UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| | [X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2011

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from . . . . . . . . . . . . to . . . . . . . . . . . . . . |

| | Commission File No. 001-10852 |

| | International Shipholding Corporation |

| | (Exact name of registrant as specified in its charter) |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

11 North Water Street, Suite 18290, Mobile, Alabama 36602

(Address of principal executive offices) (Zip Code)

| | Registrant's telephone number, including area code: (251) 243-9100 |

Former name, former address and former fiscal year, if changed since last report:

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer þ

Non-accelerated filer ¨ Smaller Reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common stock, $1 par value. . . . . . . . 7,228,252 shares outstanding as of March 31, 2011

INTERNATIONAL SHIPHOLDING CORPORATION

PART I – FINANCIAL INFORMATION

INTERNATIONAL SHIPHOLDING CORPORATION | |

| CONSOLIDATED STATEMENTS OF INCOME | |

| (All Amounts in Thousands Except Share Data) | |

| (Unaudited) | |

| | | Three Months ended March 31, | |

| | | 2011 | | | 2010 | |

| Revenues | | $ | 64,334 | | | $ | 72,914 | |

| | | | | | | | | |

| Operating Expenses: | | | | | | | | |

| Voyage Expenses | | | 48,990 | | | | 54,943 | |

| Vessel Depreciation | | | 5,374 | | | | 3,764 | |

| | | | | | | | | |

| Gross Voyage Profit | | | 9,970 | | | | 14,207 | |

| | | | | | | | | |

| Administrative and General Expenses | | | 5,829 | | | | 6,019 | |

| Gain on Dry Bulk Transaction | | | (18,714 | ) | | | - | |

| Gain on Sale of Other Assets | | | - | | | | (121 | ) |

| | | | | | | | | |

| Operating Income | | | 22,855 | | | | 8,309 | |

| | | | | | | | | |

| Interest and Other: | | | | | | | | |

| Interest Expense | | | 2,290 | | | | 1,599 | |

| Derivative Income | | | (121 | ) | | | - | |

| Other Income from Vessel Financing | | | (688 | ) | | | (604 | ) |

| Investment Income | | | (200 | ) | | | (179 | ) |

| Foreign Exchange Gain | | | (1,489 | ) | | | - | |

| | | | (208 | ) | | | 816 | |

| Income Before Provision (Benefit) for Income Taxes and | | | | | | | | |

| Equity in Net Income of Unconsolidated Entities | | | 23,063 | | | | 7,493 | |

| | | | | | | | | |

| Provision (Benefit) for Income Taxes: | | | | | | | | |

| Current | | | 207 | | | | 170 | |

| Deferred | | | - | | | | (765 | ) |

| State | | | 1 | | | | (17 | ) |

| | | | 208 | | | | (612 | ) |

| Equity in Net Income of Unconsolidated | | | | | | | | |

| Entities (Net of Applicable Taxes) | | | 1,225 | | | | 2,463 | |

| | | | | | | | | |

| Net Income | | $ | 24,080 | | | $ | 10,568 | |

| | | | | | | | | |

| Basic and Diluted Earnings Per Common Share: | | | | | | | | |

| Basic Earnings Per Common Share: | | $ | 3.33 | | | $ | 1.46 | |

| | | | | | | | | |

| Diluted Earnings Per Common Share: | | $ | 3.32 | | | $ | 1.44 | |

| | | | | | | | | |

| Weighted Average Shares of Common Stock Outstanding: | | | | | | | | |

| Basic | | | 7,232,834 | | | | 7,249,198 | |

| Diluted | | | 7,256,129 | | | | 7,321,198 | |

| | | | | | | | | |

| Dividends Per Share | | $ | 0.375 | | | $ | 0.500 | |

The accompanying notes are an integral part of these statements.

| |

| CONSOLIDATED BALANCE SHEETS | |

| (All Amounts in Thousands) | |

| (Unaudited) | |

| | |

| | | March 31, | | | December 31, | |

| ASSETS | | 2011 | | | 2010 | |

| | | | | | | |

| Current Assets: | | | | | | |

| Cash and Cash Equivalents | | $ | 51,986 | | | $ | 24,158 | |

| Marketable Securities | | | 11,293 | | | | 11,527 | |

| Accounts Receivable, Net of Allowance for Doubtful Accounts | | | | | | | | |

| of $324 and $311 in 2011 and 2010, Respectively | | | | | | | | |

| Traffic | | | 6,902 | | | | 6,364 | |

| Agents' | | | 2,943 | | | | 1,555 | |

| Other | | | 15,894 | | | | 8,555 | |

| Federal Income Taxes Receivable | | | 155 | | | | 242 | |

| Net Investment in Direct Financing Leases | | | 5,770 | | | | 5,596 | |

| Other Current Assets | | | 5,004 | | | | 2,513 | |

| Notes Receivable | | | 4,248 | | | | 4,248 | |

| Material and Supplies Inventory | | | 4,088 | | | | 3,774 | |

| Total Current Assets | | | 108,283 | | | | 68,532 | |

| | | | | | | | | |

| Investment in Unconsolidated Entities | | | 15,033 | | | | 27,261 | |

| | | | | | | | | |

| Net Investment in Direct Financing Leases | | | 48,597 | | | | 50,102 | |

| | | | | | | | | |

| Vessels, Property, and Other Equipment, at Cost: | | | | | | | | |

| Vessels | | | 497,889 | | | | 365,797 | |

| Leasehold Improvements | | | 26,128 | | | | 26,128 | |

| Construction in Progress | | | 7,907 | | | | 78,355 | |

| Furniture and Equipment | | | 9,338 | | | | 7,863 | |

| | | | 541,262 | | | | 478,143 | |

| Less - Accumulated Depreciation | | | (149,728 | ) | | | (143,667 | ) |

| Net Vessels, Property, and Other Equipment | | | 391,534 | | | | 334,476 | |

| | | | | | | | | |

| Other Assets: | | | | | | | | |

| Deferred Charges, Net of Accumulated Amortization | | | 14,498 | | | | 14,482 | |

| of $15,987 and $14,525 in 2011 and 2010, Respectively | | | | | | | | |

| Intangible Assets, Net | | | 2,576 | | | | - | |

| Due from Related Parties | | | 4,322 | | | | 4,124 | |

| Notes Receivable | | | 39,080 | | | | 40,142 | |

| Other | | | 4,933 | | | | 5,004 | |

| | | | 65,409 | | | | 63,752 | |

| | | | | | | | | |

| | | $ | 628,856 | | | $ | 544,123 | |

| | | | | | | | | |

The accompanying notes are an integral part of these statements.

| | | | | | | |

| | |

| | |

| INTERNATIONAL SHIPHOLDING CORPORATION | |

| CONSOLIDATED BALANCE SHEETS | |

| (All Amounts in Thousands) | |

| (Unaudited) | |

| | |

| | | March 31, | | | December 31, | |

| | | 2011 | | | 2010 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

| | | | | | | |

| Current Liabilities: | | | | | | |

| Current Maturities of Long-Term Debt | | $ | 24,161 | | | $ | 21,324 | |

| Accounts Payable and Accrued Liabilities | | | 46,755 | | | | 32,114 | |

| Federal Income Taxes Payable | | | 19 | | | | - | |

| Total Current Liabilities | | | 70,935 | | | | 53,438 | |

| | | | | | | | | |

| Long-Term Debt, Less Current Maturities | | | 243,562 | | | | 200,241 | |

| | | | | | | | | |

| Other Long-Term Liabilities: | | | | | | | | |

| Lease Incentive Obligation | | | 6,972 | | | | 7,022 | |

| Other | | | 51,604 | | | | 49,672 | |

| | | | 58,576 | | | | 56,694 | |

| | | | | | | | | |

| | | | | | | | | |

| Stockholders' Equity: | | | | | | | | |

| Common Stock | | | 8,555 | | | | 8,564 | |

| Additional Paid-In Capital | | | 84,657 | | | | 84,846 | |

| Retained Earnings | | | 204,674 | | | | 183,541 | |

| Treasury Stock | | | (25,403 | ) | | | (25,403 | ) |

| Accumulated Other Comprehensive Loss | | | (16,700 | ) | | | (17,798 | ) |

| | | | 255,783 | | | | 233,750 | |

| | | | | | | | | |

| | | $ | 628,856 | | | $ | 544,123 | |

| | | | | | | | | |

| | |

| | |

The accompanying notes are an integral part of these statements.

