UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-00750

Exact name of registrant as specified in charter: Delaware Group Equity Funds II

Address of principal executive offices:

2005 Market Street

Philadelphia, PA 19103

Name and address of agent for service:

David F. Connor, Esq.

2005 Market Street

Philadelphia, PA 19103

Registrant’s telephone number, including area code: (800) 523-1918

Date of fiscal year end: November 30

Date of reporting period: November 30, 2010

Item 1. Reports to Stockholders

Annual report Delaware Value® Fund

November 30, 2010 Value equity mutual fund |

This annual report is for the information of Delaware Value Fund shareholders, but it may be used with prospective investors when preceded or accompanied by a current prospectus for Delaware Value Fund. The figures in the annual report for Delaware Value Fund represent past results, which are not a guarantee of future results. The return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Delaware Value Fund prospectus contains this and other important information about the Fund. Prospectuses for all open-end funds in the Delaware Investments® Family of Funds are available from your financial advisor, online at www.delawareinvestments.com, or by phone at 800 523-1918. Please read the prospectus carefully before you invest or send money.

|

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Value® Fund at www.delawareinvestments.com.

Manage your investments online

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

Delaware Management Holdings, Inc., and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Value Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

Table of contents

| Portfolio management review | 1 |

| Performance summary | 4 |

| Disclosure of Fund expenses | 8 |

| Sector allocation and top 10 holdings | 10 |

| Statement of net assets | 11 |

| Statement of operations | 15 |

| Statements of changes in net assets | 16 |

| Financial highlights | 18 |

| Notes to financial statements | 28 |

| Report of independent registered | |

| public accounting firm | 38 |

| Other Fund information | 39 |

| Board of trustees/directors and | |

| officers addendum | 40 |

| About the organization | 50 |

Unless otherwise noted, views expressed herein are current as of Nov. 30, 2010, and are subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2011 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review | |

| Delaware Value® Fund | December 7, 2010 |

| Performance preview (for the year ended November 30, 2010) |

| Delaware Value Fund (Class A shares) | | 1-year return | | +10.16% |

| Russell 1000® Value Index (benchmark) | | 1-year return | | +8.95% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Value Fund, please see the table on page 4.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

For its fiscal year ended Nov. 30, 2010, Delaware Value Fund (Class A shares) returned +10.16% at net asset value, and +3.77% at maximum offer price (both returns assume reinvestment of all distributions). In comparison, the Fund’s benchmark, the Russell 1000 Value Index, returned +8.95% during the same time period. Complete annualized performance for Delaware Value Fund is shown in the table on page 4.

Although U.S. stock prices finished the fiscal year on an upswing and achieved solid gains overall, these results masked the stock market’s fluctuating performance during that time span.

As the Fund’s fiscal year began, many equity investors remained optimistic about the U.S. economic recovery. Stock prices, which began a long rally back in March 2009, continued to climb through late April 2010 when investor sentiment abruptly reversed course due to several factors, including:

- Worries about the financial health of certain European governments, especially Greece

- The uncertain economic effects of the Gulf of Mexico oil spill

- New economic data showing a more vulnerable U.S. economy

We continued to adhere to our bottom-up stock selection process during the Fund’s fiscal year, meaning we chose to invest in stocks one at a time, based on our assessment of their individual characteristics. We continued favoring stocks that, in our view, had consistent earnings and relatively healthy balance sheets — the types of stocks that, since the market’s April 2010 peak, have generally enjoyed better performance than their lower-quality counterparts.

1

Portfolio management review

Delaware Value® Fund

Against this backdrop, stocks turned in sluggish results through the rest of the spring and summer of 2010. However, a strong rebound in early fall propelled equity values upward during the last three months of the fiscal year.

In this environment, the Fund enjoyed good results in absolute terms, as well as relative to its benchmark, the Russell 1000 Value Index. From a sector perspective, the most notable source of outperformance came from strategic allocations within the energy and financials sectors. Among energy stocks, the Fund was helped by having less exposure than the benchmark early in the fiscal year, while a few well-chosen energy stocks actually boosted returns. In financials, the main source of the Fund’s outperformance compared with the benchmark index was the Fund’s significant underweighting in this group. The sector generated a positive return of less than 1% within the benchmark index and was one of that index’s weakest-performing sectors during the fiscal year.

One of the top individual contributors to the Fund’s performance was Xerox, a manufacturer of printers and copiers, and a provider of document-oriented and other technology services. We believe the company’s integration with recently acquired Affiliated Computer Services seems to be meeting the market’s expectations, and Xerox recently indicated that demand for its products and services is starting to look better.

Another noteworthy contributor to the Fund’s performance was National Oilwell Varco, a provider of equipment and services for oil and natural gas rigs. The company’s share price rebounded from the large selloff in energy stocks associated with the BP oil spill. It also appears to be benefiting from ongoing global activity in oil and gas exploration.

In contrast, the Fund’s unfavorable positioning in the consumer staples and consumer discretionary sectors was a source of underperformance. In addition to some disappointing stock selection in both groups, the Fund was underweighted in the outperforming consumer discretionary sector.

Two of the Fund’s weakest performers during the Fund’s fiscal year came from the healthcare sector: Quest Diagnostics and Pfizer.

Among Quest’s laboratory testing services is pre-employment testing — a business that slowed down for the company in concert with the decelerating job market. Against this backdrop, Quest forecasted slower-than-anticipated revenues for its 2010 fiscal year. We still have a positive outlook for Quest and therefore continue to hold the stock in the Fund. In our view, the company has strong cash flow and should benefit, over time, if higher testing volumes occur, for example, due to an aging population in the United States.

Pfizer, the large pharmaceutical manufacturer, has been working through its integration with Wyeth, which it acquired last year. Overall, sales results for the company have been mixed and, broadly speaking, investors remain concerned about Pfizer’s upcoming patent expirations and overall growth prospects. We continue to hold the stock in the Fund. The company remains attractive, in our view, because of what we consider its low valuation (inclusive of patent expirations), highly rated balance sheet, and above-average dividend yield.

We continued to adhere to our bottom-up stock selection process during the Fund’s fiscal year, meaning we chose to invest in stocks one at a time, based on our assessment of their individual characteristics.

2

We continued favoring stocks that, in our view, had consistent earnings and relatively healthy balance sheets — the types of stocks that, since the market’s April 2010 peak, have generally enjoyed better performance than their lower-quality counterparts.

