UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Name of Fund:

BlackRock Bond Fund, Inc.

BlackRock Total Return Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Bond Fund, Inc.,

50 Hudson Yards, New York, NY 10001

Registrant's telephone number, including area code:

Date of reporting period:

Item 1 — Reports to Stockholders

(a) The Reports to Shareholders are attached herewith

BlackRock Total Return Fund

Institutional Shares | MAHQX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares | $47(a) | 0.44%(a) |

(a) | Because the Fund invested all of its assets in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, prior to September 16, 2024, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invested for a portion of the period. |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Institutional Shares returned 12.13%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to absolute performance?

The Fund’s allocations to agency mortgage-backed securities, U.S. investment grade corporate bonds, and structured products contributed to performance for the annual period.

What detracted from absolute performance?

The Fund’s positioning with respect to U.S. interest rates was the only source of negative return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

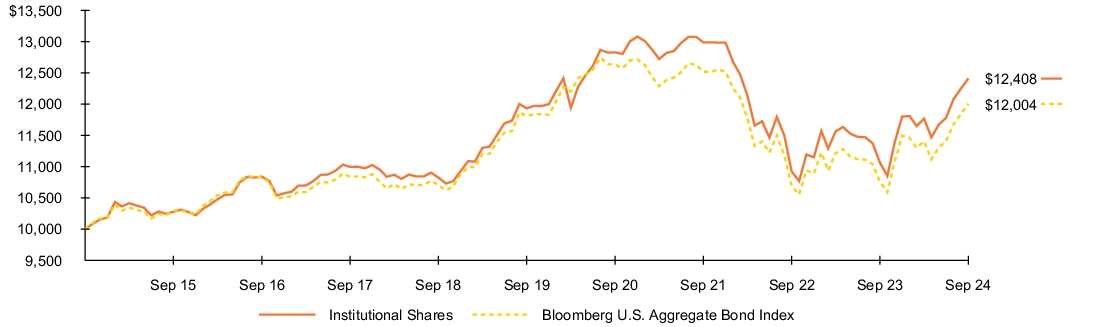

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Institutional Shares | 12.13 | % | 0.79 | % | 2.18 | % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 | | 0.33 | | 1.84 | |

| Net Assets | $20,127,307,489 |

| Number of Portfolio Holdings | 5,009 |

| Net Investment Advisory Fees | $54,171,979 |

| Portfolio Turnover Rate | 471% |

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Investment Type | Percent of Total

Investments(a) | |

| U.S. Government Sponsored Agency Securities | 32.8 | % |

| Corporate Bonds | 22.7 | % |

| U.S. Treasury Obligations | 17.4 | % |

| Asset-Backed Securities | 10.2 | % |

| Non-Agency Mortgage-Backed Securities | 9.3 | % |

| Foreign Government Obligations | 4.9 | % |

| Floating Rate Loan Interests | 1.0 | % |

| Municipal Bonds | 0.6 | % |

| Common Stocks | 0.5 | % |

| Preferred Securities | 0.3 | % |

| Fixed Rate Loan Interests | 0.2 | % |

| Foreign Agency Obligations | 0.1 | % |

| Warrants | — | % (b) |

| Investment Companies | — | % (b) |

Credit quality allocation

| Credit Rating(c) | Percent of Total

Investments(a) | |

| AAA/Aaa(d) | 57.7 | % |

| AA/Aa | 2.8 | % |

| A | 8.8 | % |

| BBB/Baa | 13.0 | % |

| BB/Ba | 1.1 | % |

| B | 0.5 | % |

| CCC/Caa | 0.4 | % |

| CC/Ca | 0.3 | % |

| C | 0.2 | % |

| N/R | 15.2 | % |

(a) | Excludes short-term securities, options purchased, options written and TBA sale commitments. |

(b) | Rounds to less than 0.1%. |

(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Material Fund changes

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after September 30, 2024 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

Effective September 16, 2024, the Fund ceased to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and instead operates as a stand-alone fund. In connection with this change and in accordance with the investment advisory agreement, the Fund now pays a monthly fee at an annual rate equal to the following percentages of the average daily value of the Fund's net assets: 0.48% (first $250 million), 0.43% ($250 million - $500 million), 0.38% ($500 million - $750 million) and 0.34% (greater than $750 million).

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return Fund

Institutional Shares | MAHQX

Annual Shareholder Report — September 30, 2024

MAHQX-09/24-AR

BlackRock Total Return Fund

Service Shares | MSHQX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Service Shares | $79(a) | 0.75%(a) |

(a) | Because the Fund invested all of its assets in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, prior to September 16, 2024, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invested for a portion of the period. |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Service Shares returned 11.79%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to absolute performance?

The Fund’s allocations to agency mortgage-backed securities, U.S. investment grade corporate bonds, and structured products contributed to performance for the annual period.

What detracted from absolute performance?

The Fund’s positioning with respect to U.S. interest rates was the only source of negative return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

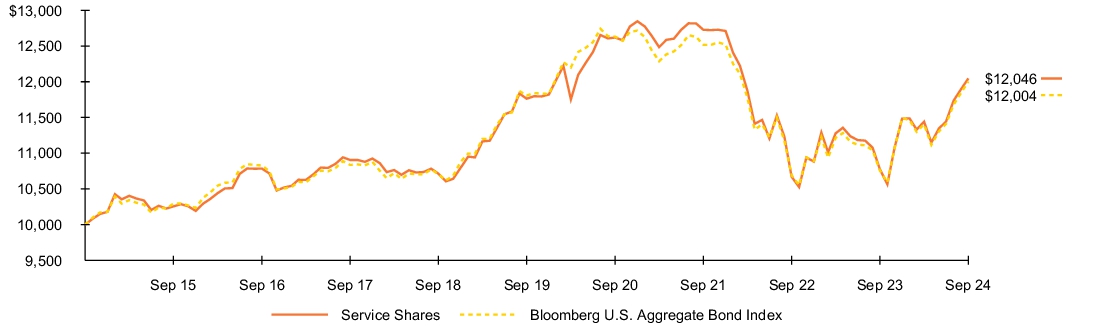

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Service Shares | 11.79 | % | 0.48 | % | 1.88 | % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 | | 0.33 | | 1.84 | |

| Net Assets | $20,127,307,489 |

| Number of Portfolio Holdings | 5,009 |

| Net Investment Advisory Fees | $54,171,979 |

| Portfolio Turnover Rate | 471% |

Average annual total returns reflect reductions for service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Investment Type | Percent of Total

