QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(Amendment No. 2)

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g)

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2003

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from TO

Commission file number: 1-13422

AGNICO-EAGLE MINES LIMITED

(Exact name of Registrants Specified in its Charter)

Not Applicable

(Translation of Registrant's Name or Organization)

Ontario, Canada

(Jurisdiction of Incorporation or Organization)

145 King Street East, Suite 500

Toronto, Ontario, M5C 2Y7

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Common Shares without par value (Title of Class) | The Toronto Stock Exchange and the New York Stock Exchange (Name of exchange on which registered) |

Securities registered or to be registered pursuant to Section 12(g) of the Act

| Share Purchase Warrants (Title of Class) | The Toronto Stock Exchange and the Nasdaq National Market (Name of exchange on which registered) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

Convertible Subordinated Debentures due 2012

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

84,469,804 Common Shares as of December 31, 2003

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 o Item 18 ý

| | Page | |||

|---|---|---|---|---|

| EXPLANATORY NOTE | 1 | |||

| PRELIMINARY NOTE | 1 | |||

| NOTE TO INVESTORS CONCERNING ESTIMATES OF MINERAL RESOURCES | 2 | |||

| NOTE TO INVESTORS CONCERNING CERTAIN MEASURES OF PERFORMANCE | 2 | |||

| ITEM 3. KEY INFORMATION | 3 | |||

| Selected Financial Data | 3 | |||

| Currency Exchange Rates | 5 | |||

| Risk Factors | 5 | |||

| ITEM 4. INFORMATION ON THE COMPANY | 10 | |||

| History and Development of the Company | 10 | |||

| Business Overview | 12 | |||

| Mining Legislation and Regulation | 14 | |||

| Organizational Structure | 14 | |||

| Property, Plant and Equipment | 15 | |||

| Mineral Reserve and Mineral Resource | 23 | |||

| Legal and Regulatory Proceedings | 31 | |||

| ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 31 | |||

| Operating Results | 31 | |||

| Liquidity and Capital Resources | 31 | |||

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 31 | |||

| Metal Price and Foreign Currency | 31 | |||

| Interest Rate | 32 | |||

| ITEM 18. FINANCIAL STATEMENTS | 33 | |||

| ITEM 19. EXHIBITS | 33 | |||

- *

- Omitted pursuant to General Instruction E(b) of Form 20-F.

- **

- Pursuant to General Instruction E(c) of Form 20-F, the registrant has elected to provide the financial statements and related information specified in Item 18.

i

This Amendment No. 2 on Form 20-F/A (the "Form 20-F") amends the Annual Report on Form 20-F/A for the year ended December 31, 2003 filed on January 18, 2005 (the "Amended Filing"), which amended and replaced the Annual Report on Form 20-F filed on May 18, 2004 (the "Original Filing"). Agnico-Eagle Mines Limited ("Agnico-Eagle" or the "Company") has filed this Form 20-F in response to comments received from securities regulators regarding the disclosure in the Amended Filing. While the Amended Filing updated the Original Filing to reflect certain 2004 operating data and 2005 budget information, neither the Amended Filing nor this 20-F reflects financial results for the financial year ended December 31, 2004.This 20-F does not update any results or information from that contained in the Amended Filing. Accordingly, you should read this Form 20-F together with the Amended Filing and other documents that we have filed with the Canadian securities regulators and the U.S. Securities and Exchange Commission (the "SEC") subsequent to the date of the Original Filing, including the Company's Annual Report on Form 20-F for the year ended December 31, 2004, which includes the Company's financial results for such period. Information in such reports and documents updates and supersedes certain information contained in this Form 20-F. The filing of this Form 20-F shall not be deemed an admission that the Original Filing or the Amended Filing, when made, included any known, untrue statement of material fact or knowingly omitted to state a material fact necessary to make a statement not misleading.

Incorporation by Reference: This Form 20-F sets out only those items of and exhibits to the Company's Annual Report on Form 20-F/A for the year ended December 31, 2003 to which amendments have been made and hereby incorporates by reference from the Amended Filing all items and exhibits from the Amended Filing that are not set out herein or attached hereto.

Exhibit 99C: Attached hereto as Exhibit 99C is the Registrant's 2003 Annual Audited Consolidated Financial Statements and Management's Discussion and Analysis (prepared in accordance with US GAAP) containing information incorporated by reference in answer or partial answer to certain items of this Form 20-F including consolidated financial statements as at and for the years ended December 31, 2003 and 2002, and the related notes, together with the auditors' report thereon and the management's discussion and analysis of financial condition and results of operations for the year ended December 31, 2003.

Currencies: The Registrant presents its consolidated financial statements in United States dollars. All dollar amounts in this Form 20-F (and in Exhibit 99C) are stated in United States dollars (US dollars, $, or US$), except where otherwise indicated. All dollar amounts in Exhibit 99D are stated in Canadian dollars, except where otherwise indicated. See "Item 3: Key Information — Selected Financial Information — Currency Exchange Rates" for a history of exchange rates of Canadian dollars into US dollars.

Generally Accepted Accounting Principles: Effective January 1, 2002, the Registrant changed its primary basis of financial reporting from Canadian generally accepted accounting principles ("Canadian GAAP") to United States generally accepted accounting principles ("US GAAP") due to its substantial U.S. shareholder base and to maintain comparability with other gold mining companies. All references to financial results herein are to those calculated under US GAAP. Financial statements and Management's Discussion and Analysis under Canadian GAAP are prepared and distributed to shareholders for statutory reporting purposes.

Forward-Looking Information: Certain statements in this Form 20-F and the documents incorporated herein by reference as Exhibits 99C and 99D constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Registrant or industry results, to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following: general economic and business conditions, which will, among other things, impact demand for gold and other metals produced by the Registrant; industry capacity; the ability of the Registrant to implement its business strategy; and changes in, or the failure to comply with, government regulations (especially safety and environmental laws and regulations). See also "Item 3: Key Information — Risk Factors", under the

1

subheadings "Recent Losses", "Dependence on the LaRonde Division", "Metal Price Volatility", "Uncertainty of Production Estimates", "Cost of Exploration and Development Programs", "Total Cash Costs of Gold Production at the LaRonde Mine", "Restrictions in the Bank Credit Facility", "Risk of Acquisitions", "Competition for and Scarcity of Mineral Lands", "Uncertainty of Mineral Reserve and Mineral Resource Estimates", "Mining Risks and Insurance", "Laws and Regulations", "Currency Fluctuations", and "Interest Rate Fluctuations".

NOTE TO INVESTORS CONCERNING ESTIMATES OF MINERAL RESOURCES

Cautionary Note to Investors concerning estimates of Measured and Indicated Resources

This document and documents incorporated by reference herein use the terms "measured resources" and "indicated resources". The Company advises investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Cautionary Note to Investors concerning estimates of Inferred Resources

This document and documents incorporated by reference herein use the term "inferred resources". The Company advises investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. "Inferred resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.Investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

NOTE TO INVESTORS CONCERNING CERTAIN MEASURES OF PERFORMANCE

This document and documents incorporated by reference herein present certain measures, including "total cash cost per ounce" and "minesite cost per ton", that are not recognized measures under US GAAP. This data may not be comparable to data presented by other gold producers. For a reconciliation of these measures to the closest measures recognized under US GAAP see "Results of Operations — Production Costs" in Exhibit 99C to this Form 20-F. The Company believes that these generally accepted industry measures are realistic indicators of operating performance and useful in allowing year over year comparisons. However, both of these non-GAAP measures should be considered together with other data prepared in accordance with US GAAP, and these measures, taken by themselves, are not necessarily indicative of operating costs or cash flow measures prepared in accordance with US GAAP.

