QuickLinks -- Click here to rapidly navigate through this document

Exhibit 15.01

Notice of Annual and Special Meeting

of Shareholders

Friday, May 6, 2005

Management Proxy Circular

AGNICO-EAGLE MINES LIMITED

Suite 500

145 King Street East

Toronto, Ontario

M5C 2Y7

NOTICE OF 2005 ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

| Date: | Friday, May 6, 2005 | |||

Time: | 10:30 a.m. (Toronto time) | |||

Place: | St. Lawrence Great Hall East Room — 3rd Floor 157 King Street East Toronto, Ontario M5C 1G9 | |||

Business of the Meeting: | (1) | Receipt of the financial statements of Agnico-Eagle for the year ended December 31, 2004 and the auditors' report on the statements; | ||

(2) | Election of directors; | |||

(3) | Appointment of auditors; | |||

(4) | Consideration of and, if deemed advisable, passing of an ordinary resolution reconfirming the Shareholders Rights Plan of Agnico-Eagle; and | |||

(5) | Consideration of any other business which may be properly brought before the Annual and Special Meeting of Shareholders. | |||

By order of the Board of Directors | ||

DAVID GAROFALO Vice-President, Finance & Chief Financial Officer March 21, 2005 |

To be effective at the meeting, proxies must be deposited with Computershare Trust Company of Canada no later than 48 hours prior to the commencement of the meeting.

This Management Proxy Circular is furnished in connection with the solicitation by the management of Agnico-Eagle Mines Limited of proxies for the use at its Annual and Special Meeting of Shareholders. Unless otherwise stated, all information in this Circular is given as of March 21, 2005 and all dollar amounts are stated in Canadian dollars.

| | | Page | ||

|---|---|---|---|---|

| SECTION 1: | VOTING INFORMATION | 2 | ||

SECTION 2: | BUSINESS OF THE MEETING | 3 | ||

| Election of Directors | 3 | |||

| Appointment of Auditors | 6 | |||

| Financial Statements | 7 | |||

| Renewal of Shareholder Rights Plan | 7 | |||

SECTION 3: | COMPENSATION AND OTHER INFORMATION | 8 | ||

| Report on Executive Compensation | 8 | |||

| Composition of Compensation Committee | 11 | |||

| Compensation of Officers | 11 | |||

| Additional Items | 17 | |||

APPENDIX A: | RECORD OF ATTENDANCE BY DIRECTORS FOR THE YEAR ENDED DECEMBER 31, 2004 | A-1 | ||

APPENDIX B: | SHAREHOLDER RIGHTS PLAN RESOLUTION | B-1 | ||

APPENDIX C: | SUMMARY OF SHAREHOLDER RIGHTS PLAN AND RELEVANT INFORMATION | C-1 | ||

APPENDIX D: | STATEMENT OF CORPORATE GOVERNANCE PRACTICES | D-1 |

1

Who is soliciting my proxy?

The management of Agnico-Eagle Mines Limited is soliciting your proxy for use at the Annual and Special Meeting of Shareholders.

What will I be voting on?

You will be voting on:

- •

- election of directors (page 4);

- •

- appointment of Ernst & Young LLP as the Corporation's auditors (page 7);

- •

- reconfirmation of the Shareholders Rights Plan; and

- •

- other business brought before the meeting if any other matter is put to a vote.

What else will happen at the meeting?

The financial statements for the year ended December 31, 2004 together with the auditors' report on these statements will be presented to the meeting.

How will these matters be decided at the meeting?

A majority of votes cast, by proxy or in person, will constitute approval of each of the matters specified in this Circular.

How many votes do I have?

You will have one vote for every common share of the Corporation you own at the close of business on March 21, 2005, the record date for the meeting. To vote shares that you acquired after the record date, you must, no later than the commencement of the meeting:

- •

- request that the Corporation add your name to the list of voters; and

- •

- properly establish ownership of the common shares or produce properly endorsed share certificates evidencing that the common shares have been transferred.

How many shares are eligible to vote?

At the close of business on March 21, 2005, the record date for this meeting, there were 86,125,229 common shares of the Corporation outstanding. Each common share held at that date entitles you to one vote. Fidelity Management & Research Company, Fidelity Management Trust Company and Fidelity International Limited have filed reports with securities regulators stating that they collectively have control over 8,998,466 (or approximately 10.35%) of Agnico-Eagle's common shares and corporate bonds and warrants convertible into common shares. To the knowledge of the directors and senior officers of the Corporation, no other person or corporation owns or exercises control or direction over 10% or more of the outstanding common shares.

How do I vote?

If you are eligible to vote and your shares are registered in your name, you can vote your shares in person at the meeting or by proxy, as explained below. If your shares are registered in the name of an intermediary, such as a bank, trust company, or securities broker, please see the instructions below under the heading "How can a non-registered shareholder vote?"

Voting by proxy

In addition to voting in person at the meeting, you may vote by mail by completing the form of proxy and returning it in the enclosed envelope to Computershare Trust Company of Canada.You may also appoint a

2

person (who need not be a shareholder), other than one of the directors or officers named in the proxy, to represent you at the meeting by inserting the person's name in the blank space provided in the proxy, striking out the other names, and returning the proxy no later than 48 hours prior to the commencement of the meeting.

You may also vote by phone or via the Internet. To vote by phone, in Canada and the United States only, call the toll-free number listed on the proxy from a touch tone phone. When prompted, enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions. To vote via the Internet, go to the website specified on the proxy and enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions on the screen.If you vote by telephone or via the Internet, do not complete or return the proxy form.

How will my proxy be voted?

On the form of proxy, you can indicate how you would like your proxyholder to vote your shares for any matter put to a vote at the meeting and on any ballot, your shares will be voted accordingly.If you do not indicate how you want your shares to be voted, the persons named in the proxy intend to vote your shares in the following manner:

- (i)

- for the election of management's nominees as directors;

- (ii)

- for the appointment of management's nominees as the auditors and the authorization of the directors to fix the remuneration of the auditors;

- (iii)

- for the reconfirmation of the Shareholder Rights Plan; and

- (iv)

- for management's proposals generally.

What if I want to revoke my proxy?

You can revoke your proxy at any time prior to its use. You may revoke your proxy by requesting, or having your authorized attorney request, in writing to revoke your proxy. This request must be delivered to Agnico-Eagle's address (as listed in this Circular) before the last business day preceding the day of the meeting or to the Chairman of the meeting on the day of the meeting or any adjournment.

How are proxies solicited?

The solicitation of proxies will be primarily by mail; however, proxies may be solicited personally or by telephone by directors, officers and regular employees of the Corporation. The cost of this solicitation will be paid by the Corporation.

How can a non-registered shareholder vote?

If your common shares are not registered in your name, they will be held by an intermediary such as a trust corporation, securities broker or other financial institution. Each intermediary has its own procedures which should be carefully followed by non-registered shareholders to ensure that their shares are voted at the meeting. If you are a non-registered shareholder, you should have received this Circular, together with the proxy from your intermediary. To vote in person at the meeting, follow the instructions set out on the form of proxy, appoint yourself a proxyholder, and return the form of proxy to the Depositary. Do not otherwise complete the proxy or voting instruction form sent to you as you will be voting at the meeting.