Investments(a) | |

| U.S. Government Sponsored Agency Securities | 32.8 | % |

| Corporate Bonds | 22.7 | % |

| U.S. Treasury Obligations | 17.4 | % |

| Asset-Backed Securities | 10.2 | % |

| Non-Agency Mortgage-Backed Securities | 9.3 | % |

| Foreign Government Obligations | 4.9 | % |

| Floating Rate Loan Interests | 1.0 | % |

| Municipal Bonds | 0.6 | % |

| Common Stocks | 0.5 | % |

| Preferred Securities | 0.3 | % |

| Fixed Rate Loan Interests | 0.2 | % |

| Foreign Agency Obligations | 0.1 | % |

| Warrants | — | % (b) |

| Investment Companies | — | % (b) |

Credit quality allocation

| Credit Rating(c) | Percent of Total

Investments(a) | |

| AAA/Aaa(d) | 57.7 | % |

| AA/Aa | 2.8 | % |

| A | 8.8 | % |

| BBB/Baa | 13.0 | % |

| BB/Ba | 1.1 | % |

| B | 0.5 | % |

| CCC/Caa | 0.4 | % |

| CC/Ca | 0.3 | % |

| C | 0.2 | % |

| N/R | 15.2 | % |

(a) | Excludes short-term securities, options purchased, options written and TBA sale commitments. |

(b) | Rounds to less than 0.1%. |

(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Material Fund changes

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after September 30, 2024 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

Effective September 16, 2024, the Fund ceased to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and instead operates as a stand-alone fund. In connection with this change and in accordance with the investment advisory agreement, the Fund now pays a monthly fee at an annual rate equal to the following percentages of the average daily value of the Fund's net assets: 0.48% (first $250 million), 0.43% ($250 million - $500 million), 0.38% ($500 million - $750 million) and 0.34% (greater than $750 million).

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return Fund

Service Shares | MSHQX

Annual Shareholder Report — September 30, 2024

MSHQX-09/24-AR

BlackRock Total Return Fund

Investor A Shares | MDHQX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares | $78(a) | 0.74%(a) |

(a) | Because the Fund invested all of its assets in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, prior to September 16, 2024, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invested for a portion of the period. |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Investor A Shares returned 11.90%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to absolute performance?

The Fund’s allocations to agency mortgage-backed securities, U.S. investment grade corporate bonds, and structured products contributed to performance for the annual period.

What detracted from absolute performance?

The Fund’s positioning with respect to U.S. interest rates was the only source of negative return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

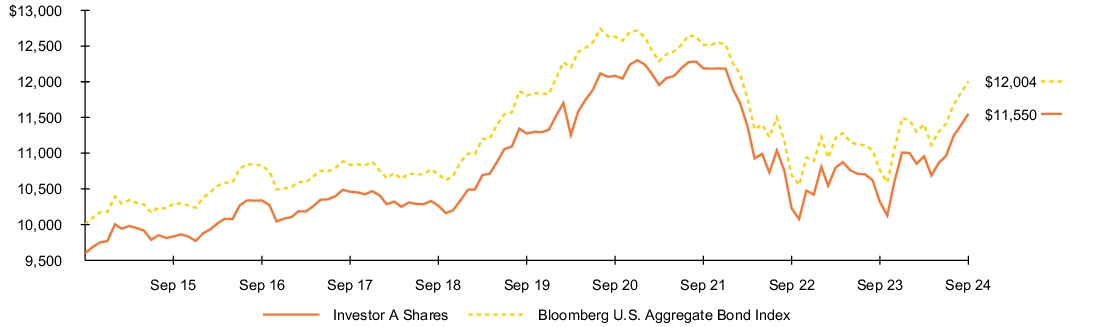

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Investor A Shares | 11.90 | % | 0.48 | % | 1.87 | % |

| Investor A Shares (with sales charge) | 7.43 | | (0.33 | ) | 1.45 | |

| Bloomberg U.S. Aggregate Bond Index | 11.57 | | 0.33 | | 1.84 | |

| Net Assets | $20,127,307,489 |

| Number of Portfolio Holdings | 5,009 |

| Net Investment Advisory Fees | $54,171,979 |

| Portfolio Turnover Rate | 471% |

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Investment Type | Percent of Total

Investments(a) | |

| U.S. Government Sponsored Agency Securities | 32.8 | % |

| Corporate Bonds | 22.7 | % |

| U.S. Treasury Obligations | 17.4 | % |

| Asset-Backed Securities | 10.2 | % |

| Non-Agency Mortgage-Backed Securities | 9.3 | % |

| Foreign Government Obligations | 4.9 | % |

| Floating Rate Loan Interests | 1.0 | % |

| Municipal Bonds | 0.6 | % |

| Common Stocks | 0.5 | % |

| Preferred Securities | 0.3 | % |

| Fixed Rate Loan Interests | 0.2 | % |

| Foreign Agency Obligations | 0.1 | % |

| Warrants | — | % (b) |

| Investment Companies | — | % (b) |

Credit quality allocation

| Credit Rating(c) | Percent of Total

Investments(a) | |

| AAA/Aaa(d) | 57.7 | % |

| AA/Aa | 2.8 | % |

| A | 8.8 | % |

| BBB/Baa | 13.0 | % |

| BB/Ba | 1.1 | % |

| B | 0.5 | % |

| CCC/Caa | 0.4 | % |

| CC/Ca | 0.3 | % |

| C | 0.2 | % |

| N/R | 15.2 | % |

(a) | Excludes short-term securities, options purchased, options written and TBA sale commitments. |

(b) | Rounds to less than 0.1%. |

(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Material Fund changes

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after September 30, 2024 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

Effective September 16, 2024, the Fund ceased to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and instead operates as a stand-alone fund. In connection with this change and in accordance with the investment advisory agreement, the Fund now pays a monthly fee at an annual rate equal to the following percentages of the average daily value of the Fund's net assets: 0.48% (first $250 million), 0.43% ($250 million - $500 million), 0.38% ($500 million - $750 million) and 0.34% (greater than $750 million).

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return Fund

Investor A Shares | MDHQX

Annual Shareholder Report — September 30, 2024

MDHQX-09/24-AR

BlackRock Total Return Fund

Investor A1 Shares | MEHQX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor A1 Shares | $63(a) | 0.59%(a) |

(a) | Because the Fund invested all of its assets in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, prior to September 16, 2024, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invested for a portion of the period. |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Investor A1 Shares returned 12.08%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to absolute performance?

The Fund’s allocations to agency mortgage-backed securities, U.S. investment grade corporate bonds, and structured products contributed to performance for the annual period.