| |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| (All Amounts in Thousands) | |

| (Unaudited) | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2011 | | | 2010 | |

| Cash Flows from Operating Activities: | | | | | | |

| Net Income | | $ | 24,080 | | | $ | 10,568 | |

| Adjustments to Reconcile Net Income to Net Cash Provided by | | | | | | | | |

| Operating Activities: | | | | | | | | |

| Depreciation | | | 5,621 | | | | 3,905 | |

| Amortization of Deferred Charges and Other Assets | | | 1,571 | | | | 2,865 | |

| Deferred Benefit for Income Taxes | | | - | | | | (765 | ) |

| Gain on Dry Bulk Transaction | | | (18,714 | ) | | | - | |

| Non-Cash Stock Based Compensation | | | 577 | | | | 734 | |

| Equity in Net Income of Unconsolidated Entities | | | (1,225 | ) | | | (2,463 | ) |

| Distributions from Unconsolidated Entities | | | 750 | | | | 750 | |

| Gain on Sale of Assets | | | - | | | | (121 | ) |

| Gain on Foreign Currency Exchange | | | (1,489 | ) | | | - | |

| Changes in: | | | | | | | | |

| Accounts Receivable | | | (9,265 | ) | | | (2,214 | ) |

| Deferred Drydocking Charges | | | (3,338 | ) | | | (125 | ) |

| Inventories and Other Current Assets | | | 867 | | | | (406 | ) |

| Other Assets | | | 71 | | | | 610 | |

| Accounts Payable and Accrued Liabilities | | | 5,563 | | | | (2,371 | ) |

| Other Long-Term Liabilities | | | 1,905 | | | | 1,511 | |

| Net Cash Provided by Operating Activities | | | 6,974 | | | | 12,478 | |

| | | | | | | | | |

| Cash Flows from Investing Activities: | | | | | | | | |

| Principal payments received under Direct Financing Leases | | | 1,330 | | | | 1,700 | |

| Capital Improvements to Vessels, Leasehold Improvements, and Other Assets | | | (12,800 | ) | | | (54,215 | ) |

| Proceeds from/Cash Paid on Sale of Assets | | | - | | | | (15 | ) |

| Purchase of Marketable Securities | | | (1,120 | ) | | | (8,649 | ) |

| Proceeds from Sale of Marketable Securities | | | 1,150 | | | | 598 | |

| Investment in Unconsolidated Entities | | | (1,646 | ) | | | (315 | ) |

| Acquisition of Unconsolidated Entity | | | 16,861 | | | | - | |

| Payments on Related Party Note Receivables | | | 1,002 | | | | 950 | |

| Net Cash Provided by (Used In) Investing Activities | | | 4,777 | | | | (59,946 | ) |

| | | | | | | | | |

| Cash Flows from Financing Activities: | | | | | | | | |

| Proceeds from Issuance of Debt | | | 34,029 | | | | 70,305 | |

| Repayment of Debt | | | (14,936 | ) | | | (4,322 | ) |

| Additions to Deferred Financing Charges | | | (69 | ) | | | (185 | ) |

| Common Stock Dividends Paid | | | (2,947 | ) | | | (3,743 | ) |

| Net Cash Provided by Financing Activities | | | 16,077 | | | | 62,055 | |

| | | | | | | | | |

| Net Increase in Cash and Cash Equivalents | | | 27,828 | | | | 14,587 | |

| Cash and Cash Equivalents at Beginning of Period | | | 24,158 | | | | 47,468 | |

| | | | | | | | | |

| Cash and Cash Equivalents at End of Period | | $ | 51,986 | | | $ | 62,055 | |

The accompanying notes are an integral part of these statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS March 31, 2011

(Unaudited)

Note 1. Basis of Preparation

We have prepared the accompanying unaudited interim financial statements pursuant to the rules and regulations of the Securities and Exchange Commission, and as permitted thereunder we have omitted certain information and footnote disclosures required by U.S. Generally Accepted Accounting Principles (GAAP) for complete financial statements. We suggest that you read these interim statements in conjunction with the financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2010. The condensed consolidated balance sheet as of December 31, 2010 included in this report has been derived from the audited financial statements at that date.

The foregoing 2011 interim results are not necessarily indicative of the results of operations for the full year 2011. Management believes that it has made all adjustments necessary, consisting only of normal recurring adjustments, for a fair statement of the information shown.

Our policy is to consolidate all subsidiaries in which we hold a greater than 50% voting interest or otherwise control its operating and financial activities. We use the equity method to account for investments in entities in which we hold a 20% to 50% voting or economic interest and have the ability to exercise significant influence over their operating and financial activities. We use the cost method to account for investments in entities in which we hold less than 20% voting interest and in which we cannot exercise significant influence over operating and financial activities.

Revenues and expenses relating to our Rail-Ferry Service segment voyages are recorded over the duration of the voyage. Our voyage expenses are estimated at the beginning of the voyages based on historical actual costs or from industry sources familiar with those types of charges. As the voyage progresses, these estimated costs are revised with actual charges and timely adjustments are made. The expenses are ratably expensed over the voyage based on the number of days in progress at the end of the period. Based on our prior experience, we believe there is no material difference between recording estimated expenses ratably over the voyage versus recording expenses as incurred. Revenues and expenses relating to our other segments' voyages, which require no estimates or assumptions, are recorded when earned or incurred during the reporting period.

We have eliminated all significant intercompany balances, accounts and transactions.

Note 2. Employee Benefit Plans

The following table provides the components of net periodic benefit cost for our pension plan and postretirement benefits plan for the three months ended March 31, 2011 and 2010:

| (All Amounts in Thousands) | | Pension Plan | | | Postretirement Benefits | |

| | | Three Months Ended March 31, | | | Three Months Ended March 31, | |

| Components of net periodic benefit cost: | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Service cost | | $ | 136 | | | $ | 140 | | | $ | 22 | | | $ | 5 | |

| Interest cost | | | 368 | | | | 372 | | | | 143 | | | | 99 | |

| Expected return on plan assets | | | (475 | ) | | | (427 | ) | | | - | | | | - | |

| Amortization of prior service cost | | | (1 | ) | | | (1 | ) | | | (3 | ) | | | (3 | ) |

| Amortization of Net Loss | | | 83 | | | | 86 | | | | 55 | | | | - | |

| Net periodic benefit cost | | $ | 111 | | | $ | 170 | | | $ | 217 | | | $ | 101 | |

We contributed $156,000 to our Pension Plan in April 2011. We are monitoring market conditions and, based on the current market conditions, we anticipate up to $450,000 in additional contributions for the year 2011.

Note 3. Operating Segments

Our four operating segments, Time Charter Contracts – U.S. Flag, Time Charter Contracts – International Flag, Contracts of Affreightment (“COA”), and Rail-Ferry Service, are identified primarily by the characteristics of the contracts and terms under which our vessels are operated. Beginning with the second quarter 2010 Form 10-Q report, we split Time Charter Contracts into two different operating segments, Time Charter Contracts – U.S. Flag and Time Charter Contracts – International Flag. We recast all prior period data for the previous Time Charter Contracts Segment based on the new operating segments. We report in the Other category the results of several of our subsidiaries that provide ship and cargo charter brokerage and agency services. We manage each reportable segment separately, as each requires different resources depending on the nature of the contract or terms under which each vessel within the segment operates.

We allocate interest expense to the segments in proportion to the book values of the vessels owned within each segment. We do not allocate to our segments administrative and general expenses, investment income, gain on sale of investment, equity in net income of unconsolidated entities, or income taxes. Intersegment revenues are based on market prices and include revenues earned by our subsidiaries that provide specialized services to our operating companies.

