FORM OF AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the “Agreement”) is made as of this __ day of __________, 2017, by and between Janus Investment Fund, a Massachusetts business trust (the “Trust”), on behalf of Janus Twenty Fund, a series of the Trust (the “Target Fund”), and Janus Forty Fund, a series of the Trust (the “Acquiring Fund”). Janus Capital Management LLC (“JCM”) joins this agreement solely for the purpose of agreeing to be bound by Paragraph 5.

All references in this Agreement to action taken by the Target Fund or the Acquiring Fund shall be deemed to refer to action taken by the Trust on behalf of the respective portfolio series.

This Agreement is intended to be and is adopted as a plan of reorganization and liquidation within the meaning of Section 368(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”). The reorganization (the “Reorganization”) will consist of the transfer by the Target Fund of all or substantially all of its assets to the Acquiring Fund, in exchange solely for Class D and T voting shares of beneficial interest in the Acquiring Fund (the “Acquiring Fund Shares”) having an aggregate net asset value equal to the aggregate net asset value of the same class of shares of the Target Fund, the assumption by the Acquiring Fund of all the liabilities of the Target Fund, and the distribution of the Class D and T Acquiring Fund Shares to the shareholders of the Target Fund in complete liquidation of the Target Fund as provided herein, all upon the terms and conditions hereinafter set forth in this Agreement.

WHEREAS, the Board of Trustees of the Trust has determined that it is in the best interest of each of the Target Fund and the Acquiring Fund that assets of the Target Fund be acquired by the Acquiring Fund and the liabilities of the Target Fund be assumed by the Acquiring Fund in exchange for Class D and T Acquiring Fund Shares pursuant to this Agreement and in accordance with the applicable statutes of the Commonwealth of Massachusetts, and that the interests of existing shareholders of the Target Fund or the Acquiring Fund will not be diluted as a result of this transaction;

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements hereinafter set forth, the parties hereto covenant and agree as follows:

1. PLAN OF REORGANIZATION

1.1 Subject to the terms and conditions herein set forth, the Trust shall (i) transfer all or substantially all of the assets of the Target Fund, as set forth in paragraph 1.2, to the Acquiring Fund, (ii) the Trust shall cause the Acquiring Fund to deliver to the Trust full and fractional Class D and T Acquiring Fund Shares having an aggregate net asset value equal to the value of the aggregate net assets of the same class of shares of the Target Fund as of the close of regular session trading on the New York Stock Exchange on the Closing Date, as set forth in paragraph 2.1 (the “Closing Date”) and (iii) the Trust shall cause the Acquiring Fund to assume all liabilities of the Target Fund, as set forth in paragraph 1.2. Such transactions shall take place at the closing provided for in paragraph 2.1 (the “Closing”).

1.2 The assets of the Target Fund to be acquired by the Acquiring Fund shall consist of all property, including, without limitation, all cash, securities, commodities and futures interests, and dividends or interest receivable which are owned by the Target Fund and any deferred or prepaid expenses shown as an asset on the books of the Target Fund on the Closing Date. The Acquiring Fund will assume all of the liabilities, expenses, costs, charges and reserves of the Target Fund of any kind, whether absolute, accrued, contingent or otherwise in existence on the Closing Date.

1.3 The Target Fund will distribute pro rata to its shareholders of record of the applicable classes, determined as of immediately after the close of business on the Closing Date (the “Current Shareholders”), the Class D and T Acquiring Fund Shares received by the Trust pursuant to paragraph 1.1. Such distribution and liquidation will be accomplished by the transfer of the Class D and T Acquiring Fund Shares then credited to the accounts of the Target Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the names of the Current Shareholders and representing the respective pro rata number of the Class D and T Acquiring Fund Shares due to such shareholders. All issued and outstanding shares of the Target Fund will simultaneously be canceled on the

books of the Trust. The Acquiring Fund shall not issue certificates representing the Class D and T Acquiring Fund Shares in connection with such exchange. Ownership of Class D and T Acquiring Fund Shares will be shown on the books of the Trust’s transfer agent. As soon as practicable after the Closing, the Trust shall take all steps necessary to effect a complete liquidation of the Target Fund.

2. CLOSING AND CLOSING DATE

2.1 The Closing Date shall be _____, 2017, or such other date as the parties may agree to in writing. All acts taking place at the Closing shall be deemed to take place simultaneously as of immediately after the close of business on the Closing Date unless otherwise agreed to by the parties. The close of business on the Closing Date shall be as of 4:00 p.m. New York Time. The Closing shall be held at the offices of Janus Capital Management LLC (“JCM”), 151 Detroit Street, Denver, Colorado 80206-4805, or at such other time and/or place as the parties may agree.

2.2 The Trust shall cause Janus Services LLC (the “Transfer Agent”), transfer agent of the Target Fund, to deliver at the Closing a certificate of an authorized officer stating that its records contain the names and addresses of the Current Shareholders and the number, class, and percentage ownership of outstanding shares of the Target Fund owned by each such shareholder immediately prior to the Closing. The Acquiring Fund shall issue and deliver a confirmation evidencing the Class D and T Acquiring Fund Shares to be credited on the Closing Date to the Secretary of the Trust or provide evidence satisfactory to the Trust that such Class D and T Acquiring Fund Shares have been credited to the accounts of the Target Fund on the books of the Acquiring Fund. At the Closing, each party shall deliver to the other such bills of sales, checks, assignments, share certificates, if any, receipts or other documents as such other party or its counsel may reasonably request.

3. REPRESENTATIONS AND WARRANTIES

3.1 The Trust, on behalf of the Target Fund, hereby represents and warrants to the Acquiring Fund as follows:

(i) the Trust is duly organized and existing under its Amended and Restated Agreement and Declaration of Trust (the “Declaration of Trust”) and the laws of the Commonwealth of Massachusetts as a voluntary association with transferable shares of beneficial interest commonly referred to as a “Massachusetts business trust;”

(ii) the Trust has full power and authority to execute, deliver and carry out the terms of this Agreement on behalf of the Target Fund;

(iii) the execution and delivery of this Agreement on behalf of the Target Fund and the consummation of the transactions contemplated hereby are duly authorized and no other proceedings on the part of the Trust or the shareholders of the Target Fund (other than as contemplated in paragraph 4.1(vii)) are necessary to authorize this Agreement and the transactions contemplated hereby;

(iv) this Agreement has been duly executed by the Trust on behalf of the Target Fund and constitutes its valid and binding obligation, enforceable in accordance with its terms, subject to applicable bankruptcy, reorganization, insolvency, moratorium and other rights affecting creditors’ rights generally, and general equitable principles;

(v) neither the execution and delivery of this Agreement by the Trust on behalf of the Target Fund, nor the consummation by the Trust on behalf of the Target Fund of the transactions contemplated hereby, will conflict with, result in a breach or violation of or constitute (or with notice, lapse of time or both) a breach of or default under, the Declaration of Trust or the Amended and Restated Bylaws of the Trust (“Bylaws”), as each may be amended, or any statute, regulation, order, judgment or decree, or any instrument, contract or other agreement to which the Trust is a party or by which the Trust or any of its assets is subject or bound;

2

(vi) if applicable, the unaudited statement of assets and liabilities of the Target Fund as of the Closing Date, determined in accordance with generally accepted accounting principles consistently applied from the prior audited period, accurately reflects all liabilities of the Target Fund as of the Closing Date;