While changes to the Fund were relatively modest during the reporting period, we did sell a handful of stocks when we felt they had reached or come close to our target price, and we replaced them with securities that we felt offered significantly better value potential. For example, within the consumer discretionary sector, we sold the Fund’s position in toy manufacturer Mattel because the company had achieved our investment objectives during the course of the past several years. We felt that it now offered more downside risk than upside potential, and we used the proceeds of our sale to add a position in cable television provider Comcast, whose shares we felt were quite inexpensive relative to their long-term performance prospects.

Similarly, we sold the Fund’s stake in food-products business H.J. Heinz, which we originally purchased when the company was seeking to turn around its declining business. As Heinz gradually improved its profit margins and earnings, the stock performed well, leading us to exchange the position for a company we felt offered better long-term value potential: Williams Companies, a natural gas exploration and production firm that we felt was well priced and stood to benefit if long-term trends favoring demand for gas continue.

We also identified what, in our view, was a favorable opportunity within the financial sector. In September 2010, we added a position in Marsh & McLennan Companies, a major insurance brokerage and consulting firm.

Marsh & McLennan had undergone significant turmoil and transformation during the past six years, including three leadership changes. Investor sentiment toward the company has seemed poor due to uncertainty about its business strategy, write-downs incurred from a recent divestiture, and weakness in property and casualty insurance pricing. However, the company seems to have “right-sized” its business, enabling it to better focus on core operations. The Fund’s investment team viewed Marsh & McLennan as an attractive long-term investment for a variety of reasons including its lower level of credit sensitivity relative to other financial companies. The company also had a global platform to help meet the needs of multinational customers, and a diversified revenue base.

We still foresee a prolonged recovery phase as the U.S. economy continues working through the excesses of the credit and housing bubbles. Similarly, our outlook for the stock market is unchanged. At the end of the Fund’s fiscal year, we continued to focus on what we believed were financially secure, attractively valued companies, which we viewed as being well positioned to withstand the potential risks in the shifting economic environment. Accordingly, the Fund’s largest allocations were in healthcare, consumer staples, and energy — sectors where we’ve been able to find attractively valued, financially strong global businesses. In addition, we feel these businesses can fare well under current market conditions. On the other hand, we continue to underweight the consumer discretionary and financial sectors due to our belief that consumer spending will likely remain soft and that credit-sensitive financials may be in f or a sustained period of lower earnings power. We’re also maintaining a below-benchmark weighting in industrials, waiting until we can find what we believe are good businesses trading at lower valuations in this sector.

3

Performance summary

| Delaware Value® Fund | November 30, 2010 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Fund performance | | Average annual total returns through Nov. 30, 2010 |

| | | 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. Sept. 15, 1998) | | | | | | | | | | | | |

| Excluding sales charge | | | +10.16% | | | | +0.48% | | | +2.55% | | n/a |

| Including sales charge | | | +3.77% | | | | -0.70% | | | +1.94% | | n/a |

| Class B (Est. May 1, 2002) | | | | | | | | | | | | |

| Excluding sales charge | | | +9.16% | | | | -0.30% | | | n/a | | +2.22% |

| Including sales charge | | | +5.16% | | | | -0.69% | | | n/a | | +2.22% |

| Class C (Est. May 1, 2002) | | | | | | | | | | | | |

| Excluding sales charge | | | +9.28% | | | | -0.28% | | | n/a | | +2.14% |

| Including sales charge | | | +8.28% | | | | -0.28% | | | n/a | | +2.14% |

| Class R (Est. Sept. 1, 2005) | | | | | | | | | | | | |

| Excluding sales charge | | | +9.81% | | | | +0.26% | | | n/a | | +0.41% |

| Including sales charge | | | +9.81% | | | | +0.26% | | | n/a | | +0.41% |

| Institutional Class (Est. Sept. 15, 1998) | | | | | | | | | | | | |

| Excluding sales charge | | | +10.39% | | | | +0.72% | | | +2.76% | | n/a |

| Including sales charge | | | +10.39% | | | | +0.72% | | | +2.76% | | n/a |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for certain classes during the periods shown in the “Fund performance” chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expense ratios” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 4 through 6.) Performance would have been lower had the expense limitations not been in effect.

4

The Fund offers Class A, B, C, R, and Institutional Class shares.

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.30% of average daily net assets. This fee has been contractually limited to 0.25% of average daily net assets from March 30, 2010, through March 30, 2011.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, which has been limited contractually to 0.50% from March 30, 2010, through March 30, 2011.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” chart. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding any 12b-1 fees and certain other expenses) from exceeding 0.85% of the Fund’s average daily net assets from March 30, 2010, through March 30, 2011. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expenses | 1.37% | | 2.07% | | 2.07% | | 1.67% | | 1.07% |

| (without fee waivers) | | | | | | | | | |

| Net expenses | 1.10% | | 1.85% | | 1.85% | | 1.35% | | 0.85% |

| (including fee waivers, if any) | | | | | | | | | |

| Type of waiver | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

5

Performance summary

Delaware Value® Fund

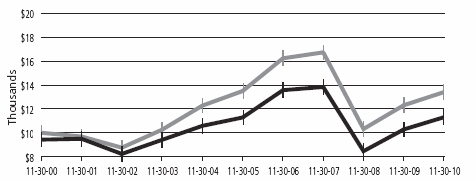

Performance of a $10,000 investment

Average annual total returns from Nov. 30, 2000, through Nov. 30, 2010

| For period beginning Nov. 30, 2000, through Nov. 30, 2010 | Starting value | Ending value |

| | Russell 1000 Value Index | $10,000 | $13,410 |

| | Delaware Value Fund — Class A Shares | $9,425 | $12,120 |

The chart assumes $10,000 invested in the Fund on Nov. 30, 2000, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 4 through 6.