2

ITEM 3. KEY INFORMATION

Selected Financial Data

The following selected financial data for each of the years in the five-year period ended December 31, 2003 are derived from the consolidated financial statements of Agnico-Eagle Mines Limited ("Agnico-Eagle" or the "Company") audited by Ernst & Young LLP. The selected financial data should be read in conjunction with management's discussion and analysis of the Company's operations and financial condition, the consolidated financial statements and accompanying notes in Exhibit 99C to this Form 20-F and other financial information included elsewhere in this Form 20-F.

| | Year ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2003 | 2002 | 2001 | 2000 | 1999 | ||||||

| | (in thousands of US dollars, US GAAP basis) | ||||||||||

| Income Statement Data | |||||||||||

| Revenues from mining operations(1) | 126,820 | 108,027 | 96,043 | 63,676 | 23,392 | ||||||

| Interest and sundry income | 2,775 | 1,943 | 5,752 | 2,145 | (5,519 | ) | |||||

| 129,595 | 109,970 | 101,795 | 65,821 | 17,873 | |||||||

| Production costs(1) | 104,990 | 75,969 | 67,009 | 49,997 | 28,447 | ||||||

| Exploration expense | 5,975 | 3,766 | 6,391 | 3,213 | 3,838 | ||||||

| Equity loss in junior exploration company(2) | 1,626 | — | — | — | — | ||||||

| Amortization | 17,504 | 12,998 | 12,658 | 9,220 | 4,479 | ||||||

| General and administrative | 7,121 | 5,530 | 4,461 | 4,223 | 4,044 | ||||||

| Provincial capital tax | 1,240 | 829 | 1,551 | 1,301 | 1,192 | ||||||

| Interest | 9,180 | 7,341 | 12,917 | 5,920 | 5,583 | ||||||

| Foreign exchange (gain) loss | 72 | (1,074 | ) | (336 | ) | 890 | 1,401 | ||||

| Write down of mining properties and other(3) | — | — | — | — | 974 | ||||||

| Income (loss) before income and mining taxes (recoveries) | (18,113 | ) | 4,611 | (2,856 | ) | (8,943 | ) | (32,085 | ) | ||

| Income and mining taxes (recoveries) | (358 | ) | 588 | 2,862 | (3,906 | ) | (13,016 | ) | |||

| Income before cumulative catch-up adjustment | (17,755 | ) | 4,023 | (5,718 | ) | (5,037 | ) | (19,069 | ) | ||

| Cumulative catch-up adjustment(1)(5) | (1,743 | ) | — | — | (1,831 | ) | — | ||||

| Net income (loss) | (19,498 | ) | 4,023 | (5,718 | ) | (6,868 | ) | (19,069 | ) | ||

| Net income (loss) before cumulative catch-up adjustment per share — basic and diluted | (0.21 | ) | 0.06 | (0.09 | ) | (0.09 | ) | (0.36 | ) | ||

| Net income (loss) per share — basic and diluted | (0.23 | ) | 0.06 | (0.09 | ) | (0.12 | ) | (0.36 | ) | ||

| Weighted average number of shares outstanding — basic | 83,889,115 | 70,821,081 | 61,333,630 | 54,446,693 | 53,331,268 | ||||||

| Weighted average number of shares outstanding — diluted | 83,889,115 | 71,631,263 | 61,333,630 | 54,446,693 | 53,331,268 | ||||||

| Total common shares outstanding | 84,469,804 | 83,636,861 | 67,722,853 | 56,139,480 | 54,216,771 | ||||||

| Dividends declared per common share | 0.03 | 0.03 | 0.02 | 0.02 | 0.02 | ||||||

As at December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2003 | 2002 | 2001 | 2000 | 1999 | |||||

| | (in thousands of US dollars, US GAAP basis) | |||||||||

| Balance Sheet Data (at end of period) | ||||||||||

| Mining properties (net) | 399,719 | 353,059 | 301,221 | 281,497 | 221,067 | |||||

| Total assets | 637,101 | 593,807 | 393,464 | 364,333 | 297,015 | |||||

| Long term debt(4) | 143,750 | 143,750 | 151,081 | 186,261 | 131,458 | |||||

| Reclamation provision and other liabilities(5) | 15,377 | 5,043 | 4,055 | 5,567 | 5,433 | |||||

| Shareholders' equity(6) | 400,723 | 397,693 | 198,426 | 124,361 | 128,569 | |||||

3

Notes:

- (1)

- Revenues from mining operations consist of gold and byproduct zinc, silver and copper revenues, net of smelting, refining and transportation costs. Effective 2000, the Company changed its accounting policy with respect to revenue recognition. As a result of the change, revenue from concentrates is recognized when legal title passes to custom smelters and is valued on an estimated net realizable value basis. Periodic adjustments on the final settlement of concentrates previously sold to smelters are included in revenue as soon as the amount can be reasonably determined. Revenue from gold and silver in the form of dore bars is recorded when the refined gold and silver are sold and also included in revenues from mining operations. Prior to this change, the Company recognized revenues from concentrates on a production basis. Under this basis of accounting, revenue was recognized once the ore was extracted and processed at the onsite mill facilities. The accounting change was accounted for as a cumulative catch-up adjustment and resulted in a loss of $1.8 million or $0.03 per share in 2000.

- (2)

- As a result of issuances of stock by Contact Diamond Corporation (formerly Sudbury Contact Mines Limited) ("Contact Diamond"), the Company's interest in Contact Diamond was diluted to below 50% during 2003. The Company therefore no longer consolidates the results of Contact Diamond but accounts for its investment using the equity method of accounting. The Company now reports its share of losses in Contact Diamond as a separate line item in the consolidated financial statements. The Company began using the equity method to account for its interest in Contact Diamond on September 1, 2003.

- (3)

- On August 31, 1999, the Company settled a lawsuit commenced by Noranda Inc. ("Noranda") relating to the acquisition of Dumagami Mines Inc. for $1.3 million (C$1.9 million), of which C$950,000 was paid on signing of settlement documentation and the remaining C$950,000 was paid in August 2000. The lawsuit was dismissed without costs.

- (4)

- On February 15, 2002, Agnico-Eagle issued $143.8 million aggregate principal amount of 4.50% convertible subordinated debentures due February 15, 2012 (the "Convertible Debentures") for net proceeds of $138.5 million after deducting underwriting commissions of $4.3 million. Other costs of issuing the debentures totalled $1.0 million. The debentures bear interest of 4.50% per annum on the principal amount payable in cash semi-annually. The debentures are convertible into common shares of Agnico-Eagle at the option of the holder, at any time on or prior to maturity, at a rate of 71.429 common shares per $1,000 principal amount. The debentures are redeemable by Agnico-Eagle, in whole or in part, at any time on or after February 15, 2006 at a redemption price equal to par plus accrued and unpaid interest. The Company may redeem the debentures in cash or, at the option of the Company, by delivering freely tradeable common shares.

- On February 15, 2002, the entire amount of the Company's senior convertible notes due January 27, 2004 (the "Senior Notes") was called for redemption.

- For the year ended December 31, 2003, interest expense was $9.2 million (2002 — $7.3 million; 2001 — $12.9 million; 2000 — $5.9 million; 1999 — $5.6 million) and cash interest payments were $8.0 million (2002 — $24.4 million; 2001 — $10.4 million; 2000 — $4.4 million; 1999 — $5.6 million). Approximately $19 million of the cash interest payments in 2002 were in connection with the redemption of the Senior Notes. See Note 4(b) to the consolidated financial statements on page 35 of Exhibit 99C to this Form 20-F.

- (5)

- Effective January 1, 2003, the Company adopted the provisions of FASB Statement No. 143 ("FAS 143") related to asset retirement obligations. FAS 143 applies to legal obligations resulting from the construction, development and operation of long-lived assets, such as mining assets. This standard requires companies to recognize the present value of reclamation costs as a liability in the period the legal obligation is incurred. The Company estimated the final reclamation provision taking into account current circumstances such as projected mine life at the end of 2003 and current throughput. Subsequent revisions to the final reclamation estimate could result from legislative changes or changes in the underlying assumptions such as life-of-mine.

