QuickLinks -- Click here to rapidly navigate through this document

Annual Audited Consolidated Financial Statements

and Management's Discussion and Analysis

(Prepared in accordance with US GAAP)

ANNUAL AUDITED CONSOLIDATED FINANCIAL STATEMENTS AND

MANAGEMENT'S DISCUSSION AND ANALYSIS

Management's Discussion and Analysis should be read in conjunction with the accompanying annual audited consolidated financial statements. These consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles. All dollar amounts are presented in US dollars unless otherwise specified.

| MANAGEMENT'S DISCUSSION AND ANALYSIS | 1 | ||

| Overview | 1 | ||

| Highlights | 1 | ||

| Outlook | 2 | ||

| Results of Operations | 2 | ||

| Liquidity and Capital Resources | 10 | ||

| Risk Profile | 12 | ||

| Outstanding Securities | 15 | ||

| Critical Accounting Estimates | 15 | ||

| Future Tax Assets and Liabilities | 17 | ||

| Stock-Based Compensation | 17 | ||

| Forward-Looking Statements | 17 | ||

| Summarized Quarterly Data | 18 | ||

| Five Year Financial and Operating Summary | 20 | ||

| Agnico-Eagle Mineral Reserve & Mineral Resource Data | 21 | ||

ANNUAL AUDITED CONSOLIDATED FINANCIAL STATEMENTS | 23 | ||

| Management's Responsibility for Financial Reporting | 23 | ||

| Auditors' Report | 24 | ||

| Summary Of Significant Accounting Policies | 25 | ||

| Consolidated Balance Sheet | 30 | ||

| Consolidated Statement Of Income (Loss) And Comprehensive Income (Loss) | 31 | ||

| Consolidated Statement Of Shareholders' Equity | 32 | ||

| Consolidated Statement Of Cash Flows | 33 | ||

| Notes To Consolidated Financial Statements | 34 | ||

i

Management's Discussion And Analysis

Overview

Agnico-Eagle Mines Limited is an intermediate-sized gold producer centered in one of the mining industry's most favorable political and regulatory environments in the world: Quebec, Canada. In its over 30 year history, Agnico-Eagle has never hedged away increases in the price of gold. Our LaRonde Mine is a proven gold producer with a long reserve life. We have amassed a large land position in one of the most prolific gold producing regions and we have the cash resources and experience to grow reserves and create a multi-mine platform.

The most important driver of financial performance for Agnico-Eagle is the spot price of gold. As we have never sold gold forward, we are positioned to benefit from rising gold prices. Due to the poly-metallic nature of the LaRonde orebody, spot prices of silver, copper and zinc are also key drivers of financial performance. Since the sale of these byproduct metals is important to both revenue and production costs per ounce, we occasionally implement hedging strategies to mitigate the effects of fluctuating prices. We have never sold gold forward because we believe that low-cost production is the best protection against decreasing gold prices. The US$/C$ exchange rate is an important financial driver to achieving low-cost production as practically all our operating costs are paid in Canadian dollars. As such, we also use hedging strategies to mitigate the impact of fluctuating exchange rates on our per ounce production costs.

In 2002 and 2003, we encountered some operational challenges at LaRonde. We fell short of our production targets due to expansion related problems in 2002 and a rock fall and production drilling challenges in 2003. However, with the expansion now complete and the implementation of a more focused and more conservative mining plan, we believe we have reduced mining risk and are well positioned to profit from higher gold and byproduct metal prices. The production challenges of the past few years have accentuated the risks of reliance on the LaRonde Mine. Our strategy over the next few years will be to reduce our dependence on LaRonde as our sole source of production while still taking advantage of the mine's personnel and infrastructure. Our strategy envisions the development of multiple mines within a short distance of LaRonde with growing reserves and increasing production in one of the most mining friendly areas of the world. With our Lapa property only 7 miles away, and our Goldex property only 35 miles away, and with over 2.8 million ounces of cumulative gold reserves on these properties, we feel we can achieve long term-growth while capitalizing on internal synergies. Our strategy is to capitalize on these opportunities by using the expertise of the LaRonde team, the mine's large processing capacity and the Company's large pool of available tax deductions.

While regional expansion represents the core of our strategy, we continue to seek growth opportunities elsewhere. Our focus will be on politically stable regions and on situations where the expertise developed at LaRonde can add value.

We anticipate that LaRonde will generate strong cash flow in 2004 and, coupled with our strong working capital position and completely undrawn credit facility, we are in a strong position to achieve our growth strategy. With a world class mine and promising properties in a mining friendly environment, we believe we can build per share value by focusing on these assets while retaining full leverage to rising gold prices.

Highlights

In 2003, an operationally challenging year, we produced 236,653 ounces of gold which was well below our original production target of 375,000 ounces. In the first quarter of 2003, we experienced a rock fall at the LaRonde Mine in Quebec which forced us to change our mining sequence, resulting in a delay in the extraction of higher grade gold mining blocks from the lower part of the mine. The effects of the rock fall continued to adversely affect production in the second quarter. In the third quarter we faced production drilling challenges and realized lower than planned recoveries in the mill.

Despite these challenges, we achieved significant improvements in operating performance in the fourth quarter of 2003 as 73% of ore production came from the lower level mining horizon. This mining horizon contains ore that has substantially higher gold grades than that of the upper mine and is also substantially richer in copper. Minesite costs per ton showed a steady improvement during the quarter and we were also able to begin accumulating a surface ore stockpile which will mitigate the inherent risks associated with mining and will act as a source of ore should unforeseen events, such as those we faced in 2003, affect mining operations. Minesite costs are onsite costs for the mining and milling of the ore. Minesite costs per ton milled is a non-GAAP measure and is explained in "Results of Operations — Production Costs".

1

The operational challenges in 2003 led to a net loss of $19.5 million or $0.23 per share compared to income of $4.0 million or $0.06 per share in 2002. Total cash costs to produce an ounce of gold were $269 for 2003 which was above our original estimate of $125 per ounce and above 2002 total cash costs of $182 per ounce. Total cash costs is a non-GAAP measure and is explained in "Results of Operations — Production Costs." Lower production, higher operating costs, and the stronger Canadian dollar were the major contributors to the increased total cash cost per ounce. Other factors that contributed to the 2003 net loss were increased exploration expenditures resulting from the work conducted on the Lapa property, increased amortization, increased interest expense as no interest was capitalized in the current year, increased administrative expenditures and a one time charge related to the adoption of a new accounting standard.

In the fourth quarter, as a result of operational improvements, we achieved net earnings of $2.4 million or $0.03 per share compared to earnings of $0.8 million or $0.01 per share in the fourth quarter of 2002. Compared to 2002, we produced 7% fewer ounces in the fourth quarter of 2003, however revenue increased 32% driven by increased gold and byproduct metal prices. Fourth quarter 2003 earnings also reflected a higher tax recovery than the fourth quarter of 2002. Total cash costs in the fourth quarter of 2003 increased to $220 per ounce of gold produced from $198 in the same period of 2002 due to lower gold production and a stronger Canadian dollar, offset by higher byproduct revenue.

We ended the year with over $140 million in working capital, which includes $110 million in cash. Despite the production difficulties, stronger gold and byproduct prices helped the Company generate positive cash flow from operations of $4 million in 2003. Operating cash flow was well below 2002 levels of $20 million due mainly to the operational challenges and stronger Canadian dollar, offset by increased metal prices. In the fourth quarter of 2003, we generated $10 million of operating cash flow compared to $5 million in the fourth quarter of 2002. The increase was mainly due to increased metal prices offset somewhat by the stronger Canadian dollar.

2003 brought exploration success which culminated in record year-end gold reserves of 7.9 million ounces. At LaRonde, not only did we replace 2003 production, but we also increased gold reserves by an additional one million ounces from four to five million ounces of gold. At Lapa, located only 7 miles east of LaRonde, the 2003 drilling program led to a conversion of 1.2 million ounces of gold resource into reserves. At Goldex, located 35 miles east of LaRonde, a new geological model and an independent engineering review led to a year end reserve of 1.6 million ounces of gold. A summary of our year end mineral reserve position can be found on page 21. Driven by this exploration success, the Company also acquired more property along the prolific Cadillac-Bousquet gold belt and the Cadillac-Larder Lake Break immediately to the south.