What detracted from absolute performance?

The Fund’s positioning with respect to U.S. interest rates was the only source of negative return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

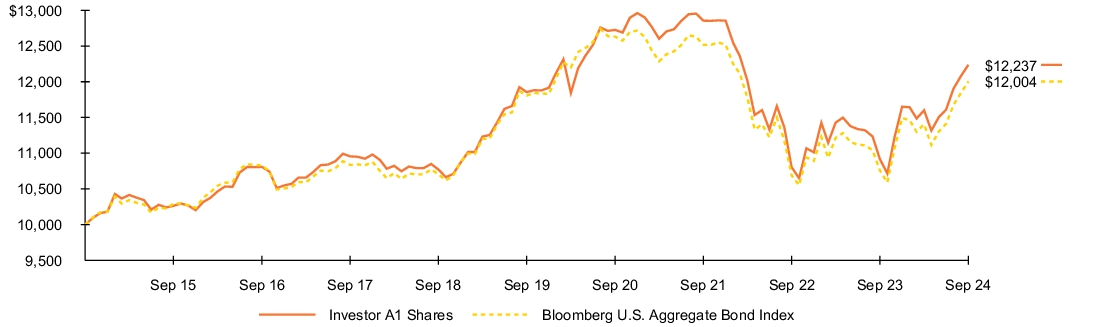

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Investor A1 Shares | 12.08 | % | 0.64 | % | 2.04 | % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 | | 0.33 | | 1.84 | |

| Net Assets | $20,127,307,489 |

| Number of Portfolio Holdings | 5,009 |

| Net Investment Advisory Fees | $54,171,979 |

| Portfolio Turnover Rate | 471% |

Average annual total returns reflect reductions for service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Investment Type | Percent of Total

Investments(a) | |

| U.S. Government Sponsored Agency Securities | 32.8 | % |

| Corporate Bonds | 22.7 | % |

| U.S. Treasury Obligations | 17.4 | % |

| Asset-Backed Securities | 10.2 | % |

| Non-Agency Mortgage-Backed Securities | 9.3 | % |

| Foreign Government Obligations | 4.9 | % |

| Floating Rate Loan Interests | 1.0 | % |

| Municipal Bonds | 0.6 | % |

| Common Stocks | 0.5 | % |

| Preferred Securities | 0.3 | % |

| Fixed Rate Loan Interests | 0.2 | % |

| Foreign Agency Obligations | 0.1 | % |

| Warrants | — | % (b) |

| Investment Companies | — | % (b) |

Credit quality allocation

| Credit Rating(c) | Percent of Total

Investments(a) | |

| AAA/Aaa(d) | 57.7 | % |

| AA/Aa | 2.8 | % |

| A | 8.8 | % |

| BBB/Baa | 13.0 | % |

| BB/Ba | 1.1 | % |

| B | 0.5 | % |

| CCC/Caa | 0.4 | % |

| CC/Ca | 0.3 | % |

| C | 0.2 | % |

| N/R | 15.2 | % |

(a) | Excludes short-term securities, options purchased, options written and TBA sale commitments. |

(b) | Rounds to less than 0.1%. |

(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Material Fund changes

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after September 30, 2024 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

Effective September 16, 2024, the Fund ceased to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and instead operates as a stand-alone fund. In connection with this change and in accordance with the investment advisory agreement, the Fund now pays a monthly fee at an annual rate equal to the following percentages of the average daily value of the Fund's net assets: 0.48% (first $250 million), 0.43% ($250 million - $500 million), 0.38% ($500 million - $750 million) and 0.34% (greater than $750 million).

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return Fund

Investor A1 Shares | MEHQX

Annual Shareholder Report — September 30, 2024

MEHQX-09/24-AR

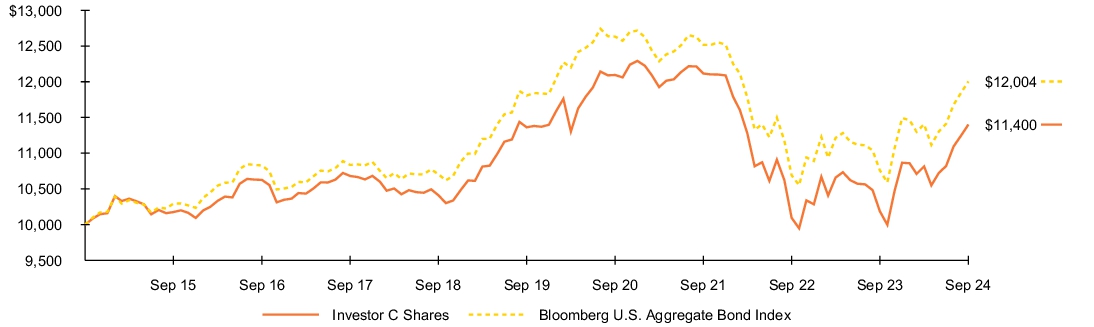

BlackRock Total Return Fund

Investor C Shares | MFHQX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares | $152(a) | 1.44%(a) |

(a) | Because the Fund invested all of its assets in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, prior to September 16, 2024, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invested for a portion of the period. |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Investor C Shares returned 11.14%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to absolute performance?

The Fund’s allocations to agency mortgage-backed securities, U.S. investment grade corporate bonds, and structured products contributed to performance for the annual period.

What detracted from absolute performance?

The Fund’s positioning with respect to U.S. interest rates was the only source of negative return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Investor C Shares | 11.14 | % | (0.21 | ) % | 1.32 | % |

| Investor C Shares (with sales charge) | 10.14 | | (0.21 | ) | 1.32 | |

| Bloomberg U.S. Aggregate Bond Index | 11.57 | | 0.33 | | 1.84 | |

| Net Assets | $20,127,307,489 |

| Number of Portfolio Holdings | 5,009 |

| Net Investment Advisory Fees | $54,171,979 |

| Portfolio Turnover Rate | 471% |

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Investment Type | Percent of Total