The chart also assumes $10,000 invested in the Russell 1000 Value Index as of Nov. 30, 2000.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses. The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | | DDVAX | | | 24610C881 | |

| Class B | | | DDVBX | | | 24610C873 | |

| Class C | | | DDVCX | | | 24610C865 | |

| Class R | | | DDVRX | | | 245907860 | |

| Institutional Class | | | DDVIX | | | 24610C857 | |

6

Disclosure of Fund expenses

For the six-month period from June 1, 2010 to November 30, 2010

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from June 1, 2010 to November 30, 2010.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Value® Fund

Expense analysis of an investment of $1,000

| | | Beginning | | Ending | | | | | Expenses |

| | | Account Value | | Account Value | | Annualized | | Paid During Period |

| | | 6/1/10 | | 11/30/10 | | Expense Ratio | | 6/1/10 to 11/30/10* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,108.40 | | | 1.10 | % | | $ | 5.81 | |

| Class B | | | 1,000.00 | | | | 1,103.10 | | | 1.85 | % | | | 9.75 | |

| Class C | | | 1,000.00 | | | | 1,102.90 | | | 1.85 | % | | | 9.75 | |

| Class R | | | 1,000.00 | | | | 1,106.10 | | | 1.35 | % | | | 7.13 | |

| Institutional Class | | | 1,000.00 | | | | 1,108.20 | | | 0.85 | % | | | 4.49 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,019.55 | | | 1.10 | % | | $ | 5.57 | |

| Class B | | | 1,000.00 | | | | 1,015.79 | | | 1.85 | % | | | 9.35 | |

| Class C | | | 1,000.00 | | | | 1,015.79 | | | 1.85 | % | | | 9.35 | |

| Class R | | | 1,000.00 | | | | 1,018.30 | | | 1.35 | % | | | 6.83 | |

| Institutional Class | | | 1,000.00 | | | | 1,020.81 | | | 0.85 | % | | | 4.31 | |

| * | “Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

9

| Sector allocation and top 10 holdings |

| Delaware Value® Fund | As of November 30, 2010 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Sector | Percentage of net assets |

| Common Stock | 99.07 | % |

| Consumer Discretionary | 6.25 | % |

| Consumer Staples | 15.02 | % |

| Energy | 15.25 | % |

| Financials | 12.09 | % |

| Healthcare | 17.79 | % |

| Industrials | 5.87 | % |

| Information Technology | 11.96 | % |

| Materials | 2.98 | % |

| Telecommunications | 5.85 | % |

| Utilities | 6.01 | % |

| Discount Note | 0.02 | % |

| Securities Lending Collateral | 16.01 | % |

| Total Value of Securities | 115.10 | % |

| Obligation to Return Securities Lending Collateral | (16.03 | %) |

| Receivables and Other Assets Net of Liabilities | 0.93 | % |

| Total Net Assets | 100.00 | % |

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 Holdings | Percentage of net assets |

