UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| | [X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2011

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from . . . . . . . . . . . . to . . . . . . . . . . . . . . |

| | Commission File No. 001-10852 |

| | International Shipholding Corporation |

| | (Exact name of registrant as specified in its charter) |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

11 North Water Street, Suite 18290, Mobile, Alabama 36602

(Address of principal executive offices) (Zip Code)

| | Registrant's telephone number, including area code: (251) 243-9100 |

Former name, former address and former fiscal year, if changed since last report:

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer þ

Non-accelerated filer ¨ Smaller Reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common stock, $1 par value. . . . . . . . 7,228,252 shares outstanding as of June 30, 2011

INTERNATIONAL SHIPHOLDING CORPORATION

In this report, the terms “we,” “us,” “our,” and the “Company” refer to International Shipholding Corporation and its sunsidiaries. In addition, the term “GAAP” means U.S. generally accepted accounting principles, the term “Newbuilding” means a vessel that is under construction, the term “Notes” means the Notes to our Consolidated Financial Statements contained elsewhere in this report, ther term “PCTC” means a Pure Car/Truck Carrier vessel, the term “SEC” means the U.S. Securities and Exchange Commission, and the term “USD” means U.S. Dollars.

PART I – FINANCIAL INFORMATION

| |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| (All Amounts in Thousands Except Share Data) | |

| (Unaudited) | |

| | |

| | | Three Months Ended June 30, | | | Six Months ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Revenues | | $ | 69,961 | | | $ | 85,084 | | | $ | 134,295 | | | $ | 157,998 | |

| | | | | | | | | | | | | | | | | |

| Operating Expenses: | | | | | | | | | | | | | | | | |

| Voyage Expenses | | | 51,814 | | | | 61,513 | | | | 100,804 | | | | 116,456 | |

| Vessel Depreciation | | | 6,095 | | | | 4,984 | | | | 11,469 | | | | 8,748 | |

| Administrative and General Expenses | | | 5,455 | | | | 5,415 | | | | 11,284 | | | | 11,434 | |

| Gain on Dry Bulk Transaction | | | (130 | ) | | | - | | | | (18,844 | ) | | | - | |

| Loss (Gain) on Sale of Other Assets | | | - | | | | 46 | | | | - | | | | (75 | ) |

| | | | | | | | | | | | | | | | | |

| Total Operating Expenses | | | 63,234 | | | | 71,958 | | | | 104,713 | | | | 136,563 | |

| | | | | | | | | | | | | | | | | |

| Operating Income | | | 6,727 | | | | 13,126 | | | | 29,582 | | | | 21,435 | |

| | | | | | | | | | | | | | | | | |

| Interest and Other: | | | | | | | | | | | | | | | | |

| Interest Expense | | | 2,330 | | | | 2,433 | | | | 4,620 | | | | 4,032 | |

| Derivative Loss (Income) | | | 106 | | | | - | | | | (15 | ) | | | - | |

| Gain on Sale of Investments | | | (114 | ) | | | (16 | ) | | | (114 | ) | | | (16 | ) |

| Other Income from Vessel Financing | | | (672 | ) | | | (590 | ) | | | (1,360 | ) | | | (1,194 | ) |

| Investment Income | | | (185 | ) | | | (987 | ) | | | (385 | ) | | | (1,166 | ) |

| Foreign Exchange Loss | | | 1,900 | | | | 3,148 | | | | 411 | | | | 3,148 | |

| | | | 3,365 | | | | 3,988 | | | | 3,157 | | | | 4,804 | |

| | | | | | | | | | | | | | | | | |

| Income Before Provision (Benefit) for Income Taxes and | | | | | | | | | | | | | | | | |

| Equity in Net (Loss) Income of Unconsolidated Entities | | | 3,362 | | | | 9,138 | | | | 26,425 | | | | 16,631 | |

| | | | | | | | | | | | | | | | | |

| Provision (Benefit) for Income Taxes: | | | | | | | | | | | | | | | | |

| Current | | | 173 | | | | 170 | | | | 381 | | | | 323 | |

| Deferred | | | - | | | | (200 | ) | | | - | | | | (965 | ) |

| | | | 173 | | | | (30 | ) | | | 381 | | | | (642 | ) |

| Equity in Net (Loss) Income of Unconsolidated | | | | | | | | | | | | | | | | |

| Entities (Net of Applicable Taxes) | | | (351 | ) | | | 448 | | | | 874 | | | | 2,911 | |

| | | | | | | | | | | | | | | | | |

| Net Income | | $ | 2,838 | | | $ | 9,616 | | | $ | 26,918 | | | $ | 20,184 | |

| | | | | | | | | | | | | | | | | |

| Basic and Diluted Earnings Per Common Share: | | | | | | | | | | | | | | | | |

| Basic Earnings Per Common Share: | | $ | 0.39 | | | $ | 1.33 | | | $ | 3.72 | | | $ | 2.79 | |

| | | | | | | | | | | | | | | | | |

| Diluted Earnings Per Common Share: | | $ | 0.39 | | | $ | 1.32 | | | $ | 3.70 | | | $ | 2.76 | |

| | | | | | | | | | | | | | | | | |

| Weighted Average Shares of Common Stock Outstanding: | | | | | | | | | | | | | | | | |

| Basic | | | 7,228,252 | | | | 7,242,126 | | | | 7,230,530 | | | | 7,245,642 | |

| Diluted | | | 7,265,092 | | | | 7,295,638 | | | | 7,260,598 | | | | 7,308,398 | |

| | | | | | | | | | | | | | | | | |

| Dividends Per Share | | $ | 0.375 | | | $ | 0.0375 | | | $ | 0.750 | | | $ | 0.875 | |

The accompanying notes are an integral part of these statements.

| |

| CONSOLIDATED BALANCE SHEETS | |

| (All Amounts in Thousands) | |

| (Unaudited) | |

| | |

| | | June 30, | | | December 31, | |

| ASSETS | | 2011 | | | 2010 | |

| | | | | | | |

| Current Assets: | | | | | | |

| Cash and Cash Equivalents | | $ | 33,836 | | | $ | 24,158 | |

| Restricted Cash | | | 6,549 | | | | - | |

| Marketable Securities | | | 8,494 | | | | 11,527 | |

| Accounts Receivable, Net of Allowance for Doubtful Accounts | | | | | | | | |

| of $329 and $311 in 2011 and 2010: | | | 21,715 | | | | 16,474 | |

| Federal Income Taxes Receivable | | | 168 | | | | 242 | |

| Net Investment in Direct Financing Leases | | | 5,935 | | | | 5,596 | |

| Other Current Assets | | | 583 | | | | 2,513 | |

| Notes Receivable | | | 4,248 | | | | 4,248 | |

| Material and Supplies Inventory | | | 4,338 | | | | 3,774 | |

| Total Current Assets | | | 85,866 | | | | 68,532 | |

| | | | | | | | | |

| Investment in Unconsolidated Entities | | | 14,722 | | | | 27,261 | |

| | | | | | | | | |

| Net Investment in Direct Financing Leases | | | 47,052 | | | | 50,102 | |

| | | | | | | | | |

| Vessels, Property, and Other Equipment, at Cost: | | | | | | | | |

| Vessels | | | 498,059 | | | | 365,797 | |

| Leasehold Improvements | | | 26,128 | | | | 26,128 | |

| Construction in Progress | | | 11,901 | | | | 78,355 | |

| Furniture and Equipment | | | 9,370 | | | | 7,863 | |

| | | | 545,458 | | | | 478,143 | |

| Less - Accumulated Depreciation | | | (156,509 | ) | | | (143,667 | ) |

| | | | 388,949 | | | | 334,476 | |

| | | | | | | | | |

| Other Assets: | | | | | | | | |

| Deferred Charges, Net of Accumulated Amortization | | | 16,456 | | | | 14,482 | |

| of $17,478 and $14,525 in 2011 and 2010, Respectively | | | | | | | | |

| Intangible Assets | | | 4,507 | | | | - | |

| Due from Related Parties | | | 4,272 | | | | 4,124 | |

| Notes Receivable | | | 38,018 | | | | 40,142 | |

| Other | | | 4,914 | | | | 5,004 | |

| | | | 68,167 | | | | 63,752 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 604,756 | | | $ | 544,123 | |

| | | | | | | | | |

The accompanying notes are an integral part of these statements.

| | | | | | | |

| | |

| | |

| INTERNATIONAL SHIPHOLDING CORPORATION | |

| CONSOLIDATED BALANCE SHEETS | |

| (All Amounts in Thousands) | |

| (Unaudited) | |

| | |

| | | June 30, | | | December 31, | |

| | | 2011 | | | 2010 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

| | | | | | | |

| Current Liabilities: | | | | | | |

| Current Maturities of Long-Term Debt | | $ | 28,045 | | | $ | 21,324 | |

| Accounts Payable and Accrued Liabilities | | | 26,139 | | | | 32,114 | |

| Total Current Liabilities | | | 54,184 | | | | 53,438 | |

| | | | | | | | | |

| Long-Term Debt, Less Current Maturities | | | 231,186 | | | | 200,241 | |

| | | | | | | | | |

| Other Long-Term Liabilities: | | | | | | | | |

| Lease Incentive Obligation | | | 6,921 | | | | 7,022 | |

| Other | | | 56,631 | | | | 49,672 | |

| | | | | | | | | |

| TOTAL LIABILITIES | | | 348,922 | | | | 310,373 | |

| | | | | | | | | |

| Stockholders' Equity: | | | | | | | | |

| Common Stock | | | 8,573 | | | | 8,564 | |

| Additional Paid-In Capital | | | 85,068 | | | | 84,846 | |

| Retained Earnings | | | 204,834 | | | | 183,541 | |

| Treasury Stock | | | (25,403 | ) | | | (25,403 | ) |

| Accumulated Other Comprehensive (Loss) | | | (17,238 | ) | | | (17,798 | ) |

| TOTAL STOCKHOLDERS’ EQUITY | | | 255,834 | | | | 233,750 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHODERS’ EQUITY | | $ | 604,756 | | | $ | 544,123 | |

| | | | | | | | | |

The accompanying notes are an integral part of these statements.