Investments(a) | |

| U.S. Government Sponsored Agency Securities | 32.8 | % |

| Corporate Bonds | 22.7 | % |

| U.S. Treasury Obligations | 17.4 | % |

| Asset-Backed Securities | 10.2 | % |

| Non-Agency Mortgage-Backed Securities | 9.3 | % |

| Foreign Government Obligations | 4.9 | % |

| Floating Rate Loan Interests | 1.0 | % |

| Municipal Bonds | 0.6 | % |

| Common Stocks | 0.5 | % |

| Preferred Securities | 0.3 | % |

| Fixed Rate Loan Interests | 0.2 | % |

| Foreign Agency Obligations | 0.1 | % |

| Warrants | — | % (b) |

| Investment Companies | — | % (b) |

Credit quality allocation

| Credit Rating(c) | Percent of Total

Investments(a) | |

| AAA/Aaa(d) | 57.7 | % |

| AA/Aa | 2.8 | % |

| A | 8.8 | % |

| BBB/Baa | 13.0 | % |

| BB/Ba | 1.1 | % |

| B | 0.5 | % |

| CCC/Caa | 0.4 | % |

| CC/Ca | 0.3 | % |

| C | 0.2 | % |

| N/R | 15.2 | % |

(a) | Excludes short-term securities, options purchased, options written and TBA sale commitments. |

(b) | Rounds to less than 0.1%. |

(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Material Fund changes

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after September 30, 2024 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

Effective September 16, 2024, the Fund ceased to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and instead operates as a stand-alone fund. In connection with this change and in accordance with the investment advisory agreement, the Fund now pays a monthly fee at an annual rate equal to the following percentages of the average daily value of the Fund's net assets: 0.48% (first $250 million), 0.43% ($250 million - $500 million), 0.38% ($500 million - $750 million) and 0.34% (greater than $750 million).

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return Fund

Investor C Shares | MFHQX

Annual Shareholder Report — September 30, 2024

MFHQX-09/24-AR

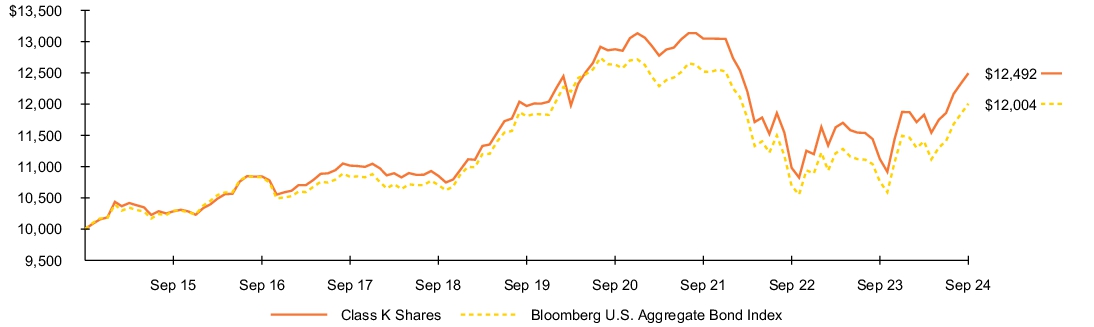

BlackRock Total Return Fund

Class K Shares | MPHQX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class K Shares | $39(a) | 0.37%(a) |

(a) | Because the Fund invested all of its assets in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, prior to September 16, 2024, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invested for a portion of the period. |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Class K Shares returned 12.33%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to absolute performance?

The Fund’s allocations to agency mortgage-backed securities, U.S. investment grade corporate bonds, and structured products contributed to performance for the annual period.

What detracted from absolute performance?

The Fund’s positioning with respect to U.S. interest rates was the only source of negative return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Class K Shares | 12.33 | % | 0.86 | % | 2.25 | % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 | | 0.33 | | 1.84 | |

| Net Assets | $20,127,307,489 |

| Number of Portfolio Holdings | 5,009 |

| Net Investment Advisory Fees | $54,171,979 |

| Portfolio Turnover Rate | 471% |

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Investment Type | Percent of Total

Investments(a) | |

| U.S. Government Sponsored Agency Securities | 32.8 | % |

| Corporate Bonds | 22.7 | % |

| U.S. Treasury Obligations | 17.4 | % |

| Asset-Backed Securities | 10.2 | % |

| Non-Agency Mortgage-Backed Securities | 9.3 | % |

| Foreign Government Obligations | 4.9 | % |

| Floating Rate Loan Interests | 1.0 | % |

| Municipal Bonds | 0.6 | % |

| Common Stocks | 0.5 | % |

| Preferred Securities | 0.3 | % |

| Fixed Rate Loan Interests | 0.2 | % |

| Foreign Agency Obligations | 0.1 | % |

| Warrants | — | % (b) |

| Investment Companies | — | % (b) |

Credit quality allocation

| Credit Rating(c) | Percent of Total

Investments(a) | |

| AAA/Aaa(d) | 57.7 | % |

| AA/Aa | 2.8 | % |

| A | 8.8 | % |

| BBB/Baa | 13.0 | % |

| BB/Ba | 1.1 | % |

| B | 0.5 | % |

| CCC/Caa | 0.4 | % |

| CC/Ca | 0.3 | % |

| C | 0.2 | % |

| N/R | 15.2 | % |

(a) | Excludes short-term securities, options purchased, options written and TBA sale commitments. |

(b) | Rounds to less than 0.1%. |

(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Material Fund changes

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after September 30, 2024 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

Effective September 16, 2024, the Fund ceased to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and instead operates as a stand-alone fund. In connection with this change and in accordance with the investment advisory agreement, the Fund now pays a monthly fee at an annual rate equal to the following percentages of the average daily value of the Fund's net assets: 0.48% (first $250 million), 0.43% ($250 million - $500 million), 0.38% ($500 million - $750 million) and 0.34% (greater than $750 million).

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return Fund

Class K Shares | MPHQX

Annual Shareholder Report — September 30, 2024

MPHQX-09/24-AR

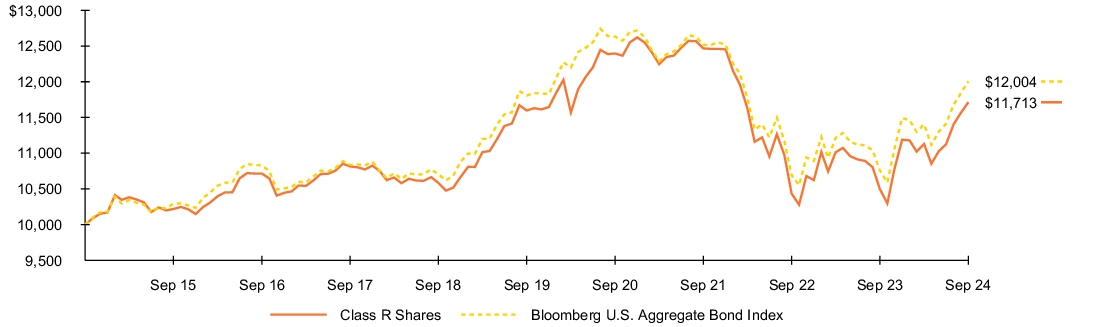

BlackRock Total Return Fund

Class R Shares | MRCBX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class R Shares | $109(a) | 1.03%(a) |

(a) | Because the Fund invested all of its assets in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, prior to September 16, 2024, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invested for a portion of the period. |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Class R Shares returned 11.59%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to absolute performance?