- For periods prior to January 1, 2003, estimated future reclamation costs were based primarily on legal, environmental and regulatory requirements. Future reclamation costs for the Company's inactive mines were accrued based on management's best estimate of the costs at the end of each period, comprising costs expected to be incurred at a site, on an undiscounted basis. Such cost estimates included, where applicable, ongoing care and maintenance and monitoring costs. Changes in estimates were reflected in income in the period an estimate was revised.

- (6)

- For each period ending December 31, 2000 or earlier, these amounts are net of the common shares of the Company held by Mentor Exploration and Development Co., Limited ("Mentor"), a former associate of the Company, which for accounting purposes, was treated as a subsidiary and was consolidated into the Company's financial statements. In October 2001, pursuant to a plan of arrangement, the Company amalgamated with Mentor and issued 369,948 common shares pursuant to that plan.

- In 2002, the Company completed a public offering of 13,800,000 units, each unit consisting of one common share and one-half warrant, at $13.90 per unit for net proceeds of $182.9 million, after deducting issue costs of $9.1 million. Each whole share purchase warrant ("Share Purchase Warrant") entitles the holder to acquire one common share for a price of $19 at any time on or prior to November 14, 2007. If all outstanding Share Purchase Warrants are exercised, the Company would be required to issue an additional 6,900,000 common shares. See Note 6(c) to the consolidated financial statements on page 39 of Exhibit 99C to this Form 20-F. In 2001, the Company completed a public offering of 10,350,000 common shares at $7.90 per common share for net proceeds of $76.2 million. See Note 6(c) to the consolidated financial statements on page 39 of Exhibit 99C to this Form 20-F.

- In 2003, the Company issued 255,768 common shares (2002 — 40,161; 2001 — 200,000; 2000 — 475,000) under a flow-through share private placement for proceeds of $3.6 million (2002 — $0.6 million; 2001 — $2.5 million; 2000 — $3.6 million) net of share issue costs. See Note 6(b) to the consolidated financial statements on page 39 of Exhibit 99C to this Form 20-F.

4

Currency Exchange Rates

All dollar amounts in this Form 20-F are in United States dollars, except where otherwise indicated. The following tables present, in Canadian dollars, the exchange rates for the US dollar, based on the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York (the "Noon Buying Rate"). On January 13, 2005, the Noon Buying Rate was US$1.00 equals C$1.2005.

| | Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | ||||||

| High | 1.3970 | 1.5750 | 1.6128 | 1.6023 | 1.5592 | 1.5302 | ||||||

| Low | 1.1775 | 1.2923 | 1.5108 | 1.4933 | 1.4350 | 1.4440 | ||||||

| End of Period | 1.2034 | 1.2923 | 1.5800 | 1.5925 | 1.4995 | 1.4440 | ||||||

| Average | 1.3017 | 1.4012 | 1.5704 | 1.5519 | 1.4855 | 1.4828 | ||||||

| | 2004 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | December | November | October | September | August | July | ||||||

| High | 1.2401 | 1.2263 | 1.2726 | 1.3071 | 1.3323 | 1.3353 | ||||||

| Low | 1.1856 | 1.1775 | 1.2194 | 1.2648 | 1.2964 | 1.3082 | ||||||

| End of Period | 1.2034 | 1.1902 | 1.2209 | 1.2648 | 1.3166 | 1.3296 | ||||||

| Average | 1.2189 | 1.1968 | 1.2469 | 1.2881 | 1.3127 | 1.3634 | ||||||

Risk Factors

Recent Losses

Although the Company reported net income for the nine months ended September 30, 2004 and expects to report net income for the year ended December 31, 2004, it incurred net losses in 2003 and in each of the five years prior to 2002. For a discussion of the factors contributing to the losses, please refer to pages 1 to 22 in Exhibit 99C to this Form 20-F under the caption "Management's Discussion and Analysis of the Company's Financial Condition and Results of Operations." The Company's profitability depends on the price of gold, gold production, total cash costs, the prices and production levels of byproduct zinc, silver and copper and other factors discussed in this section of the Form 20-F. Substantially all of these factors are beyond the Company's control and there can be no assurance that the Company will sustain profitability in the future.

Dependence on the LaRonde Division

The Company's mining and milling operations at the LaRonde Division account for all of the Company's gold production and will continue to account for all of its gold production in the future unless additional properties are acquired or brought into production. Any adverse condition affecting mining or milling conditions at the LaRonde Division could be expected to have a material adverse effect on the Company's financial performance and results of operations until such time as the condition is remedied. In addition, the Company's principal development program is the expansion of the LaRonde Division. This program involves the exploration and extraction of ore from new zones and may present new or different challenges for the Company. In addition, gold production at the LaRonde Mine is expected to begin to decline commencing in 2007. Unless the Company can successfully bring into production the Lapa property, the Goldex property or its other exploration properties or otherwise acquire gold producing assets prior to 2007, the Company's results of operations will be adversely affected. There can be no assurance that the Company's current exploration and development programs at the LaRonde Division will result in any new economically viable mining operations or yield new mineral reserves to replace and expand current mineral reserves.

Metal Price Volatility

The Company's earnings are directly related to commodity prices as revenues are derived from precious metals (gold and silver), zinc and copper. The Company's policy and practice is not to sell forward its future gold production; however, under the Company's Price Risk Management Policy, approved by its Board of Directors,

5

the Company may review this practice on a project by project basis, making use of hedging strategies where appropriate to ensure an adequate return to shareholders on new projects. In addition, in accordance with the Company's revolving bank credit facility, the Company has purchased put options to ensure projected revenues from sales of gold are sufficient to reasonably ensure that the Company will be in compliance with the financial and other covenants of the facility. See "Management's Discussion and Analysis of the Company's Financial Condition and Results of Operations — Risk Profile" on pages 12 to 15 of Exhibit 99C to this Form 20-F for more details of the Company's hedging activities. Gold prices fluctuate widely and are affected by numerous factors beyond the Company's control, including central bank sales, producer hedging activities, expectations of inflation, the relative exchange rate of the US dollar with other major currencies, global and regional demand and political and economic conditions, and production costs in major gold producing regions. The aggregate effect of these factors is impossible to predict with accuracy. Gold prices are also affected by worldwide production levels. In addition, the price of gold has on occasion been subject to very rapid short-term changes because of speculative activities. Fluctuations in gold prices may adversely affect the Company's financial performance or results of operations. If the market price of gold falls below the Company's total costs and remains at such a level for any sustained period, the Company may experience losses and may curtail or suspend some or all of its exploration, development and mining activities. The prices received for the Company's byproducts (zinc, silver and copper) affect the Company's ability to meet its targets for total cash cost per ounce of gold produced. Byproduct prices fluctuate widely and are affected by numerous factors beyond the Company's control. The Company occasionally implements hedging strategies to mitigate the effects of fluctuating byproduct metal prices.

The volatility of gold prices is illustrated in the following table which sets forth, for the periods indicated, the high and low afternoon fixing prices for gold on the London Bullion Market (the "London P.M. Fix") and the average gold prices received by the Company.

| | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| High price ($ per ounce) | 454 | 417 | 350 | 293 | 313 | 326 | ||||||

| Low price ($ per ounce) | 375 | 323 | 278 | 256 | 264 | 253 | ||||||

| Average price received ($ per ounce) | 418 | 368 | 312 | 273 | 278 | 274 |

On January 13, 2005, the London P.M. Fix was $423.60 per ounce of gold.

