UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-02896 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios, Inc. 15 |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 8/31/2018 |

| |

| Date of reporting period: | | 8/31/2018 |

Item 1 – Reports to Stockholders

PGIM SHORT DURATION HIGH YIELD INCOME FUND

(Formerly known as Prudential Short Duration High Yield Income Fund)

ANNUAL REPORT

AUGUST 31, 2018

To enroll in e-delivery, go to pgiminvestments.com/edelivery

|

| Objective: To provide a high level of current income |

Highlights (unaudited)

| • | | The Fund benefited from very strong security selection, which accounted for all of the outperformance over the period, mostly driven by positioning in the technology, electric utility, and cable & satellite sectors. |

| • | | From an industry-selection standpoint, the Fund benefited from being overweight electric utilities. An underweight to metals & mining also added value. |

| • | | Overall industry allocation was negative. An underweight to upstream energy, the best-performing industry, was the primary detractor from returns. An overweight to retailers & restaurants also hurt performance. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2018 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

PGIM FUNDS — UPDATE

The Board of Directors/Trustees for the Fund has approved the implementation of an automatic conversion feature for Class C shares, effective as of April 1, 2019. To reflect these changes, effective April 1, 2019, the section of the Fund’s Prospectus entitled “How to Buy, Sell and Exchange Fund Shares—How to Exchange Your Shares—Frequent Purchases and Redemptions of Fund Shares” is restated to read as follows:

This supplement should be read in conjunction with your Summary Prospectus, Statutory Prospectus and Statement of Additional Information, be retained for future reference and is in addition to any existing Fund supplements.

| | 1. | In each Fund’s Statutory Prospectus, the following is added at the end of the section entitled “Fund Distributions And Tax Issues—If You Sell or Exchange Your Shares”: |

Automatic Conversion of Class C Shares

The conversion of Class C shares into Class A shares—which happens automatically approximately 10 years after purchase—is not a taxable event for federal income tax purposes. For more information about the automatic conversion of Class C shares, see Class C Shares Automatically Convert to Class A Shares in How to Buy, Sell and Exchange Fund Shares.

| | 2. | In each Fund’s Statutory Prospectus, the following sentence is added at the end of the section entitled “How to Buy, Sell and Exchange Shares—Closure of Certain Share Classes to New Group Retirement Plans”: |

Shareholders owning Class C shares may continue to hold their Class C shares until the shares automatically convert to Class A shares under the conversion schedule, or until the shareholder redeems their Class C shares.

| | 3. | In each Fund’s Statutory Prospectus, the following disclosure is added immediately following the section entitled “How to Buy, Sell and Exchange Shares—How to Buy Shares—Class B Shares Automatically Convert to Class A Shares”: |

Class C Shares Automatically Convert to Class A Shares

Starting on or about April 1, 2019 (the “Effective Date”), Class C shares will be eligible for automatic conversion into Class A shares on a monthly basis approximately ten years after the original date of purchase (the “Conversion Date”). Conversion will take place based on the relative NAV of the two classes, without the imposition of any sales load, fee or other charge. All such automatic conversions of Class C shares will constitute tax-free exchanges for federal income tax purposes.

For shareholders investing in Class C shares through retirement plans or omnibus accounts, and in certain other instances, the Fund and its agents may not have transparency into how long a shareholder has held Class C shares for purposes of determining whether such

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 3 | |

Class C shares are eligible for automatic conversion into Class A shares, and the relevant financial intermediary may not have the ability to track purchases in order to credit individual shareholders’ holding periods. In these circumstances, the Fund will not be able to automatically convert Class C shares into Class A shares as described above. In order to determine eligibility for conversion in these circumstances, it is the responsibility of the financial intermediary to notify the Fund that the shareholder is eligible for the conversion of Class C shares to Class A shares, and the financial intermediary may be required to maintain and provide the Fund with records that substantiate the holding period of Class C shares. It is the financial intermediary’s (and not the Fund’s) responsibility to keep records of transactions made in accounts it holds and to ensure that the shareholder is credited with the proper holding period based on such records or those provided to the financial intermediary by the shareholder. Please consult with your financial intermediary for the applicability of this conversion feature to your shares.

A financial intermediary may sponsor and/or control accounts, programs or platforms that impose a different conversion schedule or different eligibility requirements for the exchange of Class C shares for Class A shares (see Appendix A: Waivers and Discounts Available From Certain Financial Intermediaries of the Prospectus). Please consult with your financial intermediary if you have any questions regarding your shares’ conversion from Class C shares to Class A shares.

| | 4. | In Part II of each Fund’s Statement of Additional Information, the following disclosure is added immediately following the section entitled “Purchase, Redemption and Pricing of Fund Shares—Share Classes—Automatic Conversion of Class B Shares”: |

AUTOMATIC CONVERSION OF CLASS C SHARES. Starting on or about April 1, 2019 (the “Effective Date”), Class C shares will be eligible for automatic conversion into Class A shares on a monthly basis approximately ten years after the original date of purchase (the “Conversion Date”). Conversion will take place based on the relative NAV of the two classes, without the imposition of any sales load, fee or other charge. Class C shares of a Fund acquired through automatic reinvestment of dividends or distributions will convert to Class A shares of the Fund on the Conversion Date pro rata with the converting Class C shares of the Fund that were not acquired through reinvestment of dividends or distributions. All such automatic conversions of Class C shares will constitute tax-free exchanges for federal income tax purposes.

For shareholders investing in Class C shares through retirement plans or omnibus accounts, and in certain other instances, the Fund and its agents may not have transparency into how long a shareholder has held Class C shares for purposes of determining whether such Class C shares are eligible for automatic conversion into Class A shares, and the relevant financial intermediary may not have the ability to track purchases in order to credit individual shareholders’ holding periods. In these circumstances, the Fund will not be able to automatically convert Class C shares into Class A shares as described above. In order to determine eligibility for conversion in these circumstances, it is the responsibility of the

| | |

| 4 | | Visit our website at pgiminvestments.com |

financial intermediary to notify the Fund that the shareholder is eligible for the conversion of Class C shares to Class A shares, and the financial intermediary may be required to maintain and provide the Fund with records that substantiate the holding period of Class C shares. It is the financial intermediary’s (and not the Fund’s) responsibility to keep records of transactions made in accounts it holds and to ensure that the shareholder is credited with the proper holding period based on such records or those provided to the financial intermediary by the shareholder. Please consult with your financial intermediary for the applicability of this conversion feature to your shares.

Class C shares were generally closed to investments by new group retirement plans effective June 1, 2018. Group retirement plans (and their successor, related and affiliated plans) that have Class C shares of the Fund available to participants on or before the Effective Date may continue to open accounts for new participants in such share class and purchase additional shares in existing participant accounts.

The Fund has no responsibility for monitoring or implementing a financial intermediary’s process for determining whether a shareholder meets the required holding period for conversion. A financial intermediary may sponsor and/or control accounts, programs or platforms that impose a different conversion schedule or different eligibility requirements for the exchange of Class C shares for Class A shares, as set forth on Appendix A: Waivers and Discounts Available From Certain Financial Intermediaries of the Prospectus. In these cases, Class C shareholders may have their shares exchanged for Class A shares under the policies of the financial intermediary. Financial intermediaries will be responsible for making such exchanges in those circumstances. Please consult with your financial intermediary if you have any questions regarding your shares’ conversion from Class C shares to Class A shares.

LR1094

- Not part of the Annual Report -

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 5 | |

Table of Contents

| | |

| 6 | | Visit our website at pgiminvestments.com |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM Short Duration High Yield Income Fund informative and useful. The report covers performance for the 12-month period that ended August 31, 2018.

We have important information to share with you. Effective June 11, 2018, Prudential Mutual Funds were renamed PGIM Funds. This renaming is part of our ongoing effort to further build our reputation and establish our global brand, which began when our firm adopted PGIM Investments as its name in April 2017. Please note that only the Fund’s name has changed. Your Fund’s management and operation, along with its symbols, remained the same.*

Over the reporting period, the global economy continued to grow, and central banks gradually tightened monetary policy. In the US, the economy expanded and employment increased. In June, the Federal Reserve hiked interest rates for the seventh time since 2015, based on confidence in the economy.

Equity returns were strong, due to optimistic earnings expectations and investor sentiment. Global equities, including emerging markets, generally posted positive returns. However, they trailed the performance of US equities, which rose on higher corporate profits, new regulatory policies, and tax reform benefits. Volatility spiked briefly in the middle of the period on inflation concerns, rising interest rates, and a potential global trade war, but it decreased as the period ended.

