SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO.___)

Filed by the Registrant [ X ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ X ] | | Preliminary Proxy Statement |

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | | Definitive Proxy Statement |

| [ ] | | Definitive Additional Materials |

| [ ] | | Soliciting Material Pursuant to sec. 240.14a-12 |

SEMCO Energy, Inc.

Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ X ] | | No fee required. |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: | |

| | | | |

| |

| | | (2) | | Aggregate number of securities to which transaction applies: | |

| | | | |

| |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | | | |

| |

| | | (4) | | Proposed maximum aggregate value of transaction: | |

| | | | |

| |

| | | (5) | | Total fee paid: | |

| | | | |

| |

| [ ] | | Fee paid previously with preliminary materials. | |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| | | (1) | | Amount Previously Paid: | |

| | | | |

| |

| | | (2) | | Form, Schedule or Registration Statement No.: | |

| | | | |

| |

| | | (3) | | Filing Party: | |

| | | | |

| |

| | | (4) | | Date Filed: | |

| | | | |

| |

April 13, 2004

NOTICE OF ANNUAL MEETING OF COMMON SHAREHOLDERS

TO BE HELD ON MAY 24, 2004

To the Common Shareholders of SEMCO ENERGY, INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of SEMCO Energy, Inc. (the Company) will be held at the McMorran Auditorium, 701 McMorran Boulevard, Port Huron, Michigan (see map on back), on Monday, May 24, 2004 at 10:00 a.m. (EDT), for the following purposes:

1. | To elect three members to the Board of Directors. |

| | |

2. | To vote on a proposal to authorize the issuance of Series B Preference Stock. |

| | |

3. | To vote on a proposal to amend the Restated Articles of Incorporation to increase the number of authorized Common Shares from 40,000,000 to 100,000,000. |

| | |

4. | To vote on a proposal to amend the Bylaws to provide that the number of Directors shall not be more than eleven and to authorize the Board of Directors to fix the number of Directors from time to time within this limit. |

| | |

5. | To approve the 2004 Stock Award and Incentive Plan. |

| | |

6. | To transact any other business which properly comes before the meeting. |

Only Common Shareholders of record at the close of business on March 29, 2004 may vote at the meeting.

Whether or not you plan to attend the meeting, you can ensure your shares are represented at the meeting by promptly completing, signing, dating and returning your proxy card in the enclosed postage-paid envelope or you may submit your proxy by telephone or via the internet in accordance with the instructions on the accompanying proxy card. To prevent duplication, please submit your proxy only once, either by mail, by phone or via the internet. If you attend the meeting, you may vote in person whether or not you have submitted your proxy.

By order of the Board of Directors

Sherry L. Abbott, Corporate Secretary

| 28470 13 Mile Road, Suite 300, Farmington Hills, Michigan 48334 (248) 702-6000 |

| | | |

|

|

TABLE OF CONTENTS

| PROXY STATEMENT | 1 |

|

|

| ELECTRONIC DELIVERY OF PROXY STATEMENT AND ANNUAL REPORT | 1 |

|

|

| STOCK OUTSTANDING AND VOTING RIGHTS | 2 |

|

|

Commonly Asked Questions Relating to Stock Ownership and Voting Rights | 2 |

|

|

Who is entitled to vote? | 2 |

|

|

What is the difference between holding shares as a shareholder of record and as a beneficial owner? | 2 |

|

|

How can I vote my shares in person at the annual meeting? | 2 |

|

|

How can I assure my shares are voted without attending the annual meeting? | 3 |

|

|

What does it mean if I receive more than one proxy or voting instruction card? | 3 |

|

|

Can I change my proxy? | 3 |

|

|

How many votes are required to elect directors? | 3 |

|

|

How many votes are required to pass each of the proposals? | 3 |

|

|

What is the quorum requirement for the annual meeting? | 3 |

|

|

Beneficial Ownership | 4 |

|

|

| ITEM 1 – ELECTION OF DIRECTORS | 5 |

|

|

| INFORMATION ABOUT DIRECTORS AND EXECUTIVE OFFICERS | 6 |

|

|

| ITEM 2 – AUTHORIZATION TO ISSUE SERIES B PREFERENCE STOCK | 8 |

|

|

| ITEM 3 – INCREASE IN NUMBER OF AUTHORIZED COMMON SHARES | 9 |

|

|

| ITEM 4 – AMENDMENTS TO BYLAWS AS TO NUMBER OF DIRECTORS | 11 |

|

|

| ITEM 5 – APPROVAL OF THE 2004 STOCK AWARD AND INCENTIVE PLAN | 12 |

|

|

| COMMITTEES OF THE BOARD OF DIRECTORS AND MEETING ATTENDANCE | 20 |

|

|

|

Board Member Attendance at Annual Meetings | 20 |

|

|

Audit Committee | 20 |

|

|

Compensation Committee | 21 |

|

|

Finance Committee | 21 |

|

|

Nominating and Corporate Governance Committee | 21 |

|

|

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 21 |

|

|

| CERTAIN BUSINESS RELATIONSHIPS OF DIRECTORS | 22 |

|

|

CODE OF ETHICS | 22 |

|

|

| COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS | 23 |

|

|

Summary compensation table | 23 |

|

|

Option grants in 2003 | 24 |

|

|

Options outstanding at December 31, 2003 | 24 |

|

|

Employment and related agreements | 24 |

|

|

Employee pension plan | 26 |

|

|

Supplemental pension plan for executives | 26 |

|

|

Total pension benefits | 27 |

|

|

Director compensation | 27 |

|

|

| COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION | 28 |

|

|

| EQUITY COMPENSATION PLAN INFORMATION | 30 |

|

|

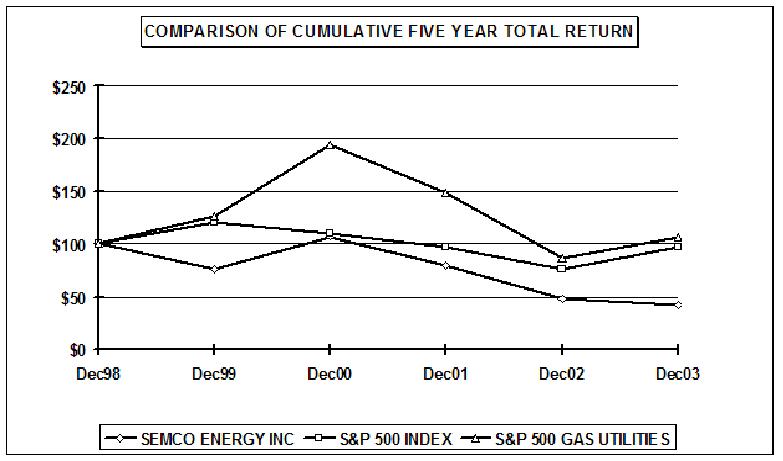

| PERFORMANCE GRAPH | 33 |

|

|

| REPORT OF THE AUDIT COMMITTEE | 33 |

|

|

| INDEPENDENT PUBLIC ACCOUNTANTS | 34 |

|

|

SHAREHOLDER PROPOSALS, COMMUNICATIONS AND RECOMMENDATIONS FOR DIRECTOR CANDIDATES | 34 |

|

|

| OTHER BUSINESS | 35 |

|

|

APPENDIX A -- 2004 STOCK AWARD AND INCENTIVE PLAN | A-1 |

|

|

MEETING LOCATION MAP | Back Cover |

|

|

28470 13 Mile Road, Suite 300, Farmington Hills, MI 48334

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of SEMCO Energy, Inc. (the Company) for use at the Annual Meeting of Common Shareholders on Monday, May 24, 2004, at 10:00 a.m. (EDT), to be held at the McMorran Auditorium, 701 McMorran Boulevard, Port Huron, Michigan, and any adjournments thereof. These proxy materials are being mailed to shareholders on or about April 13, 2004.

