Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Schedule 14(a) of the

Securities and Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Janus Investment Fund

(Exact Name of Registrant as Specified in Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ☐ | Fee paid previously with preliminary materials: |

Table of Contents

For shareholders of: |  |

Janus Henderson Global Technology and Innovation Fund and

Janus Henderson Research Fund, each a series of Janus Investment Fund

Janus Henderson Global Technology and Innovation Portfolio and

Janus Henderson Research Portfolio, each a series of Janus Aspen Series

(each, a “Fund” together, the “Funds”)

[ , 2024]

Dear Shareholder:

As a shareholder of one or more of the Funds, the Board of Trustees for your Fund is requesting that you vote on proposals that will be presented to shareholders at a joint Special Meeting of Shareholders to be held on [ ], 2024. The proposals are briefly summarized below and in the Synopsis section that precedes the enclosed proxy statement (the “Proxy Statement”). The Proxy Statement includes a detailed discussion of the proposals, which you should read carefully.

At the meeting, shareholders of each Fund are being asked to approve reclassifying the diversification status of their Fund from diversified to nondiversified and eliminating a related fundamental investment restriction and shareholders of each of Janus Henderson Global Technology and Innovation Fund and Janus Henderson Global Technology and Innovation Portfolio also are being asked to modify their Fund’s fundamental concentration policy.

The Board of Trustees of the Funds believes that the proposals are in the best interest of each Fund and has recommended that shareholders vote “FOR” the proposals.

You can vote in one of four ways:

| • | By Internet through the website listed in the proxy voting instructions; |

| • | By telephone by calling the toll-free number listed on your proxy card and following the recorded instructions; |

| • | By mail with the enclosed proxy card; or |

| • | In person at the Special Meeting of Shareholders on [ ], 2024. |

Your vote is important, so please read the enclosed Proxy Statement carefully and submit your vote. If you have any questions about the proposal, please call the proxy solicitor, [ ], at [1- ].

Thank you for your consideration of the proposal. We value you as a shareholder and look forward to our continued relationship.

Sincerely,

Michelle Rosenberg

President and Chief Executive Officer of

Janus Investment Fund

Janus Aspen Series

Table of Contents

|

JANUS INVESTMENT FUND

Janus Henderson Global Technology and Innovation Fund

Janus Henderson Research Fund

JANUS ASPEN SERIES

Janus Henderson Global Technology and Innovation Portfolio

Janus Henderson Research Portfolio

(each, a “Fund” and collectively, the “Funds”)

151 Detroit Street

Denver, Colorado 80206

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

Notice is hereby given that the Board of Trustees of Janus Investment Fund and Janus Aspen Series (together, the “Trusts”) has called a Special Meeting of Shareholders of the Funds, each a series of their respective Trusts, to be held at the [●], on [ ], 2024, at [●] Mountain Time (together with any adjournments or postponements thereof, the “Meeting”). The purpose of the Meeting is to consider and act upon the following proposals and to transact such other business, if any, as may properly come before the Meeting or any adjournments thereof:

| 1. | For each Fund, to reclassify the diversification status of the Fund from diversified to nondiversified and to eliminate a related fundamental investment restriction. |

| 2. | For each of Janus Henderson Global Technology and Innovation Fund and Janus Henderson Global Technology and Innovation Portfolio, to modify the Fund’s fundamental concentration policy. |

Shareholders of record of each Fund, as of the close of business on [ ], 2024, will receive notice of the Meeting and will be entitled to vote at the Meeting. The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting, including any adjournment or postponement of the Meeting.

Shareholders are urged to take advantage of the internet or telephonic voting procedures described in the enclosed proxy card, or complete, sign, and date the enclosed proxy card and return it in the enclosed addressed envelope, which needs no postage if mailed in the United States. If you wish to attend the Meeting and vote your shares in person at that time, you will still be able to do so.

By order of the Board of Trustees,

Michelle Rosenberg

President and Chief Executive Officer of

Janus Investment Fund

Janus Aspen Series

[ , 2024]

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON [ ], 2024:

The enclosed proxy statement is available free of charge at janushenderson.com/fund-update.

Each Fund’s most recent annual report and semiannual report are available free of charge at janushenderson.com/info or janushenderson.com/VIT (or janushenderson.com/reports if you hold shares directly with the Funds).

Table of Contents

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and may avoid any delay involved in validating your vote if you fail to sign your proxy card properly.

| 1. | Individual Account: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Account: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card. |

| 3. | All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| Registration | Valid Signature | |

Corporate Account | ||

(1) ABC Corp. | ABC Corp. | |

(2) ABC Corp. | John Doe, Treasurer | |

(3) ABC Corp. c/o John Doe, Treasurer | John Doe | |

(4) ABC Corp. Profit Sharing Plan | John Doe, Trustee | |

Trust Account | ||

(1) ABC Trust | Jane B. Doe, Trustee | |

(2) Jane B. Doe, Trustee u/t/d 12/28/78 | Jane B. Doe | |

Custodial or Estate Account | ||

(1) John B. Smith, Cust. f/b/o John B. Smith, | John B. Smith | |

(2) Estate of John B. Smith | John B. Smith, Jr., Executor |

Table of Contents

| 1 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| A-1 | ] | |||

| B-1 | ] |

i

Table of Contents

The following synopsis is intended to provide an overview of the information provided in the joint proxy statement (the “Proxy Statement”) and to summarize the proposals to be considered for Janus Henderson Global Technology and Innovation Fund, Janus Henderson Research Fund, Janus Henderson Global Technology and Innovation Portfolio, and Janus Henderson Research Portfolio (each, a “Fund” and collectively, the “Funds”) at the Special Meeting of Shareholders, or at any adjournment or postponement thereof (the “Meeting”).

What am I being asked to vote on?

Shareholders of each Fund are being asked to approve reclassifying the diversification status of the Fund from diversified to nondiversified and to approve the elimination of a related fundamental investment restriction (“Proposal 1”).

Shareholders of each of Janus Henderson Global Technology and Innovation Fund and Janus Henderson Global Technology and Innovation Portfolio (each, a “Technology and Innovation Fund” and together, the “Technology and Innovation Funds”) are being asked to modify the Fund’s fundamental concentration policy (“Proposal 2 and together with Proposal 1, the “Proposals”).

What is the difference between diversified funds and nondiversified funds?

Under the Investment Company Act of 1940 (the “1940 Act”), a fund is designated as diversified or nondiversified, which governs its ownership of securities of issuers. Each Fund is currently designated as a diversified fund and therefore must operate in compliance with the 1940 Act diversification requirements. As a diversified fund, each Fund is limited in its ownership of securities of any single issuer and is subject to the following fundamental investment restriction:

With respect to 75% of its total assets, the Fund may not purchase securities of an issuer (other than the U.S. Government, its agencies, instrumentalities or authorities, or repurchase agreements collateralized by U.S. Government securities, and securities of other investment companies) if: (a) such purchase would, at the time, cause more than 5% of the Fund’s total assets taken at market value to be invested in the securities of such issuer or (b) such purchase would, at the time, result in more than 10% of the outstanding voting securities of such issuer being held by the Fund.

