UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| Investment Company Act file number: 811-02071 |

Exact name of registrant as specified in charter:

Delaware Group® Income Funds

Address of principal executive offices:

2005 Market Street

Philadelphia, PA 19103

Name and address of agent for service:

David F. Connor, Esq.

2005 Market Street

Philadelphia, PA 19103

Registrant’s telephone number, including area code: (800) 523-1918

| Date of fiscal year end: July 31 |

| |

| Date of reporting period: July 31, 2010 |

Item 1. Reports to Stockholders

Annual report Delaware Core Bond Fund July 31, 2010 Fixed income mutual fund |

This annual report is for the information of Delaware Core Bond Fund shareholders, but it may be used with prospective investors when preceded or accompanied by a current prospectus for Delaware Core Bond Fund. The figures in the annual report for Delaware Core Bond Fund represent past results, which are not a guarantee of future results. The return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Delaware Core Bond Fund prospectus contains this and other important information about the Fund. Prospectuses for all open-end funds in the Delaware Investments® Family of Funds are available from your financial advisor, online at www.delawareinvestments.com, or by phone at 800 523-1918. Please read the prospectus carefully before you invest or send money.

|

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Core Bond Fund at www.delawareinvestments.com.

Manage your investments online

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

Delaware Management Holdings, Inc., and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Core Bond Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

| Table of contents | |

| Portfolio management review | 1 |

| Performance summary | 4 |

| Disclosure of Fund expenses | 8 |

| Security type | 10 |

| Statement of net assets | 11 |

| Statements of operations | 26 |

| Statements of changes in net assets | 28 |

| Financial highlights | 30 |

| Notes to financial statements | 38 |

| Report of independent registered | |

| public accounting firm | 49 |

| Other Fund information | 50 |

| Board of trustees/directors and | |

| officers addendum | 52 |

| About the organization | 62 |

Unless otherwise noted, views expressed herein are current as of July 31, 2010, and are subject to change. Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2010 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review | |

| Delaware Core Bond Fund | Aug. 10, 2010 |

| | | 1-year return | | 9-month return |

| Delaware Core Bond Fund (Class A shares) | | +9.99% | | +5.89% |

| Barclays Capital U.S. Aggregate Index (Benchmark) | | +8.91% | | +6.15% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Core Bond Fund, please see the table on page 4.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Delaware Core Bond Fund is the successor to The Intermediate Fixed Income Portfolio of the Delaware Pooled® Trust pursuant to a reorganization. Prior to the reorganization, the Fund had no investment operations. Accordingly, the performance information shown for Class A shares of the Fund includes historical information for The Intermediate Fixed Income Portfolio.

Fund performance

Delaware Core Bond Fund Class A shares returned +9.99% at net asset value and +5.09% at maximum offer price (both returns include distributions reinvested) for one year ended July 31, 2010. In the nine months since our last report to shareholders, the Fund’s Class A shares returned +5.89% at net asset value and +1.11% at maximum offer price (both returns include distributions reinvested). For the same periods, the Fund’s benchmark, the Barclays Capital U.S. Aggregate Index, advanced +8.91% and +6.15%, respectively. For complete annualized performance for Delaware Core Bond Fund, please see the table on page 4.

| It is important to note that, as economic conditions turned more volatile, we attempted to upgrade the quality of the Fund’s holdings within both the investment grade and high yield sectors. This decision proved generally beneficial, though our allocation to the high yield sector lost some of the gains it had generated earlier in the period. |

1

Portfolio management review

Delaware Core Bond Fund

A strong beginning, a shakier end

During the reporting period, the fixed income markets continued to normalize and corporations were generally able to refinance debt. Bond default rates dropped as a result, particularly in the high-yield sector, declining to between 5 and 6 percent from highs near 13 percent. They are expected to hover near 3 percent in 2011. (Source: Moody’s.)

Beginning in April 2010, investors seemed to turn their attention to what many economists believed were structural debt problems within certain euro zone governments — problems that could potentially create a drag on a nascent economic recovery across the developed world. The European Union, in conjunction with the International Monetary Fund, eventually backed a massive rescue fund for euro zone members, but not before investor sentiment turned sour. Greece bore the brunt of investor concern, as investors demanded upward of 1000 basis points (or 10 percentage points) of protection against default in the credit derivative swap market. Investors also demanded risk premiums from Portuguese, Italian, Irish, and Spanish government bonds.

More broadly, however, the debt concerns in Europe resulted in a global flight to quality that generated intense demand for Treasury securities. Though we began the fiscal period with the belief that rising Treasury rates could become a potential cause for concern, yields on 10-year Treasury securities declined significantly after peaking in April 2010. In turn, yields on non-Treasury spread product rose as investors navigated increasingly fragile economic conditions. (It’s important to remember that bond yields move in the opposite direction of prices.)

Within the Fund

Broadly speaking, we began the period attempting to participate in the rally that carried over from the end of the previous fiscal period. During this time, our allocations to cyclical sectors within the investment grade and high yield corporate bond sectors contributed significantly to the Fund’s return.

The Fund generally made gains relative to the benchmark index across nearly all investment-grade industries during the period. Our emphasis on BBB- and A-rated issues and in financials particularly added to the Fund’s performance over the fiscal year. Among the Fund’s high yield allocation, we generally attempted to take advantage of the potential for “snap-back” rallies in sectors that we believed had sustained the most damage during the preceding fiscal year. Specifically, we took large overweight positions in CCC- and B-rated bonds within economically sensitive cyclical sectors such as basic materials. Meanwhile, we underweighted higher-rated BB securities and bonds from defensive industries such as energy, healthcare, and utilities. Those credit and sector allocation decisions also contributed to the Fund’s relative performance.

It is important to note that, as economic conditions turned more volatile, we attempted to upgrade the quality of the Fund’s holdings within both the investment grade and high yield sectors. This decision proved generally beneficial, though our allocation to the high yield sector lost some of the gains it had generated earlier in the period.

2

In contrast, the Fund’s underweight position in Treasury securities ultimately detracted from performance versus the benchmark index. While the underweight helped at first, Treasurys advanced later in the period on the back of strong demand as noted above.

Other detractors from the Fund’s relative performance came from overweights in asset-backed securities and commercial mortgage-backed securities (particularly during the latter parts of the period). This happened despite the Fund’s bias toward higher-quality commercial mortgage-backed securities.

Although the global economic outlook is uncertain, we believe that our in-depth, fundamentals-based debt selection process has uncovered many positive stories, and should allow us to successfully steer the Fund through events that we believe could continue to test global economies and financial markets in the coming quarters.

3

| Performance summary | |

| Delaware Core Bond Fund | July 31, 2010 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Core Bond Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

| Fund performance | | Average annual total returns through July 31, 2010 |

| | | 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. March 12, 1996) | | | | | | | | | | |

| Excluding sales charge | | +9.99 | % | | +6.02 | % | | +6.25 | % | | n/a | |

| Including sales charge | | +5.09 | % | | +5.04 | % | | +5.75 | % | | n/a | |

| Class C (Est. Sept. 30, 2009) | | | | | | | | | | |

| Excluding sales charge | | n/a | | | n/a | | | n/a | | | +6.48 | % |

| Including sales charge | | n/a | | | n/a | | | n/a | | | +5.48 | % |

| Class R (Est. Sept. 30, 2009) | | | | | | | | | | |

| Excluding sales charge | | n/a | | | n/a | | | n/a | | | +7.31 | % |

| Including sales charge | | n/a | | | n/a | | | n/a | | | +7.31 | % |

| Institutional Class (Est. Sept. 30, 2009) | | | | | | | | | | |

| Excluding sales charge | | n/a | | | n/a | | | n/a | | | +7.88 | % |

| Including sales charge | | n/a | | | n/a | | | n/a | | | +7.88 | % |

Delaware Core Bond Fund is the successor to The Intermediate Fixed Income Portfolio of the Delaware Pooled® Trust pursuant to the reorganization (Reorganization) of The Intermediate Fixed Income Portfolio into the Fund. Prior to the Reorganization, the Fund had no investment operations. Accordingly, for periods before Sept. 30, 2009, the performance information shown above that includes data from that period and on pages 6 and 7 is historical information for The Intermediate Fixed Income Portfolio. The Intermediate Fixed Income Portfolio had the same investment objective and a similar investment strategy as the Fund, and was managed by the same portfolio managers. Because the Fund’s fees and ex penses are higher than those of The Intermediate Fixed Income Portfolio, the Fund’s performance would have been lower than that shown for relevant periods in this report.