The overall bond market declined modestly during the period, as measured by the Bloomberg Barclays US Aggregate Bond Index. The best performance came from higher-yielding, economically sensitive sectors. Although they finished the period with negative returns, US investment-grade corporate bonds outperformed US government nominal bonds. A major trend during the period was the flattening of the US Treasury yield curve, which increased the yield on fixed income investments with shorter maturities and made them more attractive to investors.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Short Duration High Yield Income Fund

October 15, 2018

*The Prudential Day One Funds did not change their names.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 7 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.pgiminvestments.com or by calling (800) 225-1852.

| | | | | | | | | | |

| | | Average Annual Total Returns as of 8/31/18

(with sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Since Inception (%) | |

| Class A | | 0.36 | | | 3.37 | | | | 3.31 (10/26/12) | |

| Class C | | 1.97 | | | 3.28 | | | | 3.11 (10/26/12) | |

| Class Z | | 4.11 | | | 4.34 | | | | 4.18 (10/26/12) | |

| Class R6* | | 4.15 | | | N/A | | | | 4.33 (10/27/14) | |

Bloomberg Barclays US High Yield Ba/B

Rated 1–5 Yr 1% Capped Index | | 3.83 | | | 4.28 | | | | 4.60 (10/31/12) | |

| Lipper High Yield Funds Average | | 2.60 | | | 4.39 | | | | 4.59 (10/31/12) | |

| | | | | | | | | | |

| | | Average Annual Total Returns as of 8/31/18

(without sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Since Inception (%) | |

| Class A | | 3.73 | | | 4.05 | | | | 3.89 (10/26/12) | |

| Class C | | 2.95 | | | 3.28 | | | | 3.11 (10/26/12) | |

| Class Z | | 4.11 | | | 4.34 | | | | 4.18 (10/26/12) | |

| Class R6* | | 4.15 | | | N/A | | | | 4.33 (10/27/14) | |

Bloomberg Barclays US High Yield Ba/B

Rated 1–5 Yr 1% Capped Index | | 3.83 | | | 4.28 | | | | 4.60 (10/31/12) | |

| Lipper High Yield Funds Average | | 2.60 | | | 4.39 | | | | 4.59 (10/31/12) | |

Source: PGIM Investments LLC, Lipper Inc., and Bloomberg Barclays

*Formerly known as Class Q shares.

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the class’ inception date.

| | |

| 8 | | Visit our website at pgiminvestments.com |

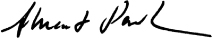

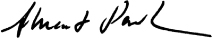

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Bloomberg Barclays US High Yield Ba/B Rated 1-5 Year 1% Capped Index by portraying the initial account values at the beginning of the period (October 26, 2012) and the account values at the end of the current fiscal year (August 31, 2018) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursement, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 9 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges which are described for each share class in the table below.

| | | | | | | | |

| | | Class A | | Class C | | Class Z | | Class R6* |

| Maximum initial sales charge | | 3.25% of the public offering price | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | | 1.00% on sales of $1 million or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.25% | | 1.00% | | None | | None |

*Formerly known as Class Q shares.

Benchmark Definitions

Bloomberg Barclays US High Yield Ba/B Rated 1–5 Year 1% Capped Index—The Bloomberg Barclays US High Yield Ba/B Rated 1–5 Year 1% Capped Index (the Index) represents the performance of US short duration, higher-rated high yield bonds. The average annual total returns for the Index measured from the month-end closest to the inception date of the Fund’s Class A, C, and Z shares is 4.60% and 3.87% for Class R6 shares.

Lipper High Yield Funds Average—The Lipper High Yield Funds Average (Lipper Average) is based on the average return of all funds in the Lipper High Yield Funds universe for the periods noted. Funds in the Lipper Average aim at high (relative) current yield from fixed income securities, have no quality or maturity restrictions, and tend to invest in lower-grade debt issues. The average annual total returns for the Lipper Average measured from the month-end closest to the inception date of the Fund’s Class A, C, and Z shares is 4.59% and 3.65% for Class R6 shares.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses of a mutual fund, but not sales charges or taxes.

| | |

| 10 | | Visit our website at pgiminvestments.com |

| | | | |

| Credit Quality expressed as a percentage of total investments as of 8/31/18 (%) | |

| BBB | | | 3.0 | |

| BB | | | 43.7 | |

| B | | | 42.6 | |

| CCC | | | 6.6 | |

| Not Rated | | | 1.3 | |

| Cash/Cash Equivalents | | | 2.8 | |

| Total Investments | | | 100.0 | |

Source: PGIM Fixed Income

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investor Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by a NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

| | | | | | |

| Distributions and Yields as of 8/31/18 |

| | Total Distributions

Paid for12 Months ($) | | SEC 30-Day

SubsidizedYield* (%) | | SEC 30-Day

UnsubsidizedYield** (%) |

| Class A | | 0.49 | | 4.53 | | 4.55 |

| Class C | | 0.42 | | 3.94 | | 3.93 |

| Class Z | | 0.51 | | 4.94 | | 4.92 |

| Class R6*** | | 0.51 | | 4.98 | | 4.98 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements).

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses.

***Formerly known as Class Q shares.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 11 | |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Short Duration High Yield Income Fund’s Class Z shares returned 4.11% during the 12-month reporting period that ended August 31, 2018, outperforming the 3.83% return of the Bloomberg Barclays US High Yield Ba/B Rated 1–5 Year 1% Capped Index (the Index) and outperforming the 2.60% return of the Lipper High Yield Funds Average.

What were market conditions?

| • | | 2017 was not expected to be a good year for bonds. There was so much for the bond market to fear. European and Japanese interest rates had risen as the European Central Bank (ECB) and Bank of Japan (BoJ) began their respective stylized tapering. The US had its Republican sweep, bringing with it expectations for pro-cyclical fiscal stimuli and upside risks for Federal Reserve (Fed) rate hikes. All said, this confluence of events was expected to finally torpedo the decades-old bond bull market. |

| • | | While European political fears turned out to be a bit overblown, all of the other fears were more or less grounded. The ECB and BoJ continued to reduce their purchases, fiscal stimulus in the US was on the way, and the world’s economy generally continued to improve. But thanks to positive yield curves lending a little yield and roll-down advantage relative to cash, coupled with a little more spread tightening (i.e., narrower spreads between yields on US Treasuries versus other types of bonds with comparable maturities), 2017 confounded many of the initial expectations and turned out to be yet another solid year for fixed income. Broad benchmarks generally outperformed cash and, as many expected, the higher-yielding sectors turned in particularly impressive performances. |

| • | | The markets struggled at the end of the period as the fears on the trade and political fronts that emerged early in 2018 were realized in the second quarter of 2018 to varying degrees, while the long shadow of quantitative tightening continued to stretch across the markets. The trade conflicts started getting uneasy at the G20 but then became real as US barbs were met with tit-for-tat measures, which PGIM Fixed Income believes are at risk of intensifying during the rest of 2018 and beyond. (The G20, or Group of Twenty, is an international forum for governments representing 19 of the world’s largest economies and the European Union.) The results from the elections in Italy in the first quarter of 2018 transformed into a market nightmare in the second quarter as renegade parties entered a coalition with a platform that appeared to jeopardize Italy’s finances and its relationship with Europe. Meanwhile, emerging market developments, including elections in Turkey and Mexico, raised concerns about the potential rise in policy heterodoxy. Over the first half of 2018, these concerns fueled a continued widening of spreads from the tight spreads in the first quarter, which may have gotten a bit ahead of fundamentals. |

| • | | The US high yield market held up reasonably well over the period as other fixed income categories retreated and experienced a bout of volatility. Strong earnings growth, minimal defaults, and a relatively light new issue calendar within an improving US economy |

| | |

| 12 | | Visit our website at pgiminvestments.com |

| | supported the high yield asset class. Despite lower valuations on average across the high yield universe, spreads ground tighter, closing the period near post-crisis lows. Over the period, the short-duration, higher-quality portion of the high yield market, as measured by the Index, returned 3.83%, outperforming the broader high yield market, as measured by the Bloomberg Barclays US High Yield 1% Issuer Capped Index, by 42 basis points (bps). (A basis point equals 0.01%.) The yield to worst of the Index ended at 5.21%, 102 bps tighter for the period. (The yield to worst is the lowest potential yield that can be received on a portfolio of bonds without the issuers defaulting.) |

| • | | The Moody’s 12-month US speculative-grade default rate ended the period at 3.4%, down from 3.5% one year earlier. While defaults were largely muted over the last four months of the period, most of the defaults in 2018 have occurred in energy, retail, and consumer products. PGIM Fixed Income believes stress for companies in retail will likely continue throughout the remainder of 2018. Moody’s expects defaults to be mild in the US over the next 12 months and forecasts the default rate will be 2.6% by the end of the year. |

