We are pleased to present the June 30, 2015 Quarterly Report of Babson Capital Corporate Investors (the “Trust”).

The Board of Trustees declared a quarterly dividend of $0.30 per share, payable on August 14, 2015 to shareholders of record on August 3, 2015. The Trust paid a $0.30 per share dividend for the preceding quarter. The Trust earned $0.28 per share of net investment income, including $0.03 per share of non-recurring income, for the second quarter of 2015, compared to $0.28 per share, including $0.03 per share of non-recurring income, in the previous quarter.

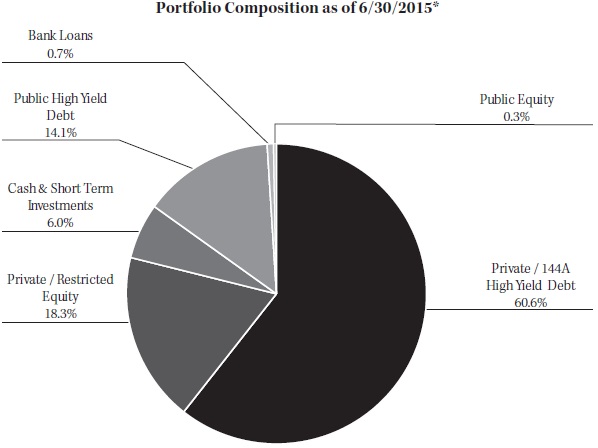

During the second quarter, the net assets of the Trust increased to $293,410,574 or $14.97 per share compared to $293,255,436 or $14.99 per share on March 31, 2015. This translates into a 1.9% total return for the quarter, based on the change in the Trust’s net assets assuming the reinvestment of all dividends. Longer term, the Trust returned 11.3%, 14.9%, 14.9%, 12.0%, and 13.9% for the 1, 3, 5, 10, and 25-year periods, respectively, based on the change in the Trust’s net assets assuming the reinvestment of all dividends.

The Trust’s share price increased 3.4% during the quarter, from $15.54 per share as of March 31, 2015 to $16.07 per share as of June 30, 2015. The Trust’s market price of $16.07 per share equates to a 7.3% premium over the June 30, 2015 net asset value per share of $14.97. The Trust’s average quarter-end premium for the 3, 5 and 10-year periods was 10.7%, 15.8% and 12.6%, respectively. U.S. equity markets, as approximated by the Russell 2000 Index, increased 0.4% for the quarter. U.S. fixed income markets, as approximated by the Barclays Capital U.S. Corporate High Yield Index, was flat for the quarter.

The Trust closed six new private placement investments, as well as one add-on investment in an existing portfolio company, during the second quarter. The six new investments were in BlueSpire Holding, Inc., FMH Holdings Corporation, GlynnDevins Acquisition Corporation, Master Cutlery LLC, Power Stop Holdings LLC and Randy’s Worldwide Automotive, while the add-on investment was in Hartland Controls Holding Corporation. A brief description of these investments can be found in the Consolidated Schedule of Investments. The total amount invested by the Trust in these transactions was $18,533,000.

It was another active quarter for the Trust in terms of new investments. Middle market merger and acquisition activity, a key driver of deal flow for the Trust, has been strong in 2015. We expect deal flow to remain steady for the rest of the year, assuming no significant external shocks to the market, so we are optimistic about the level of new investment activity for the Trust through year end. The dark cloud on the horizon, however, continues to be the high purchase prices and leverage levels that are common in buyout transactions today. Average purchase price multiples for small companies continue to be at their highest levels in the past 15 years. Leverage multiples have also been elevated and are near their highs of the past 15 years. Though we are actively making new investments on behalf of the Trust in this market, we do so cautiously and with discipline, consistent with our longstanding investment philosophy of seeking to take prudent levels of risk and getting paid appropriately for the risk taken. We are not willing to provide financial leverage at levels that we believe are imprudent. This approach has served us well over the long term and through all kinds of market cycles.

The condition of the Trust’s existing portfolio remained solid through the second quarter. We had significantly more credit upgrades than downgrades during the quarter. The number of companies on our watch list and in default continues to be at or near the lowest level we have seen over the last five years. We exited four investments during the quarter, and benefited from a dividend associated with the recapitalization of one company. In three of these exits we realized gains, while our investment in MicroGoup, Inc. was realized at a loss. We continue to have a backlog of portfolio companies that are in the process of being sold, with a number of these expected to close this year. We had five portfolio companies fully or partially prepay their debt instruments held by the Trust during the quarter. This lower level of prepayment activity is welcome after the unprecedented levels of prepayments we experienced in 2013 and early 2014.