A Shareholder giving the enclosed proxy may revoke it any time before it is used by submitting a subsequent proxy (by telephone, internet or mail), by written notice to the Corporate Secretary of the Company, or by voting in person at the meeting.

Proxies will be solicited on behalf of the board of directors by mail, telephone, other electronic means or in person, and the Company will pay the solicitation costs. Copies of proxy material and of the 2003 annual report will be supplied to brokers, dealers, banks and voting trustees, or their nominees, for the purpose of soliciting proxies from beneficial owners, and the Company will reimburse such record holders for their reasonable expenses. MacKenzie Partners, Inc. has been retained to assist in soliciting proxies at a fee of $8,500 plus expenses.

A copy of the Company's 2003 Annual Report is enclosed.

ELECTRONIC DELIVERY OF PROXY STATEMENT AND ANNUAL REPORT

This proxy statement and the 2003 annual report are available at www.proxyvote.com. Most shareholders can elect to view future proxy statements and annual reports over the internet instead of receiving paper copies in the mail.

Shareholders of record (see question below:"What is the difference between holding shares as a shareholder of record and as a beneficial owner?") may choose this option to save the Company the cost of producing and mailing these documents by:

§ following the instructions provided when giving your proxy over the internet;

§ going to www.icsdelivery.com/sem and following the instructions provided; or

§ writing to:

SEMCO Energy, Inc. Investor Relations

28470 13 Mile Road, Suite 300

Farmington Hills, MI 48334

Shareholders of record who choose to view future proxy statements and annual reports over the internet will receive an e-mail message next year containing the internet address to use to access the Company's proxy statement and annual report. The e-mail will also include instructions for giving your proxy over the internet. Electronic delivery instructions will remain in effect until revoked in writing. It is not necessary to elect internet access each year.

Beneficial owners (see question below:"What is the difference between holding shares as a shareholder of record and as a beneficial owner?") should refer to information provided by their broker, bank or nominee for instructions on how to elect to view the Company's future proxy statements and annual reports over the internet if their broker or nominee participates in the service. Beneficial owners who choose electronic delivery will receive an e-mail message next year containing the internet address to use to access the Company's proxy statement and ann ual report.

STOCK OUTSTANDING AND VOTING RIGHTS

Commonly Asked Questions

Relating to Stock Outstanding and Voting Rights

| Q: Who is entitled to vote? A: Only Common Shareholders of record at the close of business on March 29, 2004 (the record date) may vote at the meeting. |

|

Q: What is the difference between holding shares as a shareholder of record and as a beneficial owner? A: Many shareholders of the Company hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those beneficially owned. Shareholder of Record. If your shares are registered directly in your name with our transfer agent, National City Bank, you are considered the shareholder of record with regard to those shares. As the shareholder of record, you have the right to grant your proxy directly to us to vote your shares on your behalf at the meeting or the right to vote in person at the meeting. A proxy card is enclosed for you to use to grant your proxy to us. Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these materials are being forwarded to you by your broker or nominee, which is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the annual meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the meeting unless you obtain a signed proxy from the shareholder of record giving you the right to vote the shares. Your broker or nominee has enclosed or provided a voting instruction card for you to use to direct your broker or nominee how to vote these shares. |

|

|

Q: How can I vote my shares in person at the annual meeting? A: Shares held directly in your name as the shareholder of record may be voted in person at the annual meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the annual meeting, the Company recommends that you grant your proxy in advance as described below so that your shares will be voted even if you later decide not to attend the meeting. Shares held in street name (see beneficial owner explanation above) may be voted in person by you only if you obtain a signed proxy from the record holder (sometimes referred to as a "legal proxy") giving you the right to vote the shares. |

|

Q: How can I assure my shares are voted without attending the annual meeting? A: By granting your proxy by way of the internet or by telephone, or by completing and mailing your proxy card or voting instruction card in the enclosed pre-paid envelope. Please refer to the enclosed materials for details. |

|

Q: What does it mean if I receive more than one proxy or voting instruction card? A: It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. |

|

Q: Can I change my proxy? A: You may change your proxy instructions at any time prior to the vote at the annual meeting. You may accomplish this by entering new instructions by the internet or telephone or by sending in a new proxy card or new voting instruction card bearing a later date (which automatically revokes the earlier proxy instructions) or by attending the annual meeting and voting in person. Attendance at the annual meeting will not cause your previously granted proxy to be revoked unless you specifically so request at the meeting. |

|

| Q: How many votes are required to elect directors? A: The three persons receiving the highest number of votes cast will be elected. |

|

Q: How many votes are required to pass each of the proposals? A: Item 2 to authorize the issuance of Series B Preference Stock– A majority of the votes cast. Item 3 to amend the Restated Articles of Incorporation to increase the authorized Common Shares– A majority of the Common Shares outstanding on the record date. Item 4 to amend the Bylaws regarding the number of Directors– A majority of the votes cast. Item 5 to approve the 2004 Stock Award and Incentive Plan– A majority of the votes cast. If you hold shares beneficially in street name and do not provide your broker or nominee with voting instructions, your shares constitute "broker non-votes." Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions have not been given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting assuming a quorum is obtained. Abstentions have the same effect as votes against the matter. |

|

Q: What is the quorum requirement for the annual meeting? A: The Company had approximately 28,170,000 shares of Common Stock (Common Shares) outstanding on the record date. A majority of the Common Shares represented at the meeting, in person or by proxy, constitutes a quorum. Abstentions and broker non-votes are counted for the purpose of determining a quorum. See the previous question, "How many votes are required to pass each of the proposals" for an explanation of broker non-vot es and the effect on voting. |

|

Beneficial Ownership

The following table shows beneficial owners of more than 5% of the Company’s voting securities as of March 29, 2004 based on filings with the Securities and Exchange Commission (the SEC).

| Title of Class | Name and Address | Number of Shares Beneficially Owned | Percent of Class |

|

|

|

|

| 6% Series B Convertible Preference Stock | K-1 USA Ventures, Inc. [Address here] | 31,000(1)(2) | 100% |

|

|

|

|

| (1) | Based on a Schedule 13D filed by K-1 USA Ventures, Inc. ("K-1") with the SEC on March __, 2004, and includes (a) warrants to acquire 905,565 shares of Common Stock and (b) 4,678,751 shares of Common Stock issuable upon conversion of the Preference Stock. |

| | |

| (2) | The holder of the Preference Stock is entitled to cast such number of votes as the holder would have been entitled to cast if the Preference Stock had been converted into Common Stock. |

The following table reflects ownership, as of March 29, 2004, of the number of Common Shares beneficially owned by each director, nominee, and current executive officer named in the Summary Compensation Table (see the Compensation of Executive Officers and Directors section) and all directors, nominees and current executive officers as a group. [Updated through March 9, 2004.]

| | (A) | | (B) | | | |

Name | Common Shares(1) | | Exercisable Stock Options(2) | | Columns A and B Combined |

|

|

|

|

|

|

| | | | | | | | |

| John M. Albertine | 6,357 | | | 7,001 | | 13,358 | |

| Edward J. Curtis | 25,044 | (3) | | 9,101 | | 34,145 | (3) |

| Eugene N. Dubay | 4,634 | | | 0 | | 4,634 | |

| John T. Ferris | 74,280 | | | 9,101 | | 83,381 | |

| John R. Hinton | 2,892 | | | 1,001 | | 3,893 | |

| Harvey I. Klein | 33,804 | (3) | | 9,101 | | 42,905 | (3) |

| Frederick S. Moore | 33,514 | (3) | | 9,101 | | 42,615 | (3) |

| Mark T. Prendeville | 2,061 | | | 1,167 | | 3,228 | |

| Jeffrey A. Safchick | 0 | | | 0 | | 0 | |

| John E. Schneider | 14,440 | | | 30,334 | | 44,774 | |

| George A. Schreiber, Jr. | 0 | | | 0 | | 0 | |

| Thomas W. Sherman | 14,272 | (3) | | 1,001 | | 15,273 | (3) |

| Sherry A. Stanley | 0 | | | 0 | | 0 | |

| Donald W. Thomason | 20,442 | (3) | | 9,101 | | 29,543 | (3) |

| Steven W. Warsinske | 15,465 | | | 21,100 | | 36,565 | |

| All directors, nominees and current executive officers as a group (16 persons including those named above) | 249,516 | (4) | | 109,476 | | 358,992 | (4) |

| (1) | Each person has sole power to vote and sell Common Shares shown, except Shares held jointly with spouses or directly by spouses, minor children, or certain other relatives, and except as described in (3) below. |

| | |

| (2) | This column includes Common Shares that may be acquired by exercising stock options within 60 days of March 29, 2004. |

| | |

| (3) | Includes Common Shares held in a Directors’ Deferred Compensation Plan Account as follows: |