What worked?

| • | | The Fund benefited from very strong security selection, which accounted for all of the outperformance over the period, mostly driven by positioning in the technology, electric utility, and cable & satellite sectors. |

| • | | Within electric utilities, overweights to NRG Energy and Vistra Energy Corp were the top contributors to returns. Within technology, overweights to Mcafee and BMC Software were the overall largest single-name contributors. |

| • | | Other single-name contributors included overweights to Bombardier (aerospace/defense) and Coveris Holdings (paper & packaging). An underweight to Altice (telecom) also boosted performance. |

| • | | From an industry-selection standpoint, the Fund benefited from being overweight electric utilities. An underweight to metals & mining also added value. |

What didn’t work?

| • | | Overall industry allocation was negative. An underweight to upstream energy, the best-performing industry, was the primary detractor from returns. An overweight to retailers & restaurants also hurt performance. |

| • | | In terms of the largest single-name detractors from returns, overweights to Community Health Systems (healthcare & pharmaceuticals) and PetSmart (retail) were the primary culprits. |

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 13 | |

Strategy and Performance Overview (continued)

Did the Fund use derivatives, and how did they affect performance?

| • | | The Fund utilized US Treasury and Euro bund futures to hedge interest rate risk relative to the Index. The futures helped to immunize any impact from fluctuations in interest rates. |

| • | | Derivatives in the form of forward currency exchange contracts were used to hedge against the Fund’s positions not denominated in US dollars. The derivatives helped immunize any impact from fluctuating currencies outside the US dollar. |

Current outlook

| • | | PGIM Fixed Income maintains a neutral view of high yield overall, with the belief that solid fundamentals (strong earnings and low defaults) and favorable technicals (limited net supply and persistent institutional demand from Asia) appear to be almost fully priced in. PGIM Fixed Income is concerned about the timing of the next recession, with the view that this will be the key driver of high yield returns over the next 12 months and gives PGIM Fixed Income reservations to be bullish on the asset class. |

| • | | Key positioning themes continue to be underweighting financials and energy. The Fund is also underweight consumer and capital goods. Overweights include technology, building materials & construction, and cable. |

| | |

| 14 | | Visit our website at pgiminvestments.com |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended August 31, 2018. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 15 | |

Fees and Expenses (continued)

and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

PGIM

Short Duration High

Yield Income Fund | | Beginning Account

Value

March 1, 2018 | | | Ending Account

Value

August 31, 2018 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,024.50 | | | | 1.00 | % | | $ | 5.10 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,020.60 | | | | 1.75 | % | | $ | 8.91 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.38 | | | | 1.75 | % | | $ | 8.89 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,027.00 | | | | 0.75 | % | | $ | 3.83 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.42 | | | | 0.75 | % | | $ | 3.82 | |

| Class R6** | | Actual | | $ | 1,000.00 | | | $ | 1,027.20 | | | | 0.70 | % | | $ | 3.58 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.68 | | | | 0.70 | % | | $ | 3.57 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2018, and divided by the 365 days in the Fund’s fiscal year ended August 31, 2018 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

**Formerly known as Class Q shares.

| | |

| 16 | | Visit our website at pgiminvestments.com |

Schedule of Investments

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

LONG-TERM INVESTMENTS 95.3% | | | | | | | | | | | | | | | | |

| | | | |

BANK LOANS 8.7% | | | | | | | | | | | | | | | | |

| | | | |

Chemicals 0.6% | | | | | | | | | | | | | | | | |

Solenis International LP,

First Lien Initial Dollar Term Loan, 1 - 3 Month LIBOR + 4.000% | | | 6.188 | %(c) | | | 12/26/23 | | | | 13,000 | | | $ | 13,036,400 | |

| | | | |

Commercial Services 0.6% | | | | | | | | | | | | | | | | |

Laureate Education, Inc.,

Series 2024 Term Loan, 1 Month LIBOR + 3.500% | | | 5.576 | (c) | | | 04/26/24 | | | | 13,371 | | | | 13,407,581 | |

| | | | |

Computers 1.3% | | | | | | | | | | | | | | | | |

Banff Merger Sub, Inc.,

Term Loan | | | — | (p) | | | 06/28/25 | | | | 11,525 | | | | 11,528,458 | |

Exela Intermediate LLC,

2018 Repriced Term Loan, 2 Month LIBOR + 6.500% | | | 8.826 | (c) | | | 07/12/23 | | | | 5,888 | | | | 5,887,500 | |

West Corp.,

Initial Term B Loan, 1 Month LIBOR + 4.000% | | | 6.076 | (c) | | | 10/10/24 | | | | 12,811 | | | | 12,709,785 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 30,125,743 | |

| | | | |

Engineering & Construction 0.1% | | | | | | | | | | | | | | | | |

StandardAero Aviation Holdings, Inc.,

Initial Term Loan, 1 Month LIBOR + 3.750% | | | 5.830 | (c) | | | 07/07/22 | | | | 3,175 | | | | 3,185,434 | |

| | | | |

Foods 0.2% | | | | | | | | | | | | | | | | |

Shearer’s Foods LLC,

First Lien Term Loan, 1 Month LIBOR + 4.250% | | | 6.326 | (c) | | | 06/30/21 | | | | 5,610 | | | | 5,502,517 | |

| | | | |

Insurance 0.2% | | | | | | | | | | | | | | | | |

Asurion LLC,

Second Lien Replacement B-2 Term Loan, 1 Month LIBOR + 6.500%^ | | | 8.576 | (c) | | | 08/04/25 | | | | 3,450 | | | | 3,553,500 | |

| | | | |

Internet 0.3% | | | | | | | | | | | | | | | | |

Symantec Corp.,

Term A-5 Loan, 1 Month LIBOR + 1.750% | | | 3.830 | (c) | | | 08/01/21 | | | | 6,837 | | | | 6,794,872 | |

| | | | |

Media 0.3% | | | | | | | | | | | | | | | | |

Radiate Holdco LLC,

Closing Date Term Loan, 1 Month LIBOR + 3.000% | | | 5.076 | (c) | | | 02/01/24 | | | | 6,500 | | | | 6,455,312 | |

See Notes to Financial Statements.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 17 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

BANK LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Mining 0.1% | | | | | | | | | | | | | | | | |

Aleris International, Inc.,

First Lien Initial Term Loan, 1 Month LIBOR + 4.750% | | | 6.826 | %(c) | | | 02/27/23 | | | | 2,750 | | | $ | 2,786,666 | |

| | | | |

Retail 0.9% | | | | | | | | | | | | | | | | |

CEC Entertainment, Inc.,

First Lien Term B Loan, 1 Month LIBOR + 3.250% | | | 5.326 | (c) | | | 02/15/21 | | | | 10,826 | | | | 10,178,924 | |

Sally Holdings LLC,

Term B-2 Loan^ | | | 4.500 | | | | 07/05/24 | | | | 11,154 | | | | 10,596,300 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 20,775,224 | |

| | | | |

Software 1.3% | | | | | | | | | | | | | | | | |

BMC Software Finance, Inc.,

Initial B-2 US Term Loan, 1 Month LIBOR + 3.250% | | | 5.326 | (c) | | | 09/10/22 | | | | 18,098 | | | | 18,103,227 | |

Infor (US), Inc.,

Tranche B-6 Term Loan, 3 Month LIBOR + 2.750% | | | 4.826 | (c) | | | 02/01/22 | | | | 6,616 | | | | 6,618,129 | |

Informatica LLC,

Dollar Term B-1 Loan, 1 Month LIBOR + 3.250% | | | 5.326 | (c) | | | 08/05/22 | | | | 4,755 | | | | 4,774,415 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 29,495,771 | |

| | | | |

Technology 1.1% | | | | | | | | | | | | | | | | |

McAfee, LLC, | | | | | | | | | | | | | | | | |

Closing Date USD Term Loan, 1 Month LIBOR + 4.500% | | | 6.573 | (c) | | | 09/30/24 | | | | 18,154 | | | | 18,285,999 | |