The following table presents information about segment profit and loss for the three months ended March 31, 2011 and 2010:

| | | | | | | | | | | | | | | | | | | |

| (All Amounts in Thousands) | | Time Charter Contracts- U.S. Flag | | | Time Charter Contracts- International Flag | | | COA | | | Rail-Ferry Service | | | Other | | | Total | |

| 2011 | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 39,016 | | | $ | 11,210 | | | $ | 4,231 | | | $ | 9,054 | | | $ | 823 | | | $ | 64,334 | |

| Intersegment Revenues (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | (3,777 | ) | | | (3,777 | ) |

| Intersegment Expenses (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | 3,777 | | | | 3,777 | |

| Voyage Expenses | | | 29,998 | | | | 6,886 | | | | 4,310 | | | | 7,631 | | | | 165 | | | | 48,990 | |

| Vessel Depreciation | | | 2,509 | | | | 1,990 | | | | - | | | | 872 | | | | 3 | | | | 5,374 | |

| Gross Voyage Profit (Loss) | | | 6,509 | | | | 2,334 | | | | (79 | ) | | | 551 | | | | 655 | | | | 9,970 | |

| Interest Expense | | | 675 | | | | 1,301 | | | | - | | | | 193 | | | | 121 | | | | 2,290 | |

| Segment Profit (Loss) | | | 5,834 | | | | 1,033 | | | | (79 | ) | | | 358 | | | | 534 | | | | 7,680 | |

| 2010 (recast) | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 51,430 | | | $ | 11,805 | | | $ | 3,980 | | | $ | 5,139 | | | $ | 560 | | | $ | 72,914 | |

| Intersegment Revenues (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | (3,733 | ) | | | (3,733 | ) |

| Intersegment Expenses (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | 3,733 | | | | 3,733 | |

| Voyage Expenses | | | 36,687 | | | | 8,186 | | | | 4,167 | | | | 5,597 | | | | 306 | | | | 54,943 | |

| Vessel Depreciation | | | 2,380 | | | | - | | | | - | | | | 1,381 | | | | 3 | | | | 3,764 | |

| Gross Voyage Profit (Loss) | | | 12,363 | | | | 3,619 | | | | (187 | ) | | | (1,839 | ) | | | 251 | | | | 14,207 | |

| Interest Expense | | | 822 | | | | 229 | | | | - | | | | 386 | | | | 162 | | | | 1,599 | |

| Segment Profit (Loss) | | | 11,541 | | | | 3,390 | | | | (187 | ) | | | (2,225 | ) | | | 89 | | | | 12,608 | |

The following table is a reconciliation of the totals reported for the operating segments to the applicable line items in the consolidated financial statements:

| (All Amounts in Thousands) | | Three Months Ended March 31, | |

| Profit: | | 2011 | | | 2010 | |

| Total Profit for Reportable Segments | | $ | 7,680 | | | $ | 12,608 | |

| Unallocated Amounts: | | | | | | | | |

| Administrative and General Expenses | | | (5,829 | ) | | | (6,019 | ) |

| Gain on Sale of Other Assets | | | - | | | | 121 | |

| Derivative Income | | | 121 | | | | - | |

| Other Income from Vessel Financing | | | 688 | | | | 604 | |

| Investment Income | | | 200 | | | | 179 | |

| Foreign Exchange Gain | | | 1,489 | | | | - | |

| Gain on Dry Bulk Transaction | | | 18,714 | | | | - | |

| Income Before Provision (Benefit) for | | | | | | | | |

| Income Taxes and Equity in Net Income of Unconsolidated Entities | | $ | 23,063 | | | $ | 7,493 | |

Note 4. Unconsolidated Entities

In 2003, we acquired for $3,479,000 a 50% investment in Dry Bulk Cape Holding Inc. (“Dry Bulk”), which as of December 31, 2010 owned 100% of subsidiary companies owning two Capesize Bulk Carriers and two Handymax Bulk Carrier Newbuildings on order for delivery in 2012. Historically, we have accounted for this investment under the equity method and our share of earnings or losses has been reported in our consolidated statements of income, net of taxes. Our portion of earnings of Dry Bulk was $1.3 million, net of taxes of $0, and $2.2 million, net of taxes of $2.6 million, for the three months ended March 31, 2011 and 2010, respectively. The decrease in pre-tax earnings was mainly due to a $1.4 million gain on the sale of Dry Bulk’s Panamax Bulk Carrier in the first quarter of 2010. Historically, we did not provide for income taxes related to our earnings from Dry Bulk as a result of the U. S. tax law in effect prior to 2010. This tax law expired effective January 1, 2010, resulting in income taxes being applicable to our earnings from Dry Bulk during the first three quarters of 2010. A bill passed in Congress in late 2010 eliminated the need for a tax provision on these amounts and our 2010 provision for taxes was reversed in the fourth quarter of 2010.

On March 25, 2011, we acquired 100% ownership of Dry Bulk. For further information on this acquisition, see Note 5 Dry Bulk Cape Holding, Inc. Step Acquisition Gain.

We received a cash distribution from Dry Bulk of $750,000 in the first quarter of each of 2011 and 2010.

The unaudited condensed results of operations of Dry Bulk are summarized below:

| | | Three Months Ended March 31, | |

| (Amounts in Thousands) | | 2011 | | | 2010 | |

| Operating Revenues | | $ | 4,823 | | | $ | 9,576 | |

| Operating Income | | $ | 2,866 | | | $ | 6,964 | |

| Net Income | | $ | 2,613 | | | $ | 9,351 | |

In December 2009, we acquired for $6,250,000 a 25% investment in Oslo Bulk AS (“Oslo Bulk”) which in 2008, contracted to build eight new Mini Bulkers. Seven of the eight Mini-Bulkers were delivered and deployed as of April 2011. The remaining vessel is expected to be delivered in the second quarter of 2011. During 2010, we invested an additional $3.9 million in Tony Bulkers Pte Ltd, (“Tony Bulkers”), an affiliate of Oslo Bulk AS, for our 25% share of the installment payments for two additional new Mini-Bulkers, one of which was delivered in the fourth quarter of 2010. We paid our remaining share of installment payments associated with the other Mini-Bulker Newbuilding of approximately $1.7 million in January 2011 and the vessel is expected to be delivered in the second quarter of 2011. These investments are accounted for under the equity method and our share of earnings or losses is reported in our consolidated statements of income net of taxes. Our portion of the aggregate earnings of Oslo Bulk and Tony Bulkers, which included final 2010 income adjustments of $143,000 for Oslo Bulk, was $55,000 and ($98,000), respectively, for the quarter ended March 31, 2011. Our portion of the earnings of our remaining investments in unconsolidated entities was ($32,000).

Note 5. Dry Bulk Cape Holding, Inc. Step Acquisition Gain

On March 25, 2011, Cape Holding, Ltd. (a wholly-owned subsidiary of International Shipholding Corporation’s wholly-owned subsidiary LCI Shipholding, Inc.) and DryLog Ltd. completed a non-monetary transaction that restructured their respective 50% interests in Dry Bulk.

Prior to this transaction, Dry Bulk controlled through various subsidiaries two Cape Size vessels and two Handymax newbuildings. In connection with this transaction, (i) Cape Holding, Ltd. increased its ownership in Dry Bulk from 50% to 100% and (ii) in consideration, DryLog Ltd. received ownership of two former Dry Bulk subsidiaries holding one Cape Size vessel and one shipbuilding contract relating to a Handymax vessel scheduled to be delivered in the second half of 2012. Following the transfer of these subsidiaries, Dry Bulk continues to control through two subsidiaries, one Cape Size vessel and one shipbuilding contract relating to a Handymax vessel scheduled to be delivered by the end of the first quarter of 2012.

After completion of this transaction, we now hold a direct 100% ownership in Dry Bulk and have complete control of the two remaining vessels. Additionally, we now have the opportunity to manage these two vessels through our wholly-owned subsidiary, LMS Shipmanagement, Inc., leverage any cost savings by providing insurance coverage through our existing policies, and expand and diversify our bulk carrier fleet with autonomous control of the vessels after the termination of the existing time charter agreement that ends in 2012.

Due to our pre-existing 50% ownership interest in Dry Bulk, this step acquisition was accounted for as a business combination in accordance with Accounting Standards Codification (“ASC”) 805, Business Combinations. Under business combination accounting, the assets and liabilities acquired are recorded as of the acquisition date at their respective fair values. The valuation of Dry Bulk provided us with the fair value of all assets and liabilities (including intangible assets) acquired and also included the fair value of our 50% equity interest in Dry Bulk prior to the acquisition date. Accordingly, based on a fair value of $31.8 million for our previous 50% equity interest in Dry Bulk, we recognized a gain of $17.3 million as a result of the remeasurement of our equity interest prior to the acquisition date. An additional gain of $1.4 million reflects the remaining step up to fair value. The following (in thousands of dollars) is a summary of the fair value of the net assets acquired:

Working Capital $6,651

Intangibles(1) $5,151

Fixed Assets(2) $49,956

Long-Term Debt(3) ($28,554)

Fair Value Net Assets $33,204

| (1) | Includes above market time-charter contracts that are in place through 2012. This intangible amount will be amortized over the remaining term of the underlying time-charter contracts.. |

| (2) | Consists of one in-service Capesize vessel and one Handymax vessel currently under construction. |

| (3) | Consists of two credit facilities, one for each vessel acquired |

| (4) | Includes approximately $4.0 million of Restricted Cash as a result of loan covenants on debt assumed. We expect this restriction to be removed upon refinancing this debt in the second quarter of 2011. |

Previously, the Company accounted for its non-controlling interest in DBCH under the equity method. Going forward, the financial results of DBCH will be included in our consolidated financial results. Assuming the Company recorded this transaction on January 1, 2010, our consolidated financial results for the three month periods ending March 31, 2010 and March 31, 2011 would not have been materially different from what was actually reported. As such, we have not disclosed in this footnote any proforma financial information for either of these periods.