SECTION 2: BUSINESS OF THE MEETING

Election of Directors

The articles of Agnico-Eagle provide for a minimum of five and a maximum of twelve directors. By special resolution of the shareholders of Agnico-Eagle approved at the annual and special meeting of Agnico-Eagle held on June 27, 1996, the shareholders authorized the Board of Directors to determine the number of directors within that minimum and maximum. The number of directors to be elected is eight as determined by the Board

3

of Directors by resolution passed on April 23, 2003. The names of the proposed nominees for election as directors are listed below. Each director will hold office until the next annual meeting of shareholders of Agnico-Eagle or until their successors are elected or appointed or the position is vacated. Under the Corporation's retirement policy, directors elected or appointed before April 14, 1998 are required to retire at the age of 75 and directors elected or appointed on or after April 14, 1998 are required to retire at the age of 70. Mr. Kraft will turn 75 years old during September of 2005. The Board of Directors intends to waive the effect of the retirement policy in order to allow Mr. Kraft to hold office until the next annual meeting of the shareholders of Agnico-Eagle.The persons named on the enclosed form of proxy intend to VOTE FOR the election of the proposed nominees whose names are set out below and who are all currently directors of Agnico-Eagle unless a shareholder has specified in his proxy that his or her common shares are to be withheld from voting for the election of directors. The common share ownership amounts presented in the table do not include common shares underlying immediately exercisable options.

| Dr. Leanne M. Baker, 52, of Tiburon, California, is a director of Agnico-Eagle. Dr. Baker currently acts as a consultant to companies in the mining and financial services industries. Previously, Dr. Baker was employed by Salomon Smith Barney where she was one of the top-ranked mining sector equity analysts in the United States. Dr. Baker has an M.S. and a Ph.D. in mineral economics from the Colorado School of Mines. Dr. Baker is also a director of New Sleeper Gold Corporation, a mining exploration corporation which trades on the TSX Venture Exchange. Dr. Baker has been a director since January 1, 2003. | Member of the Audit Committee | 3,500 common shares 25,500 Options | ||

| Douglas R. Beaumont, P.Eng., 72, of Toronto, Ontario, is a director of Agnico-Eagle. Mr. Beaumont, now retired, is a former Senior Vice-President, Process Technology with SNC Lavalin. Mr. Beaumont is a graduate of Queen's University (B.Sc.). Mr. Beaumont has been a director of Agnico-Eagle since February 25, 1997. | Member of the Compensation and Corporate Governance Committees(1) | 5,976 common shares 44,500 Options | ||

| Sean Boyd, CA, 46, of Newmarket, Ontario, is the President and Chief Executive Officer and a director of Agnico-Eagle. Mr. Boyd has been with Agnico-Eagle since 1985. Prior to his appointment as President and Chief Executive Officer in 1998, Mr. Boyd served as Vice-President and Chief Financial Officer from 1996 to 1998, Treasurer and Chief Financial Officer from 1990 to 1996, Secretary-Treasurer during a portion of 1990, and Comptroller from 1985 to 1990 and prior to that was a chartered accountant with Clarkson Gordon. Mr. Boyd is a graduate of the University of Toronto (B.Comm.). Mr. Boyd has been a director of Agnico-Eagle since April 14, 1998, and is also Vice-Chairman and Chief Executive Officer of Contact Diamond Corporation ("Contact Diamond")(2), a 44.2% equity investee of Agnico-Eagle traded on the TSX. Mr. Boyd is also a director of Golden Goliath Resources Ltd., a junior exploration corporation which trades on the TSX Venture Exchange. | 94,162 common shares 539,900 Options | |||

4

| Eberhard (Ebe) Scherkus, 53, of Oakville, Ontario, is the Executive Vice-President and Chief Operating Officer and a director of Agnico-Eagle. Mr. Scherkus has been with Agnico-Eagle since 1985. Prior to his appointment as Executive Vice-President and Chief Operating Officer in 1998, Mr. Scherkus served as Vice-President, Operations from 1996 to 1998 and as a manager of Agnico-Eagle LaRonde Division from 1986 to 1996. Mr. Scherkus is a graduate of McGill University (B.Sc.). Mr. Scherkus was appointed director of Agnico-Eagle effective January 17, 2005. Mr. Scherkus also serves as a director of Contact Diamond and as a director of Riddarhyttan Resources AB, a Stockholm Stock Exchange listed company in which Agnico-Eagle holds a 14% equity interest. | 49,303 common shares 413,000 Options | |||

| Bernard Kraft, CA-IFA, C.B.V., A.S.A., C.F.E., 74, of Toronto, Ontario, is a director of Agnico-Eagle. Mr. Kraft is a senior partner of the Toronto accounting firm Kraft, Berger, Grill, Schwartz, Cohen & March LLP, Chartered Accountants and a principal in Kraft Yabrov Valuations Inc. Mr. Kraft is a member of the Canadian Institute of Chartered Business Valuators, the Association of Certified Fraud Examiners and the American Society of Appraisers. Mr. Kraft has been a director of Agnico-Eagle since March 12, 1992. Mr. Kraft is also a director of Canadian Shield Resources Inc., a mining exploration corporation which trades on the TSX Venture Exchange. | Chairman of the Audit Committee and Member of the Compensation Committee | 5,976 common shares 42,500 Options | ||

| Mel Leiderman, CA, TEP, 53, of Toronto, Ontario, is a director of Agnico-Eagle. Mr. Leiderman is the managing partner of the Toronto accounting firm Lipton, Wiseman, Altbaum & Partners LLP. Mr. Leiderman is a graduate of the University of Windsor (B.A.). Mr. Leiderman has been a director since January 1, 2003. | Chairman of the Compensation Committee and Member of the Audit Committee | 2,000 common shares 25,500 Options | ||

| James D. Nasso, 71, of Toronto, Ontario, is Chairman of the Board of Directors and a director of Agnico-Eagle. Mr. Nasso, recently retired, founded and was the President of Unilac Limited, a manufacturer of infant formula, for 36 years. Mr. Nasso is a graduate of St. Francis Xavier University (B. Comm.). Mr. Nasso has been a director of Agnico-Eagle since June 27, 1986. Mr. Nasso is also a director and Chairman of Contact Diamond. | Member of the Audit Committee | 17,751 common shares 32,500 Options | ||

5

| Howard R. Stockford, P.Eng., 63, of Toronto, Ontario, is an independent consultant to the mining industry. Mr. Stockford was Executive Vice-President of Aur Resources Inc. ("Aur"), a mining company which is traded on the TSX, from 1989 until his retirement at the end of 2004. From 1983 to 1989, Mr. Stockford was Vice-President of Aur. Mr. Stockford is a member of the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") and has previously served as Chairman of both the Winnipeg and Toronto branches of the CIM and as President of the CIM national body. Mr. Stockford is also a member of the Prospectors and Developers Association of Canada, the Geological Association of Canada and the Society of Economic Geologists. Mr. Stockford is a graduate of the Royal School of Mines, Imperial College, London University (B.Sc.). Mr. Stockford is not currently a director of Agnico-Eagle. Mr. Stockford is a director of Aur, an office he has held since 1983, and a director of Nuinsco Resources Limited, an office he has held since March of 2005. | As of the date of this Circular, Mr. Stockford does not hold any common shares or Options. | |||

- (1)

- The other member of the Corporate Governance Committee is currently Ernest Sheriff who will not be standing for re-election at the meeting.

- (2)

- Contact Diamond was formerly known as Sudbury Contact Mines Limited ("Sudbury Contact"). On September 30, 2004, Sudbury Contact changed its name to "Contact Diamond Corporation" and sold all of its precious metal properties to Agnico-Eagle pursuant to a shareholder approved reorganization. Articles of Amendment were filed by Sudbury Contact on the same date. References herein to Contact Diamond are deemed to be references to Sudbury Contact if the date of the information referred to is prior to September 30, 2004.

Appointment of Auditors

The persons named in the enclosed form of proxy intend to VOTE FOR the appointment of Ernst & Young LLP as Agnico-Eagle's auditors, and for the directors to fix the remuneration of the auditors unless a shareholder has specified in his proxy that his or her common shares are to be withheld from voting for the appointment of Ernst & Young LLP as Agnico-Eagle's auditors. Representatives of Ernst & Young LLP are expected to be present at the meeting to respond to appropriate questions and make a statement if they wish to do so. Ernst & Young LLP became Agnico-Eagle's auditors in 1983. Fees paid to Ernst & Young LLP for 2004 and 2003 are set out below.

| ($ thousands) | Year ended December 31, 2004 | Year ended December 31, 2003 | ||||

|---|---|---|---|---|---|---|

| Audit fees | $ | 245 | $ | 230 | ||

| Employee benefit plan | 18 | 11 | ||||

| Prospectus-related fees | 62 | — | ||||

| French translation fees | 50 | 24 | ||||

| Tax consulting fees | 116 | 152 | ||||

| $ | 491 | $ | 417 | |||

Audit fees were paid for professional services rendered by the auditors for the audit of Agnico-Eagle's annual financial statements and related statutory and regulatory filings.

Employee benefit plan fees were paid for professional services rendered by the auditors for the audit of the financial statements of Agnico-Eagle's employee benefit plans and the related statutory and regulatory filings.

6

Prospectus-related fees were paid for professional services rendered by the auditors in connection with Agnico-Eagle's filing of preliminary and final base shelf prospectuses on October 27, 2004 and November 15, 2004, respectively, and the filing of a prospectus supplement on November 15, 2004, in connection with the qualification of common shares that may be issued to certain holders of Agnico-Eagle warrants who reside in the United States. These services consisted of the audit or review, as required, of financial statements included in the prospectuses, reviewing documents filed with securities regulatory authorities, correspondence with securities regulatory authorities and all other services required by regulatory authorities in connection with the filing of these documents.

