Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Schedule 14(a) of the

Securities and Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

Janus Investment Fund

(Exact Name of Registrant as Specified in Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

|

January 20, 2017

Dear Shareholder:

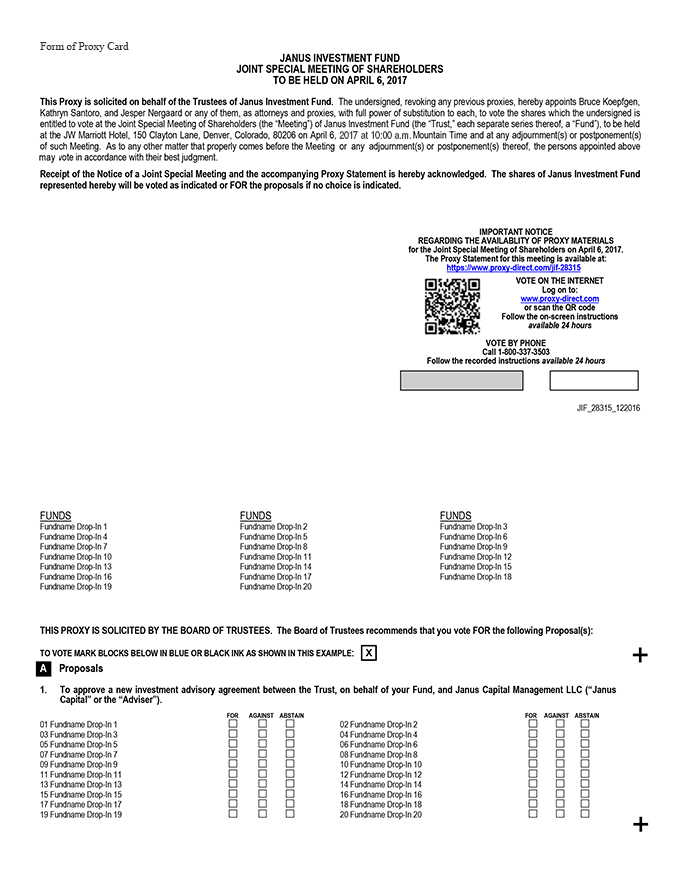

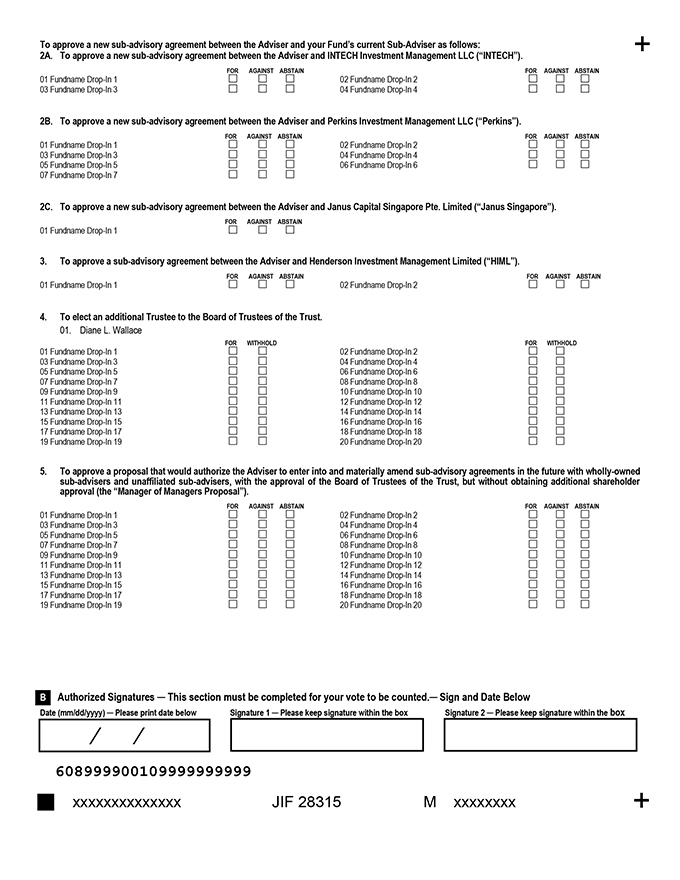

Recently, Janus Capital Group Inc. (“Janus”), the parent company of Janus Capital Management LLC (“Janus Capital”), your fund’s investment adviser, and Henderson Group plc (“Henderson”) entered into an Agreement and Plan of Merger pursuant to which Janus and Henderson have agreed to effect anall-stock merger of equals strategic combination of their respective businesses, with Janus Capital surviving the merger as a direct wholly-owned subsidiary of Henderson (the “Transaction”). Subject to certain conditions, the Transaction is currently expected to close during the second quarter of 2017. The closing may be deemed to cause an “assignment” of the current advisory agreements between Janus Capital and the Janus mutual funds, and anysub-advisory agreements entered into by Janus Capital, which would cause such agreements to terminate.

In order to provide continuity of advisory services for your fund after the closing of the Transaction, the Board of Trustees for your fund is requesting that you vote on proposals (i) to approve a new investment advisory agreement between Janus Capital and your fund to permit Janus Capital to continue to serve as investment adviser to the fund following the Transaction; and (ii) to the extent applicable to your fund, to approve a new investmentsub-advisory agreement between Janus Capital and your fund’s currentsub-adviser to permit suchsub-adviser to continue to manage the fund following the Transaction.

In addition, for Janus Asia Equity Fund and Janus Global Real Estate Fund, the Board of Trustees is requesting that you vote on a proposal to approve a newsub-advisory agreement between Janus Capital and Henderson Investment Management Limited, a subsidiary of Henderson, to become effective upon the closing of the Transaction.

The Board of Trustees is also requesting that you vote on a proposal to elect an additional trustee to serve on the Board of Trustees, to take effect upon the closing of the Transaction.

Finally, the Board of Trustees is also requesting that you vote on a proposal to authorize Janus Capital to enter into and materially amendsub-advisory agreements in the future with wholly-ownedsub-advisers and unaffiliatedsub-advisers, with the approval of the Board of Trustees, but without obtaining additional shareholder approval. This proposal is presented for approval by those funds that do not already provide this flexibility to Janus Capital.

The proposals will be presented to shareholders at a joint Special Meeting of Shareholders to be held on April 6, 2017. The proposals are briefly summarized in the synopsis that precedes the enclosed joint proxy statement (the “Proxy Statement”). The Proxy Statement includes a detailed discussion of the proposals, which you should read carefully.

The Board of Trustees unanimously recommends that shareholders vote FOR the proposal(s) applicable to their fund.

You can vote in one of four ways:

| • | By Internetthrough the website listed in the proxy voting instructions; |

| • | By telephoneby calling the toll-free number listed on your proxy card(s) and following the recorded instructions; |

| • | By mailwith the enclosed proxy card(s); or |

| • | In personat the Special Meeting of Shareholders on April 6, 2017. |

Your vote is important, so please read the enclosed Proxy Statement carefully and submit your vote. If you have any questions about the proposals, please call the proxy solicitor, Computershare Fund Services, at1-866-492-0863.

Thank you for your consideration of the proposals. We value you as a shareholder and look forward to our continued relationship.

| Sincerely, |

|

| Bruce L. Koepfgen |

| President and Chief Executive Officer |

| of Janus Investment Fund |

Table of Contents

JANUS INVESTMENT FUND

Janus Adaptive Global Allocation Fund Janus Asia Equity Fund Janus Balanced Fund Janus Contrarian Fund Janus Diversified Alternatives Fund Janus Enterprise Fund Janus Flexible Bond Fund Janus Forty Fund Janus Global Allocation Fund – Conservative Janus Global Allocation Fund – Growth Janus Global Allocation Fund – Moderate Janus Global Bond Fund Janus Global Life Sciences Fund Janus Global Real Estate Fund Janus Global Research Fund Janus Global Select Fund Janus Global Technology Fund Janus Global Unconstrained Bond Fund Janus Government Money Market Fund Janus Growth and Income Fund | Janus High-Yield Fund Janus Money Market Fund Janus Multi-Sector Income Fund Janus Overseas Fund Janus Real Return Fund Janus Research Fund Janus Short-Term Bond Fund Janus Triton Fund Janus Venture Fund INTECH Emerging Markets Managed Volatility Fund INTECH Global Income Managed Volatility Fund INTECH International Managed Volatility Fund INTECH U.S. Managed Volatility Fund Perkins Global Value Fund Perkins International Value Fund Perkins Large Cap Value Fund Perkins Mid Cap Value Fund Perkins Select Value Fund Perkins Small Cap Value Fund Perkins Value Plus Income Fund |