| |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| (All Amounts in Thousands) | |

| | | Six Months Ended June 30, | |

| | | 2011 | | | 2010 | |

| Cash Flows from Operating Activities: | | | | | | |

| Net Income | | $ | 26,918 | | | $ | 20,184 | |

| Adjustments to Reconcile Net Income to Net Cash Provided by | | | | | | | | |

| Operating Activities: | | | | | | | | |

| Depreciation | | | 11,961 | | | | 9,040 | |

| Amortization of Deferred Charges and Other Assets | | | 4,029 | | | | 5,087 | |

| Deferred Benefit for Income Taxes | | | - | | | | (965 | ) |

| Gain on Acquisition | | | (18,844 | ) | | | - | |

| Non-Cash Stock Based Compensation | | | 1,006 | | | | 1,399 | |

| Equity in Net Income of Unconsolidated Entities | | | (874 | ) | | | (2,911 | ) |

| Distributions from Unconsolidated Entities | | | 750 | | | | 1,500 | |

| Gain on Sale of Assets | | | - | | | | (75 | ) |

| Gain on Sale of Investments | | | (114 | ) | | | (16 | ) |

| Loss on Foreign Currency Exchange | | | 411 | | | | 3,148 | |

| Changes in: | | | | | | | | |

| Deferred Drydocking Charges | | | (4,359 | ) | | | (244 | ) |

| Accounts Receivable | | | (4,817 | ) | | | (11,790 | ) |

| Inventories and Other Current Assets | | | 1,816 | | | | 505 | |

| Other Assets | | | 89 | | | | (2 | ) |

| Accounts Payable and Accrued Liabilities | | | (121 | ) | | | (1,002 | ) |

| Other Long-Term Liabilities | | | 1,249 | | | | 452 | |

| Net Cash Provided by Operating Activities | | | 19,100 | | | | 24,310 | |

| | | | | | | | | |

| Cash Flows from Investing Activities: | | | | | | | | |

| Principal payments received under Direct Financing Leases | | | 2,711 | | | | 2,935 | |

| Capital Improvements to Vessels, Leasehold Improvements, and Other Assets | | | (17,216 | ) | | | (72,642 | ) |

| Proceeds from Sale of Assets | | | - | | | | 3,853 | |

| Purchase of Marketable Securities | | | (85 | ) | | | (8,708 | ) |

| Proceeds from Sale of Marketable Securities | | | 2,755 | | | | 598 | |

| Investment in Unconsolidated Entities | | | (1,796 | ) | | | (2,584 | ) |

| Acquisition of Unconsolidated Entity | | | 7,092 | | | | - | |

| Net Increase in Restricted Cash Account | | | (6,549 | ) | | | - | |

| Proceeds from Note Receivables | | | 2,069 | | | | 2,012 | |

| Net Cash Used In Investing Activities | | | (11,019 | ) | | | (74,536 | ) |

| | | | | | | | | |

| Cash Flows from Financing Activities: | | | | | | | | |

| Common Stock Repurchase | | | - | | | | (5,231 | ) |

| Proceeds from Issuance of Debt | | | 58,079 | | | | 122,306 | |

| Repayment of Debt | | | (49,378 | ) | | | (93,409 | ) |

| Additions to Deferred Financing Charges | | | (1,479 | ) | | | (518 | ) |

| Common Stock Dividends Paid | | | (5,625 | ) | | | (6,575 | ) |

| Net Cash Provided by Financing Activities | | | 1,597 | | | | 16,573 | |

| | | | | | | | | |

| Net Increase in Cash and Cash Equivalents | | | 9,678 | | | | (33,653 | ) |

| Cash and Cash Equivalents at Beginning of Period | | | 24,158 | | | | 47,468 | |

| | | | | | | | | |

| Cash and Cash Equivalents at End of Period | | $ | 33,836 | | | $ | 13,815 | |

The accompanying notes are an integral part of these statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS June 30, 2011

(Unaudited)

Note 1. Basis of Preparation

We have prepared the accompanying unaudited interim financial statements pursuant to the rules and regulations of the Securities and Exchange Commission, and as permitted thereunder we have omitted certain information and footnote disclosures required by U.S. Generally Accepted Accounting Principles (GAAP) for complete financial statements. We suggest that you read these interim statements in conjunction with the financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2010. The condensed consolidated balance sheet as of December 31, 2010 included in this report has been derived from the audited financial statements at that date.

The foregoing 2011 interim results are not necessarily indicative of the results of operations for the full year 2011. Management believes that it has made all adjustments necessary, consisting only of normal recurring adjustments, for a fair statement of the information shown.

Our policy is to consolidate all subsidiaries in which we hold a greater than 50% voting interest or otherwise control its operating and financial activities. We use the equity method to account for investments in entities in which we hold a 20% to 50% voting or economic interest and have the ability to exercise significant influence over their operating and financial activities. We use the cost method to account for investments in entities in which we hold a less than 20% voting interest and in which we cannot exercise significant influence over operating and financial activities.

Revenues and expenses relating to our Rail-Ferry Service segment voyages are recorded over the duration of the voyage. Our voyage expenses are estimated at the beginning of the voyages based on historical actual costs or from industry sources familiar with those types of charges. As the voyage progresses, these estimated costs are revised with actual charges and timely adjustments are made. The expenses are ratably expensed over the voyage based on the number of days in progress at the end of the period. Based on our prior experience, we believe there is no material difference between recording estimated expenses ratably over the voyage versus recording expenses as incurred. Revenues and expenses relating to our other segments' voyages, which require no estimates or assumptions, are recorded when earned or incurred during the reporting period.

We have eliminated all significant intercompany balances, accounts and transactions.

Note 2. Employee Benefit Plans

The following table provides the components of net periodic benefit cost for our pension plan and postretirement benefits plan for the three months ended June 30, 2011 and 2010:

| (All Amounts in Thousands) | | Pension Plan | | | Postretirement Benefits | |

| | | Three Months Ended June 30, | | | Three Months Ended June 30, | |

| Components of net periodic benefit cost: | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Service cost | | $ | 136 | | | $ | 140 | | | $ | 22 | | | $ | 5 | |

| Interest cost | | | 368 | | | | 372 | | | | 143 | | | | 99 | |

| Expected return on plan assets | | | (475 | ) | | | (427 | ) | | | - | | | | - | |

| Amortization of prior service cost | | | (1 | ) | | | (1 | ) | | | (3 | ) | | | (3 | ) |

| Amortization of Net Loss | | | 83 | | | | 86 | | | | 55 | | | | - | |

| Net periodic benefit cost | | $ | 111 | | | $ | 170 | | | $ | 217 | | | $ | 101 | |

The following table provides the components of net periodic benefit cost for our pension plan and postretirement benefits plan for the six months ended June 30, 2011 and 2010:

| (All Amounts in Thousands) | | Pension Plan | | | Postretirement Benefits | |

| | | Six Months Ended June 30, | | | Six Months Ended June 30, | |

| Components of net periodic benefit cost: | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Service cost | | $ | 272 | | | $ | 280 | | | $ | 44 | | | $ | 10 | |

| Interest cost | | | 736 | | | | 744 | | | | 286 | | | | 198 | |

| Expected return on plan assets | | | (950 | ) | | | (854 | ) | | | - | | | | - | |

| Amortization of prior service cost | | | (2 | ) | | | (2 | ) | | | (6 | ) | | | (6 | ) |

| Amortization of Net (Gain)/Loss | | | 166 | | | | 172 | | | | 110 | | | | - | |

| Net periodic benefit cost | | $ | 222 | | | $ | 340 | | | $ | 434 | | | $ | 202 | |

We contributed $312,000 to our Pension Plan this year through July 2011. We are monitoring market conditions and, based on the current market conditions, we anticipate making up to $900,000 in additional contributions for the year 2011.

Note 3. Operating Segments

Our four operating segments, Time Charter Contracts – U.S. Flag, Time Charter Contracts – International Flag, Contracts of Affreightment (“COA”), and Rail-Ferry Service, are identified primarily by the characteristics of the contracts and terms under which our vessels are operated. Beginning with the second quarter 2010 Form 10-Q report, we split Time Charter Contracts into two different operating segments, Time Charter Contracts – U.S. Flag and Time Charter Contracts – International Flag. We recast all prior period data for the previous Time Charter Contracts Segment based on the new operating segments. We report in the Other category the results of several of our subsidiaries that provide ship and cargo charter brokerage and agency services. We manage each reportable segment separately, as each requires different resources depending on the nature of the contract or terms under which each vessel within the segment operates.