| Lowe’s | 3.18 | % |

| CVS Caremark | 3.13 | % |

| Safeway | 3.13 | % |

| National Oilwell Varco | 3.10 | % |

| Williams | 3.10 | % |

| Marsh & McLennan | 3.10 | % |

| Bank of New York Mellon | 3.10 | % |

| Cardinal Health | 3.09 | % |

| ConocoPhillips | 3.08 | % |

| Intel | 3.08 | % |

10

| Statement of net assets |

| Delaware Value® Fund | | | November 30, 2010 |

| | | Number of shares | | Value |

| Common Stock – 99.07% | | | | |

| Consumer Discretionary – 6.25% | | | | |

| * | Comcast Class A | 657,600 | | $ | 13,152,000 |

| | Lowe’s | 599,400 | | | 13,606,380 |

| | | | | | 26,758,380 |

| Consumer Staples – 15.02% | | | | |

| * | Archer-Daniels-Midland | 421,000 | | | 12,204,790 |

| | CVS Caremark | 432,300 | | | 13,401,300 |

| | Kimberly-Clark | 205,700 | | | 12,730,773 |

| * | Kraft Foods Class A | 414,200 | | | 12,529,550 |

| * | Safeway | 581,800 | | | 13,375,582 |

| | | | | | 64,241,995 |

| Energy – 15.25% | | | | |

| | Chevron | 157,700 | | | 12,768,969 |

| | ConocoPhillips | 219,300 | | | 13,195,281 |

| * | Marathon Oil | 379,900 | | | 12,715,253 |

| | National Oilwell Varco | 216,700 | | | 13,281,543 |

| * | Williams | 582,100 | | | 13,277,701 |

| | | | | | 65,238,747 |

| Financials – 12.09% | | | | |

| | Allstate | 427,275 | | | 12,437,975 |

| | Bank of New York Mellon | 491,200 | | | 13,257,488 |

| * | Marsh & McLennan | 529,200 | | | 13,272,336 |

| | Travelers | 236,100 | | | 12,747,039 |

| | | | | | 51,714,838 |

| Healthcare – 17.79% | | | | |

| | Baxter International | 259,600 | | | 12,603,580 |

| | Cardinal Health | 371,500 | | | 13,217,971 |

| | Johnson & Johnson | 201,000 | | | 12,371,550 |

| | Merck | 366,700 | | | 12,640,149 |

| | Pfizer | 747,963 | | | 12,184,317 |

| * | Quest Diagnostics | 265,100 | | | 13,074,732 |

| | | | | | 76,092,299 |

| Industrials – 5.87% | | | | |

| * | Northrop Grumman | 204,600 | | | 12,619,728 |

| * | Waste Management | 364,700 | | | 12,490,975 |

| | | | | | 25,110,703 |

11

Statement of net assets

Delaware Value® Fund

| | | Number of shares | | Value |

| Common Stock (continued) | | | | | |

| Information Technology – 11.96% | | | | | |

| | Intel | | 624,700 | | $ | 13,193,664 |

| | International Business Machines | | 89,700 | | | 12,688,962 |

| † | Motorola | | 1,590,400 | | | 12,182,464 |

| | Xerox | | 1,144,600 | | | 13,117,116 |

| | | | | | | 51,182,206 |

| Materials – 2.98% | | | | | |

| | duPont (E.I.) deNemours | | 271,300 | | | 12,748,387 |

| | | | | | | 12,748,387 |

| Telecommunications – 5.85% | | | | | |

| | AT&T | | 446,900 | | | 12,419,351 |

| * | Verizon Communications | | 394,400 | | | 12,624,744 |

| | | | | | | 25,044,095 |

| Utilities – 6.01% | | | | | |

| * | Edison International | | 355,400 | | | 13,128,476 |

| * | Progress Energy | | 287,600 | | | 12,565,244 |

| | | | | | | 25,693,720 |

| Total Common Stock (cost $388,790,385) | | | | | 423,825,370 |

| | | | | | | |

| | | Principal amount | | | |

| ≠Discount Note – 0.02% | | | | | |

| | Federal Home Loan Bank 0.07% 12/1/10 | | $109,000 | | | 109,000 |

| Total Discount Note (cost $109,000) | | | | | 109,000 |

| | | | | | |

| Total Value of Securities Before Securities | | | | | |

| | Lending Collateral – 99.09% (cost $388,899,385) | | | | | 423,934,370 |

| | | | | | |

| | | Number of shares | | | |

| Securities Lending Collateral** – 16.01% | | | | | |

| | Investment Companies | | | | | |

| | BNY Mellon SL DBT II Liquidating Fund | | 144,449 | | | 140,375 |

| | Delaware Investments Collateral Fund No. 1 | | 68,351,364 | | | 68,351,364 |

| | @†Mellon GSL Reinvestment Trust II | | 89,083 | | | 0 |

| Total Securities Lending Collateral (cost $68,584,896) | | | | | 68,491,739 |

12

| | |

| Total Value of Securities – 115.10% | | | |

| (cost $457,484,281) | $ | 492,426,109 | © |

| Obligation to Return Securities | | | |

| Lending Collateral** – (16.03%) | | (68,584,896 | ) |

| Receivables and Other Assets | | | |

| Net of Liabilities – 0.93% | | 3,975,314 | |

| Net Assets Applicable to 43,583,611 | | | |

| Shares Outstanding – 100.00% | $ | 427,816,527 | |

| | | | |

| Net Asset Value – Delaware Value Fund | | | |

| Class A ($298,109,440 / 30,370,493 Shares) | | | $9.82 | |

| Net Asset Value – Delaware Value Fund | | | |

| Class B ($2,513,217 / 257,941 Shares) | | | $9.74 | |

| Net Asset Value – Delaware Value Fund | | | |

| Class C ($19,377,355 / 1,987,801 Shares) | | | $9.75 | |

| Net Asset Value – Delaware Value Fund | | | |

| Class R ($1,815,464 / 185,316 Shares) | | | $9.80 | |

| Net Asset Value – Delaware Value Fund | | | |

| Institutional Class ($106,001,051 / 10,782,060 Shares) | | | $9.83 | |

| | | | |

| Components of Net Assets at November 30, 2010: | | | |

| Shares of beneficial interest (unlimited authorization – no par) | $ | 505,043,353 | |

| Undistributed net investment income | | 7,415,091 | |

| Accumulated net realized loss on investments | | (119,583,745 | ) |

| Net unrealized appreciation of investments | | 34,941,828 | |

| Total net assets | $ | 427,816,527 | |

| @ | Illiquid security. At November 30, 2010, the aggregate amount of illiquid securities was $0, which represented 0.00% of the Fund’s net assets. See Note 9 in “Notes to financial statements.” |

| * | Fully or partially on loan. |

| ** | See Note 8 in “Notes to financial statements.” |

| © | Includes $66,983,032 of securities loaned. |

| † | Non income producing security. |

| ≠ | The rate shown is the effective yield at the time of purchase. |

13

Statement of net assets

Delaware Value® Fund

| |

| Net Asset Value and Offering Price Per Share – | | |

| Delaware Value Fund | | |

| Net asset value Class A (A) | $ | 9.82 |

| Sales charge (5.75% of offering price) (B) | | 0.60 |

| Offering price | $ | 10.42 |

| (A) | | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| (B) | | See the current prospectus for purchases of $50,000 or more. |

See accompanying Notes, which are an integral part of the financial statements.

14

| Statement of operations | |

| Delaware Value® Fund | | Year Ended November 30, 2010 |

| Investment Income: | | | | | | |

| Dividends | $ | 12,862,495 | | | | |

| Interest | | 11,883 | | | | |

| Security lending income | | 9,080 | | $ | 12,883,458 | |

| | | | | | | |

| Expenses: | | | | | | |

| Management fees | | 2,836,855 | | | | |

| Distribution expenses – Class A | | 969,096 | | | | |

| Distribution expenses – Class B | | 26,797 | | | | |

| Distribution expenses – Class C | | 213,151 | | | | |

| Distribution expenses – Class R | | 11,215 | | | | |

| Dividend disbursing and transfer agent fees and expenses | | 1,102,834 | | | | |

| Accounting and administration expenses | | 173,068 | | | | |

| Registration fees | | 88,048 | | | | |

| Reports and statements to shareholders | | 71,835 | | | | |

| Legal fees | | 50,066 | | | | |

| Audit and tax | | 32,166 | | | | |

| Dues and services | | 25,375 | | | | |

| Trustees’ fees | | 24,504 | | | | |

| Insurance fees | | 17,097 | | | | |

| Custodian fees | | 11,524 | | | | |

| Consulting fees | | 6,060 | | | | |

| Pricing fees | | 2,622 | | | | |

| Trustees’ expenses | | 1,714 | | | 5,664,027 | |

| Less fees waived | | | | | (725,288 | ) |

| Less waiver of distribution expenses – Class A | | | | | (161,463 | ) |

| Less waiver of distribution expenses – Class R | | | | | (1,869 | ) |

| Less expense paid indirectly | | | | | (1,472 | ) |

| Total operating expenses | | | | | 4,773,935 | |

| Net Investment Income | | | | | 8,109,523 | |

| | | | | | | |

| Net Realized and Unrealized Gain on Investments: | | | | | | |

| Net realized gain on investments | | | | | 802,815 | |

| Net change in unrealized appreciation/depreciation of investments | | | 34,877,647 | |

| Net Realized and Unrealized Gain on Investments | | | | | 35,680,462 | |

| | | | | | | |

| Net Increase in Net Assets Resulting from Operations | | | | $ | 43,789,985 | |

See accompanying Notes, which are an integral part of the financial statements.

15

Statements of changes in net assets

Delaware Value® Fund

| | Year Ended |

| | 11/30/10 | | 11/30/09 |

| Increase (Decrease) in Net Assets from Operations: | | | | | | | |

| Net investment income | $ | 8,109,523 | | | $ | 9,037,376 | |

| Net realized gain (loss) on investments | | 802,815 | | | | (25,798,260 | ) |

| Net change in unrealized | | | | | | | |

| appreciation/depreciation of investments | | 34,877,647 | | | | 87,455,628 | |

| Net increase in net assets resulting from operations | | 43,789,985 | | | | 70,694,744 | |

