Fidelity® Government Cash Reserves

Semi-Annual Report

May 31, 2021

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary/Performance (Unaudited)

Effective Maturity Diversification

| Days | % of fund's investments 5/31/21 |

| 1 - 7 | 62.0 |

| 8 - 30 | 11.3 |

| 31 - 60 | 8.7 |

| 61 - 90 | 5.4 |

| 91 - 180 | 10.9 |

| > 180 | 1.7 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940.

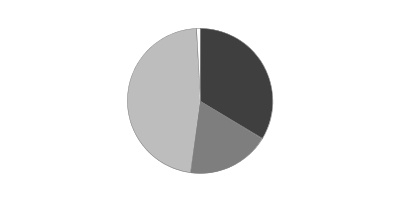

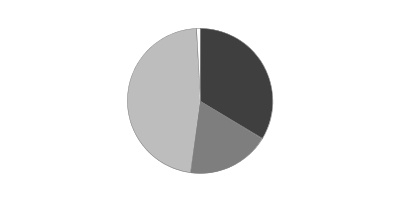

Asset Allocation (% of fund's net assets)

| As of May 31, 2021 |

| | Variable Rate Demand Notes (VRDNs) | 0.2% |

| | U.S. Treasury Debt | 33.5% |

| | U.S. Government Agency Debt | 18.4% |

| | Repurchase Agreements | 47.2% |

| | Net Other Assets (Liabilities) | 0.7% |

Current 7-Day Yield

| | 5/31/21 |

| Fidelity® Government Cash Reserves | 0.01% |

Yield refers to the income paid by the Fund over a given period. Yield for money market funds is usually for seven-day periods, as it is here, though it is expressed as an annual percentage rate. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending May 31, 2021, the most recent period shown in the table, would have been -0.27%.

Schedule of Investments May 31, 2021 (Unaudited)

Showing Percentage of Net Assets

| U.S. Treasury Debt - 33.5% | | | | |

| | | Yield(a) | Principal Amount (000s) | Value (000s) |

| U.S. Treasury Obligations - 33.5% | | | | |

| U.S. Treasury Bills | | | | |

| 6/1/21 to 5/19/22 | | 0.01 to 0.12% | $50,492,382 | $50,488,281 |

| U.S. Treasury Bonds | | | | |

| 8/15/21 to 11/15/21 | | 0.05 to 0.11 | 185,530 | 191,292 |

| U.S. Treasury Notes | | | | |

| 6/15/21 to 1/31/23 | | 0.02 to 0.32 (b) | 17,794,449 | 17,862,662 |

| TOTAL U.S. TREASURY DEBT | | | | |

| (Cost $68,542,235) | | | | 68,542,235 |

|

| Variable Rate Demand Note - 0.2% | | | | |

| California - 0.0% | | | | |

| FHLMC California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev. (Heritage Park Apts. Proj.) Series 2008 C, 0.04% 6/4/21, LOC Freddie Mac, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 10,600 | 10,600 |

| Florida - 0.0% | | | | |

| FNMA Florida Hsg. Fin. Corp. Rev. (Valencia Village Apts. Proj.) Series G, 0.08% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.08 (b)(c) | 7,900 | 7,900 |

| New York - 0.2% | | | | |

| FHLMC New York City Hsg. Dev. Corp. Multi-family Rental Hsg. Rev. (Linden Plaza Proj.) Series 2008 A, 0.08% 6/4/21, LOC Freddie Mac, VRDN | | | | |

| 6/4/21 | | 0.08 (b)(c) | 31,550 | 31,550 |

| FHLMC New York Hsg. Fin. Agcy. Rev. (Clinton Green North Hsg. Proj.) Series 2005 A, 0.04% 6/4/21, LOC Freddie Mac, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 34,955 | 34,955 |

| FHLMC New York Hsg. Fin. Agcy. Rev. (Clinton Green North Hsg. Proj.) Series 2006 A, 0.04% 6/4/21, LOC Freddie Mac, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 28,000 | 28,000 |

| FHLMC New York Hsg. Fin. Agcy. Rev. (Clinton Green South Hsg. Proj.) Series 2005 A, 0.04% 6/4/21, LOC Freddie Mac, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 17,400 | 17,400 |

| FHLMC New York Hsg. Fin. Agcy. Rev. (Saville Hsg. Proj.) Series 2002 A, 0.03% 6/4/21, LOC Freddie Mac, VRDN | | | | |

| 6/4/21 | | 0.03 (b)(c) | 30,400 | 30,400 |

| FNMA New York City Hsg. Dev. Corp. Multi-family Rental Hsg. Rev. (155 West 21st Street Dev. Proj.) Series 2007 A, 0.04% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 13,500 | 13,500 |