Note 6. Earnings Per Share

We compute basic earnings per share based on the weighted average number of common shares issued and outstanding during the relevant periods. Diluted earnings per share also reflects dilutive potential common shares, including shares issuable under restricted stock grants using the treasury stock method.

The calculation of basic and diluted earnings per share is as follows (in thousands except share amounts):

| | | Three Months Ended March 31, | |

| | | 2011 | | | 2010 | |

| Numerator | | | | | | |

| Net Income – Basic: | | | | | | |

| | | $ | 24,080 | | | $ | 10,568 | |

| Net Income – Diluted: | | | | | | | | |

| | | $ | 24,080 | | | $ | 10,568 | |

| Denominator | | | | | | | | |

| Weighted Avg Shares of Common Stock Outstanding: | | | | | | | | |

| Basic | | | 7,232,834 | | | | 7,249,198 | |

| Plus: | | | | | | | | |

| Effect of dilutive restrictive stock | | | 23,295 | | | | 72,000 | |

| Diluted | | | 7,256,129 | | | | 7,321,198 | |

| | | | | | | | | |

| Basic and Diluted Earnings Per Common Share: | | | | | | | | |

| Net Income per share – Basic: | | | | | | | | |

| | | $ | 3.33 | | | $ | 1.46 | |

| Net Income per share – Diluted: | | | | | | | | |

| | | $ | 3.32 | | | $ | 1.44 | |

| | |

Note 7. Comprehensive Income

The following table summarizes components of comprehensive income for the three months ended March 31, 2011 and 2010:

| | | Three Months Ended March 31, | |

| (Amounts in Thousands) | | 2011 | | | 2010 | |

| Net Income | | $ | 24,080 | | | $ | 10,568 | |

| Other Comprehensive Income: | | | | | | | | |

| Unrealized Foreign Currency Translation Gain | | | 18 | | | | 42 | |

Unrealized Gain on Marketable Securities, Net of Deferred Taxes of $47 and $81, Respectively | | | 87 | | | | 151 | |

Change in Fair Value of Derivatives, Net of Deferred Taxes of $68 and ($45), respectively | | | 993 | | | | (259 | ) |

| Total Comprehensive Income | | $ | 25,178 | | | $ | 10,502 | |

Note 8. Income Taxes

We recorded a provision for income taxes of $208,000 on our $23.1 million of income before equity in net income of unconsolidated entities in the first three months of 2011. For the first three months of 2010 our benefit for income taxes was $612,000 on our $7.5 million of income before equity in net income of unconsolidated entities. The decrease in our benefit for income taxes was based on improvements in our operations taxed at the U.S. corporate statutory rate and the need to record a valuation allowance on deferred tax assets. For further information on certain tax laws and elections, see our Annual Report on Form 10-K filed for the year ended December 31, 2010, including Note F to the consolidated financial statements included therein. Our qualifying U.S. flag operations continue to be taxed under a “tonnage tax” regime rather than under the normal U.S. corporate income tax regime.

Note 9. Fair Value Measurements

ASC Topic 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. A fair value measurement assumes that the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market for the asset or liability. Under ASC Topic 820, the price in the principal (or most advantageous) market used to measure the fair value of the asset or liability is not adjusted for transaction costs. An orderly transaction is a transaction that assumes exposure to the market for a period prior to the measurement date to allow for marketing activities that are usual and customary for transactions involving such assets and liabilities; it is not a forced transaction. Market participants are buyers and sellers in the principal market that are (i) independent, (ii) knowledgeable, and (iii) able and willing to complete a transaction.

Fair value measurements require the use of valuation techniques that are consistent with one or more of the market approach, the income approach or the cost approach. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets and liabilities. The income approach uses valuation techniques to convert future amounts, such as cash flows or earnings, to a single present value on a discounted basis. The cost approach is based on the amount that currently would be required to replace the service capacity of an asset (replacement cost). Valuation techniques should be consistently applied. The fair value of our interest rate swap agreements is based upon the approximate amounts required to settle the contracts. Inputs to valuation techniques refer to the assumptions that market participants would use in pricing the asset or liability. Inputs may be observable, meaning those that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from independent sources, or unobservable, meaning those that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. In that regard, ASC Topic 820 establishes a fair value hierarchy for valuation inputs that gives the highest priority to quoted prices in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The fair value hierarchy is as follows:

w Level 1 Inputs - Unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

w Level 2 Inputs - Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These might include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (including interest rates, volatilities, prepayment speeds, credit risks) or inputs that are derived principally from or corroborated by market data by correlation or other means.

w Level 3 Inputs - Unobservable inputs for determining the fair values of assets or liabilities that reflect an entity's own assumptions about the assumptions that market participants would use in pricing the assets or liabilities.

The following table summarizes our financial assets and financial liabilities measured at fair value on a recurring and non-recurring basis as of March 31, 2011, segregated by the above-described levels of valuation inputs:

| (Amounts in thousands) | | Level 1 Inputs | Level 2 Inputs | Level 3 Inputs | Total Fair Value | |

| | | | | | | |

| Marketable securities | | $ 11,293 | $ - | $ - | $ 11,293 | |

| Derivative assets | | - | 201 | - | 201 | |

| Derivative liabilities | | - | (8,481) | - | (8,481) | |

| Vessels | | - | 37,070 | - | 37,070 | (1) |

| | | | | | | |

(1) Represents the appraised fair value of the Rail-Ferry vessels after the impairment charge taken in the third quarter of 2010. The valuation technique used was a weighted average of the cost, comparable sales and income approach.

Note 10. Marketable Securities

We have categorized all marketable securities as available-for-sale securities. Management performs a quarterly evaluation of marketable securities for any other-than-temporary impairment. We determined that none of our securities were impaired as of March 31, 2011 and 2010.

The following tables include cost and valuation information on our investment securities at March 31, 2011:

| (Amounts In Thousands) | |

| | | | | | AOCI** | | | | |

| | | | | | Unrealized | | | Estimated | |

| Securities Available for Sale | | Cost Basis | | | Holding Gains | | | Fair Value | |

| | | | | | | | | | |

| Corporate Bonds* | | $ | 11,074 | | | $ | 219 | | | $ | 11,293 | |

| Total | | $ | 11,074 | | | $ | 219 | | | $ | 11,293 | |

| | | | | | | | | | | | | |

| * Various maturity dates from September 2011 – November 2015. | | | | | | | | | | | | |

** Accumulated Other Comprehensive Income

Note 11. New Accounting Pronouncements

There were no new accounting pronouncements that have been issued that may, or reasonably be expected to, have a material impact our financial position or results of operations.

Note 12. Stock Based Compensation

A summary of the activity for restricted stock awards during the three months ended March 31, 2011 is as follows:

| | |

| | Shares | Weighted Average Fair Value Per Share |

| Non-vested –December 31, 2010 | 132,500 | $22.38 |

| Shares Granted | 51,934 | $26.27 |

| Shares Vested | (96,934) | $23.98 |

| Non-vested – March 31, 2011 | 87,500 | $22.91 |

The following table summarizes the future amortization of unrecognized compensation cost, which we will include in administrative and general expenses, relating to the Company’s restricted stock grants as of March 31, 2011:

| Grant Date | | 2011 | | | 2012 | | | 2013 | | | Total | |

| | | | | | | | | | | | | |

| April 30, 2008 | | $ | 304,000 | | | $ | 34,000 | | | $ | - | | | $ | 338,000 | |

| January 27, 2011 | | $ | 799,000 | | | $ | 267,000 | | | $ | - | | | $ | 1,066,000 | |

| Total | | $ | 1,103,000 | | | $ | 301,000 | | | $ | - | | | $ | 1,404,000 | |

| | | | | | | | | | | | | | | | | |

For the three months ended March 31, 2011, the Company’s income before taxes and net income included $577,000 and $375,000, respectively, of stock-based compensation expense charges, which reduced both basic and diluted earnings per share by $0.05 per share. For the three months ended March 31, 2010, the Company’s income before taxes and net income included $734,000 and $477,000, respectively, of stock-based compensation expense charges, which resulted in decreases in basic and diluted earnings per share of $0.07 per share, respectively.