By the end of 2003, we had addressed LaRonde's operational problems. By the end of the year, we implemented a focused, more conservative mining plan and we ended the year with available cash resources of $210 million, which includes $100 million available under our revolving bank facility. We now look forward to 2004 and 2005 with a renewed focus on implementing our growth strategy.

Outlook

For 2004, we produced 271,567 ounces of gold at an estimated total cash cost per ounce between $75 and $85. The estimated decline from 2003 to 2004 in total cash costs is due to the elimination of the El Coco royalty, an increase in gold and byproduct metal production and an increase in by product metal prices. Our silver and byproduct copper and zinc production can be found in "Results of Operations — Production costs".

For 2005, we expect to produce 280,000 ounces of gold at total cash costs per ounce between $135 and $145. The estimated increase in total cash costs compared to the 2004 estimate is due to an anticipated decline in byproduct metals prices below those realized in 2004 and a reduction in the contribution of foreign exchange hedging activities. Our estimated silver and byproduct copper and zinc production, along with metal price assumptions and sensitivities, can be found in "Results of Operations — Production costs". We expect to generate strong operating cash flow which we will use to fund capital additions at LaRonde (including LaRonde II) and the continued development of our promising Lapa and Goldex properties.

Results of Operations

Revenues from Mining Operations

In 2003, revenue from mining operations increased 17% to $127 million from $108 million in 2002. The majority of our revenue is derived from precious metal sales. Sales of gold and silver typically account for more than 80% of the Company's revenue. Revenues from mining operations are accounted for net of related smelting,

2

refining and other charges. In 2003, precious metal sales accounted for 84% of revenue, down slightly from 87% in 2002. This slight decrease over 2002 was due to surging metal prices in the latter half of the year for byproduct copper and zinc. In 2004, we anticipate precious metal sales to account for 80% of overall revenue. The table below summarizes net revenue by metal:

| | 2003 | 2002 | % Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| | (thousands) | ||||||||

| Gold | $ | 85,566 | $ | 80,177 | 7 | % | |||

| Silver | 20,584 | 14,115 | 46 | % | |||||

| Copper | 6,452 | (1,027 | ) | 728 | % | ||||

| Zinc | 14,218 | 14,762 | (4 | )% | |||||

| $ | 126,820 | $ | 108,027 | 17 | % | ||||

The increase in gold revenue was due to an 18% increase in realized prices offset by a 9% decrease in gold production. Revenues benefited from a 28% increase in silver production and a 10% increase in realized silver prices. Copper production increased by 126% while copper prices realized increased 17%. In 2002, net copper revenue had a negative effect on total revenue due to historically low copper prices not being sufficient to recover the smelting, refining and transportation charges. However, since a majority of the gold ounces we recover is contained in our copper concentrate, this negative net revenue represents a necessary cost of producing gold. Finally, zinc production declined 7% while realized zinc prices increased 12% leaving net zinc revenue essentially unchanged.

Decreased gold production in 2003 was due to a number of factors. In the first quarter of 2003, we experienced a rock fall which delayed extraction of higher grade gold mining blocks from the lower part of the mine. The affected area stabilized on its own and we were able to recover and process most of the ore. We filled the affected area with cemented rock fill and paste fill to further stabilize the area, and reduced the widths of certain mining blocks to accelerate the establishment of the pyramidal mining sequence. Due to the remedial work conducted in this area, we reduced tonnage from the gold/copper rich lower levels and replaced it with tonnage from the upper zinc/silver rich areas of the mine. This resequencing of production led to increased silver production for 2003. For 2004, most of the production will come from secondary, de-stressed mining blocks which should reduce the risk of such an event reoccurring.

In the third quarter of 2003, we encountered production drilling challenges. Squeezing drill holes slowed down the planned extraction time of mining blocks from the lower part of the mine. These drilling challenges resulted in shortages of ore which lead to numerous "stop-start" cycles in the mill but were resolved in the third and fourth quarters and did not affect production in 2004. To address these drilling challenges, we added two production drills, increased drill hole diameter and changed our blasting method. The new blasting method has been successful in decreasing dilution and improving fragmentation and, coupled with the completion of the Level 219 crushing plant, has improved ore flow and increased productivity.

Although more ore was being mined from the upper areas of the mine, zinc production declined and copper production increased over 2002 as we were able to steadily increase tonnage from the lower levels throughout the year. In the fourth quarter, LaRonde delivered record quarterly production from the lower gold/copper rich levels with 73% of total tonnage processed coming from these levels. This led to fourth quarter production of 70,299 ounces which was 7% lower than the same quarter in 2002 but in line with our expectations.

In light of the operational challenges encountered in 2003, in the fourth quarter, the Company undertook a comprehensive review of short-term and long-term production targets. Based on recent experience, we implemented a more conservative mining plan. We have also taken a number of measures to reduce our exposure to normal mining risk such as increasing our surface ore stockpile. This stockpile will ensure that the mill can temporarily continue to process ore in the event of production stoppages due to unforeseen circumstances such as those encountered in 2003.

Outlook: Revenues from mining operations are estimated to have increased significantly in 2004 due to increased production levels for all metals and higher realized metals prices. In 2005, revenues from mining operations are expected

3

to be largely unchanged as slightly higher production levels for all metals are offset by anticipated lower metals prices. The table below summarizes our production for 2004 and our estimated production in 2005.

| | 2005 Estimate | 2004 Actual | 2003 Actual | % Change(1) | ||||

|---|---|---|---|---|---|---|---|---|

| Gold (ounces) | 280,000 | 271,567 | 236,653 | 14.8% | ||||

| Silver (000's ounces) | 5,500 | 5,699 | 3,953 | 44.2% | ||||

| Copper (000's pounds) | 18,000 | 22,816 | 20,131 | 13.3% | ||||

| Zinc (000's pounds) | 160,000 | 167,283 | 100,337 | 66.7% |

- (1)

- Indicates percentage change between 2003 actual production and our 2004 actual production.

Estimated production levels for gold and byproduct metals in 2006 are expected to be in line with 2005 estimates.

Interest and Sundry Income

Interest and sundry income consists of interest on cash balances, realized gains on the disposition of available-for-sale securities, and amortization related to our gold put option contracts expiring in the year. Interest and sundry income was $2.8 million in 2003 compared to $1.9 million in 2002. The $0.9 million increase was due to a number of factors. While interest on cash balances remained relatively unchanged over 2002, in 2003, we realized approximately $2.5 million in gains on the disposition of available-for-sale securities. This gain was offset by a $1.8 million charge relating to the cost of gold puts purchased in 1999.

Outlook: Interest and sundry income is estimated to have been essentially nil in 2004 and projected not to change in 2005 as interest income on our cash balance is expected to be offset by the non-cash amortization of the cost of our gold put option contracts.

Production Costs

In 2003, production costs increased 38% to $105 million from $76 million. The following table summarizes the components of production costs.

| | 2003 | 2002 | |||||

|---|---|---|---|---|---|---|---|

| Definition Drilling | $ | 511 | $ | 437 | |||

| Stope Development | 11,832 | 8,625 | |||||

| Mining | 17,263 | 10,961 | |||||

| Underground Services | 25,836 | 16,591 | |||||

| Milling | 27,478 | 20,603 | |||||

| Surface Services | 2,245 | 1,928 | |||||

| Administration | 6,472 | 5,367 | |||||

| Minesite costs | $ | 91,637 | $ | 64,513 | |||

El Coco Royalty | 12,888 | 10,764 | |||||

| Reclamation provision | 519 | 1,301 | |||||

| Inventory adjustments | (368 | ) | 1,072 | ||||

| Hedging losses (gains) | 314 | (1,680 | ) | ||||

| Total Production Costs | $ | 104,990 | $ | 75,969 | |||

The rock fall in the first quarter and the production drilling challenges encountered in the third quarter caused mining and underground service costs to increase in 2003. However, we addressed the production drilling challenges in the third quarter and steadily ramped up tonnage milled in the fourth quarter. Minesite costs increased by $27 million to $92 million from $65 million primarily as a result of the 25% increase tonnage in mined and milled in 2003. Of the increase in minesite costs in 2003, costs related to underground services and mining each increased by over 50%, contributing 33% and 23% of the total 2003 increase to minesite costs.