| FNMA New York City Hsg. Dev. Corp. Multi-family Rental Hsg. Rev. (255 West 9th Street Proj.) Series 2001 A, 0.03% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.03 (b)(c) | 20,500 | 20,500 |

| FNMA New York Hsg. Fin. Agcy. Rev. (316 Eleventh Ave. Hsg. Proj.) Series 2007 A, 0.04% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 16,600 | 16,600 |

| FNMA New York Hsg. Fin. Agcy. Rev. (600 West and 42nd St. Hsg. Proj.) Series 2007 A, 0.08% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.08 (b)(c) | 49,300 | 49,300 |

| FNMA New York Hsg. Fin. Agcy. Rev. (Taconic West 17th St. Proj.) Series 2009 A, 0.03% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.03 (b) | 10,000 | 10,000 |

| FNMA New York Hsg. Fin. Agcy. Rev. (Tribeca Park Proj.) Series 1997 A, 0.04% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 11,700 | 11,700 |

| FNMA New York Hsg. Fin. Agcy. Rev. (West 23rd Street Hsg. Proj.) Series 2001 A, 0.05% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.05 (b)(c) | 7,000 | 7,000 |

| FNMA New York Hsg. Fin. Agcy. Rev. Series 1997 A, 0.04% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.04 (b)(c) | 10,500 | 10,500 |

| FNMA New York Hsg. Fin. Agcy. Rev. Series 2008 A, 0.07% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.07 (b)(c) | 15,400 | 15,400 |

| FNMA New York Hsg. Fin. Agcy. Rev. Series 2009 A, 0.05% 6/4/21, LOC Fannie Mae, VRDN | | | | |

| 6/4/21 | | 0.05 (b) | 10,000 | 10,000 |

| | | | | 306,805 |

| TOTAL VARIABLE RATE DEMAND NOTE | | | | |

| (Cost $325,305) | | | | 325,305 |

|

| U.S. Government Agency Debt - 18.4% | | | | |

| Federal Agencies - 18.4% | | | | |

| Fannie Mae | | | | |

| 6/4/21 to 7/29/22 | | 0.09 to 0.36 (b)(d) | 9,281,200 | 9,281,243 |

| Federal Farm Credit Bank | | | | |

| 6/1/21 to 3/25/22 | | 0.01 to 0.12 (b) | 1,201,310 | 1,201,491 |

| Federal Home Loan Bank | | | | |

| 6/2/21 to 12/15/22 | | 0.01 to 0.15 (b) | 22,820,501 | 22,821,456 |

| Freddie Mac | | | | |

| 6/24/21 to 8/18/22 | | 0.10 to 0.32 (b) | 4,416,800 | 4,416,852 |

| TOTAL U.S. GOVERNMENT AGENCY DEBT | | | | |

| (Cost $37,721,042) | | | | 37,721,042 |

| U.S. Government Agency Repurchase Agreement - 14.6% | | | |

| | | Maturity Amount (000s) | Value (000s) |

| In a joint trading account at: | | | |

| 0.01% dated 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations) # | | $18,128,817 | $18,128,799 |

| 0.01% dated 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations) # | | 25,348 | 25,348 |

| With: | | | |

| ABN AMRO Bank NV at 0.02%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $547,784,354, 0.38% - 5.57%, 9/30/22 - 3/20/51) | | 537,001 | 537,000 |

| Barclays Bank PLC at 0.01%, dated: | | | |

| 5/25/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $363,120,706, 3.00% - 4.50%, 10/20/43 - 5/20/50) | | 356,001 | 356,000 |

| 5/26/21 due 6/2/21 (Collateralized by U.S. Government Obligations valued at $253,980,424, 2.00% - 3.00%, 7/20/46 - 1/20/51) | | 249,000 | 249,000 |

| 5/28/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $272,340,303, 1.50% - 4.00%, 6/20/47 - 4/20/51) | | 267,001 | 267,000 |

| BMO Harris Bank NA at: | | | |

| 0.02%, dated 5/3/21 due 6/3/21 (Collateralized by U.S. Government Obligations valued at $181,562,925, 1.48% - 4.50%, 11/1/30 - 6/1/51) | | 178,003 | 178,000 |

| 0.03%, dated 5/7/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $72,421,509, 1.35% - 3.00%, 11/1/30 - 6/1/51) | | 71,004 | 71,000 |

| 0.05%, dated 4/12/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $91,806,375, 1.35% - 3.50%, 11/1/30 - 3/20/51) | | 90,011 | 90,000 |

| CIBC Bank U.S.A. at 0.08%, dated 4/29/21 due 7/28/21 (Collateralized by U.S. Government Obligations valued at $72,637,660, 0.13% - 7.01%, 4/30/22 - 6/20/66) | | 71,014 | 71,000 |

