UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission file number 000-11917

THE DAVEY TREE EXPERT COMPANY

(Exact name of registrant as specified in its charter)

|

| |

| Ohio | 34-0176110 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1500 North Mantua Street

P.O. Box 5193

Kent, OH 44240

(Address of principal executive offices) (Zip code)

(330) 673-9511

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on which Registered |

| N/A | | N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Shares, $1.00 par value

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | |

| Large Accelerated Filer | ☐ | | Accelerated Filer | ☒ | | Emerging Growth Company | ☐ |

| Non-Accelerated Filer | ☐ | | Smaller Reporting Company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

There were 23,181,806 Common Shares outstanding as of March 4, 2020. The aggregate market value of the Common Shares held by nonaffiliates of the registrant as of June 29, 2019 was $463,691,707. For purposes of this calculation, it is assumed that the registrant's affiliates include the registrant's Board of Directors and its executive officers.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for the 2020 Annual Meeting of Shareholders, to be held on May 19, 2020, are incorporated by reference into Part III (to be filed within 120 calendar days of the registrant’s fiscal year end).

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) in "Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations," "Item 7A - Quantitative and Qualitative Disclosures About Market Risk," and elsewhere. These statements relate to future events or our future financial performance. In some cases, forward-looking statements may be identified by terminology such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to differ materially from what is expressed or implied in these forward-looking statements. Some important factors that could cause actual results to differ materially from those in the forward-looking statements or materially adversely affect our business, results of operations or financial condition include: our inability to attract and retain a sufficient number of qualified employees for our field operations or qualified management personnel; increases in the cost of obtaining adequate insurance, or the inadequacy of our self-insurance accruals or insurance coverages; inability to obtain, or cancellation of, third-party insurance coverage; the impact of wildfires in California and other areas, as well as other severe weather events and natural disasters; payment delays or delinquencies resulting from financial difficulties of our significant customers, particularly utilities; the outcome of litigation and third-party and governmental regulatory claims against us; an increase in our operating expenses due to significant increases in fuel prices for extended periods of time; our inability to withstand intense competition; the effect of various economic factors that may adversely impact our customers’ spending and pricing for our services, and impede our collection of accounts receivable; the impact of regulations initiated as a response to possible changing climate conditions; fluctuations in our quarterly results due to the seasonal nature of our business or changes in general and local economic conditions, among other factors; being contractually bound to an unprofitable contract; a disruption in our information technology systems, including a disruption related to cybersecurity, or the impact of costs incurred to comply with cybersecurity or data privacy regulations; damage to our reputation of quality, integrity and performance; limitations on our shareholders’ ability to sell their common shares due to the lack of public market for such shares; our failure to comply with environmental laws resulting in significant liabilities, fines and/or penalties; difficulties obtaining surety bonds or letters of credit necessary to support our operations; uncertainties in the credit and financial markets limiting our access to capital; fluctuations in foreign currency exchange rates; significant increases in health care costs; the impact of events such as natural disasters, public health epidemics, such as the coronavirus, or pandemics, terrorist attacks or other external events; and our inability to properly verify the employment eligibility of our employees.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update any of the forward-looking statements after the date of this annual report on Form 10-K to conform these statements to actual future results.

|

| | | |

THE DAVEY TREE EXPERT COMPANY FORM 10-K For the Year Ended December 31, 2019 TABLE OF CONTENTS |

| | | | |

| | | | Page |

| |

| | | | |

| PART I | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| PART II | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| PART III | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| PART IV | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | |

“We,” “Us,” “Our,” “Davey” and “Davey Tree,” unless the context otherwise requires, means The Davey Tree Expert Company and its subsidiaries.

PART I

Item 1. Business.

General

The Davey Tree Expert Company, which was founded in 1880 and incorporated in Ohio in 1909, and its subsidiaries ("we" or "us") provide a wide range of arboricultural, horticultural, environmental and consulting services to our customers throughout the United States and Canada. We have two reportable operating segments organized by type or class of customer: Residential and Commercial, and Utility.

Our Residential and Commercial segment provides services to our residential and commercial customers including: the treatment, preservation, maintenance, removal and planting of trees, shrubs and other plant life; the practice of landscaping, grounds maintenance, tree surgery, tree feeding and tree spraying; the application of fertilizer, herbicides and insecticides; and natural resource management and consulting, forestry research and development, and environmental planning.

Our Utility segment is principally engaged in providing services to our utility customers--investor-owned, municipal utilities, and rural electric cooperatives--including: the practice of line-clearing and vegetation management around power lines, rights-of-way and chemical brush control; and natural resource management and consulting, forestry research and development and environmental planning.

We also maintain research, technical support and laboratory diagnostic facilities.

Competition and Customers

Our Residential and Commercial segment is one of the largest national tree care organizations in the United States, and competes with other national and local firms with respect to its services. On a national level, our competition is primarily landscape construction and maintenance companies as well as residential and commercial lawn care companies. At a local and regional level, our competition comes mainly from small, local companies which are engaged primarily in tree care and lawn services. Our Utility segment is the second largest organization in the industry in the United States, and competes principally with one major national competitor, The Asplundh Tree Expert Co., as well as several smaller regional firms.

Principal methods of competition in both operating segments are customer service, marketing, image, performance and reputation. Our program to meet our competition stresses the necessity for our employees to have and project to customers a thorough knowledge of all horticultural services provided, and utilization of modern, well-maintained equipment. Pricing is not always a critical factor in a customer's decision with respect to our Residential and Commercial segment; however, pricing is generally the principal method of competition for our Utility segment, although in most instances consideration is given to reputation and past production performance.

We provide a wide range of horticultural services to private companies, public utilities, local, state and federal agencies, and a variety of industrial, commercial and residential customers. During 2019, we had revenues of approximately $137 million, or approximately 12% of total revenues, from Pacific Gas & Electric Company ("PG&E"), our largest customer. On January 29, 2019, PG&E filed for Chapter 11 bankruptcy. As a utility company, PG&E serves residential and industrial customers in California and has an ongoing obligation to continue to serve its customers. Therefore, we do not anticipate PG&E's bankruptcy to have a material impact on our future cash flows and results of operations.

Regulation and Environment

Our facilities and operations, in common with those of the industry generally, are subject to governmental regulations designed to protect the environment. This is particularly important with respect to our services regarding insect and disease control, because these services involve, to a considerable degree, the blending and application of spray materials, which require formal licensing in most areas. Constant changes in environmental conditions, environmental awareness, technology and social attitudes make it necessary for us to maintain a high degree of awareness of the impact such changes have on the market for our services. We believe that we comply in all material respects with existing federal, state and local laws regulating the use of materials in our spraying operations as well as the other aspects of our business that are subject to any such regulation.

Marketing

We solicit business from residential customers principally through referrals, direct mail programs and to a lesser extent through the placement of advertisements in national magazines and trade journals, local newspapers and "yellow pages" telephone directories. We also employ online marketing and lead generation strategies, including email marketing campaigns, search engine optimization, search engine marketing, and social media communication. Business from utility and commercial customers is obtained principally through negotiated contracts and competitive bidding. We carry out all of our sales and services through our employees. We generally do not use agents, and do not franchise our name or business.