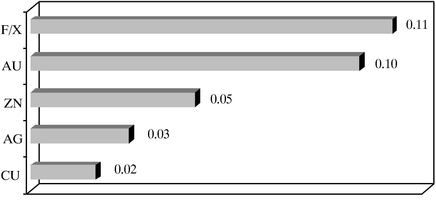

Based on 2005 production estimates, the approximate sensitivities of the Company's after-tax income to a 10% change in metal prices from 2004 market average prices are as follows:

| | Income per share | ||

|---|---|---|---|

| Gold | $ | 0.09 | |

| Zinc | $ | 0.04 | |

| Silver | $ | 0.03 | |

| Copper | $ | 0.01 | |

Sensitivities of the Company's after-tax income to changes in metal prices will increase with increased production.

Uncertainty of Production Estimates

The Company's gold production may fall below estimated levels as a result of mining accidents such as cave-ins, rock falls, rock bursts or flooding. In addition, production may be unexpectedly reduced if, during the course of mining, unfavourable ground conditions or seismic activity are encountered, ore grades are lower than expected, or the physical or metallurgical characteristics of the ore are less amenable than expected to mining or treatment. Accordingly, there can be no assurance that the Company will achieve current or future production estimates.

A rock fall that occurred in two production stopes during the first quarter of 2003 led to an initial 20% reduction in the Company's 2003 gold production estimate from 375,000 ounces to 300,000 ounces. Production

6

drilling challenges and lower than planned recoveries in the mill in the third quarter of 2003 led to a further reduction in the production estimate by 21%. Final gold production in 2003 was 236,653 ounces.

Cost of Exploration and Development Programs

The Company's profitability is significantly affected by the costs and results of its exploration and development programs. As mines have limited lives based on proven and probable mineral reserves, the Company actively seeks to replace and expand its reserves, primarily through exploration and development and, from time to time, through strategic acquisitions. Exploration for minerals is highly speculative in nature, involves many risks and frequently is unsuccessful. Among the many uncertainties inherent in any gold exploration and development program are the location of economic ore bodies, the development of appropriate metallurgical processes, the receipt of necessary governmental permits and the construction of mining and processing facilities. In addition, substantial expenditures are required to pursue such exploration and development activities. Assuming discovery of an economic ore body, depending on the type of mining operation involved, several years may elapse from the initial phases of drilling until commercial operations are commenced and during such time the economic feasibility of production may change. Accordingly, there can be no assurance that the Company's current exploration and development programs will result in any new economically viable mining operations or yield new reserves to replace and expand current reserves.

Total Cash Costs of Gold Production at the LaRonde Mine

The Company's total cash costs to produce an ounce of gold are dependent on a number of factors, including primarily the prices and production levels of byproduct zinc, silver and copper, the revenue from which is offset against the cost of gold production, the US dollar/Canadian dollar exchange rate, smelting and refining charges and production royalties, which are affected by all of these factors and the gold price. All these factors are beyond the Company's control.

Total cash cost is not a recognized measure under US GAAP and this data may not be comparable to data presented by other gold producers. Management uses this generally accepted industry measure in evaluating operating performance and believes it to be a realistic indication of such performance and useful in allowing year over year comparisons. The data also indicates the Company's ability to generate cash flow and operating income at various gold prices. This additional information should be considered together with other data prepared in accordance with US GAAP and is not necessarily indicative of operating costs or cash flow measures prepared in accordance with US GAAP (see the information set out under the caption "Results of Operations — Production Costs" on pages 4 to 7 of Exhibit C to this 20-F for a reconciliation of total cash costs per ounce and minesite costs per ton to their closest GAAP measure).

Risks of Acquisitions

The Company regularly evaluates opportunities to acquire shares or assets of other mining businesses. Such acquisitions may be significant in size, may change the scale of the Company's business, and may expose the Company to new geographic, political, operating, financial or geological risks. The Company's success in its acquisition activities depends on its ability to identify suitable acquisition candidates, acquire them on acceptable terms and integrate their operations successfully with those of the Company. Any acquisitions would be accompanied by risks, such as the difficulty of assimilating the operations and personnel of any acquired businesses; the potential disruption of the Company's ongoing business; the inability of management to maximize the financial and strategic position of the Company through the successful integration of acquired assets and businesses; the maintenance of uniform standards, controls, procedures and policies; the impairment of relationships with employees, customers and contractors as a result of any integration of new management personnel; and the potential unknown liabilities associated with acquired assets and businesses. In addition, the Company may need additional capital to finance an acquisition. Debt financing related to any acquisition may expose the Company to increased risk of leverage, while equity financing may cause existing shareholders to suffer dilution. The Company is permitted under the terms of its recently amended bank credit facility to raise additional debt financing provided that it complies with certain covenants including that no default under the credit facility has occurred and is continuing, the terms of such indebtedness are no more onerous to the Company than those under the credit facility and the incurrence of such indebtedness would not result in a

7

material adverse change in respect of the Company or the LaRonde Mine. There can be no assurance that the Company would be successful in overcoming these risks or any other problems encountered in connection with such acquisitions.

Restrictions in the Bank Credit Facility

The Company's recently amended $100 million revolving bank credit facility limits, among other things, the Company's ability to incur additional indebtedness, pay dividends or make payments in respect of its common shares, make investments or loans, transfer the Company's assets, or make expenditures relating to property secured under the credit agreement at that time that is not consistent with the mine plan and operating budget delivered pursuant to the credit facility. Further, the bank credit facility requires the Company to maintain specified financial ratios and meet financial condition covenants. Events beyond the Company's control, including changes in general economic and business conditions, may affect the Company's ability to satisfy these covenants, which could result in a default under the bank credit facility. While there are currently no amounts of principal or interest owing under the bank credit facility, if an event of default under the bank credit facility occurs, the Company would be unable to draw down on the facility, or if amounts were drawn down at the time of the default, the lenders could elect to declare all principal amounts outstanding thereunder at such time, together with accrued interest, to be immediately due and payable and to enforce their security interest over substantially all property relating to the LaRonde Mine and the El Coco property. An event of default under the bank credit facility may also give rise to an event of default under existing and future debt agreements and, in such event, the Company may not have sufficient funds to repay amounts owing under such agreements.

Competition for and Scarcity of Mineral Lands

Many companies and individuals are engaged in the mining business, including large, established mining companies with substantial capabilities and long earnings records. There is a limited supply of desirable mineral lands available for claim staking, lease or other acquisition in the areas where the Company contemplates conducting exploration activities. The Company may be at a competitive disadvantage in acquiring mining properties, as it must compete with these individuals and companies, many of which have greater financial resources and larger technical staffs than the Company. Accordingly, there can be no assurance that the Company will be able to compete successfully for new mining properties.

Uncertainty of Mineral Reserve and Mineral Resource Estimates

The figures for mineral reserves and mineral resource presented herein are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery of gold will be realized. The ore grade actually recovered by the Company may differ from the estimated grades of the mineral reserves and mineral resource. Such figures have been determined based on assumed gold prices and operating costs. The Company has estimated proven and probable mineral reserves based on a $325 per ounce gold price. While gold prices have generally been above $325 per ounce since mid 2002, for the four years prior to that the market price of gold has been, on average, below $325 per ounce. Prolonged declines in the market price of gold may render mineral reserves containing relatively lower grades of gold mineralization uneconomic to exploit and could materially reduce the Company's reserves. Should such reductions occur, the Company could be required to take a material write-down of its investment in mining properties or delay or discontinue production or the development of new projects, resulting in increased net losses and reduced cash flow. Market price fluctuations of gold, as well as increased production costs or reduced recovery rates, may render mineral reserves containing relatively lower grades of mineralization uneconomical to recover and may ultimately result in a restatement of mineral resources. Short-term factors relating to mineral reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may impair the profitability of a mine in any particular accounting period.