We allocate interest expense to the segments in proportion to the book values of the vessels owned within each segment. We do not allocate to our segments administrative and general expenses, investment income, gain on sale of investment, equity in net income of unconsolidated entities, or income taxes. Intersegment revenues are based on market prices and include revenues earned by our subsidiaries that provide specialized services to our operating companies.

The following table presents information about segment profit and loss for the three months ended June 30, 2011 and 2010:

| | | | | | | | | | | | | | | | | | | |

| (All Amounts in Thousands) | | Time Charter Contracts- U.S. Flag | | | Time Charter Contracts- International Flag | | | COA | | | Rail-Ferry Service | | | Other | | | Total | |

| 2011 | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 39,290 | | | $ | 15,813 | | | $ | 4,500 | | | $ | 9,867 | | | $ | 491 | | | $ | 69,961 | |

| Intersegment Revenues (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | (5,554 | ) | | | (5,554 | ) |

| Intersegment Expenses (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | 5,554 | | | | 5,554 | |

| Voyage Expenses | | | 29,952 | | | | 8,294 | | | | 4,601 | | | | 8,807 | | | | 160 | | | | 51,814 | |

| Vessel Depreciation | | | 2,495 | | | | 2,699 | | | | - | | | | 899 | | | | 2 | | | | 6,095 | |

| Gross Voyage Profit (Loss) | | | 6,843 | | | | 4,820 | | | | (101 | ) | | | 161 | | | | 329 | | | | 12,052 | |

| Interest Expense | | | 678 | | | | 1,337 | | | | - | | | | 193 | | | | 122 | | | | 2,330 | |

| Segment Profit (Loss) | | | 6,165 | | | | 3,483 | | | | (101 | ) | | | (32 | ) | | | 207 | | | | 9,722 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 2010 | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 58,399 | | | $ | 15,157 | | | $ | 4,513 | | | $ | 6,268 | | | $ | 747 | | | $ | 85,084 | |

| Intersegment Revenues (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | (3,708 | ) | | | (3,708 | ) |

| Intersegment Expenses (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | 3,708 | | | | 3,708 | |

| Voyage Expenses | | | 41,471 | | | | 9,357 | | | | 4,205 | | | | 6,162 | | | | 318 | | | | 61,513 | |

| Vessel Depreciation | | | 2,530 | | | | 994 | | | | - | | | | 1,457 | | | | 3 | | | | 4,984 | |

| Gross Voyage Profit (Loss) | | | 14,398 | | | | 4,806 | | | | 308 | | | | (1,351 | ) | | | 426 | | | | 18,587 | |

| Interest Expense | | | 793 | | | | 1,139 | | | | - | | | | 365 | | | | 136 | | | | 2,433 | |

| Segment Profit (Loss) | | | 13,605 | | | | 3,667 | | | | 308 | | | | (1,716 | ) | | | 290 | | | | 16,154 | |

The following table presents information about segment profit and loss for the six months ended June 30, 2011 and 2010:

| | | | | | | | | | | | | | | | | | | |

| (All Amounts in Thousands) | | Time Charter Contracts- U.S. Flag | | | Time Charter Contracts-International Flag | | | COA | | | Rail-Ferry Service | | | Other | | | Total | |

| 2011 | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 78,307 | | | $ | 27,023 | | | $ | 8,731 | | | $ | 18,921 | | | $ | 1,313 | | | $ | 134,295 | |

| Intersegment Revenues (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | (9,331 | ) | | | (9,331 | ) |

| Intersegment Expenses (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | 9,331 | | | | 9,331 | |

| Voyage Expenses | | | 59,951 | | | | 15,179 | | | | 8,912 | | | | 16,438 | | | | 324 | | | | 100,804 | |

| Vessel Depreciation | | | 5,004 | | | | 4,689 | | | | - | | | | 1,771 | | | | 5 | | | | 11,469 | |

| Gross Voyage Profit (Loss) | | | 13,352 | | | | 7,155 | | | | (181 | ) | | | 712 | | | | 984 | | | | 22,022 | |

| Interest Expense | | | 1,353 | | | | 2,638 | | | | - | | | | 386 | | | | 243 | | | | 4,620 | |

| Segment Profit (Loss) | | | 11,999 | | | | 4,517 | | | | (181 | ) | | | 326 | | | | 741 | | | | 17,402 | |

| 2010 | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 109,855 | | | $ | 26,961 | | | $ | 8,472 | | | $ | 11,404 | | | $ | 1,306 | | | $ | 157,998 | |

| Intersegment Revenues (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | (7,441 | ) | | | (7,441 | ) |

| Intersegment Expenses (Eliminated) | | | - | | | | - | | | | - | | | | - | | | | 7,441 | | | | 7,441 | |

| Voyage Expenses | | | 78,167 | | | | 17,542 | | | | 8,368 | | | | 11,756 | | | | 623 | | | | 116,456 | |

| Vessel Depreciation | | | 4,909 | | | | 994 | | | | - | | | | 2,839 | | | | 6 | | | | 8,748 | |

| Gross Voyage Profit (Loss) | | | 26,779 | | | | 8,425 | | | | 104 | | | | (3,191 | ) | | | 677 | | | | 32,794 | |

| Interest Expense | | | 1,633 | | | | 1,370 | | | | - | | | | 751 | | | | 278 | | | | 4,032 | |

| Segment Profit (Loss) | | | 25,146 | | | | 7,055 | | | | 104 | | | | (3,942 | ) | | | 399 | | | | 28,762 | |

The following table is a reconciliation of the totals reported for the operating segments to the applicable line items in the consolidated financial statements:

| (All Amounts in Thousands) | | Six Months Ended June 30, | | | Three Months Ended June 30, | |

| Profit or Loss: | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Total Profit for Reportable Segments | | $ | 17,402 | | | $ | 28,762 | | | $ | 9,722 | | | $ | 16,154 | |

| Unallocated Amounts: | | | | | | | | | | | | | | | | |

| Administrative and General Expenses | | | (11,284 | ) | | | (11,434 | ) | | | (5,455 | ) | | | (5,415 | ) |

| Gain (Loss) on Sale of Other Assets | | | - | | | | 75 | | | | - | | | | (46 | ) |

| Ineffective Portion on Derivative Instrument | | | 15 | | | | | | | | (106 | ) | | | - | |

| Gain on Sale of Investment | | | 114 | | | | 16 | | | | 114 | | | | 16 | |

| Other Income from Vessel Financing | | | 1,360 | | | | 1,194 | | | | 672 | | | | 590 | |

| Investment Income | | | 385 | | | | 1,166 | | | | 185 | | | | 987 | |

| Foreign Exchange Loss | | | (411 | ) | | | (3,148 | ) | | | (1,900 | ) | | | (3,148 | ) |

| Gain on DBCH Acquisition | | | 18,844 | | | | | | | | 130 | | | | - | |

| Income Before (Benefit) Provision for | | | | | | | | | | | | | | | | |

| Income Taxes and Equity in Net Income of Unconsolidated Entities | | $ | 26,425 | | | $ | 16,631 | | | $ | 3,362 | | | $ | 9,138 | |

Note 4. Unconsolidated Entities

In 2003, we acquired for $3,479,000 a 50% investment in Dry Bulk Cape Holding Inc. (“Dry Bulk”), which as of December 31, 2010, owned 100% of subsidiary companies owning two Capesize Bulk Carriers and two Handymax Bulk Carrier Newbuildings on order for delivery in 2012. Historically, we have accounted for this investment under the equity method and our share of earnings or losses has been reported in our consolidated statements of income, net of taxes. On March 25, 2011, we acquired 100% ownership of Dry Bulk. Following the acquisition , Dry Bulk’s results are no longer accounted for under the equity method. For further information on this acquisition, see Note 5 below.

Our portion of earnings of Dry Bulk was $1.3 million, net of taxes of $0, and $3.6 million, net of taxes of $3.3 million, for the six months ended June 30, 2011 and 2010, respectively. Historically, we did not provide for income taxes related to our earnings from Dry Bulk as a result of the U. S. tax law in effect prior to 2010. This tax law expired effective January 1, 2010, resulting in income taxes being applicable to our earnings from Dry Bulk during the first three quarters of 2010. After Congress eliminated the need for a tax provision on these amounts in late 2010, we reversed our 2010 provision for taxes in the fourth quarter of 2010.

During the first quarter of 2011 we received a $750,000 cash dividend distribution from Dry Bulk prior to acquiring full ownership of it on March 25, 2011 and a $1.5 million cash dividend distribution in the first six months of 2010.

Summarized below are the unaudited condensed results of operations of Dry Bulk through March 25, 2011, when we acquired 100% of its stock:

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| (Amounts in Thousands) | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Operating Revenues | | $ | - | | | $ | 6,337 | | | $ | 4,823 | | | $ | 15,913 | |

| Operating Income | | $ | - | | | $ | 4,617 | | | $ | 2,866 | | | $ | 11,581 | |

| Net Income | | $ | - | | | $ | 4,026 | | | $ | 2,613 | | | $ | 13,377 | |

In December 2009, we acquired for $6,250,000 a 25% investment in Oslo Bulk AS (“Oslo Bulk”) which in 2008, contracted to build eight new Mini Bulkers. All of the Mini-Bulkers have been delivered and deployed as of July 2011. During 2010, we invested an additional $3.9 million in Tony Bulkers Pte Ltd. (“Tony Bulkers”), an affiliate of Oslo Bulk AS, for our 25% share of the installment payments for two additional new Mini-Bulkers, both of which have been delivered and deployed as of July, 2011. We paid our remaining share of installment payments associated with these two Mini-Bulkers of approximately $1.7 million in January 2011. These investments are accounted for under the equity method and our share of earnings or losses is reported in our consolidated statements of income net of taxes. Our portion of the aggregate earnings of Oslo Bulk and Tony Bulkers, which included final 2010 income adjustments of $143,000 for Oslo Bulk, were losses of $399,000 and $108,000, respectively, for the six months ended June 30, 2011, largely due to initial positioning voyages on the newly delivered vessels. Our portion of the earnings of our remaining investments in unconsolidated entities was a loss of $62,000.