Name | Directors' Deferred Compensation Shares |

|

|

Edward J. Curtis | 18,774 |

Harvey I. Klein | 12,351 |

Frederick S. Moore | 26,491 |

Thomas W. Sherman | 12,272 |

Donald W. Thomason | 5,587 |

|

|

Shares in this Account may not be voted by the individual directors, but may be voted by the full Board.

| (4) | The directors, nominees and current executive officers as a group beneficially own 0.89% of outstanding Common Shares. Including options exercisable within 60 days of March 29, 2004, the same group beneficially owns 1.27% of outstanding Common Shares. Each individual holds less than one percent of outstanding Common Shares. In 1999, the Board established new stock ownership guidelines for directors. Within five years of adoption of the guidelines or within five years of joining the Company, whichever is later, each non-employee director is expected to own Common Shares equal in value to five times the director's annual retainer. Once the required shares are acquired, such shares must be retained throughout the remainder of the individual’s directorship and no additional shares need be acquired regardless of fluctuations in the Company’s stock price. |

ITEM 1 -- ELECTION OF DIRECTORS

Common Shareholders are entitled to cumulative voting for directors. Each Common Shareholder may cast a number of votes equal to the number of Common Shares owned, multiplied by the number of directors to be elected. Votes may be cast for a single nominee or distributed among nominees. Shareholders may vote their shares cumulatively at the meeting by indicating on the ballot how the votes are to be distributed among the directors.

The Restated Articles of Incorporation provide for three classes of directors. The term of office of each class is three years and the term of one class expires each year. Approximately one-third of the Board will be elected at each Annual Meeting of Shareholders. A vacancy can be filled by a vote of the shareholders or by the Board. Contained in this proxy statement is a proposal to amend the bylaws to allow the Board to set the size of the Board up to eleven members. If the shareholders approve the proposal and the size of the Board is changed, the Restated Articles of Incorporation state that any increase or decrease in Directors shall be apportioned among the classes so as to maintain all classes as nearly equal in number as possible, but in no case shall a decrease in number of Directors shorten the term of any incumbent Director.

On March 12, 2004, George A. Schreiber, Jr. was elected President, Chief Executive Officer and as a director of the Company.

Michael O. Frazer, who served as a director since 1986, and Edith A. Stotler, who served as a director since 1987, retired from the Board effective March 19, 2004. Pursuant to the provisions of the 6% Series B Convertible Preference Stock, K-1 USA Ventures, Inc., the holder of such Preference Stock, was granted the right to appoint two members to the Company’s Board. See "Item 2 – Authorization to Issue Series B Preference Stock." On March 12, 2004, the Board approved the election of the two individuals to be designated by K-1 USA Ventures, Inc. as replacements for Mr. Frazer and Ms. Stotler whose retirements took effect upon the consummation of Part I of the sale of the 6% Series B Convertible Preference Stock. Mr. Jeffrey A. Safchik and Ms. S herry A. Stanley were designated by K-1 USA Ventures, Inc. and became members of the Company’s Board on March 19, 2004.

Three directors are to be elected at this Annual Meeting. Each of the three persons receiving the highest number of votes will be elected. Proxies are being solicited to vote for the election of the following persons, each of whom is currently a director of the Company:

John M. Albertine

John R. Hinton

Donald W. Thomason

The Board does not expect that any nominee will become unavailable to serve as a director. Should that occur, however, proxies will be used to vote for another person selected by the Board.

The persons named in the enclosed proxy reserve the right to vote proxies cumulatively to the extent not inconsistent with shareholder direction. As shown on the proxy, shareholders may direct that their shares be voted for less than all three of the above-named nominees. The proxy may not be used to direct cumulative voting or to direct a vote for anyone other than the above-named nominees.

INFORMATION ABOUT NOMINEES, DIRECTORS AND EXECUTIVE OFFICERS

Name, Position* and Business Experience During Past Five Years | Age | Director Since |

|

|

|

NOMINEES (terms expiring 2007) | | |

John M. Albertine Since 1990, Chairman and Chief Executive Officer of Albertine Enterprises, Inc., an economic forecasting, public policy, and full-service mergers and acquisitions firm based in Washington, D.C. Chief Executive Officer of Jam Shoe Concepts, Inc. Jam Shoe Concepts, Inc. owns 100% of the assets of a retail family shoe chain with 46 stores in the midwest. Since March 2003, Trustee of the Virginia Retirement System. Mr. Albertine holds a Ph.D. in economics from the University of Virginia. Director of Intermagnetics General Corporation and Kadant Inc. | 59 | 2000 |

John R. Hinton Chairman of the Board of the Company since December 2003. Lead Director of the Company from April 2003 to December 2003 when the position was eliminated. Retired in 1999 from the Kellogg Company as Executive Vice President Administration - Chief Financial Officer. | 58 | 2002 |

Donald W. Thomason Lead Director of the Company from November 1998 to April 2003. Retired in 1999 from the Kellogg Company as Executive Vice President Corporate Services/Technology. | 60 | 1995 |

|

|

|

OTHER DIRECTORS (terms expiring 2005) | | |

Edward J. Curtis President of E.J. Curtis Associates, Inc., a professional management consulting firm founded in 1972 with concentration in the natural gas and electric utility industries. Mr. Curtis is a member of the Society of Gas Lighting, the Guild of Gas Managers, the American Gas Association, the American Institute of Chemical Engineers, the Association of Energy Engineers and the International Association for Energy Economics. | 61 | 1995 |

Harvey I. Klein President of Global Strategies Group L.C. since 1995. Global Strategies Group is a private consulting firm that provides direction to management on organization, strategic planning, quality and customer satisfaction, product sales and marketing, and selection and implementation of new business opportunities. Clients have been primarily from the automotive, energy, financial services and entertainment industries. | 65 | 1993 |

George A. Schreiber, Jr. President and Chief Executive Officer of the Company since March 2004. From September 1999 to March 2004, Chairman, Global Energy Group of Credit Suisse First Boston, a global investment bank. From February 1997 to August 1999, President of Pinnacle West Capital Corporation, a $7 billion diversified holding company whose principal businesses are power and real estate. | 55 | 2004 |

Thomas W. Sherman Director of Bay State Gas Company from 1975 through 2002. Executive Vice President and Chief Financial Officer of Bay State Gas Company from 1975 to June 2000. Bay State Gas Company, a gas distribution utility operating in New England, was acquired by NiSource, Inc. in 1999. NiSource Inc., during the relevant time frame, was a holding company headquartered in Indiana, whose operating companies engaged in virtually all phases of the natural gas business from exploration and production to transmission, storage and distribution, as well as electric generation, transmission and distribution. Mr. Sherman acted as a consultant to NiSource, Inc., from June 2000 to June 2001. | 63 | 2002 |

|

|

|

Name, Position* and Business Experience During Past Five Years | Age | Director Since |

|

|

|

OTHER DIRECTORS (terms expiring 2006) | | |

John T. Ferris Senior Partner in law firm of Ferris & Schwedler, P.C. in Bad Axe, Michigan. | 53 | 1994 |

Frederick S. Moore Chairman and President of DSLT Inc., a company engaging in the real estate development business. Since 1999, Chairman of Mardale Specialty Foods, LLC., a producer of individual portion control jams, jellies, condiments, and salt and pepper packets. Chairman of Diamond Crystal Specialty Foods, Inc. (Diamond Crystal), which was a subsidiary of DSLT Inc. until Diamond Crystal’s sale in November 1998. | 65 | 1995 |

Jeffrey A. Safchik Information. | __ | 2004 |

Sherry A. Stanley Executive Vice President/General Counsel with Greenstreet Partners (since [date]) with oversight responsibility for legal matters of Greenstreet Partners, K-1 USA Ventures, Inc., and their respective affiliates. | __ | 2004 |

|

|

|

_________________

* Other than Mr. Schreiber, each director's and nominee's principal employment is and has been with a company not affiliated with SEMCO.