If the proposal is approved, each of the Funds would be permitted to invest a larger percentage of its assets in a smaller number of issuers and would no longer be subject to the above fundamental investment restriction. The nondiversified status will give each Fund’s portfolio management increased flexibility to manage a Fund’s portfolio. Janus Henderson Investors US LLC, the investment adviser to each of the Funds (the “Adviser”), believes that reclassifying the Funds as nondiversified is in the best interests of each of the Funds and their shareholders because it provides the Funds’ portfolio management with increased investment flexibility and potential for better investment performance.

1

Table of Contents

Why am I being asked to approve the reclassification of the Funds from diversified to nondiversified?

Under the 1940 Act a diversified fund cannot change its diversification status to nondiversified or eliminate a fundamental investment restriction without shareholder approval.

Are there other diversification requirements that will still apply to each Fund if it becomes nondiversified under the 1940 Act?

Yes, if the proposal is approved, each Fund would continue to be subject to diversification tests under Subchapter M of the Internal Revenue Code that apply to regulated investment companies. To qualify, among other requirements, each Fund must limit its investment so that, at the close of each quarter of the taxable year, (1) not more than 25% of the Fund’s total assets will be invested in the securities of a single issuer, and (2) with respect to 50% of its total assets, not more than 5% of its total assets will be invested in the securities of a single issuer and the Fund will not own more than 10% of the outstanding voting securities of a single issuer.

Will the Funds’ risk profiles increase if they are reclassified as nondiversified under the 1940 Act?

Nondiversified funds may be subject to a heightened degree of investment risk due to their ability to invest a larger percentage of Fund assets in a smaller number of issuers.

Will the Funds make any changes to their investment strategies if reclassified as nondiversified under the 1940 Act?

No. The Funds will continue to invest in accordance with their current investment strategies.

Why am I being asked to modify the fundamental concentration policy for my Technology and Innovation Fund?

Under the 1940 Act a fund cannot change a fundamental investment restriction without shareholder approval. Each Technology and Innovation Fund currently has a fundamental concentration policy to not invest 25% or more of the value of its total assets in any particular industry (other than U.S. Government securities).

Each Technology and Innovation Fund is seeking approval to adopt the following revised concentration policy:

The Fund may not invest 25% or more of the value of its total assets in any particular industry (other than U.S. Government securities), except that the Fund will invest 25% or more of the value of its total assets in the industries within the information technology sector in the aggregate.

The Adviser is recommending the adoption of the revised concentration policy to provide greater investment flexibility and the potential for better investment

2

Table of Contents

performance, which could also maximize the benefit of the change in diversification status for the Funds.

Will the Technology and Innovation Funds’ risk profiles increase if they modify their fundamental concentration policy?

As each Technology and Innovation Fund already invests a substantial portion of their assets in the securities of companies in the information technology sector, the change is not anticipated at this time to substantively increase the risk profile of the Fund. However, each Technology and Innovation Fund may be subject to a heightened degree of investment risk to the extent that each utilizes its ability to invest a larger percentage of Fund assets in one or more of the industries within the information technology sector.

Will the Technology and Innovation Funds make any changes to their investment strategies if they modify their fundamental concentration policy?

No. The Technology and Innovation Funds will continue to invest in accordance with their current investment strategies.

What is the recommendation of the Board of Trustees?

The Adviser recommended that the Board of Trustees of the Funds approve the Proposals to provide portfolio management with increased investment flexibility and the potential for better investment performance. The Board of Trustees approved the Proposals and recommends that you vote “FOR” each Proposal.

What will happen if shareholders of a Fund do not approve the Proposals?

If shareholders of a Fund do not approve Proposal 1 for their Fund, that Fund will remain “diversified” and remain subject to its related fundamental investment restriction. If shareholders of a Technology and Innovation Fund do not approve Proposal 2 for their Fund, that Fund will continue to have a fundamental concentration policy of not investing 25% or more of the value of its total assets in any particular industry (other than U.S. Government securities). Shareholders of each respective Fund will be voting separately on a Fund-by-Fund basis. If one Fund’s shareholders do not approve a Proposal, that will not impact any other Fund whose shareholders approve the Proposal for that Fund. You are only being asked to vote on the Fund(s) of which you hold shares.

Who is eligible to vote?

Shareholders who owned shares of the Funds at the close of business on [ ], 2024 (the “Record Date”) will be entitled to be present and vote at the Meeting. Those shareholders are entitled to one vote for each whole dollar (and a proportionate fractional vote for each fractional dollar) of net asset value owned on all matters presented at the Meeting.

3

Table of Contents

How do I vote my shares?

You can vote in any one of four ways:

| • | By Internet through the website listed in the proxy voting instructions; |

| • | By telephone by calling the toll-free number listed on your proxy card and following the recorded instructions; |

| • | By mail with the enclosed proxy card; or |

| • | In person at the Special Meeting of Shareholders on [ ], 2024. |

Whichever method you choose, please take the time to read the full text of the Proxy Statement before you vote.

It is important that shareholders respond to ensure that there is a quorum for the Meeting. If we do not receive your response within a few weeks, you may be contacted by [ ], the proxy solicitor engaged by Janus Henderson, who will remind you to vote your shares and help you return your proxy. If a quorum is not present or sufficient votes to approve a Proposal are not received by the date of the Meeting, the persons designated as proxies may adjourn the Meeting to a later date so that we can continue to seek additional votes.

If I send my vote in now as requested, can I change it later?

Yes. You may revoke your proxy vote at any time before it is voted at the Meeting by: (i) delivering a written revocation to the Secretary of the Fund at 151 Detroit Street, Denver, Colorado 80206; (ii) submitting a subsequently executed proxy vote; or (iii) attending the Meeting and voting in person. Even if you plan to attend the Meeting, we ask that you return your proxy card or vote by Internet or telephone. This will help us ensure that an adequate number of shares are present at the Meeting for consideration of the Proposals.

What is the required vote to approve the Proposal?

Approval of each Proposal requires the affirmative vote of a “majority of the outstanding voting securities” of the Fund within the meaning of the Investment Company Act of 1940, as amended (such a majority is referred to herein as a “1940 Act Majority”). A 1940 Act Majority means the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (ii) more than 50% of the outstanding shares of the Fund entitled to vote.

A quorum of shareholders is required to take action at the Meeting. The presence in person or by proxy of the holders of record of 30% of shares outstanding and entitled to vote at the Meeting constitutes a quorum.

Who is paying the costs of this solicitation?

