UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-2183

| Barings Corporate Investors | |

| (Exact name of registrant as specified in charter) | |

| | |

| 1500 Main Street, P.O. Box 15189, Springfield, MA 01115-5189 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Janice M. Bishop, Vice President, Secretary and Chief Legal Officer Indepence Wharf, 470 Atlantic Ave., Boston, MA 02210 | |

| (Name and address of agent for service) | |

Registrant's telephone number, including area code: 413-226-1000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/16

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Attached hereto is the annual shareholder report transmitted to shareholders pursuant to Rule 30e-1 of the Investment Company Act of 1940, as amended.

BARINGS CORPORATE INVESTORS

Barings Corporate Investors is a closed-end investment company, first offered to the public in 1971, whose shares are traded on the New York Stock Exchange.

INVESTMENT OBJECTIVE & POLICY

Barings Corporate Investors (the "Trust") is a closed-end management investment company, first offered to the public in 1971, whose shares are traded on the New York Stock Exchange under the trading symbol "MCI". The Trust's share price can be found in the financial section of newspapers under either the New York Stock Exchange listings or Closed-End Fund Listings.

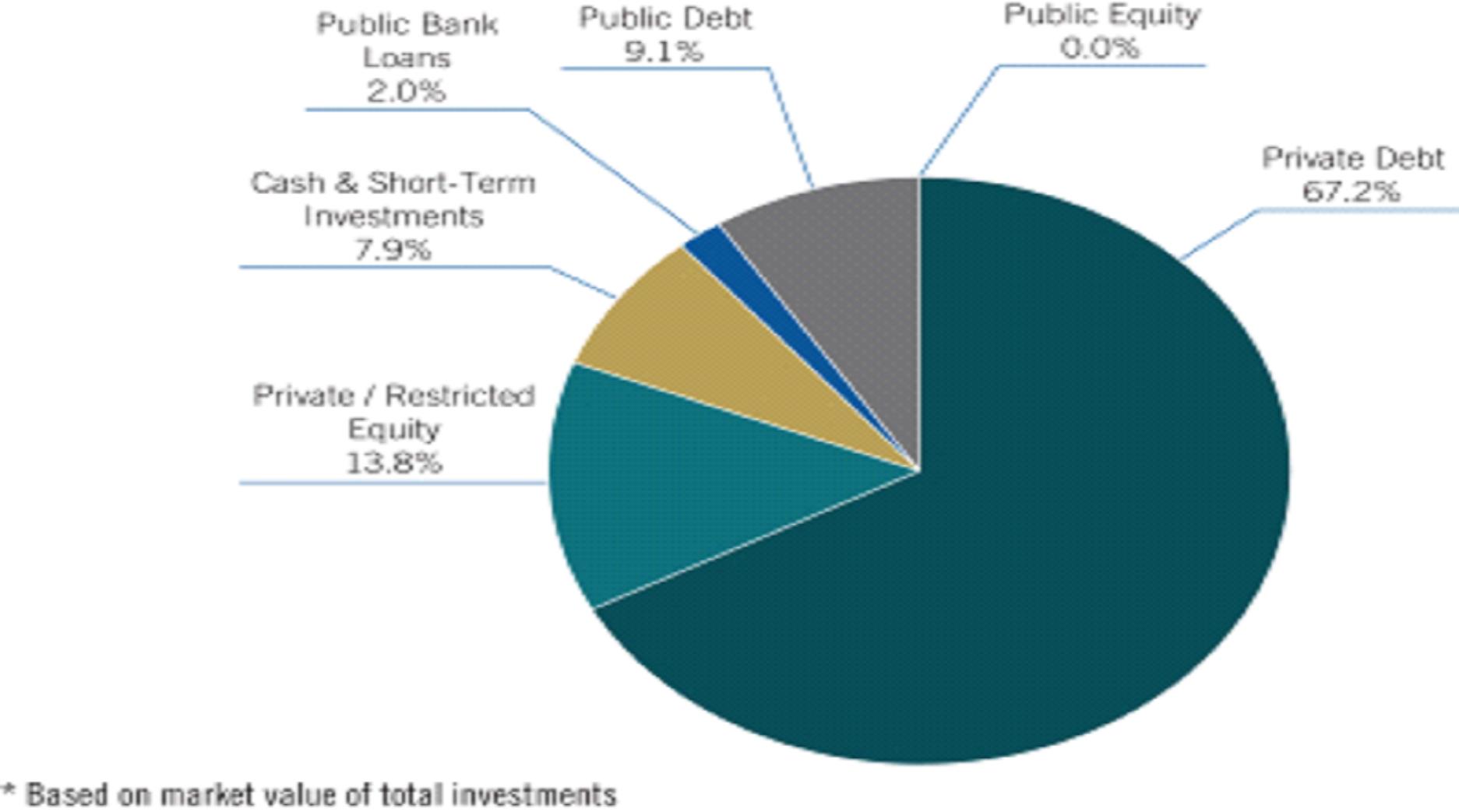

The Trust's investment objective is to maintain a portfolio of securities providing a fixed yield and at the same time offering an opportunity for capital gains. The Trust's principal investments are privately placed, below-investment grade, long-term debt obligations. Such direct placement securities may, in some cases, be accompanied by equity features such as warrants, conversion rights, or other equity features and, occasionally, preferred stocks. The Trust typically purchases these investments, which are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically mezzanine debt instruments with accompanying private equity securities made to small or middle market companies. In addition, the Trust may invest, subject to certain limitations, in marketable investment grade debt securities, other marketable debt securities (including high yield securities) and marketable common stocks. Below-investment grade or high yield securities have predominantly speculative characteristics with respect to the capacity of the issuer to pay interest and repay principal.

Barings LLC ("Barings") manages the Trust on a total return basis. The Trust distributes substantially all of its net income to shareholders each year.

Accordingly, the Trust pays dividends to shareholders four times a year in January, May, August, and November. The Trust pays dividends to its shareholders in cash, unless the shareholder elects to participate in the Dividend Reinvestment and Share Purchase Plan.

In this report, you will find a complete listing of the Trust's holdings. We encourage you to read this section carefully for a better understanding of the Trust. We cordially invite all shareholders to attend the Trust's Annual Meeting of Shareholders, which will be held on April 21, 2017 at 1:00 P.M. in Springfield, Massachusetts.

PROXY VOTING POLICIES & PROCEDURES;

PROXY VOTING RECORD

The Trustees of the Trust have delegated proxy voting responsibilities relating to the voting of securities held by the Trust to Barings. A description of Barings' proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 1-866-399-1516; (2) on the Trust's website at http://www.barings.com/mci; and (3) on the U.S. Securities and Exchange Commission's ("SEC") website at http://www.sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2016 is available (1) on the Trust's website at http://www.barings.com/mci; and (2) on the SEC's website at http://www.sec.gov.

FORM N-Q

The Trust files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This information is available (i) on the SEC's website at http://www.sec.gov; and (ii) at the SEC's Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available on the Trust's website at http://www.barings.com/mci or upon request by calling, toll-free, 1-866-399-1516.

BARINGS CORPORATE INVESTORS c / o Barings LLC 1500 Main Street P.O. Box 15189 Springfield, Massachusetts 01115-5189 (413) 226-1516 http://www.barings.com/mci ADVISER Barings LLC 1500 Main Street, P.O. Box 15189 Springfield, Massachusetts 01115-5189 INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM KPMG LLP Boston, Massachusetts 02111 | | COUNSEL TO THE TRUST Ropes & Gray LLP Boston, Massachusetts 02111 CUSTODIAN State Street Bank and Trust Company Boston, MA 02110 TRANSFER AGENT & REGISTRAR DST Systems, Inc. P.O. Box 219086 Kansas City, MO 64121-9086 1-800-647-7374 |