EXECUTIVE OFFICERS

Below is information (age, present position with the Company and business experience during the past five years) for the current Executive Officers except for Mr. Schreiber who is included with the directors above.

Eugene N. Dubay(age 55) – Vice President from October 2002 to December 2003 and again from March 2004. Interim President and Chief Executive Officer from December 2003 to March 2004. SEMCO Energy Gas Company Division Senior Vice President and Chief Operating Officer since October 2002. President, Kansas Gas Service Division of ONEOK, Inc. from 1997 to October 2002. During his term as President of the ONEOK Kansas Gas Service Division, Mr. Dubay was responsible for operations, marketing, and administrative matters for an autonomous distribution company serving 650,000 customers in the State of Kansas.

Mark T. Prendeville(age 53) -- Vice President and General Counsel since May 2003. Labor and Employment Counsel from February 2000 to May 2003. From 1990 through February 2000, General Counsel and Manager of Industrial Relations for Republic Die & Tool Co. of Belleville, Michigan. During Mr. Prendeville’s tenure, Republic, with revenues of about $40 million annually, was a tier-one supplier of sheet metal stamping dies to the auto industry.

John E. Schneider(age 55) -- Senior Vice President, Treasurer and Chief Financial Officer since January 2002. Vice President from April 2001 to January 2002 and SEMCO Energy Gas Company Division Executive Vice President and Chief Operating Officer from March 2001 to January 2002. Senior Vice President of Corporate Development from September 1999 to March 2001. Senior Vice President and Chief Operating Officer of SEMCO Energy Ventures, Inc. (a subsidiary of the Company) from May 1998 to September 1999.

Gary J. Valentz(age 47) – Vice President and Chief Information Officer and President of Aretech Information Services, Inc. (subsidiary of the Company) from April 2003. Chief Information Officer and Director of Business Services of MSX International (Southfield, Michigan) from 2001 to April 2003. MSX International is a $1 billion global organization providing outsourced business services and systems to Fortune 500 companies. While at MSX, Mr. Valentz was responsible for information technology required to operate the company, technology products and services for external customers and application service provider services for large global Fortune 100 companies. Chief Information Officer of C oastal Natural Gas Group of Coastal Corporation (Houston, Texas) from 1999 to 2001. Responsible for setting strategic direction for information technology for the natural gas business unit and guiding information technology strategy for a $13 billion energy corporation.

Steven W. Warsinske(age 48) -- Vice President and Controller since April 2000. SEMCO Energy Gas Company Division Vice President and Chief Accounting Officer from February 1998 to April 2000.

ITEM 2 – AUTHORIZATION TO ISSUE SERIES B PREFERENCE STOCK

The Company's Restated Articles of Incorporation authorize the Board of Directors of the Company to issue up to 3,000,000 shares of Preference Stock, to divide the shares of Preference Stock into series and to fix the relative rights and preferences of the shares of any series so established.

On January 16, 1997 the Board of Directors created a series of Preference Stock designated as Series A Preference Stock with the number of shares constituting such series set at 2,000,000. The Series A Preference Stock is reserved for issuance under the Company's Shareholder's Rights Plan and no shares are outstanding.

At the present time, the Company does not meet the requirements under its Indentures to issue additional Senior Notes and the Board of Directors believes issuance of equity securities in the form of a new issue of Convertible Preference Stock would enhance the liquidity of the Company. Therefore, the Board of Directors has created a new series of Preference Stock designated 6% Series B Convertible Preference Stock ("Series B Stock") consisting of 70,000 shares. Net proceeds from the sale of the Series B Stock would be used to reduce debt and for general corporate purposes.

On March 19, 2004, the Company entered into a purchase agreement ("Purchase Agreement") with K-1 USA Ventures, Inc. ("K-1") for the sale of the Series B Stock. K-1 is an investment firm that invests in a wide range of investments across diverse sectors and is domiciled and incorporated in the Republic of Singapore. The principal provisions of the Series B Stock are set forth below. The Purchase Agreement provides for the sale of the Series B Stock in two parts. Part I covering the sale of 31,000 shares of Series B Stock to K-1 was consummated on March 19, 2004. As part of the sale, the Company issued to K-1 warrants (the "Warrants") expiring on March 18, 2009 to purchase 905,565 Common Shares at a per share price of $5.7615. The 31,000 shares and the War rants are convertible into 5,584,316 shares, or approximately 19.8% of the Company’s currently outstanding Common Shares.The net proceeds received by the Company from the sale of 31,000 shares of the Series B Stock and the Warrants approximated $____________ and was used to __________________________________________.

Subject to approval by shareholders, the Company proposes to sell an additional 19,000 shares of Series B Stock to K-1 under Part II of the Purchase Agreement, which shares would be convertible into 2,867,621 shares or 10.2% of the Company's currently outstanding Common Shares.

The Company's Common Shares are traded on the New York Stock Exchange ("Exchange"). As a result, the Company is obligated to comply with the applicable rules of the Exchange. A rule of the Exchange requires shareholder approval for the issuance of securities convertible into common shares if the number of common shares issuable upon conversion exceeds twenty percent of the common shares outstanding. The issuance of Common Shares upon conversion of the Series B Stock under Part II would be combined under the Exchange rules with the shares issuable upon conversion of the Series B Stock and the Warrants under Part I and thus would exceed the threshold of the Exchange and shareholder approval is required.

The Series B Stock has a liquidation preference of $1,000 per share plus accrued and unpaid dividends. Dividends would be payable quarterly in shares of Series B Stock or Common Shares (holder's choice) at an annual rate of 6.0% for first three years, increasing by 100 basis points each year thereafter, with a maximum increase of 400 basis points. Upon a change of control, the holder of the Series B Stock may require the Company to redeem the Shares at a price equal to the higher of (i) the value of the Common Shares on an "as-if converted" basis or (ii) 200% of the liquidation preference. The Series B Stock is convertible at the holder's option at any time into shares of the Company's Common Shares at a price of $6.6257 (calculated at a 15% premium over the volume weighted average of the last 20 days' trading price of the Common Shares preceding the issue date of the shares under Part I of the Purchase Agreement) and would be mandatorily convertible at any time after the third anniversary if the Common Shares trade at or above 2.0 times the conversion price for a period of 20 consecutive days. The holders of the Series B Stock have the same voting rights as holders of Common Shares on an "as-if converted" basis.

K-1 has been granted the right to nominate two members of the Board of Directors of the Company provided that in any event K-1 would have the right at any time to appoint at least 22% of the full Board. Upon the sale of the Series B Stock under Part I of the Purchase Agreement, K-1 nominated Mr. Jeffrey A. Safchik and Ms. Sherry A. Stanley as its designated members of the Board of Directors. Thereupon, Mr. Safchik and Ms. Stanley joined the Board. See "Information About Nominees, Directors and Executive Officers" herein.