151 Detroit Street

Denver, Colorado 80206

NOTICE OF A JOINT SPECIAL MEETING OF SHAREHOLDERS

Notice is hereby given that a joint Special Meeting of Shareholders of Janus Investment Fund (the “Trust”) and the Janus funds listed above (each, a “Fund” and collectively, the “Funds”), each a series of the Trust, has been called to be held at the JW Marriott Hotel, 150 Clayton Lane, Denver, Colorado 80206, on April 6, 2017 at 10:00 a.m. Mountain Time (together with any adjournments or postponements thereof, the “Meeting”). At the Meeting, shareholders of the Trust and each Fund will be asked to vote on the proposals set forth below, to the extent applicable to their Fund, and to transact such other business, if any, as may properly come before the Meeting.

| Proposal 1. | For all Funds, to approve a new investment advisory agreement between the Trust, on behalf of your Fund, and Janus Capital Management LLC (“Janus Capital” or the “Adviser”). | |

| Proposal 2. | For certain Funds, to approve a newsub-advisory agreement between the Adviser and the Fund’s currentsub-adviser as follows: | |

a. To approve a newsub-advisory agreement between the Adviser and INTECH Investment Management LLC; | ||

b. To approve a newsub-advisory agreement between the Adviser and Perkins Investment Management LLC; and | ||

c. To approve a newsub-advisory agreement between the Adviser and Janus Capital Singapore Pte. Limited. | ||

| Proposal 3. | For Janus Asia Equity Fund and Janus Global Real Estate Fund, to approve asub-advisory agreement between Janus Capital and Henderson Investment Management Limited. | |

| Proposal 4. | For all Funds, to elect an additional trustee to the Board of Trustees of the Trust. | |

Table of Contents

| Proposal 5. | For certain Funds, to approve a proposal that would authorize the Adviser to enter into and materially amendsub-advisory agreements in the future with wholly-ownedsub-advisers and unaffiliatedsub-advisers, with the approval of the Board of Trustees of the Trust, but without obtaining additional shareholder approval. |

Proposals 2, 3 and 5 apply to certain Funds, which are set forth in the enclosed joint proxy statement.

Shareholders of record of the Trust and each Fund, as of the close of business on December 29, 2016 (the “Record Date”), will receive notice of the Meeting and will be entitled to vote at the Meeting with respect to the Proposal(s) applicable to their Fund. The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting including any adjournment or postponement of the Meeting.

Shareholders are urged to take advantage of the Internet or telephonic voting procedures described on the enclosed proxy card(s), or complete, sign and date the enclosed proxy card(s) and return it in the enclosed addressed envelope, which needs no postage if mailed in the United States. If you wish to attend the Meeting and vote your shares in person at that time, you will still be able to do so.

By Order of the Board of Trustees,

Bruce L. Koepfgen

President and Chief Executive Officer of

Janus Investment Fund

January 20, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 6, 2017:

The enclosed joint proxy statement is available free of charge at janus.com/fundupdate. Each Fund’s most recent annual report and any more recent semiannual report are available free of charge at janus.com/info (or janus.com/reports if you hold shares directly with Janus).

Table of Contents

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and may avoid any delay involved in validating your vote if you fail to sign your proxy card(s) properly.

| 1. | Individual Account: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Account: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card. |

| 3. | All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| Registration | Valid Signature | |

| ||

| Corporate Account | ||

| (1) ABC Corp. | ABC Corp. | |

| (2) ABC Corp. | John Doe, Treasurer | |

| (3) ABC Corp. c/o John Doe, Treasurer | John Doe | |

| (4) ABC Corp. Profit Sharing Plan | John Doe, Trustee | |

| Trust Account | ||

| (1) ABC Trust | Jane B. Doe, Trustee | |

| (2) Jane B. Doe, Trustee u/t/d 12/28/78 | Jane B. Doe | |

| Custodial or Estate Account | ||

| (1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | John B. Smith | |

| (2) Estate of John B. Smith | John B. Smith, Jr., Executor | |

Table of Contents

Table of Contents

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

Appendix D: Dates Relating to CurrentSub-Advisory Agreements | D-1 | |||

| E-1 | ||||

Appendix F: Information Regarding Officers and Directors of Adviser andSub-Advisers | F-1 | |||

| G-1 | ||||

| H-1 | ||||

| I-1 | ||||

Appendix J: Principal Officers of the Trust and Their Principal Occupations | J-1 | |||

| K-1 | ||||

| L-1 | ||||

| M-1 | ||||

| N-1 | ||||

| O-1 | ||||

| P-1 | ||||

Appendix Q: Form of New Janus SingaporeSub-Advisory Agreement | Q-1 | |||

| R-1 | ||||

Table of Contents

The following synopsis is a brief overview of the matters to be voted on at the joint Special Meeting of the Shareholders of the Janus funds listed in the enclosed joint proxy statement (“Proxy Statement”), or at any adjournment or postponement thereof (the “Meeting”). This synopsis is qualified in its entirety by the remainder of this Proxy Statement. The Proxy Statement contains more detailed information about each proposal, and we encourage you to read it in its entirety before voting.

| Q: | What is happening? |

| A: | Janus Capital Management LLC (“Janus Capital” or the “Adviser”) is a direct subsidiary of Janus Capital Group Inc. (“Janus”), a publicly traded company with principal operations in financial asset management businesses and approximately $198.9 billion in assets under management as of September 30, 2016. Recently, Janus and Henderson Group plc (“Henderson”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which Janus and Henderson have agreed to effect an all-stock merger of equals strategic combination of their respective businesses, with Janus surviving the merger as a direct wholly-owned subsidiary of Henderson (the “Transaction”). Henderson is an independent global asset management business founded in 1934 with approximately $131.2 billion in assets under management, as of September 30, 2016. The Transaction will be effected via a share exchange with each share of Janus common stock exchanged for 4.7190 newly issued ordinary shares in Henderson. Based on the current number of shares outstanding, upon closing of the Transaction, Henderson and Janus shareholders are expected to own approximately 57% and 43%, respectively, of the ordinary shares of the combined company, which will be renamed Janus Henderson Global Investors plc (“Janus Henderson”). In addition, each Fund’s name will change to reflect “Janus Henderson” as part of the Fund’s name. Your Fund’s investment adviser will not change, but will be a subsidiary of Janus Henderson following the completion of the Transaction. Janus Henderson will have approximately $326 billion in assets under management and a combined market capitalization of $5.75 billion. Janus expects that the combination of these two complementary businesses will create a leading global active asset manager with significant scale, diverse products and investment strategies, and depth and breadth in global distribution, resulting in an organization that will be well-positioned to provide world-class client service. |

Completion of the Transaction is subject to the satisfaction or waiver of certain conditions, including the receipt of certain third party consents, including approval of new investment advisory agreements by shareholders of Janus Capital-advised U.S. registered investment companies, including the Funds, representing at least 67.5% of the aggregate assets under management of the Janus Capital-advised U.S. registered investment companies. Janus and Henderson currently expect to complete the Transaction during the second quarter of 2017.

Shareholders of the Janus funds listed in the enclosed Proxy Statement (each a “Fund” and, collectively, the “Funds”) are not being asked to vote on the Transaction. Rather, shareholders of the Funds are being asked to vote on one or more proposals that are being presented to them as a result of the Transaction.

The Closing may be deemed to cause an “assignment” of each Fund’s current investment advisory agreement with Janus Capital, which would cause such agreement to terminate. Similarly, for those Funds with asub-advisory agreement with INTECH Investment Management LLC (“INTECH”), Perkins Investment Management LLC (“Perkins”) or Janus Capital Singapore Pte. Limited (“Janus Singapore”), the Closing may be deemed to cause an “assignment” of each such Fund’s existingsub-advisory agreement, which would cause such agreement to terminate. Janus Capital recommended, and the Board of Trustees (the “Board,” the “Board of Trustees,” or the “Trustees”) of Janus Investment Fund (the “Trust”) has approved, and recommends that shareholders of each Fund approve, a new investment advisory agreement between their Fund and Janus Capital, and a newsub-advisory agreement between Janus Capital and INTECH, Perkins, or Janus Singapore, as applicable, in order for Janus Capital and each currentsub-adviser to continue to provide advisory services to each Fund following the Transaction. Each of these proposed agreements will have substantially similar terms as the corresponding current agreement.