| Citibank NA at 0.01%, dated 5/25/21 due 6/1/21 | | | |

| (Collateralized by U.S. Treasury Obligations valued at $545,605,185, 0.00% - 8.88%, 6/11/21 - 5/1/51) | | 534,001 | 534,000 |

| (Collateralized by U.S. Government Obligations valued at $90,999,111, 0.00% - 8.50%, 6/11/21 - 9/15/65) | | 89,000 | 89,000 |

| Citigroup Global Capital Markets, Inc. at 0.01%, dated 5/25/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $363,120,749, 0.13% - 5.00%, 10/15/24 - 9/1/50) | | 356,001 | 356,000 |

| Deutsche Bank AG, New York at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $181,505,951, 0.07% - 6.50%, 7/31/22 - 9/15/28) | | 177,000 | 177,000 |

| Deutsche Bank Securities, Inc. at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $545,599,145, 0.00% - 5.00%, 8/5/21 - 1/15/56) | | 533,000 | 533,000 |

| Goldman Sachs & Co. at 0.01%, dated: | | | |

| 5/27/21 due 6/3/21 (Collateralized by U.S. Government Obligations valued at $1,454,522,020, 1.50% - 7.50%, 3/1/23 - 4/15/61) | | 1,426,003 | 1,426,000 |

| 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $77,520,086, 2.00% - 5.50%, 12/1/23 - 5/1/51) | | 76,000 | 76,000 |

| Mitsubishi UFJ Securities (U.S.A.), Inc. at: | | | |

| 0.03%, dated: | | | |

| 5/11/21 due 7/12/21 (Collateralized by U.S. Government Obligations valued at $181,563,177, 2.00% - 5.75%, 3/1/27 - 5/1/51) | | 178,009 | 178,000 |

| 5/17/21 due 7/16/21 (Collateralized by U.S. Government Obligations valued at $238,682,984, 2.00% - 5.00%, 8/1/27 - 6/1/51) | | 234,012 | 234,000 |

| 5/18/21 due 7/19/21 (Collateralized by U.S. Government Obligations valued at $273,363,189, 1.50% - 5.96%, 6/1/22 - 6/1/51) | | 268,014 | 268,000 |

| 0.04%, dated 5/4/21 due 7/2/21 (Collateralized by U.S. Government Obligations valued at $365,171,361, 1.75% - 6.15%, 12/1/21 - 6/1/51) | | 358,023 | 358,000 |

| Morgan Stanley & Co., LLC at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $626,281,139, 1.50% - 8.00%, 3/1/23 - 2/1/57) | | 614,001 | 614,000 |

| Nomura Securities International, Inc. at 0.01%, dated 5/26/21 due 6/2/21 (Collateralized by U.S. Government Obligations valued at $471,240,839, 0.00% - 5.50%, 10/5/22 - 7/20/69) | | 462,001 | 462,000 |

| RBC Dominion Securities at 0.06%, dated 3/22/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $369,288,481, 2.00% - 4.50%, 9/20/41 - 4/1/51) | | 362,112 | 362,000 |

| RBC Financial Group at: | | | |

| 0.03%, dated: | | | |

| 3/18/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $925,853,894, 1.00% - 7.25%, 12/15/23 - 7/1/56) | | 905,069 | 905,000 |

| 3/19/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $923,156,925, 1.00% - 6.50%, 10/1/27 - 1/1/58) | | 905,072 | 905,000 |

| 3/22/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $943,636,521, 1.50% - 6.50%, 12/15/23 - 8/1/59) | | 925,071 | 925,000 |

| 3/23/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $198,911,603, 1.50% - 5.00%, 1/1/27 - 5/1/58) | | 195,015 | 195,000 |

| 0.08%, dated 2/9/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $185,359,188, 1.00% - 6.00%, 1/25/29 - 8/1/59) | | 181,072 | 181,000 |

| Sumitomo Mitsui Trust Bank Ltd. at: | | | |

| 0.11%, dated 4/1/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $25,572,022, 0.38% - 3.50%, 1/31/22 - 1/20/42) | | 25,007 | 25,000 |

| 0.12%, dated: | | | |

| 3/16/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $113,539,329, 0.38% - 3.50%, 3/31/22 - 7/1/47) | | 111,282 | 111,243 |

| 3/22/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $179,474,941, 0.38% - 4.00%, 3/31/22 - 7/1/49) | | 175,967 | 175,900 |

| 3/29/21 due 6/4/21 (Collateralized by U.S. Government Obligations valued at $188,271,504, 0.38% - 3.50%, 3/31/22 - 8/1/49) | | 184,572 | 184,495 |

| TD Securities (U.S.A.) at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Government Obligations valued at $626,280,696, 2.00% - 3.50%, 5/1/36 - 5/1/51) | | 614,001 | 614,000 |