The Purchase Agreement contains various provisions requiring approval by K-1 for certain corporate actions. In addition, the unanimous approval of the Directors appointed by K-1 and approval of at least 80% of the Company's Board of Directors, would be required for any increase in the dividends on the Common Shares or the creation or increase of any dividends on any other stock as long as the debt/total capitalization ratio remains 60.0% or higher. If such ratio drops below 60.0%, then the dividend can be changed by a majority vote of the Board of Directors.

The certificate creating the Series B Stock contains anti-dilation protections and pre-emptive rights to participate on a pro-rata basis in the purchase of any equity securities issued by the Company and ancillary documents contain various registration rights.

The proposed issuance of the Series B Stock is not intended as an anti-takeover provision. However, the issuance of the Series B Stock could make more difficult, and thereby discourage, attempts to acquire control of the Company. Issuance of Common Shares upon conversion of the Series B Stock could dilute the ownership interest and voting power of present shareholders, including any shareholder who might seek control of the Company.

Incorporated by reference into this Proxy Statement are the audited financial statements of the Company included in its 2003 Annual Report to Shareholders which accompanies this Proxy Statement as well as Management's Discussion and Analysis of Financial Condition and Results of Operation included in the 2003 Annual Report.

The affirmative vote of a majority of the votes cast by the holders of Common Shares is required to authorize the issuance of the Series B Stock under Part II of the Purchase Agreement. If the shareholders do not approve the proposal, the sale of Series B Stock under Part I of the Purchase Agreement and the issuance of the Warrants remain in full force and effect. Under the rules of the New York Stock Exchange, K-1, as holder of 31,000 shares of Series B Stock is deemed an "affiliate" of the Company and is not permitted to vote its shares on this proposal.

The Board of Directors and management recommend that the Common Shareholders grant their proxy FOR the proposal.

ITEM 3 – INCREASE IN NUMBER OF AUTHORIZED COMMON SHARES

The Board of Directors of the Company at their meeting held March 12, 2004, voted that the annual meeting of Common Shareholders scheduled for Monday, May 24, 2004, would be called for, in addition to other purposes, the purpose of considering and acting upon a proposed amendment to the Restated Articles of Incorporation of the Company so as to increase the number of authorized Common Shares from the existing 40,000,000 authorized shares to 100,000,000 authorized shares.

As of March 29, 2004, of the 40,000,000 shares authorized, the Company had approximately 28,170,000 shares outstanding and approximately 3,906,000 shares reserved for issuance for the following purposes: 1,600,000 for the Direct Stock Purchase and Dividend Reinvestment Plan ("DRIP"); 901,800 for exercise of stock options under the Stock Option Plan of 2000; 523,000 for exercise of stock options under the 1997 Long-Term Incentive Plan; 176,000 for matching contributions to the 401(k) Plan; 96,400 for the Broad Based Stock Award Plan; 56,300 for the Directors’ Deferred Compensation and Stock Purchase Plan for Non-Employee Directors; 13,000 as Compensation in Lieu of Medical Plan Participation for Non-Employee Directors; 900 for employees who sign up f or the first time for payroll deduction contributions to the DRIP; and 530,000 for conversion of stock options issued as employment inducements.A reserve of 5,584,316 shares was established in March 2004 for the conversion of Series B Stock and to satisfy Common Stock Purchase Warrants. If the proposal for the sale of additional Series B Stock is approved by the shareholders, an additional 11,476,226 Common Shares would be required to satisfy the conversion provision of such stock. If the proposal for approval of the 2004 Stock Award and Incentive Plan is approved by the shareholders, an additional 637,457 Common Shares would be reserved.

The Company has embarked on a strategic plan to focus its growth on the gas distribution business. The rate of return from the Company’s natural gas distribution line of business provides an attractive source of revenue and income. The Company will be seeking to grow this business line further in future years, which may require additional common stock capital. The Company also believes it is in its best interest to lower its debt as a percentage of its total capitalization. Through the sale of the Series B Stock discussed above (see "Item 2 – Authorization to Issue Series B Preference Stock") as well as other debt reduction initiatives, the percentage of debt to total capitalization should be lowered to a moderate level. Completion of these ini tiatives may not be possible unless the shareholders approve an amendment to the Restated Articles increasing the authorized number of shares. In light of these circumstances, the Board of Directors believes it would be in the best interest of the Company to increase the authorized number of Common Shares, thereby assuring that an ample number of authorized shares will be available for issuance in order to facilitate its strategic goals.

The additional authorized Common Shares would be issuable at the Board’s discretion, normally without further shareholder action, for any proper corporate purposes. The authorization of additional shares may have an anti-takeover effect. For example, such additional authorized shares could be used to dilute the stock ownership of persons seeking to obtain control of the Company. The Board of Directors has no present plans to use such shares to inhibit any takeover and the Board knows of no plans to attempt to take over the Company. If authorization of the proposal is postponed until a specific situation arises, the time and expense incident to obtaining shareholder approval at that time might disadvantage the Company by depriving it of the flexibili ty which could be important in facilitating effective use of the shares.

Other than as indicated above, the Company’s Board of Directors and management have no definitive plans for the issuance of any of the presently authorized and unissued Common Shares or of the additional shares to be authorized. Rather, it is the intention of the Board of Directors and management to hold such authorized and unissued Common Shares in reserve for such corporate needs as may develop.

No shareholder of the Company has any preemptive rights to subscribe for or to purchase any of the authorized and unissued Common Shares including the additional shares to be authorized with the exception discussed in "Item 2 – Authorization To Issue Series B Preference Stock" above.

The Common Shareholders will be asked to adopt a resolution amending Section 1 of Article III of the Restated Articles of Incorporation to read as follows:

The total authorized capital stock consists of

(a) 500,000 shares Cumulative Preferred Stock of the par value of $1 per share, issuable in series as hereinafter provided, designated "Cumulative Preferred Stock, $1 Par Value",

(b) 3,000,000 shares of Preference Stock designated "Preference Stock, $1 Par Value", and

(c) 100,000,000 shares of stock of the par value of $1 per share, designated "Common Stock, $1 Par Value."

The affirmative vote of the holders of at least a majority of Common Shares of the Company outstanding as of the Record Date (March 29, 2004), is required to adopt the amendment.

The Board of Directors and management recommend that the Common Shareholders grant their proxy FOR the proposal.

ITEM 4 – AMENDMENTS TO BYLAWS AS TO NUMBER OF DIRECTORS

The Board of Directors unanimously recommends that the Bylaws of the Company be amended to provide that the number of Directors of the Company shall be not more than eleven (11), and that the Board of Directors shall be authorized to fix from time to time, within this limit, the number of Directors that constitute the full Board.

The current Bylaws provide that the number of Directors shall be eleven (11)[Section 1 of Article III]and that the shareholders or the Board of Directors may alter, amend, add to or repeal the Bylaws provided that the Board of Directors shall not make or alter any Bylaws fixing their number, qualifications, classification, or term of office.[Article VII]

From time to time, vacancies on the Board are created through the resignation, retirement or the death of a member of the Board. The Board of Directors believes that it is not in the best interests of the Company and its shareholders to be required to have a set number of Directors and that a more flexible approach is to provide for a maximum number of Directors with the Board of Directors, upon the recommendation of the Nominating and Corporate Governance Committee,setting the exact number. At its March 12, 2004 meeting, the Board approved a reduction to ten in the number of Directors, subject to shareholder approval of this proposal. The reduction would be accomplished through attrition and would bring the number of Directors on the Company’s Board more in line with the number on the Boards of similarly sized peer companies.

