | 555,059 | | | 04/13/06 | | | | 509,089 | | | | - | |

| | | | | | | | | | | 1,417,428 | | | | 367,354 | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | Babson Capital Corporate Investors |

June 30, 2012 (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| G C Holdings | | | | | | | | | | | | |

| A leading manufacturer of gaming tickets, industrial recording charts, security-enabled point-of sale receipts, and medical charts and supplies. | |

| 12.5% Senior Subordinated Note due 2017 | | $ | 3,000,000 | | | 10/19/10 | | | $ | 2,832,425 | | | $ | 3,060,000 | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 594 shs. | | | 10/19/10 | | | | 140,875 | | | | 201,564 | |

| | | | | | | | | | | 2,973,300 | | | | 3,261,564 | |

| Golden County Foods Holding, Inc. | | | | | | | | | | | | | | | |

| A manufacturer of frozen appetizers and snacks. | | | | | | | | | | | | | | | |

| 16% Senior Subordinated Note due 2015 (D) | | $ | 1,912,500 | | | 11/01/07 | | | | 1,772,199 | | | | - | |

| 14% PIK Note due 2015 (D) | | $ | 472,711 | | | 12/31/08 | | | | 411,209 | | | | - | |

| 8% Series A Convertible Preferred Stock, convertible into | | | | | | | | | | | | | | | |

| common shares (B) | | 287,658 shs. | | | 11/01/07 | | | | 146,658 | | | | - | |

| | | | | | | | | | | 2,330,066 | | | | - | |

| H M Holding Company | | | | | | | | | | | | | | | |

| A designer, manufacturer, and importer of promotional and wood furniture. | | | | | | | | | | | | |

| 7.5% Senior Subordinated Note due 2014 (D) | | $ | 685,100 | | | 10/15/09 | | | | 512,231 | | | | 171,275 | |

| Preferred Stock (B) | | 40 shs. | | | * | | | | 40,476 | | | | - | |

| Preferred Stock Series B (B) | | 2,055 shs. | | | 10/15/09 | | | | 1,536,694 | | | | - | |

| Common Stock (B) | | 340 shs. | | | 02/10/06 | | | | 340,000 | | | | - | |

| Common Stock Class C (B) | | 560 shs. | | | 10/15/09 | | | | - | | | | - | |

| Warrant, exercisable until 2013, to purchase | | | | | | | | | | | | | | | |

| common stock at $.02 per share (B) | | 126 shs. | | | 02/10/06 | | | | 116,875 | | | | - | |

| * 09/18/07 and 06/27/08. | | | | | | | | | | 2,546,276 | | | | 171,275 | |

| | | | | | | | | | | | | | | | |

| Handi Quilter Holding Company | | | | | | | | | | | | | | | |

| A designer and manufacturer of long-arm quilting machines and related components for the consumer quilting market. | |

| 12% Senior Subordinated Note due 2017 | | $ | 1,384,615 | | | 11/14/11 | | | | 1,287,578 | | | | 1,419,340 | |

| Common Stock (B) | | 115 shs. | | | 11/14/11 | | | | 115,385 | | | | 93,489 | |

| Warrant, exercisable until 2021, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 83 shs. | | | 11/14/11 | | | | 76,788 | | | | 66,931 | |

| | | | | | | | | | | 1,479,751 | | | | 1,579,760 | |

| Healthcare Direct Holding Company | | | | | | | | | | | | | | | |

| A direct-to-consumer marketer of discount dental plans. | | | | | | | | | | | | | | | |

| 14% Senior Subordinated Note due 2019 | | $ | 2,108,109 | | | 03/09/12 | | | | 2,067,350 | | | | 2,116,287 | |

| Common Stock (B) | | 1,552 shs. | | | 03/09/12 | | | | 155,172 | | | | 132,297 | |

| | | | | | | | | | | 2,222,522 | | | | 2,248,584 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | |

| June 30, 2012 | |

| (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| HGGC Citadel Plastics Holdings | | | | | | | | | | | | |

| A world-leading source for thermoset and thermoplastic compounds. | | | | | | | | |