French translation fees were paid for professional services rendered by the auditors in connection with the translation of securities regulatory filings required to comply with securities laws in certain Canadian jurisdictions.

Tax fees were paid for professional services relating to tax compliance, tax advice and tax planning. These services included the review of tax returns, assistance with eligibility of expenditures under the Canadian flow-through share tax regime, and tax planning and advisory services in connection with international and domestic taxation issues.

All other fees were paid for services other than the fees listed above and included fees for access to Ernst & Young LLP publications and due diligence assistance for proposed transactions.

The audit committee has adopted a policy that requires the pre-approval of all fees paid to Ernst & Young LLP prior to the commencement of the specific engagement.

The audited annual financial statements for the year ended December 31, 2004 have been mailed to Agnico-Eagle shareholders with this Circular.

Renewal of Shareholder Rights Plan

General and Background to the Rights Plan

In 1999, the Board adopted a shareholder rights plan (the "Rights Plan") to protect shareholders from unfair, abusive or coercive treatment in the event of a take-over bid. Shareholder approval of the Rights Plan was received on June 25, 1999 and the Rights Plan was reconfirmed by the shareholders of Agnico-Eagle on June 21, 2002. The Rights Plan is currently effective, but is subject to reconfirmation by the shareholders of Agnico-Eagle at the meeting. Shareholders will be asked to consider a resolution reconfirming the Rights Plan and all rights ("Rights") issued pursuant to the Rights Plan at the meeting. The text of the resolution is set out in Appendix B to this Circular.

If the Rights Plan is reconfirmed by the shareholders at the meeting, the Rights Plan will remain in effect until it expires on the close of Agnico-Eagle's annual meeting to be held in 2009. If the Rights Plan is not reconfirmed at the meeting, the Rights Plan and any outstanding Rights will cease to be of any further force or effect as at the close of such meeting unless a Flip-in Event (as defined in Appendix C) has occurred prior to such time.

For a detailed summary of the Rights Plan and other relevant information pertaining to it, please see Appendix C to this Circular.

Directors' Recommendation

The Rights Plan was adopted to assist the Board in ensuring fair treatment of shareholders in the event that a person or group of persons seeks to acquire control of the Corporation through unfair take-over strategies to which the Corporation and its shareholders may be particularly vulnerable because of the different securities laws applicable in Canada and the United States, the principal trading markets for Agnico-Eagle's shares.The Board has determined that the Rights Plan is in the best interests of Agnico-Eagle and its shareholders and unanimously recommends that shareholders VOTE FOR the reconfirmation of the Rights Plan.

7

The persons named in the enclosed form of proxy intend to vote for the resolution approving the reconfirmation of the Rights Plan unless a shareholder has specified in his proxy that his or her common shares are to be voted against the resolution approving the reconfirmation of the Rights Plan.

Shareholders' Approval

Approval by a majority of the votes cast by Independent Shareholders (as defined in Appendix C under the heading "Terms of the Rights Plan — Independent Shareholders") present, in person or by proxy at the meeting is required to reconfirm the Rights Plan. To the knowledge of Agnico-Eagle, there are no non-Independent Shareholders as of the date of this Circular. The text of the resolution reconfirming the Rights Plan is set out in Appendix B to this Circular. Assuming there are no non-Independent shareholders at the meeting, such resolution must be passed by a majority of the votes cast by the holders of common shares who vote in respect thereof in order for the Rights Plan to be reconfirmed.

SECTION 3: COMPENSATION AND OTHER INFORMATION

Report on Executive Compensation

Compensation Philosophy

The officers of Agnico-Eagle have a significant influence on corporate performance and creating shareholder value. With this in mind, Agnico-Eagle's philosophy regarding compensation is that it must:

- •

- be competitive in order to attract and retain employees with the skills and commitment needed to lead and grow Agnico-Eagle's business;

- •

- provide a strong incentive to achieve Agnico-Eagle's goals; and

- •

- ensure that interests of management and Agnico-Eagle's shareholders are aligned.

The compensation paid to Agnico-Eagle's officers has three components:

- •

- base salary and benefits;

- •

- annual incentive compensation; and

- •

- long-term incentive compensation in the form of stock options.

The Compensation Committee reviews each component of compensation for each officer and makes compensation recommendations to the Board. In its evaluation of each officer, the Compensation Committee considers, among other things, evaluations prepared by the Chairman and CEO for each officer other than the CEO, and an evaluation prepared by the Chairman for the CEO. The Board reviews the recommendations and gives final approval on compensation of Agnico-Eagle's officers. The Board has complete discretion over the amount and composition of each officer's compensation.

Base Salary

Base salary is the principal component of an executive officer's compensation package. Annual base salaries are established using internal and external surveys of average base salaries paid to officers of other mining companies of similar size as Agnico-Eagle. The Compensation Committee also conducts its own surveys to determine the level of compensation paid to its officers relative to mining companies of similar size to Agnico-Eagle. Base salary levels take into account the officers' individual responsibilities, experience, performance and contribution toward enhancing shareholder value and should be in line with average base salaries paid to officers having comparable responsibilities at other North American mining and gold companies. By keeping base salaries at or near the average base salaries for the mining industry, Agnico-Eagle has more flexibility in tying reward to performance as a greater percentage of compensation earned by officers of Agnico-Eagle can be paid in the form of bonuses and stock-option grants, which are payable at the discretion of Agnico-Eagle.

8

No salary increases were granted to the executive officers of Agnico-Eagle for 2004. However, on January 7, 2005, the Board determined, upon the recommendation of the Compensation Committee, to increase the 2005 base salary of Agnico-Eagle's officers by an average of approximately 9% in light of the significant improvement in Agnico-Eagle's financial and operational performance in 2004 and the results of the Compensation Committee's review of internally and externally generated surveys of mining companies similar in size to Agnico-Eagle which indicated that Agnico-Eagle's base salaries were at or below average.

Annual Incentive Compensation

Annual incentive compensation for Agnico-Eagle's officers is based equally on two factors, namely, Agnico-Eagle's performance and the officers' contribution to that performance. Agnico-Eagle's performance is based on its achievements of various specific targets such as return on equity and profitability. Until January 7, 2005, Agnico-Eagle's compensation policy provided for a limit on the annual incentive compensation as a percentage of base salary to 50% of base salary for Mr. Boyd, 40% of base salary for Mr. Scherkus and 35% of base salary for all other vice-presidents of Agnico-Eagle. The Compensation Committee conducted a survey which indicated that these upper limits on annual incentive compensation were lower than comparable corporations to Agnico-Eagle in the mining industry. As the base salaries of Agnico-Eagle's officers have been in recent years in line with the industry average, the Compensation Committee recommended the Board approve an increase in the maximum bonuses payable to such officers to 75% of base salary for the President and Chief Executive Officer, to 60% of base salary for the Executive Vice-President and Chief Operating Officer, to 50% of base salary for the Vice-President, Finance and Chief Financial Officer and to 40% of base salary for each of the Vice-President, Corporate Development and Vice-President, Exploration.

For 2004, the Compensation Committee rated Agnico-Eagle's performance at 85% based on the following achievements which were counter-balanced by Agnico-Eagle's failure to meet its gold production targets:

Operations and Corporation Development

- •

- maintaining gold reserves at 7.9 million ounces and a 19% increase in regional global gold resources to 12.9 million;

- •

- a vast improvement in operating results with record gold production, record low cash costs and record earnings and cash flow;

- •

- achievement of completion tests under Agnico-Eagle's bank facility;

- •

- the acquisition of a minority interest in Riddarhyttan Resources AB which owns the Suurikuusikko gold deposit in Finland, thereby establishing a position in a highly prospective new gold camp at a very low entry price;

Exploration and Projects

- •

- initiation of underground programs at both Lapa and Goldex;

- •

- acquisition of key land package in Nevada adjacent to the Cortez Hills discovery;

Financial

- •

- raising of $23 million in flow-through shares at a 33% premium to Agnico-Eagle's then share price to finance underground programs at the Lapa and Goldex properties;

- •

- refinancing of bank facility which features a US$100 million three-year revolving credit facility on significantly improved terms and pricing relative to the previous bank facility;

- •

- incremental cash flow of over US$6 million realized from foreign exchange hedge position, thereby reducing cash operating cost per ounce by over US$20 and contributing approximately US$0.08 per share to net earnings;

- •

- increase of 11% in Agnico-Eagle's share price compared to a 7% decline in the S&P/TSX Capped Gold Index in 2004.