Second Lien Initial Loan, 1 Month LIBOR + 8.500% | | | 10.573 | (c) | | | 09/29/25 | | | | 6,300 | | | | 6,410,250 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 24,696,249 | |

| | | | |

Telecommunications 1.7% | | | | | | | | | | | | | | | | |

Digicel International Finance Ltd.,

First Lien Initial Term B Loan, 3 Month LIBOR + 3.250% | | | 5.570 | (c) | | | 05/27/24 | | | | 9,677 | | | | 9,144,658 | |

Intelsat Jackson Holdings SA (Luxembourg), | | | | | | | | | | | | | | | | |

Tranche B-3 Term Loan, 1 Month LIBOR + 3.750% | | | 5.815 | (c) | | | 11/27/23 | | | | 4,000 | | | | 4,015,000 | |

Tranche B-5 Term Loan | | | 6.625 | | | | 01/02/24 | | | | 12,475 | | | | 13,036,375 | |

Xplornet Communications, Inc. (Canada),

New Term B Loan, 3 Month LIBOR + 4.000%^ | | | 6.334 | (c) | | | 09/09/21 | | | | 11,900 | | | | 11,944,869 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 38,140,902 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

BANK LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Tobacco 0.0% | | | | | | | | | | | | | | | | |

Jacobs Douwe Egberts Holdings BV (Netherlands),

Term Loan B - EUR, 3 Month EURIBOR + 2.000% | | | 2.750 | %(c) | | | 07/02/22 | | | EUR | 202 | | | $ | 235,022 | |

| | | | | | | | | | | | | | | | |

TOTAL BANK LOANS

(cost $197,458,945) | | | | | | | | | | | | | | | 198,191,193 | |

| | | | | | | | | | | | | | | | |

| | | | |

CORPORATE BONDS 86.5% | | | | | | | | | | | | | | | | |

| | | | |

Advertising 0.8% | | | | | | | | | | | | | | | | |

Outfront Media Capital LLC/Outfront Media Capital Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.625 | | | | 02/15/24 | | | | 16,245 | | | | 16,427,756 | |

Gtd. Notes | | | 5.875 | | | | 03/15/25 | | | | 1,695 | | | | 1,709,831 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 18,137,587 | |

| | | | |

Aerospace & Defense 3.0% | | | | | | | | | | | | | | | | |

Bombardier, Inc. (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 7.500 | | | | 12/01/24 | | | | 24,700 | | | | 25,965,875 | |

Sr. Unsec’d. Notes, 144A(a) | | | 8.750 | | | | 12/01/21 | | | | 27,650 | | | | 30,415,000 | |

TransDigm, Inc.,

Gtd. Notes | | | 6.000 | | | | 07/15/22 | | | | 13,025 | | | | 13,155,250 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 69,536,125 | |

| | | | |

Auto Parts & Equipment 0.2% | | | | | | | | | | | | | | | | |

American Axle & Manufacturing, Inc.,

Gtd. Notes | | | 7.750 | | | | 11/15/19 | | | | 4,740 | | | | 4,977,000 | |

| | | | |

Banks 0.1% | | | | | | | | | | | | | | | | |

CIT Group, Inc.,

Sr. Unsec’d. Notes | | | 5.250 | | | | 03/07/25 | | | | 2,100 | | | | 2,135,438 | |

| | | | |

Building Materials 1.9% | | | | | | | | | | | | | | | | |

Griffon Corp.,

Gtd. Notes(a) | | | 5.250 | | | | 03/01/22 | | | | 25,825 | | | | 25,477,654 | |

Standard Industries, Inc.,

Sr. Unsec’d. Notes, 144A | | | 5.375 | | | | 11/15/24 | | | | 3,025 | | | | 3,028,781 | |

Summit Materials LLC/Summit Materials Finance Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.125 | | | | 07/15/23 | | | | 2,000 | | | | 2,027,500 | |

See Notes to Financial Statements.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 19 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Building Materials (cont’d.) | | | | | | | | | | | | | | | | |

Summit Materials LLC/Summit Materials Finance Corp., (cont’d.) | | | | | | | | | | | | | |

Gtd. Notes | | | 8.500 | % | | | 04/15/22 | | | | 3,550 | | | $ | 3,794,062 | |

U.S. Concrete, Inc.,

Gtd. Notes | | | 6.375 | | | | 06/01/24 | | | | 9,853 | | | | 9,939,214 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 44,267,211 | |

| | | | |

Chemicals 3.9% | | | | | | | | | | | | | | | | |

Blue Cube Spinco LLC,

Gtd. Notes | | | 10.000 | | | | 10/15/25 | | | | 4,274 | | | | 4,947,155 | |

Chemours Co. (The), | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.625 | | | | 05/15/23 | | | | 32,702 | | | | 34,255,345 | |

Gtd. Notes | | | 7.000 | | | | 05/15/25 | | | | 1,605 | | | | 1,713,338 | |

Hexion, Inc.,

Sr. Sec’d. Notes, 144A(a) | | | 10.375 | | | | 02/01/22 | | | | 2,940 | | | | 2,893,048 | |

NOVA Chemicals Corp. (Canada),

Sr. Unsec’d. Notes, 144A(a) | | | 4.875 | | | | 06/01/24 | | | | 19,350 | | | | 18,914,625 | |

Platform Specialty Products Corp.,

Gtd. Notes, 144A(a) | | | 6.500 | | | | 02/01/22 | | | | 15,060 | | | | 15,398,850 | |

PQ Corp.,

Sr. Sec’d. Notes, 144A | | | 6.750 | | | | 11/15/22 | | | | 6,656 | | | | 6,955,520 | |

TPC Group, Inc.,

Sr. Sec’d. Notes, 144A | | | 8.750 | | | | 12/15/20 | | | | 3,175 | | | | 3,175,000 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 88,252,881 | |

| | | | |

Commercial Services 2.0% | | | | | | | | | | | | | | | | |

Jaguar Holding Co. II/Pharmaceutical Product Development LLC,

Gtd. Notes, 144A(a) | | | 6.375 | | | | 08/01/23 | | | | 13,029 | | | | 13,094,145 | |

Laureate Education, Inc.,

Gtd. Notes, 144A | | | 8.250 | | | | 05/01/25 | | | | 3,820 | | | | 4,120,825 | |

Nielsen Co. Luxembourg SARL (The),

Gtd. Notes, 144A | | | 5.500 | | | | 10/01/21 | | | | 1,655 | | | | 1,657,069 | |

Nielsen Finance LLC/Nielsen Finance Co.,

Gtd. Notes, 144A(a) | | | 5.000 | | | | 04/15/22 | | | | 26,550 | | | | 25,781,377 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 44,653,416 | |

| | | | |

Computers 2.6% | | | | | | | | | | | | | | | | |

Dell International LLC/EMC Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.875 | | | | 06/15/21 | | | | 11,520 | | | | 11,853,100 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Computers (cont’d.) | | | | | | | | | | | | | | | | |

Dell International LLC/EMC Corp., (cont’d.) | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 7.125 | % | | | 06/15/24 | | | | 4,000 | | | $ | 4,276,200 | |

EMC Corp.,

Sr. Unsec’d. Notes | | | 2.650 | | | | 06/01/20 | | | | 7,435 | | | | 7,270,821 | |

Everi Payments, Inc.,

Gtd. Notes, 144A | | | 7.500 | | | | 12/15/25 | | | | 1,700 | | | | 1,727,200 | |

NCR Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.625 | | | | 02/15/21 | | | | 5,000 | | | | 4,912,500 | |

Gtd. Notes | | | 5.000 | | | | 07/15/22 | | | | 1,320 | | | | 1,287,000 | |

Gtd. Notes | | | 5.875 | | | | 12/15/21 | | | | 7,685 | | | | 7,755,318 | |

Gtd. Notes(a) | | | 6.375 | | | | 12/15/23 | | | | 19,392 | | | | 19,464,720 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 58,546,859 | |

| | | | |

Distribution/Wholesale 0.3% | | | | | | | | | | | | | | | | |

Global Partners LP/GLP Finance Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.250 | | | | 07/15/22 | | | | 2,630 | | | | 2,610,275 | |