Seasonality

Our business is seasonal, primarily due to fluctuations in horticultural services provided to Residential and Commercial customers. We can also be affected to a lesser extent by budget constraints of our Utility customers. Because of this seasonality, we have historically incurred losses in the first quarter, while sales and earnings are generally highest in the second and third quarters of the calendar year. Consequently, this has created heavy demands for additional working capital at various times throughout the year. We borrow primarily against bank commitments in the form of a revolving credit facility and issue notes to provide the necessary funds for our operations. You can find more information about our bank commitments in “Liquidity and Capital Resources” of this report under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Other Factors

Due to rapid changes in equipment technology and intensity of use, we must constantly update our equipment and processes to ensure that we provide competitive services to our customers and continue our compliance with the Occupational Safety and Health Act.

We own several trademarks including "Davey," "Davey and Design," "Arbor Green Pro," "Arbor Green," and "Davey Resource Group." Through substantial advertising and use, we believe that these trademarks have become of value in the identification and acceptance of our products and services.

Employees

We employed approximately 9,700 employees at December 31, 2019. However, employment levels fluctuate due to seasonal factors affecting our business. We consider our employee relations to be good.

Domestic and Foreign Operations

We sell our services to customers in the United States and Canada.

We do not consider the risks associated with our business with foreign customers, other than currency exchange risks, to be materially different from those of our domestic customers.

Access to Company Information

Davey Tree’s internet address is http://www.davey.com. Through our internet website, by hyperlink to the Securities and Exchange Commission (“SEC”) website (http://www.sec.gov), we make available, free of charge, our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports. Availability of the reports occurs contemporaneously with the electronic posting to the SEC’s website as the reports are electronically filed with or furnished to the SEC. The information on our website is not a part of this Annual Report on Form 10-K.

The following documents are also made available on our website and a copy will be mailed, without charge, upon request to our Corporate Secretary:

| |

| ▪ | Code of Ethics for Financial Matters |

Item 1A. Risk Factors.

The factors described below represent the principal risks we face. Except as otherwise indicated, these factors may or may not occur and we are not in a position to express a view on the likelihood of any such factor occurring. Other factors may exist that we do not consider to be significant based on information that is currently available or that we are not currently able to anticipate.

We may be unable to employ a sufficient workforce for our field operations.

Our industry operates in an environment that requires heavy manual labor. We may experience slower growth in the labor force for this type of work than in the past. As a result, we may experience labor shortages or the need to pay more to attract and retain qualified employees. Additionally, changes to the laws and regulations that govern the classification or wages of workers may require us to make changes to our operations and may negatively impact our business, increase our costs and expose us to various liabilities.

We could be negatively impacted if our self-insurance accruals or our insurance coverages prove to be inadequate.

We are generally self-insured for losses and liabilities related to workers' compensation, vehicle liability and general liability claims (including any wildfire-related claims, up to certain retained coverage limits). A liability for unpaid claims and associated expenses, including incurred but not reported losses, is actuarially determined and reflected in our consolidated balance sheet as an accrued liability. The determination of such claims and expenses, and the extent of the need for accrued liabilities, are continually reviewed and updated. If we were to experience insurance claims or costs above our estimates and were unable to offset such increases with earnings, our business could be adversely affected. Also, where we self-insure, a deterioration in claims management, whether by our management or by a third-party claims administrator, could lead to delays in settling claims, thereby increasing claim costs, particularly as it relates to workers’ compensation. In addition, catastrophic

uninsured claims filed against us or the inability of our insurance carriers to pay otherwise-insured claims would have an adverse effect on our financial condition.

Furthermore, many customers, particularly utilities, prefer to do business with contractors with significant financial resources, who can provide substantial insurance coverage. Should we be unable to renew our excess liability insurance and other commercial insurance policies at competitive rates, this loss would have an adverse effect on our financial condition and results of operations.

The unavailability or cancellation of third-party insurance coverage may have a material adverse effect on our financial condition and results of operations as well as disrupt our operations.

Any of our existing excess insurance coverage may not be renewed upon the expiration of the coverage period or future coverage may not be available at competitive rates for the required limits. In addition, our third-party insurers could fail, suddenly cancel our coverage or otherwise be unable to provide us with adequate insurance coverage. If any of these events occur, they may have a material adverse effect on our financial condition and results of operations as well as disrupt our operations. For example, we have operations in California, which has an environment prone to wildfires. Should our third-party insurers determine to exclude coverage for wildfires in the future, we could be exposed to significant liabilities, having a material adverse effect on our financial condition and results of operations and potentially disrupting our California operations.

We could be materially adversely affected by wildfires in California and other areas and other severe weather events and natural disasters, including negative impacts to our business, reputation, financial condition, results of operations, liquidity and cash flows.

Our financial condition, results of operations, liquidity and cash flows could be materially affected by potential losses resulting from the impact of wildfires and other major weather events and natural disasters, in California and other areas, which have in the past and could in the future expose the Company to litigation and liabilities pursuant to the Company’s indemnification obligations to its customers. Such weather events and natural disasters could result in severe business disruptions, property damage, injuries or loss of life. Such events could result in significant decreases in revenues, cost increases, and other financial difficulties to the Company’s customers and could cause them to file for bankruptcy protection, as has occurred with PG&E in 2019. Any such event could have a material adverse effect on our business, reputation, financial condition, results of operations, liquidity and cash flows. Further, these events could result in government enforcement actions or regulatory penalties, litigation and/or civil or governmental actions, including investigations, citations and fines, against our customers and against us if any related losses are found to be the result of their or our activities and services. Any litigation relating to wildfires could take a number of years to resolve due to the complexity of the matters, including ongoing investigations into the cause of the fire and the number of claims or parties that may be involved.

Any regulatory responses or wildfire reforms taken by the state of California or any other jurisdiction where we have operations could adversely impact our business, financial condition, results of operations, liquidity and cash flows.

Our business is highly seasonal and weather dependent.

Our business, other than tree services to utility customers, is highly seasonal and weather dependent, primarily due to fluctuations in horticultural services provided to Residential and Commercial customers. We have historically incurred losses in the first quarter, while revenue and operating income are generally highest in the second and third quarters of the calendar year. Inclement weather, such as uncharacteristically low or high (drought) temperatures, in the second and third quarters could dampen the demand for our horticultural services, resulting in reduced revenues that would have an adverse effect on our results of operations.

Financial difficulties or the bankruptcy of one or more of our major customers could adversely affect our results.

Our ability to collect our accounts receivable and future sales depends, in part, on the financial strength of our customers. We grant credit, generally without collateral, to our customers. Consequently, we are subject to credit risk related to changes in business and economic factors throughout the United States and Canada. In the event customers experience financial difficulty, and particularly if bankruptcy results, our profitability may be adversely impacted by our failure to collect our accounts receivable in excess of our estimated allowance for uncollectible accounts. Additionally, our future revenues could be reduced by the loss of a customer due to bankruptcy. Our failure to collect accounts receivable and/or the loss of one or more major customers could have an adverse effect on our net income and financial condition.

On January 29, 2019, our largest customer, PG&E, filed for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code. Our total outstanding pre-petition receivables from PG&E as of December 31, 2019 was approximately $15 million and we continue to perform work for PG&E under the terms of our contract.

We are subject to third-party and governmental regulatory claims and litigation and adverse litigation judgments or settlements resulting from those claims could materially adversely affect our business.

From time-to-time, customers, vendors, employees, governmental regulatory authorities and others may make claims and take legal action against us. Allegations, claims or proceedings may, for example, relate to personal injury, property damage, general liability claims, vehicle accidents involving our vehicles and our employees, regulatory issues, contract disputes or employment matters and may include class actions. Defending against these and other such claims and proceedings is costly and time consuming and may divert management’s attention and personnel resources from our normal business operations, and the outcome of many of these claims and proceedings cannot be predicted. Whether these claims and legal actions are founded or unfounded, if such claims and legal actions are not resolved in our favor, they may result in significant financial liability. Any such financial liability could have a material adverse effect on our financial condition and results of operations. While we carry a broad range of insurance for the protection of our assets and operations, such insurance may not fully cover all material expenses related to potential allegations, claims and proceedings, or any adverse judgments, fines or settlements that may result. We reserve currently for anticipated losses and related expenses in excess of anticipated insurance coverage that may exist.

