SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a-12

SEMCO Energy, Inc.

(Name of Registrant as Specified In Its Charter)

_______________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

_______________________________________________________________________

2) Aggregate number of securities to which transaction applies:

_______________________________________________________________________

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

_______________________________________________________________________

4) Proposed maximum aggregate value of transaction:

_______________________________________________________________________

5) Total fee paid:

_______________________________________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

_______________________________________________

2) Form, Schedule or Registration Statement No.:

_______________________________________________

3) Filing Party:

_______________________________________________

4) Date Filed:

_______________________________________________

April 29, 2005

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 24, 2005

To the Shareholders of SEMCO ENERGY, INC.:

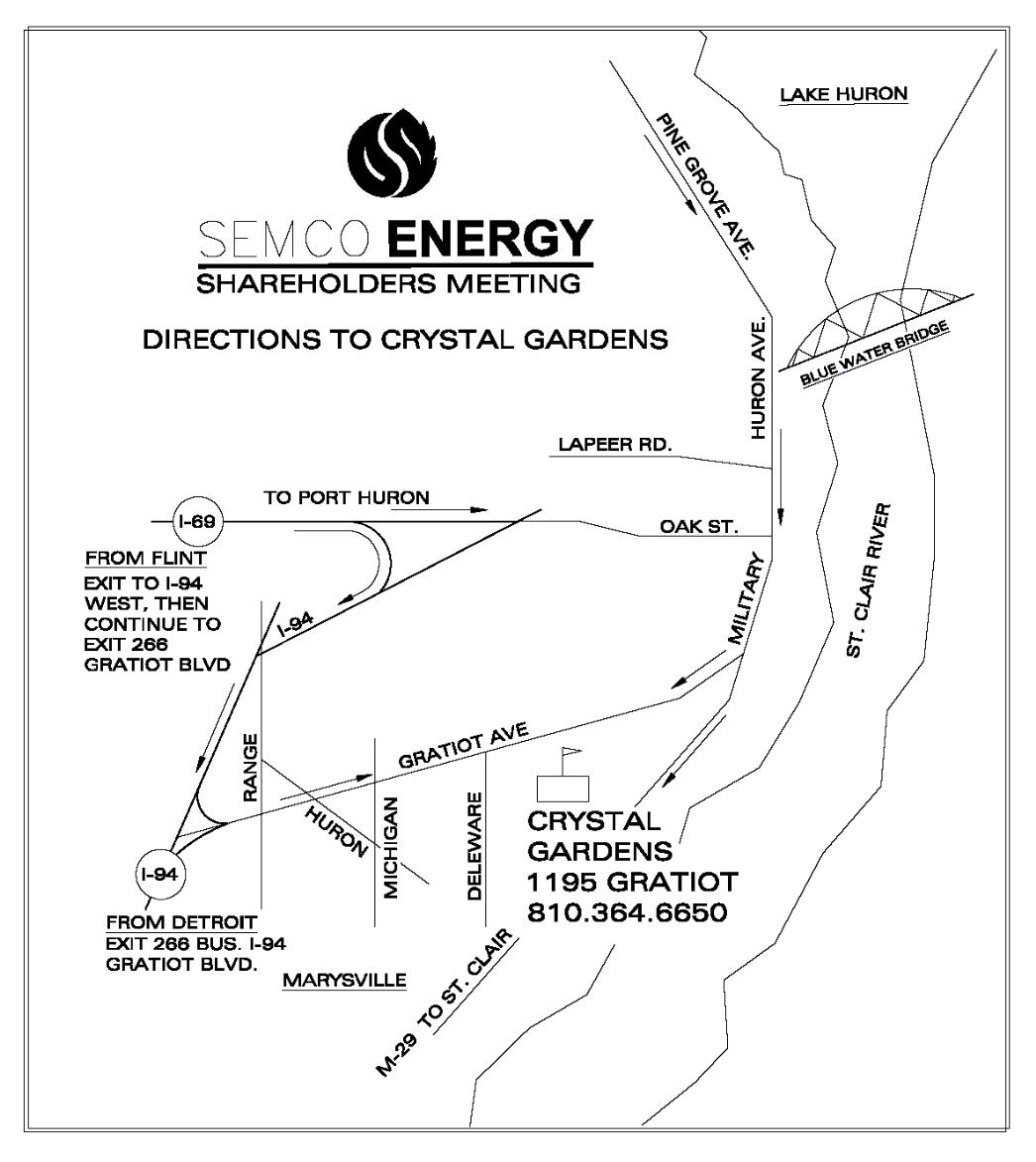

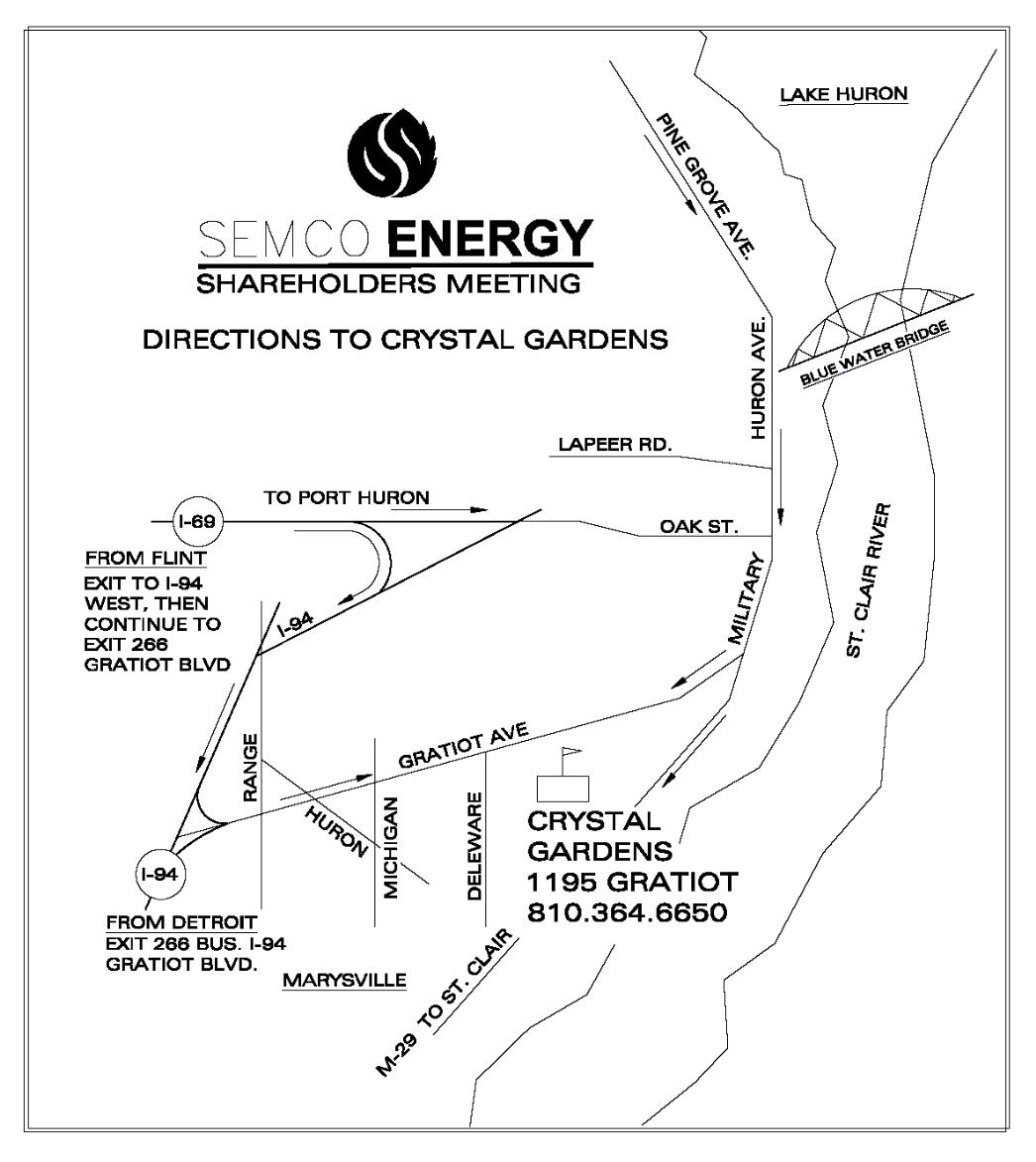

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of SEMCO Energy, Inc. (the Company) will be held at Crystal Gardens, 1195 Gratiot Boulevard, Marysville, Michigan (see map on back), on Tuesday, May 24, 2005 at 10:00 a.m. (EDT), for the following purposes:

1. To elect three members to the Board of Directors.

2. To transact any other business which properly comes before the meeting.

Only holders of record of the Company’s Common Stock at the close of business on March 28, 2005 may vote at the meeting.

Whether or not you plan to attend the meeting, you can ensure your shares are represented at the meeting by promptly completing, signing, dating and returning your proxy card in the enclosed postage-paid envelope or you may submit your proxy by telephone or via the internet in accordance with the instructions on the accompanying proxy card. To prevent duplication, please submit your proxy only once, either by mail, by telephone or via the internet. If you attend the meeting, you may vote in person whether or not you have submitted your proxy.