Mineral resource estimates for properties that have not commenced production are based, in most instances, on very limited and widely spaced drill hole information, which is not necessarily indicative of conditions between and around the drill holes. Accordingly, such mineral resource estimates may require revision as more drilling information becomes available or as actual production experience is gained.

8

Mining Risks and Insurance

The business of gold mining is generally subject to certain types of risks and hazards, including environmental hazards, industrial accidents, unusual or unexpected rock formations, changes in the regulatory environment, cave-ins, rock bursts, rock falls and flooding and gold bullion losses. Such occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability. The Company carries insurance to protect itself against certain risks of mining and processing in amounts that it considers to be adequate but which may not provide adequate coverage in certain unforeseen circumstances. The Company may also become subject to liability for pollution, cave-ins or other hazards against which it cannot insure or against which it may elect not to insure because of high premium costs or other reasons or the Company may become subject to liabilities which exceed policy limits. In such case, the Company may be required to incur significant costs that could have a material adverse effect on its financial performance and results of operations.

Laws and Regulations

The Company's mining and mineral processing operations and exploration activities are subject to extensive Canadian federal and provincial laws and regulations, and local laws and regulations governing prospecting, development, production, exports, taxes, labour standards, occupational health and safety, waste disposal, toxic substances, environmental protection, mine safety and other matters. Compliance with such laws and regulations increases the costs of planning, designing, drilling, developing, constructing, operating, closing, reclaiming and rehabilitating mines and other facilities. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation or interpretation thereof could have a material adverse impact on the Company, cause a reduction in levels of production and delay or prevent the development of new mining properties.

In January 2003, the Company received a notice of infraction from the Quebec Ministry of the Environment in connection with a controlled discharge of water of excess toxicity, which was carried out over a three-month period in the summer of 2002. The purpose of the discharge was to establish favourable construction conditions for the increase of tailings pond capacity in the autumn of 2002. No fine was payable in respect of the notice of infraction, however, the notice required production of a report detailing the causes of algae proliferation at the LaRonde Mine, which was delivered in 2003.

Under mine closure plans originally submitted to the Minister of Natural Resources in Quebec in 1996, the estimated current reclamation costs for the LaRonde Division and the Bousquet property are approximately $17 million and $6 million respectively. These reclamation plans are subject to approval by the Minister of Natural Resources and there can be no assurance that the Minister of Natural Resources will not impose additional reclamation obligations with attendant higher costs. In addition, the Minister of Natural Resources may require that the Company provide financial assurances to support such plans. At December 31, 2003, the Company had a total reclamation provision of $11.7 million, with $5.8 million allocated for the LaRonde Division and $5.9 million allocated for Bousquet.

Prior to January 1, 2003, reclamation costs were accrued on an undiscounted unit-of-production basis, using proven and probable reserves as the base. On this basis, the Company recorded its annual reclamation provision for the LaRonde Division at approximately $5 per ounce of gold produced. Effective January 1, 2003, the Company adopted the provisions of Financial Accounting Standards Board Statement No. 143 relating to asset retirement obligations, which applies to long-lived assets such as mines. (See Note 6 to the table under the caption "Item 3 Key Information — Selected Financial Information" for an explanation of the new standard.) The application of the new provisions resulted in the Company recording a one-time, net of tax, non-cash charge of $1.7 million on January 1, 2003 reflecting the cumulative effect of adopting this standard.

Currency Fluctuations

The Company's operating results and cash flow are significantly affected by changes in the US dollar/Canadian dollar exchange rate. Exchange rate movements can have a significant impact as all of the Company's revenues are earned in US dollars but most of its operating and capital costs are in Canadian dollars. The US dollar/Canadian dollar exchange rate has varied significantly over the last several years. During the period from

9

January 1, 1999 to December 31, 2004, the Noon Buying Rate fluctuated from a high of C$1.6128 to a low of C$1.1775. Historical fluctuations in the US dollar/Canadian dollar exchange rate are not necessarily indicative of future exchange rate fluctuations. Based on the Company's anticipated 2005 after-tax operating results, a 10% change in the average annual US dollar/Canadian dollar exchange rate would affect net income by approximately $0.10 per share. To hedge its foreign exchange risk and minimize the impact of exchange rate movements on operating results and cash flow, the Company has periodically used foreign currency options and forward foreign exchange contracts to purchase Canadian dollars. However, there can be no assurance that the Company's foreign exchange hedging strategies will be successful or that foreign exchange fluctuations will not materially adversely affect the Company's financial performance and results of operations.

Interest Rate Fluctuations

Fluctuations in interest rates can affect the Company's results of operations and cash flows. The Company's 4.50% convertible subordinated debentures due 2012 are at a fixed rate of interest; however both its bank debt and cash balances are subject to variable interest rates.

Potential Unenforceability of Civil Liabilities and Judgments

The Company is incorporated under the laws of the Province of Ontario, Canada. All but one of the Company's directors and officers and certain of the experts named in this Form 20-F are residents of Canada. Also, almost all of the Company's assets and the assets of these persons are located outside of the United States. As a result, it may be difficult for shareholders to initiate a lawsuit within the United States against these non-United States residents, or to enforce judgments in the United States against the Company or these persons which are obtained in a United States court. Our Canadian counsel has advised us that a monetary judgment of a U.S. court predicated solely upon the civil liability provisions of U.S. federal securities laws would likely be enforceable in Canada if the U.S. court in which the judgment was obtained had a basis for jurisdiction in the matter that was recognized by a Canadian court for such purposes. We cannot assure you that this will be the case. It is less certain that an action could be brought in Canada in the first instance on the basis of liability predicated solely upon such laws.

ITEM 4. INFORMATION ON THE COMPANY

History and Development of the Company

The Company is an established Canadian gold producer with mining operations located in northwestern Quebec and exploration and development activities in Canada and the western United States (principally Nevada and Idaho). The Company's operating history includes almost three decades of continuous gold production primarily from underground operations. Since its formation in 1972, the Company has produced over 3.5 million ounces of gold. The Company believes it is currently one of the lowest cash cost producers in the North American gold mining industry. In 2004, the Company produced 271,567 ounces of gold at an average cash cost estimated to have been between $75 and $85 per ounce and, in 2003, the Company produced 236,653 ounces of gold at an average cash cost of $269 per ounce, in each case net of revenues received from the sale of zinc, silver and copper byproducts. For 2005, the Company expects total cash costs per ounce of gold produced to be between $135 and $145. These expected increased costs are due to an anticipated decline in byproduct metals prices below those realized in 2004 and a reduction in the contribution of foreign exchange hedging activities. The Company has traditionally sold all of its production at the spot price of gold due to its general policy not to sell forward its future gold production. However, the Company has purchased put options that will allow it to set a floor price of $260 per ounce on a portion of its gold production prior to December 31, 2007. For a definition of terms used in the following discussion, see the section entitled "Mineral Reserve and Mineral Resource" on page 21.

The Company's principal operating divisions are the LaRonde Division and the Exploration Division. The LaRonde Division consists of the LaRonde Mine and the adjacent El Coco and Terrex properties, each of which is 100% owned and operated by the Company. The LaRonde Mine, with its single production shaft (the "Penna Shaft"), currently accounts for all of the Company's gold production. Since the commissioning of the mill in 1988, the LaRonde Division has produced over 2.5 million ounces of gold. In March 2000, the Company

10

completed the Penna Shaft at the LaRonde Mine to a depth of 7,380 feet, which the Company believes makes it the deepest single-lift shaft in the Western Hemisphere. Production was expanded at the LaRonde Mine to 7,000 tons of ore treated per day in October 2002. An extensive surface and underground exploratory drilling program to delineate additional mineral reserve began in 1990 and is continuing. The program successfully outlined several ore zones and a large mineral resource to the east of what was, at the time, the main production shaft. As at December 31, 2003, the LaRonde Division had established proven and probable mineral reserves of approximately 5.0 million ounces of contained gold.