The Common Shareholders will be asked to adopt a resolution amending the Bylaws to read as follows:

ARTICLE III

Section 1. Number, Classification and Term of Office.The business and the property of the corporation shall be managed and controlled by the Board of Directors. The number of Directors constituting the full Board of Directors shall be not more than eleven (11). Directors shall hold office for staggered terms as provided in the Restated Articles of Incorporation.

ARTICLE VII

AMENDMENTS

The shareholders entitled to vote or the Board of Directors may alter, amend, add to or repeal these Bylaws, provided that the Board of Directors shall not make or alter any Bylaws fixing qualifications, classification, or term of office.

The affirmative vote of a majority of the votes cast by the holders of Common Shares is required to adopt the amendments.

The Board of Directors and management recommend that the Common Shareholders grant their proxy FOR the proposal.

ITEM 5 -- APPROVAL OF THE 2004 STOCK AWARD AND INCENTIVE PLAN

At the Annual Meeting, shareholders will be asked to approve the 2004 Stock Award and Incentive Plan (the "2004 Plan"), which was approved by the Board of Directors on March 12, 2004. The 2004 Plan would replace the 1997 Long-Term Incentive Plan (the "1997 Plan") and the Stock Option Plan of 2000 (the "SOP") (together with the 1997 Plan, the "Preexisting Plans"). If shareholders approve the 2004 Plan, 1,500,000 Common Shares (comprised of approximately 863,000 shares remaining under the Preexisting Plans plus approximately 637,000 new shares), an estimated 5.33% of the currently outstanding class of Common Stock, plus the number of shares that become available (through forfeitures or expirations of awards) from the Preexisting Plans after the effective d ate of the 2004 Plan, will be available for issuance under the Plan.

The Board and Compensation Committee (the "Committee") believe that attracting and retaining executives, other key employees, non-employee directors and other service providers of high quality has been and will continue to be essential to the Company’s growth and success. The 2004 Plan will enable the Company to implement a compensation program with different types of incentives for motivating employees of the Company and encouraging them to give the Company long-term, excellent service. In particular, stock options, restricted stock and stock-related-awards are an important element of compensation for employees and directors, because such awards enable them to acquire or increase their proprietary interest in the Company, thereby promoting a closer identity of interests between them and the Company's shareholders. Annual incentive awards and other performance-based awards provide rewards for achieving specific performance objectives, such as earnings goals. The ability to grant such awards as compensation under the 2004 Plan will help the Company to remain competitive, and provide an increased incentive for each person granted an award to expend his or her maximum efforts for the success of the Company's business. The Board and Committee therefore view the 2004 Plan as a key part of the Company’s compensation program.

The 2004 Plan authorizes a broad range of awards, including:

stock options

stock appreciation rights ("SARs")

restricted stock, a grant of actual shares subject to a risk of forfeiture and restrictions on transfer

deferred stock, a contractual commitment to deliver shares at a future date; if such a grant is forfeitable, it may be referred to as "restricted stock units"

other awards based on Common Stock

dividend equivalents

stock-based performance award, which are in effect deferred stock awards that may be earned by achieving specific performance objectives

cash-based performance awards tied to achievement of specific performance objectives

shares issuable in lieu of rights to cash compensation, including under the Company's elective deferred compensation program

If the 2004 Plan is approved by shareholders, no new awards would be authorized for grant under the Preexisting Plans, but previously authorized awards under such Plans would remain in effect.

Under the terms of the employment agreement with Mr. Schreiber, he will be granted stock options to acquire 200,000 shares of the common stock of the Company ("Mr. Schreiber’s employment options") and 50,000 restricted stock units of the Company ("Mr. Schreiber’s employment RSUs"). If shareholder approval of the 2004 Plan is not received, Mr. Schreiber’s employment options will be granted on a non-qualified basis. Mr. Schreiber’s employment options shall be granted at fair market value on the date of grant, and one-third of the shares shall vest on each of the first three anniversaries of the effective date of Mr. Schreiber’s employment agreement. If Mr. Schreiber meets the performance targets, which will be established by the Co mpensation Committee prior to the grant date, the restrictions with respect to 20,000 of Mr. Schreiber’s employment RSUs will lapse upon the first anniversary of the effective date of Mr. Schreiber’s employment agreement, the restrictions with respect to 15,000 on the second anniversary of the effective date of Mr. Schreiber’s employment agreement and the final 15,000 on the third anniversary.

Reasons for Shareholder Approval

The Board seeks shareholder approval of the 2004 Plan in order to satisfy certain legal requirements, including requirements of the New York Stock Exchange. In addition, the Board regards shareholder approval of the 2004 Plan as desirable and consistent with corporate governance best practices.

The Board and Committee also seek to preserve the Company’s ability to claim tax deductions for compensation paid, to the greatest extent practicable. Section 162(m) of the Internal Revenue Code limits the deductions a publicly held company can claim for compensation in excess of $1 million in a given year paid to the Chief Executive Officer and the four other most highly compensated executive officers serving on the last day of the fiscal year (generally referred to as the "named executive officers"). "Performance-based" compensation that meets certain requirements is not counted against the $1 million deductibility cap, and therefore remains fully deductible. If the 2004 Plan is approved by shareholders, annual incentive awards granted under the P lan to named executives generally will be payable only upon achievement of pre-established performance goals relating to the Company as a whole or specific business units for which the individual executive has principal responsibility. The Board and Committee believe that such annual incentive awards have and will continue to provide strong motivation to executives to achieve performance objectives set by the Committee, and in that way place strong emphasis on the building of value for all shareholders.

For purposes of Section 162(m) of the Code, approval of the 2004 Plan will be deemed also to include approval of the eligibility of executive officers and other employees and service providers to participate in the Plan, the annual per-person limitations described below under the caption "Description of the 2004 Plan --Per-Person A ward Limitations," the general business criteria upon which performance objectives for performance awards, including annual incentive awards, are based, described below under the caption "Performance-Based Awards" and "Annual Incentive Awards," and the stock-price appreciation performance goal inherent in stock options and SARs. Because shareholder approval of general business criteria, without specific targeted levels of performance, qualifies incentive awards for a period of approximately five years, shareholder approval of such business criteria will meet the requirements under Section 162(m) until 2009. Shareholder approval of the performance goal inherent in stock options and SARs (increases in the market price of stock) is not subject to a time limit under Section 162(m).

In addition, shareholder approval will permit designated stock options to qualify as incentive stock options under the Internal Revenue Code. Such qualification can give the holder of the options more favorable tax treatment, as explained below.

Restriction on Repricing

The 2004 Plan includes a restriction providing that, without shareholder approval, the Company will not amend or replace options previously granted under the Plan in a transaction that constitutes a "repricing." For this purpose, a "repricing" means amending the terms of an option after it is granted to lower its exercise price, any other action that is treated as a repricing under generally accepted accounting principles, and canceling an Option at a time when its strike price is equal to or greater than the fair market value of the underlying Stock, in exchange for another option (including on a delayed basis), restricted stock, or other equity, unless the cancellation and exchange occurs in connection with a merger, acquisition, spin-off or other simi lar corporate transaction. Adjustments to the exercise price or number of shares subject to an option to reflect the effects of a stock split or other extraordinary corporate transaction will not constitute a "repricing."

Description of the 2004 Plan

The following is a brief description of the material features of the 2004 Plan. This description is qualified in its entirety by reference to the full text of the 2004 Plan, a copy of which is attached to this Proxy Statement as Appendix A.

Shares Available under the 2004 Plan.The 2004 Plan will reserve 1.5 million shares of Common Stock for awards (inclusive of any shares remaining under the Preexisting Plans), in addition to any shares that later become available due to forfeitures or expirations of awards under the 2004 Plan or the Preexisting Plans. The number of shares reserved under the 2004 Plan is subject to adjustment in the event of stock splits, stock dividends, and other extraordinary events.