On January 14, 2011, our Independent Directors received an unrestricted grant of 4,434 shares of common stock from the 2009 Stock Incentive Plan.

On January 27, 2011, our Compensation Committee granted 47,500 shares of restricted stock to certain executive officers. The shares vest on the day in 2012 when we file our Form 10-K for the fiscal year 2011, contingent upon the Company achieving certain performance measures for fiscal year 2011 and the executive officer remaining employed by us on such date. The fair value of the Company’s restricted stock, which is determined using the average stock price as of the date of the grant, is applied to the total shares that are expected to fully vest and is amortized to compensation expense on a straight-line basis over the vesting period.

Note 13. Derivative Instruments

The Company uses derivative instruments to manage certain foreign currency exposures and interest rate exposures. The Company does not use derivative instruments for speculative trading purposes. All derivative instruments are recorded on the balance sheet at fair value. For derivatives designated as cash flow hedges, the effective portion of changes in the fair value of the derivative is recorded to other comprehensive income, and is reclassified to earnings when the derivative instrument is settled. Any ineffective portion of changes in the fair value of the derivative is reported in earnings. None of the Company’s derivative contracts contain credit-risk related contingent features that would require us to settle the contract upon the occurrence of such contingency. However, all of our contracts contain clauses specifying events of default under specified circumstances, including failure to pay or deliver, breach of agreement, default under the specific agreement to which the hedge relates, bankruptcy, misrepresentation and mergers, without exception. The remedy for default is settlement in entirety or payment of the fair market value of the contracts, which is $8.3 million in the aggregate for all of our contracts, less posted collateral of $540,000 as of March 31, 2011. The unrealized loss related to the Company’s derivative instruments included in accumulated other comprehensive loss was $7.7 million as of March 31, 2011 and $8.7 million as of December 31, 2010.

The notional and fair value amounts of our derivative instruments as of March 31, 2011 were as follows:

| (Amounts in thousands) | | Asset Derivatives | Liability Derivatives |

| | | | |

| | Current Notional | Balance Sheet | Fair Value | Balance Sheet | Fair Value |

| | Amount | Location | | Location | |

| Interest Rate Swaps - L/T* | $138,562 | N/A | N/A | Other Liabilities | $8,481 |

| Foreign Exchange Contacts | $2,100 | Other Current Assets | $201 | N/A | N/A |

| Total Derivatives designated as hedging instruments | $140,662 | - | $201 | - | $8,481 |

| | | | | | |

*With regard to the interest rates of our long-term debt that have been swapped to a fixed rate under contracts, they include an interest rate swap on a Yen based facility for the financing of a new PCTC delivered in March 2010. The notional amount under this contract is $72,973,514 (based on a Yen to USD exchange rate of 83.19 as of March 31, 2011). With the bank exercising its option to reduce the underlying Yen loan from 80% to 65% funding of the vessel’s delivery cost, the 15% reduction represents the ineffective portion, which consists of the portion of the derivative instrument that is no longer supported by an underlying credit facility. The change in fair value related to the ineffective portion of this swap was a $121,000 gain for the quarter ended March 31, 2011 and this amount was included in earnings. |

The effect of derivative instruments designated as cash flow hedges on our condensed consolidated statement of income for the three months ended March 31, 2011 was as follows:

| (Amounts in thousands) | Gain Recognized in Other Comprehensive Income | Location of Gain(Loss) Reclassified from AOCI to Income | Amount of (Loss) Gain Reclassified from AOCI to Income | Gain Recognized in Income from Ineffective portion |

| | 2011 | | 2011 | 2011 |

| Interest Rate Swaps | $965 | Interest Expense | ($970) | $121 |

| Foreign Exchange contracts | $28 | Voyage Expenses | $219 | - |

| Total | $993 | - | ($751) | $121 |

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

Certain statements made by us or on our behalf in this report or elsewhere that are not based on historical facts are intended to be “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on beliefs and assumptions about future events that are inherently unpredictable and are therefore subject to significant known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from the anticipated results expressed or implied by such forward-looking statements. In this report, the terms “we,” “us,” “our,” and “the Company” refer to International Shipholding Corporation and its subsidiaries.

Such statements include, without limitation, statements regarding (1) anticipated future operating and financial performance, financial position and liquidity, growth opportunities and growth rates, acquisition and divestiture opportunities, business prospects, regulatory and competitive outlook, investment and expenditure plans, investment results, pricing plans, strategic alternatives, business strategies, and other similar statements of expectations or objectives; (2) estimated fair values of capital assets, the recoverability of the cost of those assets, the estimated future cash flows attributable to those assets, and the appropriate discounts to be applied in determining the net present values of those estimated cash flows; (3) estimated scrap values of assets; (4) estimated proceeds from selling assets and the anticipated cost of constructing or purchasing new or existing vessels; (5) estimated fair values of financial instruments, such as interest rate, commodity and currency swap agreements; (6) estimated losses (including independent actuarial estimates) under self-insurance arrangements, as well as estimated gains or losses on certain contracts, trade routes, lines of business or asset dispositions; (7) estimated losses attributable to asbestos claims or other litigation; (8) estimated obligations, and the timing thereof, relating to vessel repair or maintenance work; (9) the adequacy of our capital resources and the availability of additional capital resources on commercially acceptable terms; (10) our ability to remain in compliance with our debt covenants; (11) anticipated trends in government sponsored cargoes; (12) our ability to effectively service our debt; (13) financing opportunities and sources (including the impact of financings on our financial position, financial performance or credit ratings); (14) changes in laws, regulations or tax rates, or the outcome of pending legislative or regulatory initiatives; and (15) assumptions underlying any of the foregoing.

Important factors that could cause our actual results to differ materially from our expectations include our ability to:

| · | identify customers who require marine transportation services or vessels offered by us, |

| · | secure financing on satisfactory terms to repay existing debt or support operations, including to acquire, modify, or construct vessels if such financing is necessary to service the potential needs of current or future customers, |

| · | maximize the usage of our vessels and other assets on favorable economic terms, |

| · | manage the amount and rate of growth of our administrative and general expenses and costs associated with operating our vessels, |

| · | manage our growth in terms of implementing internal controls and information systems and hiring or retaining key personnel, among other things, and |

| · | effectively handle our substantial leverage by servicing and meeting the covenant requirements in each of our debt instruments, thereby avoiding any defaults under those instruments and avoiding cross defaults under others. |

Other factors that could cause actual results to differ materially from our expectations include, without limitation:

| · | unanticipated changes in vessel utilization or cargo rates, or in charter hire, cost of fuel we are not able to pass on to customers, or other operating expenses, |

| · | the rate at which competitors add or scrap vessels, as well as demolition scrap prices and the availability of scrap facilities in the areas in which we operate, |

| · | changes in interest rates, which could increase or decrease the amount of interest we incur on our variable rate debt and the availability and cost of capital to us, |

| · | the impact on our financial statements of nonrecurring accounting charges that may result from our ongoing evaluation of business strategies, asset valuations, and organizational structures, |

| · | changes in accounting policies and practices adopted voluntarily or as required by accounting principles generally accepted in the United States, |

| · | changes in laws and regulations such as those related to government assistance programs and tax rates, |

| · | the frequency and severity of claims against us, and unanticipated outcomes of current or possible future legal proceedings, |

| · | unexpected out-of-service days on our vessels whether due to unplanned maintenance or other causes, |

| · | the ability of customers to fulfill their obligations with us, |

| · | the performance of unconsolidated subsidiaries, |

| · | political events in the United States and abroad, including terrorism and piracy, and the U.S. military's response to those events, |

| · | election results, regulatory activities and the appropriation of funds by the U.S. Congress, |

| · | changes in foreign currency exchange rates, and |

| · | other economic, competitive, governmental, and technological factors which may affect our operations. |

Due to these uncertainties, we cannot assure that we will attain our anticipated results, that our judgments or assumptions will prove correct, or that unforeseen developments will not occur. Accordingly, you are cautioned not to place undue reliance upon any of our forward-looking statements, which speak only as of the date made. Additional risks that we currently deem immaterial or that are not presently known to us could also cause our actual results to differ materially from those expected in our forward-looking statements. Except for meeting our ongoing obligations under the federal securities laws, we undertake no obligation to update or revise for any reason any forward-looking statements made by us or on our behalf, whether as a result of new information, future events or developments, changed circumstances or otherwise. For additional information on our forward-looking statements and risks, see Items 1 and 7 of our Annual Report on Form 10-K for the year ended December 31, 2010.