We are subject to the risk of changes in fuel costs.

The cost of fuel is a major operating expense of our business. Significant increases in fuel prices for extended periods of time will cause our operating expenses to fluctuate. An increase in cost with partial or no corresponding compensation from customers would lead to lower margins that would have an adverse effect on our results of operations.

We are subject to intense competition.

We believe that each aspect of our business is highly competitive. Principal methods of competition in our operating segments are customer service, marketing, image, performance and reputation. Pricing is not always a critical factor in a customer’s decision with respect to our Residential and Commercial segment; however, pricing is generally the principal method of competition for our Utility segment, although in most instances consideration is given to reputation and past production performance. On a national level, our competition is primarily landscape construction and maintenance companies as well as residential and commercial lawn care companies. At a local and regional level, our competition comes mainly from small, local companies which are engaged primarily in tree care and lawn services. Our Utility segment competes principally with one major national competitor, as well as several smaller regional firms. Furthermore, competitors may have lower costs because privately-owned companies operating in a limited geographic area may have significantly lower labor and overhead costs. Our

competitors may develop the expertise, experience and resources to provide services that are superior in both price and quality to our services. These strong competitive pressures could inhibit our success in bidding for profitable business and may have a material adverse effect on our business, financial condition and results of operations. We may also seek acquisitions or other transactions to further enhance our competitive position, and have, in the past, acquired businesses aimed at expanding the geography and scope of our services. Such acquisitions or other transactions involve risks and may present financial or operational challenges and may not provide the benefits intended.

Our business is dependent upon service to our utility customers and we may be affected by developments in the utility industry.

We derive approximately 53% of our total revenues from our Utility segment. Significant adverse developments in the utility industry generally, or specifically for our major utility customers, including the January 2019 Chapter 11 filing by PG&E, could result in pressure to reduce costs by utility industry service providers (such as us), delays in payments of our accounts receivable, or increases in uncollectible accounts receivable, among other things. As a result, such developments could have an adverse effect on our results of operations.

We cannot predict the impact that policies regarding changing climate conditions, including legal, regulatory and social responses thereto, may have on our business.

Many scientists, environmentalists, international organizations, political activists, regulators and other commentators believe that global climate change has added, and will continue to add, to the unpredictability, frequency and severity of natural disasters in certain parts of the world. In response, a number of legal and regulatory measures and social initiatives have been introduced in an effort to reduce greenhouse gas and other carbon emissions that these parties believe may be contributors to global climate change. These proposals, if enacted, could result in a variety of regulatory programs, including potential new regulations, additional charges and taxes to fund energy efficiency activities, or other regulatory actions. Any of these actions could result in increased costs associated with our operations and impact the prices we charge our customers.

We cannot predict the impact, if any, that changing climate conditions will have on us or our customers. However, it is possible that the legal, regulatory and social responses to real or perceived climate change could have a negative effect on our results of operations or our financial condition.

Our quarterly results may fluctuate.

We have experienced and expect to continue to experience quarterly variations in revenues and operating income as a result of many factors, including:

| |

| ▪ | the seasonality of our business; |

| |

| ▪ | the timing and volume of customers' projects; |

| |

| ▪ | budgetary spending patterns of customers; |

| |

| ▪ | the commencement or termination of service agreements; |

| |

| ▪ | costs incurred to support growth internally or through acquisitions; |

| |

| ▪ | changes in our mix of customers, contracts and business activities; |

| |

| ▪ | fluctuations in insurance expense due to changes in claims experience and actuarial assumptions; and |

| |

| ▪ | general and local economic conditions. |

Accordingly, our operating results in any particular quarter may not be indicative of the results that you can expect for any other quarter or for the entire year.

We may be adversely affected if we enter into a major unprofitable contract.

Our Residential and Commercial segment and our Utility segment frequently operate in a competitive bid contract environment. As a result, we may misjudge a bid and be contractually bound to an unprofitable contract, which could adversely affect our results of operations.

We may be unable to attract and retain skilled management.

Our success depends, in part, on our ability to attract and retain key managers. Competition for the best people can be intense and we may not be able to promote, hire or retain skilled managers. The loss of services of one or more of our key managers could have a material adverse impact on our business because of the loss of the manager's skills, knowledge of our industry and years of industry experience, and the difficulty of promptly finding qualified replacement personnel.

A disruption in our information technology systems, including a disruption related to cybersecurity, could adversely affect our financial performance.

We rely on the accuracy, capacity and security of our information technology systems. Despite the security measures that we have implemented, including those measures related to cybersecurity, our systems, or the systems of third parties upon whom we rely, could be breached or damaged by computer viruses, natural or man-made incidents or disasters or unauthorized physical or electronic access. A cyberattack or breach involving our information technology systems or those of our suppliers or other partners could result in business disruption including disruptions in critical systems, corruption or loss of data, loss or theft of funds, theft of our intellectual property, trade secrets, customer information or other data and unauthorized access to, or release of, personnel information. To the extent that our business is interrupted or data is lost, destroyed or inappropriately used or disclosed, such disruptions could adversely affect our competitive position, reputation, relationships with our customers, financial condition, operating results and cash flows and could expose us to data loss, allow others to unfairly compete with us, and subject us to litigation, government enforcement actions, regulatory penalties and costly response measures. In addition, we may be required to incur significant costs to protect against the damage caused by these disruptions or security breaches in the future, and we may not have adequate insurance coverage to compensate us for any losses relating to such events.

Because the techniques used to obtain unauthorized access to, or disable, degrade or sabotage, information technology systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques, implement adequate preventative measures or remediate any intrusion on a timely or effective basis. Moreover, the development and maintenance of these preventative and detective measures is costly and requires ongoing monitoring and updating as technologies change and efforts to overcome security measures become more sophisticated. We, therefore, remain potentially vulnerable to additional known or yet unknown threats, as in some instances, we, or our suppliers and other partners, may be unaware of an incident or its magnitude and effects. We also face the risk that we may expose our customers or partners to cybersecurity attacks. Any of these factors could have a material adverse effect on us.

In addition, we may incur costs in order to comply with cybersecurity or data privacy regulations in the regions in which we operate. Such regulations may impose additional requirements on us and increase our regulatory and litigation risk.

We may be adversely affected if our reputation is damaged.

We are dependent, in part, upon our reputation of quality, integrity and performance. If our reputation were damaged in some way, it may impact our ability to grow or maintain our business.

Because no public market exists for our common shares, the ability of shareholders to sell their common shares may be limited.

Our common shares are not traded on any national exchange, market system or over-the-counter bulletin board. Because no public market exists for our common shares, the ability of shareholders to sell these shares is limited.

Natural disasters, pandemics, terrorist attacks and other external events could adversely affect our business.

Natural disasters, public health epidemics, such as the coronavirus, or pandemics, terrorist attacks and other adverse external events could materially damage our facilities or disrupt our operations, or damage the facilities or disrupt the operations of our customers or vendors, and may pose the risk that we or our employees, contractors, suppliers, customers and other business partners may be prevented from conducting business activities for an indefinite period of time. The occurrence of any such event could adversely affect our business, financial condition and results of operations.