9

Accordingly, since 50% of an officer's bonus is determined by Agnico-Eagle's performance, each of the officers of Agnico-Eagle was awarded a bonus in respect of Agnico-Eagle's performance equal to half of 85% of the maximum bonus payable to such officers under the revised executive compensation policy described above.

The remaining 50% of the bonus for each of the Named Executive Officers (other than the President and the Chief Executive Officer) was determined by the individual performance of such officer as assessed by the Chairman of the Board and the President and Chief Executive Officer with reference to the achievements noted above, as applicable to each Named Executive Officer. Based on this assessment, the Compensation Committee's recommendation with respect to the portion of each of the Named Executive Officers' bonus based on individual performance ranged from 75% to 90% of the maximum bonus allocated to individual performance.

Stock Options

Stock options tie officers' compensation to increases in the value of the Corporation's common shares and therefore provide an incentive to enhance shareholder value. Grants of stock options are based on three factors:

- •

- the employee's performance;

- •

- the employee's level of responsibility within Agnico-Eagle; and

- •

- the number and exercise price of options previously issued to the employee.

During 2004, the Compensation Committee completed an internal compensation survey which indicted that the number of options issued to the senior management of Agnico-Eagle as a percentage of shares of Agnico-Eagle outstanding was in line with industry averages.

Share Ownership

In order to align the interests of Agnico-Eagle and those of its officers and employees, the Corporation encourages stock ownership and facilitates this through its incentive share purchase plan. Details of this plan can be found on page 14 of this Circular.

All of the Corporation's officers own common shares of Agnico-Eagle. The following table summarizes each officer's holdings as at March 21, 2005:

| Sean Boyd, Director, President and Chief Executive Officer | 94,162 | |

| Eberhard Scherkus, Director, Executive Vice-President and Chief Operating Officer | 49,303 | |

| David Garofalo, Vice-President, Finance and Chief Financial Officer | 22,834 | |

| Donald G. Allan, Vice-President, Corporate Development | 3,287 | |

| Alain Blackburn, Vice-President, Exploration | 3,588 |

Chief Executive Officer's 2004 Compensation

Mr. Boyd served as President and Chief Executive Officer of the Corporation and received a $600,000 base salary and a bonus of $393,000 in 2004. In determining the base salary and bonus of Mr. Boyd, the Compensation Committee reviewed externally prepared industry surveys, an internally generated industry survey and public information regarding base salaries paid to chief executive officers of public mining companies of comparable size and complexity. The Committee also considered other factors such as Mr. Boyd's responsibilities and contribution to business performance such as his leadership in connection with the continued pursuit of Agnico-Eagle's regional growth strategy. The principal responsibilities of the President and Chief Executive Officer include selecting and appointing senior officers, establishing and monitoring long-term strategic corporate objectives and supervising Agnico-Eagle's mining exploration and development activities.

10

The bonus granted to Mr. Boyd was based on the Compensation Committee's rating of Agnico-Eagle's performance at 85% and of Mr. Boyd's performance at 90%.

| Position | Corporate % of Maximum Bonus | Individual % of Maximum Bonus | Overall % Corporate/Individual | Maximum Bonus as % of Base Salary | Cash Bonus Paid | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| President and Chief Executive Officer | 85% | 90% | 87.5% | 75% | $ | 393,000 | |||||

In increasing Mr. Boyd's base salary and determining his individual performance, the Compensation Committee considered his contribution to the following achievements of Agnico-Eagle:

- •

- the turnaround in operating and share price performance in 2004 when compared to 2003;

- •

- the acquisition by Agnico-Eagle of a 14.1% stake in Riddarhyttan Resources AB, a corporation whose principal asset is a 100% interest in the Suurikuusikko gold deposit in Finland;

- •

- steering Agnico-Eagle through operating challenges and the re-evaluation of the Corporation's mining plan in order to reduce mining risk;

- •

- the successful increase of reserves at the LaRonde Mine; and

- •

- continued rationalization of Agnico-Eagle's structure, including the implementation of plans to increase Contact Diamond's independence from the Corporation and the acquisition by the Corporation of Contact Diamond's gold and other precious metal exploration properties in Canada and the United States.

The foregoing report is submitted by the Compensation Committee of the Board of Directors.

Mel Leiderman, CA, TEP, Chairman

Bernard Kraft, CA·IFA, C.B.V., A.S.A., C.F.E.

Douglas R. Beaumont

Composition of Compensation Committee

The Compensation Committee consists of Mel Leiderman, Bernard Kraft, Doug Beaumont and Dr. Alan Green. Mr. Green ceased to be a member of the Compensation Committee when he resigned from the Board of Directors on January 17, 2005. As of March 21, 2005, no additional members had been added to the Committee. None of the members of the Committee is an officer or employee or former officer or employee of the Corporation or any of its subsidiaries and all of the members are considered to be unrelated to and independent from Agnico-Eagle.

Compensation of Officers

The executive officers of Agnico-Eagle are:

- •

- Sean Boyd, President and Chief Executive Officer

- •

- Eberhard Scherkus, Executive Vice-President and Chief Operating Officer

- •

- David Garofalo, Vice-President, Finance and Chief Financial Officer

- •

- Donald G. Allan, Vice-President, Corporate Development

- •

- Alain Blackburn, Vice-President, Exploration

Anton Adamcik was the Vice-President, Environment of Agnico-Eagle until his retirement on March 1, 2004. Mr. Adamcik continues to provide services to Agnico-Eagle as a consultant and has entered into a consulting agreement with Agnico-Eagle and offers consulting services in consideration for enhanced pension and other benefits.

Barry Landen ceased to be Agnico-Eagle's Vice-President, Corporate Affairs on December 7, 2004.

11

The following Summary Compensation Table sets out compensation during the three fiscal years ended December 31, 2004 for the President and Chief Executive Officer, the Vice-President, Finance and Chief Executive Officer and the three other most highly compensated officers (collectively the "Named Executive Officers") of Agnico-Eagle measured by base salary and bonus earned during the fiscal year ended December 31, 2004.

Summary Compensation Table — Agnico-Eagle Mines Limited

| | Annual Compensation | Long-Term Compensation Awards | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Securities Under Options | All Other Compensation (1) | |||||

| Sean Boyd President and Chief Executive Officer | 2004 2003 2002 | 600,000 600,000 555,481 | 393,000 — 275,000 | 90,000 — 225,000 | 47,268 30,574 27,701 | |||||

Eberhard Scherkus Executive Vice-President and Chief Operating Officer | 2004 2003 2002 | 435,000 435,000 402,596 | 228,000 — 150,000 | 70,000 — 135,000 | 54,656 23,074 22,430 | |||||

David Garofalo Vice-President, Finance and Chief Financial Officer | 2004 2003 2002 | 290,000 290,000 270,000 | 120,000 — 88,000 | 50,000 — 75,000 | 31,644 3,324 15,896 | |||||

Donald G. Allan Vice-President, Corporate Development | 2004 2003 2002 | 220,000 220,000 200,000 | (2) | 70,000 — 45,000 | 40,000 — 50,000 | 35,139 13,376 6,250 | ||||

Alain Blackburn Vice-President, Exploration | 2004 2003 2002 | 200,000 175,000 152,885 | 65,000 75,000 36,000 | 50,000 — 25,000 | 36,470 13,376 13,830 | |||||

- (1)

- Consists of annual contributions made by Agnico-Eagle on behalf of the Named Executive Officers under the Corporation's defined contribution pension plan (see "Pension Arrangements"), premiums paid for term life insurance and automobile allowances for the Named Executive Officers.

- (2)

- Mr. Allan joined the Corporation in May 2002. This amount represents his annualized salary as if he had been employed for the full year.

Stock Option Plan

Under the Corporation's Stock Option Plan, options to purchase common shares may be granted to directors, officers, employees and service providers of the Corporation. The exercise price of options granted may not be less than the closing market price for the common shares of the Corporation on the Toronto Stock Exchange on the day prior to the date of grant. At the annual and special meeting of shareholders of the Corporation held on May 28, 2004, a resolution was passed by the shareholders approving amendments to the Stock Option Plan as follows:

- •

- to reduce the maximum term of options granted under the Stock Option Plan from ten to five years;

- •

- to limit the number of stock options issued in any one year to 1% of the Corporation's shares outstanding; and

- •

- to implement a mandatory delayed vesting of options.