| | | | | | | | |

| Dividends and Distributions to Shareholders from: | | | | | | | |

| Net investment income: | | | | | | | |

| Class A | | (6,336,133 | ) | | | (8,722,039 | ) |

| Class B | | (40,558 | ) | | | (74,017 | ) |

| Class C | | (337,169 | ) | | | (542,744 | ) |

| Class R | | (36,356 | ) | | | (49,682 | ) |

| Institutional Class | | (1,847,274 | ) | | | (1,539,972 | ) |

| | | (8,597,490 | ) | | | (10,928,454 | ) |

| | | | | | | | |

| Capital Share Transactions: | | | | | | | |

| Proceeds from shares sold: | | | | | | | |

| Class A | | 105,703,060 | | | | 100,483,549 | |

| Class B | | 33,967 | | | | 328,113 | |

| Class C | | 1,853,744 | | | | 3,448,921 | |

| Class R | | 374,782 | | | | 466,254 | |

| Institutional Class | | 53,267,499 | | | | 39,358,079 | |

| | | | | | | | |

| Net asset value of shares issued upon reinvestment | | | | | | | |

| of dividends and distributions: | | | | | | | |

| Class A | | 6,002,782 | | | | 8,275,384 | |

| Class B | | 35,459 | | | | 65,978 | |

| Class C | | 309,111 | | | | 494,585 | |

| Class R | | 36,355 | | | | 49,682 | |

| Institutional Class | | 1,463,194 | | | | 1,516,149 | |

| | | 169,079,953 | | | | 154,486,694 | |

16

| | | Year Ended | |

| | 11/30/10 | | 11/30/09 |

| Capital Share Transactions (continued): | | | | | | | |

| Cost of shares repurchased: | | | | | | | |

| Class A | $ | (142,906,681 | ) | | $ | (116,500,682 | ) |

| Class B | | (678,000 | ) | | | (1,233,962 | ) |

| Class C | | (8,167,392 | ) | | | (7,423,103 | ) |

| Class R | | (689,487 | ) | | | (508,819 | ) |

| Institutional Class | | (36,048,313 | ) | | | (15,533,519 | ) |

| | | (188,489,873 | ) | | | (141,200,085 | ) |

| Increase (decrease) in net assets derived | | | | | | | |

| from capital share transactions | | (19,409,920 | ) | | | 13,286,609 | |

| Net Increase in Net Assets | | 15,782,575 | | | | 73,052,899 | |

| | | | | | | | |

| Net Assets: | | | | | | | |

| Beginning of year | | 412,033,952 | | | | 338,981,053 | |

| End of year (including undistributed net investment | | | | | | | |

| income of $7,415,091 and $7,903,058, respectively) | $ | 427,816,527 | | | $ | 412,033,952 | |

See accompanying Notes, which are an integral part of the financial statements.

17

Financial highlights

Delaware Value® Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain on investments |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects waivers by the manager and distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying Notes, which are an integral part of the financial statements.

18

| | Year Ended |

| | | 11/30/10 | | 11/30/09 | | 11/30/08 | | 11/30/07 | | 11/30/06 | |

| | | $9.100 | | | $7.760 | | | $13.360 | | | $13.470 | | | $11.370 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 0.171 | | | 0.205 | | | 0.224 | | | 0.241 | | | 0.225 | | |

| | | 0.738 | | | 1.389 | | | (4.935 | ) | | 0.064 | | | 2.068 | | |

| | | 0.909 | | | 1.594 | | | (4.711 | ) | | 0.305 | | | 2.293 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | (0.189 | ) | | (0.254 | ) | | (0.239 | ) | | (0.191 | ) | | (0.122 | ) | |

| | | — | | | — | | | (0.650 | ) | | (0.224 | ) | | (0.071 | ) | |

| | | (0.189 | ) | | (0.254 | ) | | (0.889 | ) | | (0.415 | ) | | (0.193 | ) | |

| | | | | | | | | | | | | | | | | |

| | | $9.820 | | | $9.100 | | | $7.760 | | | $13.360 | | | $13.470 | | |

| | | | | | | | | | | | | | | | | |

| | | 10.16% | | | 21.21% | | | (37.78% | ) | | 2.25% | | | 20.48% | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $298,110 | | | $302,849 | | | $266,386 | | | $420,120 | | | $271,378 | | |

| | | 1.10% | | | 1.07% | | | 1.00% | | | 1.00% | | | 1.01% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.32% | | | 1.37% | | | 1.26% | | | 1.15% | | | 1.17% | | |

| | | 1.85% | | | 2.60% | | | 2.11% | | | 1.75% | | | 1.84% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.63% | | | 2.30% | | | 1.85% | | | 1.60% | | | 1.68% | | |

| | | 29% | | | 27% | | | 43% | | | 24% | | | 24% | | |

19

Financial highlights

Delaware Value® Fund Class B

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain on investments |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information.

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect.

See accompanying Notes, which are an integral part of the financial statements.

20

| | | Year Ended | |

| | | 11/30/10 | | 11/30/09 | | 11/30/08 | | 11/30/07 | | 11/30/06 | |

| | | $9.050 | | | $7.690 | | | $13.240 | | | $13.370 | | | $11.290 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 0.101 | | | 0.146 | | | 0.142 | | | 0.138 | | | 0.134 | | |

| | | 0.719 | | | 1.391 | | | (4.905 | ) | | 0.055 | | | 2.058 | | |

| | | 0.820 | | | 1.537 | | | (4.763 | ) | | 0.193 | | | 2.192 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | (0.130 | ) | | (0.177 | ) | | (0.137 | ) | | (0.099 | ) | | (0.041 | ) | |

| | | — | | | — | | | (0.650 | ) | | (0.224 | ) | | (0.071 | ) | |

| | | (0.130 | ) | | (0.177 | ) | | (0.787 | ) | | (0.323 | ) | | (0.112 | ) | |

| | | | | | | | | | | | | | | | | |

| | | $9.740 | | | $9.050 | | | $7.690 | | | $13.240 | | | $13.370 | | |

| | | | | | | | | | | | | | | | | |

| | | 9.16% | | | 20.44% | | | (38.25% | ) | | 1.41% | | | 19.59% | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $2,513 | | | $2,930 | | | $3,279 | | | $9,514 | | | $9,914 | | |

| | | 1.85% | | | 1.82% | | | 1.75% | | | 1.75% | | | 1.76% | | |

| | | | | | | | | | | | | | | | | |

| | | 2.02% | | | 2.07% | | | 1.96% | | | 1.85% | | | 1.87% | | |

| | | 1.10% | | | 1.85% | | | 1.36% | | | 1.00% | | | 1.09% | | |

| | | | | | | | | | | | | | | | | |

| | | 0.93% | | | 1.60% | | | 1.15% | | | 0.90% | | | 0.98% | | |

| | | 29% | | | 27% | | | 43% | | | 24% | | | 24% | | |

21

Financial highlights

Delaware Value® Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain on investments |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information.