Executive Summary

Overview of First Quarter 2011

Overall Strategy

The Company operates a diversified fleet of U.S. and International flag vessels that provide international and domestic maritime transportation services to commercial and governmental customers primarily under medium to long-term contracts. Our business strategy consists of identifying growth opportunities as market needs change, utilizing our extensive experience to meet those needs, and continuing to maintain a diverse portfolio of medium to long-term contracts, as well as protect our long-standing customer base by providing quality transportation services. From time to time, we augment the results of our term contracts with incremental supplemental cargoes.

Consolidated Financial Performance – First Quarter 2011 vs. First Quarter 2010

| § | Overall net income increased from $10.6 million in the first quarter of 2010 to $24.1 million in the first quarter of 2011. Included in the first quarter 2011 results was an $18.7 million non-cash gain generated from our acquisition of 100% of Dry Bulk Cape Holding, Inc., a company in which we previously held a 50% equity method investment. In addition, the Company recorded a $1.5 million foreign exchange gain on its Yen denominated facility, reflecting a weakening of the Japanese Yen against the U.S. dollar. These two events were offset by: (i) a decrease in consolidated gross voyage profit of $4.2 million primarily driven by lower supplemental cargoes, (ii) an increase in our interest cost resulting from higher debt balances associated with the financing of our new International Flag Pure Car Truck Carrier and three new Handy-Size Bulk Carriers, and (iii) a decrease in our income from unconsolidated entities from $2.5 million to $1.2 million due to the gain on the sale of a Panamax Bulk Carrier in the first quarter of 2010. |

Segment Performance – First Quarter 2011 vs. First Quarter 2010

Time Charter Contracts – U.S. Flag

| § | Decrease in revenues and gross profits of $12.4 million and $5.9 million, respectively (for further explanation see Results of Operations). |

| § | Lower supplemental cargo volumes. |

| § | Increase in off-hire days in 2011 due to drydocking of a vessel that we operate for the Military Sealift Command. |

Time Charter Contracts – International Flag

| § | Slight decrease in revenues. |

| § | Reduction in gross profits from $3.6 million in 2010 to $2.3 million in 2011. |

| § | Introduction of three new Handysize vessels for hire in the first quarter of 2011. |

| § | Lower results from our Indonesian operation due to 2010 voyage settlements. |

Contract of Affreightment (“COA”)

| § | Slight increase in gross profits due to additional tonnage carried in 2011. |

| § | Guaranteed minimum tonnage for the contract year. |

Rail-Ferry

| § | Improvement in gross profits from a loss of $1.8 million in the first quarter of 2010 to a profit of $0.6 million for the same period in 2011. |

| § | Significant improvement in northbound volumes driven by strong sugar cargo movement. |

| § | Lower depreciation due to lower basis after impairment write-down. |

Other

| § | Increase of $0.4 million driven primarily by additional brokerage commissions. |

Financial Discipline & Strong Balance Sheet for the Quarter Ended March 31, 2011

| § | Total cash and marketable securities of $63.3 million. |

| § | Cash generated from operations of $7.0 million. |

| § | Working capital of $37.3 million. |

| § | Debt payments of $14.9 million. |

RESULTS OF OPERATIONS

THREE MONTHS ENDED MARCH 31, 2011

COMPARED TO THE THREE MONTHS ENDED MARCH 31, 2010

| | | | | | | | | | | | | | | | | | | |

| (All Amounts in Thousands) | | Time Charter Contracts- U.S. Flag | | | Time Charter Contracts-International Flag | | | COA | | | Rail-Ferry Service | | | Other | | | Total | |

| 2011 | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 39,016 | | | $ | 11,210 | | | $ | 4,231 | | | $ | 9,054 | | | $ | 823 | | | $ | 64,334 | |

| Voyage Expenses | | | 29,998 | | | | 6,886 | | | | 4,310 | | | | 7,631 | | | | 165 | | | | 48,990 | |

| Vessel Depreciation | | | 2,509 | | | | 1,990 | | | | - | | | | 872 | | | | 3 | | | | 5,374 | |

| Gross Voyage Profit (Loss) | | | 6,509 | | | | 2,334 | | | | (79 | ) | | | 551 | | | | 655 | | | | 9,970 | |

| 2010 (Recast) | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 51,430 | | | $ | 11,805 | | | $ | 3,980 | | | $ | 5,139 | | | $ | 560 | | | $ | 72,914 | |

| Voyage Expenses | | | 36,687 | | | | 8,186 | | | | 4,167 | | | | 5,597 | | | | 306 | | | | 54,943 | |

| Vessel Depreciation | | | 2,380 | | | | - | | | | - | | | | 1,381 | | | | 3 | | | | 3,764 | |

| Gross Voyage Profit (Loss) | | | 12,363 | | | | 3,619 | | | | (187 | ) | | | (1,839 | ) | | | 251 | | | | 14,207 | |

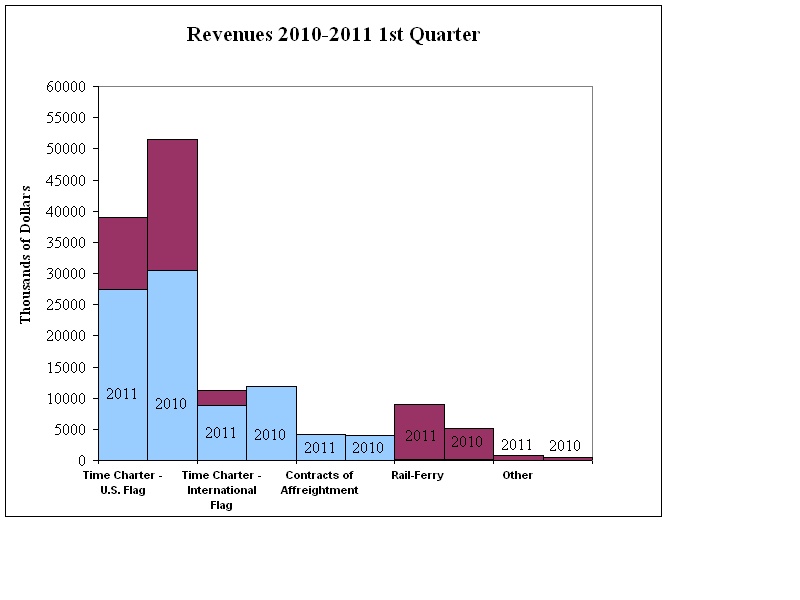

The following table shows the breakout of revenues by segment between fixed and variable for the first three months of 2011 and 2010, respectively:

o Variable Revenue o Fixed Revenue

Beginning with the second quarter 2010, we split Time Charter Contracts operations into two different operating segments, U.S. Flag and International Flag. The changes of revenue and expenses associated with each of our segments are discussed within the following analysis below.

Time Charter Contracts-U.S. Flag: Overall revenues decreased by 24% or $12.4 million when comparing the first quarter of 2011 to the first quarter of 2010. The decrease was driven primarily by a drop in the carriage of supplemental cargoes on our U.S. Flag Pure Car Truck Carriers, as volume returns to more historic levels. The segment’s gross voyage profit decreased from $12.4 million in the first quarter of 2010 to $6.5 million in the first quarter of 2011 primarily as a result of the decrease in supplemental cargoes. Our fixed revenues of $27.4 million and $30.5 million in the first quarter of 2011 and 2010, respectively, represent revenues derived from our fixed time charter contracts, and our variable revenues of $11.7 million and $21.0 million for the same periods in 2011 and 2010, respectively, represent revenues derived from our supplemental cargoes.

Our U.S. Flag Time Charter Contracts include operating three roll on-roll off vessels for the United States Navy’s Military Sealift Command (“MSC”) for varying time periods. In July 2010, the MSC notified us that we would be excluded from further consideration for extending the current operating agreements on the three U.S. Flag roll on-roll off vessels. Shortly thereafter, we protested this action and were reinstated for consideration by the MSC. The MSC has notified us of their intent to exercise the options to extend all three agreements through July 31, 2011. These three contracts represented 10.0% of our total revenue in the first quarter of 2011. Even if we successfully retain any one or more of these MSC contracts, we anticipate materially reduced revenues in future periods.

Time Charter Contracts-International Flag: Revenues decreased from $11.8 million in the first quarter of 2010 to $11.2 million in the first quarter of 2011 and gross voyage profit decreased $1.3 million in the first quarter of 2011, both primarily due to lower results from our Indonesian operation. Our fixed revenues of $8.7 million in the first quarter of 2011 represents revenues derived from our fixed time charter contracts. Our variable revenues of $2.5 million in the first quarter of 2011 represents voyages on three new Handy-Size Bulk Carriers pursuant to a revenue sharing agreement which commenced in January 2011. All revenues in the first quarter of 2010 were derived under fixed revenue time charter contracts.