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

4

Expense limitations were in effect for certain classes during the periods shown in the “Fund performance” chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expense ratios” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 4 through 7.) Performance would have been lower had the expense limitations not been in effect.

The Fund offers Class A, C, R, and Institutional Class shares.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.30% of average daily net assets. This fee has been contractually limited to 0.25% of average daily net assets from Aug. 26, 2009, through Nov. 30, 2010.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, which has been limited contractually to 0.50% from Aug. 26, 2009, through Nov. 30, 2010.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

If and when we invest in forward foreign currency contracts or use other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

5

Performance summary

Delaware Core Bond Fund

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” chart. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees from Aug. 26, 2009, through Nov. 30, 2010. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | | Class A | �� | Class C | | Class R | | Institutional Class |

| Total annual operating expenses | | 2.52% | | 3.22% | | 2.82% | | 2.22% |

| (without fee waivers) | | | | | | | | |

| Net expenses | | 0.90% | | 1.65% | | 1.15% | | 0.65% |

| (including fee waivers, if any) | | | | | | | | |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual |

6

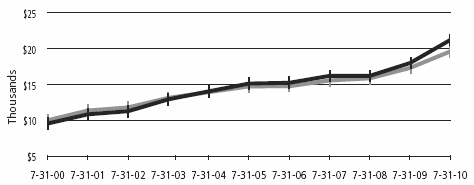

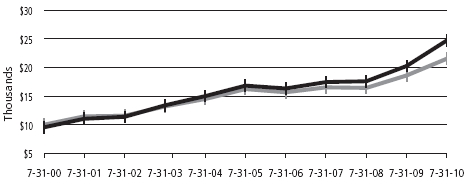

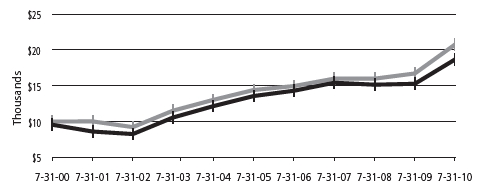

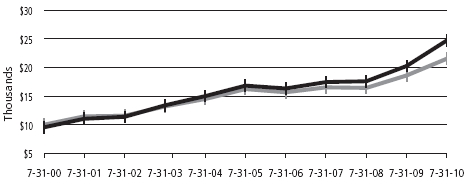

Performance of a $10,000 investment

Average annual total returns from July 31, 2000, through July 31, 2010

| For period beginning July 31, 2000, through July 31, 2010 | Starting value | Ending value |

| Barclays Capital U.S. Aggregate Index | $10,000 | $18,742 |

| Delaware Core Bond Fund — Class A Shares | $9,550 | $17,493 |

The chart assumes $10,000 invested in the Fund on July 31, 2000, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 4 through 7.

The chart also assumes $10,000 invested in the Barclays Capital U.S. Aggregate Index as of July 31, 2000.

The Barclays Capital U.S. Aggregate Index is a broad composite of more than 8,000 securities that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | | DPFIX | | | 245908710 | |

| Class C | | | DCBCX | | | 245908694 | |

| Class R | | | DEBRX | | | 245908686 | |

| Institutional Class | | | DCBIX | | | 245908678 | |

7

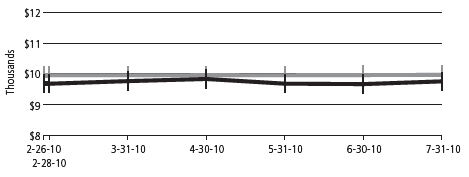

Disclosure of Fund expenses

For the six-month period February 1, 2010 to July 31, 2010

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from February 1, 2010 to July 31, 2010.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Core Bond Fund

Expense analysis of an investment of $1,000

| | | Beginning | | Ending | | | | Expenses |

| | | Account Value | | Account Value | | Annualized | | Paid During Period |

| | | 2/1/10 | | 7/31/10 | | Expense Ratio | | 2/1/10 to 7/31/2010* |

| Actual Fund return | | | | | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $1,039.50 | | | 0.90% | | | $4.55 | |

| Class C | | | 1,000.00 | | | | 1,036.60 | | | 1.65% | | | 8.33 | |

| Class R | | | 1,000.00 | | | | 1,038.80 | | | 1.15% | | | 5.81 | |

| Institutional Class | | | 1,000.00 | | | | 1,041.60 | | | 0.65% | | | 3.29 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | | $1,000.00 | | | | $1,020.33 | | | 0.90% | | | $4.51 | |

| Class C | | | 1,000.00 | | | | 1,016.61 | | | 1.65% | | | 8.25 | |

| Class R | | | 1,000.00 | | | | 1,019.09 | | | 1.15% | | | 5.76 | |

| Institutional Class | | | 1,000.00 | | | | 1,021.57 | | | 0.65% | | | 3.26 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

9

| Security type | |

| Delaware Core Bond Fund | As of July 31, 2010 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type | Percentage of net assets |

| Agency Asset-Backed Securities | 0.13% | |

| Agency Collateralized Mortgage Obligations | 1.24% | |

| Agency Mortgage-Backed Securities | 31.31% | |

| Commercial Mortgage-Backed Securities | 7.55% | |

| Corporate Bonds | 30.75% | |

| Banking | 6.67% | |

| Basic Industry | 1.69% | |

| Brokerage | 0.77% | |

| Capital Goods | 0.70% | |

| Communications | 4.20% | |

| Consumer Cyclical | 0.99% | |

| Consumer Non-Cyclical | 4.23% | |

| Electric | 3.18% | |

| Energy | 3.20% | |

| Financials | 1.08% | |

| Insurance | 1.37% | |

| Natural Gas | 1.95% | |

| Real Estate | 0.39% | |

| Technology | 0.22% | |

| Transportation | 0.11% | |

| Non-Agency Asset-Backed Securities | 8.45% | |

| Non-Agency Collateralized Mortgage Obligation | 0.42% | |

| Regional Authorities | 2.87% | |

| Sovereign Agencies | 4.16% | |

| Supranational Banks | 2.50% | |

| U.S. Treasury Obligations | 10.81% | |

| Preferred Stock | 0.18% | |

| Discount Note | 27.69% | |

| Total Value of Securities | 128.06% | |

| Liabilities Net of Receivables and Other Assets | (28.06% | ) |

| Total Net Assets | 100.00% | |

10

| Statement of net assets |

| Delaware Core Bond Fund | | | July 31, 2010 |

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Agency Asset-Backed Securities – 0.13% | | | | | |

| | Fannie Mae Grantor Trust | | | | | |

| | Series 2003-T4 2A5 5.407% 9/26/33 | $ | 11,004 | | $ | 10,300 |

| | Fannie Mae Whole Loan | | | | | |

| | Series 2001-W2 AS5 6.473% 10/25/31 | | 12,856 | | | 13,217 |

| | •Series 2002-W11 AV1 0.669% 11/25/32 | | 2,033 | | | 1,814 |

| Total Agency Asset-Backed Securities | | | | | |

| | (cost $25,771) | | | | | 25,331 |

| | |

| Agency Collateralized Mortgage Obligations – 1.24% | | | | | |

| | Fannie Mae REMIC | | | | | |

| | Series 2004-49 EB 5.00% 7/25/24 | | 65,000 | | | 71,378 |

| | Fannie Mae Whole Loan | | | | | |

| | Series 2003-W15 2A7 5.55% 8/25/43 | | 26,217 | | | 28,577 |

| | Freddie Mac REMIC | | | | | |

| | Series 2326 ZQ 6.50% 6/15/31 | | 51,066 | | | 56,986 |

| | Series 3027 DE 5.00% 9/15/25 | | 60,000 | | | 65,703 |

| • | Vendee Mortgage Trust | | | | | |

| | Series 2000-1 1A 6.817% 1/15/30 | | 23,732 | | | 26,209 |

| Total Agency Collateralized Mortgage Obligations | | | | | |

| | (cost $235,599) | | | | | 248,853 |

| | |

| Agency Mortgage-Backed Securities – 31.31% | | | | | |

| | Fannie Mae 8.50% 9/20/10 | | 51 | | | 52 |

| • | Fannie Mae ARM | | | | | |

| | 2.801% 8/1/34 | | 27,490 | | | 28,761 |

| | 2.846% 12/1/33 | | 19,880 | | | 20,707 |

| | Fannie Mae FHAVA 11.00% 12/1/15 | | 4 | | | 4 |

| | Fannie Mae Relocation 30 yr 5.00% 1/1/34 | | 3,174 | | | 3,359 |

| | Fannie Mae S.F. 15 yr 8.00% 10/1/14 | | 274 | | | 288 |

| | Fannie Mae S.F. 15 yr TBA | | | | | |

| | 4.00% 8/1/25 | | 905,000 | | | 946,432 |

| | 4.50% 8/1/25 | | 1,010,000 | | | 1,070,127 |

| | 5.00% 8/1/25 | | 905,000 | | | 966,654 |

| | 5.50% 8/25/25 | | 590,000 | | | 637,938 |

| | Fannie Mae S.F. 20 yr 5.50% 8/1/28 | | 88,596 | | | 95,688 |

11

Statement of net assets

Delaware Core Bond Fund

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Agency Mortgage-Backed Securities (continued) | | | | | |