Our failure to comply with environmental laws could result in significant liabilities.

Our facilities and operations are subject to governmental regulations designed to protect the environment, particularly with respect to our services regarding insect and tree, shrub and lawn disease management, because these services involve to a considerable degree the blending and application of spray materials, which require formal licensing in most areas. Continual changes in environmental laws, regulations and licensing requirements, environmental conditions, environmental awareness, technology and social attitudes make it necessary for us to maintain a high degree of awareness of the impact such changes have on our compliance programs and the market for our services. We are subject to existing federal, state and local laws, regulations and licensing requirements regulating the use of materials in our spraying operations as well as certain other aspects of our business. If we fail to comply with such laws, regulations or licensing requirements, we may become subject to significant liabilities, fines and/or penalties, which could adversely affect our financial condition and results of operations.

We may be adversely affected if we are unable to obtain necessary surety bonds or letters of credit.

We utilize surety bonds and letters of credit on a project-by-project basis and for our self-insurance program. If surety providers were to limit or eliminate our access to bonding, we would need to post other forms of collateral for project performance, such as letters of credit or cash. We may be unable to secure sufficient letters of credit on acceptable terms, or at all. Accordingly, if we were to experience an interruption or reduction in the availability of bonding capacity, our liquidity may be adversely affected.

Economic conditions may adversely impact our customers’ future spending as well as pricing and payment for our services, thus negatively impacting our operations and growth.

Various economic factors may adversely impact the demand for our services and potentially result in depressed prices for our services and the delay or cancellation of projects. That may make it difficult to estimate our customers' requirements for our services and, therefore, add uncertainty to customer demand. Various economic factors and customers' confidence in future economic conditions may cause a reduction in our customers' spending for our services and may also impact the ability of our customers to pay amounts owed, which could reduce our

cash flow and adversely impact our debt or equity financing. These events could have a material adverse effect on our operations and our ability to grow at historical levels.

We may not have access to capital in the future due to uncertainties in the financial and credit markets.

We may need new or additional financing in the future to conduct our operations, expand our business or refinance existing indebtedness. Future changes in the general economic conditions and/or financial markets in the United States or globally could affect adversely our ability to raise capital on favorable terms or at all. From time-to-time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity for working capital requirements, acquisitions and general corporate purposes. Our access to funds under our revolving credit facility is dependent on the ability of the financial institutions that are parties to the facility to meet their funding commitments. Those financial institutions may not be able to meet their funding commitments if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests within a short period of time. Economic disruptions and any resulting limitations on future funding, including any restrictions on access to funds under our revolving credit facility, could have a material adverse effect on us.

We are subject to the effect of foreign currency exchange rate fluctuations, which may have a material adverse impact on us.

We are exposed to foreign currency exchange rate risk resulting from our operations in Canada, where we provide a comprehensive range of horticultural services. Our financial results could be affected by factors such as changes in the foreign currency exchange rate or differing economic conditions in the Canadian markets as compared with the markets for our services in the United States. Our earnings are affected by translation exposures from currency fluctuations in the value of the U.S. dollar as compared to the Canadian dollar.

Revenues from customers in Canada are subject to foreign currency exchange. Thus, certain revenues and expenses have been, and are expected to be, subject to the effect of foreign currency fluctuations, and these fluctuations may have a material adverse impact on our operating results, asset values and could reduce shareholders’ equity. In addition, if we expand our Canadian operations, exposures to gains and losses on foreign currency transactions may increase.

Increases in our health insurance costs and uncertainty about federal health care policies could adversely affect our results of operations and cash flows.

Our ability to offer affordable health care coverage to our employees is a significant expense to the business. Changes in our employees' behavior, cost of health care programs offered by third party providers or any future legislation or regulations that may be implemented at the federal or state level could impact our ability to provide health care coverage. Significant increases in the cost of health care coverage over time could have a material negative impact on our financial position, results of operations and cash flows and may also limit our ability to attract and retain qualified employees.

Our inability to properly verify the employment eligibility of our employees could adversely affect our business.

We utilize the U.S. government’s E-Verify program to assist in verifying the employment eligibility of potential new employees and require all new potential employees provide us with government-specified documentation evidencing their employment eligibility. However, the use of E-Verify does not guarantee that we will successfully identify all applicants who are ineligible for employment. While we believe we are in compliance with applicable laws and regulations of U.S. Immigration and Customs Enforcement, it is possible some of our employees may, without our knowledge, be unauthorized workers. The employment of unauthorized workers may subject the Company to fines, penalties and other costs related to compliance with laws and regulations as well as adverse publicity that negatively impacts our reputation and brand

and may make it more difficult to hire and retain qualified employees. Our operations may also be impacted by additional costs to hire and train new employees. Furthermore, immigration laws have been an area of considerable political focus in recent years, and, from time-to-time, the U.S. government considers or implements changes to federal immigration laws, regulations or enforcement programs. Changes in immigration or work authorization laws may increase our obligations for compliance and oversight, which could subject us to additional costs and potential liability and make our hiring process more cumbersome, or reduce the availability of potential employees.

Item 1B. Unresolved Staff Comments.

There are no unresolved comments from the Staff of the SEC.

Item 2. Properties.

Our corporate headquarters campus is located in Kent, Ohio, which, along with several other properties in the surrounding area, includes The Davey Institute's research, technical support and laboratory diagnostic facilities.

We conduct administrative functions through our headquarters and our offices in Livermore, California (Utility Services). Our Canadian operations’ administrative functions are conducted through properties located in the provinces of Ontario and British Columbia. We believe our properties are well maintained, in good condition and suitable for our present operations. A summary of our properties follows:

|

| | | | | | | | | |

| Segment | | Number of Properties | | How Held | | Square Footage | | Number of States or Provinces |

| Residential and Commercial | | 30 | | Owned | | 308,480 |

| | 15 |

| Utility | | 3 | | Owned | | 36,307 |

| | 3 |

| Residential and Commercial, and Utility | | 4 | | Owned | | 43,406 |

| | 4 |

We also lease approximately 203 properties in 32 states and five provinces.

None of our owned or leased properties used by our business segments is individually material to our operations.

Item 3. Legal Proceedings.

We are party to a number of lawsuits, threatened lawsuits and other claims arising out of the normal course of business. We assess our liabilities and contingencies in connection with outstanding legal proceedings utilizing the latest information available. Where it is probable that we will incur a loss and the amount of the loss can be reasonably estimated, we record a liability in our consolidated financial statements. These legal accruals may be increased or decreased to reflect any relevant developments on a quarterly basis. Where a loss is not probable or the amount of the loss is not estimable, we do not record an accrual, consistent with applicable accounting guidance. Based on information currently available to us, advice of counsel, and available insurance coverage, we believe that our established accruals are adequate and the liabilities arising from the legal proceedings will not have a material adverse effect on our consolidated financial condition. We note, however, that in light of the inherent uncertainty in legal proceedings there can be no assurance that the ultimate resolution of a matter will not exceed established accruals. As a result, the outcome of a particular matter or a combination of matters may be material to our results of operations for a particular period, depending upon the size of the loss or our income for that particular period.

In November 2017, a suit was filed in Savannah, Georgia state court (“State Court”) against Davey Tree, its subsidiary, Wolf Tree, Inc. ("Wolf Tree"), a former Davey employee, two Wolf Tree employees, and a former Wolf Tree employee alleging various acts of negligence and seeking compensatory and punitive damages for wrongful death and assault and battery of the plaintiff’s husband, a Wolf Tree employee, who was

shot and killed in August 2017. The case was mediated unsuccessfully in December 2018 and was set for trial on January 22, 2019. As discussed below, the case was stayed on December 28, 2018.