The Fund’s allocations to agency mortgage-backed securities, U.S. investment grade corporate bonds, and structured products contributed to performance for the annual period.

What detracted from absolute performance?

The Fund’s positioning with respect to U.S. interest rates was the only source of negative return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Class R Shares | 11.59 | % | 0.20 | % | 1.59 | % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 | | 0.33 | | 1.84 | |

| Net Assets | $20,127,307,489 |

| Number of Portfolio Holdings | 5,009 |

| Net Investment Advisory Fees | $54,171,979 |

| Portfolio Turnover Rate | 471% |

Average annual total returns reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Investment Type | Percent of Total

Investments(a) | |

| U.S. Government Sponsored Agency Securities | 32.8 | % |

| Corporate Bonds | 22.7 | % |

| U.S. Treasury Obligations | 17.4 | % |

| Asset-Backed Securities | 10.2 | % |

| Non-Agency Mortgage-Backed Securities | 9.3 | % |

| Foreign Government Obligations | 4.9 | % |

| Floating Rate Loan Interests | 1.0 | % |

| Municipal Bonds | 0.6 | % |

| Common Stocks | 0.5 | % |

| Preferred Securities | 0.3 | % |

| Fixed Rate Loan Interests | 0.2 | % |

| Foreign Agency Obligations | 0.1 | % |

| Warrants | — | % (b) |

| Investment Companies | — | % (b) |

Credit quality allocation

| Credit Rating(c) | Percent of Total

Investments(a) | |

| AAA/Aaa(d) | 57.7 | % |

| AA/Aa | 2.8 | % |

| A | 8.8 | % |

| BBB/Baa | 13.0 | % |

| BB/Ba | 1.1 | % |

| B | 0.5 | % |

| CCC/Caa | 0.4 | % |

| CC/Ca | 0.3 | % |

| C | 0.2 | % |

| N/R | 15.2 | % |

(a) | Excludes short-term securities, options purchased, options written and TBA sale commitments. |

(b) | Rounds to less than 0.1%. |

(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Material Fund changes

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after September 30, 2024 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

Effective September 16, 2024, the Fund ceased to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and instead operates as a stand-alone fund. In connection with this change and in accordance with the investment advisory agreement, the Fund now pays a monthly fee at an annual rate equal to the following percentages of the average daily value of the Fund's net assets: 0.48% (first $250 million), 0.43% ($250 million - $500 million), 0.38% ($500 million - $750 million) and 0.34% (greater than $750 million).

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return Fund

Class R Shares | MRCBX

Annual Shareholder Report — September 30, 2024

MRCBX-09/24-AR

(b) Not Applicable

| Item 2 – | Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762. |

| Item 3 – | Audit Committee Financial Expert – The registrant’s board of directors (the “board of directors”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent: |

Lorenzo A. Flores

Catherine A. Lynch

Arthur P. Steinmetz

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors.

| Item 4 – | Principal Accountant Fees and Services |

The following table presents fees billed by Deloitte & Touche LLP (“D&T”) in each of the last two fiscal years for the services rendered to the Fund:

| | | | | | | | | | | | | | | | |

| | | (a) Audit Fees | | (b) Audit-Related Fees1 | | (c) Tax Fees2 | | (d) All Other Fees |

| Entity Name | | Current

Fiscal

Year End | | Previous

Fiscal

Year End | | Current

Fiscal

Year End | | Previous

Fiscal

Year End | | Current

Fiscal

Year End | | Previous

Fiscal

Year End | | Current

Fiscal

Year End | | Previous

Fiscal

Year End |

| BlackRock Total Return Fund | | $86,700 | | $8,262 | | $7,000 | | $0 | | $62,856 | | $19,700 | | $0 | | $0 |

The following table presents fees billed by D&T that were required to be approved by the registrant’s audit committee (the “Committee”) for services that relate directly to the operations or financial reporting of the Fund and that are rendered on behalf of BlackRock Advisors, LLC ( the “Investment Adviser” or “BlackRock”) and entities controlling, controlled by, or under common control with BlackRock (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund (“Affiliated Service Providers”):

2

| | | | |

| | | Current Fiscal Year End | | Previous Fiscal Year End |

(b) Audit-Related Fees1 | | $0 | | $0 |

(c) Tax Fees2 | | $0 | | $0 |

(d) All Other Fees3 | | $2,149,000 | | $2,154,000 |

1 The nature of the services includes assurance and related services reasonably related to the performance of the audit or review of financial statements not included in Audit Fees, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators.

2 The nature of the services includes tax compliance and/or tax preparation, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, taxable income and tax distribution calculations.

3 Non-audit fees of $2,149,000 and $2,154,000 for the current fiscal year and previous fiscal year, respectively, were paid to the Fund’s principal accountant in their entirety by BlackRock, in connection with services provided to the Affiliated Service Providers of the Fund and of certain other funds sponsored and advised by BlackRock or its affiliates for a service organization review and an accounting research tool subscription. These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The Committee has adopted policies and procedures with regard to the pre-approval of services. Audit, audit-related and tax compliance services provided to the registrant on an annual basis require specific pre-approval by the Committee. The Committee also must approve other non-audit services provided to the registrant and those non-audit services provided to the Investment Adviser and Affiliated Service Providers that relate directly to the operations and the financial reporting of the registrant. Certain of these non-audit services that the Committee believes are (a) consistent with the SEC’s auditor independence rules and (b) routine and recurring services that will not impair the independence of the independent accountants may be approved by the Committee without consideration on a specific case-by-case basis (“general pre-approval”). The term of any general pre-approval is 12 months from the date of the pre-approval, unless the Committee provides for a different period. Tax or other non-audit services provided to the registrant which have a direct impact on the operations or financial reporting of the registrant will only be deemed pre-approved provided that any individual project does not exceed $10,000 attributable to the registrant or $50,000 per project. For this purpose, multiple projects will be aggregated to determine if they exceed the previously mentioned cost levels.