| | Fannie Mae S.F. 30 yr | | | | | |

| | 5.00% 12/1/37 | $ | 7,225 | | $ | 7,708 |

| | 5.00% 1/1/38 | | 12,944 | | | 13,810 |

| | 5.00% 2/1/38 | | 6,139 | | | 6,550 |

| | 7.50% 12/1/32 | | 5,324 | | | 6,094 |

| | 9.50% 4/1/18 | | 967 | | | 1,115 |

| | Fannie Mae S.F. 30 yr TBA | | | | | |

| | 4.50% 9/1/40 | | 170,000 | | | 177,119 |

| | 5.00% 9/1/40 | | 550,000 | | | 584,203 |

| • | Freddie Mac ARM | | | | | |

| | 2.672% 4/1/33 | | 6,246 | | | 6,501 |

| | 3.417% 4/1/34 | | 4,692 | | | 4,881 |

| | 5.059% 8/1/38 | | 269,119 | | | 285,915 |

| | 5.672% 7/1/36 | | 11,174 | | | 11,757 |

| | Freddie Mac Relocation 15 yr 3.50% 10/1/18 | | 3,467 | | | 3,416 |

| | Freddie Mac S.F. 15 yr 5.00% 4/1/20 | | 17,063 | | | 18,366 |

| | Freddie Mac S.F. 15 yr TBA | | | | | |

| | 5.00% 8/1/25 | | 180,000 | | | 192,291 |

| | 5.50% 8/1/25 | | 180,000 | | | 194,288 |

| | Freddie Mac S.F. 30 yr TBA | | | | | |

| | 6.00% 8/1/40 | | 840,000 | | | 912,319 |

| | 6.50% 8/1/40 | | 75,000 | | | 82,195 |

| | GNMA I S.F. 15 yr 7.50% 4/15/13 | | 494 | | | 489 |

| | GNMA I S.F. 30 yr 7.50% 2/15/32 | | 2,979 | | | 3,440 |

| Total Agency Mortgage-Backed Securities | | | | | |

| | (cost $6,250,436) | | | | | 6,282,467 |

| | |

| Commercial Mortgage-Backed Securities – 7.55% | | | | | |

| | Bank of America Commercial Mortgage Securities | | | | | |

| | Series 2004-2 A3 4.05% 11/10/38 | | 91,028 | | | 92,273 |

| | Series 2005-1 A3 4.877% 11/10/42 | | 28,811 | | | 29,050 |

| | Bear Stearns Commercial Mortgage Securities | | | | | |

| | •Series 2005-PW10 A4 5.405% 12/11/40 | | 225,000 | | | 243,284 |

| | •Series 2005-T20 A4A 5.149% 10/12/42 | | 25,000 | | | 27,180 |

| | Series 2006-PW14 A4 5.201% 12/11/38 | | 50,000 | | | 52,666 |

| | Series 2007-PW15 A4 5.331% 2/11/44 | | 25,000 | | | 25,170 |

12

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Commercial Mortgage-Backed Securities (continued) | | | | | |

| u• | Commercial Mortgage Pass Through Certificates | | | | | |

| | Series 2005-C6 A5A 5.116% 6/10/44 | $ | 120,000 | | $ | 129,072 |

| #• | Credit Suisse First Boston Mortgage Securities | | | | | |

| | Series 2001-SPGA A2 144A 6.515% 8/13/18 | | 65,000 | | | 67,620 |

| • | Credit Suisse Mortgage Capital Certificates | | | | | |

| | Series 2006-C1 AAB 5.549% 2/15/39 | | 20,000 | | | 21,190 |

| • | General Electric Capital Commercial Mortgage | | | | | |

| | Series 2005-C4 A2 5.305% 11/10/45 | | 23,490 | | | 23,639 |

| | Goldman Sachs Mortgage Securities II | | | | | |

| | •Series 2004-GG2 A6 5.396% 8/10/38 | | 20,000 | | | 21,380 |

| | Series 2005-GG4 A4 4.761% 7/10/39 | | 35,000 | | | 36,078 |

| | Series 2005-GG4 A4A 4.751% 7/10/39 | | 115,000 | | | 121,700 |

| | •Series 2006-GG6 A4 5.553% 4/10/38 | | 120,000 | | | 127,217 |

| • | JPMorgan Chase Commercial Mortgage Securities | | | | | |

| | Series 2005-LDP5 A4 5.195% 12/15/44 | | 15,000 | | | 16,282 |

| | Lehman Brothers-UBS Commercial Mortgage Trust | | | | | |

| | Series 2004-C1 A4 4.568% 1/15/31 | | 100,000 | | | 104,245 |

| | Morgan Stanley Capital I | | | | | |

| | Series 2005-HQ6 A4A 4.989% 8/13/42 | | 160,000 | | | 171,536 |

| | •Series 2007-T27 A4 5.649% 6/11/42 | | 190,000 | | | 204,464 |

| Total Commercial Mortgage-Backed Securities | | | | | |

| | (cost $1,409,964) | | | | | 1,514,046 |

| | |

| Corporate Bonds – 30.75% | | | | | |

| Banking – 6.67% | | | | | |

| | BB&T | | | | | |

| | 5.20% 12/23/15 | | 30,000 | | | 32,482 |

| | 5.25% 11/1/19 | | 91,000 | | | 94,741 |

| | JPMorgan Chase 4.40% 7/22/20 | | 135,000 | | | 135,596 |

| | JPMorgan Chase Capital XXV 6.80% 10/1/37 | | 70,000 | | | 71,463 |

| | KFW 4.00% 1/27/20 | | 55,000 | | | 57,965 |

| # | NIBC Bank 144A 2.80% 12/2/14 | | 100,000 | | | 102,150 |

| | Oesterreichische Kontrollbank | | | | | |

| | 1.75% 3/11/13 | | 50,000 | | | 50,754 |

| | 4.875% 2/16/16 | | 95,000 | | | 106,424 |

13

Statement of net assets

Delaware Core Bond Fund

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Banking (continued) | | | | | |

| | PNC Funding | | | | | |

| | 5.125% 2/8/20 | $ | 160,000 | | $ | 169,826 |

| | 5.25% 11/15/15 | | 15,000 | | | 16,240 |

| | Rentenbank | | | | | |

| | 3.125% 7/15/15 | | 50,000 | | | 52,439 |

| | 3.25% 3/15/13 | | 55,000 | | | 57,965 |

| | 4.125% 7/15/13 | | 25,000 | | | 27,013 |

| | US Bancorp 3.15% 3/4/15 | | 55,000 | | | 56,816 |

| • | USB Capital IX 6.189% 4/15/49 | | 70,000 | | | 54,558 |

| | Wachovia | | | | | |

| | 5.25% 8/1/14 | | 195,000 | | | 208,912 |

| | 5.625% 10/15/16 | | 40,000 | | | 43,925 |

| | | | | | | 1,339,269 |

| Basic Industry – 1.69% | | | | | |

| | Alcoa 6.15% 8/15/20 | | 25,000 | | | 25,382 |

| | ArcelorMittal 9.85% 6/1/19 | | 25,000 | | | 32,352 |

| | Cytec Industries 8.95% 7/1/17 | | 35,000 | | | 43,080 |

| | Dow Chemical 8.55% 5/15/19 | | 40,000 | | | 50,036 |

| | International Paper 9.375% 5/15/19 | | 50,000 | | | 65,116 |

| | Reliance Steel & Aluminum 6.85% 11/15/36 | | 10,000 | | | 9,605 |

| | Teck Resources | | | | | |

| | 9.75% 5/15/14 | | 70,000 | | | 85,160 |

| | 10.25% 5/15/16 | | 10,000 | | | 12,114 |

| | Vale Overseas 6.875% 11/10/39 | | 15,000 | | | 16,611 |

| | | | | | | 339,456 |

| Brokerage – 0.77% | | | | | |

| | Goldman Sachs Group | | | | | |

| | 3.70% 8/1/15 | | 30,000 | | | 30,248 |

| | 5.375% 3/15/20 | | 45,000 | | | 46,407 |

| | Jefferies Group | | | | | |

| | 5.875% 6/8/14 | | 10,000 | | | 10,707 |

| | 6.45% 6/8/27 | | 15,000 | | | 14,239 |

14

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Brokerage (continued) | | | | | |