| 14% Senior Subordinated Note due 2019 | | $ | 2,715,865 | | | 02/29/12 | | | $ | 2,663,497 | | | $ | 2,719,361 | |

| Common Stock (B) | | 302 shs. | | | 02/29/12 | | | | 302,419 | | | | 239,904 | |

| | | | | | | | | | | 2,965,916 | | | | 2,959,265 | |

| Home Décor Holding Company | | | | | | | | | | | | | | | |

| A designer, manufacturer and marketer of framed art and wall décor products. | | | | | | | | | | | | |

| Common Stock (B) | | 63 shs. | | | * | | | | 62,742 | | | | 138,471 | |

| Warrant, exercisable until 2013, to purchase | | | | | | | | | | | | | | | |

| common stock at $.02 per share (B) | | 200 shs. | | | * | | | | 199,501 | | | | 440,308 | |

| * 06/30/04 and 08/19/04. | | | | | | | | | | 262,243 | | | | 578,779 | |

| | | | | | | | | | | | | | | | |

| HOP Entertainment LLC | | | | | | | | | | | | | | | |

| A provider of post production equipment and services to producers of television shows and motion pictures. | |

| Limited Liability Company Unit Class F (B) | | 89 uts. | | | 10/14/11 | | | | - | | | | - | |

| Limited Liability Company Unit Class G (B) | | 215 uts. | | | 10/14/11 | | | | - | | | | - | |

| Limited Liability Company Unit Class H (B) | | 89 uts. | | | 10/14/11 | | | | - | | | | - | |

| Limited Liability Company Unit Class I (B) | | 89 uts. | | | 10/14/11 | | | | - | | | | - | |

| | | | | | | | | | | - | | | | - | |

| Hospitality Mints Holding Company | | | | | | | | | | | | | | | |

| A manufacturer of individually-wrapped imprinted promotional mints. | | | | | | | | | | | | |

| 14% Senior Subordinated Note due 2016 | | $ | 2,963,853 | | | 08/19/08 | | | | 2,833,331 | | | | 2,815,660 | |

| Common Stock (B) | | 474 shs. | | | 08/19/08 | | | | 474,419 | | | | - | |

| Warrant, exercisable until 2016, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 123 shs. | | | 08/19/08 | | | | 113,773 | | | | - | |

| | | | | | | | | | | 3,421,523 | | | | 2,815,660 | |

| Ideal Tridon Holdings, Inc. | | | | | | | | | | | | | | | |

| A designer and manufacturer of clamps and couplings used in automotive and industrial end markets. | | |

| 13.5% Senior Subordinated Note due 2018 | | $ | 2,749,542 | | | 10/27/11 | | | | 2,698,562 | | | | 2,782,207 | |

| Common Stock (B) | | 279 shs. | | | 10/27/11 | | | | 278,561 | | | | 268,856 | |

| | | | | | | | | | | 2,977,123 | | | | 3,051,063 | |

| Insurance Claims Management, Inc. | | | | | | | | | | | | | | | |

| A third party administrator providing auto and property claim administration services for insurance companies. | | | | | |

| Common Stock (B) | | 89 shs. | | | 02/27/07 | | | | 2,689 | | | | 459,074 | |

International Offshore Services LLC

A leading provider of marine transportation services, platform decommissioning, and salvage services to oil and gas producers in the shallow waters of the Gulf of Mexico.

| 14.25% Senior Subordinated Secured Note due 2017 (D) | | $ | 2,550,000 | | | 07/07/09 | | | | 2,335,431 | | | | 1,275,000 | |

| Limited Liability Company Unit (B) | | 3,112 uts. | | | 07/07/09 | | | | 186,684 | | | | - | |

| | | | | | | | | | | 2,522,115 | | | | 1,275,000 | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | Babson Capital Corporate Investors |