There are 5,229,635 common shares of the Corporation reserved for issuance under the Stock Option Plan (which includes options available for future grants and unexercised options). The maximum amount of shares issuable under the Stock Option Plan is 6.07% of the Corporation's 86,125,229 common shares outstanding as at March 21, 2005.

The Stock Option Plan restricts the entitlement to loans, guarantees or other support arrangements to facilitate option exercises to eligible persons who are not directors or officers of the Corporation. During 2004, no loans, guarantees or other financial assistance were provided under the plan.

12

The following table sets out stock option awards received by the Named Executive Officers during the year ended December 31, 2004.

Option grants of Agnico-Eagle Mines Limited during 2004

| Name | Securities Under Options | % of Total Option Grants in Year | Exercise Price | Market Value of Underlying Options on Date of Grant | Expiration Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Sean Boyd | 90,000 | 7 | $ | 16.69 | NIL | January 12, 2009 | |||||

Ebe Scherkus | 70,000 | 5 | 16.69 | NIL | January 12, 2009 | ||||||

David Garofalo | 50,000 | 4 | 16.69 | NIL | January 12, 2009 | ||||||

Donald Allan | 40,000 | 3 | 16.69 | NIL | January 12, 2009 | ||||||

Alain Blackburn | 50,000 | 4 | 16.69 | NIL | January 12, 2009 | ||||||

The following table shows, for each Named Executive Officer, the number of common shares acquired through the exercise of stock options of the Corporation during the year ended December 31, 2004, the aggregate value realized upon exercise and the number of unexercised options under the Stock Option Plan as at December 31, 2004. The value realized upon exercise is the difference between the market value of common shares on the exercise date and the exercise price of the option. The value of unexercised in-the-money options at December 31, 2004 is the difference between the exercise price of the options and the market value of Agnico-Eagle's common shares on December 31, 2004, which was $16.52 per share of the Corporation's common stock.

Aggregate option exercises during 2004 and year end option values

| | | | Unexercised options at December 31, 2004 | Value of unexercised in-the-money options at December 31, 2004 ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Securities acquired at exercise | Aggregate value realized ($) | |||||||||||

| Exerciseable | Unexerciseable | Exerciseable | Unexerciseable | ||||||||||

| Agnico-Eagle Mines Limited | |||||||||||||

| Sean Boyd | 85,100 | $ | 638,788 | 347,400 | 67,500 | 768,138 | Nil | ||||||

| Ebe Scherkus | 58,200 | $ | 658,550 | 260,500 | 52,500 | 740,610 | Nil | ||||||

| David Garofalo | 15,000 | $ | 148,700 | 100,500 | 37,500 | 123,810 | Nil | ||||||

| Donald G. Allan | Nil | Nil | 60,000 | 30,000 | Nil | Nil | |||||||

| Alain Blackburn | Nil | Nil | 95,500 | 37,500 | 79,110 | Nil | |||||||

The following table shows, as at December 31, 2004, compensation plans under which equity securities of Agnico-Eagle are authorized for issuance from treasury. The information has been aggregated by plans approved by shareholders and plans not approved by shareholders, of which there are none.

| Plan Category | Number of securities to be issued on exercise of outstanding options | Weighted average exercise price of outstanding options | Number of securities remaining available for future issuances under equity compensation plans | ||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by shareholders | 2,383,150 | $ | 15.16 | 2,846,485 | |||

| Equity compensation plans not approved by shareholders | Nil | Nil | Nil | ||||

Incentive Share Purchase Plan

In 1997, the shareholders of Agnico-Eagle approved the Share Purchase Plan to encourage directors, officers and full-time employees of Agnico-Eagle to purchase common shares of Agnico-Eagle. Full-time employees who have been continuously employed by Agnico-Eagle or its subsidiaries for at least twelve months are eligible at the beginning of each fiscal year to elect to participate in the Share Purchase Plan. Eligible

13

employees may contribute up to 10% of their basic annual salary through monthly payroll deductions or quarterly payments by cheque. Directors may contribute up to 100% of their annual Board and committee retainer fees. Agnico-Eagle contributes an amount equal to 50% of the individual's contributions and issues shares which have a market value equal to the total contributions (individual and Corporation) under the Share Purchase Plan. Agnico-Eagle has reserved 1,151,272 common shares for issuance under the plan.

Pension Arrangements

Two individual Retirement Compensation Arrangement Plans (RCA Plans) for Mr. Boyd and Mr. Scherkus provide pension benefits which are generally equal (on an after-tax basis) to what the pension benefits would be if they were provided directly from a registered pension plan. There are no pension benefit limits under the RCA Plans. The RCA Plans provide an annual pension at age 60 equal to 2% of the executive's final three-year average pensionable earnings for each year of continuous service with the Corporation, less the annual pension payable under the Corporation's basic defined contribution plan. Payments under the RCA Plans are secured by a letter of credit from a Canadian chartered bank.

The following chart provides illustrations of the total estimated pension payable from both the RCA Plan and the Basic Plan assuming various current pensionable earnings, current ages and total years of service to retirement at age 60. In all cases, it was assumed that current pensionable earnings would increase at the rate of 3% per annum, compounded annually.

| | | Total Years of Service with the Corporation to Age 60(1) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Current Earnings | Current Age | ||||||||||||||||

| 15 years | 20 years | 25 years | 30 years | 35 years | |||||||||||||

| $400,000 | 45 | $ | 176,400 | $ | 235,000 | $ | 294,000 | $ | 352,700 | $ | 411,500 | ||||||

| 50 | 152,100 | 202,900 | 253,600 | 304,300 | 355,000 | ||||||||||||

| 55 | 131,200 | 175,000 | 218,700 | 262,500 | 306,200 | ||||||||||||

| 60 | 113,200 | 150,900 | 188,700 | 226,400 | 264,200 | ||||||||||||

| $500,000 | 45 | $ | 220,300 | $ | 293,700 | $ | 367,100 | $ | 440,600 | $ | 514,000 | ||||||

| 50 | 190,000 | 253,400 | 316,700 | 380,000 | 443,400 | ||||||||||||

| 55 | 163,900 | 218,500 | 273,200 | 327,800 | 382,500 | ||||||||||||

| 60 | 141,400 | 188,500 | 235,600 | 282,800 | 329,900 | ||||||||||||

| $600,000 | 45 | 264,300 | 352,400 | 440,600 | 528,700 | 616,800 | |||||||||||

| 50 | 228,000 | 304,000 | 380,000 | 456,000 | 532,000 | ||||||||||||

| 55 | 196,700 | 262,300 | 327,800 | 393,400 | 458,900 | ||||||||||||

| 60 | 169,700 | 226,200 | 282,800 | 339,300 | 395,900 | ||||||||||||

| $700,000 | 45 | 308,400 | 411,200 | 514,000 | 616,800 | 719,600 | |||||||||||

| 50 | 266,000 | 354,700 | 443,400 | 532,000 | 620,700 | ||||||||||||

| 55 | 229,500 | 306,000 | 382,500 | 458,900 | 535,400 | ||||||||||||

| 60 | 197,900 | 263,900 | 329,900 | 395,900 | 461,900 | ||||||||||||

- (1)

- All amounts are stated in Canadian dollars.

At December 31, 2004, the two individuals under the RCA Plans had the following years of service:

| • | Mr. Boyd | 19 years | ||

| • | Mr. Scherkus | 19 years |

Accordingly, the total projected pension payable at retirement from both the RCA Plan and the Basic Plan for Mr. Boyd and Mr. Scherkus are $557,650 and $247,835 per annum, respectively. The 2004 annual service cost and total accrued pension obligation, respectively, for each of Mr. Boyd and Mr. Scherkus as at December 31, 2004 are as follows: Mr. Boyd — $203,500 and $1,763,300, Mr. Scherkus — $146,700 and $1,430,700. The annual service cost represents the value of the projected pension benefit earned during the year. The total accrued pension obligation represents the value of the projected pension benefit earned for all service to date. The pensionable earnings for the purposes of the RCA Plans consist of all basic remuneration and do not include benefits, bonuses, automobile or other allowances, and unusual payments.