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect.

See accompanying Notes, which are an integral part of the financial statements.

22

| | | Year Ended | |

| | | 11/30/10 | | 11/30/09 | | 11/30/08 | | 11/30/07 | | 11/30/06 | |

| | | $9.050 | | | $7.690 | | | $13.250 | | | $13.370 | | | $11.290 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 0.101 | | | 0.146 | | | 0.142 | | | 0.137 | | | 0.134 | | |

| | | 0.729 | | | 1.391 | | | (4.915 | ) | | 0.066 | | | 2.058 | | |

| | | 0.830 | | | 1.537 | | | (4.773 | ) | | 0.203 | | | 2.192 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | (0.130 | ) | | (0.177 | ) | | (0.137 | ) | | (0.099 | ) | | (0.041 | ) | |

| | | — | | | — | | | (0.650 | ) | | (0.224 | ) | | (0.071 | ) | |

| | | (0.130 | ) | | (0.177 | ) | | (0.787 | ) | | (0.323 | ) | | (0.112 | ) | |

| | | | | | | | | | | | | | | | | |

| | | $9.750 | | | $9.050 | | | $7.690 | | | $13.250 | | | $13.370 | | |

| | | | | | | | | | | | | | | | | |

| | | 9.28% | | | 20.28% | | | (38.21% | ) | | 1.49% | | | 19.59% | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $19,377 | | | $23,925 | | | $23,733 | | | $65,890 | | | $41,013 | | |

| | | 1.85% | | | 1.82% | | | 1.75% | | | 1.75% | | | 1.76% | | |

| | | | | | | | | | | | | | | | | |

| | | 2.02% | | | 2.07% | | | 1.96% | | | 1.85% | | | 1.87% | | |

| | | 1.10% | | | 1.85% | | | 1.36% | | | 1.00% | | | 1.09% | | |

| | | | | | | | | | | | | | | | | |

| | | 0.93% | | | 1.60% | | | 1.15% | | | 0.90% | | | 0.98% | | |

| | | 29% | | | 27% | | | 43% | | | 24% | | | 24% | | |

23

Financial highlights

Delaware Value® Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain on investments |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information.

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects waivers by the manager and distributor. Performance would have been lower had the waivers not been in effect.

See accompanying Notes, which are an integral part of the financial statements.

24

| | | Year Ended | |

| | | 11/30/10 | | 11/30/09 | | 11/30/08 | | 11/30/07 | | 11/30/06 | |

| | | $9.090 | | | $7.740 | | | $13.320 | | | $13.420 | | | $11.350 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 0.148 | | | 0.185 | | | 0.197 | | | 0.207 | | | 0.218 | | |

| | | 0.731 | | | 1.393 | | | (4.923 | ) | | 0.057 | | | 2.058 | | |

| | | 0.879 | | | 1.578 | | | (4.726 | ) | | 0.264 | | | 2.276 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | (0.169 | ) | | (0.228 | ) | | (0.204 | ) | | (0.140 | ) | | (0.135 | ) | |

| | | — | | | — | | | (0.650 | ) | | (0.224 | ) | | (0.071 | ) | |

| | | (0.169 | ) | | (0.228 | ) | | (0.854 | ) | | (0.364 | ) | | (0.206 | ) | |

| | | | | | | | | | | | | | | | | |

| | | $9.800 | | | $9.090 | | | $7.740 | | | $13.320 | | | $13.420 | | |

| | | | | | | | | | | | | | | | | |

| | | 9.81% | | | 20.98% | | | (37.90% | ) | | 1.95% | | | 20.39% | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $1,816 | | | $1,957 | | | $1,669 | | | $2,246 | | | $6 | | |

| | | 1.35% | | | 1.32% | | | 1.25% | | | 1.25% | | | 1.26% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.62% | | | 1.67% | | | 1.56% | | | 1.45% | | | 1.47% | | |

| | | 1.60% | | | 2.35% | | | 1.86% | | | 1.50% | | | 1.59% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.33% | | | 2.00% | | | 1.55% | | | 1.30% | | | 1.38% | | |

| | | 29% | | | 27% | | | 43% | | | 24% | | | 24% | | |

25

Financial highlights

Delaware Value® Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain on investments |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information.

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflect a waiver by the manager. Performance would have been lower had the waiver not been in effect.

See accompanying Notes, which are an integral part of the financial statements.

26

| | | Year Ended | |

| | | 11/30/10 | | 11/30/09 | | 11/30/08 | | 11/30/07 | | 11/30/06 | |

| | | $9.110 | | | $7.770 | | | $13.380 | | | $13.500 | | | $11.390 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 0.194 | | | 0.225 | | | 0.250 | | | 0.276 | | | 0.256 | | |

| | | 0.735 | | | 1.394 | | | (4.936 | ) | | 0.051 | | | 2.077 | | |

| | | 0.929 | | | 1.619 | | | (4.686 | ) | | 0.327 | | | 2.333 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | (0.209 | ) | | (0.279 | ) | | (0.274 | ) | | (0.223 | ) | | (0.152 | ) | |

| | | — | | | — | | | (0.650 | ) | | (0.224 | ) | | (0.071 | ) | |

| | | (0.209 | ) | | (0.279 | ) | | (0.924 | ) | | (0.447 | ) | | (0.223 | ) | |

| | | | | | | | | | | | | | | | | |

| | | $9.830 | | | $9.110 | | | $7.770 | | | $13.380 | | | $13.500 | | |

| | | | | | | | | | | | | | | | | |

| | | 10.39% | | | 21.43% | | | (37.54% | ) | | 2.41% | | | 20.85% | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $106,001 | | | $80,373 | | | $43,914 | | | $126,023 | | | $189,557 | | |

| | | 0.85% | | | 0.82% | | | 0.75% | | | 0.75% | | | 0.76% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.02% | | | 1.07% | | | 0.96% | | | 0.85% | | | 0.87% | | |

| | | 2.10% | | | 2.85% | | | 2.36% | | | 2.00% | | | 2.09% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.93% | | | 2.60% | | | 2.15% | | | 1.90% | | | 1.98% | | |

| | | 29% | | | 27% | | | 43% | | | 24% | | | 24% | | |

27

| Notes to financial statements |

| Delaware Value® Fund | November 30, 2010 |

Delaware Group® Equity Funds II (Trust) is organized as a Delaware statutory trust and offers two series: Delaware Large Cap Value Fund and Delaware Value Fund. These financial statements and the related notes pertain to Delaware Value Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended, and offers Class A, Class B, Class C, Class R and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 5.75%. Class A share purchases of $1,000,000 or more will incur a contingent deferred sales charge (CDSC) of up to 1% if redeemed during the first year and 0.50% during the second year, provided that Delaware Distributors, L.P. (DDLP) paid a financial advisor a commission on the purchase of those shares. Class B shares may only be purchased through div idend reinvestment and certain permitted exchanges. Prior to June 1, 2007, Class B shares were sold with a CDSC that declined from 4% to zero depending upon the period of time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Class C shares are sold with a CDSC of 1%, if redeemed during the first 12 months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors.