June 30, 2012 (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| J A C Holding Enterprises, Inc. | | | | | | | | | | | | |

| A supplier of luggage racks and accessories to the original equipment manufacturers. | | |

| 12.5% Senior Subordinated Note due 2017 | | $ | 2,500,000 | | | 12/20/10 | | | $ | 2,183,266 | | | $ | 2,295,590 | |

| Preferred Stock A (B) | | 495 shs. | | | 12/20/10 | | | | 495,000 | | | | 102,026 | |

| Preferred Stock B (B) | | 0.17 shs. | | | 12/20/10 | | | | - | | | | 34 | |

| Common Stock (B) | | 100 shs. | | | 12/20/10 | | | | 5,000 | | | | - | |

| Warrant, exercisable until 2020, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 36 shs. | | | 12/20/10 | | | | 316,931 | | | | - | |

| | | | | | | | | | | 3,000,197 | | | | 2,397,650 | |

| Jason Partners Holdings LLC | | | | | | | | | | | | | | | |

| A diversified manufacturing company serving various industrial markets. | | | | | | | | | | | | |

| Limited Liability Company Unit (B) | | 90 uts. | | | 09/21/10 | | | | 848,275 | | | | 48,185 | |

| | | | | | | | | | | | | | | | |

| K & N Parent, Inc. | | | | | | | | | | | | | | | |

| A manufacturer and supplier of automotive aftermarket performance air filters and intake systems. | | | | | | | | | |

| 14% Senior Subordinated Note due 2017 | | $ | 2,608,696 | | | 12/23/11 | | | | 2,558,878 | | | | 2,644,205 | |

| Preferred Stock Series A (B) | | 305 shs. | | | 12/23/11 | | | | 289,733 | | | | 284,580 | |

| Preferred Stock Series B (B) | | 86 shs. | | | 12/23/11 | | | | 82,006 | | | | 80,546 | |

| Common Stock (B) | | 391 shs. | | | 12/23/11 | | | | 19,565 | | | | - | |

| | | | | | | | | | | 2,950,182 | | | | 3,009,331 | |

| K N B Holdings Corporation | | | | | | | | | | | | | | | |

| A designer, manufacturer and marketer of products for the custom framing market. | | | | | | | | | | | | |

| 15% Senior Subordinated Note due 2017 | | $ | 4,447,360 | | | 04/12/11 | | | | 4,119,189 | | | | 4,447,360 | |

| Common Stock (B) | 134,210 shs. | | | 05/25/06 | | | | 134,210 | | | | 60,923 | |

| Warrant, exercisable until 2013, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 82,357 shs. | | | 05/25/06 | | | | 71,534 | | | | 37,385 | |

| | | | | | | | | | | 4,324,933 | | | | 4,545,668 | |

K P H I Holdings, Inc.

A manufacturer of highly engineered plastic and metal components for a diverse range of end-markets, including medical, consumer and industrial, automotive and defense.

| 15% Senior Subordinated Note due 2017 | | $ | 2,711,801 | | | 12/10/10 | | | | 2,666,721 | | | | 2,735,874 | |

| Common Stock (B) | | 698,478 shs. | | | 12/10/10 | | | | 698,478 | | | | 509,533 | |

| | | | | | | | | | | 3,365,199 | | | | 3,245,407 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | | |

| June 30, 2012 | | |

| (Unaudited) | | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| K P I Holdings, Inc. | | | | | | | | | | | | |

| The largest player in the U.S. non-automotive, non-ferrous die casting segment. | | | | | |

| 6% Senior Subordinated Note due 2015 | | $ | 2,619,885 | | | 07/16/08 | | | $ | 2,483,154 | | | $ | 2,488,891 | |

| Convertible Preferred Stock Series C (B) | | 55 shs. | | | 06/30/09 | | | | 55,435 | | | | 110,000 | |

| Convertible Preferred Stock Series D (B) | | 24 shs. | | | 09/17/09 | | | | 24,476 | | | | 73,410 | |

| Common Stock (B) | | 443 shs. | | | 07/15/08 | | | | 443,478 | | | | - | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 96 shs. | | | 07/16/08 | | | | 96,024 | | | | - | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 128 shs. | | | 09/17/09 | | | | - | | | | - | |

| | | | | | | | | | | 3,102,567 | | | | 2,672,301 | |

| K W P I Holdings Corporation | | | | | | | | | | | | | | | |

| A manufacturer and distributor of vinyl windows and patio doors throughout the northwestern United States. | | | | | |