In July 2018, a related survival action was filed by the deceased’s estate against Davey Tree, its subsidiary, Wolf Tree, and four current and former employees in Savannah, Georgia, which arises out of the same allegations, seeks compensatory and punitive damages and also includes three Racketeer Influenced and Corrupt Organizations Act ("RICO") claims under Georgia law seeking compensatory damages, treble damages, and punitive damages. The 2018 case was removed to the United States District Court for the Southern District of Georgia, Savannah Division (“Federal Court”), on August 2, 2018. The Company filed a motion to dismiss the RICO claims. Plaintiffs filed a motion to remand the case to state court, which the Company has opposed. The motions are pending.

On December 6, 2018, a former Wolf Tree employee pled guilty to conspiracy to conceal, harbor, and shield illegal aliens. On December 21, 2018, the United States federal prosecutors filed a motion to stay both actions on the grounds that on December 13, 2018, an indictment was issued charging two former Wolf Tree employees and one other individual with various crimes, including conspiracy to murder the deceased. On December 17, 2018, the United States Attorney’s Office for the Southern District of Georgia informed the Company and Wolf Tree that they are also under investigation for potential violations of immigration and other laws relating to the subject matter of the ongoing criminal investigation referenced above. The Company and Wolf Tree are cooperating with the investigation.

On December 28, 2018, the State Court granted the United States’ motion to stay but indicated that it would nonetheless consider certain pending matters, including: (1) Plaintiff and a co-defendant’s motions that Davey Tree be forced to produce privileged documents and testimony, which had been submitted to a Special Master for recommendation; and (2) the Defendants’ motions for summary judgment. On January 11, 2019, the Special Master issued his recommendation that both Plaintiff and the co-defendant’s motions to force Davey to disclose privileged information be denied. The State Court judge has not yet moved on the recommendation. On January 29, 2019, the State Court heard oral argument on Defendants’ motions for summary judgment, and the motions remain pending.

On January 28, 2019, the Federal Court also granted the United States’ motion to stay. On January 29, 2019, the State Court ordered the parties to return to mediation, which occurred on April 17, 2019 but was unsuccessful in resolving the matters.

In both cases, the Company has denied all liability and is vigorously defending the action. It also has retained separate counsel for some of the individual defendants, each of whom has denied all liability and also is vigorously defending the action.

Item 4. Mine Safety Disclosures.

Not applicable.

Information about our Executive Officers.

Our executive officers and their present positions and ages as of March 1, 2020 follow:

|

| | | | |

| Name | Age | Position | Years with Company | Served as an Executive Officer Since |

| | | | | |

| Patrick M. Covey | 56 | Chairman, President and Chief Executive Officer | 28 | 2007 |

| | | | | |

| Joseph R. Paul, CPA | 58 | Executive Vice President, Chief Financial Officer and Secretary | 14 | 2005 |

| | | | | |

| Christopher J. Bast, CPA, CTP | 52 | Vice President and Treasurer | 6 | 2013 |

| | | | | |

| James E. Doyle | 51 | Executive Vice President and General Manager, Davey Tree Expert Co. of Canada, Limited | 30 | 2014 |

| | | | | |

| Gregory M. Ina | 48 | Executive Vice President, The Davey Institute and Employee Development | 24 | 2016 |

| | | | | |

| Dan A. Joy | 62 | Executive Vice President and General Manager, Commercial Landscape Services and Operations Support Services | 43 | 2013 |

| | | | | |

| Brent R. Repenning | 48 | Executive Vice President, U.S. Utility and Davey Resource Group | 25 | 2014 |

| | | | | |

| Erika J. Schoenberger | 40 | Vice President, General Counsel and Assistant Secretary | 2 | 2018 |

| | | | | |

| Thea R. Sears, CPA | 51 | Vice President and Controller | 26 | 2010 |

| | | | | |

| James F. Stief | 65 | Executive Vice President, U.S. Residential Operations | 41 | 2010 |

Mr. Covey was appointed Chairman effective March 6, 2020, Chief Executive Officer effective July 21, 2017 and served as President and Chief Operating Officer since March 4, 2016 and as a Director since May 20, 2014. He previously served as President and Chief Operating Officer, U.S. Operations, having been appointed in April 2014, and as Chief Operating Officer, U.S. Operations, having been appointed in February 2012. Prior to that time, Mr. Covey served as Executive Vice President, having been appointed in January 2007, Vice President and

General Manager of the Davey Resource Group, having been appointed in March 2005, and Vice President, Southern Operations, Utility Services, having been appointed in January 2003. Previously, having joined Davey Tree in August 1991, Mr. Covey held various managerial positions, including Manager of Systems and Process Management and Administrative Manager, Utility Services.

Mr. Paul was elected Executive Vice President, Chief Financial Officer and Secretary effective March 4, 2016 and previously served as Chief Financial Officer and Secretary, having been appointed in March 2013. Prior to that time, he served as Vice President and Treasurer, having been appointed in May 2011. Mr. Paul joined Davey Tree as Treasurer in December 2005.

Mr. Bast was elected Vice President effective September 18, 2017 having previously served as Treasurer since April 2013. Mr. Bast joined Davey Tree in March 2013 and prior to joining us, served in various management positions from 1994 to 2013 at Diebold, Incorporated, a provider of self-service delivery and security systems.

Mr. Doyle was elected Executive Vice President and General Manager, Davey Tree Expert Co. of Canada, Limited (“Davey Tree Limited”), effective May 21, 2014 and previously served as Vice President and General Manager, Davey Tree Limited, having been appointed in February 2012. Prior to that time, he served as Vice President and General Manager, Operations, Davey Tree Limited, having been appointed in May 2011, and Vice President, Operations, Davey Tree Limited, having been appointed in January 2006. Previously, having joined Davey Tree in 1989, Mr. Doyle held various managerial positions, including District Manager and Operations Manager.

Mr. Ina was elected Executive Vice President, The Davey Institute and Employee Development in July 2017, having previously served as Vice President and General Manager of Research, Recruiting and Human Resource Development effective April 4, 2016, and having previously been elected an officer effective March 4, 2016. Prior to this time, he served as Vice President and General Manager of the Davey Institute, having been appointed in May 2009, and General Manager of the Davey Institute, having been appointed in May 2006. Previously, having joined Davey Tree in 1996, Mr. Ina held various managerial and operational positions in the Davey Institute and Davey Resource Group.

Mr. Joy was elected Executive Vice President and General Manager, Commercial Landscape Services and Operations Support Services, effective August 15, 2014 and previously served as Executive Vice President and General Manager, Commercial Landscape Services, having been appointed in May 2014. Prior to that time, he served as Vice President and General Manager, Commercial Landscape Services, having been appointed in May 2013, and Vice President, Commercial Landscape Services, having been appointed in December 2004. Previously, having joined Davey Tree in 1976, Mr. Joy held various managerial positions, including Operations Manager, District Manager and Assistant District Manager.

Mr. Repenning was elected Executive Vice President, U.S. Utility and Davey Resource Group in July 2017, having previously served as Senior Vice President, Davey Resource Group and Eastern Utility, effective October 2, 2016 and as Vice President and General Manager, Davey Resource Group, having been appointed in June 2010. Prior to that time, he served as Vice President, Davey Resource Group, having been appointed in October 2009. Previously, having joined Davey Tree in 1994, Mr. Repenning held various managerial and operational positions, including Regional Manager, Production Manager and Supervisor.