By order of the Board of Directors

Sherry L. Abbott, Corporate Secretary

1411 Third Street, Suite A, Port Huron, Michigan 48060 (810) 987-2200

1411 Third Street, Suite A, Port Huron, Michigan 48060

The enclosed proxy is solicited by the Board of Directors of SEMCO Energy, Inc. (the Company) for use at the Annual Meeting of Shareholders on Tuesday, May 24, 2005, at 10:00 a.m. (EDT), to be held at Crystal Gardens, 1195 Gratiot Boulevard, Marysville, Michigan, and any adjournments thereof. These proxy materials are being mailed to shareholders on or about April 29, 2005.

A shareholder giving the enclosed proxy may revoke it any time before it is used by submitting a subsequent proxy (by telephone, internet or mail), by written notice to the Corporate Secretary of the Company, or by voting in person at the Annual Meeting.

Proxies will be solicited on behalf of the Board of Directors by mail, telephone, other electronic means or in person, and the Company will pay the costs of solicitation. Copies of proxy materials and the Company’s 2004 Annual Report will be supplied to brokers, dealers, banks and voting trustees, or their nominees, for the purpose of soliciting proxies from beneficial owners, and the Company will reimburse such record holders for their reasonable expenses for such solicitation efforts. The Company may also retain outside organizations to assist in soliciting proxies.

A copy of the Company's 2004 Annual Report is enclosed.

This proxy statement and the Company’s 2004 Annual Report are available at www.proxyvote.com. Shareholders can elect to view future proxy statements and annual reports over the internet instead of receiving paper copies in the mail.

| | § | following the instructions provided when giving their proxy over the internet; or |

| | § | going to www.icsdelivery.com/sem and following the instructions there. |

Holders of record who choose to view future proxy statements and annual reports over the internet will receive an e-mail message next year containing the internet address to use to access the Company's proxy statement and annual report. The e-mail will also include instructions for giving their proxy over the internet. Electronic delivery instructions will remain in effect until revoked in writing. It is not necessary to elect internet access each year.

1

Beneficial owners (see question below:What is the difference between a holder of record of the Company’s Common Stock and a beneficial owner?) should refer to information provided by their broker, bank or nominee for instructions on how to elect to view the Company's future proxy statements and annual reports over the internet if their broker, bank or nominee participates in the service. Beneficial owners who choose electronic delivery will receive an e-mail message next year containing the internet address to use to access the Company's proxy statement and annual report.

Relating to Stock Ownership and Voting Rights

A: | Only holders of record of the Company’s Common Stock at the close of business on March 28, 2005 (the record date), may vote at the Annual Meeting. |

A: | Many holders of Common Stock hold their shares through a broker, bank or other nominee rather than directly in their own names. As summarized below, there are some differences between shares held of record and those beneficially owned. |

| | Holder of Record. If your shares are registered directly in your name with the Company’s transfer agent, National City Bank, you are considered the holder of record with regard to those shares. As the holder of record, you have the right to grant your proxy directly to the Company’s Board of Directors to vote your shares on your behalf at the Annual Meeting or the right to vote in person at the meeting. A proxy card is enclosed for you to use to grant your proxy to the Company’s Board of Directors. |

| | Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these materials are being forwarded to you by your broker, bank or nominee, which is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote and are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the meeting unless you obtain a signed proxy from the shareholder of record giving you the right to vote the shares. Your broker, bank or nominee has enclosed or provided a voting instruction card for you to use to direct your broker, bank or nominee how to vote these shares. |

A: | Shares held directly in your name as the shareholder of record may be voted in person at the Annual Meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the Annual Meeting, the Company recommends that you grant your proxy in advance as described below so that your shares will be voted even if you later decide not to attend the meeting or are unable to do so. |

| Shares held in street name (see beneficial owner explanation above) may be voted in person by you only if you obtain a signed proxy from the record holder (sometimes referred to as a legal proxy) giving you the right to vote the shares. |

A: | You may do this by granting your proxy by way of the internet or by telephone, or by completing and mailing your proxy card or voting instruction card in the enclosed pre-paid envelope. Please refer to the enclosed materials for details. |

2

A: | It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. |

A: | You may change your proxy instructions at any time prior to the vote at the Annual Meeting. You may accomplish this by entering new instructions by way of the internet or telephone or by sending in a new proxy card or new voting instruction card bearing a later date (which automatically revokes the earlier proxy instructions) or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request at the meeting. |

A: | The three persons receiving the highest number of votes cast will be elected. |

A: | If you hold shares beneficially in street name and do not provide your broker or nominee with voting instructions, your shares may constitute broker non-votes. Generally, broker non-votes occur when a broker is not permitted to vote on a matter without instructions from the beneficial owner and instructions have not been given. For routine matters, such as the election of directors, your broker may vote your shares without receiving your instructions. |

A: | As of the record date, 28,446,845 shares of the Company’s Common Stock, representing the same number of votes, were outstanding. A majority of these outstanding shares present or represented by proxy at the Annual Meeting constitutes a quorum. A quorum is necessary to conduct the Annual Meeting. Abstentions and broker non-votes are counted for the purpose of determining a quorum. |

The following table shows beneficial owners of more than 5% of the Company’s voting securities as of March 28, 2005, based on filings with the Securities and Exchange Commission (the SEC) and the Company’s records:

Title of Class | Name and Address | Number of Shares Beneficially Owned | Percent of Class |

| Common Stock | Pioneer Global Asset Management S.p.A.(1) Galleria San Carlo 6 20122 Milan, Italy | 2,782,109(1) | 9.8%(1) |

| Common Stock | Artisan Partners Limited Partnership(2) 875 East Wisconsin Avenue, Suite 800 Milwaukee, WI 53202 | 2,588,640(2) | 9.1%(2) |

| (1) | Based on a Schedule 13G filed with the SEC on March 14, 2005, by Pioneer Global Asset Management S.p.A. stating that they hold these shares of stock for investment and not with a view to directing management policies. |

| (2) | Based on a Schedule 13G filed with the SEC on January 26, 2005, by Artisan Partners Limited Partnership stating that they hold these shares of stock for investment and not with a view to directing management policies. |

3

The following table reflects ownership, as of March 28, 2005, of the number of shares of the Company’s Common Stock beneficially owned by each director, nominee, and current executive officer named in the Summary Compensation Table (see the Compensation of Executive Officers and Directors section) and all directors, nominees and current executive officers as a group:

Name | (A) Shares of Common Stock(1) | | (B) Exercisable Stock Options(2) | | Columns A and B Combined |

| | | | | | | | |

| John M. Albertine | 8,982 | | | 8,001 | | | 16,983 | |

| Edward J. Curtis | 25,952 | (3) | | 10,101 | | 36,053 | (3) |

| Eugene N. Dubay | 5,411 | | | 9,000 | | 14,411 | |

| John T. Ferris | 74,280 | | | 10,101 | | 84,381 | |

| Harvey I. Klein | 34,618 | (3) | | 10,101 | | 44,719 | (3) |

| Paul F. Naughton | 0 | | | 0 | | 0 | |

| Michael V. Palmeri | 1,363 | | | 0 | | 1,363 | |

| Mark T. Prendeville | 3,581 | | | 3,834 | | 7,415 | |

| Edwina Rogers | 0 | | | 0 | | 0 | |

| George A. Schreiber, Jr. | 20,000 | | | 66,667 | | 86,667 | |

| Thomas W. Sherman | 15,059 | (3) | | 2,001 | | 17,060 | (3) |

| Ben A. Stevens | 1,433 | (3) | | 0 | | 1,433 | (3) |

| Donald W. Thomason | 21,245 | (3) | | 10,101 | | 31,346 | (3) |

| John C. van Roden, Jr. | 0 | | | 0 | | 0 | |

| Steven W. Warsinske | 16,999 | | | 24,350 | | 41,349 | |

| All directors, nominees and current executive officers as a group (17 persons including those named above) | 232,952 | (4) | | 157,424 | | 390,376 | (4) |

_____________

(1) Each person has sole power to vote and sell shares of the Company’s Common Stock shown, except shares held jointly with spouses or directly by spouses, minor children, or certain other relatives, and except as described in (3) below.

(2) This column includes shares of the Company’s Common Stock that may be acquired by exercising stock options within 60 days of March 28, 2005.

(3) Includes shares of the Company’s Common Stock held in a Directors’ Deferred Compensation Plan Account as follows:

Name | | Directors' Deferred Compensation Shares |

| Edward J. Curtis | | 19,647 |

| Harvey I. Klein | | 8,972 |

| Thomas W. Sherman | | 13,059 |

| Ben A. Stevens | | 1,433 |

| Donald W. Thomason | | 6,285 |

Shares in this account may not be voted by the individual directors, but may be voted by the Board of Directors.