Note 5. Dry Bulk Cape Holding, Inc. Step Acquisition

On March 25, 2011, Cape Holding, Ltd. (one of our indirect wholly-owned subsidiaries) and DryLog Ltd. completed a transaction that restructured their respective 50% interests in Dry Bulk.

Prior to this transaction, Dry Bulk controlled through various subsidiaries two Cape Size vessels and two Handymax Newbuildings. In connection with this transaction, (i) Cape Holding, Ltd. increased its ownership in Dry Bulk from 50% to 100% and (ii) in consideration, DryLog Ltd. received ownership of two former Dry Bulk subsidiaries holding one Cape Size vessel and one shipbuilding contract relating to a Handymax vessel scheduled to be delivered in the second half of 2012. Following the transfer of these subsidiaries, Dry Bulk continues to control through two subsidiaries, one Cape Size vessel and one shipbuilding contract relating to a Handymax vessel scheduled to be delivered by the end of the first quarter of 2012. After completion of this transaction, we now beneficially own 100% of Dry Bulk and have complete control of the two remaining vessels.

In early 2011, we retained an independent, third party firm with shipping industry experience to assist us in determining the fair value of Dry Bulk and the fair value of our previous 50% interest in Dry Bulk.

At the time of the acquisition, the assets of Dry Bulk consisted of cash, trade receivables, prepayments, inventory, two capesize vessels, two handysize vessels under construction and time charter agreements on the two capesize vessels which expire in early 2013 and are currently fixed at attractive time charter rates. Current liabilities consisted primarily of accrued interest on debt and the non-current liabilities consisting primarily of floating rate bank borrowings. With the exception of the capesize vessels and the intangible value assigned to the above-market time charter contracts, the fair value of all assets and liabilities were equal to the carrying values.

As of March 31, 2011, the combined appraised value for both capesize vessels was $84.0 million as compared to the book value of approximately $53.6 million. In determining the appraised fair value of the capesize vessels, the cost and comparable sales approaches were used with equal weight applied to each approach. In addition to the fair value adjustment on the capesize vessels, an intangible asset was established reflecting the difference between the existing value of the time charter contracts in place as compared to current market rates for similar vessels under short-term contracts, discounted back to present value. Based on the income approach, the fair value of the intangible asset was calculated to be $10.4 million and will be amortized over the remaining life of both contracts, each of which is set to expire on January 7, 2013. As a result of the combined fair value adjustments noted above, we concluded that the total fair value of the net assets of Dry Bulk acquired was $69.0 million.

In order to arrive at the fair value of our existing interest in Dry Bulk, 50% of the total fair value of $69.0 million was discounted by 5.1%, reflecting our lack of control of Dry Bulk as a 50% owner. The discount rate of 5.1% was derived from a sample of recent industry data. As a result, we concluded that the fair value of our existing 50% interest was $32.7 million.

Under Accounting Standards Codification 805, a step up to fair value is required when an equity interest changes from a non-controlling interest to a controlling interest (step acquisition). Based on the step up from a 50% interest to a 100% interest in Dry Bulk, a gain of approximately $18.3 million was generated by taking the difference between the fair value of our previously held 50% interest less the book value of the previously held interest. This calculation is shown below:

Fair Value of Previously Held 50% Interest $32.7M

Less: Book Value of Previously Held Interest (14.4)M

Gain on Previously Held 50% Interest $18.3M

We also recognized a bargain purchase gain $0.5 million with respect to a step up to fair value of the 50% interest we acquired, calculated as follows:

Fair Value of Net Assets Acquired $69.0M

Less: Fair Value of Purchase Consideration (35.8)M

Less: Fair Value of Previously Held 50% Interest (32.7)M

Bargain Purchase Gain $ 0.5M

Previously, we accounted for our non-controlling interest in Dry Bulk under the equity method. We now include the financial results of Dry Bulk in our consolidated financial results, which include revenues and net income for Dry Bulk for the second quarter of 2011 of $2.4 million and $539,000 respectively. Assuming we recorded this transaction on January 1, 2010, our consolidated financial results for the three month periods ending June 30, 2010 and June 30, 2011 and the six months ending June 30, 2010 and June 30, 2011 would not have been materially different from what we actually reported. As such, we have not disclosed in this report any proforma financial information for either of these periods.

Note 6. Earnings Per Share

We compute basic earnings per share based on the weighted average number of common shares issued and outstanding during the relevant periods. Diluted earnings per share also reflects dilutive potential common shares, including shares issuable under restricted stock grants using the treasury stock method.

The calculation of basic and diluted earnings per share is as follows (in thousands except share amounts):

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Numerator | | | | | | | | | | | | |

| Net Income – Basic: | | | | | | | | | | | | |

| | | $ | 2,838 | | | $ | 9,616 | | | $ | 26,918 | | | $ | 20,184 | |

| Net Income – Diluted: | | | | | | | | | | | | | | | | |

| | | $ | 2,838 | | | $ | 9,616 | | | $ | 26,918 | | | $ | 20,184 | |

| Denominator | | | | | | | | | | | | | | | | |

| Weighted Avg Shares of Common Stock Outstanding: | | | | | | | | | | | | | | | | |

| Basic | | | 7,228,252 | | | | 7,242,126 | | | | 7,230,530 | | | | 7,245,642 | |

| Plus: | | | | | | | | | | | | | | | | |

| Effect of dilutive restrictive stock | | | 36,840 | | | | 53,512 | | | | 30,068 | | | | 62,756 | |

| Diluted | | | 7,265,092 | | | | 7,295,638 | | | | 7,260,598 | | | | 7,308,398 | |

| | | | | | | | | | | | | | | | | |

| Basic and Diluted Earnings Per Common Share: | | | | | | | | | | | | | | | | |

| Net Income per share - Basic | | | | | | | | | | | | | | | | |

| | | $ | 0.39 | | | $ | 1.33 | | | $ | 3.72 | | | $ | 2.79 | |

| Net Income per share – Diluted: | | | | | | | | | | | | | | | | |

| | | $ | 0.39 | | | $ | 1.32 | | | $ | 3.70 | | | $ | 2.76 | |

| | | | | | | | | | |

Note 7. Comprehensive Income

The following table summarizes components of comprehensive income for the three months ended June 30, 2011 and 2010:

| | | Three Months Ended June 30, | |

| (Amounts in Thousands) | | 2011 | | | 2010 | |

| Net Income | | $ | 2,838 | | | $ | 9,616 | |

| Other Comprehensive Income (Loss): | | | | | | | | |

| Unrealized Foreign Currency Translation Gain (Loss) | | | 56 | | | | (17 | ) |

Unrealized Holding (Loss) Gain on Marketable Securities, Net of Deferred Taxes of ($1) and $47, respectively | | | (4 | ) | | | 86 | |

Net Change in Fair Value of Derivatives, Net of Deferred Taxes of ($16) and ($82), respectively | | | (590 | ) | | | (1,682 | ) |

| Total Comprehensive Income | | $ | 2,300 | | | $ | 8,003 | |

The following table summarizes components of comprehensive income for the six months ended June 30, 2011 and 2010:

| | | Six Months Ended June 30, | |

| (Amounts in Thousands) | | 2011 | | | 2010 | |

| Net Income | | $ | 26,918 | | | $ | 20,184 | |

| Other Comprehensive Income (Loss): | | | | | | | | |

| Unrealized Foreign Currency Translation Gain | | | 74 | | | | 24 | |

Unrealized Holding Gain on Marketable Securities, Net of Deferred Taxes of $29 and $83, respectively | | | 83 | | | | 238 | |

Net Change in Fair Value of Derivatives, Net of Deferred Taxes of $84 and ($127), respectively | | | 403 | | | | (1,941 | ) |

| Total Comprehensive Income | | $ | 27,478 | | | $ | 18,505 | |

Note 8. Income Taxes

We recorded a provision for income taxes of $381,000 on our $26.4 million of income before equity in net income of unconsolidated entities in the first six months of 2011. For the first six months of 2010 our benefit for income taxes was $642,000 on our $16.6 million of income before equity in net income of unconsolidated entities. The decrease in our benefit for income taxes was based on improvements in our operations taxed at the U.S. corporate statutory rate and the need to record a valuation allowance on certain deferred tax assets. Our qualifying U.S. flag operations continue to be taxed under a “tonnage tax” regime rather than under the normal U.S. corporate income tax regime. For further information on certain tax laws and elections, see our Annual Report on Form 10-K filed for the year ended December 31, 2010, including Note F to the consolidated financial statements included therein.