Contingent upon the closing of the Transaction, shareholders of Janus Asia Equity Fund are being asked to approve asub-advisory agreement between Janus Capital and Henderson Investment Management Limited (“HIML”), a subsidiary of Henderson. If approved, HIML would replace Janus Singapore assub-adviser to Janus Asia Equity Fund following the Closing of the Transaction. If the Closing does not occur, Janus Singapore would continue to serve assub-adviser to Janus Asia Equity Fund.

Contingent upon the closing of the Transaction, shareholders of Janus Global Real Estate Fund are being asked to approve asub-advisory agreement between Janus Capital and HIML. If approved, HIML would become thesub-adviser to Janus

i

Table of Contents

Global Real Estate Fund and would be responsible for theday-to-day management of a portion of the investment portfolio of Janus Global Real Estate Fund following the Closing of the Transaction, subject to the oversight of Janus Capital. Janus Capital would continue to be responsible for theday-to-day management of the remaining portion of the investment operations of Janus Global Real Estate Fund. If the Closing does not occur, Janus Capital would continue to manage the entire portfolio of Janus Global Real Estate Fund.

The Board of Trustees is requesting that shareholders elect an additional Trustee, Diane L. Wallace (the “Trustee Nominee”).

Shareholders are also being asked to consider a proposal to implement a“manager-of-managers” structure in order to provide Janus Capital with greater flexibility with respect to the appointment ofsub-advisers in the future.

Each of these proposals is discussed further below. Not all of these proposals impact all Funds. Please refer to the table at the end of this synopsis as a reference for which proposal(s) applies to you.

| Q: | How will I as a Fund shareholder be affected by the Transaction? |

| A: | Your Fund investment will not change as a result of the Transaction. You will still own the same Fund shares and the underlying value of those shares will not change as a result of the Transaction. The Adviser, and, if applicable, your Fund’ssub-adviser, will continue to manage your Fund according to the same objectives and policies as before and do not anticipate any significant changes to your Fund, except as described in Proposal 3 with respect to Janus Asia Equity Fund and Janus Global Real Estate Fund. The proposal to engage HIML assub-adviser for Janus Asia Equity Fund and Janus Global Real Estate Fund, are not anticipated to result in changes to the Fund’s investment objective, policies or restrictions; however, HIML may determine to purchase and sell certain securities of these Funds which may result in Janus Asia Equity Fund and/or Janus Global Real Estate Fund incurring transaction costs or capital gains that otherwise may not have occured if HIML were not serving as sub-adviser. |

Proposals 1, 2 and 3: Approve New Investment Advisory andSub-advisory Agreements

| Q: | Why am I being asked to approve a new investment advisory agreement between my Fund and Janus Capital? |

| A: | Janus Capital currently serves as each Fund’s investment adviser. The Transaction may be deemed to cause an “assignment” of the current investment advisory agreement with your Fund, which would cause the agreement to terminate. Shareholders are being asked to approve a new investment advisory agreement between the Adviser and their Fund to permit the Adviser to continue to serve as investment adviser to the Fund. |

| Q: | Why am I being asked to approve a newsub-advisory agreement between Janus Capital and my Fund’s currentsub-adviser? |

| A: | For certain Funds, Janus Capital has retained INTECH, Perkins or Janus Singapore to manage the assets of the Fund. The subsidiary that serves assub-adviser to eachsub-advised Fund is identified in the enclosed Proxy Statement. The Transaction may cause the currentsub-advisory agreement for your Fund to terminate. Shareholders are being asked to approve a newsub-advisory agreement between Janus Capital and their Fund’s currentsub-adviser to permit suchsub-adviser to continue to manage the Fund following the Closing. |

| Q: | Will the Transaction result in any important differences between the new investment advisory agreement and investmentsub-advisory agreement compared to the current agreements for my Fund? |

| A: | No. The terms of the new agreements with the Adviser and your Fund’s currentsub-adviser are substantially similar to the current agreements. There will be no change in the contractual advisory fee rate your Fund pays or the investment advisory services it receives as a result of the Transaction. |

| Q: | What will happen if shareholders of my Fund do not approve the new investment advisory agreement orsub-advisory agreement before consummation of the Transaction? |

| A: | Janus Capital, and if applicable, your Fund’s currentsub-adviser, will continue to manage your Fund under an interim investment advisory agreement and if applicable, an interimsub-advisory agreement, but must place their compensation for their services during this interim period in escrow, pending shareholder approval of the proposed new agreement(s). The Board of Trustees urges you to vote without delay in order to avoid potential disruption to your Fund if the Adviser and anysub-adviser were unable to continue to manage the Fund. |

ii

Table of Contents

| Q: | For shareholders of Janus Asia Equity Fund and Janus Global Real Estate Fund, why am I being asked to vote on asub-advisory agreement with HIML? |

| A: | The Adviser has determined that it would be in the best interest of Janus Asia Equity Fund to draw upon the resources of Janus Henderson following the closing of the Transaction. The Adviser recommended, and the Board of Trustees approved, asub-advisory agreement between the Adviser and HIML with respect to Janus Asia Equity Fund, to take effect upon the Closing of the Transaction. Thesub-advisory agreement with Janus Singapore will terminate concurrently with the effectiveness of the HIMLsub-advisory agreement. Andrew Gillan, Head of HIML’s Asia(ex-Japan) Equity Team and Mervyn Koh, Associate Portfolio Manager, will serve as portfolio managers of the Fund. HIML is an SEC registered investment adviser and is an indirect, wholly-owned subsidiary of Henderson and serves as investmentsub-adviser to several mutual funds offered by Henderson. No changes to the investment objective, policies or restrictions of Janus Asia Equity Fund are anticipated in connection with the appointment of HIML assub-adviser. The Adviser will pay HIML a sub-advisory fee out of the investment advisory fee it receives from the Fund. There will be no change to the advisory fee rate paid by your Fund to the Adviser in connection with the appointment of HIML as sub-adviser. Thesub-advisory agreement with HIML will not take effect if the Closing does not occur. In that case, Janus Capital would continue to serve as adviser and Janus Singapore would continue to serve assub-adviser to Janus Asia Equity Fund. |

The Adviser has determined that it would be in the best interest of Janus Global Real Estate Fund to draw upon the resources of Janus Henderson following the closing of the Transaction. The Adviser recommended, and the Board of Trustees approved, asub-advisory agreement with HIML with respect to Janus Global Real Estate Fund, to take effect upon the Closing of the Transaction. HIML would be responsible for theday-to-day management of a portion of the investment portfolio of Janus Global Real Estate Fund subject to the general oversight of Janus Capital. Janus Capital would continue to be responsible for theday-to-day management of the remaining portion of the investment portfolio of Janus Global Real Estate Fund. Guy Barnard,Co-Head of HIML’s Global Property Equities Team, Tim Gibson,Co-Head of HIML’s Global Property Equities Team, and Patrick Brophy, Portfolio Manager of Janus Global Real Estate Fund for Janus Capital, would serve as portfolio managers of Janus Global Real Estate Fund. HIML is an SEC registered investment adviser and is an indirect, wholly-owned subsidiary of Henderson and serves as investmentsub-adviser to several mutual funds offered by Henderson. No changes to the investment objective, policies or restrictions of Janus Global Real Estate Fund are anticipated in connection with the appointment of HIML assub-adviser. Thesub-advisory agreement with HIML will not take effect if the Closing does not occur. In that case, Janus Capital would continue to manage the entire portfolio of Janus Global Real Estate Fund as adviser.

HIML is an SEC registered investment adviser and is an indirect, wholly-owned subsidiary of Henderson. As a global money manager, HIML and its affiliates (“Henderson Global Investors”) provide a full spectrum of investment products and services to institutions and individuals around the world. Henderson Global Investors has been managing assets for clients since 1934. Henderson Global Investors is a multi-skill, multi-asset management business with a worldwide distribution network. The business address of HIML is 201 Bishopsgate, London UK EC2M 3AE.