14

Employment Contracts/Termination Arrangements

Agnico-Eagle has employment agreements with all executive officers which provide for an annual base salary, bonus and certain pension, health, dental and other insurance and automobile benefits. The agreements were amended in December 2002 and provide minimum annual base salaries for the Named Executive Officers as follows:

| • | Mr. Boyd | $600,000 | ||

| • | Mr. Scherkus | $435,000 | ||

| • | Mr. Garofalo | $290,000 | ||

| • | Mr. Allan | $220,000 | ||

| • | Mr. Blackburn | $200,000 |

These amounts may be increased at the discretion of the Board of Directors upon the recommendation of the Compensation Committee. If the individual agreements are terminated other than for cause, death or disability, or upon their resignations following certain events, all of the above named individuals would be entitled to a payment equal to two and one-half times the annual base salary at the date of termination plus an amount equal to two and one-half times the annual bonus (averaged over the preceding two years) and a continuation of benefits for up to two years or until the individual commences new employment. Certain events that would trigger a severance payment are:

- •

- a substantial alteration of responsibilities;

- •

- a reduction of base salary or benefits;

- •

- an office relocation of greater than 50 miles;

- •

- a failure to obtain a satisfactory agreement from any successor to assume the individual's employment agreement or provide the individual with a comparable position, duties, salary and benefits; or

- •

- any change in control of the Corporation.

Compensation of Directors

Mr. Boyd, who is a director, and is also the President and Chief Executive Officer of the Corporation and Mr. Scherkus, who is a director and is also the Executive Vice-President and Chief Operating Officer, receive no remuneration for their services as directors.

The table below summarizes the annual retainers and attendance fees paid to the other directors during the year ended December 31, 2004. On March 17, 2004, the Compensation Committee decided to implement changes to the directors' compensation structure to improve corporate governance practices and to compensate directors for the increased risk, workload and responsibilities demanded by their positions.

| | Compensation paid during the period from January — June 2004 | Compensation from July1 — December 31, 2004 | ||||

|---|---|---|---|---|---|---|

| Annual board retainer | $ | 18,000 | $ | 20,000 | ||

| Annual retainer for Chairman of the Board | $ | 50,000 | $ | 50,000 | ||

| Annual retainer for Chairman of the Audit Committee | $ | 3,000 | $ | 7,500 | ||

| Annual retainer for chairpersons of other Board committees | $ | 3,000 | $ | 5,000 | ||

| Board meeting attendance fee | $ | 1,000 | $ | 1,500 | ||

| Long-distance Board meeting attendance fee | $ | 1,500 | $ | 2,000 | ||

| Board meeting phone attendance fee | $ | 1,000 | $ | 750 | ||

In addition to the changes made to the annual retainers and attendance fees, on March 17, 2004, the Compensation Committee also implemented the following changes related to director compensation.

15

- •

- To align the interests of directors with those of shareholders, directors, other than Mr. Boyd and Mr. Scherkus, are now required to own the equivalent of at least three years of their annual retainer fee in Agnico-Eagle's stock. Directors have a period of three years to achieve this ownership level either through open market purchases or through participation in Agnico-Eagle's Incentive Share Purchase Plan.

- •

- Each director, other than Mr. Boyd and Mr. Scherkus, will be eligible to be granted a maximum of 7,500 options per year under Agnico-Eagle's Stock Option Plan. Beginning with the 2005 fiscal year, individual grants will be determined annually by the Compensation Committee based on performance evaluations for each director.

During the year ended December 31, 2004, Agnico-Eagle issued a total of 5,000 common shares under its Incentive Share Purchase Plan to its directors. Agnico-Eagle will provide healthcare benefits to Mr. Sheriff for a period of five years after his resignation from the Board.Indebtedness of Directors, Executive Officers and Senior Officers

During the year ended December 31, 2004, there was no outstanding indebtedness to Agnico-Eagle by any of its officers or directors made in connection with the purchase of securities of Agnico-Eagle. In addition, during the year ended December 31, 2004 and as at March 21, 2005, the only officer indebted to the Corporation was Alain Blackburn, Vice-President, Exploration. The non-interest bearing loan was advanced by Agnico-Eagle to Mr. Blackburn in 1999 for the purchase of a residence as a relocation incentive. The loan matures in 2024 and is secured by a second mortgage on the residence of Mr. Blackburn which provides for full recourse against the assets of Mr. Blackburn. As at December 31, 2004, the amount outstanding under this loan was $97,500.30. As at March 21, 2005, the amount outstanding under this loan was $96,442.69. The highest aggregate amount of indebtedness outstanding under the loan in 2004 was $102,500. Agnico-Eagle will no longer make loans to officers under any circumstances.

16

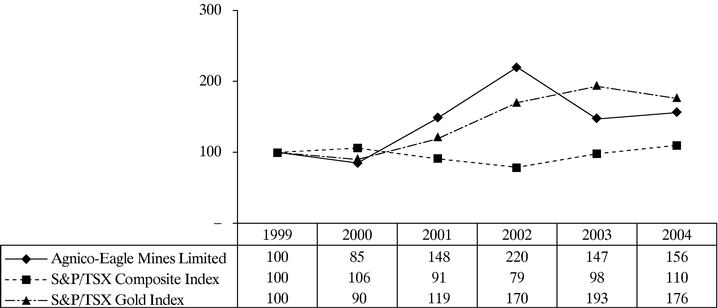

Performance Graph

The following graph compares the total cumulative return of $100 invested in the Corporation's common shares on December 31, 1999 with the cumulative total return for each of The S&P/TSX Composite Index and the S&P/TSX Capped Gold Index over the five-year period ended December 31, 2004 (in each case, assuming reinvestment of dividends). The table shows what a $100 investment in each of the above mentioned indices and in Agnico-Eagle common shares, made at December 31, 1999, would be worth in each of the five years following the initial investment.

Agnico-Eagle Mines Limited Stock Price vs.

S&P/TSX Indices(1)

Note:

- (1)

- Assumes reinvestment of dividends paid in 2000, 2001 and 2002 of Cdn$0.03 per Common Share and Cdn.$0.04 in 2003 and 2004, respectively.

Additional Items

Corporate Governance

Under the rules of the Toronto Stock Exchange, the Corporation is required to disclose information relating to its system of corporate governance. The Corporation's corporate governance disclosure is set out in Appendix D to this Circular under the heading "Corporate Governance". In addition to describing the Corporation's governance practices with reference to the rules of the Toronto Stock Exchange, Appendix D to this Circular indicates how these governance practices align with the requirements and U.S. Securities and Exchange Commission regulations under theSarbanes-Oxley Act of 2002 ("SOX") and the recent amendments under the rules of the New York Stock Exchange (the "NYSE Amendments").

The Board meets without management regularly at the request of the directors and at least once each quarter after each Board meeting held to consider interim and annual financial statements. In 2004, the Board met without management on six separate occasions including the four scheduled quarterly meetings.

Directors' and Officers' Liability Insurance

The Corporation has purchased, at its expense, directors' and officers' liability insurance policies to provide insurance against possible liabilities incurred by them in their capacity as directors and officers of the Corporation. The premium for these policies for the period from December 31, 2004 to December 31, 2005 is

17

$686,150. The policies provide coverage of up to $50 million per occurrence, to a maximum of $50 million per annum. There is no deductible for directors and officers and a $250,000 deductible for each claim made by the Corporation ($1 million deductible for securities claims). The insurance applies in circumstances where the Corporation may not indemnify its directors and officers for their acts or omissions.

Additional Information

The Corporation is a reporting issuer under the securities acts of all the provinces of Canada and a registrant under the United States Securities Exchange Act of 1934 and is therefore required to file certain documents with various securities commissions. To obtain a copy of any of the following documents, please contact the Director, Investor Relations:

- •

- the Corporation's most recent Annual Information Form consisting of the Corporation's Annual Report on Form 20-F under the United States Securities Exchange Act of 1934;

- •

- the Corporation's Audited Annual Financial Statements and Management's Discussion and Analysis for the year ended December 31, 2004, which includes the Corporation's financial information;

- •

- any interim financial statements of the Corporation subsequent to the financial statements for the year ended December 31, 2004; and

- •

- the Management Proxy Circular.

Alternatively, these documents may be viewed at the Corporation's website athttp://www.agnico-eagle.com or on the SEDAR website athttp://www.sedar.com.

General

Management knows of no matters to come before the meeting other than matters referred to in the Notice. However, if any other matters which are not now known to management should properly come before the meeting, the proxy will be voted on such matters in accordance with the best judgment of the person or persons voting the proxy.

Directors' Approval

The Board of Directors of the Corporation has approved the content and sending of this Management Proxy Circular.