2016 Annual Report

PORTFOLIO COMPOSITION AS OF 12/31/16*

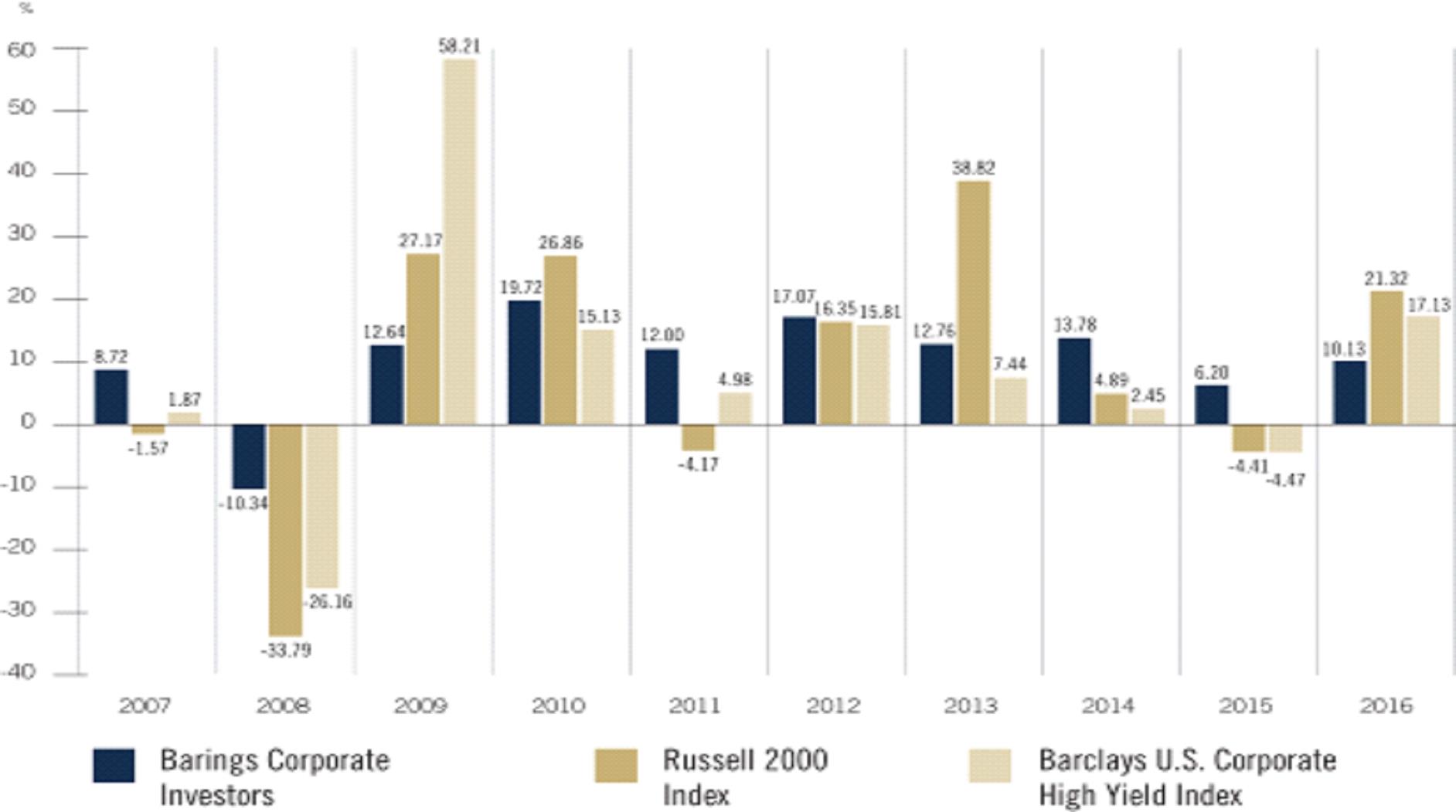

TOTAL ANNUAL PORTFOLIO RETURN (AS OF 12/31 EACH YEAR)*

| * | Data for Barings Corporate Investors (the "Trust") represents returns based on the change in the Trust's net asset value (net of all fees and expenses) assuming the reinvestment of all dividends and distributions. These returns differ from the total investment return based on market value of the Trust's shares due to the difference between the Trust's net asset value of its shares outstanding (See page 12 for total investment return based on market value). Past performance is no guarantee of future results. |

Barings Corporate Investors (formerly known as Babson Capital Corporate Investors)

TO OUR SHAREHOLDERS

I am pleased to share with you the Trust's Annual Report for the year ended December 31, 2016.

PORTFOLIO PERFORMANCE

The Trust's net total portfolio rate of return for 2016 was 10.1%, as measured by the change in net asset value assuming the reinvestment of all dividends and distributions. The Trust's total net assets were $281,570,891 or $14.23 per share, as of December 31, 2016. This compares to $275,915,289 or $14.03 per share, as of December 31, 2015. The Trust paid a quarterly dividend of $0.30 per share for each of the four quarters of 2016, for a total annual dividend of $1.20 per share. In 2015, the Trust also paid four quarterly dividends of $0.30 per share, for a total annual dividend of $1.20 per share. Net taxable investment income for 2016 was $1.21 per share, including approximately $0.16 per share of non-recurring income, compared to 2015 net taxable investment income of $1.21 per share, which included approximately $0.27 per share of non-recurring income.

The Trust's stock price decreased 10.3% during 2016, from $17.25 as of December 31, 2015 to $15.48 as of December 31, 2016. The Trust's stock price of $15.48 as of December 31, 2016 equates to a 8.8% premium over the December 31, 2016 net asset value per share of $14.23. The Trust's average quarter-end premium for the

3-, 5-, 10- and 25-year periods ended December 31, 2016 was 11.1%, 14.8%, 13.0%, and 6.2%, respectively.

The table below lists the average annual net returns of the Trust's portfolio, based on the change in net assets and assuming the reinvestment of all dividends and distributions. Average annual returns of the Barclays U.S. Corporate High Yield Index and the Russell 2000 Index for the 1-, 3-, 5-, 10- and 25-year periods ended December 31, 2016 are provided for comparison purposes only.

| | The Trust | Barclays Capital U.S.

Corporate High Yield Index | Russell

2000 Index |

| | | | |

| 1 Year | 10.13% | 17.13% | 21.32% |

| | | | |

| 3 Years | 9.99% | 4.66% | 6.74% |

| | | | |

| 5 Years | 11.93% | 7.36% | 14.46% |

| | | | |

| 10 Years | 9.98% | 7.45% | 7.07% |

| | | | |

| 25 Years | 13.57% | 8.04% | 9.69% |

Past performance is no guarantee of future results.

PORTFOLIO ACTIVITY

In 2016, the Trust closed 15 new private placement investments, as well as 10 "add-on" investments in existing portfolio companies. The 15 new investments were in AM Conservation Holding Corp; API Technologies Corp.; CORA Health Services, Inc.; Del Real LLC; Dunn Paper; Elite Sportswear Holding, LLC; Glynlyon Holding Companies, Inc.; Happy Floors Acquisition, Inc.; Midwest Industrial Rubber, Inc.; Money Mailer Equity LLC; NSi Industries Holdings, Inc.; PANOS Brands LLC; Software Paradigms International Group, LLC; Veritext Corporation and Wolf-Gordon, Inc. In addition, the Trust added to existing private placement investments in Church Services Holding Company; Clarion Brands Holding Corp.; CTM Holding, Inc.; ERG Holding Company LLC; Hollandia

2016 Annual Report

Produce LLC; HVAC Holdings, Inc.; JMH Investors LLC; Merex Holding Corporation; Petroplex Inv Holdings LLC and PPC Event Services. A brief description of these investments can be found in the Consolidated Schedule of Investments. The total amount invested by the Trust in these transactions was $55,320,585, which was only slightly less than the $55,820,480 of new private placement investments made by the Trust in 2015, and the third highest dollar volume over the past ten years. We are pleased to have generated strong new investment volume for the Trust three years in a row.

The Trust's level of new investment activity in 2016 benefited from larger average transaction sizes as compared to 2015, a steady flow of investment opportunities from an established network of private equity sponsors, and several follow-on investments in companies which the Trust had an existing investment. After spending most of 2016 at levels below prior year, middle market buyout volume ended the year flat compared to 2015, due to strong fourth quarter activity, particularly at the upper end of the middle market. Competition for new investment opportunities remains intense, as there continues to be an ever increasing abundance of private debt and equity capital looking to be invested. As a result, attractive companies are being aggressively pursued by both buyers and lenders alike. As a result, high purchase multiples and leverage levels continue to be prevalent in the market. In 2016, average purchase price multiples for middle market companies decreased modestly (approximately 3%) but remain higher than any year since 2000 (other than 2015). Average leverage multiples also remained elevated in 2016, albeit modestly lower than 2015. However, the average leverage multiple steadily increased each quarter during 2016 resulting in the fourth quarter average being the fourth highest since 2003.

Though we remained very active investors on behalf of the Trust in 2016, we did so, and will continue to do so, cautiously and with discipline, consistent with our longstanding investment philosophy of seeking to take prudent levels of risk and getting paid appropriately for the risk taken. In 2016, in the face of these aggressive market conditions, we continued our history of investing in companies at lower than market leverage levels. The average leverage of the Trust's new private placement investments in 2016 was 4.9 times EBITDA, compared to the average market multiple of 5.3 times EBITDA. This approach has served us well over the long term and through all kinds of market cycles.

In addition to strong new investment activity, the condition of the Trust's existing portfolio remained solid throughout the year. Sales and earnings for the Trust's portfolio companies as a whole continued their upward momentum. In addition, the number of companies on our watch list or in default remained at acceptable levels in 2016.

We had 19 companies exit from the Trust's portfolio during 2016. This level of exit activity remains relatively high for the Trust's portfolio, especially after the unprecedented 32 exits experienced in 2014 and 21 exits in 2015, and is another indicator of how active and aggressive the markets continued to be in 2016. In all but four of these exits, the Trust realized a positive return on its investment. Of note, 14 of the 19 exits in 2016 were the realization of stub equity holdings in companies where the interest bearing debt securities had previously been prepaid.