Proposal 4: Election of an Additional Trustee

| Q: | Why am I being asked to elect an additional Trustee? |

| A: | Currently, the Board of Trustees of the Trust has eight members, each of whom is an Independent Trustee (as described below). In connection with the Transaction, the Board has sought to increase the size of the Board to nine members and has nominated Diane L. Wallace (the “Trustee Nominee”) to stand for election as a Trustee. Ms. Wallace currently serves as a trustee of certain mutual funds advised by Henderson Global Investors (North America) Inc., a subsidiary of Henderson. Ms. Wallace was unanimously approved by the Board to stand for election, upon a recommendation from the Board’s Nominating and Governance Committee. Among other things, the Board considered Ms. Wallace’s background and experience in the financial services industry, including with the Henderson funds, and determined that the addition of Ms. Wallace to the Board would provide valuable continuity and enhance the Board’s oversight of the Funds following the completion of the Transaction. |

Each current Trustee and the Trustee Nominee is an Independent Trustee, meaning that each is not an “interested person” (as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Trust, Janus Capital, any sub-adviser, or Henderson. Information about the Trustee Nominee, including age, principal occupations during the past five years, and other information, such as the Trustee Nominee’s experience, qualifications, attributes, or skills, is set forth in this Proxy Statement.

iii

Table of Contents

Proposal 5: Approval of Manager of Managers Structure

| Q: | Why am I being asked to vote on the Manager of Managers structure? |

| A: | Janus Capital and the Trust obtained exemptive relief from the U.S. Securities and Exchange Commission (“SEC”) that provides Janus Capital with the flexibility to enter into and materially amendsub-advisory agreements in the future with wholly-ownedsub-advisers and unaffiliatedsub-advisers, with the approval of the Board of Trustees of the Trust, but without the costs and delays associated with holding a shareholder meeting. This is referred to as “Manager of Managers” relief. However, in order to utilize the relief, shareholders of a Fund must approve its use for their Fund. There are no proposed changes to any Fund’s existingsub-advisory arrangement at this time, except for recommending approval of HIML assub-adviser for Janus Asia Equity Fund, replacing Janus Singapore, and adding HIML assub-adviser for Janus Global Real Estate Fund. In the future, if Janus Capital and/or the Board determines that resources of asub-adviser, or differentsub-adviser, would be beneficial for a Fund, your approval of the Manager of Managers Proposal would allow Janus Capital to engage thesub-adviser, and change the sub-adviser, without incurring the costs related to a shareholder meeting and proxy solicitation. The appointment of thesub-adviser is subject to Board approval and you would receive notification of each such engagement. |

Voting

| Q: | How does the Board of Trustees of the Trust suggest I vote with respect to each proposal? |

| A: | After careful consideration, the Board of Trustees of the Trust unanimously recommends that you vote FOR each proposal. Please see the section of the Proxy Statement for a discussion of the Board’s considerations in making such recommendations. |

| Q: | Who is eligible to vote? |

| A: | Shareholders who owned shares of a Fund and other series of the Trust at the close of business on December 29, 2016 (the “Record Date”) will be entitled to be present and vote at the Meeting. Those shareholders are entitled to one vote for each whole dollar (and a proportionate fractional vote for each fractional dollar) of net asset value owned on all matters presented at the Meeting regarding their Fund. |

| Q: | How can I vote my shares? |

| A: | You can vote in any one of four ways: |

| • | By Internetthrough the website listed in the proxy voting instructions; |

| • | By telephoneby calling the toll-free number listed on your proxy card(s) and following the recorded instructions; |

| • | By mail,by sending the enclosed proxy card(s) (completed, signed and dated) in the enclosed envelope; or |

| • | In personat the Meeting on April 6, 2017. |

Whichever method you choose, please take the time to read the full text of the Proxy Statement before you vote.

It is important that shareholders respond to ensure that there is a quorum for the Meeting. If we do not receive your response within a few weeks, you may be contacted by Computershare Fund Services (“Computershare”), the proxy solicitor engaged by Janus Capital, who will remind you to vote your shares and help you return your proxy. If a quorum is not present or sufficient votes to approve the proposals are not received by the date of the Meeting, the persons designated as proxies may adjourn the Meeting to a later date so that we can continue to seek additional votes.

| Q: | If I send my vote in now as requested, can I change it later? |

| A: | Yes. You may revoke your proxy vote at any time before it is voted at the Meeting by: (i) delivering a written revocation to the Secretary of the Trust; (ii) submitting a subsequently executed proxy vote; or (iii) attending the Meeting and voting in person. Even if you plan to attend the Meeting, we ask that you return your proxy card(s) or vote by telephone or Internet. This will help us to ensure that an adequate number of shares are present at the Meeting for consideration of the proposals. Shareholders should send notices of revocation to Janus Investment Fund at 151 Detroit Street, Denver, Colorado 80206, Attn: Secretary. |

iv

Table of Contents

| Q: | What is the required vote to approve the proposals? |

| A: | Approval of Proposals 1, 2, 3 and 5 with respect to each applicable Fund requires the affirmative vote of a “majority of the outstanding voting securities” as defined under the 1940 Act (such a majority referred to herein as a “1940 Act Majority”), of such Fund. A 1940 Act Majority means the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the Meeting, if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. |

Shareholders of each applicable Fund (with all classes of shares of a Fund voting together as a single class) will vote separately on Proposals 1, 2, 3 and 5 relating to their Fund. An unfavorable vote on any proposal by the shareholders of one Fund will not affect the implementation of such proposal by another Fund if the proposal is approved by the shareholders of that Fund. However, Proposals 1, 2 and 3 will only take effect upon the closing of the Transaction, which is conditioned upon obtaining the approval of new investment advisory agreements by shareholders of Janus funds representing a specified percentage of assets under management.

For Proposal 4, the Trustee election will be determined by the affirmative vote of a plurality (the greatest number of affirmative votes) of the shares of all funds of the Trust, including all Funds listed in this Proxy Statement and certain funds of the Trust for which votes are being solicited pursuant to separate proxy statements. Proposal 4 will only take effect upon the closing of the Transaction.

A quorum of shareholders is required to take action at the Meeting. The presence in person or by proxy of the holders of record of 30% of shares outstanding and entitled to vote at the Meeting constitutes a quorum.

| Q: | Who is paying the costs of this solicitation? |

| A: | Janus Capital will pay the fees and expenses related to each proposal, including the cost of the preparation of these proxy materials and their distribution, and all other costs incurred with the solicitation of proxies, including any additional solicitation made by letter, telephone, or otherwise, and the Meeting. |

| Q: | Whom should I call for additional information about this Proxy Statement? |

| A: | Please call Computershare, the proxy solicitor engaged by Janus Capital, at1-866-492-0863. |

v

Table of Contents

Proposals

| Fund | Proposal 1: Advisory Agreement | Proposal 2: New Sub-Advisory Agreement (with thesub-adviser listed below) | Proposal 3: New Sub- Advisory Agreement with HIML | Proposal 4: Election of Additional Trustee | Proposal 5: Manager of Managers | |||||