(4) The directors, nominees and current executive officers as a group beneficially own 0.82% of outstanding shares of the Company’s Common Stock. Including options exercisable within 60 days of March 28, 2005, the same group beneficially owns 1.35% of outstanding shares of the Company’s Common Stock. Each individual holds less than one percent of outstanding shares of the Company’s Common Stock. In 1999, the Board of Directors established new stock ownership guidelines for directors. Within five years of adoption of the guidelines or within five years of joining the Company’s Board of Directors, whichever is later, each non-employee director is expected to own shares of the Company’s Common Stock equal in value to five times the director's annual retainer. Once the required shares are acquired, such shares must be retained throughout the remainder of the individual’s directorship and no additional shares need be acquired regardless of fluctuations in the Common Stock price.

4

Holders of shares of the Company’s Common Stock are entitled to vote for directors on a cumulative voting basis. Each holder of record may cast a number of votes equal to the number of shares of Common Stock owned, multiplied by the number of directors to be elected. Votes may be cast for a single nominee or distributed among nominees. Holders of record may vote their shares cumulatively at the meeting by indicating on the ballot how the votes are to be distributed among the nominees.

The Company’s Articles of Incorporation provide for three classes of directors. The term of office of each class of directors is three years and the term of one class expires each year. Approximately one-third of the Board of Directors will be elected at each annual meeting of shareholders. A vacancy can be filled by a vote of the shareholders or by the Board of Directors.

Pursuant to the provisions of the Securities Purchase Agreement (relating to the 6% Series B Convertible Preference Stock) (the Series B Preference Stock), dated March 19, 2004, between the Company and K-1 GHM, LLLP (K-1), K-1 was granted the right to nominate two members of the Board of Directors; provided that, in any event, K-1 would have the right at any time to appoint at least 22% of the Board of Directors. Mr. Jeffrey A. Safchik and Ms. Sherry A. Stanley were nominated by K-1 as its designated members of the Board of Directors and elected to the Board of Directors effective March 26, 2004. Upon the Company’s repurchase of the Series B Preference Stock from K-1, Mr. Safchik and Ms. Stanley resigned from their positions as members of the Board of Directors effective March 15, 2005. On April 19, 2005, the Board of Directors elected Paul F. Naughton and Edwina Rogers to fill the vacancies created by the resignations of Mr. Safchik and Ms. Stanley.

The Board of Directors currently has ten members. Under the Company’s bylaws, the number of directors shall not be more than eleven. On April 19, 2005, the Board of Directors fixed the size of the Board of Directors at nine effective at the May 24, 2005 Annual Meeting of Shareholders. As a result, only three directors are to be elected at this Annual Meeting. Each of the three persons receiving the highest number of votes will be elected. Proxies are being solicited to vote for the election of the following persons:

Harvey I. Klein

George A. Schreiber, Jr.

John C. van Roden, Jr.

Messrs. Klein and Schreiber are currently directors of the Company. Mr. van Roden was recommended to the Nominating and Corporate Governance Committee by an executive officer other than the Chief Executive Officer (the CEO).

The Board of Directors does not expect that any nominee will become unavailable to serve as a director. Should that occur, however, proxies will be used to vote for another person selected by the Board of Directors.

The persons named in the enclosed proxy reserve the right to vote proxies cumulatively to the extent not inconsistent with shareholder direction. As shown on the proxy, shareholders may direct that their shares be voted for less than all three of the above-named nominees. The proxy may not be used to direct cumulative voting or to direct a vote for anyone other than the above-named nominees.

Name, Position and Business Experience During Past Five Years | Age | Director Since |

NOMINEES (terms expiring 2008) | | |

Harvey I. Klein President of Global Strategies Group L.C. since 1995. Global Strategies Group is a private consulting firm that provides direction to management on organization, strategic planning, quality and customer satisfaction, compensation and benefits programs, product sales and marketing, and selection and implementation of new business opportunities. Clients of Global Strategies have been primarily from the automotive, energy, financial services and entertainment industries. | 66 | 1993 |

George A. Schreiber, Jr. President and Chief Executive Officer of the Company since March 2004. From September 1999 to March 2004, Chairman of the Global Energy Group of Credit Suisse First Boston, a global investment bank. From February 1997 to August 1999, President of Pinnacle West Capital Corporation, a diversified energy holding company with subsidiaries in various businesses, including electricity transmission and distribution, unregulated power production and power marketing and trading. | 56 | 2004 |

John C. van Roden, Jr. Executive Vice President and Chief Financial Officer of P. H. Glatfelter Company since 2003. P.H. Glatfelter is a $600 million specialty paper producer with operations in Pennsylvania, Wisconsin, Germany, France and the Philippines. From 1998 to 2003, Senior Vice President and Chief Financial Officer of Conectiv until the merger involving Conectiv and Potomac Electric Power Company was completed. Director of H.B. Fuller Company. | 56 | -- |

OTHER DIRECTORS (terms expiring 2006) | | |

John T. Ferris Senior Partner in law firm of Ferris & Schwedler, P.C. in Bad Axe, Michigan, since 1978. | 54 | 1994 |

Paul F. Naughton Consultant with P.F. Naughton, LLC, a consulting firm which provides financial advisory services to small and mid-sized companies. From 1996 to 2004, partner in Thompson and Naughton, Inc., a company providing financial consulting, merger and acquisition services, investment banking advice, interim financial officer positions and public policy advocacy strategies on energy, taxes, telecommunications for public and private corporations. | 62 | 2005 |

Edwina Rogers Vice President, Health Policy for The ERISA Industry Committee, a Washington, D.C.-based advocate of employee benefits and compensation interests of America’s major employers. Until May 2004, Counselor to United States Senator Jeff Sessions of Alabama, handling matters before the Senate Health, Education, Labor and Pensions Committee, and advising the Senator on housing, Social Security and welfare matters. From January 2001 to November 2002, Associate Director for the National Economic Council, which advises the President of the United States on matters related to U.S. and global economic policy. From 1996 to 2000, partner in the Washington, D.C., office of the law firm Johnson, Rogers & Clifton, LLP, focusing on general corporate law, business acquisitions, international law and government affairs. | 40 | 2005 |

6

Name, Position and Business Experience During Past Five Years | Age | Director Since |

OTHER DIRECTORS (terms expiring 2007) | | |

John M. Albertine Chairman of the Board of Directors of the Company since October 2004. Since 1990, Chairman and Chief Executive Officer of Albertine Enterprises, Inc., an economic forecasting, public policy, and mergers and acquisitions firm based in Washington, D.C. Chief Executive Officer of Jam Shoe Concepts, Inc. Jam Shoe Concepts, Inc. owns 100% of the assets of a retail family shoe chain with 46 stores in the midwest. Since March 2003, Trustee of the Virginia Retirement System. Dr. Albertine holds a Ph.D. in economics from the University of Virginia. Director of Intermagnetics General Corporation and Kadant Inc. | 60 | 2000 |

Ben A. Stevens Alaska State Senator since August 2001, Alaska Senate Majority Leader from January 2003 to December 2004 and, since January 2005, Alaska Senate President. He currently has the following Alaska state legislative assignments: Senate Finance Committee member, Senate Resources Committee member, Legislative Budget and Audit Committee member, Select Committee on Legislative Ethics member, Legislative Council member, and Joint Armed Services Committee member. From 2001 until his appointment to the Company’s Board of Directors, he served on the Advisory Board for the Company’s ENSTAR Natural Gas Company division. From July 1998 to June 2001, President and CEO of Special Olympics World Winter Games Inc. From January 1992 to present, owner and managing director of Stevens & Associates, Inc., a Washington, D.C.-based government relations consulting firm. | 46 | 2004 |

Donald W. Thomason Lead Director of the Company from November 1998 to April 2003. Retired in 1999 from the Kellogg Company as Executive Vice President, Corporate Services/Technology. | 61 | 1995 |

_________________

EXECUTIVE OFFICERS

Below is information (age, present position with the Company and business experience during the past five years) for the current Executive Officers except for Mr. Schreiber, who is included with the directors above.

Peter F. Clark(age 51) - Senior Vice President and General Counsel since September 2004. From 2000 to 2002, he was Vice President, General Counsel and Secretary of Conectiv until the merger involving Conectiv and Potomac Electric Power Company was completed. Conectiv is a mid-Atlantic electric and gas utility holding company with $2 billion in annual core utility business revenues. During his tenure as Vice President, General Counsel and Secretary at Conectiv, he managed the legal and internal audit services departments, set Conectiv’s legal strategy for all major matters involving the company, ensured compliance with Securities and Exchange Commission and New York Stock Exchange rules, served as ethics officer, and was lead attorney for all regulatory and legislative issues raised by the creation of competitive retail electricity markets in Delaware and Maryland. Between 1998 and 2000, he was General Counsel at Conectiv.

Eugene N. Dubay(age 56) - Senior Vice President of Operations from September 2004. Vice President from October 2002 to December 2003 and again from March 2004 to September 2004. Interim President and Chief Executive Officer from December 2003 to March 2004. SEMCO Energy Gas Company division Senior Vice President and Chief Operating Officer since October 2002. President, Kansas Gas Service Division of ONEOK, Inc. from 1997 to October 2002. During his term as President of the ONEOK Kansas Gas Service Division, Mr. Dubay was responsible for operations, marketing, and administrative matters for an autonomous distribution company serving 650,000 customers in the State of Kansas.