(vii) no authorization, consent or approval of any governmental or other public body or authority or any other party is necessary (other than as contemplated in paragraph 4.1(vii)) for the execution and delivery of this Agreement by the Trust on behalf of the Target Fund or the consummation of any transactions contemplated hereby by the Trust, other than as shall be obtained at or prior to the Closing;

(viii) On the Closing Date, all Federal and other tax returns, dividend reporting forms, and other tax-related reports of the Target Fund required by law to have been filed by such date (including any extensions) shall have been filed and are or will be correct in all material respects, and all Federal and other taxes shown as due or required to be shown as due on said returns and reports shall have been paid or provision shall have been made for the payment thereof;

(ix) For each taxable year of its operation (including the taxable year ending on the Closing Date), the Target Fund: (i) has elected to qualify, and has qualified or will qualify (in the case of the short taxable year ending on the Closing Date), for taxation as a “regulated investment company” under the Code (a “RIC”); (ii) has been eligible to compute and has computed its federal income tax under Section 852 of the Code, and on or prior to the Closing Date will have declared and paid a distribution with respect to all its investment company taxable income (determined without regard to the deduction for dividends paid), the excess of its interest income excludible from gross income under Section 103(a) of the Code over its deductions disallowed under Sections 265 and 171(a)(2) of the Code and its net capital gain (as such terms are defined in the Code) in each case that has accrued or will accrue on or prior to the Closing Date; and (iii) has been, and will be (in the case of the short taxable year ending on the Closing Date), treated as a separate corporation for U.S. federal income tax purposes;

(x) Except as otherwise disclosed in writing to the Acquiring Fund, the Target Fund is in compliance in all material respects with the Internal Revenue Code (the “Code”) and applicable regulations promulgated under the Code pertaining to the reporting of dividends and other distributions on and redemptions of its capital stock and has withheld in respect of dividends and other distributions and paid to the proper taxing authority all taxes required to be withheld, and is not liable for any penalties with respect to such reporting and withholding requirements;

(xi) The Target Fund has not been granted any waiver, extension or comparable consent regarding the application of the statute of limitations with respect to any taxes or tax return that is outstanding, nor has any request for such waiver or consent been made;

(xii) The Target Fund does not own any “converted property” (as that term is defined in Treasury Regulation Section 1.337(d)-7(a)(1)) that is subject to the rules of Section 1374 of the Code as a consequence of the application of Section 337(d)(1) of the Code and Treasury Regulations thereunder;

(xiii) Except as otherwise disclosed to the Acquiring Fund, the Target Fund has not previously been a party to a transaction that qualified as reorganization under Section 368(a) of the Code; and

(xiv) The Target Fund has not received written notification from any tax authority that asserts a position contrary to any of the representations in (x) through (xvi) above.

3.2 The Trust, on behalf of the Acquiring Fund, hereby represents and warrants to the Target Fund as follows:

(i) the Trust is duly organized and existing under its Declaration of Trust and the laws of the Commonwealth of Massachusetts as a voluntary association with transferable shares of beneficial interest commonly referred to as a “Massachusetts business trust;”

3

(ii) the Trust has full power and authority to execute, deliver and carry out the terms of this Agreement on behalf of the Acquiring Fund;

(iii) the execution and delivery of this Agreement on behalf of the Acquiring Fund and the consummation of the transactions contemplated hereby are duly authorized and no other proceedings on the part of the Trust or the shareholders of the Acquiring Fund are necessary to authorize this Agreement and the transactions contemplated hereby;

(iv) this Agreement has been duly executed by the Trust on behalf of the Acquiring Fund and constitutes its valid and binding obligation, enforceable in accordance with its terms, subject to applicable bankruptcy, reorganization, insolvency, moratorium and other rights affecting creditors’ rights generally, and general equitable principles;

(v) neither the execution and delivery of this Agreement by the Trust on behalf of the Acquiring Fund, nor the consummation by the Trust on behalf of the Acquiring Fund of the transactions contemplated hereby, will conflict with, result in a breach or violation of or constitute (or with notice, lapse of time or both constitute) a breach of or default under, the Declaration of Trust or the Bylaws of the Trust, as each may be amended, or any statute, regulation, order, judgment or decree, or any instrument, contract or other agreement to which the Trust is a party or by which the Trust or any of its assets is subject or bound;

(vi) the net asset value per share of a Class D and T Acquiring Fund Share as of the close of regular session trading on the New York Stock Exchange on the Closing Date reflects all liabilities of the Acquiring Fund as of that time and date;

(vii) no authorization, consent or approval of any governmental or other public body or authority or any other party is necessary for the execution and delivery of this Agreement by the Trust on behalf of the Acquiring Fund or the consummation of any transactions contemplated hereby by the Trust, other than as shall be obtained at or prior to the Closing;

(viii) On the Closing Date, all Federal and other tax returns, dividend reporting forms, and other tax-related reports of the Acquiring Fund required by law to have been filed by such date (including any extensions) shall have been filed and are or will be correct in all material respects, and all Federal and other taxes shown as due or required to be shown as due on said returns and reports shall have been paid or provision shall have been made for the payment thereof; and

(ix) For each taxable year of its operation (including the taxable year that includes the Closing Date), the Acquiring Fund: (i) has elected or will elect to qualify, has qualified or will qualify (in the case of the year that includes the Closing Date) and intends to continue to qualify for taxation as a RIC under the Code; (ii) has been eligible to and has computed its federal income tax under Section 852 of the Code, and will do so for the taxable year that includes the Closing Date; and (iii) has been, and will be (in the case of the taxable year that includes the Closing Date), treated as a separate corporation for U.S. federal income tax purposes.

4. CONDITIONS PRECEDENT

4.1 The obligations of the Trust on behalf of the Target Fund and the Trust on behalf of the Acquiring Fund to effectuate the Reorganization shall be subject to the satisfaction of the following conditions with respect to such Reorganization:

(i) The Trust shall have filed with the Securities and Exchange Commission (the “Commission”) a registration statement on Form N-14 under the Securities Act of 1933, as amended (the “Securities Act”) and such amendment or amendments thereto as are determined by the Board of Trustees of the Trust and/or JCM to be necessary and appropriate to effect the registration of the Class D and T Acquiring Fund Shares (the “Registration Statement”), and the Registration Statement shall have become effective, and no stop-order suspending the effectiveness of the Registration Statement shall have been

4

issued, and no proceeding for that purpose shall have been initiated or threatened by the Commission (and not withdrawn or terminated);

(ii) Class D and T Acquiring Fund Shares shall have been duly qualified for offering to the public in all states in which such qualification is required for consummation of the transactions contemplated hereunder;

(iii) All representations and warranties of the Trust on behalf of the Target Fund contained in this Agreement shall be true and correct in all material respects as of the date hereof and as of the Closing, with the same force and effect as if then made, and the Trust on behalf of the Acquiring Fund shall have received a certificate of an officer of the Trust acting on behalf of the Target Fund to that effect in form and substance reasonably satisfactory to the Trust on behalf of the Acquiring Fund;

(iv) All representations and warranties of the Trust on behalf of the Acquiring Fund contained in this Agreement shall be true and correct in all material respects as of the date hereof and as of the Closing, with the same force and effect as if then made, and the Trust on behalf of the Target Fund shall have received a certificate of an officer of the Trust acting on behalf of the Acquiring Fund to that effect in form and substance reasonably satisfactory to the Trust on behalf of the Target Fund;

(v) The Acquiring Fund and Target Fund shall have received an opinion, dated as of the Closing Date, of Skadden, Arps, Slate, Meager and Flom LLP, substantially to the effect that for U.S. federal income tax purposes the Reorganization will constitute a “reorganization” within the meaning of Section 368(a) of the Code; notwithstanding anything herein to the contrary, the Trust may not waive the condition set forth in this paragraph;

(vi) The Target Fund shall have declared and paid a dividend prior to the Closing Time, which, together with all previous dividends, will have the effect of distributing to its shareholders all of the Target Fund’s investment company taxable income (within the meaning of Section 852(b)(2) of the Code, computed without regard to any deduction for dividends paid), if any, plus any excess of its interest income excludible from gross income under Section 103(a) of the Code over its deductions disallowed under Sections 265 and 171(a)(2) of the Code for all periods up to and including the Closing Date, and all of the Target Fund’s net capital gain (as defined in Section 1222(11) of the Code), if any, for the avoidance of doubt after reduction for any usable capital loss carryforwards, recognized in all periods up to and including the Closing Date; and

(vii) The shareholders of the Target Fund shall have approved this Agreement at a special meeting of its shareholders.