March 21, 2005

DAVID GAROFALO

Vice-President, Finance & Chief Financial Officer

18

APPENDIX A

RECORD OF ATTENDANCE BY DIRECTORS

FOR THE YEAR ENDED DECEMBER 31, 2004

| Director | Board Meetings Attended | Committee Meetings Attended | ||

|---|---|---|---|---|

| Leanne M. Baker | 20 of 20 | 5 of 5 | ||

| Douglas R. Beaumont, P.Eng. | 20 of 20 | 6 of 6 | ||

| Sean Boyd, CA | 20 of 20 | N/A | ||

| Dr. Alan Green | 20 of 20 | 6 of 6 | ||

| Bernard Kraft, CA | 20 of 20 | 10 of 10 | ||

| Mel Leiderman, CA, TEP | 20 of 20 | 10 of 10 | ||

| James D. Nasso | 20 of 20 | 5 of 5 | ||

| Ernest Sheriff | 20 of 20 | 1 of 1 |

A-1

APPENDIX B

SHAREHOLDER RIGHTS PLAN RESOLUTION

BE IT RESOLVED THAT:

- 1.

- the Rights Plan adopted by the Board of Directors of Agnico-Eagle Mines Limited (the "Corporation") on the terms of the Shareholder Rights Plan Agreement dated as of April 22, 1999 between the Corporation and Montreal Trust Company of Canada, as Rights Agent, and approved, confirmed and ratified by a resolution of the shareholders of the Corporation on June 25, 1999 and reconfirmed by the shareholders of the Corporation on June 21, 2002, is hereby reconfirmed; and

- 2.

- any director or officer of the Corporation be, and is hereby authorized and directed, for and on behalf of and in the name of the Corporation, to do all such acts and things and to execute, whether under the corporate seal of the Corporation or otherwise, and deliver all such documents and instruments as may be considered necessary or desirable to give effect to the foregoing.

B-1

APPENDIX C

SUMMARY OF SHAREHOLDER RIGHTS PLAN

AND RELEVANT INFORMATION

Purpose of the Rights Plan

The Rights Plan is designed to encourage the fair treatment of shareholders in connection with any take-over bid for the Corporation. The Rights Plan provides the Board and the shareholders with more time to fully consider any unsolicited take-over bid for the Corporation without undue pressure, to allow the Board to pursue, if appropriate, other alternatives to maximize shareholder value and to allow additional time for competing bids to emerge. Securities legislation in Canada requires a take-over offer to remain open for only 35 days. The Board does not believe that this period is sufficient to permit the Board to determine whether there may be alternatives available to maximize shareholder value or whether other bidders may be prepared to pay more for the Corporation's shares than the offeror. Under the Rights Plan, a bidder may make a Permitted Bid (as defined below) for Voting Shares (as defined below) of the Corporation but may not take up any shares before the close of business on the 75th day after the date of the bid and unless at least 50% of the Corporation's Voting Shares not Beneficially Owned (as defined below) by the person making the bid and certain related parties are deposited, in which case the bid must be extended for 10 business days.

The Rights Plan is intended to encourage an offeror to proceed by way of Permitted Bid or to approach the Board with a view to negotiation by creating the potential for substantial dilution of the offeror's position. The Permitted Bid provisions of the Rights Plan are designed to ensure that, in any take-over bid, all shareholders are treated equally, receive the maximum available value for their investment and are given adequate time to properly assess the bid on a fully informed basis. Under the Rights Plan, a bid for less than all of the Voting Shares will not qualify as a Permitted Bid.

While existing securities legislation has substantially addressed many concerns of unequal treatment of shareholders, there remains the possibility that control or effective control of a Corporation may be acquired pursuant to a private agreement in which a small number of shareholders dispose of shares at a premium to market price which is not shared with the other shareholders. In addition, a person may slowly accumulate shares through stock exchange acquisitions which may result, over time, in an acquisition of control without payment of fair value for control or fair sharing of any control premium among all shareholders. The Rights Plan addresses these concerns by applying to all acquisitions of Voting Shares over the 20% level.

In recent years, unsolicited bids were made for the shares of a number of Canadian public companies. Most of these companies had shareholder rights plans which were used by the target's Board of Directors to gain time to seek alternatives to the bid with the objective of enhancing shareholder value. In a number of these transactions, a change of control ultimately occurred at a price in excess of the original bid price; accordingly, the existence of a shareholder rights plan will not prevent unsolicited take-over bids for the Voting Shares of the Corporation.

It is not the intention of the Board in seeking reconfirmation of the Rights Plan to secure the continuance of existing directors or management in office, nor to avoid a bid for control of the Corporation. Through the Permitted Bid mechanism, described in more detail below, shareholders may tender to a bid which meets the Permitted Bid criteria without triggering the Rights Plan, regardless of the acceptability of the bid to the Board. Even in the context of a bid that does not meet the Permitted Bid criteria, the Board will continue to be bound by its fiduciary duties to consider any bid for the Voting Shares in exercising its discretion whether to waive the application of the Rights Plan to the offer or to redeem the Rights. In discharging that responsibility, the directors must act honestly and in good faith with a view to the best interest of the Corporation and its shareholders. In addition, the Ontario Securities Commission has concluded in its decisions relating to shareholder rights plans that a target Corporation's Board of Directors will not be permitted to maintain a shareholder rights plan indefinitely to prevent a successful bid, but only for such time as the Board is actively seeking alternatives to a take-over bid and there is a real and substantial possibility that it can increase shareholder choice and maximize shareholder value.

The reconfirmation of the Rights Plan is not being proposed in response to, or in anticipation of, any acquisition or take-over bid. The Rights Plan does not inhibit any shareholder from using the proxy mechanism

C-1

set out in theBusiness Corporations Act (Ontario) to promote a change in the management or direction of the Corporation, including the right of holders of not less than 5% of the issued voting shares to requisition the directors to call a shareholders' meeting to transact any proper business stated in the requisition.

The reconfirmation of the Rights Plan will not lessen or affect the duty of the directors to act honestly and in good faith with a view to the best interests of the Corporation and its shareholders. The Rights Plan does not affect in any way the financial condition of the Corporation. The initial issuance of the Rights is not dilutive and is not expected to have any effect on the trading of the common shares. However, under certain circumstances, the exercise of the Rights may affect reported earnings per share. Even after the Separation Time (as defined below), unless the Flip-in Event (as defined below) has occurred, it is possible that the Exercise Price (as defined below) will be substantially in excess of the market price of the common shares, thereby precluding any economic motivation to exercise the Rights. In the event that a Flip-in Event has occurred and not all holders of Rights exercise their Rights, any holders not exercising their Rights may suffer substantial dilution with respect to common shares which they then hold. The Corporation is not aware, however, of any instance in which rights similar to the Rights have been exercised.

By permitting holders of Rights other than an Acquiring Person (as defined below) to acquire common shares of the Corporation at a discount to market value, the Rights may cause substantial dilution to a person or group that acquires 20% or more of the common shares alone or 20% or more of the Voting Shares without the Rights being terminated by the Board. The possibility of such dilution is intended to encourage such a person or group to seek to negotiate with the Board, which would be in the best position to protect the interests of the Corporation and all of its shareholders.

This issuance of Rights will not change the manner in which shareholders currently trade their common shares. Shareholders do not have to return their certificates in order to have the benefit of the Rights.

Terms of the Rights Plan

The following is a summary of the principal terms of the Rights Plan.

Issue of Rights

To implement the Rights Plan, the Board authorized the issue, effective as of the close of business on May 10, 1999 (the "Record Time"), of one Right in respect of each outstanding common share to holders of record as at the Record Time. The Board also authorized the issue of one Right in respect of each common share issued after the Record Time and prior to the Separation Time (as defined below) and the Expiration Time (as defined below). The Corporation has entered into an agreement (the "Rights Agreement") dated as of April 22, 1999, with Montreal Trust Company of Canada, as rights agent, which provides for the exercise of the Rights, the issue of certificates evidencing the Rights and other related matters.

Exercise of Rights

The Rights are not exercisable initially and certificates representing the Rights will not be sent to shareholders. Until the Separation Time (as defined below), the Rights will be transferred with the associated common shares. Subject to certain exceptions, the Rights will separate from the common shares and become exercisable eight trading days after the earlier of the first public announcement of the acquisition of beneficial ownership of 20% of the common shares of the Corporation by any person or the commencement of or announcement of a person's intention to commence a take-over bid other than a Permitted Bid which would result in such person acquiring 20% of the Corporation's common shares, or such later time as the Board may determine (in any such case, the "Separation Time"). After the Separation Time, but prior to the occurrence of a Flip-in Event (described below), each Right may be exercised to purchase one common share of the Corporation at the stipulated exercise price.