During 2016, the Trust had five portfolio companies fully or partially prepay their debt obligations. The level of refinancing activity in the portfolio in 2016 was notably lower than in each of the prior three years when prepayments numbered 15, 20, and 32 in 2015, 2014, and 2013, respectively. These transactions, in which the debt instruments held by the Trust were fully or partially prepaid, are generally driven by performing companies seeking to take advantage of lower interest rates and the abundant availability of debt capital. Unless replaced by new private debt investments, these prepayments reduce net investment income.

Barings Corporate Investors (formerly known as Babson Capital Corporate Investors)

As a result of the level of new investment activity, combined with the composition of the realizations (majority being the sale of non-cash pay equity securities) and lower level of prepayments, the Trust's recurring net investment income, increased nearly 14% to $1.05 per share as compared to $0.92 per share in 2015.

OUTLOOK FOR 2017

As we enter 2017, the pipeline of investment opportunities remains relatively healthy. The market appears optimistic that the new Presidential administration will result in a favorable economic environment, particularly for middle market companies, the very type of companies in which we focus our investment activities. Various surveys of middle market investment banks and capital providers would suggest the same. However, as previously mentioned, the market dynamics have, and are expected to continue to remain aggressive. And while there is much economic optimism, there is also a level of uncertainty that always comes with changes in governmental leadership. Rest assured that despite constantly changing market conditions, we will continue to employ on behalf of the Trust the same investment philosophy that has served it well since its inception: investing in companies which we believe have a strong business proposition, solid cash flow, and experienced, ethical management. We believe this philosophy, along with Barings' seasoned investment management team, positions the Trust well to meet its long-term investment objectives.

The Trust was able to maintain its $0.30 per share quarterly dividend in 2016 for a total annual dividend of $1.20 per share. However, it was once again necessary to supplement recurring investment income in each quarter of 2016 with non-recurring income and earnings carry forward in order to maintain the $1.20 per share annual dividend. As has been discussed in prior reports, recurring investment income alone has not been sufficient, and while improving, is not projected to be sufficient in the near term, to fully fund the current dividend rate. Net investment income has been below the dividend rate since 2013 due principally to the considerable reduction in the number of private debt securities in the portfolio resulting from the high level of exits and prepayment activity that occurred from 2013 through 2015, combined with generally lower investment returns available due to market and competitive dynamics over the past several years. As mentioned above, we made good progress in growing recurring investment income in 2016, but it remains below the dividend rate and will continue to require supplementation from non-recurring income in the near term. The level of expected recurring investment income generated by the Trust in 2017, combined with the availability of earnings carry forwards and other non-recurring income, maintenance of the current dividend rate over the next several quarters is expected. But over time, the Trust's dividend paying ability tends to be correlated with its recurring earnings capacity. As such, until recurring investment income reaches a level equal to the current dividend rate, there is the risk that the dividend may need to be reduced in the future.

As always, I would like to thank you for your continued interest in and support of Barings Corporate Investors. I look forward to seeing you at the Trust's annual shareholder meeting in Springfield on April 21, 2017.

Sincerely,

Robert M. Shettle

President

2016 Annual Report

2016 Dividends | Record Date | Total Paid | Ordinary Income | Short-Term Gains | Long-Term Gains |

| Regular | 5/2/2016 | 0.3000 | 0.3000 | — | — |

| Regular | 8/1/2016 | 0.3000 | 0.3000 | — | — |

| Regular | 11/7/2016 | 0.3000 | 0.3000 | — | — |

| Regular | 12/30/2016 | 0.3000 | 0.3000 | — | — |

| | | $1.2000 | $1.2000 | $0.0000 | $0.0000 |

The following table summarizes the tax effects of the relation of capital gains for 2016:

| | Amount per Share | Form 2439 |

| 2016 Gains Retained | 0.1140 | Line 1a |

| Long-Term Gains Retained | 0.1140 | |

| Taxes Paid | 0.0399 | Line 2* |

| Basis Adjustment | 0.0741 | ** |

| * | If you are not subject to federal capital gains tax (e.g. charitable organizations, IRAs and Keogh Plans) you may be able to claim a refund by filing Form 990-T. |

| ** | For federal income tax purposes, you may increase the adjusted cost basis of your shares by this amount (the excess of Line 1a over Line 2). |

Annual Dividend | Qualified for Dividend Received Deduction*** | Qualified Dividends**** | Interest Earned on U.S. Gov't. Obligations |

Amount Per

Share | Percent | Amount Per

Share | Percent | Amount Per

Share | Percent | Amount Per

Share |

| $ 1.20 | 13.4944% | 0.1479 | 13.4944% | 0.1479 | 0% | 0.0000 |

| *** | Not available to individual shareholders |

| **** | Qualified dividends are reported in Box 1b on IRS Form 1099-Div for 2016 |

BARINGS CORPORATE INVESTORS Financial Report | | |

| | | |

| | | |

| Consolidated Statement of Assets and Liabilities | 7 | |

| | | |

| Consolidated Statement of Operations | 8 | |

| | | |

| Consolidated Statement of Cash Flows | 9 | |

| | | |

| Consolidated Statements of Changes in Net Assets | 10 | |

| | | |

| Consolidated Selected Financial Highlights | 11 | |

| | | |

| Consolidated Schedule of Investments | 12-40 | |

| | | |

| Notes to Consolidated Financial Statements | 41-48 | |

| | | |

| Report of Independent Registered Public Accounting Firm | 49 | |

| | | |

| Interested Trustees | 50-51 | |

| | | |

| Independent Trustees | 52-53 | |

| | | |

Officers of the Trust | 54 | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Quantitative Information about Level 3 Fair Value Measurements

The following table represents quantitative information about Level 3 fair value measurements as of December 31, 2016:

| | | | | | |

| | Fair Value | Valuation Technique | Unobservable Inputs | Range | Weighted Average |

| Bank Loans | $4,412,500 | Broker Quote | Single Broker | 98% to 98.3% | 98.1% |

| | $6,984,560 | Discounted Cash Flows | Discount Rate | 8.8% to 9.2% | 9.0% |

| | | | | | |

| Corporate Bonds | $136,204,881 | Discounted Cash Flows | Discount Rate | 9.3% to 17.1% | 12.5% |

| | | | | | |

| | $10,734,805 | Market Approach | Valuation Multiple | 3.8x to 10.2x | 7.3x |

| | | | | | |

| | | | EBITDA | $0.0 million to $9.2 million | $5.1 million |

| | | | | | |

| Equity Securities | $42,246,087 | Market Approach | Valuation Multiple | 3.8x to 12.2x | 8.0x |

| | | | | | |

| | | | EBITDA | $0.0 million to $157.6 million | $27.1 million |

Certain of the Trust's Level 3 investments have been valued using unadjusted inputs that have not been internally developed by the Trust, including recently purchased securities held at cost. As a result, fair value of assets of $1,607,588 have been excluded from the preceding table.

Fair Value Hierarchy

The Trust categorizes its investments measured at fair value in three levels, based on the inputs and assumptions used to determine fair value. These levels are as follows:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Trust's own assumptions in determining the fair value of investments)

The following table summarizes the levels in the fair value hierarchy into which the Trusts' financial instruments are categorized as of December 31, 2016.

The fair values of our investments disaggregated into the three levels of the fair value hierarchy based upon the lowest level of significant input used in the valuation as of December 31, 2016 are as follows:

| | | | | | | | | | | | | |

| Assets: | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

| Restricted Securities | | | | | | | | | | | | |

| Corporate Bonds | | $ | 203,426,203 | | | $ | — | | | $ | 56,486,517 | | | $ | 146,939,686 | |

| Bank Loans | | | 10,414,560 | | | | — | | | | — | | | | 10,414,560 | |

| Common Stock - U.S. | | | 13,321,840 | | | | — | | | | — | | | | 13,321,840 | |

| Preferred Stock | | | 8,047,466 | | | | — | | | | — | | | | 8,047,466 | |

| Partnerships and LLCs | | | 22,484,369 | | | | — | | | | — | | | | 22,484,369 | |

| Public Securities | | | | | | | | | | | | | | | | |

| Bank Loans | | | 6,473,823 | | | | — | | | | 5,491,323 | | | | 982,500 | |

| Corporate Bonds | | | 28,845,261 | | | | — | | | | 28,845,261 | | | | — | |

| Common Stock - U.S. | | | 191 | | | | 191 | | | | — | | | | — | |

| Short-term Securities | | | 10,898,470 | | | | — | | | | 10,898,470 | | | | — | |

| Total | | $ | 303,912,183 | | | $ | 191 | | | $ | 101,721,571 | | | $ | 202,190,421 | |

See information disaggregated by security type and industry classification in the Consolidated Schedule of Investments.