| 12% Senior Subordinated Note due 2015 (D) | | $ | 3,162,920 | | | 03/14/07 | | | | 2,878,056 | | | | 1,581,460 | |

| Preferred Stock PIK (B) | | 1,499 shs. | | | 02/07/11 | | | | 579,500 | | | | - | |

| Common Stock (B) | | 232 shs. | | | 03/13/07 | | | | 232,000 | | | | - | |

| Warrant, exercisable until 2019, to purchase | | | | | | | | | | | | | | | |

| preferred stock at $.01 per share (B) | | 134 shs. | | | 07/07/09 | | | | - | | | | - | |

| Warrant, exercisable until 2017, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 167 shs. | | | 03/14/07 | | | | 162,260 | | | | - | |

| | | | | | | | | | | 3,851,816 | | | | 1,581,460 | |

| LPC Holding Company | | | | | | | | | | | | | | | |

A designer and manufacturer of precision-molded silicone rubber components that are utilized in the medical and automotive end markets.

| 13.5% Senior Subordinated Note due 2018 | | $ | 2,742,871 | | | 08/15/11 | | | | 2,693,555 | | | | 2,822,391 | |

| Common Stock (B) | | 283 shs. | | | 08/15/11 | | | | 283,019 | | | | 224,558 | |

| | | | | | | | | | | 2,976,574 | | | | 3,046,949 | |

| M V I Holding, Inc. | | | | | | | | | | | | | | | |

| Common Stock (B) | | | 61 shs. | | | 09/12/08 | | | | 60,714 | | | | 98,798 | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | | 66 shs. | | | 09/12/08 | | | | 65,571 | | | | 106,707 | |

| | | | | | | | | | | 126,285 | | | | 205,505 | |

| Mail Communications Group, Inc. | | | | | | | | | | | | | | | |

| A provider of mail processing and handling services, letter shop services, and commercial printing services. | | |

| Limited Liability Company Unit (B) | | | 24,109 uts. | | | * | | | | 314,464 | | | | 402,704 | |

| Warrant, exercisable until 2014, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | | 3,375 shs. | | | 05/04/07 | | | | 43,031 | | | | 56,374 | |

| * 05/04/07 and 01/02/08. | | | | | | | | | | 357,495 | | | | 459,078 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | Babson Capital Corporate Investors |

| June 30, 2012 | |

| (Unaudited) | |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Manhattan Beachwear Holding Company | | | | | | | | | | | | |

| A designer and distributor of women’s swimwear. | | | | | | | | | | | | |

| 12.5% Senior Subordinated Note due 2018 | | $ | 1,259,914 | | | 01/15/10 | | | $ | 1,130,475 | | | $ | 1,259,914 | |

| 15% Senior Subordinated Note due 2018 | | $ | 320,850 | | | 10/05/10 | | | | 315,472 | | | | 318,120 | |

| Common Stock (B) | | 106 shs. | | | 10/05/10 | | | | 106,200 | | | | 159,463 | |

| Common Stock Class B (B) | | 353 shs. | | | 01/15/10 | | | | 352,941 | | | | 529,951 | |

| Warrant, exercisable until 2019, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 312 shs. | | | 01/15/10 | | | | 283,738 | | | | 469,003 | |

| | | | | | | | | | | 2,188,826 | | | | 2,736,451 | |

| Marshall Physicians Services LLC | | | | | | | | | | | | | | | |

A provider of emergency department and hospital medicine services to hospitals located in the state of Kentucky. The Company was founded in 1999 and is owned by seven practicing physicians.

| 13% Senior Subordinated Note due 2016 | | $ | 1,330,293 | | | 09/20/11 | | | | 1,305,895 | | | | 1,352,743 | |

| Limited Liability Company Unit Class A (B) | | 8,700 uts. | | | 09/20/11 | | | | 180,000 | | | | 109,058 | |

| Limited Liability Company Unit Class D (B) | | 874 uts. | | | 09/20/11 | | | | - | | | | 10,960 | |

| | | | | | | | | | | 1,485,895 | | | | 1,472,761 | |

| MBWS Ultimate Holdco, Inc. | | | | | | | | | | | | | | | |

A provider of services throughout North Dakota that address the fluid management and related transportation needs of an oil well.