Ms. Schoenberger was elected Assistant Secretary in September 2018 having joined the Company in August 2018 as Vice President and General Counsel. Prior to joining Davey Tree, Ms. Schoenberger served as General Counsel, Corporate Secretary and Senior Vice President at the Oneida Group, Inc., a global marketer of tabletop and food preparation products from September 2013 until she joined the Company. Prior to that, she was a Partner at Frost Brown Todd, LLC, a national full service law firm.

Ms. Sears was elected Vice President effective September 18, 2017 having served as Controller since September 16, 2016 and prior to that, served as Assistant Controller, having been appointed in May 2010. Prior to that time, she served as Manager of Financial Accounting, having

been appointed in April 1998, and as Supervisor of Financial Accounting, having been appointed in September 1995. Having joined Davey Tree in 1993, Ms. Sears has held a variety of roles in financial reporting, managerial reporting and operations accounting.

Mr. Stief was elected Executive Vice President, U.S. Residential Operations, effective February 12, 2012 and previously served as Vice President and General Manager, Residential/Commercial Services, since January 2010. Prior to that time, Mr. Stief served as Vice President and General Manager, South, West and Central Residential/Commercial Operations, having been appointed in January 2007, and Vice President South, West and Central Residential/Commercial Operations, having been appointed in January 1997. Previously, having joined Davey Tree in 1978, Mr. Stief held various managerial positions, including Operations Manager and District Manager.

Our officers serve from the date of their election to the next organizational meeting of the Board of Directors and until their respective successors are elected.

PART II

Item 5. Market for Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common shares are not listed or traded on an established public trading market and market prices are, therefore, not available. Semiannually, for purposes of the Davey 401KSOP and ESOP, the fair market value of our common shares is determined by an independent stock valuation firm, based upon our performance and financial condition, using a peer group of comparable companies selected by that firm. The peer group currently consists of: ABM Industries Incorporated; Comfort Systems USA, Inc.; Dycom Industries, Inc.; FirstService Corporation; MYR Group, Inc.; Quanta Services, Inc.; Rollins, Inc.; and Scotts Miracle-Gro Company. The semiannual valuations are effective for a period of six months and the per-share price established by those valuations is the price at which our Board of Directors has determined our common shares will be bought and sold during that six-month period in transactions involving Davey Tree or one of its employee benefit or stock purchase plans. Since 1979, we have provided a ready market for all shareholders through our direct purchase of their common shares, although we are under no obligation to do so (other than for repurchases pursuant to the put option under The Davey 401KSOP and ESOP Plan, as described in Note M). These purchases are added to our treasury stock.

The following table sets forth, for the periods indicated, the high and low common share price (in dollars) and the cash dividends declared per common share (in cents).

|

| | | | | | | | | | | |

| | Common Stock Price Range | | Cash Dividends Declared | |

| | High | | Low | | |

| Fiscal Year 2019 | | | | | | |

| First quarter ended March 30, 2019 | $ | 21.10 |

| | $ | 19.70 |

| | 2.5 |

| |

| Second quarter ended June 29, 2019 | 21.10 |

| | 21.10 |

| | 2.5 |

| |

| Third quarter ended September 28, 2019 | 22.60 |

| | 21.10 |

| | 2.5 |

| |

| Fourth quarter ended December 31, 2019 | 22.60 |

| | 22.60 |

| | 2.5 |

| |

| Fiscal Year 2018 | | | | | | |

| First quarter ended March 31, 2018 | 19.10 |

| | 18.30 |

| | 2.5 |

| |

| Second quarter ended June 30, 2018 | 19.10 |

| | 19.10 |

| | 2.5 |

| |

| Third quarter ended September 29, 2018 | 19.70 |

| | 19.10 |

| | 2.5 |

| |

| Fourth quarter ended December 31, 2018 | 19.70 |

| | 19.70 |

| | 2.5 |

| |

We presently expect to pay comparable cash dividends in 2020.

Record Holders and Common Shares

On March 4, 2020 we had 4,026 record holders of our common shares.

On March 4, 2020 we had 23,181,806 common shares outstanding and options exercisable to purchase 937,597 common shares.

Recent Sales of Unregistered Securities

None.

Purchases of Equity Securities

The following table provides information on purchases made by the Company of our common shares during the fiscal year ended December 31, 2019.

|

| | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs |

| Fiscal 2019 | | | | | | | | |

| January 1 to January 26 | | 624 |

| | $ | 19.70 |

| | — |

| | 954,492 |

|

| January 27 to February 23 | | 1,165 |

| | 21.10 |

| | — |

| | 954,492 |

|

| February 24 to March 30 | | 208,289 |

| | 21.10 |

| | — |

| | 954,492 |

|

| Total First Quarter | | 210,078 |

| | 21.10 |

| | — |

| | |

|

| | | | | | | | | |

| March 31 to April 27 | | 375,434 |

| | 21.10 |

| | — |

| | 954,492 |

|

| April 28 to May 25 | | 180,505 |

| | 21.10 |

| | — |

| | 954,492 |

|

| May 26 to June 29 | | 236,546 |

| | 21.10 |

| | 41,448 |

| | 913,044 |

|

| Total Second Quarter | | 792,485 |

| | 21.10 |

| | 41,448 |

| | |

|

| | | | | | | | | |

| June 30 to July 27 | | 1,114 |

| | 21.10 |

| | — |

| | 913,044 |

|

| July 28 to August 24 | | 100,558 |

| | 22.60 |

| | — |

| | 913,044 |

|

| August 25 to September 28 | | 88,606 |

| | 22.60 |

| | — |

| | 913,044 |

|

| Total Third Quarter | | 190,278 |

| | 22.59 |

| | — |

| | |

|

| | | | | | | | | |

| September 29 to October 26 | | 164,933 |

| | 22.60 |

| | — |

| | 913,044 |

|

| October 27 to November 30 | | 182,935 |

| | 22.60 |

| | 44,413 |

| | 868,631 |

|

| December 1 to December 31 | | 59,886 |

| | 22.60 |

| | 2,061 |

| | 866,570 |

|

| Total Fourth Quarter | | 407,754 |

| | 22.60 |

| | 46,474 |

| | |

|

| | | | | | | | | |

| Total Year to Date | | 1,600,595 |

| | $ | 21.66 |

| | 87,922 |

| | |

At the Annual Meeting of Shareholders of the Company held on May 16, 2017, the shareholders of the Company approved proposals to amend the Company's Articles of Incorporation to (i) expand the Company's right of first refusal with respect to proposed transfers of shares of the Company's common shares, (ii) clarify provisions regarding when the Company may provide notice of its decision to exercise its right of first refusal with respect to proposed transfers of common shares by the estate or personal representative of a deceased shareholder, and (iii) grant the Company a right to repurchase common shares held by certain shareholders of the Company.

On May 10, 2017, the Board of Directors of the Company adopted a policy regarding the Company's exercise of the repurchase rights granted to the Company through amendments to the Company's Articles of Incorporation, as approved by shareholders on May 16, 2017.

Until further action by the Board, it is the policy of the Company not to exercise its repurchase rights under the amended Articles with respect to shares of the Company's common shares held by current and retired employees and current and former directors of the Company (subject to exceptions set forth in the policy) (collectively, "Active Shareholders"), their spouses, their first-generation descendants and trusts established exclusively for their benefit.