Janus Adaptive Global Allocation Fund | X | X | ||||||||

Janus Asia Equity Fund* | X | X (Janus Singapore) | X | X | X | |||||

Janus Balanced Fund | X | X | X | |||||||

Janus Contrarian Fund | X | X | X | |||||||

Janus Diversified Alternatives Fund | X | X | X | |||||||

Janus Enterprise Fund | X | X | X | |||||||

Janus Flexible Bond Fund | X | X | X | |||||||

Janus Forty Fund | X | X | X | |||||||

Janus Global Allocation Fund – Conservative | X | X | X | |||||||

Janus Global Allocation Fund – Moderate | X | X | X | |||||||

Janus Global Allocation Fund – Growth | X | X | X | |||||||

Janus Global Bond Fund | X | X | X | |||||||

Janus Global Life Sciences Fund | X | X | X | |||||||

Janus Global Real Estate Fund | X | X | X | X | ||||||

Janus Global Research Fund | X | X | X | |||||||

Janus Global Select Fund | X | X | X | |||||||

Janus Global Technology Fund | X | X | X | |||||||

Janus Global Unconstrained Bond Fund | X | X | X | |||||||

Janus Government Money Market Fund | X | X | X | |||||||

Janus Growth and Income Fund | X | X | X | |||||||

Janus High-Yield Fund | X | X | X | |||||||

Janus Money Market Fund | X | X | X | |||||||

Janus Multi-Sector Income Fund | X | X | X | |||||||

Janus Overseas Fund | X | X | X | |||||||

Janus Real Return Fund | X | X | X | |||||||

Janus Research Fund | X | X | X | |||||||

Janus Short-Term Bond Fund | X | X | X | |||||||

Janus Triton Fund | X | X | X | |||||||

Janus Venture Fund | X | X | X | |||||||

| INTECH Emerging Markets Managed Volatility Fund | X | X (INTECH) | X | |||||||

| INTECH Global Income Managed Volatility Fund | X | X (INTECH) | X | X | ||||||

| INTECH International Managed Volatility Fund | X | X (INTECH) | X | X | ||||||

INTECH U.S. Managed Volatility Fund | X | X (INTECH) | X | X | ||||||

Perkins Global Value Fund | X | X (Perkins) | X | X | ||||||

Perkins International Value Fund | X | X (Perkins) | X | X | ||||||

Perkins Large Cap Value Fund | X | X (Perkins) | X | X | ||||||

Perkins Mid Cap Value Fund | X | X (Perkins) | X | X | ||||||

Perkins Select Value Fund | X | X (Perkins) | X | X | ||||||

Perkins Small Cap Value Fund | X | X (Perkins) | X | X | ||||||

Perkins Value Plus Income Fund | X | X (Perkins) | X | X |

vi

Table of Contents

January 20, 2017

JANUS INVESTMENT FUND

Janus Adaptive Global Allocation Fund Janus Asia Equity Fund Janus Balanced Fund Janus Contrarian Fund Janus Diversified Alternatives Fund Janus Enterprise Fund Janus Flexible Bond Fund Janus Forty Fund Janus Global Allocation Fund – Conservative Janus Global Allocation Fund – Growth Janus Global Allocation Fund – Moderate Janus Global Bond Fund Janus Global Life Sciences Fund Janus Global Real Estate Fund Janus Global Research Fund Janus Global Select Fund Janus Global Technology Fund Janus Global Unconstrained Bond Fund Janus Government Money Market Fund Janus Growth and Income Fund | Janus High-Yield Fund Janus Money Market Fund Janus Multi-Sector Income Fund Janus Overseas Fund Janus Real Return Fund Janus Research Fund Janus Short-Term Bond Fund Janus Triton Fund Janus Venture Fund INTECH Emerging Markets Managed Volatility Fund INTECH Global Income Managed Volatility Fund INTECH International Managed Volatility Fund INTECH U.S. Managed Volatility Fund Perkins Global Value Fund Perkins International Value Fund Perkins Large Cap Value Fund Perkins Mid Cap Value Fund Perkins Select Value Fund Perkins Small Cap Value Fund Perkins Value Plus Income Fund |

151 Detroit Street

Denver, Colorado 80206

JOINT SPECIAL MEETING OF SHAREHOLDERS

This is a joint proxy statement (“Proxy Statement”) for the Janus funds listed above (each, a “Fund” and collectively, the “Funds”), each a series of Janus Investment Fund (the “Trust”). Proxies for a joint Special Meeting of Shareholders of each Fund are being solicited by the Board of Trustees of the Trust (the “Board,” the “Board of Trustees,” or the “Trustees”) to approve the following proposals (each, a “Proposal”) that have already been approved by the Board:

Proposal | Applicable Funds | |||

| 1. | To approve a new investment advisory agreement between the Trust, on behalf of your Fund, and Janus Capital Management LLC (“Janus Capital” or the “Adviser”). | All Funds | ||

| 2. | To approve a newsub-advisory agreement between the Adviser and your Fund’s currentsub-adviser as follows: | |||

a. To approve a newsub-advisory agreement between the Adviser and INTECH Investment Management LLC (“INTECH”); | INTECH Emerging Markets Managed Volatility Fund INTECH Global Income Managed Volatility Fund INTECH International Managed Volatility Fund INTECH U.S. Managed Volatility Fund | |||

b. To approve a newsub-advisory agreement between the Adviser and Perkins Investment Management LLC (“Perkins”); and | Perkins Global Value Fund Perkins International Value Fund Perkins Large Cap Value Fund Perkins Mid Cap Value Fund Perkins Select Value Fund Perkins Small Cap Value Fund Perkins Value Plus Income Fund | |||

1

Table of Contents

Proposal | Applicable Funds | |||

c. To approve a newsub-advisory agreement between the Adviser and Janus Capital Singapore Pte. Limited (“Janus Singapore” and together with INTECH and Perkins, each a“Sub-Adviser” and collectively, the“Sub-Advisers”). | Janus Asia Equity Fund | |||

| 3. | To approve asub-advisory agreement between the Adviser and Henderson Investment Management Limited (“HIML”). | Janus Asia Equity Fund Janus Global Real Estate Fund | ||

| 4. | To elect an additional Trustee to the Board of Trustees of the Trust. | All Funds | ||

| 5. | To approve a proposal that would authorize the Adviser to enter into and materially amendsub-advisory agreements in the future with wholly-ownedsub-advisers and unaffiliatedsub-advisers, with the approval of the Board of Trustees of the Trust, but without obtaining additional shareholder approval (the “Manager of Managers Proposal”). | All Funds (except Janus Adaptive Global Allocation Fund and INTECH Emerging Markets Managed Volatility Fund) | ||

The joint Special Meeting of Shareholders will be held at the JW Marriott Hotel, 150 Clayton Lane, Denver, Colorado 80206, on April 6, 2017 at 10:00 a.m. Mountain Time, or at such later time as may be necessary due to adjournments or postponements thereof (the “Meeting”). Any shareholder of record who owned shares of the Trust or a Fund as of the close of business on December 29, 2016 (the “Record Date”) will receive notice of the Meeting and will be entitled to vote at the Meeting.

At the Meeting, you will be asked to vote on each proposal applicable to each Fund of which you held shares as of the Record Date. You should read the entire Proxy Statement before voting. If you have any questions, please call our proxy solicitor, Computershare Fund Services (“Computershare”), at1-866-492-0863. This Proxy Statement, Notice of a Joint Special Meeting, and the proxy card(s) are first being mailed to shareholders and contract owners on or about January 20, 2017.

The Funds provide annual and semiannual reports to their shareholders that highlight relevant information, including investment results and a review of portfolio changes. Additional copies of each Fund’s most recent annual report and any more recent semiannual report are available, without charge, by calling a Janus representative at1-877-335-2687 (or1-800-525-3713 if you hold shares directly with Janus Capital), via the Internet at janus.com/info (or janus.com/reports if you hold shares directly with Janus Capital), or by sending a written request to the Secretary of the Trust at 151 Detroit Street, Denver, Colorado 80206.

2

Table of Contents

The Adviser is a direct subsidiary of Janus Capital Group Inc. (“Janus”), a publicly traded company with principal operations in financial asset management businesses and approximately $198.9 billion in assets under management as of September 30, 2016. Recently, Janus and Henderson Group plc (“Henderson”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which Janus and Henderson have agreed to effect anall-stock merger of equals strategic combination of their respective businesses, with Janus surviving the merger as a direct wholly-owned subsidiary of Henderson (the “Transaction”). Henderson is an independent global asset management business founded in 1934 with approximately $131.2 billion in assets under management, as of September 30, 2016.

The Transaction will be effected via a share exchange with each share of Janus common stock exchanged for 4.7190 newly issued ordinary shares in Henderson. Based on the current number of shares outstanding, upon closing of the Transaction, Henderson and Janus shareholders are expected to own approximately 57% and 43%, respectively, of the ordinary shares of the combined company, which will be renamed Janus Henderson Global Investors plc (“Janus Henderson”). Janus Henderson will have approximately $326 billion in assets under management and a combined market capitalization of $5.75 billion. The name of your Fund, and most of the mutual funds offered by the Adviser, will also be renamed to reflect “Janus Henderson” in the name. Janus expects that the combination of these two complementary businesses will create a leading global active asset manager with significant scale, diverse products and investment strategies, and depth and breadth in global distribution, resulting in an organization that will be well-positioned to provide world-class client service.

Under the terms of the Merger Agreement, as of the effective time of the Transaction, (i) Richard M. Weil, the current Chief Executive Officer of Janus, will become aco-Chief Executive Officer of Janus Henderson and (ii) Andrew J. Formica, the current Chief Executive Officer of Henderson, will become aco-Chief Executive Officer of Janus Henderson.

Janus Henderson will have a Board of Directors consisting initially of twelve directors, (i) six of whom will be persons designated by the existing Board of Directors of Henderson, and (ii) six of whom will be persons designated by the existing Board of Directors of Janus.

Completion of the Transaction is subject to the satisfaction or waiver of certain conditions, including (i) the requisite approval of the Merger Agreement by the holders of common stock of Janus; (ii) the requisite approval of the shareholders of Henderson of the Transaction and certain related matters; (iii) regulatory approvals; and (iv) receipt of certain third party consents, including approval of new investment advisory agreements by shareholders of Janus Capital-advised U.S. registered investment companies, including the Funds, representing at least 67.5% of the aggregate assets under management of the Janus Capital-advised U.S. registered investment companies.