| 12% Senior Subordinated Note due 2016 | | $ | 3,352,486 | | | * | | | | 3,094,756 | | | | 3,419,536 | |

| Preferred Stock Series A (B) | | 4,164 shs. | | | 09/07/10 | | | | 416,392 | | | | 1,527,208 | |

| Common Stock (B) | | 487 shs. | | | 03/01/11 | | | | 48,677 | | | | 178,614 | |

| Common Stock (B) | | 458 shs. | | | 09/07/10 | | | | 45,845 | | | | 167,978 | |

| Warrant, exercisable until 2020, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 310 shs. | | | 03/01/11 | | | | 30,975 | | | | 113,697 | |

| Warrant, exercisable until 2016, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 1,158 shs. | | | 09/07/10 | | | | 115,870 | | | | 424,713 | |

| * 09/07/10 and 03/01/11. | | | | | | | | | | 3,752,515 | | | | 5,831,746 | |

| | | | | | | | | | | | | | | | |

| MedSystems Holdings LLC | | | | | | | | | | | | | | | |

| A manufacturer of enteral feeding products, such as feeding tubes and other products related to assisted feeding. | | | | | |

| 13% Senior Subordinated Note due 2015 | | $ | 1,193,059 | | | 08/29/08 | | | | 1,106,113 | | | | 1,193,059 | |

| Preferred Unit (B) | | 126 uts. | | | 08/29/08 | | | | 125,519 | | | | 163,764 | |

| Common Unit Class A (B) | | 1,268 uts. | | | 08/29/08 | | | | 1,268 | | | | - | |

| Common Unit Class B (B) | | 472 uts. | | | 08/29/08 | | | | 120,064 | | | | - | |

| | | | | | | | | | | 1,352,964 | | | | 1,356,823 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | |

| |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| MEGTEC Holdings, Inc. | | | | | | | | | | | | | |

| A supplier of industrial and environmental products and services to a broad array of industries. | | | | | | | |

| Preferred Stock (B) | | | 107 shs. | | | 09/24/08 | | | $ | 103,255 | | | $ | 146,156 | |

| Limited Partnership Interest (B) | | | 1.40% int. | | | 09/16/08 | | | | 388,983 | | | | 461,223 | |

| Warrant, exercisable until 2018, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | | 35 shs. | | | 09/24/08 | | | | 33,268 | | | | 29,747 | |

| | | | | | | | | | | 525,506 | | | | 637,126 | |

Merex Holding Corporation

A provider of after-market spare parts and components, as well as Maintenance, Repair and Overhaul services for “out of production” or “legacy” aerospace and defense systems that are no longer effectively supported by the original equipment manufacturers.

| 14% Senior Subordinated Note due 2018 | | $ | 1,103,774 | | | 09/22/11 | | | | 1,083,388 | | | | 1,122,911 | |

| Limited Liability Company Unit Series B (B) | 396,226 uts. | | | 09/22/11 | | | | 396,226 | | | | 244,785 | |

| | | | | | | | | | | 1,479,614 | | | | 1,367,696 | |

| MicroGroup, Inc. | | | | | | | | | | | | | | | |

| A manufacturer of precision parts and assemblies, and a value-added supplier of metal tubing and bars. | | |

| 12% Senior Subordinated Note due 2013 (D) | | $ | 2,685,614 | | | * | | | | 2,577,220 | | | | 671,403 | |

| Common Stock (B) | | 450 shs. | | | * | | | | 450,000 | | | | - | |

| Warrant, exercisable until 2013, to purchase | | | | | | | | | | | | | | | |

| common stock at $.02 per share (B) | | 164 shs. | | | * | | | | 162,974 | | | | - | |

| * 08/12/05 and 09/11/06. | | | | | | | | | | 3,190,194 | | | | 671,403 | |

| | | | | | | | | | | | | | | | |

| Monessen Holding Corporation | | | | | | | | | | | | | | | |

| A designer and manufacturer of a broad line of gas, wood, and electric hearth products and accessories. | | |