Until further action by the Board, it is also the policy of the Company not to exercise its rights under the amended Articles to repurchase shares of the Company's common shares proposed to be transferred by an Active Shareholder to his or her spouse, a first-generation descendant, or a trust established exclusively for the benefit of one or more of an Active Shareholder, his or her spouse and first-generation descendants of an Active Shareholder, or upon the death of an Active Shareholder, such transfers from the estate or personal representative of a deceased Active Shareholder. The Board may suspend, change or discontinue the policy at any time without prior notice.

In accordance with the amendments to the Articles approved by the Company's shareholders at the 2017 Annual Meeting on May 17, 2017, the Company's Board of Directors authorized the Company to repurchase up to 200,000 common shares, which authorization was increased by an additional 1,000,000 common shares in May 2018. Of the 1,200,000 total shares authorized, 866,570 remain available under the program. Share repurchases may be made from time to time and the timing of any repurchases and the actual number of shares repurchased will depend on a variety of factors. The Company is not obligated to purchase any shares, and repurchases may be commenced, suspended or discontinued from time to time without prior notice. The repurchase program does not have an expiration date.

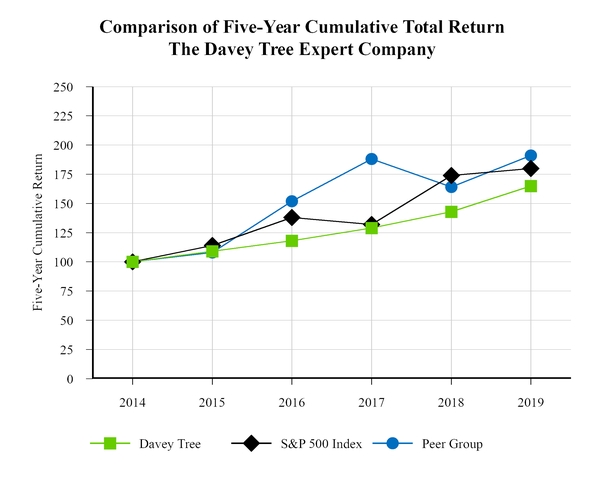

Stock Performance Graph

Comparison of five-year cumulative return among The Davey Tree Expert Company, S&P 500 Stock Index and Selected Peer Group Companies Index

The following Performance Graph compares cumulative total shareholder returns (assuming reinvestment of dividends) for The Davey Tree Expert Company common shares during the last five years to the Standard & Poor’s 500 Stock Index (the "S&P 500 Index") and to an index of selected peer group companies. The peer group, which is the same group used by Davey’s independent stock valuation firm, consists of: ABM Industries Incorporated; Comfort Systems USA, Inc.; Dycom Industries, Inc.; FirstService Corporation; MYR Group, Inc.; Quanta Services, Inc.; Rollins, Inc.; and Scotts Miracle-Gro Company. The peer group are all publicly held companies deemed to be engaged in similar lines of business.

|

| | | | | | | | | | | | |

| | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 |

| Davey Tree | | 100 | | 109 | | 118 | | 129 | | 143 | | 165 |

| S&P 500 Index | | 100 | | 114 | | 138 | | 132 | | 174 | | 180 |

| Peer Group | | 100 | | 108 | | 152 | | 188 | | 164 | | 191 |

The Performance Graph and related information above shall not be deemed “soliciting material” or be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

Item 6. Selected Financial Data. |

| | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended December 31, |

| | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| | (In thousands, except ratio and per share data) |

| Operating Statement Data: | | | | | | | | | |

| Revenues | $ | 1,143,720 |

| | $ | 1,024,791 |

| | $ | 915,958 |

| | $ | 845,678 |

| | $ | 821,904 |

|

| Costs and expenses: | |

| | |

| | |

| | | | |

| Operating | 730,507 |

| | 665,388 |

| | 587,333 |

| | 541,486 |

| | 528,899 |

|

| Selling | 209,148 |

| | 184,388 |

| | 167,934 |

| | 152,106 |

| | 144,234 |

|

| General and administrative | 76,738 |

| | 67,462 |

| | 59,403 |

| | 58,293 |

| | 55,518 |

|

| Depreciation | 57,292 |

| | 54,914 |

| | 50,702 |

| | 47,284 |

| | 44,677 |

|

| Amortization of intangible assets | 2,545 |

| | 2,055 |

| | 2,384 |

| | 2,306 |

| | 2,214 |

|

| Gain on sale of assets, net | (2,055 | ) | | (5,106 | ) | | (3,989 | ) | | (4,664 | ) | | (2,026 | ) |

| Income from operations | 69,545 |

| | 55,690 |

| | 52,191 |

| | 48,867 |

| | 48,388 |

|

| Interest expense | (8,514 | ) | | (7,039 | ) | | (4,886 | ) | | (4,393 | ) | | (3,355 | ) |

| Interest income | 348 |

| | 350 |

| | 292 |

| | 255 |

| | 249 |

|

| Other expense | (8,112 | ) | | (11,505 | ) | | (9,603 | ) | | (7,485 | ) | | (10,024 | ) |

| Income before income taxes | 53,267 |

| | 37,496 |

| | 37,994 |

| | 37,244 |

| | 35,258 |

|

| Income taxes | 12,470 |

| | 9,519 |

| | 15,874 |

| | 14,960 |

| | 13,460 |

|

| Net income | $ | 40,797 |

| | $ | 27,977 |

| | $ | 22,120 |

| | $ | 22,284 |

| | $ | 21,798 |

|

| Earnings per share--diluted * | $ | 1.70 |

| | $ | 1.10 |

| | $ | .83 |

| | $ | .82 |

| | $ | .78 |

|

| Shares used for computing per share amounts--diluted * | 23,978 |

| | 25,481 |

| | 26,697 |

| | 27,247 |

| | 27,955 |

|

| | | | | | | | | | |

| Other Financial Data: | |

| | |

| | |

| | | | |

| Depreciation and amortization | $ | 59,837 |

| | $ | 56,969 |

| | $ | 53,086 |

| | $ | 49,590 |

| | $ | 46,891 |

|

| Capital expenditures | 58,355 |

| | 60,410 |

| | 57,100 |

| | 56,646 |

| | 56,047 |

|

| Cash flow provided by (used in): | |

| | |

| | |

| | | | |

| Operating activities | 83,353 |

| | 62,104 |

| | 56,776 |

| | 55,370 |

| | 62,689 |

|

| Investing activities | (63,322 | ) | | (61,377 | ) | | (59,518 | ) | | (54,808 | ) | | (56,046 | ) |

| Financing activities | (31,824 | ) | | 9,065 |

| | 6,410 |

| | (7,721 | ) | | (7,140 | ) |

| Cash dividends declared per share * | $ | .10 |

| | $ | .10 |

| | $ | .10 |

| | $ | .10 |

| | $ | .10 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | As of December 31, |

| | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| | (In thousands, except ratio and per share data) |

| Balance Sheet Data: | | | | | | | |

| | |

| Working capital | $ | 115,753 |

| | $ | 115,756 |

| | $ | 80,468 |

| | $ | 59,868 |

| | $ | 48,984 |

|

| Current ratio | 1.70 |

| | 1.83 |

| | 1.63 |

| | 1.50 |

| | 1.44 |

|

| Property and equipment, net | 199,850 |

| | 202,285 |

| | 193,183 |

| | 179,436 |

| | 166,422 |

|

| Total assets | 596,862 |

| | 526,623 |

| | 473,135 |

| | 423,939 |

| | 393,586 |

|

| Long-term debt | 145,149 |

| | 158,425 |

| | 119,210 |

| | 92,623 |

| | 85,104 |

|

| Other long-term liabilities | 99,581 |

| | 66,476 |

| | 63,878 |

| | 60,565 |

| | 55,464 |

|

| Redeemable common shares related to 401KSOP and Employee Stock Ownership Plan (ESOP) | 124,555 |

