Exhibit 10.13

SECOND AMENDMENT TO LOAN AGREEMENT

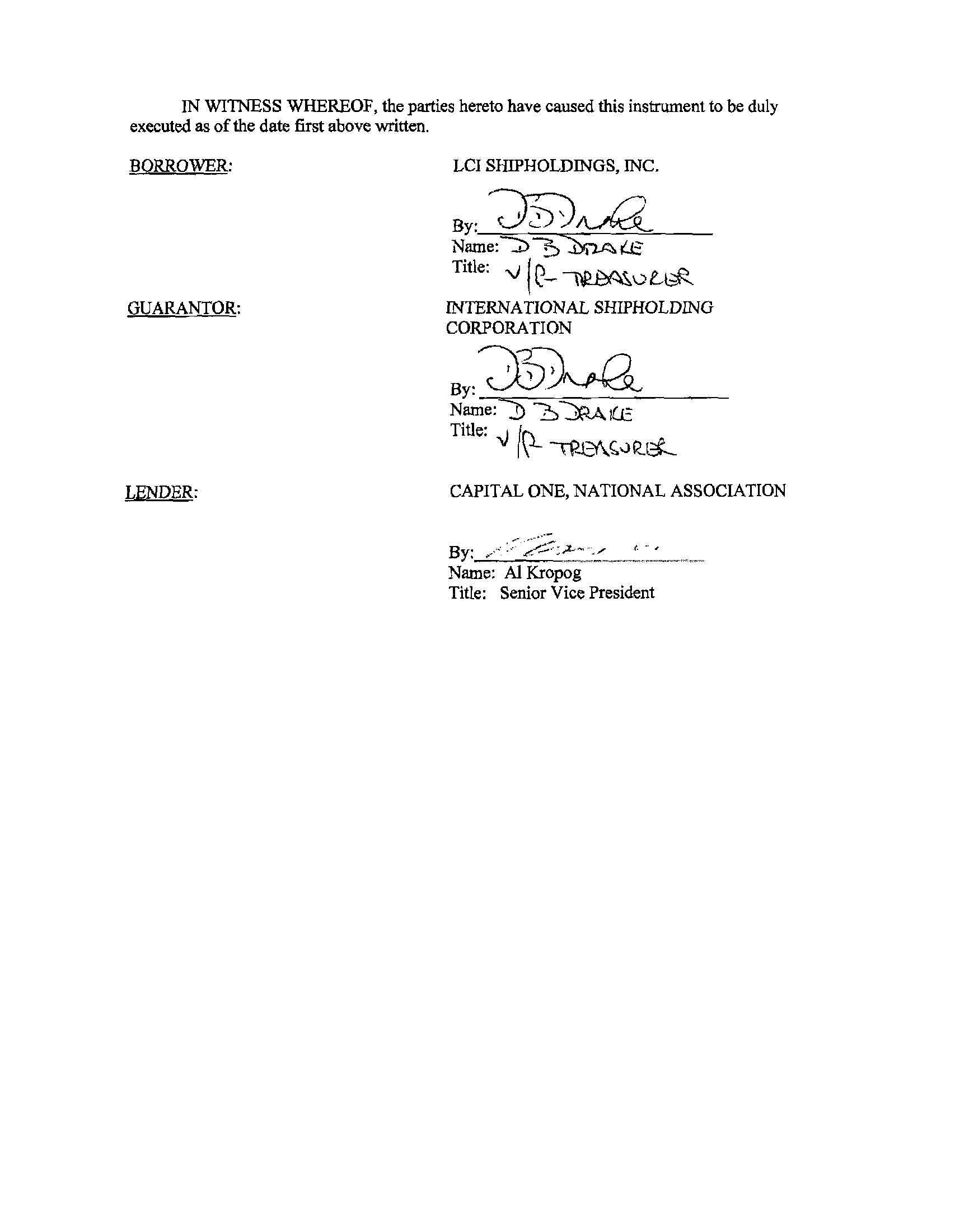

THIS SECOND AMENDMENT TO LOAN AGREEMENT (this "Second Amendment"), dated as of the 30th day of October, 2014, is made between LCI SHIPHOLDINGS, INC., a Marshall Islands corporation ("Borrower"), INTERNATIONAL SHIPHOLDING CORPORATION, a Delaware corporation ("Guarantor") and CAPITAL ONE, NATIONAL ASSOCIATION ("Lender"), who agree as follows:

Recitals.

| a. | | Waterman Steamship Corporation ("WSC"), Guarantor and Lender are parties to that certain Loan Agreement dated as of December 28, 2011 (the "Original Loan Agreement"), which was amended by a First Amendment to Loan Agreement dated as of December 14, 2012 by and among WSC, Borrower, Guarantor and Lender (the "First Amendment", the Original Loan Agreement, as amended by the First Amendment, this Second Amendment and any future amendments, the "Agreement"). |

| b. | | The parties wish to replace the Consolidated Indebtedness to Consolidate EBITDA ratio in Section 7.01 of the Original Loan Agreement with a new financial covenant, as set forth below. |

NOW THEREFORE, the parties agree as follows.