Michael V. Palmeri(age 46) - Senior Vice President, Treasurer and Chief Financial Officer since July 2004. From September 2000 to January 2003, Vice President of Finance and Chief Financial Officer for Pinnacle West Capital Corporation, a diversified energy holding company with subsidiaries in various businesses, including electricity transmission and distribution, unregulated power production and power marketing and trading. He held several increasingly senior financial positions during his more than 15 years with the Pinnacle West Capital Corporation.

Mark T. Prendeville(age 54) - Vice President and Deputy General Counsel since September 2004. Vice President and General Counsel from May 2003 to September 2004. Labor and Employment Counsel from February 2000 to May 2003. From 1990 through February 2000, General Counsel and Manager of Industrial Relations for Republic Die & Tool Co. of Belleville, Michigan. During Mr. Prendeville’s tenure, Republic was a tier-one supplier of sheet metal stamping dies to the auto industry.

7

Lance S. Smotherman(age 48) - Vice President of Human Resources since February 2005. Director of Human Resources for the Company from January 2004 to February 2005. Director of Human Resources for the Company’s non-regulated businesses from April 1999 to January 2004, with responsibility for all human resource activities other than those of the Company’s regulated gas distribution business segment.

Steven W. Warsinske(age 49) - Vice President and Controller since April 2000. SEMCO Energy Gas Company Division Vice President and Chief Accounting Officer from February 1998 to April 2000.

AND MEETING ATTENDANCE

Membership in Committees of the Board of Directors as of December 31, 2004, was as follows:

Name | Audit | Compensation | Finance | Nominating and Corporate Governance |

| John M. Albertine(1) | | | xx | |

| Edward J. Curtis | | | | x |

| John T. Ferris | | x | | xx |

| Harvey I. Klein | x | | x | |

| Jeffrey A. Safchik(2) | x | | x | |

| George A. Schreiber, Jr. | | | | |

| Thomas W. Sherman | xx | | x | |

| Sherry A. Stanley(2) | | x | | x |

| Ben A. Stevens | x | | | |

| Donald W. Thomason | | xx | | x |

_________________

x Member

xx Chairman

(1) The Chairman of the Board of Directors is expected to attend all committee meetings. Dr. Albertine was elected Chairman of the Board of Directors on October 1, 2004.

(2) Upon the Company’s repurchase of the Series B Preference Stock from K-1, Mr. Safchik and Ms. Stanley resigned from their positions as members of the Board of Directors effective March 15, 2005.

Under New York Stock Exchange (NYSE) rules, a majority of the Board of Directors is required to be independent. Membership on the Company’s Board of Directors is the only relationship between the Company and Dr. Albertine, Mr. Curtis, Mr. Ferris, Mr. Klein, Mr. Sherman and Mr. Thomason. Mr. Naughton has been a consultant for the Company for a number of years, but that consulting relationship ended on April 15, 2005. Mr. Naughton also served as the Company’s interim Chief Financial Officer on a non-employee basis from October 1998 to January 1999 and as the Company’s Vice President of Corporate Development on a non-employee basis from August 1997 to September 1999. Ms. Rogers served on the Company’s ENSTAR Natural Gas Company division advisory board from December 2002 to March 2003. Mr. Stevens was a member of the Company’s ENSTAR Natural Gas Company division advisory board prior to becoming a member of the Company’s Board of Directors. Mr. van Roden and Mr. Clark were members of Conectiv senior management. Neither reported to the other. The Board of Directors has determined that these relationships did not create material relationships with the Company’s management that would preclude finding Messrs. Naughton, Stevens or van Roden or Ms. Rogers to be independent. The Board of Directors has affirmatively determined that all of the non-employee directors and Mr. van Roden are independent as defined by NYSE rules and, thus, the majority of the Company’s Board of Directors is independent.

The Board of Directors held 11 meetings during 2004. Each director attended more than 75% of the total number of meetings of the Board of Directors and Committees on which he or she served in 2004.

8

The independent members of the Board of Directors meet regularly in executive sessions without management present. The executive sessions are led by the Chairman of the Board of Directors, who is an independent director.

Directors are encouraged to attend annual meetings of shareholders. Ten of the Company’s eleven directors at the time of the 2004 Annual Meeting were in attendance at that meeting.

The Audit Committee is comprised of independent directors, as the term is defined by NYSE rules. Seven Audit Committee meetings were held in 2004. Primary duties of this committee include the responsibility for the appointment and compensation of the Company’s independent registered public accounting firm and for the oversight of any work performed by the Company’s independent registered public accounting firm. The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. The Committee also reviews the Company’s interim and annual financial statements filed with the SEC, and oversees the Company’s accounting policies, internal controls over financial reporting, risk management practices, internal auditing, and compliance with the Company’s code of conduct. During the year, the Board of Directors examined the composition of the Audit Committee in light of NYSE rules governing audit committees and confirmed that all members of the Audit Committee are independent within the meaning of those rules. For additional information about the responsibilities of the Audit Committee, see the revised and restated Audit Committee Charter, which is included in theAppendix to this proxy statement beginning at page A-1. The Committee’s charter can also be found on the Company’s website atwww.semcoenergy.com in the Investor Information section under Corporate Governance. For additional information on the Audit Committee’s activities, see the Report of the Audit Committee herein. The Board of Directors has determined that Mr. Thomas W. Sherman is an audit committee financial expert as that term is defined by SEC regulations and Mr. Sherman is independent as defined in the NYSE rules.

The Compensation Committee is comprised of independent directors, as the term is defined by NYSE rules. The Compensation Committee held three meetings in 2004. Primary duties of this committee include reviewing the Company’s general compensation strategy and recommending compensation of executive officers and directors to the Board of Directors. The Compensation Committee monitors the Company's succession planning and recommends the election of officers to the Board of Directors. The Compensation Committee administers the Company’s 2004 Stock Award and Incentive Plan. The Committee’s charter can be found on the Company’s website atwww.semcoenergy.com in the Investor Information section under Corporate Governance.

The Finance Committee is comprised of independent directors, as the term is defined by NYSE rules. The Finance Committee held three meetings in 2004. Primary duties of this committee include reviewing capital and operating budgets, financing plans, and significant securities offerings, prior to consideration of such matters by the Board of Directors. The Committee’s charter can be found on the Company’s website atwww.semcoenergy.com in the Investor Information section under Corporate Governance.

The Nominating and Corporate Governance Committee is comprised of independent directors as the term is defined by NYSE rules. The Nominating and Corporate Governance Committee held five meetings in 2004. Primary duties of this committee include recommending director nominees and personal qualifications criteria for Board membership. Minimum qualifications are (a) a degree from an accredited college or a combination of training, experience and education; and (b) at least five years of work experience at a senior management level. Desired professional skills and personal attributes for directors include knowledge and understanding of the free enterprise system; the ability to read and understand financial and operating reports; an awareness of laws, rules and regulations governing securities and corporate governance; the absence of current or anticipated conflicts of interest; business and social integrity; a willingness to stand on personal convictions; short and long range vision; and time and commitment to fulfill their responsibilities. Additional professional skills and personal attributes are outlined in the Corporate Director Position Description, which can be found on the Company’s website atwww.semcoenergy.com in the Investor Information section under Corporate Governance.

9

The Nominating and Corporate Governance Committee will consider shareholder recommendations of candidates for Board membership. Procedures for shareholder recommendation of director nominees are described below in the section labeled Shareholder Proposals, Communications and Recommendations for Director Nominees.

Potential director candidate suggestions may come from current directors, search firms, law firms, shareholders, or other sources. The Nominating and Corporate Governance Committee determines the Company’s current and prospective needs, then narrows the list of potential nominees based on the specific attributes being sought. The Nominating and Corporate Governance Committee then conducts interviews to determine if any of the proposed nominees are suitable and, if so, recommends nomination; if not, additional potential nominees are sought.

The Nominating and Corporate Governance Committee also recommends general criteria regarding committee composition, directors’ assignments to committees and changes to Board of Director and Company policies. The Committee’s charter can be found on the Company’s website atwww.semcoenergy.com in the Investor Information section under Corporate Governance.

The Company’s Corporate Governance Policies and related documents, such as the charters of the committees listed above, articles of incorporation, bylaws and code of business conduct and ethics, can be found on the Company’s website atwww.semcoenergy.com in the Investor Information section under Corporate Governance. Any shareholder who wishes to receive a print copy of the Company’s Corporate Governance Policies, committee charters, articles of incorporation, bylaws, the code of business conduct and ethics, or any other information provided on the Corporate Governance page of the Company’s website, may write to Ms. Sherry L. Abbott, Corporate Secretary, 1411 Third Street, Suite A, Port Huron, Michigan 48060.

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, directors, officers and ten percent beneficial holders must file a form with the SEC to report changes in their ownership of Company securities. All such reports were filed timely for 2004 except for the following:

The initial report for Ben A. Stevens on Form 3 to report his holdings at the time he joined the Board of Directors was not filed timely as Mr. Stevens was unable to obtain electronic filing access codes before the filing deadline passed.

