UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02857

Name of Fund: BlackRock Bond Fund, Inc.

BlackRock Sustainable Total Return Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Bond Fund, Inc., 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2024

Date of reporting period: 09/30/2024

Item 1 – Reports to Stockholders

(a) The Reports to Shareholders are attached herewith.

BlackRock Sustainable Total Return Fund

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Sustainable Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441-7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class K Shares | $42 | 0.39% |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Class K Shares returned 12.12%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to performance?

Allocations to structured products, high yield bonds, and agency mortgage-backed securities contributed.

What detracted from performance?

Duration positioning and currency strategies detracted. (Duration is a measure of interest rate sensitivity.) The Fund’s use of derivatives, namely futures and forward currency contracts, also detracted.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

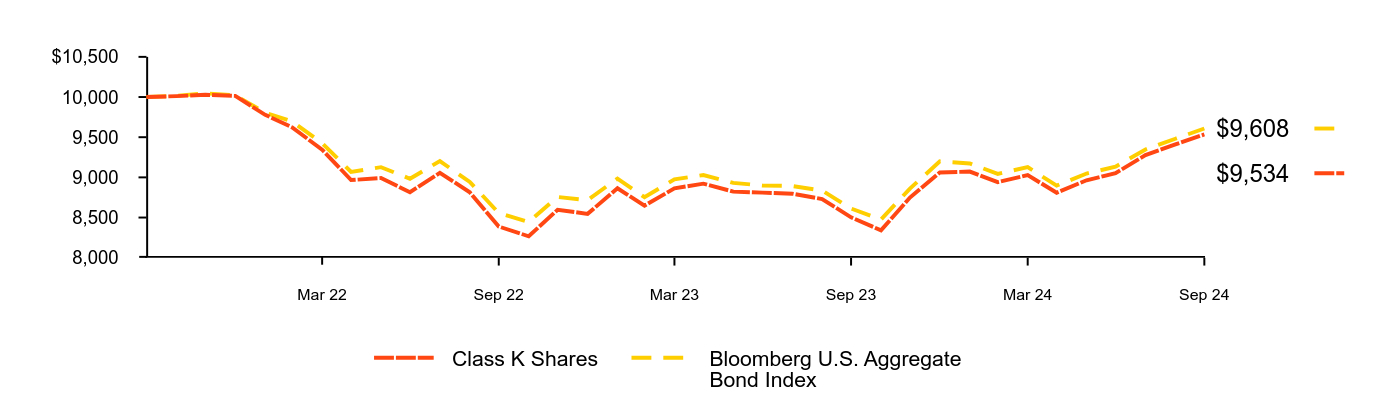

Cumulative performance: October 18, 2021 through September 30, 2024

Initial Investment of $10,000

| Class K Shares | Bloomberg U.S. Aggregate Bond Index |

|---|

| Sep 21 | $10,000 | $10,000 |

| Oct 21 | $10,011 | $10,016 |

| Nov 21 | $10,028 | $10,046 |

| Dec 21 | $10,014 | $10,020 |

| Jan 22 | $9,779 | $9,805 |

| Feb 22 | $9,622 | $9,695 |

| Mar 22 | $9,345 | $9,426 |

| Apr 22 | $8,967 | $9,068 |

| May 22 | $8,992 | $9,127 |

| Jun 22 | $8,815 | $8,983 |

| Jul 22 | $9,057 | $9,203 |

| Aug 22 | $8,814 | $8,943 |

| Sep 22 | $8,388 | $8,556 |

| Oct 22 | $8,267 | $8,446 |

| Nov 22 | $8,597 | $8,756 |

| Dec 22 | $8,546 | $8,717 |

| Jan 23 | $8,864 | $8,985 |

| Feb 23 | $8,648 | $8,753 |

| Mar 23 | $8,863 | $8,975 |

| Apr 23 | $8,922 | $9,029 |

| May 23 | $8,823 | $8,931 |

| Jun 23 | $8,810 | $8,899 |

| Jul 23 | $8,797 | $8,893 |

| Aug 23 | $8,731 | $8,836 |

| Sep 23 | $8,503 | $8,612 |

| Oct 23 | $8,341 | $8,476 |

| Nov 23 | $8,749 | $8,860 |

| Dec 23 | $9,061 | $9,199 |

| Jan 24 | $9,072 | $9,173 |

| Feb 24 | $8,940 | $9,044 |

| Mar 24 | $9,028 | $9,127 |

| Apr 24 | $8,809 | $8,897 |

| May 24 | $8,964 | $9,048 |

| Jun 24 | $9,053 | $9,133 |

| Jul 24 | $9,277 | $9,347 |

| Aug 24 | $9,411 | $9,481 |

| Sep 24 | $9,534 | $9,608 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | Since Fund Inception |