Note 9. Fair Value Measurements

ASC Topic 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. A fair value measurement assumes the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market for the asset or liability. Under ASC Topic 820, the price in the principal (or most advantageous) market used to measure the fair value of the asset or liability is not adjusted for transaction costs. An orderly transaction is a transaction that assumes exposure to the market for a period prior to the measurement date to allow for marketing activities that are usual and customary for transactions involving such assets and liabilities; it is not a forced transaction. Market participants are buyers and sellers in the principal market that are (i) independent, (ii) knowledgeable, and (iii) able and willing to complete a transaction.

Fair value measurements require the use of valuation techniques that are consistent with one or more of the following: the market approach, the income approach or the cost approach. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets and liabilities. The income approach uses valuation techniques to convert future amounts, such as cash flows or earnings, to a single present value on a discounted basis. The cost approach is based on the amount that currently would be required to replace the service capacity of an asset (replacement cost). Valuation techniques should be consistently applied. The fair value of our interest rate swap agreements is based upon the approximate amounts required to settle the contracts. Inputs to valuation techniques refer to the assumptions that market participants would use in pricing the asset or liability. Inputs may be observable, meaning those that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from independent sources, or unobservable, meaning those that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. In that regard, ASC Topic 820 establishes a fair value hierarchy for valuation inputs that gives the highest priority to quoted prices in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The fair value hierarchy is as follows:

w Level 1 Inputs - Unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

w Level 2 Inputs - Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These might include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (including interest rates, volatilities, prepayment speeds, credit risks) or inputs that are derived principally from or corroborated by market data by correlation or other means.

w Level 3 Inputs - Unobservable inputs for determining the fair values of assets or liabilities that reflect an entity's own assumptions about the assumptions that market participants would use in pricing the assets or liabilities.

The following table summarizes certain of our financial assets and financial liabilities measured at fair value on a recurring and non-recurring basis as of June 30, 2011, segregated by the above-described levels of valuation inputs:

| (Amounts in thousands) | | Level 1 Inputs | | | Level 2 Inputs | | | Level 3 Inputs | | | Total Fair Value | | |

| | | | | | | | | | | | | | | |

| Marketable securities | | $ | 8,494 | | | $ | - | | | $ | - | | | $ | 8,494 | | | |

| Derivative assets | | $ | - | | | $ | 143 | | | $ | - | | | $ | 143 | | | |

| Derivative liabilities | | $ | - | | | $ | (9,103 | ) | | $ | - | | | $ | (9,103 | ) | | |

| Vessels | | $ | - | | | $ | 37,070 | | | $ | - | | | $ | 37,070 | | (1) | |

| | | | | | | | | | | | | | | | | | | |

(1) Represents the appraised fair value of the Rail-Ferry vessels after the impairment charge taken in the third quarter of 2010. The valuation technique used was a weighted average of the cost, comparable sales and income approach.

Note 10. Marketable Securities

We have categorized all marketable securities as available-for-sale securities. Management performs a quarterly evaluation of marketable securities for any other-than-temporary impairment. We determined that none of our securities were impaired as of June 30, 2011.

The following tables include cost and valuation information on our investment securities at June 30, 2011:

| (Amounts In Thousands) | |

| | | | | | AOCI** | | | | |

| | | | | | Unrealized | | | | |

| Securities Available for Sale | | Cost Basis | | | Holding Gains | | | Fair Value | |

| | | | | | | | | | |

| Corporate Bonds* | | $ | 8,411 | | | $ | 83 | | | $ | 8,494 | |

| Total | | $ | 8,411 | | | $ | 83 | | | $ | 8,494 | |

| | | | | | | | | | | | | |

| * Various maturity dates from February 2014 – April 2016. | | | | | | | | | | | | |

** Accumulated Other Comprehensive Income

Note 11. New Accounting Pronouncements

There were no new accounting pronouncements that have been issued that may, or reasonably could be expected to, have a material impact on our financial position or results of operations.

Note 12. Stock Based Compensation

A summary of the activity for restricted stock awards during the six months ended June 30, 2011 is as follows:

| | |

| | Shares | Weighted Average Fair Value Per Share |

| Non-vested –December 31, 2010 | 132,500 | $22.38 |

| Shares Granted | 51,934 | $26.27 |

| Shares Vested | (96,934) | $23.98 |

| Non-vested – June 30, 2011 | 87,500 | $22.91 |

The following table summarizes the future amortization of unrecognized compensation cost, which we will include in administrative and general expenses, relating to the Company’s restricted stock grants as of June 30, 2011:

| Grant Date | | 2011 | | | 2012 | | | Total | |

| | | | | | | | | | |

| April 30, 2008 | | $ | 203,000 | | | $ | 34,000 | | | $ | 237,000 | |

| January 14, 2011 | | $ | 60,000 | | | $ | | | | $ | 60,000 | |

| January 27, 2011 | | $ | 533,000 | | | $ | 267,000 | | | $ | 800,000 | |

| Total | | $ | 796,000 | | | $ | 301,000 | | | $ | 1,097,000 | |

| | | | | | | | | | | | | |

For the six months ended June 30, 2011, the Company’s income before taxes and net income included $1,006,000 and $654,000, respectively, of stock-based compensation expense charges, which reduced both basic and diluted earnings per share by $0.09 per share. For the six months ended June 30, 2010, the Company’s income before taxes and net income included $1,399,000 and $909,000, respectively, of stock-based compensation expense charges, which resulted in decreases in basic and diluted earnings per share of $0.12 per share, respectively.

For the three months ended June 30, 2011, the Company’s income before taxes and net income included $428,000 and $278,000, respectively, of stock-based compensation expense charges, which reduced both basic and diluted earnings per share by $0.04 per share. For the three months ended June 30, 2010, the Company’s income before taxes and net income included $665,000 and $432,000, respectively, of stock-based compensation expense charges, which resulted in decreases in basic and diluted earnings per share of $0.05 per share, respectively.

On January 14, 2011, our Independent Directors received an unrestricted grant of a total of 4,434 shares of common stock from the 2009 Stock Incentive Plan.

On January 27, 2011, our Compensation Committee granted a total of 47,500 shares of restricted stock to certain executive officers. The shares vest on the day in 2012 when we file our Form 10-K annual report for the fiscal year 2011, contingent upon the Company achieving certain performance measures for fiscal year 2011 and the executive officer remaining employed by us on such date. The fair value of the Company’s restricted stock, which is determined using the average stock price as of the date of the grant, is applied to the total shares that are expected to fully vest and is amortized to compensation expense on a straight-line basis over the vesting period.

Note 13. Derivative Instruments

The Company uses derivative instruments to manage certain foreign currency and interest rate risk exposures. The Company does not use derivative instruments for speculative trading purposes. All derivative instruments are recorded on the balance sheet at fair value. For derivatives designated as cash flow hedges, the effective portion of changes in the fair value of the derivative is recorded to other comprehensive income, and is reclassified to earnings when the derivative instrument is settled. Any ineffective portion of changes in the fair value of the derivative is reported in earnings. None of the Company’s derivative contracts contain credit-risk related contingent features that would require us to settle the contract upon the occurrence of such contingency. However, all of our contracts contain clauses specifying events of default under specified circumstances, including failure to pay or deliver, breach of agreement, default under the specific agreement to which the hedge relates, bankruptcy, misrepresentation and mergers, without exception. The remedy for default is settlement in entirety or payment of the fair market value of the contracts, which is $9.0 million in the aggregate for all of our contracts, less posted collateral of $373,500 as of June 30, 2011. The unrealized loss related to the Company’s derivative instruments included in accumulated other comprehensive loss was $8.3 million as of June 30, 2011 and $8.7 million as of December 31, 2010.

The notional and fair value amounts of our derivative instruments as of June 30, 2011 were as follows:

| (Amounts in thousands) | | Asset Derivatives | Liability Derivatives |

| | | | |

| | Current Notional | Balance Sheet | Fair Value | Balance Sheet | Fair Value |

| | Amount | Location | | Location | |

| Interest Rate Swaps - L/T* | $159,567 | N/A | N/A | Other Liabilities | $9,103 |

| Foreign Exchange Contacts | $1,200 | Other Current Assets | $143 | N/A | N/A |

| Total Derivatives designated as hedging instruments | $160,767 | - | $143 | - | $9,103 |

| | | | | | |

*We have outstanding a variable-to-fixed interest rate swap with respect to a Yen-based facility for the financing of a new PCTC delivered in March 2010. The notional amount under this contract is $74,047,412 (based on a Yen to USD exchange rate of 80.57 as of June 30, 2011). With the bank exercising its option to reduce the underlying Yen loan from 80% to 65% funding of the vessel’s delivery cost, the 15% reduction represents the ineffective portion of this swap, which consists of the portion of the derivative instrument that is no longer supported by an underlying borrowings. The change in fair value related to the ineffective portion of this swap was a $106,000 loss for the quarter ended June 30, 2011 and this amount was included in earnings. |

The effect of derivative instruments designated as cash flow hedges on our condensed consolidated statement of income for the six months ended June 30, 2011 was as follows:

| (Amounts in thousands) | Net Gain / (Loss) Recognized in Other Comprehensive Income | Location of Gain(Loss) Reclassified from AOCI to Income | Amount of (Loss) Gain Reclassified from AOCI to Income | Gain Recognized in Income from Ineffective portion |

| | 2011 | | 2011 | 2011 |

| Interest Rate Swaps | $412 | Interest Expense | ($1,945) | $15 |

| Foreign Exchange contracts | ($9) | Voyage Expenses | $415 | - |

| Total | $403 | - | ($1,530) | $15 |

Note 14. Subsequent Events

In July 2011, pursuant to early buy-out options contained in existing lease agreements which we declared on January 3, 2011 and January 13, 2011, we purchased two vessels for an aggregate purchase price of $64.5 million. On June 29, 2011, we entered into a secured term loan facility agreement that permitted us to borrow up to $45.9 million, for these purposes. In July, 2011, we drew the full amount of borrowings available under this facility agreement to finance a substantial portion of the aggregate purchase price for the two vessels, and paid the remainder of the purchase price with cash on hand. For further information, please see our Current Report on Form 8-K dated June 29, 2011.