| TOTAL U.S. GOVERNMENT AGENCY REPURCHASE AGREEMENT | | | |

| (Cost $29,861,785) | | | 29,861,785 |

|

| U.S. Treasury Repurchase Agreement - 32.6% | | | |

| With: | | | |

| ABN AMRO Bank NV at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $401,583,718, 1.50% - 3.00%, 9/30/22 - 8/15/49) | | 393,000 | 393,000 |

| Barclays Bank PLC at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $1,440,495,681, 0.13% - 4.38%, 3/31/22 - 8/15/50) | | 1,409,002 | 1,409,000 |

| BNP Paribas, SA at: | | | |

| 0.01%, dated: | | | |

| 5/17/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $1,356,915,017, 0.00% - 8.00%, 6/15/21 - 11/15/50) | | 1,329,006 | 1,329,000 |

| 5/25/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $900,996,677, 0.00% - 7.25%, 7/15/21 - 11/15/50) | | 883,005 | 883,000 |

| 0.02%, dated: | | | |

| 5/3/21 due 6/3/21 (Collateralized by U.S. Treasury Obligations valued at $2,052,686,235, 0.06% - 6.50%, 10/31/21 - 2/15/50) | | 2,005,035 | 2,005,000 |

| 5/4/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $494,158,363, 0.06% - 6.50%, 10/31/21 - 11/15/50) | | 484,008 | 484,000 |

| 5/5/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $742,571,160, 0.07% - 7.25%, 10/31/21 - 11/15/50) | | 728,013 | 728,000 |

| 5/6/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $1,655,785,115, 0.00% - 8.00%, 7/15/21 - 2/15/50) | | 1,620,030 | 1,620,000 |

| 5/10/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $1,708,657,884, 0.06% - 7.25%, 8/15/21 - 8/15/46) | | 1,674,028 | 1,674,000 |

| CIBC Bank U.S.A. at: | | | |

| 0.01%, dated: | | | |

| 5/4/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $165,307,009, 0.13% - 4.63%, 4/30/22 - 11/15/49) | | 162,001 | 162,000 |

| 5/27/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $229,500,377, 0.25% - 1.50%, 1/15/23 - 8/15/30) | | 225,002 | 225,000 |

| 0.02%, dated 5/25/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $328,927,656, 0.13% - 4.63%, 8/31/22 - 8/15/46) | | 322,008 | 322,000 |

| Citigroup Global Capital Markets, Inc. at 0.01%, dated 5/24/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $487,176,853, 1.63% - 3.38%, 2/15/26 - 11/15/49) | | 473,003 | 473,000 |

| Commerz Markets LLC at 0.01%, dated: | | | |

| 5/25/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $880,465,729, 0.07% - 6.75%, 7/31/22 - 5/15/30) | | 863,202 | 863,200 |

| 5/26/21 due 6/2/21 (Collateralized by U.S. Treasury Obligations valued at $660,014,439, 0.07% - 6.75%, 7/15/22 - 5/15/51) | | 647,001 | 647,000 |

| 5/27/21 due 6/3/21 (Collateralized by U.S. Treasury Obligations valued at $330,356,713, 0.07% - 6.75%, 1/31/22 - 11/15/48) | | 323,821 | 323,820 |

| 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $1,703,203,831, 0.07% - 6.75%, 1/31/22 - 11/15/46) | | 1,667,002 | 1,667,000 |

| Credit AG at 0.01%, dated: | | | |

| 5/26/21 due 6/2/21 (Collateralized by U.S. Treasury Obligations valued at $495,371,359, 2.25% - 8.13%, 8/15/21 - 5/15/51) | | 482,000 | 482,000 |

| 5/27/21 due: | | | |

| 6/2/21 (Collateralized by U.S. Treasury Obligations valued at $330,630,339, 2.38% - 3.13%, 5/15/48 - 11/15/49) | | 321,000 | 321,000 |

| 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $331,660,498, 2.38% - 3.13%, 11/15/41 - 11/15/49) | | 322,003 | 322,000 |

| 5/28/21 due 6/3/21 (Collateralized by U.S. Treasury Obligations valued at $331,660,205, 1.25% - 3.13%, 11/15/41 - 5/15/50) | | 322,000 | 322,000 |

| 6/1/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations)(e) | | 641,000 | 641,000 |

| Deutsche Bank AG, New York at 0.01%, dated 5/28/21 due 6/1/21 | | | |

| (Collateralized by U.S. Treasury Obligations valued at $326,400,182, 0.38% - 2.88%, 7/31/21 - 4/30/25) | | 320,000 | 320,000 |

| (Collateralized by U.S. Treasury Obligations valued at $822,424,194, 1.13% - 4.38%, 2/15/38 - 8/15/50) | | 802,000 | 802,000 |