5. EXPENSES

JCM agrees that it will bear all costs and expenses of the Reorganization and transactions contemplated thereby; provided, however that the Acquiring Fund and the Target Fund will each pay any brokerage commissions, dealer mark-ups and similar expenses that they may incur in connection with the purchase or sale of portfolio securities.

6. ENTIRE AGREEMENT

The Trust agrees on behalf of each of the Target Fund and the Acquiring Fund that this Agreement constitutes the entire agreement between the parties.

7. TERMINATION

This Agreement and the transactions contemplated hereby may be terminated and abandoned by resolution of the Board of Trustees of the Trust at any time prior to the Closing Date, if circumstances should develop that, in the opinion of the Board of Trustees of the Trust, make proceeding with the Agreement inadvisable.

5

8. AMENDMENTS

This agreement may be amended, modified or supplemented in such manner as may be mutually agreed upon in writing by the parties.

9. NOTICES

Any notice, report, statement or demand required or permitted by any provisions of this Agreement shall be in writing and shall be given by prepaid telegraph, telecopy or certified mail addressed to the parties hereto at their principal place of business.

10. HEADINGS; COUNTERPARTS; GOVERNING LAW; ASSIGNMENT; LIMITATION OF LIABILITY

10.1 The Article and paragraph headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

10.2 This Agreement may be executed in any number of counterparts each of which shall be deemed an original.

10.3 This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts.

10.4 This Agreement shall bind and inure to the benefit of the parties hereto and their respective successors and assigns, but no assignment or transfer hereof or of any rights or obligations hereunder shall be made by any party without the written consent of the other party. Nothing herein expressed or implied is intended or shall be construed to confer upon or give any person, firm or corporation, other than the parties hereto and their respective successors and assigns, any rights or remedies under or by reason of this Agreement.

10.5 It is expressly agreed that the obligations of the Trust hereunder shall not be binding upon any of the Trustees, consultants, shareholders, nominees, officers, agents or employees of the Trust personally, but shall bind only the trust property of the Trust, as provided in the Declaration of Trust. The execution and delivery by such officers of the Trust shall not be deemed to have been made by any of them individually or to impose any liability on any of them personally, but shall bind only the trust property of the Trust as provided in the Declaration of Trust. The Trust is a series company with multiple series and has entered into this Agreement on behalf of each of the Target Fund and the Acquiring Fund.

10.6 The sole remedy of a party hereto for a breach of any representation or warranty made in this Agreement by the other party shall be an election by the non-breaching party not to complete the transactions contemplated herein.

6

IN WITNESS WHEREOF, the undersigned has caused this Agreement to be executed as of the date set forth above.

|

JANUS INVESTMENT FUND |

For and on behalf of the Acquiring Fund |

|

|

By: |

Title: |

|

JANUS INVESTMENT FUND |

For and on behalf of the Target Fund |

|

|

By: |

Title: |

|

JANUS CAPITAL MANAGEMENT, LLC |

|

|

By: |

Title: |

7

| | | |

| Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund online at janus.com/info. You can also get this information at no cost by calling a Janus representative at 1-877-335-2687 or by sending an email request to prospectusrequest@janus.com. | | [JANUS LOGO]

|

Summary Prospectus dated January 28, 2016

Janus Forty Fund

| | | | | | | | | | | | | | | | | | | |

| Ticker: | | JDCAX | | Class A Shares | | JARTX | | Class S Shares | | JFRNX | | Class N Shares | | JACTX | | Class T Shares | | |

| | | JACCX | | Class C Shares | | JCAPX | | Class I Shares | | JDCRX | | Class R Shares | | | | | | |

INVESTMENT OBJECTIVE

Janus Forty Fund seeks long-term growth of capital.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold Shares of the Fund. Each share class has different expenses, but represents an investment in the same Fund. For Class A Shares, you may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund or in other Janus mutual funds. More information about these and other discounts, as well as eligibility requirements for each share class, is available from your financial professional and in the “Purchases” section on page 94 of the Fund’s Prospectus and in the “Purchases” section on page 84 of the Fund’s Statement of Additional Information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SHAREHOLDER FEES

(fees paid directly from your investment) | | | | | | | Class A | | | | | | | | Class C | | | | | | | | Class S | | | | | | | | Class I | | | | | | | | Class N | | | | | | | | Class R | | | | | | | | Class T | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Maximum Sales Charge (load) Imposed on Purchases (as a percentage of offering price) | | | | | | | 5.75% | | | | | | | | None | | | | | | | | None | | | | | | | | None | | | | | | | | None | | | | | | | | None | | | | | | | | None | |

| Maximum Deferred Sales Charge (load) (as a percentage of the lower of original purchase price or redemption proceeds) | | | | | | | None | | | | | | | | 1.00% | | | | | | | | None | | | | | | | | None | | | | | | | | None | | | | | | | | None | | | | | | | | None | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment) | | | | | | | Class A | | | | | | | | Class C | | | | | | | | Class S | | | | | | | | Class I | | | | | | | | Class N | | | | | | | | Class R | | | | | | | | Class T | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Management Fees (may adjust up or down) | | | | | | | 0.65% | | | | | | | | 0.65% | | | | | | | | 0.65% | | | | | | | | 0.65% | | | | | | | | 0.65% | | | | | | | | 0.65% | | | | | | | | 0.65% | |

| Distribution/Service (12b-1) Fees | | | | | | | 0.25% | | | | | | | | 1.00% | | | | | | | | 0.25% | | | | | | | | None | | | | | | | | None | | | | | | | | 0.50% | | | | | | | | None | |

| Other Expenses | | | | | | | 0.15% | | | | | | | | 0.15% | | | | | | | | 0.29% | | | | | | | | 0.10% | | | | | | | | 0.04% | | | | | | | | 0.28% | | | | | | | | 0.30% | |

| Total Annual Fund Operating Expenses | | | | | | | 1.05% | | | | | | | | 1.80% | | | | | | | | 1.19% | | | | | | | | 0.75% | | | | | | | | 0.69% | | | | | | | | 1.43% | | | | | | | | 0.95% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EXAMPLE:

The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and reinvest all dividends and distributions. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | | | | |

| If Shares are redeemed: | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class A Shares | | $ | 676 | | | $ | 890 | | | $ | 1,121 | | | $ | 1,784 | |

| Class C Shares | | $ | 283 | | | $ | 566 | | | $ | 975 | | | $ | 2,116 | |

| Class S Shares | | $ | 121 | | | $ | 378 | | | $ | 654 | | | $ | 1,443 | |

| Class I Shares | | $ | 77 | | | $ | 240 | | | $ | 417 | | | $ | 930 | |

| Class N Shares | | $ | 70 | | | $ | 221 | | | $ | 384 | | | $ | 859 | |

| Class R Shares | | $ | 146 | | | $ | 452 | | | $ | 782 | | | $ | 1,713 | |

| Class T Shares | | $ | 97 | | | $ | 303 | | | $ | 525 | | | $ | 1,166 | |

1 ï Janus Forty Fund

| | | | | | | | | | | | | | | | | |

| If Shares are not redeemed: | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class A Shares | | $ | 676 | | | $ | 890 | | | $ | 1,121 | | | $ | 1,784 | |

| Class C Shares | | $ | 183 | | | $ | 566 | | | $ | 975 | | | $ | 2,116 | |

| Class S Shares | | $ | 121 | | | $ | 378 | | | $ | 654 | | | $ | 1,443 | |

| Class I Shares | | $ | 77 | | | $ | 240 | | | $ | 417 | | | $ | 930 | |

| Class N Shares | | $ | 70 | | | $ | 221 | | | $ | 384 | | | $ | 859 | |

| Class R Shares | | $ | 146 | | | $ | 452 | | | $ | 782 | | | $ | 1,713 | |

| Class T Shares | | $ | 97 | | | $ | 303 | | | $ | 525 | | | $ | 1,166 | |

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 49% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its investment objective by normally investing primarily in a core group of 20-40 common stocks selected for their growth potential. The Fund may invest in companies of any size, from larger, well-established companies to smaller, emerging growth companies. The Fund may also invest in foreign securities, which may include investments in emerging markets. As of September 30, 2015, the Fund held stocks of 38 companies. Of these holdings, 20 comprised approximately 65.23% of the Fund’s holdings.

The portfolio managers apply a “bottom up” approach in choosing investments. In other words, the portfolio managers look at companies one at a time to determine if a company is an attractive investment opportunity and if it is consistent with the Fund’s investment policies.

The Fund may lend portfolio securities on a short-term or long-term basis, in an amount equal to up to one-third of its total assets as determined at the time of the loan origination.

PRINCIPAL INVESTMENT RISKS

The biggest risk is that the Fund’s returns will vary, and you could lose money. The Fund is designed for long-term investors seeking an equity portfolio, including common stocks. Common stocks tend to be more volatile than many other investment choices.

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple companies or securities, in the portfolio decreases or if the portfolio managers’ belief about a company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole.

Growth Securities Risk. The Fund invests in companies after assessing their growth potential. Securities of companies perceived to be “growth” companies may be more volatile than other stocks and may involve special risks. If the portfolio managers’ perception of a company’s growth potential is not realized, the securities purchased may not perform as expected, reducing the Fund’s returns. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole and other types of securities.

Nondiversification Risk. The Fund is classified as nondiversified under the Investment Company Act of 1940, as amended. This gives the Fund’s portfolio managers more flexibility to hold larger positions in a smaller number of securities. As a result, an increase or decrease in the value of a single security held by the Fund may have a greater impact on the Fund’s net asset value and total return.

2 ï Janus Investment Fund

Foreign Exposure Risk. The Fund may have exposure to foreign markets as a result of its investments in foreign securities, including investments in emerging markets, which can be more volatile than the U.S. markets. As a result, its returns and net asset value may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in a particular country. In some foreign markets, there may not be protection against failure by other parties to complete transactions. It may not be possible for the Fund to repatriate capital, dividends, interest, and other income from a particular country or governmental entity. In addition, a market swing in one or more countries or regions where the Fund has invested a significant amount of its assets may have a greater effect on the Fund’s performance than it would in a more geographically diversified portfolio. To the extent the Fund invests in foreign debt securities, such investments are sensitive to changes in interest rates. Additionally, investments in securities of foreign governments involve the risk that a foreign government may not be willing or able to pay interest or repay principal when due. The Fund’s investments in emerging market countries may involve risks greater than, or in addition to, the risks of investing in more developed countries.

Securities Lending Risk. The Fund may seek to earn additional income through lending its securities to certain qualified broker-dealers and institutions. There is the risk that when portfolio securities are lent, the securities may not be returned on a timely basis, and the Fund may experience delays and costs in recovering the security or gaining access to the collateral provided to the Fund to collateralize the loan. If the Fund is unable to recover a security on loan, the Fund may use the collateral to purchase replacement securities in the market. There is a risk that the value of the collateral could decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Fund.

Management Risk. The Fund is an actively managed investment portfolio and is therefore subject to the risk that the investment strategies employed for the Fund may fail to produce the intended results. The Fund may underperform its benchmark index or other mutual funds with similar investment objectives.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

PERFORMANCE INFORMATION

The following information provides some indication of the risks of investing in the Fund by showing how the Fund’s performance has varied over time. Class S Shares, Class A Shares, Class C Shares, Class I Shares, and Class R Shares of the Fund commenced operations on July 6, 2009, after the reorganization of each corresponding class of shares of Janus Adviser Forty Fund (“JAD predecessor fund”) into each respective share class of the Fund. Class T Shares of the Fund commenced operations on July 6, 2009. Class N Shares of the Fund commenced operations on May 31, 2012.

| |

| • | The performance shown for Class S Shares reflects the performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares) from August 1, 2000 to July 6, 2009 (prior to the reorganization), calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, net of any applicable fee and expense limitations or waivers. For the periods prior to August 1, 2000, the performance shown for Class S Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of those Retirement Shares into the JAD predecessor fund). The performance shown for certain periods prior to August 1, 2000 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. |

| • | The performance shown for Class A Shares reflects the performance of the JAD predecessor fund’s Class A Shares from September 30, 2004 to July 6, 2009 (prior to the reorganization), calculated using the fees and expenses of Class A Shares of the JAD predecessor fund, net of any applicable fee and expense limitations or waivers. For the periods August 1, 2000 to September 30, 2004, the performance shown for Class A Shares reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares). For the periods prior to August 1, 2000, the performance shown for Class A Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of those Retirement Shares into the JAD predecessor fund). The performance shown for certain periods prior to September 30, 2004 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. |

| • | The performance shown for Class C Shares reflects the performance of the JAD predecessor fund’s Class C Shares from September 30, 2002 to July 6, 2009 (prior to the reorganization), calculated using the fees and expenses of Class C Shares of the JAD predecessor fund, net of any applicable fee and expense limitations or waivers. For the periods August 1, 2000 to September 30, 2002, the performance shown for Class C Shares reflects the historical performance of the JAD |