Contracts of Affreightment: Revenues increased from $4.0 million in the first quarter of 2010 to $4.2 million in the first quarter of 2011 and gross voyage profit improved from a loss of $187,000 in the first quarter of 2010 to a loss of $79,000 in the first quarter of 2011 primarily due to increased tonnage in 2011.

Rail-Ferry Service: Gross voyage profit increased from a loss of $1.8 million in the first quarter of 2010 to a profit of $551,000 in the first quarter of 2011. Revenues for this segment increased from $5.1 million in the first quarter of 2010 to $9.1 million in the first quarter of 2011, reflecting an increase in our Northbound cargo due to strong sugar cargo movement.

Other: Gross profit increased from $251,000 in the first quarter of 2010 to $655,000 in the first quarter of 2011 due to increased brokerage revenue.

Administrative and General Expenses

Administrative and general expenses decreased from $6.0 million in the first quarter of 2010 to $5.8 million in the first quarter of 2011 primarily due to the recording of the present value of a life insurance policy reserved by us in 2010.

The following table shows the significant A&G components for the first quarter of 2011 and 2010, respectively.

(Amounts in Thousands) | | Three Months Ended March 31, | | | | |

| A&G Account | | 2011 | | | 2010 | | | Variance | |

| | | | | | | | | | |

| Wages & Benefits | | $ | 2,856 | | | $ | 2,932 | | | $ | 76 | |

| Executive Stock Compensation | | | 577 | | | | 734 | | | | 157 | |

| Professional Services | | | 731 | | | | 543 | | | | (188 | ) |

| Office Building Expenses | | | 323 | | | | 323 | | | | - | |

| Insurance and Worker’s Comp | | | 132 | | | | 519 | | | | 387 | |

| Other | | | 1,210 | | | | 968 | | | | (242 | ) |

| TOTAL: | | $ | 5,829 | | | $ | 6,019 | | | $ | 190 | |

Other Income and Expense

Interest Expense increased from $1.6 million in the first quarter of 2010 to $2.3 million in the first quarter of 2011 due to higher debt balances associated with the financing of our new International Flag Pure Car Truck Carrier and three new Handy-Size Bulk Carriers.

Derivative Income of $121,000 represents the ineffectiveness of a portion of a derivative contract and the related mark-to-market adjustment associated with this portion of the derivative (See Note 13).

Other income from vessel financing of $688,000 in 2011 is due to interest earned on a note receivable on vessels sold to an Indonesian company in the third quarter of 2009.

Foreign Exchange Gain of $1.5 million in 2011 is due to the revaluation of our Yen denominated loan due to a weakening of the Yen value in the exchange rate associated with the financing of our International flag PCTC Newbuilding (See Item 1A Risk Factors).

Income Taxes

We recorded a provision for income taxes of $208,000 on our $23.1 million of income before equity in net income of unconsolidated entities in the first three months of 2011. For the first three months of 2010 our benefit was $612,000 on our $7.5 million of income before equity in net income of unconsolidated entities. The increase in our provision for income taxes was based on improvements in our operations taxed at the U.S. corporate statutory rate, and the need to record a valuation allowance on deferred tax assets. For further information on certain tax laws and elections, see our Annual Report on Form 10-K filed for the year ended December 31, 2010, including Note F to the consolidated financial statements included therein. Our qualifying U.S. flag operations continue to be taxed under a “tonnage tax” regime rather than under the normal U.S. corporate income tax regimes.

Equity in Net Income of Unconsolidated Entities

Equity in net income of unconsolidated entities, net of taxes, decreased from $2.5 million in the first quarter of 2010 to $1.2 million in the first quarter of 2011.

The results were primarily driven by our 50% investment in Dry Bulk, which as of December 31, 2010 owned two Capesize Bulk Carriers and has two Handymax Bulk Carrier Newbuildings on order for delivery in 2012. Dry Bulk contributed $2.2 million in the first quarter of 2010 as compared to $1.3 million in the first quarter of 2011. Included in the 2010 results is a gain of $1.4 million on the sale of a Panamax Bulk Carrier by a Dry Bulk subsidiary. Offsetting Dry Bulk’s positive contributions were 2011 losses of $88,000 and $99,000 attributable to our 25% investments in Oslo and Tony Bulkers, respectively.

LIQUIDITY AND CAPITAL RESOURCES

The following discussion should be read in conjunction with the more detailed Consolidated Balance Sheets and Condensed Consolidated Statements of Cash Flows included elsewhere herein as part of our Consolidated Financial Statements.

Our working capital (which we define as the difference between our total current assets and total current liabilities) increased from $15.1 million at December 31, 2010, to $37.3 million at March 31, 2011. Cash and cash equivalents increased during the first three months of 2011 by $27.8 million to a total of $52.0 million at March 31, 2011. The increase in cash and cash equivalents was a result of cash provided by operating activities of $7.0 million, cash provided by investing activities of $4.8 million and by cash provided by financing activities of $16.1 million. Total current liabilities of $70.9 million as of March 31, 2011 included current maturities of long-term debt of $24.2 million.

Net cash provided by operating activities for the first three months of 2011 was $7.0 million after adjusting net income of $24.1 million for the first three months of 2011 for non-cash provisions such as depreciation and amortization and cash dividends of $750,000 from our investment in unconsolidated entities, partially offset by, among other things, the deduction of the non-cash $1.2 million of net income from our equity in net income of these unconsolidated entities, foreign exchange gain of $1.5 million on the Yen denominated loan and a $18.7 million non-cash gain on the acquisition of an unconsolidated entity, net of the original investment amount (See Note 5).

Net cash provided by investing activities of $4.8 million included capital expenditures of $12.8 million, offset by principal payments received under direct financing leases of $1.3 million and $16.9 million related to the acquisition of Dry Bulk.

Net cash provided by financing activities of $16.1 million included outflows of regularly scheduled debt payments of $4.9 million, a line of credit payment of $10 million and cash dividends paid of $2.9 million. These cash outflows were offset by proceeds of $34.0 million from the final bank draw on the facility agreement to finance the construction and delivery of three Handy-Size dry bulk carriers delivered in January 2011.

On March 31, 2010 we adjusted our $30 million unsecured revolving line of credit upward to $35 million and extended the maturity date to April 6, 2012. As of March 31, 2011, we had pledged $6.4 million as collateral for a letter of credit. The remaining $28.6 million was available as of March 31, 2011. Associated with this credit facility is a commitment fee of .125% per year on the undrawn portion of this facility.

We filed a universal shelf registration statement with the Securities and Exchange Commission which was declared effective on October 27, 2010. We believe this registration statement will provide us with additional flexibility to access the public equity and debt capital markets as needed for accretive opportunities. For further information, see the Form S-3, filed with the Securities and Exchange Commission on October 13, 2010.

Debt and Lease Obligations – As of March 31, 2011, we held five vessels under operating contracts, five vessels under bareboat charter or lease agreements and two vessels under time charter agreements. The types of vessels held under these agreements include two Pure Car/Truck Carriers, two Breakbulk/Multi Purpose vessels, three Roll-On/Roll-Off vessels and four Container vessels, all of which operate in our Time Charter Contracts – U.S. Flag and International Flag segments, and a Molten Sulphur Carrier operating in our Contracts of Affreightment segment.

Our operating lease agreements have fair value renewal options and fair value purchase options. Most of the agreements impose defined minimum working capital and net worth requirements, impose restrictions on the payment of dividends, and prohibit us from incurring, without prior written consent, additional debt or lease obligations, subject to certain specified exceptions. On January 3, 2011 and January 13, 2011, we exercised the early buy out options on two vessels. Based on the terms of the existing lease agreements, the aggregate early buy out price for both vessels is approximately $64.5 million and is payable in July 2011. We have received numerous proposals to finance the upcoming purchase of the vessels. We are actively working with an existing Lender and believe we will complete the required financing for the purchase of the vessels. However, if we are unable to secure financing for the two vessels, we believe we could purchase them by using a combination of available cash, a draw on the line of credit and seek to obtain a waiver on our debt leverage covenants. Alternatively, we believe we could sell both of the vessels outright.

We also conduct certain of our operations from leased office facilities. Refer to our 2010 form 10-K for a schedule of our contractual obligations.

Substantially all of our credit agreements require us to comply with various loan covenants, including financial covenants that require minimum levels of net worth, working capital and interest expense coverage and a maximum amount of debt leverage.