The Company's strategy is to focus on the continued exploration, development and expansion of its properties in the Abitibi region of Quebec in which the LaRonde Mine is situated, with a view to increasing annual gold production and gold mineral reserve. The Company also plans to pursue opportunities for growth in gold production and gold reserves through the acquisition or development of advanced exploration properties, development properties, producing properties and other mining businesses in the Americas or Europe.

Expenditures on the expansion of the LaRonde Mine and exploration and development in the surrounding region as at September 30, 2004 and the three preceding fiscal years were $32.0 million, $44.1 million, $62.5 million and $37.6 million, respectively. Expenditures for mine expansion, exploration and development for 2004 are expected to have been $55 million. These estimated 2004 expenditures include $27 million of capital expenditures at the LaRonde Mine, $8 million at the LaRonde II project, $13 million for the exploration and development of the Lapa property, $5 million for the exploration and development of the Goldex property, and $2 million for the exploration and development of the Bousquet and Ellison properties. Budgeted 2005 exploration and capital expenditures of $42.0 million consist of $14.1 million of sustaining capital expenditures at the LaRonde Mine, $12.7 million on projects relating to the LaRonde II project, $12.1 million at the Lapa property, $1.5 million on bulk sample and engineering projects at the Goldex property and $1.6 million on drilling at the Bousquet and Ellison properties. The financing for these expenditures is expected to be from internally generated cash flow from operations and from the Company's existing cash balances. Depending on the success of the exploration programs at this and other properties, the Company may be required to make additional capital expenditures for exploration, development and preproduction.

In addition, the Company continuously evaluates opportunities to make strategic acquisitions. In the second quarter of 2004, the Company acquired an ownership interest in Riddarhyttan Resources AB ("Riddarhyttan"), representing 13.8% of its outstanding shares. In late December 2004, Riddarhyttan concluded a rights offering for 7.5 million shares pursuant to which the Company raised its ownership level to 14% of Riddarhyttan's outstanding shares. In connection with this acquisition, two representatives of the Company were elected to Riddarhyttan's board of directors. Riddarhyttan is a precious and base metals exploration and development company with a focus on the Nordic region of Europe. Its shares are listed on the Stockholm Stock Exchange under the symbol "RHYT". Riddarhyttan is the 100% owner of the Suurikuusikko gold deposit, located approximately 550 miles north of Helsinki near the town of Kittilä in Finnish Lapland. Riddarhyttan's property position in the Suurikuusikko area consists of 22 contiguous claims (approximately 4,261 acres) with similar Precambrian greenstone belt geology and topography to the Company's land package in the Abitibi region of Quebec. The Company also recently signed a non-binding letter of intent pursuant to which it is conducting due diligence on an exploration property in northern Mexico with a view to purchasing an option to acquire the property. The Company has no other commitments or agreements with respect to any other acquisitions.

The Company, through its Exploration Division, focuses its exploration activities primarily on the identification of new mineral reserve, mineral resource and development opportunities in the proven producing regions of Canada, with a particular emphasis on northwestern Quebec. The Company currently directly manages exploration on 56 properties in central and eastern Canada and the western United States, including properties acquired from Contact Diamond Corporation (formerly Sudbury Contact Mines Limited) ("Contact Diamond") in September 2004. The Company's Reno, Nevada exploration office, acquired in that transaction, is focused on evaluating exploration opportunities in the western United States and northern Mexico.

11

The Company was formed by articles of amalgamation under the laws of the Province of Ontario on June 1, 1972 as a result of the amalgamation of Agnico Mines Limited ("Agnico Mines") and Eagle Gold Mines Limited ("Eagle"). Agnico Mines was incorporated under the laws of the Province of Ontario on January 21, 1953 under the name "Cobalt Consolidated Mining Corporation Limited". Eagle was incorporated under the laws of the Province of Ontario on August 14, 1945. The Company's executive and registered office is located at Suite 500, 145 King Street East, Toronto, Ontario, Canada M5C 2Y7; telephone number (416) 947-1212; website: http://www.agnico-eagle.com. The information contained on the website is not part of this Form 20-F.

On December 19, 1989, Agnico-Eagle acquired the remaining 57% interest in Dumagami Mines Limited not already owned by it as a consequence of the amalgamation of Dumagami Mines Limited with a wholly-owned subsidiary of Agnico-Eagle, to continue as one company under the name Dumagami Mines Inc. ("Dumagami"). On December 29, 1992, Dumagami transferred all of its property and assets, including the LaRonde Mine, to Agnico-Eagle and was subsequently dissolved. On December 8, 1993, the Company acquired the remaining 46.3% interest in Goldex Mines Limited not already owned by it, as a consequence of the amalgamation of Goldex Mines Limited with a wholly-owned subsidiary of the Company, to continue as one company under the name Goldex Mines Limited. On January 1, 1996, the Company amalgamated with two wholly-owned subsidiaries, including Goldex Mines Limited.

In October 2001, pursuant to a plan of arrangement, the Company amalgamated with an associated corporation, Mentor Exploration and Development Co., Limited ("Mentor"). In connection with the arrangement, the Company issued 369,348 common shares in consideration for the acquisition of all of the issued and outstanding shares of Mentor that it did not already own.

Effective February 11, 1999, two subsidiaries of the Company, Sudbury Contact Mines, Limited and Silver Century Explorations Ltd. ("Silver Century"), amalgamated pursuant to a court-approved plan of arrangement to form Contact Diamond.

The Company has an approximate 44.2% interest in Contact Diamond. Contact Diamond is a junior exploration and development company with diamond properties in Ontario, Quebec, Nunavut and the Northwest Territories. Contact Diamond is incorporated under the laws of the Province of Ontario and is listed on the Toronto Stock Exchange.

Business Overview

The Company believes that it has a number of key operating strengths that provide distinct competitive advantages.

First, the Company and its predecessors have over three decades of continuous gold production, experience and expertise in metals mining. The Company's operations are located in areas that are supportive of the mining industry. These operations are concentrated in areas among North America's principal gold-producing regions.

Second, the Company believes that it is one of the lowest total cash cost producers in the North American gold mining industry. Although total cash cost per ounce of gold was $269 for 2003, this increased level resulted, in part, from the rescheduling of stope mining sequencing required as a result of the rock fall that occurred during the first quarter of 2003. For 2004, the Company's total cash cost per ounce of gold is estimated to have been between $75 and $85, due principally to higher gold production, higher net byproduct revenue resulting from increased production, higher byproduct metal prices and the elimination of the production royalty on an area of the mine that is mined out. The Company has achieved significant improvements in these measures through the strength of its byproduct revenue, the economies of scale afforded by its large single shaft mine and its dedication to cost-efficient mining operations. In addition, the Company believes its highly motivated work force contributes significantly to continued operational improvements and to the Company's low cost producer status. For 2005, the Company expects total cash cost per ounce of gold produced to be between $135 and $145.

Third, the Company's existing operations at the LaRonde Division provide a sound economic base for additional mineral reserve and production development at the property. The experience gained through building and operating the LaRonde Mine, along with the LaRonde Mine's extensive infrastructure, are expected to support the development of new projects in the region including the Lapa property, the Goldex property and the

12

development project at LaRonde to access the Company's mineral resource base located outside of the Penna Shaft infrastructure (the "LaRonde II" project).

Fourth, the Company's senior management team has an average of 16 years of operating and exploration experience in the mining industry. Management's significant experience has been instrumental in the Company's historical growth and provides a solid base upon which to expand the Company's operations. The geological knowledge that management has gained through its years of experience in mining and developing the LaRonde Division is expected to benefit the Company's current expansion program in the region.

The Company believes it can benefit not only from the existing infrastructure at its mines, but also from geological knowledge that it has gained in mining and developing its properties. The Company's strategy is to capitalize on its mining expertise to exploit fully the potential of its properties. The Company's goal is to apply the proven operating principles of the LaRonde Division to each of its existing and future properties.