|---|

Class K Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.12% | (1.60)% |

Bloomberg U.S. Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.57 | (1.35) |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $45,177,787 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 700 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $0 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 832% |

The Fund commenced operations on October 18, 2021.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

Credit quality allocation

| Investment Type | Percent of Total InvestmentsFootnote Reference(a) |

|---|

U.S. Government Sponsored Agency Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 34.8% |

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 29.8 |

U.S. Treasury Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.5 |

Asset-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.4 |

Non-Agency Mortgage-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.3 |

Foreign Government Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

Foreign Agency Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.0 |

Investment Companies........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

Municipal Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

Common Stocks........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

|

Credit RatingFootnote Reference(b) | Percent of Total InvestmentsFootnote Reference(a) |

|---|

AAA/AaaFootnote Reference(c)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 54.8% |

AA/Aa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.8 |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.2 |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 20.5 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.0 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.0Footnote Reference(d) |

CC/Ca........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

N/R........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.2 |

| Footnote | Description |

Footnote(a) | Excludes short-term securities, short investments and options, if any. |

Footnote(b) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Footnote(c) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Footnote(d) | Rounds to less than 0.1%. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

© 2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Sustainable Total Return Fund

Annual Shareholder Report — September 30, 2024

BlackRock Sustainable Total Return Fund

Institutional Shares | BISTX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Sustainable Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441-7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $46 | 0.43% |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Instititional Shares returned 12.08%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to performance?

Allocations to structured products, high yield bonds, and agency mortgage-backed securities contributed.

What detracted from performance?

Duration positioning and currency strategies detracted. (Duration is a measure of interest rate sensitivity.) The Fund’s use of derivatives, namely futures and forward currency contracts, also detracted.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