Based on the Company's equity award plans in effect and outstanding awards at March 29, 2004, if shareholders approve the 2004 Plan, the total number of shares available for future awards under all such plans plus the number of shares subject to outstanding options and non-vested awards would be approximately 2,062,000 shares, or 7.32% of the shares then outstanding. Only the number of shares actually delivered to and retained by participants in connection with an award after all restrictions have lapsed will be counted against the number of shares reserved under the 2004 Plan. Thus, shares will become available again for new awards if an award expires, is forfeited, or is settled in cash, if shares are withheld or separately surrendered to pay the exercise price of an option or to satisfy tax withh olding obligations relating to an award, if fewer shares are delivered upon exercise of an SAR than the number to which the SAR related, or if shares that had been issued as restricted stock are forfeited. Shares delivered under the 2004 Plan shall be newly issued shares.

On [last date prior to proxy printing], the last reported sale price of the Company's Common Stock on the New York Stock Exchange was [$____] per share.

Per-Person Award Limitations. The 2004 Plan includes limitations on the amount of awards that may be granted to a participant in a given year in order to qualify awards as "performance-based" compensation not subject to the limitation on deductibility under Section 162(m) of the Code. Under this annual per-person limitation, a participant may in any year be granted share-based awards of each type authorized under the 2004 Plan -- options, SARs, restricted stock, deferred stock, bonus stock or stock in lieu of other compensation obligations, dividend equivalents, and other stock-based awards -- relating to no more than his or her "Annual Limit." The Annu al Limit equals 250,000 shares plus the amount of the participant's unused Annual Limit relating to share-based awards as of the close of the previous year, subject to adjustment for splits and other extraordinary corporate events. With respect to incentive awards not valued by reference to Common Stock at the date of grant, the 2004 Plan limits such performance awards that may be earned by a participant to the participant's defined Annual Limit, which for this purpose equals $500,000 plus the amount of the participant's unused cash Annual Limit as of the close of the previous year. The per person limits for each type of stock-based award are independent of one another and independent of the limit on cash-denominated performance awards. These limits apply only to awards under the 2004 Plan, and do not limit the Company’s ability to enter into compensation arrangements outside of the 2004 Plan.

Adjustments to Shares Reserved, Awards and Award Limits.Adjustments to the number and kind of shares subject to the share limitations and specified in the share-based Annual Limit are authorized in the event of a large, special or non-recurring dividend or distribution, recapitalization, stock split, stock dividend, reorganization, business combination, or other similar corporate transaction or event affecting the Common Stock. Adjustments also will be made to outstanding awards upon occurrence of these events, including to the number of shares subject to an award, any exercise price or share price referenced in the award terms (such as an SAR's base pr ice) and other terms of the award to preserve without enhancing the value of the award. The Committee is also authorized to adjust performance conditions and other terms of awards in response to these kinds of events or to changes in applicable laws, regulations, or accounting principles.

Eligibility. Executive officers and other officers and employees of the Company and its subsidiaries (including directors), non-employee directors of the Company, and any other person who provides substantial services will be eligible to be granted awards under the 2004 Plan.

Administration.The 2004 Plan will be administered by the Committee, except that the Board may itself act in place of the Committee to administer the 2004 Plan and determinations with respect to grants to non-employee directors must be made by the Board. The members of the Committee must be non-employee directors. Subject to the terms and conditions of the 2004 Plan, the Committee is authorized to select participants, determine the type and number of awards to be granted and the number of shares to which awards will relate or the amount of an annual or long-term incentive award, specify times at which awards will be exercisable or settled, including perf ormance conditions that may be required as a condition thereof, set other terms and conditions of such awards, prescribe forms of award agreements, interpret and specify rules and regulations relating to the 2004 Plan, and make all other determinations which may be necessary or advisable for the administration of the 2004 Plan. Nothing in the 2004 Plan precludes the Committee from authorizing payment of other compensation, including bonuses based upon performance, to executive officers and other employees. The Committee is permitted to delegate authority to executive officers for the granting of awards, but action pursuant to delegated authority generally will be limited to grants to employees who are below the executive officer level. The 2004 Plan provides that Committee members shall not be personally liable, and shall be fully indemnified, in connection with any action, determination, or interpretation taken or made in good faith under the 2004 Plan.

Stock Options and SARs. The Committee is authorized to grant stock options, including both incentive stock options ("ISOs"), which can result in potentially favorable tax treatment to the participant, and non-qualified stock options. SARs may also be granted, entitling the participant to receive the excess of the fair market value of a share on the date of exercise over the SAR's designated "base price." The exercise price of an option and the base price of an SAR are determined by the Committee, but generally may not be less than the fair market value of the shares on the date of grant (except as described below under "Other Terms of Awards"). The maximum term of each option or SAR will be ten years. Subject to this limit, the times at which each option or SAR will be exercisable and provisions requiring forfeiture of unexercised options at or following termination of employment or upon the occurrence of other events generally are fixed by the Committee. Options may be exercised by payment of the exercise price in cash, shares or other property (which may include through broker-assisted cashless exercise procedures) or by surrender of other outstanding awards having a fair market value equal to the exercise price. Methods of exercise and settlement and other terms of SARs will be determined by the Committee. SARs may be exercisable for shares or for cash, as determined by the Committee.

Restricted and Deferred Stock/Restricted Stock Units. The Committee is authorized to grant restricted stock and deferred stock. Prior to the end of the restricted period, shares granted as restricted stock may not be sold, and will be forfeited in the event of termination of employment in specified circumstances. The Committee will establish the length of the restricted period for awards of restricted stock. Aside from the risk of forfeiture and non-transferability, an award of restricted stock entitles the participant to the rights of a shareholder of the Company, including the right to vote the shares and to receive dividends, unless otherwise determined by the Committee.

Deferred stock gives a participant the right to receive shares at the end of a specified deferral period. Deferred stock subject to forfeiture conditions may be denominated as an award of "restricted stock units." The Committee will establish any vesting requirements for deferred stock/restricted stock units granted for continuing services. One advantage of restricted stock units, as compared to restricted stock, is that the period during which the award is deferred as to settlement can be extended past the date the award becomes non-forfeitable, so the Committee can require or permit a participant to continue to hold an interest tied to Common Stock on a tax-deferred basis. Prior to settlement, deferred stock awards, including restricted stock units, ca rry no voting or dividend rights or other rights associated with stock ownership, but dividend equivalents will be paid or accrue if authorized by the Committee.

Other Stock-Based Awards, Stock Bonus Awards, and Awards in Lieu of Other Obligations.The 2004 Plan authorizes the Committee to grant awards that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to Common Stock. The Committee will determine the terms and conditions of such awards, including the consideration to be paid to exercise awards in the nature of purchase rights, the periods during which awards will be outstanding, and any forfeiture conditions and restrictions on awards. In addition, the Committee is authorized to grant shares as a bonus free of restrictions, or to grant shares or other awards in lieu of obligations under other plans or compensatory arrangements, subject to such terms as the Committee may specify.