| | Lazard Group | | | | | |

| | 6.85% 6/15/17 | $ | 45,000 | | $ | 46,644 |

| | 7.125% 5/15/15 | | 5,000 | | | 5,345 |

| | | | | | | 153,590 |

| Capital Goods – 0.70% | | | | | |

| | Allied Waste North America | | | | | |

| | 6.875% 6/1/17 | | 10,000 | | | 11,053 |

| | 7.125% 5/15/16 | | 20,000 | | | 21,626 |

| | L-3 Communications 4.75% 7/15/20 | | 65,000 | | | 66,541 |

| | Thermo Fisher Scientific 3.20% 5/1/15 | | 40,000 | | | 42,027 |

| | | | | | | 141,247 |

| Communications – 4.20% | | | | | |

| | American Tower 7.00% 10/15/17 | | 45,000 | | | 51,694 |

| | AT&T 6.50% 9/1/37 | | 50,000 | | | 57,135 |

| | Cisco Systems 4.45% 1/15/20 | | 75,000 | | | 80,470 |

| | Comcast 5.90% 3/15/16 | | 55,000 | | | 63,176 |

| # | COX Communications 144A 6.45% 12/1/36 | | 5,000 | | | 5,518 |

| | DIRECTV Holdings/Financing 7.625% 5/15/16 | | 145,000 | | | 161,140 |

| # | NBC Universal 144A 5.15% 4/30/20 | | 40,000 | | | 42,598 |

| | Qwest 8.375% 5/1/16 | | 65,000 | | | 74,263 |

| | Telecom Italia Capital | | | | | |

| | 5.25% 10/1/15 | | 80,000 | | | 84,340 |

| | 6.175% 6/18/14 | | 90,000 | | | 97,888 |

| | Time Warner Cable | | | | | |

| | 8.25% 2/14/14 | | 5,000 | | | 5,966 |

| | 8.25% 4/1/19 | | 40,000 | | | 50,320 |

| | Verizon Communications | | | | | |

| | 6.40% 2/15/38 | | 10,000 | | | 11,359 |

| | 7.35% 4/1/39 | | 10,000 | | | 12,666 |

| # | Vivendi 144A | | | | | |

| | 5.75% 4/4/13 | | 30,000 | | | 32,338 |

| | 6.625% 4/4/18 | | 10,000 | | | 11,273 |

| | | | | | | 842,144 |

15

Statement of net assets

Delaware Core Bond Fund

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Consumer Cyclical – 0.99% | | | | | |

| #u | CVS Pass Through Trust 144A 8.353% 7/10/31 | $ | 113,077 | | $ | 136,823 |

| | International Game Technology 5.50% 6/15/20 | | 20,000 | | | 20,872 |

| | Wal-Mart Stores 3.625% 7/8/20 | | 40,000 | | | 40,279 |

| | | | | | | 197,974 |

| Consumer Non-Cyclical – 4.23% | | | | | |

| | Abbott Laboratories 4.125% 5/27/20 | | 65,000 | | | 68,985 |

| | Amgen 4.50% 3/15/20 | | 10,000 | | | 10,823 |

| # | Anheuser-Busch InBev Worldwide 144A | | | | | |

| | 5.00% 4/15/20 | | 70,000 | | | 75,314 |

| | Baxter International 4.50% 8/15/19 | | 50,000 | | | 54,104 |

| # | Brambles USA 144A | | | | | |

| | 3.95% 4/1/15 | | 20,000 | | | 20,491 |

| | 5.35% 4/1/20 | | 20,000 | | | 20,864 |

| | Covidien International Finance 4.20% 6/15/20 | | 45,000 | | | 46,836 |

| | General Mills 5.65% 2/15/19 | | 15,000 | | | 17,200 |

| # | Genzyme 144A | | | | | |

| | 3.625% 6/15/15 | | 15,000 | | | 15,786 |

| | 5.00% 6/15/20 | | 35,000 | | | 38,021 |

| | Hospira 6.40% 5/15/15 | | 30,000 | | | 34,330 |

| | Kraft Foods 5.375% 2/10/20 | | 40,000 | | | 43,836 |

| | Life Technologies | | | | | |

| | 4.40% 3/1/15 | | 5,000 | | | 5,248 |

| | 6.00% 3/1/20 | | 65,000 | | | 71,795 |

| | Medco Health Solutions 7.125% 3/15/18 | | 120,000 | | | 143,746 |

| | Pfizer 6.20% 3/15/19 | | 30,000 | | | 36,263 |

| # | Roche Holdings 144A 6.00% 3/1/19 | | 60,000 | | | 70,905 |

| | St. Jude Medical 4.875% 7/15/19 | | 10,000 | | | 11,044 |

| | Yale University 2.90% 10/15/14 | | 20,000 | | | 21,074 |

| | Zimmer Holdings 4.625% 11/30/19 | | 40,000 | | | 42,294 |

| | | | | | | 848,959 |

| Electric – 3.18% | | | | | |

| # | American Transmission Systems 144A 5.25% 1/15/22 | | 75,000 | | | 79,080 |

| | Commonwealth Edison | | | | | |

| | 4.00% 8/1/20 | | 55,000 | | | 56,358 |

| | 5.80% 3/15/18 | | 5,000 | | | 5,758 |

16

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Electric (continued) | | | | | |

| | Duke Energy Carolinas 4.30% 6/15/20 | $ | 45,000 | | $ | 48,244 |

| | Illinois Power 9.75% 11/15/18 | | 45,000 | | | 59,227 |

| | Indiana Michigan Power 7.00% 3/15/19 | | 45,000 | | | 53,910 |

| | Jersey Central Power & Light 5.625% 5/1/16 | | 20,000 | | | 21,896 |

| | PacifiCorp 5.50% 1/15/19 | | 235,000 | | | 271,303 |

| | Pennsylvania Electric 5.20% 4/1/20 | | 20,000 | | | 21,115 |

| | Public Service Oklahoma 5.15% 12/1/19 | | 20,000 | | | 21,481 |

| | | | | | | 638,372 |

| Energy – 3.20% | | | | | |

| | EOG Resources 2.95% 6/1/15 | | 25,000 | | | 25,828 |

| | Nexen 7.50% 7/30/39 | | 45,000 | | | 56,032 |

| | Noble Energy 8.25% 3/1/19 | | 55,000 | | | 68,713 |

| | Noble Holding International | | | | | |

| | 4.90% 8/1/20 | | 30,000 | | | 31,420 |

| | 6.20% 8/1/40 | | 15,000 | | | 16,204 |

| | Petrobras International Finance 5.75% 1/20/20 | | 55,000 | | | 58,750 |

| | Pride International 8.50% 6/15/19 | | 15,000 | | | 16,838 |

| # | Ras Laffan Liquefied Natural Gas III 144A | | | | | |

| | 5.832% 9/30/16 | | 90,000 | | | 98,526 |

| # | SEMCO Energy 144A 5.15% 4/21/20 | | 60,000 | | | 64,099 |

| | Total Capital 4.45% 6/24/20 | | 55,000 | | | 58,379 |

| | Transocean 6.80% 3/15/38 | | 15,000 | | | 13,538 |

| | Weatherford International 9.625% 3/1/19 | | 55,000 | | | 69,756 |

| # | Woodside Finance 144A | | | | | |

| | 4.50% 11/10/14 | | 50,000 | | | 52,121 |

| | 8.125% 3/1/14 | | 10,000 | | | 11,570 |

| | | | | | | 641,774 |

| Financials – 1.08% | | | | | |

| | Capital One Capital V 10.25% 8/15/39 | | 30,000 | | | 32,663 |

| | City National Capital Trust I 9.625% 2/1/40 | | 50,000 | | | 53,099 |

| # | Erac USA Finance 144A 5.25% 10/1/20 | | 20,000 | | | 20,539 |

| | General Electric Capital 6.00% 8/7/19 | | 100,000 | | | 110,884 |

| | | | | | | 217,185 |

17

Statement of net assets

Delaware Core Bond Fund

| | | Principal amount (U.S. $) | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Insurance – 1.37% | | | | | |