The Company continues to focus its resources and efforts on the exploration and development of its properties in the Abitibi region of Quebec, including LaRonde II, the Lapa property, the Goldex property and the LaRonde Mine with a view to increasing annual gold production and gold mineral reserve. The Company is evaluating these properties as potential growth opportunities in the Abitibi region. In 2003, although LaRonde's proven and probable gold mineral reserves were essentially unchanged on a tonnage basis, on the basis of contained gold ounces the Company added approximately 1.0 million ounces of gold to proven and probable mineral reserve, including replacement of 252,000 ounces of gold mined (before mill recoveries and smelter charges). As a result, the LaRonde Division's current proven and probable mineral reserve is estimated to contain approximately 5.0 million ounces of gold, 68.2 million ounces of silver, 2.2 billion pounds of zinc and almost 271.0 million pounds of copper.

The underground workings at the Penna Shaft provide a base from which the Company conducted its drilling program of 161,000 feet in 2004 and will conduct an estimated 174,000 feet of drilling in 2005. For 2004, capital expenditures at the LaRonde Mine together with expenditures on regional projects and other exploration and development projects are estimated to have been $55 million, of which $44.1 million had been spent as at September 30, 2004. These 2004 estimates include $27 million of capital expenditures at the LaRonde Mine, $8 million at the LaRonde II project, $13 million for the exploration and development of the Lapa property, $5 million for the exploration and development of the Goldex property and $2 million for the exploration and development of the Bousquet and Ellison properties. Expenditures at LaRonde II in 2004 are estimated to have been $8 million. The regional development team continues to evaluate the LaRonde II, Lapa and Goldex development project. The Company plans to continue to invest in sustaining and project capital expenditures at the LaRonde Mine together with regional projects and other exploration and development projects. Budgeted 2005 exploration and capital expenditures of $42.0 million consist of $14.1 million at the LaRonde Mine, $12.7 million at the LaRonde II project, $12.1 million at the Lapa property, $1.5 million at the Goldex property and $1.6 million at the Bousquet and Ellison properties. There can be no assurance that the Company will not revise its anticipated capital expenditure program.

In the first quarter of 2003, a rock fall of an estimated 30,000 tons occurred in two production stopes above Level 215 at 7,050 feet below surface during routine operations at the LaRonde Mine. The rock fall did not cause any injuries to employees, damage to equipment or loss of mineral reserves. However, the incident limited the Company's ability to extract ore from the higher grade areas of the mine. Remedial steps were taken, the fallen ore was extracted and the void was backfilled with cemented rock fill. Recovery studies also established that the mining width on four blocks needed to be narrower to establish more quickly the pyramid sequence. This narrowing of stope sizes was a contributing factor to the lower than budget gold production for 2003. In the third quarter of 2003, production drilling challenges further limited the Company's ability to mine higher grade mining blocks in the gold-copper mining areas in the lower part of the mine. As a result, mining activity was concentrated in the zinc-silver rich zones in the upper part of Zone 20 North rather than the higher grade gold stopes in Zone 20 North at depth. This re-sequencing of production resulted in lower than anticipated gold production in 2003 and pushed into future years gold production initially scheduled for 2003.

The Company's growth strategy has been to pursue the expansion of its development base through the acquisition of additional properties in the Americas and Europe. Historically, the Company's producing properties have resulted from a combination of investments in early-stage exploration companies and primary

13

exploration activities. By investing in early-stage exploration companies, the Company has been able to acquire control of exploration properties at favourable prices. The Company's approach to property acquisition has evolved to include joint ventures and partnerships and the acquisition of producing properties and, more recently, has evolved to include consideration of properties outside of Canada and the United States. The Company is currently considering opportunities to acquire development and producing properties in the Americas and Europe.

In the first quarter of 2004, two accidents claimed the lives of an employee and a contract miner. The Commission de la santé et de la sécurité du travail has completed an investigation into these accidents, but has not yet announced a decision as to if it intends to proceed further in respect of the matter. Also, in January 2005, an accident claimed the life of an employee. Other than the investigation discussed above, no regulatory or other action has been initiated against the Company in connection with these industrial accidents. The Company's LaRonde Mine remains one of the safest mines in Quebec with a lower accident frequency index than the provincial mining industry average. Nevertheless, the Company and all of its employees continue with a focused effort to improve workplace safety.

Mining Legislation and Regulation

The mining industry in Canada operates under both federal and provincial legislation governing the exploration, development, operation and decommissioning of mines and mineral processing facilities. Such legislation relates to the method of acquisition and ownership of mining rights, labour, occupational or worker health and safety standards, royalties, mining, exports, reclamation, closure and rehabilitation of mines, and other matters.

The mining industry in Canada is also subject to extensive laws and regulations at both the federal and provincial levels concerning the protection of the environment. The primary federal and provincial regulatory authorities with jurisdiction over the Company's mining operations in respect of environmental matters are the Department of Fisheries and Oceans, the Quebec Ministry of the Environment and the Quebec Ministry of Natural Resources. The construction, development and operation of a mine, mill or refinery requires compliance with applicable environmental laws and regulations and/or review processes including the obtaining of land use permits, water permits, air emissions certifications, hazardous substances management and similar authorizations from various governmental agencies. Environmental laws and regulations impose high standards on the mining industry to reduce or eliminate the effects of waste generated by mining and processing operations and subsequently deposited on the ground or emitted into the air or water. Laws and regulations regarding the decommissioning, reclamation and rehabilitation of mines may require approval of reclamation plans, the provision of financial assurance and the long-term management of former mines.

In Quebec, mining rights are governed by theMining Act (Quebec). In 1966, the mining concession system set out for Crown lands containing mineralized zones by theMining Act (Quebec) was replaced by a system of claims and mining leases. A claim entitles its holder to explore for minerals on the subject land. It remains in force for a term of two years from the date it is registered and may be renewed indefinitely subject to continued exploration works in relation thereto. A mining lease entitles its holder to mine and remove valuable mineral substances from the subject land. Leases are granted initially for a term of 20 years and are renewable up to three times, each for a duration of 10 years.

Organizational Structure

The Company's only significant associate is Contact Diamond (formerly Sudbury Contact Mines Limited), a public company listed on the TSX under the symbol "CO". The Company has an approximate 44.2% interest in Contact Diamond. Contact Diamond is an exploration and development company with diamond properties in Ontario, Quebec, Nunavut and the Northwest Territories. Contact Diamond is a corporation incorporated under the laws of the Province of Ontario. Historically and until August 31, 2003 Contact Diamond had been a subsidiary of the Company. However in 2003, through a series of equity financings, Contact Diamond became more financially independent and the Company's ownership was diluted to less than 50%. Accordingly, Contact Diamond is no longer a subsidiary of the Company and the Company no longer consolidates Contact Diamond's operations with its own. The Company now uses the equity method to account for its interest in Contact

14

Diamond. Each member of Contact Diamond's management team (other than Matthew Manson, its recently appointed President and Chief Operating Officer) is also a member of the management team of the Company, two of its directors are also directors of the Company (including one director of the Company who is also an officer of the Company), and two of its directors are also officers of the Company. The Company does not have any significant subsidiaries.

Property, Plant and Equipment

LaRonde Division Property

The Company's LaRonde Division consists of the LaRonde property, currently the Company's only material property, and the adjacent El Coco and Terrex properties (collectively the "LaRonde Mine"), each of which is 100% owned and operated by the Company. The LaRonde Mine is situated approximately 35 miles west of the City of Val d'Or in northwestern Quebec (approximately 400 miles northwest of Montreal, Canada) in the municipalities of Preissac and Cadillac. The LaRonde Mine can be accessed from either Val d'Or or Rouyn- Noranda, which is approximately 35 miles west of the LaRonde Mine, via Quebec provincial highway No. 117. The LaRonde Mine is situated approximately 1.2 miles north of highway No. 117 on Quebec regional highway No. 395. The Company has access to the Canadian National Railway at Cadillac, Quebec, roughly four miles from the LaRonde Mine.