ARTICLE 1

GENERAL TERMS

Section 1.01 Terms Defined Above. As used in this Second Amendment, the terms "Agreement," "Borrower," "First Amendment," "Second Amendment," "Guarantor," "Original Loan Agreement," "WSC," and "Lender" shall have the meanings indicated above.

Section 1.02 Certain Definitions. The following defined terms are hereby added to the Loan Agreement:

"Commodity Exchange Act" means the Commodity Exchange Act (7 U.S.C. § 1 et seq.), as amended from time to time, and any successor statute,

"Consolidated EBITDAR" means, with respect to the Guarantor and the Subsidiaries, on a consolidated basis, for any period (without duplication) the sum of (i) Consolidated EBITDA for such period and (ii) Consolidated Lease Expense for such period.

"Consolidated Lease Adjusted Indebtedness" means the sum of (i) All Debt of the Guarantor and its Subsidiaries (other than obligations under any Swap Contract) determined on a consolidated basis in accordance with GAAP and (ii) the product of 6 times the Consolidated

Lease Expense of the Guarantor and its Subsidiaries for the past 12 months determined on a consolidated basis in accordance with GAAP.

"Consolidated Lease Expense" means with respect to the Guarantor and its Subsidiaries, on a consolidated basis, for any period (without duplication), all amounts payable under any leases (whether capital leases or operating leases) and time charter agreements which may be classified as operating lease expenses, charter hire expenses, or rent, as determined in accordance with GAAP during the period in question.

"Consolidated Leverage Ratio" means the ratio of Consolidated Lease Adjusted Indebtedness to Consolidated EBITDAR.

"Fiscal Quarter" means Guarantor's fiscal quarters, ending on March 31st, June 30th, September 30th and December 31st of each year.

"Swap Contract" means any Interest Rate Protection Product, as well any interest rate hedging or swap agreement between Guarantor or its Subsidiaries and any financial institution other than Lender, including any obligation to pay or perform under any agreement, contract or transaction that constitutes a "swap" within the meaning of section 1 a(47) of the Commodity Exchange Act.

Section 1.03 Accounting Terms. Unless otherwise specified herein, all accounting terms used herein shall be interpreted, all accounting determinations hereunder shall be made, and all financial statements and certificates and reports as to financial matters required to be delivered hereunder shall be prepared in accordance with generally accepted accounting principles for the United States ("GAAP") as amended from time to time, including amendments to GAAP made as a result of the conforming of GAAP to International Financial Reporting Standards, provided, however, that for purposes of determining Guarantor's ratios and covenants set forth in Section 7.01, GAAP shall be GAAP in effect as of September 30, 2011.

Section 1.04. Section 7.01 (a) is amended and restated to read as follows:

(a) Guarantor and its Subsidiaries shall maintain, on a consolidated basis a Consolidated Leverage Ratio of not greater than (i) 4.50 to 1.00, through the Fiscal Quarter ending June 30, 2014, (ii) 5.00 to 1.00 beginning with the Fiscal Quarter ending September 30, 2014 through the Fiscal Quarter ending December 31, 2015, (iii) 4.75 to 1.00 for the Fiscal Quarter ending March 31, 2016, (iv) 4.50 to 1.00 beginning with the Fiscal Quarter ending June 30, 2016 through the Fiscal Quarter ending September 30, 2016, and (v) 4.25 to 1.00 thereafter, measured at the end of each Fiscal Quarter based on the four most recent Fiscal Quarters for which financial information is available.

Section 1.05 Counterparts. This Second Amendment may be executed in two or more counterparts, and it shall not be necessary that the signatures of all parties hereto be contained on any one counterpart hereof; each counterpart shall be deemed an original, but all of which together shall constitute one and the same instrument.

Section 1.06 Fees and Costs. Borrower agrees to pay, upon demand, all of Lender's out-of-pocket expenses, including reasonable attorneys' fees, incurred in connection with the preparation, execution, enforcement and collection of this Second Amendment or in connection with the Loan made pursuant to the Agreement. If an Event of Default occurs, Lender may pay someone else to help collect the Loan and to enforce the Agreement, and Borrower will pay that amount. This includes, subject to any limits under applicable law, Lender's reasonable attorneys' fees and Lender's legal expenses, whether or not there is a lawsuit, including reasonable attorneys' fees for bankruptcy proceedings (including efforts to modify or vacate any automatic stay or injunction), appeals, and any anticipated post-judgment collection services. Borrower also will pay any court costs, in addition to all other sums provided by law.

Section 1.07 Guarantor Confirmation. AND INTO THESE PRESENTS INTERVENES the undersigned Guarantor, who acknowledges and consents to the execution and delivery of this Second Amendment by Borrower, and further acknowledges that such guarantor's guaranty of the Indebtedness, remains in full force and extent.