Each Fund will pay the fees and expenses related to the Proposals, including the cost of the preparation of these proxy materials and their distribution, and all other costs incurred with the solicitation of proxies, including any additional solicitation

4

Table of Contents

made by letter, telephone, or otherwise, and the Meeting. For any Funds subject to contractual expense limitations, the proxy expenses over and above any contractually stated expense limitation will be borne by the Adviser.

Whom should I call for additional information about this Proxy Statement?

Please call [ ], the proxy solicitor engaged by Janus Henderson, at [1- ].

5

Table of Contents

, 2024

JANUS INVESTMENT FUND

Janus Henderson Global Technology and Innovation Fund

Janus Henderson Research Fund

JANUS ASPEN SERIES

Janus Henderson Global Technology and Innovation Portfolio

Janus Henderson Research Portfolio

151 Detroit Street

Denver, Colorado 80206

JOINT SPECIAL MEETING OF SHAREHOLDERS

This is a joint proxy statement (“Proxy Statement”) for Janus Henderson Global Technology and Innovation Fund, Janus Henderson Research Fund, Janus Henderson Global Technology and Innovation Portfolio, and Janus Henderson Research Portfolio (each, a “Fund” and collectively, the “Funds”), each a series of Janus Investment Fund or Janus Aspen Series (each, a “Trust” and together, the “Trusts”). Proxies for the Special Meeting of Shareholders of the Funds are being solicited by the Board of Trustees of the Trusts (the “Board,” the “Board of Trustees,” or the “Trustees”) to approve the following proposals (together, the “Proposals”) that have already been approved by the Board:

Proposal 1: To reclassify the diversification status for each of Janus Henderson Global Technology and Innovation Fund, Janus Henderson Research Fund, Janus Henderson Global Technology and Innovation Portfolio, and Janus Henderson Research Portfolio from diversified to nondiversified and to eliminate the following related fundamental investment restriction:

With respect to 75% of its total assets, the Fund may not purchase securities of an issuer (other than the U.S. Government, its agencies, instrumentalities or authorities, or repurchase agreements collateralized by U.S. Government securities, and securities of other investment companies) if: (a) such purchase would, at the time, cause more than 5% of the Fund’s total assets taken at market value to be invested in the securities of such issuer or (b) such purchase would, at the time, result in more than 10% of the outstanding voting securities of such issuer being held by the Fund.

Proposal 2: To modify the fundamental concentration policy for each of Janus Henderson Global Technology and Innovation Fund and Janus Henderson Global Technology and Innovation Portfolio to read as follows:

The Fund may not invest 25% or more of the value of its total assets in any particular industry (other than U.S. Government securities), except that the Fund will invest 25% or more of the value of its total assets in the industries within the information technology sector in the aggregate.

6

Table of Contents

Unless otherwise indicated, the joint Special Meeting of Shareholders of the Funds (together with any adjournments or postponements thereof) is referred to herein as the “Meeting.”

The joint Special Meeting of Shareholders will be held at the [●], on [ ], 2024 at [●] Mountain Time, or at such later time as may be necessary due to adjournments or postponements thereof. Any shareholder of record who owned shares of the Fund as of the close of business on [ ], 2024 (the “Record Date”), will receive notice of the Meeting and will be entitled to vote at the Meeting. You should read the entire Proxy Statement before voting. If you have any questions, please call our proxy solicitor, [ ], at [1- ]. This Proxy Statement, Notice of Special Meeting, and the proxy card are first being mailed to shareholders on or about [ , 2024].

Each Fund provides annual and semiannual reports to its shareholders that highlight relevant information, including investment results. Additional copies of each Fund’s most recent annual report and semiannual report are available, without charge, by calling a Janus Henderson representative at 1-877-335-2687 (or 1-800-525-3713 if you hold shares directly with the Funds), via the Internet at janushenderson.com/info (or janushenderson.com/reports if you hold shares directly with the Funds) or janushenderson.com/VIT, or by sending a written request to the Secretary of the Trust at 151 Detroit Street, Denver, Colorado 80206.

7

Table of Contents

PROPOSAL 1: APPROVE THE RECLASSIFICATION FROM DIVERSIFIED TO NONDIVERSIFIED AND ELIMINATE A RELATED FUNDAMENTAL INVESTMENT RESTRICTION

Shareholders are being asked to review and consider re-classifying the diversification status of each of the Funds from diversified to nondiversified and eliminating the following related fundamental investment restriction:

With respect to 75% of its total assets, the Fund may not purchase securities of an issuer (other than the U.S. Government, its agencies, instrumentalities or authorities, or repurchase agreements collateralized by U.S. Government securities, and securities of other investment companies) if: (a) such purchase would, at the time, cause more than 5% of the Fund’s total assets taken at market value to be invested in the securities of such issuer or (b) such purchase would, at the time, result in more than 10% of the outstanding voting securities of such issuer being held by the Fund.

Section 5(b) of the 1940 Act requires funds to be classified as either diversified or nondiversified. Diversified funds are subject to the above fundamental investment restriction and nondiversified funds are not. As a result, a nondiversified fund is permitted to hold a greater percentage of its assets in the securities of a single issuer. Under the 1940 Act, a nondiversified fund is permitted to operate as a diversified fund, but a diversified fund cannot become nondiversified unless shareholders approve the change. If a nondiversified fund operates for more than three years as diversified, it is considered diversified for SEC diversification purposes, which would then require Janus Henderson to present the change to the Board and shareholders for approval if it wanted to again be classified as nondiversified.

Although the Funds are not designed to track their respective indices, they do select securities from the indices’ universes and Fund performance is measured against the Funds’ respective indices. As discussed below, certain stocks in the Funds’ performance indices have performed well and have become a larger portion of the Funds’ performance indices, which has limited portfolio management’s ability to allocate to or manage around these large index holdings. Janus Henderson Investors US LLC, the investment adviser to the Funds (the “Adviser”) is therefore proposing to change each Fund’s classification from diversified to nondiversified and to eliminate the above fundamental investment restriction to provide the Funds’ portfolio management with increased investment flexibility and the potential for better investment performance.

For example, the performance benchmark of each of Janus Henderson Global Technology and Innovation Fund and Janus Henderson Global Technology and Innovation Portfolio (the “Global Technology Funds”) is the MSCI All Country World Information Technology Index (the “MSCI Index”). Although the Global Technology Funds are not designed to track the MSCI Index, they do select securities from the MSCI Index’s universe and their performance is measured against the MSCI Index. Over the past year or so, certain stocks have experienced extraordinary

8

Table of Contents

increases in market capitalization and the MSCI Index’s allocation to such stocks has increased. Notably, these stocks have included Apple, Microsoft, and Nvidia. As a result, indices with higher weightings to technology stocks have become much more concentrated at the individual stock level.