Two beneficial ownership changes by K-1 were not filed timely. Two transactions were reported on a single Form 4 filed on July 2, 2004. One of the transactions involved a stock dividend paid on the Series B Preference Stock on May 15, 2004. Generally, stock dividends are exempt from reporting requirements, but, because the Series B Preference Stock was held by only one shareholder, it was determined that the stock dividend did not qualify for the exemption. The other transaction was the purchase on June 1, 2004, of additional shares of the Company’s Series B Preference Stock by K-1.

Mr. Schreiber was Chairman of Credit Suisse First Boston LLC’s Global Energy Group from September 1999 until joining the Company as President and Chief Executive Officer on March 10, 2004. During the Company’s last fiscal year, Credit Suisse First Boston LLC (CSFB) acted as: (a) the Company’s financial advisor with respect to the Company’s continuing review of strategic and financial planning matters; and (b) the Company’s exclusive placement agent in connection with a private placement of equity, equity linked or debt securities of the Company, including the Series B Preference Stock. The amount of compensation the Company paid to CSFB for their services was less than five percent of CSFB’s consolidated gross revenues for CSFB’s last fiscal year.

10

K-1 purchased 50,000 shares of the Series B Preference Stock in 2004. The sole general partner of K-1 is K-1 Ventures Michigan, Inc. of which the sole voting shareholder is k1 Ventures Limited. Mr. Safchik is Chief Financial Officer and Chief Operating Officer of k1 Ventures Limited. Ms. Stanley is a Vice President and Secretary of K-1 Ventures Michigan, Inc. Neither Mr. Safchik nor Ms. Stanley controls the investment decisions of K-1 Ventures Michigan, Inc. or K-1. Upon the Company’s repurchase of the Series B Preference Stock from K-1, Mr. Safchik and Ms. Stanley resigned from their positions as members of the Board of Directors effective March 15, 2005.

Mr. Naughton is the owner of P.F. Naughton, LLC. He was a partner in Thompson and Naughton, Inc. until November 2004. In 2004, the Company paid these firms approximately $111,500 for consulting services and related expenses. Mr. Naughton’s interest in those payments (excluding expense reimbursements totaling $5,300) was approximately $53,100. The amount paid to these consulting firms exceeded five percent of the consolidated gross revenues for these firms in the last fiscal year. Mr. Naughton and the Company ended the consulting relationship on April 15, 2005.

In February 2003, the Company’s Board of Directors adopted a Code of Business Conduct and Ethics (Code of Ethics) that applies to directors, officers, employees, affiliates, agents, consultants, advisors and representatives of the Company. The Company did have a code of ethics in place prior to February 2003, but expanded the information provided into a handbook on conduct and ethics that would be better understood by those required to abide by it. The Code of Ethics can be found on the Company’s website atwww.semcoenergy.com in the Investor Information section under Corporate Governance and is referenced in Part III, Item 10 of the Company’s annual report on Form 10-K for the year ended December 31, 2003. Shareholders may also request a print copy of the Code of Ethics by writing to Ms. Sherry L. Abbott, Corporate Secretary, 1411 Third Street, Suite A, Port Huron, Michigan 48060.

11

The following table sets forth information with respect to the compensation of the named executive officers.

| | | Annual Compensation | Long Term Compensation Awards | |

Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation(2) | Restricted Stock Unit Awards(3) | Common Share Options(4) | All Other Compensation |

George A. Schreiber, Jr.(1) | 2004 | $333,461 | $ 0 | $19,501 | $304,000 | 200,000 | $60,185 (5) |

Eugene N. Dubay(1) Senior Vice President of Operations | 2004 | $230,962 | $25,000 (6) | $11,457 | $ 46,000 | 50,000 | $ 4,400 (7) |

Mark T. Prendeville Vice President and Deputy General Counsel | 2004 | $149,734 | | $ 9,264 | | 4,500 | $ 5,989 (10) $ 5,273 (10) $ 3,000 (10) |

Steven W. Warsinske Vice President and Controller | 2004 | $140,679 | $ 0 $ 0 | $ 8,046 | $ 0 | 5,250 | $ 5,627 (10) |

Michael V. Palmeri(1) Senior Vice President, Treasurer and CFO | 2004 | $114,843 | | $ 5,616 | $ 66,250 | 40,000 | $53,686 (12) |

John E. Schneider(1) Former Senior Vice President, Treasurer and CFO | 2004 | $143,769 | $ 0 $ 0 | $ 5,904 | $ 0 | 10,500 | $90,408 (13) |

Gary J. Valentz(1) Former Vice President and Chief Information Officer | 2004 | $131,923 | $ 0 | $ 3,760 | $ 0 | 4,500 | $51,937 (14) |

____________________

(1) Mr. Schreiber joined the Company on March 10, 2004. Mr. Dubay joined the Company in October 2002 as Vice President and SEMCO Energy Gas Company Division Senior Vice President and Chief Operating Officer; was named to act as interim President and CEO from December 3, 2003, to March 10, 2004, while retaining his position as Chief Operating Officer for the Company’s gas distribution business; and received a change in title on September 2, 2004, to Senior Vice President of Operations. Mr. Palmeri joined the Company on July 20, 2004. Mr. Schneider retired from the Company effective July 30, 2004. Mr. Valentz joined the Company on April 28, 2003, and left the Company on August 26, 2004.

(2) Includes the premium and income tax gross up for a life insurance policy. Also includes stipends in lieu of use of Company-provided auto. The annual stipend ranged from $3,000 to $10,800 in 2004 for the named executive officers.

(3) The value of the restricted stock units shown in the table is based on the closing price of the Company’s Common Stock on the date the award was granted. The aggregate number of restricted stock units outstanding at December 31, 2004, was 92,500 units with a value of $493,950 based on the December 31, 2004 closing price of the Company’s Common Stock of $5.34. The vesting schedule of the units awarded to Messrs. Schreiber and Palmeri is: 40% of the units vest one year from the effective date of their respective employment agreements, 30% vest two years from the effective date if certain performance measures are met, and the remaining 30% vest three years from the effective date if certain performance measures are met. The vesting schedule of the units awarded to Mr. Dubay and the other executive officers is: 50% of the units vest one year from the effective date of their respective employment agreements, 25% vest two years from the effective date if certain performance measures are met, and the remaining 25% vest three years from the effective date if certain performance measures are met. If dividends are paid on the Company’s Common Stock, dividend equivalents will be credited on the restricted stock units.

(4) Number of shares of Common Stock underlying stock-option awards granted in the respective year.

(5) Taxable moving expenses of $34,427, non-taxable moving expenses of $24,083 and tax preparation expenses of $1,675.

(6) Bonus paid for additional duties while performing interim CEO duties.

(7) Gain on exercise of stock options.

(8) Moving expenses of $60,683.

(9) Signing bonus of $25,000.

12

(10) Company matching contribution to 401(k) plan.

(11) Includes $28,000 cash value distribution of accrued benefits under the Supplemental Executive Retirement Plan and Company matching contribution to 401(k) plan of $5,752.

(12) Taxable moving expenses of $32,762, non-taxable moving expenses of $16,990, and Company matching contribution to 401(k) plan of $3,934.

(13) Includes severance compensation of $80,770, Company matching contribution to 401(k) plan of $5,751, and $3,888 for federally-mandated benefits continuation costs. Mr. Schneider will receive an additional $129,231 in severance compensation and $11,584 federally-mandated benefits continuation costs pursuant to an Employment Settlement and Release Agreement dated August 4, 2004.

(14) Includes severance compensation of $42,731, Company matching contribution to 401(k) plan of $5,277, and $3,929 for federally-mandated benefits continuation costs. Mr. Valentz will receive an additional $50,769 in severance compensation and $4,480 federally-mandated benefits continuation costs pursuant to an Employment Release and Severance Agreement dated August 26, 2004.

(15) Includes a signing bonus of $15,000 and Company matching contribution to 401(k) plan of $3,815.

| Name | Number of Common Shares Underlying Options Granted | % of Total Options Granted to Employees in 2004 | Exercise Price ($/Sh.) (1) | Expiration Date(2) | Value When Options Expire if 5% or 10% Annual Stock Price Appreciation from Date of Grant 5%(3) 10%(3) |

| George A. Schreiber, Jr. | 200,000 | 49.0% | $5.64 | 5/24/14 | $709,393 | | $1,797,741 |

| Eugene N. Dubay | 30,000 20,000 | 7.4% 4.9% | $4.61 | 12/09/14 | $ 86,976 | | $ 220,415 |

| Mark T. Prendeville | 4,500 | 1.1% | $5.78 | 3/01/14 | $ 16,343 | | $ 41,417 |

| Steven W. Warsinske | 5,250 | 1.3% | $5.78 | 3/01/14 | $ 19,067 | | $ 48,320 |

| Michael V. Palmeri | 40,000 | 9.8% | $5.27 | 10/28/14 | $132,571 | | $ 335,961 |

| John E. Schneider | 10,500 (4) | 2.6% | $5.78 | 7/30/07 (4) | $ 9,558 | | $ 20,071 |

| Gary J. Valentz | 4,500 (4) | 1.1% | $5.78 | 11/26/04 (4) | N/A (4) | | N/A (4) |

_________________

(1) The exercise price for all stock options granted by the Company is the market price of the Common Stock at the time options were granted.