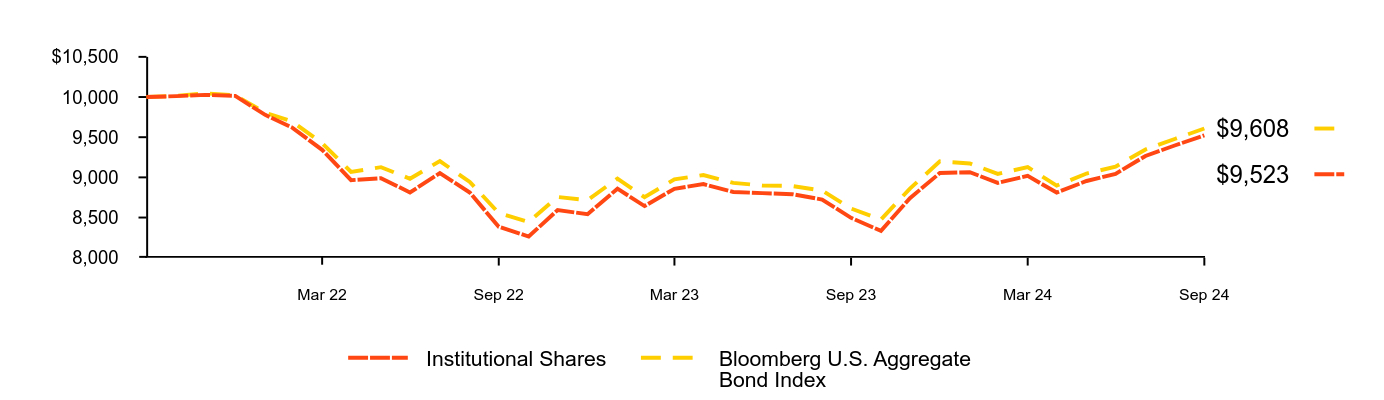

Cumulative performance: October 18, 2021 through September 30, 2024

Initial Investment of $10,000

| Institutional Shares | Bloomberg U.S. Aggregate Bond Index |

|---|

| Sep 21 | $10,000 | $10,000 |

| Oct 21 | $10,011 | $10,016 |

| Nov 21 | $10,027 | $10,046 |

| Dec 21 | $10,014 | $10,020 |

| Jan 22 | $9,778 | $9,805 |

| Feb 22 | $9,620 | $9,695 |

| Mar 22 | $9,343 | $9,426 |

| Apr 22 | $8,965 | $9,068 |

| May 22 | $8,990 | $9,127 |

| Jun 22 | $8,812 | $8,983 |

| Jul 22 | $9,054 | $9,203 |

| Aug 22 | $8,811 | $8,943 |

| Sep 22 | $8,385 | $8,556 |

| Oct 22 | $8,264 | $8,446 |

| Nov 22 | $8,593 | $8,756 |

| Dec 22 | $8,542 | $8,717 |

| Jan 23 | $8,859 | $8,985 |

| Feb 23 | $8,643 | $8,753 |

| Mar 23 | $8,858 | $8,975 |

| Apr 23 | $8,917 | $9,029 |

| May 23 | $8,818 | $8,931 |

| Jun 23 | $8,804 | $8,899 |

| Jul 23 | $8,791 | $8,893 |

| Aug 23 | $8,724 | $8,836 |

| Sep 23 | $8,496 | $8,612 |

| Oct 23 | $8,334 | $8,476 |

| Nov 23 | $8,741 | $8,860 |

| Dec 23 | $9,054 | $9,199 |

| Jan 24 | $9,064 | $9,173 |

| Feb 24 | $8,932 | $9,044 |

| Mar 24 | $9,019 | $9,127 |

| Apr 24 | $8,811 | $8,897 |

| May 24 | $8,955 | $9,048 |

| Jun 24 | $9,044 | $9,133 |

| Jul 24 | $9,266 | $9,347 |

| Aug 24 | $9,400 | $9,481 |

| Sep 24 | $9,523 | $9,608 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | Since Fund Inception |

|---|

Institutional Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.08% | (1.64)% |

Bloomberg U.S. Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.57 | (1.35) |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $45,177,787 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 700 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $0 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 832% |

The Fund commenced operations on October 18, 2021.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

Credit quality allocation

| Investment Type | Percent of Total InvestmentsFootnote Reference(a) |

|---|

U.S. Government Sponsored Agency Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 34.8% |

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 29.8 |

U.S. Treasury Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.5 |

Asset-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.4 |

Non-Agency Mortgage-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.3 |

Foreign Government Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

Foreign Agency Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.0 |

Investment Companies........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

Municipal Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

Common Stocks........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

|

Credit RatingFootnote Reference(b) | Percent of Total InvestmentsFootnote Reference(a) |

|---|

AAA/AaaFootnote Reference(c)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 54.8% |

AA/Aa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.8 |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.2 |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 20.5 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.0 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.0Footnote Reference(d) |

CC/Ca........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

N/R........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.2 |

| Footnote | Description |

Footnote(a) | Excludes short-term securities, short investments and options, if any. |

Footnote(b) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Footnote(c) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Footnote(d) | Rounds to less than 0.1%. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

© 2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Sustainable Total Return Fund

Institutional Shares | BISTX

Annual Shareholder Report — September 30, 2024

BlackRock Sustainable Total Return Fund

Investor A Shares | BASTX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Sustainable Total Return Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441-7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor A Shares | $79 | 0.75% |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Investor A Shares returned 11.73%

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 11.57%.

What contributed to performance?

Allocations to structured products, high yield bonds, and agency mortgage-backed securities contributed.

What detracted from performance?