| | MetLife 6.817% 8/15/18 | $ | 185,000 | | $ | 212,599 |

| | Prudential Financial 3.875% 1/14/15 | | 60,000 | | | 61,834 |

| | | | | | | 274,433 |

| Natural Gas – 1.95% | | | | | |

| • | Enbridge Energy Partners 8.05% 10/1/37 | | 30,000 | | | 29,593 |

| | Energy Transfer Partners 9.70% 3/15/19 | | 35,000 | | | 44,116 |

| | Enterprise Products Operating | | | | | |

| | 7.50% 2/1/11 | | 15,000 | | | 15,416 |

| | 9.75% 1/31/14 | | 60,000 | | | 73,424 |

| | Kinder Morgan Energy Partners | | | | | |

| | 6.55% 9/15/40 | | 10,000 | | | 11,054 |

| | 9.00% 2/1/19 | | 45,000 | | | 58,476 |

| # | Midcontinent Express Pipeline 144A | | | | | |

| | 5.45% 9/15/14 | | 10,000 | | | 10,574 |

| | 6.70% 9/15/19 | | 45,000 | | | 47,881 |

| | Plains All American Pipeline/Finance 8.75% 5/1/19 | | 40,000 | | | 49,916 |

| • | TransCanada PipeLines 6.35% 5/15/67 | | 55,000 | | | 50,117 |

| | | | | | | 390,567 |

| Real Estate – 0.39% | | | | | |

| | Developers Diversified Realty 7.50% 4/1/17 | | 10,000 | | | 9,914 |

| # | Digital Realty Trust 144A 5.875% 2/1/20 | | 5,000 | | | 5,131 |

| | ProLogis | | | | | |

| | 6.25% 3/15/17 | | 5,000 | | | 4,846 |

| | 7.375% 10/30/19 | | 45,000 | | | 44,249 |

| | Regency Centers 5.875% 6/15/17 | | 14,000 | | | 14,910 |

| | | | | | | 79,050 |

| Technology – 0.22% | | | | | |

| | National Semiconductor | | | | | |

| | 3.95% 4/15/15 | | 15,000 | | | 15,463 |

| | 6.60% 6/15/17 | | 25,000 | | | 28,247 |

| | | | | | | 43,710 |

18

| | | | Principal amount (U.S. $) | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | |

| Transportation – 0.11% | | | | | | |

| | Burlington Northern Santa Fe 4.70% 10/1/19 | | $ | 20,000 | | $ | 21,404 |

| | | | | | | | 21,404 |

| Total Corporate Bonds (cost $5,932,795) | | | | | | 6,169,134 |

| | | | | | | | |

| Non-Agency Asset-Backed Securities – 8.45% | | | | | | |

| #• | AH Mortgage Advance Trust Series 2009-ADV3 A1 | | | | | | |

| | 144A 2.297% 10/6/21 | | | 110,000 | | | 109,923 |

| | Ally Auto Receivables Trust Series 2010-2 A3 | | | | | | |

| | 1.38% 7/15/14 | | | 15,000 | | | 15,114 |

| • | American Express Issuance Trust Series 2005-2 A | | | | | | |

| | 0.411% 8/15/13 | | | 100,000 | | | 99,601 |

| | #Bank of America Auto Trust Series 2009-3A A4 | | | | | | |

| | 144A 2.67% 12/15/16 | | | 100,000 | | | 103,527 |

| • | Bank of America Credit Card Trust | | | | | | |

| | Series 2007-A6 A6 0.401% 9/15/16 | | | 75,000 | | | 74,105 |

| | Series 2008-A5 A5 1.541% 12/16/13 | | | 100,000 | | | 100,917 |

| • | Capital One Multi-Asset Execution Trust | | | | | | |

| | Series 2007-A4 A4 0.371% 3/16/15 | | | 100,000 | | | 99,382 |

| • | Chase Issuance Trust Series 2009-A2 A2 | | | | | | |

| | 1.891% 4/15/14 | | | 200,000 | | | 204,348 |

| • | Citibank Credit Card Issuance Trust | | | | | | |

| | Series 2004-C1 C1 0.991% 7/15/13 | | | 20,000 | | | 19,800 |

| | Series 2008-A6 A6 1.538% 5/22/17 | | | 115,000 | | | 118,850 |

| | Series 2009-A1 A1 2.091% 3/17/14 | | | 100,000 | | | 102,467 |

| | Series 2009-A2 A2 1.891% 5/15/14 | | | 100,000 | | | 102,345 |

| | CNH Equipment Trust | | | | | | |

| | •Series 2007-A A4 0.381% 9/17/12 | | | 3,697 | | | 3,694 |

| | Series 2008-A A3 4.12% 5/15/12 | | | 891 | | | 895 |

| | Series 2008-A A4A 4.93% 8/15/14 | | | 10,000 | | | 10,356 |

| | Series 2008-B A3A 4.78% 7/16/12 | | | 2,931 | | | 2,962 |

| | Series 2009-C A3 1.85% 12/16/13 | | | 5,000 | | | 5,065 |

| | Series 2009-C A4 3.00% 8/17/15 | | | 110,000 | | | 114,938 |

| | Series 2010-A A4 2.49% 1/15/16 | | | 50,000 | | | 51,517 |

| | Discover Card Master Trust Series 2008-A4 A4 | | | | | | |

| | 5.65% 12/15/15 | | | 100,000 | | | 112,110 |

19

Statement of net assets

Delaware Core Bond Fund

| | | | Principal amount (U.S. $) | | Value (U.S. $) |

| Non-Agency Asset-Backed Securities (continued) | | | | | | |

| | Harley Davidson Motorcycle Trust 2008-1 A4 | | | | | | |

| | 4.90% 12/15/13 | | $ | 100,000 | | $ | 104,921 |

| | John Deere Owner Trust Series 2010-A A4 | | | | | | |

| | 2.13% 10/17/16 | | | 35,000 | | | 35,839 |

| • | Merrill Auto Trust Securitization Series 2007-1 A4 | | | | | | |

| | 0.401% 12/15/13 | | | 3,931 | | | 3,914 |

| | Mid-State Trust Series 11 A1 4.864% 7/15/38 | | | 26,818 | | | 25,986 |

| #• | Nissan Master Owner Trust Receivables | | | | | | |

| | Series 2010-AA A 144A 1.491% 1/15/15 | | | 50,000 | | | 50,132 |

| • | World Omni Auto Receivables Trust | | | | | | |

| | Series 2007-B A3B 0.731% 1/17/12 | | | 3,412 | | | 3,412 |

| | World Omni Automobile Lease Securitization Trust | | | | | | |

| | Series 2009-A A3 1.65% 2/15/13 | | | 20,000 | | | 20,183 |

| Total Non-Agency Asset-Backed Securities | | | | | | |

| | (cost $1,681,930) | | | | | | 1,696,303 |

| | | | | | | |

| Non-Agency Collateralized Mortgage Obligation – 0.42% | | | | | | |

| | Deutsche Alternative Securities Loan Trust | | | | | | |

| | Series 2003-4XS A6A 4.82% 10/25/33 | | | 89,738 | | | 84,049 |

| Total Non-Agency Collateralized Mortgage Obligation | | | | | | |

| | (cost $87,705) | | | | | | 84,049 |

| | | | | | | |

| Regional Authorities – 2.87%Δ | | | | | | |

| Canada – 2.87% | | | | | | |

| | Province of British Columbia Canada 2.85% 6/15/15 | | | 65,000 | | | 68,375 |