Performance-Based Awards.The Committee may grant performance awards, which may be cash-denominated awards or share-based awards. Generally, performance awards require satisfaction of pre-established performance goals, consisting of one or more business criteria and a targeted performance level with respect to such criteria as a condition of awards being granted or becoming exercisable or settleable, or as a condition to accelerating the timing of such events. Performance may be measured over a period of any length specified by the Committee. If so determined by the Committee, in order to avoid the limitations on tax deductibility under Section 162( m) of the Code, the business criteria used by the Committee in establishing performance goals applicable to performance awards to the named executive officers will be selected from among the following:

(1) | revenues; |

| | |

(2) | earnings, before or after taxes, from operations (generally or specified operations), before or after interest expense, depreciation, amortization, incentives, or extraordinary or special items; |

| | |

(3) | earnings per share (basic or fully diluted); |

| | |

(4) | return on net assets, return on assets, return on investment, return on capital, return on equity; |

| | |

(5) | cash flow;free cash flow, cash flow return on investment (discounted or otherwise), net cash provided by operations, or cash flow in excess of cost of capital; |

| | |

(6) | economic value created or added (representingthe amount by which a business unit's income exceeds the cost of the capital used by the business unit during the performance period, as determined by the Committee); |

| | |

(7) | operating margin or operating expense; |

| | |

(8) | net income; |

| | |

(9) | stock price or total shareholder return; and |

| | |

(10) | strategic business criteria, consisting of one or more objectives based on meeting specified market penetration or value added, geographic business expansion goals, cost targets, customer satisfaction, employee satisfaction, management of employment practices and employee benefits, supervision of litigation and information technology,and goals relating to acquisitions or divestitures of subsidiaries, affiliates or joint ventures. |

These goals may be set with fixed, quantitative targets, targets relative to past Company performance, or targets compared to the performance of other companies, such as a published or special index or a group of companies selected by the Committee for comparison. The Committee may specify that these performance measures will be determined before payment of bonuses, capital charges, non-recurring or extraordinary income or expense, or other financial and general and administrative expenses for the performance period, if so specified by the Committee.

Annual Incentive Awards. One type of performance award that may be granted under the 2004 Plan is Annual Incentive Awards, settleable in cash or in shares upon achievement of preestablished performance objectives achieved during a specified period of up to one year. The Committee generally must establish the terms of annual incentive awards, including the applicable performance goals and the corresponding amounts payable (subject to per-person limits), and other terms of settlement, and all other terms of these awards, not later than 90 days after the beginning of the fiscal year. As stated above, annual incentive awards granted to named executives are intended to constitute "performance-based compensation" not subject to the limitation on deductibility under Code Section 162(m). In order for such an annual incentive award to be earned, one or more of the performance objectives described in the preceding paragraph must be achieved. The Committee may specify additional requirements for the earning of such awards.

Other Terms of Awards. Awards may be settled in cash, shares, other awards or other property, in the discretion of the Committee. The Committee may require or permit participants to defer the settlement of all or part of an award, including shares issued upon exercise of an option, in accordance with such terms and conditions as the Committee may establish, including payment or crediting of interest or dividend equivalents on any deferred amounts. The Committee is authorized to place cash, shares or other property in trusts or make other arrangements to provide for payment of the Company's obligations under the 2004 Plan. The Committee may condition awards on the payment of taxes, such as by withho lding a portion of the shares or other property to be distributed in order to satisfy tax obligations. Awards granted under the Plan generally may not be pledged or otherwise encumbered and are not transferable except by will or by the laws of descent and distribution, or to a designated beneficiary upon the participant's death, except that the Committee may permit transfers of awards other than incentive stock options on a case-by-case basis. This flexibility can allow for estate planning or other limited transfers consistent with the incentive purpose of the Plan.

The Committee is authorized to impose non-competition, non-solicitation, confidentiality, non-disparagement and other requirements as a condition on the participant's right to retain an award or gains realized by exercise or settlement of an award. Awards under the 2004 Plan may be granted without a requirement that the participant pay consideration in the form of cash or property for the grant (as distinguished from the exercise), except to the extent required by law. The Committee may, however, grant awards in substitution for, exchange for or as a buyout of other awards under the 2004 Plan, awards under other Company plans, or other rights to payment from the Company, and may exchange or buy out outstanding awards for cash or other property. The Committee also may grant awards in addition to and in tandem with other awards, awards, or rights. In granting a new award, the Committee may determine that the in-the-money value of any surrendered award may be applied to reduce the exercise price of any option, base price of any SAR, or purchase price of any other award.

Dividend Equivalents.The Committee may grant dividend equivalents. These are rights to receive payments equal in value to the amount of dividends paid on a specified number of shares of Common Stock while an award is outstanding. These amounts may be in the form of cash or rights to receive additional Awards or additional shares of Common Stock having a value equal to the cash amount. The awards may be granted on a stand-alone basis or in conjunction with another award. Typically, rights to dividend equivalents are granted in connecti on with restricted stock units or deferred stock, so that the participant can earn amounts equal to dividends paid on the number of shares covered by the award while the award is outstanding.

Vesting, Forfeitures, and Related Award Terms.The Committee may, in its discretion, determine the vesting schedule of options and other awards, the circumstances that will result in forfeiture of awards, the post-termination exercise periods of options and similar awards, and the events that will result in acceleration of the ability to exercise and the lapse of restrictions, or the expiration of any deferral period, on any award.

The 2004 Plan provides that upon a change in control, as defined, unless the Committee limited these rights in the grant agreement, awards will become vested and exercisable and restrictions thereon will lapse, any option that was not vested and exercisable throughout the 60 day period prior to the change in control may be surrendered for a cash payment equal to spread, determined based on the highest market price during that 60-day period or, if higher, the consideration received by shareholders in the change in control transaction. The Committee may also specify in any award agreement that performance conditions will be deemed met upon a change in control.

Amendment and Termination of the 2004 Plan.The Board may amend, suspend, discontinue, or terminate the 2004 Plan or the Committee's authority to grant awards thereunder without shareholder approval, except as required by law or regulation or under the NYSE rules. Proposed changes to NYSE rules, if adopted, will require shareholder approval of material modifications to plans such as the 2004 Plan. Under these rules, shareholder approval will not necessarily be required for amendments which might increase the cost of the 2004 Plan or broaden eligibility. Unless earlier terminated, the 2004 Plan will terminate at such time that no shares reserved under the 2004 Plan remain available and the Company has no further obligation with respect to any outstanding award.

Federal Income Tax Implications of the 2004 Plan

The Company believes that under current law the following Federal income tax consequences generally would arise with respect to awards under the 2004 Plan. The grant of an option or an SAR will create no federal income tax consequences for the participant or the Company. A participant will not have taxable income upon exercising an option which is an ISO, except that the alternative minimum tax may apply. Upon exercising an option which is not an ISO, the participant generally must recognize ordinary income equal to the difference between the exercise price and the fair market value of the freely transferable and nonforfeitable shares acquired on the date of exercise. Upon exercising an SAR, the participant must generally recognize ordinary income equal to the cash or the fair market value of the sh ares received.

Upon a disposition of shares acquired upon exercise of an ISO before the end of the applicable ISO holding periods, the participant must generally recognize ordinary income equal to the lesser of (i) the fair market value of the ISO shares at the date of exercise minus the exercise price or (ii) the amount realized upon the disposition of the ISO shares minus the exercise price. Otherwise, a participant's sale of shares acquired by exercise of an option generally will result in short-term or long-term capital gain or loss measured by the difference between the sale price and the participant's tax "basis" in such shares. The tax "basis" normally is the exercise price plus any amount he or she recognized as ordinary income in connection with the option's exercise. A participant's sale of shares acquir ed by exercise of an SAR generally will result in short-term or long-term capital gain or loss measured by the difference between the sale price and the tax "basis" in the shares, which generally is the amount he or she recognized as ordinary income in connection with the SAR's exercise.

The Company normally can claim a tax deduction equal to the amount recognized as ordinary income by a participant in connection with an option or SAR, but no tax deduction relating to a participant's capital gains. Accordingly, the Company will not be entitled to any tax deduction with respect to an ISO if the participant holds the shares for the applicable ISO holding periods before selling the shares.

The Company may, however, permit participants to elect to defer taxation upon certain exercises of options other than ISOs. Under such a transaction, the participant must pay for the option exercise by surrendering shares, and the option shares that represent the gain upon exercise are deferred as to delivery by the Company. The participant generally should not realize income upon exercise, but will realize ordinary income equal to the value of shares delivered at the end of the specified deferral period. The Company is not entitled to a tax deduction at the time of exercise, but becomes entitled to a tax deduction at the time shares are delivered at the end of the deferral period. Proposed legislation may limit this kind of deferral, however.