Barings Corporate Investors (formerly known as Babson Capital Corporate Investors)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets: | | Beginning

balance

at 12/31/2015 | | | Included in

earnings | | | Purchases | | | Sales | | | Prepayments | | | Transfers

into

Level 3 | | | Transfers

out

of Level 3 | | | Ending

balance at

12/31/2016 | |

| Restricted Securities | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Bonds | | $ | 137,668,650 | | | $ | (9,961,618 | ) | | $ | 44,297,056 | | | $ | (9,907,191 | ) | | $ | (15,157,211 | ) | | $ | — | | | $ | — | | | $ | 146,939,686 | |

| Bank Loans | | | 6,381,040 | | | | 293,520 | | | | 6,860,000 | | | | (3,570,000 | ) | | | — | | | | — | | | | — | | | | 10,414,560 | |

| Common Stock - U.S. | | | 17,650,577 | | | | (688,129 | ) | | | 2,563,162 | | | | (6,203,770 | ) | | | — | | | | — | | | | — | | | | 13,321,840 | |

| Preferred Stock | | | 13,760,307 | | | | 1,424,530 | | | | 681,059 | | | | (7,818,430 | ) | | | — | | | | — | | | | — | | | | 8,047,466 | |

| Partnerships and LLCs | | | 21,562,089 | | | | 6,311,685 | | | | 2,182,645 | | | | (7,572,050 | ) | | | — | | | | — | | | | — | | | | 22,484,369 | |

| Public Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank Loans | | | — | | | | 2,500 | | | | 980,000 | | | | — | | | | — | | | | — | | | | — | | | | 982,500 | |

| | | $ | 197,472,663 | | | $ | (2,617,512 | ) | | $ | 57,563,922 | | | $ | (35,071,441 | ) | | $ | (15,157,211 | ) | | $ | — | | | $ | — | | | $ | 202,190,421 | |

There were no transfers into or out of Level 1 or Level 2 assets.

Income, Gains and Losses included in Net Increase in Net Assets resulting from Operations for the period are presented in the following accounts on the Statement of Operations:

| | | | | | | |

| | | Net Increase in

Net Assets Resulting

from Operations | | | Change in Unrealized

Gains & (Losses) in Net Assets from assets still held | |

| Interest (Amortization) | | $ | 536,455 | | | $ | — | |

Net realized gain on investments before taxes | | $ | 7,477,556 | | | | — | |

Net change in unrealized depreciation of investments before taxes | | $ | (10,631,523 | ) | | | (11,723,837 | ) |

B. Accounting for Investments:

Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis, including the amortization of premiums and accretion of discounts on bonds held using the yield-to-maturity method. The Trust does not accrue income when payment is delinquent and when management believes payment is questionable.

Realized gains and losses on investment transactions and unrealized appreciation and depreciation of investments are reported for financial statement and Federal income tax purposes on the identified cost method.

C. Use of Estimates:

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Actual results could differ from those estimates.

D. Federal Income Taxes:

The Trust has elected to be taxed as a "regulated investment company" under the Internal Revenue Code, and intends to maintain this qualification and to distribute substantially all of its net taxable income to its shareholders. In any year when net long-term capital gains are realized by the Trust, management, after evaluating the prevailing economic conditions, will recommend that the Trustees either designate the net realized long-term gains as undistributed and pay the Federal capital gains taxes thereon or distribute all or a portion of such net gains. In 2016, the fund incurred $776,619 of tax as a result of retaining capital gains.

The Trust is taxed as a regulated investment company and is therefore limited as to the amount of non-qualified income that it may receive as the result of operating a trade or business, e.g. the Trust's pro rata share of income allocable to the Trust by a partnership operating company. The Trust's violation

2016 Annual Report

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

of this limitation could result in the loss of its status as a regulated investment company, thereby subjecting all of its net income and capital gains to corporate taxes prior to distribution to its shareholders. The Trust, from time-to-time, identifies investment opportunities in the securities of entities that could cause such trade or business income to be allocable to the Trust. The CI Subsidiary Trust (described in Footnote 1 above) was formed in order to allow investment in such securities without adversely affecting the Trust's status as a regulated investment company.

Net investment income and net realized gains or losses of the Trust as presented under U.S. GAAP may differ from distributable taxable earnings due to earnings from the CI Subsidiary Trust as well as certain permanent and temporary differences in the recognition of income and realized gains or losses on certain investments. Permanent differences will result in reclassifications to the capital accounts. In 2016, the Trust decreased undistributed net investment income by $1,164,856, increased accumulated net realized gains by $1,262,232, increased retained net realized gain on investments by 2,256,038, and decreased additional paid in capital by $2,353,414 to more accurately display the Trust's capital financial position on a tax-basis in accordance with U.S. GAAP. These re-classifications had no impact on net asset value.

The Trusts' current income tax expense as shown on the Statement of Operations is $2,277,985 which is comprised of income tax expense on long term capital gains retained related to the regulated investment company of $776,619 as well as taxes related to the CI Subsidiary Trust as described in the table below of $1,501,366.

The CI Subsidiary Trust is not taxed as a regulated investment company. Accordingly, prior to the Trust receiving any distributions from the CI Subsidiary Trust, all of the CI Subsidiary Trust's taxable income and realized gains, including non-qualified income and realized gains, is subject to taxation at prevailing corporate tax rates.

The components of income taxes included in the consolidated Statement of Operations for the year ended December 31, 2016 were as follows:

Income tax expense (benefit)

| Current: | | | |

| Federal | | $ | 967,016 | |

| State | | | 534,350 | |

| Total current | | | 1,501,366 | |

| | | | | |

| Deferred: | | | | |

| Federal | | | (101,340 | ) |

| State | | | (13,636 | ) |

| Total deferred | | | (114,976 | ) |

| | | | | |

| Total income tax expense from continuing operations | | $ | 1,386,390 | |

| | | | | |

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of the existing assets and liabilities and their respective tax basis.

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and liabilities as of December 31, 2016 were as follows:

Deferred tax liabilities:

| Unrealized gain on investments | | | 1,013,201 | |

| | | | | |

| Total deferred tax liabilities | | | 1,013,201 | |

| Net deferred tax liability | | $ | (1,013,201 | ) |

| | | | | |

The Trust recognizes a tax benefit from an uncertain position only if it is more likely than not that the position is sustainable, based solely on its technical merits and consideration of the relevant taxing authority's widely understood administrative practices and precedents. If this threshold is met, the Trust measures the tax benefit as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. Tax positions not deemed to meet the "more-likely-than-not" threshold are reserved and recorded as a tax benefit or expense in the current year. All penalties and interest associated with income taxes are included in income tax expense. The Trust has evaluated and determined that the tax positions did not have a material effect on the Trust's financial position and results of operations for the year ended December 31, 2016.

A reconciliation of the differences between the Trust's income tax expense and the amount computed by applying the prevailing U.S. Federal tax rate to pretax

Barings Corporate Investors (formerly known as Babson Capital Corporate Investors)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

income for the year ended December 31, 2016 is as follows:

| | | | | | | |

| | | Amount | | | Percentage | |

| | | | | | | |

Provision for income taxes at the U.S. federal rate | | $ | 855,637 | | | | 34.00% | |

| | | | | | | | | |

State tax, net of federal effect | | | 520,714 | | | | 20.69% | |

| | | | | | | | | |

Change in valuation allowance | | | — | | | | 0.00% | |

| | | | | | | | | |

| Other | | | 10,039 | | | | 0.40% | |

| | | | | | | | | |

| Income tax expense | | $ | 1,386,390 | | | | 55.09% | |

| | | | | | | | | |

Each of the Trust's Federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

E. Distributions to Shareholders:

The Trust records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Trust's net investment income dividend is declared four times per year, in April, July, October, and December. The Trust's net realized capital gain distribution, if any, is declared in December.

The components of capital shown in the following table represent the Trust's undistributed net investment income, undistributed net capital gain, losses the Trust may be able to offset against gains in future taxable years, as well as unrealized appreciation (depreciation) on securities and other fund investments, if any, at December 31, 2016, each of which determined on a U.S. Federal tax basis:

Undistributed (Overdistributed) Net Investment

Income | | | Undistributed Net Capital

Gain | | | Accumulated

Loss Carryforward | | | Net Unrealized

Appreciation (Depreciation)

on Securities and Other

Investments | |

| $ | 2,808,212 | | | $ | 0 | | | $ | 0 | | | $ | (5,764,619 | ) |

| | | | | | | | | | | | | | | |

The tax character of distributions declared during the years ended December 31, 2016 and 2015 was as follows:

| Distributions paid from: | | 2016 | | | 2015 | |

| | | | | | | |

| Ordinary Income | | $ | 23,688,009 | | | $ | 23,539,826 | |

| | | | | | | | | |

| Long-term Capital Gains | | $ | — | | | $ | — | |

| 3. | Investment Services Contract |

A. Services:

Under an Investment Services Contract (the "Contract") with the Trust, Barings agrees to use its best efforts to present to the Trust a continuing and suitable investment program consistent with the investment objectives and policies of the Trust. Barings represents the Trust in any negotiations with issuers, investment banking firms, securities brokers or dealers and other institutions or investors relating to the Trust's investments. Under the Contract, Barings also provides administration of the day-to-day operations of the Trust and provides the Trust with office space and office equipment, accounting and bookkeeping services, and necessary executive, clerical and secretarial personnel for the performance of the foregoing services.