| 15% Senior Subordinated Note due 2015 (D) | | $ | 1,556,056 | | | 06/28/11 | | | | 1,034,632 | | | | - | |

| 7% Senior Subordinated Note due 2014 (D) | | $ | 2,550,000 | | | 06/28/11 | | | | 2,420,572 | | | | - | |

| Warrant, exercisable until 2014, to purchase | | | | | | | | | | | | | | | |

| common stock at $.02 per share (B) | | 152 shs. | | | 03/31/06 | | | | 138,125 | | | | - | |

| | | | | | | | | | | 3,593,329 | | | | - | |

| Motion Controls Holdings | | | | | | | | | | | | | | | |

| A manufacturer of high performance mechanical motion control and linkage products. | | | |

| 14.25% Senior Subordinated Note due 2017 | | $ | 2,796,191 | | | 11/30/10 | | | | 2,752,234 | | | | 2,852,115 | |

| Limited Liability Company Unit Class B-1 (B) | 281,250 uts. | | | 11/30/10 | | | | - | | | | 276,035 | |

| Limited Liability Company Unit Class B-2 (B) | | 25,504 uts. | | | 11/30/10 | | | | - | | | | 25,031 | |

| | | | | | | | | | | 2,752,234 | | | | 3,153,181 | |

| NABCO, Inc. | | | | | | | | | | | | | | | |

| A producer of explosive containment vessels in the United States. | | | | | | | | | | | | | | | |

| 14% Senior Subordinated Note due 2014 (D) | | $ | 625,000 | | | 02/24/06 | | | | 578,174 | | | | 156,250 | |

| Limited Liability Company Unit (B) | | 825 uts. | | | * | | | | 825,410 | | | | - | |

| Warrant, exercisable until 2016, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 129 shs. | | | 02/24/06 | | | | 37,188 | | | | - | |

| * 02/24/06 and 06/22/07. | | | | | | | | | | 1,440,772 | | | | 156,250 | |

20

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | Babson Capital Corporate Investors |

| |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| NetShape Technologies, Inc. | | | | | | | | | | | | |

A manufacturer of powder metal and metal injection molded precision components used in industrial, consumer, and other applications.

| 14% Senior Subordinated Note due 2014 | | $ | 2,014,718 | | | 02/02/07 | | | $ | 1,835,540 | | | $ | 1,611,774 | |

| Limited Partnership Interest of | | | | | | | | | | | | | | | |

| Saw Mill PCG Partners LLC (B) | | 2.73% int. | | | 02/01/07 | | | | 1,110,810 | | | | - | |

| Limited Liability Company Unit Class D of | | | | | | | | | | | | | | | |

| Saw Mill PCG Partners LLC (B) | | 17 uts. | | | * | | | | 16,759 | | | | - | |

| Limited Liability Company Unit Class D-1 of | | | | | | | | | | | | | | | |

| Saw Mill PCG Partners LLC (B) | | 229 uts. | | | 09/30/09 | | | | 228,858 | | | | - | |

| Limited Liability Company Unit Class D-2 of | | | | | | | | | | | | | | | |

| Saw Mill PCG Partners LLC (B) | | 128 uts. | | | 04/29/11 | | | | 65,256 | | | | - | |

| * 12/18/08 and 09/30/09. | | | | | | | | | | 3,257,223 | | | | 1,611,774 | |

| | | | | | | | | | | | | | | | |

| Newark Group, Inc. | | | | | | | | | | | | | | | |

| A major producer of paper products from recycled materials. | | | | | | | | | | | | | | | |

| Common Stock (B) | | 134,520 shs. | | | 09/02/10 | | | | 796,863 | | | | 259,422 | |

Nicoat Acquisitions LLC

A manufacturer of water-based and ultraviolet coatings for high-performance graphic arts, packaging and other specialty coating applications.

| 12.5% Senior Subordinated Note due 2016 | | $ | 1,448,276 | | | 11/05/10 | | | | 1,338,729 | | | | 1,473,465 | |

| Limited Liability Company Unit Series B (B) | | 51,724 uts. | | | 11/05/10 | | | | 51,724 | | | | 57,894 | |

| Limited Liability Company Unit Series B (B) | | 104,792 uts. | | | 11/05/10 | | | | 104,792 | | | | 117,292 | |

| Limited Liability Company Unit Series F (B) | | 156,516 uts. | | | 11/05/10 | | | | - | | | | 145,287 | |

| | | | | | | | | | | 1,495,245 | | | | 1,793,938 | |

Northwest Mailing Services, Inc.