Duration positioning and currency strategies detracted. (Duration is a measure of interest rate sensitivity.) The Fund’s use of derivatives, namely futures and forward currency contracts, also detracted.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

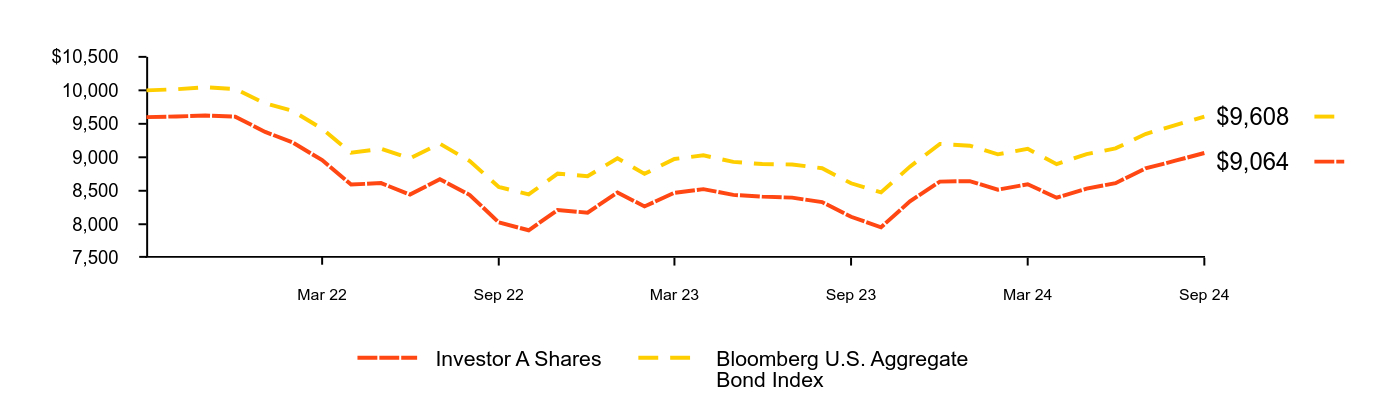

Cumulative performance: October 18, 2021 through September 30, 2024

Initial Investment of $10,000

| Investor A Shares | Bloomberg U.S. Aggregate Bond Index |

|---|

| Sep 21 | $9,600 | $10,000 |

| Oct 21 | $9,610 | $10,016 |

| Nov 21 | $9,623 | $10,046 |

| Dec 21 | $9,607 | $10,020 |

| Jan 22 | $9,379 | $9,805 |

| Feb 22 | $9,225 | $9,695 |

| Mar 22 | $8,958 | $9,426 |

| Apr 22 | $8,593 | $9,068 |

| May 22 | $8,615 | $9,127 |

| Jun 22 | $8,443 | $8,983 |

| Jul 22 | $8,673 | $9,203 |

| Aug 22 | $8,437 | $8,943 |

| Sep 22 | $8,027 | $8,556 |

| Oct 22 | $7,910 | $8,446 |

| Nov 22 | $8,213 | $8,756 |

| Dec 22 | $8,173 | $8,717 |

| Jan 23 | $8,474 | $8,985 |

| Feb 23 | $8,266 | $8,753 |

| Mar 23 | $8,470 | $8,975 |

| Apr 23 | $8,524 | $9,029 |

| May 23 | $8,438 | $8,931 |

| Jun 23 | $8,412 | $8,899 |

| Jul 23 | $8,397 | $8,893 |

| Aug 23 | $8,331 | $8,836 |

| Sep 23 | $8,112 | $8,612 |

| Oct 23 | $7,955 | $8,476 |

| Nov 23 | $8,342 | $8,860 |

| Dec 23 | $8,637 | $9,199 |

| Jan 24 | $8,644 | $9,173 |

| Feb 24 | $8,516 | $9,044 |

| Mar 24 | $8,597 | $9,127 |

| Apr 24 | $8,397 | $8,897 |

| May 24 | $8,532 | $9,048 |

| Jun 24 | $8,614 | $9,133 |

| Jul 24 | $8,834 | $9,347 |

| Aug 24 | $8,949 | $9,481 |

| Sep 24 | $9,064 | $9,608 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | Since Fund Inception |

|---|

Investor A Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.73% | (1.93)% |

Investor A Shares (with sales charge)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.26 | (3.28) |

Bloomberg U.S. Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.57 | (1.35) |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $45,177,787 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 700 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $0 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 832% |

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

The Fund commenced operations on October 18, 2021.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

Credit quality allocation

| Investment Type | Percent of Total InvestmentsFootnote Reference(a) |

|---|

U.S. Government Sponsored Agency Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 34.8% |

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 29.8 |

U.S. Treasury Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.5 |

Asset-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.4 |