The investment objective of the Fund is to seek long-term capital appreciation.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities, except those traded on the Nasdaq Stock Market, Inc. (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange (NYSE) on the valuation date. Securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If on a particular day an equity security does not trade, then the mean between the bid and ask prices will be used. Short-term debt securities are valued at market value. Investment company securities are valued at net asset value per share. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Fund’s Board of Trustees (Board) . In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The Fund may use fair value pricing more frequently for securities traded primarily in non-U.S. markets because, among other things, most foreign markets close well before the Fund values its securities generally as of 4:00 p.m. Eastern time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, government actions or pronouncements, aftermarket trading, or news events may have occurred in the interim. To account for this, the Fund may frequently value foreign securities using fair value prices based on third-party vendor modeling tools (international fair value pricing).

Federal Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite

28

distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (November 30, 2007 – November 30, 2010), and has concluded that no position for federal income tax is required in the Fund’s financial statements.

Class Accounting — Investment income, common expenses and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Use of Estimates — The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Investments® Family of Funds are generally allocated amongst such funds on the basis of average net assets. Management fees and some other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. The Fund declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, annually. Dividends and distributions, if any, are recorded on the ex-dividend date.

Subject to seeking best execution, the Fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the Fund in cash. Such commission rebates are included in realized gain on investments in the accompanying financial statements and totaled $ 11,599 for the year ended November 30, 2010. In general, best execution refers to many factors, including the price paid or received for a security, the commission charged, the promptness and reliability of execution, the confidentiality and placement accorded the order, and other factors affecting the overall benefit obtained by the Fund on the transaction.

The Fund may receive earnings credits from its custodian when positive cash balances are maintained, which are used to offset custody fees. There were no earnings credits for the year ended November 30, 2010.

The Fund may receive earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. The expense paid under this arrangement is included in dividend disbursing and transfer agent fees and expenses on the statement of operations with the corresponding expense offset shown as “expense paid indirectly.” For the year ended November 30, 2010, the Fund earned $1,472 under this agreement.

29

Notes to financial statements

Delaware Value® Fund

2. Investment Management, Administration Agreements and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Delaware Management Business Trust and the investment manager, an annual fee which is calculated daily at the rate of 0.65% on the first $500 million of average daily net assets of the Fund, 0.60% on the next $500 million, 0.55% on the next $1.5 billion and 0.50% on average daily net assets in excess of $2.5 billion.

Effective March 30, 2010, DMC has contractually agreed to waive that portion, if any, of its management fee and reimburse the Fund to the extent necessary to ensure that annual operating expenses, (excluding any 12b-1 plan and certain other expenses), do not exceed 0.85% of average daily net assets of the Fund through March 30, 2011. Prior to March 30, 2010, the expense limitation was voluntary. This expense waiver and reimbursement applies only to expenses paid directly by the Fund.

Delaware Service Company, Inc. (DSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, the Fund pays DSC fees based on the aggregate daily net assets of the Delaware Investments® Family of Funds at the following annual rate: 0.0050% of the first $30 billion; 0.0045% of the next $10 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $50 billion. The fees payable to DSC under the service agreement described above are allocated among all Funds in the Delaware Investments Family of Funds on a relative net asset value basis. For the year ended November 30, 2010, the Fund was charged $21,791 for these services.

DSC also provides dividend disbursing and transfer agency services. The Fund pays DSC a monthly fee based on the number of shareholder accounts for dividend disbursing and transfer agent services.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual distribution and service fee not to exceed 0.30% of the average daily net assets of the Class A shares, 1.00% of the average daily net assets of the Class B and C shares and 0.60% of the average daily net assets of the Class R shares. Institutional Class shares pay no distribution and services expenses. DDLP has contracted to waive distribution and service fees through March 30, 2011 in order to prevent distribution and service fees of Class A and Class R shares from exceeding 0.25% and 0.50%, respectively, of average daily net assets.

30

At November 30, 2010, the Fund had liabilities payable to affiliates as follows:

| Investment management fee payable to DMC | | $ | 193,671 |

| Dividend disbursing, transfer agent and fund accounting | | | |

| oversight fees and other expenses payable to DSC | | | 41,506 |

| Distribution fees payable to DDLP | | | 82,332 |

| Other expenses payable to DMC and affiliates* | | | 31,235 |

*DMC, as part of its administrative services, pays operating expenses on behalf of the Fund and is reimbursed on a periodic basis. These expenses include items such as printing of shareholder reports, fees for audit, legal and tax services, registration fees and trustees’ fees.

As provided in the investment management agreement, the Fund bears the cost of certain legal and tax services, including internal legal and tax services provided to the Fund by DMC and/or its affiliates’ employees. For the year ended November 30, 2010, the Fund was charged $18,749 for internal legal and tax services provided by DMC and/or its affiliates’ employees.

For the year ended November 30, 2010, DDLP earned $5,442 for commissions on sales of the Fund’s Class A shares. For the year ended November 30, 2010, DDLP received gross CDSC commissions of $0, $1,715 and $614 on redemption of the Fund’s Class A, Class B and Class C shares, respectively, and these commissions were entirely used to offset up-front commissions previously paid by DDLP to broker-dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DSC and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

3. Investments

For the year ended November 30, 2010, the Fund made purchases of $121,813,389 and sales of $129,429,183 of investment securities other than short-term investments.

At November 30, 2010, the cost of investments for federal income purposes was $461,456,121. At November 30, 2010, net unrealized appreciation was $30,969,988, of which $50,796,620 related to unrealized appreciation of investments and $19,826,632 related to unrealized depreciation of investments.

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available under the circumstance s.