Certificates for common shares issued after the Record Time will bear a legend incorporating the Rights Agreement by reference. As soon as is practicable following the Separation Time, separate certificates evidencing the Rights ("Rights Certificates") will be mailed to the holders of record of common shares as of the Separation Time and the Rights Certificates alone will evidence the Rights. The Rights will expire at the close of

C-2

the Corporation's annual meeting next following the tenth anniversary date of the Rights Agreement (the "Expiration Time") unless earlier redeemed or exchanged by the Corporation and subject to shareholder re-ratification of the Rights Plan and the Corporation's annual meeting following the sixth anniversary date of the Rights Agreement. The exercise price payable and the number of securities issuable upon the exercise of the Rights are subject to adjustment from time to time to prevent dilution upon the occurrence of certain corporate events affecting the Voting Shares.

Exercise Price

The initial exercise price of the Rights is $80. The exercise price of the Rights is subject to adjustment from time to time in accordance with the provisions of the Rights Agreement.

Separation Time

Until the Separation Time, the Rights will trade together with the common shares, will be represented by the common share certificates and will not be exercisable. After the Separation Time, the Rights will become exercisable, will be evidenced by Rights certificates and will be transferable separately from the common shares.

The "Separation Time" is the close of business on the eighth trading day (or such later day as may be determined by the Board) after the earlier of:

- (a)

- the "Stock Acquisition Date", which is the date of the first public announcement of facts indicating that a person has become an Acquiring Person (as defined below); and

- (b)

- the date of the commencement of, or first public announcement of the intent of any person (other than the Corporation or a subsidiary of the Corporation) to commence a take-over bid (other than a Permitted Bid or a Competing Permitted Bid (described below)) to acquire Beneficial Ownership of shares of the Corporation to which is attached a right to vote for the election of all directors generally ("Voting Shares") which, together with such person's Voting Shares, constitute in the aggregate more than 20% of the Voting Shares.

Permitted Bid

A "Permitted Bid" is defined in the Rights Agreement as a take-over bid made by take-over bid circular and which also complies with the following requirements:

- (a)

- the bid is made by take-over bid circular to all holders of Voting Shares wherever resident, other than the offeror, for all outstanding Voting Shares other than those held by the offeror;

- (b)

- Voting Shares may be deposited under the bid any time between the date of the bid and the date Voting Shares are taken up and paid for, and any Voting Shares deposited under the bid may be withdrawn until taken up and paid for; and

- (c)

- the take-over bid must be open for at least 75 days and more than 50% of the outstanding Voting Shares of the Corporation (other than shares Beneficially Owned by the offeror on the date of the bid) must be deposited under the bid and not withdrawn before any shares may be taken up and paid for and, if 50% of the Voting Shares are so deposited and not withdrawn, an announcement of such fact must be made and the bid must remain open for a further 10 business day period.

A Permitted Bid, even if not approved by the Board, may be made directly to the shareholders of the Corporation. Shareholders' approval at a special meeting will not be required for a Permitted Bid. Instead, shareholders of the Corporation will initially have 75 days to deposit their shares.

If a potential offeror does not wish to make a Permitted Bid, it can negotiate with, and obtain the prior approval of, the Board to make a bid by take-over bid circular on terms which the Board considers fair to all shareholders. In such circumstances, the Board may waive the application of the Rights Plan to that transaction, thereby allowing such bid to proceed without dilution to the offeror, and will be deemed to have waived the application of the Rights Plan to all other contemporaneous bids made by take-over bid circular.

C-3

A "Competing Permitted Bid" is a take-over bid that is made after a Permitted Bid has been made but prior to its expiry, satisfies all the requirements of a Permitted Bid as described above, except that a Competing Permitted Bid is not required to remain open for 75 days so long as it is open until the later of 35 days after the date of the Competing Permitted Bid was made and 75 days after the earliest date on which a Permitted Bid then in existence was made.

Acquiring Person

In general, an "Acquiring Person" is a person who is the Beneficial Owner of 20% or more of the Corporation's outstanding Voting Shares. Currently, no Voting Shares other than the common shares are outstanding. Excluded from the definition of "Acquiring Person" are the Corporation and its subsidiaries, and any person who becomes the Beneficial Owner of 20% or more of the outstanding Voting Shares as a result of one or more, or any combination of, an Exempt Acquisition, a Permitted Bid Acquisition, a Pro Rata Acquisition or a Voting Share Reduction. Under the Rights Plan:

- (a)

- an "Exempt Acquisition" is a share acquisition in respect of which the Board has waived the application of the Rights Plan or which was made prior to the date of the Rights Plan;

- (b)

- a "Permitted Bid Acquisition" is an acquisition of Voting Shares made pursuant to a Permitted Bid or a Competing Permitted Bid;

- (c)

- a "Pro Rata Acquisition" is an acquisition of Voting Shares pursuant to a stock dividend, a stock split or other similar event or a dividend reinvestment plan or other plan made available by the Corporation to holders of all of its Voting Shares. It also means the acquisition or exercise of share purchase rights distributed pursuant to a rights offering or a public or private distribution of Voting Shares but only if the acquisition allows the acquiror to maintain its percentage holding of Voting Shares; and

- (d)

- a "Voting Share Reduction" is an acquisition or redemption by the Corporation of Voting Shares.

Beneficial Ownership

In general, a person "Beneficially Owns" Voting Shares held by the person and Voting Shares actually held by others in circumstances where those holdings are or should be grouped together for purposes of the Rights Plan. Included are holdings by the person's "Affiliates" (generally, a person that controls, is controlled by, or under common control with the other person) and "Associates" (generally includes relatives sharing the same residence, partners, corporations in which an interest is held for 10% or more of the voting securities and trusts in which a substantial beneficial interest is held). Also included are securities which the person or any of the person's Affiliates or Associates has the right to acquire within 60 days (other than customary agreements with and between underwriters and/or banking group and/or selling group members with respect to a distribution of securities, and other than pledges of securities in the ordinary course of business).

A person is also deemed to "Beneficially Own" any securities that are Beneficially Owned by any other person with which the person is acting jointly or in concert (a "Joint Actor"). Under the Rights Agreement, a person is a Joint Actor with anyone who is a party to an agreement, commitment or understanding with the first person or another person acting jointly or in concert with the first person for the purpose of acquiring or offering to acquire Voting Shares or for the purpose of exercising jointly any voting rights.

The definition of "Beneficial Ownership" contains several exclusions whereby a person is not considered to "Beneficially Own" a security. There are exemptions from the deemed "Beneficial Ownership" provisions for institutional shareholders acting in the ordinary course of business. These exemptions apply to (i) a fund manager ("Fund Manager") which holds securities in the ordinary course of business in the performance of its duties for the account of any other person (a "Client"); (ii) a licensed trust corporation ("Trust Company") acting as trustee or administrator or in a similar capacity in relation to accounts of deceased or incompetent persons ("Estate Accounts") in relation to other accounts (each an "Other Account") and which holds such security in the ordinary course of its duties for such accounts; (iii) the administrator or the trustee (a "Plan Administrator") of one or more pension funds or plans (a "Pension Plan") registered under Canadian or U.S. law and the Pension Plan itself; or (iv) an agency (the "Crown Agent") established by statute, the ordinary business or activity of which includes the management of investment funds for employee benefit plans, pension

C-4

plans, insurance plans, or various public bodies. The foregoing exemptions only apply so long as the Fund Manager, Trust Company, Plan Administrator or Crown Agent is not then making or has not then announced an intention to make a take-over bid, other than an offer to acquire Voting Shares or other securities pursuant to certain market transactions made in the ordinary course of business, a distribution by the Corporation or by means of a Permitted Bid. A Fund Manager, Trust Company, Plan Administrator or Crown Agent which loses its exemption from deemed Beneficial Ownership under the foregoing provision will generally not become an Acquiring Person until a period of 10 days has elapsed since the first date of public announcement of its intention to make or participate in the making of a take-over bid.

A person will not be deemed to "Beneficially Own" a security because (i) the person is a Client of the same Fund Manager, an Estate Account or an Other Account of the same Trust Company, or Plan with the same Plan Administrator as another person or Pension Plan on whose account the Fund Manager, Trust Company or Plan Administrator, as the case may be, holds such security; or (ii) the person is a Client of a Fund Manager, Estate Account, Other Account or Pension Plan, and the security is owned by the Fund Manager, Trust Company or Plan Administrator, as the case may be.

Flip-in Event