(2) One-third of the options become exercisable each of the three years following the date granted. Each option expires ten years after it was granted.

(3) These two columns show what the value of the options would be after ten years if the market price of the Common Stock increased 5% or 10% each year for the ten years from the date the options were granted until the options expired. The values shown for Mr. Schneider’s options are based on the expiration of those options in 2007. This table is required by the SEC and does not mean that the Company predicts that these options will have any such value or that the market price of Common Stock will increase by any specific amount. The actual value that these options will have depends entirely on increases or decreases in the market price of Common Stock and when the options are exercised.

(4) Mr. Valentz left the Company before the options granted to him in 2004 vested and therefore the options were forfeited. Upon his retirement from the Company, Mr. Schneider’s options became fully vested and will remain exercisable for a period of three years from the date of his retirement.

13

| Name | Shares Acquired on Exercise | Value Realized | Number of Options at December 31, 2004 Exercisable Unexercisable | Value of Options at December 31, 2004(1) Exercisable Unexercisable |

| George A. Schreiber, Jr. | 0 | $ 0 | | 200,000 | | $ 0 |

| Eugene N. Dubay | 2,334 | $4,400 | 0 | 54,666 | | $27,546 |

| Mark T. Prendeville | | | 1,167 | 6,833 | $ 0 | |

| Steven W. Warsinske | | | 21,100 | 8,250 | $1,815 | $ 3,630 |

| Michael V. Palmeri | | | | 40,000 | | $ 2,800 |

| John E. Schneider | | | 45,500 | 0 | $8,470 | |

| Gary J. Valentz(2) | | | | 0 | | |

_________________

(1) Option values are based on the difference between the exercise price and the closing price for the Common Stock of $5.34 per share on December 31, 2004.

(2) Mr. Valentz left the Company prior to year end. All vested and unvested options were forfeited prior to year end.

| Name | Number of Restricted Stock Units(1) | Performance or Other Period Until Maturation or Payout | Estimated Future Payouts under Non-Stock Price-Based Plans (2) Threshold Target(3) Maximum |

| George A. Schreiber, Jr. | 50,000 | 03/10/04 - 03/09/07 | n/a | 50,000 | n/a |

| Eugene N. Dubay | 10,000 | 09/02/04 - 09/01/07 | n/a | 10,000 | n/a |

| Mark T. Prendeville | 0 | n/a | n/a | n/a | n/a |

| Steven W. Warsinske | 0 | n/a | n/a | n/a | n/a |

| Michael V. Palmeri | 12,500 | 07/19/04 - 07/18/07 | n/a | 12,500 | n/a |

| John E. Schneider | 0 | n/a | n/a | n/a | n/a |

| Gary J. Valentz | 0 | n/a | n/a | n/a | n/a |

__________________

(1) These restricted stock units were awarded under the Company’s 2004 Stock Award and Incentive Plan in conjunction with employment agreements entered into with each person. Each unit is a notional unit of measurement equivalent to one share of Common Stock. The restricted stock units have no voting rights unless and until paid in shares of Common Stock. Any dividends paid on the Common Stock while the restricted stock units are outstanding are deemed reinvested as restricted stock units. A portion of the restricted stock units become vested if the executive officer remains employed by the Company for one year from the effective date of the executive officer’s employment agreement. The performance goals for the second and third vesting periods will be set by the Compensation Committee within the first 90 days of the second vesting period. Vesting will be accelerated upon a triggering event following a change in control of the Company, as defined under the Company’s 2004 Stock Award and Incentive Plan. The portion of the awards relating to the second and third vesting periods are intended to be qualified performance-based compensation under Internal Revenue Code Section 162(m).

(2) If the performance goals are met for the applicable performance period, the awards will be paid in shares of Common Stock no earlier than the third anniversary of the effective date of the executive’s employment agreement. Any shares of Common Stock issued under an award will be derived from the share reserve under the 2004 Stock Award and Incentive Plan.

(3) If the performance goals are met for the applicable performance period, the target payout will be awarded. There are no threshold or maximum levels.

The Company has entered into an employment agreement with George A. Schreiber, Jr. under which he is employed as President and Chief Executive Officer for an initial term ending March 9, 2007 (subject to automatic annual one-year extensions, unless either party gives notice that the agreement shall not be extended). The agreement provides for an annual base salary of $425,000 and an annual target bonus, subject to achieving 100% of designated performance targets, in an amount equal to 50% of base salary for the first year and in an amount equal to 60% of base salary for each succeeding year. Under the agreement, Mr. Schreiber was granted options to acquire 200,000 shares of Common Stock at a per share exercise price equal to the fair market value on the date of grant and 50,000 restricted stock units. If Mr. Schreiber's employment is terminated by the Company during the term of the agreement other than for cause or disability, or if he terminates for good reason, he will be entitled to receive his annual base salary through the date of termination plus an amount equal to 2 times his base salary. If his employment is terminated without cause or for good reason and within one year of a change in control of the Company, he would be entitled to receive an amount equal to 2.99 times the sum of his base salary plus the annual bonus paid to him for the preceding year. The aggregate amounts payable in the event of a change in control of the Company shall be reduced so that all payments to Mr. Schreiber do not exceed 2.99 times the base amount (as defined in the Internal Revenue Code).

14

The Company has also entered into employment agreements with Messrs. Palmeri and Dubay.

Mr. Palmeri’s agreement provides for an annual base salary of $250,000 and an annual target bonus, subject to achieving 100% of designated performance targets, in an amount equal to 35% of base salary for each full calendar year of employment. Under the agreement, Mr. Palmeri was granted options to acquire 40,000 shares of Common Stock at a per share exercise price equal to the fair market value on the date of grant and 12,500 restricted stock units. If Mr. Palmeri’s employment is terminated without cause, or if he terminates for good reason, he will be entitled to receive an amount equal to the sum of his annual base salary as of the date of termination plus a prorated bonus. If his employment is terminated within six months of a change in control of the Company, he would be entitled to receive an amount equal to 2.99 times the sum of his base salary plus the annual bonus paid to him for the preceding year. The aggregate amounts payable in the event of a change in control of the Company shall be reduced so that all payments to Mr. Palmeri do not exceed 2.99 times the base amount (as defined in the Internal Revenue Code).

Mr. Dubay’s agreement provides for an annual base salary of $235,000 and an annual target bonus, subject to achieving 100% of designated performance targets, in an amount equal to 30% of base salary for each full calendar year of employment. Under the agreement, Mr. Dubay was granted options to acquire 30,000 shares of Common Stock at a per share exercise price equal to the fair market value on the date of grant and 10,000 restricted stock units. If Mr. Dubay’s employment is terminated without cause, or if he terminates for good reason, he will be entitled to receive an amount equal to the sum of his annual base salary as of the date of termination plus a prorated bonus. If his employment is terminated within six months of a change in control of the Company, he would be entitled to receive an amount equal to 2.99 times the sum of his base salary plus the annual bonus paid to him for the preceding year. The aggregate amounts payable in the event of a change in control of the Company shall be reduced so that all payments to Mr. Dubay do not exceed 2.99 times the base amount (as defined in the Internal Revenue Code). This agreement replaced another agreement with Mr. Dubay.

Messrs. Schreiber, Palmeri, and Dubay may be awarded base salary increases, additional options to purchase shares of Common Stock, restricted stock units, and other forms of compensation by the Board of Directors.

The Company entered into an agreement with Mr. Prendeville which provides that in the event of a change in control of the Company, he would have specific rights and receive certain benefits if, within two years after the change in control, either employment was terminated by the Company without cause or he was to terminate employment for good reason. In these circumstances, he would be entitled to receive (a) full base salary through the date of termination, including vacation, (b) a pro-rata amount of any bonus award earned by him during the year of termination, (c) a severance payment in an amount equal to the product of 2.99 and (i) the sum of (x) his annual base salary and (y) his recent average bonus reduced by all payments, benefits or amounts which constitute parachute payments within the meaning of the Internal Revenue Code, (d) all legal fees and expenses incurred by him to enforce his rights under the agreement and (e) continuation of medical insurance coverage for a period of time.

Mr. Schneider entered into an agreement with the Company effective July 31, 2004, pursuant to which he is to receive (a) bi-weekly payments that total $210,000; (b) payment of the expenses for medical dental and vision coverage plus gross-up at 42.857% for a period of eighteen months or his decision to terminate benefits prior thereto; (c) an amount equal to his accrued and unused vacation; (d) $11,000 for re-employment services with the unused funds retained by him; and (e) retention of any rights to Pension Plan and Supplemental Executive Retirement Plan benefits. Additionally, pursuant to this agreement, Mr. Schneider released the Company from any and all claims he may have against the Company arising out of his employment.