Gtd. Notes | | | 7.000 | | | | 06/15/23 | | | | 4,865 | | | | 4,889,325 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 7,499,600 | |

| | | | |

Diversified Financial Services 2.1% | | | | | | | | | | | | | | | | |

Alliance Data Systems Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 5.375 | | | | 08/01/22 | | | | 15,825 | | | | 15,904,125 | |

Gtd. Notes, 144A, MTN | | | 5.875 | | | | 11/01/21 | | | | 3,000 | | | | 3,067,500 | |

Nationstar Mortgage Holdings, Inc.,

Gtd. Notes, 144A(a) | | | 8.125 | | | | 07/15/23 | | | | 20,100 | | | | 20,853,750 | |

Navient Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 6.500 | | | | 06/15/22 | | | | 3,400 | | | | 3,515,770 | |

Sr. Unsec’d. Notes | | | 6.625 | | | | 07/26/21 | | | | 2,505 | | | | 2,608,331 | |

Sr. Unsec’d. Notes, MTN | | | 8.000 | | | | 03/25/20 | | | | 150 | | | | 159,038 | |

VFH Parent LLC/Orchestra Co-Issuer, Inc.,

Sec’d. Notes, 144A | | | 6.750 | | | | 06/15/22 | | | | 1,125 | | | | 1,158,750 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 47,267,264 | |

| | | | |

Electric 4.7% | | | | | | | | | | | | | | | | |

Calpine Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.875 | | | | 01/15/24 | | | | 2,375 | | | | 2,395,781 | |

Sr. Unsec’d. Notes(a) | | | 5.375 | | | | 01/15/23 | | | | 18,325 | | | | 17,408,750 | |

Sr. Unsec’d. Notes(a) | | | 5.500 | | | | 02/01/24 | | | | 10,187 | | | | 9,351,462 | |

GenOn Energy, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(d) | | | 7.875 | | | | 06/15/17 | | | | 3,750 | | | | 2,559,375 | |

See Notes to Financial Statements.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 21 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Electric (cont’d.) | | | | | | | | | | | | | | | | |

GenOn Energy, Inc., (cont’d.) | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(d) | | | 9.500 | % | | | 10/15/18 | | | | 7,953 | | | $ | 5,358,334 | |

Sr. Unsec’d. Notes(a)(d) | | | 9.875 | | | | 10/15/20 | | | | 3,463 | | | | 2,328,868 | |

NRG Energy, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.250 | | | | 07/15/22 | | | | 12,995 | | | | 13,417,338 | |

Gtd. Notes(a) | | | 6.250 | | | | 05/01/24 | | | | 8,725 | | | | 9,030,375 | |

Red Oak Power LLC,

Sr. Sec’d. Notes, Series B | | | 9.200 | | | | 11/30/29 | | | | 3,225 | | | | 3,664,406 | |

Vistra Energy Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 7.375 | | | | 11/01/22 | | | | 30,244 | | | | 31,491,565 | |

Gtd. Notes(a) | | | 7.625 | | | | 11/01/24 | | | | 10,164 | | | | 10,926,300 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 107,932,554 | |

| | | | |

Engineering & Construction 0.3% | | | | | | | | | | | | | | | | |

StandardAero Aviation Holdings, Inc.,

Gtd. Notes, 144A | | | 10.000 | | | | 07/15/23 | | | | 6,160 | | | | 6,637,400 | |

| | | | |

Entertainment 2.6% | | | | | | | | | | | | | | | | |

AMC Entertainment Holdings, Inc.,

Gtd. Notes(a) | | | 5.875 | | | | 02/15/22 | | | | 457 | | | | 464,426 | |

CCM Merger, Inc.,

Sr. Unsec’d. Notes, 144A | | | 6.000 | | | | 03/15/22 | | | | 14,450 | | | | 14,666,750 | |

GLP Capital LP/GLP Financing II, Inc.,

Gtd. Notes(a) | | | 5.375 | | | | 11/01/23 | | | | 2,130 | | | | 2,241,825 | |

International Game Technology PLC,

Sr. Sec’d. Notes, 144A(a) | | | 6.250 | | | | 02/15/22 | | | | 6,775 | | | | 6,991,800 | |

Jacobs Entertainment, Inc.,

Sec’d. Notes, 144A | | | 7.875 | | | | 02/01/24 | | | | 2,257 | | | | 2,381,135 | |

National CineMedia LLC,

Sr. Sec’d. Notes | | | 6.000 | | | | 04/15/22 | | | | 10,436 | | | | 10,592,540 | |

Scientific Games International, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.250 | | | | 09/01/20 | | | | 775 | | | | 771,125 | |

Gtd. Notes(a) | | | 6.625 | | | | 05/15/21 | | | | 8,212 | | | | 8,129,880 | |

Gtd. Notes | | | 10.000 | | | | 12/01/22 | | | | 12,600 | | | | 13,325,760 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 59,565,241 | |

| | | | |

Environmental Control 0.2% | | | | | | | | | | | | | | | | |

Clean Harbors, Inc.,

Gtd. Notes(a) | | | 5.125 | | | | 06/01/21 | | | | 4,961 | | | | 4,973,402 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Foods 1.6% | | | | | | | | | | | | | | | | |

B&G Foods, Inc.,

Gtd. Notes(a) | | | 4.625 | % | | | 06/01/21 | | | | 5,400 | | | $ | 5,373,000 | |

Iceland Bondco PLC (United Kingdom),

Sr. Sec’d. Notes, 144A, 3 Month GBP LIBOR + 4.250% | | | 5.003 | (c) | | | 07/15/20 | | | GBP | 382 | | | | 493,590 | |

JBS USA LUX SA/JBS USA Finance, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 7.250 | | | | 06/01/21 | | | | 10,850 | | | | 10,972,063 | |

Gtd. Notes, 144A | | | 7.250 | | | | 06/01/21 | | | | 19,925 | | | | 20,149,156 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 36,987,809 | |

| | | | |

Forest Products & Paper 0.5% | | | | | | | | | | | | | | | | |

Cascades, Inc. (Canada),

Gtd. Notes, 144A | | | 5.500 | | | | 07/15/22 | | | | 7,403 | | | | 7,403,000 | |

Mercer International, Inc. (Canada),

Sr. Unsec’d. Notes | | | 7.750 | | | | 12/01/22 | | | | 2,073 | | | | 2,166,285 | |

Neenah, Inc.,

Gtd. Notes, 144A | | | 5.250 | | | | 05/15/21 | | | | 2,350 | | | | 2,338,250 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 11,907,535 | |

| | | | |

Gas 0.3% | | | | | | | | | | | | | | | | |

AmeriGas Partners LP/AmeriGas Finance Corp.,

Sr. Unsec’d. Notes | | | 5.625 | | | | 05/20/24 | | | | 1,550 | | | | 1,538,375 | |

Rockpoint Gas Storage Canada Ltd. (Canada),

Sr. Sec’d. Notes, 144A(a) | | | 7.000 | | | | 03/31/23 | | | | 6,270 | | | | 6,317,025 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 7,855,400 | |

| | | | |

Healthcare-Products 0.6% | | | | | | | | | | | | | | | | |

Mallinckrodt International Finance SA,

Gtd. Notes(a) | | | 4.750 | | | | 04/15/23 | | | | 2,500 | | | | 2,168,750 | |

Mallinckrodt International Finance SA/Mallinckrodt CB LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.875 | | | | 04/15/20 | | | | 1,060 | | | | 1,056,025 | |

Gtd. Notes, 144A(a) | | | 5.750 | | | | 08/01/22 | | | | 10,565 | | | | 9,851,862 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 13,076,637 | |

| | | | |

Healthcare-Services 6.3% | | | | | | | | | | | | | | | | |

Acadia Healthcare Co., Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.125 | | | | 07/01/22 | | | | 4,160 | | | | 4,180,800 | |

Gtd. Notes(a) | | | 5.625 | | | | 02/15/23 | | | | 1,300 | | | | 1,326,000 | |

See Notes to Financial Statements.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 23 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Healthcare-Services (cont’d.) | | | | | | | | | | | | | | | | |

Acadia Healthcare Co., Inc., (cont’d.)