Similarly, the performance benchmark of each of Janus Henderson Research Fund and Janus Henderson Research Portfolio (the “Research Funds”) is the Russell 1000 Growth Index (the “Russell Index”). Although the Research Funds are not designed to track the Russell Index, they do select securities from the Russell Index’s universe and their performance is measured against the Russell Index. Over the past year or so, certain stocks have experienced extraordinary increases in market capitalization and the Russell Index’s allocation to such stocks has increased. Notably, these stocks have included Alphabet, Amazon, Apple, Meta, Microsoft, and Nvidia. As a result, large market cap growth indices have become much more concentrated at the individual stock level.

Although increased levels of concentration in individual stocks have fluctuated in both of the MSCI Index and the Russell Index in the past, the Adviser believes that this market concentration is likely to persist rather than “self-correct” as it has historically.

Due to the 1940 Act diversification requirements portfolio management’s ability to allocate to or manage around these large index holdings has been limited. The Adviser is therefore proposing to change each Fund’s classification from diversified to nondiversified and to eliminate the related fundamental investment restriction, which it believes will provide portfolio management with increased investment flexibility and the potential for better investment performance. Additionally, because nondiversified funds may be subject to a heightened degree of investment risk due to their ability to invest a larger percentage of their assets in a smaller number of issuers, the following disclosure will be added to the prospectus of any Fund re-classified as nondiversified:

Nondiversification Risk. The Fund is classified as nondiversified under the Investment Company Act of 1940, as amended. This gives portfolio management more flexibility to hold larger positions in securities. As a result, an increase or decrease in the value of a single security held by the Fund may have a greater impact on the Fund’s net asset value and total return.

The Trustees of the Trust unanimously recommend that you vote “FOR” approval of the reclassification from diversified to nondiversified.

9

Table of Contents

PROPOSAL 2: APPROVE THE MODIFICATION OF THE FUNDAMENTAL CONCENTRATION POLICY

Shareholders of each Technology and Innovation Fund are being asked to modify the fundamental concentration policy for each of Janus Henderson Global Technology and Innovation Fund and Janus Henderson Global Technology and Innovation Portfolio to read as follows:

The Fund may not invest 25% or more of the value of its total assets in any particular industry (other than U.S. Government securities), except that the Fund will invest 25% or more of the value of its total assets in the industries within the information technology sector in the aggregate.

Under the 1940 Act, a fund may not change its fundamental concentration policy without shareholder approval. As discussed above, certain stocks have experienced extraordinary increases in market capitalization and the MSCI Index’s allocation to such stocks has increased. This, in turn, has resulted in increased concentration in certain industries and sub-industries in the MSCI Index. The Adviser is therefore proposing to change each Technology and Innovation Fund’s fundamental concentration policy to provide the Funds’ portfolio management with increased investment flexibility and the potential for better investment performance, which could also maximize the benefit of the change in diversification status for the Funds.

If the modified fundamental concentration policy is approved, the Technology and Innovation Funds will continue to invest in accordance with their current investment strategies. Further, as each Technology and Innovation Fund already invests a substantial portion of their assets in the securities of companies in the information technology sector, the change is not anticipated at this time to substantively increase the risk profile of the Fund. However, each Technology and Innovation Fund may be subject to a heightened degree of investment risk to the extent that each utilizes its ability to invest a larger percentage of Fund assets in one or more of the industries within the information technology sector.

The Trustees of the Trust unanimously recommend that you vote “FOR” approval of the modified fundamental concentration policy.

10

Table of Contents

SERVICE PROVIDERS TO THE FUNDS

Adviser and Administrator. Janus Henderson Investors US LLC, located at 151 Detroit Street, Denver, Colorado 80206, also serves as the investment adviser and administrator for the Funds.

Distributor. Janus Henderson Distributors LLC, located at 151 Detroit Street, Denver, Colorado 80206, a wholly-owned subsidiary of Janus Henderson, serves as distributor of the Funds.

Transfer Agent. Janus Henderson Services US LLC, located at 151 Detroit Street, Denver, Colorado 80206, a wholly-owned subsidiary of Janus Henderson, serves as the Funds’ transfer agent.

Custodian. BNP Paribas, acting through its New York branch, 787 Seventh Avenue, New York, New York 10019 is the custodian of the domestic securities and cash of the Funds.

11

Table of Contents

ADDITIONAL INFORMATION ABOUT THE MEETING

Each holder of a whole or fractional share shall be entitled to one vote for each whole dollar and a proportionate fractional vote for each fractional dollar of net asset value of shares held in such shareholder’s name as of the Record Date. If you are not the owner of record, but your shares are instead held for your benefit by a financial intermediary such as a retirement plan service provider, broker-dealer, bank trust department, insurance company, or other financial intermediary, that financial intermediary may request that you provide instruction on how to vote the shares you beneficially own. Your financial intermediary will provide you with additional information. Thirty percent of the outstanding shares of the Janus Henderson Global Technology and Innovation Fund and Janus Henderson Research Fund entitled to vote (all classes of a Fund voting together) shall be a quorum for the transaction of business by the Fund at the Meeting. One-third of the outstanding shares of the Janus Henderson Global Technology and Innovation Portfolio and Janus Henderson Research Portfolio entitled to vote (all classes of a Fund voting together) shall be a quorum for the transaction of business by the Fund at the Meeting. Any lesser number is sufficient for adjournments. In the event that the necessary quorum to transact business is not present or the vote required to approve the Proposals is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments or postponements of the Meeting, in accordance with applicable law, to permit further solicitation of proxies. Any such adjournment or postponement as to the Proposals will require the affirmative vote of the holders of a majority of the shares of the Fund present in person or by proxy at the Meeting. If a quorum is not present or the vote required to approve the Proposals is not obtained, the persons named as proxies will vote those proxies for the Fund (excluding broker non-votes and abstentions) in favor of such adjournment or postponement if they determine additional solicitation is warranted and in the interest of the Fund.

“Broker non-votes” are shares held by a broker or nominee for which an executed proxy is received by the Fund, but are not voted because instructions have not been received from beneficial owners or persons entitled to vote, and the broker or nominee does not have discretionary voting power. For purposes of voting on the Proposals, abstentions and “broker non-votes” will be counted as present for purposes of determining whether a quorum is present, but do not represent votes cast in favor of an adjournment, postponement, or the Proposals. Therefore, if your shares are held through a broker or other nominee, it is important for you to instruct the broker or nominee how to vote your shares.

To become effective, each Proposal requires the affirmative vote of a 1940 Act Majority of the Fund in favor of the Proposal, with all classes of shares voting together as a single class. A 1940 Act Majority means the lesser of the vote of: (i) 67% or more of the shares of the Fund entitled to vote thereon present at the

12

Table of Contents

meeting if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. For purposes of determining the approval of a Proposal, abstentions and broker non-votes will have the same effect as shares voted against the Proposal.

The number of outstanding shares and net assets of each class of the Fund, as applicable, as of the close of business on the Record Date, is attached in Appendix A to this Proxy Statement.