Milling costs increased by 33% in 2003, due to increased mill throughput during 2003 and the 37% increase in stope development costs was also attributable to the drilling challenges encountered at depth. Of the overall production cost increase of $29 million in 2003 compared to 2002, the strengthening Canadian dollar accounted for $10 million, or 35%.

4

In the fourth quarter of 2003, we milled 627,000 tons, which represents a 17% increase over the same quarter of 2002. Fourth quarter gold production was 7% lower than 2002 due to decreased gold grades as a result of the implementation of a more conservative mining plan. Increased minesite costs for both the fourth quarter and year to date were a result of increased tonnage mined and processed coupled with increased mining and underground services costs resulting from the first quarter rock fall and the production drilling challenges encountered in the third quarter.

Minesite costs per ton milled for the year remained essentially unchanged compared to 2002 at C$52 per ton. (Minesite costs per ton is a non-GAAP measure and is explained below.) Minesite costs per ton in the fourth quarter were C$54 per ton compared to C$53 per ton in the prior year; however, steady improvement was made throughout the quarter as our minesite costs decreased to C$48 per ton in December.

For 2004 we expect a slight increase in minesite costs to be offset by an estimated 4% increase in total tons milled. Therefore, we expect minesite costs per ton to decrease to between C$49 and C$51 per ton.

In 2003, total cash costs to produce an ounce of gold increased 48% to $269 from $182. In 2002, total cash costs increased 17% over the prior year from $155 to $182. Total cash costs are comprised of minesite costs reduced by net silver, zinc and copper revenue. Total cash costs are affected by various factors such as the number of gold ounces produced, operating costs, US$/C$ exchange rates, production royalties and byproduct metal prices. The table below illustrates the change in total cash costs attributable to each of the variables which affected it for 2003 and 2002. The most significant factors contributing to the increase in total cash costs in 2003 were increased operating costs and the stronger Canadian dollar. Increasing byproduct metal prices had a more significant effect in the fourth quarter than on the entire year as most of the yearly increase in metal prices occurred in the fourth quarter. Copper and zinc prices increased 8% and 2%, respectively in the first nine months of 2003 and increased 22% and 17%, respectively in the fourth quarter. For 2004, we expect the El Coco royalty to be completely eliminated as that area of the mine is essentially mined out. Total cash costs per ounce is not a recognized measure under US GAAP and is described more fully below.

| | 2003 | 2002 | |||||

|---|---|---|---|---|---|---|---|

| Total cash costs per ounce (prior year) | $ | 182 | $ | 155 | |||

| Lower (higher) gold production | 19 | (15 | ) | ||||

| Stronger (weaker) Canadian dollar | 30 | (3 | ) | ||||

| Higher El Coco royalty | 13 | 20 | |||||

| Cost associated with increased throughput | 77 | 24 | |||||

| (Higher) lower byproduct revenue | (52 | ) | 1 | ||||

| Total cash costs per ounce (current year) | $ | 269 | $ | 182 | |||

Total cash cost is not a recognized measure under US GAAP and this data may not be comparable to data presented by other gold producers. We believe that this generally accepted industry measure is a realistic indication of operating performance and is useful in allowing year over year comparisons. As illustrated in the table below, this measure is calculated by adjusting Production Costs as shown in the Statement of Income (Loss) and Comprehensive Income (Loss) for net byproduct revenues, royalties, inventory adjustments and asset retirement provisions. This measure is intended to provide investors with information about the cash generating capabilities of our mining operations. Management uses this measure to monitor the performance of our mining operations. Since market prices for gold are quoted on a per ounce basis, using this per ounce measure allows management to assess the mine's cash generating capabilities at various gold prices. Management is aware that this per ounce measure of performance can be impacted by fluctuations in byproduct metal prices and exchange rates. Management compensates for the limitation inherent with this measure by using it in conjunction with the minesite cost per ton measure (discussed below) as well as other data prepared in accordance with US GAAP. Management also performs sensitivity analyses in order to quantify the effects of fluctuating metal prices and exchange rates.

Minesite cost per ton is not a recognized measure under US GAAP and this data may not be comparable to data presented by other gold producers. As illustrated in the table below, this measure is calculated by adjusting Production Costs as shown in the Statement of Income (Loss) and Comprehensive Income (Loss) for royalties, inventory and hedging adjustments and asset retirement provisions and then dividing by tons processed through the mill. Since total cash cost data can be affected by fluctuations in byproduct metal prices and exchange rates, management believes this measure provides additional information regarding the performance of mining operations and allows management to monitor operating costs on a more consistent basis as the per ton measure

5

eliminates the cost variability associated with varying production levels. Management also uses this measure to determine the economic viability of mining blocks. As each mining block is evaluated based on the net realizable value of each ton mined, in order to be economically viable the estimated revenue on a per ton basis must be in excess of the minesite cost per ton. Management is aware that this per ton measure is impacted by fluctuations in production levels and thus uses this evaluation tool in conjunction with production costs prepared in accordance with US GAAP. This measure supplements production cost information prepared in accordance with US GAAP and allows investors to distinguish between changes in production costs resulting from changes in production versus changes in operating performance.

Both of these non-GAAP measures used should be considered together with other data prepared in accordance with US GAAP, and none of the measures taken by themselves is necessarily indicative of operating costs or cash flow measures prepared in accordance with US GAAP. The tables presented below reconcile total cash costs and minesite costs per ton to the figures presented in the financial statements prepared in accordance with US GAAP.

Reconciliation of Total Cash Costs per ounce

| | 2003 | 2002 | 2001 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | (thousands, except as noted) | ||||||||||

| Production costs per Consolidated Statement of Income (Loss) | $ | 104,990 | $ | 75,969 | $ | 67,009 | |||||

| Adjustments: | |||||||||||

| Inventory adjustments(i) | 368 | 593 | (1,139 | ) | |||||||

| Byproduct revenues, net of smelting, refining and marketing charges | (41,254 | ) | (27,850 | ) | (28,383 | ) | |||||

| El Coco royalty | (12,888 | ) | (10,764 | ) | (5,424 | ) | |||||

| Reclamation provision | (519 | ) | (1,301 | ) | (1,155 | ) | |||||

| Cash costs | $ | 50,697 | $ | 36,647 | $ | 30,908 | |||||

| Gold production (ounces) | 236,653 | 260,183 | 234,860 | ||||||||

| Cash costs (per ounce) | $ | 215 | $ | 141 | $ | 132 | |||||

| El Coco royalty | 54 | 41 | 23 | ||||||||

| Total cash costs | $ | 269 | $ | 182 | $ | 155 | |||||

Reconciliation of Minesite Costs per ton

| | 2003 | 2002 | 2001 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | (thousands, except as noted) | ||||||||||

| Production costs per Consolidated Statement of Income (Loss) | $ | 104,990 | $ | 75,969 | $ | 67,009 | |||||

| Adjustments: | |||||||||||

| Inventory(i) and hedging(ii) adjustments | 54 | 609 | (1,163 | ) | |||||||

| El Coco royalty | (12,888 | ) | (10,764 | ) | (5,424 | ) | |||||

| Reclamation provision | (519 | ) | (1,301 | ) | (1,155 | ) | |||||

| Minesite costs (US$) | $ | 91,637 | $ | 64,513 | $ | 59,267 | |||||

| Minesite costs (C$) | C$ | 127,931 | C$ | 101,289 | C$ | 91,752 | |||||

| Tons milled (000s tons) | 2,449 | 1,963 | 1,805 | ||||||||

| Minesite costs per ton (C$) | C$ | 52 | C$ | 52 | C$ | 51 | |||||

Notes:

- (i)

- Under the Company's revenue recognition policy, revenue is recognized on concentrates when legal title passes. Since total cash costs and minesite costs per ton are calculated on a production basis, this adjustment reflects the portion of concentrate production for which revenue has not been recognized in the year.