B. Fee:

For its services under the Contract, Barings is paid a quarterly investment advisory fee of 0.3125% of the net asset value of the Trust as of the last business day of each fiscal quarter, which is approximately equal to 1.25% annually. A majority of the Trustees, including a majority of the Trustees who are not interested persons of the Trust or of Barings, approve the valuation of the Trust's net assets as of such day.

| 4. | Senior Secured Indebtedness |

MassMutual holds the Trust's $30,000,000 Senior Fixed Rate Convertible Note (the "Note") issued by the Trust on November 15, 2007. The Note is due November 15, 2017 and accrues interest at 5.28% per annum. MassMutual, at its option, can convert the principal amount of the Note into common shares. The dollar amount of principal would be converted into an equivalent dollar amount of common shares based upon the average price of the common shares for ten business days prior to the notice of conversion. For the year ended December 31, 2016, the Trust incurred total interest expense on the Note of $1,584,000.

The Trust may redeem the Note, in whole or in part, at the principal amount proposed to be redeemed together with the accrued and unpaid interest thereon through the redemption date plus a Make Whole Premium. The Make Whole Premium equals the excess of (i) the present value of the scheduled payments of principal and interest which the Trust would have paid but for the proposed redemption, discounted at the rate of interest of U.S. Treasury obligations whose maturity approximates that of the Note plus 0.50% over (ii) the principal of the Note proposed to be redeemed.

2016 Annual Report

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Management estimates that the fair value of the Note was $30,835,320 as of December 31, 2016. The fair value of the Note is categorized as a Level 3 under ASC 820.

| 5. | Purchases and Sales of Investments |

| | | For the year ended

12/31/2016 | |

| | | Cost of

Investments

Acquired | | | Proceeds

from

Sales or

Maturities | |

| | | | | | | |

| Corporate restricted securities | | $ | 78,502,579 | | | $ | 73,978,189 | |

| | | | | | | | | |

| Corporate public securities | | | 10,463,105 | | | | 28,558,396 | |

The difference between book-basis and tax-basis cost is primarily due to holdings of partnerships. The net unrealized depreciation of investments for financial reporting and Federal tax purposes as of December 31, 2016 is $2,631,413 and consists of $26,362,755 appreciation and $28,994,168 depreciation.

Net unrealized depreciation of investments on the Statement of Assets and Liabilities reflects the balance net of a deferred tax accrual of $1,013,201 on net unrealized losses on the CI Subsidiary Trust.

| 6. | Quarterly Results of Investment Operations (Unaudited) |

| | | March 31, 2016 | |

| | | Amount | | | Per Share | |

| Investment income | | $ | 6,313,481 | | | | |

| Net investment income | | | 4,808,831 | | | $ | 0.24 | |

Net realized and unrealized loss on investments

(net of taxes) | | | 1,368,826 | | | | 0.07 | |

| | | | | | | | | |

| | | | |

| | | June 30, 2016 | |

| | | Amount | | | Per Share | |

| Investment income | | $ | 7,014,018 | | | | | |

| Net investment income | | | 5,503,645 | | | $ | 0.28 | |

Net realized and unrealized gain on investments

(net of taxes) | | | 2,858,595 | | | | 0.15 | |

| | | September 30, 2016 | |

| | | Amount | | | Per Share | |

| Investment income | | $ | 6,815,924 | | | | |

| Net investment income | | | 5,290,597 | | | $ | 0.27 | |

Net realized and unrealized gain on investments

(net of taxes) | | | 6,058,772 | | | $ | 0.31 | |

| | | | | | | | | |

| | | | |

| | | December 31, 2016 | |

| | | Amount | | | Per Share | |

| Investment income | | $ | 8,039,384 | | | | | |

| Net investment income | | | 6,568,766 | | | $ | 0.33 | |

Net realized and unrealized loss on investments

(net of taxes) | | | (5,217,976 | ) | | | (0.26 | ) |

In the normal course of its business, the Trust trades various financial instruments and enters into certain investment activities with investment risks. These risks include: (i) market risk, (ii) volatility risk and (iii) credit, counterparty and liquidity risk. It is the Trust's policy to identify, measure and monitor risk through various mechanisms including risk management strategies and credit policies. These include monitoring risk guidelines and diversifying exposures across a variety of instruments, markets and counterparties. There can be no assurance that the Trust will be able to implement its credit guidelines or that its risk monitoring strategies will be successful.

| 8. | Commitments and Contingencies |

During the normal course of business, the Trust may enter into contracts and agreements that contain a variety of representations and warranties. The exposure, if any, to the Trust under these arrangements is unknown as this would involve future claims that may or may not be made against the Trust and which have not yet occurred. The Trust has no history of prior claims related to such contracts and agreements.

At December 31, 2016, the Trust had the following unfunded commitments:

Investment | | Unfunded Amount | |

| | | | |

| CORA Health Services, Inc. | | $ | 1,807,693 | |

| | | | | |

| HVAC Holdings, Inc. | | $ | 1,218,493 | |

Barings Corporate Investors (formerly known as Babson Capital Corporate Investors)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

| 9. | Aggregate Remuneration Paid to Officers, Trustees and Their Affiliated Persons |

For the year ended December 31, 2016, the Trust paid its Trustees aggregate remuneration of $317,400. During the year, the Trust did not pay any compensation to any of its Trustees who are "interested persons" (as defined by the 1940 Act) of the Trust. The Trust classifies Messrs. Noreen and Joyal as "interested persons" of the Trust.

All of the Trust's officers are employees of Barings or MassMutual. Pursuant to the Contract, the Trust does not compensate its officers who are employees of Barings or MassMutual (except for the Chief Compliance Officer of the Trust unless assumed by Barings). For the year ended December 31, 2016, Barings paid the compensation of the Chief Compliance Officer of the Trust.

Mr. Noreen, one of the Trust's Trustees, is an "affiliated person" (as defined by the 1940 Act) of MassMutual and Barings.

The Trust did not make any payments to Barings for the year ended December 31, 2016, other than amounts payable to Barings pursuant to the Contract.

As required under New York Stock Exchange ("NYSE") Corporate Governance Rules, the Trust's principal executive officer has certified to the NYSE that he was not aware, as of the certification date, of any violation by the Trust of the NYSE's Corporate Governance listing standards. In addition, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and related SEC rules, the Trust's principal executive and principal financial officers have made quarterly certifications, included in filings with the SEC on Forms N-CSR and N-Q, relating to, among other things, the Trust's disclosure controls and procedures and internal control over financial reporting, as applicable.

The Trust has evaluated the possibility of subsequent events after the balance sheet date of December 31, 2016, through the date that the financial statements are issued. The Trust has determined that there are no material events that would require recognition or disclosure in this report through this date.

48

2016 Annual Report

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Trustees of Barings Corporate Investors:

We have audited the accompanying consolidated statement of assets and liabilities of Barings Corporate Investors (f/k/a Babson Capital Corporate Investors) (the "Trust"), including the consolidated schedule of investments, as of December 31, 2016, and the related consolidated statements of operations and cash flows for the year then ended, the consolidated statements of changes in net assets for each of the years in the two-year period then ended, and the consolidated selected financial highlights for each of the years in the five-year period then ended. These consolidated financial statements and consolidated selected financial highlights are the responsibility of the Trust's management. Our responsibility is to express an opinion on these consolidated financial statements and consolidated selected financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements and consolidated selected financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2016, by correspondence with custodian and counterparties. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements and consolidated selected financial highlights referred to above present fairly, in all material respects, the financial position of Barings Corporate Investors (f/k/a Babson Capital Corporate Investors) as of December 31, 2016, the consolidated results of their operations and cash flows for the year then ended, the consolidated changes in their net assets for each of the years in the two-year period then ended, and the consolidated selected financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 24, 2017