| | Province of Manitoba Canada 2.625% 7/15/15 | | | 25,000 | | | 26,018 |

| | Province of Nova Scotia Canada 2.375% 7/21/15 | | | 40,000 | | | 40,550 |

| | Province of Ontario Canada | | | | | | |

| | 4.10% 6/16/14 | | | 145,000 | | | 158,366 |

| | 4.40% 4/14/20 | | | 100,000 | | | 108,264 |

| | Province of Quebec Canada | | | | | | |

| | 4.875% 5/5/14 | | | 60,000 | | | 66,480 |

| | 5.00% 3/1/16 | | | 95,000 | | | 107,699 |

| Total Regional Authorities (cost $553,451) | | | | | | 575,752 |

20

| | | | Principal amount (U.S. $) | | Value (U.S. $) |

| Sovereign Agencies – 4.16%Δ | | | | | | |

| Canada – 0.76% | | | | | | |

| | Export Development Canada | | | | | | |

| | 2.25% 5/28/15 | | $ | 40,000 | | $ | 41,084 |

| | 3.125% 4/24/14 | | | 105,000 | | | 111,900 |

| | | | | | | | 152,984 |

| Norway – 2.35% | | | | | | |

| | Eksportfinans | | | | | | |

| | 1.875% 4/2/13 | | | 105,000 | | | 106,850 |

| | 3.00% 11/17/14 | | | 150,000 | | | 156,885 |

| | 5.50% 5/25/16 | | | 90,000 | | | 103,292 |

| | #Kommunalbanken 144A 2.75% 5/5/15 | | | 100,000 | | | 103,144 |

| | | | | | | | 470,171 |

| Sweden – 1.05% | | | | | | |

| | Swedish Export Credit 3.25% 9/16/14 | | | 200,000 | | | 210,640 |

| | | | | | | | 210,640 |

| Total Sovereign Agencies (cost $808,119) | | | | | | 833,795 |

| | | | | | | |

| Supranational Banks – 2.50% | | | | | | |

| | African Development Bank 3.00% 5/27/14 | | | 50,000 | | | 52,960 |

| | Asian Development Bank | | | | | | |

| | 1.625% 7/15/13 | | | 105,000 | | | 106,901 |

| | 2.75% 5/21/14 | | | 65,000 | | | 68,233 |

| | Inter-American Development Bank | | | | | | |

| | 1.625% 7/15/13 | | | 70,000 | | | 71,054 |

| | 2.25% 7/15/15 | | | 40,000 | | | 40,931 |

| | 3.50% 7/8/13 | | | 25,000 | | | 26,674 |

| | International Bank for Reconstruction & | | | | | | |

| | Development 2.375% 5/26/15 | | | 70,000 | | | 72,412 |

| | International Finance 3.00% 4/22/14 | | | 35,000 | | | 37,350 |

| | Nordic Investment Bank 2.50% 7/15/15 | | | 25,000 | | | 25,738 |

| Total Supranational Banks (cost $488,896) | | | | | | 502,253 |

21

Statement of net assets

Delaware Core Bond Fund

| | | | Principal amount (U.S. $) | | Value (U.S. $) | |

| U.S. Treasury Obligations – 10.81% | | | | | | | |

| | U.S. Treasury Bond 4.625% 2/15/40 | | $ | 1,035,000 | | $ | 1,151,114 | |

| | U.S. Treasury Notes | | | | | | | |

| | 1.875% 6/30/15 | | | 25,000 | | | 25,373 | |

| | 3.50% 5/15/20 | | | 945,000 | | | 992,550 | |

| Total U.S. Treasury Obligations (cost $2,129,885) | | | | | | 2,169,037 | |

| | | | | | | | |

| | | | Number of shares | | | | |

| Preferred Stock – 0.18% | | | | | | | |

| • | PNC Financial Services Group 8.25% | | | 35,000 | | | 36,653 | |

| Total Preferred Stock (cost $30,388) | | | | | | 36,653 | |

| | | | | | | | |

| | | | Principal amount (U.S. $) | | | | |

| ≠Discount Note – 27.69% | | | | | | | |

| | Federal Home Loan Bank 0.06% 8/2/10 | | $ | 5,556,029 | | | 5,556,020 | |

| Total Discount Note (cost $5,556,020) | | | | | | 5,556,020 | |

| | | | | | | | |

| Total Value of Securities – 128.06% | | | | | | | |

| | (cost $25,190,959) | | | | | | 25,693,693 | |

| Liabilities Net of Receivables and | | | | | | | |

| | Other Assets – (28.06%)z | | | | | | (5,629,259 | ) |

| Net Assets Applicable to 1,855,532 | | | | | | | |

| | Shares Outstanding – 100.00% | | | | | $ | 20,064,434 | |

| | | | | | | | | |

| Net Asset Value – Delaware Core Bond Fund Class A | | | | | | | |

| | ($4,022,287 / 374,288 Shares) | | | | | | $10.75 | |

| Net Asset Value – Delaware Core Bond Fund Class C | | | | | | | |

| | ($145,317 / 13,472 Shares) | | | | | | $10.79 | |

| Net Asset Value – Delaware Core Bond Fund Class R | | | | | | | |

| | ($2,168 / 200.20 Shares) | | | | | | $10.83 | |

| Net Asset Value – Delaware Core Bond Fund Institutional Class | | | | |

| | ($15,894,662 / 1,467,572 Shares) | | | | | | $10.83 | |

22

| | | | | |

| Components of Net Assets at July 31, 2010: | | | | |

| Shares of beneficial interest (unlimited authorization – no par) | | $ | 19,708,291 | |

| Undistributed net investment income | | | 3,325 | |

| Accumulated net realized loss on investments | | | (149,916 | ) |

| Net unrealized appreciation of investments | | | 502,734 | |

| Total net assets | | $ | 20,064,434 | |

| • | Variable rate security. The rate shown is the rate as of July 31, 2010. Interest rates reset periodically. |

| w | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At July 31, 2010, the aggregate amount of Rule 144A securities was $1,395,948, which represented 6.96% of the Fund’s net assets. See Note 9 in “Notes to financial statements.” |

| ≠ | The rate shown is the effective yield at the time of purchase. |

| Δ | Securities have been classified by country of origin. |

| z | Of this amount, $6,591,299 represents payable for securities purchased as of July 31, 2010. |

Summary of abbreviations:

ARM — Adjustable Rate Mortgage

FHAVA — Federal Housing Administration & Veterans Administration

GNMA — Government National Mortgage Association

REMIC — Real Estate Mortgage Investment Conduit

S.F. — Single Family

TBA — To be announced

yr — Year

23

Statement of net assets

Delaware Core Bond Fund

| | | | |

| Net Asset Value and Offering Price Per Share – | | | |

| Delaware Core Bond Fund | | | |

| Net asset value Class A (A) | | $ | 10.75 |

| Sales charge (4.50% of offering price) (B) | | | 0.51 |

| Offering Price | | $ | 11.26 |

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| (B) | See the current prospectus for purchases of $100,000 or more. |

See accompanying Notes, which are an integral part of the financial statements

24

Statements of operations

Delaware Core Bond Fund

| | | 11/1/09 | | Year |

| | | to | | Ended |

| | | 7/31/10* | | 10/31/09 |

| Investment Income: | | | | | | |

| Interest | | $ | 334,867 | | | $ | 343,268 | |

| Dividends | | | 3,300 | | | | 5,930 | |

| Securities lending income | | | — | | | | 1,792 | |

| | | | 338,167 | | | | 350,990 | |

| Expenses: | | | | | | | | |

| Registration fees | | | 60,701 | | | | 20,798 | |

| Management fees | | | 57,567 | | | | 28,311 | |

| Legal fees | | | 30,429 | | | | 3,382 | |

| Reports and statements to shareholders | | | 20,927 | | | | 4,763 | |

| Audit and tax | | | 16,815 | | | | 13,316 | |

| Dividend disbursing and transfer agent fees and expenses | | | 15,062 | | | | 3,968 | |

| Distribution expense – Class A | | | 11,024 | | | | 1,656 | |

| Distribution expense – Class C | | | 313 | | | | 2 | |

| Distribution expense – Class R | | | 8 | | | | 1 | |

| Pricing fees | | | 9,754 | | | | 10,594 | |

| Dues and services | | | 6,122 | | | | 37 | |

| Accounting and administration expenses | | | 4,574 | | | | 2,776 | |

| Custodian fees | | | 2,023 | | | | 1,898 | |

| Trustees’ fees | | | 560 | | | | 479 | |

| Consulting fees | | | 195 | | | | 110 | |

| Insurance fees | | | 168 | | | | 192 | |

| Trustees’ expenses | | | 40 | | | | 37 | |

| | | | 236,282 | | | | 92,320 | |

| Less fees waived | | | (150,310 | ) | | | (59,577 | ) |

| Less waived distribution expenses – Class A | | | (1,837 | ) | | | (276 | ) |

| Less waived distribution expenses – Class R | | | (1 | ) | | | — | |

| Less expense paid indirectly | | | (2 | ) | | | — | |

| Total operating expenses | | | 84,132 | | | | 32,467 | |

| Net Investment Income | | | 254,035 | | | | 318,523 | |

26

| Net Realized and Unrealized Gain (Loss) on Investments: | | | | | | | |

| Net realized gain (loss) on: | | | | | | | |

| Investments | | $ | 300,943 | | $ | 279,025 | |

| Futures contracts | | | — | | | 1,285 | |

| Written options | | | — | | | (64,814 | ) |

| Swap contracts | | | — | | | (5,145 | ) |

| Net realized gain | | | 300,943 | | | 210,351 | |

| Net change in unrealized appreciation/depreciation of investments | | | 396,380 | | | 641,103 | |

| Net Realized and Unrealized Gain on Investments | | | 697,323 | | | 851,454 | |

| | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 951,358 | | $ | 1,169,977 | |

*During the period ended July 31, 2010 the Fund changed its fiscal year end from October to July.