Beneficial owners of 5% or more of the outstanding shares of each class of the Fund are shown in Appendix B to this Proxy Statement. To the best knowledge of the Trust, no person or entity beneficially owned more than 5% of the outstanding shares of any class of the Fund except as stated in Appendix B. To the best knowledge of the Trust, the entities shown in Appendix B as owning 25% or more of the Fund, unless otherwise indicated, are not the beneficial owners of such shares.

[As of the Record Date, the officers and Trustees as a group owned less than 1% of the outstanding shares of the Fund.]

The cost of preparing, printing, and mailing the proxy card and this Proxy Statement, and all other costs incurred with the solicitation of proxies, including any additional solicitation made by letter, telephone, or otherwise, will be paid by the Funds. For any Funds subject to contractual expense limitations, the proxy expenses over and above any contractually stated expense limitation will be borne by the Adviser. In addition to solicitation of proxies by mail, certain officers and representatives of the Trust, certain officers and employees of Janus Henderson or its affiliates, and certain financial services firms and their representatives, without extra compensation, or a solicitor, may conduct additional solicitations personally, by telephone, U.S. mail, verbal, internet, email, or by any other means available.

Janus Henderson has engaged [ ], a professional proxy solicitation firm, to assist in the solicitation of proxies for the Fund, at an estimated cost of $[ ], plus [any out-of-pocket] expenses. These costs are part of the proxy expenses to be paid by the Funds, subject to any contractually stated expense limitations. Among other things, [ ] will be: (i) required to maintain the confidentiality of all shareholder information; (ii) prohibited from selling or otherwise disclosing shareholder information to any third party; and (iii) required to comply with applicable telemarketing laws.

Brokers, banks, and other fiduciaries may be required to forward soliciting material to their principals on behalf of the Fund and to obtain authorization for the execution of proxies. To the extent that Janus Henderson or the Fund would have directly borne the expenses for those services, Janus Henderson will reimburse these intermediaries for their expenses.

13

Table of Contents

As the Meeting date approaches, certain shareholders whose votes have not been received may receive telephone calls from a representative of [ ]. Authorization to permit [ ] to execute proxies may be obtained by telephonic or electronically transmitted instructions from shareholders of the Fund. Proxies that are obtained telephonically will be recorded in accordance with the procedures described below. Janus Henderson believes that these procedures are reasonably designed to ensure that both the identity of the shareholder casting the vote and the voting instructions of the shareholder are accurately determined.

In all cases where a telephonic proxy is solicited, the [ ] representative is required to ask for each shareholder’s full name, address and title (if the shareholder is authorized to act on behalf of an entity, such as a corporation), and to confirm that the shareholder has received the Proxy Statement and proxy card in the mail or electronically. If the information solicited agrees with the information provided to the representative, then the representative has the responsibility to explain the process, and ask for the shareholder’s instructions on a Proposal. Although the representative is permitted to answer questions about the process, he or she is not permitted to recommend to the shareholder how to vote. The representative may read any recommendation set forth in this Proxy Statement. The representative will record the shareholder’s instructions. Within 72 hours, the shareholder will be sent a confirmation of his or her vote asking the shareholder to call [ ] immediately if his or her instructions are not accurately reflected in the confirmation.

Internet Voting. Shareholders may provide their voting instructions through Internet voting by following the instructions on the enclosed proxy card. Shareholders who vote via the Internet, in addition to confirming their voting instructions prior to submission and terminating their Internet voting session, will, upon request, receive an e-mail confirming their voting instructions.

Telephone Touch-Tone Voting. Shareholders may provide their voting instructions through telephone touch-tone voting by following the instructions on the enclosed proxy card. Shareholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call.

If a shareholder wishes to participate in the Meeting but does not wish to give a proxy via the Internet or by telephone, the shareholder may still submit the proxy card originally sent with the Proxy Statement in the postage-paid envelope provided or otherwise mailed or provided to the shareholder, or attend the Meeting in person. Shareholders requiring additional information regarding the proxy or replacement proxy card may contact [ ] at [1- ]. Any proxy given by a shareholder is revocable until voted at the Meeting.

Revoking a Proxy. Any shareholder submitting a proxy has the power to revoke it at any time before it is exercised at the Meeting by submitting to the Secretary of the Trust at 151 Detroit Street, Denver, Colorado 80206, a written notice of revocation or a subsequently executed proxy or voting instructions, or by attending the Meeting and

14

Table of Contents

voting in person. All properly executed and unrevoked proxies received in time for the Meeting will be voted as specified in the proxy or, if no specification is made, will be voted “FOR” the Proposals, as described in this Proxy Statement.

Attending the Meeting. If you wish to attend the Meeting and vote in person, you will be able to do so. If you intend to attend the Meeting in person and you are a record holder of a Fund’s shares, in order to gain admission you may be asked to show photographic identification, such as your driver’s license. If you intend to attend the Meeting in person and you hold your shares through a broker, bank or other intermediary, in order to gain admission you may be asked to show photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of a Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other intermediary you will not be able to vote in person at the Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other intermediary and present it at the Meeting. You may contact [ ] at [ ] to obtain directions to the site of the Meeting.

Shareholder Proposals for Subsequent Meetings

Each Trust is not required, and does not intend, to hold annual shareholder meetings. Shareholder meetings may be called from time to time as described in the Trusts’ charter documents.

Under the proxy rules of the SEC, shareholder proposals that meet certain conditions may be included in the Fund’s proxy statement for a particular meeting. Those rules currently require that for future meetings, the shareholder must be a record or beneficial owner of Fund shares either: (i) with a value of at least $2,000; or (ii) in an amount representing at least 1% of the Fund’s securities to be voted at the time the proposal is submitted and for one year prior thereto, and must continue to own such shares through the date on which the meeting is held. Another requirement relates to the timely receipt by a Fund of any such proposal. Under those rules, a proposal must have been submitted within a reasonable time before the Fund began to print and mail this Proxy Statement in order to be included in this Proxy Statement. A proposal submitted for inclusion in a Fund’s proxy material for the next special meeting after the meeting to which this Proxy Statement relates must be received by the Fund within a reasonable time before the Fund begins to print and mail the proxy materials for that meeting.

A shareholder wishing to submit a proposal for inclusion in a proxy statement subsequent to the Meeting, if any, should send the written proposal to the Secretary of the Trust at 151 Detroit Street, Denver, Colorado 80206, within a reasonable time before the Fund begins to print and mail the proxy materials for that meeting. Notice of shareholder proposals to be presented at the Meeting must have been received within a reasonable time before the Fund began to mail this Proxy Statement. The timely submission of a proposal does not guarantee its inclusion in the proxy materials.

15

Table of Contents

The Trustees provide for shareholders to send written communications to the Trustees via regular mail. Written communications to the Trustees, or to an individual Trustee, should be sent to the attention of the Trust’s Secretary at the address of the Trust’s principal executive office. All such communications received by the Trust’s Secretary shall be promptly forwarded to the individual Trustee to whom they are addressed or to the full Board of Trustees, as applicable. If a communication does not indicate a specific Trustee, it will be sent to the Chairperson of the Nominating and Governance Committee and the independent counsel to the Trustees for further distribution, as deemed appropriate by such persons. The Trustees may further develop and refine this process as deemed necessary or desirable.