3 ï Janus Forty Fund

| |

| predecessor fund’s Class S Shares (formerly named Class I Shares). For the periods prior to August 1, 2000, the performance shown for Class C Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of those Retirement Shares into the JAD predecessor fund). The performance shown for certain periods prior to September 30, 2002 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. |

| |

| • | The performance shown for Class I Shares reflects the performance of the JAD predecessor fund’s Class I Shares from November 28, 2005 to July 6, 2009 (prior to the reorganization), calculated using the fees and expenses of Class I Shares of the JAD predecessor fund, net of any applicable fee and expense limitations or waivers. For the periods August 1, 2000 to November 28, 2005, the performance shown for Class I Shares reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares). For the periods prior to August 1, 2000, the performance shown for Class I Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of those Retirement Shares into the JAD predecessor fund). The performance shown for certain periods prior to November 28, 2005 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. |

| • | The performance shown for Class N Shares reflects the performance of the Fund’s Class S Shares from July 6, 2009 to May 31, 2012, calculated using the fees and expenses of Class S Shares, net of any applicable fee and expense limitations or waivers. For the period from August 1, 2000 to July 6, 2009, the performance shown for Class N Shares reflects the performance of Class S Shares (formerly named Class I Shares) of the JAD predecessor fund (prior to the reorganization of those Class S Shares into the Fund), calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, net of any applicable fee and expense limitations or waivers. For the periods prior to August 1, 2000, the performance shown for Class N Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of those Retirement Shares into the JAD predecessor fund). The performance for certain periods prior to August 1, 2000 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. |

| • | The performance shown for Class R Shares reflects the performance of the JAD predecessor fund’s Class R Shares from September 30, 2004 to July 6, 2009 (prior to the reorganization), calculated using the fees and expenses of Class R Shares of the JAD predecessor fund, net of any applicable fee and expense limitations or waivers. For the periods August 1, 2000 to September 30, 2004, the performance shown for Class R Shares reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares). For the periods prior to August 1, 2000, the performance shown for Class R Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of those Retirement Shares into the JAD predecessor fund). The performance shown for certain periods prior to September 30, 2004 was calculated using the fees and expenses of Class R Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. |

| • | The performance shown for Class T Shares reflects the performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares) from August 1, 2000 to July 6, 2009 (prior to the reorganization), calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, net of any applicable fee and expense limitations or waivers. For the periods prior to August 1, 2000, the performance shown for Class T Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of those Retirement Shares into the JAD predecessor fund). The performance shown for certain periods prior to August 1, 2000 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. |

If Class A Shares, Class C Shares, Class I Shares, Class R Shares, and Class T Shares of the Fund had been available during each period prior to July 6, 2009, or Class N Shares of the Fund had been available during periods prior to May 31, 2012, the performance shown for each respective share class may have been different. The performance shown for periods following the Fund’s commencement of Class S Shares, Class A Shares, Class C Shares, Class I Shares, Class N Shares, Class R Shares, and Class T Shares reflects the fees and expenses of each respective share class, net of any applicable fee and expense limitations or waivers.

The bar chart depicts the change in performance from year to year during the periods indicated. The bar chart figures do not include any applicable sales charges that an investor may pay when they buy or sell Class A Shares or Class C Shares of the Fund. If sales charges were included, the returns would be lower. The table compares the Fund’s average annual returns for the periods indicated to broad-based securities market indices. The indices are not actively managed and are not available for direct investment. All figures assume reinvestment of dividends and distributions. For certain periods, the Fund’s performance

4 ï Janus Investment Fund

reflects the effect of expense waivers. Without the effect of these expense waivers, the performance shown would have been lower.

The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Updated performance information is available at janus.com/advisor/mutual-funds or by calling 1-877-335-2687.

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Annual Total Returns for Class S Shares (calendar year-end) |

| | | | | | | | | | | | | | | | | | | |

| 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 |

10.18% | | 35.57% | | −44.02% | | 43.53% | | 5.62% | | −7.32% | | 23.65% | | 31.73% | | 8.57% | | 11.75% |

| | | | | | | | | | | | | | | | | | | |

Best Quarter: 2nd Quarter 2009 20.90% Worst Quarter: 4th Quarter 2008 −25.11% |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 12/31/15) |

| | | | 1 Year | | | | 5 Years | | | | 10 Years | | | | Since

Inception

of Predecessor Fund

(5/1/97) | |

Class S Shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Return Before Taxes | | | 11.75% | | | | 12.86% | | | | 8.79% | | | | 10.78% | |

| | | | | | | | | | | | | | | | | |

| Return After Taxes on Distributions | | | 8.11% | | | | 9.21% | | | | 6.87% | | | | 9.70% | |

| | | | | | | | | | | | | | | | | |

Return After Taxes on Distributions and Sale of Fund Shares(1) | | | 9.67% | | | | 9.90% | | | | 6.98% | | | | 9.28% | |

| | | | | | | | | | | | | | | | | |

Russell 1000® Growth Index | | | 5.67% | | | | 13.53% | | | | 8.53% | | | | 6.61% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S&P 500® Index | | | 1.38% | | | | 12.57% | | | | 7.31% | | | | 7.13% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Class A Shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Return Before Taxes(2) | | | 5.40% | | | | 11.63% | | | | 8.31% | | | | 10.54% | |

| | | | | | | | | | | | | | | | | |

Russell 1000® Growth Index | | | 5.67% | | | | 13.53% | | | | 8.53% | | | | 6.61% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S&P 500® Index | | | 1.38% | | | | 12.57% | | | | 7.31% | | | | 7.13% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Class C Shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Return Before Taxes(3) | | | 10.48% | | | | 12.16% | | | | 8.16% | | | | 10.20% | |

| | | | | | | | | | | | | | | | | |

Russell 1000® Growth Index | | | 5.67% | | | | 13.53% | | | | 8.53% | | | | 6.61% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S&P 500® Index | | | 1.38% | | | | 12.57% | | | | 7.31% | | | | 7.13% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Class I Shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Return Before Taxes | | | 12.20% | | | | 13.28% | | | | 9.25% | | | | 10.78% | |

| | | | | | | | | | | | | | | | | |

Russell 1000® Growth Index | | | 5.67% | | | | 13.53% | | | | 8.53% | | | | 6.61% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S&P 500® Index | | | 1.38% | | | | 12.57% | | | | 7.31% | | | | 7.13% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

5 ï Janus Forty Fund

| | | | | | | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 12/31/15) |

| | | | 1 Year | | | | 5 Years | | | | 10 Years | | | | Since

Inception

of Predecessor Fund

(5/1/97) | |

| | | | | | | | | | | | | | | | | |

Class N Shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Return Before Taxes | | | 12.22% | | | | 12.86% | | | | 8.79% | | | | 10.78% | |

| | | | | | | | | | | | | | | | | |

Russell 1000® Growth Index | | | 5.67% | | | | 13.53% | | | | 8.53% | | | | 6.61% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S&P 500® Index | | | 1.38% | | | | 12.57% | | | | 7.31% | | | | 7.13% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Class R Shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Return Before Taxes | | | 11.45% | | | | 12.54% | | | | 8.49% | | | | 10.52% | |

| | | | | | | | | | | | | | | | | |

Russell 1000® Growth Index | | | 5.67% | | | | 13.53% | | | | 8.53% | | | | 6.61% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S&P 500® Index | | | 1.38% | | | | 12.57% | | | | 7.31% | | | | 7.13% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Class T Shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Return Before Taxes | | | 12.00% | | | | 13.11% | | | | 8.79% | | | | 10.78% | |

| | | | | | | | | | | | | | | | | |

Russell 1000® Growth Index | | | 5.67% | | | | 13.53% | | | | 8.53% | | | | 6.61% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S&P 500® Index | | | 1.38% | | | | 12.57% | | | | 7.31% | | | | 7.13% | |

| (reflects no deduction for expenses, fees, or taxes) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| |

| (1) | If the Fund incurs a loss, which generates a tax benefit, the Return After Taxes on Distributions and Sale of Fund Shares may exceed the Fund’s other return figures. |

| (2) | Calculated assuming maximum permitted sales loads. |

| (3) | The one year return is calculated to include the contingent deferred sales charge. |

The Fund’s primary benchmark index is the Russell 1000® Growth Index. The Fund also compares its performance to the S&P 500® Index. The Russell 1000® Growth Index is used to calculate the Fund’s performance fee adjustment. The indices are described below.

| |

| • | The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. |

| |

| • | The S&P 500® Index is a commonly recognized, market-capitalization weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance. |

After-tax returns are calculated using distributions for the Fund’s Class S Shares for periods following July 6, 2009; for the JAD predecessor fund’s Class S Shares (formerly named Class I Shares) for the periods August 1, 2000 to July 6, 2009; and actual distributions for other classes of shares for periods prior to August 1, 2000. After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your individual tax situation and may differ from those shown in the preceding table. The after-tax return information shown above does not apply to Fund shares held through a tax-deferred account, such as a 401(k) plan or an IRA.