Any proposed services exceeding the pre-approved cost levels will require specific pre-approval by the Committee, as will any other services not subject to general pre-approval (e.g., unanticipated but permissible services). The Committee is informed of each service approved subject to general pre-approval at the next regularly scheduled in-person board meeting. At this meeting, an analysis of such services is presented to the Committee for ratification. The Committee may delegate to the Committee Chairman the authority to approve the provision of and fees for any specific engagement of permitted non-audit services, including services exceeding pre-approved cost levels.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the Committee pursuant to the de minimis exception in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not Applicable

(g) The aggregate non-audit fees, defined as the sum of the fees shown under “Audit-Related Fees,” “Tax Fees” and “All Other Fees,” paid to the accountant for services rendered by the accountant to the registrant, the Investment Adviser and the Affiliated Service Providers were:

3

| | | | |

| Entity Name | | Current Fiscal Year End | | Previous Fiscal Year End |

| BlackRock Total Return Fund | | $69,856 | | $19,700 |

Additionally, the amounts billed by D&T in connection with services provided to the Affiliated Service Providers of the Fund and of other funds sponsored or advised by BlackRock or its affiliates during the current and previous fiscal years for a service organization review and an accounting research tool subscription were:

| | |

Current Fiscal Year End | | Previous Fiscal Year End |

$2,149,000 | | $2,154,000 |

These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(h) The Committee has considered and determined that the provision of non-audit services that were rendered to the Investment Adviser and the Affiliated Service Providers that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) – Not Applicable

(j) – Not Applicable

| Item 5 – | Audit Committee of Listed Registrant – Not Applicable |

(a) The registrant’s Schedule of Investments is included as part of the Financial Statement and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

| Item 7 – | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

4

| | |

| | SEPTEMBER 30, 2024 |

| | |

| |

| | 2024 Annual Financial Statements and Additional Information |

BlackRock Bond Fund, Inc.

| · | | BlackRock Total Return Fund |

|

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

Derivative Financial Instruments

The Fund may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Fund must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Fund’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments, if any, are discussed in detail in the Notes to Consolidated Financial Statements.

| | |

D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S | | 3 |

| | |

Consolidated Schedule of Investments September 30, 2024 | | BlackRock Total Return Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

Asset-Backed Securities | |

1988 CLO 5 Ltd., Series 2024-5A, Class A1, (3-mo. CME Term SOFR + 1.54%), 6.87%, 07/15/37(a)(b) | | | USD 3,675 | | | $ | 3,676,768 | |

510 Loan Acquisition Trust, Series 2020-1, Class A, 8.11%, 09/25/60(a)(c) | | | 3,923 | | | | 3,893,974 | |

522 Funding CLO Ltd. | | | | | | | | |

Series 2019-4A, Class CR, (3-mo. CME Term SOFR + 2.66%), 7.94%, 04/20/30(a)(b) | | | 625 | | | | 625,435 | |

Series 2019-4A, Class DR, (3-mo. CME Term SOFR + 3.91%), 9.19%, 04/20/30(a)(b) | | | 2,170 | | | | 2,193,308 | |

Series 2019-5A, Class AR, (3-mo. CME Term SOFR + 1.33%), 6.63%, 04/15/35(a)(b) | | | 510 | | | | 510,346 | |

Series 2020-6A, Class A1R, (3-mo. CME Term SOFR + 1.41%), 6.70%, 10/23/34(a)(b) | | | 1,130 | | | | 1,130,688 | |

AB BSL CLO 4 Ltd., Series 2023-4A, Class A, (3-mo. CME Term SOFR + 2.00%), 7.28%, 04/20/36(a)(b) | | | 1,660 | | | | 1,670,796 | |

ACE Securities Corp. Home Equity Loan Trust | | | | | | | | |

Series 2003-OP1, Class A2, (1-mo. CME Term SOFR + 0.83%), 5.69%, 12/25/33(b) | | | 497 | | | | 472,906 | |

Series 2005-AG1, Class M2, (1-mo. CME Term SOFR + 0.80%), 5.66%, 08/25/35(b) | | | 491 | | | | 398,997 | |

Series 2006-CW1, Class A2C, (1-mo. CME Term SOFR + 0.39%), 5.25%, 07/25/36(b) | | | 225 | | | | 182,017 | |

Series 2007-HE4, Class A2A, (1-mo. CME Term SOFR + 0.37%), 5.23%, 05/25/37(b) | | | 2,378 | | | | 407,477 | |

Series 2007-HE4, Class A2C, (1-mo. CME Term SOFR + 0.71%), 5.57%, 05/25/37(b) | | | 210 | | | | 36,268 | |

Affirm Asset Securitization Trust, Series 2024-A, Class A, 5.61%, 02/15/29(a) | | | 3,805 | | | | 3,854,646 | |

AGL CLO 11 Ltd., Series 2021-11A, Class E, (3-mo. CME Term SOFR + 6.62%), 11.92%, 04/15/34(a)(b) | | | 250 | | | | 250,105 | |

AGL CLO 12 Ltd., Series 2021-12A, Class A1, (3-mo. CME Term SOFR + 1.42%), 6.70%, 07/20/34(a)(b) | | | 7,640 | | | | 7,651,361 | |

AGL CLO 13 Ltd., Series 2021-13A, Class A1, (3-mo. CME Term SOFR + 1.42%), 6.70%, 10/20/34(a)(b) | | | 250 | | | | 250,369 | |

AGL CLO 14 Ltd. | | | | | | | | |

Series 2021-14A, Class A, (3-mo. CME Term SOFR + 1.41%), 6.69%, 12/02/34(a)(b) | | | 1,000 | | | | 1,001,103 | |

Series 2021-14A, Class B1, (3-mo. CME Term SOFR + 1.91%), 7.19%, 12/02/34(a)(b) | | | 1,450 | | | | 1,452,908 | |

AGL CLO 20 Ltd., Series 2022-20A, Class BR, (3-mo. CME Term SOFR + 1.75%), 10/20/37(a)(b)(d) | | | 3,331 | | | | 3,331,000 | |

AGL CLO 23 Ltd., Series 2022-23A, Class A, (3-mo. CME Term SOFR + 2.20%), 7.48%, 01/20/36(a)(b) | | | 1,990 | | | | 1,999,438 | |

AGL CLO 32 Ltd., Series 2024-32A, Class A1, (3-mo. CME Term SOFR + 1.38%), 6.65%, 07/21/37(a)(b) | | | 1,230 | | | | 1,234,920 | |

AGL CLO 5 Ltd., Series 2020-5A, Class A1R, (3-mo. CME Term SOFR + 1.42%), 6.70%, 07/20/34(a)(b) | | | 2,830 | | | | 2,834,222 | |