- (ii)

- Hedging adjustments reflect gains and losses on the Company's derivative positions entered into to hedge the effects of foreign exchange fluctuations on production costs. These items are not reflective of operating performance and thus have been eliminated when calculating minesite costs per ton.

6

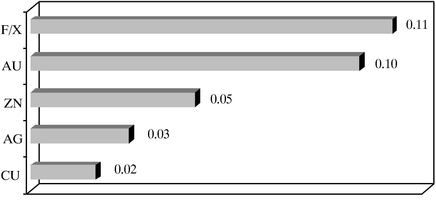

Outlook: For 2004, our total cash costs are estimated to have been between $75 and $85 per ounce of gold. For 2005, we expect our total cash costs to be in the range of $135 to $145 per ounce of gold. The estimated increase in total cash costs compared to the 2004 estimate is due to an anticipated decline in byproduct metal prices below those realized in 2004 and a reduction in the contribution of foreign exchange hedging activities. As net silver, zinc and copper revenue are treated as a reduction of costs in arriving at total cash costs per ounce, production and price assumptions play an important role in our estimates. As our operating costs are denominated in Canadian dollars, the US$/C$ exchange rate can also affect our estimate. The table below summarizes the metal price assumptions and exchange rate assumptions used in deriving our 2005 estimate. 2005 production estimates for each metal are shown in the section entitled "Revenues from mining operations".

| Silver | $ | 6.00 | |

| Zinc | $ | 0.45 | |

| Copper | $ | 1.15 | |

| US$/C$ exchange rate | $ | 1.27 |

Estimated total cash costs for 2006 are expected to be in line with 2005 estimates, assuming no change in the Company's metals price assumptions or exchange rate assumptions from those set out for 2005 above and assuming no change in the contribution of foreign hedging activities from that expected in 2005.

As we have currently not hedged any of the above production, changes in the prices of these metals will impact our total cash cost estimate. We currently have hedges in place to protect the downside risk associated with a strengthening Canadian dollar. For 2005, we have hedged approximately 15% of our estimated Canadian dollar operating costs at exchange rates well above the prevailing exchange rates that are in effect when the hedges expire. The chart below shows the impact on total cash costs per ounce of changes in the variables discussed above. The sensitivities presented for the changes in the US$/C$ exchange rate take into account the above hedges.

Exploration and Corporate Development Expense

In 2003, our exploration team continued to focus on the Lapa property which is located only 7 miles east of LaRonde. Their efforts resulted in a resource to probable reserve conversion of 1.2 million ounces of gold. The property did not have reserves in 2002. In conjunction with our exploration success, our corporate development team was active in acquiring a 100% interest in the Lapa property, a transaction completed late in the second quarter of 2003. We also acquired the Bousquet property adjacent to the LaRonde Mine, expanding our property interests along the gold belt which hosts our LaRonde Mine. The former Bousquet mine office is now being used by a dedicated regional development team to evaluate and prioritize the Company's exploration and development projects in the region.

In 2003, we re-evaluated our Goldex project. A new reserve and resource model was estimated which showed positive economics and led to a resource to probable reserve conversion of 1.6 million ounces of gold. The property did not have reserves in 2002. We decided to undertake an underground program to provide additional geological information. Over the course of 2004, we expect to complete three vertical slot raises through the orebody. We expect to process this material early in 2005. The objective of this bulk sample and additional drilling planned for 2004 is to attempt to increase the level of confidence in the gold grade. Although our current focus is growth in our own backyard, we continue to evaluate corporate development opportunities which could potentially increase returns for our shareholders.

7

Total exploration and corporate development expense, including equity losses of Sudbury, increased 102% in 2003 to $7.6 from $3.8 million in 2002. The table below summarizes exploration and corporate development expense (thousands):

| | 2003 | 2002 | ||||

|---|---|---|---|---|---|---|

| Lapa property | $ | 1,751 | $ | 246 | ||

| Other regional properties | 465 | 976 | ||||

| Exploration conducted by Sudbury Contact Mines Limited | 4,216 | 2,271 | ||||

| Corporate development expense | 1,169 | 273 | ||||

| $ | 7,601 | $ | 3,766 | |||

Exploration is only conducted if warranted by drilling results and project economics. Therefore, the increase in expenses over 2002 reflects the success of our exploration and development work during 2003. The 2003 gross exploration expenses on the Lapa property were approximately $3.0 million. However, these expenses were reduced by exploration investment tax credits received from the provincial government of Quebec. In 2003, our equity investee, Contact Diamond Corporation (formerly Sudbury Contact Mines Limited) ("Contact Diamond"), conducted more exploration due to the encouraging results on the Timiskaming diamond project. In 2002, we owned approximately 64% of Contact Diamond and were fully consolidating its exploration expenses as we were providing full funding for its projects. In 2003, through a series of equity financings, Contact Diamond became more financially independent and our ownership interest was diluted to less than 50%. Therefore, as of August 31, 2003, we are no longer required to consolidate Contact Diamond's operations with our own. Our 2003 exploration expenses reflect 100% of Contact Diamond's exploration expenses up to that time and a 49.9% share of exploration expenses subsequent to de-consolidation.

In 2003 the Company issued flow-through shares to take advantage of its large undeducted exploration tax pools. Issuing flow-through shares is common practice in the mining industry for companies with large pools of available tax deductions. Under the terms of the flow-through share agreements, the Company is required to spend the proceeds of the offering on eligible Canadian exploration expenses and renounce the tax deductions associated with those exploration expenses to the initial purchasers of the flow-through shares. Since investors are receiving tax deductions for the exploration expenses incurred by the Company, these flow-through shares typically command a premium to the market price of the Company's stock on the date of issuance. Should the Company fail to spend the proceeds of the flow-through share offering on eligible Canadian exploration expenses, the investors would lose their tax deductions, which would create the potential for shareholder lawsuits and penalties imposed by the Canada Revenue Agency. In its history, the Company has never failed to spend flow-through share proceeds on eligible exploration nor has it ever failed to renounce those exploration expenditures to investors. To comply with flow-through share purchase agreements, the Company must spend $3.5 million on eligible Canadian exploration expenses in 2004 relating to the expenditures renounced effective in 2003.

Outlook: Exploration and corporate development expense, including our share of Contact Diamond's exploration expenses, are expected to decrease in 2004 as we have met the criteria for capitalization at the Lapa and Goldex properties and exploration expenditures related to these properties will not be recorded in the income statement in 2004 or 2005. However, our acquisition of shares of Riddarhyttan will result in an increased amount of exploration expense in 2005. We expect to record $3.2 million of exploration expense on our income statement in 2004 which includes $1.2 million in non-cash expenses representing our share of Contact Diamond's exploration expenses. We expect to record $7.2 million of exploration expense on our income statement in 2005 which includes $2.4 million in non-cash expenses representing our share of the exploration expenses of Contact Diamond and Riddarhyttan. However, these estimates could increase materially if we have success on our various exploration properties.

General and Administrative Expenses

General and administrative expenses increased to $7.1 million in 2003 from $5.5 million in 2002. Of the $1.6 million increase, 42% is attributable to the stronger Canadian dollar as general and administrative expenses are almost entirely denominated in Canadian dollars. An additional 30% is attributable to compliance with new

8

financial reporting and securities law requirements. The remainder of the increase is attributable to increased corporate activities.

Outlook: General and administrative expenses are not expected to increase materially in 2004 or 2005.

Provincial and Federal Capital Taxes

Provincial capital taxes were $1.2 million in 2003 compared to $0.8 million in 2002. These taxes are assessed on the Company's capitalization (paid-up capital and debt) less certain allowances. The increase in 2003 was attributable to less exploration expenses being eligible for provincial tax credits that decrease capital taxes otherwise payable. We estimate 2004 capital taxes to be $1.9 million due to increases in capitalization and less exploration expenses eligible for the provincial tax credits.

Federal capital taxes are assessed on essentially the same capitalization base as provincial capital taxes. The increase in 2003 to $1.1 million from $0.9 million in 2002 represents increases in capitalization throughout the year. New legislation introduced in 2003 will completely eliminate federal capital taxes by 2008. These changes will be phased in gradually with rate reductions each year. Based on new legislation, we estimate federal capital taxes to be $0.9 million in 2004.