See accompanying Notes, which are an integral part of the financial statements

27

Statements of changes in net assets

Delaware Core Bond Fund

| | | 11/1/09 | | Year | | Year |

| | | to | | Ended | | Ended |

| | | 7/31/10* | | 10/31/09 | | 10/31/08 |

| Increase (Decrease) in Net Assets | | | | | | | | | | | | |

| from Operations: | | | | | | | | | | | | |

| Net investment income | | $ | 254,035 | | | $ | 318,523 | | | $ | 364,424 | |

| Net realized gain on investments | | | 300,943 | | | | 210,351 | | | | 157,470 | |

| Net change in unrealized appreciation/ | | | | | | | | | | | | |

| depreciation of investments | | | 396,380 | | | | 641,103 | | | | (539,825 | ) |

| Net increase (decrease) in net assets resulting | | | | | | | | | | | | |

| from operations | | | 951,358 | | | | 1,169,977 | | | | (17,931 | ) |

| | | | | | | | | | | | | |

| Dividends and Distributions to | | | | | | | | | | | | |

| Shareholders from: | | | | | | | | | | | | |

| Net investment income: | | | | | | | | | | | | |

| Class A | | | (104,466 | ) | | | (337,265 | ) | | | (393,379 | ) |

| Class C | | | (507 | ) | | | (6 | ) | | | — | |

| Class R | | | (24 | ) | | | (6 | ) | | | — | |

| Institutional Class | | | (198,771 | ) | | | (7 | ) | | | — | |

| | | | (303,768 | ) | | | (337,284 | ) | | | (393,379 | ) |

| | | | | | | | | | | | | |

| Capital Share Transactions: | | | | | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | | | | | |

| Class A | | | 415,835 | | | | 153,596 | | | | 144,850 | |

| Class C | | | 140,412 | | | | 2,022 | | | | — | |

| Class R | | | — | | | | 2,022 | | | | — | |

| Institutional Class | | | 16,968,441 | | | | 2,022 | | | | — | |

| | | | | | | | | | | | | |

| Net asset value of shares issued upon | | | | | | | | | | | | |

| reinvestment of dividends and distributions: | | | | | | | | | | | | |

| Class A | | | 104,466 | | | | 300,080 | | | | 347,507 | |

| Class C | | | 483 | | | | 4 | | | | — | |

| Class R | | | 24 | | | | 5 | | | | — | |

| Institutional Class | | | 190,236 | | | | 6 | | | | — | |

| | | | 17,819,897 | | | | 459,757 | | | | 492,357 | |

28

| | | 11/1/09 | | Year | | Year |

| | | to | | Ended | | Ended |

| | | 7/31/10* | | 10/31/09 | | 10/31/08 |

| Capital Share Transactions (continued): | | | | | | | | | | | | |

| Cost of shares repurchased: | | | | | | | | | | | | |

| Class A | | $ | (3,001,525 | ) | | $ | (1,697,319 | ) | | $ | (7,114,923 | ) |

| Institutional Class | | | (1,754,001 | ) | | | — | | | | — | |

| | | | (4,755,526 | ) | | | (1,697,319 | ) | | | (7,114,923 | ) |

| Increase (decrease) in net assets derived from | | | | | | | | | | | | |

| capital share transactions | | | 13,064,371 | | | | (1,237,562 | ) | | | (6,622,566 | ) |

| Net Increase (Decrease) in Net Assets | | | 13,711,961 | | | | (404,869 | ) | | | (7,033,876 | ) |

| | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | |

| Beginning of period | | | 6,352,473 | | | | 6,757,342 | | | | 13,791,218 | |

| End of period (including undistributed net | | | | | | | | | | | | |

| investment income of $3,325, $9,166 and | | | | | | | | | | | | |

| $8,315, respectively) | | $ | 20,064,434 | | | $ | 6,352,473 | | | $ | 6,757,342 | |

*During the period ended July 31, 2010 the Fund changed its fiscal year end from October to July.

See accompanying Notes, which are an integral part of the financial statements

29

Financial highlights

Delaware Core Bond Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income3 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return4 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 During the period ended July 31, 2010, the Fund changed its fiscal year end from October to July. Ratios have been annualized and portfolio turnover and total return have not been annualized. |

2 Effective September 30, 2009, the Fund received all of the assets and liabilities of the Delaware Pooled® Trust – The Intermediate Fixed Income Portfolio (the Portfolio). The Class A shares financial highlights for the periods prior to September 30, 2009 reflect the performance of the Institutional Class shares of the Portfolio. Fees paid by Portfolio were less than Class A share fees, and performance would have been lower if Class A fees were paid. See Note 2 in “Notes to financial statements.” |

See accompanying Notes, which are an integral part of the financial statements

30

| | 11/1/09 | | | | | | | | | | | | | | | | |

| | to | | Year Ended | |

| | 7/31/101 | | 10/31/092 | | 10/31/082 | | 10/31/072 | | 10/31/062 | | 10/31/052 | |

| | $10.370 | | | $9.200 | | | $9.880 | | | $9.940 | | | $9.960 | | | $10.310 | | |

| | | | |

| | | | |

| | 0.159 | | | 0.445 | | | 0.460 | | | 0.457 | | | 0.427 | | | 0.382 | | |

| | 0.434 | | | 1.195 | | | (0.643 | ) | | (0.014 | ) | | 0.025 | | | (0.283 | ) | |

| | 0.593 | | | 1.640 | | | (0.183 | ) | | 0.443 | | | 0.452 | | | 0.099 | | |

| | | | |

| | | | |

| | (0.213 | ) | | (0.470 | ) | | (0.497 | ) | | (0.503 | ) | | (0.472 | ) | | (0.449 | ) | |

| | (0.213 | ) | | (0.470 | ) | | (0.497 | ) | | (0.503 | ) | | (0.472 | ) | | (0.449 | ) | |

| | | | |

| | $10.750 | | | $10.370 | | | $ 9.200 | | | $ 9.880 | | | $ 9.940 | | | $ 9.960 | | |

| | | | |

| | 5.89% | | | 18.29% | | | (2.07% | ) | | 4.68% | | | 4.68% | | | 0.97% | | |

| | | | |

| | | | |

| | $4,022 | | | $6,346 | | | $6,757 | | | $13,791 | | | $28,795 | | | $15,786 | | |

| | 0.90% | | | 0.70% | | | 0.39% | | | 0.39% | | | 0.43%5 | | | 0.44% | | |

| | | | |

| | 2.25% | | | 1.60% | | | 1.12% | | | 0.66% | | | 0.67% | | | 0.68% | | |

| | 2.04% | | | 4.35% | | | 4.66% | | | 4.61% | | | 4.38% | | | 3.76% | | |

| | | | |

| | 0.69% | | | 3.45% | | | 3.93% | | | 4.33% | | | 4.14% | | | 3.52% | | |

| | 528% | | | 346% | | | 391% | | | 251% | | | 342% | | | 212% | | |

3 The average shares outstanding method has been applied for per share information. |

4 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during some of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

5 Ratio for the year ended October 31, 2006, including fees paid indirectly in accordance with Securities and Exchange Commission rules, was 0.44%. |

31

Financial highlights

Delaware Core Bond Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income from investment operations: |

| Net investment income3 |

| Net realized and unrealized gain on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return4 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived |

| Ratio of net investment income to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived |

| Portfolio turnover |

1 During the period ended July 31, 2010, the Fund changed its fiscal year end from October to July. Ratios have been annualized and portfolio turnover and total return have not been annualized. |