Reports to Shareholders and Financial Statements

The annual report to shareholders of the Fund has previously been sent to shareholders. The Fund provides annual and semiannual reports to its shareholders that highlight relevant information, including investment results. Additional copies of the Fund’s most recent annual report and any more recent semiannual report are available, without charge, by calling a Janus Henderson representative at 1-877-335-2687 (or 1-800-525-3713 if you hold shares directly with the Fund), via the Internet at janushenderson.com/info (or janushenderson.com/reports if you hold shares directly with Janus Henderson), or by sending a written request to the Secretary of the Trust at 151 Detroit Street, Denver, Colorado 80206.

To avoid sending duplicate copies of materials to households, the Fund may mail only one copy of each report or this Proxy Statement to shareholders having the same last name and address on the Fund’s records. The consolidation of these mailings benefits the Fund through reduced mailing expenses. With respect to Class D Shares, if a shareholder wants to receive multiple copies of these materials or to receive only one copy in the future, the shareholder should contact the Fund’s transfer agent, Janus Henderson, at 1-800-525-3713 or notify the Fund’s transfer agent in writing at P.O. Box 219109, Kansas City, Missouri 64121-9109. With respect to other share classes, shareholders should contact their financial intermediary.

Other Matters to Come Before the Meeting

The Board of Trustees is not aware of any matters that will be presented for action at the Meeting other than the matter described in this Proxy Statement. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares as to any other matters, in accordance with their best judgment in the interest of the Trust and/or Fund.

16

Table of Contents

Please vote by Internet or telephone promptly, or complete, date, sign and return the enclosed proxy card. No postage is required if you mail your proxy card in the United States.

By order of the Board of Trustees,

Michelle Rosenberg

President and Chief Executive Officer of

Janus Investment Fund

Janus Aspen Series

17

Table of Contents

SHARES OUTSTANDING AND NET ASSETS

The following charts show the shares outstanding and net assets of each class of the Funds as of [●].

Fund | Share Class | Total Number of Outstanding Shares | Net Assets | |||||||||

Janus Henderson Global Technology and Innovation Fund | ||||||||||||

Class A Shares | ||||||||||||

Class C Shares | ||||||||||||

Class D Shares | ||||||||||||

Class I Shares | ||||||||||||

Class S Shares | ||||||||||||

Class T Shares | ||||||||||||

Janus Henderson Research Fund | ||||||||||||

Class A Shares | ||||||||||||

Class C Shares | ||||||||||||

Class D Shares | ||||||||||||

Class I Shares | ||||||||||||

Class S Shares | ||||||||||||

Class T Shares | ||||||||||||

Janus Henderson Global Technology and Innovation Portfolio | ||||||||||||

Institutional Shares | ||||||||||||

Service Shares | ||||||||||||

Janus Henderson Research Portfolio | ||||||||||||

Institutional Shares | ||||||||||||

Service Shares | ||||||||||||

A-1

Table of Contents

PRINCIPAL HOLDERS

Except as set forth below, as of [●], the Trustees and the officers of the Funds, individually, and all Trustees and officers of the Funds, as a group, owned less than 1% of the outstanding shares of any class of a Fund.

Fund | Share Class | Trustee/Officer | Shares Owned | Percentage Owned | ||||||||||||||||

| Janus Henderson Global Technology and Innovation Fund | ||||||||||||||||||||

| Janus Henderson Research Fund | ||||||||||||||||||||

In addition, an investment by Janus Henderson’s funds of funds may comprise a significant percentage of a share class or a Fund.

As of [●], the percentage ownership of any person or entity owning 5% or more of the outstanding Shares of any class of the Fund is listed below. Any person or entity that beneficially owns, directly or through one or more controlled companies, more than 25% of the voting securities of a company is presumed to “control” such company. Accordingly, to the extent that a person or entity is identified as the beneficial owner of more than 25% of the voting securities of the Fund, or is identified as the record owner of more than 25% of the Fund and has voting and/or investment powers, that person or entity may be presumed to control the Fund. A controlling shareholder’s vote could have a more significant effect on matters presented to shareholders for approval than the vote of other Fund shareholders. In addition, a large redemption by a controlling shareholder could significantly reduce the asset size of a Fund, which may adversely affect the Fund’s investment flexibility, portfolio diversification, and expense ratio.

To the extent that Janus Henderson, an affiliate, or an individual, such as the Fund’s portfolio manager(s), owns a significant portion of the Shares of any class of the Fund or the Fund as a whole, the redemption of those Shares may have an adverse effect on the Fund, a share class, and/or its shareholders. Janus Capital may consider the effect of redemptions on such Fund and the Fund’s other shareholders in deciding whether to redeem its Shares. In certain circumstances, Janus Henderson’s or JHG’s ownership may not represent beneficial ownership. To the best knowledge of the Trust, entities other than Janus Henderson shown as owning more than 25% of the outstanding Shares of a class of a Fund are not the beneficial owners of such Shares, unless otherwise indicated. The following chart lists each shareholder or group of shareholders who beneficially (or of record) owned more than 5% of any class of shares for a Fund as of [●]:

Fund Name and Class | Shareholder and Address of Record | Number of Shares | Percentage Ownership |