| | 119,049 |

| | 123,520 |

| | 124,201 |

| | 127,089 |

|

| Total common shareholders' equity | 61,905 |

| | 43,361 |

| | 37,870 |

| | 27,978 |

| | 14,450 |

|

| Redeemable common shares * | 5,147 |

| | 5,642 |

| | 6,467 |

| | 7,057 |

| | 7,773 |

|

| Common shares: * | |

| | |

| | |

| | |

| | |

|

| Issued | 37,767 |

| | 37,272 |

| | 36,447 |

| | 35,857 |

| | 35,141 |

|

| Less: In treasury | 19,737 |

| | 20,033 |

| | 18,693 |

| | 17,991 |

| | 17,427 |

|

| Net outstanding | 23,177 |

| | 22,881 |

| | 24,221 |

| | 24,923 |

| | 25,487 |

|

| Stock options: * | |

| | |

| | |

| | |

| | |

|

| Outstanding | 1,428 |

| | 1,466 |

| | 1,529 |

| | 1,599 |

| | 1,634 |

|

| Exercisable | 938 |

| | 890 |

| | 801 |

| | 751 |

| | 834 |

|

| ESOT valuation per share * | $ | 24.20 |

| | $ | 21.10 |

| | $ | 19.10 |

| | $ | 17.60 |

| | $ | 16.35 |

|

* Years 2015 and 2016 have been adjusted for a two-for-one stock split, effective June 1, 2017.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

(Amounts in thousands, except share data)

Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”) is provided as a supplement to the accompanying consolidated financial statements and notes to help provide an understanding of our financial condition, cash flows and results of operations. MD&A is organized as follows:

| |

| ▪ | Overview of 2019 Results; |

| |

| ▪ | Results of Operations, including fiscal 2019 compared to fiscal 2018, fiscal 2018 compared to fiscal 2017 and other matters; |

| |

| ▪ | Liquidity and Capital Resources, including cash flow summary, off-balance sheet arrangements, and capital resources; |

| |

| ▪ | Recent Accounting Guidance; |

| |

| ▪ | Critical Accounting Policies and Estimates; and |

| |

| ▪ | Market Risk Information, including interest rate risk and foreign currency exchange rate risk. |

OVERVIEW OF 2019 RESULTS

General

We provide a wide range of horticultural, arboricultural, environmental and consulting services to residential, commercial, utility and institutional customers throughout the United States and Canada.

Our Business--We have two reportable operating segments organized by type or class of customer: Residential and Commercial, and Utility.

Residential and Commercial--Residential and Commercial provides services to our residential and commercial customers including: the treatment, preservation, maintenance, removal and planting of trees, shrubs and other plant life; the practice of landscaping, grounds maintenance, tree surgery, tree feeding and tree spraying; the application of fertilizer, herbicides and insecticides; and natural resource management and consulting, forestry research and development, and environmental planning.

Utility--Utility is principally engaged in providing services to our utility customers--investor-owned, municipal utilities, and rural electric cooperatives--including: the practice of line-clearing and vegetation management around power lines, rights-of-way and chemical brush control; and natural resource management and consulting, forestry research and development and environmental planning.

All other operating activities, including research, technical support and laboratory diagnostic facilities, are included in “All Other.”

RESULTS OF OPERATIONS

The following table sets forth our consolidated results of operations as a percentage of revenues and the percentage change in dollar amounts of the results of operations for the periods presented:

|

| | | | | | | | | | | | | | |

| | Year Ended December 31, | | Percentage Change |

| | 2019 | | 2018 | | 2017 | | 2019/2018 | | 2018/2017 |

| Revenues | 100.0 | % | | 100.0 | % | | 100.0 | % | | 11.6 | % | | 11.9 | % |

| Costs and expenses: | |

| | |

| | |

| | | | |

|

| Operating | 63.9 |

| | 64.9 |

| | 64.1 |

| | 9.8 |

| | 13.3 |

|

| Selling | 18.3 |

| | 18.0 |

| | 18.3 |

| | 13.4 |

| | 9.8 |

|

| General and administrative | 6.7 |

| | 6.6 |

| | 6.5 |

| | 13.7 |

| | 13.6 |

|

| Depreciation | 5.0 |

| | 5.4 |

| | 5.5 |

| | 4.3 |

| | 8.3 |

|

| Amortization of intangible assets | .2 |

| | .2 |

| | .3 |

| | 23.8 |

| | (13.8 | ) |

| Gain on sale of assets, net | (.2 | ) | | (.5 | ) | | (.4 | ) | | (59.8 | ) | | 28.0 |

|

| | 93.9 |

| | 94.6 |

| | 94.3 |

| | 10.8 |

| | 12.2 |

|

| Income from operations | 6.1 |

| | 5.4 |

| | 5.7 |

| | 24.9 |

| | 6.7 |

|

| Other income (expense): | |

| | |

| | |

| | |

| | |

|

| Interest expense | (.7 | ) | | (.7 | ) | | (.5 | ) | | 21.0 |

| | 44.1 |

|

| Interest income | — |

| | — |

| | — |

| | — |

| | — |

|

| Other | (.7 | ) | | (1.1 | ) | | (1.1 | ) | | (29.5 | ) | | 19.8 |

|

| Income before income taxes | 4.7 |

| | 3.6 |

| | 4.1 |

| | 42.1 |

| | (1.3 | ) |

| Income taxes | 1.1 |

| | .9 |

| | 1.7 |

| | 31.0 |

| | (40.0 | ) |

| Net income | 3.6 | % | | 2.7 | % | | 2.4 | % | | 45.8 | % | | 26.5 | % |

Fiscal 2019 Compared to Fiscal 2018

A comparison of our fiscal year 2019 results to 2018 follows:

|

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | Change | | % Change |

| Revenues | $ | 1,143,720 |

| | $ | 1,024,791 |

| | $ | 118,929 |

| | 11.6 | % |

| Costs and expenses: | |

| | |

| | |

| | |

|

| Operating | 730,507 |

| | 665,388 |

| | 65,119 |

| | 9.8 |

|

| Selling | 209,148 |

| | 184,388 |

| | 24,760 |

| | 13.4 |

|

| General and administrative | 76,738 |

| | 67,462 |

| | 9,276 |

| | 13.7 |

|

| Depreciation | 57,292 |

| | 54,914 |

| | 2,378 |

| | 4.3 |

|

| Amortization of intangible assets | 2,545 |

| | 2,055 |

| | 490 |

| | 23.8 |

|

| Gain on sale of assets, net | (2,055 | ) | | (5,106 | ) | | (3,051 | ) | | (59.8 | ) |

| | 1,074,175 |

| | 969,101 |

| | 105,074 |

| | 10.8 |

|

| Income from operations | 69,545 |

| | 55,690 |

| | 13,855 |

| | 24.9 |

|

| Other income (expense): | |

| | |

| | |

| | |

|

| Interest expense | (8,514 | ) | | (7,039 | ) | | (1,475 | ) | | 21.0 |

|

| Interest income | 348 |

| | 350 |

| | (2 | ) | | (.6 | ) |

| Other | (8,112 | ) | | (11,505 | ) | | 3,393 |

| | (29.5 | ) |

| Income before income taxes | 53,267 |

| | 37,496 |

| | 15,771 |

| | 42.1 |

|

| Income taxes | 12,470 |

| | 9,519 |

| | 2,951 |

| | 31.0 |

|

| Net income | $ | 40,797 |