Gtd. Notes | | | 6.500 | % | | | 03/01/24 | | | | 2,440 | | | $ | 2,528,450 | |

Centene Corp.,

Sr. Unsec’d. Notes | | | 5.625 | | | | 02/15/21 | | | | 1,775 | | | | 1,810,500 | |

CHS/Community Health Systems, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.875 | | | | 02/01/22 | | | | 2,872 | | | | 1,464,720 | |

Sec’d. Notes, 144A(a) | | | 8.125 | | | | 06/30/24 | | | | 13,896 | | | | 11,429,460 | |

Sr. Sec’d. Notes(a) | | | 5.125 | | | | 08/01/21 | | | | 450 | | | | 434,250 | |

Sr. Sec’d. Notes | | | 6.250 | | | | 03/31/23 | | | | 5,250 | | | | 4,987,500 | |

HCA Healthcare, Inc.,

Sr. Unsec’d. Notes | | | 6.250 | | | | 02/15/21 | | | | 8,976 | | | | 9,379,920 | |

HCA, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.875 | | | | 05/01/23 | | | | 450 | | | | 472,500 | |

Gtd. Notes(a) | | | 7.500 | | | | 02/15/22 | | | | 4,285 | | | | 4,702,788 | |

Gtd. Notes | | | 7.500 | | | | 12/15/23 | | | | 3,000 | | | | 3,288,750 | |

LifePoint Health, Inc.,

Gtd. Notes(a) | | | 5.500 | | | | 12/01/21 | | | | 11,025 | | | | 11,204,156 | |

MEDNAX, Inc.,

Gtd. Notes, 144A | | | 5.250 | | | | 12/01/23 | | | | 4,710 | | | | 4,698,225 | |

Molina Healthcare, Inc.,

Gtd. Notes | | | 5.375 | | | | 11/15/22 | | | | 6,619 | | | | 6,751,380 | |

Select Medical Corp.,

Gtd. Notes | | | 6.375 | | | | 06/01/21 | | | | 6,950 | | | | 7,019,500 | |

Surgery Center Holdings, Inc.,

Gtd. Notes, 144A(a) | | | 8.875 | | | | 04/15/21 | | | | 10,400 | | | | 10,829,000 | |

Tenet Healthcare Corp., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A(a) | | | 7.500 | | | | 01/01/22 | | | | 5,760 | | | | 6,031,814 | |

Sr. Sec’d. Notes(a) | | | 4.375 | | | | 10/01/21 | | | | 350 | | | | 349,125 | |

Sr. Sec’d. Notes(a) | | | 4.625 | | | | 07/15/24 | | | | 9,650 | | | | 9,452,465 | |

Sr. Sec’d. Notes | | | 4.750 | | | | 06/01/20 | | | | 5,850 | | | | 5,908,500 | |

Sr. Unsec’d. Notes | | | 6.750 | | | | 02/01/20 | | | | 6,395 | | | | 6,570,863 | |

Sr. Unsec’d. Notes(a) | | | 6.750 | | | | 06/15/23 | | | | 4,350 | | | | 4,350,000 | |

Sr. Unsec’d. Notes(a) | | | 8.125 | | | | 04/01/22 | | | | 22,398 | | | | 23,657,887 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 142,828,553 | |

| | | | |

Home Builders 7.0% | | | | | | | | | | | | | | | | |

Ashton Woods USA LLC/Ashton Woods Finance Co.,

Sr. Unsec’d. Notes, 144A | | | 6.875 | | | | 02/15/21 | | | | 14,206 | | | | 14,348,060 | |

AV Homes, Inc.,

Gtd. Notes | | | 6.625 | | | | 05/15/22 | | | | 6,450 | | | | 6,595,125 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Home Builders (cont’d.) | | | | | | | | | | | | | | | | |

Beazer Homes USA, Inc.,

Gtd. Notes(a) | | | 8.750 | % | | | 03/15/22 | | | | 22,293 | | | $ | 23,567,937 | |

Brookfield Residential Properties, Inc. (Canada),

Gtd. Notes, 144A | | | 6.500 | | | | 12/15/20 | | | | 6,423 | | | | 6,461,538 | |

Brookfield Residential Properties, Inc./Brookfield Residential

US Corp. (Canada),

Gtd. Notes, 144A | | | 6.125 | | | | 07/01/22 | | | | 4,846 | | | | 4,882,345 | |

KB Home, | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 7.000 | | | | 12/15/21 | | | | 2,770 | | | | 2,915,425 | |

Gtd. Notes | | | 7.500 | | | | 09/15/22 | | | | 5,345 | | | | 5,679,063 | |

Gtd. Notes | | | 7.625 | | | | 05/15/23 | | | | 796 | | | | 850,844 | |

Gtd. Notes | | | 8.000 | | | | 03/15/20 | | | | 500 | | | | 528,750 | |

Lennar Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.125 | | | | 01/15/22 | | | | 8,200 | | | | 8,148,750 | |

Gtd. Notes(a) | | | 4.875 | | | | 12/15/23 | | | | 3,350 | | | | 3,354,188 | |

Gtd. Notes | | | 6.250 | | | | 12/15/21 | | | | 1,382 | | | | 1,451,100 | |

M/I Homes, Inc.,

Gtd. Notes | | | 6.750 | | | | 01/15/21 | | | | 10,175 | | | | 10,402,716 | |

Mattamy Group Corp. (Canada),

Sr. Unsec’d. Notes, 144A | | | 6.875 | | | | 12/15/23 | | | | 4,725 | | | | 4,807,688 | |

Meritage Homes Corp.,

Gtd. Notes | | | 7.000 | | | | 04/01/22 | | | | 2,295 | | | | 2,467,125 | |

New Home Co., Inc. (The),

Gtd. Notes | | | 7.250 | | | | 04/01/22 | | | | 10,310 | | | | 10,464,650 | |

PulteGroup, Inc.,

Gtd. Notes | | | 4.250 | | | | 03/01/21 | | | | 2,000 | | | | 2,010,600 | |

Taylor Morrison Communities, Inc./Taylor Morrison Holdings II, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.250 | | | | 04/15/21 | | | | 13,123 | | | | 13,106,596 | |

Gtd. Notes, 144A | | | 5.625 | | | | 03/01/24 | | | | 9,498 | | | | 9,331,785 | |

Gtd. Notes, 144A | | | 5.875 | | | | 04/15/23 | | | | 3,170 | | | | 3,170,951 | |

TRI Pointe Group, Inc.,

Gtd. Notes | | | 4.875 | | | | 07/01/21 | | | | 8,395 | | | | 8,374,012 | |

TRI Pointe Group, Inc./TRI Pointe Homes, Inc.,

Gtd. Notes | | | 4.375 | | | | 06/15/19 | | | | 4,000 | | | | 4,020,000 | |

William Lyon Homes, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 7.000 | | | | 08/15/22 | | | | 5,150 | | | | 5,246,563 | |

Gtd. Notes, 144A | | | 6.000 | | | | 09/01/23 | | | | 7,475 | | | | 7,215,617 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 159,401,428 | |

See Notes to Financial Statements.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 25 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Home Furnishings 0.3% | | | | | | | | | | | | | | | | |

Tempur Sealy International, Inc.,

Gtd. Notes | | | 5.625 | % | | | 10/15/23 | | | | 7,842 | | | $ | 7,842,000 | |

| | | | |

Internet 0.5% | | | | | | | | | | | | | | | | |

Zayo Group LLC/Zayo Capital, Inc.,

Gtd. Notes(a) | | | 6.000 | | | | 04/01/23 | | | | 10,554 | | | | 10,877,691 | |

| | | | |

Iron/Steel 1.1% | | | | | | | | | | | | | | | | |

AK Steel Corp.,

Sr. Sec’d. Notes | | | 7.500 | | | | 07/15/23 | | | | 9,825 | | | | 10,267,125 | |

Cleveland-Cliffs, Inc.,

Sr. Sec’d. Notes, 144A(a) | | | 4.875 | | | | 01/15/24 | | | | 15,642 | | | | 15,250,950 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 25,518,075 | |

| | | | |

Leisure Time 0.3% | | | | | | | | | | | | | | | | |

Silversea Cruise Finance Ltd.,

Sr. Sec’d. Notes, 144A | | | 7.250 | | | | 02/01/25 | | | | 5,324 | | | | 5,783,195 | |

| | | | |

Lodging 1.2% | | | | | | | | | | | | | | | | |

Jack Ohio Finance LLC/Jack Ohio Finance 1 Corp., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A(a) | | | 10.250 | | | | 11/15/22 | | | | 5,735 | | | | 6,236,812 | |

Sr. Sec’d. Notes, 144A | | | 6.750 | | | | 11/15/21 | | | | 12,200 | | | | 12,627,000 | |