AGL CLO 7 Ltd. | | | | | | | | |

Series 2020-7A, Class AR, (3-mo. CME Term SOFR + 1.46%), 6.76%, 07/15/34(a)(b) | | | 2,400 | | | | 2,400,947 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

Asset-Backed Securities (continued) | |

AGL CLO 7 Ltd. | | | | | | | | |

Series 2020-7A, Class DR, (3-mo. CME Term SOFR + 3.36%), 8.66%, 07/15/34(a)(b) | | | USD 500 | | | $ | 500,479 | |

AGL Core CLO 15 Ltd., Series 2021-15A, Class A1, (3-mo. CME Term SOFR + 1.41%), 6.69%, 01/20/35(a)(b) | | | 1,344 | | | | 1,345,972 | |

AGL Core CLO 2 Ltd., Series 2019-2A, Class A1R, (3-mo. CME Term SOFR + 1.46%), 6.79%, 07/20/37(a)(b) | | | 14,335 | | | | 14,373,944 | |

AGL Core CLO 4 Ltd., Series 2020-4A, Class AR2, (3-mo. CME Term SOFR + 1.38%), 6.15%, 10/20/37(a)(b) | | | 3,620 | | | | 3,621,187 | |

AIMCO CLO | | | | | | | | |

Series 2017-AA, Class AR, (3-mo. CME Term SOFR + 1.31%), 6.59%, 04/20/34(a)(b) | | | 250 | | | | 250,019 | |

Series 2017-AA, Class CR, (3-mo. CME Term SOFR + 2.36%), 7.64%, 04/20/34(a)(b) | | | 500 | | | | 501,339 | |

Series 2017-AA, Class DR, (3-mo. CME Term SOFR + 3.41%), 8.69%, 04/20/34(a)(b) | | | 250 | | | | 250,775 | |

AIMCO CLO 11 Ltd., Series 2020-11A, Class BR2, (3-mo. CME Term SOFR + 1.65%), 6.89%, 07/17/37(a)(b) | | | 3,490 | | | | 3,500,518 | |

AIMCO CLO 12 Ltd., Series 2020-12A, Class AR, (3-mo. CME Term SOFR + 1.17%), 6.46%, 01/17/32(a)(b) | | | 6,039 | | | | 6,044,539 | |

AIMCO CLO 21 Ltd., Series 2024-21A, Class B, (3-mo. CME Term SOFR + 1.92%), 7.25%, 04/18/37(a)(b) | | | 750 | | | | 755,282 | |

Ajax Mortgage Loan Trust | | | | | | | | |

Series 2021-G, Class A, 1.88%, 06/25/61(a)(b) | | | 32,801 | | | | 31,867,414 | |

Series 2021-G, Class B, 3.75%, 06/25/61(a)(b) | | | 8,006 | | | | 8,541,126 | |

Series 2021-G, Class C, 0.00%, 06/25/61(a)(e) | | | 14,366 | | | | 13,194,036 | |

Series 2023-B, Class A, 4.25%, 10/25/62(a)(c) | | | 14,187 | | | | 13,831,596 | |

Series 2023-B, Class B, 4.25%, 10/25/62(a)(c) | | | 1,749 | | | | 1,663,627 | |

Series 2023-B, Class C, 0.00%, 10/25/62(a)(e) | | | 3,993 | | | | 1,883,634 | |

Series 2023-B, Class SA, 0.00%, 10/25/62(a)(e) | | | 687 | | | | 524,174 | |

AMMC CLO 18 Ltd., Series 2016-18A, Class AR, (3-mo. CME Term SOFR + 1.36%), 6.43%, 05/26/31(a)(b) | | | 762 | | | | 764,296 | |

AMMC CLO 21 Ltd., Series 2017-21A, Class A, (3-mo. CME Term SOFR + 1.51%), 6.75%, 11/02/30(a)(b) | | | 228 | | | | 227,904 | |

AMMC CLO 22 Ltd., Series 2018-22A, Class B, (3-mo. CME Term SOFR + 1.71%), 7.00%, 04/25/31(a)(b) | | | 500 | | | | 501,258 | |

AMMC CLO XII Ltd., Series 2013-12A, Class AR2, (3-mo. CME Term SOFR + 1.21%), 6.31%, 11/10/30(a)(b) | | | 111 | | | | 110,582 | |

AMSR Trust | | | | | | | | |

Series 2020-SFR1, Class E, 3.22%, 04/17/37(a) | | | 1,280 | | | | 1,262,350 | |

Series 2020-SFR2, Class D, 3.28%, 07/17/37(a) | | | 2,437 | | | | 2,405,206 | |

| | |

| 4 | | 2 0 2 4 B L A C K R O C K A N N U A L F I N A N C I A L S T A T E M E N T S A N D A D D I T I O N A L I N F O R M A T I O N |

| | |

Consolidated Schedule of Investments (continued) September 30, 2024 | | BlackRock Total Return Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

Asset-Backed Securities (continued) | |

AMSR Trust | | | | | | | | |

Series 2020-SFR3, Class E1, 2.56%, 09/17/37(a) | | | USD 2,490 | | | $ | 2,417,809 | |

Series 2020-SFR4, Class E2, 2.46%, 11/17/37(a) | | | 2,500 | | | | 2,419,180 | |

Series 2020-SFR4, Class F, 2.86%, 11/17/37(a) | | | 2,760 | | | | 2,678,008 | |

Anchorage Capital CLO 16 Ltd., Series 2020-16A, Class A1R, (3-mo. CME Term SOFR + 1.46%), 6.74%, 01/19/35(a)(b) | | | 250 | | | | 250,254 | |

Anchorage Capital CLO 17 Ltd., Series 2021-17A, Class A1, (3-mo. CME Term SOFR + 1.43%), 6.73%, 07/15/34(a)(b) | | | 11,115 | | | | 11,125,309 | |

Anchorage Capital CLO 29 Ltd., Series 2024-29A, Class A1, (3-mo. CME Term SOFR + 1.60%), 6.92%, 07/20/37(a)(b) | | | 3,020 | | | | 3,032,718 | |

Anchorage Capital CLO 6 Ltd. | | | | | | | | |

Series 2015-6A, Class AR3, (3-mo. CME Term SOFR + 1.44%), 6.77%, 04/22/34(a)(b) | | | 5,470 | | | | 5,471,541 | |

Series 2015-6A, Class BR3, (3-mo. CME Term SOFR + 2.10%), 7.43%, 04/22/34(a)(b) | | | 5,490 | | | | 5,523,763 | |