The Merger Agreement contains certain termination rights for each of Henderson and Janus, including in the event that (i) the Transaction is not consummated on or before September 30, 2017, (ii) the approval of the Transaction by the shareholders of Henderson or the stockholders of Janus is not obtained at the respective shareholder meetings or (iii) if any restraint that prevents, makes illegal or prohibits the consummation of the Transaction shall have become final and non-appealable. In addition, Henderson and Janus can each terminate the Merger Agreement prior to the shareholder meeting of the other party if, among other things, the other party’s board of directors has changed its recommendation that its shareholders approve the Transaction, and adopt the Merger Agreement.

Janus and Henderson currently expect to complete the Transaction during the second quarter of 2017.

Shareholders of the Funds are being asked to consider Proposals1-3 (approval of advisory andsub-advisory agreements) and 4 (appointment of trustee) in connection with the Transaction. These Proposals are contingent upon the Closing of the Transaction and will take effect only if the Transaction closes. Proposal 5 (manager of managers proposal) is not related to the Transaction and will take effect whether or not the Transaction closes.

3

Table of Contents

APPROVAL OF NEW INVESTMENT ADVISORY AGREEMENT

(All Funds)

Pursuant to a separate investment advisory agreement between Janus Capital and the Trust on behalf of each Fund (each a “Current Advisory Agreement” and collectively, the “Current Advisory Agreements”), Janus Capital serves as each Fund’s investment adviser. The date of each Fund’s Current Advisory Agreement and the date on which it was last approved by shareholders and approved for continuance by the Board are provided inAppendix B to this Proxy Statement.

Each Current Advisory Agreement, as required by Section 15 of the Investment Company Act of 1940, as amended (the “1940 Act”), provides for its automatic termination in the event of its “assignment” (as defined in the 1940 Act). The consummation of the Transaction may be deemed an “assignment” of each Current Advisory Agreement which would cause the automatic termination of each Current Advisory Agreement, as required by the 1940 Act. The 1940 Act requires that a new advisory agreement be approved by the board of trustees and the shareholders of a fund in order for it to become effective.

With respect to each Fund, shareholders of the Fund are being asked to approve a new investment advisory agreement between the Trust, on behalf of the Fund, and the Adviser that are substantially similar to the Current Advisory Agreement to take effect immediately after the Transaction or shareholder approval, whichever is later (each, a “New Advisory Agreement” and collectively, the “New Advisory Agreements”).

At an in-person meeting of the Board on December 8, 2016, and for the reasons discussed below (see “Board Considerations” after Proposal 3 in this Proxy Statement), the Board, all of whom are Trustees who are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Funds, the Adviser, anysub-adviser or Henderson (the “Independent Trustees”), unanimously approved the New Advisory Agreement on behalf of each Fund and unanimously recommended approval of the New Advisory Agreement by shareholders. For additional information regarding the Board’s consideration of the New Advisory Agreements, see “Board Considerations” after Proposal 3 in this Proxy Statement. The form of the New Advisory Agreement is attached hereto asAppendix N to this Proxy Statement.

Comparison of Current Advisory Agreements and New Advisory Agreements

The terms of each New Advisory Agreement are substantially similar to those of the Current Advisory Agreement. There is no change in the fee rate payable by each Fund to the Adviser. Changes made to the New Advisory Agreement compared to the Current Advisory Agreement include the date of expiration, and, for Funds with a performance-based investment advisory fee, changes to ensure continuity of the advisory fee based on the Fund’s historical performance, as provided for under the Current Advisory Agreement. If approved by shareholders of a Fund, the New Advisory Agreement for each Fund will have an initial term until February 1, 2018 and will continue in effect from year to year if such continuance is approved at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a comparison of certain terms of the Current Advisory Agreement to the terms of the New Advisory Agreement.

Investment Advisory Services. The investment advisory services to be provided by the Adviser to each Fund are the same under the Current Advisory Agreements and the New Advisory Agreements. Both the Current Advisory Agreements and New Advisory Agreements provide that the Adviser shall furnish continuous advice and recommendations to each Fund, and shall have authority to act with respect thereto, as to the acquisition, holding, or disposition of any or all of the securities or other assets which each Fund may own or contemplate acquiring from time to time. The Adviser shall give due consideration to the investment policies and restrictions and the other statements concerning each Fund in the Trust’s Amended and Restated Declaration of Trust, as then in effect, the Trust’s Amended and Restated Bylaws, as then in effect, and the registration statements of the Trust, and to provisions of the Internal Revenue Code, as applicable to each Fund as a regulated investment company. In addition, the Adviser shall cause its officers to attend meetings and furnish oral and written reports, as each Fund may reasonably require, in order to keep the Board and appropriate officers of each Fund and the Trust fully informed as to the condition of the investment portfolio of each Fund. The investment advisory services are expected to be provided by the same personnel of the Adviser under the New Advisory Agreements as under the Current Advisory Agreements.

Janus Global Unconstrained Bond Fund and Janus Diversified Alternatives Fund each have a subsidiary to which Janus Capital provides investment advisory services (each a “Subsidiary”). Each Subsidiary has entered into a separate investment

4

Table of Contents

advisory agreement with Janus Capital (each a “Subsidiary Advisory Agreement”). The consummation of the Transaction may be deemed an “assignment” of each Subsidiary Advisory Agreement, which would cause the automatic termination of each Subsidiary Advisory Agreement, as required by the 1940 Act. In order to permit Janus Capital to continue to serve as investment adviser to each Subsidiary following the Transaction, if the New Advisory Agreement is approved, Janus Capital will enter into a new investment advisory agreement with each Subsidiary, which will be substantially similar to the current Subsidiary Advisory Agreement.

Fees. Under each Current Advisory Agreement and New Advisory Agreement, the Fund pays to the Adviser an investment advisory fee which is calculated daily and paid monthly. Each Fund’s investment advisory fee rate under the New Advisory Agreement for such Fund is identical to the investment advisory fee rate under the Current Advisory Agreement. Certain Funds pay an investment advisory fee rate that may adjust up or down based on such Fund’s performance relative to the cumulative investment record of its benchmark index over a performance measurement period. For each such Fund, the terms of such performance adjustment under the New Advisory Agreement are identical to the terms of such performance adjustment under the Current Advisory Agreement.Appendix C to this Proxy Statement sets forth the investment advisory fee rate applicable to each Fund.Appendix G to this Proxy Statement sets forth the amount of fees paid to the Adviser during each Fund’s most recently ended fiscal year.

Payment of Expenses. Under each Current Advisory Agreement and the New Advisory Agreement, the Funds assume and pay all expenses incidental to their organization, operations and business not specifically assumed or agreed to be paid by the Adviser. These Fund expenses include custodian and transfer agency fees and expenses, brokerage commissions and dealer spreads, and other expenses in connection with the execution of portfolio transactions, legal and accounting expenses, interest, taxes, a portion of trade association or other investment company organization dues and expenses, registration fees, expenses of shareholders’ meetings, reports to shareholders, fees and expenses of Independent Trustees, and other costs of complying with applicable laws regulating the sales of Fund shares. The Funds, along with other Janus funds, also pay some or all of the salaries, fees, and expenses of certain Fund officers and employees of the Adviser (also sharing certain expenses and salaries for the Funds’ Chief Compliance Officer and other compliance-related personnel employed by the Adviser as authorized by the Trustees from time to time). For Janus Money Market Fund and Janus Government Money Market Fund, the Adviser pays for certain of these expenses pursuant to an Administration Agreement between the Adviser and these Funds.

Other Services. Under each Current Advisory Agreement and New Advisory Agreement, the Adviser is authorized, but not obligated, to perform management and administrative services necessary for the operation of each Fund. Specifically, the Adviser is authorized to conduct relations with custodians, depositories, transfer and pricing agents, accountants, attorneys, underwriters, brokers and dealers, corporate fiduciaries, insurance company separate accounts, insurers, banks and such other persons in any such other capacity deemed by the Adviser to be necessary or desirable. The Adviser shall also generally monitor and report to the officers of the Trust regarding each Fund’s compliance with investment policies and restrictions as set forth in the currently effective prospectus and statement of additional information relating to the shares of each Fund. Additionally, the Adviser shall make reports to the Board of its performance of services upon request and furnish advice and recommendations with respect to such other aspects of the business and affairs of each Fund as it shall determine to be desirable. The Adviser is also authorized, subject to review by the Board, to furnish such other services as the Adviser shall from time to time determine to be necessary or useful to perform the services contemplated by the agreement. The Adviser also serves as administrator to the Funds pursuant to an Administration Agreement between Janus Capital and the Trust. See “Affiliated Service Providers, Affiliated Brokerage and Other Fees—Administrator” for additional information regarding these administrative services.