| DNB Bank ASA at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $262,140,295, 2.38% - 2.88%, 3/31/25 - 5/15/29) | | 257,000 | 257,000 |

| Federal Reserve Bank of New York at 0%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $35,892,000,073, 0.50% - 3.75%, 8/31/23 - 5/15/50) | | 35,892,000 | 35,892,000 |

| Fixed Income Clearing Corp. - BNYM at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $573,240,006, 0.13% - 1.13%, 5/31/22 - 2/28/25) | | 562,000 | 562,000 |

| ING Financial Markets LLC at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $491,146,599, 2.13% - 2.50%, 12/31/22 - 5/15/27) | | 481,000 | 481,000 |

| J.P. Morgan Securities, LLC at: | | | |

| 0.01%, dated: | | | |

| 5/24/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $402,901,530, 2.50%, 3/31/23) | | 395,001 | 395,000 |

| 5/28/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $562,020,674, 0.13% - 1.50%, 10/31/21 - 4/30/22) | | 551,001 | 551,000 |

| 0.03%, dated 5/26/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $96,900,412, 1.88% - 7.25%, 7/31/22 - 10/31/22) | | 95,000 | 95,000 |

| Lloyds Bank Corp. Markets PLC at: | | | |

| 0.05%, dated 3/26/21 due 6/28/21 (Collateralized by U.S. Treasury Obligations valued at $167,331,853, 1.13% - 2.75%, 4/30/25 - 2/15/31) | | 164,021 | 164,000 |

| 0.06%, dated 4/12/21 due 7/12/21 (Collateralized by U.S. Treasury Obligations valued at $166,314,725, 0.13% - 2.75%, 7/31/22 - 4/30/25) | | 163,025 | 163,000 |

| 0.09%, dated: | | | |

| 3/3/21 due 6/3/21 (Collateralized by U.S. Treasury Obligations valued at $132,649,161, 0.25% - 2.75%, 11/15/23 - 4/30/25) | | 130,030 | 130,000 |

| 3/10/21 due 6/10/21 (Collateralized by U.S. Treasury Obligations valued at $83,672,937, 2.75% - 2.88%, 10/31/23 - 4/30/25) | | 82,019 | 82,000 |

| 3/11/21 due 6/11/21 (Collateralized by U.S. Treasury Obligations valued at $134,351,469, 0.88% - 2.75%, 4/30/25 - 11/15/30) | | 131,030 | 131,000 |

| Lloyds Bank PLC at: | | | |

| 0.04%, dated: | | | |

| 5/18/21 due 8/18/21 (Collateralized by U.S. Treasury Obligations valued at $166,337,292, 0.13%, 10/15/23) | | 163,017 | 163,000 |

| 5/19/21 due 7/20/21 (Collateralized by U.S. Treasury Obligations valued at $315,092,676, 1.63% - 2.75%, 2/28/25 - 2/15/26) | | 309,021 | 309,000 |

| 0.05%, dated: | | | |

| 4/19/21 due 7/19/21 (Collateralized by U.S. Treasury Obligations valued at $166,305,888, 1.50% - 2.75%, 11/15/23 - 11/30/24) | | 163,021 | 163,000 |

| 4/26/21 due: | | | |

| 7/26/21 (Collateralized by U.S. Treasury Obligations valued at $166,303,363, 1.50% - 2.75%, 11/15/23 - 11/30/24) | | 163,021 | 163,000 |

| 7/27/21 (Collateralized by U.S. Treasury Obligations valued at $98,937,625, 1.50% - 1.63%, 11/15/22 - 11/30/24) | | 97,012 | 97,000 |

| 4/28/21 due 7/28/21 (Collateralized by U.S. Treasury Obligations valued at $165,314,187, 6.00%, 2/15/26) | | 162,020 | 162,000 |

| 5/10/21 due 8/10/21 (Collateralized by U.S. Treasury Obligations valued at $165,215,416, 1.50% - 2.88%, 11/30/24 - 11/30/25) | | 162,021 | 162,000 |

| 5/12/21 due 8/12/21 (Collateralized by U.S. Treasury Obligations valued at $165,301,679, 0.13% - 1.50%, 10/15/23 - 11/30/24) | | 162,021 | 162,000 |

| 0.06%, dated: | | | |

| 3/30/21 due 6/29/21 (Collateralized by U.S. Treasury Obligations valued at $166,302,076, 1.50% - 1.88%, 2/28/22 - 11/30/24) | | 163,025 | 163,000 |

| 3/31/21 due: | | | |

| 7/1/21 (Collateralized by U.S. Treasury Obligations valued at $116,273,413, 1.50% - 2.63%, 7/15/21 - 11/30/24) | | 114,017 | 114,000 |

| 7/2/21 (Collateralized by U.S. Treasury Obligations valued at $116,256,323, 3.00%, 9/30/25) | | 114,018 | 114,000 |