Outlook: Provincial capital taxes are expected to be $1.7 to $2.0 million in 2004 and, based on new legislation, we estimate federal capital taxes to be $0.9 million in 2004. In 2005, we expect these amounts to be $1.6 million and $0.8 million, respectively.

Amortization Expense

Amortization expense was $17.5 million in 2003 compared to $13.0 million in 2002. The Company calculates its amortization on a unit-of-production basis using proven and probable reserve tonnage as its amortization base. A 25% increase in tons processed coupled with an increased capital base due to the recently completed LaRonde expansion more than offset the year end increase in reserves.

Outlook: Amortization is expected to increase as milled throughput increases in 2004 and 2005. On a per ton basis, amortization is expected to remain unchanged in 2004 at $8 per ton as the increased capital base was offset by the year end increase in reserves and to increase to $9 per ton in 2005.

Interest Expense

In 2003, interest expense increased 25% to $9.2 million from $7.3 million in 2002 as no interest was capitalized in 2003. In 2002, $2.3 million in interest on our revolving bank facility was capitalized as the facility was used to fund the expansion at LaRonde. Of the $9.2 million interest expense in 2003, approximately $6.5 million relates to cash interest on the 2012 convertible subordinated debentures, $1.5 million relates to cash standby fees and other costs associated with the revolving bank facility, and the remaining $1.2 million represents non-cash amortization of the financing costs associated with the 2012 convertible subordinated debentures and revolving bank facility.

In the fourth quarter of 2003, we entered into an interest rate swap whereby we swapped our fixed rate payments on the convertible subordinated debentures for variable rate payments. The notional amount under the swap exactly matches the $144 million face value of the debentures and the swap agreement terminates on February 15, 2006, which is the earliest date that the debentures can be called for redemption. Under the terms of the swap agreement, we make interest payments of three-month LIBOR plus a spread of 2.37% and receive fixed interest payments of 4.50% which completely offsets the interest payments we make on the subordinated convertible debentures. The three-month LIBOR rate was also capped at 3.38% such that total variable interest payments will not exceed 5.75%. Based on the current three-month LIBOR rate of 1.12%, we estimate that this transaction will save approximately $1.5 million in debenture interest annually.

Outlook: Interest expense is expected to decrease by approximately $1.5 million as we realize the benefits of our interest rate swap, assuming variable LIBOR rates remain at current levels throughout the year. In 2005, interest expense is expected to decrease by a further $1.0 million as a result of the same factors.

9

Income and Mining Taxes

In 2003, the effective accounting income tax recovery rate was 8.0% compared to an income tax recovery rate of 7.8% in 2002. Although we reported a loss before income and mining taxes of $18.1 million, we did not record a tax recovery due the uncertainty surrounding the realization of the benefit of these losses. The loss we incurred in 2003 can be carried forward to reduce taxable income of future years and expires, if not used, within a legislated time period. Normally, the benefits of being able to utilize these losses against future taxable income would be recorded as a future tax asset. However, due to the uncertainty surrounding the realization of this and other limited life tax assets, we have provided a full valuation allowance against these tax assets thereby reducing their value in our financial statements to nil. The effect of not recognizing the benefits of these potential future deductions reduces the tax recovery that we would have otherwise recorded against the current year's loss. The Company paid no cash income or mining taxes in the year ended December 31, 2003.

In 2002, we recorded income before income and mining taxes of $4.6 million yet recorded a tax recovery of 7.8%. The recovery was due to the utilization of previously unrecognized losses carried forward. In prior years, just as in 2003, when the Company incurred losses, the benefit of the future tax deduction was not recorded as a future tax asset. In 2002, when the Company used these prior losses to reduce taxable income, the tax that would have otherwise been recorded against 2002 income was reduced.

Outlook: We expect our effective income tax rate for accounting purposes to be approximately 10% in 2004 and to be between 35% and 40% in 2005 (in each case, including provincial mining duties). These effective tax rates could decrease if we are able to realize unrecognized tax assets. Due to uncertainty surrounding the realization of certain tax assets, we have provided a full valuation allowance against limited life tax assets and, as such, the possible benefit of these future tax deductions is not recorded as an asset in the financial statements. Due to rising metal prices, we expect to be able to realize some of these assets before they expire thus leading to corresponding tax credits in income representing the decrease in valuation allowance attached to these tax assets.

Liquidity and Capital Resources

As a result of the operating challenges encountered in 2003, we ended 2003 with less capital resources than 2002. Including $100 million of undrawn credit under our revolving bank facility, we ended 2004 with available cash resources of approximately $210 million, unchanged from those available at the end of 2003 and to $253 million at the end of 2002. In 2004 we amended our revolving bank facility with a syndicate of international banks. Under the amended facility, the Company will have a $100 million line of credit on a revolving basis for at least three years. In 2003, we used $43 million in cash compared to 2002 when we added $132 million to our cash position. The largest components of the cash used in 2003 were:

- •

- $42 million in capital expenditures at LaRonde; and

- •

- $10 million net investment and acquisition expenditures including $9 million for Lapa and $4 million for Bousquet offset by $3 million generated from the sale of available-for-sale securities.

These cash outflows were offset by $4 million in operating cash flow and $6 million of financing cash flows. Despite the production difficulties, we still managed to generate positive operating cash flow due in large part to the increase in metal prices. The metal price increases were offset somewhat by the strengthening Canadian dollar and our increased exploration activities driven by our success at Lapa. The $6 million in financing cash flows included $5 million of employee stock purchases under our share purchase and stock option plans. In 2003, working capital changes had a negligible effect on cash flow.

In 2003, the Company declared its 24th consecutive annual dividend of $0.03 per share, unchanged from 2002. Although the Company expects to continue paying dividends, future dividends will be at the discretion of the Company's Board of Directors and will be subject to factors such as income, financial condition, and capital requirements.

10

Agnico-Eagle's contractual obligations as at December 31, 2003 are summarized as follows:

| Contractual Obligations | Total | Less than 1 Year | 1-3 Years | 3-5 Years | More than 5 Years | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long-term debt(1) | $ | 143.8 | $ | — | $ | — | $ | — | $ | 143.8 | |||||

| Capital lease obligations | 0.7 | 0.7 | — | — | — | ||||||||||

| Reclamation obligations(2) | 23.2 | 0.9 | 2.7 | 0.8 | 18.8 | ||||||||||

| Pension obligations(3) | 5.9 | 0.1 | 0.2 | 0.2 | 5.4 | ||||||||||

| $ | 173.6 | $ | 1.7 | $ | 2.9 | $ | 1.0 | $ | 168.0 | ||||||

Notes:

- (1)

- The Company's convertible subordinated debentures in aggregate principal amount of $143.8 million mature on February 15, 2012. The Company may redeem the debentures on or after February 15, 2006, in cash, or at the option of the Company, be delivering freely tradeable common shares.

- (2)

- Mining operations are subject to environmental regulations which require companies to reclaim and remediate land disturbed by mining operations. The Company has submitted closure plans to the appropriate governmental agencies which estimate the nature, extent and costs of reclamation for each of its mining properties. The estimated undiscounted cash outflows of these reclamation obligations are presented here. These estimated costs are recorded in the Company's financial statements on a discounted basis in accordance with FAS 143. See Note 5(a) to the Audited Annual Financial Statements.

- (3)

- The Company has entered into Retirement Compensation Arrangements ("RCA") with certain executives. The RCAs provide pension benefits to the executives equal to 2% of the executive's final three-year average pensionable earnings for each year of service with the Company less the annual pension payable under the Company's basic defined contribution plan. Payments under the RCAs are secured by letter of credit from a Canadian chartered bank. The figures presented in this table have been actuarially determined.

In 2003, the Company was unable to achieve its completion test and was in default of its interest coverage covenants under its revolving bank facility. Given that the facility was completely undrawn throughout 2003, these were technical violations which were waived by all the banks in the lending syndicate for the third and fourth quarters of 2003. The syndicate also extended the deadline for achieving the completion test to September 30, 2004. This completion test was satisfied in the third quarter of 2004.