B-1

Table of Contents

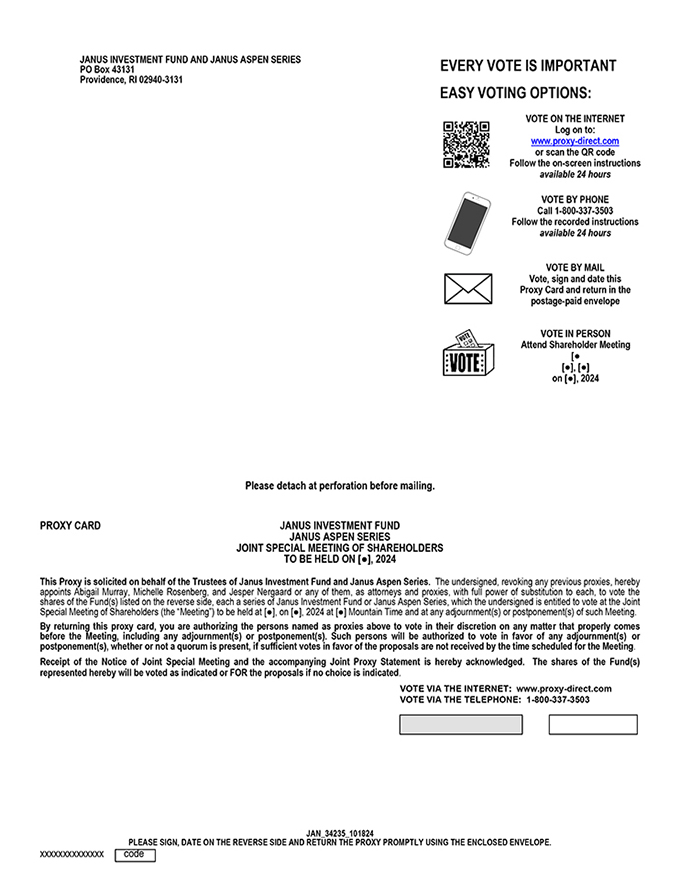

JANUS INVESTMENT FUND AND JANUS ASPEN SERIES PO Box 43131 Providence, RI 02940-3131 EVERY VOTE IS IMPORTANT EASY VOTING OPTIONS: VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VOTE IN PERSON Attend Shareholder Meeting [• [•], [•] on [•], 2024 Please detach at perforation before mailing. PROXY CARD JANUS INVESTMENT FUND JANUS ASPEN SERIES JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON [•], 2024 This Proxy is solicited on behalf of the Trustees of Janus Investment Fund and Janus Aspen Series. The undersigned, revoking any previous proxies, hereby appoints Abigail Murray, Michelle Rosenberg, and Jesper Nergaard or any of them, as attorneys and proxies, with full power of substitution to each, to vote the shares of the Fund(s) listed on the reverse side, each a series of Janus Investment Fund or Janus Aspen Series, which the undersigned is entitled to vote at the Joint Special Meeting of Shareholders (the “Meeting”) to be held at [•], on [•], 2024 at [•] Mountain Time and at any adjournment(s) or postponement(s) of such Meeting. By returning this proxy card, you are authorizing the persons named as proxies above to vote in their discretion on any matter that properly comes before the Meeting, including any adjournment(s) or postponement(s). Such persons will be authorized to vote in favor of any adjournment(s) or postponement(s), whether or not a quorum is present, if sufficient votes in favor of the proposals are not received by the time scheduled for the Meeting. Receipt of the Notice of Joint Special Meeting and the accompanying Joint Proxy Statement is hereby acknowledged. The shares of the Fund(s) represented hereby will be voted as indicated or FOR the proposals if no choice is indicated. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 PLEASE SIGN, DATE ON THE REVERSE SIDE AND JAN_34235_101824 RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code

Table of Contents

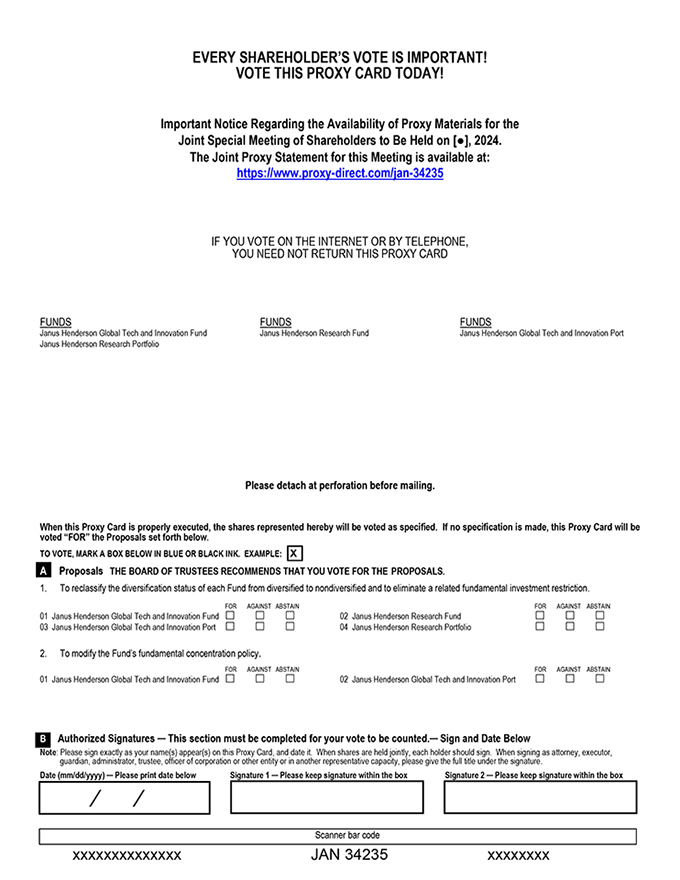

EVERY SHAREHOLDER’S VOTE IS IMPORTANT! VOTE THIS PROXY CARD TODAY! Important Notice Regarding the Availability of Proxy Materials for the Joint Special Meeting of Shareholders to Be Held on [•], 2024. The Joint Proxy Statement for this Meeting is available at: https://www.proxy-direct.com/jan-34235 IF YOU VOTE ON THE INTERNET OR BY TELEPHONE, YOU NEED NOT RETURN THIS PROXY CARD FUNDS FUNDS FUNDS Janus Henderson Global Tech and Innovation Fund Janus Henderson Research Fund Janus Henderson Global Tech and Innovation Port Janus Henderson Research Portfolio Please detach at perforation before mailing. When this Proxy Card is properly executed, the shares represented hereby will be voted as specified. If no specification is made, this Proxy Card will be voted “FOR” the Proposals set forth below. TO VOTE, MARK A BOX BELOW IN BLUE OR BLACK INK. EXAMPLE: X A Proposals THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE FOR THE PROPOSALS. 1. To reclassify the diversification status of each Fund from diversified to nondiversified and to eliminate a related fundamental investment restriction. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN 01 Janus Henderson Global Tech and Innovation Fund ï,£ ï,£ ï,£ 02 Janus Henderson Research Fund ï,£ ï,£ ï,£ 03 Janus Henderson Global Tech and Innovation Port ï,£ ï,£ ï,£ 04 Janus Henderson Research Portfolio ï,£ ï,£ ï,£ 2. To modify the Fund’s fundamental concentration policy. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN 01 Janus Henderson Global Tech and Innovation Fund ï,£ ï,£ ï,£ 02 Janus Henderson Global Tech and Innovation Port ï,£ ï,£ ï,£ B Authorized Signatures — This section must be completed for your vote to be counted.— Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) — Please print date below Signature 1 — Please keep signature within the box Signature 2 — Please keep signature within the box / / Scanner bar code xxxxxxxxxxxxxx JAN 34235 xxxxxxxx