As of March 31, 2011, the Company was in compliance with all financial covenants related to its debt obligations and we believe, based on current circumstances, that it is likely that we will continue to meet such covenants in the near future. The following table represents the actual and required covenant amounts for the period ending March 31, 2011:

Actual Required

Net Worth (thousands of dollars) $255,783 $237,464

Working Capital (thousands of dollars) $37,348 $ 0

Interest Expense Coverage Ratio (minimum) (1) 14.93 2.5

Leverage Ratio (maximum) (2) 3.03 4.25

| 1. | Defined as the ratio between consolidated earnings before interest, taxes, depreciation, and amortization (“EBITDA”) to interest expense. |

| 2. | Defined as the ratio between consolidated indebtedness to consolidated EBITDA. |

In the unanticipated event that our cash flow and capital resources are not sufficient to fund our debt service obligations, we could be forced to reduce or delay capital expenditures, sell assets, obtain additional equity capital, enter into financings of our unencumbered vessels or restructure debt. We believe we can continue to fund our working capital and routine capital investment liquidity needs through cash flow from operations and/or accessing available lines of credit. To the extent we are required to seek additional capital, our efforts could be hampered by the on-going turmoil in the credit markets. We presently have variable to fixed interest rate swaps on 53% of our long-term debt. We have debt of $18.0 million due in 2011, $36.3 million due in 2012, $37.9 million due in 2013 and $22.1 million due in 2014.

Bulk Carriers - In November 2009, we contracted with a Korean shipyard to construct three double hull Handy-Size Bulk Carrier Newbuildings. We made contract payments of $17.0 million in the fourth quarter 2009, $60.0 million in 2010, and $12.0 million in January 2011 on these vessels. All three vessels were delivered in January 2011. With our equity position on these Newbuildings being fully funded, on August 2, 2010, we entered into a $55.2 million Senior Secured Term Loan Facility Agreement to finance the construction and delivery installment payments under separate shipbuilding contracts for these three Newbuildings. The Facility matures in seven years and is based on a 15-year amortization.

As a result of increasing our ownership in Dry Bulk from 50% to 100% on March 25, 2011, we presently own a 100% interest in a Handymax Bulk Carrier newbuilding, scheduled to be delivered in the first quarter of 2012. Total investment in this newbuilding is anticipated to be approximately $39.0 million. During the period of construction up to delivery, we expect to contribute 35% of the purchase price and have permanent finance commitments in place during the second quarter.

In December 2009, we acquired for $6,250,000 a 25% investment in Oslo Bulk AS (“Oslo Bulk”), which, in 2008, contracted to build eight new Mini Bulkers. Seven of the eight Mini-Bulkers were delivered and entered into a commercial management agreement as of March 31, 2011. The remaining vessel is expected to be delivered in the second quarter of 2011. During 2010, we invested an additional $3.9 million in Tony Bulkers, an affiliate of Oslo Bulk AS, for our 25% share of the installment payments for two more new Mini-Bulkers. One of the Mini-Bulkers was delivered in the fourth quarter, 2010. We paid our remaining share of installment payments associated with the Mini-Bulker Newbuilding of approximately $1.7 million in January 2011 and the vessel is expected to be delivered in the second quarter 2011. These investments are accounted for under the equity method and our share of earnings or losses is reported in our consolidated statements of income, net of taxes.

Cash Dividend Payments – The payment of dividends to common stockholders is at the discretion of our board of directors. On October 29, 2008, our Board of Directors authorized the reinstitution of a quarterly cash dividend program beginning in the fourth quarter of 2008. Since then, the Board has declared a cash dividend each quarter.

Environmental Issues – Our environmental risks primarily relate to oil pollution from the operation of our vessels. We have pollution liability insurance coverage with a limit of $1 billion per occurrence, with deductible amounts not exceeding $250,000 for each incident.

New Accounting Pronouncements - There were no new accounting pronouncements that have been issued that may have a material impact our financial position or results of operations.

ITEM 3 – QUANTITATIVE AND QUALITATIVE INFORMATION ABOUT MARKET RISK

In the ordinary course of our business, we are exposed to foreign currency, interest rate, and commodity price risk. We utilize derivative financial instruments including interest rate swap agreements and forward exchange contracts, and in the past we have also utilized commodity swap agreements to manage certain of these exposures. We hedge only firm commitments or anticipated transactions and do not use derivatives for speculation. We neither hold nor issue financial instruments for trading purposes.

Interest Rate Risk. The fair value of our cash and short-term investment portfolio at March 31, 2011 approximated its carrying value due to the short-term duration. The potential decrease in fair value resulting from a hypothetical 10% increase in interest rates at quarter-end for our investment portfolio is not material.

The fair value of long-term debt at March 31, 2011, including current maturities, was estimated to equal the carrying value of $267.7 million.

We enter into interest rate swap agreements to manage well-defined interest rate risks. The Company records the fair value of the interest rate swaps as an asset or liability on its balance sheet. Currently, each of the Company’s interest rate swaps is accounted for as an effective cash flow hedge Accordingly, the effective portion of the change in fair value of the swap is recorded in Other Comprehensive Income (Loss). A portion of the Yen interest rate swap we entered into in 2009 is deemed ineffective and recorded to earnings due to the portion of the derivative instrument that is no longer supported by an underlying credit facility. As of March 31, 2011, the Company has the following interest rate swap contracts outstanding:

| Effective Date | Termination Date | Current Notional Amount | Swap Rate | Type |

| 11/30/05 | 11/30/12 | $13,265,000 | 5.17% | Fixed |

| 3/31/08 | 9/30/13 | $11,663,333 | 3.46% | Fixed |

| 9/30/10 | 9/30/13 | $11,663,333 | 2.69% | Fixed |

| 9/30/10 | 9/30/13 | $11,663,333 | 2.45% | Fixed |

| 9/26/05 | 9/28/15 | $8,666,667 | 4.41% | Fixed |

| 9/26/05 | 9/28/15 | $8,666,667 | 4.41% | Fixed |

| 3/15/09 | 9/15/20 | ¥ 6,070,666,668 | 2.065% | Fixed |

The fair value of these agreements at March 31, 2011, estimated based on the amount that the banks would receive or pay to terminate the swap agreements at the reporting date, taking into account current market conditions and interest rates, is a liability of $8.5 million. A hypothetical 10% decrease in interest rates as of March 31, 2011, would have resulted in a liability of $9.1 million.

Commodity Price Risk. As of March 31, 2011, we do not have commodity swap agreements in place to manage our exposure to price risk related to the purchase of the estimated 2011 fuel requirements for our Rail-Ferry Service segment. We have fuel surcharges in place for our Rail-Ferry Service, which we expect to effectively manage the price risk for those services during 2011. If we had commodity swap agreements, they could be structured to reduce our exposure to increases in fuel prices. However, they would also limit the benefit we might otherwise receive from any price decreases associated with this commodity. We estimate that a 20% increase in the price of fuel for the period January 1, 2011 through March 31, 2011 would have resulted in an increase of approximately $196,000 in our fuel costs for the same period, and in a corresponding decrease of approximately $0.03 in our basic earnings per share based on the shares of our common stock outstanding as of March 31, 2011. The additional fuel costs assume no additional revenue would be generated from fuel surcharges, even though we believe that we could have passed on to our customers some or all of the fuel price increases through the aforementioned fuel surcharges during the same period, subject to the need to maintain competitive freight rates. Our charterers in the Time Charter Contracts – U.S. Flag and the Time Charter Contracts – International Flag segments are responsible for purchasing vessel fuel requirements; thus, we have no fuel price risk in these segments.

Foreign Exchange Rate Risk. We have entered into foreign exchange contracts to hedge certain firm foreign currency purchase commitments. In 2010, we entered into two forward purchase contracts which expire in 2011. The first was for Mexican Pesos for $1,725,000 U.S. Dollar equivalents at an exchange rate of 13.1524 and the second was for Indonesian Rupiah for $1,800,000 U.S. Dollar equivalents at an exchange rate of 9670.

The following table summarizes the current value of these contracts:

| (Amounts in Thousands) | | | | | | |

| Transaction Date | | Type of Currency | | Transaction Amount in Dollars | | Effective Date | | Expiration Date |

| June 2010 | | Rupiah | | $ 1,350 | | January 2011 | | December 2011 |

| June 2010 | | Peso | | $ 750 | | September 2010 | | August 2011 |

The fair value of these contracts at March 31, 2011, is an asset of $201,000. The potential fair value of these contracts that would have resulted from a hypothetical 10% adverse change in the exchange rates would be an asset of $181,000.