Outlook: In 2004 sustaining and project capital expenditures are estimated to have been approximately $23 million at LaRonde and approximately $30 million on other projects, including Lapa, Goldex and LaRonde II. At Lapa, we will continue construction of the shaft with underground diamond drilling scheduled to start in late 2005. At Goldex, we have conducted a bulk sampling program to obtain an increased level of confidence in the gold grade. The bulk sample consisted of three vertical slot raises through the orebody and we expect to process this material early in 2005. At LaRonde II, we expect a detailed feasibility study to be completed in mid 2005.

In 2005 we expect to incur approximately $14.1 million in sustaining capital expenditures at LaRonde, $12.7 million in sustaining capital expenditures on projects relating to LaRonde II, $12.1 million on the underground program at the Lapa property, $1.5 million on the bulk sample and engineering at the Goldex property and $1.6 million on drilling at the Bousquet and Ellison properties. We expect all these capital expenditures to be completely funded out of operating cash flow.

The following table provides a summary of our revised 2004 estimated and 2005 estimated capital and exploration expenditures. The grassroots exploration amount is the cash component of our exploration expense and does not include our share of Contact Diamond's or Riddarhyttan's exploration expense.

| | 2005 | 2004 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Project | ||||||||||||||||||

| Capitalized | Expensed | Total | Capitalized | Expensed | Total | |||||||||||||

| | | | (millions) | | | |||||||||||||

| LaRonde I projects & sustaining | $ | 14,100 | $ | — | $ | 14,100 | $ | 23,000 | $ | — | $ | 23,000 | ||||||

| LaRonde II drilling & feasibility | 12,700 | — | 12,700 | 13,000 | — | 13,000 | ||||||||||||

| Goldex bulk sample & engineering | 1,500 | — | 1,500 | 5,000 | — | 5,000 | ||||||||||||

| Lapa drilling & engineering | 12,100 | — | 12,100 | 10,000 | — | 10,000 | ||||||||||||

| Bousquet/Ellison drilling | 1,600 | — | 1,600 | 2,000 | — | 2,000 | ||||||||||||

| Grassroots exploration | — | 4,800 | 4,800 | — | 2,000 | 2,000 | ||||||||||||

| $ | 42,000 | $ | 4,800 | $ | 46,800 | $ | 53,000 | $ | 2,000 | $ | 55,000 | |||||||

11

Risk Profile

Agnico-Eagle is subject to various risks that it encounters in its day-to-day operations. We mitigate the likelihood and potential severity of these risks through the application of the highest standards in the planning, construction and operation of our facilities. In addition, emphasis is placed on hiring and retaining competent personnel and developing their skills through training in safety and loss control. Agnico-Eagle's operating and technical personnel have a solid track record of developing and operating precious metal mines and the LaRonde Mine has been recognized for its excellence in this regard with various safety and development awards. Unfortunately, in spite of our extensive efforts to ensure the safety of our employees, industrial accidents can occur. In February 2004, an underground explosion claimed the life of a contract miner, and in March 2004, an accident in a storage area claimed the life of an employee.

We also mitigate some of the Company's normal business risk through the purchase of insurance coverage. An Insurable Risk Management Policy, approved by the Board of Directors, governs our purchase of insurance coverage and only permits the purchase of coverage from insurance companies of the highest credit quality. For a more complete list of the risk factors affecting Agnico-Eagle, please see the Company's Annual Report on Form 20-F filed with the United States Securities and Exchange Commission.

As disclosed by the Company on March 18, 2004, the staff of the Ontario Securities Commission had been investigating the Company in relation to the timing and content of the Company's disclosure concerning a rock fall that occurred at the LaRonde Mine in the first quarter of 2003. The Company is currently in discussions with Ontario Securities Commission staff concerning this matter and the timing of the Company's disclosure of a production shortfall prior to its earnings announcement in the third quarter of 2003. The Company believes it is unlikely that there will be any material financial impact resulting from this matter.

Financial Risk

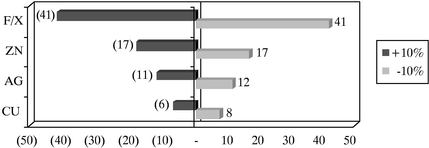

Agnico-Eagle's net income is most sensitive to metal prices and the US$/C$ exchange rate. For the purpose of the sensitivities presented in the graph below, Agnico-Eagle used the following metal price and exchange rate assumptions:

- •

- Gold — $340;

- •

- Silver — $5.00;

- •

- Zinc — $0.40;

- •

- Copper — $0.85; and

- •

- US$/C$ — $1.30

Changes in the market prices of gold are due to numerous factors such as demand, global mine production levels, forward selling by producers, central bank sales and investor sentiment. Changes in the market prices of other metals are due to factors such as demand and global mine production levels. Changes in the US$/C$ exchange rate are due to factors such as supply and demand for Canadian and U.S. currencies and economic conditions in each country. In 2003, the price ranges for metal prices and the US$/C$ exchange rate were:

- •

- Gold — $323-$416;

- •

- Silver — $4.35-$5.97;

- •

- Zinc — $0.34-$0.46;

- •

- Copper — $0.70-$1.05; and

- •

- US$/C$ — $1.29-$1.57.

The following graph shows the estimated impact on budgeted income per share ("EPS") in 2004 of a 10% change in assumed metal prices and exchange rates. A 10% change in each variable was considered in isolation

12

while holding all other assumptions constant. Based on historical market data and 2003 price ranges shown above, a 10% change in assumed metal prices and exchange rates is reasonably likely in 2004.

In order to mitigate the impact of fluctuating precious and base metal prices, Agnico-Eagle enters into hedging transactions under its Metal Price Risk Management Policy, approved by the Board of Directors. The Company's policy and practice is not to sell forward its gold production. The Policy does allow the Company to review this to use hedging strategies where appropriate to ensure an adequate return on new projects. In the past, we have bought put options to protect a minimum gold price while maintaining full participation to gold price increases. The Company's policy does not allow speculative trading. At the end of 2003, the Company's only metal hedges are gold puts with a strike price of $260. These gold puts protect a minimum gold price of $260 for 44% to 64% of anticipated gold production between 2004 and 2007. Gold puts are exercised at our option therefore they do not limit participation to rising gold prices.

The Company receives payment for all of its metal sales in US dollars and pays most of its operating and capital costs in Canadian dollars. This gives rise to significant currency risk exposure. We have entered into currency hedging transactions under the Company's Foreign Exchange Risk Management Policy, approved by the Board of Directors, to hedge part of our exposure. The policy does not permit the hedging of translation exposure (that is, the gains and losses that arise from the accounting translation of Canadian dollar assets and liabilities into US dollars) as these do not give rise to cash exposure. In 2004, we hedged approximately 40% of our Canadian dollar operating cost requirement at a level well above the prevailing exchange rates that are in effect when the hedges expire. As shown in the chart above, a 10% increase in budget exchange rates would increase EPS by $0.11. Due to the 2004 foreign currency hedges, a 10% decrease in exchange rates would decrease EPS by only $0.05.

Fluctuations in interest rates can also affect income and cash flows. Due to the interest rate swap entered into in 2003, increases in LIBOR rates will increase interest expense. The maximum interest rate payable under the swap transaction is 5.75% thus, based on this maximum rate, the maximum exposure from rising interest rates is $0.02 per share. The Company has a Short-Term Investment Risk Management Policy, approved by the Board of Directors, which only permits investment of excess cash balances in short-term money market instruments of the highest credit quality. Based on historical market data and the 2003 LIBOR range, the Company believes that a 10% change in interest rates is reasonably likely in 2004.

Operational Risk

The business of gold mining is generally subject to certain types of risks and hazards such as environmental hazards, industrial accidents such as cave-ins, rock bursts, rock falls and flooding, unusual or unexpected rock formations, changes in the regulatory environment and metal losses. Such occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability. As a result, the Company may be required to incur significant costs that could have a material adverse effect on its financial performance, liquidity and results of operations.