On July 25, 2011, we were notifed by the United States Navy’s Military Sealift Command (“MSC”) that our current operating agreements on three U.S. Flag Roll on Roll Off vessels have been extended through October 31, 2011. All three agreements had been set to expire on July 31, 2011. For further information about these agreements with the MSC, please see Item 2 – Management’s Discussion and Analysis of Financial Condition and Results of Operations.

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

Certain statements made by us or on our behalf in this report or elsewhere that are not based on historical facts are intended to be “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on beliefs and assumptions about future events that are inherently unpredictable and are therefore subject to significant known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from the anticipated results expressed or implied by such forward-looking statements.

Such statements include, without limitation, statements regarding (1) anticipated future operating and financial performance, financial position and liquidity, growth opportunities and growth rates, acquisition and divestiture opportunities, business prospects, regulatory and competitive outlook, investment and expenditure plans, investment results, pricing plans, strategic alternatives, business strategies, and other similar statements of expectations or objectives; (2) estimated fair values of capital assets, the recoverability of the cost of those assets, the estimated future cash flows attributable to those assets, and the appropriate discounts to be applied in determining the net present values of those estimated cash flows; (3) estimated scrap values of assets; (4) estimated proceeds from selling assets and the anticipated cost of constructing or purchasing new or existing vessels; (5) estimated fair values of financial instruments, such as interest rate, commodity and currency swap agreements; (6) estimated losses under self-insurance arrangements, as well as estimated gains or losses on certain contracts, trade routes, lines of business or asset dispositions; (7) estimated losses attributable to asbestos claims or other litigation; (8) estimated obligations, and the timing thereof, relating to vessel repair or maintenance work; (9) the adequacy of our capital resources and the availability of additional capital resources on commercially acceptable terms; (10) our ability to remain in compliance with our debt covenants; (11) anticipated trends in government sponsored cargoes; (12) our ability to effectively service our debt; (13) financing opportunities and sources (including the impact of financings on our financial position, financial performance or credit ratings); (14) changes in laws, regulations or tax rates, or the outcome of pending legislative or regulatory initiatives; and (15) assumptions underlying any of the foregoing.

Important factors that could cause our actual results to differ materially from our expectations include our ability to:

| · | identify customers who require marine transportation services or vessels offered by us, |

| · | secure financing on satisfactory terms to repay existing debt or support operations, including to acquire, modify, or construct vessels if such financing is necessary to service the potential needs of current or future customers, |

| · | maximize the usage of our vessels and other assets on favorable economic terms, |

| · | manage the amount and rate of growth of our administrative and general expenses and costs associated with operating our vessels, |

| · | manage our growth in terms of implementing internal controls and information systems and hiring or retaining key personnel, among other things, and |

| · | effectively handle our substantial leverage by servicing and meeting the covenant requirements in each of our debt instruments, thereby avoiding any defaults under those instruments and avoiding cross defaults under others. |

Other factors that could cause our actual results to differ materially from our expectations include, without limitation:

| · | unanticipated changes in vessel utilization or cargo rates, or in charter hire, cost of fuel we are not able to pass on to customers, or other operating expenses, |

| · | the rate at which competitors add or scrap vessels, as well as demolition scrap prices and the availability of scrap facilities in the areas in which we operate, |

| · | changes in interest rates, which could increase or decrease the amount of interest we incur on our variable rate debt and the availability and cost of capital to us, |

| · | the impact on our financial statements of nonrecurring accounting charges that may result from our ongoing evaluation of business strategies, asset valuations, and organizational structures, |

| · | changes in accounting policies and practices adopted voluntarily or as required by accounting principles generally accepted in the United States, |

| · | changes in laws and regulations such as those related to government assistance programs and tax rates, |

| · | the frequency and severity of claims against us, and unanticipated outcomes of current or possible future legal proceedings, |

| · | unexpected out-of-service days on our vessels whether due to unplanned maintenance or other causes, |

| · | the ability of customers to fulfill their obligations with us, |

| · | the performance of unconsolidated subsidiaries, |

| · | political events in the United States and abroad, including terrorism and piracy, and the U.S. military's response to those events, |

| · | election results, regulatory activities and the appropriation of funds by the U.S. Congress, |

| · | changes in foreign currency exchange rates, and |

| · | other economic, competitive, governmental, and technological factors which may affect our operations. |

Due to these uncertainties, we cannot assure that we will attain our anticipated results, that our judgments or assumptions will prove correct, or that unforeseen developments will not occur. Accordingly, you are cautioned not to place undue reliance upon any of our forward-looking statements, which speak only as of the date made. Additional risks that we currently deem immaterial or that are not presently known to us could also cause our actual results to differ materially from those expected in our forward-looking statements. Except for meeting our ongoing obligations under the federal securities laws, we undertake no obligation to update or revise for any reason any forward-looking statements made by us or on our behalf, whether as a result of new information, future events or developments, changed circumstances or otherwise. For additional information on our forward-looking statements and risks, see Items 1 and 7 of our Annual Report on Form 10-K for the year ended December 31, 2010, and Part II, Item 1A, of this report.

Executive Summary

Overview of Second Quarter 2011

Overall Strategy

The company operates a diversified fleet of U.S. and foreign flag vessels that provide international and domestic maritime transportation services to commercial and governmental customers primarily under medium to long-term contracts. Our business strategy consists of identifying growth opportunities in niche markets as market needs change, utilizing our extensive experience to meet those needs, and continuing to maintain a diverse portfolio of medium to long-term contracts, as well as protect our long-standing customer base by providing quality transportation services. From time to time, we augment the results of our term contracts with incremental supplemental cargoes.

Overview

While the Company has experienced some effects from the slowdown in the global economy over the past couple of years, we continue to remain profitable due in part to our diverse portfolio of vessels and contracts. Our Time Charter vessels operated normally for the quarter with the exception of one vessel which completed her scheduled dry-dock and a second vessel that was out of service for nine days for a scheduled repair. Total off-hire days for the second quarter of 2011 was 21.81, as compared to 30.37 for the same period in 2010. The recent earthquake in Japan has slowed freight movements in and out of the country for our time charter customers but has had no material financial impact on us to date, as the vessels servicing this market are under fixed time charters. Our Rail-Ferry segment, which is highly sensitive to market conditions, recorded another quarter of strong earnings as a result of northbound demand for sugar cargo. Our Contract of Affreightment segment, which is supported by our Sulphur Carrier, carried less tonnage this past quarter driven by an overall drop in the demand for fertilizer, however we are guaranteed a minimum tonnage for the contract year. For detailed information on our current fleet, see page 21.

As mentioned in our previous filings, on January 23, 2008, the Company entered into a Senior Secured Term Loan Facility denominated in Japanese Yen for the purchase of a PCTC Newbuilding delivered in March 2010. Since the facility is not denominated in our functional currency, the outstanding balance of the Facility is revalued to USD at the end of each reporting period. Due to the amount of the Facility, we may sustain fluctuations that may cause material non-cash swings in our results of operations reported under GAAP. For more information on the sensitivity of our foreign exchange risk, see page 32.

Results

Consolidated Financial Performance – Second Quarter 2011 vs. Second Quarter 2010

Overall net income decreased from $9.6 million in the second quarter of 2010 to $2.8 million in the second quarter of 2011. The Company’s operating income decreased by $6.4 million reflecting a drop in our supplemental cargoes and lower results from our Coal Carrier and Sulphur Carrier vessels, partially offset by improved results from our Rail-Ferry vessels. Administrative and General expenses were relatively unchanged from last year’s second quarter. During the second quarter of 2011, we recorded a non-cash foreign exchange loss of $1.9 million, reflecting the further weakening of the US dollar against the Japanese Yen since the first quarter of 2011. The non-cash foreign exchange loss for the second quarter of 2010 was $3.1 million. Net income from unconsolidated entities decreased from a profit of $448,000 for the three months ended 2010, to a loss of $351,000 for the same period 2011. This decrease is primarily attributable to reporting earnings from Dry Bulk after the acquisition as part of our consolidated operating results, as opposed to being recorded as a component of Net Income from Unconsolidated Entities. In addition, we recorded a loss of $311,000 from results of our 25% interest in Oslo Bulk.

Financial Discipline & Strong Balance Sheet

| § | Total cash and marketable securities of $42.3 million. |

| § | Working capital of $31.7 million. |

| § | Debt payments of $5.9 million. |

Overview of Fleet

Our Time Charter segments, which are primarily serviced by our Pure Car Truck Carrier vessels generally operating under medium to long-term contracts, provide us with a fixed income stream and consistent cash flow and revenues are only impacted by the amount of our off-hire time. The average firm contract charterhire period for our International Flag PCTC fleet and U.S. Flag PCTC fleet is approximately five years and three years, respectively, and our total off-hire days, excluding routine drydocking for the first six months in 2011 for all of our PCTC fleet was less than a day. In addition to this contractually fixed income, we also earn from time to time supplemental income as a result of chartering our U.S. Flag PCTC vessels back for the carriage of supplemental cargo when available.