| Mizuho Bank, Ltd. at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $503,019,246, 2.38%, 5/15/29) | | 493,001 | 493,000 |

| MUFG Securities EMEA PLC at 0.01%, dated 5/28/21 due: | | | |

| 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $2,210,180,549, 0.13% - 3.13%, 12/31/21 - 8/15/50) | | 2,165,002 | 2,165,000 |

| 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $905,536,624, 0.13% - 3.13%, 2/15/22 - 5/15/48) | | 888,003 | 888,000 |

| Natixis SA at 0.01%, dated: | | | |

| 5/24/21 due 6/4/21 (Collateralized by U.S. Treasury Obligations valued at $819,629,307, 0.00% - 7.63%, 6/10/21 - 11/15/49) | | 803,005 | 803,000 |

| 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $326,400,198, 0.13% - 4.75%, 7/31/21 - 2/15/37) | | 320,000 | 320,000 |

| Norinchukin Bank at: | | | |

| 0.05%, dated: | | | |

| 5/12/21 due 8/12/21 (Collateralized by U.S. Treasury Obligations valued at $165,243,758, 2.38%, 5/15/27) | | 162,021 | 162,000 |

| 5/18/21 due 8/18/21 (Collateralized by U.S. Treasury Obligations valued at $165,242,357, 2.38%, 5/15/27) | | 162,021 | 162,000 |

| 5/19/21 due 8/19/21 (Collateralized by U.S. Treasury Obligations valued at $132,601,770, 2.00%, 11/15/26) | | 130,017 | 130,000 |

| 5/21/21 due 8/23/21 (Collateralized by U.S. Treasury Obligations valued at $237,662,389, 1.50%, 8/15/26) | | 233,030 | 233,000 |

| 5/24/21 due 8/24/21 (Collateralized by U.S. Treasury Obligations valued at $164,220,966, 2.75%, 6/30/25) | | 161,021 | 161,000 |

| 0.06%, dated: | | | |

| 4/9/21 due 7/9/21 (Collateralized by U.S. Treasury Obligations valued at $275,422,561, 2.00%, 11/15/26) | | 270,041 | 270,000 |

| 4/12/21 due 7/12/21 (Collateralized by U.S. Treasury Obligations valued at $198,915,386, 6.75%, 8/15/26) | | 195,030 | 195,000 |

| 4/13/21 due 7/13/21 (Collateralized by U.S. Treasury Obligations valued at $166,272,568, 1.50%, 8/15/26) | | 163,025 | 163,000 |

| 0.09%, dated 3/3/21 due 6/3/21 (Collateralized by U.S. Treasury Obligations valued at $82,637,832, 2.38%, 5/15/27) | | 81,019 | 81,000 |

| Royal Bank of Canada at 0.01%, dated 5/12/21 due 6/2/21 (Collateralized by U.S. Treasury Obligations valued at $82,620,511, 1.63%, 4/30/23) | | 81,000 | 81,000 |

| SMBC Nikko Securities America, Inc. at 0.01%, dated 5/28/21 due 6/1/21 (Collateralized by U.S. Treasury Obligations valued at $785,233,501, 2.25% - 2.75%, 4/30/23 - 11/15/27) | | 770,001 | 770,000 |

| Societe Generale at 0.01%, dated 5/27/21 due 6/3/21 (Collateralized by U.S. Treasury Obligations valued at $161,218,783, 0.00% - 8.00%, 6/3/21 - 8/15/50) | | 158,000 | 158,000 |

| TD Securities (U.S.A.) at 0.01%, dated 5/26/21 due 6/2/21 (Collateralized by U.S. Treasury Obligations valued at $483,480,829, 1.88% - 2.50%, 3/31/22 - 2/15/27) | | 474,001 | 474,000 |

| TOTAL U.S. TREASURY REPURCHASE AGREEMENT | | | |

| (Cost $66,802,020) | | | 66,802,020 |

| TOTAL INVESTMENT IN SECURITIES - 99.3% | | | |

| (Cost $203,252,387) | | | 203,252,387 |

| NET OTHER ASSETS (LIABILITIES) - 0.7% | | | 1,363,532 |

| NET ASSETS - 100% | | | $204,615,919 |

Security Type Abbreviations

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

Legend

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(d) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(e) Represents a forward settling transaction and therefore no collateral securities had been allocated as of period end. The agreement contemplated the delivery of U.S. Treasury Obligations as collateral on settlement date.