After-tax returns are only shown for Class S Shares of the Fund. After-tax returns for the other classes of Shares will vary from those shown for Class S Shares due to varying sales charges (as applicable), fees, and expenses among the classes.

6 ï Janus Investment Fund

MANAGEMENT

Investment Adviser: Janus Capital Management LLC

Portfolio Managers: A. Douglas Rao is Executive Vice President and Co-Portfolio Manager of the Fund, which he has managed or co-managed since June 2013. Nick Schommer, CFA, is Co-Portfolio Manager of the Fund, which he has co-managed since January 2016.

PURCHASE AND SALE OF FUND SHARES

Minimum Investment Requirements*

| | | | |

| Class A Shares, Class C Shares**, Class S Shares, Class R Shares, and Class T Shares |

| Non-retirement accounts | | $ | 2,500 |

| | | | |

| Certain tax-deferred accounts or UGMA/UTMA accounts | | $ | 500 |

| | | | |

Class I Shares |

| | | | |

| Institutional investors (investing directly with Janus) | | $ | 1,000,000 |

| | | | |

| Through an intermediary institution | | | |

| • non-retirement accounts | | $ | 2,500 |

• certain tax-deferred accounts or UGMA/UTMA accounts | | $ | 500 |

| | | | |

Class N Shares |

| | | | |

| No minimum investment requirements imposed by the Fund | | | None |

| | | | |

| |

| * | Exceptions to these minimums may apply for certain tax-deferred, tax-qualified and retirement plans, and accounts held through certain wrap programs. |

| ** | The maximum purchase in Class C Shares is $500,000 for any single purchase. |

Purchases, exchanges, and redemptions can generally be made only through institutional channels, such as financial intermediaries and retirement platforms. Class I Shares may be purchased directly by certain institutional investors. You should contact your financial intermediary or refer to your plan documents for information on how to invest in the Fund. Requests must be received in good order by the Fund or its agents (financial intermediary or plan sponsor, if applicable) prior to the close of the regular trading session of the New York Stock Exchange in order to receive that day’s net asset value. For additional information, refer to “Purchases,” “Exchanges,” and/or “Redemptions” in the Prospectus.

TAX INFORMATION

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account (in which case you may be taxed upon withdrawal of your investment from such account).

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Class A Shares, Class C Shares, Class S Shares, Class I Shares, Class R Shares, or Class T Shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment or to recommend one share class over another. Ask your salesperson or visit your financial intermediary’s website for more information.

7 ï Janus Forty Fund

| | | | |

| | | |

| | | ANNUAL REPORT September 30, 2016 |

| | |

| | Janus Forty Fund |

| | |

| | Janus Investment Fund |

| | | |

| | | HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics

and holdings |

| | | |

| | |

|

Table of Contents

Janus Forty Fund

| | |

Management Commentary and Schedule of Investments | 1 |

Notes to Schedule of Investments and Other Information | 11 |

Statement of Assets and Liabilities | 12 |

Statement of Operations | 14 |

Statements of Changes in Net Assets | 15 |

Financial Highlights | 16 |

Notes to Financial Statements | 20 |

Report of Independent Registered Public Accounting Firm | 31 |

Additional Information | 32 |

Useful Information About Your Fund Report | 44 |

Shareholder Meeting | 47 |

Designation Requirements | 48 |

Trustees and Officers | 49 |

Janus Forty Fund (unaudited)

| | | | | | |

FUND SNAPSHOT We believe that constructing a concentrated portfolio of quality growth companies will allow us to outperform our benchmark over time. We define quality as companies that enjoy sustainable “moats” around their businesses, potentially allowing companies to grow faster, with higher returns than their competitors. We believe the market often underestimates these companies’ sustainable competitive advantage periods. | | | |

Doug Rao co-portfolio manager |

Nick Schommer co-portfolio manager |

| | | |

PERFORMANCE OVERVIEW

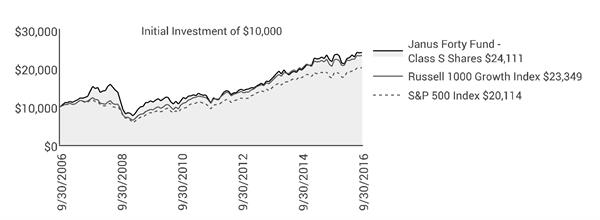

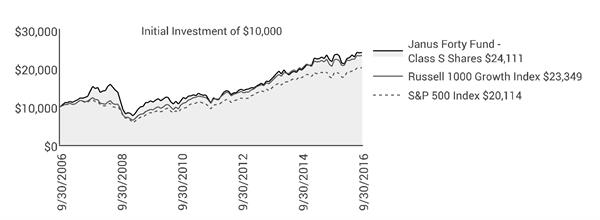

For the one-year period ended September 30, 2016, Janus Forty Fund’s Class S Shares returned 11.15% versus a return of 13.76% for the Fund’s primary benchmark, the Russell 1000 Growth Index. The Fund’s secondary benchmark, the S&P 500 Index, returned 15.43% for the period.

INVESTMENT ENVIRONMENT

A series of concerns about economic growth and geopolitics were not enough to keep stocks from registering solid gains. Early in the period, stocks continued their recovery from the summer of 2015 correction. Later, investors largely took the Federal Reserve’s (Fed) first interest rate hike in a decade in stride. However, volatility returned in early 2016 as concerns about global growth re-emerged. Once again, the culprit was worse-than-expected data out of China, joined by a soft patch of U.S. data. Investors also were fearful that decade-low crude oil prices may have been indicative of slowing global demand rather than excess North American production. Improving data enabled stocks to recover during the spring, but that ended with the UK’s surprise decision to leave the European Union. During the summer, stocks again proved resilient, driven, in part, by solid employment data and the expectation that the Fed would forgo a September interest rate hike.

PERFORMANCE DISCUSSION

As part of our investment strategy, we seek companies that have built clear, sustainable, competitive moats around their businesses, which should help them grow market share within their respective industries over time. Important competitive advantages could include a strong brand, network effects from a product or service that would be hard for a competitor to replicate, a lower cost structure than competitors in the industry, a distribution advantage or patent protection over valuable intellectual property. We think emphasizing these sustainable competitive advantages can be a meaningful driver of outperformance over longer time horizons because the market often underestimates the duration of growth for these companies and the long-term potential return to shareholders. While we held some stocks that detracted from performance this period, we remain excited about the long-term growth potential of the companies in our portfolio.

Chipotle Mexican Grill was our largest detractor. The company’s shares declined after news about food-borne illnesses tied to some of its stores. It has been hard for Chipotle to re-establish its reputation for food integrity since then, and we sold the stock due to those concerns.