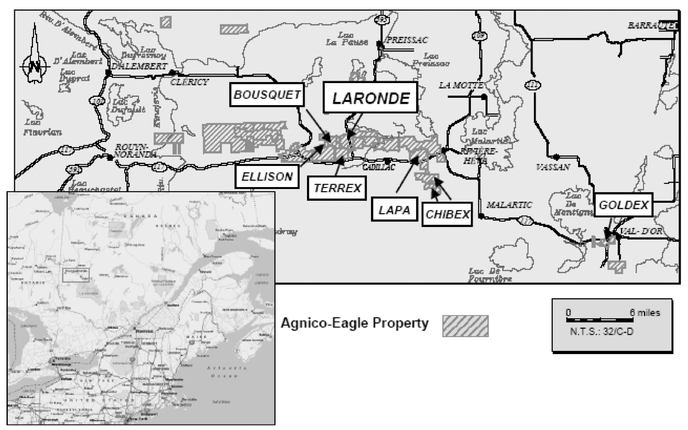

Location Map of Agnico-Eagle LaRonde Division

The LaRonde Mine is located in the Abitibi region of northwestern Quebec, a region characterized by its availability of experienced mining personnel. The elevation is 1,106 feet above sea level. All of the LaRonde Mine's power requirements are supplied by Hydro-Quebec through connections to its main power transmission grid. Water used in the LaRonde Mine's operations is sourced from Lac Preissac and is transported approximately 2.5 miles to the mine site through a surface pipeline. The climate of the region is continental and the average annual rainfall is 25 inches and the average annual snowfall is 125 inches. The average monthly temperatures range from a minimum of -23 degrees Celsius in January to a maximum of 23 degrees Celsius in July. Under normal circumstances, mining operations are conducted year round without interruption due to

15

weather conditions. However, in 2002 high underground temperatures due to extreme summer heat caused delay in development activity in lower portions of the mine.

The LaRonde Mine operates under mining leases obtained from the Quebec Ministry of Natural Resources and under certificates of approval granted by the Quebec Ministry of the Environment. The LaRonde property consists of 35 contiguous mining claims and two provincial mining leases and covers in total approximately 2,785 acres. The El Coco property consists of 22 contiguous mining claims and a portion of one of the LaRonde provincial mining leases and covers in total approximately 888 acres. The Terrex property consists of 20 mining claims that cover in total approximately 1,009 acres. In Quebec, in order to retain title to mining claims, in addition to paying a small bi-annual rental fee, exploration work (or an equivalent value cash payment) has to be completed in advance (either on the claim or on adjacent claims) and filed with the Quebec Ministry of Natural Resources. The amount of exploration work (and bi-annual rental fee) required bi-annually ranges from $500 to $2,500 per claim (the rate is fixed by Quebec Government regulations). The mining leases on the LaRonde property and on the LaRonde and El Coco properties expire in 2008 and 2021, respectively, and are automatically renewable for three further ten-year terms on payment of a small fee.

The LaRonde Mine includes underground operations at the LaRonde and El Coco properties that can both be accessed from the Penna Shaft, a mill, treatment plant, secondary crusher building and related facilities. The El Coco property was acquired from Barrick Gold Corporation ("Barrick") in June 1999 and is subject to a 50% net profits interest in future production from approximately 500 meters (1,640 feet) east of the LaRonde property boundary. The remaining 1,500 meters (4,921 feet) is subject to a 4% net smelter return royalty. This area of the property is now substantially mined out and therefore the Company did not pay royalties in 2004 and does not expect to pay royalties in 2005. In 2003, exploration work started to extend outside of the LaRonde property on to the Terrex property where a down plunge extension of the 20 North gold zone was discovered. The Terrex property is subject to a 5% net profits royalty to Delfer Gold Mines Inc., a 1% of the net smelter return royalty to Breakwater Resources Ltd. and a 2% of the net smelter return royalty to Barrick. In addition, the Company owns 100% of the Sphinx property immediately to the east of the El Coco property.

Mining and Milling Facilities

The LaRonde Mine was originally developed utilizing a 3,961 foot shaft (Shaft #1) and an underground ramp access system. The ramp access system is available down to the 25th Level of Shaft #1 and then continues down to Level 152 at the Penna Shaft. The mineral reserve accessible from Shaft #1 was depleted in September 2000. Shaft #1 is currently being used as a second escape way and provides services for the Penna Shaft (i.e. ventilation, compressed air, water). A second production shaft (Shaft #2), located 4,000 feet to the east of Shaft #1, was completed in 1994 down to a depth of 1,722 feet and was used to mine Zones #6 and #7. Both ore zones were depleted in March 2000 and the workings were allowed to flood up to the 6th Level. A third shaft (Penna Shaft, formerly called Shaft #3) located approximately 1,640 feet to the east of Shaft #1, was completed down to a depth of 7,380 feet in March 2000. The Penna Shaft is used to mine Zones 20 North, 20 South, 7 and 6.

Four mining methods have historically been used at the LaRonde Mine: open pit for the two surface deposits, sublevel retreat, longitudinal retreat with cemented backfill, and transverse open stoping with both cemented and unconsolidated backfill. The primary source of ore at the LaRonde Mine continues to be from underground mining methods. During 2003, two methods were used: longitudinal retreat with cemented backfill and transverse open stoping with both cemented and unconsolidated backfill. In the underground mine, sublevels are driven at 100 foot and 130 foot intervals, depending on the depth. Stopes are undercut in 45-foot panels. In the longitudinal method, panels are mined in 45-foot sections and backfilled with 100% cemented rock fill or paste fill. In the transverse open stoping method, 50% of the ore is mined in the first pass and filled with cemented rock fill or paste fill from the paste backfill plant completed two years ago located on the surface at the milling facility. On the second pass, the remainder of the ore is mined and filled with unconsolidated waste rock fill or paste fill.

Currently, water is treated at various facilities at the LaRonde Division. Prior to the water entering the tailings pond system, cyanide is removed at a cyanide destruction facility using a sulphur dioxide (Inco) process. A secondary treatment plant located between the #1 and #2 polishing ponds uses a peroxysilica process to

16

complete the cyanide destruction process. In addition, water with higher than permissible acidity is treated by lime in the mill complex prior to being released to the environment. In the first quarter of 2004, in response to revised Federal mining effluent regulations, the Company completed and commissioned a new water treatment plant that will reduce tailing effluent toxicity immediately prior to discharge. The plant uses a biological treatment process. Prior to the completion of the water treatment plant, the Company retained excess water in its tailing pond complex. At the end of March 2004 treated water released from the plant successfully passed a toxicity test. The flow rate is steadily being increased as the biomass continues to build up. In 2004, high water levels at the tailings pond at LaRonde caused by above average rainfall and overcast conditions were mitigated by a discharge of slightly toxic water into the environment that was permitted by the Quebec Ministere de l'Environnement. Also, the Company installed a coffer dam in the tailings pond to provide extra capacity. In 2004, the Company initiated construction on a second phase expansion of the water treatment plant and to further increase treatment capacity. Estimated expenditures on this second phase expansion are $4.2 million and construction is expected to be completed in the first quarter of 2005.

Tailings are stored in tailings ponds covering an area of approximately 293 acres and waste rock is stored in two waste rock piles with a combined volume of approximately 50.4 million cubic feet. The Company holds mining claims to the northeast, to the east and to the southeast of the tailings ponds that would allow expansion of the tailings ponds and the establishment of additional waste disposal areas.