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Other Information

# Additional information on each counterparty to the repurchase agreement is as follows:

| Repurchase Agreement / Counterparty | Value (000s) |

| $18,128,799,000 due 6/01/21 at 0.01% | |

| BNY Mellon Capital Markets LLC | $963,506 |

| Bank Of America, N.A. | 1,109,192 |

| Bank of America Securities, Inc. | 1,371,022 |

| Citibank NA | 308,109 |

| Citigroup Global Markets, Inc. | 462,163 |

| Credit Agricole CIB New York Branch | 2,038,709 |

| Credit Suisse AG of New York | 138,586 |

| HSBC Securities (USA), Inc. | 107,838 |

| ING Financial Markets LLC | 84,527 |

| J.P. Morgan Securities LLC | 138,586 |

| Mitsubishi UFJ Securities Holdings Ltd. | 781,398 |

| Mizuho Securities USA, Inc. | 146,320 |

| Nomura Securities International | 2,091,933 |

| RBC Dominion Securities, Inc. | 1,429,665 |

| Societe Generale | 585,280 |

| Sumitomo Mitsui Banking Corp. NY | 3,951,795 |

| Sumitomo Mitsui Banking Corp. | 2,341,627 |

| Wells Fargo Securities LLC | 78,543 |

| | $18,128,799 |

| $25,348,000 due 6/01/21 at 0.01% | |

| Wells Fargo Securities LLC | $25,348 |

| | $25,348 |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amount) | | May 31, 2021 (Unaudited) |

| Assets | | |

Investment in securities, at value (including repurchase agreements of $96,663,805) — See accompanying schedule:

Unaffiliated issuers (cost $203,252,387) | | $203,252,387 |

| Receivable for investments sold | | 1,047,195 |

| Receivable for fund shares sold | | 1,887,674 |

| Interest receivable | | 90,471 |

| Prepaid expenses | | 36 |

| Other receivables | | 3,093 |

| Total assets | | 206,280,856 |

| Liabilities | | |

| Payable for investments purchased | $641,000 | |

| Payable for fund shares redeemed | 1,012,255 | |

| Distributions payable | 291 | |

| Accrued management fee | 7,375 | |

| Other affiliated payables | 405 | |

| Other payables and accrued expenses | 3,611 | |

| Total liabilities | | 1,664,937 |

| Net Assets | | $204,615,919 |

| Net Assets consist of: | | |

| Paid in capital | | $204,615,937 |

| Total accumulated earnings (loss) | | (18) |

| Net Assets | | $204,615,919 |

| Net Asset Value, offering price and redemption price per share ($204,615,919 ÷ 204,576,187 shares) | | $1.00 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Six months ended May 31, 2021 (Unaudited) |

| Investment Income | | |

| Interest | | $104,130 |

| Expenses | | |

| Management fee | $157,735 | |

| Transfer agent fees | 181,051 | |

| Accounting fees and expenses | 2,479 | |

| Custodian fees and expenses | 742 | |

| Independent trustees' fees and expenses | 319 | |

| Registration fees | 3,405 | |

| Audit | 27 | |

| Legal | 187 | |

| Miscellaneous | 217 | |

| Total expenses before reductions | 346,162 | |

| Expense reductions | (252,519) | |

| Total expenses after reductions | | 93,643 |

| Net investment income (loss) | | 10,487 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | | 8 |

| Total net realized gain (loss) | | 8 |

| Net increase in net assets resulting from operations | | $10,495 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended May 31, 2021 (Unaudited) | Year ended November 30, 2020 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $10,487 | $629,421 |

| Net realized gain (loss) | 8 | 391 |

| Net increase in net assets resulting from operations | 10,495 | 629,812 |

| Distributions to shareholders | (10,473) | (629,418) |

| Share transactions | | |

| Proceeds from sales of shares | 491,865,943 | 912,482,652 |

| Reinvestment of distributions | 8,717 | 527,141 |

| Cost of shares redeemed | (497,823,450) | (858,159,881) |

| Net increase (decrease) in net assets and shares resulting from share transactions | (5,948,790) | 54,849,912 |

| Total increase (decrease) in net assets | (5,948,768) | 54,850,306 |

| Net Assets | | |

| Beginning of period | 210,564,687 | 155,714,381 |

| End of period | $204,615,919 | $210,564,687 |

| Other Information | | |

| Shares | | |

| Sold | 491,865,943 | 912,482,652 |

| Issued in reinvestment of distributions | 8,717 | 527,141 |

| Redeemed | (497,823,450) | (858,159,881) |

| Net increase (decrease) | (5,948,790) | 54,849,912 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Government Cash Reserves

| | Six months ended (Unaudited) May 31, | Years endedNovember 30, | | | | |

| | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | – | .004 | .019 | .014 | .005 | .001 |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | – | .004 | .019 | .014 | .005 | .001 |

| Distributions from net investment income | – | (.004) | (.019) | (.014) | (.005) | (.001) |

| Total distributions | – | (.004) | (.019) | (.014) | (.005) | (.001) |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | -% | .39% | 1.95% | 1.43% | .50% | .08% |

| Ratios to Average Net AssetsD,E | | | | | | |

| Expenses before reductions | .33%F | .34% | .38% | .38% | .37% | .37% |

| Expenses net of fee waivers, if any | .09%F | .26% | .37% | .38% | .37% | .35% |

| Expenses net of all reductions | .09%F | .26% | .37% | .38% | .37% | .35% |

| Net investment income (loss) | .01%F | .33% | 1.93% | 1.42% | .50% | .08% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $204,616 | $210,565 | $155,714 | $137,789 | $133,855 | $138,117 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Annualized