Recent downturns in our revenues, market capitalization, threats to our MSC revenues and other adverse trends suggest that impairment indicators may be present. The following facts, however, support our position that no impairment analysis was required for vessels servicing our Time Charter segments:

| · | Based on the earnings capacity from our existing firm contracts as well as the anticipated future earning capacity beyond these firm periods, we believe (i) the market value of our individual owned vessels is greater than book value and (ii) basing the market value of these vessels on our market capitalization, which is influenced by a number of factors unrelated to the actual value of our owned vessels, would be understating the value of the assets. |

| · | Revenues decreased by 18%, operating income by 49% and net income by 70% in the second quarter of 2011 compared to the same period in 2010, all driven primarily by our decreases in supplemental cargoes. Even though our earnings decreased, the vessels continued to generate revenues from their fixed time charter contracts and positive cash flows to support the asset values. |

| · | Our contract with MSC is an operating agreement with no assets owned by us that are subject to impairment if the contracts are terminated. |

| · | Our leverage ratios are negatively impacted by the downward trend in net income (mainly due to a decrease in supplemental cargo revenues) but our fixed time charter revenue streams continue to support the underlying asset values. |

| · | We have maintained a long-standing relationship with our customers for this segment by providing quality service and vessels that are in good working order , which we believe minimizes our risk with respect to the potential loss of a contract. |

| · | Other than the MSC, none of our customers have advised us of their intent to terminate their relationships with us. |

We test our long-lived assets on an individual vessel basis for recoverability whenever events or changes in circumstances indicate that the vessel’s carrying amount may not be recoverable. However, based on the facts listed above, we believe there were no triggering events to support an impairment analysis with respect to the time charter segments.

Our Rail-Ferry segment, which is supported by two special purpose vessels, carries rail cars between the U.S. Gulf and Mexico. Since there are no fixed time charter contracts to support this service, this segment is exposed to changes in market conditions. Due to a history of losses, the recent economic downturn, and the inability to replace one of our former major northbound customers, we took an impairment charge of $25.4 million in the third quarter of 2010, to reduce the carrying value of these assets to their estimated fair values. No additional indicators of further impairment of these assets were deemed to be present as of June 30, 2011.

As of June 30, 2011, we operated 38 vessels of which 16 we owned 100% directly through our wholly owned subsidiaries. All of the 16 vessels we owned are under individual fixed time charter contracts varying from short, medium to long term in length and all operated within our Time Charter International Flag and Time Charter U.S. Flag Segments with the exception of our two Rail-Ferry vessels which operated on a voyage to voyage basis with no fixed time charter contract in place.

For additional information on our vessels, please see the chart below:

| The following table lists the vessels in our fleet as of June 30, 2011: | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| INTERNATIONAL SHIPHOLDING CORPORATION |

| | | | | | | | | | | | |

| FLEET STATISTICS |

| | | | | | | | | | | | |

| | | | Build Date | Business Segment (1) | Owned | BareboatCharter/Leased | Operating Contracts | Partially-owned | Time Chartered | Total Dead-Weight Carrying Capacity (LT) | Market Value less than Carrying Value "Y" |

| VESSELS: | | | | | | | | | | |

| | GREEN BAY | PURE CAR/TRUCK CARRIER | 2007 | TC-US | X | | | | | 18,381 | |

| | GREEN COVE | PURE CAR/TRUCK CARRIER | 1994 | TC-US | X | | | | | 16,178 | |

| | GREEN LAKE | PURE CAR/TRUCK CARRIER | 1998 | TC-US | X | | | | | 22,799 | |

| | GREEN POINT | PURE CAR/TRUCK CARRIER | 1994 | TC-US | X | | | | | 14,930 | |

| | GREEN RIDGE | PURE CAR/TRUCK CARRIER | 1998 | TC-US | X | | | | | 21,523 | |

| (4) | GREEN DALE | PURE CAR/TRUCK CARRIER | 1999 | TC-US | | X | | | | 16,157 | |

| | USNS SGT. MATEJ KOCAK | ROLL-ON/ROLL-OFF | 1981 | TC-US | | | X | | | 25,073 | |

| | USNS PFC. EUGENE A. OBREGON | ROLL-ON/ROLL-OFF | 1983 | TC-US | | | X | | | 25,073 | |

| | USNS MAJOR STEPHEN W. PLESS | ROLL-ON/ROLL-OFF | 1983 | TC-US | | | X | | | 25,073 | |

| | ENERGY ENTERPRISE | BELT SELF-UNLOADING BULK CARRIER | 1983 | TC-US | X | | | | | 38,234 | |

| | MAERSK ALABAMA | CONTAINER SHIP | 1998 | TC-US | | X | | | | 17,524 | |

| | MAERSK CALIFORNIA | CONTAINER SHIP | 1992 | TC-US | | X | | | | 25,375 | |

| | ASIAN EMPEROR | PURE CAR/TRUCK CARRIER | 1999 | TC-I | X | | | | | 21,479 | |

| (4) | ASIAN KING | PURE CAR/TRUCK CARRIER | 1998 | TC-I | | X | | | | 21,511 | |

| | RIO GEIKE | PURE CAR/TRUCK CARRIER | 2010 | TC-I | X | | | | | 18,400 | |

| | FLORES SEA | MULTI-PURPOSE VESSEL | 2008 | TC-I | | | X | | | 11,151 | |

| | SAWU SEA | MULTI-PURPOSE VESSEL | 2008 | TC-I | | | X | | | 11,184 | |

| | OCEAN PORPOISE | TANKER | 1996 | TC-I | X | | | | | 13,193 | |

| | MARINA STAR 2 | CONTAINER SHIP | 1982 | TC-I | | | | | X | 5,020 | |

| | TERRITORY TRADER | CONTAINER SHIP | 1991 | TC-I | | | | | X | 4,915 | |

| | EGS CREST | HANDY-SIZE BULK CARRIER | 2011 | TC-I | X | | | | | 36,000 | |

| | EGS TIDE | HANDY-SIZE BULK CARRIER | 2011 | TC-I | X | | | | | 36,000 | |

| | EGS WAVE | HANDY-SIZE BULK CARRIER | 2011 | TC-I | X | | | | | 36,000 | |

| | SULPHUR ENTERPRISE | MOLTEN SULPHUR CARRIER | 1994 | COA | | X | | | | 27,241 | |

| (2) | BALI SEA | ROLL-ON/ROLL-OFF SPV | 1995 | RF | X | | | | | 22,220 | |

| (2) | BANDA SEA | ROLL-ON/ROLL-OFF SPV | 1995 | RF | X | | | | | 22,239 | |

| | BULK AUSTRALIA | CAPE-SIZE BULK CARRIER | 2003 | UE | X | | | | | 170,578 | |

| (3) | TSUNEISHI NEWBUILDING | HANDYMAX-SIZE BULK CARRIER | 2012 | UE | X | | | | | 58,000 | |

| | OSLO BULK 1 | MINI BULKER CARRIERS | 2010 | UE | | | | X | | 8,000 | |

| | OSLO BULK 2 | MINI BULKER CARRIERS | 2010 | UE | | | | X | | 8,000 | |

| | OSLO BULK 3 | MINI BULKER CARRIERS | 2010 | UE | | | | X | | 8,000 | |

| | OSLO BULK 4 | MINI BULKER CARRIERS | 2010 | UE | | | | X | | 8,000 | |

| | OSLO BULK 5 | MINI BULKER CARRIERS | 2010 | UE | | | | X | | 8,000 | |

| | OSLO BULK 6 | MINI BULKER CARRIERS | 2011 | UE | | | | X | | 8,000 | |

| | OSLO BULK 7 | MINI BULKER CARRIERS | 2011 | UE | | | | X | | 8,000 | |

| | OSLO BULK 8 | MINI BULKER CARRIERS | 2011 | UE | | | | X | | 8,000 | |

| | OSLO BULK 9 | MINI BULKER CARRIERS | 2011 | UE | | | | X | | 8,000 | |

| | OSLO BULK 10 | MINI BULKER CARRIERS | 2011 | UE | | | | X | | 8,000 | |

| | | | | | 16 | 5 | 5 | 10 | 2 | 845,451 | |

| | | | | | | | | | | | |

| (1) | Business Segments: | | | | | | | | | | |

| | TC-US | Time Charter Contracts-U.S. Flag | | | | | | | | |

| | TC-I | Time Charter Contracts-International Flag | | | | | | | | |

| | COA | Contracts of Affreightment | | | | | | | | | |

| | RF | Rail-Ferry | | | | | | | | | |

| | UE | Unconsolidated Entity | | | | | | | | | |

| | | | | | | | | | | | |

| (2) | Originally built in 1982 - Converted 1995 | | | | | | | | | |

| | | | | | | | | | | | |

| (3) | Vessel currently under contract to be constructed, delivering in 1st Quarter of 2012 | | | | | | |

| | | | | | | | | | | | |

| (4) | Purchased in July 2011 | | | | | | | | | | |

Management Gross Voyage Profit Financial Measures

In connection with discussing the results of our various operating segments in this report, we refer to “gross voyage profit,” a metric that management reviews to assist in monitoring and managing our business. The following table provides a reconciliation of consolidated gross voyage profit to operating income.