MGM Resorts International, | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.000 | | | | 03/15/23 | | | | 2,075 | | | | 2,154,161 | |

Gtd. Notes(a) | | | 6.625 | | | | 12/15/21 | | | | 3,000 | | | | 3,172,500 | |

Gtd. Notes(a) | | | 8.625 | | | | 02/01/19 | | | | 2,866 | | | | 2,922,174 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 27,112,647 | |

| | | | |

Media 13.9% | | | | | | | | | | | | | | | | |

Altice US Finance I Corp.,

Sr. Sec’d. Notes, 144A | | | 5.375 | | | | 07/15/23 | | | | 13,727 | | | | 13,812,794 | |

CCO Holdings LLC/CCO Holdings Capital Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.125 | | | | 02/15/23 | | | | 3,575 | | | | 3,579,469 | |

Sr. Unsec’d. Notes | | | 5.250 | | | | 03/15/21 | | | | 5,111 | | | | 5,149,333 | |

Sr. Unsec’d. Notes | | | 5.250 | | | | 09/30/22 | | | | 21,560 | | | | 21,708,225 | |

Sr. Unsec’d. Notes | | | 5.750 | | | | 01/15/24 | | | | 1,000 | | | | 1,017,330 | |

Sr. Unsec’d. Notes, 144A | | | 5.125 | | | | 05/01/23 | | | | 24,372 | | | | 24,372,000 | |

Sr. Unsec’d. Notes, 144A | | | 5.875 | | | | 04/01/24 | | | | 7,000 | | | | 7,140,000 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Media (cont’d.) | | | | | | | | | | | | | | | | |

Cequel Communications Holdings I LLC/Cequel Capital Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 5.125 | % | | | 12/15/21 | | | | 4,402 | | | $ | 4,396,453 | |

Sr. Unsec’d. Notes, 144A | | | 5.125 | | | | 12/15/21 | | | | 47,336 | | | | 47,336,000 | |

Clear Channel Worldwide Holdings, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, Series A(a) | | | 6.500 | | | | 11/15/22 | | | | 7,315 | | | | 7,452,156 | |

Gtd. Notes, Series A(a) | | | 7.625 | | | | 03/15/20 | | | | 5,470 | | | | 5,456,325 | |

Gtd. Notes, Series B | | | 6.500 | | | | 11/15/22 | | | | 6,467 | | | | 6,612,508 | |

Gtd. Notes, Series B(a) | | | 7.625 | | | | 03/15/20 | | | | 10,770 | | | | 10,810,388 | |

DISH DBS Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.125 | | | | 05/01/20 | | | | 22,757 | | | | 22,870,785 | |

Gtd. Notes(a) | | | 5.875 | | | | 07/15/22 | | | | 3,242 | | | | 3,112,320 | |

Gtd. Notes(a) | | | 6.750 | | | | 06/01/21 | | | | 7,290 | | | | 7,399,350 | |

Mediacom Broadband LLC/Mediacom Broadband Corp.,

Sr. Unsec’d. Notes | | | 5.500 | | | | 04/15/21 | | | | 18,535 | | | | 18,674,012 | |

Midcontinent Communications/Midcontinent Finance Corp.,

Gtd. Notes, 144A | | | 6.875 | | | | 08/15/23 | | | | 1,945 | | | | 2,044,681 | |

Nexstar Broadcasting, Inc.,

Gtd. Notes, 144A | | | 6.125 | | | | 02/15/22 | | | | 3,950 | | | | 4,016,656 | |

Quebecor Media, Inc. (Canada),

Sr. Unsec’d. Notes | | | 5.750 | | | | 01/15/23 | | | | 2,000 | | | | 2,070,000 | |

Radiate Holdco LLC/Radiate Finance, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 6.625 | | | | 02/15/25 | | | | 600 | | | | 561,000 | |

Sr. Unsec’d. Notes, 144A | | | 6.875 | | | | 02/15/23 | | | | 3,745 | | | | 3,613,925 | |

Sinclair Television Group, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.375 | | | | 04/01/21 | | | | 18,470 | | | | 18,539,262 | |

Gtd. Notes(a) | | | 6.125 | | | | 10/01/22 | | | | 9,443 | | | | 9,680,964 | |

Gtd. Notes, 144A(a) | | | 5.625 | | | | 08/01/24 | | | | 5,050 | | | | 4,974,250 | |

TEGNA, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.375 | | | | 10/15/23 | | | | 4,185 | | | | 4,336,706 | |

Gtd. Notes, 144A | | | 4.875 | | | | 09/15/21 | | | | 11,887 | | | | 11,916,717 | |

Tribune Media Co.,

Gtd. Notes(a) | | | 5.875 | | | | 07/15/22 | | | | 12,325 | | | | 12,509,875 | |

Univision Communications, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | | 5.125 | | | | 05/15/23 | | | | 9,910 | | | | 9,414,500 | |

Sr. Sec’d. Notes, 144A | | | 6.750 | | | | 09/15/22 | | | | 19,516 | | | | 19,930,715 | |

UPCB Finance IV Ltd. (Netherlands),

Sr. Sec’d. Notes, 144A | | | 5.375 | | | | 01/15/25 | | | | 2,535 | | | | 2,503,566 | |

Videotron Ltd. (Canada),

Gtd. Notes | | | 5.000 | | | | 07/15/22 | | | | 1,335 | | | | 1,358,363 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 318,370,628 | |

See Notes to Financial Statements.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 27 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Metal Fabricate/Hardware 0.6% | | | | | | | | | | | | | | | | |

Novelis Corp.,

Gtd. Notes, 144A | | | 6.250 | % | | | 08/15/24 | | | | 5,966 | | | $ | 6,040,575 | |

Zekelman Industries, Inc.,

Sr. Sec’d. Notes, 144A | | | 9.875 | | | | 06/15/23 | | | | 7,430 | | | | 8,070,837 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 14,111,412 | |

| | | | |

Mining 1.5% | | | | | | | | | | | | | | | | |

First Quantum Minerals Ltd. (Zambia),

Gtd. Notes, 144A(a) | | | 7.000 | | | | 02/15/21 | | | | 9,390 | | | | 9,290,231 | |

Freeport-McMoRan, Inc.,

Gtd. Notes(a) | | | 3.875 | | | | 03/15/23 | | | | 11,605 | | | | 11,155,306 | |

International Wire Group, Inc.,

Sec’d. Notes, 144A | | | 10.750 | | | | 08/01/21 | | | | 3,500 | | | | 3,473,750 | |

New Gold, Inc. (Canada),

Gtd. Notes, 144A(a) | | | 6.250 | | | | 11/15/22 | | | | 8,680 | | | | 7,703,500 | |

Teck Resources Ltd. (Canada),

Gtd. Notes | | | 4.500 | | | | 01/15/21 | | | | 2,367 | | | | 2,396,588 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 34,019,375 | |

| | | | |

Miscellaneous Manufacturing 0.0% | | | | | | | | | | | | | | | | |

FXI Holdings, Inc.,

Sr. Sec’d. Notes, 144A | | | 7.875 | | | | 11/01/24 | | | | 850 | | | | 819,188 | |

| | | | |

Oil & Gas 6.1% | | | | | | | | | | | | | | | | |

Alta Mesa Holdings LP/Alta Mesa Finance Services Corp.,

Gtd. Notes(a) | | | 7.875 | | | | 12/15/24 | | | | 9,425 | | | | 9,248,281 | |

Antero Resources Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 5.125 | | | | 12/01/22 | | | | 300 | | | | 303,000 | |

Gtd. Notes | | | 5.375 | | | | 11/01/21 | | | | 2,700 | | | | 2,743,875 | |

Gtd. Notes | | | 5.625 | | | | 06/01/23 | | | | 1,900 | | | | 1,955,195 | |

Ascent Resources Utica Holdings LLC/ARU Finance Corp.,

Sr. Unsec’d. Notes, 144A(a) | | | 10.000 | | | | 04/01/22 | | | | 31,098 | | | | 34,363,290 | |

Citgo Holding, Inc.,

Sr. Sec’d. Notes, 144A | | | 10.750 | | | | 02/15/20 | | | | 20,427 | | | | 21,805,822 | |

CNX Resources Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 5.875 | | | | 04/15/22 | | | | 16,649 | | | | 16,648,168 | |