A producer of promotional materials for companies that use direct mail as part of their customer retention and loyalty programs.

| 12% Senior Subordinated Note due 2016 | | $ | 2,818,421 | | | * | | | | 2,419,715 | | | | 2,796,387 | |

| Limited Partnership Interest (B) | | 3,287 uts. | | | * | | | | 328,679 | | | | 64,411 | |

| Warrant, exercisable until 2019, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 4,920 shs. | | | * | | | | 492,016 | | | | 96,420 | |

| * 07/09/09 and 08/09/10. | | | | | | | | | | 3,240,410 | | | | 2,957,218 | |

| | | | | | | | | | | | | | | | |

| NT Holding Company | | | | | | | | | | | | | | | |

| A leading developer, manufacturer and provider of medical products used primarily in interventional pain management. | | | | | |

| 12% Senior Subordinated Note due 2019 | | $ | 2,649,351 | | | 02/02/11 | | | | 2,460,775 | | | | 2,702,338 | |

| Common Stock (B) | | 377 shs. | | | * | | | | 377,399 | | | | 265,466 | |

| Warrant, exercisable until 2021, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 176 shs. | | | 02/02/11 | | | | 158,961 | | | | 123,983 | |

| *02/02/11 and 06/30/11. | | | | | | | | | | 2,997,135 | | | | 3,091,787 | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) | |

| |

| | | Principal Amount, Shares, Units or Ownership Percentage | | | Acquisition Date | | | Cost | | | Fair Value | |

| Corporate Restricted Securities: (A) (Continued) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Nyloncraft, Inc. | | | | | | | | | | | | |

| A supplier of engineered plastic components for the automotive industry. | | | | | | | | | | |

| Preferred Stock Series B (B) | | 1,000 shs. | | | 05/15/12 | | | $ | - | | | $ | 458 | |

| Common Stock (B) | | 312,500 shs. | | | 01/28/02 | | | | 312,500 | | | | 424,316 | |

| Warrant, exercisable until 2015, to purchase | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 243,223 shs. | | | 01/28/02 | | | | 162,045 | | | | 330,251 | |

| | | | | | | | | | 474,545 | | | | 755,025 | |

| O E C Holding Corporation | | | | | | | | | | | | | | |

| A provider of elevator maintenance, repair and modernization services. | | | | | | | | | | | | |

| 13% Senior Subordinated Note due 2017 | | $ | 1,333,333 | | | 06/04/10 | | | | 1,236,678 | | | | 1,333,333 | |

| Preferred Stock Series A (B) | | 1,661 shs. | | | 06/04/10 | | | | 166,062 | | | | 72,560 | |

| Preferred Stock Series B (B) | | 934 shs. | | | 06/04/10 | | | | 93,376 | | | | 40,800 | |

| Common Stock (B) | | 1,032 shs. | | | 06/04/10 | | | | 1,032 | | | | - | |

| | | | | | | | | | | 1,497,148 | | | | 1,446,693 | |

| Ontario Drive & Gear Ltd. | | | | | | | | | | | | | | | |

| A manufacturer of all-wheel drive, off-road amphibious vehicles and related accessories. | | | | | | | | | | | | |

| Limited Liability Company Unit (B) | | 3,667 uts. | | | 01/17/06 | | | | 572,115 | | | | 1,568,284 | |

| Warrant, exercisable until 2013, to purchase | | | | | | | | | | | | | | | |

| common stock at $.01 per share (B) | | 619 shs. | | | 01/17/06 | | | | 170,801 | | | | 264,782 | |

| | | | | | | | | | | 742,916 | | | | 1,833,066 | |

| P K C Holding Corporation | | | | | | | | | | | | | | | |