| (All Amounts in Thousands) | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Revenues | | $ | 69,961 | | | $ | 85,084 | | | $ | 134,295 | | | $ | 157,998 | |

| | | | | | | | | | | | | | | | | |

| Voyage Expenses | | $ | 51,814 | | | $ | 61,513 | | | $ | 100,804 | | | $ | 116,456 | |

| Vessel Depreciation | | $ | 6,095 | | | $ | 4,984 | | | $ | 11,469 | | | $ | 8,748 | |

| | | | | | | | | | | | | | | | | |

| Gross Voyage Profit | | $ | 12,052 | | | $ | 18,587 | | | $ | 22,022 | | | $ | 32,794 | |

| | | | | | | | | | | | | | | | | |

| Other Operating Expenses: | | | | | | | | | | | | | | | | |

| Administrative and General Expenses | | $ | 5,455 | | | $ | 5,415 | | | $ | 11,284 | | | $ | 11,434 | |

| Gain on Dry Bulk Transaction | | $ | (130 | ) | | $ | - | | | $ | (18,844 | ) | | $ | - | |

| Loss (Gain) on Sale of Other Assets | | $ | - | | | $ | 46 | | | $ | - | | | $ | (75 | ) |

| Total Other Operating Expenses | | $ | 5,325 | | | $ | 5,461 | | | $ | (7,560 | ) | | $ | 11,359 | |

| | | | | | | | | | | | | | | | | |

| Operating Income | | $ | 6,727 | | | $ | 13,126 | | | $ | 29,582 | | | $ | 21,435 | |

RESULTS OF OPERATIONS

THREE MONTHS ENDED JUNE 30, 2011

COMPARED TO THE THREE MONTHS ENDED JUNE 30, 2010

| | | | | | | | | | | | | | | | | | | |

| (All Amounts in Thousands) | | Time Charter Contracts- U.S. Flag | | | Time Charter Contracts-International Flag | | | COA | | | Rail-Ferry Service | | | Other | | | Total | |

| 2011 | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 39,290 | | | $ | 15,813 | | | $ | 4,500 | | | $ | 9,867 | | | $ | 491 | | | $ | 69,961 | |

| Voyage Expenses | | $ | 29,952 | | | $ | 8,294 | | | $ | 4,601 | | | $ | 8,807 | | | $ | 160 | | | $ | 51,814 | |

| Vessel Depreciation | | $ | 2,495 | | | $ | 2,699 | | | $ | - | | | $ | 899 | | | $ | 2 | | | $ | 6,095 | |

| Gross Voyage Profit (Loss) | | $ | 6,843 | | | $ | 4,820 | | | $ | (101 | ) | | $ | 161 | | | $ | 329 | | | $ | 12,052 | |

| 2010 | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues from External Customers | | $ | 58,399 | | | $ | 15,157 | | | $ | 4,513 | | | $ | 6,268 | | | $ | 747 | | | $ | 85,084 | |

| Voyage Expenses | | $ | 41,471 | | | $ | 9,357 | | | $ | 4,205 | | | $ | 6,162 | | | $ | 318 | | | $ | 61,513 | |

| Vessel Depreciation | | $ | 2,530 | | | $ | 994 | | | $ | - | | | $ | 1,457 | | | $ | 3 | | | $ | 4,984 | |

| Gross Voyage Profit (Loss) | | $ | 14,398 | | | $ | 4,806 | | | $ | 308 | | | $ | (1,351 | ) | | $ | 426 | | | $ | 18,587 | |

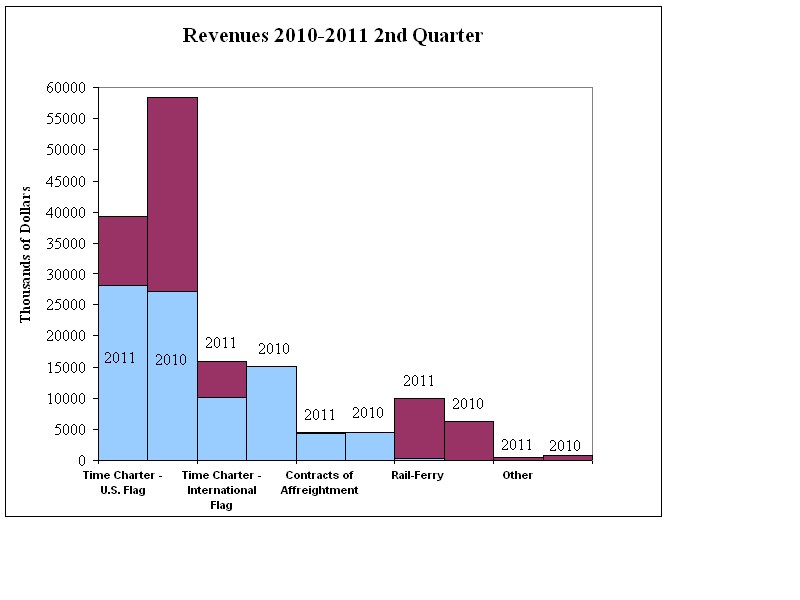

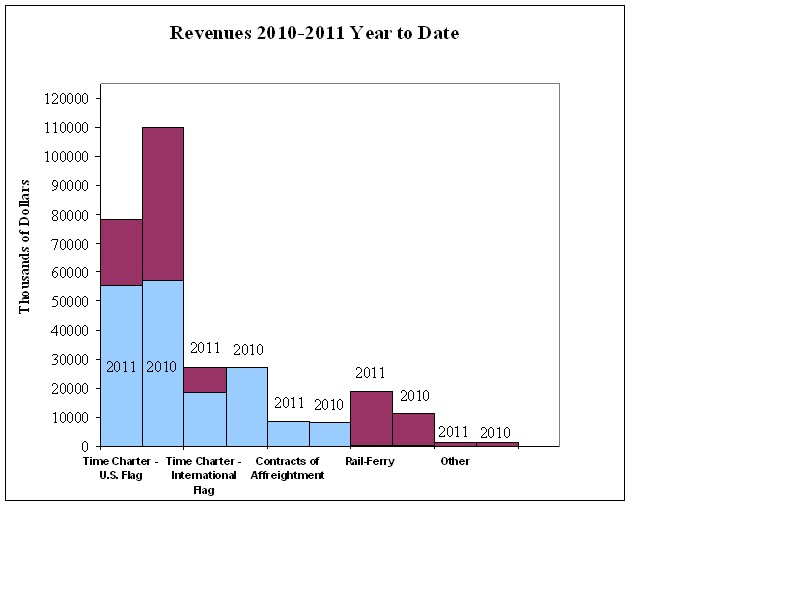

The following table shows the breakout of revenues by segment between fixed and variable for the three months ended June 30, 2011 and 2010, respectively:

Variable Revenue Fixed Revenue

The changes in revenues and expenses associated with each of our segments are discussed within the gross voyage analysis below.

Time Charter Contracts-U.S. Flag:Overall revenues decreased by 33% or $19.1 million when comparing the second quarter of 2011 to the second quarter of 2010. The decrease was driven primarily by a drop in the carriage of supplemental cargoes on our U.S. Flag Pure Car Truck Carriers, as volume returns to more historic levels. The segment’s gross voyage profit decreased from $14.4 million in the second quarter of 2010 to $6.8 million in the second quarter of 2011 primarily as a result of the decrease in supplemental cargoes. Our fixed revenues of $28.1 million and $27.2 million in the second quarter of 2011 and 2010, respectively, represent revenues derived from our fixed time charter contracts, and our variable revenues of $11.1 million and $31.2 million for the same periods in 2011 and 2010, respectively, represent revenues derived from our supplemental cargoes.

Our U.S. Flag Time Charter Contracts include operating three roll on-roll off vessels for the MSC. In early 2009, we received notification from MSC that we have been excluded from further consideration for extending the current operating agreements on three U.S. Flag Roll on Roll Off vessels. Subsequently, they have exercised options to extend the agreement several times with the most recent extension set to expire on October 31, 2011 for all three vessels. These three contracts represented 9.9% of our total revenue in the second quarter of 2011. Recently the MSC has reopened to bidding process and even if we successfully retain any one or more of these MSC contracts, we anticipate materially reduced revenues in future periods.

Time Charter Contracts-International Flag: Revenues increased slightly from $15.2 million in the second quarter of 2010 to $15.8 million in the second quarter of 2011 and gross voyage profit for this segment remained relatively unchanged at $4.8 million in the second quarter of 2011. Lower results from our Indonesian operation, and the discontinuation of an International Flag Container vessel were offset by contributions made by our three new Handy-Size Bulk Carriers placed in service in the first quarter of 2011 and our Capesize Bulk Carrier acquired from Dry Bulk at the end of the first quarter of 2011. Our fixed revenues of $10.1 million in the second quarter of 2011 represents revenues derived from our fixed time charter contracts. Our variable revenues of $5.8 million in the second quarter of 2011 represents revenues earned by our three new Handy-Size Bulk Carriers pursuant to a revenue sharing agreement which commenced in January 2011. All revenues in the second quarter of 2010 were derived under fixed revenue time charter contracts.