Another detractor from performance was Valeant Pharmaceuticals. We trimmed our holdings prior to the period amid the media attention surrounding the industry’s drug pricing practices. When news about Valeant’s specific pricing practices came to light, we exited our position. We felt the level of uncertainty surrounding the company’s business practices and the lack of visibility created too high a risk for a position in a high-conviction portfolio.

Norwegian Cruise Line was a leading detractor during the period. The stock traded down as geopolitical concerns in Europe weighed on the willingness of North American tourists to book cruises to the region. Over the long term, however, we remain encouraged by Norwegian’s potential. We appreciate the company’s position in the market, and believe industry dynamics are setting up an environment for improving returns on invested capital for cruise lines. Increased cruise demand from China and new routes such as Cuba also offer growth potential.

While some stocks negatively affected performance, we are pleased with the performance of a number of our positions. Amazon was a leading contributor. Increasing profitability in its core retail business and growth in Amazon Web Services have helped drive the stock during

Janus Forty Fund (unaudited)

the period. We believe Amazon is a good example of the types of competitively advantaged companies we tend to seek in our portfolio. Amazon has already rewritten the rules for retail shopping and we believe it will continue to gain consumers’ wallet share as more shopping moves from physical stores to online and mobile purchases. Meanwhile, Amazon Web Services is revolutionizing the way companies utilize IT services, using its scale to offer a disruptive pricing model to businesses seeking IT functions in the cloud.

Alphabet, the parent company of Google, was another top contributor. The company continues to benefit from strong growth in its mobile search business and also its YouTube platform. We believe there are powerful network effects around Alphabet’s advertising business and its Android operating system. As mobile users turn to their devices more frequently, it enables Google to better understand users’ context and intent. This in turn improves the value proposition Google offers both consumers and advertisers. We believe these advantages will make Alphabet a key beneficiary as more advertising transitions from offline channels such as print and television to mobile and online video channels, which are more measurable.

Medical device maker Boston Scientific was another leading contributor to performance. During the second quarter, the company reported stronger-than-expected earnings per share, and the pace of organic sales growth was the highest reported in more than a decade. Results were especially strong in the company’s interventional cardiology unit, as well as in urology and neuromodulation. Margin performance was also impressive. Earlier in the year at the American College of Cardiology conference, strong data for transcatheter aortic valve replacement (TAVR) devices in intermediate risk patients led many to raise their estimates of the long-term market potential. Boston Scientific is the number three player in the TAVR market and stands to benefit from wider acceptance of these devices.

OUTLOOK

In the near term, we expect heightened market volatility heading into the U.S. elections. We also expect continued modest U.S. and global economic growth. Despite that outlook, we continue to like the long-term growth potential of the companies in our portfolio. Many of these companies are tied to secular growth themes: the shift from offline to online spending, the shift of enterprise software from on-premise data centers to the cloud, a proliferation of connected devices in the home and business, and a growing global middle class, to name just a few. Those trends should push forward even if broader economic growth remains challenging. Just as important, we believe the companies we own have built competitive moats around their businesses that uniquely position them to be key beneficiaries of these trends or pivotal players driving them forward. In the coming months, we’ll look past the near-term volatility that is likely, and instead focus on the long-term growth we believe lies ahead as these trends push forward.

Thank you for your investment in Janus Forty Fund.

Janus Forty Fund (unaudited)

Fund At A Glance

September 30, 2016

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | 5 Top Performers Holdings | | | | 5 Bottom Performers - Holdings | |

| | | | Contribution | | | Contribution |

| | Amazon.com Inc | | 2.35% | | Chipotle Mexican Grill Inc | -1.51% |

| | Alphabet Inc - Class C | | 1.39% | | Norwegian Cruise Line Holdings Ltd | -0.88% |

| | Boston Scientific Corp | | 1.12% | | Valeant Pharmaceuticals International Inc | -0.82% |

| | Zoetis Inc | | 1.03% | | Advance Auto Parts Inc | -0.63% |

| | Adobe Systems Inc | | 1.01% | | Synchrony Financial | -0.30% |

| | | | | | | |

| | 5 Top Performers - Sectors* | | | | | |

| | | | | | Fund Weighting | Russell 1000 Growth Index |

| | | | Fund Contribution | | (Average % of Equity) | Weighting |

| | Information Technology | | 0.93% | | 28.93% | 28.61% |

| | Health Care | | 0.68% | | 17.20% | 16.56% |

| | Industrials | | 0.24% | | 8.67% | 10.83% |

| | Materials | | 0.21% | | 3.09% | 3.55% |

| | Financials | | 0.13% | | 12.42% | 5.34% |

| | | | | | | |

| | 5 Bottom Performers - Sectors* | | | | | |

| | | | | | Fund Weighting | Russell 1000 Growth Index |

| | | | Fund Contribution | | (Average % of Equity) | Weighting |

| | Consumer Discretionary | | -2.39% | | 24.30% | 21.12% |

| | Other** | | -0.58% | | 3.10% | 0.00% |

| | Telecommunication Services | | -0.38% | | 0.00% | 1.96% |

| | Consumer Staples | | -0.33% | | 2.08% | 11.16% |

| | Utilities | | 0.00% | | 0.00% | 0.05% |

| | | | | | | |

| | Security contribution to performance is measured by using an algorithm that multiplies the daily performance of each security with the previous day’s ending weight in the portfolio and is gross of advisory fees. Fixed income securities and certain equity securities, such as private placements and some share classes of equity securities, are excluded. |

* | Based on sector classification according to the Global Industry Classification Standard (“GICS”) codes, which are the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

** | Not a GICS classified sector. | | | | | |

Janus Forty Fund (unaudited)

Fund At A Glance

September 30, 2016

| | |

5 Largest Equity Holdings - (% of Net Assets) |

Amazon.com Inc | |

Internet & Direct Marketing Retail | 5.9% |

Alphabet Inc - Class C | |

Internet Software & Services | 5.7% |

Zoetis Inc | |

Pharmaceuticals | 5.3% |

General Electric Co | |

Industrial Conglomerates | 4.9% |

MasterCard Inc | |

Information Technology Services | 4.6% |

| | 26.4% |

| | | | | | |

Asset Allocation - (% of Net Assets) |

Common Stocks | | 96.1% |

Investment Companies | | 4.1% |

Other | | (0.2)% |

| | | 100.0% |

| | |

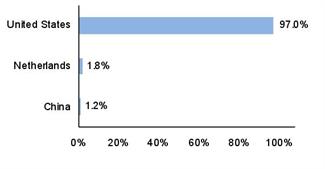

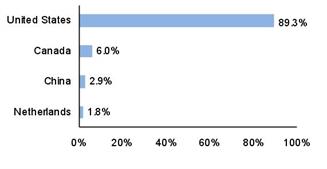

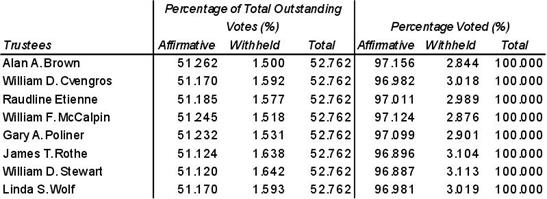

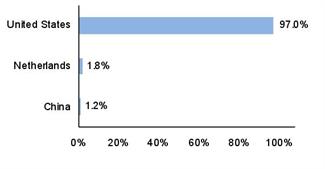

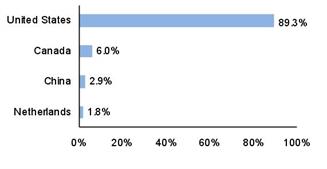

Top Country Allocations - Long Positions - (% of Investment Securities) |

As of September 30, 2016

| As of September 30, 2015

|

Janus Forty Fund (unaudited)