The Company's LaRonde Mine and milling operations account for all of our gold production and will continue to account for all of our gold production in the future unless additional properties are acquired or

13

brought into production. Any adverse condition affecting mining or milling conditions at LaRonde could have a material adverse effect on our financial performance, liquidity and results of operations. At current reserves and mining rates, LaRonde has a mine life of approximately 15 years.

Our gold production estimates for subsequent years may fall below estimated levels as a result of the general mining risks summarized above. Furthermore, production may be unexpectedly reduced if, during the course of mining, unfavorable ground conditions or seismic activity are encountered or grades are lower than expected. Production estimates may also be affected if the physical or metallurgical characteristics of ore are less amenable than expected to mining or treatment. Therefore, there can be no assurance that the Company will achieve current or future production estimates.

Our reported proven and probable mineral reserves are estimates and there can be no assurance that anticipated tonnage and grade can be achieved. Reserve figures have been determined based on assumed gold prices and operating costs. We have estimated mineral reserves based on a $325 per ounce gold price. Though the gold price is higher than the $300 per ounce assumption used in last year's reserve estimate, this impact was essentially negated by the change in the US$/C$ exchange rate assumed from $1.50 to $1.40. While gold prices were generally above $325 for 2003, the average gold price over the past three years has been below $325 per ounce. If gold prices of $300 and $350 were assumed, our gold reserve position would change by 6%. Substantial prolonged decreases in the price of gold, silver, copper and zinc and the US$/C$ exchange rate could have a material adverse effect on our financial performance, liquidity and results of operations. To help maintain or grow production levels over the long term, Agnico-Eagle must continually replace mineral reserves depleted by production by reclassifying mineral resources to reserves, expanding known orebodies or locating new ones. Success in gold exploration is highly uncertain and there is a risk that future depletion of mineral reserves through normal mining operations will not be adequately replaced.

Environmental Risk

Agnico-Eagle's activities are subject to extensive federal and local laws and regulations governing environmental protection and employee health and safety. Agnico-Eagle is required to obtain governmental permits and comply with mine reclamation rules. Although Agnico-Eagle makes provisions for reclamation costs, there can be no assurance that these provisions will be adequate to discharge the obligations associated with these regulations. Failure to comply with applicable environmental and health and safety laws can result in injunctions, damages or revocation of permits and imposition of penalties. There can be no assurance that Agnico-Eagle has been or will be at all times in complete compliance with such laws and regulations or that the costs of complying will not have a material adverse effect on our financial performance, liquidity and results of operations.

Environmental laws and regulations are complex and have become more stringent over time. Any changes in such laws or environmental conditions could have a material adverse effect on Agnico-Eagle's financial condition, liquidity or results of operations. Agnico-Eagle is not able to estimate the impact of future changes in laws and regulations due to the uncertainty surrounding the ultimate form these changes may take. At December 31, 2003, Agnico-Eagle has accrued approximately $6 million for each of its reclamation obligations on its LaRonde and Bousquet properties.

Derivatives Risk

Management enters into derivative contracts to limit the downside risk associated with fluctuating metal prices. The contracts act as economic hedges of our underlying exposures to metal price risk and foreign currency exchange risk and are not held for speculative purposes. We do not use complex derivative contracts to hedge our exposures. We use simple contracts, such as puts and calls, to mitigate downside risk yet maintain full participation to rising metal prices. We also enter into forward contracts to lock in exchange rates based on our projected Canadian dollar operating and capital needs.

By using derivative instruments, we have various financial risks. Credit risk is the risk that the counterparties to our derivative contracts will fail to perform on an obligation to us. We mitigate this risk by dealing with high quality counterparties such as financial institutions. Market liquidity risk is the risk that a derivative position cannot be liquidated quickly. We mitigate market liquidity risk by spreading out the maturity of derivative contracts over time, usually based on our projected production levels for the specific metal being

14

hedged, such that the relevant markets will be able to absorb the contracts. Mark-to-market risk is the risk that an adverse change in market prices for our metals will affect our financial condition. Since we use derivative contracts as economic hedges, for most of the contracts, changes in the mark-to-market value do no affect income. For a description of the accounting treatment of our derivative contracts, please see "Critical Accounting Estimates — Financial Instruments."

For 2003, we have recorded a $1.8 million charge against our total revenue to reflect the maturity of our gold put option contracts purchased in 1999. This amount is simply the original cost for gold puts maturing in the year. Mark-to-market losses on the 2003 gold put option contracts had originally been recorded as part of accumulated other comprehensive income and these amounts were reclassified to earnings for the current year and are included as part of the $1.8 million charge. Also for 2003, we recorded a $1.9 million gain on our byproduct metal derivative contracts which was recorded as revenue for the specific metal being hedged and a $0.5 million gain on our foreign currency derivative contracts maturing in 2003 which was recorded as part of our production costs. Since the Company uses only over-the-counter instruments, the fair value of individual hedging instruments is based on readily available market values.

Outstanding Securities

The following table presents the maximum number of common shares that would be outstanding if all dilutive instruments outstanding at March 31, 2004 were exercised:

| Common shares outstanding at March 31, 2004 | 84,956,333 | |

| Convertible debentures (based on debenture holders' option) | 10,267,919 | |

| Employee stock options | 3,301,400 | |

| Warrants | 6,900,000 | |

| 105,425,652 | ||

The convertible debentures are convertible into common shares, at the option of the holder, at any time prior to maturity, at a conversion rate of 71.429 common shares per $1,000 principal amount of debentures. The debentures mature on February 15, 2012 but may be redeemed at the option of the Company on or after February 15, 2006 in cash or, at the option of the Company, by delivering freely tradable common shares.

Each warrant entitles the holder to purchase one common share at a price of US$19.00. The warrants expire on November 6, 2007.

Critical Accounting Estimates

The preparation of the financial statements in accordance with US GAAP requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. The Company evaluates the estimates periodically, including those relating to metals awaiting settlement, inventories, future tax assets and liabilities, and mining properties. In making judgments about the carrying value of assets and liabilities, the Company uses estimates based on historical experience and various assumptions that are considered reasonable in the circumstances. Actual results may differ from these estimates.

The Company believes the following critical accounting policies relate to its more significant judgments and estimates used in the preparation of its financial statements. Management has discussed the development and selection of the following critical accounting policies with the Audit Committee of the Board of Directors and the Audit Committee has reviewed the Company's disclosure in this MD&A.

Mining Properties

The Company capitalizes the cost of acquiring land and mineral rights. If a mineable ore body is discovered, such costs are amortized when production begins, using the unit-of-production method based on proven and probable reserves. If no mineable orebody is discovered, such costs are expensed in the period in which it is determined the property has no future economic value. Costs for grassroots exploration are charged to income when incurred until an orebody is discovered. Further exploration and development to delineate costs of the orebody are capitalized as mine development costs once a feasibility study is successfully completed and proven and probable reserves established.

15

Mine development costs incurred after the commencement of production are capitalized or deferred to the extent that these costs benefit the entire ore body. Costs incurred to access single ore blocks are expensed as incurred; otherwise, such vertical and horizontal developments are classified as mine development costs.

Construction costs, including interest costs for projects specifically financed by debt, are capitalized at cost and are not depreciated until commercial production begins. Amortization is based on the unit-of-production method over the estimated proven and probable reserves of the mine.

Subsequent capital expenditures which benefit future periods, such as the construction of underground infrastructure, are capitalized at cost and depreciated as mentioned above.

The carrying values of mining properties, plant and equipment and mining development costs are periodically reviewed for impairment. Impairment testing is based on the future undiscounted net cash flows of the operating mine or development property. If it is determined that the estimated net recoverable amount is less than the carrying value, the asset is written down to its fair value with a charge to income. Estimated future cash flows include estimates of recoverable metals in proven and probable reserves. Metals price assumptions are determined considering current and historical prices, price trends and other market-related factors. Estimated future cash flows also consider ongoing capital requirements, reclamation costs, and related income and mining taxes, and are based on detailed engineering life-of-mine plans.

Revenue Recognition

Revenue is recognized when the following conditions are met:

- (a)

- persuasive evidence of an arrangement to purchase exists;

- (b)

- the price is determinable;

- (c)

- the product has been delivered; and

- (d)

- collection of the sales price is reasonably assured.