Limitation on Liability. The Current Advisory Agreements and New Advisory Agreements provide that the Adviser will not be liable for any error of judgment or mistake of law or for any loss arising out of any investment or for any act or omission taken with respect to a Fund, except for willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties and except to the extent otherwise provided by law.

Continuance. The Current Advisory Agreement for each Fund continues in effect for successiveone-year periods after its initial term, if such continuance is specifically approved at least annually by (a) the vote of a majority of the Independent Trustees cast in person at a meeting called for the purpose of voting on the terms of such renewal, and (b) either the Trustees of the Trust or the affirmative vote of a majority of the outstanding voting securities of the Fund. The New Advisory Agreement for each Fund will have an initial term until February 1, 2018, and will continue thereafter for successiveone-year periods if approved annually in the same manner required under the Current Advisory Agreement.

Termination. The Current Advisory Agreement and New Advisory Agreement for each Fund provide that the agreement may be terminated at any time, without penalty, by the Board, or by the shareholders of the Fund acting by vote of at least a

5

Table of Contents

majority of its outstanding voting securities, provided in either case that sixty (60) days’ advance written notice of termination be given to the Adviser at its principal place of business. Further, the Current Advisory Agreement and the New Advisory Agreement may be terminated by the Adviser at any time, without penalty, by giving sixty (60) days’ advance written notice of termination to the Fund, addressed to its principal place of business.

In the event shareholders of a Fund do not approve the New Advisory Agreement at the Meeting prior to the closing of the Transaction, an interim investment advisory agreement between the Adviser and such Fund (each, an “Interim Advisory Agreement” and collectively, the “Interim Advisory Agreements”) will take effect upon the closing of the Transaction. At the December 8, 2016 meeting, the Board, all of whom are Independent Trustees, unanimously approved an Interim Advisory Agreement for each Fund in order to assure continuity of investment advisory services to the Funds after the Transaction. The terms of each Interim Advisory Agreement are substantially identical to those of the applicable Current Advisory Agreement and New Advisory Agreement, except for the term and escrow provisions described below. The Interim Advisory Agreement will continue in effect for a term ending on the earlier of 150 days from the closing of the Transaction (the“150-day period”) or when shareholders of the Fund approve the New Advisory Agreement. Pursuant to Rule15a-4 under the 1940 Act, compensation earned by the Adviser under an Interim Advisory Agreement will be held in an interest-bearing escrow account. If shareholders of a Fund approve the New Advisory Agreement prior to the end of the150-day period, the amount held in the escrow account under the Interim Advisory Agreement will be paid to the Adviser. If shareholders of a Fund do not approve the New Advisory Agreement prior to the end of the150-day period, the Board will take such action as it deems to be in the best interests of the Fund, and the Adviser will be paid the lesser of its costs incurred in performing its services under the Interim Advisory Agreement or the total amount in the escrow account, plus interest earned.

Other Actions Contemplated in Connection with the Transaction

Fund mergers involving certain Funds are proposed to occur at or about the time of the closing of the Transaction:

Janus Forty Fund. The Board has approved a merger of Janus Twenty Fund, a series of the Trust, into Janus Forty Fund. The merger is contingent on approval by shareholders of Janus Twenty Fund, which will be solicited pursuant to a separate proxy statement/prospectus that will contain information about the proposed merger and will be sent separately to Janus Twenty Fund shareholders. The merger does not require approval of shareholders of Janus Forty Fund and shareholders of Janus Forty Fund are not being asked to vote on the merger. The merger will not result in any changes to Janus Forty Fund’s investment strategies, policies, management or contractual advisory fee rates.

Janus Research Fund. The Board has approved a merger of Janus Fund, a series of the Trust, into Janus Research Fund. The merger is contingent on approval by shareholders of Janus Fund, which will be solicited pursuant to a separate proxy statement/prospectus that will contain information about the proposed merger and will be sent separately to Janus Fund shareholders. The merger does not require approval of shareholders of Janus Research Fund and shareholders of Janus Research Fund are not being asked to vote on the merger. The merger will not result in any changes to Janus Research Fund’s investment strategies, policies, management or contractual advisory fee rates.

INTECH U.S. Managed Volatility Fund. The Board has approved a merger of INTECH U.S. Core Fund into INTECH U.S. Managed Volatility Fund. The merger is contingent on approval by shareholders of INTECH U.S. Core Fund, which will be solicited pursuant to a separate proxy statement/prospectus that will contain information about the proposed merger and will be sent separately to INTECH U.S. Core Fund shareholders. The merger does not require approval of shareholders of INTECH U.S. Managed Volatility Fund and shareholders of INTECH U.S. Managed Volatility Fund are not being asked to vote on the merger. The merger will not result in any changes to INTECH U.S. Managed Volatility Fund’s investment strategies, policies, management or contractual advisory fee rates.

Janus Global Technology Fund. The Board has approved a merger of Henderson Global Technology Fund, a mutual fund organized as a series of Henderson Global Funds and advised by Henderson Global Investors (North America) Inc. (“HGINA”), a subsidiary of Henderson, into Janus Global Technology Fund. The merger is contingent on (i) the closing of the Transaction and (ii) approval by shareholders of Henderson Global Technology Fund. The merger does not require approval by shareholders of Janus Global Technology Fund and shareholders of Janus Global Technology Fund are not being asked to vote on the merger. The merger will not result in any changes to Janus Global Technology Fund’s investment strategies, policies, management or contractual advisory fee rates.

6

Table of Contents

Certain Conditions under the 1940 Act

The Board has been advised that the parties to the Merger Agreement have structured the Transaction in reliance upon Section 15(f) of the 1940 Act. Section 15(f) provides in substance that when a sale of a controlling interest in an investment adviser occurs, the investment adviser or any of its affiliated persons may receive any amount or benefit in connection with the sale so long as two conditions are satisfied. The first condition of Section 15(f) is that, during the three-year period following the consummation of a transaction, at least 75% of the investment company’s board of directors must not be “interested persons” (as defined in the 1940 Act) of the investment adviser or predecessor adviser. The composition of the Board of the Trust currently meets this test and would continue to meet this test after the election of an additional trustee pursuant to Proposal 4. Second, an “unfair burden” (as defined in the 1940 Act, including any interpretations orno-action letters of the Securities and Exchange Commission (the “SEC”) or the staff of the SEC) must not be imposed on the investment company as a result of the transaction relating to the sale of such interest, or any express or implied terms, conditions or understandings applicable thereto. The term “unfair burden” (as defined in the 1940 Act) includes any arrangement, during thetwo-year period after the transaction, whereby the investment adviser (or predecessor or successor adviser), or any “interested person” (as defined in the 1940 Act) of such an adviser, receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its security holders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for the investment company). Under the Merger Agreement, Henderson has acknowledged Janus’s reliance upon the benefits and protections provided by Section 15(f) and has agreed not to take, and to cause its affiliates not to take, any action that would have the effect, directly or indirectly, of causing the requirements of any of the provisions of Section 15(f) not to be met in respect of the Transaction.

Additional Information About the Adviser

The Adviser, a registered investment adviser, is organized as a Delaware limited liability company and is a direct subsidiary of Janus. Janus is a publicly traded company with principal operations in financial asset management businesses and approximately $198.9 billion in assets under management as of September 30, 2016. Janus offers a broad range of investment solutions, including fixed income, equity, alternative and multi-asset class strategies. Investment strategies are offered throughopen-end funds domiciled in both the U.S. and offshore, as well as through separately managed accounts, collective investment trusts and exchange-traded products. Based in Denver, Janus has offices located in 12 countries throughout North America, Europe, Asia and Australia.

The Adviser has managed primarily growth equity portfolios since 1969. The Adviser has leveraged its research-driven investment philosophy and culture to other areas of the markets, including fundamental fixed income, global macro fixed income, diversified alternatives and exchange-traded products. As of September 30, 2016, the Adviser had approximately $148.8 billion in assets under management. The business address of Janus and the Adviser is 151 Detroit Street, Denver, Colorado 80206.

Information regarding other registered investment companies or series thereof (other than the Trust and the Funds) managed by the Adviser, aSub-Adviser or Henderson that have similar investment strategies to a Fund is set forth inAppendix E to this Proxy Statement.