31

Notes to financial statements

Delaware Value® Fund

3. Investments (continued)

The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three level hierarchy of inputs is summarized below.

| Level 1 | – | inputs are quoted prices in active markets for identical investments (e.g. equity securities, open-end investment companies, futures contracts, options contracts) |

| | | |

| Level 2 | – | other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) ( e.g. debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing) |

| | | |

| Level 3 | – | inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g. broker-quoted securities, fair valued securities) |

The following table summarizes the valuation of the Fund’s investments by fair value hierarchy levels as of November 30, 2010:

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Common Stock | | $ | 423,825,370 | | $ | — | | $ | — | | $ | 423,825,370 |

| Short-Term | | | — | | | 109,000 | | | — | | | 109,000 |

| Securities Lending Collateral | | | — | | | 68,491,739 | | | — | | | 68,491,739 |

| Total | | $ | 423,825,370 | | $ | 68,600,739 | | $ | — | | $ | 492,426,109 |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | Securities |

| | | Lending |

| | | Collateral |

| Balance as of 11/30/09 | | $ | 3,988 | |

| Sales | | | (4,748 | ) |

| Net change in unrealized appreciation/depreciation | | | 760 | |

| Balance as of 11/30/10 | | $ | — | |

| | | | | |

| Net change in unrealized appreciation/depreciation from | | | | |

| investments still held as of 11/30/10 | | $ | (3,786 | ) |

32

In January 2010, the Financial Accounting Standards Board issued an Accounting Standards Update, Improving Disclosures about Fair Value Measurements, which introduced new disclosure requirements and clarified certain existing disclosure requirements around fair value measurements currently presented above. The new disclosures and clarifications of existing disclosures are generally effective for the Fund’s fiscal year end November 30, 2011 and interim periods therein. During the fiscal year ended November 30, 2010, there were no transfers between Level 1 investments, Level 2 investments or Level 3 investments that had a material impact to the Fund.

4. Dividend and Distribution Information

Income and long-term capital gain distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. Additionally, distributions from net short-term gains on sales of investment securities are treated as ordinary income for federal income tax purposes. The tax character of dividends and distributions paid during the years ended November 30, 2010 and 2009 was as follows:

| | | 11/30/10 | | 11/30/09 |

| Ordinary income | | $ | 8,597,490 | | $ | 10,928,454 |

5. Components of Net Assets on a Tax Basis

As of November 30, 2010, the components of net assets on a tax basis were as follows:

| Shares of beneficial interest | | $ | 505,043,353 | |

| Undistributed ordinary income | | | 7,415,091 | |

| Capital loss carryforwards | | | (115,611,905 | ) |

| Unrealized appreciation of investments | | | 30,969,988 | |

| Net assets | | $ | 427,816,527 | |

The differences between book basis and tax basis components of net assets are primarily attributable to tax deferral of losses on wash sales.

For federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains. $3,312,892 was utilized in 2010. Capital loss carryforwards remaining at November 30, 2010 will expire as follows: $89,722,915 expires in 2016 and $25,888,990 expires in 2017.

33

Notes to financial statements

Delaware Value® Fund

6. Capital Shares

Transactions in capital shares were as follows:

| | | Year Ended |

| | | 11/30/10 | | 11/30/09 |

| Shares sold: | | | | | | |

| Class A | | 11,549,124 | | | 12,801,028 | |

| Class B | | 3,643 | | | 45,194 | |

| Class C | | 200,919 | | | 448,443 | |

| Class R | | 40,545 | | | 60,019 | |

| Institutional Class | | 5,712,985 | | | 5,018,644 | |

| | | | | | | |

| Shares issued upon reinvestment of dividends and distributions: | | | | | | |

| Class A | | 661,099 | | | 1,096,074 | |

| Class B | | 3,905 | | | 8,727 | |

| Class C | | 34,043 | | | 65,421 | |

| Class R | | 3,999 | | | 6,572 | |

| Institutional Class | | 161,322 | | | 201,081 | |

| | | 18,371,584 | | | 19,751,203 | |

| | | | | | | |

| Shares repurchased: | | | | | | |

| Class A | | (15,110,094 | ) | | (14,967,432 | ) |

| Class B | | (73,500 | ) | | (156,392 | ) |

| Class C | | (890,855 | ) | | (954,814 | ) |

| Class R | | (74,588 | ) | | (66,870 | ) |

| Institutional Class | | (3,911,595 | ) | | (2,050,520 | ) |

| | | (20,060,632 | ) | | (18,196,028 | ) |

| Net increase (decrease) | | (1,689,048 | ) | | 1,555,175 | |

For the years ended November 30, 2010 and 2009, 21,573 Class B shares were converted to 21,461 Class A shares valued at $198,909 and 18,769 Class B shares were converted to 18,687 Class A shares valued at $141,883, respectively. The respective amounts are included in Class B redemptions and Class A subscriptions in the table above and the statements of changes in the net assets.

7. Line of Credit

The Fund, along with certain other funds in the Delaware Investments® Family of Funds (Participants), was a participant in a $35,000,000 revolving line of credit with The Bank of New York Mellon (BNY Mellon) to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. Under the agreement, the Participants were charged an annual commitment fee, which was allocated across the Participants on the basis of each Participant’s allocation of the entire facility. The Participants were permitted to borrow up to a maximum of one third of their net assets under the agreement. The line of credit expired on November 16, 2010.

34

Effective as of November 16, 2010, the Fund along with the other Participants entered into an amendment to the agreement with BNY Mellon for a $50,000,000 revolving line of credit. The agreement as amended is to be used and operated in substantially the same manner as the original agreement. The new line of credit under the agreement as amended expires on November 15, 2011. The Fund had no amounts outstanding as of November 30, 2010, or at any time during the period then ended.

8. Securities Lending

The Fund, along with other funds in the Delaware Investments® Family of Funds, may lend its securities pursuant to a security lending agreement (Lending Agreement) with BNY Mellon. With respect to each loan, if on any business day the aggregate market value of securities collateral plus cash collateral held is less than the aggregate market value of the securities which are the subject of such loan, the borrower will be notified to provide additional collateral by the end of the following business day which, together with the collateral already held, will be not less than the applicable collateral requirements for such security loan. If the aggregate market value of securities collateral and cash collateral held with respect to a security loan exceeds the applicable collateral requirement, upon the request of the borrower BNY Mellon must return enough collateral to the borr ower by the end of the following business day to reduce the value of the remaining collateral to the applicable collateral requirement for such security loan. As a result of the foregoing, the value of the collateral held with respect to a loaned security may be temporarily more or less than the value of the security on loan.