15

Mr. Valentz entered into an agreement with the Company effective August 26, 2004, pursuant to which he is to receive (a) bi-weekly payments that total $82,500; (b) payment of the expenses for medical, dental and vision coverage plus gross-up at 42.857% for a period of six months or his decision to terminate benefits prior thereto; (c) an amount equal to his accrued and unused vacation; and (d) $11,000 for re-employment services with the unused funds retained by him. Additionally, pursuant to this agreement, Mr. Valentz released the Company from any and all claims he may have against the Company arising out of his employment.

The following table sets forth the estimated annual benefits payable at normal retirement age (65) under the Company’s Pension Plan (the Pension Plan). Benefits under the Pension Plan last for the life of the executive.

Average Compensation* | Years of Service |

5 | 10 | 15 | 20 | 25 | 30 |

| $100,000 | $ 7,000 | $14,000 | $21,000 | $28,000 | $35,000 | $42,000 |

| 150,000 | 10,500 | 21,000 | 31,500 | 42,000 | 52,500 | 63,000 |

| 200,000 | 14,000 | 28,000 | 42,000 | 56,000 | 70,000 | 84,000 |

| 250,000 | 14,350 | 28,700 | 43,050 | 57,400 | 71,750 | 86,100 |

| 300,000 | 14,350 | 28,700 | 43,050 | 57,400 | 71,750 | 86,100 |

| 350,000 | 14,350 | 28,700 | 43,050 | 57,400 | 71,750 | 86,100 |

| 400,000 | 14,350 | 28,700 | 43,050 | 57,400 | 71,750 | 86,100 |

| 450,000 | 14,350 | 28,700 | 43,050 | 57,400 | 71,750 | 86,100 |

| 500,000 | 14,350 | 28,700 | 43,050 | 57,400 | 71,750 | 86,100 |

| 550,000 | 14,350 | 28,700 | 43,050 | 57,400 | 71,750 | 86,100 |

| | * | Average Compensation under the Pension Plan is based on five-year average salary plus bonus. Under regulation, eligible salary cannot exceed $205,000. |

The following table sets forth the estimated annual benefits payable at normal retirement age (65) under the Pension Plan and 2004 Supplemental Executive Retirement Plan (2004 SERP) (assuming eligibility to participate in both plans simultaneously). Benefits under the 2004 SERP are paid for 15 years. Benefits under the Pension Plan last for the life of the executive.

Average Compensation* | Years of Service |

5 | 10 | 15 | 20 | 25 | 30 |

| $100,000 | $ 20,000 | $ 35,000 | $ 50,000 | $ 50,000 | $ 50,000 | $ 50,000 |

| 150,000 | 30,000 | 52,500 | 75,000 | 75,000 | 75,000 | 75,000 |

| 200,000 | 40,000 | 70,000 | 100,000 | 100,000 | 100,000 | 100,000 |

| 250,000 | 50,000 | 87,500 | 125,000 | 125,000 | 125,000 | 125,000 |

| 300,000 | 60,000 | 105,000 | 150,000 | 150,000 | 150,000 | 150,000 |

| 350,000 | 70,000 | 122,500 | 175,000 | 175,000 | 175,000 | 175,000 |

| 400,000 | 80,000 | 140,000 | 200,000 | 200,000 | 200,000 | 200,000 |

| 450,000 | 90,000 | 157,500 | 225,000 | 225,000 | 225,000 | 225,000 |

| 500,000 | 100,000 | 175,000 | 250,000 | 250,000 | 250,000 | 250,000 |

| 550,000 | 110,000 | 192,500 | 275,000 | 275,000 | 275,000 | 275,000 |

| | * | Average Compensation under the Pension Plan is based on five-year average salary plus bonus. Average Compensation under the 2004 SERP is based on the average of three calendar years of a participant's annual salary, using the three calendar years of employment which produce the highest average. |

16

Each named executive officer above, except Mr. Valentz, participates in the Pension Plan, which is available to non-union employees generally. Mr. Valentz left the Company before his Pension Plan benefits vested.

At age 65, a Pension Plan participant is eligible to receive an annual pension equal to 1.4% of his average five-year adjusted compensation multiplied by his years of service. Adjusted compensation includes salary and bonus, but excludes fringe benefits, expense reimbursements, bonuses to pay taxes on fringe benefits, and similar types of compensation. These benefits are not subject to any deduction for Social Security or other offsets.

As of January 1, 2005, years of service earned were as follows: Mr. Schreiber - 0.8 years, Mr. Dubay -- 2.3 years, Mr. Prendeville -- 3.9 years, Mr. Warsinske -- 26.7 years, and Mr. Palmeri - 0.4 years. At the time of his retirement, Mr. Schneider had 6.2 years of service earned. At the time he left the Company, Mr. Valentz had 1.3 years of service earned.

The 2004 SERP provides pension benefits to mid-career hires which could not be provided by the Pension Plan because of limited tenure and the limit on compensation on which Pension Plan benefits are calculated ($205,000 in 2004). In addition, the 2004 SERP provides protection for the named officers in the event of a change in control by requiring the funding of a trust (under certain circumstances) and vesting of benefits (under other circumstances) before a participant reaches age 55 and before he or she has 5 years of service.

Messrs. Schreiber, Dubay and Palmeri are covered by the 2004 SERP, which provides for additional retirement benefits for fifteen years after a participant has five years of service. If the executive officer retires at age 65 or after age 55 with five years of vested service, yearly payments will equal (a) times (b) offset by (c), as such amounts are set forth below:

(a) The sum of:

(i) 4% of the executive officer’s first five years of service; plus

(ii) 3% of the executive officer’s years of service in excess of five years of service, but not exceeding 15 years of service.

(b) The percentage as determined in paragraph (a) (not exceeding 50%) is multiplied by the executive officer's salary.

(c) The product of (a) times (b) is offset by the benefit accrued by the executive officer under the Pension Plan.

Mr. Schneider was covered by the 2000 Supplemental Executive Retirement Plan (2000 SERP) at the time of his retirement and retained his rights to benefits under the 2000 SERP, which provided for additional retirement benefits for fifteen years after five years of service. If the executive officer retired at age 65, yearly payments would equal 50% of his last base salary. An executive officer who retired before age 65, but after 55, receives from 30% (age 55) to 48% (age 64) of base salary.

Eligibility for participation was limited to the CEO and those individuals reporting directly to the CEO as of the 2004 SERP effective date. In 2003, Mr. Warsinske accepted a buy-out in lieu of continued participation in the 2000 SERP. Mr. Prendeville was not enrolled in the 2000 SERP and is not eligible to participate in the 2004 SERP as he does not report directly to the CEO. Mr. Valentz was not eligible to participate in either the 2000 SERP or the 2004 SERP.

Annual Compensation

For their services on the Board of Directors, non-employee directors are paid a retainer of $1,000 per month. Board Committee Chairmen receive an additional retainer of $400 per month. The Chairman of the Board of Directors received an additional retainer of $1,700 per month until May 2004, when the additional retainer was increased to $3,000 per month.

17

Meeting Fees

Each non-employee director received $1,000 for each Board of Directors meeting attended and $800 for each Board Committee meeting attended by Committee members. Board Committee Chairmen each received an additional meeting fee of $200 per Committee meeting chaired. Directors are reimbursed for expenses incurred in attending Board of Directors and Committee meetings.

In addition to the Board of Directors and Committee meetings, in 2004 the Board of Directors was compensated at the Board of Directors meeting rate for the conduct of CEO interviews, two strategy sessions, and attendance at a division advisory board meeting to meet potential director nominees.

Throughout the year, the independent directors held a number of executive sessions for which they were not compensated regardless of whether or not the executive sessions were held in conjunction with regular or special Board of Directors meetings.

Other Compensation

Non-employee directors who were members of the Board of Directors prior to 1996 may participate in the Company's medical benefits program. Directors who joined the Board of Directors after 1995 may not participate in the medical benefits program. Directors who do not participate in the medical benefits program receive a grant of $3,850 worth of shares of Common Stock each year.

In 2001, the Board of Directors adopted a Stock Grant Plan for Non-Employee Directors, pursuant to which each non-employee director receives a grant of 500 shares of Common Stock each year while serving as a member of the Board of Directors.

Non-employee directors also accrue $3,000 per year under a non-qualified defined contribution plan, which is payable after leaving the Board of Directors. Interest accrues on contributions at 8% per annum.

Deferred Compensation

Under the Deferred Compensation and Common Stock Purchase Plan for Non-Employee Directors, directors' cash compensation may be deferred for each upcoming year. If deferred, compensation accrues interest at the prime rate or is invested in newly issued shares of Common Stock, with dividends reinvested through the Direct Stock Purchase and Dividend Reinvestment Plan (DRIP). Five directors deferred some or all cash compensation for 2004, which was used to purchase shares of Common Stock. Seven directors have chosen to purchase shares of Common Stock by deferring some or all cash compensation for 2005.