2 Date of commencement of operations; ratios have been annualized and total return has not been annualized. |

3 The average shares outstanding method has been applied for per share information. |

See accompanying Notes, which are an integral part of the financial statements

32

| | 11/1/09 | | | 9/30/092 | | |

| | to | | | to | | |

| | 7/31/101 | | | 10/31/09 | | |

| | $10.370 | | | $10.310 | | |

| | | | |

| | | | |

| | 0.103 | | | 0.030 | | |

| | 0.469 | | | 0.059 | | |

| | 0.572 | | | 0.089 | | |

| | | | |

| | | | |

| | (0.152 | ) | | (0.029 | ) | |

| | (0.152 | ) | | (0.029 | ) | |

| | | | |

| | $10.790 | | | $10.370 | | |

| | | | |

| | 5.67% | | | 0.86% | | |

| | | | |

| | | | |

| | $145 | | | $2 | | |

| | 1.65% | | | 1.65% | | |

| | | | |

| | 2.95% | | | 5.32% | | |

| | 1.29% | | | 3.33% | | |

| | | | |

| | (0.01% | ) | | (0.34% | ) | |

| | 528% | | | 346% | 5 | |

4 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

5 Portfolio turnover reflects the portfolio turnover rate that the Fund experienced from 11/1/08 through 10/31/09. |

33

Financial highlights

Delaware Core Bond Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income from investment operations: |

| Net investment income3 |

| Net realized and unrealized gain on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return4 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived |

| Portfolio turnover |

1 During the period ended July 31, 2010, the Fund changed its fiscal year end from October to July. Ratios have been annualized and portfolio turnover and total return have not been annualized. |

2 Date of commencement of operations; ratios have been annualized and total return has not been annualized. |

3 The average shares outstanding method has been applied for per share information. |

See accompanying Notes, which are an integral part of the financial statements

34

| | 11/1/09 | | | 9/30/092 | | |

| | to | | | to | | |

| | 7/31/101 | | | 10/31/09 | | |

| | $10.370 | | | $10.310 | | |

| | | | |

| | | | |

| | 0.141 | | | 0.035 | | |

| | 0.510 | | | 0.059 | | |

| | 0.651 | | | 0.094 | | |

| | | | |

| | | | |

| | (0.191 | ) | | (0.034 | ) | |

| | (0.191 | ) | | (0.034 | ) | |

| | | | |

| | $10.830 | | | $10.370 | | |

| | | | |

| | 6.44% | | | 0.90% | | |

| | | | |

| | | | |

| | $2 | | | $2 | | |

| | 1.15% | | | 1.15% | | |

| | | | |

| | 2.55% | | | 4.92% | | |

| | 1.79% | | | 3.83% | | |

| | | | |

| | 0.39% | | | 0.06% | | |

| | 528% | | | 346% | 5 | |

4 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects waivers by the manager and distributor. Performance would have been lower had the waivers not been in effect. |

5 Portfolio turnover reflects the portfolio turnover rate that the Fund experienced from 11/1/08 through 10/31/09. |

35

Financial highlights

Delaware Core Bond Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income from investment operations: |

| Net investment income3 |

| Net realized and unrealized gain on investments |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return4 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived |

| Portfolio turnover |

1 During the period ended July 31, 2010, the Fund changed its fiscal year end from October to July. Ratios have been annualized and portfolio turnover and total return have not been annualized. |

2 Date of commencement of operations; ratios have been annualized and total return has not been annualized. |

3 The average shares outstanding method has been applied for per share information. |

See accompanying Notes, which are an integral part of the financial statements

36

| | 11/1/09 | | | 9/30/092 | | |

| | to | | | to | | |

| | 7/31/101 | | | 10/31/09 | | |

| | $10.370 | | | $10.310 | | |

| | | | |

| | | | |

| | 0.181 | | | 0.039 | | |

| | 0.512 | | | 0.060 | | |

| | 0.693 | | | 0.099 | | |

| | | | |

| | | | |

| | (0.233 | ) | | (0.039 | ) | |

| | (0.233 | ) | | (0.039 | ) | |

| | | | |

| | $10.830 | | | $10.370 | | |

| | | | |

| | 6.76% | | | 0.96% | | |

| | | | |

| | | | |

| | $15,895 | | | $2 | | |

| | 0.65% | | | 0.65% | | |

| | | | |

| | 1.95% | | | 4.32% | | |

| | 2.29% | | | 4.33% | | |

| | | | |

| | 0.99% | | | 0.66% | | |

| | 528% | | | 346% | 5 | |

4 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

5 Portfolio turnover reflects the portfolio turnover rate that the Fund experienced from 11/1/08 through 10/31/09. |

37

| Notes to financial statements | |

| Delaware Core Bond Fund | July 31, 2010 |

Delaware Group® Income Funds (Trust) is organized as a Delaware statutory trust and offers five Series: Delaware Core Bond Fund, Delaware Corporate Bond Fund, Delaware Extended Duration Bond Fund, Delaware Diversified Floating Rate Fund and Delaware High-Yield Opportunities Fund. These financial statements and the related notes pertain to Delaware Core Bond Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended, and offers Class A, Class C, Class R and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 4.50%. Class A share purchases of $1,000,000 or more will incur a contingent deferred sales charge (CDSC) of 1% if redeemed during the first year and 0.50% during the second year, provided that Delaware Distributors, L.P. (DDLP) paid a fin ancial advisor a commission on the purchase of those shares. Class C shares are sold with a CDSC of 1%, if redeemed during the first twelve months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors.

The investment objective of the Fund is to seek maximum long term total return, consistent with reasonable risk.

In May 2009, the Fund’s Board of Trustees (Board) approved changing the Fund’s fiscal year-end from October 31 to July 31, effective July 31, 2010.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities, except those traded on the Nasdaq Stock Market, Inc. (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange (NYSE) on the valuation date. Securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If on a particular day an equity security does not trade, then the mean between the bid and ask prices will be used. Securities listed on a foreign exchange are valued at the last quoted sales price on the valuation date. Short-term debt securities are valued at market value. U.S. government and agency securities are valued at the mean between the bid and ask prices. Other debt securities, credit default swap (CDS) contracts and interest rate swap co ntracts are valued by an independent pricing service or broker. To the extent current market prices are not available, the pricing service may take into account developments related to the specific security, as well as transactions in comparable securities. Financial futures contracts and options on futures contracts are valued at the daily quoted settlement prices. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Fund’s Board. In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The Fund may use fair value pricing more frequently for securities traded primarily in non-U.S. markets because, among other things, most foreign markets close well before the Fund values its securities at 4:00 p.m. Eastern time. The earlier close of t hese foreign markets gives rise to the possibility that significant events, including broad market moves, government actions or pronouncements, aftermarket trading, or news events may have occurred in the interim. To account for this, the Fund may frequently value foreign securities using fair value prices based on third-party vendor modeling tools (international fair value pricing).

38

Federal Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (October 31, 2007 – July 3 1, 2010), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. During the period ended July 31, 2010, the Fund changed its fiscal year end from October to July.

Class Accounting — Investment income and common expenses are allocated to the various classes of the Fund on the basis of “settled shares” of each class in relation to the net assets of the Fund. Realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Repurchase Agreements — The Fund may invest in a pooled cash account along with other members of the Delaware Investments® Family of Funds pursuant to an exemptive order issued by the Securities and Exchange Commission. The aggregate daily balance of the pooled cash account is invested in repurchase agreements secured by obligations of the U.S. government. The respective collateral is held by the Fund’s custodian bank until the maturity of the respective repurchase agreements. Each repurchase agreement is at least 102% collateralized. However, in the event of default or bankruptcy by the counterparty to the agreement, realization of the collateral may be subject to legal proceedings. At July 31, 2010, the Fund held no investments in repurchase agree ments.

To Be Announced Trades — The Fund may contract to purchase securities for a fixed price at a transaction date beyond the customary settlement period (i.e., “when issued,” “delayed delivery,” “forward commitment,” or “TBA transactions”) consistent with the Fund’s ability to manage its investment portfolio and meet redemption requests. These transactions involve a commitment by the Fund to purchase securities for a predetermined price or yield with payment and delivery taking place more than three days in the future, or after a period longer than the customary settlement period for that type of security. No interest will be earned by the Fund on such purchases until the securities are delivered; however the market value may change prior to delivery.

Use of Estimates — The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material.

39