Barings Corporate Investors

INTERESTED TRUSTEES

| | | | | | |

| Name (Age), Address | Position With

The Trust | Office Term / Length

of Time Served | Principal Occupations

During Past 5 Years | Portfolios Overseen

in Fund Complex | Other Directorships

Held by Director |

| | | | | | |

| | | | | | |

Clifford M. Noreen* (59) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Trustee, Chairman | Term expires 2018; Trustee since 2009 | Deputy Chief Investment Officer and Managing Director (since 2016), MassMutual; President (2008-2016), Vice Chairman (2007-2008), Member of the Board of Managers (2006-2016), Managing Director (2000-2016), Barings; President (2005-2009), Vice President (1993-2005) of the Trust. | 2 | Chairman and Trustee (since 2009), President (2005-2009), Vice President (1993-2009), Barings Participation Investors; President (since 2009), Senior Vice President (1996-2009), HYP Management LLC (LLC Manager); Director (2005-2013), MassMutual Corporate Value Limited (investment company); Director (2005-2013), MassMutual Corporate Value Partners Limited (investment company); Director (since 2008), Jefferies Finance LLC (finance company); Chairman and Chief Executive Officer (since 2009), Manager (since 2007), MMC Equipment Finance LLC; Director (2011-2016), Wood Creek Capital Management, LLC (investment advisory firm); Chairman (since 2009), Trustee (since 2005), President (2005-2009), CI Subsidiary Trust and PI Subsidiary Trust; Member of Investment Committee (since 1999), Diocese of Springfield; and Member of Investment Committee (since 2015), Baystate Health Systems |

| | | | | | |

| * | Mr. Noreen is classified as an "interested person" of the Trust and Barings (as defined by the Investment Company Act of 1940, as amended) because of his position as an Officer of the Trust and his former position as President of Barings. |

2016 Annual Report

INTERESTED TRUSTEES

| | | | | | |

| Name (Age), Address | Position With

The Trust | Office Term / Length

of Time Served | Principal Occupations

During Past 5 Years | Portfolios Overseen

in Fund Complex | Other Directorships

Held by Director |

| | | | | | |

| | | | | | |

Robert E. Joyal* (72) Barings Corporate Investors 1500 Main Street P.O. Box 15189

Springfield, MA

01115-5189 | Trustee | Term expires 2019; Trustee since 2003 | Retired (since 2003); President (2001-2003), Barings; and President (1993-2003) of the Trust. | 95 | Trustee (since 2003), President (1993-2003), Barings Participation Investors; Director (2006-2014), Jefferies Group, Inc. (financial services); Director (2007-2011), Scottish Re Group Ltd. (global life reinsurance specialist); Trustee (since 2003), MassMutual Select Funds (an open-end investment company advised by MassMutual); Trustee (since 2003), MML Series Investment Fund (an open-end investment company advised by MassMutual); Trustee (since 2012), MML Series Investment Fund II (an open-ended investment company advised by MassMutual); Trustee (since 2012), MassMutual Premier Funds (an open-ended investment company advised by MassMutual); Director (since 2012), Ormat Technologies, Inc. (a geothermal energy company); Director (since 2013), Leucadia National Corporation (holding company owning businesses ranging from insurance to telecommunications); and Director (2013-2016), Baring Asset Management Korea Limited (company that engages in asset management, business administration and investment management). |

| | | | | | |

| * | Mr. Joyal retired as President of Barings in June 2003. In addition and as noted above, Mr. Joyal is a director of Leucadia National Corporation, which is the parent company of Jefferies Group, Inc., and a former Director of Jefferies Group, Inc., which has a wholly-owned broker-dealer subsidiary that may execute portfolio transactions and/or engage in principal transactions with the Trust, other investment companies advised by Barings or any other advisory accounts over which Barings has brokerage placement discretion. Accordingly, the Trust has determined to classify Mr. Joyal as an "interested person" of the Trust and Barings (as defined by the Investment Company Act of 1940, as amended). |

Barings Corporate Investors

INDEPENDENT TRUSTEES

| Name (Age), Address | Position With

The Trust | Office Term / Length

of Time Served | Principal Occupations

During Past 5 Years | Portfolios Overseen

in Fund Complex | Other Directorships

Held by Director |

| | | | | | |

| | | | | | |

Michael H. Brown (59) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Trustee/

Nominee | Term expires 2017; Trustee since 2005 | Private Investor; and Managing Director (1994-2005), Morgan Stanley. | 2 | Trustee (since 2005), Barings Participation Investors; Independent Director (2006-2014), Invicta Holdings LLC and its subsidiaries (a derivative trading company owned indirectly by MassMutual). |

| | | | | |

Barbara M. Ginader (60) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Trustee/

Nominee | Term expires 2017; Trustee since 2013 | Managing Director and General Partner (since 1993), Boston Ventures Management (private equity firm). | 2 | Trustee (since 2013), Barings Participation Investors; Managing Director (since 1993), Boston Ventures VI L.P. (private equity fund); Managing Director (since 1993), Boston Ventures V L.P. (private equity fund); Member of the Board Overseers (2013-2014), MSPCA-Angell; Member of the Grants Committee (2013-2014), IECA Foundation; and President of the Board (2006-2012), Codman Academy Public Charter School. |

| | | | | |

Edward P. Grace III (66) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Trustee | Term expires 2018; Trustee since 2012 | President (since 1997), Phelps Grace International, Inc. (investment management); Managing Director (since 1998), Grace Ventures Partners LP (venture capital fund); Senior Advisor (since 2011), Angelo Gordon & Co. (investment adviser). | 2 | Trustee (since 2012), Barings Participation Investors; Director (since 2010), Larkburger, Inc. (restaurant chain); Director (since 2012), Benihana, Inc. (restaurant chain); Director (since 2011), Firebirds Wood Fired Holding Corporation (restaurant chain), Director (since 1998), Shawmut Design and Construction (construction management and general contracting firm); Director (2004-2012), Not Your Average Joe's, Inc. (restaurant chain). |

| | | | | |

Susan B. Sweeney (64) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Trustee | Term expires 2019; Trustee since 2012 | Retired (since 2014); Senior Vice President and Chief Investment Officer (2010-2014), Selective Insurance Company of America; Senior Managing Director (2008-2010), Ironwood Capital. | 95 | Trustee (since 2012), Barings Participation Investors; Trustee (since 2009), MassMutual Select Funds (an open-ended investment company advised by MassMutual); Trustee (since 2009), MML Series Investment Fund (an open-ended investment company advised by MassMutual); Trustee (since 2012), MassMutual Premier Funds (an open-ended investment company advised by MassMutual); Trustee (since 2012), MML Series Investment Fund II (an open-ended investment company advised by MassMutual). |

2016 Annual Report

| Name (Age), Address | Position With

The Trust | Office Term / Length

of Time Served | Principal Occupations

During Past 5 Years | Portfolios Overseen

in Fund Complex | Other Directorships

Held by Director |

| | | | | | |

| | | | | | |

Maleyne M. Syracuse (60) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Trustee/

Nominee | Term expires 2017; Trustee since 2007 | Private Investor; Managing Director (1999-2000), JP Morgan Securities, Inc. (investments and banking); Managing Director (1999-2000), Deutsche Bank Securities; Managing Director (1981-1999), Bankers Trust/ BT Securities | 2 | Trustee (since 2007), Barings Participation Investors. |

| | | | | | |

Barings Corporate Investors

OFFICERS OF THE TRUST

| | | | |

| Name (Age), Address | Position With

The Trust | Office Term / Length

of Time Served | Principal Occupations

During Past 5 Years |

| | | | |

| | | | |

Robert M. Shettle (49) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | President | Since 2016 | Vice President (2015-2016) of the Trust; President (since 2016), Vice President (2015-2016), Barings Participation Investors; Managing Director (since 2006), Director (1998-2006), Barings; President (since 2016), Vice President (2005-2016), CI Subsidiary Trust and PI Subsidiary Trust. |

| | | |

Janice M. Bishop (52) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Vice President, Secretary and Chief Legal Officer | Since 2015 | Associate Secretary (2008-2015) of the Trust; Vice President, Secretary and Chief Legal Officer (since 2015), Associate Secretary (2008-2015), Barings Participation Investors; Vice President, Secretary and Chief Legal Officer (since 2013), Barings Funds Trust; Vice President, Secretary and Chief Legal Officer (since 2012), Barings Global Short Duration High Yield Fund; Senior Counsel and Managing Director (since 2014), Counsel (2007-2014), Barings; Vice President and Secretary (since 2015), Assistant Secretary (2008-2015), CI Subsidiary Trust and PI Subsidiary Trust. |

| | | |

James M. Roy (54) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Vice President and Chief Financial Officer | Since 2005 | Treasurer (2003-2005), Associate Treasurer (1999-2003) of the Trust; Vice President and Chief Financial Officer (since 2005), Treasurer (2003-2005), Associate Treasurer (1999-2003), Barings Participation Investors; Managing Director (since 2005), Director (2000-2005), Barings; and Trustee (since 2005), Treasurer (since 2005), Controller (2003-2005), CI Subsidiary Trust and PI Subsidiary Trust. |

| | | |

Melissa M. LaGrant (43) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Chief Compliance Officer | Since 2006 | Chief Compliance Officer (since 2006), Barings Participation Investors; Chief Compliance Officer (since 2013), Barings Finance LLC; Chief Compliance Officer (since 2013), Barings Funds Trust; Chief Compliance Officer (since 2012), Barings Global Short Duration High Yield Fund; Managing Director (since 2005), Barings. |

| | | |

Daniel J. Florence (44) Barings Corporate Investors 1500 Main Street P.O. Box 15189 Springfield, MA 01115-5189 | Treasurer | Since 2008 | Associate Treasurer (2006-2008) of the Trust; Treasurer (since 2008), Associate Treasurer (2006-2008), Barings Participation Investors; and Director (since 2013), Associate Director (2008-2013), Analyst (2000-2008), Barings. |

| | | |

Sean Feeley (49) Barings

Corporate Investors

1500 Main Street

P.O. Box 15189

Springfield, MA 01115-5189 | Vice President | Since 2011 | Vice President (since 2011), Barings Participation Investors; Vice President (since 2012), Barings Global Short Duration High Yield Fund; Managing Director (since 2003), Barings and Vice President (since 2011), CI Subsidiary Trust and PI Subsidiary Trust. |

| * | Officers hold their position with the Trust until a successor has been duly elected and qualified. Officers are generally elected annually by the Board of Trustees of the Trust. The officers were last elected on July 20, 2016. |

2016 Annual Report

This page left intentionally blank.