Stock Options

Under the 1997 Long-Term Incentive Plan (1997 LTIP), each non-employee director received an annual grant on each March 1 of options to acquire 1,000 shares of Common Stock at fair market value on date of grant. Upon joining the Board of Directors, new non-employee directors received a grant of 1,000 shares of Common Stock under The Stock Option Plan of 2000 (SOP). Thus, a non-employee director joining the Board of Directors prior to the date options are granted to all directors for the year would receive two grants within the same year. However, no grant of stock options would be made to directors who are known to be leaving the Board of Directors within six months after the grant date. The stock options granted under the 1997 LTIP and the SOP become exercisable one-third each year for three years and expire ten years from the date of grant. Subsequent to the May 2004 shareholder approval of the 2004 Stock Award and Incentive Plan (2004 Plan), no further grants may be made from the 1997 LTIP or the SOP. Future grants to directors under the 2004 Plan, if any, have not yet been determined.

18

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate by reference this Proxy Statement, in whole or in part, the following report shall not be incorporated by reference into any such filings.

The Compensation Committee of the Board of Directors is responsible for reviewing and establishing corporate policies, goals and objectives related to executive compensation. Accordingly, the Compensation Committee reviews and recommends to the Board of Directors the compensation of the CEO, the executive officers and other key executives based upon performance against established goals and objectives. The Compensation Committee is composed of three independent directors and all decisions of the Compensation Committee regarding executive compensation are reviewed by the Board of Directors.

Compensation Philosophy

The objective of the Company’s executive compensation policies and incentive plans is to inspire and reward achievement of the Company’s strategic objectives while balancing sound business decision making for the long term benefit of the Company. Short-term incentives focus efforts on the achievement of annual targets, while long-term incentives encourage the accomplishment of ongoing objectives that are consistent with the long-term best interests of the enterprise. The Compensation Committee believes that this approach aligns the interests of management with those of the shareholders.

Elements of Executive Compensation

The Company’s executive compensation program consists of base salary, bonuses, incentive based equity compensation and various other benefits, including life and medical insurance plans. The Compensation Committee seeks to provide salary and other non-incentive compensation opportunities for an executive based upon a comparison to that paid to executives with similar responsibilities and authority in other comparably sized companies in the same line of business, as appropriate. Bonuses and equity incentives provide each executive with an opportunity for additional compensation if the Company’s financial targets or other performance goals are met or exceeded.

All base salaries of officers, including those shown in the Salary column of the above Compensation Table, were approved by the Compensation Committee. Performance goals and objectives established by the Compensation Committee in 2004 included certain corporate and business financial goals, customer focused objectives, organizational development and learning objectives.

Bonuses for Mr. Schreiber and Mr. Palmeri are paid under their respective employment agreements at the rates of 50% and 35%, respectively, of salary at target. The other Executive Officers are paid under the Company's Short-Term Incentive Plan (STIP). Payments under this plan depend on the achievement of performance targets set at the beginning of each year, which have subjective and objective components and a discretionary amount. Performance above or below these targets results in proportionately higher or lower bonuses up to the maximum (54% of salary) or down to the threshold (5% of salary). Additionally, bonus payments may be adjusted by the Compensation Committee for unusual or extenuating circumstances, including, for example, significantly warmer than normal weather that may affect Company earnings or an individual’s significant contribution to the Company’s performance. Additionally, certain other executive officers were hired in 2004 and under the terms of their respective employment agreements were granted bonuses outside of the STIP, upon approval of the Compensation Committee.

In 2004, equity incentive awards were made pursuant to the Company’s Long Term Incentive Plan and the 2004 Plan, which was approved by the shareholders at the Annual Meeting held May 24, 2004. Going forward, we expect future equity incentives to be awarded under the 2004 Plan. In 2004, stock options and restricted stock units were awarded to the executive officers, although other award types are available under this plan. These equity incentive awards are based on and increase in value in relation to overall Company performance, business unit performance and individual performance.

19

Compensation of the Chief Executive Officer

Mr. George Schreiber became the CEO of the Company effective March 10, 2004, pursuant to an employment agreement between Mr. Schreiber and the Company. Under the terms of Mr. Schreiber's employment agreement, for the first year of his employment, he had a target bonus of up to 50% of base salary, based on the achievement of performance goals. Under his employment agreement, Mr. Schreiber was also granted stock options for 200,000 shares of Company common stock, which vest in thirds on each of the first three anniversaries of the date of grant, and was granted 50,000 restricted stock units, the restrictions upon which will be lifted over a period of three years if certain performance targets are met. Mr. Schreiber is also eligible for further awards under the compensation programs described in this report.

For additional detail on the total compensation provided to Mr. Schreiber and the other executive officers of the Company in 2004, please refer to the section of this proxy statement entitled Compensation of Directors and Executive Officers.

Deductibility of Compensation Expenses

Section 162(m) of the Internal Revenue Code of 1986 generally limits the tax deductibility by the Company for compensation paid to the CEO and the Executive Officers to $1 million per officer per year, unless it qualifies as performance-based compensation. To qualify as performance-based, compensation payments must satisfy certain conditions, including limitations on the discretion of the Compensation Committee in determining the amounts of such compensation.

The foregoing has been furnished by the Compensation Committee of SEMCO Energy’s Board of Directors.

COMPENSATION COMMITTEE

Donald W. Thomason, Chairman

John T. Ferris

Sherry A. Stanley (resigned 3/15/2005)

20

The following table provides information as of December 31, 2004, with respect to shares of the Company's Common Stock that may be issued under the Company's existing equity compensation plans.

Plan Category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (b) Weighted-average exercise price of outstanding options, warrants and rights(1) | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)) |

| Equity compensation plans approved by security holders(1) | 817,012(2) | $ 8.44(2) | 1,090,999 |

| Equity compensation plans not approved by security holders(3) | 567,530 | $10.93 | 172,316(4)(5) |

| Total | 1,384,542 | $ 9.46 | 1,263,315 |

__________

| (1) | Includes the 2004 Plan and the 1997 LTIP. |

| (2) | Includes the number (column a) and weighted average exercise price (column b) of restricted stock units that have been awarded. |

| (3) | Includes stock options awarded pursuant to the SOP and stock options awarded pursuant to employment agreements. |

| (4) | Includes 858 shares of Common Stock pursuant to the Employee Stock Gift Program, 96,359 shares of Common Stock pursuant to the Broad Based Stock Award Plan of SEMCO Energy, Inc. and Subsidiaries, 56,320 shares of Common Stock pursuant to the Directors' Deferred Compensation and Stock Purchase Plan for Non-Employee Directors, 8,279 shares of Common Stock pursuant to the Compensation in Lieu of Medical Plan Participation for Non-Employee Directors, and 10,500 shares of Common Stock pursuant to the Stock Grant Plan for Non-Employee Directors. |

| (5) | No stock option grants made pursuant to employment agreements are included as available for future grant as of December 31, 2004. There is no specific amount set aside for future employment inducement grants. |

Equity Compensation Plans Not Approved by Shareholders

SOP

On August 17, 2000, the Company's Board of Directors approved the SOP. The SOP allowed stock options to be granted in excess of the 1997 LTIP maximum number to the extent deemed appropriate by the Compensation Committee. SOP stock options granted to one person could not exceed 1% of the Company’s outstanding Common Stock at the time of grant. In addition, no more than 5% of the Company’s outstanding Common Stock could be issued pursuant to exercises of options granted under any non-shareholder approved plan. To the extent not otherwise specified in a Board resolution, SOP stock options were issued upon the same terms and conditions as 1997 LTIP stock options.

As of December 31, 2004, there were 142,250 shares of Common Stock reserved for issuance under the SOP. There were outstanding options to purchase 142,250 shares of Common Stock and no shares of Common Stock remaining available for grant as of December 31, 2004. Shares of Common Stock that remained available for grant on the effective date of the 2004 Plan were included in the 1,500,000 shares available under the 2004 Plan and any shares that become available subsequent to that date, through forfeiture or otherwise, are added to the 2004 Plan and no further grants may be made from the SOP. 7,000 shares were forfeited between the effective date of the 2004 Plan and December 31, 2004, and were added to the 2004 Plan.

Employee Stock Gift Program

On December 16, 1999, the Board of Directors created a reserve for the Employee Stock Gift Program, which was established to encourage employee stock ownership. Employees may make optional payments into the DRIP through payroll deduction. The first time an employee elects payroll deduction for such optional payments into the DRIP, one share of stock is added to their account at no charge.

As of December 31, 2004, there were 858 shares of Common Stock reserved for the program.

21

Broad Based Stock Award Plan of SEMCO Energy, Inc. and Subsidiaries

On October 14, 1999, the Board of Directors created a reserve for a Broad Based Stock Award Plan (the BBSA Plan) in order to develop a program to: provide an incentive similar to competitive market practice; create a mid-term incentive for retention purposes; and increase the link between individual and corporate success. The BBSA Plan was designed to grant full value shares of the Company's Common Stock to employees at all levels in the organization, with participants given one-time or ongoing restricted stock awards subject to service-based vesting requirements. The restrictions are subject to three-year vesting requiring continued employment with the Company and forfeiture of the Common Stock upon termination of employment.

As of December 31, 2004, there were 96,359 shares of Common Stock reserved for the BBSA Plan.

Directors' Deferred Compensation and Stock Purchase Plan for Non-Employee Directors