Certain information regarding the executive officers and directors of the Adviser andSub-Advisers is set forth inAppendix F to this Proxy Statement.

Additional Information About Henderson

Henderson is the holding company of the investment management group, Henderson Global Investors, an independent global asset management business with over 1,000 employees worldwide and approximately $131.2 billion in assets under management as of September 30, 2016. As a global money manager, Henderson provides a full spectrum of investment products and services to institutions and individuals around the world. Headquartered in London at 201 Bishopsgate, London, UK EC2M 3AE, Henderson has been managing assets for clients since 1934. Henderson is a multi-skill, multi-asset management business with a worldwide distribution network. Henderson’s U.S. subsidiary Henderson Global Investors (North America) Inc. serves as investment adviser to a family of 11 U.S. registered mutual funds with approximately $12.4 billion in assets as of September 30, 2016 (excluding liquidated funds), most of which are proposed to be integrated into the Janus fund complex upon the closing of the Transaction.

7

Table of Contents

Affiliated Service Providers, Affiliated Brokerage and Other Fees

Administrator. Janus Capital also serves as administrator to the Funds pursuant to an Administration Agreement between Janus Capital and the Trust. Janus Capital is authorized to delegate to others to perform certain administrative and other services. Pursuant to the Administration Agreement between Janus Capital and the Trust, thenon-money market Funds (except for Janus Global Allocation Fund – Conservative, Janus Global Allocation Fund – Moderate, and Janus Global Allocation Fund – Growth (together, the “Allocation Funds”)) reimburse Janus Capital for reasonable costs incurred in performing certain administrative and clerical functions. Some examples of these reimbursable expenses include net asset value determination, fund accounting, updating of the Trust’s registration statement, and supporting the Board of Trustees. Pursuant to an Administration Agreement between Janus Capital and the Trust, on behalf of the Allocation Funds, Janus Capital bears expenses not otherwise detailed in the Current Advisory Agreement and New Advisory Agreement for the Allocation Funds, that are incurred in connection with the operation of the Allocation Funds. Janus Capital does not receive compensation as administrator of thenon-money market funds or the Allocation Funds. Pursuant to Administration Agreements between Janus Capital and each of Janus Government Money Market Fund and Janus Money Market Fund (together, the “Money Market Funds”), Janus Capital receives an annual administration fee at the rate of 0.46% of average net assets for Class D shares and 0.48% of average net assets for Class T shares of the Money Market Funds. Janus Capital uses this fee to pay for the Money Market Funds’ expenses such as, but not limited to, custody, transfer agency, and fund accounting services; shareholder servicing; provision of office facilities and personnel necessary to carry on the business of the Funds; recordkeeping; and preparation of prospectuses, statements of additional information, and required tax reports. The administration fee paid by Class T shares of the Money Market Funds to Janus Capital may also be used to compensate financial intermediaries who perform services on behalf of Class T shareholders. Janus Capital intends to continue to provide the same administrative services after implementation of the proposed New Advisory Agreements. Information regarding the amounts paid by the Money Market Funds to Janus Capital, as administrator, during the Funds’ last fiscal year is set forth inAppendix G to this Proxy Statement.

Distributor. Janus Distributors LLC (the “Distributor”), located at 151 Detroit Street, Denver, Colorado 80206, a wholly-owned subsidiary of the Adviser, serves as the distributor for the Funds’ shares. According to plans adopted pursuant to Rule12b-1 under the 1940 Act for Class R Shares, Class S Shares, Class A Shares and Class C Shares of the Funds, the Distributor receives a12b-1 fee from each such class of shares that is used to pay for distribution and/or shareholder services. Class A Shares and Class S Shares pay the Distributor a12b-1 fee at the annual rate of up to 0.25% of the average daily net assets of Class A Shares and Class S Shares. Class C Shares pay a12b-1 fee to the Distributor of up to 1.00% (0.75% distribution fee and 0.25% shareholder services fee) of the average daily net assets of Class C Shares. Class R Shares pay a12b-1 fee to Janus Distributors of up to 0.50% of the average daily net assets of Class R Shares. Payments are made to the Distributor, who may make ongoing payments to financial intermediaries and may retain amounts paid by the Funds. Payments under the plans are not tied exclusively to actual distribution and shareholder service expenses, and the payments may exceed distribution and shareholder service expenses actually incurred. The Distributor intends to continue to provide the same services after implementation of the proposed New Advisory Agreements. Fees paid by Class A Shares, Class C Shares, Class R Shares and Class S Shares of each Fund to the Distributor, pursuant to their respective12b-1 plan, during the Fund’s last fiscal year is set forth inAppendix G to this Proxy Statement.

Transfer Agent. Janus Services LLC (“Janus Services”), located at 151 Detroit Street, Denver, Colorado 80206, a wholly-owned subsidiary of the Adviser, serves as each Fund’s transfer agent. In addition, Janus Services provides or arranges for the provision of certain other administrative services including, but not limited to, recordkeeping, accounting, order processing, and othernon-distribution related shareholder services for the Funds. Pursuant to the Transfer Agency Agreement between the Trust and Janus Services, each class of shares of each Fund reimburses Janus Services forout-of-pocket expenses incurred by Janus Services in connection with services rendered. In addition, Janus Services receives a shareholder servicing fee paid by Class D Shares at the annual rate of 0.12% of Class D Shares’ average daily net assets, and paid by each of Class T Shares, Class S Shares and Class R Shares at the annual rate of 0.25% of the average daily net assets of such share class. Such fee compensates Janus Services for providing or arranging for the provision of certain other administrative or other shareholder services. Janus Services may pass through all or a portion of the shareholder services fee received from Class T Shares, Class R Shares and Class S Shares to financial intermediaries. Janus Services intends to continue to provide the same services after implementation of the proposed New Advisory Agreement. Fees paid by Class D Shares, Class T Shares, Class S Shares and Class R Shares of each Fund to Janus Services during the Fund’s last fiscal year is set forth inAppendix G to this Proxy Statement.

Affiliated Brokerage. No Fund paid brokerage commissions within the last fiscal year to (i) any broker that is an affiliated person of such Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of such Fund, the Adviser or anySub-Adviser of such Fund.

8

Table of Contents

Payments to Affiliates. During each Fund’s last fiscal year, no Fund made any material payments to the Adviser orSub-Adviser to such Fund or any affiliated person of the Adviser orSub-Adviser to such Fund for services provided to the Fund (other than pursuant to the Current Advisory Agreement, CurrentSub-Advisory Agreement, Administration Agreement, or fees paid to the Distributor or Janus Services as described herein).

To become effective with respect to a Fund, each New Advisory Agreement requires the affirmative vote of a 1940 Act Majority (as defined herein) of such Fund, with all classes of shares voting together as a single class. For purposes of determining the approval of the New Advisory Agreement, abstentions and brokernon-votes will have the same effect as shares voted against the proposal.

An unfavorable vote on the proposal to approve the New Advisory Agreement by the shareholders of one Fund will not affect the implementation of the proposal by another Fund if the proposal is approved by the shareholders of that Fund. However, the New Advisory Agreement will only take effect upon the closing of the Transaction, which is conditioned upon obtaining the approval of new advisory agreements by shareholders of Janus funds representing a specified percentage of assets under management.

In the event that the Transaction does not, for any reason, occur, each Current Advisory Agreement will continue in effect in accordance with its terms.

The Board unanimously recommends that shareholders of each Fund vote FOR approval of the Fund’s New Advisory Agreement.

9

Table of Contents

APPROVAL OF NEW INVESTMENTSUB-ADVISORY AGREEMENT WITH CURRENTSUB-ADVISER

(Sub-Advised Funds)

For certain Funds, the Adviser has retained either a direct wholly-owned subsidiary, or an indirect wholly-owned subsidiary of Janus assub-adviser to manage the assets of the Fund.

Sub-Adviser | Funds | |

| INTECH | INTECH Emerging Markets Managed Volatility Fund INTECH Global Income Managed Volatility Fund INTECH International Managed Volatility Fund INTECH U.S. Managed Volatility Fund (each an “INTECH Fund” and collectively, the “INTECH Funds”) | |

Perkins | Perkins Global Value Fund Perkins International Value Fund Perkins Large Cap Value Fund Perkins Mid Cap Value Fund Perkins Select Value Fund Perkins Small Cap Value Fund Perkins Value Plus Income Fund (each a “Perkins Fund” and collectively, the “Perkins Funds”) | |

Janus Singapore | Janus Asia Equity Fund | |