Barings Corporate Investors (formerly known as Babson Capital Corporate Investors)

This page left intentionally blank.

Barings Corporate Investors (the "Trust") offers a Dividend Reinvestment and Share Purchase Plan (the "Plan"). The Plan provides a simple way for shareholders to add to their holdings in the Trust through the receipt of dividend shares issued by the Trust or through the investment of cash dividends in Trust shares purchased in the open market. A shareholder may join the Plan by filling out and mailing an authorization card to DST Systems, Inc., the Transfer Agent.

Participating shareholders will continue to participate until they notify the Transfer Agent, in writing, of their desire to terminate participation. Unless a shareholder elects to participate in the Plan, he or she will, in effect, have elected to receive dividends and distributions in cash. Participating shareholders may also make additional contributions to the Plan from their own funds. Such contributions may be made by personal check or other means in an amount not less than $10 nor more than $5,000 per quarter. Cash contributions must be received by the Transfer Agent at least five days (but no more then 30 days) before the payment date of a dividend or distribution.

Whenever the Trust declares a dividend payable in cash or shares, the Transfer Agent, acting on behalf of each participating shareholder, will take the dividend in shares only if the net asset value is lower than the market price plus an estimated brokerage commission as of the close of business on the valuation day. The valuation day is the last day preceding the day of dividend payment.

When the dividend is to be taken in shares, the number of shares to be received is determined by dividing the cash dividend by the net asset value as of the close of business on the valuation date or, if greater than net asset value, 95% of the closing share price. If the net asset value of the shares is higher than the market value plus an estimated commission, the Transfer Agent, consistent with obtaining the best price and execution, will buy shares on the open market at current prices promptly after the dividend payment date.

The reinvestment of dividends does not, in any way, relieve participating shareholders of any federal, state or local tax. For federal income tax purposes, the amount reportable in respect of a dividend received in newly-issued shares of the Trust will be the fair market value of the shares received, which will be reportable as ordinary income and/or capital gains.

As compensation for its services, the Transfer Agent receives a fee of 5% of any dividend and cash contribution (in no event in excess of $2.50 per distribution per shareholder.)

Any questions regarding the Plan should be addressed to DST Systems, Inc., Agent for Barings Corporate Investors' Dividend Reinvestment and Share Purchase Plan, P.O. Box 219086, Kansas City, MO 64121-9086.

| | | |

| Members of the Board of Trustees |

Michael H. Brown* Private Investor | Barbara M. Ginader Managing Director and General Partner Boston Ventures Management | Edward P. Grace President Phelps Grace International, Inc |

Robert E. Joyal Retired President, Barings | Clifford M. Noreen Deputy Chief Investment Officer Massachusetts Mutual Life Insurance Company | Susan B. Sweeney* Private Investor |

Maleyne M. Syracuse* Private Investor | | |

|

| Officers |

Clifford M. Noreen Chairman | Robert M. Shettle President | James M. Roy Vice President & Chief Financial Officer |

Janice M. Bishop Vice President, Secretary & Chief Legal Officer | Sean Feeley Vice President | Daniel J. Florence Treasurer |

Melissa M. LaGrant Chief Compliance Officer | | |

* Member of the Audit Committee

ITEM 2. CODE OF ETHICS.

The Registrant adopted a Code of Ethics for Senior Financials Officers (the "Code") on October 17, 2003, which is available on the Registrant's website at www.barings.com/mci. During the period covered by this Form N-CSR, there were no amendments to, or waivers from, the Code.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Registrant's Board of Trustees has determined that Mr. Michael H. Brown, a Trustee of the Registrant and a member of its Audit Committee, is an audit committee financial expert. Mr. Brown is "independent" for purposes of this Item 3 as required by applicable regulation.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

The Registrant has engaged its principal accountant, KPMG LLP, to perform audit services, audit-related services, tax services and other services during the past two fiscal years. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years by KPMG LLP.

Fees Billed to the Registrant:

| | | KPMG LLP Year Ended December 31, 2016 | | | KPMG LLP Year Ended December 31, 2015 | |

Audit Fees | | $ | 78,100 | | | $ | 71,000 | |

Audit-Related Fees | | | 0 | | | | 0 | |

Tax Fees | | | 45,665 | | | | 45,665 | |

All Other Fees | | | 0 | | | | 0 | |

Total Fees | | $ | 123,765 | | | $ | 116,665 | |

Non-Audit Fees Billed to Barings and MassMutual:

| | | KPMG LLP Year Ended December 31, 2016 | | | KPMG LLP Year Ended December 31, 2015 | |

Audit-Related Fees | | $ | 1,239,527 | | | $ | 1,393,808 | |

Tax Fees | | | 227,500 | | | | 333,000 | |

All Other Fees | | | 35,000 | | | | 23,100 | |

Total Fees | | $ | 1,502,027 | | | $ | 1,749,908 | |

The category "Audit Fees" refers to performing an audit of the Registrant's annual financial statements or services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements for those fiscal years. The category "Audit-Related Fees" reflects fees billed by KPMG LLP for various non-audit and non-tax services rendered to the Registrant, Barings and MassMutual, such as a SOC - 1 review, consulting and agreed upon procedures reports. Preparation of Federal, state and local income tax and tax compliance work are representative of the fees reported in the "Tax Fees" category. The category "All Other Fees" represents fees billed by KPMG LLP for consulting rendered to the Registrant, Barings and MassMutual.

The Sarbanes-Oxley Act of 2002 and its implementing regulations allow the Registrant's Audit Committee to establish a pre-approval policy for certain services rendered by the Registrant's principal accountant. During 2016, the Registrant's Audit Committee approved all of the services rendered to the Registrant by KPMG LLP and did not rely on such a pre-approval policy for any such services.

The Audit Committee has also reviewed the aggregate fees billed for professional services rendered by KPMG LLP for 2015 and 2016 for the Registrant and for the non-audit services provided to Barings, and Barings' parent, MassMutual. As part of this review, the Audit Committee considered whether the provision of such non-audit services was compatible with maintaining the principal accountant's independence.

The 2015 fees billed represent final 2015 amounts, which may differ from the preliminary figures available as of the filing date of the Registrant's 2015 Annual Form N-CSR and includes, among other things, fees for services that may not have been billed as of the filing date of the Registrant's 2015 Annual Form N-CSR, but are now properly included in the 2015 fees billed to the Registrant, Barings and MassMutual.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The Registrant maintains an Audit Committee composed exclusively of Trustees of the Registrant who qualify as "independent" Trustees under the current listing standards of the New York Stock Exchange and the rules of the U.S. Securities and Exchange Commission. The Audit Committee operates pursuant to a written Audit Committee Charter, which is available (1) on the Registrant's website, www.barings.com/mci; and (2) without charge, upon request, by calling, toll-free 866-399-1516. The current members of the Audit Committee are Michael H. Brown, Susan B. Sweeney and Maleyne M. Syracuse.

ITEM 6. SCHEDULE OF INVESTMENTS

A schedule of investments for the Registrant is included as part of this report to shareholders under Item 1 of this Form N-CSR.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

The Registrant's Board of Trustees has delegated proxy voting responsibilities relating to the voting securities held by the Registrant to its investment adviser, Barings LLC ("Barings"). A summary of Barings' proxy voting policies and procedures are set forth below.

Summary of Barings' Proxy Voting Policy:

Barings understands that the voting of proxies is an integral part of its investment management responsibility and believes, as a general principle, that proxies should be acted upon (voted or abstained) solely in the best interest of its clients (i.e. in a manner believed by Barings to best pursue a client's investment objectives). To implement this general principle, Barings engages a proxy service provider (the "Service Provider") that is responsible for processing and maintaining records of proxy votes. In addition, the Service Provider will retain the services of an independent third party research provider (the "Research Provider") to provide research and recommendations on proxies. It is Barings' Proxy Voting Policy to generally vote proxies in accordance with the recommendations of the Research Provider. In circumstances where the Research Provider has not provided recommendations with respect to a proxy, Barings will vote in accordance with the Research Provider's proxy voting guidelines (the "Guidelines"). In circumstances where the Research Provider has not provided a recommendation or has not contemplated an issue within its Guidelines, the proxy will be analyzed on a case-by-case basis.