Anchorage Capital CLO 7 Ltd. | | | | | | | | |

Series 2015-7A, Class AR3, (3-mo. CME Term SOFR + 1.56%), 6.89%, 04/28/37(a)(b) | | | 5,686 | | | | 5,723,056 | |

Series 2015-7A, Class BR3, (3-mo. CME Term SOFR + 2.05%), 7.38%, 04/28/37(a)(b) | | | 7,620 | | | | 7,680,631 | |

Series 2015-7A, Class CR3, (3-mo. CME Term SOFR + 2.45%), 7.78%, 04/28/37(a)(b) | | | 4,250 | | | | 4,314,152 | |

Series 2015-7A, Class DR3, (3-mo. CME Term SOFR + 3.80%), 9.13%, 04/28/37(a)(b) | | | 1,140 | | | | 1,161,177 | |

Anchorage Capital CLO 8 Ltd. | | | | | | | | |

Series 2016-8A, Class AR2A, (3-mo. CME Term SOFR + 1.46%), 6.73%, 10/27/34(a)(b) | | | 2,395 | | | | 2,397,390 | |

Series 2016-8A, Class BR2, (3-mo. CME Term SOFR + 2.06%), 7.33%, 10/27/34(a)(b) | | | 2,800 | | | | 2,811,169 | |

Anchorage Capital Europe CLO 2 DAC | | | | | | | | |

Series 2A, Class B1R, (3-mo. EURIBOR + 1.60%), 5.29%, 04/15/34(a)(b) | | | EUR 1,327 | | | | 1,473,532 | |

Series 2A, Class DR, (3-mo. EURIBOR + 3.55%), 7.24%, 04/15/34(a)(b) | | | 1,380 | | | | 1,544,087 | |

Anchorage Capital Europe CLO DAC, Series 4A, Class D, (3-mo. EURIBOR + 3.20%), 6.89%, 04/25/34(a)(b) | | | 542 | | | | 604,320 | |

Apidos CLO XV, Series 2013-15A, Class A1RR, (3-mo. CME Term SOFR + 1.27%), 6.55%, 04/20/31(a)(b) | | | USD 547 | | | | 547,571 | |

Apidos CLO XVIII, Series 2018-18A, Class AR, (3-mo. CME Term SOFR + 1.15%), 6.43%, 10/22/30(a)(b) | | | 671 | | | | 671,002 | |

Apidos CLO XX | | | | | | | | |

Series 2015-20A, Class A1RA, (3-mo. CME Term SOFR + 1.36%), 6.65%, 07/16/31(a)(b) | | | 283 | | | | 283,723 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

Asset-Backed Securities (continued) | |

Apidos CLO XX | | | | | | | | |

Series 2015-20A, Class A2RR, (3-mo. CME Term SOFR + 1.81%), 7.10%, 07/16/31(a)(b) | | | USD 250 | | | $ | 250,721 | |

Apidos CLO XXII | | | | | | | | |

Series 2015-22A, Class A1R, (3-mo. CME Term SOFR + 1.32%), 6.60%, 04/20/31(a)(b) | | | 126 | | | | 126,242 | |

Series 2015-22A, Class A2R, (3-mo. CME Term SOFR + 1.76%), 7.04%, 04/20/31(a)(b) | | | 500 | | | | 501,319 | |

Series 2015-22A, Class BR, (3-mo. CME Term SOFR + 2.21%), 7.49%, 04/20/31(a)(b) | | | 250 | | | | 250,740 | |

Series 2015-22A, Class CR, (3-mo. CME Term SOFR + 3.21%), 8.49%, 04/20/31(a)(b) | | | 850 | | | | 856,731 | |

Apidos CLO XXIV, Series 2016-24A, Class A2LX, (3-mo. CME Term SOFR + 1.61%), 6.89%, 10/20/30(a)(b) | | | 660 | | | | 660,778 | |

Apidos CLO XXV | | | | | | | | |

Series 2016-25A, Class A1R2, (3-mo. CME Term SOFR + 1.15%), 6.43%, 10/20/31(a)(b) | | | 856 | | | | 856,687 | |

Series 2016-25A, Class A2R2, (3-mo. CME Term SOFR + 1.80%), 7.08%, 10/20/31(a)(b) | | | 6,850 | | | | 6,863,984 | |

Apidos CLO XXVI, Series 2017-26A, Class BR, (3-mo. CME Term SOFR + 2.21%), 7.49%, 07/18/29(a)(b) | | | 570 | | | | 571,684 | |

Apidos CLO XXXI, Series 2019-31A, Class BR, (3-mo. CME Term SOFR + 1.81%), 7.11%, 04/15/31(a)(b) | | | 500 | | | | 500,660 | |

Apidos CLO XXXII, Series 2019-32A, Class A1R, (3-mo. CME Term SOFR + 1.10%), 6.38%, 01/20/33(a)(b) | | | 830 | | | | 831,309 | |

Apidos CLO XXXIV, Series 2020-34A, Class A1R, (3-mo. CME Term SOFR + 1.41%), 6.69%, 01/20/35(a)(b) | | | 6,244 | | | | 6,249,698 | |

Apidos CLO XXXVI, Series 2021-36A, Class B, (3-mo. CME Term SOFR + 1.86%), 7.14%, 07/20/34(a)(b) | | | 625 | | | | 627,514 | |

Apidos CLO XXXVII | | | | | | | | |

Series 2021-37A, Class A, (3-mo. CME Term SOFR + 1.39%), 6.67%, 10/22/34(a)(b) | | | 450 | | | | 450,227 | |

Series 2021-37A, Class D, (3-mo. CME Term SOFR + 3.31%), 8.59%, 10/22/34(a)(b) | | | 250 | | | | 250,136 | |

Series 2021-37A, Class E, (3-mo. CME Term SOFR + 6.56%), 11.84%, 10/22/34(a)(b) | | | 455 | | | | 455,746 | |

Aqua Finance Trust, Series 2021-A, Class A, 1.54%, 07/17/46(a) | | | 315 | | | | 290,619 | |

Arbor Realty Commercial Real Estate Notes Ltd., Series 2022-FL1, Class A, (SOFR (30-day) + 1.45%), 6.79%, 01/15/37(a)(b) | | | 267 | | | | 265,953 | |

Ares European CLO XII DAC, Series 12A, Class B1R, (3-mo. EURIBOR + 1.70%), 5.39%, 04/20/32(a)(b) | | | EUR 889 | | | | 988,239 | |

Ares LII CLO Ltd. | | | | | | | | |