Performance

| |

See important disclosures on the next page. |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | Expense Ratios - |

Average Annual Total Return - for the periods ended September 30, 2016 | | | per the January 28, 2016 prospectus |

| | One

Year | Five

Year | Ten

Year | Since

Inception* | | | Total Annual Fund

Operating Expenses |

Class A Shares at NAV | | 11.36% | 17.14% | 9.36% | 10.53% | | | 1.05% |

Class A Shares at MOP | | 4.95% | 15.76% | 8.72% | 10.31% | | | |

Class C Shares at NAV | | 10.72% | 16.37% | 8.58% | 9.96% | | | 1.80% |

Class C Shares at CDSC | | 9.78% | 16.37% | 8.58% | 9.96% | | | |

Class I Shares | | 11.67% | 17.50% | 9.67% | 10.53% | | | 0.75% |

Class N Shares | | 11.73% | 17.07% | 9.20% | 10.53% | | | 0.69% |

Class R Shares | | 10.88% | 16.72% | 8.90% | 10.27% | | | 1.43% |

Class S Shares | | 11.15% | 17.07% | 9.20% | 10.53% | | | 1.19% |

Class T Shares | | 11.43% | 17.32% | 9.20% | 10.53% | | | 0.95% |

Russell 1000 Growth Index | | 13.76% | 16.60% | 8.85% | 6.66% | | | |

S&P 500 Index | | 15.43% | 16.37% | 7.24% | 7.26% | | | |

Morningstar Quartile - Class S Shares | | 2nd | 1st | 1st | 1st | | | |

Morningstar Ranking - based on total returns for Large Growth Funds | | 717/1,677 | 175/1,503 | 161/1,307 | 29/720 | | | |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 877.33JANUS(52687) or visit janus.com/advisor/mutual-funds.

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

Janus Forty Fund (unaudited)

Performance

This Fund has a performance-based management fee that may adjust up or down based on the Fund’s performance.

A Fund’s performance may be affected by risks that include those associated with nondiversification, non-investment grade debt securities, high-yield/high-risk securities, undervalued or overlooked companies, investments in specific industries or countries and potential conflicts of interest. Additional risks to a Fund may also include, but are not limited to, those associated with investing in foreign securities, emerging markets, initial public offerings, real estate investment trusts (REITs), derivatives, short sales, commodity-linked investments and companies with relatively small market capitalizations. Each Fund has different risks. Please see a Janus prospectus for more information about risks, Fund holdings and other details.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

See Financial Highlights for actual expense ratios during the reporting period.

Class A Shares, Class C Shares, Class I Shares, Class R Shares, and Class S Shares commenced operations on July 6, 2009 after the reorganization of each class of Janus Adviser Forty Fund (the “JAD predecessor fund”) into corresponding shares of the Fund.

Performance shown for Class S Shares reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares) from August 1, 2000 to July 6, 2009, calculated using the fees and expenses of the JAD predecessor fund’s Class S Shares, net of any applicable fee and expense limitations or waivers. For the periods prior to August 1, 2000, the performance shown for Class S Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization of the Retirement Shares into the JAD predecessor fund). Performance shown for certain periods prior to August 1, 2000 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers.

Performance shown for Class C Shares reflects the historical performance of the JAD predecessor fund’s Class C Shares from September 30, 2002 to July 6, 2009, calculated using the fees and expenses of the JAD predecessor fund’s Class C Shares, net of any applicable fee and expense limitations or waivers. For the periods August 1, 2000 to September 30, 2002, the performance shown for Class C Shares reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares). For the periods prior to August 1, 2000, the performance shown for Class C Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization). Performance shown for certain periods prior to September 30, 2002 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitation or waivers.

Performance shown for Class A Shares and Class R Shares reflects the historical performance of each corresponding class of the JAD predecessor fund from September 30, 2004 to July 6, 2009, calculated using the fees and expenses of the corresponding class of the JAD predecessor fund respectively, net of any applicable fee and expense limitations or waivers. Performance shown for each class for the periods August 1, 2000 to September 30, 2004 reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares). Performance shown for each class for the periods prior to August 1, 2000 reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization). Performance shown for Class A Shares for certain periods prior to September 30, 2004 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers. Performance shown for Class R Shares for certain periods prior to September 30, 2004 was calculated using the fees and expenses of Class R Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers.

Performance shown for Class I Shares reflects the historical performance of the JAD predecessor fund’s Class I Shares from November 28, 2005 to July 6, 2009, calculated using the fees and expenses of the JAD predecessor fund’s Class I Shares, net of any applicable fee and expense limitations or waivers. For the periods August 1, 2000 to November 28, 2005, the performance shown for Class I Shares reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares). For the periods prior to August 1, 2000, the performance shown for Class I Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization). Performance shown for certain periods prior to November 28, 2005 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers.

Class T Shares commenced operations on July 6, 2009. Performance shown for Class T Shares reflects the historical performance of the JAD predecessor fund’s Class S Shares (formerly named Class I Shares) from August 1, 2000 to July 6, 2009, calculated using the fees and expenses of the JAD predecessor fund’s Class S Shares, net of any applicable fee and expense limitations or waivers. For the periods prior to August 1, 2000, the performance shown for Class T Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization). Performance shown for certain periods prior to August 1, 2000 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers.

Class N Shares commenced operations on May 31, 2012. Performance shown for Class N Shares reflects the performance of the Fund’s Class S Shares from July 6, 2009 to May 31, 2012, calculated using the fees and expenses of Class S Shares, net of any applicable fee and expense limitations or waivers. For the periods August 1, 2000 to July 6, 2009, the performance shown for Class N Shares reflects the performance of Class S Shares (formerly named Class I Shares) of the JAD predecessor fund (prior to the reorganization), calculated using the fees and expenses of the JAD predecessor fund’s Class S Shares, net of any applicable fee and expense limitations or waivers. For the periods prior to August 1, 2000, the performance shown for Class N Shares reflects the historical performance of the Retirement Shares of Janus Aspen Series – Forty Portfolio (as a result of a separate prior reorganization). Performance shown for certain periods prior to August 1, 2000 was calculated using the fees and expenses of Class S Shares of the JAD predecessor fund, without the effect of any fee and expense limitations or waivers.

If each share class of the Fund had been available during periods prior to its commencement, the performance shown may have been different. The performance shown for periods following the Fund's commencement of each share class reflects the fees and expenses of each respective share class, net of any applicable fee and expense limitations or waivers. Please refer to the Fund's prospectus for further details concerning historical performance.

Janus Forty Fund (unaudited)

Performance

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2016 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

A Fund’s portfolio may differ significantly from the securities held in an index. An index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

See “Useful Information About Your Fund Report.”

Effective January 12, 2016, Douglas Rao and Nick Schommer are Co-Portfolio Managers of the Fund.

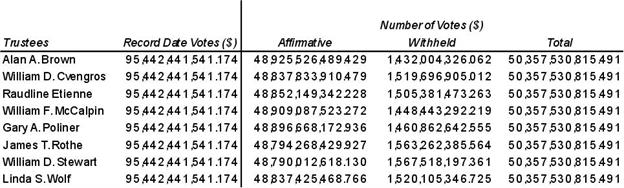

*The predecessor Fund’s inception date - May 1, 1997