Barings recognizes that there could be times when it is in the best interest of clients to vote proxies (i) against the Research Provider's recommendations or (ii) in instances where the Research Provider has not provided a recommendation vote against the Guidelines. Barings can vote, in whole or in part, against the Research Provider's recommendations or Guidelines, as it deems appropriate. The procedures set forth in the Proxy Voting Policy are designed to ensure that votes against the Research Provider's recommendations or Guidelines are made in the best interests of clients and are not the result of any material conflict of interest (a "Material Conflict"). For purposes of the Proxy Voting Policy, a Material Conflict is defined as any position, relationship or interest, financial or otherwise, of Barings or a Barings associate that could reasonably be expected to affect the independence or judgment concerning proxy voting.

Summary of Barings' Proxy Voting Procedures:

Barings will vote all client proxies for which it has proxy voting discretion, where no Material Conflict exists, in accordance with the Research Provider's recommendations or Guidelines, unless (i) Barings is unable or determines not to vote a proxy in accordance with the Proxy Voting Policy or (ii) an authorized investment person or designee (a "Proxy Analyst") determines that it is in the client's best interests to vote against the Research Provider's recommendations or Guidelines. In such cases where a Proxy Analyst believes a proxy should be voted against the Research Provider's recommendations or Guidelines, the proxy administrator will vote the proxy in accordance with the Proxy Analyst's recommendation as long as (i) no other Proxy Analyst disagrees with such recommendation and (ii) no known Material Conflict is identified by the Proxy Analyst(s) or the proxy administrator. If a Material Conflict is identified by a Proxy Analyst or the proxy administrator, the proxy will be submitted to the Trading Practices Committee to determine how the proxy is to be voted in order to achieve that client's best interests.

No associate, officer, director or board of managers/directors of Barings or its affiliates (other than those assigned such responsibilities under the Proxy Voting Policy) can influence how Barings votes client proxies, unless such person has been requested to provide assistance by a Proxy Analyst or Trading Practices Committee member and has disclosed any known Material Conflict. Pre-vote communications with proxy solicitors are prohibited. In the event that pre-vote communications occur, it should be reported to the Trading Practices Committee or Barings' Chief Compliance Officer prior to voting. Any questions or concerns regarding proxy-solicitor arrangements should be addressed to Barings' Chief Compliance Officer.

Investment management agreements generally delegate the authority to vote proxies to Barings in accordance with Barings' Proxy Voting Policy. In the event an investment management agreement is silent on proxy voting, Barings should obtain written instructions from the client as to their voting preference. However, when the client does not provide written instructions as to their voting preferences, Barings will assume proxy voting responsibilities. In the event that a client makes a written request regarding voting, Barings will vote as instructed.

Obtaining a Copy of the Proxy Voting Policy:

Clients can obtain a copy of Barings' Proxy Voting Policy and information about how Barings voted proxies related to their securities, free of charge, by contacting the Chief Compliance Officer, Barings LLC, 1500 Main Street, Suite 2800, P.O. Box 15189, Springfield, MA 01115-5189, or calling toll-free, 1-877-766-0014.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

The following disclosure item is made as of the date of this Form N-CSR unless otherwise indicated.

PORTFOLIO MANAGER. Robert M. Shettle serves as the President of the Registrant (since June 2016) and as one of its Portfolio Managers. Mr. Shettle began his service to the Registrant in 2015 as a Vice President. With over 17 years of industry experience, Mr. Shettle is a Managing Director of Barings and Head of the North America Mezzanine and Private Equity Group of Barings. He joined Barings in 2006. Prior to joining Barings, he spent six years at Fleet National Bank as a Vice President and commercial loan officer and three years at Anderson Consulting. At Barings, he has focused on originating, analyzing, structuring and documenting mezzanine and private equity investments. Mr. Shettle holds a B.S. from the University of Connecticut and a M.B.A. from Rensselaer Polytechnic Institute. He is also a Chartered Financial Analyst. Mr. Shettle also presently serves as President of Barings Participation Investors, another closed-end management investment company advised by Barings.

PORTFOLIO MANAGEMENT TEAM. Mr. Shettle has primary responsibility for overseeing the investment of the Registrant's portfolio, with the day-to-day investment management responsibility of the Registrant's portfolio being shared with the following Barings' investment professional (together with the Portfolio Manager, the "Portfolio Team").

Sean Feeley is responsible for the day-to-day management of the Registrant's public high yield and investment grade fixed income portfolio. Mr. Feeley has been a Vice President of the Registrant since 2011. Mr. Feeley is a Managing Director of Barings and head of the High Yield Research Team with over 22 years of industry experience in high yield bonds and loans in various investment strategies. Prior to joining Barings in 2003, he was a Vice President at Cigna Investment Management in project finance and a Vice President at Credit Suisse in leveraged loan finance. Mr. Feeley holds a B.S. from Canisius College and an M.B.A. from Cornell University. Mr. Feeley is a Certified Public Accountant and a Chartered Financial Analyst. Mr. Feeley also serves as Vice President of Barings Participation Investors, another closed-end management investment company advised by Barings.

OTHER ACCOUNTS MANAGED BY THE PORTFOLIO TEAM. The members of the Registrant's Portfolio Team also have primary responsibility for the day-to-day management of other Barings advisory accounts, including, among others, closed-end and open-end investment companies, private investment funds, MassMutual-affiliated accounts, as well as separate accounts for institutional clients. These advisory accounts are identified below.

| | | | | | | | | | NUMBER OF | | | |

| | | | | | | | | | ACCOUNTS | | | APPROXIMATE |

| | | | | TOTAL | | | | | WITH | | | ASSET SIZE OF |

| | | | | NUMBER | | | APPROXIMATE | | PERFORMANCE- | | | PERFORMANCE- |

PORTFOLIO | | ACCOUNT | | OF | | | TOTAL ASSET | | BASED | | | BASED ADVISORY |

TEAM | | CATEGORY | | ACCOUNTS | | | SIZE (A) (B) | | ADVISORY FEE | | | FEE ACCOUNTS (A) (B) |

| | | | | | | | | | | | | |

| Eric | | Registered | | | 1 | | | $152.6 | | | 0 | | | N/A |

Lloyd (C) (D) | | Investment | | | | | | | | | | | | |

| | Companies | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Other Pooled | | | 1 | | | $479.9 | | | 0 | | | N/A |

| | | Investment | | | | | | | | | | | | |

| | | Vehicles | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Other | | | 0 | | | N/A | | | 0 | | | N/A |

| | | Accounts | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Sean | | Registered | | | 7 | | | $1,458.1 | | | 0 | | | N/A |

Feeley (C) | | Investment | | | | | | | | | | | | |

| | Companies | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Other Pooled | | | 5 | | | $2,749.8 | | | 0 | | | N/A |

| | | Investment | | | | | | | | | | | | |

| | | Vehicles | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Other | | | 14 | | | $4,165.4 | | | 0 | | | N/A |

| | | Accounts (E) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Robert M. | | Registered | | | 1 | | | $152.6 | | | 0 | | | N/A |

Shettle (C) | | Investment | | | | | | | | | | | | |

| | Companies | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Other Pooled | | | 6 | | | $540.9 | | | 0 | | | N/A |

| | Investment | | | | | | | | | | | | |

| | Vehicles | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Other | | | 0 | | | N/A | | | 0 | | | N/A |

| | Accounts (F) | | | | | | | | | | | | |

| (A) | Account asset size has been calculated as of December 31, 2016. |

| |

| (B) | Asset size in millions. |

| |

| (C) | Represents accounts advised by Barings over which Messrs. Lloyd, Feeley and Shettle have day-to-day management responsibilities. |

| |

| (D) | Mr. Lloyd, as head of Barings' Global Private Finance Group, has overall responsibility for all private placement mezzanine assets managed by Barings. Except for the accounts noted in the table above, Mr. Lloyd is not primarily responsible for the day-to-management of the other accounts managed by Barings' Global Private Finance Group. |

| |

| (E) | Mr. Feeley manages the high yield sector of the general investment account of Massachusetts Mutual Life Insurance Company and C.M. Life Insurance Company; however, these assets are not represented in the table above. |

| |

| (F) | Mr. Shettle manages the private placement mezzanine debt securities of the general investment account of Massachusetts Mutual Life Insurance Company and C.M. Life Insurance Company; however, these assets are not represented in the table above. |

MATERIAL CONFLICTS OF INTEREST. The potential for material conflicts of interest may exist as the members of the Portfolio Management Team have responsibilities for the day-to-day management of multiple advisory accounts. These conflicts may be heightened to the extent the individual, Barings and/or an affiliate has an investment in one or more of such accounts. Barings has identified (and summarized below) areas where material conflicts of interest are most likely to arise, and has adopted policies and procedures that it believes are reasonable to address such conflicts.