Gtd. Notes | | | 8.000 | | | | 04/01/23 | | | | 1,592 | | | | 1,684,034 | |

Denbury Resources, Inc.,

Sec’d. Notes, 144A | | | 9.000 | | | | 05/15/21 | | | | 2,150 | | | | 2,311,250 | |

Endeavor Energy Resources LP/EER Finance, Inc.,

Sr. Unsec’d. Notes, 144A(a) | | | 5.500 | | | | 01/30/26 | | | | 6,500 | | | | 6,483,750 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Oil & Gas (cont’d.) | | | | | | | | | | | | | | | | |

MEG Energy Corp. (Canada), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 6.375 | % | | | 01/30/23 | | | | 18,772 | | | $ | 17,035,590 | |

Gtd. Notes, 144A | | | 7.000 | | | | 03/31/24 | | | | 1,325 | | | | 1,202,438 | |

Range Resources Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 5.000 | | | | 03/15/23 | | | | 4,325 | | | | 4,231,147 | |

Gtd. Notes | | | 5.875 | | | | 07/01/22 | | | | 4,124 | | | | 4,165,240 | |

Sasol Financing International Ltd. (South Africa),

Gtd. Notes | | | 4.500 | | | | 11/14/22 | | | | 2,000 | | | | 1,934,720 | |

Sunoco LP/Sunoco Finance Corp.,

Gtd. Notes, 144A(a) | | | 4.875 | | | | 01/15/23 | | | | 7,400 | | | | 7,300,396 | |

WPX Energy, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 6.000 | | | | 01/15/22 | | | | 4,000 | | | | 4,130,000 | |

Sr. Unsec’d. Notes | | | 8.250 | | | | 08/01/23 | | | | 1,750 | | | | 1,986,250 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 139,532,446 | |

| | | | |

Packaging & Containers 1.2% | | | | | | | | | | | | | | | | |

ARD Finance SA (Luxembourg),

Sr. Sec’d. Notes, Cash coupon 7.125% or PIK 7.875% | | | 7.125 | | | | 09/15/23 | | | | 7,950 | | | | 8,059,312 | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc. (Ireland),

Sr. Sec’d. Notes, 144A(a) | | | 4.250 | | | | 09/15/22 | | | | 7,550 | | | | 7,446,188 | |

Greif, Inc.,

Sr. Unsec’d. Notes | | | 7.750 | | | | 08/01/19 | | | | 3,000 | | | | 3,105,000 | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 5.750 | | | | 10/15/20 | | | | 7,222 | | | | 7,230,818 | |

Sr. Sec’d. Notes, 144A(a) | | | 5.125 | | | | 07/15/23 | | | | 1,000 | | | | 996,250 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 26,837,568 | |

| | | | |

Pharmaceuticals 0.3% | | | | | | | | | | | | | | | | |

Bausch Health Cos., Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 7.500 | | | | 07/15/21 | | | | 670 | | | | 680,640 | |

Sr. Sec’d. Notes, 144A | | | 6.500 | | | | 03/15/22 | | | | 2,575 | | | | 2,665,125 | |

Endo Finance LLC,

Gtd. Notes, 144A(a) | | | 5.750 | | | | 01/15/22 | | | | 710 | | | | 656,750 | |

Endo Finance LLC/Endo Finco, Inc.,

Gtd. Notes, 144A | | | 5.375 | | | | 01/15/23 | | | | 3,300 | | | | 2,821,500 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 6,824,015 | |

See Notes to Financial Statements.

| | | | |

| PGIM Short Duration High Yield Income Fund | | | 29 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Pipelines 0.8% | | | | | | | | | | | | | | | | |

DCP Midstream Operating LP,

Gtd. Notes, 144A(a) | | | 4.750 | % | | | 09/30/21 | | | | 4,347 | | | $ | 4,412,205 | |

Genesis Energy LP/Genesis Energy Finance Corp.,

Gtd. Notes | | | 6.000 | | | | 05/15/23 | | | | 10,931 | | | | 10,753,371 | |

NGPL PipeCo LLC,

Sr. Unsec’d. Notes, 144A | | | 4.375 | | | | 08/15/22 | | | | 4,050 | | | | 4,080,375 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 19,245,951 | |

| | | | |

Real Estate 0.2% | | | | | | | | | | | | | | | | |

Realogy Group LLC/Realogy Co-Issuer Corp.,

Gtd. Notes, 144A(a) | | | 4.875 | | | | 06/01/23 | | | | 5,000 | | | | 4,675,000 | |

WeWork Cos., Inc.,

Gtd. Notes, 144A(a) | | | 7.875 | | | | 05/01/25 | | | | 850 | | | | 823,565 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 5,498,565 | |

| | | | |

Real Estate Investment Trusts (REITs) 1.8% | | | | | | | | | | | | | | | | |

FelCor Lodging LP,

Gtd. Notes | | | 6.000 | | | | 06/01/25 | | | | 8,300 | | | | 8,569,750 | |

MPT Operating Partnership LP/MPT Finance Corp.,

Gtd. Notes | | | 6.375 | | | | 03/01/24 | | | | 3,955 | | | | 4,169,757 | |

Sabra Health Care LP/Sabra Capital Corp.,

Gtd. Notes | | | 5.500 | | | | 02/01/21 | | | | 6,110 | | | | 6,228,381 | |

SBA Communications Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | | 4.000 | | | | 10/01/22 | | | | 18,915 | | | | 18,493,952 | |

Sr. Unsec’d. Notes | | | 4.875 | | | | 07/15/22 | | | | 668 | | | | 676,350 | |

VICI Properties 1 LLC/VICI FC, Inc.,

Sec’d. Notes(a) | | | 8.000 | | | | 10/15/23 | | | | 2,730 | | | | 3,016,650 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 41,154,840 | |

| | | | |

Retail 4.5% | | | | | | | | | | | | | | | | |

Brinker International, Inc.,

Gtd. Notes, 144A | | | 5.000 | | | | 10/01/24 | | | | 1,000 | | | | 965,000 | |

CEC Entertainment, Inc.,

Gtd. Notes(a) | | | 8.000 | | | | 02/15/22 | | | | 7,100 | | | | 6,709,500 | |

Ferrellgas LP/Ferrellgas Finance Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.750 | | | | 06/15/23 | | | | 4,425 | | | | 3,805,500 | |

Sr. Unsec’d. Notes(a) | | | 6.750 | | | | 01/15/22 | | | | 3,000 | | | | 2,670,000 | |

Ferrellgas Partners LP/Ferrellgas Partners Finance Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | | 8.625 | | | | 06/15/20 | | | | 2,700 | | | | 2,646,000 | |

Sr. Unsec’d. Notes(a) | | | 8.625 | | | | 06/15/20 | | | | 8,525 | | | | 8,354,500 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Retail (cont’d.) | | | | | | | | | | | | | | | | |

Golden Nugget, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 8.750 | % | | | 10/01/25 | | | | 8,375 | | | $ | 8,835,625 | |

Sr. Unsec’d. Notes, 144A(a) | | | 6.750 | | | | 10/15/24 | | | | 2,600 | | | | 2,642,250 | |

Hot Topic, Inc.,

Sr. Sec’d. Notes, 144A | | | 9.250 | | | | 06/15/21 | | | | 3,906 | | | | 3,788,820 | |

L Brands, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 5.625 | | | | 02/15/22 | | | | 5,625 | | | | 5,688,281 | |

Gtd. Notes(a) | | | 5.625 | | | | 10/15/23 | | | | 13,525 | | | | 13,525,000 | |

Gtd. Notes | | | 6.625 | | | | 04/01/21 | | | | 10,000 | | | | 10,500,000 | |

PetSmart, Inc.,

Gtd. Notes, 144A | | | 7.125 | | | | 03/15/23 | | | | 11,200 | | | | 7,532,000 | |

PF Chang’s China Bistro, Inc.,

Gtd. Notes, 144A(a) | | | 10.250 | | | | 06/30/20 | | | | 4,159 | | | | 3,992,640 | |

Rite Aid Corp.,

Gtd. Notes, 144A(a) | | | 6.125 | | | | 04/01/23 | | | | 15,057 | | | | 13,509,140 | |

Sally Holdings LLC/Sally Capital, Inc.,

Gtd. Notes(a) | | | 5.500 | | | | 11/01/23 | | | | 825 | | | | 796,125 | |

Stonegate Pub Co. Financing PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.875 | | | | 03/15/22 | | | GBP | 3,400 | | | | 4,363,482 | |