Table of Contents

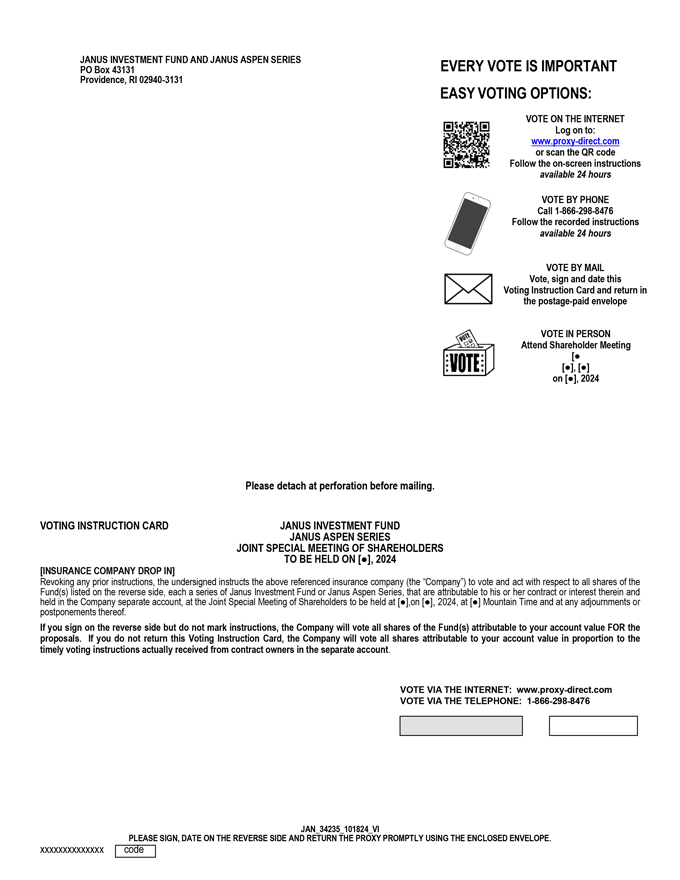

JANUS INVESTMENT FUND AND JANUS ASPEN SERIES PO Box 43131 EVERY VOTE IS IMPORTANT Providence, RI 02940-3131 EASY VOTING OPTIONS: VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-866-298-8476 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Voting Instruction Card and return in the postage-paid envelope VOTE IN PERSON Attend Shareholder Meeting [• [•], [•] on [•], 2024 Please detach at perforation before mailing. VOTING INSTRUCTION CARD JANUS INVESTMENT FUND JOINT SPECIAL JANUS MEETING ASPEN OF SERIES SHAREHOLDERS TO BE HELD ON [•], 2024 [INSURANCE COMPANY DROP IN] Revoking any prior instructions, the undersigned instructs the above referenced insurance company (the “Company”) to vote and act with respect to all shares of the Fund(s) held in the listed Company on the separate reverse side, account, each at a the series Joint of Special Janus Investment Meeting of Fund Shareholders or Janus to Aspen be held Series, at [•],on that [are •], attributable 2024, at [•] to Mountain his or her Time contract and at or any interest adjournments therein and or postponements thereof. If you sign on the reverse side but do not mark instructions, the Company will vote all shares of the Fund(s) attributable to your account value FOR the proposals. If you do not return this Voting Instruction Card, the Company will vote all shares attributable to your account value in proportion to the timely voting instructions actually received from contract owners in the separate account. VOTE VIA THE INTERNET: www.proxy-direct.com 1-866-298-8476 JAN_34235_101824_VI PLEASE SIGN, DATE ON THE REVERSE SIDE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code

Table of Contents

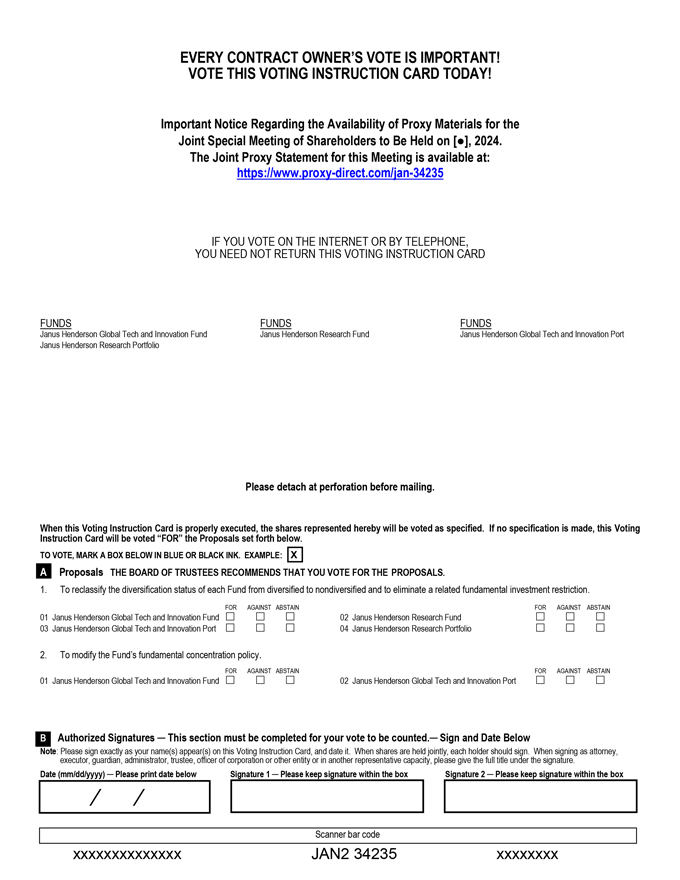

EVERY CONTRACT OWNER’S VOTE IS IMPORTANT! VOTE THIS VOTING INSTRUCTION CARD TODAY! Important Notice Regarding the Availability of Proxy Materials for the Joint Special Meeting of Shareholders to Be Held on [•], 2024. The Joint Proxy Statement for this Meeting is available at: https://www.proxy-direct.com/jan-34235 IF YOU VOTE ON THE INTERNET OR BY TELEPHONE, YOU NEED NOT RETURN THIS VOTING INSTRUCTION CARD FUNDS FUNDS FUNDS Janus Henderson Global Tech and Innovation Fund Janus Henderson Research Fund Janus Henderson Global Tech and Innovation Port Janus Henderson Research Portfolio Please detach at perforation before mailing. When this Voting Instruction Card is properly executed, the shares represented hereby will be voted as specified. If no specification is made, this Voting Instruction Card will be voted “FOR” the Proposals set forth below. VOTE, MARK A BOX BELOW IN BLUE OR BLACK INK. EXAMPLE: X A Proposals THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE FOR THE PROPOSALS. 1. To reclassify the diversification status of each Fund from diversified to nondiversified and to eliminate a related fundamental investment restriction. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN 01 Janus Henderson Global Tech and Innovation Fund ??? 02 Janus Henderson Research Fund ??? 03 Janus Henderson Global Tech and Innovation Port ??? 04 Janus Henderson Research Portfolio ??? 2. To modify the Fund’s fundamental concentration policy. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN 01 Janus Henderson Global Tech and Innovation Fund ??? 02 Janus Henderson Global Tech and Innovation Port ??? B Authorized Signatures ? This section must be completed for your vote to be counted.? Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Voting Instruction Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) ? Please print date below Signature 1 ? Please keep signature within the box Signature 2 ? Please keep signature within the box / / Scanner bar code xxxxxxxxxxxxxx JAN2 34235 xxxxxxxx