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended May 31, 2021

(Amounts in thousands except percentages)

1. Organization.

Fidelity Government Cash Reserves (the Fund) is a fund of Fidelity Phillips Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

2. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Investment Transactions and Income. The net asset value per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. The principal amount on inflation-indexed securities is periodically adjusted to the rate of inflation and interest is accrued based on the principal amount. The adjustments to principal due to inflation are reflected as increases or decreases to Interest in the accompanying Statement of Operations.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for certain Funds, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in affiliated mutual funds, are marked-to-market and remain in a fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees presented below are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, as applicable.

| Fidelity Government Cash Reserves | $3,093 |

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustees compensation and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities for federal income tax purposes were as follows:

| Gross unrealized appreciation | $– |

| Gross unrealized depreciation | – |

| Net unrealized appreciation (depreciation) | $– |

| Tax cost | $203,252,387 |

Repurchase Agreements. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, funds and other registered investment companies having management contracts with Fidelity Management and Research Company LLC, or its affiliates are permitted to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. Funds may also invest directly with institutions in repurchase agreements. Repurchase agreements may be collateralized by cash or government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The collateral balance is monitored on a daily basis to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

3. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is calculated on the basis of a group fee rate plus a total income-based component. The annualized group fee rate averaged .10% during the period. The group fee rate is based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreases as assets under management increase and increases as assets under management decrease. The total income-based component is comprised of an income-based fee and an asset-based fee, and is calculated according to a graduated schedule providing for different rates based on the Fund's gross annualized yield. The rate increases as the Fund's gross yield increases.

During the period the income-based portion of this fee was $54,673 or an annualized rate of .05% of the Fund's average net assets. For the reporting period, the Fund's total annualized management fee rate was .15% of the Fund's average net assets.

During the period, the investment advisor or its affiliates waived a portion of these fees.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing and shareholder servicing agent. FIIOC receives account fees and asset-based fees that vary according to account size and type of account. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annualized rate of .17% of average net assets.

During the period, the investment advisor or its affiliates waived a portion of these fees.

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to the following annualized rates:

| | % of Average Net Assets |

| Fidelity Government Cash Reserves | –(a) |

(a) Amount represents less than .005%.

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act.

| | Purchases ($) | Sales ($) |

| Fidelity Government Cash Reserves | 68,400 | – |

4. Expense Reductions.

The investment adviser or its affiliates voluntarily agreed to waive certain fees in order to avoid a negative yield. Such arrangements may be discontinued by the investment adviser at any time. For the period, the amount of the waiver was $252,306.

In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses by $1.

In addition, during the period the investment adviser or an affiliate reimbursed and/or waived a portion of operating expenses in the amount of $212.

5. Other.

Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

6. Coronavirus (COVID-19) Pandemic.

An outbreak of COVID-19 first detected in China during December 2019 has since spread globally and was declared a pandemic by the World Health Organization during March 2020. Developments that disrupt global economies and financial markets, such as the COVID-19 pandemic, may magnify factors that affect the Fund's performance.

Shareholder Expense Example

As a shareholder, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or redemption proceeds, as applicable and (2) ongoing costs, which generally include management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (December 1, 2020 to May 31, 2021).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class/Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If any fund is a shareholder of any underlying mutual funds or exchange-traded funds (ETFs) (the Underlying Funds), such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses incurred presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. If any fund is a shareholder of any Underlying Funds, such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses as presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Annualized Expense Ratio-A | Beginning

Account Value

December 1, 2020 | Ending

Account Value

May 31, 2021 | Expenses Paid

During Period-B

December 1, 2020

to May 31, 2021 |

| Fidelity Government Cash Reserves | .09% | | | |

| Actual | | $1,000.00 | $1,000.00 | $.45** |

| Hypothetical-C | | $1,000.00 | $1,024.48 | $.45** |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/ 365 (to reflect the one-half year period). The fees and expenses of any Underlying Funds are not included in each annualized expense ratio.

C 5% return per year before expenses

** If certain fees were not voluntarily waived by the investment adviser or its affiliates during the period, the annualized expense ratio would have been .33% and the expenses paid in the actual and hypothetical examples above would have been $1.64 and $1.66, respectively.

CAS-SANN-0721

1.704549.123