| Shares or Principal Amounts | | |

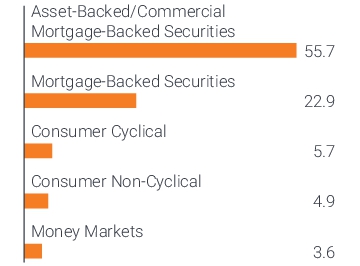

Asset-Backed/Commercial Mortgage-Backed Securities – (continued) | | | |

Rad CLO Ltd 2023-21A C, CME Term SOFR 3 Month + 2.5500%, 7.8736%, | | | |

Reach Financial LLC 2021-1A B, 2.1700%, 5/15/29ž | | | |

Reach Financial LLC 2024-1A A, 6.3000%, 2/18/31ž | | | |

Regatta Funding 2018-1A AR, CME Term SOFR 3 Month + 1.4000%, 0%, | | | |

Saluda Grade Alternative Mortgage Trust 2023-FIG3 A, 7.0670%, 8/25/53ž,‡ | | | |

Saluda Grade Alternative Mortgage Trust 2023-FIG4 A, 6.7180%, 11/25/53ž,‡ | | | |

Saluda Grade Alternative Mortgage Trust 2024-CES1 A1, 6.3060%, 3/25/54ž,‡ | | | |

Saluda Grade Alternative Mortgage Trust 2024-FIG5 A, 6.2550%, 4/25/54ž,‡ | | | |

Saluda Grade Alternative Mortgage Trust 2024-RTL4 A1, 7.5000%, 2/25/30ž,Ç | | | |

Saluda Grade Alternative Mortgage Trust 2024-RTL5 A1, 7.7620%, 4/25/30ž,Ç | | | |

Saluda Grade Alternative Mortgage Trust 2024-RTL6 A1, 7.4390%, 7/25/30ž,‡ | | | |

Santander Bank Auto Credit-Linked Notes 2021-1A B, 1.8330%, 12/15/31ž | | | |

Santander Bank Auto Credit-Linked Notes 2021-1A C, 3.2680%, 12/15/31ž | | | |

Santander Bank Auto Credit-Linked Notes 2022-A B, 5.2810%, 5/15/32ž | | | |

Santander Bank Auto Credit-Linked Notes 2023-B A2, 5.6440%, 12/15/33ž | | | |

Santander Bank Auto Credit-Linked Notes 2024-A B, 5.6220%, 6/15/32ž | | | |

Santander Drive Auto Receivables Trust 2021-1 D, 1.1300%, 11/16/26 | | | |

Sierra Receivables Funding Co LLC 2021-1A A, 0.9900%, 11/20/37ž | | | |

Signal Peak CLO LLC 2022-12A A1, 7.1207%, 7/10/28ž,‡ | | | |

SMRT 2022-MINI A, CME Term SOFR 1 Month + 1.0000%, 6.3290%, 1/15/39ž,‡ | | | |

SoFi Professional Loan Program 2020-C Trust, 1.9500%, 2/15/46ž | | | |

Sound Point CLO Ltd 2019-1A AR, CME Term SOFR 3 Month + 1.3416%, | | | |

SREIT Trust 2021-MFP A, CME Term SOFR 1 Month + 0.8453%, 6.1741%, | | | |

Stack Infrastructure Issuer LLC 2024-1A A2, 5.9000%, 3/25/49ž | | | |

THE 2023-MIC Trust 2023-MIC A, 8.7315%, 12/5/38ž,‡ | | | |

The Huntington National Bank 2024-1 B1, 6.1530%, 5/20/32ž | | | |

Theorem Funding Trust 2022-3A A, 7.6000%, 4/15/29ž | | | |

THL Credit Wind River CLO Ltd 2014-1A ARR, CME Term SOFR 3 Month + 1.3116%, 6.6385%, 7/18/31ž,‡ | | | |

Tricolor Auto Securitization Trust 2023-1A A, 6.4800%, 8/17/26ž | | | |

Tricolor Auto Securitization Trust 2024-1A A, 6.6100%, 10/15/27ž | | | |

Tricolor Auto Securitization Trust 2024-2A A, 6.3600%, 12/15/27ž | | | |

TTAN 2021-MHC A, CME Term SOFR 1 Month + 0.9645%, 6.2935%, | | | |

TYSN 2023-CRNR Mortgage Trust 2023-CRNR A, 6.7991%, 12/10/33ž,‡ | | | |

TYSN 2023-CRNR Mortgage Trust 2023-CRNR B, 6.7991%, 12/10/33ž,‡ | | | |

UNIFY Auto Receivables Trust 2021-1A A4, 0.9800%, 7/15/26ž | | | |

Upstart Securitization Trust 2022-1 A, 3.1200%, 3/20/32ž | | | |

Upstart Securitization Trust 2022-2 A, 4.3700%, 5/20/32ž | | | |

US Bank National Association 2023-1 B, 6.7890%, 8/25/32ž | | | |

USASF Receivables LLC 2021-1A C, 2.2000%, 5/15/26ž | | | |

Vantage Data Centers LLC 2020-1A A2, 1.6450%, 9/15/45ž | | | |

VASA Trust 2021-VASA A, CME Term SOFR 1 Month + 1.0145%, 6.3435%, | | | |

Verus Securitization Trust 2020-1, 3.6420%, 1/25/60ž,Ç | | | |

VMC Finance LLC 2021-HT1 A, CME Term SOFR 1 Month + 1.7645%, 7.0964%, | | | |

WB Commercial Mortgage Trust 2024-HQ A, 6.1344%, 3/15/40ž,‡ | | | |

Westgate Resorts 2022-1A A, 1.7880%, 8/20/36ž | | | |

Westlake Automobile Receivable Trust 2023-3A A2A, 5.9600%, 10/15/26ž | | | |

Westlake Automobile Receivable Trust 2023-4A A2, 6.2300%, 1/15/27ž | | | |

Woodward Capital Management 2021-3 A21, US 30 Day Average SOFR + 0.8000%, 5.0000%, 7/25/51ž,‡ | | | |

Woodward Capital Management 2023-CES1 A1A, 6.5150%, 6/25/43ž,‡ | | | |

Woodward Capital Management 2023-CES2 A1A, 6.8080%, 9/25/43ž,‡ | | | |

Woodward Capital Management 2023-CES3 A1A, 7.1130%, 11/25/43ž,‡ | | | |