Revenue from gold and silver in the form of dore bars is recorded when the refined gold and silver is sold. Generally all the gold and silver in the form of dore bars recovered in the Company's milling process is sold in the period in which it is produced.

Under the terms of our concentrate sales contracts with third-party smelters, final prices for the gold, silver, zinc and copper in the concentrate are set based on the prevailing spot market metal prices on a specified future date based on the date that the concentrate is delivered to the smelter. We record revenues under these contracts based on forward prices at the time of delivery, which is when transfer of legal title to concentrate passes to the third-party smelters. The terms of the contracts result in differences between the recorded estimated price at delivery and the final settlement price. These differences are adjusted through revenue at each subsequent financial statement date.

Revenues from mining operations consist of gold revenues, net of smelting, refining and other marketing charges. Revenues from byproduct sales are shown net of smelter charges as part of Revenues from mining operations.

Reclamation Obligations

Estimated reclamation costs are based on legal, environmental and regulatory requirements. Current accounting standards require us to recognize the present value of mine reclamation costs as a liability in the period the obligation is incurred and to periodically re-evaluate the liability. At the date a reclamation liability is incurred, an amount equal to the present value of the final liability is recorded as an increase to the carrying value of the related long-lived asset. Each period, an accretion amount is charged to income to adjust the liability to the estimated future value. The initial liability, which is included in the carrying value of the asset, is also depreciated each period based on the depreciation method used for that asset. In order to calculate the present value of mine reclamation costs, we have made estimates of the final reclamation costs based on mine-closure plans approved by environmental agencies. We periodically review these estimates and update our reclamation cost estimates if assumptions change. Material assumptions that are made in deriving these estimates include variables such as mine life and inflation rates.

16

Future Tax Assets and Liabilities

The Company uses the liability method of tax allocation for accounting for income taxes. Under the liability method, future tax assets and liabilities are determined based on differences between the financial reporting and tax bases of assets and liabilities. Future tax assets are reduced by a valuation allowance if it is more likely than not that some or all of the future tax asset will not be realized. The Company evaluates the carrying value of its future tax assets quarterly by assessing its valuation allowance and by adjusting the amount of such allowance, if necessary. The factors used to assess the likelihood of realization are forecasts of future taxable income and available tax planning strategies that could be implemented to realize future tax assets.

Financial Instruments

We use derivative financial instruments, primarily option contracts, to manage exposure to fluctuations in metal prices and foreign currency exchange rates. Under the Company's treasury management system which complies with Statement of Financial Accounting Standard ("FAS") 133 requirements for hedge accounting, unrealized mark-to-market losses on our gold put option contracts are originally recorded in equity as a component of accumulated other comprehensive loss. On the contracts' scheduled maturity dates, the realization of losses on these contracts is reflected by removing the accumulated mark-to-market losses from accumulated other comprehensive loss and recording these losses as part of normal income. The Company's other derivative contracts hedging byproduct silver, copper and zinc production do not qualify for hedge accounting under FAS 133 and thus changes in the market value of these contracts are recorded in income as part of the hedged transactions. All the Company's hedging contracts on byproduct production were liquidated in 2003 with a corresponding charge being recorded in income. Effective January 1, 2003, our foreign currency hedges also qualified for hedge accounting and as such are now being accounted for in the same manner as the gold puts. Unrealized mark-to-market gains and losses on these hedges are recorded in accumulated other comprehensive loss and realized gains and losses are recorded in income in the same period the hedged transaction affects income, or on the scheduled maturity dates. Prior to 2003, unrealized mark-to-market gains and losses on our foreign currency hedges were recorded in income.

Stock-Based Compensation

In 2003, the Company prospectively adopted FAS 123, "Accounting for Stock-Based Compensation" as amended by FAS 148, "Accounting for Stock-Based Compensation — Transition and Disclosure". These accounting standards recommend the expensing of stock option grants after January 1, 2003. The standards recommend that the fair value of stock options be recognized in income over the applicable vesting period as a compensation expense.

The Company's existing stock-based compensation plan provides for the granting of options to directors, officers, employees and service providers to purchase common shares. Share options have exercise prices equal to market price at the grant date or over the life of the applicable vesting period depending on the terms of the option agreements. The fair value of these stock options is recorded as an expense on the date of grant. Fair value is determined using the Black-Scholes option valuation model which requires us to estimate the expected volatility of the Company's share price and the expected life of the stock options. Limitations with existing option valuation models and the inherent difficulties associated with estimating these variables creates difficulties in determining a reliable single measure of the fair value of stock option grants. The dilutive impact of stock option grants is currently factored into the Company's reported diluted income (loss) per share.

Forward-Looking Statements

The information in this report has been prepared as at February 24, 2004. Certain statements contained in this annual report constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. When used in this document, the words "anticipate", "expect", "estimate," "forecast," "planned" and similar expressions are intended to identify forward-looking statements. Such statements reflect the Company's views at the time with respect to future events and are subject to certain risks, uncertainties and assumptions. Many factors could cause the actual results to be materially different from those expressed or implied by such forward-looking statements, including, among others, those which are discussed under the heading "Risk Factors" in the Company's Annual Information Form and Annual Report on Form 20-F for the year ended December 31, 2003. The Company does not intend, and does not assume any obligation, to update these forward-looking statements.

17

AGNICO-EAGLE MINES LIMITED

Summarized Quarterly Data

(thousands of United States dollars, except where noted)

| | March 31, 2003 | June 30, 2003 | September 30, 2003 | December 31, 2003 | Total 2003 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Consolidated Financial Data | |||||||||||||||||

Income and cash flows | |||||||||||||||||

| LaRonde Division | |||||||||||||||||

| Revenues from mining operation | $ | 30,112 | $ | 30,014 | $ | 24,845 | $ | 41,849 | $ | 126,820 | |||||||

| Production costs | 24,347 | 24,581 | 25,909 | 30,153 | 104,990 | ||||||||||||

| Gross profit (exclusive of amortization shown below) | $ | 5,765 | $ | 5,433 | $ | (1,064 | ) | $ | 11,696 | $ | 21,830 | ||||||

| Amortization | $ | 4,517 | $ | 4,787 | $ | 4,471 | $ | 3,729 | $ | 17,504 | |||||||

| Gross profit | $ | 1,248 | $ | 646 | $ | (5,535 | ) | $ | 7,967 | $ | 4,326 | ||||||

| Net income (loss) for the period | $ | (6,237 | ) | $ | (3,779 | ) | $ | (11,869 | ) | $ | 2,387 | $ | (19,498 | ) | |||

| Net income (loss) per share (basic and fully diluted) | $ | (0.07 | ) | $ | (0.05 | ) | $ | (0.14 | ) | $ | 0.03 | $ | (0.23 | ) | |||

| Cash provided by (used in) operating activities | $ | 612 | $ | (2,823 | ) | $ | 761 | $ | 5,703 | $ | 4,253 | ||||||

| Cash used in investing activities | $ | (11,025 | ) | $ | (18,370 | ) | $ | (62,542 | ) | $ | (13,970 | ) | $ | (15,907 | ) | ||

| Cash provided by (used in) financing activities | $ | (1,236 | ) | $ | 1,125 | $ | 4,640 | $ | 910 | $ | 5,439 | ||||||

| Weighted average number of common shares outstanding (in thousands) | 83,725 | 83,836 | 83,954 | 84,424 | 83,889 | ||||||||||||

| Tons of ore milled | 602,633 | 648,292 | 570,661 | 626,994 | 2,448,580 | ||||||||||||

| Head grades: | |||||||||||||||||

| Gold (ounces per ton) | 0.10 | 0.10 | 0.10 | 0.12 | 0.11 | ||||||||||||

| Silver (ounces per ton) | 2.44 | 2.24 | 1.69 | 2.22 | 2.16 | ||||||||||||

| Zinc | 3.55 | % | 3.14 | % | 2.71 | % | 2.87 | % | 3.10 | % | |||||||

| Copper | 0.45 | % | 0.52 | % | 0.62 | % | 06.60 | % | 0.55 | % | |||||||

| Recovery rates: | |||||||||||||||||